TRADE & COMMODITIES

Rising acreage for corn and soyabeans improves feedstuffs outlook in 2023/24

www.drycargomag.com

Maria Cappuccio The International Monetary Fund (IMF) predict global growth at 3% in both 2023 and 2024, the slowdown being concentrated in advanced economies, where growth will fall this year and 1.4% next year. The euro area, still reeling from last year’s sharp spike in gas prices caused by the war, is set to decelerate sharply. By contrast, growth in emerging markets and developing economies is still expected to pick-up with year-on-year growth to 4.1% this year and next. The average, masks

significant differences between countries, emerging and developing, Asia growing strongly at 5.3% this year, while many commodity producers will suffer from a decline in export revenues. The IMF confirms that while stronger growth, lower inflation and some adverse risks have moderated, the balance remains tilted to the downside. Global crop prices are expected to fall in 2023/24 as global supply improves on rising acreage for coarse grains and

oilseeds with record output for corn and soybeans. Global wheat supply is forecast slightly lower in 2023/24. Increasing uncertainty around Black Sea exports following Russia's withdrawal from the Black Sea Grain Initiative, means global grain and oilseed prices are expected to experience further volatility in 2023/24.

DROUGHT CURBS WHEAT YIELDS IN NORTH AMERICA The global wheat and coarse grain harvests

SEPTEMBER 2023

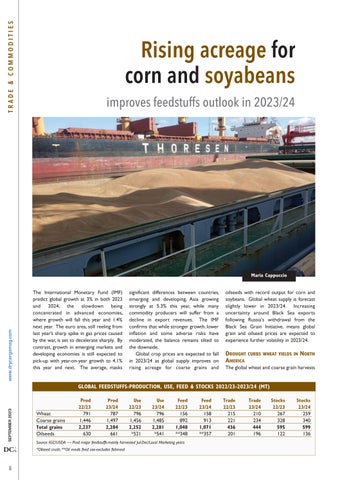

GLOBAL FEEDSTUFFS-PRODUCTION, USE, FEED & STOCKS 2022/23-2023/24 (MT)

DCi 6

Wheat Coarse grains Total grains Oilseeds

Prod 22/23 791 1,446 2,237 630

Prod 23/24 787 1,497 2,284 661

Use 22/23 796 1,456 2,252 *521

Use 23/24 796 1,485 2,281 *541

Feed 22/23 156 892 1,048 **348

Source: IGC/USDA — Prod major feedstuffs-mainly harvested Jul-Dec/Local Marketing years *Oilseed crush; **Oil meals feed use-excludes fishmeal

Feed 23/24 158 913 1,071 **357

Trade 22/23 215 221 436 201

Trade 23/24 210 234 444 196

Stocks 22/23 267 328 595 122

Stocks 23/24 259 340 599 136