We are looking for business owners who like to join the

• Accounting Services

• Acupuncture

• Architect

• Architectural Interior Design

• Attorney- Family

• Auctions- Real Estate

• Bookkeeper

• Bowen Therapy

• Builder- Commercial

• Business Coach

• Business Equipment Financing

• Business Insurance

• Cabinets

• Caterer

• Graphic Designer

• Plasterer

• Chinese Medicine

• Chiropractor

• Creative Director

• Commercial Mortgage

• Computer Repair

• Computer Web Design

• Concrete

• Copywriting/Copy Editing

• Counselor/ Psychotherapist

• Dentist

• Digital Media

• Electrical Operations

• Electrician

• Finance Bookeeper

• Financial Planner

• Fitness Trainer

• Flooring

• Pilates

• Garage Doors

• General Insurance

• Health & Wellness Coach

• Homeopathy

• Lactation Consultant

• Lawn Care

• Lawyer

• Life Coach

• Loans

• Marketing

• Massage Therapist

• Meditation/Yoga

• Mortgage Broker

• Naturopathic Medicine

• Nutrition

• Osteopathy

• Painter

• Personal Trainer

• Photographer

• Plumber

• Podiatrist

• Printer

• Project Management

• Psychologist

• Real Estate Rentals

• Real Estate Sales

• Reiki

• Residential Cleaning

• Residential Mortgage

• Security

• Signs

• Solar

• Solicitor

• Travel Agent

• Website Developer

• Wedding Planner

The Find Manningham is a community paper that aims to support all things Manningham. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Manningham for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 warren@findnetwork.com.au

PUBLISHER: Issuu Pty Ltd

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local business owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmanningham) so you keep up to date with what we are doing.

We value your support,

The Find Manningham Team.

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmanningham.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: sport@manningham.com.au

WEBSITE: www.findmanningham.com.au

The Find Manningham was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with a core focus of helping other Not-ForProfits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Manningham has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Manningham is a local government area in Victoria, Australia in the north-eastern suburbs of Melbourne. Manningham had a population of approximately 125,508 as at the 2018 Report which includes 27,500 business and close to 45,355 households. The Doncaster and Templestowe Council administered the area until December 15, 1994.

The Find Manningham acknowledge the Traditional Owners of the lands where Manningham now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Manningham accepts no responsibility for financial, health or other claims published in advertising or in articles written in this newspaper. All comments are of a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

Every second Sunday of May, hearts around the world beat in unison to celebrate one of the most cherished relationships in human existence: the bond between a mother and her children. Mother’s Day, a day dedicated to honouring the women who gave us life, love, and endless support, serves as a poignant reminder of the invaluable role mothers play in shaping our lives.

In every culture, in every corner of the globe, the essence of motherhood is celebrated with great fervor. From the quiet moments of tenderness shared between a mother and her newborn to the enduring love and wisdom passed down through generations, the influence of mothers knows no bounds.

Motherhood is a journey marked by selflessness, sacrifice, and unwavering devotion. From the moment of conception, mothers embark on a remarkable voyage, nurturing life within them and embracing the profound responsibility of shaping the future. Through sleepless nights and tender lullabies, through scraped knees and broken hearts, mothers stand as the steadfast guardians of their children's dreams and aspirations.

Yet, the beauty of Mother’s Day lies not only in celebrating biological mothers but also in honouring all women who embody the spirit of maternal love. Whether it's a grandmother, an

aunt, a foster parent, or a mentor, these remarkable women leave an indelible mark on our lives, guiding us with their wisdom and showering us with their unconditional love.

As we celebrate Mother’s Day, let us take a moment to reflect on the countless ways mothers enrich our lives. Let us cherish the memories of laughter shared and tears shed, the lessons learned, and the dreams realised under their loving guidance. Let us express our gratitude not just through gifts and gestures but through acts of kindness, empathy, and understanding that honour the essence of motherhood.

In a world that often moves at breakneck speed, Mother’s Day serves as a gentle reminder to pause, to reflect, and to express our deepest appreciation for the women who have shaped us into the

individuals we are today. Whether it’s a simple, heartfelt "thank you" or a loving embrace, let us seize this opportunity to celebrate the pillars of love in our lives and to honour the boundless spirit of motherhood.

This Mother’s Day, as we gather with loved ones to celebrate the women who have touched our lives in countless ways, let us remember that the truest measure of a mother's love lies not in grand gestures or extravagant gifts but in the quiet moments of tenderness, the unspoken words of encouragement, and the eternal bond that binds us together, heart to heart, soul to soul.

So, here's to the mothers—the unsung heroes whose love knows no bounds, whose strength knows no limits, and whose legacy will endure for generations to come. Havppy Mother’s Day!

They say there are two things guaranteed in life – death and taxes. GST, or Goods and Services Tax, is a 10% tax added onto most products and services sold in Australia. It is the consumer who pays it, but every business that is registered for GST acts as the go-between, passing the tax from the consumer to the ATO.

As a small business, how do you know if you need to be registered for GST, and what does that mean? The first answer is relatively simple – when your business revenue is $75,000 or more each year, or you anticipate your revenue exceeding this amount, you must register for GST. If your revenue is less than $75,000 then you can choose whether you want to register for GST. Keep an eye on your revenue throughout the year though as once you hit that $75,000 revenue, you

Hey everyone,

will have just 21 days to register. A chat with your accountant or bookkeeper can help with this decision. A not-forprofit organisation has a threshold of $150,000 before they need to apply for GST, and a taxi/rideshare business must register regardless of their turnover.

As a GST-registered business, you must add the 10% GST onto every invoice you produce. Keep in mind though that not everything is subject to GST such as fresh food and rental income. There are also specific requirements when producing invoices depending on the amount of the invoice. I’ll cover this in a future edition.

When a client or customer pays for their goods or services, it is good practice to have a separate bank account to store the GST component. This is so that when it is time to pay the GST to the ATO, you already have it and do not need to scrounge around looking for those funds.

Keep in mind, this money is not yours

I'm thrilled to announce that I have the pleasure of assisting with judging the submissions from the 2024 Australian Wealth Management Awards finalists.

From what I’ve seen, the past year has been filled with many exemplary achievements, demonstrating the impressive abilities of individuals and businesses committed to the growth of the mortgage business industry in Australia.

All of the dedication and hard work over the past year will culminate in a huge night of celebration on 8 May at The Star, Sydney. Visit the website at http://tinyurl.com/h68342re to learn more about the awards and to secure your tickets before they sell out!

I hope to see you there on the night.

anyway so you should not consider it as revenue and spend it in your business.

Each time your business buys something or uses a service, you will also be paying GST to that other business. It is important that you receive a GST invoice so you can claim the GST back. This is called a GST credit, or input tax credit.

Every three months, you are required to complete a BAS, Business Activity Statement, to determine how much GST you need to pay to the ATO. The BAS will calculate how much GST you paid to other businesses and how much GST your clients paid to you. The difference determines how much GST you owe the ATO, or whether the ATO owes you. If you are using accounting software such as Xero, you could do this yourself, otherwise you will need to use a registered BAS Agent.

Image - https://www.xero.com/au/ guides/gst-and-bas/what-is-gst/

Does a person need to fully use their current year’s concessional contribution cap before they can access their unused concessional contribution cap from earlier financial year?

For the 2023-24 financial year, the unused concessional contribution cap can be carried forward when a person had a total superannuation balance on 30 June 2023 of less than $500,000.

Then, once they have fully used their 2023-24 concessional contribution cap of $27,500, they are able to carry forward their unused cap, starting with any unused cap from 2018-19.

This can be a very useful strategy to reduce tax in the current year for people able to maximise their salary sacrifice contributions, or to make personal tax deductible contributions.

The unused cap can be carried forward for a period of up to five years.

Therefore, from 1 July 2024, any unused cap remaining from 2018-19 will no longer be available.

However, from 1 July 2024, even though any unused cap from 2018-19 will drop off, the maximum concessional contributions available to a person who has not made any concessional contributions since 1 July 2019 will be:

Cautionary notes:

1. Reportable superannuation contributions are added back for the purpose of determining liability to pay Division 293 tax. When maximising concessional contributions, it is important to consider if all, or a part of the contributions will be subject to the additional 15% Division 293 tax.

2. If aged between 67 and 75, a contributor will need to have met the work test (or be eligible for the work test exemption) in the current financial year to be able to claim a tax deduction for their personal superannuation contributions.

Warren Strybosch

Warren Strybosch

You can call them on 1300 88 38 30 or email info@findaccountant.com.au / www.findaccountant.com.au

This information is of a general nature only. It does not take into account your particular financial needs, circumstances and objectives. You should obtain professional financial advice if you have not already done so before acting on this information. You should read the Product Disclosure Statement (PDS) before making a decision to buy or sell a financial product. Any case studies, graphs or examples are for illustrative purposes only and are based on specific assumptions and calculations. Past performance is not an indication of future performance. Superannuation, tax, Centrelink and other relevant information is current as at the date of this document.This information contained does not constitute legal or tax advice.

On 27 February 2024 the Albanese government’s proposed changes to the previously legislated stage 3 tax cuts passed both Houses of Parliament. The Bill received Royal Assent on 5 March 2024.

As a result, the tax rates that will apply to Australian resident taxpayers from 1 July 2024 are:

Being able to carry forward the unused concessional contribution cap can be very useful for, amongst other things, people wishing to manage a capital gains tax liability following the disposal of assets such as an investment property.

The changes will result in a tax cut for all Australians with a taxable income exceeding $22,575 however, for higher income earners (those with taxable income of more than ~$146,000),the tax cuts will be less than originally legislated.

By Liz Sanzaro

By Liz Sanzaro

Croydon Conservation Society has its origins in tree preservation. While this is still one of our highest priorities, we have affiliations with a number of other groups. One of these, is the group called Boomerang Alliance which began in 2003, the idea being that containers of all descriptions should be able to be boomeranged back to their place of origin. https://www.boomerangalliance. org.au/national_soft_plastics_ summit_producers_and_retailers_ urged_to_fastrack_solution

Croydon conservation society has been lobbying with Boomerang Alliance to get a container deposit scheme up and running, often being listened to, but with no foreseeable action. So, after 20 years of this lobbying, we are very pleased to see the roll out of the new refunding opportunities.

At last in Victoria, we have begun to see the first few return vending machines. The State has been divided up into 3 areas, each area is run by a different provider, lacking consistency. In the East the area is serviced by Return It, while the west is under Cleanaway and the north by Visy. Consistency would have been great, but Government contracts work in mysterious ways.

The concept is for people to collect the plastic drink bottles aluminium cans then once you have enough to make the trip worthwhile you can return them to Mitre 10 on Mountain Highway has a working recycling machine.

If left to blow around by the wind from parkland or in gutters, empty containers are caught up by storm water and end up choking our creeks.

First, they disappear down roadside drains,then into creeks this image is locally, from a litter trap in Dandenong Creek.

Some return venues are not quite where you would expect to find them and currently the refund is done over the counter at many of these sites while manufacture of these machines is underway for more locations in our area

• K&B Plus Fresh Market Croydon 126 Main Street, Croydon

• Inflatable World Ringwood (Ringwood Indoor Sports Centre) 160 New Street, Ringwood

• Eastwood Milk Bar Ringwood East 83 Bedford Road, Ringwood East

• Chinland Asian Grocery Ringwood East 52 Railway Avenue,Ringwood East

• Dorset Convenient Store & Gifts Cart 500-502 Dorset Road, Croydon South

Some people want to redeem this cash for themselves and others are doing it collectively as Scouts Australia used to many years ago by collecting and stacking beer bottles for return. Whatever your reason, the most important thing is to remove this floatable litter from getting into our waterways and potentially being washed out to sea.

When caught up like this, the creature cannot eat, and will die, a simple snip through with scissors prevents this outcome.

Polystyrene, which is a problem product, is now able to be returned locally to this location. It must be free of sticky tape, packing tape, labels, texta, glue or food. The bin for polystyrene is at 7 Bessemer Road, Bayswater North. Domestic quantities. Open 8.30 am to 5 pm Monday through Friday.

As users of materials that are dangerous to the environment and our ecology it is absolutely our responsibility to make sure that those items return in a way that does not allow them to escape into the environment. It is good to use your time to develop new habits, to ensure your recycling disposal is appropriately. Once a good habit is started, it is easy to continue and we all win the war against floatable plastic.

If you already recycle at home make sure that your milk bottle lids are either separate or if they’re taken off cut through the ring that is left this is particularly important

because this can become snagged around a limb of a bird or other creature causing deformity.

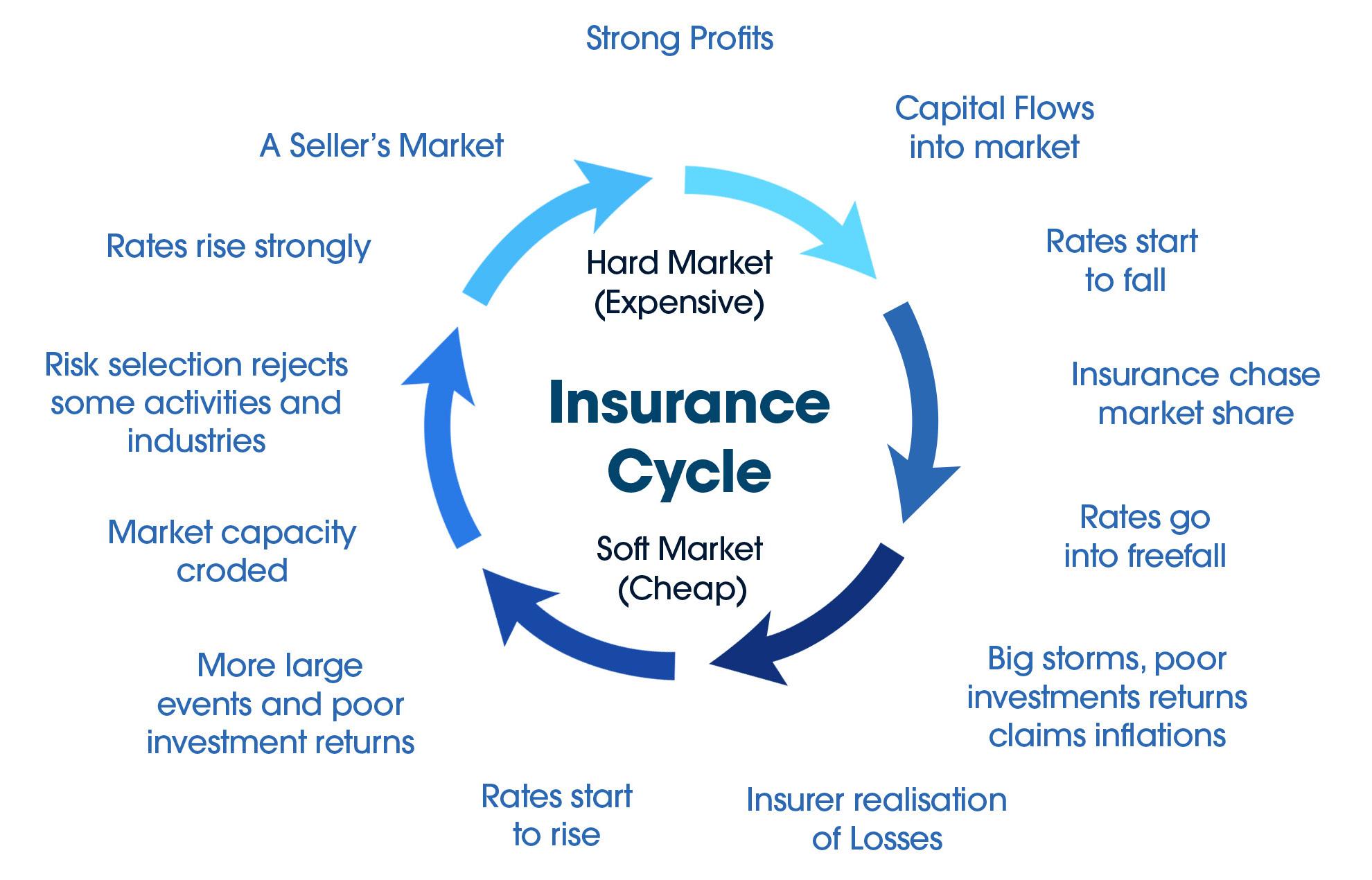

By Craig Anderson GENERAL INSURANCE

By Craig Anderson GENERAL INSURANCE

The insurance market is historically cyclical, moving through both hard and soft markets. A soft market is generally characterised by lower premiums, high limits and readily available cover. In a hard market, insurance premiums increase and insurer capacity will generally decrease. This can be caused by a number of factors:

• falling investment returns / low interest rates

• increases in frequency or severity of losses

• reduced capacity

• cost of reinsurance

• regulatory intervention

In recent years while interest rates were low, it meant that insurers could no longer rely on their investment returns to bolster unprofitable results. Insurers focussed on underwriting profitability, which meant raising premiums, tightening underwriting guidelines and being more selective about risk they were prepared to insure.

Rising interest returns for insurers and their investors, and falling loss frequency alone have not been enough to soften the market though as we have seen recently. The rapid inflationary pressure applied to claims costs has outstripped the savings created, and this has led to further increases. For example in regard to property damage losses, interest rates have now increased since 2020 by more than 3.5%, however the cost of materials like corrugated roof sheeting, plasterboard and plywood bracing have all increased in excess of 30% which is putting upward pressure on claims costs, and in turn insurance premiums.

Adding to this is the cost of the wellintentioned compliance regime implemented in the wake of the Wood Royal Commission. Insurers and Underwriting Agencies are spending more time, and more money on meeting recently imposer regulatory changes, and this has added to the staff costs which ultimately get passed on to the consumer.

A shortage of qualified applicants in the insurance industry has led to claims bottlenecks and this is adding costs due to the delays. In an effort to

shorten waiting times and to circumvent trade shortages there has been a shift towards cash settlements. Whereas the insurer may in the past have engaged the trades and supervised the works it's now harder to action, so the easier but more expensive option of cash settlements is taken. Big data has also had an impact Big data has also had an impact, as insurers can utilise more accurate flood mapping, and increase premium in a targeted way. This often means large jumps in specific areas, as opposed to a cost spreading approach. Reinsurance cost is now calculated using better long-term catastrophe models, so this additional future cost is factored in earlier. Rate adjustments are largely being driven by reinsurance markets, who are the insurers who provide the underlying capacity insurers need in order to provide their offerings to the public and businesses alike.

In relation to financial lines like Professional Indemnity, insurance claims are increasing because of social inflation, which is the societal trend towards increased litigation, broader contract terms, plaintiff-friendly legal decisions and larger jury awards (Insurance Journal, 4 December 2019). An example of this is the increased number of Securities Class Actions (think

Centro Group, Commonwealth Bank, Takata airbags) seen over recent years.

In fact in the 12 months to 31 March 2020 underwriting profitability decreased by almost 50% for most major classes of insurance, and that was before the impact of COVID-19 emerged over the following 12 months (KPMG General Insurance Insights, May 2020).

So where is the good news? The cycle always returns to a soft market eventually, and there is no reason to think that when inflation is under control, and financial conditions improve, that we will not see a return to the buyersmarket within the next few years.

Any advice in this article has been prepared without taking into account your objectives, financial situation or needs. Because of that, before acting on the above advice, you should consider its appropriateness (having regard to your objectives,needs and financial situation).

Craig Anderson

GENERAL INSURANCE

Small Business Insurance Brokers www. heightsafetyinsurancebrokers.com.au 0418 300 096

For a health check of your business insurance, contact Small Business Insurance Brokers via email sales@smallbusinessinsurancebrokers.com.au

Any advice in this article has been prepared without taking into account your objectives, financial situation or needs. Because of that, before acting on the above advice, you should consider its appropriateness (having regard to your objectives, needs and financial situation).

Local Warranwood Primary School teacher, Andrew Tonkin, is getting on his bike this July to ride 500km across Thailand to support charity Hands Across The Water.

The ride will see Andrew and other riders following the Mekong River before traversing areas not often seen by other foreigners.

The devastating effect of the 2004 Boxing Day Tsunami on the children of Thailand led to the founding of Hands Across the Water by Peter Baines. Since then, thanks to fundraisers like Andrew, over 350 children have received food, education, and a loving home after losing parents or being abandoned.

Peter Baines OAM was an NSW Police forensic investigator for 22 years and led the Australian and International teams following the tsunami. Peter was deployed into Thailand for several months leading the teams in the identification of the 5395 bodies that were recovered.

On his last rotation into Thailand he met a group of children who had all lost their parents. He then made a commitment to raise funds to contribute to the building of a home for them. That was the start of Hands Across the Water, the charity. 18 years later and there are now seven orphanages helping to take care of these children and give them everything they need to thrive, including lifesaving medication.

“Not only does the support change lives, but it saves lives. Due to a lack of life saving medicine, children were dying from HIV related illnesses. By making a long-term commitment we stopped the children dying” says Baines.

For Andrew, it is the physical and mental challenge that he is looking forward to. Being a casual rider before this event, he understands he will have to face and conquer the pain barrier that will inevitably come from pushing his body to cover the vast distances each day.

Add to that the extreme humidity that Thailand can face at that time of year with the start of the monsoon season and Andrew has his work cut out for him.

All 50 riders in the team each have a target of $5,000 to raise. If you would like to join many of the children in his classroom by donating to support Andrew, simply click on this link (https://www.handsacrossthewater. org.au/fundraisers/andrewtonkin/ red23-ride-to-provide-2024 ).

To find out more about Hands Across The Water, click here. (https://www.handsacrossthewater. org.au/event/red23-ride-to-provide-2024)

By Ethan Strybosch

By Ethan Strybosch

In today's fast-paced digital world, staying ahead of the competition is crucial for any business. One innovative tool that can give you the edge you need is an AI chatbot on your website. Here are three compelling reasons why you should consider adding this technology to your digital arsenal.

1. Increase Productivity: Businesses that utilize an AI chatbot experience a significant increase in productivity. According to recent studies, companies with an AI chatbot are able to spend 14% more time solving complex, money-making problems. This means that by incorporating this technology into your website, you can free up

more of your staff's time to focus on critical tasks, ultimately leading to increased efficiency and profitability.

2. Reduce Inquiries, Increase Efficiency: An AI chatbot can significantly reduce the number of meaningless inquiries your business receives by up to 70%. This reduction in trivial queries allows you and your team to spend more time on highvalue tasks,ultimately leading to improved productivity and customer satisfaction.

3. Generate High-Quality Leads: Implementing an AI chatbot can also lead to an immediate increase in high-quality leads for your business. Studies show that 55% of companies using chatbots for marketing purposes experience a boost in the number of highquality leads. Additionally, businesses with AI chatbots are perceived as more

legitimate and established, which can further enhance your brand's credibility and attract potential customers.

In conclusion, incorporating an AI chatbot into your website can provide numerous benefits for your business, including increased productivity, efficiency, and lead generation. By leveraging this innovative technology, you can stay ahead of the competition and take your business to new heights of success.

1. Concessional contribution cap$30,000, up from $27,500 in the 2023-2024 financial year.

Concessional contributions include superannuation contributions made by your employer, contributions salary sacrificed by you as well as contributions you make post tax that you then claim as a deduction in your tax return.

Should you exceed this amount, the excess will be treated as assessable income and taxed at your marginal tax rate. However, an offset of 15% will be given to account for the 15% tax taken when the Super fund received the excess amount.

There are additional consequences to consider if you contribute more than the allowed cap.

• There is an excess concessional contribution charge on the excess amount to offset any timing advantage gained by the tax deduction.

• You can choose to leave the money in your super fund or transfer it back out.

• If you choose to take it back out it will be treated as a non-concessional contribution which means, there will be tax owing on it. You may also trigger the application of the bring forward of non-concessional contributions.

• If you choose to leave it in your super fund, 85% of it will be paid to the ATO to cover the tax liability and excess concessional contribution charge.

Once all charges have been paid, any remaining will be paid back to the member.

2. Non-concessional contribution cap - $120,000, up from $110,000 in the 20232024 financial year.

Non-concessional contributions are superannuation contributions where a tax deduction is not or cannot be claimed.

You need to be eligible to make nonconcessional contributions.

• You must be under 75years of age

• Your superannuation balance immediately before the financial year in which the contribution is made must be less than the general transfer balance cap. In the 20242025 financial year this cap is $1,900,000.

There are certain contributions however that aren’t included in the non-concessional category. These include downsizer contributions, CGT contributions, personal injury contributions and government cocontributions.

Should you exceed the cap, the excess amount will be taxed at 47%. To avoid the 47% tax liability, you can:

The first method is to apply the “bring forward” of non-concessional contributions. See below for more detail on this.

Withdraw the excess amount plus an additional 85% of the associated earnings. The 85% associated earnings needs to be included in your assessable income. The associated earnings are determined by a statutory rate of return. For the 2023-2024 financial year, this rate is 11.19%.

3. Bring forward (non-concessional contribution) cap - $360,000, up from $330,000 in the 2023-2024 financial year.

The “Bring Forward” allows you to make up to three years’ worth of non-concessional contributions in advance. Eligibility for this is includes:

• You are under 75years of age

• Your super balance is less than the general transfer balance cap - $1,900,000 for the 2024-2025 financial year

4. Transfer balance cap - $1,900,000, no change from the 2023-2024 financial year.

The transfer balance cap has two functions:

• Limit the amount of non-concessional contributions you can make to your super fund

• Limit the amount of superannuation that can be transferred to earnings tax exempt (retirement) phase.

5. CGT cap amount - $1,780,000, up from $1,705,000 in the 2023-2024 financial year. If you make a small business capital gain and take advantage of the 15year concession, you can make a nonconcessional superannuation contribution for that amount without affecting your non-concessional cap. Instead, this amount will count towards your CGT cap which is a lifetime cap rather than an annual cap.

This contribution is not reliant on your super balance being less than $1,900,000.

This means that if your CGT contribution will cause your super balance to go over the $1.9m balance, this will affect your ability to make non-concessional super contributions.

Additionally, if you have previously contributed up to the CGT cap in a previous year, you can make further cgt contributions in subsequent years up to

the increase in value each year. For example, if you have made contributions of $1,705,000 by the end of the 2024 financial year, you can then make a further contribution of $75,000 in the 2025 financial year.

6. Division 293 tax threshold - $250,000, no change from the 2023-2024 financial year.

If your Adjusted Taxable Income (ATI) exceeds $250,000 you will be subject to an additional 15% tax on either:

• The amount of the concessional contribution that causes your Taxable Income (TI) to exceed $250,000 OR

• The amount your Adjusted Taxable Income (ATI) exceeds $250,000, whichever is the lesser amount.

The ATI is the sum of you Taxable Income (TI) plus reportable fringe benefits plus reportable superannuation contributions plus total net investment losses.

7. Low-rate cap amount - $235,000, up from $230,000 in the 2023-2024 financial year. This is a cap on the amount of taxable components (taxed and untaxed elements) of a superannuation lump sum payment which can receive:

• A nil rate rather than a 15 per cent (taxed elements) or

• A lower rate of 15 per cent rather than the 20 per cent rate (untaxed elements) This only applies to

superannuation lump sum payments made to a member who has attained their preservation age and is less than age 60.

8. Preservation age and pension drawdown rates

There are no changes to either the preservation age or to the age-related pension drawdown rates.

You can call them on 1300 88 38 30 or email info@findaccountant.com.au / www.findaccountant.com.au

This information is of a general nature only. It does not take into account your particular financial needs, circumstances and objectives. You should obtain professional financial advice if you have not already done so before acting on this information. You should read the Product Disclosure Statement (PDS) before making a decision to buy or sell a financial product. Any case studies,graphs or examples are for illustrative purposes only and are based on specific assumptions and calculations. Past performance is not an indication of future performance. Superannuation, tax, Centrelink and other relevant information is current as at the date of this document. This information contained does not constitute legal or tax advice.

The ATO has advised that it will acquire account identification and transaction data from crypto designated service providers for the 2023-24 financial year through to the 2025-26 financial year (inclusive).

The data items will include:

a) Client identification details (names, addresses, date of birth, phone numbers, social media account and email addresses); and,

b) transaction details (bank account details, wallet addresses, transaction dates, transaction time, transaction type, deposits, withdrawals, transaction quantities and coin type).

The ATO says the data will be acquired and matched to ATO systems to identify and treat clients who failed to report a disposal of crypto assets in their income tax return.

Polycystic Ovary Syndrome (PCOS) is a complex endocrine disorder caused by androgen excess. Androgens are male hormones which can be characterised by significant facial hair and seen in hormonal blood tests. Because the disease can present very differently amongst women, there can be a lot of confusion about what the best treatment to bring these high androgen levels back within their normal range. The disease is characterised by hormonal imbalance, irregular menstruation (often months without a cycle), and sometimes the presence of small cysts on the ovaries. According to Dr. Lara Briden, there are four types of PCOS: insulin-resistant PCOS, inflammatory PCOS, post-pill PCOS, and adrenal PCOS.

Insulin resistance, leading to hyperinsulinemia can cause the increase in androgen production by the ovaries. Excess androgens, such as testosterone, can disrupt normal ovarian function, leading to irregular ovulation. If this is the cause of your PCOS, the first step is to regulate your insulin levels. This is best done with a combination of diet, herbal medicine and nutritional products.

allergies or autoimmune disease can stimulate the ovaries to increase cause, it may take longer to get your hormones under control, and the process will look different depending on the symptoms. As a naturopath, I spend time at every appointment to look and treat the cause of the problem and well as the current symptoms. So, in this case, treatment would also involve the immune system, and possibly removing allergens.

If you have recently come off the pill (or other hormonal contraception), you can have a temporary increase in androgens, but this should stabilise and your period return given time. If not, or if you have significant acne, herbal medicine is one of the best ways to regulate your hormones. There are so many herbs that effect oestrogen and androgen levels, and if the problem was caused by the birth control pill, your hormones can be bought under control in a relatively short time.

Adrenal PCOS is less common and largely genetic. This is best treated with herbal medicine and homeopathy to target the adrenal glands.

For those that do have PCOS and are planning to conceive, allow plenty of time to bring your hormone levels under control. Depending on how long you have had an absent period, and the

extent of other disease states, I would aim to have an established cycle at least 6 months prior to conception. If you do have an absent or very irregular period, regardless of the cause, I have seen great results in my clinic in not only returning the cycle back to normal, but also in treating period pain, hormonal acne,and hormonal mood dysregulation.

Kathryn Messenger

BHSc (Naturopathy)

kathryn@wholenaturopathy.com.au

Suite 1 53/1880 Ferntree Gully Rd

Mountain Gate Shopping Centre

Ferntree Gully, Victoria

This advice is general in nature and not intended to be prescriptive. For individualised prescriptive advice, please see a naturopath or other health care practitioner.

The time you’ll spend in retirement and the lifestyle you’re planning both make a difference to the savings and income you’ll need. Being realistic and getting clear about plans for your future can help you figure out the cost of your ideal retirement.

People who are retired re-evaluate priorities and where you are willing to spend the money”.

Donna, aged 66, retired for two years.

Start with a ballpark estimate

Retirement Standard figures from The Association of Super Funds of Australia (ASFA) make a good starting point for estimating the income you might want or need. By comparing these calculations with your own spending plans, you’ll get a rough idea of how your overall spending in retirement could add up.

The Retirement Standard estimates the total annual budget for either a comfortable or modest lifestyle for retired singles and couples. Figures are updated each quarter in line with the changing costs of living in retirement and include detailed budget breakdowns for all sorts of living costs. What they don’t include is rent or home loan payments. Each estimate assumes an individual or couple live in their own home, mortgage free.

“I’ve always lived on a budget and live comfortably... I still believe in budgeting, wise spending, but I don’t feel restricted.

Help the local community know you exist and what sets you a part compared to other aged care facilities, Financial Planners and other providers in the local area.

We have developed Find Aged Care Services (www.findagedcare. services) so you can promote your facilities and services to the general public. You can also place any job vacancies on our website that is available in your facilities.

By Warren Strybosch

By Warren Strybosch

The tax-free portion of a genuine redundancy or approved early retirement scheme for 2024/25 is $12,524 plus $6,264 for every completed year of service.

The superannuation guarantee contribution rate is legislated to increase to 11.5% from 1 July 2024.

The maximum SG contributions base will be $65,070 per quarter or $260,280 per annum. Employers are not required to pay SG contributions on amounts over this threshold.

The maximum Government co-contribution amount of $500 is available where income is less than $45,400. The higher threshold above which the co-contribution will not be paid is $60,400.

The Low Income Superannuation Tax Offset income threshold is $37,000 and is not indexed.

When a superannuation death benefit is paid as a death benefit income stream, how is the minimum pension calculation performed?

As we know, there are minimum pension standards that apply to retirement income streams such as account-based pensions. These minimum payments are based on the age of the client and the account balance at 1 July each year or at the commencement of the pension.

However, when a death benefit account-based pension commences, the minimum pension payments that must be received by the beneficiary (usually the surviving spouse) will depend on whether the account-based pension automatically reverted to the beneficiary or not.

The following table provides a comparison of the minimum payment requirements in the financial year the death benefit pension started based on whether the pension automatically reverted to the beneficiary or not.

new death benefit pension is commenced by the beneficiary (eg BDBN to spouse)

As a new ABP has started in the financial year, the minimum income is calculated based on the purchase price and age of the beneficiary at commencement.

The minimum payment is prorated based on the number of days remaining in the year.

The deceased’s ABP automatically reverts to the beneficiary

1 July 2023 to 22 September 2023

&0 Alex had not yet received a pension payment in the year before his death and there is no requirement to pay the minimum when the full commutation was made due to his death.

23 September 2023 to 30 November 2023

31 November 2023 to 30 June 2024

Where the deceased owned an ABP at death, the requirement to take a pro rata minimum payment that normally applies with a full commutation of an ABP does not apply.

An exemption to the pro rata rules exists where the commutation occurs as a result of the pensioner’s death.

There is also no minimum payment requirement for the period between death and starting the new ABP in the beneficiaries name

As the pension payments from the deceased’s ABP continue to the beneficiary without a commutation, the minimum payment amount as calculated on the 1 July for the deceased continues to apply until the end of the financial year.

In the year of death (only), the beneficiaries age and the account balance is irrelevant for minimum payment requirements.

Pro rata rules to not apply in this situation.

The full year’s minimum drawdown will be met from:

- The pension payments received by the deceased (if any), plus

- The pension payments received by the reversionary beneficiary.

Alex (age 65) and Sarah (63) both have account-based pensions that were valued at $600,000 and $650,000 respectively on 1 July 2023. They have nominated each other as beneficiary under a non-lapsing binding death benefit nomination.

Alex has an annual minimum pension payment of $30,000 and Sarah’s minimum is $26,000. They have both elected to receive their pension payments quarterly with the first payment for the year due on 30 September 2023.

Alex dies on 22 September 2023 and therefore did not receive a pension payment before his death. Sarah ultimately decides to commence a new death benefit account-based pension with the proceeds from Alex’s super which is now valued at $615,000 on 31 November 2023.

In this financial year, how much income must be received from Alex’s account-based pension that is now in Sarah’s name?

$0 No minimum payable as the death benefit pension had not yet commenced.

$14,290 Pro rata minimum payable based on 212 days remaining in the year, Sarah’s age and the starting balance of $615,000.

Total income Fy 24: $14,290

What would happen in the same scenario if Alex’s account-based pension automatically reverted to Sarah under a reversionary nomination?

As the pension already existed on the 1 July 2023 when Alex’s minimum pension payment was calculated as $30,000 and the account-based pension was not commuted at time of death, Sarah is required to receive the full minimum amount of $30,000 by the end of the financial year.

As Alex died before the first pension payment of the year was received, Sarah would have to receive $30,000 between 23 September 2023 and 30 June 2024.

Erryn Langley

1300 557 144 | erryn@findwealth.com.au www.findwealth.com.au

Financial Planning is offered via Find Wealth Pty Ltd ACN 140 585 075 t/a Find Wealth. Find Wealth is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No.449221). Part of the CentrepointAlliance group https://www.centrepointalliance. com.au/

Erryn Langley is Authorised representative (No. 1269525) of Alliance Wealth Pty Ltd.

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

In great news for local biodiversity and wildlife habitat, Manningham Council has received a second round of funding to monitor and control the wild deer population.

Manningham Council’s deer monitoring and control project was launched in 2017 and has expanded over this time to support deer control on 45 properties across our green wedge.

Manningham Mayor, Councillor Carli Lange, welcomed the Victorian Department of Energy, Environment and Climate Action grant funding, saying

wild deer continued to pose a major environmental threat in Manningham by destroying native vegetation, ring barking native trees and eroding waterways through their grazing behaviours.

“The funding we have received from the state government to fund the program has resulted in the removal of 227 deer from Manningham, with a visible reduction in the damage to native trees, our waterways, and biodiversity.”

The funding means Council will continue to support fully funded deer control on eligible green wedge properties until

June 2025 through its Local Environment Assistance Fund (LEAF) grant program.

“This is a great outcome for landowners, I’d encourage anyone who is interested in joining the program to visit our website,” Cr Lange said.

For more information about our land management grants visit:

manningham.vic.gov.au/deer-control

To report deer sightings and damage contact environment@manningham.vic. gov.au

Educators are excitedly welcoming families back to the new-look Tunstall Square Kindergarten in term two, following the completion of its muchanticipated upgrade and expansion.

Manningham’s Mayor, Councillor Carli Lange,said the upgraded facility will better meet the needs of children, families and the teaching team at the kindergarten.

“Tunstall Square Kindergarten now offers upgraded, welcoming facilities that are enhanced by an amazing range of equipment and resources to support children’s learning,” Cr Lange said.

“Children will love the new multi-use softfall rubber, synthetic grass play zone, and water pump and creek water play

area. It’s all about learning through play.” The kindergarten expansion includes:

• a second kindergarten room, offering an extra 52 enrolments

• upgraded accessible ramp and external entrance to provide universal access

• partial playspace upgrades and landscaping including a new multiuse softfall rubber undersurfacing synthetic grass play zone, water pump and creek water play area

• improved new entry into the neighbouring Maternal and Child Health Centre

• new pedestrian path link from Russell Crescent into St Clems Reserve and car park

• mprovements to the Maternal and Child Health Centre (to be completed in April/May).

The design also incorporated sustainable features, such as energy efficient solar PV systems, energy efficient lighting and eco-friendly, sustainable materials.

This project was delivered in partnership with the Victorian Government and the kindergarten.

For more information, visit: yoursay. manningham.vic.gov.au/tunstall-squarekindergarten-expansion

Manningham Council is inviting the community to have their say on its Manningham Residential Discussion Paper, with insights to help shape the future of housing in Manningham.

Over the next 12 years, Manningham’s population is expected to increase by around 18,000 people, to more than 144,000 people. This means around 8,000 new homes will be required across Manningham.

Council is reviewing the Manningham Residential Strategy 2012 to help plan for and manage future housing growth and change – so that it best meets the ongoing needs of the community. The Residential Strategy will consider the type of homes required for the future, where new homes should be built and how to provide greater housing choice. Manningham Mayor, Cr Carli Lange said, “Manningham is renowned for its balance of city and country, admired for its unique range of urban

and leafy suburbs, rural lifestyle areas and vibrant activity centres”.

“Our current Residential Strategy has been successful in guiding how we have managed growth across Manningham – directing higher density development into the right locations,” Cr Lange said.

“When planning for future housing, it’s important that we support the emerging needs of our growing community, while also respecting the valued neighbourhood attributes of Manningham.

“We also need to carefully plan and manage the future of housing to provide for a range of incomes, lifestyles and life stages,” Cr Lange said.

The first stage in developing the new Residential Strategy is the preparation of the Manningham Residential Discussion Paper. The Discussion Paper considers a range of housing matters, including

the existing and future housing needs of the Manningham community.

Community feedback on the Discussion Paper will help Council better understand community views, priorities, needs and expectations relating to housing. It will help inform the preparation of the draft Manningham Residential Strategy, which Council plans to exhibit for community consultation in 2025.

The short survey closes on 19 May 2024. Survey participants will have the opportunity to enter the draw to win one of three $100 Westfield gift vouchers.

Council is also running two focus group sessions in May, to discuss the future of housing in Manningham.

For more information and to complete the survey, visit yoursay.manningham. vic.gov.au/residential-strategy.

Manningham Council is creating principles to guide good design for neighbourhood activity centres and is inviting the community to contribute.

With the population expected to increase to more than 140,000 people in the next 12 years, activity centres will play an integral role in accommodating urban growth and development in Manningham.

Consultation is now open for the Activity Centre ‘Design Concepts’ which include objectives under six key themes:

1. Building height

2. Residential interfaces

3. Architectural presentation

4. Public realm

5. Sustainability

6. Access and carparking.

Manningham Mayor, Councillor Carli Lange said, “We want to hear from the community on how we can best accommodate growth and development, while ensuring that our activity centres and surrounding neighbourhoods maintain their liveability”.

“If you’re a resident, chances are you regularly visit at least one of

our vibrant activity centres across the municipality,” Cr Lange said.

“We want to ensure that they continue to provide desirable destinations for people to live, shop, work and play – offering a range of retail, office and business opportunities, housing, community and education facilities,” Cr Lange added.

Community feedback will help inform development of the Activity Centre Design Guidelines (Guidelines).

The Guidelines will aim to ensure future development meets the community’s emerging needs and achieves vibrant centres that make a positive contribution to Manningham’s character and neighbourhoods. They will also consider economic, social and environmental outcomes.

When adopted, the Guidelines will be implemented through an amendment to the Manningham Planning Scheme. They will then be used to assess planning permit applications in activity centres.

They will apply across nine neighbourhood activity centres in Manningham, including:

• Bulleen Plaza

• Donburn

• Doncaster East Village (Devon Plaza)

• Jackson Court

• Macedon Square/ Plaza

• Park Orchards

• Templestowe Village

• Tunstall Square

• Warrandyte Goldfields

The draft Guidelines will be exhibited for community consultation in 2025.

For more information and to complete the short survey, visit yoursay.manningham.vic.gov.au/ activity-centre-design-guidelines

Survey closes on Sunday 16 June. Survey participants will have the opportunity to enter the draw to win a $100 Westfield gift voucher.

Attend a focus group session

Council is also running two focus group sessions in May to discuss how to best manage growth across our activity centres.

At these sessions, we will also discuss the future of housing across Manningham, as part of our Residential Discussion Paper consultation, and the Victorian Government’s new plan for Victoria.