This budget will raise more revenue from property taxes than last year's budget by an amount of $425,711, which is a 10.92 percent increase from last year's budget. The property tax revenue to be raised from new property added to the tax roll this year is $234,596.

The members of the governing body voted on the budget as follows: FOR: AGAINST:

PRESENT and not voting:

Property Tax Rate Comparison

Property Tax Rate:

No-New-Revenue Tax Rate:

No-New-Revenue Maintenance & Operations Tax: Rate: Voter-Approval Tax Rate:

$0.5078/100 $0.4861/100 $0.4370/100 $0.5215/100 $0.0479/100

& ORGANIZATIONAL

Transmittal Letter

Budget Highlights

City Council & City Official

Organizational Chart

Core Values

2023–2024 Strategic Plan

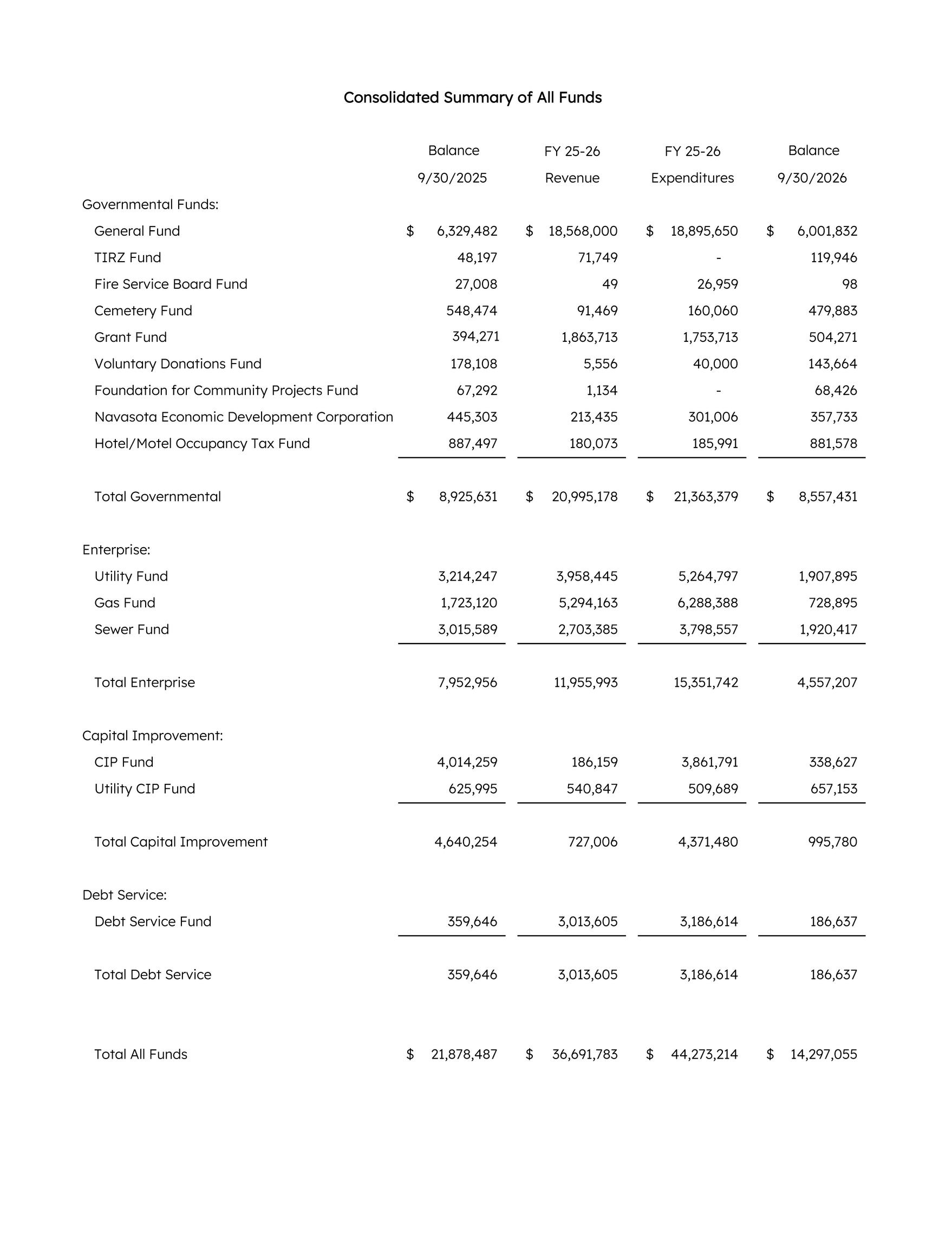

Consolidated Fund Summary

General Fund

Summary

General Fund - Statement of Revenues

General Fund - Summary of Department and Divisions

Utility Fund – Revenues & Expenditures

Gas Fund – Revenues & Expenditures

Sewer Fund – Revenues & Expenditures

TIRZ No 1 Fund – Revenues & Expenditures

Firemen’s Services Fund – Revenues & Expenditures

Cemetery Fund – Revenues & Expenditures

Grant Fund – Revenues & Expenditures

Voluntary Donations Fund – Revenues & Expenditures

&

Projects Fund – Revenues & Expenditures

CIP Fund – Revenues & Expenditures

Service Fund – Revenues & Expenditures

To: Mayor and City Council

From: Robert Hemminger, City Manager

Date: August 5, 2025

It is with great pleasure and honor that the staff and I present the proposed fiscal year 2025-2026 budget and tax rate. This budget considers many factors, including, and most significantly, the will of the people as expressed through their elected officials. This budget is a balanced proposal between anticipated revenues and expenses and is an extension of the on-going progress in Navasota. We believe this budget mirrors the priorities expressed by the Council and meets the needs of the individual departments.

As we discussed in the Budget Workshops, this year’s budget follows a “back-to-basics” approach of living within our means. There are no new personnel positions, there is no proposed debt issuance this year, and no changes to our tax rate or utility rates. This provides us with an opportunity to truly evaluate our fiscal position and make wise choices for our future. NOTE: There will be an increase in garbage collection rates, as that contract allows for an annual increase and the City collects this as a pass-through.

The proposed tax rate is $0.5078 per $100 of appraised valuation, which is the same as last year. The no-new-revenue tax rate would be $0.4832 and the voter approval tax rate is $0.5155.

This tax rate will yield approximately $3,931,000 (rounded) in ad valorem tax and taxrelated revenue. The total anticipated General Fund revenue is approximately $18,500,000. This reflects an increase of approximately 22.6% from last year’s adopted General Fund revenue; however, much of this is due to a change in our budget methodology (described further below) and only represents a 7.9% increase in property tax revenue.

This budget is a solid product of staff dedication and effort. As Navasota prepares to grow, our city staff is dedicated to ensuring long-term success and sustainability of city services. The staff has made a commitment to hold their current staffing levels to allow a review of operations and potentially undergo a reallocation of resources to most efficiently serve the community. This was critical to meeting our goals of having a balanced budget while funding priority needs.

This year’s budget embarks on an effort to ensure financial transparency and accountability. Some of the noteworthy points regarding this budget, and areas the Council has identified as a priority, are described in the bulleted list below.

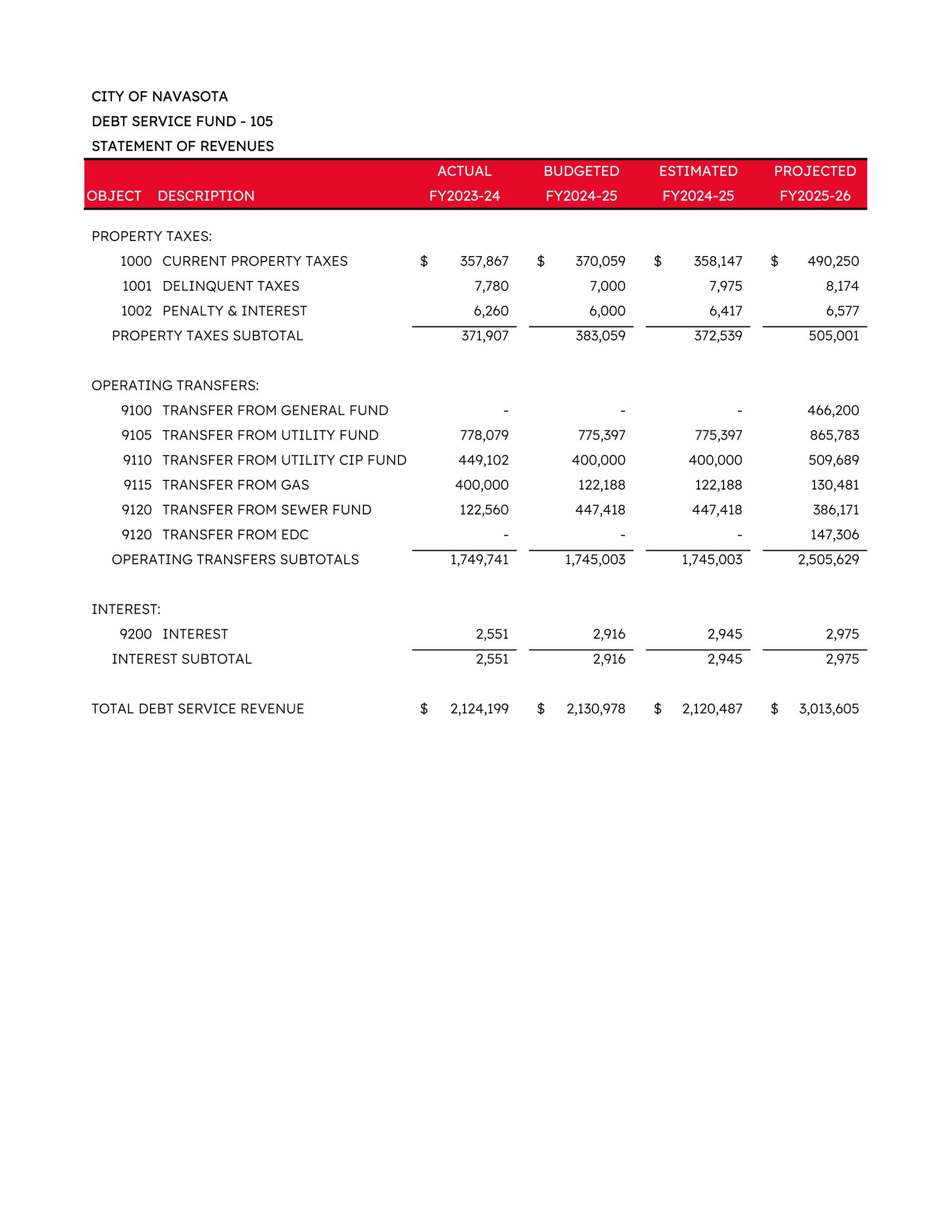

Budget Methodology Changes – Previous city budgets made it difficult to discern the funding source and accounting for various projects and particularly debt service obligations. This budget will incorporate a wholly separate Debt Service Fund, which will allow the efficient tracking of debt obligations. We are also preparing to separate CIP projects, whether they are cash- or debt-funded, into their own Fund with unique project codes. This also allows for more efficient tracking of expenditures and keeps these projects from impacting our annual General Fund budget. Finally, we will be ensuring that our enterprise funds are accurately paying for their own proportionate operational costs so that our utility rates can be accurately established.

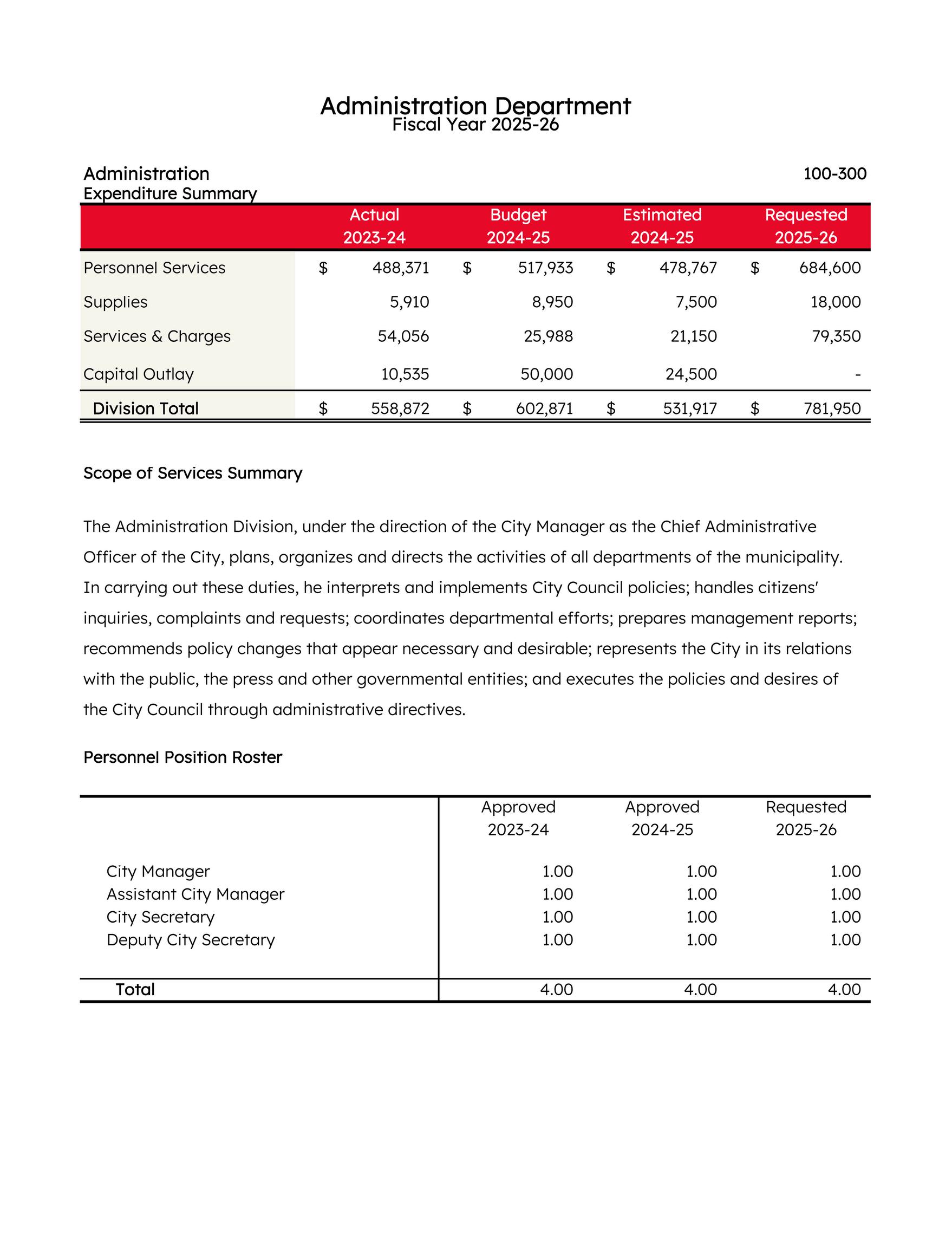

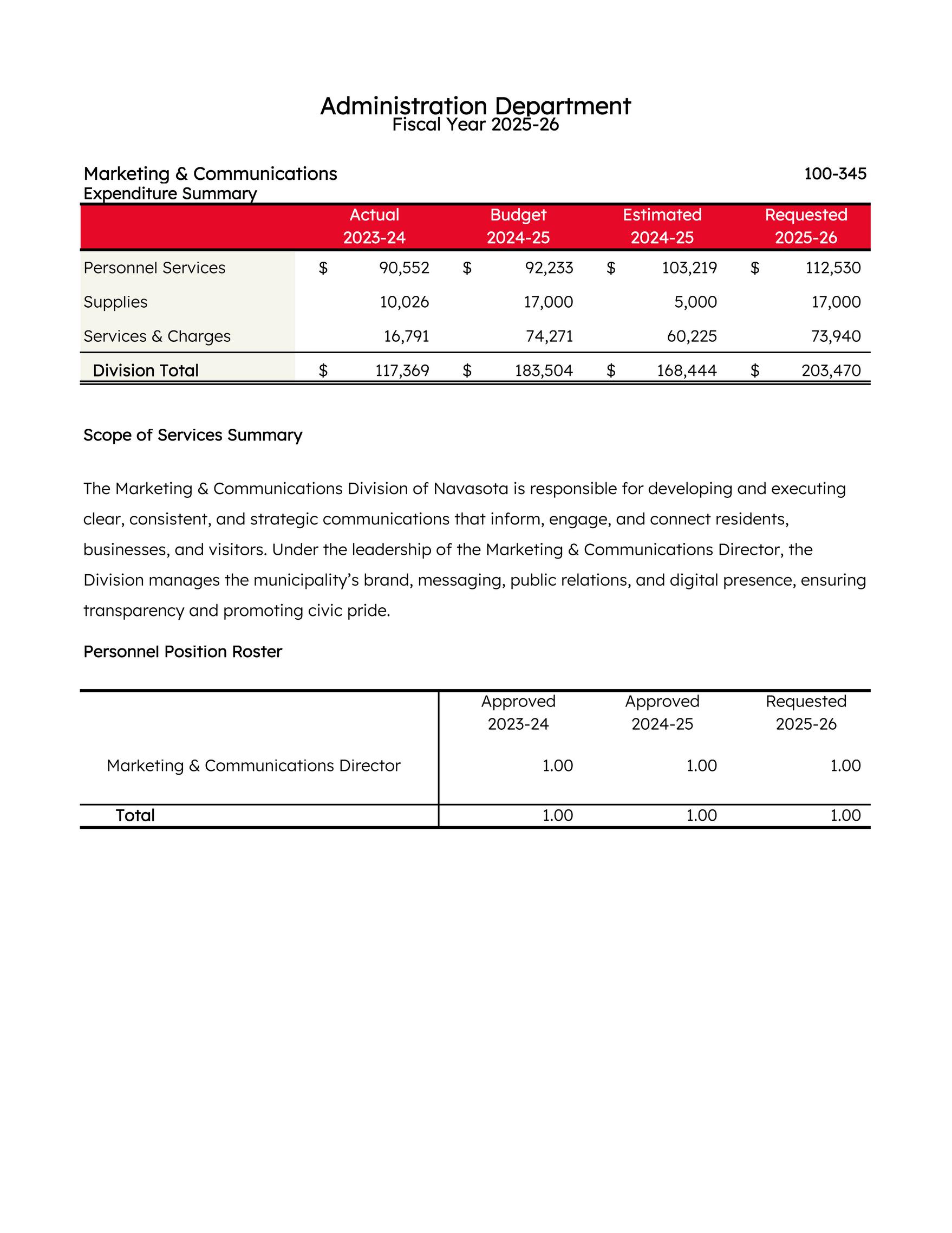

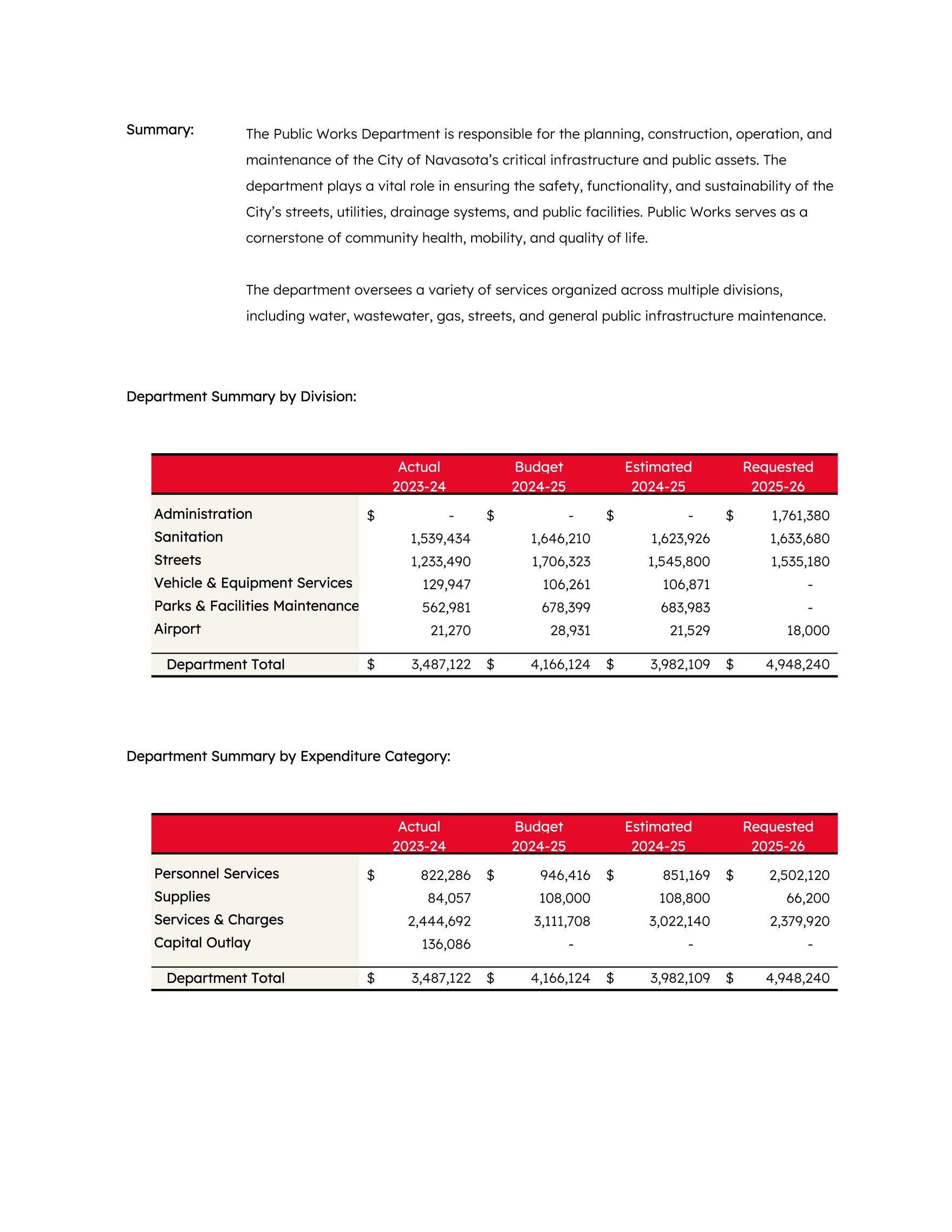

Organizational Structure – Two new departments have been created to organize our staff more effectively and track funding more accurately. The Maintenance Services Department will oversee all of the city’s maintenance operations, including facilities, parks, property, and vehicles. The custodial personnel previously assigned within the City Hall budget, the Parks and Facility Maintenance Staff, and the Vehicle Services division have all been consolidated within the Maintenance Services Department with their respective divisions. Many of our Public Works personnel have responsibilities that include working on matters within the General Fund as well as our Enterprise Funds for water, wastewater, and gas operations. Historically, these personnel have been assigned to one fund or another and tracking costs between funds was difficult. We have created a Public Works Administration Department, which will contain those personnel whose responsibilities are split between funds. A transfer from the enterprise funds will occur to cover the proportionate personnel costs to cover work done for the respective operations.

Employee Compensation and Benefits – Employee compensation and the overall benefits package were identified as a priority, and specifically, the retirement benefits package offered to full-time employees. This budget addresses several important salary and benefit components.

The City currently offers retirement benefits to full-time employees through the Texas Municipal Retirement System (TMRS) and those benefits were identified as a priority in the Strategic Plan because they were not at the level offered by most communities.

The city currently participates at 5% of the employee’s salary with a 2:1 match and full retirement benefits are earned after 25 years of service. TMRS allows cities to choose 5%, 6% or 7% as the contribution amount, and the Strategic Plan identifies 7% as a goal. (NOTE: As of September 1, 2025, TMRS will also offer 8% as an option.) TMRS allows cities to choose whether retirement eligibility is met after 20 or 25 years of service (regardless of age), and the Strategic Plan also identifies 20 years as a goal. This proposed budget takes a step toward the goal, by including a 6% contribution rate and 20-year retirement eligibility.

A salary survey and new Pay Plan are also proposed. The salary survey will compare our pay rates and Pay Plan to other cities and will include a combination of cities our size and cities in our immediate vicinity with whom we compete for applicants. The Pay Plan includes defined steps for each pay grade. This is a comprehensive Plan that includes all positions and incorporates standardized job titles and parity of like positions and responsibilities across the organization.

A 2.5% cost-of-living adjustment (COLA) is included in the proposed budget for all positions “across the board”. The current plan is to implement the COLA immediately following the fiscal year’s commencement, and then to implement the Pay Plan upon the completion of the salary survey (expected to be early in the 2026 calendar year).

Our health insurance broker has asked us to budget for a 10% increase in health insurance premiums, which we have done in order to sustain the employee health insurance benefits without change. Final renewal rates are expected in the coming weeks, and any required changes to the budget will be discussed at a Council meeting.

Capital Improvements and Debt Projects – The staff has diligently evaluated their current budgets, and we have identified budgeted funds that will not be required within the current fiscal year. This is a result of personnel vacancies, project savings or projects/initiatives that were not undertaken. The proposed budget would utilize the surplus funding from the current fiscal year to offset the otherwise unbalanced condition of the proposed budget. This essentially allows us to “cash-fund” extra projects without any debt, but also achieve progress on priority projects.

To take advantage of this same philosophy, we are also proposing to utilize the 2025 CO revenue, which will be contained in our CIP Fund, to complete several other projects that are eligible expenses based on the Offering Statement provided when those Certificates of Obligation were issued. An itemized list of major projects included for funding in this budget, and their respective funding source, is included as follows:

Capital Projects incorporated into the proposed General Fund budget:

Annual Street Maintenance - $600,000

Renovations at Animal Shelter - $40,000

Replacement of public safety vehicles (cash, no lease) - $250,000

Mobile Data Computers (MDC’s) for police - $75,000

City Hall/Council Chambers audio/video - $125,000

Compensation Plan Survey - $25,000

Strategic Plan Update and CIP Development - $25,000

Vehicle services maintenance lift - $20,000

Capital projects funded through the CIP (2025 Certificates of Obligation):

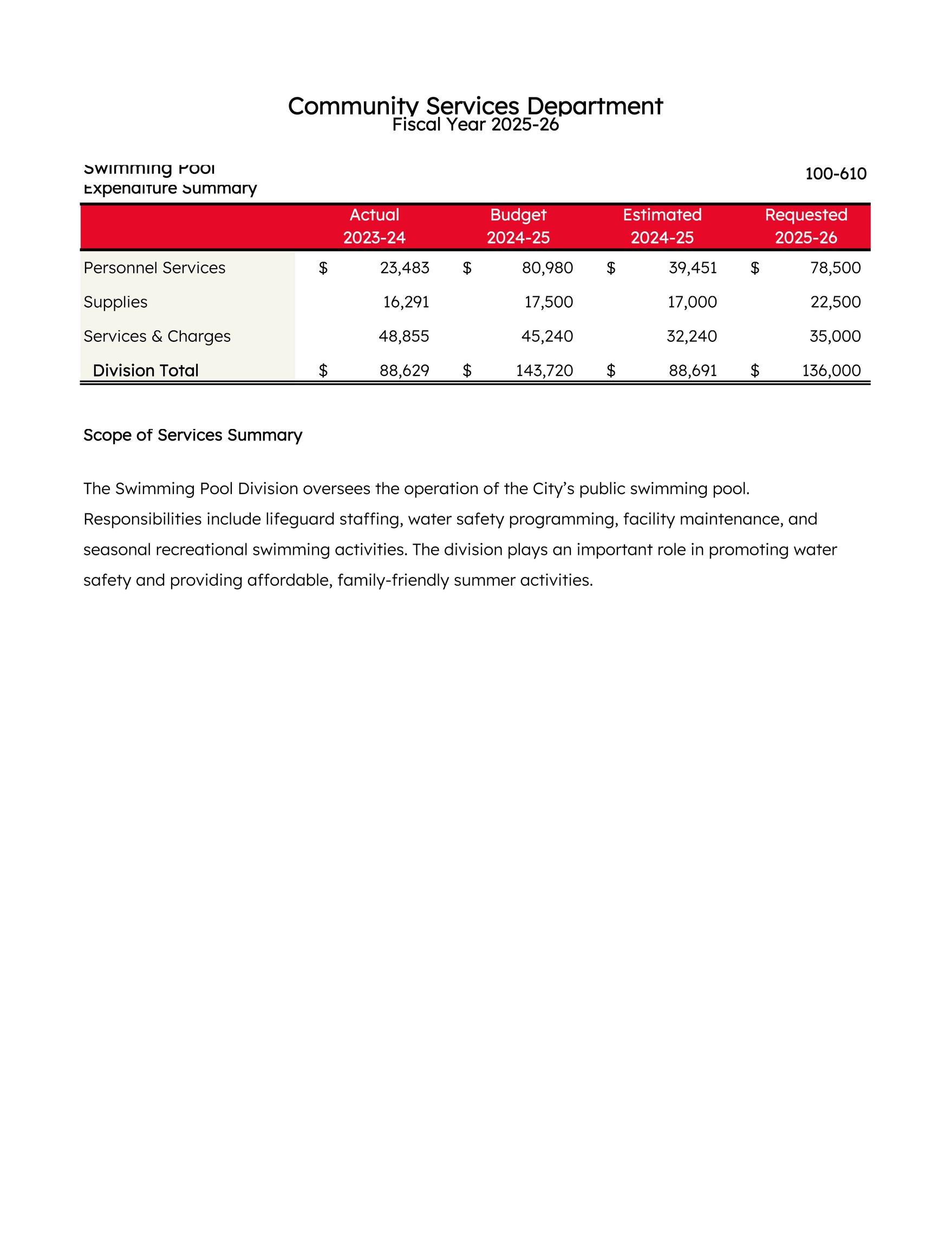

Pool repairs (already complete) - $690,000

Roof repairs at Library - $30,000

Interior repairs at Library - $90,000

Basketball court at Miller Park - $25,000

Roof repair at Pool House - $55,000

Interior repairs at Pool House - $100,000

Interior repairs at Fire Station - $100,000

A/C replacements at Navasota Center - $150,000

Repainting of Navasota Center - $25,000

Repaving walking trails at August Horst Park - $40,000

Barrier fence at August Horst Park - $45,000

Once again, it is my privilege to submit my first proposed budget here in Navasota. I am very proud of the work this budget represents and the dedication of our staff. I consider it a high honor to work alongside you all and the exemplary staff members of Navasota. I look forward to implementing this budget and seeing Navasota’s continued success.

Respectfully submitted,

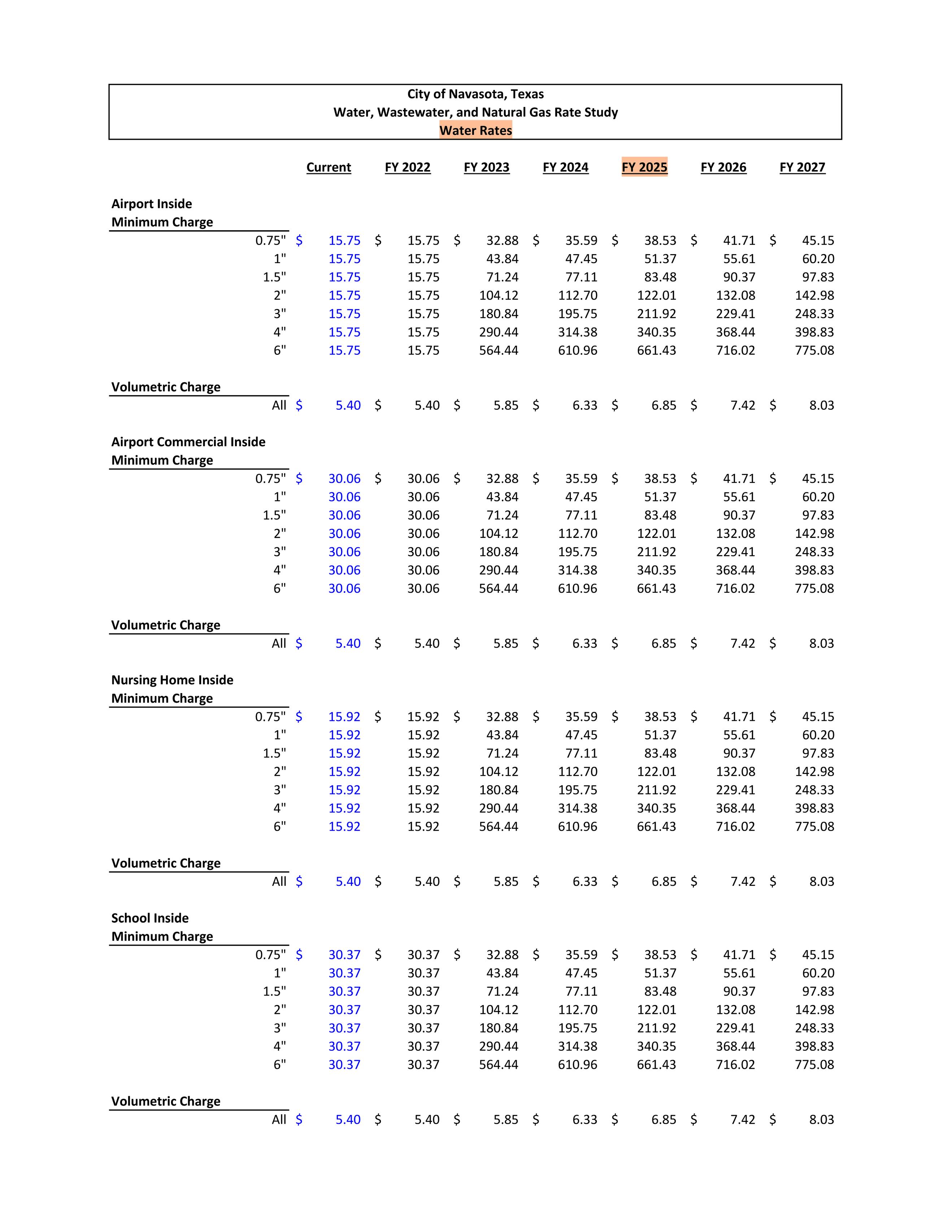

The FY2026 Proposed Budget incorporates the utility rate structure established by the Water, Wastewater, and Natural Gas Rate Study completed in 2021. This study provided projected rates for fiscal years 2022 through 2027. Although we are currently in FY2026, the City will continue to use the FY2025 rates for the current fiscal year, maintaining consistency with the previous year's adopted rate schedule.