FYou check the fence. You ride the pasture. You trust your gut. And when something goes wrong, you hope you’re not already too late.That model is changin because of economics, labor realities, and scale of modern operations no longer allow for constant eyes on every animal. Precision ranching isn’t a trend. It’s a response.

This month’s cover story takes us inside 701x, a Fargo-based company quietly reshaping how cattle are managed across some of the most remote land in the country. Founded by Kevin Biffert, 701x applies a mindset more commonly found in advanced manufacturing than agriculture: if you can see what’s happening in real time, you can make better decisions with less guesswork— and fewer hours on the ground.

What makes this story compelling isn’t just the technology. GPS-enabled ear tags. Satellite connectivity. Real-time health and breeding alerts. That’s the how. The why is more human.

Biffert believes productivity is what gives people their lives back. It’s a philosophy shaped by

decades in industrial automation and now aimed squarely at ranch families facing tighter margins, fewer workers, and rising stakes. When cattle values climb and labor gets scarce, every missed signal costs more than money.

701x’s tools don’t replace ranchers. They extend them. They surface problems earlier. They reduce unnecessary check-ins. They let families step away—knowing that if something changes, they’ll know.

This cover isn’t about futuristic farming. It’s about practicality. About building technology tough enough to survive cattle, weather, and skepticism. About a North Dakota company solving North Dakota problems, then scaling them outward.

Precision ranching is here. And if companies like 701x are right, it’s not just changing how cattle are managed—it’s changing what ranch life can look like in the years ahead.

Brady Drake Future Farmer Editor

Austin

AustinCuka@SpotlightMediaFargo.com

Spencer

Matt

ClientRelations@SpotlightMediaFargo.com

KEVIN BIFFERT 701x Founder

By Brady Drake | J. Alan Paul Photography

2:17 a.m., a rancher’s phone vibrates. A bull, worth more than a nice used pickup truck, has crossed a fence line miles from the nearest road. In another pasture, a cow’s movement has slowed just enough to trigger a health alert before visible symptoms appear. These are the moments ranchers rarely see in time.

On a screen in downtown Fargo, those moments show up as dots moving across a map of western North Dakota. Each dot is an animal. Together, they form a realtime picture of where cattle are, how they’re moving, and what their behavior might be signaling about breeding, health, or risk.

The company behind it all is 701x, a company with a straightforward mission statement to help ranchers “do more with less," but the path to getting there is anything but typical. 701x’s founder and CEO, Kevin Biffert, didn’t come up through software startups or agtech accelerators. He came up through industrial automation. Precision ranching, as Biffert frames it, is about using real-time data, including location, movement, behavior, and records, to reduce guesswork and physical check-ins, especially across large, remote operations.

Biffert described to us that earlier chapter in numbers that still sound unreal: high-speed lines reaching “1,200 a minute” producing sophisticated packaging equipment for syringes and medical devices. He founded his first company, Fargo Automation, in 1996, and sold it in 2017. After the acquisition, the company became part of Körber (via Körber Medipak).

That two-decade run in automation did more than teach Biffert how to build machines. It helped him build a philosophy that productivity is what unlocks a better life.

He says he learned that early at 3M, where he watched a company maintain roughly the same headcount while growing revenue. That wasproof, to him, that “you’re always going to have to do more with less.” Whether it’s factory lines or ranch work, efficiency that improves someone else’s day.

701x is his attempt to transplant that worldview onto the cattle industry with precision ranching, which is the idea that you can manage cattle and infrastructure with real-time data—location, behavior, health signals, and records—so fewer decisions depend on physical check-ins.

Biffert’s origin story for 701x starts with observation. He told us at Future Farmer that he’s long tracked markets and public companies, and he kept seeing the pattern that businesses that tightly combine hardware and software can build durable ecosystems. He points to Apple, Google, and Microsoft as examples of companies that made the experience seamless by controlling both the device and the interface.

Those observations became the blueprint for 701x. Where it gets interesting is what he chose as the “wearable.”

At a basic level, 701x’s system works by turning cattle into moving data points without requiring fixed antennas, base stations, or constant connectivity. GPS-enabled ear tags collect movement and activity data throughout the day. When connectivity is available, via cellular or satellite, the data syncs to the platform. When it’s not, the system stores information and uploads later.

The result is periodic insight that includes alerts when something changes, trends over time, and records that can be reviewed without being physically present in the pasture.

701x builds GPS-enabled smart ear tags and a connected software platform meant to help ranchers keep better records, locate animals, and catch problems earlier, especially the kind of problems cattle can’t verbalize. As North Dakota’s Department of Commerce describes it, 701x’s tags gather data “similar to a smart watch” and can generate alerts from deviations in movement and other signals.

If you ask most people what makes GPS livestock tracking difficult, they’ll talk about coverage in remote areas. That is a real problem, but the biggest hurdle 701x worked to overcome was irritation. According to Biffert, one of the biggest early lessons was how to put a device on cattle so it survives—without the animal deciding it doesn’t belong there. “If you irritate the animal,” he said, “they’ll find a way to get it off.”

- Kevin Biffert

Of course, durability is only part of the challenge. The devices also have to coexist with animals that have no interest in wearing technology. Biffert said one of the company’s earliest lessons was simply that if you irritate the animal, it will find a way to remove the device.

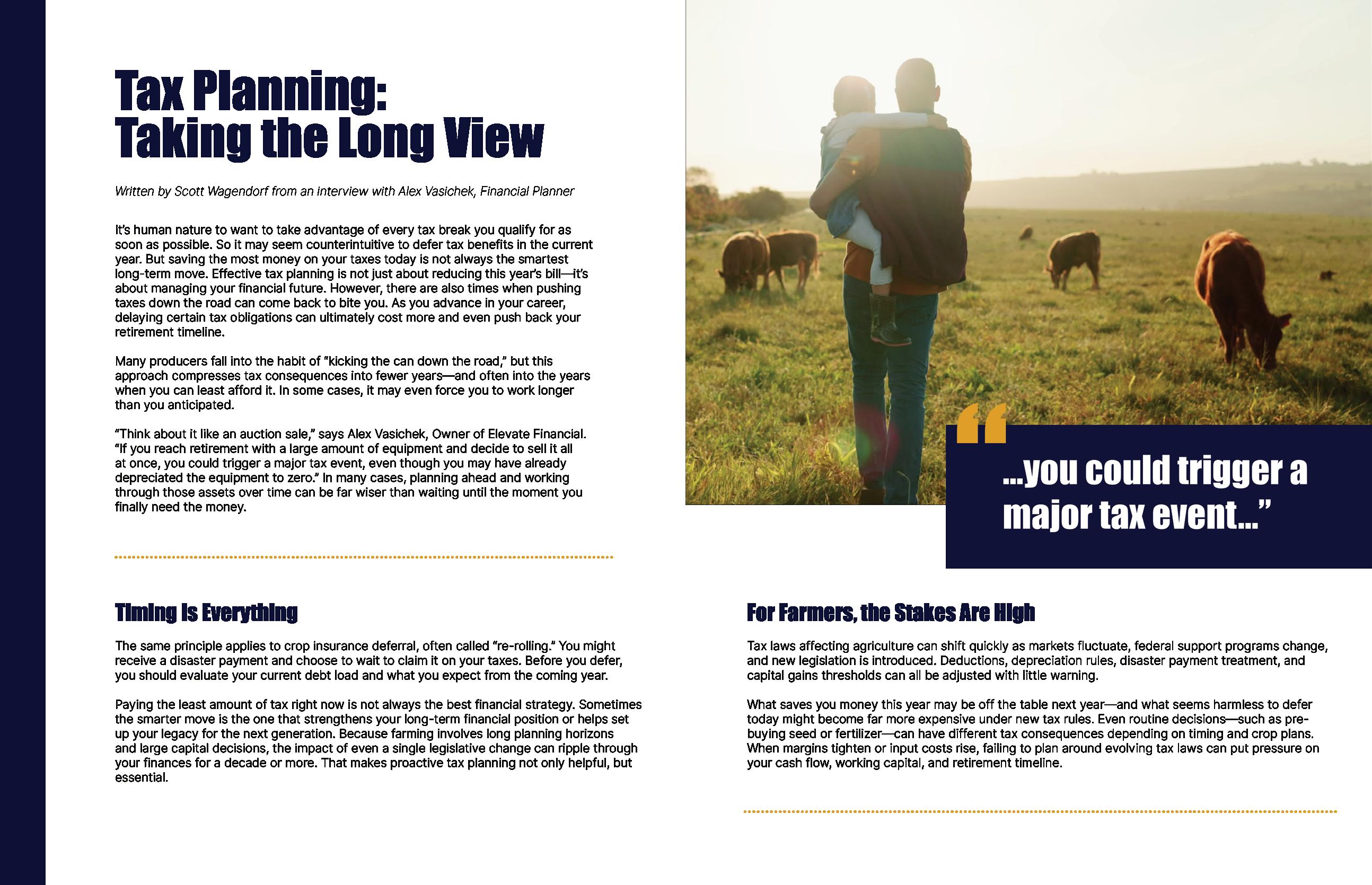

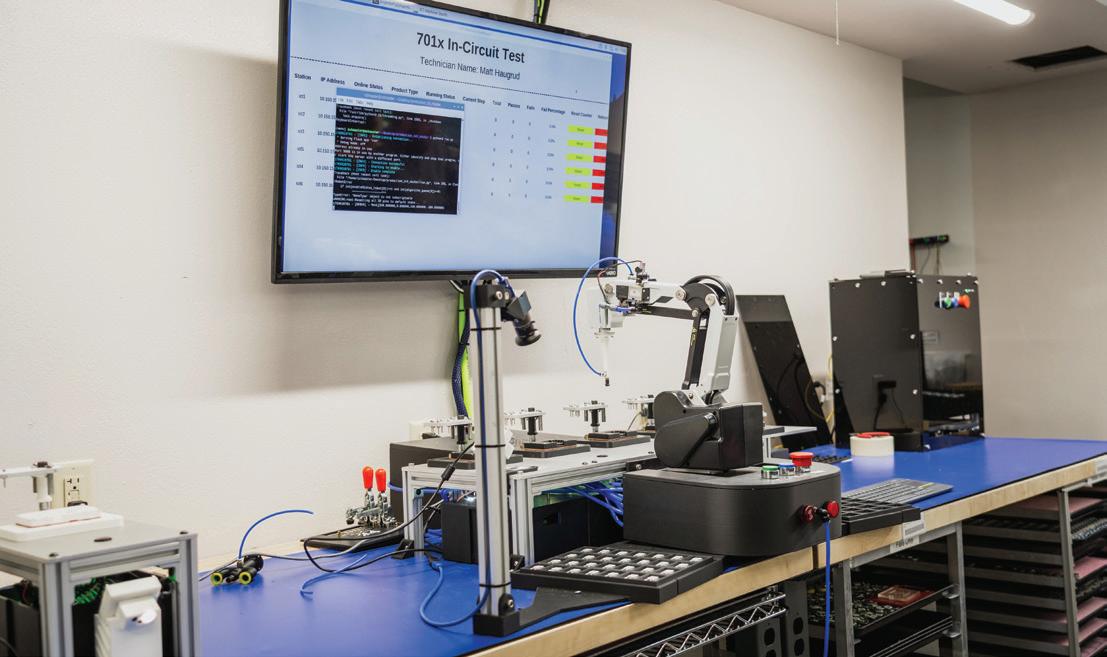

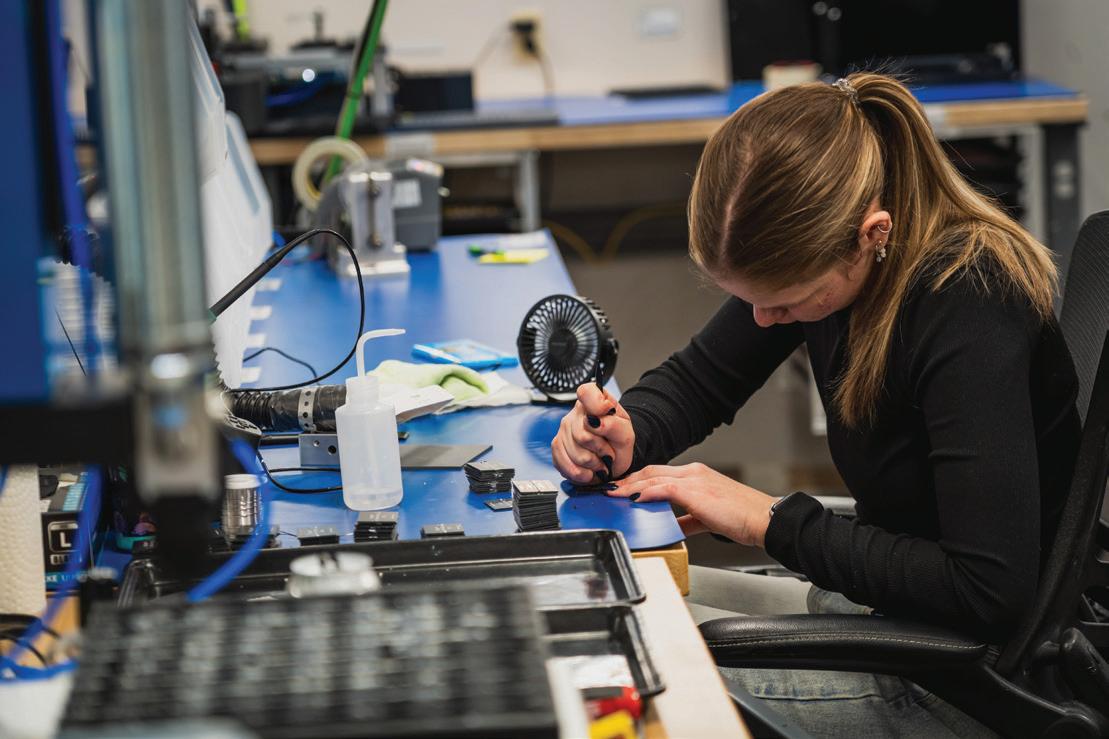

Inside 701x’s downtown facility, that lesson shows up everywhere. When we toured the space, 3D printers were running continuously—one producing a life-size cow head for a trade show display, others prototyping housings and components. The team laser-engraves its own devices. Engineers have built custom machines to simulate the wear, impact, and stress the tags face in real-world conditions.

The goal of this self-sufficient team is to create hardware that stays on the animal, survives the environment, and earns trust by not becoming another thing ranchers have to fix.

Biffert started building 701x the day COVID was announced. As supply chains and electronics companies slowed, Fargo’s talent market changed overnight, allowing him to hire engineers and software developers who were suddenly available due to layoffs at other local firms.

Biffert doesn’t describe 701x as a tag company. He describes it as an ecosystem company.

When talking to him, he consistently uses Apple as the analogy: not just one device, but a family of devices that work together. At 701x, that means a stack of products that connect to a single workflow: knowing where cattle are, what they’re doing, and whether something is going wrong—without a ranch family having to be physically present every hour.

701x has a robust in how production line.

xTpro: GPS smart ear tag (cellular + satellite)

The xTpro is positioned as a satellite-connected GPS ear tag with features that 701x markets around three core jobs: location, health/activity insights, and breeding insights like bull mounting data. The company explicitly highlights the “no antennas or base stations required” concept on its own product page.

xTlite: a smaller tag aimed at calves / herdwide coverage

701x describes xTlite as “small enough for a calf” and built for cost-effective, broader deployment, including “relative GPS tracking.”

xWatSen: remote water monitoring

Cattle management isn’t only about animals; it’s about infrastructure. 701x’s xWatSen is described as a remote system that tracks water tank levels and temperature in real time, aiming to reduce labor and prevent shortages.

Biffert’s “do more with less” framing is a good slogan. It also maps to the economic reality of cattle production in the United States.

USDA’s National Agricultural Statistics Service reported 86.7 million head of cattle and calves in the U.S. as of January 1, 2025, down about 1% from the year prior.

Later, USDA reported 94.2 million head as of July 1, 2025 (mid-year totals can be seasonally higher as the calf crop comes in), and estimated the 2025 calf crop at 33.1 million head

Against that backdrop, two pressures stand out:

Fewer people are stepping into ranch work (or at least, fewer are willing to live the “90 hours a week”).

Each animal matters more when replacement costs rise, and herds are tight.

"If ranch life doesn’t offer flexibility. If parents can’t take kids to a game or go on vacation, then the next generation will opt out."

The most striking part of Biffert’s interview is how he described health monitoring. He said 701x is essentially translating animal behavior—movement, eating, ruminating—into a form a rancher can interpret quickly.

- Kevin Biffert

He claims that a “health alert” from the tag is “almost 100% accurate,” and frames the value in terms of timing. If you catch a problem early, a small veterinary intervention may prevent a loss. He also cites a broader industry loss rate, saying 10% of cattle born die before market, and sets a goal to cut that by more than half.

Those are ambitious statements, and accuracy metrics can vary by herd, environment, and study design. But the general magnitude of death loss—and its cost— has been documented. A USDA APHIS/NAHMS summary of the 2015 cattle death loss study estimates the value of 2015 death losses at $3.9 billion, with 6.2% of the calf crop lost and 2.2% of cattle inventory (500 lb. or more) lost.

That’s the basic ROI logic behind 701x. If you can reduce loss and improve reproduction efficiency even modestly, the economics can work, especially as cattle values rise.

Biffert said 701x bought a ranch in western North Dakota early in the company’s life to test on live animals under real conditions and generate the data needed to build analytics and AI models.

From there, he said they moved into university trials and studies with NDSU, the University of Missouri, universities in Colorado, TCU, and West Texas A&M and mentions the USDA.

The 701x story took a major turn in late 2024 with the acquisition of DigitalBeef, a registry platform used by breed associations. 701x had reached a point where hardware adoption alone was no longer the limiting factor. The challenge was what happened to the data after it was collected—how it moved into the systems ranchers already used for genetics, registration, and performance tracking.

In its announcement, 701x described DigitalBeef as a B2B SaaS company whose software enables association members to submit performance data and obtain registration certificates and performance rankings. 701x positions itself as the operational layer where ranchers record data in real time in 701x, and then send it to DigitalBeef for registration workflows.

In our interview, Biffert explained the strategic “why” in market terms.

Start at the “top” of the cattle world—seedstock and registered cattle producers who set genetics and performance expectations.

Build tools they already need (registry + data capture).

Then filter down into commercial cattle as practices spread.

Their adoption strategy is to win credibility and workflow integration where record-keeping is already rigorous, and then broaden to the much larger base of commercial operations.

Biffert stressed that 701x is not done building. In the interview, he described the cow-calf market as only part of the lifecycle, and he pointed to the feedlot phase as the next big opportunity.

He said 701x has filed a patent for a system aimed at tracing animals in feedlots, and that the lack of changes to the patent signaled to him that the market was “wide

open.” He also noted the core constraint that feedlots are price sensitive. If technology costs too much, operators may simply absorb losses rather than deploy it at scale. His proposed answer is a different deployment model:

701x would create a SaaS system where customers pay pennies per day per animal—more like renting than buying.

Going public (his stated timeline is around 2030) would be part of the capital strategy to deploy hardware broadly into feedlot environments.

Ask Biffert about challenges, and he doesn’t start with technology. He starts with funding.

He said the company has the engineers, the talent, and the right people. The bottleneck is “convinc[ing] an investor,” and he emphasizes that most of their investors are local—by choice. In speaking with us, he noted that traditional venture capital hasn’t been a fit, partly because he has kept roughly 60% ownership, which he says is important to maintain control and avoid the “stifling” outcomes he’s seen when competitors get bought by large corporations.

He also mentions two other principles that shape the company:

Employees as stakeholders, through stock options and incentives

Hiring for energy and fit over perfect credentials: “We don’t look just at grades…you come here and prove to us…you’re going to be energetic to do it.”

Those are leadership choices, and they’re also part of the Fargo story. A downtown HQ, local hiring, local investors, and a control-minded founder is a very different profile than the hyper-funded coastal startup stereotype.

This machine, built in-house by the 701x team, simulates cattle steps.

This machine, built in-house by the 701x team, simulates cattle wear and tear.

Late in the interview, Biffert offers the clearest articulation of what he believes 701x could become, which is the equivalent of autosteer on a tractor—a technology that starts as optional, then becomes standard because it changes the economics of time and precision.

He says ranchers talk to each other; adoption spreads through trust and proof. And he argues that the real payoff isn’t just fewer lost animals or better breeding data, it's that a ranch family can finally step away.

That’s the “improving other people’s lives” thread that connects his career arcs—from medical packaging automation to livestock wearables.

701x is still early in its scale story. But the ambition is clear—and distinctly North Dakota in its execution. A downtown Fargo headquarters. A Badlands test ranch. A founder who looks at ranching the same way he once looked at factory floors: as a system constrained by time, labor, and visibility.

If Biffert is right, the real breakthrough won’t be smarter cattle. It will be ranch families who can finally step away—knowing that if something changes, they’ll know.

701x uses precision ranching—GPS-enabled ear tags plus software—to turn cattle into real-time data points so ranchers can monitor location, health, and behavior without constant physical check-ins.

Founder Kevin Biffert brings a “do more with less” productivity mindset from industrial automation, building 701x as a full hardware–software ecosystem (including a test ranch and the DigitalBeef acquisition) rather than just a tag company.

The broader vision is to make 701x as indispensable to ranching as autosteer is to tractors, reducing death loss and labor demands so ranch families gain flexibility and can step away while still knowing if something goes wrong.

agriculture today, timing isn’t just important—it’s everything. Weather windows are tighter. Margins are thinner. Decisions that once took weeks now happen in hours. For CEO of Maple River Coop Alex Richard and the cooperative he helps lead, innovation isn’t a buzzword or a shiny new tool. It’s the discipline of staying ahead of the grower—every single day.

“We have to make hay when the sun shines,” Alex said. “When field conditions are right, when planting season hits, we have to be ready. If we’re not efficient, we’re holding our patrons back.”

That mindset defines how the cooperative operates across its many divisions: fertilizer, crop protection, grain handling, full-service agronomy, and application. Each area is distinct, but all of them are built around the idea of putting the right product in the right place at the right time, without slowing the farm down.

In an industry flooded with new technology, not everything is worth adopting. Alex is clear about that.

“There’s always something new coming out,” he said. “But we have to vet it. It has to be usable. We have to be able to implement it and execute it.”

That practical filter has shaped how technology is woven into daily operations. Fertilizer floaters are GPStracked in real time, ensuring products are applied to the correct fields with accuracy. Each floater is equipped with an iPad, receiving digital job orders that eliminate guesswork and reduce errors.

From the cooperative’s perspective, that internal technology matters just as much as what patrons see on the outside. Accuracy, speed, and accountability all start behind the scenes.

“If we don’t get it right internally, it doesn’t matter what tools the customer has,” Alex said.

WHEN FIELD CONDITIONS ARE RIGHT, WHEN PLANTING SEASON HITS, WE HAVE TO BE READY. IF WE’RE NOT EFFICIENT, WE’RE HOLDING OUR PATRONS BACK.”

- Alex Richard

On the customer-facing side, the cooperative has focused heavily on communication—specifically, removing friction from it.

A dedicated app connects patrons directly to their accounts, giving them real-time access to invoices, statements, grain contracts, scale tickets, and digital signatures. But more importantly, it closes the communication gap during critical moments.

“When we finish spreading a field, the grower gets a text immediately,” Alex said. “They know it’s done. They know they can go work it in. There’s no waiting, no wondering.”

That same platform allows agronomists and grain merchandisers to send quick messages, daily grain bids, or market updates—without relying on phone calls that may or may not get answered in the middle of a busy day. Patrons can respond just as easily, turning communication into a two-way, real-time exchange.

In an industry where minutes matter, that speed changes everything.

Ask Alex what has changed most in the last five to ten years, and his answer is immediate.

“Speed,” he said. “The velocity at which things happen now.”

Farmers are moving faster than ever—planting faster, harvesting faster, making decisions faster. To keep up, cooperatives have had to scale alongside them, investing in larger equipment, more efficient application methods, and systems that reduce downtime.

“We have to stay ahead of them,” Alex said. “That’s the goal. If we’re behind, we’re the bottleneck.”

Staying ahead isn’t just about machinery. It’s about staffing, logistics, and infrastructure—having enough people, enough storage, and enough capacity to absorb peak demand without slowing anyone down.

That philosophy shows up most clearly during harvest, when grain handling becomes mission-critical.

“Fast unloading and receiving is huge,” Alex said. “We want trucks back in the field as fast as possible so combines don’t stop. That’s something we really pride ourselves on.”

pressure creates a delicate balance. Patrons still expect the same level of service, speed, and expertise, but they’re also asking tougher questions about where their dollars are going and what kind of return they can realistically expect.

That’s where innovation becomes less about adding more and more about choosing better.

Rather than pushing inputs for the sake of volume, the cooperative has leaned into its advisory role by using data, agronomy expertise, and fieldlevel insight to help growers invest where it matters most.

In 2024, Maple River Coop bought out its AGP partnership and became 100% ooperative-owned.

While technology has accelerated nearly every aspect of modern agriculture, the economic reality behind it has become more complex and more constrained.

Over the past 18 to 24 months, Maple River Coop has been navigating a difficult environment shared across the ag sector that includes rising input costs paired with falling commodity prices.

“Margins are tight across the farm gate,” he said. “Fertilizer costs are up. Chemical costs are up. Grain prices have come down. That squeeze affects every decision.”

For a full-service cooperative, that

“We try to offer recommendations that help them spend that dollar wisely,” Alex said. “Where are they going to see a return? Where does it actually make sense?”

That approach shows up in precision agriculture tools like satellite imagery, yield mapping, and variable-rate prescriptions. Instead of blanket applications, inputs are tailored to field variability.

But data alone isn’t enough.

“There’s a lot of data out there,” Alex said. “The key is having someone process it, interpret it, and turn it into something usable.”

That human layer—agronomists who understand both the technology and the realities of farming—is what bridges the gap

between raw information and practical decision-making.

Not every innovation challenge is economic. Some are regulatory, and a few areas highlight that tension more clearly than drones.

The technology itself is ready. The potential is obvious. But implementation hasn’t always been straightforward.

“We’ve seen technology outrun regulation,” Alex said. “That’s been an industry-wide struggle.”

Licensing requirements, approvals, and airspace rules slowed adoption early on, even as drone capabilities advanced. In the past year to year-and-a-half, the FAA has streamlined parts of the licensing process, making it easier and faster for operators to get approved.

That progress has helped, but limitations remain.

“Drone swarming is still restricted,” he said. “From an efficiency standpoint, that holds things back.”

For cooperatives focused on speed and scale, those constraints matter. Every delay, every limitation affects how quickly new tools can move from promise to practice.

Still, Alex remains pragmatic. Progress, even incremental, is progress, and the industry continues to push for regulations that keep pace with innovation.

THERE’S A LOT OF DATA OUT THERE. THE KEY IS HAVING SOMEONE PROCESS IT, INTERPRET IT, AND TURN IT INTO SOMETHING USABLE.” - Alex Richard

Looking five to ten years ahead, Alex doesn’t hesitate when asked what excites him most.

“AI,” he said. “That’s the big one.”

The cooperative already works with enormous amounts of data—field trials, yield maps, satellite imagery, and application records. The next step isn’t collecting more of it, but using it better.

“There’s going to be a lot of data we have to look at,” Alex said. “The goal is figuring out where it actually helps our patrons see a return.”

AI-powered analysis has the potential to identify patterns, refine recommendations, and support more precise decisionmaking across entire operations. But, as with every other tool the cooperative adopts, Alex emphasizes restraint and realism.

“It still comes back to making sure it works in the field,” he said.

Innovation often gets framed as software, data, or emerging technology. But for Alex and the cooperative, some of the most important investments are still physical—steel, concrete, storage, and people. When the season hits, there’s no workaround for capacity.

“We do a lot of stuff,” Alex said.

The cooperative operates nine grain locations stretching from Valley City, ND down to Rosedale, MN, creating a regional footprint designed to meet growers where they are. Across those sites, the cooperative maintains roughly 17 million bushels of licensed

commercial grain storage, giving patrons flexibility at harvest and reducing bottlenecks when timing is tight.

That infrastructure is paired with speed. Fast receiving, efficient unloading, and systems designed to move grain quickly back into the field aren’t just conveniences— they’re competitive advantages.

“Our goal is to keep combines running,” Alex said. “If trucks are waiting, the whole system slows down.”

On the agronomy side, the cooperative operates two major centers—its main location in Castleton, ND, and a second facility in Barnesville, MN. Together, those hubs support both product supply and application at scale.

The cooperative maintains approximately 80,000 tons of fertilizer storage and deploys 16

fertilizer floaters during the spring application season. Each unit is integrated into the cooperative’s GPS and job-management systems, allowing for accurate placement, real-time tracking, and efficient routing.

When windows are short, and acres are many, that combination of equipment, technology, and coordination becomes essential.

“You don’t get second chances in spring,” Alex said. “You have to be ready.”

~80,000 tons of fertilizer storage

16 fertilizer floaters in spring

Over the past decade, the coop has returned nearly $10 million in patronage to its farmer-owners.

The cooperative operates nine grain locations across North Dakota and Minnesota, with roughly 17 million bushels of licensed commercial storage.

Behind every system is a workforce built to flex with the seasons. The cooperative employs about 70 full-time team members, supplemented by roughly 30 seasonal and part-time employees during peak periods

That staffing model allows the organization to surge when demand is highest—planting, spraying, harvest—without sacrificing service quality or safety.

“Our whole focus is staying ahead of the patron,” Alex said. “That takes people just as much as it takes equipment.”

Training, communication, and alignment matter just as much internally as they do externally. When floaters roll, bins fill, and markets move quickly, everyone has to be operating from the same playbook.

As agriculture continues to evolve, the pace isn’t likely to slow. Markets

BE READY. BE EFFICIENT. AND DON’T BE THE THING THAT SLOWS THE FARMER DOWN.”

- Alex Richard, on MRGA's company mission.

will keep moving. Regulations will keep shifting. Technology will keep advancing.

But the cooperative’s strategy remains steady: combine scale with precision, speed with accuracy, and innovation with accountability.

Because at the end of the day, Alex says, the mission is simple.

“Be ready. Be efficient. And don’t be the thing that slows the farmer down.”

David Black serves as executive vice president of enterprise transformation and chief information officer at CHS Inc., where he leads the company’s technology strategy, transformation efforts, and marketing, communications, and sustainability initiatives. With more than 30 years of experience at the intersection of agriculture and technology—including previous leadership roles at Monsanto— Black is focused on ensuring CHS Inc. is positioned not just for today’s challenges, but for the next generation of farming. He plays a key role in advancing innovation through partnerships like Grand Farm, helping scale emerging technologies in autonomy, analytics, and AI so they can deliver real-world value to farmers. Grounded in the cooperative mission, Black views his work through a long-term lens: building systems, strategies, and relationships that will allow CHS Inc.—and the farmers it serves—to thrive for the next 100 years.

Innovation has always been part of agriculture and CHS. For us, it means finding better ways to serve our owners and customers—whether that’s creating new crop protection products, using AI to improve operations or reducing transportation costs. The goal is simple: keep improving to strengthen agriculture and our business.

Innovation at CHS starts with what our owners need. Sometimes we build solutions ourselves; other times we acquire proven technologies or partner with leaders like Microsoft, SAP, and AgVend. Through Cooperative Ventures, our joint venture fund with GROWMARK, we invest in high-potential ag tech. Whatever the method, the goal is the same: invest in innovative solutions and emerging technologies that positively impact farming.

Our mission—creating connections to empower agriculture—hasn’t changed. What has changed is the speed and impact of technology. Today, data drives decisions, from soil sampling to supply chain logistics, making us more efficient and better equipped to support owners in a global market.

Low commodity prices, global trade shifts and labor challenges make efficiency critical. We’re advocating for policies that boost grain demand and investing in AI, autonomy and cost-saving systems to help owners stay competitive.

We start by listening to owners. Innovations that improve efficiency, cut costs, or expand market access rise to the top. Through Cooperative Ventures, we invest in crop production, supply chain, business enablement and sustainability— areas critical to long-term success. And innovation isn’t limited to leadership; everyone at CHS is encouraged to contribute.

We’re focused on securing long-term market access and helping growers adapt to changing seasons and cycles. Macrotrends like labor shortages and consolidation make efficiency essential, and technology will play a big role in meeting those challenges.

From its beginnings in the late 1920s, CHS has grown into a leading global agribusiness cooperative. Here’s a glance at how they've evolved over the decades:

We’re proud of our Cooperative Ventures investments, including Precision AI, which enables plant-by-plant decisions to boost yields and reduce inputs, and Traction Ag, which offers cloud-based farm accounting. Other partners like Sabanto and EarthOptics are advancing autonomy and soil mapping—innovations that make farming more efficient.

We’re investing in digital tools like MyCHS and partnering with AgVend to make it easier for retailers and farmers to access products and manage their business online.

Innovation gives us confidence in the future. By investing in new ideas and technologies, we’ll keep creating connections that empower agriculture and deliver more value to our owners. We also deeply believe in the power of the cooperative system, and when we invest in that system, we know that it will support our owners and customers into the future.

Here’s a quick peek at a few of the products and services they offer:

Agronomy: Including crop nutrients, crop protection, and seeds.

Energy: Ranging from refined fuels and propane to renewable fuels and lubricants.

Grains: Handling, marketing, and processing of grains.

Foods: High-quality ingredients like oilseed products for diverse culinary needs.

Animal Nutrition: Products and services to ensure livestock are healthy and nourished.

Transportation and Logistics: Expert solutions for moving goods efficiently and effectively.

CHS Hedging: Helping manage price risk in commodities.

We partner with universities, startups, and programs like Grand Farm to test new ideas and invest in the future of agriculture. These collaborations accelerate innovation and strengthen rural communities. Through our stewardship work, CHS invests in innovative and important university programs, provides grant funding for member cooperative projects, supports students with ag education like FFA and 4H, and invests in ag communities. These partnerships are critical because they not only drive innovation, but they also invest in the future of agriculture and rural America where our employees, owners and customers live and work.

While there are many different metrics we could share, we think it's important to highlight the impact of CHS. CHS is owned by 575,000 farmer-owners, including 750 member cooperatives. In 2026, we’ll return $120 million in cash and equity to owners, bringing our five-year total to $2.6 billion. Last year, we invested over $8 million in rural communities through grants, giving, and volunteerism.

Farming today demands more than hard work and good weather. It requires systems thinking, financial discipline, adaptability, and a long view of land stewardship. Some of the books focus on soil, others on business, leadership, or mindset, but all share one thing in common: they help farmers make better decisions over the long haul. Whether you’re managing thin margins, rebuilding resilience, or thinking about the next generation, these 20 books offer ideas worth returning to, season after season.

by Kristin Ohlson

This book is a grounded exploration of how healthy soil underpins long-term farm viability. Ohlson connects regenerative practices with real-world economics, showing how soil health influences yield stability, water retention, and climate resilience without turning the book into ideology.

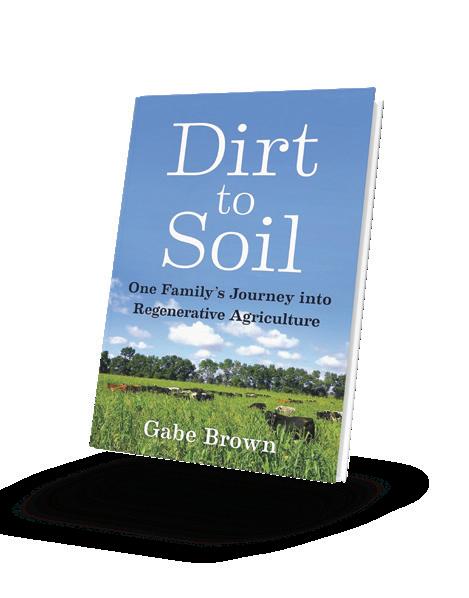

by Gabe Brown

Part memoir, part field manual, this book follows a North Dakota farmer who rebuilt his operation after repeated failures. It’s especially valuable for farmers navigating thin margins, unpredictable weather, and the pressure to rethink long-held practices.

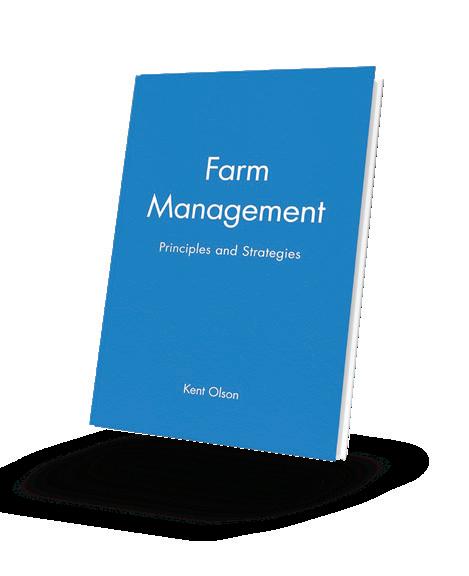

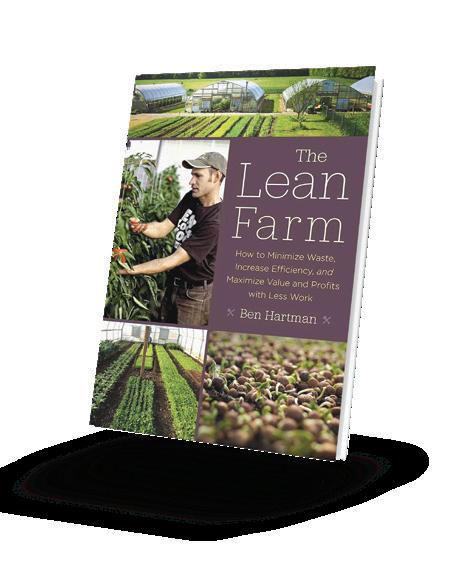

by Kent Olson by Ben Hartman

This is a practical guide to decision-making at the whole-farm level. Rather than focusing on any single crop or technique, the book emphasizes planning, risk management, labor decisions, and financial clarity—useful for both family farms and larger operations.

This book applies efficiency principles to agriculture without stripping away the humanity of farming. Hartman focuses on workflow, waste reduction, and intentional design—ideas that resonate whether you’re running a market garden or a diversified operation.

by Donella H. Meadows

Not a farming book on the surface, but deeply relevant. Meadows helps readers understand how interconnected systems behave over time—an invaluable lens for anyone managing land, labor, capital, weather risk, and longterm sustainability all at once.

by Joel Salatin

A practical, candid look at how small and midsized farms can build profitable, values-driven businesses. While not every approach will fit every operation, the book excels at challenging assumptions and encouraging entrepreneurial thinking in agriculture.

6.

by Angela Duckworth

Farming demands persistence more than almost any profession. This book explores why long-term commitment and resilience often matter more than raw talent—something most farmers understand intuitively, but benefit from seeing articulated clearly.

by Dan Barber

Barber examines the future of food through the lens of chefs and farmers working together. For producers interested in quality, terroir, and long-term land health, this book offers a broader cultural and economic perspective on why farming practices matter beyond the field.

by Jocko Willink & Leif Babin

Though rooted in military leadership, the lessons translate cleanly to farm operations. The book emphasizes accountability, decisionmaking under pressure, and leading teams— skills increasingly critical as farms grow more complex.

by Gary Zimmer

This book emphasizes nutrient cycling, livestock integration, and long-term land productivity. It’s especially relevant for farmers who want to reduce dependency on external inputs without sacrificing performance.

by Eliot Coleman

This is a foundational text for farmers focused on efficiency, season extension, and careful planning. Coleman emphasizes observation and intentional systems over brute force, making the book relevant well beyond organic vegetable production.

by

SARE

Less philosophy, more application. This book dives into how cover crops affect soil structure, nutrient cycling, weed pressure, and long-term yields. It’s a solid reference farmers can return to season after season.

by Allan Savory

This book introduces a decision-making framework that helps farmers balance land health, finances, and quality of life. It’s particularly useful for those managing grazing systems or trying to align economic survival with ecological responsibility.

by

Benjamin Graham

Not about farming directly, but invaluable for understanding risk, patience, and long-term capital decisions. Farmers making equipment, land, or expansion investments will find the mindset especially useful.

by Jean-Martin Fortier

Focused on high-efficiency small-scale production, this book shows how careful planning, layout, and time management can outperform sheer acreage. Even larger operations can borrow ideas around labor efficiency and task design.

by Aldo Leopold

A quiet, reflective book that shapes how readers think about land ethics. For farmers who view stewardship as a long-term responsibility rather than a short-term calculation, this remains one of the most influential works ever written.

by Michael E. Gerber

Many farmers are excellent producers but accidental business owners. This book helps clarify systems, delegation, and structure— ideas that matter once a farm grows beyond a one-person operation.

by SARE

A hands-on guide to business planning tailored specifically to farms. It covers marketing, financing, labor, and legal structure in a way that feels grounded in real agricultural constraints.

by Helmut Kohnk

This book strips soil science down to what farmers actually need to know. It’s technical without being overwhelming, making it a strong bridge between academic research and day-to-day field decisions.

by Peter J. Barry

A clear, no-nonsense guide to understanding cash flow, debt structure, and risk exposure. Especially helpful during volatile markets and uncertain growing seasons.

ohn Deere (NYSE: DE) today announced a series of updates to its Model Year 2027 (MY27) application portfolio, delivering advancements in maneuverability, visibility, and precision agriculture. Highlights include Four-Wheel Steering for improved handling and enhanced precision ag tools and insights to streamline logistics and data analysis. Most notably, John Deere introduced the next generation of its See & Spray™ technology, building on a proven foundation to expand targeted application across more crops and more operating conditions, allowing for more passes throughout the season. The updated See & Spray Gen 2 solution is designed to support operations of all sizes, helping farmers manage rising

input costs, tighter application windows, and increasing weed pressure with greater confidence and flexibility at any time of day throughout the season.

“We understand the increasing pressures farmers are facing, driving them to find solutions that allow them more flexibility and the opportunity to do more with less,” said Josh Ladd, marketing manager for application equipment at John Deere. “That is why we have updated See & Spray to directly address those challenges by helping farmers apply exactly what’s needed, where it’s needed, and across more acres and more crops.”

It doesn’t matter if you’ve never driven a tractor, mowed a lawn, or operated a dozer. With John Deere’s role in helping produce food, fiber, fuel, and infrastructure, we work for every single person on the planet. It all started nearly 200 years ago with a steel plow. Today, John Deere drives innovation in agriculture, construction, forestry, turf, power systems, and more.

Model year 2027 brings one simplified and unified See & Spray Gen 2 platform that builds upon the success of Select, Premium, and Ultimate options. The integration eliminates confusion between the previous system levels, making it easier for farmers to implement See & Spray on their operation.

Farmers and Custom Applicators can now customize the machine to match their operation without feature compromise or compatibility challenges. They have the option to choose between a single- or dualtank configuration and add optional features, such as full boom lighting to maximize operating time by allowing nighttime operations and ExactApply™ or Individual Nozzle Control (INC) Pro nozzle systems.

range of crops, including the notable addition of wheat, barley and canola. With real-time weed detection and treatment, farmers gain the flexibility to adapt weed control strategies by crop and field conditions, maintaining effective weed control while optimizing input use and protecting profitability and supporting long-term agronomic outcomes.

In addition to crop expansion, customers will also benefit from the new Variable Rate capability (previously only available on See & Spray Select) giving farmers prescription-like application without the need to build prescriptions. Using real-time living biomass detection from See & Spray cameras, the system automatically adjusts application rates at the nozzle level during fungicide, harvest aid/desiccation, and plant growth regulator passes. This expanded capability allows farmers to improve job quality, increase productivity, and extend the value of See & Spray into later-season applications, helping them make more efficient passes when timing and consistency matter most.

As weed resistance continues to be a challenge across various crop production systems, precision and flexibility are more critical for farmers than ever. John Deere’s expanded See & Spray technology now enables targeted application across a wider

“Season after season new challenges continue to emerge, meaning farmers must continue to adapt, as must the equipment and tools they rely on to manage their operations,” Ladd said.

“See & Spray now works across more crop conditions, and with features like variable rate, farmers enable their opportunity to save time, reduce costs and increase productivity when timing matters most.”

Alongside the expanded See & Spray capabilities, John Deere is introducing several MY27 sprayer enhancements designed to improve overall productivity, operator awareness and infield efficiency across a wider range of applications.

New center-frame camera placement, on the front of the sprayer, to reduce dust interference and enhance detection accuracy for more-consistent application quality. For operators with MY18 to MY26, these cameras will be available through a Precision Upgrade kit.

Higher operating speeds in targeted modes — up to 16 mph depending on crop and configuration, allowing more acres to be covered when application windows are tight.

Optional full boom lighting enables targeted fallow application at night to extend productive hours.

The expanded See & Spray capabilities will be available on MY27 John Deere 408R, 410R, 412R, 612R, and 616R sprayers. In addition, all Hagie sprayers – STS12, STS16, and STS20 – will now feature See & Spray Premium as a factoryinstalled option.

Model year 2027 application updates also improve maneuverability with the introduction of a Four-Wheel Steering option on the 400 Series chassis – an innovation previously available only on the Hagie sprayer lineup. The system includes a Crab Steer feature giving operators greater control in tight, irregular, or high-value crop fields.

By allowing the rear wheels to precisely follow the path of the front wheels on headlands, Four-Wheel Steer reduces crop damage, compaction, and drip tape disturbance while improving overall field efficiency. The reduced turn radius enables confident operation in tight turnrows and challenging field shapes, helping protect yield potential.

SmartView camera system improves visibility around the machine, reducing blind spots and increasing operator situational awareness.

These updates apply across the broader John Deere application portfolio:

ExactInject™ Direct Chemical Injection system adds flexibility to manage complex chemistries while increasing productivity with less clean out and change over time between fields. This solution is available as a John Deere aftermarket option for MY27 machines.

Enhanced G5Plus display experience simplifies setup, monitoring and in-field adjustments for operators.

John Deere Operations Center™ integration generates weed pressure maps, as-applied data, and savings insights accessible via web and mobile..

Estimated time-to-empty and sprayer alerts help operators and tenders coordinate refills more efficiently, reducing downtime.

AutoTrac™ Vision 2.0–ready capability for Hagie machines, available from the factory, enables enhanced guidance performance in challenging crop conditions.

John Deere remains committed to helping farmers produce more with less — less time, less cost, and less complexity. The new MY27 sprayer updates and expanded See & Spray technology is another step forward in delivering smarter, more-productive application solutions across the production system.

To learn more about the latest MY27 updates to the John Deere application portfolio, visit JohnDeere.com or contact your local John Deere dealer.

johndeere.com /JohnDeereUSCA @johndeere /john-deere

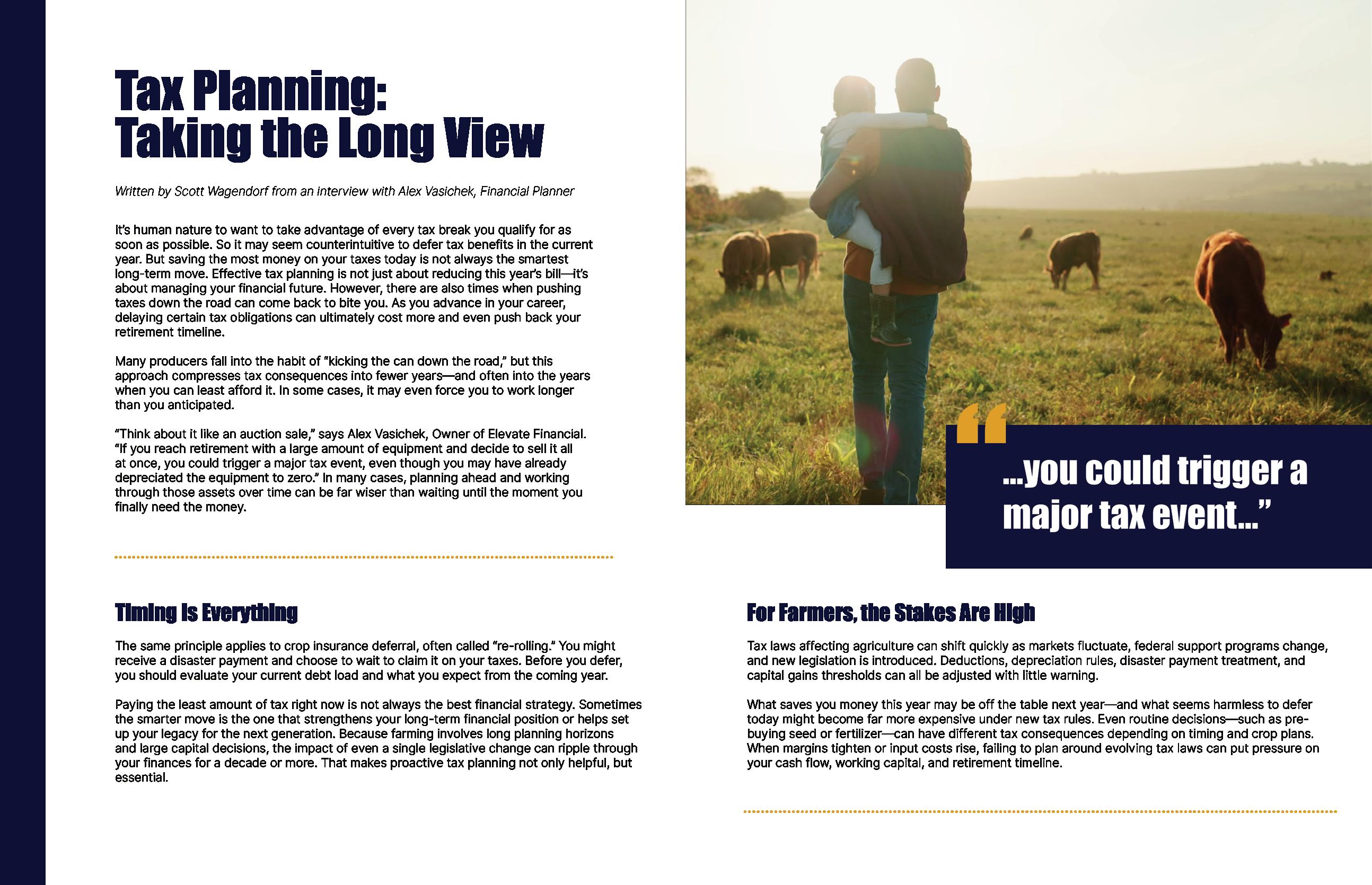

griculture has always been shaped by innovation, but the technology wave moving through farming in 2025 looks different than the mechanization booms of the past. Much of today’s transformation is about intelligence. It’s about tractors that can drive themselves, irrigation systems that can be managed from a phone, crop inputs that are increasingly guided by data, and farm decisions that depend as much on software as they do on soil.

For investors, that shift has made “agtech” one of the most compelling intersections of tradition and technology. The sector spans autonomous equipment, precision guidance systems, digital agronomy platforms, next-generation seed and crop protection companies, and even animal health firms using AI-driven diagnostics.

The companies below represent some of the most important publicly traded names shaping agriculture’s future in 2025. Some delivered strong stock performance, others struggled through a difficult equipment cycle, but each plays a major role in the modernization of farming.

AGCO has long been a major global machinery competitor through brands like Fendt, Massey Ferguson, and Valtra, but its agtech relevance in 2025 came from its accelerating focus on precision farming and platform-building.

Historically, AGCO has been strongest in specific equipment categories and international markets, but the company has spent recent years working to deepen its software and technology layer. Rather than trying to build everything internally, AGCO has leaned into partnerships and acquisitions designed to strengthen its precision ecosystem.

Its most significant strategic development is PTx Trimble, a joint venture combining Trimble’s precision agriculture business with AGCO’s own technology capabilities. The goal is to create a mixed-fleet precision platform, meaning farmers can adopt the technology even if they operate equipment from multiple brands, which is common across modern operations.

In 2025, the market viewed AGCO as a company attempting to become more resilient by expanding beyond iron sales and into higher-margin precision services. The stock still moved with the broader equipment cycle, but the precision narrative helped support investor optimism.

AGCO posted a calendar-year 2025 total return of +12.85%, as investors watched closely for evidence that its technology investments could reshape longterm growth.

CNH—owner of Case IH, New Holland, and STEYR—sits alongside Deere and AGCO in the race to define the next generation of connected agricultural machinery. The company’s agtech strategy is centered on building a fully digital fleet where machines, agronomic data, and remote services operate together.

A major challenge for precision agriculture has always been infrastructure. Advanced technology is only useful if farmers can actually connect their machines in remote rural regions. In 2025, CNH made headlines by announcing an agreement with SpaceX’s Starlink, aiming to provide satellite connectivity for customers.

CNH has also continued developing FieldOps, its digital platform designed to unify machine data, operational insights, and farm management tools.

Still, 2025 was a difficult year for CNH stock. Weakness in machinery demand and margin pressures weighed heavily on investor sentiment, even as the company’s long-term technology direction remained intact.

CNH finished the year with a calendar-year 2025 total return of -17.10%, showing how harsh the market can be on equipment makers during down cycles.

Deere remains the flagship name in global agricultural machinery, but in 2025 the company’s identity continued to evolve beyond its iconic green equipment. Deere is increasingly positioning itself not simply as a manufacturer of tractors and combines, but as a technology provider building a precision farming ecosystem.

The company’s product strategy has shifted toward integrating automation, machine vision, GPS-guided workflows, and software-based decision tools into its equipment lineup. Deere’s push into autonomy has become one of its defining themes. At CES 2025, the company showcased updated autonomous machines and next-generation autonomy kits. This has further built on their belief that self-driving capability will become a practical solution to labor shortages and tight seasonal work windows.

Deere’s long-term bet is that farms will increasingly operate like connected systems with machines collecting field data, software optimizing input usage, and automation reducing wasted time and cost. Investors in 2025 weighed that technological promise against the reality that equipment demand remains cyclical.

Despite those pressures, Deere delivered a calendaryear 2025 total return of +11.39%, reflecting steady confidence that precision technology and recurring digital revenue could gradually reduce the company’s dependence on pure machinery cycles.

Trimble occupies a unique role in agtech. It isn’t primarily a tractor company or an input supplier, but rather a foundational technology provider powering precision agriculture behind the scenes.

The company’s expertise in GPS positioning, guidance systems, steering automation, and farm software makes it one of the most important “picks-andshovels” names in the precision farming economy. Trimble technology often functions as the invisible infrastructure that allows modern equipment to operate accurately down to the inch.

In 2025, Trimble’s agricultural business became increasingly tied to the PTx Trimble joint venture with AGCO. This structural shift reflects how precision agriculture is maturing into its own standalone platform business rather than simply an add-on feature.

Trimble also continued emphasizing recurring revenue models, including subscription-based services, which investors often reward more than cyclical hardware sales.

The stock delivered a calendar-year 2025 total return of +10.88%.

Corteva represents the agtech sector from the perspective of biology and crop science rather than machinery. Formed after DowDuPont’s agriculture business separation in 2019, Corteva has become a leading pure-play company in seeds, traits, and crop protection.

Its relevance in 2025 came from the growing reality that agricultural innovation isn’t only mechanical— it’s genetic, chemical, and increasingly data-driven. Corteva operates at the center of the global push to improve yields while reducing environmental impact through more targeted inputs.

In 2025, Corteva remained a key barometer for how growers balance premium performance products against cost scrutiny during uncertain commodity conditions. Late in the year, the company also announced plans to split into two independent businesses—one focused on seeds and one on crop protection—reflecting investor demand for clearer, more specialized exposure.

Corteva posted a calendar-year 2025 total return of +18.89%, one of the stronger performances among major agtech-linked firms.

Nutrien is best known as one of the world’s largest fertilizer producers, but its agtech relevance lies in how it connects nutrients, retail agronomy, and digital farm services into a single ecosystem.

The company supplies potash, nitrogen, and phosphate, but it also operates one of the largest farm retail networks in North America. In recent years, Nutrien has invested heavily in digital platforms designed to integrate agronomy recommendations, purchasing, and operational planning.

This matters because modern farming increasingly depends on precision placement and timing of inputs, and digital tools can strengthen long-term customer relationships.

In 2025, Nutrien stock surged, reflecting renewed optimism around the fertilizer cycle and improved market expectations.

The company delivered a calendar-year 2025 total return of +43.33%, making it one of the standout performers on this list.

Bayer’s role in agtech sits within its massive Crop Science division, which includes seeds, traits, crop protection, and its well-known digital farming platform Climate FieldView.

FieldView has become one of the most widely recognized digital agriculture tools globally, enabling farmers to collect field data, analyze performance, and optimize decision-making across seasons.

Bayer’s complexity as a conglomerate means its stock is influenced by factors beyond agriculture alone, but its scale and innovation footprint keep it central to any discussion of agtech investing.

In 2025, Bayer delivered an extraordinary market move, with a calendar-year total return of +122.77%—far more than a typical steady agriculture stock performance. It was a year defined by major repricing and renewed investor attention.

Check out our interview with Bayer's Head of North

Australia, and New Zealand Product Supply Shannon Hauf!

Valmont’s agtech identity comes through Valley Irrigation, one of the world’s leading irrigation equipment providers. Water efficiency has become one of the most urgent agricultural challenges, and irrigation is increasingly driven by software, sensors, and remote management.

In 2025, Valley consolidated multiple technology offerings into its AgSense 365 platform, simplifying how growers monitor and control irrigation systems. That reflects a broader agtech trend that usability and integration matter just as much as innovation.

Valmont posted a calendar-year 2025 total return of +32.22%.

Lindsay is another irrigation leader, known for its center pivot systems and FieldNET remote management platform. FieldNET allows growers to control irrigation assets digitally by improving scheduling, reducing labor, and maximizing water efficiency.

The company represents a quieter but extremely practical corner of agtech that is focused less on AI buzzwords and more on operational necessity, especially in regions where water scarcity defines profitability.

Lindsay’s stock was essentially flat in 2025, with a calendar-year total return of +0.76%.

Zoetis is primarily an animal health company, but it increasingly overlaps with agtech through diagnostics, monitoring, and AI-powered veterinary tools.

In 2025, Zoetis launched AI-driven diagnostic capabilities within its Vetscan Imagyst platform.

Still, Zoetis had a difficult stock year, declining despite product innovation.

The company finished with a calendar-year 2025 total return of -21.75%