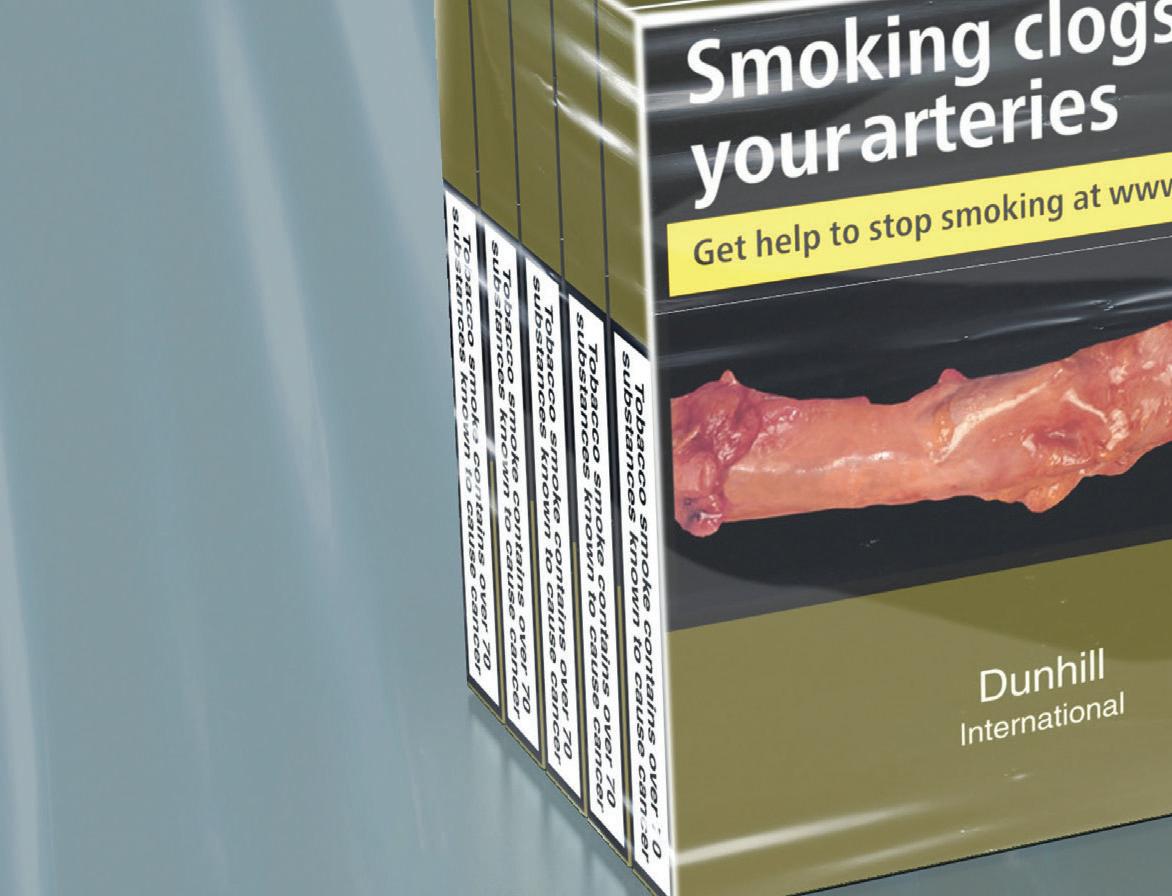

As part of our ongoing vision for a Better Tomorrow we are changing the wrapping of Dunhill International from printed film to clear cellophane. However, rest assured, the contents of the BAT outers – whether packs of Dunhill or other BAT brands – remain completely unchanged and are just as authentic as before

If you have any questions or concerns about our new cellophane wrapping, please contact BAT customer service, your Account Manager or local rep

It’s an offence to sell tobacco to person under 18 years of age. For tobacco trade use only. Not to be left within sight of consumers.

e substrate b ate st su e r gradable g b e ada l r eaving g eavin

TheDepositReturnScheme (DRS)forScotland,tobeintroducedinAugustnextyear, needsalotofadjustmentsand clarificationofthefinerpointsbeforeit isdeemedworkablebywholesalersand theircustomers.

Indeed,everywholesalerIhave spokentohasdescribedtheforthcominglegislationasacompletemess(but inmuchstrongerterms).

Thescheme–wherebyconsumers inScotlandbuyingadrinkinasingleusecanorbottlewillpaya20pdeposit whichtheywillgetbackwhenthey returntheemptycontainer–iswell intentionedbutimpracticalinitscurrent formforseveralreasons(pages12-13).

TheScottishWholesaleAssociation (SWA)andothertradebodiesaretrying topersuadetheScottishGovernment andtheScottishEnvironmentProtection Agency(SEPA)notonlytoclarifykey pointsbutalsotosimplifythescheme.

Theseorganisationshavebeen workingbehindthescenesformonths inanattempttogettheimportantissues resolvedsothattheDRSisfitforpurpose.

Theyhavehadsomesuccess–such asgettingSEPAtoconfirmthatitwill allowthecontinueduseofUK-wide barcodes–butthefactthatthereisso muchmoretobedonegivesthe impressionthattheauthoritiesare eithernotlisteningproperlytothemany concernsofstakeholdersoraresimply notactingonthoseconcerns.

SimonHannah,CEOofGlasgowbasedJWFilshill,tooktosocialmedia tosay:‘Weallknowhowoursector worksbetterthanthoseresponsiblefor deliveringthispoorlythought-through scheme,butforsomereasonourcollectivefeedbackfallsondeafears. Surelytheentiretradecan’tbewrong?’

JoeWall,MDofDunfermline-based finefoodwholesalerTheCressCo, added:‘CircularityScotland[the schemeadministrator],SEPAandScot Govaredeaftotheflawsinthisscheme anddon’twanttotalktoindustry’.

BusinesscommentatorshavesuggestedthattheDRSneedsatotal rethink,withmanyinsistingthatthe bestwayforthisschemetoworkisifall homenationsintroduceitatthesame time.‘AUK-wideschemewouldbea goodstartingpointfortherethink’,said Filshill’sHannah.

However,thepowersthatbein Scotlandaredeterminedtoforgeahead, andconsequentlytheSWAiscontinuing itsbattletogettheDRStothepoint wheretheschemecanoperateeffectively.Meanwhile,wholesalersinthe otherhomenationsarewatchinghowthe situationinScotlandunfoldsandhoping dearlythattheproblemswiththeScottish systemareironedoutbeforeaDRSis introducedontheirownhometurf.

Booker has locked down prices on more than 450 catering products until 3 January 2023.

A new autumn guide, which is available in depots and online, gives details of the range on promotion.

It includes foodservice staples such as chips, burg ers and hot beverages, as well as fresh meats and fresh produce, seasonal desserts, snacks, soft drinks, alcohol, and non foods including cleaning lines and glassware.

Also featured are own brand value items in several categories including tinned tomatoes, cheese and frozen vegetables.

The wholesaler has locked down prices on cook ing oil, and is offering £10 off when caterers recycle 20 litres of cooking oil, equating to 50p per litre.

SPAR UK is seeing smaller trips to stores growing by 10%.

“This footfall growth is a massive opportunity, espe cially when we capitalise on it with extra items in the bas ket,” SPAR UK’s managing director Louise Hoste told delegates at the organisa tion’s national conference in Gran Canaria.

“SPAR is delivering robust growth well ahead of the symbol sector and con tinues to report year on year sales increases,” she added.

To support this sustained solid performance, SPAR UK is committing to investing £122 million over the next 12 months in stores and supply chain, after spending £125 million last year.

Hyperama has sold its two remaining depots at Nottingham and West Bromwich to Dhamecha Group for an undisclosed sum.

The sale, effective 14 November, follows the recent sale of Hyperama’s Peterborough depot to London based Holland Bazaar and Hyperama’ s foodservice delivered busi ness Tiger Foodservice to Birmingham based Giro Foods.

Hyperama’ s managing director Marcus Singh com mented: “I am delighted to announce the sale of these two depots to Dhamecha Group. I could not have wished for a better business to acquire the sites and take the business forward.

“Dhamecha is a fantastic operator and has success fully expanded already into the Midlands, and I know I am leaving my employees, customers and suppliers in good hands.

“I would like to take this opportunity to give thanks to God, my parents and grand parents for providing me with this platform, and my supportive wife. I am looking forward now to turning the page onto the next chapter

of our business develop ment.”

Singh will remain a Unitas Wholesale member with his JK Foods East Asian foods distribution business.

John Kinney, managing director of Unitas, said: “This is a great acquisition for Dhamecha Group as they continue with their expan sion plans outside of London.

“Knowing the Dhamecha business as I do, I know that they will be successful in Nottingham and West Bromwich, and this is only good news for the existing customers in the region and our suppliers who work with them, as I expect to see significant growth from these two sites once the Dhamecha team is fully up and running.”

50% to all funds raised, the amount donated to GroceryAid was £24,038.

CJ Lang & Son recently announced a 10.7% rise in pre tax profits to £3.4 million in the year ending 30 April 2022. The company also saw its margin rise by 0.3% to 23.3% while its turnover was down slightly, by 0.1% to £212.3 million.

Employees of Scottish SPAR wholesaler and retailer CJ Lang & Son took part in all four Kiltwalks over the sum mer to raise funds for GroceryAid.

A total of 186 colleagues from stores across Scotland and the Dundee based depot and head office, as well as members of the field teams, got involved in the mass par ticipation walking events in

Glasgow, Aberdeen, Dundee and Edinburgh.

They completed various lengths, from the Wee Wander (six miles) to the Mighty Stride (26 miles).

Participants in the Kiltwalks raise funds for a charity of their choice, with GroceryAid being the CJ Lang preferred option. In total, including the top up by Sir Tom Hunter, who adds

The Dundee based busi ness points out that the results were delivered against the backdrop of a challenging economic cli mate, which continues to drive changes in shopping behaviour. The relaxation of Covid 19 restrictions saw a return to some pre pan demic shopping behaviours, while the habits of shopping locally were retained by a noticeable proportion of consumers.

Bestway Wholesale has made several senior appoint ments to help deliver its growth plans.

Les Mohammed, formerly senior trading controller at Unitas Wholesale, has been appointed head of trading operations.

Mohammed spent nearly nine years at Unitas. Before that, he spent a short time with 2 Sisters Food Group and over a decade with Brakes, including stints with Pauleys Produce and M&J Seafood.

He started his career in the catering industry, rising to senior catering manager for Posthouse Hotels, where he stayed for 11 years before switching to wholesale in 2002.

In addition, Bestway has appointed Andrew Kenny as trading director of Bestway

Retail and Robbie Moore as retail commercial manager.

Kenny was previously general manager commer cial at Coles Group in Australia, and prior to that, he was a senior director for various product categories at Asda.

In his new role, he is responsible for refining and enhancing Bestway ’s propo sition for off licence and con venience sectors. He will

Sugro UK has achieved year to date growth of 22% on the same period in 2021.

The strong performance was announced to the 70 delegates that attended the group’s convention in Nepal.

At the event, Sugro UK facilitated its annual network ing event, with suppliers and members discussing key industry topics while build ing relationships.

The attendees also had the chance to visit a local school Shree Adharbhut Vidyalaya Shabas, based 2km away from the village of Taj Meghauli Serai.

The school provides facil ities for 294 students and has 14 teaching staff, and although it is government run, it receives no help from the local authorities to assist

with its running costs.

The school was in urgent need of refurbishment and lacking basic equipment that would allow children to study safely on its premises, so Sugro UK stepped in to help investing in full reno vation of the classrooms and purchasing equipment.

Moore, who reports to Kenny, was formerly head of trading at SPAR Scotland wholesaler and retailer CJ Lang & Son.

Bestway has also announced that Adrian O’Brien has been made head of symbol at Bestway Retail on a permanent basis after being seconded to this role

earlier this year.

O’ Brien joined Bestway from Costcutter, where he spent a decade, latterly as regional controller of Northern Ireland, Scotland and Northern England. He also previously worked for Palmer & Harvey as a symbol manager.

Bestway has also named Richard Scrimgeour as cen tral operations director of Bestway Retail. Scrimgeour spent nearly 20 years at Nisa Retail, latterly as sales & transformational lead, and he succeeds Janine Tomkins who is leaving the business.

Scrimgeour ’ s new responsibilities include head ing up the central operations team, business support, cus tomer services and commu nications. He will also lead on all major projects involv ing new store concepts.

National Buying Consortium (NBC) has two new mem bers The Atrium Cash & Carry and Northern Retail Group.

The Atrium Cash & Carry is a family owned food and drink wholesaler based in Douglas on the Isle of Man. It is open to both the general public and businesses.

Northern Retail Group is a wholesaler and exporter of British and European FMCG products and is located in Speke, Liverpool.

In other news, NBC has appointed Caroline Barr as business development man ager, reporting directly to managing director David Lunt.

Barr (pictured) was for merly a national account manager for the out of home foodservice channel at

Nestlé Waters for four years. Before that she spent over 15 years at Nestlé Professional in account management.

Lunt said: “We have known Caroline for a number of years because of her experience in the channel, and to be able to build upon her skills, experience and relationships will be a great asset for the company.”

replace Mike Owen who is leaving the business at the end of the year.Employee owned whole saler Parfetts is awarding its employees an 8% profit share bonus to recognise their contribution to the continued growth of the business.

The move follows a bonus of up to 2% in June and an exceptional cost of living payment of up to £500.

Parfetts has seen a series of record trading periods over the last six months, with its annual Parfest and the September Savers promo tional event driving record

sales. The September event saw sales top £14.6 million.

Guy Swindell, joint man aging director of Parfetts, said: “Our team continues to go above and beyond to deliver great customer ser vice and help retailers max imise their margins in a chal lenging economic climate. We want to ensure that we recognise this dedication with a bonus that will help with the rising cost of living that we all face.”

In other news, Parfetts has appointed Joe Kaye as

the new general manager of its Aintree depot.

Kaye has been with Parfetts for 13 years. He started on the checkouts and was most recently general manager at the Middles brough depot. His replace ment at Middlesbrough is Joe Tindle, who has been promoted from assistant manager.

The 106,000 sq ft Aintree depot employs more than 150 people and has recently benefited from upgraded facilities and expansion of its delivered and collection capacity.

Commenting on his new role, Kaye said: “I’m joining a great team that has hit sales records over the last 12 months. I aim to build on this success by continuing to grow the delivered opera tions, provide a best in class depot experience and expand our fascia operations with Go Local, Go Local Extra and The Local. There is potential to reach out to new

Lomond: The Wholesale Food Co has launched an own label cooked meats range in response to cus tomer demand for locally sourced, top quality prod ucts.

The new range includes sliced cooked meats and joints such as pulled smoked ham hock, sliced topside beef and sliced honey glazed gammon.

“We have spent the past six months creating this range with our Scottish man ufacturing partner to deliver

a heightened quality product at a Lomond best price,” said director Barbara Henderson.

“This decision reflects our strategy to deliver top quality locally sourced products, and our reputation means our cus tomers recognise that a Lomond product will deliver the best quality, value pricing and truly excellent service.”

The introduction of the new range follows the launch of a dedicated guide to Scottish produce, featur ing 69 Scottish producers.

areas and grow our business across the North West and North Wales.”

Swindell added: “Joe Kaye is a hugely experienced operator and he brings energy and enthusiasm to growing the Aintree business by delivering exemplary cus tomer service. We are seeing an acceleration in the num ber of retailers joining our fascia operations as they appreciate that employee ownership allows us to go the extra mile in protecting their margins in this difficult economic environment.”

George Hepburn (pictured), former managing director of JW Gray & Co for 36 years, has died.

He successfully led the development of JW Gray & Co, which is the largest wholesaler that services the islands of Shetland and Orkney.

Founded in 1912, the firm’s wholesale operation was bought by George and Anna Hepburn in 1983. Based in Lerwick in Shetland it also has a depot in Orkney, and offers a wide range of products. It also operates a bonded warehouse serving the offshore sector, shipping,

and export customers.

Hepburn was a former board member of Landmark and Unitas.

Since 2000, JW Gray has been run by George and Anna Hepburn’s son in law, Iain Johnston, although the Hepburns remained direc tors of the business.

Unitas Wholesale has recruited Andy Stubley to the newly created role of licensed strategy manager.

Stubley (pictured) will join the group on 28 November from Booker where he spent more than 12 years, latterly as cat egory man ager spirits.

Prior to that he devel oped and managed his own off licence and convenience chain in Lincolnshire. In addi tion, he previously worked for Scottish & Newcastle and then Scottish Courage as director of field sales.

The Clink Charity has been chosen to provide the cater ing services for the Country Range Group’ s upcoming ‘An Evening With’ event, which will take place at St Paul’s Cathedral in London on 1 December.

The charity was founded in 2010 and provides cater ing training to offenders so they can find work on their release.

As well as operating three restaurants at HMP Brixton in London, HMP High Down in Surrey and HMP Styal in Cheshire, the charity ’s out side events operation Clink Events provides bespoke catering beyond the walls of the prison so that serving prisoners can gain experi ence in event catering.

The CRG event will fea ture a three course dinner, and the food will be pre pared at Clink ’s central pro duction training kitchen at HMP Downview by prisoners who are training for Level 1 and Level 2 NVQ in Professional Cookery.

Bidfood has identified the food and drink trends set to shape and inspire the food service industry in 2023.

The wholesaler ’ s latest research shows that con sumer demand for eating out remains strong. In fact, seven in 10 say eating and drinking out is the treat they most look forward to (CGA).

Trends include:

• Retro love: This is about revamping childhood memo ries and conjuring a sense of nostalgia, especially through desserts, cakes and cocktails.

• Flavours less travelled: There is a rise in demand for more unusual dishes. Over one in three people say that emerging cuisines have replaced the more estab lished ones in their regular meal choices. In addition the four leading cuisines Bidfood identified this year Cuban, Sri Lankan, pan African and

‘unusual fusions’ do not have a strong presence on menus, so now is the best time for foodservice opera tors to adopt them.

• Conscious choices: Con sumers are becoming more mindful of where they eat and drink out and what they order.

• Pizza evolution: Because of the format and versatility

of pizza, it lends itself well to creative and accessible inno vation.

• Nature’s gifts: This focuses on the role of plants within a dish and the ways chefs are incorporating the fruits, herbs and spices they have found themselves in the wild.

Bidfood also highlights the alcoholic drinks trends for 2023, including the top spirits (tequila and rum) and the growth in demand for more unique cocktails.

Catherine Hinchcliff, head of corporate marketing & insights at Bidfood, said: “We’re thrilled to see how the food and drink trends landing in 2023 are embrac ing sustainability, flavour experimentation and a jour ney through time, which in turn will allow the chefs to have fun while building their menus.”

Country Range Group’ s head of marketing Emma Holden said: “The food and drink are such an important part of our ‘An Evening With’ event and one area we knew we needed to get spot on for all our guests attending. For that reason, we’re thrilled to have secured the Clink ser vices and are delighted to be supporting the charity which is doing so much great work helping prisoners get back on their feet.”

In other news, CRG has introduced four new potato products in time for the busy festive period. They are Seasoned Waffle Fries (4 x 2.5kg), Potato Dauphinoise (10 x 1kg), Roasted Potatoes (4 x 2.5kg) and Roasted Pota toes with Duck Fat (4 x 2.5kg).

Bobby ’s Foods has signed a deal to become the exclusive distributor for Yummy chocolate vitamin bars in the convenience channel.

The Yummy bar is claimed to be a revolutionary product within the confec tionery category. Each bar contains one third less sugar than leading brands and pro vides 50% of a child’s rec ommended daily vitamins.

Available from Bobby ’s in caramel and strawberry variants, the Yummy bars are nut and gluten free, contain no artificial flavours or colours, and are suitable for vegetarians.

Bobby ’s is supporting the launch with a free standing display unit (FSDU), which holds 12 shelf ready packs.

Bidfresh business Direct Seafoods has won the Marine Stewardship Council (MSC) Award for Fresh Fish Foodservice Supplier of the Year for the second year running.

The MSC awards cele brate outstanding achieve ments and performances in sustainable fishing and seafood across the entire UK business spectrum.

The Scottish Wholesale Association (SWA) and Volvo Trucks have launched a trial to accelerate the use of electric vehicles in Scotland’s wholesale industry.

Glasgow based whole saler JW Filshill and other SWA members are partici pating in the pilot featuring Volvo’s electric 19t curtain sider truck with rear tail lift.

Filshill is testing the truck for a fortnight to explore the feasibility of using it in the business in the future.

Sysco companies Brakes and M&J Seafood were also winners at the MSC Awards, jointly collecting the MSC Foodservice Wholesaler of the Year award for the ninth consecutive year.

G.A.P Convenience Distribution part of the James Hall & Co group has won the BP Supply Chain Award for the second consecutive year.

Backing up the 2021 award win for flexible sup port to BP ’s national network of 330 company owned ser vice stations, the 2022 acco lade recognised the G.A.P team’s expert navigation of supply chain pressures in the last 12 months.

Key factors in winning the award were supply and stock availability, goods arriving on time, the flexibility to deliver into site, and strong commu nication.

Ylva Haglund, SWA head of sustainability and engage ment, commented: “We are committed to supporting our members on their journey to a more environmentally sus tainable future as we acceler ate the transition to net zero and progress towards a cir cular economy.

“Our aim is to inspire and facilitate action and increase awareness of the ways in

which our members can move towards fleet decar bonisation, and a further seven SWA members have already signed up to partici pate in the trial.”

Keith Geddes, chief finan cial & operating officer at JW Filshill, said: “We ’ re very pleased to be working with the SWA and Volvo in this

vehicle trial and hope it encourages other whole salers to do the same.

“The industry cannot make sweeping changes overnight and there are cost implications to consider but we all have a duty to engage and look to the future this is the type of activity that can help us on our journey.”

Birchall Foodservice has promoted purchasing man ager Andy Green to buying director.

Green joined the Country Range Group member in 2001 as a warehouse picker. Since then, he has pro gressed through the ranks and now leads the whole saler ’s buying operation.

In his new role, Green will continue to work alongside director Keith Horner and oversee the day to day run ning of the buying depart ment.

Managing director Justin Birchall told Cash & Carry Management: “I am confi dent that Andy will succeed in his new role.

“The experience he ’ s

gained over the last 20 years gives him a great platform to

help us drive the business forward.”

Alongside our own efforts to globally become carbon neutral by 2030 and Net Zero by 2050, we are continuing to provide advice to support wholesalers to implement sustainable practices – from reducing energy consumption to improving social sustainability.

Here at JTI UK, we are committed to identifying, understanding and reducing the environmental impact of our business activities. We also understand how important it is to support wholesalers to do the same.

It has never been more important for companies to think and act sustainably, not just for the good of the industry, but for society. It’s not only wholesalers

who need to act responsibly – the entire supply chain across the sector also needs to reduce its energy consumption and implement sustainable business practices. Ultimately, the industry needs to work together so that we can make the necessary changes, improving sustainability and preserving natural resources.

Having pledged to reach Net Zero globally by 2050, we want to lead the way in helping wholesalers become more sustainable one step at a time. Our aim is to help facilitate a sector-wide push to implement environmentally friendly business practices and maximise our industry’s sustainability potential.

Top tips for improving your environmental sustainability:

Allowing

Consider what the return on investment would be if you have solar panels installed.

Whether it’s through switching your vehicles or training your drivers, targeting and cut costs simultaneously.

For more information on what JTI is doing to improve its environmental sustainability, wholesalers can talk to their JTI Business Adviser or visit www.jti.com/uk/sustainability

Scotland’s Deposit Return Scheme, which comes into force in August 2023, has huge implications for wholesalers selling drinks in cans and bottles to customers in Scotland.

From 16 August 2023, con sumers in Scotland buying a drink in a single use container will pay a 20p deposit, which they will get back when they return the empty bottle or can.

Scotland’s Deposit Return Scheme (DRS) is designed to tackle climate change, increase the quantity and qual ity of materials collected for recycling, and decrease litter.

However, as it stands, the DRS has been widely criticised for being unwieldy, and even unworkable. The Scottish Wholesale Association (SWA), together with other stakeholders includ ing the Wine & Spirit Trade Association and the Scottish Retail Consortium, has been toiling behind the scenes for months to try to get important issues resolved so that the DRS is fit for purpose.

The SWA has also raised the whole sale industry ’s concerns and requests for change directly with Lorna Slater MSP, the minister for green skills, circu lar economy and biodiversity.

Meanwhile, the Scottish Environ ment Protection Agency (SEPA), which

is responsible for enforcing and regulat ing the scheme, has launched a media campaign urging businesses to find out what the DRS means for them and to take the necessary action to prepare for its introduction.

Drinks producers and importers

Wholesalers that sell drinks to cus tomers in Scotland are advised by the Scottish Wholesale Association to take the following steps:

1. Register on the Circularity Scot land website circularityscotland.com for updates. Circularity Scotland is the organisation that was created to ensure the smooth roll out and suc cessful operation of Scotland’s DRS. As the scheme administrator, it is responsible for working with hospital ity, wholesale and retail businesses, as well as producers and importers, to ensure that the scheme is designed and implemented effectively and to support everyone in meeting their legal obligations.

2. Follow the Q&A on the Zero Waste

Scotland and SEPA websites: www.sepa.org.uk and depositreturn scheme.zerowastescotland.org.uk/

3. Attend the Circularity Scotland DRS conference on 22 23 November at the Hilton Glasgow. If the meeting is full, wholesalers may be able to secure a place through the SWA email info@scottishwholesale.co.uk.

4. Prepare and budget for cashflow impacts for when the legislation takes effect on 16 August 2023. This is when all drinks containers for sale in, or into, Scotland will have a 20p deposit on them. It is expected that producers will also increase the actual container costs to cover the increased cost of production, including the producer fees charged by Circularity Scotland.

must register to be part of the scheme or else they will not be able to sell their products in Scotland.

Retailers, wholesalers and hospitality businesses will have to make sure that any drinks they sell in Scotland are from a registered producer and they must charge a 20p deposit on each drinks container.

All drinks that are sold in single use containers made from PET plastic, glass, steel or aluminium and between 50ml and three litres in size are included in the DRS. These are referred to as ‘scheme articles’ or ‘scheme containers’

Wholesalers selling drinks in Scotland, or to a customer in Scotland, will be legally obliged to:

• only sell drinks to customers in Scotland that a registered producer has made available for sale in Scotland.

• charge the 20p deposit when market ing, offering for sale or selling a drink in Scotland or to a customer in Scotland.

• make it clear to the customer that the drink is part of the scheme and a 20p deposit applies.

• clearly display the price of the deposit (20p) in any place that a drink is displayed for sale. The SWA is seeking clarification as to whether this applies in

a business to business context, such as where wholesalers sell only to trade customers.

Wholesalers that also sell drinks which are not part of Scotland’s DRS or are not intended for sale to customers in Scotland (non Scottish articles) must clearly display information at the point of sale to show that:

• the drinks are not part of the scheme.

• the empty containers from these drinks cannot be returned in exchange for the 20p deposit.

SWA chief executive Colin Smith explains that these two points cover the scenario where non scheme drinks will still be in stock after 16 August 2023 potentially for years afterwards in the case of expensive whiskies and wines.

Equally, these points cover whole salers, such as those on the border of Scotland and England, that sell both Scottish scheme articles and non Scottish articles in other words to markets elsewhere in the UK and over seas, as well as in Scotland.

Wholesalers that are also producers and/or retailers would be expected to comply with all obligations identified for those groups too. These may include operating a return point for the drinks containers and returning deposits to consumers.

Circularity Scotland has contracted Biffa to be responsible for collecting the drinks bottles and cans from return points in Scotland, as well as managing the centres that will process material for recycling.

Along with other industry bodies, the SWA is working to persuade the Scottish Government and SEPA not only to clarify some fundamental points but also to simplify the scheme. The following requests have been made of the authorities:

• Remove or modify the obligation for online sellers to offer a takeback ser vice. The SWA has been having positive discussions with Scottish government about the removal of this obligation for the wholesale/convenience channel, and an announcement is expected imminently.

The efforts of the Scottish Wholesale Association and other industry bodies to encourage the authorities to make the Deposit Return Scheme less cumbersome have already resulted in positive developments:

• SEPA has confirmed that it will allow the continued use of UK wide barcodes (EANs).

• A minimum size has been intro duced for retail return points to apply for a potential environmental health exemption. This applies to operators with premises of between 100 sq m and 280 sq m.

• Confirm that the 20p deposit is not included as part of the price mark on a PMP, and provide clarity on point of sale materials and labels for PMPs. Although a statement on this issue has been made by Trading Standards, it still does not provide the clarity and reassurance that the SWA requires and therefore fur ther detail is being sought.

• Provide clarification on the treatment of VAT with regards to its various inter actions within the DRS.

• Give exemptions to small producers and importers for some of the obliga tions, fees and cashflow implications.

In addition to the above cross indus try requests, the SWA has highlighted additional areas of concern and sug gested solutions that would lower the cost of the scheme and simplify it too:

• Create a cost effective model for the backhaul of the empty bottles and cans.

’

• Extend the producer registration window that opens in December 2022 and closes on 28 February 2023. The SWA has asked SEPA and the Scottish Government for their contingency plan should producers not have registered by this date.

• Suspend deposits being paid on transactions while the products are in a bonded warehouse.

• Clarify the IT and system changes required to comply with VAT, invoicing/ receipt, EPoS, etc.

• Introduce a grace period from 16 August 2023 for stock already in the market to be sold through without pro ducer charges.

• Consider the business and consumer impacts of a 20p deposit on top of the cost of living crisis and the additional DRS ’cost of doing business’

“Given the current market turmoil and the rising price of glass and energy, the SWA is concerned that if cost is not stripped out of the scheme (achievable through the requests above) then the producer fee and product costs are likely to rise in the future,” says Smith.

“By highlighting all the areas that still need resolution, the SWA will have given Lorna Slater, and other ministers, a better understanding of the myriad problems that businesses face at this late stage. We hope that they will act on our suggestions,” he adds. “Our aim is to ensure as successful a scheme launch as possible.”

How would you describe your personality?

Caring, emotional, empathetic, engaged and supportive.

What has been the biggest challenge you have faced?

It concerns my emotions when dealing with a wellness intervention. While I try to set boundaries, I find it difficult not to worry about the people I am trying to support.

What is your favourite film, book and song/piece of music?

What have been your biggest achievements in work and outside work?

The introduction of our wellness pro gramme at Filshill and how successful it has been, with 116 interventions of sup port to date. I am very proud of the pro gramme and all 23 of our mental health first aiders. The fact that we won ‘Best for Mental Health’ at the Glasgow Business Awards 2021 was the icing on the cake.

Another big achievement was suc cessfully changing career. It was daunt ing to return to higher education while raising a family and working, but my role at Sainsbury ’s had given me an insight into what I was passionate about: health & safety. Now I am hap pier and more successful in my career than I have ever been.

Who has been the biggest inspiration to you?

My family is my biggest inspiration; I want to make my daughter Rebecca proud. Since she was born (she’s now 14) I have always tried to act as a role model for her. I want to show her that hard work and determination can get you to a point in life you would not have thought possible and you can do this

while still helping others. My husband, too, is an inspiration. He was very sup portive of my career change, even help ing me to study when it was exam time.

What were your ambitions when you were growing up?

I wanted to be a nun! And later, when at high school, I found I had a passion for languages and decided I wanted to be an international business woman. This was around the time the Channel Tunnel was being built and I thought that a sec ond and third language would be essen tial to a good career. I was probably a bit naïve of how the world works, and it wasn’t until later in life that I discovered what career I actually wanted to pursue.

What are your interests outside work? Spending time with my family: we travel around Scotland extensively and go on road trips most weekends. Due to problems with my eyesight after losing my sight for a month when Rebecca was a baby, I was not able to drive until three years ago. There were so many places it would have been impossible to visit without a car, and we now make the most of it.

Not surprising, given my original choice of career, my favourite film is Sister Act! I can also recite word for word the dialogue of the original Charlie and the Chocolate Factory. My music tastes are varied but my favourite is the song that was played for the first dance at my wedding: You’re Still The One by Shania Twain.

What would people be surprised to know about you?

I am a black belt in karate! CCM

Amanda Casey achieved a degree in Business with Languages from Glasgow Caledonian University. With few job vacancies in interna tional business, she returned to Sainsbury ’s where she had worked during her student days as a petrol assistant. She spent time in different departments and became interested in the health & safety aspects of the work. At that point she returned to higher education on a part time basis to gain National Examination Board in Occupational Safety and Health (NEBOSH) Certificates. Casey then secured a role with a health & safety consultancy and attended college on a day release basis (self funded) to take a NEBOSH Diploma. She then joined JW Filshill in 2020 in her cur rent role of health & safety manager.

“During tough economic times, people still choose to pur chase little luxuries to treat themselves, and wine and spirits is an area where people traditionally spend more to treat themselves or others,” he says. “In the off trade, we will see some trade down; however, people will also trade up when staying in to make the occasion more special. For these reasons, we’re optimistic about this Christmas.”

He adds that the World Cup will make this Christmas different to any other, driving new drinking occasions in and out of home. In celebration of the World Cup, Jameson has created a limited edition bottle range. There are five designs, each featuring a unique, vibrant football shirt, and the initiative is being supported by a £1 million media campaign across digital, social, PR and in store.

With consumer spending in December 2020 and 2021 eclipsing pre pandemic levels (ONS) and with Christmas this year set to be the first free of restrictions for three years it is expected to be a prime opportunity to boost sales, according to Campari Group UK.

Adding sparkle to festive proceedings, prosecco is a known big seller at Christmas. Last year, sparkling wine sales grew by 22%, with Brits spending £15.5 million on fizz during the festive season (Kantar). “This should come as no surprise to wholesalers pre pandemic, one in every four bottles of prosecco in the UK off trade was sold during the eight week run up to Christmas (Nielsen),” reports Sandra Brunet, marketing director at Campari Group UK.

As consumers look to make their celebrations stand out, wholesalers should encourage retailers to highlight premium sparkling drinks. “This should not be limited to the traditional prosecco or champagne offerings, with retailers offering guidance on how to elevate sparkling wines into sophisti cated serves such as adding Aperol or other flavoured liqueurs to help increase in store spend,” Brunet suggests.

The Aperol Spritz presents an opportunity for retailers to help shoppers premiumise their prosecco moment by enjoy ing the best selling branded cocktail in the UK (CGA). “Retail ers can add further value by encouraging their customers to try something new by enjoying cocktails at home a trend that has risen in prominence in recent years,” says Brunet.

The long term premiumisation trend is a resilient one, with people drinking less but better and, as they do, engag ing more with what they ’re drinking, paying more attention to wine pairings and enjoying more cocktails, points out Chris Shead, off trade channel director at Pernod Ricard UK.

Some 60% of shoppers will give alcohol as a gift this Christmas (Toluna). According to Pernod Ricard UK, Chivas 12 and Jameson Black Barrell offer the perfect gifting solution, and Stoneleigh, Leaps & Bounds, Jacob’s Creek Double Barrel, Campo Viejo Gran Reserva, Cafayate Estate and Castillo de Ibiza wines are ideal to take to a festive drinks party.

In addition, Havana Club 7 Year Old has been given a festive makeover, with a new black and gold limited edition bottle featuring a metallic screen printed finish.

Meanwhile, to inspire consumers and drive cocktail ingre dient sales, Pernod Ricard UK has launched a new YouTube channel featuring fun, festive tutorials on how to create the most searched winter cocktails, including an Absolut & Kahlúa Espresso Martini and The Glenlivet Hot Toddy.

Tim Dunlop, brand director at Hammonds of Knutsford, believes that people are seeking out fun new products to share with their friends: “We expect there to be a huge desire this Christmas period for gatherings and parties in the home, and consumers are looking for simple, versatile cocktail serves that bring excitement to the occasion and cash & carries are key in this route to market.”

“BuzzBallz Cocktails are a different, no mess solution with a strong visual appeal and unique round shape. They are

Despite the ongoing cost of living crisis, consumers are expected to spend on drinks this festive season to give as presents and bring excitement to the occasion at home.

also one of the few top quality, bar strength cocktail options on the market.”

Christmas themed PoS materials, including Christmas tree shaped display units, filled stockings, and eye catching signage, are available to depots to support BuzzBallz.

Jo Taylorson, head of marketing and product manage ment at Kingsland Drinks, agrees that consumers are looking for fun and experimentation from brand innovators who cre ate high quality drinks with appealing packaging. “They want brands to grab their attention on shelf,” she says. “They are willing to try new things and different flavour combina tions and want their drinks to be fun and a reflection of their personality.”

Kingsland Drinks is seeing ‘ explosive growth’ in the canned wine and RTD cate gories, with products such as Vin Crowd canned wine spritzers and Mix Up RTDs proving popular among younger drinkers in particular. “This is a key trend that is set to flourish as the category benefits from an upswing in socialising,” says Taylorson.

She continues: “We’re expecting very different spending patterns this year but consumers will still want good value and quality, plenty of choice, and wines at a range of price points.”

Kingsland Drinks predicts that its Spanish Campaneo red wines will perform well this festive season.

In time for Christmas, Provence Wine has launched its two rosés into the wholesale sector. Monte Carlo Blush and Monte Carlo Prestige AOP have the unique attribute that they are backed by the Monte Carlo Principality.

“The customer demand for rosé in wholesale is accelerating impressively, and the brand will bring new cus tomers into the category who desire delicious tasting rosés and aspire to the lifestyle, ambience and aura of the Côte d’Azur,” says sales director John Roblings.

Provence Wine is backing the launch with a Christmas offer featuring competitive rsps. Display units are also available.

Also offering something different is Love Drinks, which has entered the Japanese drinks sector for the first time after taking on the UK distribution for the Ikigai Collection.

The Kurayoshi Distillery ’s The Matsui Single Malt, The Kurayoshi Pure Malt and The Tottori Blended whisky ranges are available initially, before Love Drinks rolls out additional Japanese brands from the collection to the wholesale sector.

Samantha Burke, managing director of Love Drinks, com ments: “The Japanese whisky sector has been one of the most exciting internationally in the last few years and there are definitely more UK consumers delving into the category, as many adapt a more discerning quality over quantity approach to drinking.”

Mast-Jägermeister UK has produced 500,000 bottles with a temperature sensitive back label featuring a secret code that becomes visible only after reaching the ‘perfect serve’ temperature of 18°C. The code gives consumers the chance to win one of more than 1,500 prizes, such as mini Jägermeister freezers. There is also a grand prize of a European festival experience for four.

“Stocking well known brands during the Christmas period is essential,” maintains head of brand & trade marketing Johnny Dennys, “and Jägermeister is a must stock product as the shot occasion is synonymous with celebrations.”

Building on its popular Gordon’s gin brand, Diageo is introducing Gordon’s Premium Pink Gin & Lemonade RTD in the wholesale trade early next year.

The 5% abv drink, which comes in a 250ml slimline can (rsp £2.19), was initially launched in Tesco and Waitrose in October. The product is designed to capitalise on the drink ’s popular ity in the on trade 61% of Gordon’s Premium Pink serves are made with lemonade in the on trade (Kantar).

Jessica Lace, head of Gordon’s, comments: “Following the success of Gordon’s Premium Pink and know ing the huge opportunity within the RTD category, we were keen to replicate the popular Gordon’s Premium Pink and lemonade in an accessible format for more consumers to enjoy. The launch of the RTD does exactly that and places the brand at the forefront of emerging trends.”

The rise in popularity of premium and super premium brands isn’t going away, even during these tough times, maintains Sunny Mirpuri, director for wholesale & convenience at Budweiser Brewing Group.

“Beer drinkers have the taste for premium which is why we’re seeing a rise in popularity of brands like Stella Artois and Corona,” he says. “Stella Artois also has a festive her itage and is consistently voted the No.1 alcohol brand at Christmas (Nielsen). The beer was originally crafted in 1926 as a Christmas gift to the people of Leuven, Belgium. This back story, combined with strong sales during the Christmas period, makes it a stand out choice for wholesalers.”

Last Christmas, there was a 21% rise in sales of no and low alcohol beers (Nielsen). Mirpuri says: “Wholesalers

should not ignore the growing customer base who are looking to moderate their intake whilst still wanting to taste something special. One option for consumers is Stella Artois Alcohol Free, which saw an 80% increase in volume during Christmas 2021 (Nielsen).”

He continues: “Christmas offers a clear opportunity for wholesalers to maximise sales, but the unfolding cost of living crisis adds an extra layer of complexity this year. Since consumers may be more discerning about how they spend their hard earned cash, wholesalers will have to rely more heavily on brands and products that consumers already know and love.”

Krombacher UK has unveiled a new 33cl can design for its iconic Pils in time for the busy winter and festive season.

The sleek white can showcases the brand’s heritage and also highlights its natural brewing credentials and use of Felsquellwasser local water found in around 50 wells within 3 km radius of the production site. This water is naturally soft and low in mineral salts, giving the beer its unique, refreshing taste.

The redesigned can is available in cases of 24 through importer Morgenrot.

For consumers who want to add a refreshing twist or a lighter option to their usual drinking habits this Christmas, Heineken UK also offers a selection of products.

Heineken 0.0 is the leading alcohol free beer brand in the UK, while the recently introduced Heineken Silver (4% abv) is aimed at consumers looking for easy to drink, less bitter and more refreshing lagers. “As consumers continue to look to indulge in better quality drinks dur ing the festive season, Heineken Silver is perfectly positioned to help upgrade moments at home,” claims Alexander Wilson, category & com mercial strategy director.

“Our advice to wholesalers is to continue to support the brands that you know shoppers will purchase, ensuring you’re offering a number of more premium brands to cater to those convenience store customers looking to trade up.”

A new format of Birra Moretti a 4 x 440ml can pack was recently added to Heineken’s portfolio, and for con sumers seeking out alcoholic drinks that fit their desire to lead a more balanced lifestyle, the company introduced Strongbow Ultra Dark Fruit earlier this year. The cider has 30% less calories than Strongbow Dark Fruit.

An additional half a million UK households buy apple and fruit ciders during the Christmas period versus the summer months, notes Aston Manor Cider. “For cash & carries, stock ing a range of brands, flavours and pack formats is key to max imise this opportunity,” says head of marketing Calli O’Brien.

The company recently launched a four pack of Crumpton Oaks pint cans to broaden the brand’s consumer base and reinforce its quality and value proposition. O’Brien points out

that a third of shoppers only ever buy cider in cans, so it is important that cash & carries offer both bottles and cans. Frosty Jack ’s and Crumpton Oaks come in both formats.

She adds: “Aston Manor ’ s state of the art production facili ties means shoppers can get their hands on award winning, great quality cider that doesn’t cost the earth.”

In addition to paying closer attention to their spending, con sumers are continuing to value convenience and are focusing on their drink experience at home. “From favourites such as Crumpton Oaks Apple Cider, through to branching out from wine into perry with our new look Chardolini, consumers welcome the chance to try something new at home, and seasonal opportunities like Christmas are when they are more likely to explore different options,” says O’Brien.

Nicola Randall, head of marketing at Brothers Drinks Co, says that the festive season provides consumers with the chance to experiment. “The festive season is also associated with rich, warming flavours, and Brothers’ best known SKU, Toffee Apple, is certain to capture consumers’ interests and help drive retailers’ sales,” she claims.

Innovation in flavour is one of the most prominent trends in the cider category, and this trend extends to both alcohol and alcohol free variants (Mintel). Brothers last year intro duced its first alcohol free cider, Toffee Apple Alcohol Free.

Soft drinks play a key role in driving sales during the festive season. The category was worth £809 million to retailers during December 2021, up 8.7% on the same period in 2020, and saw the second biggest growth year on year across all food and drink (Nielsen). Colas, mixers, lemonade and adult soft drinks overtrade during the festive period compared to the rest of the year (Nielsen).

Coca Cola from Coca-Cola Europacific Partners (CCEP) is the biggest soft drinks brand in GB (Nielsen) and it has become a festive staple thanks to its iconic Christmas cam paigns and the ‘Holidays are Coming’ Coca Cola truck.

This year, CCEP has launched an on pack promotion to help cover the cost of festive moments, whether mealtimes or gifts for friends and family. Shoppers can scan QR codes on pack for the chance to win £200 ‘ Festive Feast ’ gift cards from Love2Shop, as well as exclusive Coca Cola and festive gifts.

CCEP has also introduced festive packagaging for Coca Cola Original Taste, Zero Sugar and Zero Sugar Cherry.

FareShare is a safety net for us.

it’s there has been really comforting during these unusual times.

Other popular brands from the supplier include Appletiser, sales of which were up by 26% in December last year, and Schweppes, the No.1 mixers brand in convenience (Nielsen).

Last year, soft drinks sales increased in the convenience sector by 20% (IRI). “This period also added £92 million in retail sales value versus 2020 to convenience a true suc cess story for the channel,” reports Ben Parker, GB retail commercial director at Britvic.

“This year, in the current climate, a proportion of shop pers may be more value conscious, but there is still opportu nity for convenience retailers,” he insists. “Retailers should offer premium ranges that tempt shoppers to trade up, while still being a lower cost alternative to socialising at a pub or dining out (Lumina).

“Of course, the Christmas period in 2022 is unusual as it ’s the first ever winter World Cup, and this represents a great opportunity for convenience stores to drive even more sales among a broader customer base,” he adds.

The trade can maximise its soft drinks sales by focusing on the availability of key categories such as cola, lemonade, mixers and adult socialising drinks, says Parker.

J2O Glitterberry and Fruit Shoot Christmas packs, including the limited edition Fruit Shoot Merrylicious, can drive inspiration for special occasions. Glitterberry achieved 35% value growth in the last 12 weeks of 2021 (Nielsen), while J2O sells 25% of its value over the Christmas trading period in the convenience channel (IRI).

Suntory Beverage & Food GB&I recently introduced Ribena Sparkling Zero Sugar to help cash & carries and retail ers meet the growing demand for zero sugar choices within the flavoured carbonates category. The product is available in 500ml and two litre bottles.

“With the ongoing rise in the cost of living, more shop pers may look to celebrate the festive season at home this year,” says Matt Gouldsmith, channel director, wholesale. “Retailers should stock up on larger soft drink formats, such as two litre bottles of Ribena Sparkling Zero Sugar, to pro vide options for shoppers looking to share their favourite soft drinks with loved ones at home.”

The company has also introduced a reduced price for PMPs of Ribena Sparkling bottles. “We know that consumers are especially price conscious at the moment,” says Gouldsmith. “This is likely to continue into the festive season, so introducing reduced price marked packs is a move that will help retailers boost sales even further.”

Suntory is giving shoppers the chance to win cash prizes this winter through a text to win promotion on Lucozade Sport as part of its ongoing partnership with the England national football team.

Running until 12 December on all Lucozade Sport products, the campaign is designed to help retailers create excitement about the international tournament in store and tap into additional sales.

Within the sports & energy drinks category, flavoured variants have grown by 20.1% (Nielsen) and Red Bull Editions have been increasing penetration by 165.3% (Kantar). “With tropical and exotic flavours growing by 23% more than all other mainstream flavours on offer (Nielsen), Christmas is the perfect time for retailers to stock up on the Red Bull Editions 250ml range to capitalise on consumer demand for different flavoured varieties and maximise sales over the winter months,” says a company spokesperson.

Over the last year, the sports & energy category has grown by more than £254.6 million versus 2021 and is now worth over £1.8 billion (Nielsen). “This growth has been fuelled by the increased demand for functional energy drinks amongst shoppers,” says the spokesperson. “These drinks have added over £171.6 million in value versus a year ago (Nielsen).”

Understanding the formats that consumers want most has always been a top priority for Red Bull. Red Bull Energy Drink 250ml is not only the company ’s most familiar and best selling SKU but also the single most valuable soft drink in the UK. This format is worth over £164 million and delivers 10% of all sports & energy drink sales in the UK (Nielsen).

As the temperature decreases, wholesalers are advised to stock up on the UK’s No.1 ginger beer, Old Jamaica it is made with authentic root ginger ‘which is sure to heat things up a little this festive season’, says Refresco.

The company claims that Old Jamaica meets shopper demand for products that add interest and excitement to their drinks repertoire.

The line between the soft drink and mixer categories is increasingly blurring, and ginger beer has proven to be a versatile mixer across all spirit categories, says Refresco. Old Jamaica ginger beer is already being used as a mixer by one in four consumers in the UK.

Donna McKay, senior category & innovation manager at Refresco, says: “Ginger beer has seen a resurgence as consumers require a ver satile mixer that offers flavoursome and exciting drinks creation. Our Ginger Beer collection does just that.

“The data is showing that dark spirits are growing in pref erence, and Old Jamaica offers the perfect mixer to catapult growth and bring new consumers into the category.”

Refresco recommends that wholesalers and retailers ensure presence of sharing formats of soft drinks as demand spikes for larger packs during the Christmas period. In addi tion, offering variation in the range will help meet a multitude of shopping missions and maximise larger format sales this festive season.

The cereal category still tops the breakfast occasion, which has become a segment that has seen plenty of activity over the last couple of years. Since a consumption boom triggered by lockdown, there’s been reformulation and innovation to satisfy the demands of the HFSS legislation and health conscious consumers, and the choice on the shelves continues to widen dominated by the big cereal brands.

With environmental responsibility in mind, leading Scottish porridge oats and oatmeal brand Hamlyns of

Scotland is bringing out a new range of sustainable paper packaging, which will be launched across the portfolio before the end of the winter porridge eating season. The Hamlyns popular pinhead oatmeal tin is also having a revamp.

“We are waiting on delivery of a new packaging machine, which will allow us to package our full range of porridge oats and oatmeals in paper bags. We already generate our own electricity via our wind turbine, and this is the next exciting stage in our sustainability journey,” says managing director Alan Meikle.

Hamlyns will be placing advertising in a selection of popular consumer magazines, complementing a social media campaign to promote the rebrand so that shoppers are aware of the switch to paper and can easily find the prod ucts in store.

The investment comes as Hamlyns is ramping up produc tion in the lead into winter. The value of oats, economically and nutritionally, is expected to be particularly beneficial for consumers this winter. “Oats are one of the best value break fast options, and as families really start to feel the squeeze from the cost of living crisis, we anticipate that more

people will switch from other breakfast choices to oats. We would advise convenience retailers to stock up for win ter,” says Meikle.

“Oats have been a staple of the Scottish diet for centuries, and in recent years porridge has enjoyed something of a resurgence as healthy eaters recognise the many health ben efits,” he continues. “Younger consumers enjoy oats in differ ent formats, and the trend for overnight oats and baked oats has helped to ensure that oats are also a popular choice across the generations.”

wholesale,” says the company spokesperson.

There is also a place for NPD to boost sales, and this year the Krave Cookies & Cream launch was impactful in the convenience channel, particularly with the accompanying depot incentives that included most creative dis plays and biggest sales uplift com pared to previous NPD.

Along with its cereal core range, Kellogg’s recommends that wholesalers and retailers pay attention to the recent growth of Pop Tarts in cash & carries up by 329% in value versus last year. A total of 13% of symbols and independents stock Pop Tarts, compared to 5% at this time last year.

Hamlyns Scottish Oatmeal is the No.1 selling oatmeal brand in Scotland, and its porridge oats products continue to increase market share. “As a nation, we Scots are very proud of our food and drink heritage. As a healthy product that ’s 100% Scottish from field to mill to finished product, Hamlyns porridge oats and oatmeals are the natural choice. Convenience retailers can help consumers to select Scottish products with end of aisle displays and simple shelf labelling,” Meikle suggests.

Kellogg’s is also responding to the cost of living breakfast habits with a focus on its price marked cereal packs for sym bols and independents. “We’re seeing a gradual upward trend in people skipping breakfast or mov ing back to a one item breakfast 45% of breakfasts are now one item. Cereal is a low cost option and where consumers are choos ing a one item breakfast, it is most likely to be cereal 66% of one item breakfasts are cereal,” points out a company spokesperson.

“At Kellogg’s, we are helping to drive the value perception of cereal by focusing on PMPs within cash & carries.” A total of 64% of cereal sales in symbols & independents are from PMPs.

The manufacturer has a core brand strategy that involves driving availability and distribution in the wholesale sector, supported by significant media investment and activations in stores and depots.

Crunchy Nut is the No.1 brand for taste within cereal, and continues to grow in symbols & independents at 1.6% versus last year, ahead of major multiples, reports the company. “We know that taste is key for convenience shoppers almost a third of cereal sales come from taste led brands in convenience versus around 20% in total market, so having a good range of taste led brands will help drive sales within

PepsiCo has launched a multimedia campaign for the Quaker brand to highlight the taste message to consumers exploring breakfast options for winter. The ‘Heat It To Release It ’ initiative promotes healthy hot breakfast choices for the colder months and encourages shoppers to choose Quaker sachets and pots.

“Consumers are increasingly looking for tasty breakfasts that also deliver on their need for healthier options,” says Quaker Oats senior marketing manager Claire Molyneux. “The ‘Heat It To Release It ’ campaign will be sure to boost percep tions of hot breakfasts within the wider cereals market.”

The manufacturer prioritised health credentials in its recent activity for its Quaker oats brand. The range is almost all non HFSS, after extensive reformulation, and there are also new SKUs that include Heavenly Oats Chocolate Orange and Heavenly Oats Caramel Fudge pots, as well as a new Quaker Oats So Simple range that provides a 100% whole grain porridge with no added sugar.

“As a market leader across the breakfast segment, includ ing No.1 positions in both pots and sachets, our reformula tions mark a statement of intent for Quaker in healthy break fasts,” says Corinne Chant, Quaker marketing director. “Health is the driver for choices at breakfast, with consumers striving for options they believe will leave them feeling fuelled and nourished for the day ahead. However, there is also a need for the category to offer consumers healthier choices that don’t forgo taste, and this has fuelled the devel opment of our most recent non HFSS NPD.”

With a portfolio that is already totally HFSS compliant, Weetabix has continued with its taste led innovations. “With HFSS regulations now introduced, it ’s business as usual

‘As families really start to feel the squeeze from the cost-of-living crisis, we anticipate that more people will switch from other breakfast choices to oats’

Alan Meikle, managing director, Hamlyns of Scotland

for us. We’ll continue to confidently invest in store pro motions, as well as in out of home and on TV and social. Weetabix Melts and our new Oatibix Nutty Crunch are per fect examples to show that health and enjoyment are not mutually exclusive,” says Darryl Burgess, head of sales.

“Chocolate orange has been a big flavour across FMCG in the past couple of years and earlier this year we launched the limited edition Weetos Orange Chocolatey Hoops, backed by in store promotions and online marketing campaigns. Weetos Orange Chocolatey Hoops is HFSS compliant with no red traffic lights, while it also boasts strong nutritional scores as it ’s high in fibre. The new flavour represents a bril liant opportunity to encourage sales of Weetos all year round and drive additional penetration for the brand.”

Weetabix also has promo tional activity to coincide with the World Cup this month, building on the manufacturer ’s partner ship with the FA for the Home Nations and the Republic of Ireland. This summer, an on pack promotion featuring female foot ballers offered a selection of money can’t buy prizes and was well received during the excitement of the Euros success, so Weetabix has high hopes for the return of football fever this winter. “With some kick offs at 10am, we expect cereal and breakfast snack sales to perform strongly during this period,” predicts Burgess.

General Mills is another supplier to introduce on the go, HFSS compliant breakfast and snacking NPD to suit the demand for convenient, healthy, multi occasion products. The Nature Valley Fruit & Nut range is high in fibre and con tains no colours, artificial flavours or preservatives.

Nature Valley is the UK’s No.1 cereal bar brand and includes Nature Valley Crunchy, made with 100% wholegrain oats, and Nature Valley Protein, which is high in protein and fibre. These key ranges are major contributors to the brand’s growth at 5.7% versus last year (Nielsen).

On the go breakfast brand belVita, from Mondelez International, has seen its portfolio expand with several non HFSS products that prioritise taste credentials. The recently launched belVita Fruit Crunch has Raisin & Currant and Apple & Pear variants and each biscuit is less than 100 calories. Meanwhile, in the belVita Soft Bakes range, a new filled apricot style has joined the line up.

“The healthier biscuit category is growing at 4.5%, with more consumers showing a renewed interest in their wellbeing. BelVita is a key driver of this category growth, growing at 10% and leading the way in terms of both frequency (+4% MAT) and penetration (+11%) (Kantar),” says Susan Nash, trade communications manager.

“With a need to keep hunger at bay throughout the morn ing for on the go shoppers, belVita delivers a quick and easy way to get additional nourishment,” she adds.

Cost is now a huge factor for shopper baskets. Dole Sunshine Company highlights the versatility and nutritional benefits of fruit, plus the convenience of ambient formats. “As the cost of living crisis continues to bite, it ’s safe to assume that consumers are likely to continue to change their shopping behaviours and be more conscious of product value for money incorporating quality, waste, convenience and choice, which is where ambient products increasingly have a role to play,” says UK sales director Andrew Bradshaw.

The supplier ’s line up of packaged fruit snacks has been extended with Fruit in Juice mango and pear variants. These come in four packs and have less than 100 calories per serving.

Lockdown saw a rise in food creativity as people had time on their hands and were looking to enhance their mood and occupy themselves. Chocolate spread saw a 5% rise in household penetration, and the idea of elevating a breakfast offering quickly and easily is still prevalent.

Ferrero s Nutella brand is the No.1 brand in the spreads category (Kantar) and a popular choice to add indulgence to the breakfast occasion. “The popularity of the ‘Instagrammable’ meal, particularly brunch, is helping to evolve traditional morning meals as consumers look for ver satile ingredients, such as Nutella, to add a layer of excite ment and visual appeal,” says Jason Sutherland, UK&I sales director. “Its versatility and much loved flavour make it the ideal breakfast spread to stock throughout the year.”

Kepak Consumer Foods also identified an increased shopper desire for upscaled breakfast occasions and responded with the Rustlers All Day Breakfast Pancake Stack. “Rustlers recognised an ambient multi serve dominance in morning goods, which presented an opportunity for the brand to expand into the category with a chilled single serve offering similar to the well established variants in QSR (quick service restaurants),” says Monisha Singh, shopper marketing manager.

“Since launching in April, the All Day Breakfast Pancake Stack has become the second fastest growing product in micro snacking, adding more than £300,000 to the cate gory,” she adds.

Sales of cigars are expected to spike as Christmas approaches, offering the trade a chance to cash in on this category, which typically offers higher profit margins than cigarettes.

Sales of cigars increase in the run up to Christmas, so now is a good time to encourage retailers to review their range and stock up in anticipation of the seasonal spike in demand.

“It ’s really important for both retailers and cash & carries to get their range right so they can enjoy those extra sales and rewarding profit margins which are typically three times those of cigarettes,” says Alastair Williams, coun try director at Scandinavian Tobacco Group UK (STG UK).

“It tends to be larger cigars that people gravitate towards as a bit of a Christmas treat when they are in celebratory mood and typically have more time to enjoy them,” he adds. “Make sure you have brands like our Henri Wintermans Half Corona in stock as it is the UK’ s best selling medium/large cigar and a real festive favourite.”

When considering ranging at other times of the year, it is worth noting that the top 10 cigar brands account for over 90% of sales (IRI). “Don’t tie up your cashflow with slow moving brands,” Williams advises.

Williams emphasises the importance of effective mer chandising in depot: “Of course, consistent availability and competitive cost prices are essential, but keeping the range in sight for the retailer to buy will ensure we have our prod ucts at the ‘risk of sale’ within their outlets. Brand blocking is an effective tool, along with a clear ‘category versus market trend’ approach to stocking products.”

Commenting on the importance of value in the cigars category, he says: “There is no doubt that consumers are going to be increasingly price conscious as the cost of living crisis continues to bite, and this will affect cigars and the wider tobacco category purchases just as much as any other category in store.

“Having said that, the search for value has been a trend in cigars for some time now, evidenced by the success of our Moments Blue brand, which offers a quality smoke at a low price. It is now the sixth best selling cigar brand in the UK in value terms, but interestingly most of its sales go through the multiple grocery channel, so I wonder if it ’s one area where independent retailers and cash & carries might be missing a trick by not stocking it?

“With the current cost of living crisis only likely to get worse in the coming 12 months or so, it ’s sensible to assume that value products will only increase in importance across the store, and that will certainly include cigars, so cash & carries who don’t currently stock Moments should absolutely do so,” he adds.

“It ’s miniatures that remain the engine room of the cigar category, so it is important to get this segment right. By far the biggest player here is our Signature range, which is ably supported by our Moments brand.”

He continues: “The cigarillos category barely existed three years ago but now makes up over 46% of the total volume and just under £100 million in value sales (IRI).

“Our Signature Action brand is not the best selling cigar illo on the market but it ’ s growing steadily in popularity and a good option for adult smokers who enjoy the pepper mint flavour.”

Cash & carries should also consider brands in the small and medium/large segments to ensure they are covering their bases. “Think about including the top selling brands from each segment as a minimum,” suggests Williams. “Our Henri Wintermans Half Corona accounts for over 72% of sales in the medium/ large segment (IRI).”

Another brand positioned to offer “an affordable rsp” is Sterling Dual Capsule Leaf Wrapped from JTI. It is the UK’s No.1 cigarillo brand with a 92% share (IRI) and includes a mentholated Virginia blend tobacco and capsule filter that when crushed releases a peppermint flavour.

“We would recommend that whole salers stock up on both the 10s and 20s formats to offer more choice to customers and make the most of this successful brand,” says Gemma Bateson, sales direc tor at JTI UK.

In addition to highlighting strong growth in the cigarillos category it is now worth around £8 million a month (IRI) Bateson emphasises the importance of the festive season to cigar sales: “A trend that we continue to see from year to year is that cigars and cigarillos are most popular around particular seasons, with a volume uplift trend in the run up to December (IRI). It is therefore important for whole salers to stock up ahead of Christmas to make the most of their popularity,” she advises.

‘The top 10 cigar brands account for over 90% of sales. Don’t tie up your cashflow with slow moving brands’

Alastair Williams, country director, Scandinavian Tobacco Group UK

Henri Wintermans sales traditionally go up over the winter period. Remember to stock up in time to profit from the demand.

creating healthier snacks

convenience channel. Siobhan Kielty reports.

The crisps, snacks and nuts (CSN) category in conve nience is one of the main impulse drivers and has remained resilient over a couple of rocky years. It is worth £3.7 billion (Nielsen), and one in five baskets contain a bagged snack. With HFSS restrictions and associ ated manufacturer reformulation coming into play now, it ’s more important than ever for wholesalers to be informed of category developments and help their customers to mer chandise the fixture and secondary sites correctly.

Envis Snacks continues with its robust growth in the savoury snacks market, thanks to its distribution agreements with Lorenz Snackworld and OK Snacks. Activity this year has included new eye catching graphics for the Lorenz range, containing Lorenz Pomsticks and Curly, which are increasing on shelf stand out and driv ing incremental sales.

In addition, Lorenz Pommels a light, airy potato snack available in Paprika and Original variants has joined the line up. “The new graphics have been really well received this year, as growth has come across our range with products offering real differentia tion,” says Andy Brown, sales director.

He adds: “My advice to both whole salers and convenience retailers is

’t

make sure you have an interesting range that covers not only the core lines from major suppliers but also less well known but interesting lines from new and emerging suppliers for examples Lorenz Pomsticks that are available in five interest ing flavours to suit all palates.”

With sharing snacks still experiencing strong sales, price marked packs are not necessarily always the preferred option for retailers, and smaller sharing pack sizes can be beneficial for those with limited shelf space. “While sharing PMPs are still key drivers of sales, things are changing a little now as there are also a lot more non PMPs that allow retailers to structure

‘Things are changing a little now as there are also a lot more non-PMPs that allow retailers to structure their margin around their overheads’

Andy Brown, sales director, Envis Snacks

From upping the appeal for Generation Z consumers to

that don

compromise on taste, manufacturers have been working hard to ensure that the snacking category continues to prosper in the

their margin around their overheads,” explains Brown. “As examples, we have a range of smaller 75g X cut Crunchips which retail between £1 and £1.25, and larger 150g X cut Crunchips that sell for between £1.75 and £1.99, allowing a range of choice for retailers.”

PepsiCo also offers advice about maximising sharing sales: “Whether it ’s a BBQ with friends, big night in, watch ing a key sporting event or simply having a routine evening in, sharing packs play an important role in all of these occa sions,” says Kirsten Reid, impulse category management channel lead. “Stocking the right sharing formats is key to unlocking growth in these social occasions. In the latest year, both PMP and non PMP have seen good growth, with a value growth of 9% and unit growth of 7% (Nielsen).”

The snacking category is one where new flavours and textures are well received and innovations necessary along side core range favourites.

“Shoppers continue to look for ways to add excitement to their snacking occasions, and this is particularly the case for Gen Zs, who over index in this channel versus other chan nels. We know retailers are always on the lookout to offer something completely different to their shop pers and our NPD offers a variety of options,” adds Reid.

With this in mind, PepsiCo has launched Loaded Pepperoni Pizza flavour Doritos to cater to the Gen Z market, available in a 70g PMP for the convenience channel. The launch was supported by a large scale media campaign last month to high light the sharing opportunities for the new SKU. “The new Doritos Loaded Pepperoni Pizza taps into a very clear need from Gen Z for new and exciting flavours that they can enjoy during sharing occasions,” says Alex Nicholas, Doritos mar keting manager.

Big merchandising opportunities include seasonal events, and PepsiCo’s Asian snack brand, Kurkure, predicts an uplift in sales during festivals such as Eid and Diwali. In addition, the FIFA World Cup is expected to boost sharing snack sales as the nation settles down for the duration.

A Kurkure retailer survey has revealed that 50% of conve nience retailers now stock Asian inspired savoury snacks and this proportion is increasing while 22% have noticed a rise in demand from customers for Asian inspired savoury snacks. “The findings demonstrate the demand from shop pers, and therefore the opportunity for retailers, to stock authentic Asian inspired snacks that consumers can enjoy together,” says brand manager Annabel Lewis.

PepsiCo’s bold tasting new products this year include the Wotsits Crunchy line up. The on trend Really Cheesy and Flamin’ Hot flavours are available in both 60g packs at the ever popular £1 price mark and 140g packs.

The demand for healthier snacks is also a driver in the present climate as well as HFSS restrictions, the consumer requirement for suppliers to offer healthier snacking choices is present. “The savoury snacks category is well positioned to adapt to the changing requirements through reformula tion, and we are well prepared to support retailers through this transition. As part of our commitment to encourage shop pers towards healthier snacking choices, we will also be reformulating and innovating across our portfolio,” says Reid.

“The key to encouraging shoppers towards healthier choices will be providing a strong range of HFSS compliant savoury snacks that can complement existing core best sellers, helping retailers to offer taste and health in order to deliver great returns for store owners,” she adds.

This year ’s NPD from KP Snacks includes KP Nuts Flavour Kravers, targeting evening sharing opportunities and cater ing to the trend for bold flavours. The Flame Grilled Steak, Smokin’ Paprika and Fiery Caribbean Jerk Sauce variants look to appeal to younger consumers.