INTHEABSENCEOFSPOT DEMAND,BTCISDRIFTING

MARKETSIGNALS

BitcoinDropsBelowResistanceand RemainsRangeBound

MACROUPDATE

GrowthUnderPressure: Consumers,In ation,andthe RepricingofRisk

BitcoinDropsBelowResistanceand RemainsRangeBound

GrowthUnderPressure: Consumers,In ation,andthe RepricingofRisk

Bitcoinʼs attempt to break higher has stalled, with the price failing to hold above the $95,000$98,000 resistance zone and slipping back into its established range. After peaking at $97,850 in mid-January, BTC retraced more than 10 percent,fallingbelowtheyearlyopenasspotbuyingmomentum fadedandETF outflowsintensified.Therejectionofanyupwardgainshastakenplacenearthe short-term holder cost basis, highlighting a fragile equilibrium, where downside continuestobeabsorbedbutupsideprogressisconsistentlymetbydistribution from prior-cycle buyers. Derivatives positioning has reset in an orderly manner, and the volatility response remains confined to the very short end of the curve, suggesting event-driven caution rather than a broader regime shift. In the absence of renewed spot and ETF demand, Bitcoin is likely to remain range-bound, with consolidation prevailing until a clearer demand catalyst emerges.

Geopolitical uncertainty has contributed to market volatility, most notably during the recent escalation, and then subsequent de-escalation, of US strategic ambitions in Greenland. While tariff threats briefly triggered a risk-off response across equities and saw volatility spike, the rapid pullback in policy rhetoric restored near-term stability. However, investor positioning suggests that markets view recent rebounds as stabilisation rather than a return to expansionary conditions.

US economic growth on the other hand, remains resilient, supported by strong consumer spending, but the expansion is increasingly constrained by persistent inflation,weakeninghouseholdsavings,andtighteningfinancialconditions.While demand has kept output above trend, income growth has lagged, forcing households to rely more heavily on credit. Elevated prices, particularly for essential goods, continue to weigh on lower- and middle-income households, limitingtheFederalReserveʼsabilitytoeasepolicydespitesignsofcoolinginthe labourmarket.Asaresult,monetaryconditionsarelikelytoremainrestrictiveuntil clearerandbroader-baseddisinflationemerges.

Financial markets are reinforcing this caution through a broad repricing of risk Rising long-term yields, a higher term premium, and the unusual combination of USdollarweaknessalongsidebondmarketstresssignalgrowingconcernaround fiscal sustainability, policy stability, and geopolitical risk. Capital has gradually rotatedtowarddefensiveassets,indicatingthatfinancialconditionsaretightening inpracticeevenaspolicyrateseaseatthemargin.

Withinthisenvironment,longer-termstructuralshiftscontinuetotakeshape.The NewYorkStockExchange,viaitsparentIntercontinentalExchange,islaunchinga blockchain-enabled, 24/7 trading venue for tokenised equities, reflecting the gradual integration of digital infrastructure into traditional markets. At the same time, corporate adoption of digital assets continues, with perennial buyers Strategy and Bitmine Immersion Technologies expanding bitcoin and Ether holdingsaslong-termstrategicreserves.

1.MarketSignals

● BitcoinDropsBelowResistanceand RemainsRangeBound

● TrumpʼsGreenlandSaga:FromArctic AmbitionstoMarketTurbulence

2.GeneralMacroUpdate

● USConsumersKeepGrowthAlive,But InflationAndPolicyRisksLimitThePath Ahead

● RiskRepricingSignalsAShiftInGlobal FinancialConditions

3.NewsFromTheCryptosphere

● NYSEʼsBlockchain-PoweredPush: Buildinga24/7TradingVenuefor TokenisedStocksandETFs

● InstitutionalCryptoTreasuriesDeepen ExposureasStrategyandBitmine ExpandBitcoinandEthereumHoldings

Bitcoin reached a high of $97,850 on 14 January,hitting a two-month high. Overthecourseoflastweek,however,BTCmanagedtoretraceallpricegains sincethestartoftheyear,droppingmorethan10.8percent,towhatisnow thenewsupportlevelforBTC.

Source:Bitfinex)

Followingtheinitialbreakoutabove$95,000,perpetualcontractopeninterestOI begantodecline,reflectingacombinationoflongstakingprofitintostrengthand shortpositionsbeingforcedtoclosethroughliquidationsandstop-outs.Whilethe move initially appeared constructive from a market-structure perspective, spot market data has since shown a clear fading in buy-side aggression, limiting follow-through. OI is down more than 4 percent, equivalent to $1.18 billion notional,afterBTChititstwo-monthhigh.

Since the rejection from the 6 October, 2025 all-time high of $126,110, BTC has now endured the deepest correction of the current cycle, with a peak-to-trough decline approaching 36 percent. The latest price action nevertheless marked a notableinflectionpoint:aftertradingmorethan21percentabovetherecentlows, BTChasfallen10.8percentandisnowdown6.8percentfromtheweeklyopen. This represents a failed reclaim of the 2025 yearly open, a level that had previouslyactedasanimportantstructuralpivot.

While pullbacks exceeding 10 percent are not uncommon during broader uptrends, such moves are less statistically favourable when there is a potential transition taking place between consolidation to a sustained downtrend. As a result,thebalanceofevidencesuggestsBTCislikelytoremainrange-boundfor now, having fallen back into the established $85,000$94,500 range, until strongerspotdemandre-emergestosupportamoredurablebreakout.

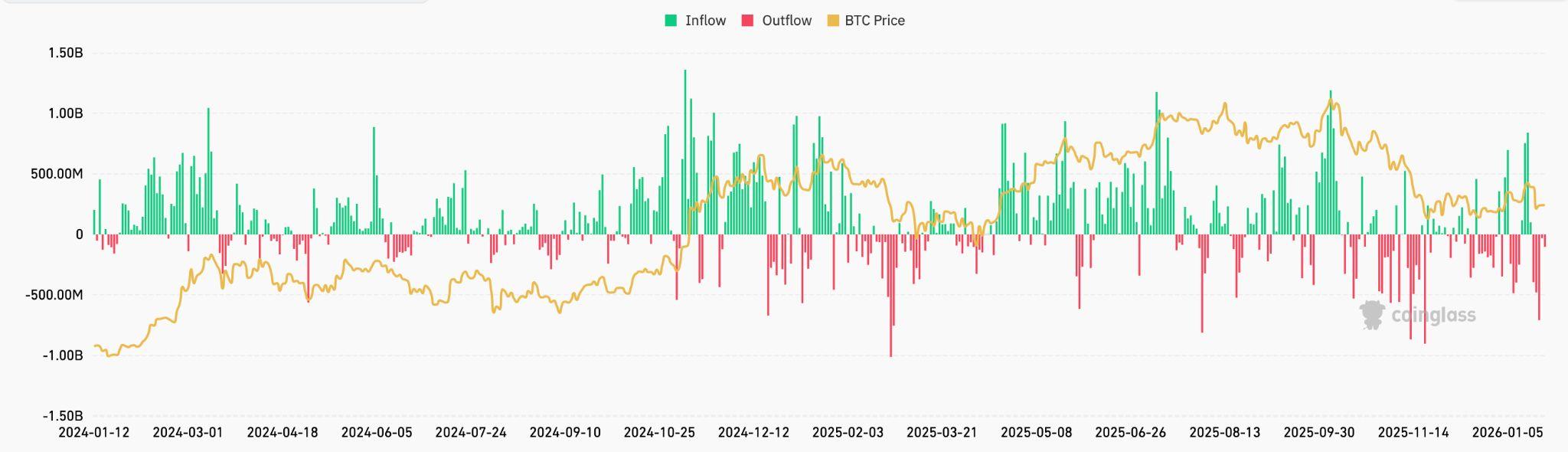

In the past week, spot ETF flows have intensified on the sell side, undermining anybreakoutattempts,abovethekey$95,000resistancelevel.Cumulativespot outflowshaveexceeded$1.3billionoverthisperiod.

Notably, this has included five consecutive days of net outflows across all providers, a relatively rare occurrence that underscores the breadth of the de-risking move. The consistency and scale of these redemptions point to a coordinatedreductioninexposureratherthanisolatedfundrotation,reinforcing theviewthatinstitutionaldemandhassoftenedmateriallyatcurrentpricelevels.

In the absence of renewed ETF inflows, upside attempts remain vulnerable to failure, leaving BTC more susceptible to retracement and range-bound conditionsuntilspotdemandreassertsitself.

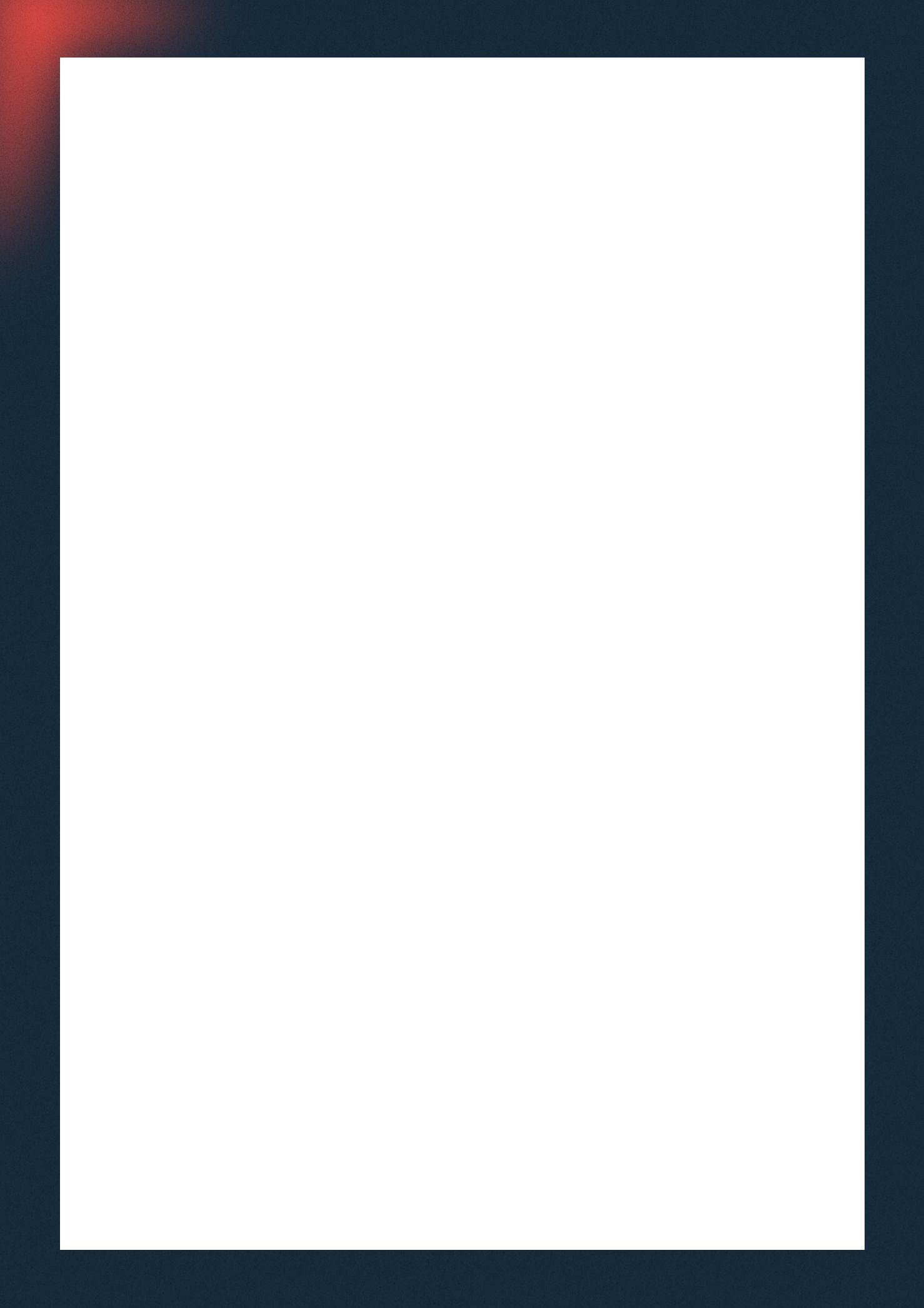

BTCremainscappedontheupsidebytheshort-termholdersʼSTHRP)realised price, a level that has defined a fragile equilibrium in recent weeks. Within this range, downside pressure has been absorbed, yet upside attempts have consistently encountered distribution from investors who accumulated during theQ1Q32025period.

4.BitcoinShort-TermHolderRealisedPrice.

BitcoinMagazinePro)

As we moved into early January 2026, emerging signs of seller exhaustion allowed for a rebound toward the upper boundary of this range. However, this advancecarriedelevatedrisk,asthepricepushedtowardsthe$98,000region, anareawherebreakevensupplyfromrecentbuyersbecameincreasinglyactive.

The latest rejection near the STH cost basis, which sits at approximately $98,309, closely mirrors behaviour observed in previous cycles. Historically, repeated failures to reclaim the STHRP have extended consolidation phases, as this on-chain level has often functioned as a critical support–resistance pivot. Thisunderscoresthefragilityofthecurrentrecoveryattempt,particularlyinthe absence of sustained, aggressive spot buying to absorb residual sell-side pressure.

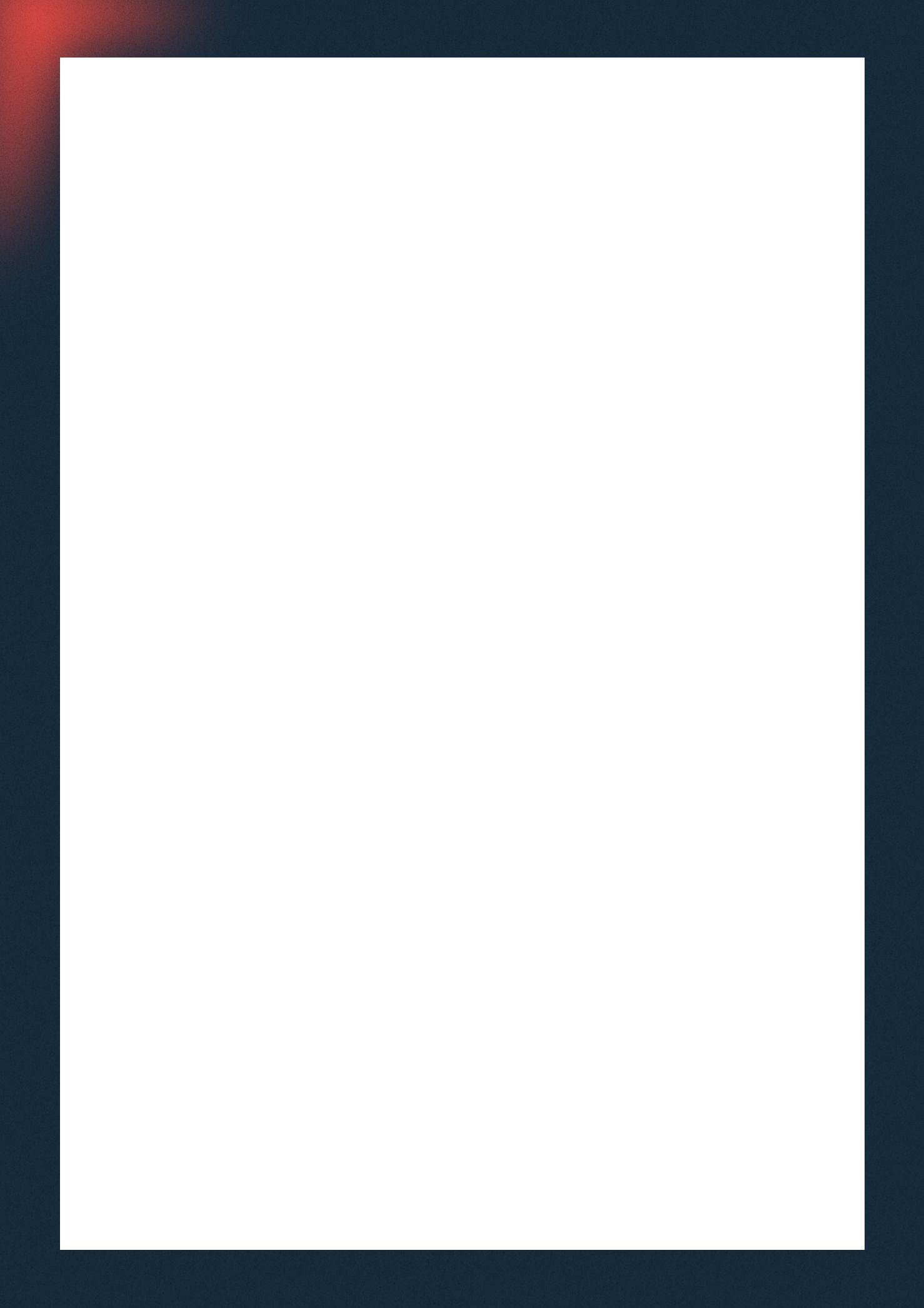

5. BTCOptionsAt-The-MoneyImpliedVolatility.

Deribit/Glassnode)

Therecentspotsell-off,drivenbymacroeconomicandgeopoliticalheadlinesvia ETFoutflows,hasalsoseenareactionattheveryfrontendofthevolatilitycurve.

One-week implied volatility has risen by more than 13 volatility points since last weekʼssell-off,whilethree-monthimpliedvolatilityhasincreasedbyonlyaround twopointsandsix-monthimpliedvolatilityhasremainedlargelyunchanged.

This pronounced steepening at the short-dated end of the curve indicates that market participants are responding tactically rather than reassessing medium-term risk assumptions. When adjustments are confined to near-term implied volatility, it typically reflects event-driven uncertainty rather than the onsetofabroadervolatilityregimeshift.

Inthiscontext,theoptionsmarketispricingtransitoryriskratherthanasustained disruption to market structure. The lack of movement further out the curve suggests that expectations for medium- and longer-term conditions remain broadlyintact,despiteelevatedheadline-drivennoiseintheneartermforBitcoin.

TheUnitedStates'strategicinterestinGreenlandisnotnew.Itdatesbackto1867, when then US Secretary of State William Seward explored the possibility of purchasing the island due to its Arctic location. The proposal ultimately failed to advance, as Washington prioritised post-Civil War reconstruction and domestic concerns.

In the twenty-first century, Greenland has re-emerged as a focal point of geopolitical interest. Accelerating ice melt has increased access to critical mineral deposits, while the islandʼs location has gained renewed strategic relevance amid rising Arctic competition. These developments have intensified tensions between US strategic ambitions, Denmarkʼs sovereignty, and Greenlandʼs own long-term independenceaspirations.

RenewedUSPressureInLate2024

TheissuefirstresurfacedinDecember2024,whenPresident-electDonaldTrump, in a Truth Social post, described US “ownership and controlˮ of Greenland as essential for national security, citing growing Russian and Chinese activity in the Arctic.TheremarksechoedTrumpʼs2019characterisationofGreenlandasa“large realestatedealˮ.

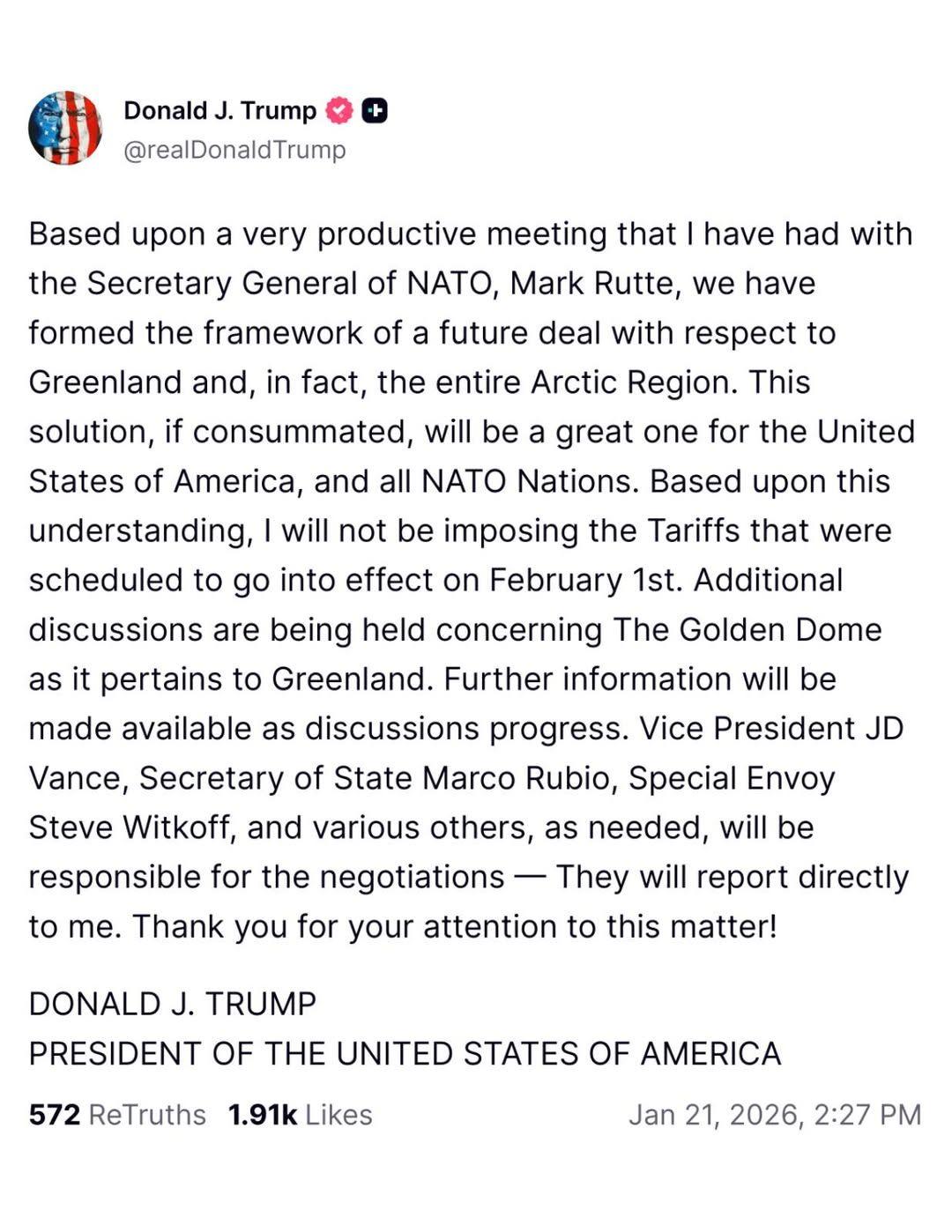

In January 2025, Trump escalated his rhetoric by signalling potential tariffs on Denmarkshouldnegotiationsfail,whiledecliningtoruleouttheuseofeconomic or military pressure. By January 9, 2026, Trump warned publicly that Greenland couldbeacquired“theeasywayorthehardwayˮ,drawingglobalmediaattention andtriggeringdiplomaticbacklash.

Tensions peaked on January 17 2026. Protests were reported in Nuuk, Greenlandʼs capital, as Trump announced a 10 percent tariff on goods from Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland. The proposal included an escalation to 25 percent tariffs by June if no agreementwasreached.

DenmarkraisedconcernsovercollectivesecuritywithintheNorthAtlanticTreaty Organisation,whileseveralalliedcountriesincreasedtheirmilitarypresenceinthe Arcticregion.TheEuropeanUnionsignalledthatitcoulddeploycountermeasures underitstradedefenceframeworkiftariffswereimplemented.

At the World Economic Forum in Davos on 21 January 2026, Trump softened his position.HeruledouttheuseofforceandframedUSdemandsaslimitedsecurity requirements. This shift followed what Trump described as “productiveˮ discussionswithNATOSecretary-GeneralMarkRutte.

On 22 January 2026, Trump announced a provisional “frameworkˮ centredonexpandedUSbasingrights, cooperation on mineral development, and deeper Arctic defence coordination. The proposal did not include a transfer of sovereignty and wasaccompaniedbythewithdrawalof proposedtariffmeasures.

By 23 January, Danish Prime Minister Mette Frederiksen met with Rutte to reaffirm Denmarkʼs position. Greenlandʼs leadership reiterated that sovereignty remains a non-negotiable red line. While discussions continue, the immediate risk of escalation has eased.

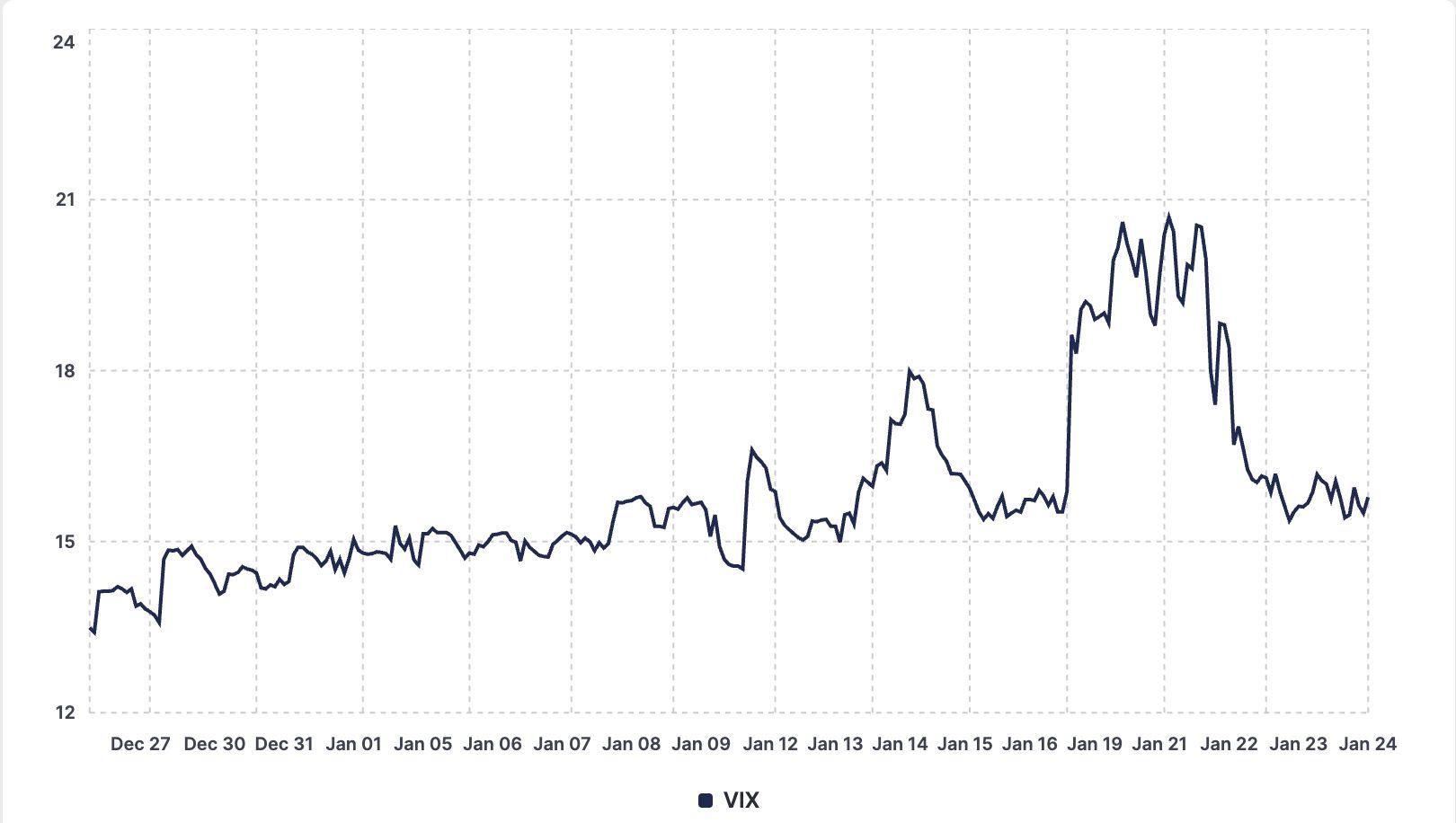

ThegeopoliticaluncertaintysurroundingPresidentTrumpʼstariffthreatsagainst eightEuropeancountriesoverhisrenewedinterestinacquiringGreenlandbriefly spilled into financial markets. The threats initially triggered a risk-off sentiment among investors, fearing renewed trade disputes. On January 20, the CBOE VolatilityIndexVIX)spiked,reaching20.61.  Meanwhile,theS&P500declined sharply that day, opening at 6,865.24 but closing down approximately one percent at 6,796.86 (a drop of about 2.1 percent from the previous close on January16ataround6,940.

However, after Trump backed away from the tariff threats and ruled out military action in Greenland during his remarks at the World Economic Forum in Davos on January 21, tensions eased rapidly. Volatility subsided as the VIX fell to 15 by January22.  TheS&P500reboundedto6,913.35onJanuary22and6,915.61on January23.

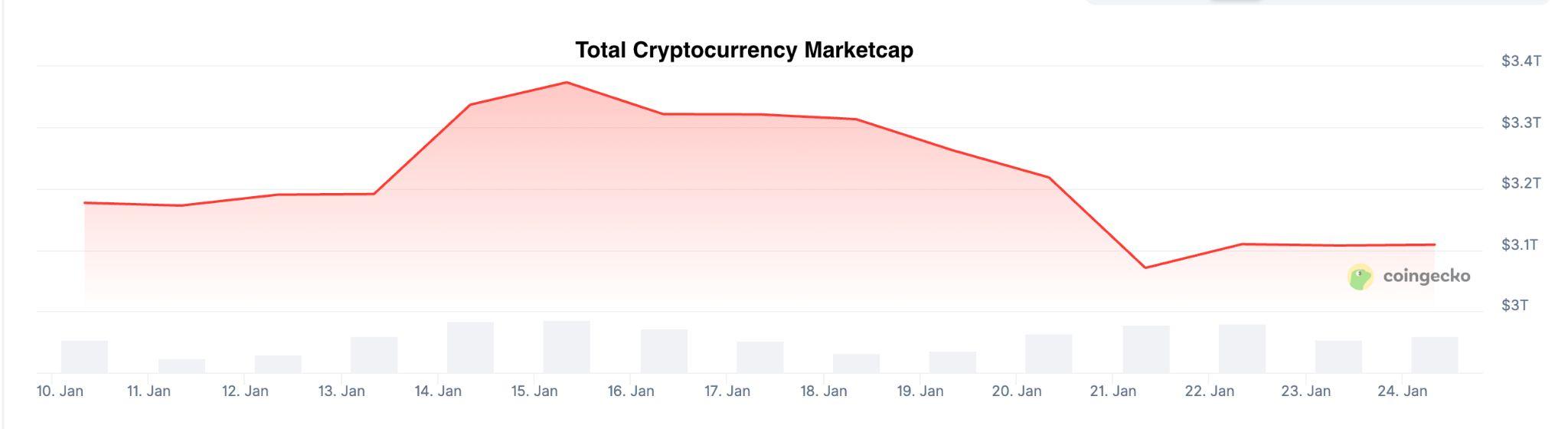

Digital asset markets showed a differentiated response amid the uncertainty. Despiteaninitialdip, withBitcoinfallingabout2.7percentonJanuary19tobelow $90,000,itrecoveredandroseroughly7percentweek-on-weekfromJanuary17 (around$85,000)toJanuary24,andaddedanestimated$130billiontoitsmarket capitalisation. The total cryptocurrency market capitalisation, recovered to approximately $3.2 trillion by January 22, while stablecoin supply expanded to around$310billion,anall-timehighasofJanuary16,reachingover$311billionby January 22, suggesting elevated demand for liquidity and reduced volatility exposureratherthanoutrightrisk-onbehaviour.

The reduction in immediate trade tensions provides short-term support for risk assets globally. If this improvement in the macro backdrop is sustained, it could help restore confidence across markets and allow liquidity conditions to ease further, creating a more constructive environment for both equities and digital assetsinthenearterm.

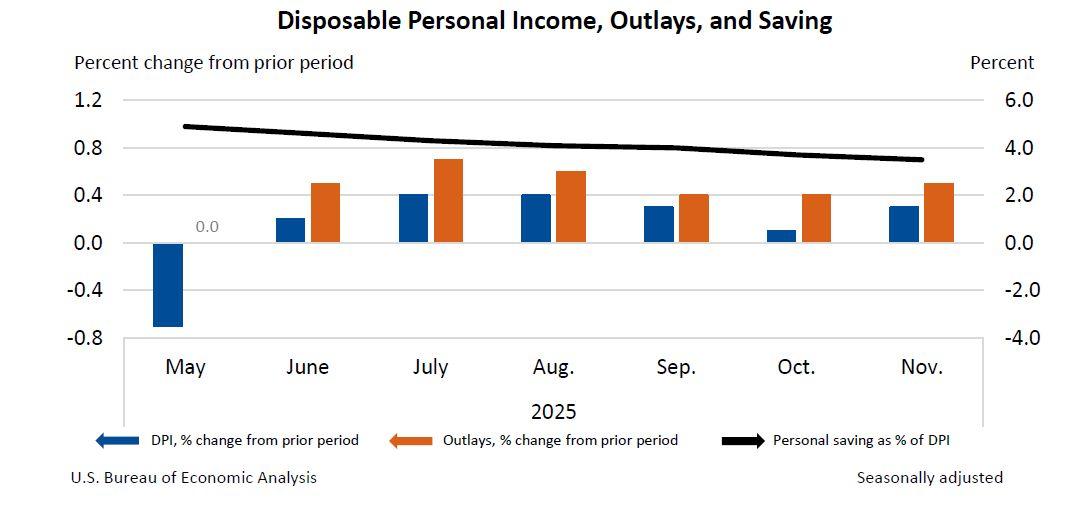

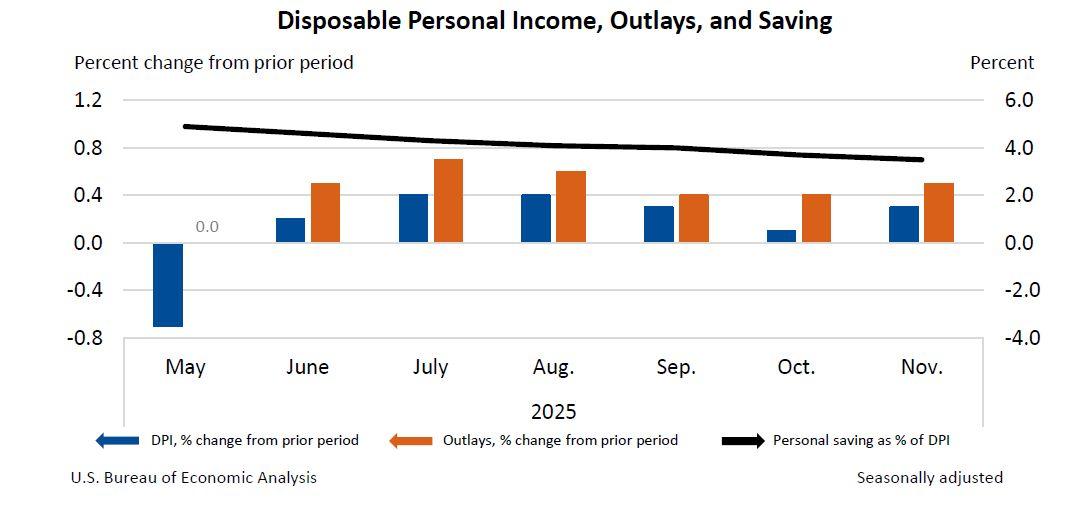

Figure12.DisposablePersonalIncome,OutlaysandSaving Source:BureauofEconomicAnalysis)

US economic growth remains strong as consumers continue to spend, but inflation pressures, uneven income gains and rising policy risks are limiting theFederalReserveʼsabilitytoeasefinancialconditions.

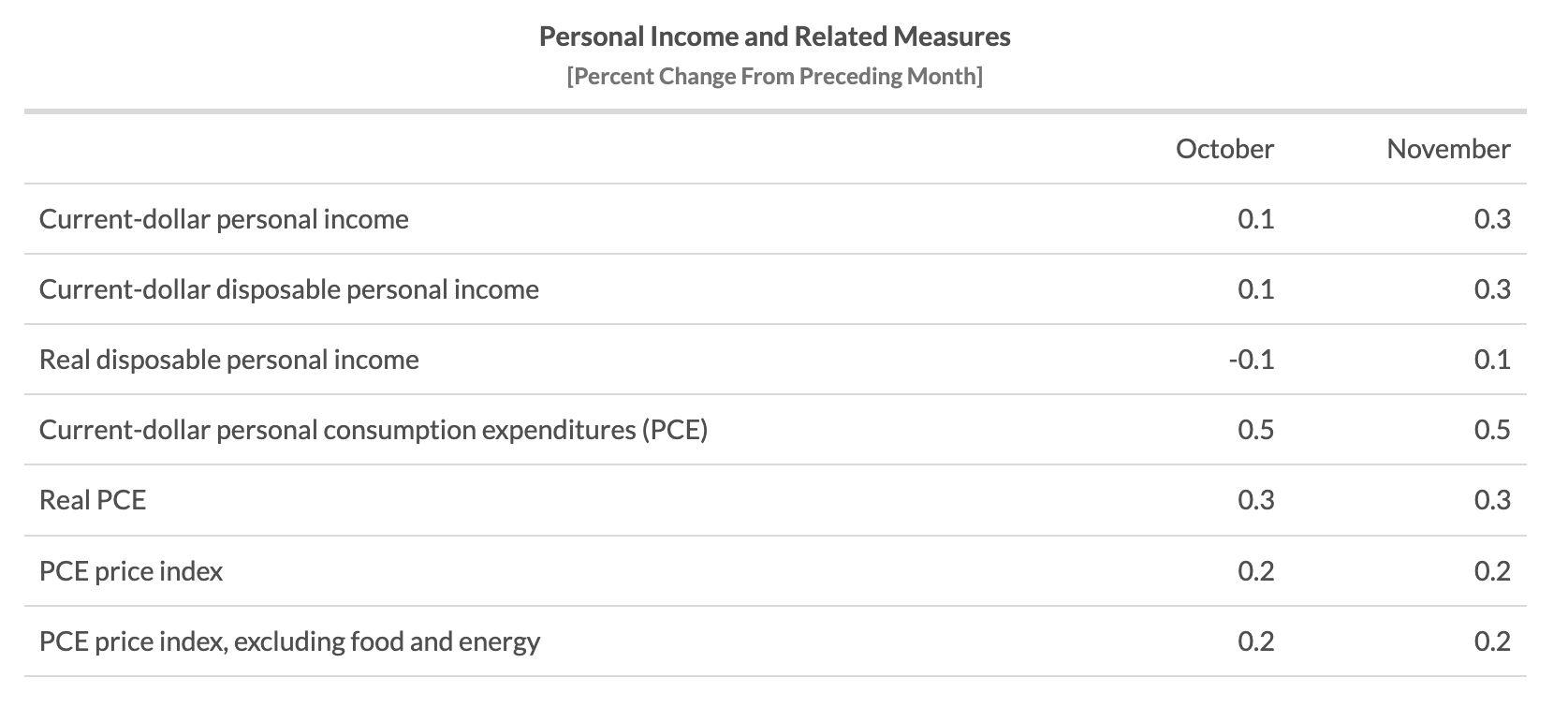

The Personal Income and Outlays report released by the US Commerce Departmentʼs Bureau of Economic Analysis BEA) last Thursday, January 22, shows that consumer spending rose by 0.5 percent in both October and November. This matters because consumer spending accounts for more than two-thirds of total US economic activity, meaning household behaviour largely determineswhethergrowthacceleratesorslows.

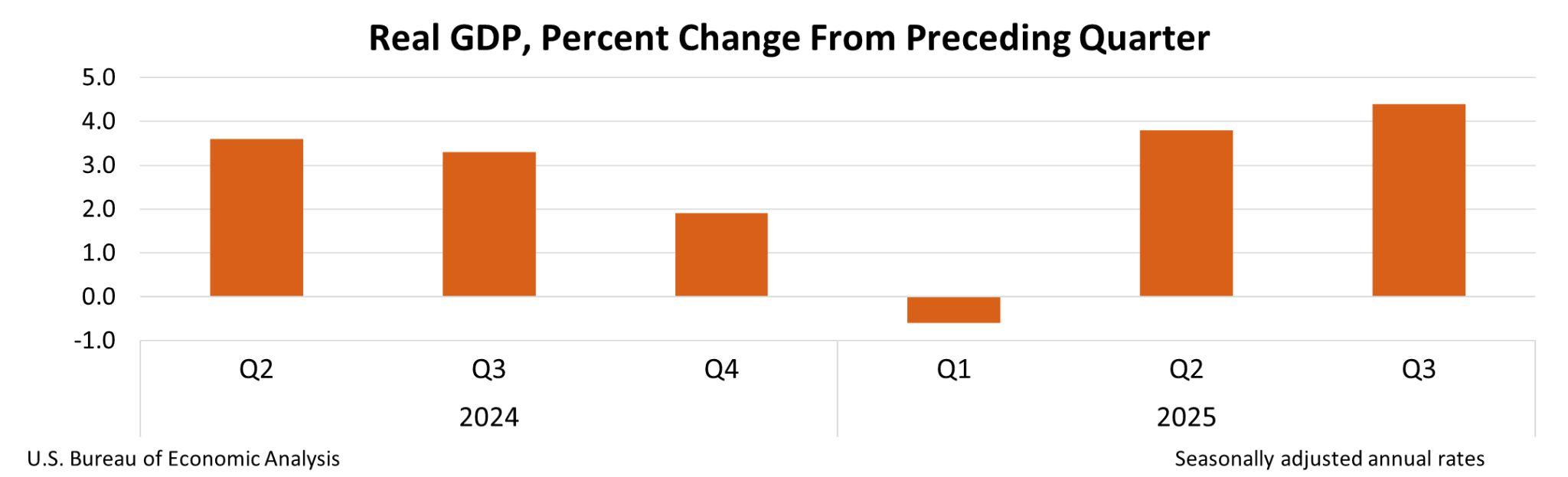

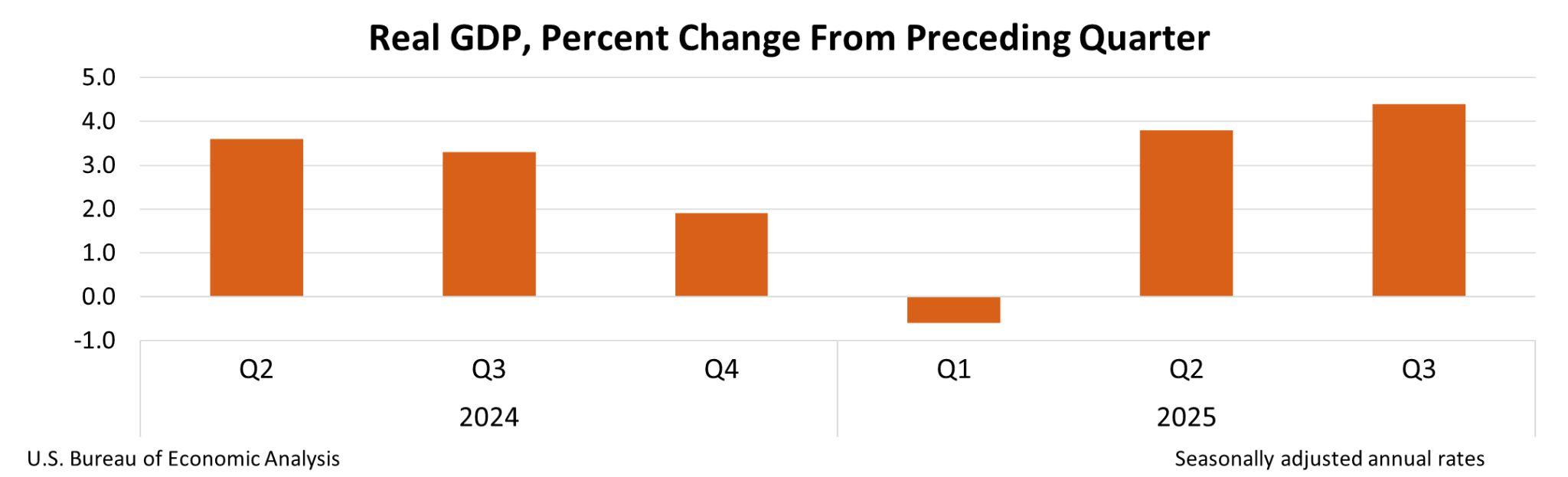

13.RealGDP,PercentChangefromPrecedingQuarter

Spendingstrengthhaskeptoverallgrowthelevated.TheUSeconomyexpanded at a 4.4 percent annualised rate in the third quarter, its fastest pace since late 2023, while the Atlanta Federal Reserveʼs GDPNow model estimates fourth-quartergrowthnear5.4percent(asofJanuary22.Thesefiguresindicate that demand remained strong heading into year-end, supported primarily by services such as healthcare, housing and financial services, alongside steady demandforgoodsincludingvehiclesandclothing.

Source:BureauofEconomicAnalysis)

However, income growth has not kept pace with spending. Personal income increased 0.1 percent in October and 0.3 percent in November, while the householdsavingratefellto3.5percent,itslowestlevelinthreeyears.Insimple terms, many households were spending more by saving less or using more credit, particularly ahead of the holiday season. This pattern suggests resilience in the short term but raises concerns about how long consumers can maintain currentspendinglevels.

Inflation remains the key constraint on monetary policy. The Personal Consumption Expenditures PCE Price Index, the Federal Reserveʼs preferred inflation measure, rose 0.2 percent month over month in both October and November and increased 2.8 percent year over year. Core PCE, which excludes foodandenergy,showedthesameannualpace.

Other price indicators support this view. December Consumer Price Index data showedpricesrisingata2.7percentannualpace,withfoodcostsincreasing3.1 percentovertheyear.Elevatedpricesforeverydayitemssuchasgroceriesmean inflation continues to weigh more heavily on lower- and middle-income households.

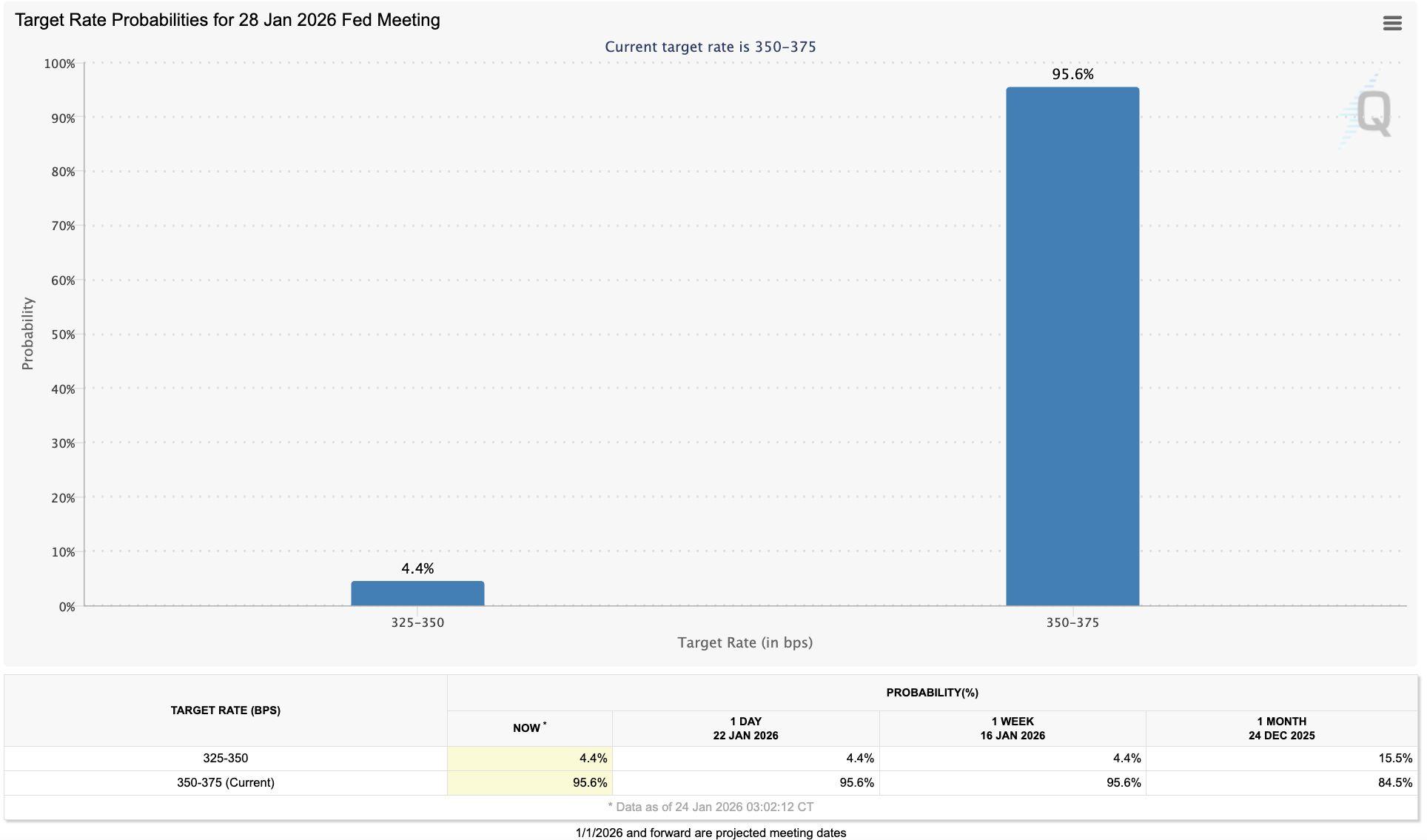

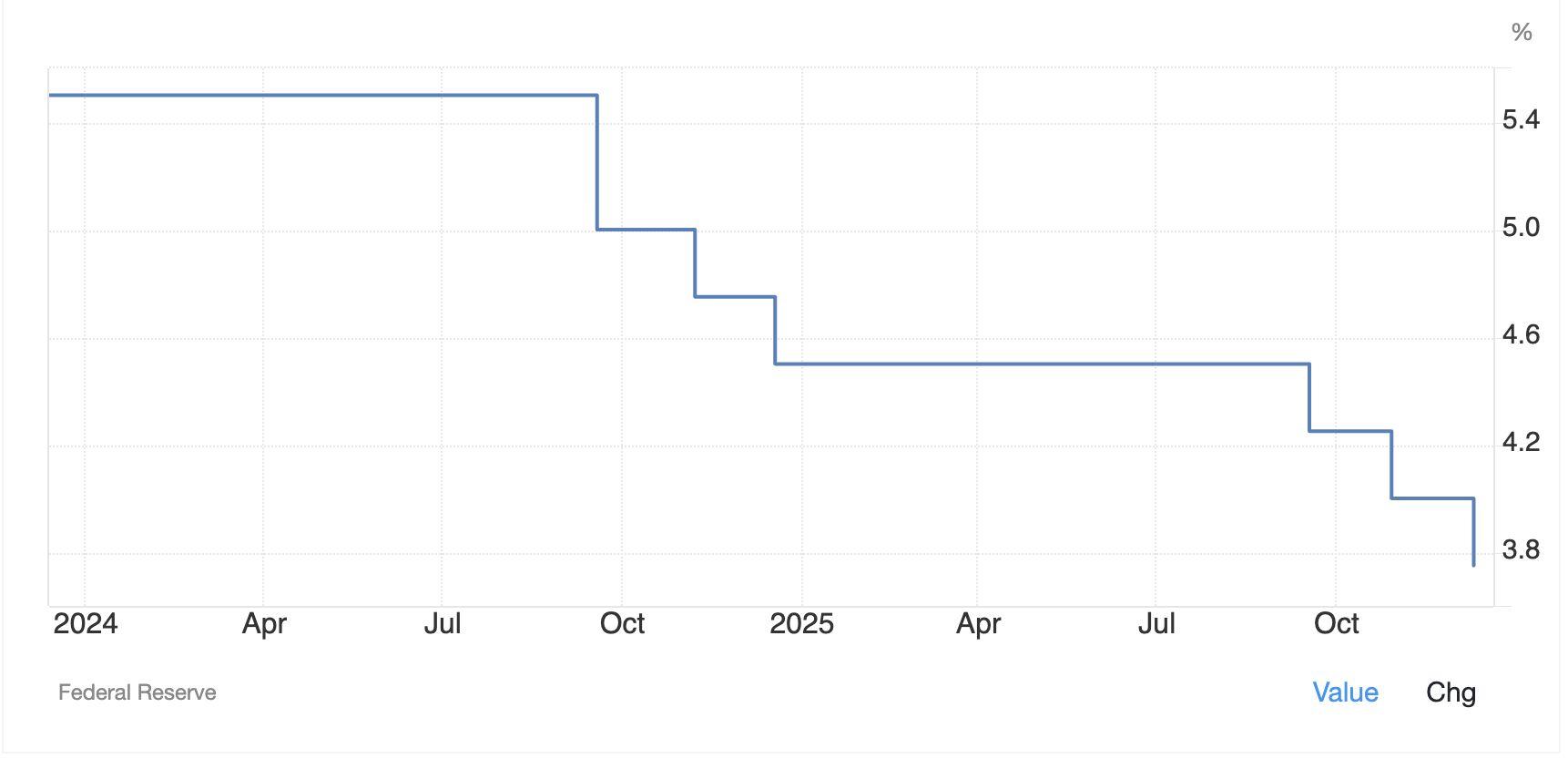

Figure15.TargetRateProbabilitiesforJanuary2026FedMeeting

CMEFedwatchTool)

As a result, markets now expect the US Federal Reserve to keep interest rates unchangedinthenearterm.Thecombinationoffirmspending,easingsavingsand persistent inflation suggests there is little justification for rate cuts in the first quarter. In practical terms, the Fed wants to see clearer evidence that price pressuresarecoolingbeforeloweringborrowingcosts.

The labour market adds another layer of complexity. Headline indicators remain stable, with jobless claims near historical lows and payroll growth continuing. However, hiring has slowed, creating what economists describe as a “low-hiring, low-firingˮ environment. This reflects corporate caution and increased use of automationratherthanbroad-basedlabourdemand.

These trends show an economy where higher-income households and large corporations continue to benefit from growth, while lower- and middle-income households face weaker wage gains and higher living costs. Over time, this divergence increases inequality and reduces the durability of consumer-led growth.

Looking ahead, political and policy risks remain intertwined with the economic outlook. While some policymakers argue that tax cuts and future rate reductions could unlock faster growth, past experience shows that similar policy mixes have also fuelled inflation. For now, the data suggest the US economy is strong but increasingly stretched, with consumers carrying much of the burden as inflation limitstheFederalReserveʼsroomtoact.

Financial markets are undergoing a broad repricing of risk as geopolitical uncertainty,tradepolicyvolatility,andrisingfiscalconcernsintersect.Recent developments have disrupted long-standing asset correlations and tightened global financial conditions, despite ongoing monetary easing by the Federal Reserve.

A notable feature of recent market behaviour has been the simultaneous weakness in US Treasuries and the US dollar. This configuration, often associated with heightened systemic stress, suggests a reassessment of the USʼsroleasarelativelysafehavenwithintheglobalfinancialsystem.

Similar dynamics were observed in early April last year following the announcement of wide-ranging US tariffs. At that time, traditional relationships, including the inverse link between the US dollar and long-term interest rates, temporarily broke down as investors repriced trade and policy risk. Subsequent increases in bond yields tightened financial conditions sufficiently to prompt a partialreversalinpolicy.Theeffectiveaveragetariffratelatersettledwellbelow initialproposals.

Current market conditions indicate that investors are once again testing the durability of US policy commitments. While a further moderation in trade policy remains possible, the adjustment phase is unfolding amid elevated volatility and reduced risk tolerance. This is creating tension with recent interest rate cuts, whichwereintendedtosupporteconomicactivityamidslowinggrowth.

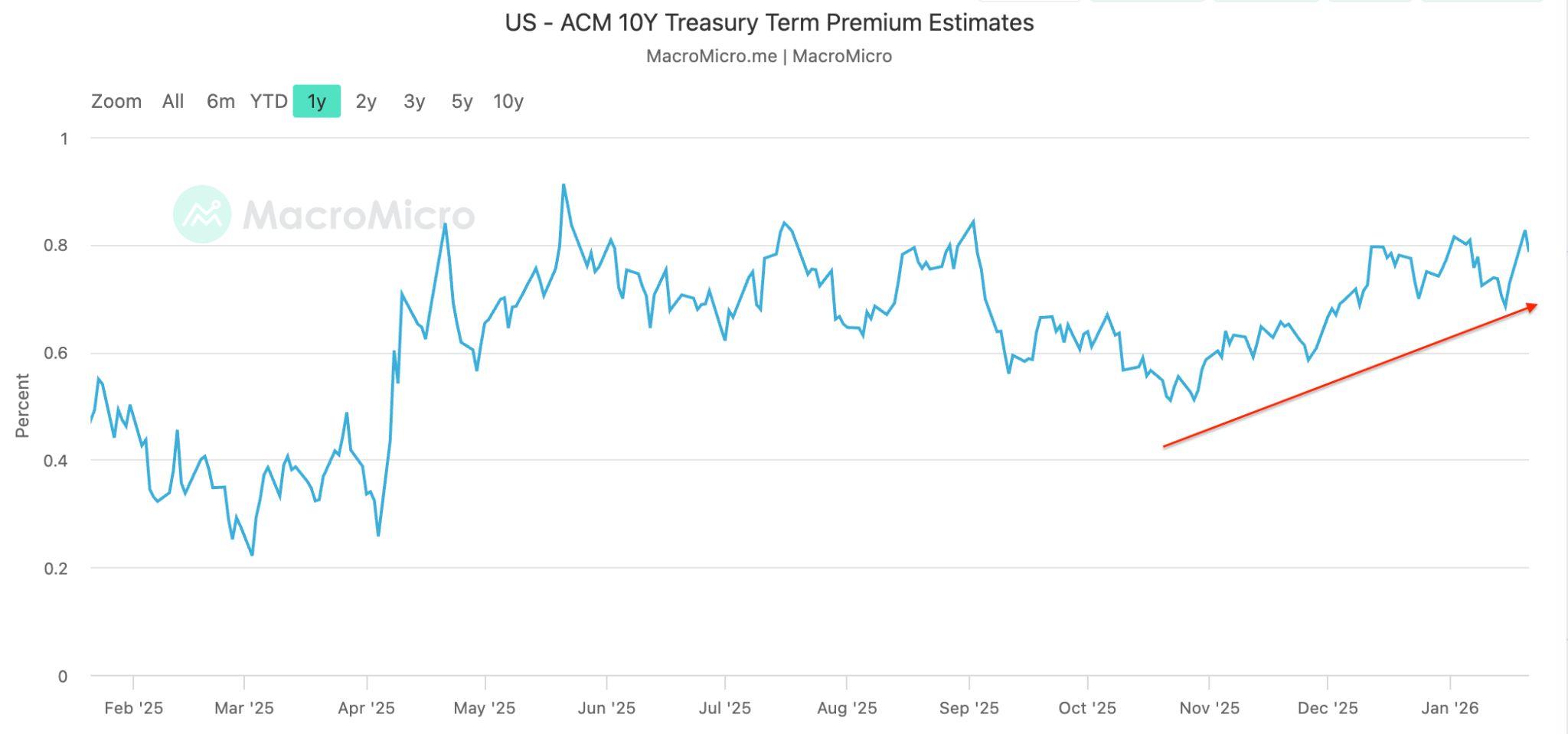

While equity markets have, until recently, shown resilience to geopolitical developments, bond markets have been signalling stress since late November. Long-termUSTreasuryyieldshavemovedhigher,evenastheFedhaslowered itspolicyrate.

Thisdivergencereflectsariseinthetermpremium,theadditionalcompensation investors demand for holding longer-dated debt. The increase reflects several overlapping concerns. Expectations of higher public debt issuance, reduced foreign demand for US assets, and a weaker US dollar have all contributed to higher required returns. These forces limit the Fedʼs ability to ease financial conditionswithoutreignitinginflationarypressures.

Rising yields across the ten-year and 30-year segments indicate that investors are pricing a higher probability of persistent inflation, particularly if trade frictionsescalatebeyondtheircurrentscope.

Investorpositioningsuggestsagradualmoveawayfromgrowth-sensitiveassets towardstoresofvalue.Demandforgoldhasremainedstrong,withpricesrising sharply over the past year. At the same time, the US dollar has depreciated meaningfully.

Together,thesetrendssignalareassessmentofeconomicandgeopoliticalrisk that predates recent disputes involving Europe and the US. The shift implies increased sensitivity to inflation outcomes and reduced confidence in policy stability.

Importantly,manyoftheUSʼsmajortradingpartnersarealsoitslargestexternal creditors. Sustained selling of US assets would raise funding costs, constrain fiscalflexibilityandincreasethecostofcapitalacrosstheeconomy.

Recentmarketreboundsfollowingtariffreversalshighlightarecurringpatternin trade negotiations. Aggressive policy announcements have repeatedly been followedbypartialretreatsoncefinancialmarketsreactnegatively.

While such reversals have supported short-term recoveries in risk assets, defensive positioning has not fully unwound. Gold prices have remained elevated, and traditionally defensive equity sectors continue to attract capital. This suggests that investors view recent rallies as stabilisation rather than a returntoexpansionaryconditions.

19.USHealthcareETFATraditionallyDefensiveEquitySector)

Takeaway

Markets are signalling that financial conditions are tightening, not easing. Rising long-term yields, a higher term premium and persistent demand for defensive assetsindicatethatriskisbeingrepricedacrossassetclasses.

Even with lower policy rates, structural concerns around debt, trade policy and geopolitical alignment are limiting the effectiveness of monetary easing. As a result,globalfinancialconditionsappearlessaccommodativethanheadlinepolicy movesalonewouldsuggest.

TheNewYorkStockExchangeNYSE,underitsparentcompanyIntercontinental Exchange ICE, is actively developing a new trading venue that leverages blockchaintechnologytoenableround-the-clocktradingoftokenizedstocksand exchange-tradedfundsETFs,amarkeddeparturefromtraditionalmarkethours. This initiative, announced in mid-January 2026, aims to marry the NYSEʼs established matching infrastructure with distributed ledger systems to facilitate continuous,near-real-timetradingandsettlementofdigitalrepresentationsofUS equitiesandETFs,onceitsecuresthenecessaryregulatoryapprovals.

Atthecoreofthisvisionisthetokenisationoftraditionalsecurities,digitaltokens that are fungible with their conventional counterparts, preserve dividend rights and governance entitlements, and can be traded without the constraints of pre-definedmarkethours.Theplatformisdesignedtosupportinstantsettlement via blockchain, fractional-share pricing via dollar-denominated orders, and stablecoin-based funding mechanisms that facilitate liquidity outside normal banking hours, contrasting sharply with the current T1 settlement cycle in US equitymarkets.

ICEʼs strategy extends beyond the trading layer to the post-trade ecosystem, including clearinghouse readiness and tokenised deposit support in collaboration with major financial institutions such as BNY Mellon and Citigroup. This infrastructure is intended to ensure market participants can move funds and collateralseamlesslyacrosstimezonesandoutsidetraditionalsettlementperiods, potentiallyreducingfrictionandlatencyassociatedwithoff-hourtransactions.

Market observers see this move as part of a broader evolution in capital markets, in which legacy exchanges and brokerages, including Nasdaq and othertradingvenues,arerespondingtoinvestordemandforcontinuousaccess to US equities while adopting blockchain rails that have long powered cryptocurrency markets. Critics, however, have questioned how much of this promiseisfullyengineeredversusaspirational,notingthatcoreimplementation details, such as the specific blockchain architecture and governance model remainunspecified.

Overall, the NYSEʼs 24/7 tokenised trading platform represents a potentially transformative step in integrating distributed ledger technology with traditional financial markets, offering faster settlement, broader access, and persistent liquidity, but its ultimate impact will depend on regulatory clearance and operationalexecution.

Institutional adoption of digital assets continues to accelerate, with recent disclosures from Strategy and Bitmine Immersion Technologies highlighting a growing trend of corporations treating cryptocurrencies as long-term strategic reserveassetsratherthanshort-termtradinginstruments.

StrategyexecutedoneofthelargestcorporateBitcoinpurchasesinrecentyears, acquiring22,305bitcoinforapproximately$2.13billionbetweenJanuary12and January 19, 2026. The transaction lifted the companyʼs total Bitcoin holdings to 709,715Bitcoin,cementingitspositionastheworldʼslargestcorporateholderof theasset.

Thepurchasewascompletedatanaveragepriceofroughly$95,284perbitcoin, bringing Strategyʼs aggregate cost basis across its entire Bitcoin portfolio to approximately$75,979percoin,inclusiveoffeesandexpenses.Thetotalvalue of its Bitcoin holdings now stands in the tens of billions of dollars, underscoring thescaleofthefirmʼsbalance-sheetexposure.

Fundingfortheacquisitionwassourcedentirelythroughcapitalmarkets,withnet proceedsofapproximately$2.1billionraisedviaat-the-marketofferingsofClass Acommonstockandmultiplepreferredstockseries.Managementreiteratedthat proceeds from these offerings were directed exclusively toward Bitcoin accumulation,consistentwithStrategyʼslong-standingtreasurystrategy.

Despite the size of the acquisition, Strategyʼs equity declined by roughly five percentinpre-markettradingfollowingtheannouncement,reflectingthestockʼs growingsensitivitytoBitcoinpricemovements.Overtime,Strategyʼsshareshave increasinglyfunctionedasaliquidproxyforinstitutionalinvestorsseekingBitcoin exposurewithoutdirectcustody.

Inparallel,BitmineImmersionTechnologiesdisclosedasubstantialexpansionof its Ethereum reserves. As of January 19, 2026, the company holds 4,203,000 Ether,positioningitamongthelargestinstitutionalholdersofEthereumglobally. Combined with cash and other digital assets, Bitmineʼs total crypto and cash treasurynowstandsatapproximately$14.5billion.

Unlike Strategyʼs Bitcoin-only approach, Bitmine has adopted a hybrid accumulation and yield strategy. Of its total Ether holdings, 1,838,003 ETH are actively staked across three providers, allowing the company to generate ongoing staking rewards while maintaining exposure to Ethereumʼs long-term networkgrowth.

Company leadership also highlighted strong governance support, noting that more than 52 percent of outstanding shares voted in favour of management proposals at the 2026 annual stockholder meeting. Chairman Tom Lee emphasisedadisciplinedcapitalstrategyfocusedonexpandingcryptoholdings whileavoidingequityissuancebelownetassetvalue.

Bitmineʼs Ethereum accumulation reflects a broader ambition to secure a meaningfulshareoftotalETHsupplywhilemaintainingliquidityandoperational flexibility. The company steadily increased its digital asset base throughout 2025, signalling sustained conviction in Ethereumʼs role within institutional portfolios.