MARKETSTRUCTURE IMPROVESBUT SELLOVERHANGPERSISTS

MARKETSIGNALS

BitcoinBreaksAbove$94KWith Momentum MACROUPDATE

USIn ationAndConsumerDemand

SignalPersistentUnderlying Pressures

BitcoinBreaksAbove$94KWith Momentum MACROUPDATE

USIn ationAndConsumerDemand

SignalPersistentUnderlying Pressures

Bitcoinmomentarilybrokeabovethe$94,000$95,000resistancezonelastweek, on strong spot demand, rallying to an intraday high of $97,850 on 14 January, its highestlevelinovertwomonths.Themovetriggeredameaningfulshortsqueeze, with the largest single-day short liquidations in almost 100 days, as open interest normalised with leveraged longs taking profit and shorts being forced out. Since thereclaimofthe2025yearlyopenandtradingmorethan21percentaboverecent lows,therehasbeenaclearimprovementinmarketstructure,evenwiththeprice retracing around 6 percent from the highs. The breakout, even if temporary, remains constructive, reflecting reduced leverage overhang and improving conditions,providedspotdemandpersists.

However, BTC is advancing into a dense long-term holder LTH) supply zone between roughly $93,000 and $110,000, where previous recovery attempts stalled. While LTHs remain net sellers, the pace of distribution has slowed sharply, with realised profits down to around 12,800 BTC per week from cycle peaks above 100,000 BTC. This moderation, combined with supportive Q1 seasonality and stronger order-flow dynamics than prior rallies, improves the probability that BTC can absorb overhead supply. A sustained move through this zone would require furthereasinginLTHsellpressure,pavingthewayforamoredurablerecoveryand apotentialre-testofall-timehighs.

Recenteconomicdatapointstoanincreasinglycomplexglobalmacroandfinancial backdrop,markedbypersistentinflationpressures,unevenconsumerresilience,and tighteningregulatoryoversight.

In the US, December inflation appeared stable on the surface, but rising food and housingcostscontinuestostrainhouseholdbudgets,limitingtheFederalReserveʼs roomtocutinterestratesquickly.

At the same time, consumer spending held up in November, driven largely by higher-income households, with lower-income groups facing mounting pressure from higher essential prices, tariffs, and uneven tax benefits as refund season approaches,highlightinggrowingimbalancesbeneathheadlinestrength.

BeyondtheUSeconomy,regulatorscontinuedtoassertgreatercontroloverdigital asset markets, with Dubai banning privacy-focused tokens, tightening stablecoin rules,andshiftingresponsibilityfortokenapprovaltofirms.InSouthKorea,access to unregistered overseas crypto exchange apps via Google Play is being blocked, tocomplywithdomesticregulatoryrequirements.Alongsidetheseregulatoryshifts, Chinaʼscross-borderdigitalcurrencyinitiative gainedmomentum,withtransaction volumes on the mBridge platform surpassing $55 billion and domestic use of the digital yuan expanding rapidly, signalling a gradual move toward parallel payment infrastructurethatreducesrelianceondollar-basedsystems.Thesedevelopments underscore a global environment where economic resilience is increasingly uneven, policy flexibility is constrained, and both traditional finance and crypto markets are being reshaped by tighter regulation and evolving payment architecturesratherthanshort-termgrowthdynamics.

1.MarketSignals

● BitcoinAttemptsA$94KBreakout

2.GeneralMacroUpdate

● USInflationDataSignalsPersistentCost PressuresDespiteSofterHeadline Reading

● USConsumerSpendingHeldFirmin NovemberasUnevenGrowthDeepened

3.NewsFromTheCryptosphere

● DubaiʼsCryptoReset:PrivacyTokens BannedandStablecoinRulesReinforced toAlignWithGlobalStandards

● GooglePlayinSouthKoreaWillBlock OverseasCryptoExchangeAppsto EnforceLocalRegistrationRules

● China-LedDigitalCurrencyProjectGains MomentuminCross-BorderPayments

Aggressive spot buying provided the catalyst for a decisive breakout above $95,000lastweek,liftingBitcointoanintradayhighof$97,850on14January; itshighestlevelinmorethantwomonths.

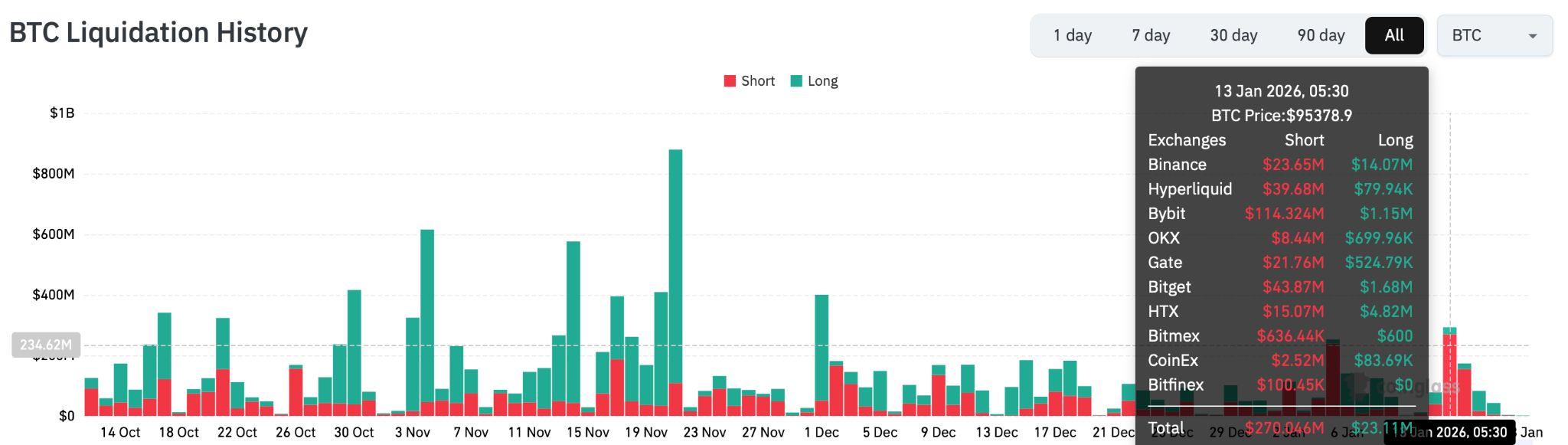

Followingthisadvance,openinteresthasbeguntofall,reflectingacombination ofperpetuallongstakingprofitintostrength,andshortpositionsbeingforcibly closed through liquidations and stop-outs. Notably, 13 January recorded the highestvolumeofshortliquidationsinasinglesessioninalmost100days,with thepreviouspeakoccurringon10October,thelargest24-hourliquidationevent incryptomarkethistory.

Thismarksanimportantinflectionpointforthebullswithinperpetualmarkets. SincetherejectionfromtheOctober6all-timehighof$126,110,BTChasendured the deepest correction of the current cycle with an almost 36 percent drop, peak-to-trough. The latest move however, confirms a material shift in market structure: thenprice has now reclaimed the 2025 yearly open and was trading morethan21percentabovetherecentlowsbeforetodayʼspullback.

WhileBTChasretraced6.1percentsincethe$97,850highs,webelievethemoveto beconstructiveoverall.Takentogether,thebreakoutoverkeyresistance,short-side capitulation, and reduced leverage overhang suggest improving conditions for furtherupside,providedspotdemandremainsresilientandthemarketcancontinue absorbingresidualsell-sidepressurefromhighercost-basisholders.

Bitcoinperpetualandfuturesmarketsacrossallexchangessawover$270millionin short liquidations on 13 January and $155 million on 14 January. While the former wasthelargestinasingledailycandleinover3months,thecombinedfiguresmark the largest two-day short liquidation numbers since July of last year (excluding October10th).

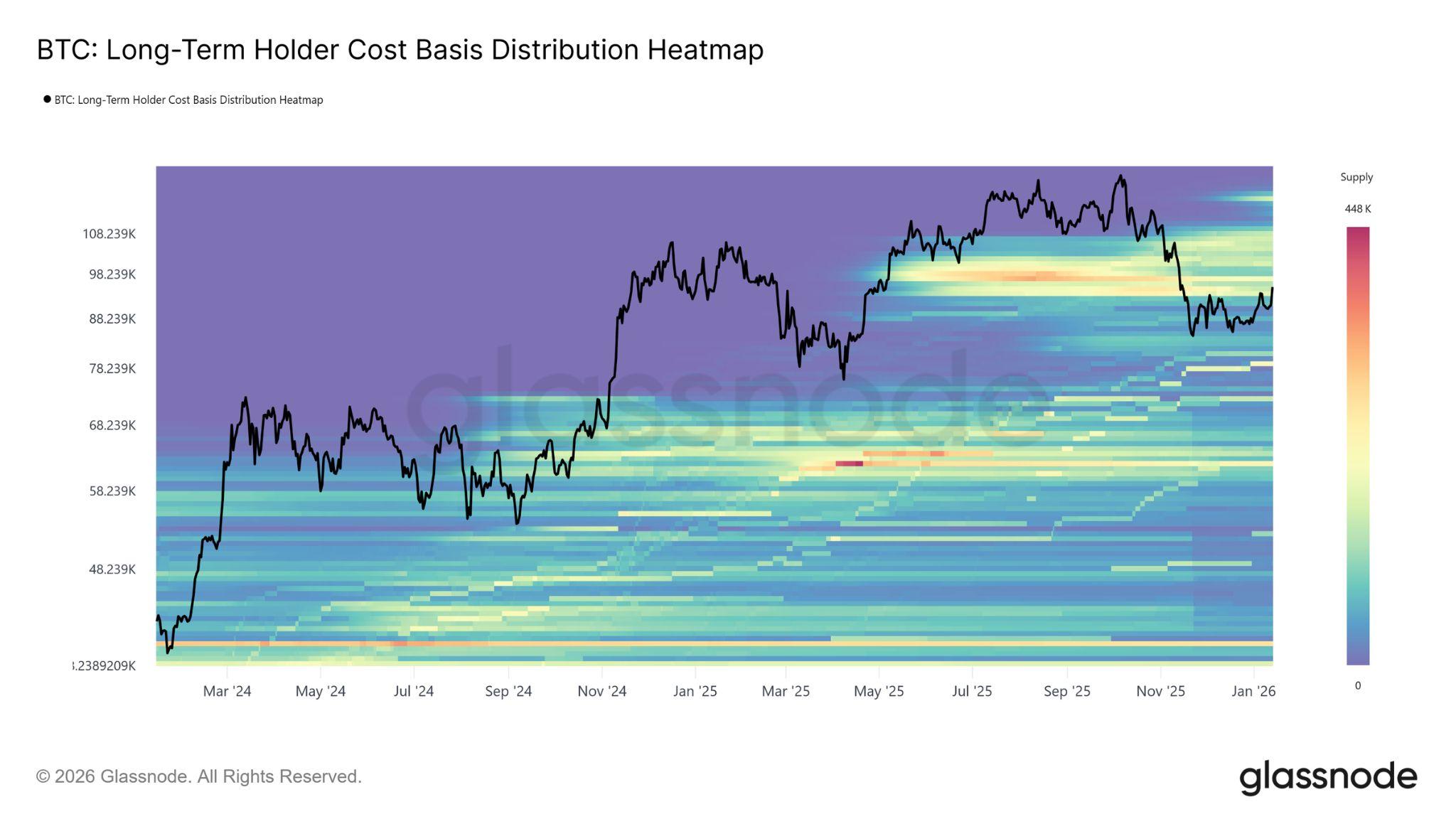

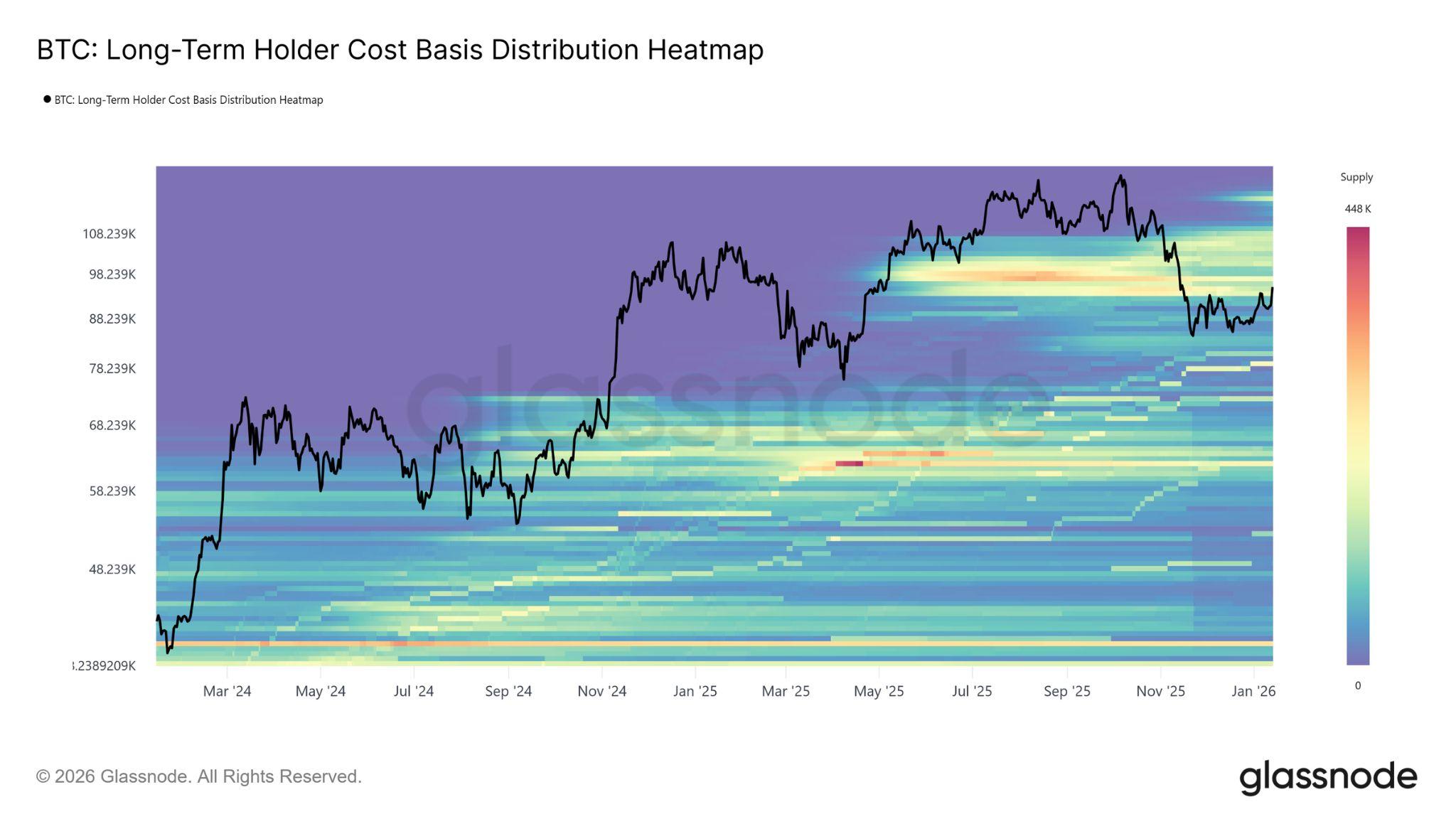

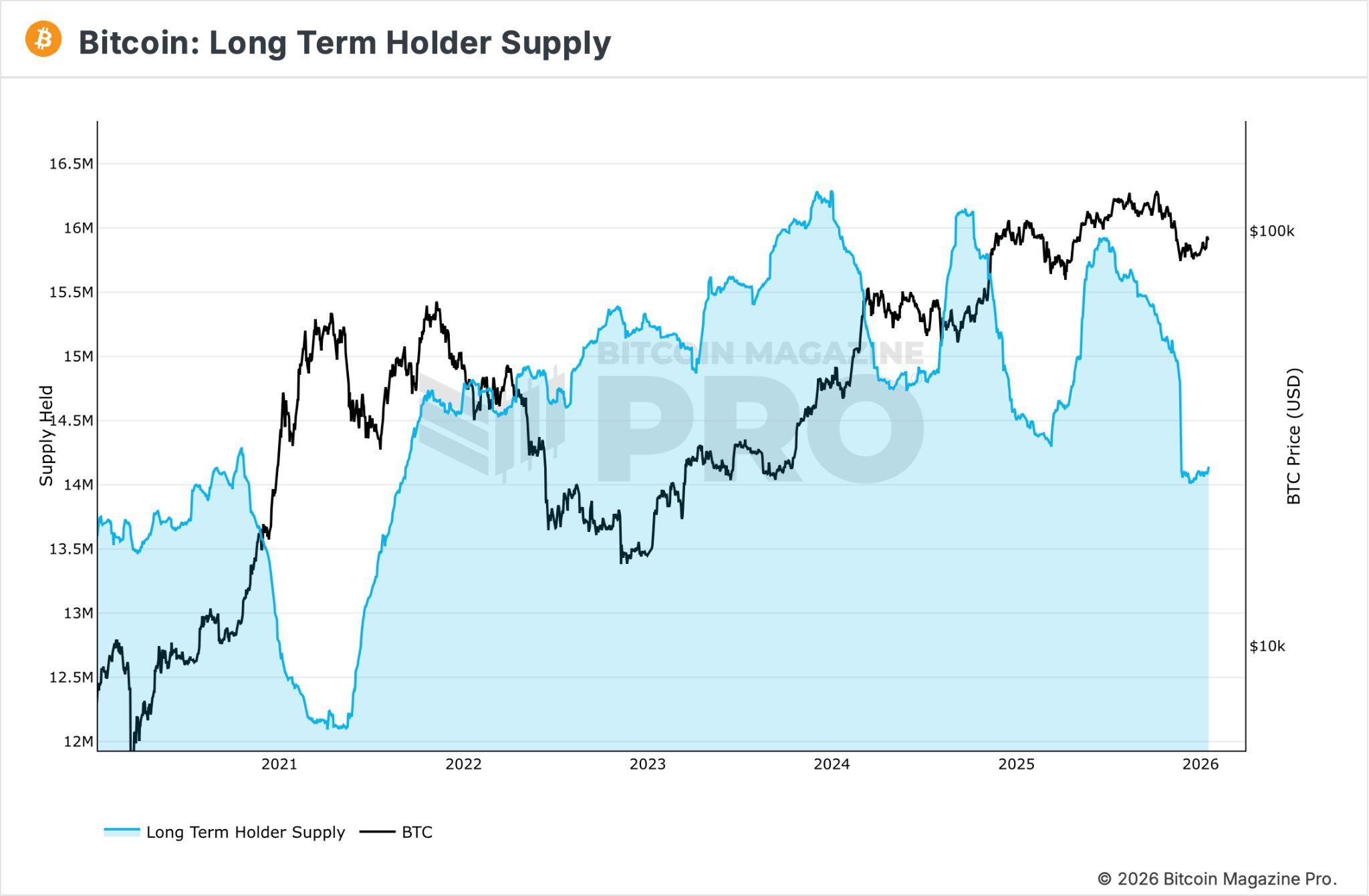

This early-year advance has carried BTC directly into a historically significant supplyzone.Currentpricelevelssitwithinadensebandoflong-termholderLTH supply accumulated between April and July 2025, an area where in the last few monthstherehasbeensustaineddistributionfromwhalesandLTHs.

Source:Glassnode)

Asillustratedbythefigureabove,eachreboundsinceNovember2025hasstalledat the lower edge of this cluster, broadly spanning the $93,000$110,000 range. Repeatedadvancesintothiszonehavemetrenewedsell-sidepressure,preventing thepricefromestablishingadurablestructuralrecoveryoverthepasttwomonths.

WithBTConceagainpressingintothisoverheadsupply,themarketfacesafamiliar testofresilience.AbsorbingLTHdistributionremainsanecessaryconditionforany broadertrendreversal.Thatsaid,currentorder-flowdynamicspointtoastructurally stronger rally than prior attempts. When combined with supportive first-quarter seasonality, this raises the probability that the market may finally be positioned to clearthissupplyzoneandopenapathtowardarenewedtestofall-timehighs.

Bitcoin has a median performance of 4.56 percent in January. Additionally Q1 has historically been a positive month for BTC and other assets as well, with a 48 percentaveragereturnforBTCand71percentforETH.

Aspriceadvancesintoareasdominatedbylong-termholderLTH)supply,attention naturallyturnstowhethertheseinvestorsareacceleratingdistributionorbeginning to ease sell-side pressure. A useful lens here is Total Supply Held by Long-Term Holders, which captures the balance between coins ageing beyond the 155-day threshold(i.e.theLTHcohort),andcoinsbeingspentbackintothemarket.

As can be seen in Figure 5 above, LTH supply continues to trend lower, but the pace of decline has slowed markedly compared with the aggressive distribution observedthroughoutQ3andQ42025.Thissuggeststhatwhilelong-termholders remainnetsellers,theintensityoftheirsellinghasmoderated.Currently,LTHsare realisingroughly12,800BTCperweekinnetprofit,asharpdecelerationfromcycle peaks that exceeded 100,000 BTC per week. In other words, profit-taking is still occurring, but at a far more measured rate than during prior phases of heavy distribution.

Foramoredurablerallytotakehold,marketstructurewillneedtotransitionintoa regime where maturation supply begins to outweigh long-term holder spending. Such a shift would drive LTH supply higher, signalling renewed conviction and reducedsell-sidepressure.Historically,thisconfigurationwaslastobservedduring August 2022September 2023 and again from March 2024July 2025, both periodsthatprecededstrongerandmoresustainedtrendrecoveriesforBitcoin.

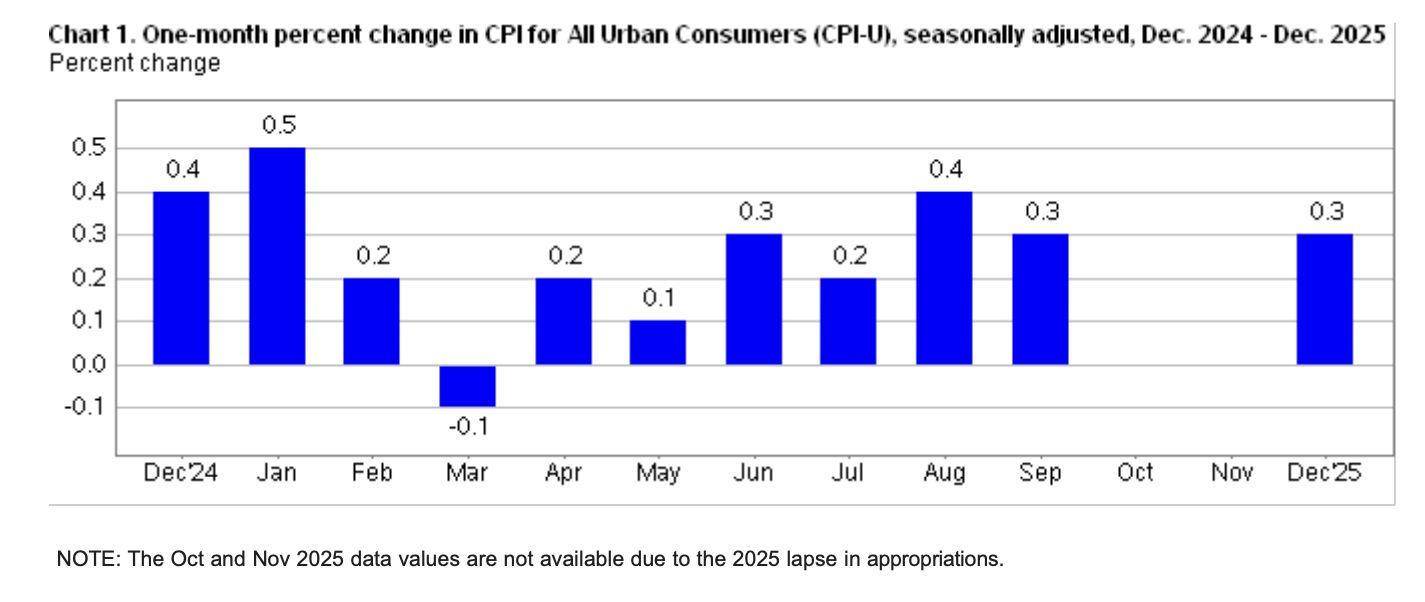

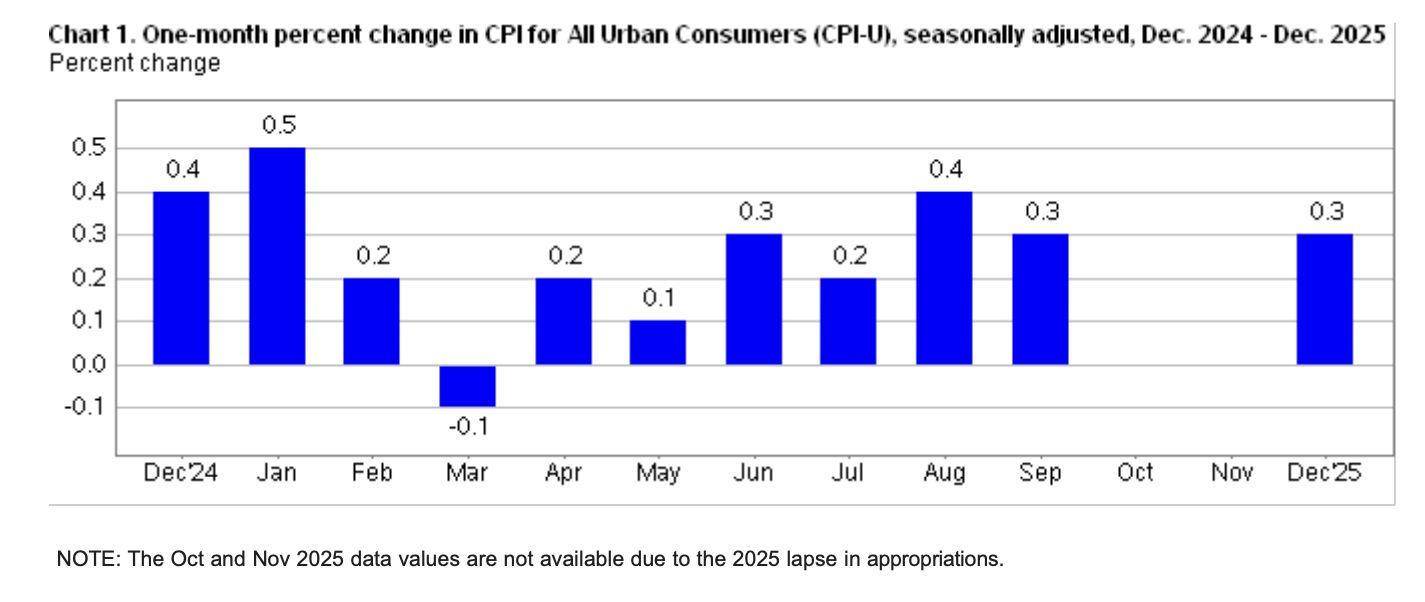

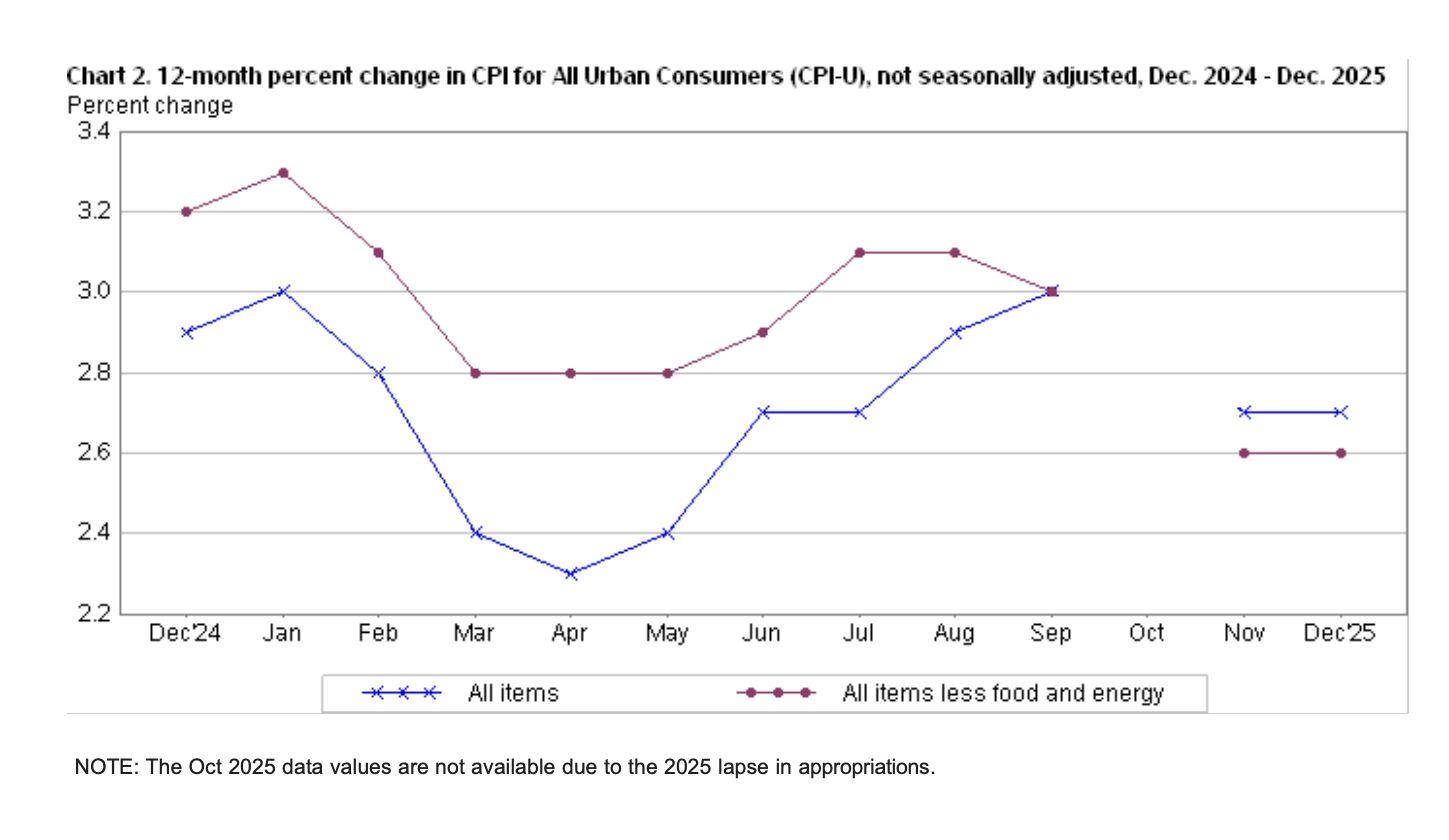

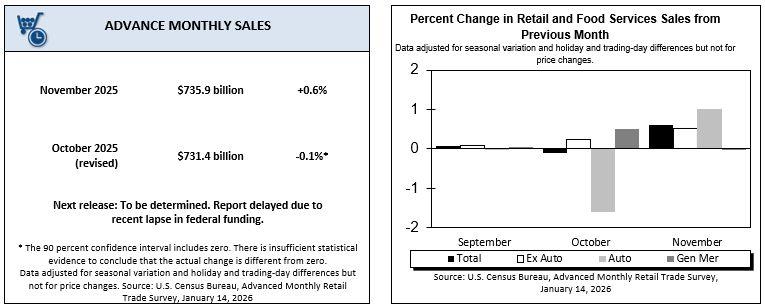

Figure6.One-MonthPercentageChangeinConsumerPriceIndex Source:BureauofLaborStatistics)

USinflationroseinDecemberashousingandfoodcostsincreased,reinforcing expectationsthattheFederalReservewillkeepinterestratesunchangedinthe nearterm.Whileheadlineinflationappearedstable,underlyingpricepressures suggestthepathtowardslowerratesisnarrowingratherthanopening.

US consumer prices increased by 0.3 percent in December, lifting the annual inflationrateto2.7percent,accordingtotheBureauofLaborStatisticsʼConsumer Price Index CPI Summary. Core inflation, which excludes food and energy, rose by 0.2 percent on the month and 2.6 percent from a year earlier. These figures broadly met expectations, but the composition of inflation revealed continued strainonhouseholdbudgets,particularlyfromessentialitems.

Foodpricesincreasedby0.7percentinDecember,thelargestmonthlyrisesince October 2022. This pushed annual food inflation to just over 3 percent. Higher prices were recorded across fruits, vegetables, dairy, and meat, with beef and steak prices showing particularly strong gains. Eating out also became more expensive,asrestaurantpricesroseatthefastestpaceinmorethantwoyears.

Source:BureauofLaborStatistics)

Housing costs were another major driver. Shelter prices, which include rents, increased by 0.4 percent during the month and by over 3 percent on an annual basis. A key component, ownersʼ equivalent rent, also moved higher. These increases followed the resumption of data collection after recent government disruptions,suggestingearlierinflationreadingsunderstatedhousingpressures.

Together,foodandhousingcostsexplainwhymanyhouseholdscontinuetofeelan affordabilitycrisis,evenasheadlineinflationappearscontained.

Some components helped keep overall inflation from rising faster. Gasoline prices declinedby0.5percent,whileusedcarandtruckpricesfellbymorethan1percent. These declines offset rising costs elsewhere, including utilities, medical care, apparel,andairtravel.

Energy costs outside petrol told a different story. Fuels and utilities increased sharply on both a monthly and annual basis, reflecting higher demand and contributing to rising household expenses. Electricity prices, in particular, continuedtoclimbyear-on-year.

This mix highlights why headline inflation can look calm while everyday expenses keeprising.

The Federal Reserve closely monitors inflation measures that exclude food and energy because these items tend to be volatile. Policymakers also favour the Personal Consumption Expenditures PCE) index, which better reflects how consumers actually spend their money. Unlike the Consumer Price Index, which usesafixedbasketofgoods,PCEadjuststochangingspendingpatterns.

TherecentCPIdatamayunderstatepricepressurescapturedbyPCE,especiallyin services and technology-related spending. As a result, Decemberʼs PCE inflation, dueonThursday,22January,couldcomein higherthanCPIsuggests.

Federal Reserve officials have signalled that inflation will hover near 2.6 percent thisyearbeforeeasinggradually.However,withservicesectorinflationremaining firmandhousingcostsrebounding,themarginforearlyratecutsisshrinking.

Distortions caused by recent government shutdowns and data collection issues are expected to fade by spring. As this happens, both headline and core inflation couldmovehigher,offeringaclearerpictureofanypersistentpricepressures.

For now, the data supports taking a cautious stance. Inflation is no longer accelerating rapidly, but it remains elevated in areas that matter most to households. This reality limits the Federal Reserveʼs flexibility and suggests that lowerinterestratesarelikelytoarrivelaterratherthansooner.

US consumer spending remained resilient in November, supported by higher-income households, even as rising prices and a softer labour market weighedonlower-incomegroups.Thedatapointstostrongeconomicgrowthat the end of 2025, but underscores widening imbalances in how inflation and policychangesaffecthouseholds.

In its Retail Sales report, the US Department of Commerce reported that total salesrose0.6percentinNovember,exceedingexpectations.Retailsalesmeasure how much consumers spend on goods and are a key indicator of economic momentum.Theso-calledcontrolgroup,whichfeedsdirectlyintogrossdomestic productGDP,rose by0.4percent,showingthatspendinggrowthremainedsolid evenafteradjustingforinflation.

Ten of the thirteen retail categories recorded gains during the month. Motor vehiclesalesroseonepercent,whilebuildingmaterials,clothing,sportinggoods, and online retail also showed healthy increases. Spending at restaurants and drinking places climbed 0.6 percent, signalling continued demand for discretionaryservices.

Higher-income households continued to spend freely, while lower-income groups became more cautious. The Federal Reserve, in its Beige Book survey, noted that wealthierconsumersincreasedspendingontravel,luxurygoods,andexperiences, while low- to moderate-income households grew more price-sensitive and were hesitanttospendonnon-essentialitems.

Rising prices for essentials amplified these divides. Although overall inflation remained moderate, higher grocery and dining costs disproportionately affected householdswithlessfinancialflexibility.

Tariffscontinuedtoraisepricesforbasicgoods,evenasbusinessesabsorbedpart of the cost. At the same time, recent tax changes delivered larger gains to higher-incomehouseholdsbecausetheypaymoreincometaxupfrontandbenefit more from reductions in marginal tax rates, while lower-income groups rely more on credits that saw limited expansion. As the refund season approached, when householdsbeginreceivingannualincometaxrefunds,thesedynamicsreinforced unevenincomeeffects.

Looking ahead, we expect consumer spending to remain firm in the near term, supportedbyworkersreturningfromgovernmentshutdowns,higherassetprices, and recent fiscal stimulus filtering into household balance sheets. However, a cooling labour market could limit how long this strength lasts, especially for lower-incomehouseholdsconcernedaboutjobsecurity.

With consumer spending having driven strong growth in recent quarters, the economy entered the year on a solid footing. Still, the growing gap between income groups suggests that resilience at the headline level masks rising strain beneaththesurface.

Dubai has undertaken a significant overhaul of its cryptocurrency regulatory framework with the Dubai Financial Services Authority DFSA) implementing sweeping changes that came into force on January 12, 2026, aimed at bolstering compliance, investor protection and alignment with international anti-money-laundering AML) standards across the Dubai International Financial Centre DIFC. Central to this reset is a comprehensive ban on privacy-focused cryptocurrencies,suchasMoneroXMR,ZcashZEC)andothersimilarassetsthat aredesignedtokeepprivatetransactiondetails.Inaddition,privacy-enhancingtools likemixersandtumblersarealsotoberestricted.Underthenewregime,regulated entities within the DIFC are prohibited from trading, promoting, offering or using these tokens and tools because their inherent anonymity features conflict with global compliance norms and make satisfying Financial Action Task Force FATF requirementsdifficult.

In tandem with the privacy token ban, Dubai has tightened the definition and regulatorytreatmentofstablecoins,carvingout“fiatcryptotokensˮasthecategory eligibleforusewithintheDIFConlyiftheyarepeggedtofiatcurrenciesandbacked by high-quality, liquid reserve assets capable of ensuring redemption even during market stress. Algorithmic stablecoins, whose supply dynamics are governed by code rather than actual collateral, no longer qualify under this definition and will instead be treated as general crypto assets subject to more rigorous risk assessmentsandcompliancechecks,thoughtheyarenotoutrightprohibited.

Another transformative aspect of the updated framework is the shift in the token approval process: the DFSA has abandoned its centralised list of “recognisedˮ crypto tokens, placing responsibility on licensed firms to perform and document their own internal suitability assessments for all digital assets they choose to offer, monitor and manage for clients. This firm-led, principles-based approach is intendedtoprovidemoreflexibilityandresponsivenesstomarketinnovationswhile reinforcingcorporateaccountabilityforcompliance,ratherthanhavingtheregulator endorsespecificassetsdirectly.

Google Play is set to implement a major change in how Android users access cryptocurrency trading platforms, in order to align its service with new stringent domestic regulations that require virtual asset service providers VASPs to be registered locally with the Financial Intelligence Unit FIU) in order to offer apps in the country. Under an updated ‘Crypto Exchange and Software Wallet Policyʼ that Google plans to enforce starting January 28, 2026, users in South Korea will no longer be able to download or update mobile applications from overseas crypto exchanges that have not completed Koreaʼs VASP registration process, effectively removing many of the most widely used global platforms from the Android app ecosystemintheregion.

The requirement for local registration as a VASP, which entails compliance with South Korean anti-money-laundering AML) standards, security certifications and reporting obligations, has proven to be a difficult hurdle for many foreign firms, meaningthatmanylargeexchangeswilleffectivelybeblockedfrombeinglistedor updated on the Google Play Store unless they meet the regulatory bar. Only a relatively small number of domestic platforms, including major Korean exchanges such as Upbit and Bithumb, have completed FIU registration, highlighting a gap betweenlocalandinternationalserviceproviders.

While this measure does not outright prevent users from accessing overseas exchangesviawebbrowsers,itrepresentsasignificantshiftinthedistributionand visibility of crypto trading app software and signals deepening regulatory enforcement in one of the worldʼs most vibrant cryptocurrency markets. South Koreaʼsapproachechoesprioreffortstocurbunregisteredforeigncryptoactivity,in which regulators have already blocked unregistered exchange apps and worked with app stores to tighten compliance, but the upcoming Play Store enforcement escalates the policy by embedding regulatory requirements directly into app marketplaceeligibilitycriteria.

For local retail traders who have historically turned to overseas platforms for featuressuchashigherleverage,broadertokenlistings,orarbitrageopportunities, the ban may drastically reduce ease of access to these services through conventional Android app channels, potentially driving some users toward riskier alternatives such as VPNs or direct APK sideloading with heightened security risks.Atthesametime,aligningappdistributionwithSouthKoreaʼsVASPregime may further crystallise the domestic regulatory perimeter and reinforce investor protections in a market with one of the highest per-capita rates of crypto engagementglobally.

AChina-backedcross-borderdigitalcurrencyinitiativeisgainingscale,highlighting growing momentum behind alternatives to traditional, dollar-centred payment systems.AccordingtoanalysisbytheAtlanticCouncil,transactionvolumesonthe experimental mBridge platform have exceeded $55 billion, marking a sharp increaseinactivitysincetheprojectʼslaunch.

The mBridge platform is being tested by central banks in China, Hong Kong, Thailand, the United Arab Emirates, and Saudi Arabia. To date, it has processed more than four thousand cross-border transactions, with cumulative settlement volumes expanding rapidly from negligible levels in 2022. Digital yuan payments, alsoknownase-CNY,isestimatedtoaccountforthevastmajorityoftransactions ontheplatform,underscoringChinaʼscentralroleintheproject.

Separate figures released by the Peopleʼs Bank of China last December show that domestic usage of the digital yuan has also accelerated. Since launch, the e-CNY hasbeenusedforbillionsoftransactions,withtotaltransactionvaluereachingthe equivalentofseveraltrillionUSdollars.

Rather than attempting to replace the US dollar outright, the mBridge initiative reflects a strategy of developing parallel settlement infrastructure that reduces reliance on existing dollar-based systems. While the project is unlikely to overturn dollar dominance in the near term, it may gradually weaken it by offering an alternative route for cross-border payments, particularly among participating economies.

The projectʼs progress is being closely monitored by policymakers worldwide. mBridge was initially coordinated by the Bank for International Settlements, which steppedbackfromtheinitiativeinlate2024.Sincethen,theBIShasshiftedfocus to a separate multi-currency settlement project involving several major Western central banks. That effort, which includes cooperation with more than forty commercial banks, recently entered an expanded testing phase, signalling that competitiontoshapethefutureofcross-borderdigitalpaymentsisintensifying.