SUSTAINABILITY NEWS

Prepared by S Scruggs and L Sterne

FOCUS TOPIC:

REPORTING

DIRECTIVE (EU) 2022/2464 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL OF 14 DECEMBER 2022 AMENDING REGULATION (EU) NO 537/2014, DIRECTIVE 2004/109/EC, DIRECTIVE 2006/43/EC AND DIRECTIVE 2013/34/EU, AS REGARDS CORPORATE SUSTAINABILITY REPORTING

On 5 January 2023 Directive 2022/2464 came into force that amends several regulations and directives which relates to Corporate Sustainability Reporting. In short, the EU now requires all EU-listed undertakings, EU-based large undertakings, and NonEU Parent Companies (subject to the criteria provided) to prepare and publish a report in which organizations will need to share data and provide management commentary on various prescribed topics.

The CSRD aims to improve the disclosure process by creating a consistent way to understand and compare an organization's ESG impact, affording companies, stakeholders, and investors an opportunity to make better-informed decisions based on sustainability data. Companies will, therefore, no longer have the luxury of cherry-picking which sustainability information they wish to share.

The EU’s commitment to sustainability has led to a wave of new legislation. In this edition we take a look at requirements for Corporate Sustainability Reporting in the future and how it will impact our business. Longer-term, the overarching goals of the CSRD are to reduce climate risk and improve overall EU sustainability, combined with Europe’s 2050 climate-neutrality target and European Green Deal initiatives.

WHY DOES CSRD MATTER?

CORPORATE SUSTAINABILITY REPORTING

HOW DID CORPORATE SUSTAINBILITY REPORTING COME ABOUT?

The term corporate social responsibility ("CSR") first appeared in the 1950s. In the 1980s, CSR started adopting more of an "environmental dimension," whereafter the concept of sustainability reporting covering the social, environmental, and economic dimensions was established during the 1990s. With transparency becoming increasingly important and, with that, holding companies accountable for their environmental and social impacts, Denmark, in 2008, became one of the first countries to implement mandatory non-financial reporting requirements for larger companies.

Sustainability reporting is a form of non-financial reporting that enables companies to convey their progress toward goals on a variety of sustainability parameters, including environmental, social, and governance metrics. Sustainability reporting is a valuable tool as it assists businesses in identifying risks and opportunities that may impact their long-term performance. It also provides a means to improve transparency and enhance a company’s brand image by demonstrating corporate responsibility.

STANDING TALL

ECOBAT HAS PUBLISHED CORPORATE SUSTAINABILITY REPORTS IN 2023 AND 2024

In addition, Ecobat, as part of our commitment to society, our people and the environment, completes an annual assessment of our business sustainability practices through EcoVadis (the global standard for business sustainability ratings). The EcoVadis assessment includes 21 sustainability criteria across 4 core themes: Environment, Labor & Human Rights, Ethics and Sustainable Procurement.

In our latest rating, we earned a Gold status, which places us in the top 5% among more than 125,000 companies spanning over 200 sectors and 180 countries evaluated by EcoVadis.

“At Ecobat, we provide an essential service and value proposition to the world. We incorporate a business model that focuses on recycling in a circular environment We strive to deliver products in a timely fashion that are designed for longevity and extended product use with exceptional quality and service ”

TOM SLABE (CEO)

EU CORPORATE SUSTAINABILITY REPORTING

CSRD EXPECTATIONS

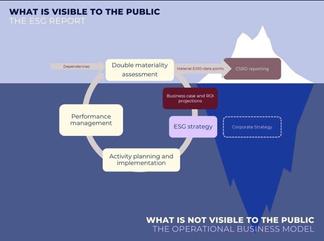

CSRD reporting is based on the concept of “double materiality”, therefore, recognizing and understanding that a company's impact on the environment and society is material to its financial performance. This concept requires companies to disclose not only how sustainability issues affect them, but also how their operations and activities affect the environment and society at large. By example, this means that a company is not only required to show its energy usage and cost, but also how that energy use impacts the environment, its targets for reducing that impact as well as information on how achieving said target will affect the organisation financially.

In December 2023 the ESRS was published in the Officail Jouranl of the EU as a legally binding document.

The European Financial Reporting Advisory Group (EFRAG), who is responsible for the new directive standards on behalf of the European Commission, released its first set of European Sustainability Reporting Standards (ESRS) in 2022. The ESRS outline the metrics companies must report and how to report them to comply with CSRD disclosure requirements. There are 12 ESRS in all, which detail disclosures and metrics across sustainability matters in 4 categories: Cross-Cutting; Environmental, Social & Governance.

CSRD IS JUST THE BEGINNING

Subsequent to the CSRD the EU also published a Corporate Sustainability Due Diligence Directive 2024/1760 which entered into force on 25 July 2024.

CORPORATE SUSTAINABILITY DUE DILIGENCE

DIRECTIVE (EU) 2024/1760 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL OF 13 JUNE 2024 ON CORPORATE SUSTAINABILITY DUE DILIGENCE AND AMENDING DIRECTIVE (EU) 2019/1937 AND REGULATION (EU) 2023/2859

AN OVERVIEW OF THE CSDDD

The CSDDD places a duty on companies that meet a specific criteria to identify and address adverse human rights and environmental impacts and their respective chain of activities. This will include a company’s upstream business partners, which relate to the production of goods or provision of services including sourcing, manufacture, transport, storage and supply of raw material, and products as well as a company’s downstream business partners concerning the distribution, transport and storage of products and services.

The CSDDD further, requires companies to put forward plans which demonstrates its efforts toward becoming carbon neutral by adopting specific plans to address climate change by, for example, reducing its carbon footprint and green house gas emissions.

The CSDDD will apply to EU companies that, amongst others, employ more than 1000 people, and achieved a net worldwide turnover of EUR 450 million during its last financial year as well as non-EU companies that generated a net turnover in the Union of more than EUR 450 million in the preceding financial year and has maintained same for two consecutive finanical years. Companies are expected to start reporting by 2027.

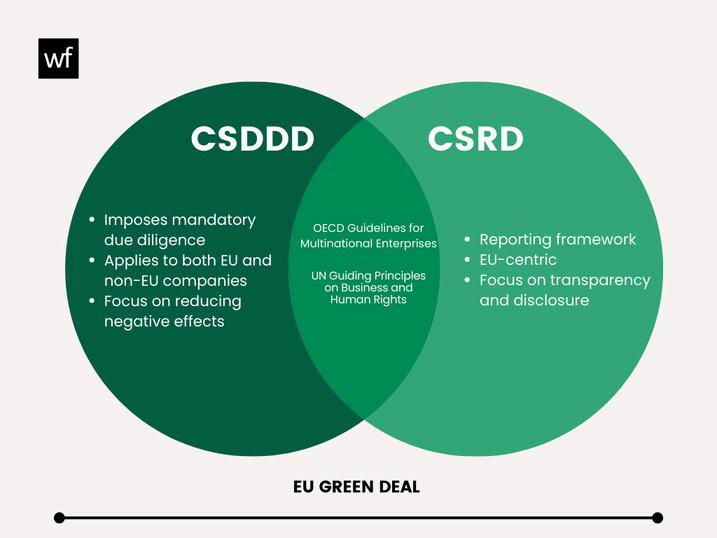

The CSDDD and the CSRD have a very similar aim, which is to ensure companies’ transparency throughout the supply chain. However, there are a number of differences?

In comparison the CSDDD requires:

Mandatory due diligence - CSDDD outlines due diligence steps that companies must take. Companies covered by the CSDDD are legally obliged to investigate and address how their operations and supply chains impact the environment and human rights.

Global application - Applies to both EU and non-EU companies and expands its actions to wherever they operate and source globally.

Reducing negative effects - The main objective of the CSDDD is to make ensure that companies take measurable actions to reduce or stop any harmful effects their activities might have on the environment and human rights.

On the other hand the CSRD requries:

Reporting framework - CSRD establishes reporting guidelines on how companies should communicate information on their sustainability effort and practices as per the ESRS.

EU-centric: CSRD is primarily focused on, and designed for companies within the EU.

Transparency and disclosure - The main goal of CSRD is to ensure consistent and comparable reporting of ESG performance.

DIRECTIVES VS REGULATIONS

A directive sets binding goals but allows each Member State to choose how to achieve them through national legislation.

A regulation applies uniformly across all EU Member States and becomes enforceable as law immediately.

WHAT IS NEXT?

During the past year Ecobat has already partnered with experts in the field to assist with the identification and scoping of its CSRD reporting requirements. Ecobat has also already started engaging in several processes, such as the implementation of Exiger and publication of the Third Party Code of Conduct in support of the CSRD and has assigned dedicated resources to assist with data processing and strategic planning.

In the coming year, Ecobat will set out to collect and collate data from its EU operations to produce a Consolidated Corporate Sustainability Report for 2024

We look forward to engaging with your Department in our data collection efforts and invite your thoughts and feedback regarding Corporate Sustainability Reporting.

HITTING THE MARK

The CSRD and CSDDD places a positive duty on companies to take such measures that is appropriate, to ensure that it is capable of achieving its sustainability objectives and targets Such measures include, amongst others: Identifying its risks and acting upon it by developing and implementing prevention action plans; Seeking assurance from business partners in order to verify their compliance to due dilligence policies adopted by the Company; Making financial or non-financial investments, adjustments or upgrades to operational processes and infrastructures; Modifying the Company's strategies and operations to include sustainable purchasing, design and distribution practices; Addressing impacts by means of remediation, where so required.

FINAL THOUGHTS

From a US perspective, California has passed 2 new laws requiring companies to disclose their carbon emissions and climate-related financial risks.

Of importance to Ecobat is the Climate-Related Financial Risk Act (Bill 261) which mandates that companies disclose the threats they face as a result of climate change.

Bill 261 requires business entity with annual revenue over $500M USD doing business in California to prepare and submit a biannual climate-related financial risk report, publicly disclosing their climate-related financial risks and the measures they’re taking to mitigate these risks.

Submissions will be reviewed by the Climate-Related Risk Disclosrue Advisory Group that will identify inadequate reports, as well as propose additional policy changes and best practices for disclosure.

The bill also addresses the financial risks businesses could face if they are unprepared for the transition toward a low-carbon economy.

Initial climate risk disclosure reports will be due by 1 January 2026.

PleasecontactLiezlSterneatliezlsterne@ecobatcom

Also, please join us for our monthly broadcast and information onCorporateSustainabilityReportingon30October2024.