CRYPTOUNDERGOES STRUCTURALRESET

MARKETSIGNALS

BitcoinLeadstheMarketLower:Fresh Lowsand$2.5BillionLiquidationWave

MACROUPDATE

FederalReserveHoldsRatesSteadyAs GrowthRemainsResilient

BitcoinLeadstheMarketLower:Fresh Lowsand$2.5BillionLiquidationWave

FederalReserveHoldsRatesSteadyAs GrowthRemainsResilient

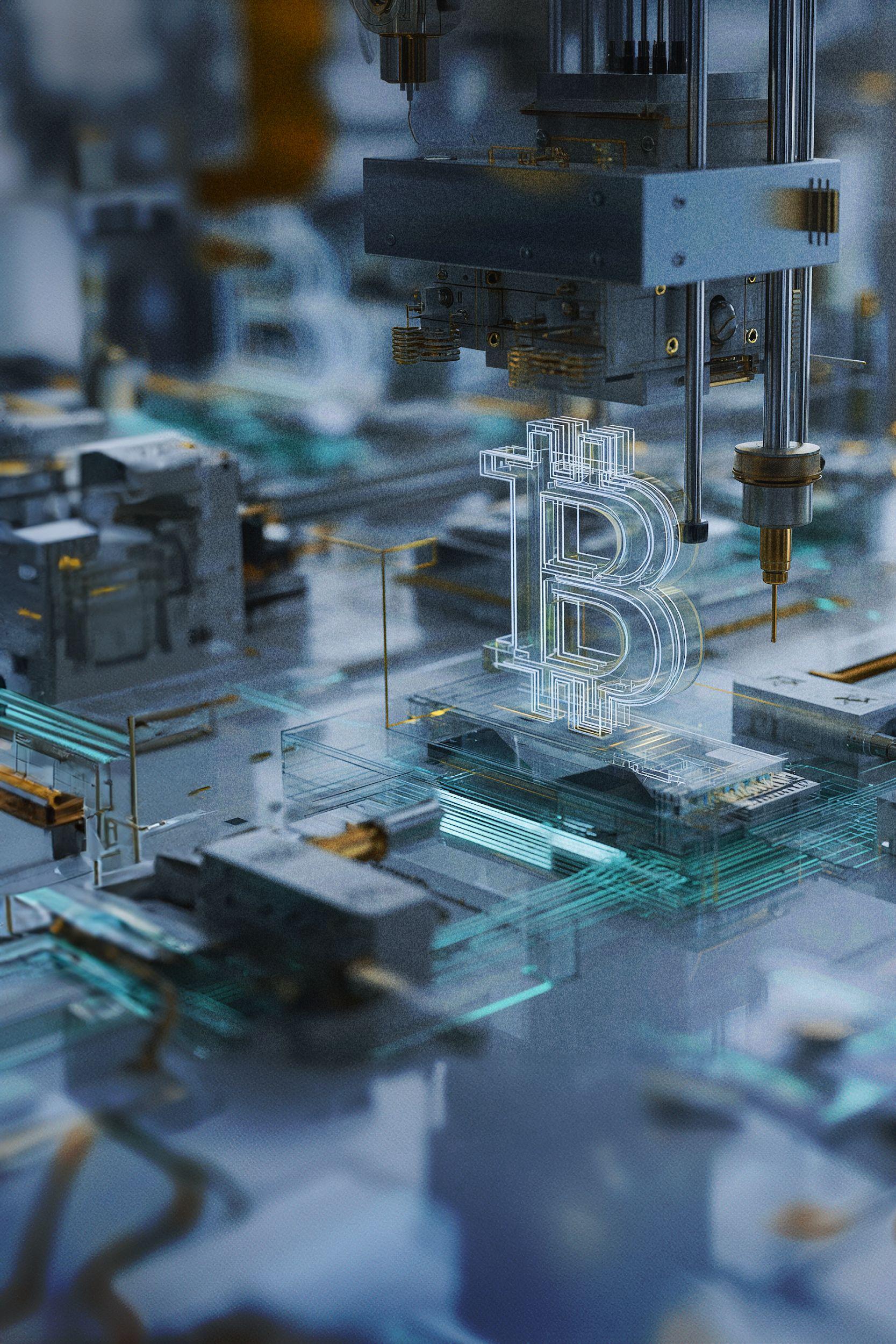

Bitcoinhasledarenewedrisk-offmoveacrosscrypto,breakingdecisivelybelow $80,000forthefirsttimesinceApril2025andmarkingthedeepestdrawdownof the current cycle at nearly 40 percent from the October peak. Thin weekend liquidity accelerated the sell-off, triggering a $2.5 billion liquidation wave dominated by long positions, while US spot Bitcoin ETFs recorded their largest weeklyoutflowssincelaunchatroughly$1.5billion.Thelossofkeyon-chainand technical supports, including the True Market Mean, highlights the absence of marginalspotdemandatatimewhenleveragewasstillelevated.

The drawdown has been driven less by internal crypto weakness and more by a sharp deterioration in the macro backdrop. Hawkish implications from the proposed Fed chair succession, renewed US fiscal uncertainty, and escalating geopolitical risks have pushed capital toward cash and Treasuries, amplifying downside volatility in digital assets. Altcoins suffered sharper dislocations, particularly Ethereum and Solana, though selective inflows into smaller-cap ETFs suggest tactical rotation rather than broad capitulation. With leverage now materially reduced and speculative excess flushed, the market appears to be undergoingastructuralreset.Near-termdirectionwillhingeonwhetherpricecan reclaim key realised cost levels and whether macro pressure eases enough to allowinstitutionaldemandtore-emerge.

The current macro and digital asset landscape reflects an economy that remains resilient but increasingly complex, with policymakers, investors, and institutions navigatingpersistentinflationrisks,shiftingconfidence,andstructuralchange.

The Federal Reserveʼs decision to hold rates steady at 3.53.75 percent underscoresitsviewthatUSgrowthremainsstrongenoughtowarrantcautionon cuttingfurther,asinflation,particularlyinservices,continuestorunabovetarget, especiallyas productivitygains,whileencouraging,haveyettoprovedurable.

Recent data reinforces this stance: producer prices surprised to the upside, drivenbyservicesratherthangoods;manufacturingsurveyspointtostabilisation rather than a full expansion, and rising inventories suggest growth is steady but not accelerating, leaving the Fed comfortable remaining patient unless labour market conditions weaken meaningfully. At the same time, financial markets are sendingcontinuedsignalsthatitisre-settingrisk,asa sharplyweakerUSdollar andasustainedrallyingoldreflectgrowingconcernsoverfiscaldiscipline,policy predictability, and long-term purchasing power (even as goldʼs recent pullback appears more consistent with profit-taking than a reversal of the broader trend). These dynamics add pressure to policymakers, as a softer dollar complicates inflation control while rising gold prices hint at declining confidence in fiat systems.

Against this macro backdrop, structural shifts in digital finance are accelerating: TetherʼsrecordprofitsandmassiveUSTreasuryexposurehighlightsurgingglobal demand for dollar liquidity outside traditional banking rails. Meanwhile, Japanʼs move toward approving crypto ETFs by 2028 signals deeper institutional acceptanceofdigitalassetswithinregulatedmarkets.

1.MarketSignals

● BitcoinLeadstheMarketLower:Fresh Lowsand$2.5BillionLiquidationWave

2.GeneralMacroUpdate

● FederalReserveHoldsRatesSteadyas GrowthRemainsResilient

● GoldRalliesastheDollarWeakens, SignallingaShiftinGlobalConfidence

● InflationSignalsandBusinessActivity PointtoaCautiousUSOutlook

3.NewsFromTheCryptosphere

● TetherPostsRecordProfitsandTreasury ExposureinQ42025Attestation

● JapantoApproveFirstCryptoETFsby 2028AMajorRegulatoryShift

Thecryptocurrencymarketcontinuedtodeteriorateoverthepastweek,with Bitcoinbreakingdecisivelybelowthe$80,000psychologicalthresholdforthe first time since April 2025. The move pushed price beneath the lower boundary of a multi-month range and below several key technical and on-chainreferencelevels,includingtheTrueMarketMean.

BTC is now trading in the $7778,000 range, having declined more than 6 percent on Saturday 31 January, marking the sharpest single-day drop in nearlyfourmonths.Thelasttimesuchamovehappenedwas on10October, which marked the largest liquidation event in crypto market history. The cumulative peak-to-trough drawdown is now approaching 40 percent, makingthisthedeepestcorrectionofthecurrentcycle.

1BTC/USDDailyChart.Source:Bitfinex)

Weekend liquidity conditions exacerbated the sell-off. Thin order books allowed thepricetocascadelower,withBTCbrieflytradingdownto$75,731duringNew Yorkafternoonhoursbeforestabilisingbackintothehigh-$70,000range.Intotal, Bitcoin has now fallen approximately 39.95 percent from the October 2025 all-time high of $126,110, erasing more than one-third of its value in just three monthsandunderscoringtheseverityoftheongoingrisk-offphase.

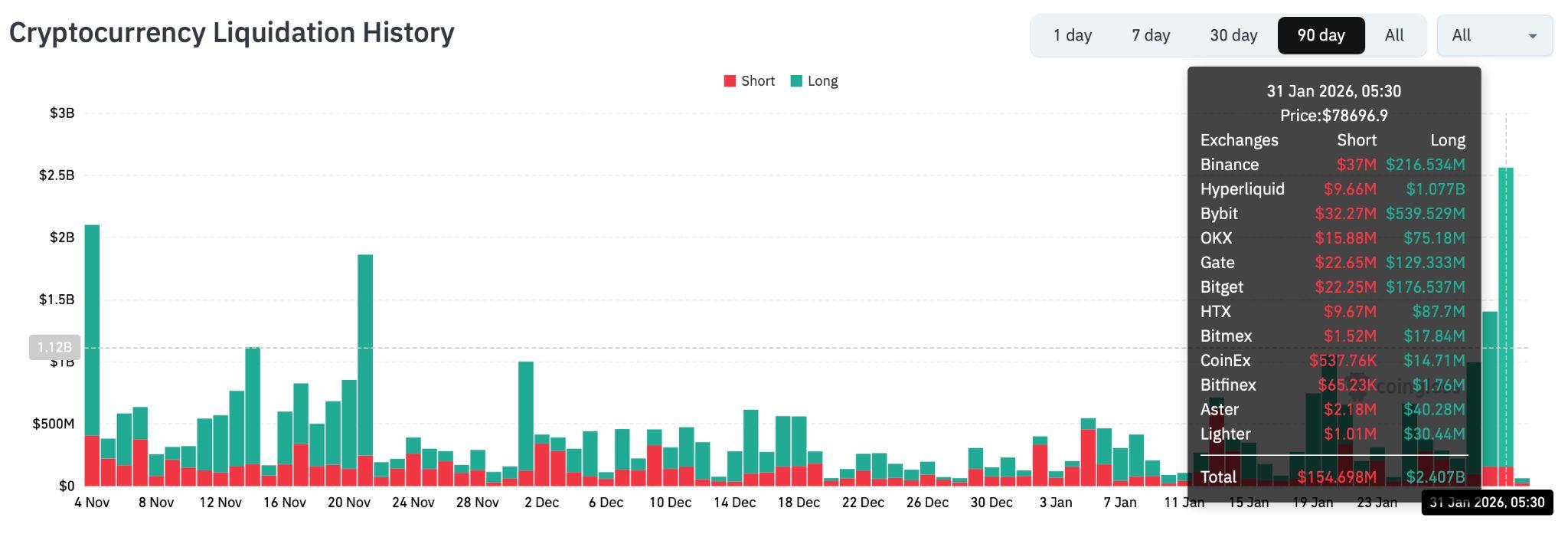

Thesell‑offtriggeredrecordliquidationsinthederivativesmarkets.Intotal,$2.54 billion of futures positions were liquidated on Saturday across major exchanges, ofwhich$2.4billionwerelongpositions.Notably,Ethereumaccountedfor$1.14 billionofthattotal,whileBitcoincontributed$765million.

Earlier in the week, there was another $1.4 billion in liquidations within a single day,underscoringhowvolatilityhasintensifiedastheweekprogressed.

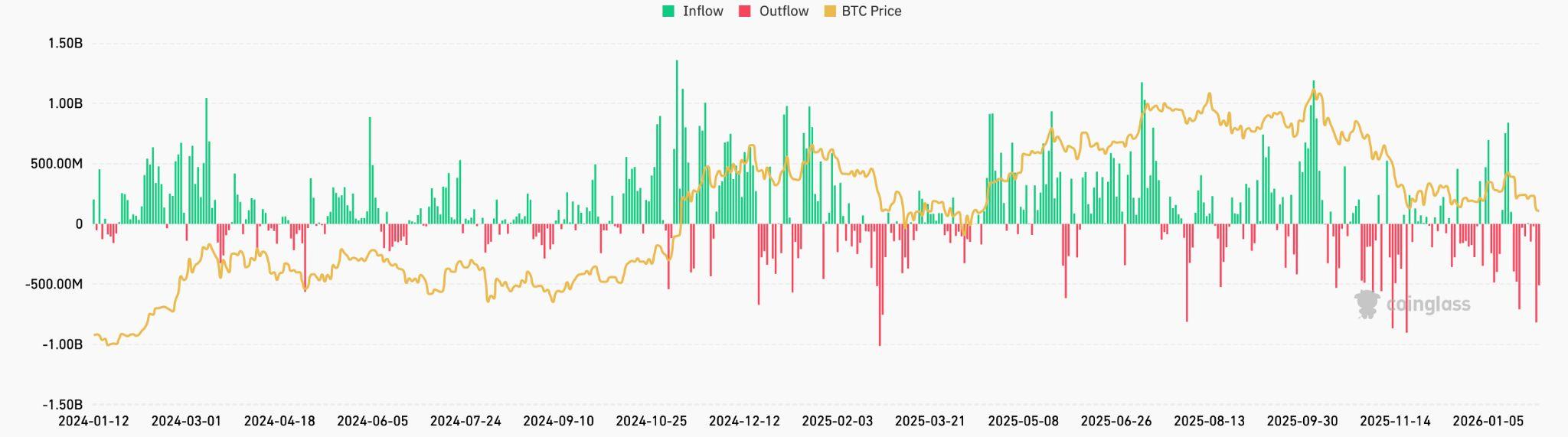

US-listed spot Bitcoin ETFs have also recorded their largest weekly net outflows sincelaunch,withapproximately$1.5billionexitingtheseproductsoverthepast week.Indeed,evenaslong-termholdersellpressurehadbeguntoeaseandthe price had been stabilising around key structural levels such as the True Market Mean, a long-term on-chain valuation benchmark that reflects the average cost basis of the network. However, for the price to transition from stabilisation to a sustainedadvance,ETF-ledinflowsandparticipationfromothermarginalbuyers wererequired.Thatdemandfailedtomaterialise.

Instead, the absence of incremental spot demand, combined with heightened geopolitical and policy uncertainty, has left the price vulnerable. Data from Farsideindicatesthatcumulativeoutflowsfrommajorproducts,specificallyIBIT, FBTC, and GBTC have accelerated, effectively reversing the inflow streak that underpinnedBTCʼsrallythroughQ2Q32025.

The broader flow picture suggests a clear risk-off rotation, with investors reallocating toward cash and gold amid rising macroeconomic and political uncertainty. In this environment, the lack of ETF absorption has amplified downsidevolatility,reinforcingtheimportanceofinstitutionalspotdemandasa stabilisingforceduringperiodsofmarketstress.

The immediate catalysts behind BTCʼs slide mirror those weighing on other markets. Market sentiment deteriorated sharply following the announcement that former Federal Reserve governor Kevin Warsh has been nominated to succeedJeromePowellasFedChair.Warshiswidelyviewedasmorehawkish, with a strong preference for a smaller central bank balance sheet. His nomination lifted the US dollar and reinforced expectations of tighter liquidity conditions,triggeringaswiftrepricingacrossriskassets.

ConcernsaroundtheFederalReserveʼsexpandedbalancesheetandrestrictive regulatoryposturehavelongcentredonliquidityremainingconcentratedwithin financial markets rather than the real economy. Against this backdrop, Warshʼs perceivedstanceoftightermonetarypolicyandasmallerbalancesheet,raised fearsofawithdrawalofaccommodativesupport,promptinginvestorstoreduce exposuretohigher-betaassets.

Geopolitical factors compounded the risk-off move. Renewed concerns of a partial US government shutdown surfaced after Congress failed to reach agreement on a funding package. While widely expected to be temporary, the episode echoed last yearʼs shutdown and underscored persistent fiscal dysfunction, adding to investor unease. These concerns were amplified by sharp, historic single-day declines in the rare earth metals sector, alongside risingUSIrantensionsandgrowingdebatearoundanAI-drivenequitybubble.

Together, these macro and geopolitical risks have driven a rotation toward traditional safe havens, with capital flowing into cash and short-dated US Treasuries. The combined effect has weighed heavily on risk sentiment, reinforcing the fragile backdrop for digital assets amid tightening financial conditions.

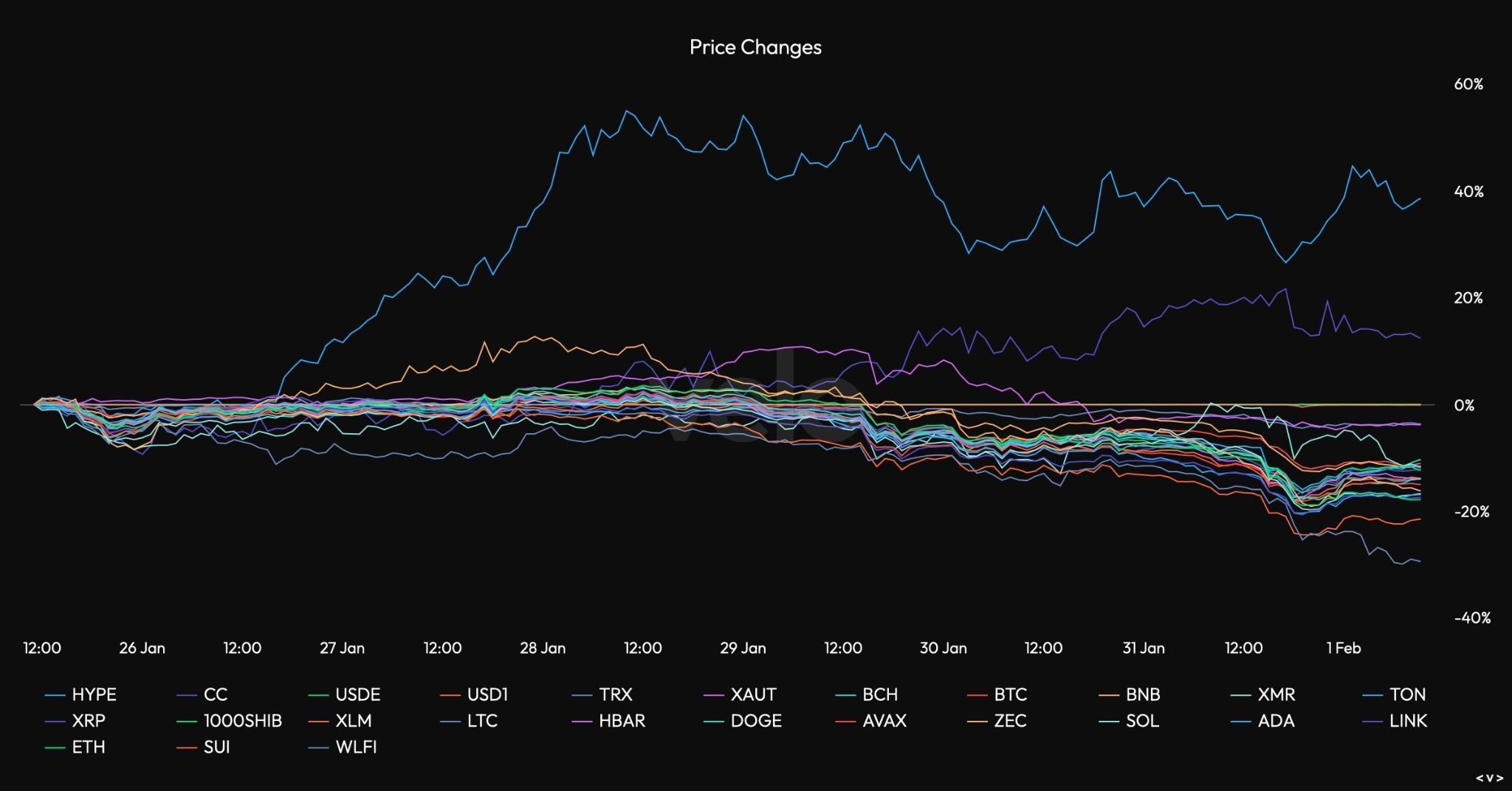

Major altcoins followed BTC lower, though the magnitude of the sell-off varied across the complex. Ethereum declined 17.33 percent in a single session to around $2,243, extending its drawdown to roughly 54 percent from the August peak of $4,958. XRP fell 14.25 percent to approximately $1.5, while Solana slid 18.89 percent to near $96.5, falling below $100 for the first time in 300 days. Thesemovesrepresentaclearaccelerationinsellingpressurerelativetoearlier in the week. The only major altcoin that is positive for the week is Hype at 44 percent.

Derivativesmarketsamplifiedthedownside,particularlyinEther.Futurestraders absorbed significant losses, with the largest single liquidation involving an ETH position worth approximately $220 million, underscoring the extent of leverage thatremainedinaltcoinmarketspriortotheweekendsell-off.

Notably, a divergence has emerged within exchange-traded products. Despite heavyredemptionsfromBitcoinandEthereumETFs,totallingroughly$1.5billion and $327 million respectively last week, from January 2630, some altcoin-focused ETFs continued to attract incremental inflows. Solana and XRP-linked ETPs saw net inflows of $32 million and $8 million respectively during the same period. This points to a degree of tactical rotation from large-cap crypto assets into select smaller-cap exposures, although these inflows remain modest relative to the scale of outflows from the broader asset class.

From an institutional perspective, current conditions resemble a structural reset rather than a terminal end to the crypto cycle. The combination of record liquidation volumes, substantial ETF redemptions, and mounting macro headwinds suggests that speculative excess is being actively purged from the system.Severalreferencepointsnowwarrantclosemonitoring:

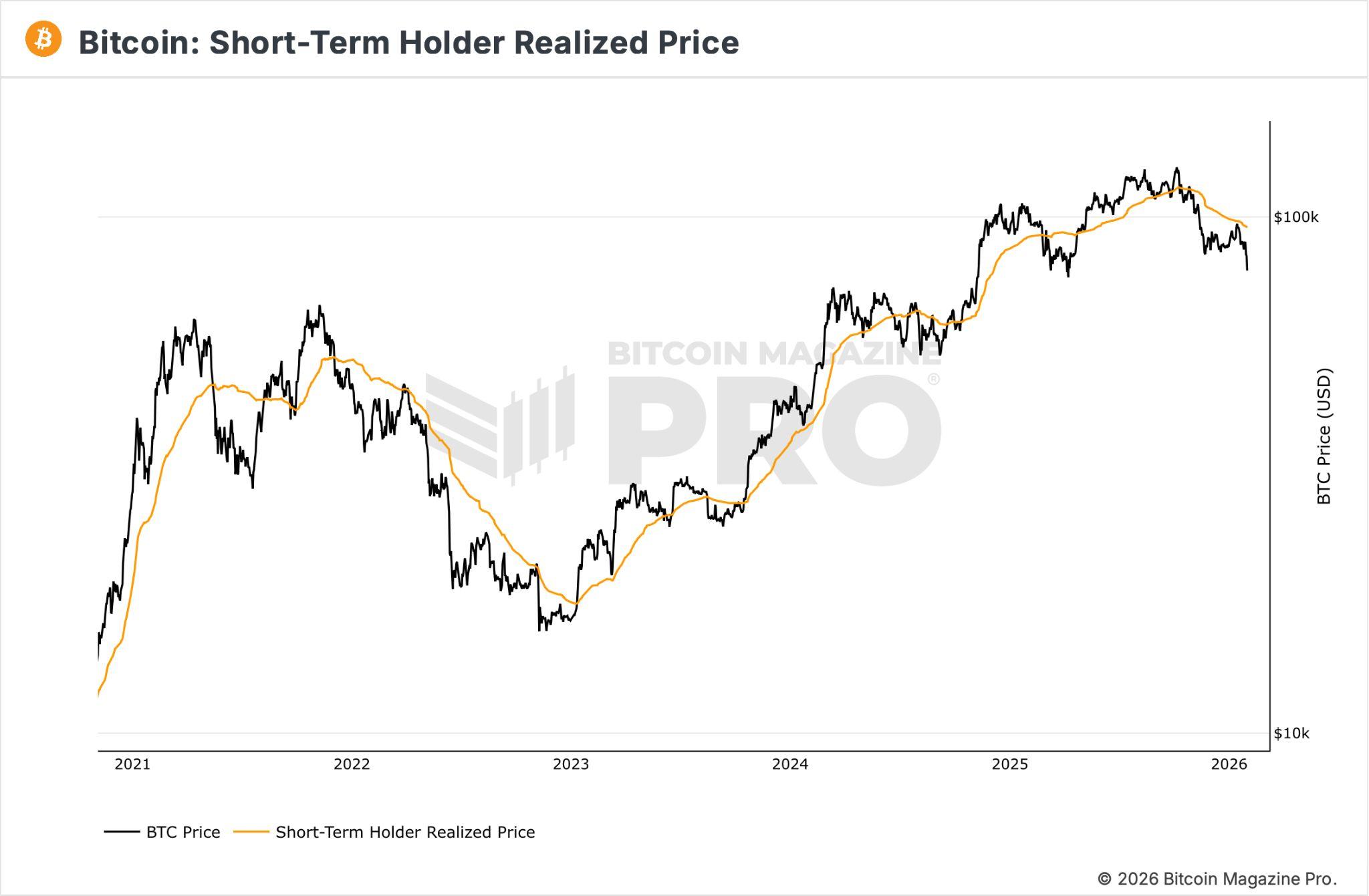

● Price structure: Bitcoinʼs short-term holder cost basis (around $95,800 acted as resistance in our early January relief rally and the True Market Mean(near$80,700)hasflippedfromsupporttooverheadresistance.

● Asustainedmovebackabove$80,000andtheactiverealisedpricenear $87,000 would indicate improving supply absorption. Conversely, a decisive move below this weekendʼs lows would increase the probability ofpriceformingarangeorbleedingfurtherfromcurrentlevels.

● Macro catalysts: Markets remain sensitive to confirmation of Warshʼs nomination as Fed Chair, developments around US government funding, andshiftsingeopoliticalrisk.Adovishpolicysignalorresolutionoffiscal uncertainty could spark a relief rally, whereas additional liquidity drains wouldlikelyprolongtherisk-offregime.

● Derivativessignals:Optionsmarketscontinuetopriceelevateddownside risk, with the 25-delta skew holding near 17 percent, reflecting strong demand for protection. Open interest has already declined from approximately $58 billion to $46 billion. A stabilisation in skew and funding rates, followed by a rebuild in open interest under neutral conditions, would suggest that fear is receding and that the market is layingthegroundworkforamoresustainablerecovery.

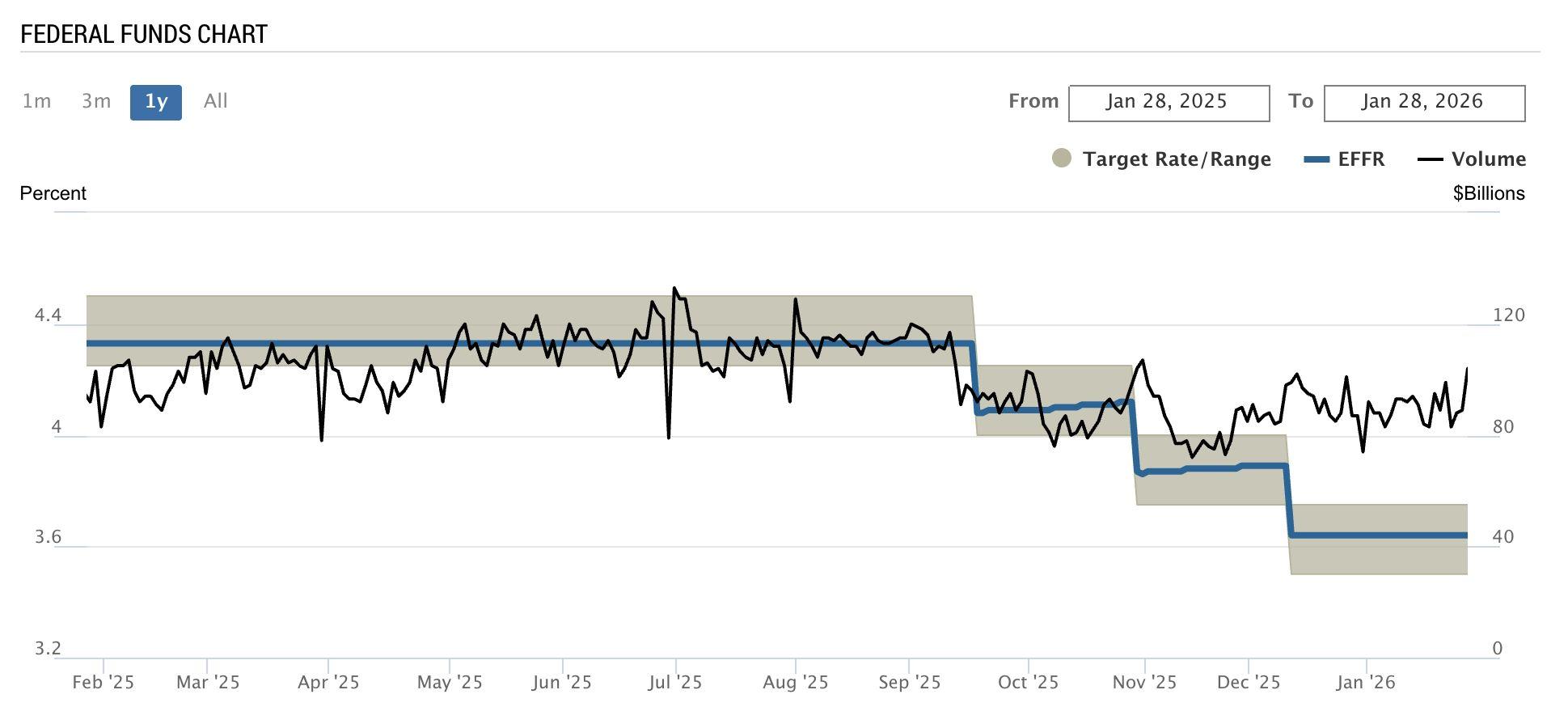

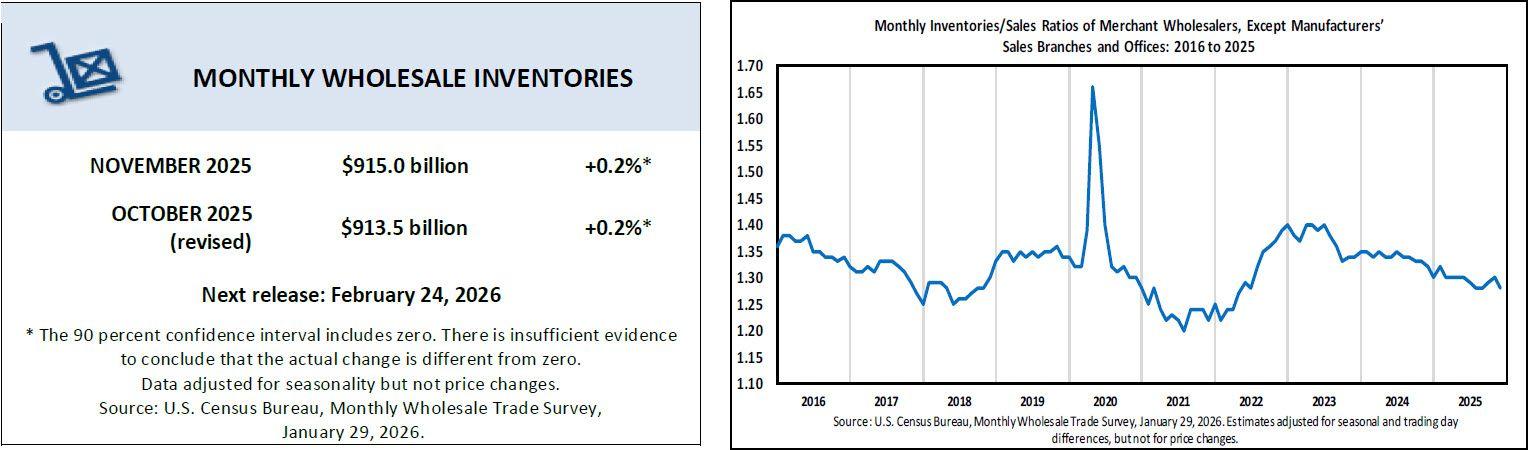

Figure6FederalFundsRateChartSource:FederalReserve)

The US central bank is holding interest rates steady as economic growth remainsstrongandinflationstaysabovetarget.Whilepolicymakersbroadly agree on the near-term outlook, uncertainty around jobs, inflation, and productivity is keeping the Federal Reserve cautious about cutting rates too soon.

ThelatestFederalOpenMarketCommitteeFOMC)policydecision,releasedlast Wednesday,January28,confirmedthatrateswould remaininarangebetween 3.53.75 percent. The committee noted that economic activity continues to expand at a solid pace, hiring has slowed but not weakened sharply, and inflationremainssomewhatelevated.Insimpleterms,theFedissayingthatthe economy is still strong enough, and that lowering interest rates now could risk pushingpriceshigheragain.

The committee also announced that it will maintain its overnight liquidity tools, withstandingrepurchaseagreementoperationssetat3.75percentandreverse repurchaseagreementoperationsat3.5percent.Twogovernors,StephenMiran and Christopher Waller, dissented and supported a 25 basis point rate cut. However, the majority view within the committee favours a wait-and-see approach.

FederalReserveChairJeromePowellreinforcedthisduringhispressconference, repeatedlysteeringawayfrompoliticalissuesandfocusinginsteadoneconomic fundamentals. He highlighted the economyʼs resilience, while acknowledging weaker housing activity and a labour market that appears to be stabilising at lower levels of hiring. Powell also noted that inflation, as measured by the personal consumption expenditures index, rose 2.9 percent over 2025, with tariffspushingupgoodspricesevenasservice-sectorinflationcontinuedtocool.

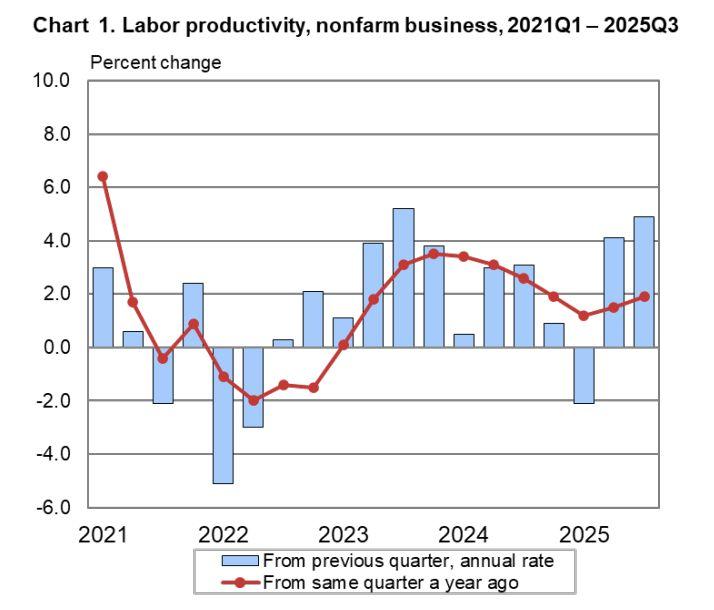

A key theme emerging from Powellʼs press conference was centred on productivity,whichboththeFedandtheUSadministrationseeasapotentialway for the economy to grow without reigniting inflation. Higher productivity means businessescanproducemorewithoutraisingprices,buttheFedisstillcautious about this. Nonfarm business sector labour productivity in the US climbed 4.9% inQ32025,aftera 4.1percentriseinthesecondquarter,thestrongestrisesince Q3 2023. The Fed argues that clearer evidence is needed that any productivity gainswilllast,beforetheycandecidetoadjustinterestrates,assuchsurgescan fadeasquicklyastheyappear.

Despitepoliticalpressureforfasteranddeeperratecuts,theFederalReserveis signallingthatanymovelowerwilldependheavilyonlabourmarketdata.Current unemployment,at4.4percent,appearstobestabilising,reducingtheurgencyto ease policy. Market participants continue to price in the possibility of two small cuts later in the year, but policymakers have made it clear that weaker job data wouldneedtoemergefirst.

Fornow,thecentralmessageisclear:theFederalReserveiscomfortableholding rates steady while growth runs above its long-term trend. Unless inflation slows more convincingly or employment weakens meaningfully, interest rate cuts are more likely to come later in the year, or not at all if the economy continues to outperformexpectations.

The recent decline in the US dollar and the sharp rise in gold prices are not isolated market events. Together, they represent a broader reassessment of confidence, policy direction, and capital allocation in the global financial system.

The US dollar has fallen nearly twelve percent since the start of 2025, slipping below its five-year moving average. This move suggests that the long period of dollar strength may be ending, driven less by short-term data and more by uncertainty around fiscal discipline, trade policy, and the long-term cost of financingUSdebt.

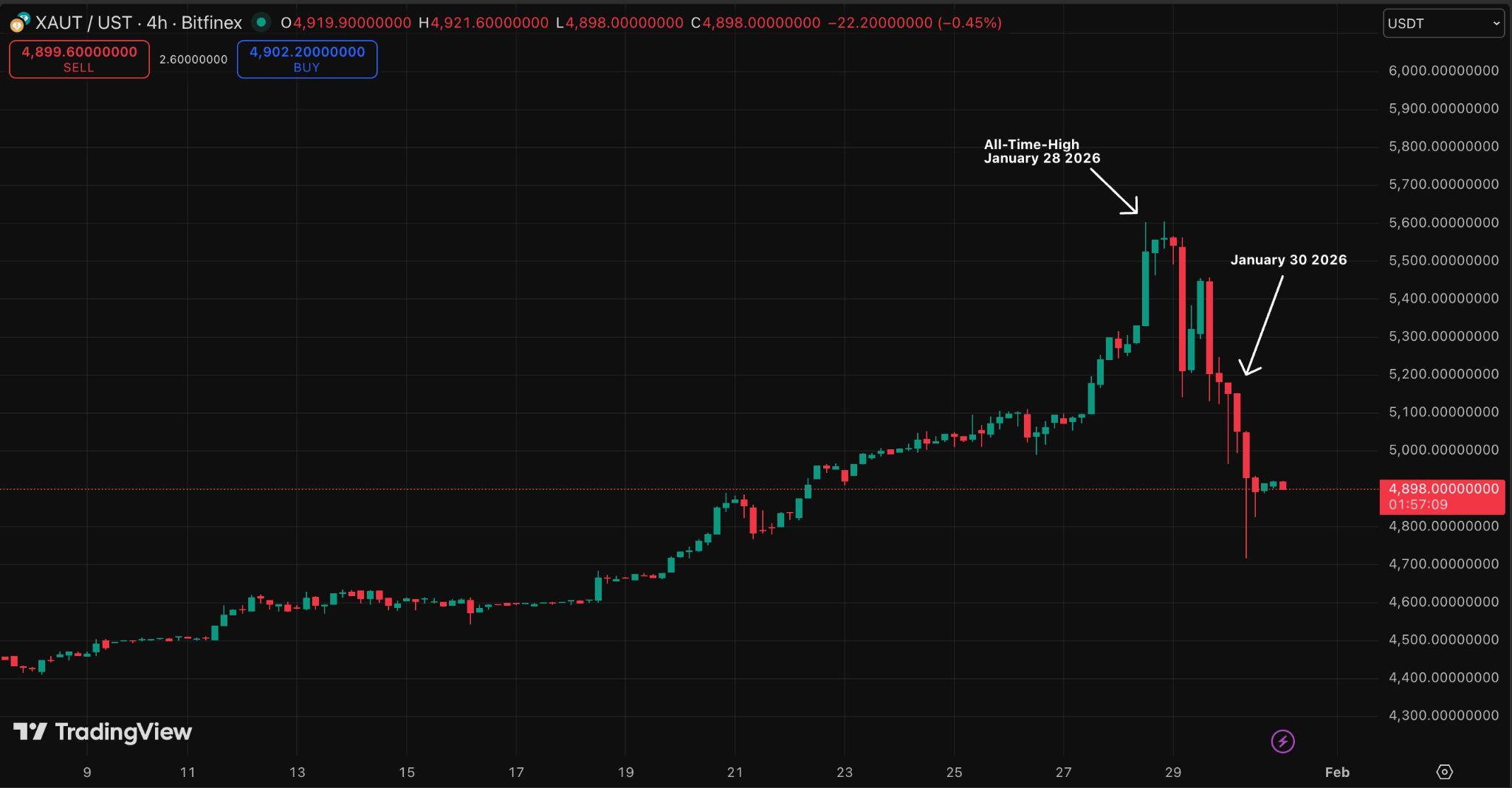

Goldʼsbehaviouroverthesameperiodreinforcesthismessage.

Since mid-2025, gold has surged to repeated new highs, reflecting its traditional role as a store of value during periods of monetary and political uncertainty. Pricesclimbedsharplythroughlate2025andintoearly2026,brieflyreachingjust under $5,646 per ounce before experiencing a sharp pullback. Even after this correction,goldremainsupmorethanthirteenpercentforthemonth,markingits sixthconsecutivemonthlygain.

The underlying drivers are closely linked to the same forces weighing on the dollar. Investors are increasingly questioning the predictability of US economic policy, particularly as trade tensions, tariff threats, and public pressure on the Federal Reserve have intensified under the administration of Donald Trump. These developments have encouraged global investors to reduce exposure to dollar-denominated assets and increase allocations to perceived neutral or hard assets.

Gold benefits directly from this shift. Unlike currencies, it carries no credit risk and does not depend on the policy choices of a single government. When concernsrisearoundthepersistenceofinflation,realyields,ortheindependence ofcentralbanks,goldoftenabsorbsthatuncertainty.

The sharp sell-off at the end of the week highlights an important nuance. Following the announcement of a new Federal Reserve chair nominee, former governorKevinWarsh,goldpricesfellnearlytenpercentinasinglesession.The movehowever,appearstoreflectprofit-takingratherthanashiftinthebroader trend. Expectations for real yields, short-term dollar stabilisation, and crowded positioninglikelycombinedtotriggerthecorrection.

Whenviewedalongsidetheweakeningdollar,goldʼsstrengthsuggestsadeeper signal. Global capital appears to be diversifying away from a system heavily centredonUSfinancialassets.Overthepastdecade,strongequityreturnsand technology-led growth concentrated investment flows into the US. That concentration now represents a vulnerability. As investors rebalance, the dollar facesheadwinds,whilealternativestoresofvaluegainsupport.

The interaction between these markets also matters for policy. A weaker dollar raises import costs and complicates inflation management. Rising gold prices signal declining confidence in fiat purchasing power and long-term fiscal sustainability. Together, they increase the pressure on US policymakers to balancegrowth,debtissuance,andmonetarycredibility.

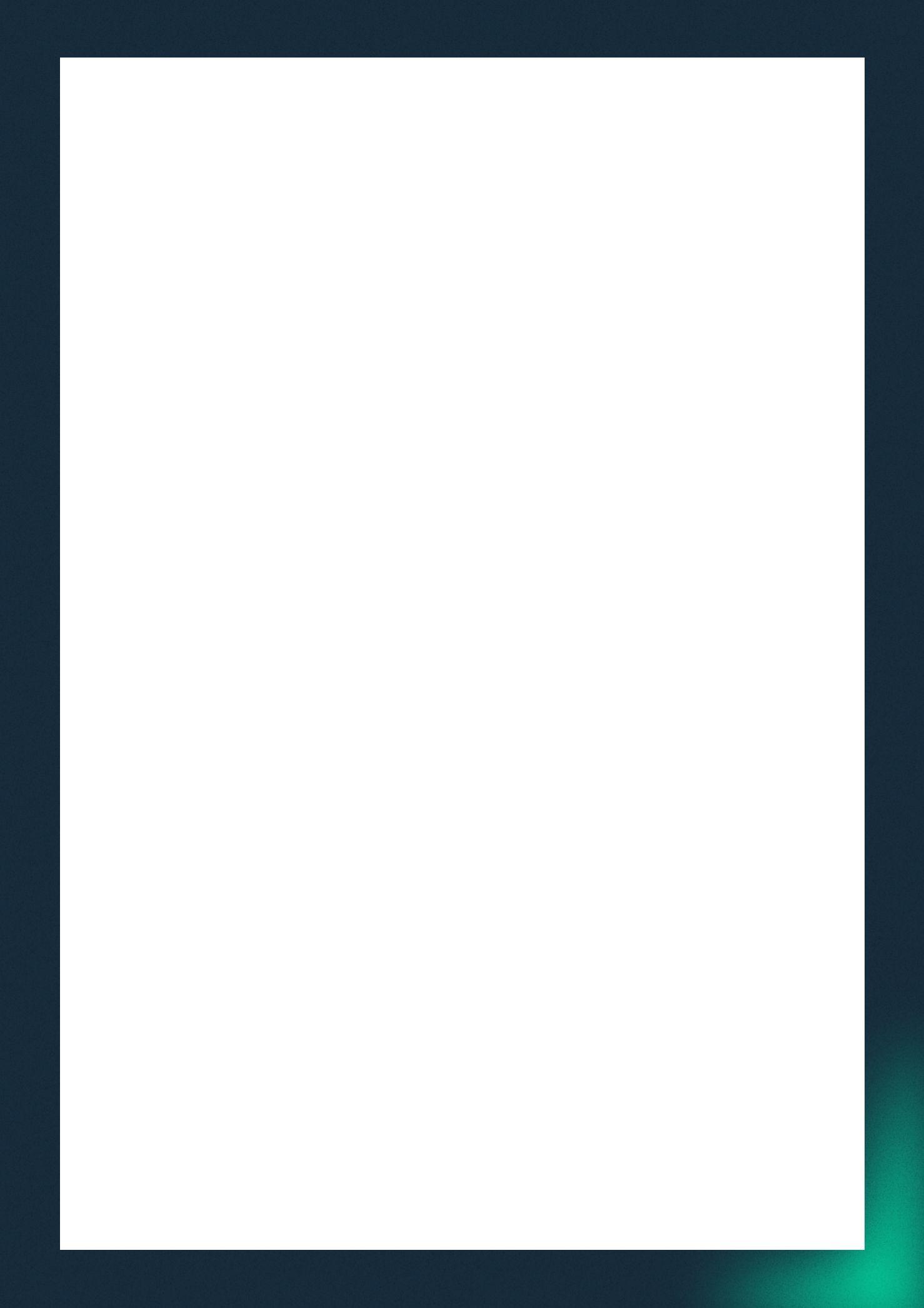

RecentUSeconomicdatashowsrisingcostpressuresalongsideearlysignsof stabilisation in business activity,reinforcing the Federal Reserveʼs decision to remainpatientoninterestrates.Together,inflationdata,manufacturingsurveys, andinventoryfiguressuggestthatgrowthisholdingup,butpricerisksremain unresolved.

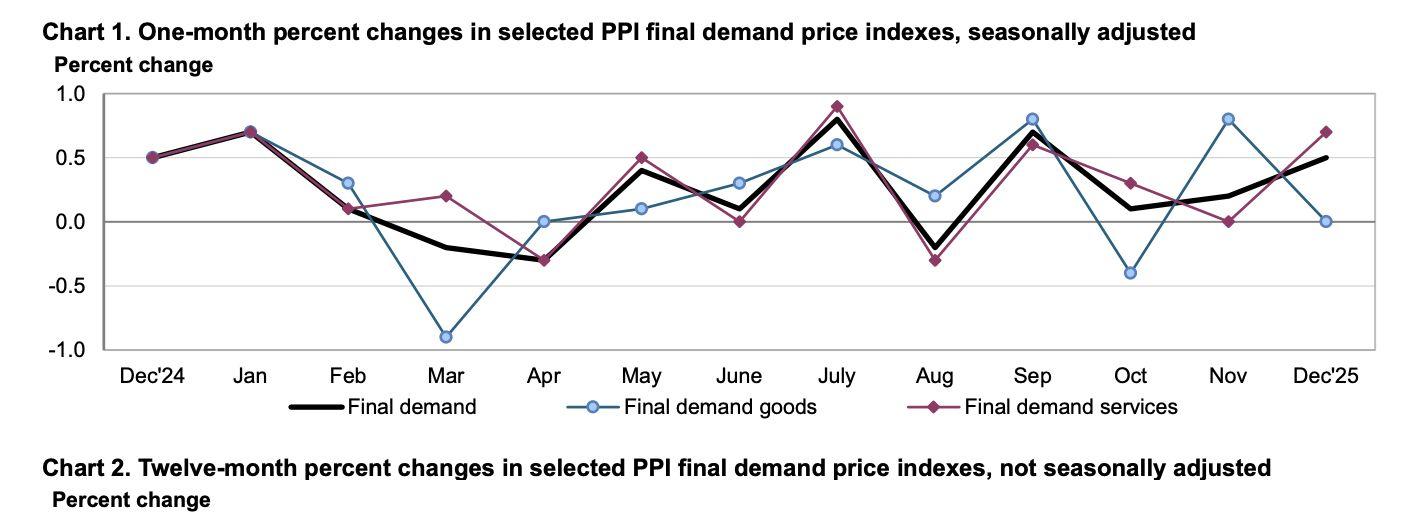

Figure10One-MonthPercentChangesinSelectedPPIFinalDemandPrice Indexes,SeasonallyAdjusted

The latest Producer Price Index PPI released by the US Bureau of Labor Statistics BLS) showed that prices charged by US producers rose faster than expected in December. The index increased 0.5 percent month-on-month, the strongest rise in five months, exceeding the consensus forecast. The PPI tracks price changes at the wholesale level and often signals future movements in consumerinflation.

The increase was driven almost entirely by services rather than goods. Trade services, which reflect the margins earned by wholesalers and retailers, rose sharply, alongside higher prices for hotel accommodation, airline fares, and financial services. Goods prices were flat, as lower energy and food costs offset price increases elsewhere. This suggests that businesses are absorbing part of thecostpressurefromtariffs,butarealsograduallypassingsomeofthosecosts onthroughhigherserviceprices.

From a policy perspective, this matters because services inflation tends to be more persistent than goods inflation. Services are less sensitive to short-term supply changes and are often linked to wages and operating costs. As a result, elevated services prices increase the risk that inflation stays above the Federal Reserveʼstwopercenttargetforlonger.ThissupportstheFedʼsrecentdecisionto keepitspolicyrateunchangedat3.53.75percentandsignalslimitedurgencyto cutratesinthenearterm.

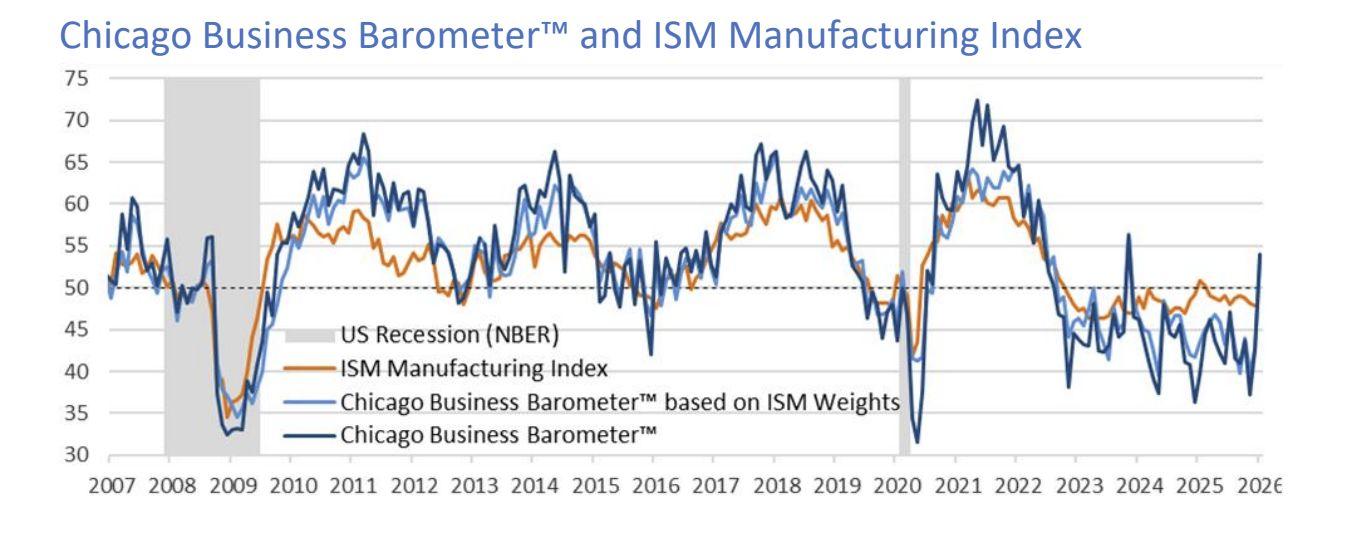

Atthesametime,regionalmanufacturingdataofferedamoreconstructivesignal. The Chicago Purchasing Managersʼ Index, also known as the Chicago Business Barometer,rosesharplyto54.0inJanuary,itshighestreadinginovertwoyears. A reading above 50 indicates expanding activity, meaning manufacturers in the Chicago region reported improving conditions after more than a year of contraction.

The Chicago PMI is closely watched because it often moves in line with the national Institute for Supply Management ISM Manufacturing Index, although it is released earlier. While the latest rebound points to stabilisation, the index remains below levels typically seen at the start of past economic expansions. This suggests that manufacturing is improving from a weak base rather than enteringastronggrowthphase.

Inventory data adds another layer to the outlook. Figures from the US Census Bureauʼs Monthly Wholesale Trade Report for November showed that wholesale inventoriesrose0.2percentinNovember,markingasecondconsecutivemonthly increase.Inventoriesareakeyinputintogrossdomesticproductcalculations,as risingstocklevelscanboostgrowthbyaddingtobusinessinvestment.

After subtracting from economic growth for two straight quarters, inventory accumulationnowappearslikelytocontributepositivelytofourth-quarteroutput. WholesalesalesalsoreboundedinNovember,reducingthetimeneededtoclear existing stock. This combination points to healthier demand conditions and less pressurefromexcessinventories.

Takentogether,thedatapaintsamixedbutcoherentpicture.Inflationpressures arenolongerbroad-basedacrossgoods,butservicepricesremainelevateddue to tariffs and operating costs. Manufacturing activity is showing early signs of recovery,whileinventorydynamicssuggestthatgrowthisstabilisingratherthan accelerating. For markets, this reinforces expectations that the Federal Reserve will stay on hold, balancing steady growth against the risk that inflation remains abovetarget.

Tether has published its Q4 2025 attestation, highlighting a landmark year, markedbyrecordstablecoinissuance,balancesheetgrowth,andprofitability.

In 2025, Tether generated over $10 billion in net profits, with excess reserves reaching $6.3 billion, reinforcing its position as one of the most profitable privately held companies globally. Total USDt in circulation climbed past $186 billion,drivenbynearly$50billioninnewissuanceduringtheyear,withdemand accelerating sharply in the second half amid rising global demand for dollar liquidity.

Tetherʼs reserve assets rose to almost $193 billion, continuing to exceed liabilities. A major driver of this strength was its expanding exposure to US Treasuries. By year-end, direct Treasury holdings surpassed $122 billion, while total direct and indirect exposure exceeded $141 billion, placing Tether among thelargestholdersofUSgovernmentdebtworldwide.

TheattestationalsoconfirmsthatTetherʼsproprietaryinvestments,spanningAI, energy, fintech, media, agriculture, and digital assets, are fully segregated from USDt reserves and funded solely from excess capital. This investment portfolio nowexceeds$20billion.

CEO Paolo Ardoino emphasized that USDtʼs growth reflects a structural shift in globaldollardemandawayfromtraditionalbankingrails,particularlyinemerging markets. With reserves exceeding liabilities and a conservative asset allocation, Tetherenters2026withoneofthestrongestbalancesheetsinglobalfinance.

ThisattestationreinforcesUSDtasafoundationalpillarofglobaldigitalliquidity, strengthening confidence across trading, DeFi, and cross-border payments, exactlythekindofstructuralsignallong-termcryptoadoptiondependson.

Japan is positioning itself for a significant shift in digital asset regulation by preparing to approve its first cryptocurrency exchange-traded funds ETFs as earlyas2028,accordingto recentreportscitingthecountryʼsFinancialServices Agency FSA. This development reflects a broader effort by Japanese authoritiestomodernizefinancialmarketsandbringregulatedcryptoinvestment productsintothemainstream.

Under the proposed changes, the FSA plans to amend existing investment and securities regulations to allow digital assets such as Bitcoin, Ethereum and potentially other major cryptocurrencies to qualify as eligible underlying assets forETFs.ThiswouldmarkadeparturefromJapanʼstraditionallycautiousstance oncryptoproductsandalignthecountrymorecloselywithglobalfinancialhubs suchastheUnitedStatesandHongKong,whichhavealreadymadeprogresson regulatedcryptoETFs.

A core driving force behind the initiative is expanding investor access while maintaining robust protections. Crypto ETFs would permit both retail and institutional investors to gain exposure to digital assets through familiar, regulated securities traded on the Tokyo Stock Exchange, eliminating the need for investors to hold and manage crypto wallets directly. The regulatory framework under consideration reportedly includes enhanced investor protectionsandoversighttoaddressconcernsaboutvolatilityandcustodyrisks.

Major Japanese financial institutions are already preparing for this shift. Firms suchasNomuraHoldingsandSBIHoldingsarewidelyexpectedtobeamongthe first issuers of crypto ETF products once approval is secured, reflecting early industry alignment with the regulatory roadmap. These preparations highlight growing institutional interest in digital assets within Japan and suggest that a domesticETFmarketcouldscalequicklyoncethelegalframeworkisinplace.

The potential 2028 launch timeline coincides with broader changes to Japanʼs crypto regulatory and tax environment. For example, policymakers are considering revisions to tax treatment, including reducing the high tax rates on crypto gains, and updating classifications of digital assets within Japanʼs financial regime to support ETFs and related products. Although these reforms are still under review, they underscore Japanʼs strategic push to balance innovationwithinvestorsafety.