SPECIAL TOPIC

SPECIAL TOPIC

EAGE NEWS GET 2025 returns to Rotterdam

INDUSTRY NEWS Norway confirms APA winners

TECHNICAL ARTICLE Unsupervised clustering for geomorphological interpretation

Engage with industry experts and researchers in a collaborative environment, exploring cutting-edge advancements shaping the future of near-surface geoscience and engineering. Register now to secure your spot at this premier event in scenic city of Xi'an, China!

CHAIR EDITORIAL BOARD

Clément Kostov (cvkostov@icloud.com)

EDITOR

Damian Arnold (arnolddamian@googlemail.com)

MEMBERS, EDITORIAL BOARD

• Lodve Berre, Norwegian University of Science and Technology (lodve.berre@ntnu.no)

Philippe Caprioli, SLB (caprioli0@slb.com) Satinder Chopra, SamiGeo (satinder.chopra@samigeo.com)

• Anthony Day, PGS (anthony.day@pgs.com)

• Peter Dromgoole, Retired Geophysicist (peterdromgoole@gmail.com)

• Kara English, University College Dublin (kara.english@ucd.ie)

• Stephen Hallinan, Viridien (Stephen.Hallinan@viridiengroup.com)

• Hamidreza Hamdi, University of Calgary (hhamdi@ucalgary.ca)

Fabio Marco Miotti, Baker Hughes (fabiomarco.miotti@bakerhughes.com)

Susanne Rentsch-Smith, Shearwater (srentsch@shearwatergeo.com)

• Martin Riviere, Retired Geophysicist (martinriviere@btinternet.com)

• Angelika-Maria Wulff, Consultant (gp.awulff@gmail.com)

EAGE EDITOR EMERITUS Andrew McBarnet (andrew@andrewmcbarnet.com)

PUBLICATIONS MANAGER

Hang Pham (publications@eage.org)

MEDIA PRODUCTION

Saskia Nota (firstbreakproduction@eage.org) Ivana Geurts (firstbreakproduction@eage.org)

ADVERTISING INQUIRIES corporaterelations@eage.org

EAGE EUROPE OFFICE

Kosterijland 48 3981 AJ Bunnik

The Netherlands

• +31 88 995 5055

• eage@eage.org

• www.eage.org

EAGE MIDDLE EAST OFFICE

EAGE Middle East FZ-LLC Dubai Knowledge Village PO Box 501711

Dubai, United Arab Emirates

• +971 4 369 3897

• middle_east@eage.org www.eage.org

EAGE ASIA PACIFIC OFFICE

EAGE Asia Pacific Sdn. Bhd.

UOA Centre Office Suite 19-15-3A No. 19, Jalan Pinang 50450 Kuala Lumpur

Malaysia +60 3 272 201 40

• asiapacific@eage.org

• www.eage.org

EAGE LATIN AMERICA OFFICE

EAGE Americas SAS Av. 19 #114-65 - Office 205 Bogotá, Colombia

• +57 310 8610709

• americas@eage.org

• www.eage.org

EAGE MEMBERS’ CHANGE OF ADDRESS Update via your MyEAGE account, or contact the EAGE Membership Dept at membership@eage.org

FIRST BREAK ON THE WEB

www.firstbreak.org

ISSN 0263-5046 (print) / ISSN 1365-2397 (online)

29 Unsupervised clustering as a tool for geomorphological interpretation: a case study from a Sarmatian delta in Romania’s Dacian Basin

Luca Fava

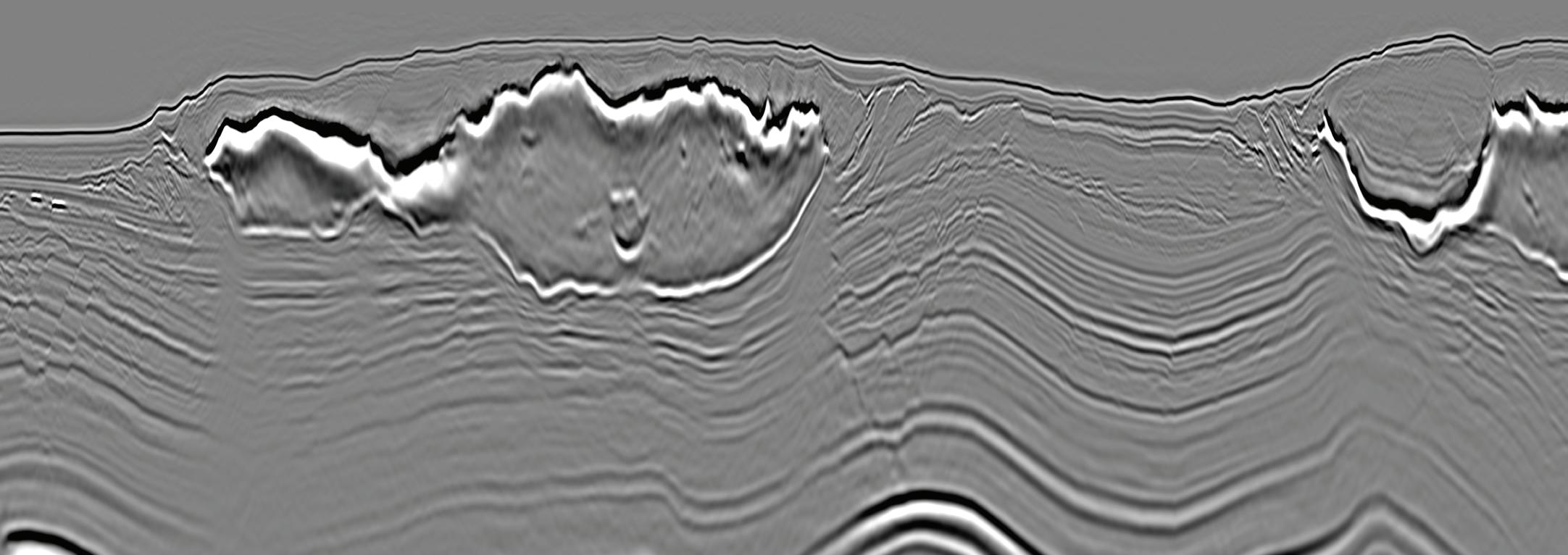

41 Twenty five years of monitoring the Troll gas and oil field with time-lapse gravity and seafloor deformation surveys

Siri Vassvåg, Felix Halpaap, Charlotte Faust Andersen and Laust Jørgensen

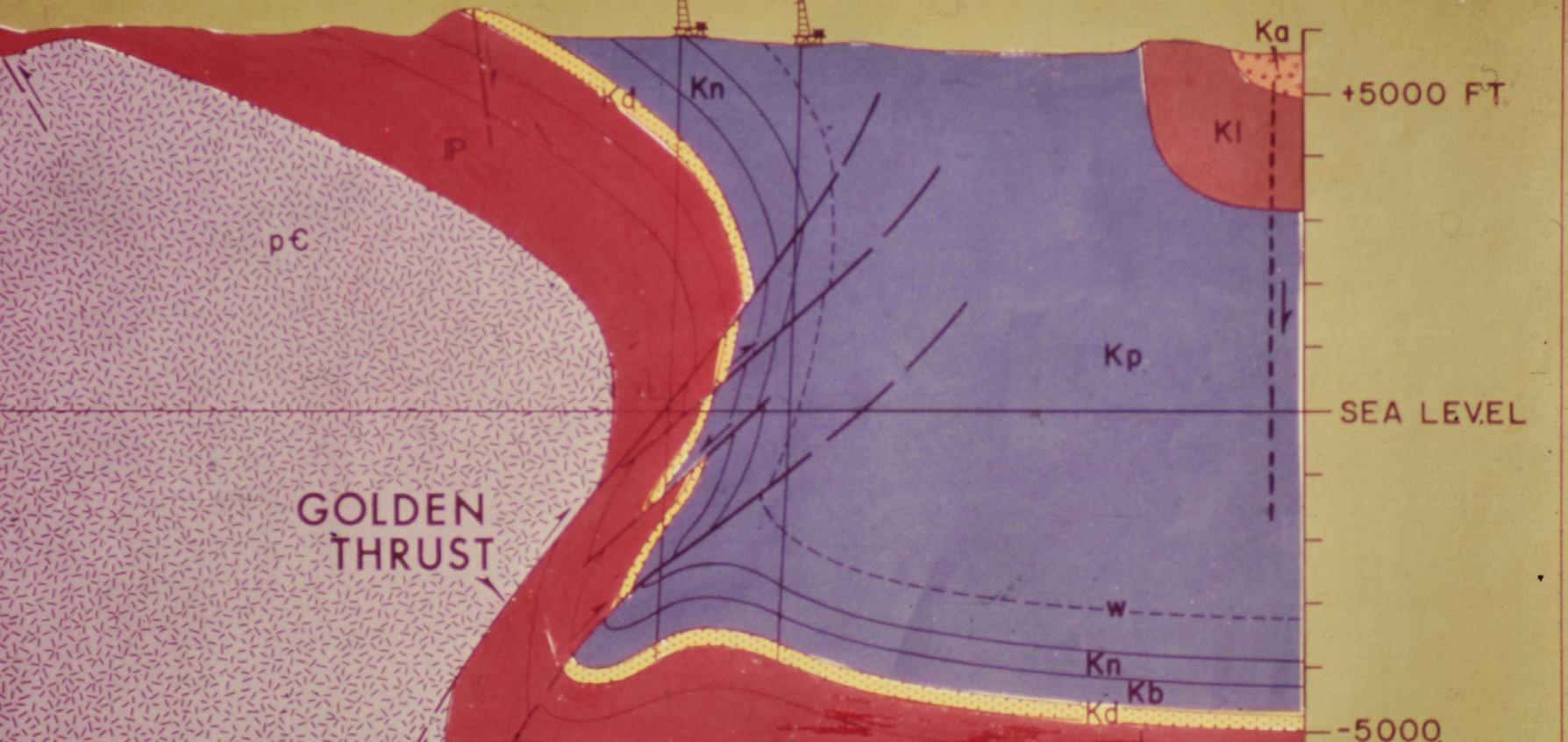

47 Musings on the Golden Fault and the Front Range Zone of Flank Deformation

Tom Davis

53 Ametista Block – An unusual prospect in Santos Basin – Albian atoll upon exhumed mantle

Pedro V. Zalan, Milos Cvetkovic, Henri Houllevigue, Kyle Reuber and Andrew Hartwig

61 Estimating petrophysical parameters from acoustic impedance and P to S wave velocity ratio using a simple rock physics model

Krishna Agra Pranatikta and Ignatius Sonny Winardhi

71 Implementation of time-lapse gravity and subsidence monitoring for optimising the development of the Scarborough gas field

Mohamad Yousof Hourani, Abid Ghous, Rabin Sridaran, Martha Lien, Siri Vassvåg and Hugo Ruiz

78 Calendar

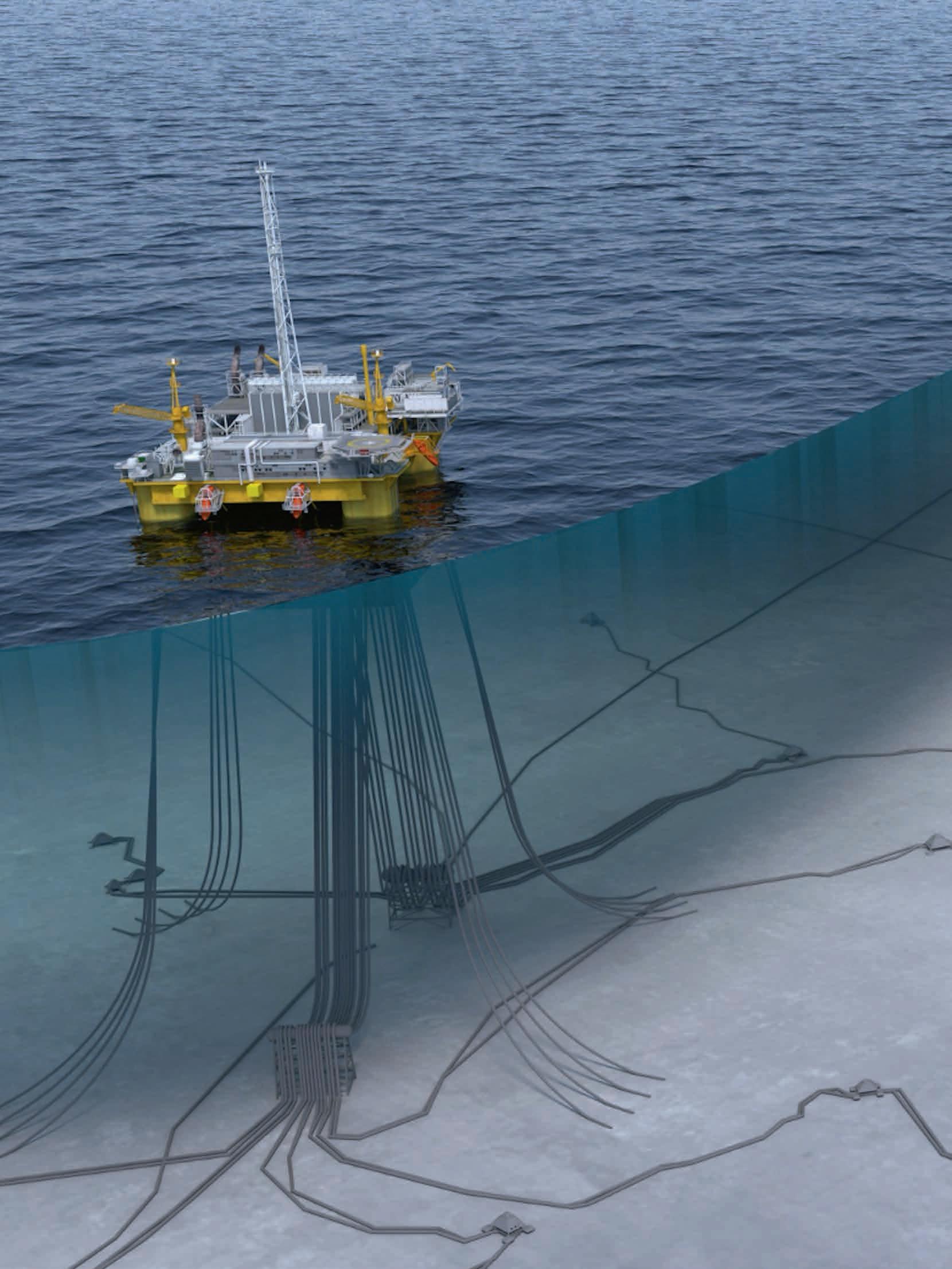

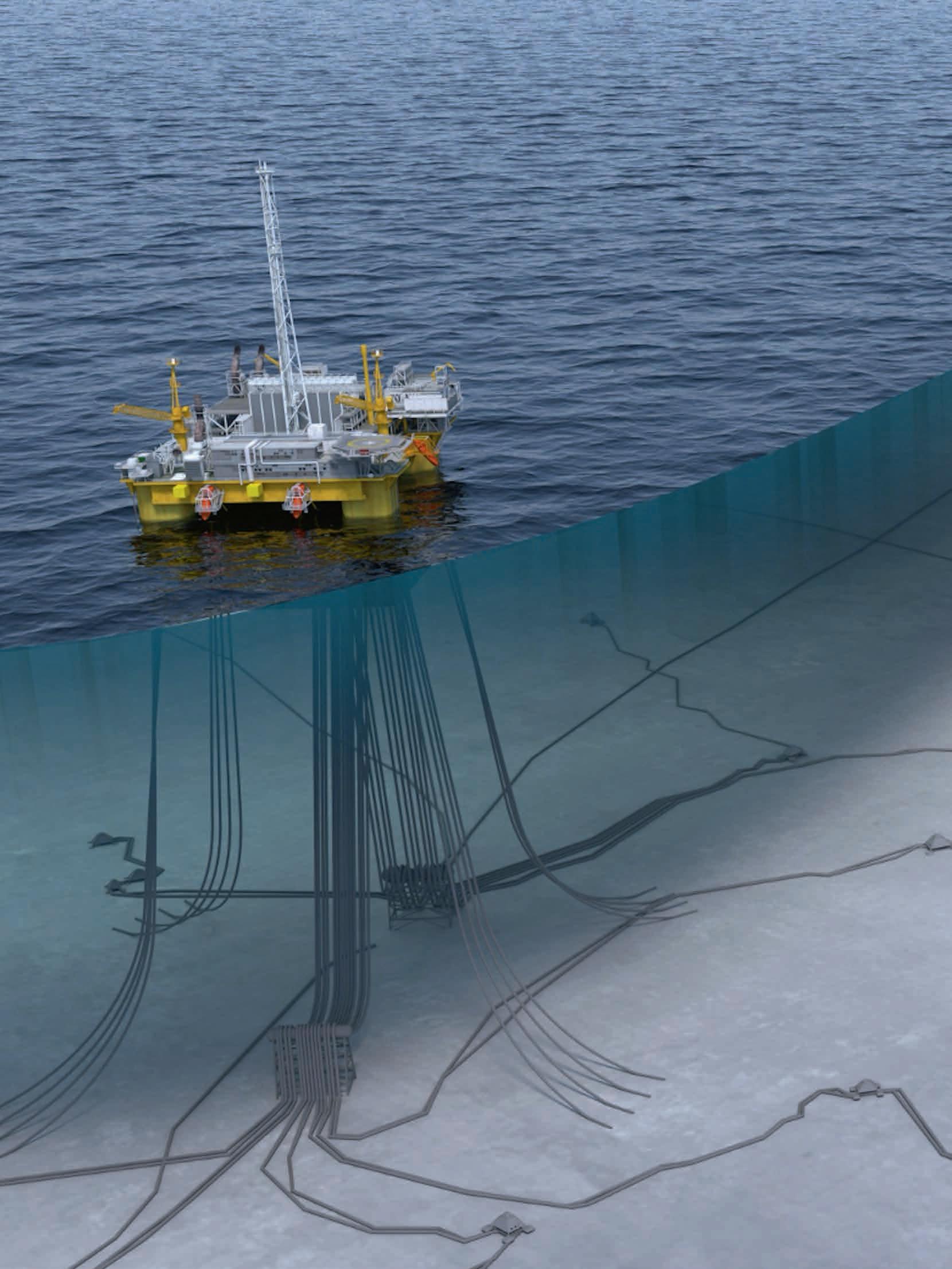

cover: Reservoir monitoring at the Troll Field in the Norwegian North Sea. This month we present the results of time lapse gravity and seafloor deformation surveys at the field photo courtesy of Equinor. Musings

Andreas Aspmo Pfaffhuber Chair

Florina Tuluca Vice-Chair

Esther Bloem Immediate Past Chair

Micki Allen Contact Officer EEGS/North America

Hongzhu Cai Liaison China

Deyan Draganov Technical Programme Officer

Eduardo Rodrigues Liaison First Break

Hamdan Ali Hamdan Liaison Middle East

Vladimir Ignatev Liaison CIS / North America

Musa Manzi Liaison Africa

Myrto Papadopoulou Young Professional Liaison

Catherine Truffert Industry Liaison

Mark Vardy Editor-in-Chief Near Surface Geophysics

Yohaney Gomez Galarza Chair

Johannes Wendebourg Vice-Chair

Lucy Slater Immediate Past Chair

Wiebke Athmer Member

Alireza Malehmir Editor-in-Chief Geophysical Prospecting

Adeline Parent Member

Jonathan Redfern Editor-in-Chief Petroleum Geoscience

Xavier Troussaut EAGE Observer at SPE-OGRC

Robert Tugume Member

Timothy Tylor-Jones Committee Member

Anke Wendt Member

Martin Widmaier Technical Programme Officer

Carla Martín-Clavé Chair

Giovanni Sosio Vice-Chair

SUBSCRIPTIONS

First Break is published monthly. It is free to EAGE members. The membership fee of EAGE is € 85.00 a year including First Break, EarthDoc (EAGE’s geoscience database), Learning Geoscience (EAGE’s Education website) and online access to a scientific journal.

Companies can subscribe to First Break via an institutional subscription. Every subscription includes a monthly hard copy and online access to the full First Break archive for the requested number of online users.

Orders for current subscriptions and back issues should be sent to First Break B.V., Journal Subscriptions, Kosterijland 48, 3981 AJ Bunnik, The Netherlands. Tel: +31 (0)88 9955055, E-mail: subscriptions@eage.org, www.firstbreak.org.

First Break is published by First Break B.V., The Netherlands. However, responsibility for the opinions given and the statements made rests with the authors.

COPYRIGHT & PHOTOCOPYING © 2025 EAGE

All rights reserved. First Break or any part thereof may not be reproduced, stored in a retrieval system, or transcribed in any form or by any means, electronically or mechanically, including photocopying and recording, without the prior written permission of the publisher.

The publisher’s policy is to use acid-free permanent paper (TCF), to the draft standard ISO/DIS/9706, made from sustainable forests using chlorine-free pulp (Nordic-Swan standard).

EAGE’s Global Energy Transition (GET) Conference and Exhibition is scheduled to return to Rotterdam on 27-31 October 2025 with every hope of building on last year’s success which saw a 600% increase in attendance from the 2023 event.

GET 2025 will feature four concurrent conferences, each focusing on different aspects of the energy transition. This structure not only allows for field-specific discussions but also fosters an inter-disciplinary exchange of ideas, helping to bridge the gaps between various scientific and technical disciplines. The goal is to collaboratively tackle complex challenges and drive impactful, sustainable energy solutions.

The call for abstracts is now open, with submissions welcomed until the deadline of 15 June 2025. We invite contributions to all four technical conferences. These are the topics:

Top of the agenda will be the operational aspects and challenges of delivering CO2 storage projects, addressing both scale and uncertainty in CO2 studies. Detailed discussions will include high-level reservoir screening techniques through to comprehensive reservoir characterisation. Monitoring strategies and technologies essential for ensuring CO2 remain contained within the storage complexes will also be a discussion point. The role of wells in CO2 storage, the impact of geochemistry and reactive transport modelling, as well as the application of AI and machine learning in enhancing CCS efficiencies, will be thoroughly explored. Additionally, the conference will investigate alternative reservoirs and innovative solutions for atmospheric CO2 removal, presenting a broad spectrum of approaches and technologies critical to advancing the CCS field.

The intention is to review innovative subsurface energy storage technologies, such as hydrogen and underground gas storage, ammonia storage in wells, tunnels, and lined rock caverns, along with compressed air and underground thermal energy storage methods. Discussions will extend to underground pumped hydro storage, with examples from various pilot projects and case studies. Key topics will include the

exploration and technological enablers for subsurface energy storage, addressing geological, mineralogical, microbiological, and geochemical considerations. The conference will also explore the natural mechanisms of hydrogen generation, its migration and trapping, and the modelling of hydrogen systems and basins. The integration of the energy storage and hydrogen value chain, including demand modelling, techno-economic assessments, and the social and regulatory frameworks necessary for advancing these technologies in global markets will all be part of the conversation.

Three major themes essential for advancing geothermal technology and its applications will form the basis of the conference. The first theme, Resource Assessment and Sustainable Development, will cover basin-scale geothermal resource assessments, reservoir characterisation, and

modelling, along with the integration of geophysics and multiphysics to enhance system efficiency. This segment also addresses decarbonising heating and cooling solutions. The second theme, Reservoir Development and Production Optimisation, will explore cutting-edge drilling technologies and well completion techniques. Discussions will extend to transitioning traditional oil and gas infrastructures to geothermal systems and the exploration of unconventional geothermal system developments. The final theme, Cross-Sectoral Solutions for Long-Term Sustainability, will examine the environmental and societal impacts of geothermal projects, highlight the role of data and digitalisation in geothermal energy, and discuss the potential of cogeneration and cascade use. This comprehensive approach aims to drive innovation and sustainable practices within the geothermal sector.

Here the spotlight will be on comprehensive advancements and strategies in offshore wind technology. The conference will cover a breadth of topics, starting with Geophysical Data Acquisition, featuring innovations in geophysical methods for near-surface and seabed data acquisition, and strategies for fixed versus floating offshore windfarms. The discussion will also explore the optimisation of acquisition strategies and future trends,

including acoustic underwater noise analyses and very shallow water data acquisition. The Seismic Data Processing discussion will look at advances in processing techniques, inversion of near-surface seismic data, and re-processing of oil and gas seismic legacy data tailored for offshore wind applications. The Seabed Mapping & Characterisation sessions will explore improvements in backscatter data processing, seabed target detection, and benthic habitat mapping. Meanwhile the Ground Modelling & Data Integration sessions will highlight case studies integrating geophysical, geological, and geotechnical data for comprehensive site analysis, while the conference will also discuss novel geophysical methods for seabed characterisation and the use of machine learning in geomodelling, stressing the ongoing evolution and integration of technologies in offshore wind development.

Whether you are a scientist, engineer, policy maker, industry leader, or a student, this conference offers a unique platform to learn from the best, share your knowledge, and contribute to shaping a sustainable energy future. We encourage you to explore the range of topics and take an active role by submitting your abstracts.

DUG Elastic MP-FWI Imaging solves for reflectivity, Vp, Vs, P-impedance, S-impedance and density. It delivers not only another step change in imaging quality, but also elastic rock properties for quantitative interpretation and prestack amplitude analysis — directly from field-data input. A complete replacement for traditional processing and imaging workflows — we talk the talk and walk the walk!

info@dug.com | dug.com/fwi

For over a decade, Full Waveform

Inversion (FWI) has been reshaping the landscape of geophysical exploration. Renowned geophysicist Ian Jones, who has been at the forefront of migration and model-building advancements, is now focusing on this transformative technology. His new course, State of the Art in Full Waveform Inversion (FWI), to be held at the EAGE Annual 2025, aims to demystify FWI’s complexities and provide a comprehensive understanding of its capabilities and limitations.

‘I’ve been teaching the EAGE course on migration and model building for 15 years now,’ Jones explains. ‘Initially, the development of methods for both migration and model update was gradual and incremental. However, the industrial deployment of FWI represented more of a step-change.’

Jones underscores FWI’s revolutionary potential to streamline workflows, bypassing the months of preprocessing traditionally required to remove noise, ensure wavelet stationarity, and suppress multiples. ‘When fully implemented, FWI offers a means to avoid all these precursory processing steps,

delivering a product that utilises more of the full recorded wavefield,’ he says.

The past decade has witnessed remarkable advancements in FWI, primarily fuelled by rapid increases in cost-effective computational power. While the foundational ideas of FWI date back to the early 1980s with pioneers like Lailly and Tarantola, it is only in recent years that these concepts have been fully realised in practice.

Jones notes, however, that the journey hasn’t been without challenges. Early implementations faced limitations with error-prone least-squares minimisation methods and simplistic approximations. These hurdles, coupled with inflated expectations, initially hindered widespread adoption.

Today, the technology has evolved to incorporate robust alternatives such as anisotropic and visco-acoustic FWI, with ongoing progress toward elastic FWI. Yet, significant challenges remain. ‘The state of the art still deals with simultaneous inversion for only one or two parameters,’ Jones explains. ‘We still have a way to go in mathematical formulation, numerical implementation, and cost-effective delivery of true elastic attributes.’

One of the most exciting recent developments in FWI is the integration of machine learning. ‘Machine learning is making rapid

inroads into the formulation of numerical optimisation problems, including FWI,’ says Jones. This emerging technology has the potential to further refine and accelerate the inversion process, opening new avenues for exploration in challenging geological environments.

Jones’ course will provide participants with a thorough understanding of the diverse implementations of FWI, highlighting the motivations behind each method, their limitations, and their potential benefits. It’s a unique opportunity to learn from one of the field’s leading experts and gain insights into the future of geophysical exploration.

Whether you’re a seasoned professional or a newcomer to the field, this course promises to equip you with the knowledge and tools to navigate the evolving landscape of FWI. Don’t miss the chance to deepen your understanding and stay ahead in this dynamic discipline.

Join the course at EAGE Annual 2025

The State of the Art in Full Waveform Inversion (FWI) course will be held during the EAGE Annual 2025. Mark your calendars and secure your spot to explore the cutting-edge developments in FWI with Ian Jones. For more details and registration, visit eageannual.org.

When you come to Toulouse for the 2025 Annual, you will find that we’ve made special arrangements to make sure your transport needs are met. In collaboration with the Toulouse Convention Bureau, we are offering a complimentary public transport card to all attendees, which can be collected during badge pick-up. The card provides full access to Toulouse’s public transportation network, encouraging participants to use this eco-friendly option, easing congestion, thereby meeting the

conference’s commitment to sustainability.

We are also complementing the city’s existing public transport service with a dedicated, non-stop shuttle bus to and from the city centre to the MEETT conference and exhibition venue, a journey which can take anything between 25 and 45 minutes depending on traffic. The buses will run every 10-15 minutes. Exact details will be announced nearer the time of the event.

Attendees are invited to check eageannual.org/plan-your-visit to receive the latest information as it becomes available.

Registration for the 86th EAGE Annual Conference and Exhibition (2-5 June) in Toulouse is now open, and we recommend members take advantage of the All Access Pass, the way to experience everything this great event offers under the over-arching theme of ‘Navigating change: Geosciences shaping a sustainable transition’.

The All Access Pass not only grants admission to the Conference and Exhibition but also opens the door to a variety of interactive side activities. This includes entry to side activities like workshops, field trips, short courses, and hackathons. Each of these components is tailored to complement the learning and connections made during the main sessions, providing a holistic view of geosciences’ role in sustainable development.

Participants can engage in any of the 22 workshops and a variety of short courses. These sessions are led by experts and cover a range of topics from geophysical monitoring of CO2 storage and AI in seismic processing to the latest in reservoir engineering for hydrogen storage and

full waveform inversion techniques. They offer to provide the route to advance skills and knowledge in specific areas of the geoscience disciplines.

The longstanding tradition of field trips offers educational and enjoyable guided visits to sites of relevance to the interests of members, such as natural hydrogen sources in the Pyrenees, dynamic analogues in groundwater reservoirs near Montpellier, and space exploration facilities in Toulouse. Each trip is designed to enhance theoretical knowledge with a practical view of realworld applications.

Included at the conference is a two-day hackathon guided by the EAGE AI Com

mittee. This event challenges participants to form teams and develop AI-driven solutions for enhancing power efficiency or optimising workflows. It’s a perfect

To fully experience what the EAGE Annual has to offer, the All Access Pass is indispensable. Early bird registrants can save up to €370 if they secure their pass by 15 March 2025. This substantial discount makes the All Access Pass exceptional value, ensuring participants can enjoy the complete range of activities.

Check out more details and sign up for the event at eageannual.org.

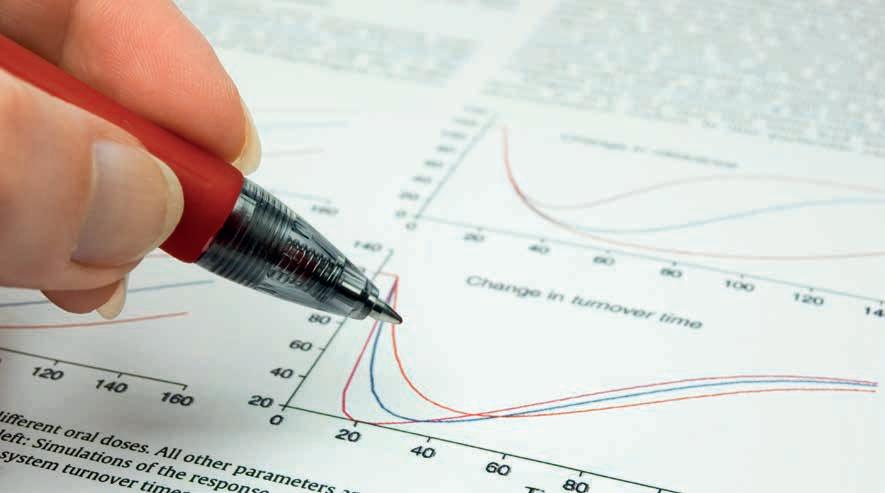

Dr Steve Horne (Silixa UK) discusses his forthcoming short course on Data Visualization Principles for Scientists on 27 March at EAGE Digital 2025.

What sparked your fascination with scientific data visualisation dating back 20 years?

I can remember very clearly! I had just started a new posting and needed to write an academic paper. I thought that there must be a rigorous set of scientific principles that I could use in preparing the figures. As with many others, I quickly discovered Edward Tufte’s books and started to apply some of those principles, not only in my own work but when reviewing papers. I was really surprised to find that the plots in our literature weren’t consistent with the ideas I had been reading. And so, over the next couple of decades, I started collecting various articles and publications with the initial idea of writing some articles to promote better data visualisation hygiene. I soon realised that I couldn’t easily cover all the material in a couple of tutorial articles, as I had originally planned, and so I started to write a book that was written on my long daily train commutes or whilst waiting for my children to complete their sporting activities. The book is nearly complete and has been for the last five years. It will probably keep me busy when I retire!

Why is accurate data visualisation so critical?

We owe it to our readers and to respect their time by efficiently communicating our ideas. If we don’t do this then, at worst, our audience will be led to the wrong conclusion or, more commonly, left confused or uninformed. I reviewed a year’s worth of publications from a couple of the major geophysical publications and by far the biggest pitfall was the use of inappropriate colour schemes, specifically the overuse of the rainbow-like colour schemes. It is well known that these are a terrible choice for scientific purposes despite the many publications explaining their failings. It seems rainbow colour schemes are the zombies of the data visualisation world – they will not die!

Were there any surprises when you were putting the course together?

One fascinating discovery was that John W. Tukey was a pioneer in data visualisation. Not only did he invent the Fast Fourier Transform and coined the word ‘bit’ (short for binary digit), but he also promoted the concept of exploratory data analysis, and invented the box plot. Among Tukey’s many memorable quotes was: ‘Visualisation is often used for evil

— twisting insignificant data changes and making them look meaningful. Don’t do that crap if you want to be my friend.’ No surprise to learn to learn that the W in John W. Tukey stands for Wilder.

Where does visualisation go wrong?

I could give you many examples as they are so abundant. For example, I just thumbed through last month’s First Break and it was full of the usual viz crimes such as inappropriate colour maps (rainbow), 3D effects, and pie charts. As part of the course, I collected a representative sample of these published visuals. Participants will get the opportunity to identify how the plots could be improved and remake the plots based on what they have learnt.

What can we expect to learn from your course?

I want to improve the standard of data visualisation for our community; so that we can elegantly and efficiently communicate our ideas. Participants will get to use these principles in their daily lives, not only in communicating their own work, but also when they review papers, and even when watching social and media reports where visualisation crimes are far more prevalent.

In this new section we will every month highlight some of the key upcoming conferences, workshops, etc. in the EAGE’s calendar of events. We will be covering separately our four flagship events – the EAGE Annual, Digitalization, Near Surface Geoscience (NSG), and Global Energy Transition (GET).

23rd EAGE European Symposium on Improved Oil Recovery (IOR+ 2025)

2-4 April 2025 – Edinburgh, UK

Improved Oil Recovery (IOR) remains the foundation of the event, the ‘+’ indicates the integration of broader topics to reflect how reservoir technologies and innovations developed for oil recovery can contribute to a sustainable energy transition. The programme will feature diverse technical sessions, providing updates and results from the latest research into IOR/EOR technologies together with assessments of recent pilots and field-scale deployment showcasing the successes, technical challenges and new technologies deployed. In addition, the conference will cover (re)emerging applications where IOR/EOR experience and knowledge are fundamental, and wrap up with a panel discussion titled ‘The Future of IOR+’.

Register today at www.ior2025.org

First EAGE/SBGf Workshop on Marine Seismic Acquisition

21-22 May 2025 – Rio de Janeiro, Brazil

This event will emphasise innovations and sustainable solutions shaping the future of marine exploration and monitoring. Topics will span seismic sources and sensors, pioneering geophysical methods for CCS, permanent reservoir monitoring systems and deepwater technologies, and latest technologies designed to enhance efficiency while minimising environmental impact. Key areas include advances in marine vibrators, broadband and simultaneous source techniques, and the integration of fibre optics and ocean-bottom nodes for data acquisition. AI-driven applications, drones, and satellite technology for wildlife monitoring, alongside sustainable approaches to seismic acquisition will also be discussed.

Join us in shaping the future in marine seismic acquisition!

EAGE/AAPG Workshop on Tectonostratigraphy 2-5 November 2025 – Riyadh, Saudi Arabia

Tectonic wonders of the Arabian Plate will be centre stage for those eager to expand their knowledge of regional geology. The proceedings are set to explore the intricate relationship between tectonics, lithostratigraphy, and the structural phases that have shaped this geologically significant region, addressing topics such as salt tectonics, sequence stratigraphy, structural evolution, and emerging challenges in petroleum systems and CO2 trapping. Contributions will be led by representatives of major companies such as Aramco, ADNOC, Shell, and more. A two-day field trip is also planned featuring the East Janadriyah and Umm-Shual anticlines, offering insights into the region’s folds, faults, and their impact on petroleum systems.

Abstract submissions deadline: 5 May 2025

Third EAGE Seabed Seismic Today Workshop 24-26 November 2025 – Manama, Bahrain

After the successful Milan event, the third workshop in Bahrain will reflect on the evolution of acquisition and processing over the past few years. This has led to a step-change in efficiency and quality, with seabed seismic being the sought-after solution for subsurface imaging for exploration and development. Presentations can be expected from industry experts on advances in acquisition technology on both the source and receiver side, acquisition methodologies, along with processing, FWI and imaging. Also look forward to discussions focusing on seabed seismic applications for site surveys, offshore wind, marine minerals, CCS/CCUS, transition zone, ultra-shallow water and co-located fields.

Abstract submissions deadline: 30 April 2025

Two of EAGE’s journals – Geoenergy and Petroleum Geoscience – are planning special themed issues to which members are encouraged to contribute. This presents a valuable opportunity to share your research with a global audience and contribute to key discussions shaping the future of geoscience and energy. The collections’ details are summarised here.

Geoenergy : CCS in the AsiaPacific region

This collection explores carbon capture and storage (CCS) technologies, policy frameworks, and deployment strategies in the Asia-Pacific region, with a focus on regional implementation and cross-border industrial partnerships and collaboration.

Geoenergy : The minerals-energy nexus in Africa

The idea of the theme is to explore the relationship between mineral resources and energy systems in Africa, highlighting sustainability challenges, economic opportunities, and the role of critical minerals in the energy transition.

Petroleum Geoscience: Geoscience driving the North Africa and Eastern Mediterranean energy hub

The intention is to investigate the geology, resource potential, and energy prospectivity of North Africa and the Eastern Mediterranean, emphasising the role of geoscience in exploration, development, and regional energy sustainability.

The submission deadline for all collections is 30 April 2025. We encourage you to take advantage of this opportunity to have your research featured in our renowned journals. For more information, visit the respective journal websites.

Geoscience skills and techniques for the energy transition was the theme of a meeting last November held by Local Chapter Norway at the Oslo office of TGS in a welcome return to in-person presentations.

Carine Roalkvam, regional geophysical advisor and support manager from TGS, led proceedings in the talk on ‘Advanced 3D seismic crossover technologies between hydrocarbon exploration, CCS development and offshore wind’ highlighting innovative seismic acquisition techniques. Roalkvam showcased some fascinating examples of how these new techniques have significantly improved subsurface imaging, sparking engaging discussions and questions from the audience about seismic acquisition.

Benjamin Bellwald from NGI offered a deep dive into the challenges of understanding the shallow subsurface in glaciated margins. His presentation, ‘Resolution requirements for characterisation of sedimentary environments in glaciated margins: A geomorphological perspective,’ addressed the complexity of glacially influenced

geology. He illustrated how the shallow subsurface exhibits considerable lateral heterogeneity, with features like eskers and moraines leading to difficulties in geological correlation. He emphasised that these variations in glacial deposits require high-resolution data to accurately characterise the subsurface. This is crucial for environmental assessments and energy development projects such as wind projects. The audience showed a keen interest in this topic, as evidenced by the detailed questions and discussions that followed.

The event was well-attended, with over 30 participants enjoying an evening of insightful talks, pizza, and

refreshments. Its success was a testament to the community’s enthusiasm for reconnecting and exchanging expertise on the cutting edge of geoscience. Such meetings are essential for advancing the collective understanding of geoscience’s role in the energy transition, and with ongoing support from local companies and EAGE. The chapter will continue to facilitate these valuable opportunities for its members.

Connect with EAGE Local Chapter Oslo

The EAGE Local Chapter Netherlands held its year-end event of 2024 at the Delft University of Technology campus. EAGE President Prof Valentina Socco, who recently joined TU Delft, was the guest speaker. Her presentation centered on active and passive surface wave surveying in hard rock sites, showcasing advancements in surface wave surveying techniques.

Dong Zhang (EAGE LC Netherlands) writes: The talk began with an introduction to surface waves, particularly Rayleigh waves, and their propagation in homogeneous and layered media. Prof Socco discussed methodological developments such as surface wave tomography for estimating shear (VS) and compressional (VP) wave velocities. She presented case studies demonstrating the application of these methods in geotechnical characterisation, mining sites, and geological modelling. Challenges in surveying hard rock sites were addressed through improved data acqui-

sition techniques, including interferometry and reciprocity principles. Prof Socco also covered inversion techniques like laterally constrained inversion and surface wave tomography, emphasising their role in building robust subsurface models. The W/D method’s application was detailed, showcasing its ability to estimate time-average velocities and its sensitivity to Poisson’s ratio. Case studies from the Middle East and the Siilinjärvi apatite site illustrated the efficiency and quality of these methods in various challenging environments. The talk concluded with a discussion on future directions and potential developments in surface wave surveying techniques.

After the talk, the audience engaged with numerous questions. One attendee was particularly interested in combining passive and active seismic surface wave inversion. The use of higher

modes was also discussed, along with the advantages of multi-component data compared to single-component data for surface waves. The role of full waveform inversion for surface waves was briefly mentioned and discussed. Many students and young professionals attended the event and enjoyed a networking dinner afterward. The efforts and contributions of our invited speakers are highly appreciated. Those interested in staying updated on chapter initiatives are encouraged to follow the Chapter’s LinkedIn page.

PIET GERRITSMA

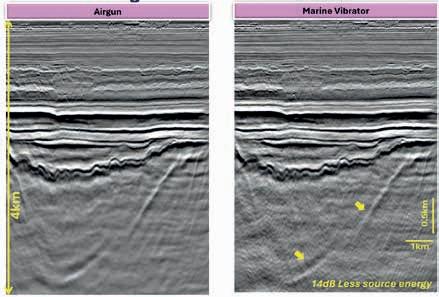

For its penultimate technical lecture of 2024, EAGE Local Chapter London invited Dr Tiexing Wang (Shearwater) to present acquisition and processing results from the first broadband 3D marine vibrator data in the North Sea. Some of the community members gathered at Imperial College while others joined online, many of whom from overseas, making it a truly global gathering and allowing for students and professionals to meet experts in the field, exchange ideas and prompt discussion – all in a friendly and relaxed setting.

Wang started his presentation with a brief history of the marine sources development and where on the timeline the marine vibrator (MV) is positioned. It will not come as a surprise that the concept of MV is as old as that of the air-gun. He reminded us that the many attempts to build a marine vibrator with more or less documented field results and pointed out that the development has certainly accelerated in recent years, due to air-gun permitting and environmental concerns in general.

To meet the energy transition goal and the demand for environmentally friendly sources, Shearwater has been developing more advanced MV technology and its associated data processing methods. Recently an alpha test was conducted in the

North Sea where among other field configurations a 3D source carpet swath of data was acquired with a single marine vibrator (sweep frequency 3-150Hz). In the same area a PRM data has been available and was used to benchmark the MV results. Wang described the specific processing workflow that was applied to the data generated by the continuous sweeping to generate an equivalent of an impulsive gather for a one-to-one comparison of the raw common receiver gathers. Subsequently shown processing results not only demonstrated quality comparable to traditional airgun arrays but also highlighted the MVs’ ability to generate signals down to 1.5Hz over large offsets. These findings indicate that MVs can act as a sustainable alternative to traditional sources for large-scale broadband acquisition. Moreover, MVs hold significant potential for enhancing 4D seismic monitoring, as they provide precise control over their emitted signal.

The future of this technology lies in advancing marine vibrators as a sustainable and precise alternative for

conventional seismic acquisition, leveraging greater operational efficiency and better control of emitted seismic frequencies, enabling enhanced 4D monitoring, improved ultra-low-frequency data quality, environmentally friendly energy exploration, and carbon storage monitoring.

EAGE members at all stages of their career connect through a network of dedicated communities, unlocking new skills and new connections to empower their journey ahead.

MARTA CYZ

EAGE Women in Geoscience & Engineering Committee Member

I had the privilege of being part of the WGE team since 2019. Our focus has always been on empowering women and fostering a supportive community, and I did my best to contribute. During difficult times in my life, I was grateful to find strong support from the Committee. Being part of WGE not only helped me develop new skills but also, hopefully, positively impacted others and contributed to building a more inclusive environment.

YEARS OF MENTORING PROGRAMMES 9

INVEST IN YOUR CAREER DEVELOPMENT

STUDENTS CAN APPLY FOR THEIR FIRST YEAR OF MEMBERSHIP FOR FREE (RE)ACTIVATE YOUR MEMBERSHIP TODAY!

‘Forging Collaboration and Innovation in Advancing Asia’ was the theme for the highly successful Asia Petroleum Geoscience Conference & Exhibition (APGCE) 2024 hosted by PETRONAS and organised by ICEP with EAGE as co-organiser. The event brought together more than 3500 participants from 21 countries, representing 108 organisations.

On the evidence of the 2024 proceedings, APGCE is rapidly becoming the premier event for Asia’s geoscience community to discuss the region’s opportunities and responsibilities. The theme underscored the critical need for cooperative efforts and creative approaches in the region’s petroleum geoscience sector to drive sustainable development and ensure energy security.

Ahmad Faisal Bakar, chairperson of APGCE 2024 in his opening address, made the point. ‘Together, we can share knowledge, create new technologies, and develop scalable solutions. The geoscientists, technology providers, and energy leaders here have the unique opportunity to shape the future. It is our responsibility

to push the boundary of innovative frontiers to achieve efficiency and deliver the discoveries that our society needs.’

The Opening Ceremony was attended by experts from various geoscience field with guest of honour Montri Rawanchaikul, CEO of PTT Exploration and Production (PTTEP), delivering an inspiring keynote address emphasising the hope for everyone to work together collaboratively using technology while sharing the knowledge.

Notable sessions included the executive plenary sessions which explored the perspectives of host authorities and operators, while the executive panel sessions focused on geophysics and geology respectively. The Technical Programme – 81 oral sessions and 70 poster sessions – offered participants a comprehensive look at emerging trends and developments in geoscience.

A staple feature of the conference was the Core Display, showcasing 13 Malaysian core booths that offered participants access to rocks and mineral samples from the region. This interactive exhibit provided delegates with a unique opportunity to engage in hands-on learning enabling them to examine core samples up close and apply theoretical knowledge to realworld materials.

The APGCE Exhibition featured 35 leading companies, including PETRONAS, Halliburton, SLB and TGS, presenting the latest geoscientific innovations and solutions. Over the course of two days, the exhibition welcomed more than 1700 visitors, creating a dynamic platform for knowledge sharing and collaboration.

APGCE 2024 hosted a series of pre-conference events that fostered innovation, talent development and collaboration, beginning with a field trip to Langkawi. A GeoHackathon also took place with 60 participants leveraging big data analytics and machine learning to solve real-world geoscience challenges.

Alongside the main conference, the Student Programme attracted 75 aspiring geoscientists in a mentorship and networking session with industry leaders, while the brand new NexGen Explorers Programme was attended by 47 young energy professionals to gain valuable networking opportunities and industry insights to advance their careers.

APGCE 2024 hopefully leaves a lasting foundation for knowledge-sharing, partnerships and innovation, influencing change in Asia’s geoscience landscape. Looking ahead, the next edition of APGCE expects to build on the momentum established in advancing the dialogue and collaboration needed to shape the future of Asia’s geoscience sector.

The EAGE Student Fund supports student activities that help students bridge the gap between university and professional environments. This is only possible with the support from the EAGE community. If you want to support the next generation of geoscientists and engineers, go to donate.eagestudentfund.org or simply scan the QR code. Many thanks for your donation in advance!

Born in East Germany before unification, Susanne Rentsch remembers the Berlin Wall coming down. After high school she headed for Berlin, enrolling in geoscience at Freie Universität and working in a lawyer’s office to earn some money. Ultimately she joined SLB (WesternGeco) as a researcher focused for many years on the Isometrix seismic acquisition system. Today, she is head of geoscience at Shearwater GeoServices.

I was born and raised in a tiny village in East Germany, near the Czech and Polish borders. My family had no academic background — my mum was an anaesthetic nurse, and my dad a tiler. East Germany heavily promoted youth programmes, particularly in sports. I spent my spare time training in cross-country and alpine skiing earning medals until being a rebellious teenager got in the way of structured training. I was too young to understand the restrictions that defined the political system but remember the joy of people when the Berlin wall came down. Most memorable to me was the sudden access to bananas and oranges without restriction.

A few weeks after finishing school, I packed a bag, moved to Berlin with only €100, and started building a life. I found a job, a small apartment, and enrolled at university. Torn between law and geoscience, I ultimately chose geophysics but kept law as an option by working at a law firm for quite a few years.

At an EAGE event in Paris, I met a Senior Researcher from SLB who later offered me an internship at its Cambridge Research Center. That internship turned out to be truly life-changing — it not only shaped my professional path but also my personal one, as I met my future husband who was also an intern there. After completing my PhD, I joined WesternGeco.

through the years

For nearly a decade, I worked on Isometrix. It was exciting, groundbreaking work that earned multiple awards and patents for our team. Later, I transferred to the engineering centre in Oslo to oversee and advance real-time processing. The Isometrix streamer remains an engineering marvel with capabilities we’ve not yet fully explored, all enabled by live access to over 600,000 traces in a conventional streamer spread.

Innovation comes with its share of disappointments. Some brilliant hardware designs from the engineering team never reached the market due to shifting priorities and the need to align with the energy transition. It’s tough to see excellent work not bear fruit, but the learnings are invaluable and will stay with me no matter what. On the success side, I’m proud of leading Shearwater’s fastest engineering project to date: bringing the Harmony low-frequency-rich broadband source to life and to market during Covid. I had limited experience with source technology at the time and the challenge pushed me far out of my comfort zone.

The transition to Shearwater during SLB’s divestment of the Marine Acquisition business was difficult. Downsizing and uncertainty took a toll, but spotting Irene (Shearwater CEO) in the WesternGeco lobby reignited the spirit. Shearwater’s agile and empowering culture was refresh-

ing, and being part of shaping a growing organisation has been a highlight of my career.

A year ago, I became head of geoscience at Shearwater. While the company already had strong geoscience branches, it wasn’t unified under a single leadership. My role is to bring them together, fostering close collaboration not only across all disciplines internally but also with our clients. With a one-team culture, we deliver expertise to business lines.

Energy transition thoughts Affordable, sustainable, and reliable energy is crucial for geopolitical and environmental stability. Geoscience is indispensable in achieving this goal, playing a vital role in today’s energy supply and tomorrow’s innovations. The energy transition presents immense opportunities for growth and groundbreaking solutions, reinforcing the importance of our field. There is more to explore in securing energy now and into the future.

Living in Norway is a privilege, especially for someone who loves the outdoors as much as I do. As a family we enjoy hiking, skiing, and simply spending time in nature throughout the seasons. Gardening is another hobby of mine, though it’s a challenge with Norway’s long winters and short growing season. Every strawberry, tomato, and green bean I grow brings immense satisfaction.

BY ANDREW M c BARNET

President Trump has an uncanny ability to expose and exploit the vulnerablity of others, a trait that is in full rein now that he is back in office. No need to rehearse here all the potential weaknesses in the US Constitution that he has already threatened in an unprecedented blitz of executive orders rolling back the power of federal government.

In this context President Trump’s musings about buying Greenland are entirely in character. Not for the first time he has touched on the increasingly fragile relationship between Denmark and Greenland (population 56,000) where calls for total independence are ever present. Currently Greenland (known as Kalaallit Nunaat to its indigenous Inuit people who make up 88% of the population) is, like the Faroe Islands, an autonomous territory of Denmark.

Trump’s timing is perfect because on 11 March Greenlanders go to the polls with independence again an issue. Prime Minster Múte B. Egede, leader of the pro-independence party Inuit Ataqatigiit, heads a coalition government and has made clear that Trump’s overtures are unwelcome stating ‘We do not want to be Danes. We do not want to be Americans’.

‘Greenlanders going to the polls’

Meantime Danish Prime Minister Mette Frederikse called Trump to tell him Greenland was not for sale.

Egede has suggested that a post-election referendum on full independence could be on the cards. This might seem reckless because a successful outcome could have major consequences. The Danish government’s position is that the wish of Greenlanders would be respected. The kicker is that Denmark’s block financial grant would be in jeopardy. This is a big deal. Half of the self-rule government’s revenue comes from Danish subsidy in an economy where over 40% of the workforce are employed by administration, and is basically dependent on its fish export industry, tourism and some mining. A 2019 poll showed that 67.8% of Greenlanders support independence from Denmark sometime in the next two decades, but in an apparent recognition of the economic repercussions, a 2017 poll showed that 78% would oppose independence if it implied a lower standard of living.

So we have it, Trump feeling out the weaknesses of an object of prey. He has even suggested that Denmark may not be the legitimate ruler of Greenland. This is a stretch but a good windup given the many sagas of nordic history over the centuries. It seems early Norse settlements including Eric the Red, who named the country, died out sometime in the early 14th Century during the so called Little Ice Age, leaving only local inuit inhabitants. Their ancestory is said to date back to the Thule people who arrived in Greenland between 1000 and 1300 A.D. A Lutheran missionary/ evangelist Hans Egede in the early 18th century helped the Dano-Norwegian government of the time claim Greenland as a colony. Things unravelled when the Denmark-Norway union was dissolved by the Treaty of Kiel in 1814 with Denmark assuming Greenland as part of its monarchy and keeping the land mass and its trade very much to itself. Norway continued to claim territorial rights until an international arbitration in 1931 went Denmark’s way.

Largely unnoticed in the Trump-generated furore is that the US first showed interest in Greenland around the time Secretary of State William Steward in 1868 negotiated the purchase of Alaska from Russia for $7.2 million. This expansionism was soon being mocked as ‘Steward’s folly’, so his enthusiam to also buy Greenland got the shoulder. However he presciently reported the bountiful natural resources especially coal, whale blubber and cryolite that could enable the US to ‘command the commerce of the world’. Nothing came of a further attempt to negotiate a deal with Denmark in 1910.

In 1946, a $100 million cash offer from the US was rejected, but the thinking behind it resonates today. During the Second World War, the Nazi occupation of neutral Denmark raised fears that Germany would invade Greenland. So, in 1941, the US agreed a ‘Defence of Greenland’ treaty with the Danish ambasador in New York. As a result the US established a military presence in Greenland which continues today on a modest basis under a treaty signed in 1951. At the peak of the Cold War, the US Thule Air Base (now

Pituffik Space base) housed 10,000 American troops. It now hosts a missile early warning system, space surveillance installation and is doubtless used for other military purposes.

Ironically climate change – one of Trump’s bête noires – is a major factor in bringing Greenland’s importance back into US strategic thinking. It may not be so long before global warming may conceivably free up shipping routes through the Arctic. It is not too far fetched to suggest that these options could emerge as plausible alternatives to transport through the Suez and Panama canals. That would put a more accessible Greenland in prime position to provide harbour for shipping, international trade and other roles.

For the US, additional maritime activity in the Arctic has more menacing implications. It fears Russia and to a lesser extent China can come uncomfortably closer to the US in a scenario where ports in Greenland would act as enablers. Russia’s increasing belligerence has prompted Finland and Sweden to join NATO which already includes the Arctic countries of Canada, Denmark, Finland, Iceland, Norway and the US.

in the era of climate change and would endanger traditional industries and the way of life. In 2021 the issuing of new oil and gas exploration was officially banned by the incoming Inuit Ataqatigiit administration.

A much more flexible approach is being adopted by the same government regarding the exploitation of Greenland’s massive mineral riches including unexploited critical minerals needed for the world’s energy transition goals. These are what President Trump is most likely talking about, not ruling out force or economic sanctions to get his way.

‘Natural resources of almost mythical proportions’

As geoscientists know better than anyone, all these high level considerations cannot disguise the more pressing reason for Trump eyeing up Greenland real estate. The world’s biggest island has a wealth of unrealised natural resources of almost mythical proportions, including offshore oil and gas, which will come more accessible if the big melt continues.

Most of the undiscovered oil, gas, and natural gas liquids are likely to be offshore associated with the Upper Jurassic Composite Total Petroleum System. A much quoted estimate from the US Geological Survey in 2007 guessed that the East Greenland Rift Basins Province contains approximately (mean) 31,400 million barrels oil equivalent of oil, natural gas, and natural gas liquids. During a high oil price period in the 1970s, some limited seismic persuaded oil companies to drill five wells, all dry, plugged and abandoned before turning to more hospitable climates (For more, see Proving up petroleum prospectivity, J.C Olsen, First Break, Vol 24, 4, 2006).

From 2007 TGS embarked on multi-year seismic acquisition programmes on behalf of licensed operators, when oil was supposed to be running out. In 2009 or thereabouts new marine geophysical contractor Polarcus announced the launching of a fleet of innovative design vessels including some purpose-built for seismic surveys in arctic conditions, an indicator of anticipated E&P industry interest. However, none of later substantial seismic shot around Greeland on behalf of TGS and others translated into successful exploration wells, e.g., Cairns Energy came up with nothing after a drilling campaign ending in 2011. Just about all the majors relinquished their licences discouraged by the drop in oil price in 2014, the rise of US shale production and of course the challenging arctic environment.

Even if the industry wanted to reengage, Greenland’s government has made clear that oil and gas activity is inappropriate

Coincidentally last month Greenland’s government published Mineral Resources Strategy for 2025-2029 outlining a vision for a sustainable and prosperous future driven by responsible development of its mineral wealth emphasising sustainability, attracting investment, capitalising on critical mineral resources and further geological mapping of areas of commercial interest. (As recently as 2019 under the Biden admistration, the US Department of State and the Greenland Ministry of Mineral Resources and Labour joined forces on a new aerial hyperspectral survey to boost mineral exploration investment in South Greenland.)

The takeaway is that Greenland is happy to collaborate with the likes of the US and EU countries but on its own terms. In essence this means not rushing things, i.e., taking account of the wishes and capabilities of its tiny population and the need for a gradual build-up of infrastructure investment. In fact Greenland has had plenty of experience with the ups and downs of mining investment, minerals have been a source of revenue since the 1700s, with cryolite, copper and graphite being the main early targets. From 1958 until 1980 uranium was also exported before Denmark opted against nuclear power. Numerous mining licences have been issued over the years with varying outcomes, see Greenland mineral exploration history Flemming G. Christiansen, Mineral Economics (online), October 2022.

Currently Greenland has two operating mines, one producing anorthosite, the other rubies and pink sapphires with other projects in the works including zinc and titanium mines. Rare earths are definitely on the horizon but all eyes are on what happens at the large-scale Kvanefjeld project in southern Greenland proposed by Energy Transition Minerals. The company claims over one billion tonnes of mineral resources have already been delineated making it the most significant western world producer of crtical rare earths. However the project has fallen foul of legislation passed in 2021 that precludes extraction of the uranium associated with the other minerals at the site.

So far Greenlanders have been able to lay down the law but how long it can hold out against international commercial and geopolitical pressures to open up its mineral resources, not to mention the unwanted attention of the US president, is another matter.

Views expressed in Crosstalk are solely those of the author, who can be contacted at andrew@andrewmcbarnet.com.

Twenty companies have been offered ownership interests in a total of 53 production licences on the Norwegian continental shelf (NCS) in the 2024 awards in pre-defined areas (APA).

The authorities reviewed applications from 21 companies in autumn 2024. Of these 53 production licences, 33 are in the North Sea, 19 in the Norwegian Sea and 1 in the Barents Sea, while 20 licences are additional acreage for existing production licences.

‘This year’s awards show that the companies on the NCS are still very confident in their ability to make more discoveries near existing oil and gas infrastructure,’ said Kalmar Ildstad, director of licence management in the Norwegian Offshore Directorate.

Equinor was the biggest winner in the APA round, scooping 27 production licences, 20 in the North Sea, six in the Norwegian Sea and one in the Barents Sea. Equinor is the operator of seven of the licences and a partner in 20.

‘We will continue to make robust investments, and our ambition is to drill around 250 exploration wells by 2035. In order to do this, we need regular access to acreage,’ said Jez Averty, Equinor’s senior-vice president for subsurface, the Norwegian Continental Shelf. ‘We have a significant portfolio of smaller discoveries near existing infrastructure. We’re working alongside the supplier industry to accelerate developments and reduce costs, which will ensure that several of these discoveries can come on stream even earlier. Despite most exploration wells being drilled near existing infrastructure, it is important that we also explore new areas and new ideas and concepts with the potential for more major discoveries. Our confidence in the Norwegian shelf remains strong.’

Aker BP has won ownership interest in 19 exploration licenses in APA 2024. For 16 of the licenses Aker BP is also granted operatorship. It has won licences in the North Sea and the Norwegian Sea and an operatorship on the former Frigg field, where the partnership plans to drill an exploration well in Q2 2025.

Per Øyvind Seljebotn, SVP exploration and reservoir development at Aker BP, said: ‘Although the NCS is maturing, we manage to continuously identify new opportunities. Leveraging new technology, digitalisation and investments in new data are crucial for creating good exploration opportunities for many years to come. Our strategy is to have a portfolio

of exploration licences that provides a good balance between exploration wells near existing fields and infrastructure, and wells that, if successful, can form the basis for standalone developments,’ said Seljebotn.

Norwegian oil and gas operator DNO has been awarded participation in 13 exploration licenses, of which four are operatorships. Of the 13 new licences, 10 are in the North Sea and three in the Norwegian Sea.

Vår Energi has been offered nine licences in the North Sea, six licences in the Norwegian Sea, and one in the Barents Sea. Most of the licences are close to existing infrastructure.

OKEA has been offered interests in eight new production licences on the NCS. The awards strengthen OKEA’s portfolio of near-field exploration opportunities around the Draugen, Gjøa, Brage and Ivar Aasen production hubs.

PL 1266 and PL 1252 are awarded with OKEA as the operator, located close to the Draugen field in the Norwegian Sea, and close to the Brage Field in the North Sea.

Sval Energi has been awarded seven new exploration licences, two as operator and five as partner.

The Norwegian Offshore Directorate is launching an APA 2024 dashboard showing acreage, work programmes and companies with associated ownership interests and roles with GIS interfaces (Esri platform).

TGS has announced an expansion of its CO2 Storage Assessment initiative for 2025 to enhance understanding of CO2 sequestration potential across critical regions along with basin-scale stratigraphy, reservoir properties, formation penetration and the associated risks related to pressure and seals. TGS is expanding its CO2 Storage Assessments to include seven additional basins across the Gulf Coast and West Midwest. These new basins include the Central Gulf Coast–Haynesville, Uinta Basin, Piceance Basin, Greater Green River Basin, Wind River Basin, Powder River Basin and the Greater Williston Basin. This expansion complements the company’s existing models in the Midwest-Northeast regions (Illinois, Michigan, an Appalachia basins) and the Gulf Coast (East Gulf Coast and Gulf Coast regions), further solidifying TGS’ comprehensive data coverage.

Will Ashby, executive vice-president of new energy solutions at TGS, highlighted the importance of these assessments: ‘Our expanded CO2 Storage Assessments

provide detailed mapping of stratigraphic architecture and petrophysical properties, delivering actionable insights into potential storage sites. By leveraging quad combo log data, inferred curves, core samples, bottom hole temperatures, and wireline formation tests, we are equipping the industry with precise evaluations of storage capacities. These assessments also incorporate analyses of seal thicknesses to evaluate containment potential, ensuring a robust understanding of storage feasibility.’

Meanwhile, TGS has won a 30-day offshore wind site characterisation contract on the UK Continental Shelf. The vessel Ramform Vanguard will mobilise for the project in Q2 2025.

Kristian Johansen, CEO of TGS, said: ‘Our geophysical approach for mapping the shallow subsurface layers with an ultra-high resolution 3D streamer is significantly more efficient than conventional site survey solutions. Energy companies value the shorter lead time we can offer to access high-quality data.’

The vessel will start the project after completing a 60-day offshore wind site characterisation contract, also in the UK continental shelf for a repeat customer in the first quarter.

The vessel is equipped with ultra-high-resolution 3D (UHR-3D) streamers. The streamer technology samples the seismic wavefield at a high spatial and temporal rate providing high-resolution data of the shallow subsurface targets for wind farm development.

Johansen said: ‘This project further highlights the integral role UHR-3D acquisition has in providing our clients with better seismic data and helping them make data-driven decisions for their wind farm developments.’

Energy Drilling has agreed in principle a share-for-share acquisition of seismic vessel provider SeaBird Exploration. ‘The combined company will be a diversified offshore oil and gas services provider with strong cash flows and significant capacity for near-term shareholder distributions,’ said SeaBird.

The transaction will be carried out by issuing approximately 651 million new SeaBird shares to Energy Drilling shareholders. The seismic and drilling businesses will continue to operate as Seabird Exploration and Energy Drilling.

Headquartered in Singapore, Energy Drilling controls approximately 38% of the world’s actively marketed tender rigs, strategically positioned to address Southeast Asia’s growing demand for natural gas to fuel its growth. With approximately 80% of available days contracted for

2025 and 2026 Energy Drilling has a firm revenue backlog of $490 million.

The combined company will have a pro-forma market capitalisation of $381 million and net debt of $44 million.

‘Merging with an operationally and financially robust market leader provides our shareholders with increased scale and reduced operational risk. Energy Drilling shares our focus on niche market leadership with strong profitability and a capital allocation strategy that prioritises distribution of all excess cash to shareholders. Based on already solid backlog visibility, our ambition is to create a leading dividend platform within offshore oil and gas services,’ said Ståle Rodahl, executive chairman of Seabird Exploration.

The agreed exchange ratio will result in Energy Drilling shareholders owning 89% of the combined company.

The transaction is supported by the board of directors of both companies and the shareholders of Energy Drilling. In addition, the five largest shareholders in SeaBird; MH Capital, Anderson Invest, Alden, Grunnfjellet and Storfjell have expressed support for the transaction. Together with shares held by the BoD, this constitutes approximately 39% of the shares outstanding in SeaBird.

The financial transaction remains subject to final documentation, approval of the transaction by a SeaBid shareholders meeting, confirmatory due diligence by both parties, relevant regulatory approvals and consents. The transaction is expected to close in Q2 this year.

Should the deal go ahead, the merged company will have ‘ample financial flexibility to pursue growth opportunities’.

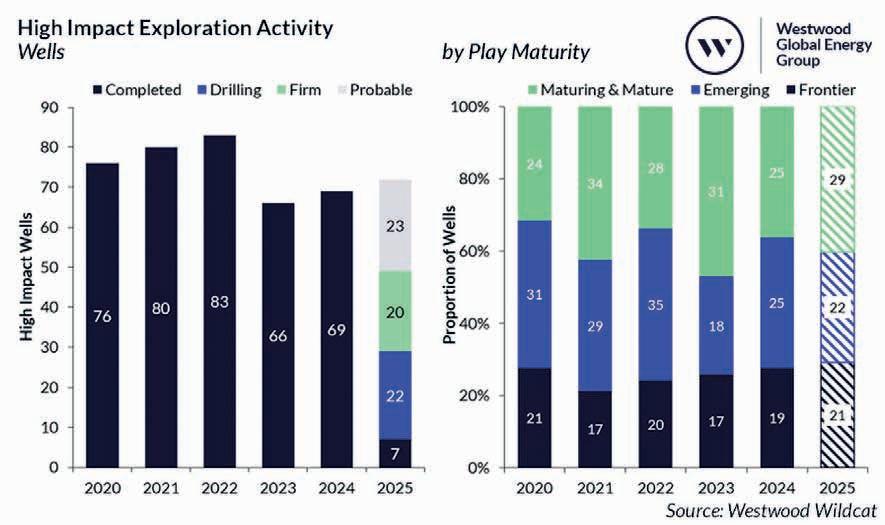

Some 65-75 high impact exploration wells are expected to be completed this year, compared to the 69 completed in 2024, according to the energy analyst Westwood.

As of the end of January, seven high impact wells have been completed, 22 wells are drilling, 20 firm wells have been identified and an additional 23 wells are classed as probable.

Twenty one frontier wells are expected in 2025, a small increase on the 19 wells in 2024. Eleven of these 21 are targeting frontier basins, whilst new plays will be tested in the proven Sabah, Rio Muni, Western Black Sea, Suriname-Guyana and Cauvery basins. Emerging play wells are expected to account for ~30% of the high impact inventory in 2025 down from 36% in 2024. High value, >100mmboe prospects in mature and maturing plays are forecast to make up 40% of the high impact programme, an increase on last year. The Arabian, Campos, Gulf of Mexico, Kutei, Norwegian Sea, Santa Cruz and Santos basins will all have multiple high impact maturing/mature play prospects drilled.

QatarEnergy is expected to be the most active explorer in 2025, participating in 13 high impact wells. All of these are operated by supermajors apart from one well in Brazil, operated by Petrobras. Chevron will rank second, participating in seven wells. Six companies are expected to drill six high impact wells in 2025, including all of the remaining supermajors.

In Africa 14 high impact wells are expected to be drilled. There are expected to be 7-10 wells in the newly opened Orange Basin. Key wells for the Orange Basin include Olympe-1X and Sagittarius-1X. Azule Energy is expected to drill the Kianda-1 well in the outboard area of the Congo Basin, Angola in 2H 2025, and there are potential high impact wells being drilled offshore in the Namibe, Rio Muni and Tano basins, as well as potential frontier onshore tests in the Cabora Bassa and Kavango basins.

High impact drilling in North America continues to decline, with only five high impact wells currently anticipated to be

drilled in 2025, down from 13 completed in 2024 and 20 in 2023. Four high impact sub-salt Miocene tests are expected to complete in the US GoM, including the Far South well which is currently drilling. In Alaska, the Armstrong-led JV is expected to drill the Sockeye-2 well in the 20242025 drilling season attempting to extend the Cretaceous topset play further east.

There could be 17 high impact wells in South America in 2025, making it the busiest region globally. There will be key wells at Andorinha in the Campos Basin, south of Marlim Sul, and the Bumerangue well in the Santos, which will attempt to

in 2025, with Elektra currently drilling, testing a significant extension of the Nile Delta Miocene play and Pegasus testing the emerging Cretaceous carbonate play. Matsola offshore Libya is testing the offshore extension of the Sirte Basin. In the Western Black Sea, OMV Petrom will drill the Vinekh well aiming to extend the Sakarya play from Turkey into Bulgaria. Elsewhere, high impact wells will be drilled in Kuwait, Kazakhstan, and the UAE.

Fourteen high impact wells are expected in Asia Pacific, including the Hai Su Vang-1X well which was completed as a discovery in early 2025. Key frontier

extend the pre-salt play further south. In Colombia, Petrobras is expected to drill the Buena Suerte well targeting assumed Miocene reservoirs over a basement high close to the multi-tcf Sirius discovery. A key well in Suriname in 2024 is Korikori, which will test a shallow-water Upper Cretaceous play inboard of the prolific deep-water play. Two wells are also expected in the Demerara area offshore Suriname targeting the Macaw and Araku Deep prospects.

In the Mediterranean, Black Sea and Middle East, 14 high impact wells are expected. Key wells to watch are the dry Khendjer well and the Nefertari gas discovery in the Herodotus Basin offshore Egypt. Two wells are expected offshore Cyprus

wells are expected offshore South Korea at Daewanggorae, as well as at Mailu offshore Papua New Guinea. Drilling will continue in the Kutei Basin offshore Indonesia, and at the Megah high impact well offshore Malaysia. There will be at least 5-6 high impact wells in India from Oil India and ONGC across the east coast and Andaman Islands basins

In Europe, eight high impact wells are expected. Two high impact wells are expected in the Barents Sea, including the frontier ILX well Elgol. In the UK, the Dabinett well will test an emerging Permian carbonate play in the Southern North Sea, and in Poland the frontier Wolin East-1 well is expected to complete in the coming months.

Viridien has won a three-year contract from Petroleum Development Oman (PDO) to provide advanced land seismic imaging services at its dedicated processing centre (DPC) in Muscat, Oman.

Viridien geophysical experts at the Muscat centre, its largest DPC worldwide, will work to deploy advanced proprietary algorithms to bring step-changes

in image quality to PDO’s ever-growing library of seismic data, said Viridien.

Oman land data is characterised by complex near-surface conditions and strong multiples. High-resolution velocity model building, and elastic full-waveform inversion will be key to overcoming these challenges and to enhancing subsurface understanding, said Viridien. The company also will address chal-

lenges such as increased data density, developing land 4D monitoring and reinforcing synergies between seismic imaging and reservoir characterisation. To support these capabilities, Viridien HPC & Cloud Solutions specialists will deliver the in-house high-performance computing (HPC) capacity required to implement the most advanced workflows.

GTGi International has acquired 30,000 STRYDE nodes to be deployed as part of a series of contract wins to deliver 2D and 3D land seismic projects across Europe.

GTGi is delivering seismic data for a range of energy exploration and decarbonisation initiatives across the EU, including carbon capture and storage (CCS), geothermal energy, and hydrogen resource exploration.

Mike Popham, CEO of STRYDE, said: ‘This agreement further underscores our ability to transform seismic data acquisition by delivering solutions that not only enhance trace density for superior imaging but also do so at no additional cost and with unprecedented speed, even

in challenging urban environments and in difficult terrain.’

David Dupuy, director of GTGi, said: ‘Apart from delivering superior data quality, STRYDE’s nodes offer unparalleled operational advantages. They require 4 to 5 times fewer vehicles and personnel for transportation, can be deployed using light vehicles as opposed to heavy trucks, eliminate the need for receiver line cutting, and have minimal environmental impact due to their small and discreet footprint. Combined with our expertise in operating multiple vibrators simultaneously within a given area, these benefits significantly reduce acquisition time while ensuring the highest data quality.’

Artificial intelligence could lead to significant energy demand growth as the technology is implemented across industries, but its use could ultimately halve carbon intensity by 2050, according to a report from Shell.

As productivity improvements resulting from AI — including automation, especially in manufacturing — enable major economic growth, consumption of oil will continue to expand by three to five million barrels a day into the 2030s, before peaking and then declining slowly over a long period, Shell said. Natural gas demand could increase into the 2040s while the use of petrochemicals is

likely to continue into the 22nd century.

‘In all scenarios, coal stops growing as a source of electricity before 2030, with natural gas following by 2035,’ the report says. ‘After these dates there is no further net addition of generation from these energy sources.’

The report is the first global energy outlook in two years from the London-based oil and gas giant. It is also the first time it has included AI outcomes, which dominate the 57-page document assembled by Shell scientists, economists and researchers.

Shell sees the pace of decarbonisation gaining in the decades ahead —

with great assistance from AI becoming immersed across energy systems from transport to manufacturing. That will help the world avoid an increase in average global temperatures of 3C or 4C, the report says.

Shell’s scenarios forsee widespread electrification of the energy system, and also a world where carbon-removal technologies scale and become more economical, helping reduce global carbon intensity over time. ‘Any analysis which seeks to reach net-zero CO2 emissions by 2050 must fully embrace the use of carbon management and carbon removal technologies,’ says the report.

Upstream merger and acquisition (M&A) activity is expected to slow significantly in 2025 after two years of record-high transactions driven by US shale mergers, said Rystad Energy.

The global deal pipeline value stands at approximately $150 billion as much of the sector’s consolidation has run its course, said Rystad. Furthermore, geopolitical tension in the Middle East, the conflict in Ukraine and the UK’s challenging fiscal environment are expected to create notable headwinds for market participants, the company added.

North America will continue to lead global M&A activity, driven by nearly $80 billion in upstream opportunities on the market. Elsewhere in the Americas, South American deal value rose from $3.6 billion in 2023 to $14.1 billion in 2024 (excluding Chevron’s acquisition of Hess), largely due to regional exploration and production (E&P) growth ambitions — and despite Petrobras halting its divestment program.

‘Last year marked a significant year of consolidation in the US shale sector, with approximately 17 consolidation-focused

deals, compared to just three acquisitions in late 2023. Activity was always expected to fall after such dramatic highs, but there is still plenty of business to be done. There is potential for further upside if US shale gas M&A activity increases,’ said Atul Raina, vice-president, oil and gas research, Rystad Energy.

Meanwhile, the Middle East is emerging as a significant centre for M&A activity. Bolstered by liquefied natural gas (LNG) expansion plans, the region recorded its second-highest year of M&A

activity since 2019, with deal value reaching nearly $9.65 billion in 2024, following a five-year peak of $13.3 billion in 2022.

The North Field expansion aims to elevate QatarEnergy’s LNG production to 142 million tonnes per annum (Mtpa) by the early 2030s. ADNOC is reportedly considering awarding an additional 5% stake in Ruwais LNG to an international partner.

M&A deal value in Europe decreased by around 10% year-on-year, to $14 billion in 2024. Around 75% of the regional total centered on the UK, where majors have been adopting an autonomous model strategy to expand their presence in the North Sea. The largest deal this year involved Shell and Equinor merging their UK North Sea upstream portfolios, excluding some of Equinor’s cross-border assets.

Despite $8 billion worth of upstream opportunities in the region, the outlook for future M&A activity in Europe remains uncertain due to tighter fiscal terms for oil and gas in the UK, which accounts for 73% of the potential deals, valued at about $5.9 billion.

TGS has entered into an agreement with deepC Store to carry out subsurface well location planning, storage resource verification and evaluation for carbon storage in the G-14-AP permit area in the Browse Basin, offshore northwestern Australia.

The assessment will take place throughout 2025 on the permit, which is co-owned by deepC Store and Azuli (Australia).

The G-14-AP permit is one of the two offshore CO2 storage acreages awarded to deepC Store and Azuli by the Australian government in August 2024, alongside the G13-AP permit. deepC Store serves as the designated operator of the G-14-AP

permit and the associated CStore1 project, with an estimated CO2 storage potential of approximately 1 gigatonne (1 billion tonnes) in the permit area. The integration of TGS’ advanced subsurface data and deepC Store’s expertise in CCS project development will be essential in assessing the feasibility and long-term security of carbon storage in the Browse Basin.

deepC Store’s managing director Daein Cha said: ‘We are very pleased to work with TGS for progressing one of its key technical activities for G-14-AP. This work demonstrates our commitment to establishing CStore1 as the first offshore floating

CCS hub project in the Asia Pacific region, and to advance Australia’s strategic position in the CCS business.’

deepC Store and Azuli are CCS project developers with their core area of activity in the Browse basin and Bonaparte basin in offshore Western Australia. deepC Store has championed its ‘CStore1’ project as an innovation in the Asia-Pacific region, a commercial-scale floating CCS hub that integrates with CO2 emission facilities and covers all of the CCS value chain, being capture and liquefaction of CO2 onshore; transport by ships to the floater hub; and injection from the floater hub.

The UK government’s backing of carbon capture, storage and utilisation projects is unproven and high risk, according to one of the country’s spending watchdogs.

The UK Public Accounts Committee (PAC) has called on the British government to assess whether its full carbon capture, usage and storage (CCUS) programme will be affordable for taxpayers and consumers, given wider pressures on energy bills and the cost of living.

The PAC’s inquiry heard that CCUS may not capture as much carbon as expected, with international examples showing that government’s expectations for its performance are far from guaranteed.

The report notes recent scientific evidence that producing liquid natural gas, which will be used to run several CCUS projects, leaks more greenhouse gases into the atmosphere than previously thought. ‘This could undermine the rationale for pursuing certain schemes, and the PAC calls on government to consider the impact of up-to-date scientific understanding on CCUS,’ it said in a statement.

The report praised the government for learning from previous failed attempts to support CCUS, with the first two projects expected to begin operating in 2028. However, it notes that three-quarters of the almost-£22 billion envisaged to support the projects will come from levies on consumers who are already facing some of the highest energy bills in the world – yet the report finds the government has not yet looked at the likely financial impact of CCUS on households.

The PAC’s inquiry further found that neither of the contracts for the two new CCUS projects include any provision for the government to share the profits or for consumers to benefit from lower energy bills should things go well. This is despite any such profits, which could be significant if the programme is successful, being a result of early public support. The report calls on government to introduce mechanisms to make sure taxpayers and consumers benefit financially from the

success of all future CCUS projects that they have supported.