8 minute read

Does Avatrade Have Negative Balance Protection

by ForexMakets

Does Avatrade Have Negative Balance Protection

In the dynamic world of forex trading, risk management is paramount. One of the most crucial aspects traders consider is whether a broker offers Negative Balance Protection (NBP). This feature ensures that traders cannot lose more than their deposited funds, providing a safety net during volatile market conditions. ✅ AvaTrade, a prominent online broker, offers NBP to its retail clients, safeguarding them from potential debts beyond their initial investments. ❌ However, this protection is not universal for all account types.

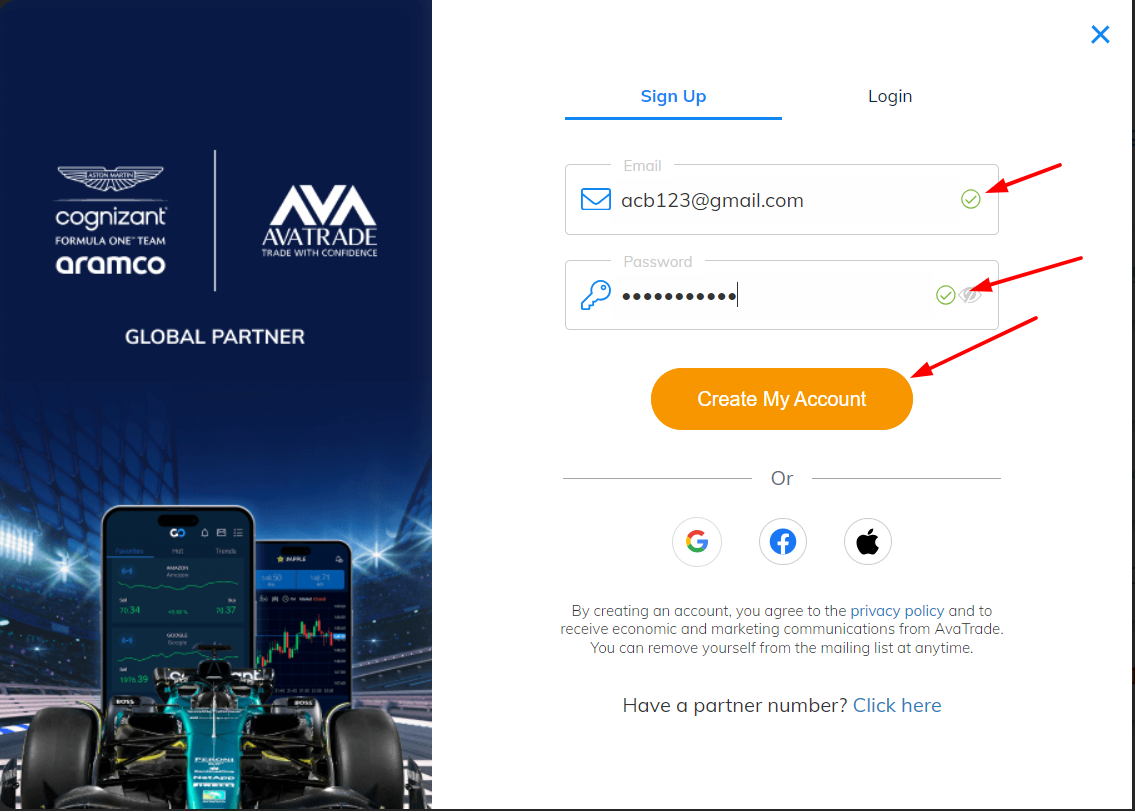

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

Understanding Negative Balance Protection

Negative Balance Protection is a critical feature in trading that prevents a trader’s account from falling into a negative value. In essence, you cannot lose more money than you have deposited. This policy is especially beneficial during periods of extreme volatility, market crashes, or unpredicted slippage events.

✅ For novice and intermediate traders, this feature provides peace of mind, allowing you to focus more on trading strategies rather than worrying about owing money to the broker.

AvaTrade's Negative Balance Protection Policy

AvaTrade automatically applies NBP to all retail accounts under the jurisdictions that require or support it. The goal is to reset any negative balances to zero, protecting traders from owing money during unexpected market moves.

✅ If your trade results in losses that exceed your balance due to slippage or gap-downs, AvaTrade covers that difference for you.❌ This protection is not extended to professional accounts, so clients classified as professional traders assume full risk.

Eligibility Criteria for NBP at AvaTrade

To benefit from AvaTrade’s NBP:

You must be registered under a regulated entity that mandates or supports negative balance protection.

You must have a retail trading account. Professional accounts are excluded from this feature.

You must comply with local financial laws and trading guidelines for eligibility.

Note: AvaTrade's application of NBP depends on your account type and jurisdiction.

Professional vs. Retail Accounts: Key Differences

Here’s how NBP plays out across different account types:

Retail Clients: ✅ NBP is active and automatically enforced.

Professional Clients: ❌ No NBP – you are liable for all trading losses, even beyond your account balance.

Leverage: Retail accounts have restricted leverage (e.g., 1:30), while professional accounts may access higher leverage (e.g., 1:100 or more).

Protection Level: Retail accounts benefit from additional regulatory protections.

How AvaTrade's NBP Works

Let’s say your account holds $1,000. You enter a leveraged position that suddenly goes against you due to a major market event (e.g., geopolitical shock, economic data release). The market gaps overnight and your position is closed at a significant loss.

✅ If the loss is $1,500, instead of showing a -$500 balance, AvaTrade will reset your account balance to $0. You lose your $1,000 deposit, but owe nothing further.

✅ This automatic adjustment is built into AvaTrade’s retail account management system. There is no need to apply manually for this protection.

Benefits of Negative Balance Protection

Some key advantages of AvaTrade's NBP include:

✅ Peace of Mind: Traders can focus on strategy, not survival.

✅ Loss Limitation: Prevents catastrophic financial consequences.

✅ Regulatory Compliance: AvaTrade aligns with top-tier regulations across several jurisdictions.

✅ Beginner Friendly: Ideal for newer traders unsure of how to manage major risk.

Limitations and Exclusions

While NBP offers significant protection, there are some important limitations to keep in mind:

❌ No Coverage for Professional Accounts: These accounts are exempt and may incur negative balances.❌ Not Universal Across Jurisdictions: NBP might not be available in some countries (such as those under offshore regulations).❌ NBP is Not Insurance: It doesn’t reimburse you for a loss; it only prevents your balance from going below zero.❌ Slippage Risk Still Exists: While NBP catches the fallout, it does not prevent slippage or stop-loss failure.

AvaProtect: An Additional Layer of Security

Besides NBP, AvaTrade offers another powerful risk management tool called AvaProtect.

✅ With AvaProtect, you can pay a fee to insure a specific trade for a defined time (1 hour to 1 day, for example). If the market moves against your trade during that time, you’re reimbursed 100% for the loss, minus the insurance fee.

This tool is perfect for:

Trading during high-impact news events

Testing new strategies

Entering large trades with reduced fear

When used correctly alongside NBP, AvaProtect makes AvaTrade one of the safest platforms to start trading on.

Comparing AvaTrade's NBP with Other Brokers

How does AvaTrade’s Negative Balance Protection stack up against other popular brokers like Exness, XM, and JustMarkets? Let’s break it down clearly and objectively, using practical insights that matter to traders.

✅ AvaTrade

Offers Negative Balance Protection (NBP) by default to all retail clients.

❌ NBP not available for professional accounts (this is standard across most brokers).

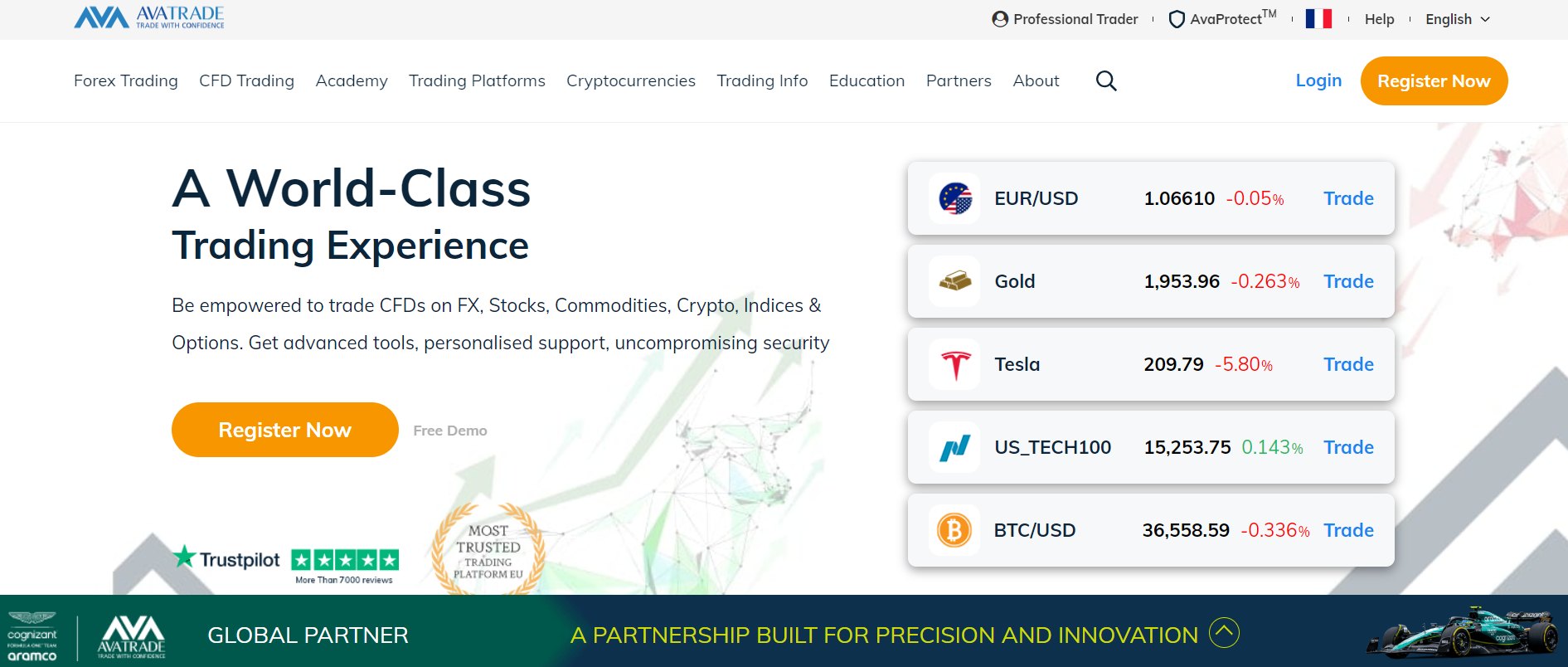

Fully regulated in multiple tier-1 jurisdictions (EU, Australia, UAE, Japan, South Africa).

Offers AvaProtect, an innovative tool to insure trades — unique among major brokers.

Maintains strict fund segregation and client money protection.

Strong focus on risk management tools and trader education.

👌 If you choose Avatrade, 👉 Click here to open an account

❌ Exness

Exness does not consistently offer NBP across all jurisdictions.

✅ In certain regulated zones (like the EU), NBP is enforced by law — but not guaranteed for global or Pro accounts.

Offers ultra-high leverage (up to unlimited in some regions), increasing risk exposure significantly.

❌ No equivalent tool to AvaProtect for trade insurance.

✅ Offers fast execution and good spreads, but risk control is largely trader-dependent.

👌 If you choose Exness, 👉 Click here to open an account

✅ XM

Offers Negative Balance Protection across both standard and micro accounts for retail clients.

✅ NBP is clearly documented and enforced on regulated platforms (especially EU entities).

❌ NBP may be waived for high-leverage accounts or certain offshore clients.

No trade-specific insurance like AvaProtect.

✅ Strong on customer service and educational resources.

❌ Leverage offerings can be high, and traders must manage risk manually.

👌 If you choose XM, 👉 Click here to open an account

❌ JustMarkets

❌ NBP not guaranteed — only available under certain regional terms.

✅ For retail clients under regulated entities, NBP may apply — but it's not always automatic.

❌ Broker focuses on high leverage (up to 1:3000), which increases the chance of balance going negative in fast markets.

❌ No unique risk management features like AvaProtect.

✅ Low spreads and flexible account types, but NBP is not a core focus of the platform.

❌ Client protection varies significantly depending on where the account is opened.

👌 If you choose JustMarkets, 👉 Click here to open an account

AvaTrade stands out because it doesn’t just meet minimum regulatory requirements – it exceeds them with added features like AvaProtect and strict compliance policies.

Conclusion

✅ If you’re considering opening a trading account, AvaTrade offers one of the most secure and transparent environments in the industry. With Negative Balance Protection, you’re protected against going into debt, and with AvaProtect, you can trade even during turbulent markets without fear.

AvaTrade gives you access to:

Top-tier regulation

Fair trading conditions

Innovative tools

Strong financial safeguards

❌ Not every broker offers this level of protection. Many traders have faced bankruptcies or heavy losses by using brokers that lack NBP. With AvaTrade, your risk is limited, and your growth is supported.

FAQs

1. What is Negative Balance Protection?It is a feature that prevents traders from losing more than their deposited capital.

2. Does AvaTrade offer NBP to all clients?✅ Only retail clients receive NBP. ❌ Professional clients are excluded.

3. Do I have to apply for NBP separately?No. NBP is automatically applied to all eligible retail accounts.

4. What if I lose more than I deposited?✅ Your account will be reset to $0, and you won’t owe anything to AvaTrade.

5. Can AvaProtect replace NBP?❌ No. AvaProtect is an optional trade-specific insurance, while NBP is account-wide protection.

6. Is NBP a guarantee I won’t lose money?❌ No. You can still lose all your deposited funds — but not more than that.

7. Is NBP available worldwide?❌ Not always. It depends on your location and regulatory body.

8. Why is NBP important for new traders?✅ It protects against unexpected large losses, which are common for inexperienced traders.

9. Can I switch from a retail to a professional account?Yes, but you’ll lose NBP and other protections in the process.

10. Is AvaTrade the best option for safe trading?For traders who value security, risk control, and modern tools — AvaTrade is definitely one of the best options available today.

🎯 Ready to Trade with Protection?

Your capital deserves more than chance. It deserves structure. It deserves a shield. It deserves AvaTrade.✅ Start your trading journey today with one of the most trusted, secure, and trader-focused platforms in the world.

👉 Open your AvaTrade account now and experience the difference of trading with real protection.

💥 Read more: