No.1 PREMIUM FLAVOURED CARBONATES BRAND*

FRUIT JUICE

Excellence in all sectors of the Scottish wholesale trade was recognised at the Achievers awards.

Daniel Larkin, chief commercial officer of Sterling Supergroup, outlines his plans to increase the organisation’s profile and further improve the services it offers to

and suppliers.

Unitas Wholesale members

will share more than £2 million in incremental revenue in return for their participation in the group’s central promotions, publications and events.

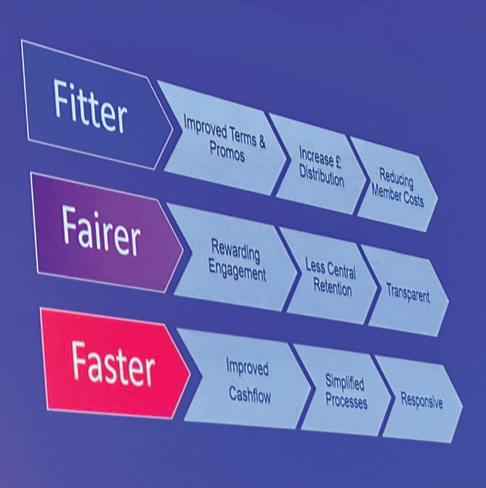

The ‘More for More’ incentive, revealed by managing director John Kinney at the Unitas connect25 trade show in Liverpool, will help drive engagement, execution and compliance in supplier partnership activities.

It will reward members who can demonstrate a higher level of engagement in schemes including the retail promotional programme, the retailer support portal Plan for Profit, customer-facing promotional materials and the group’s trade show and conference.

Kinney said: “Our mission is to be a fitter, fairer and faster organisation, delivering incremental revenue for our members and return on investment for suppliers.

“We have made great progress on being fitter –increasing the revenue returned to members by 17% in the last year, and 35% over the last five years, and we have helped members reduce their overheads

by £3 million through our Unitas Procurement scheme.

“We are also faster –increasing members’ cash flow through more efficient financial systems, reducing the days taken to process payments.

“Now we need to be fairer – ensuring that those members who contribute most to the group get the most out of it. This is why we are putting aside more than £2 million in additional rewards for those who actively engage, and incentivise others to do the same.”

More for More offers members the opportunity to more than recoup their annual membership fee from the additional revenue stream. Details of the criteria for accessing the income is being shared with members.

Unitas interim chair Dr Jason Wouhra OBE, CEO of

Hancocks has added Ultimate Trail Mix to its 1kg

bulk bag Pick ‘N‘ Mix Station range.

The product features a random mix of blanched and caramelised peanuts, chocolate-covered raisins, fudge cubes, sultanas, yoghurtcoated banana-flavoured fruit pieces, orange-flavoured sweetened cranberries, caramelised cocoa-dusted almonds, sweetened banana chips, and dried date pieces.

Lioncroft Wholesale, commented: “Offering members a greater financial incentive to actively participate in Unitas’ central schemes will appeal to wholesalers’ entrepreneurial instincts and ensure that those who put the most into the group will be rewarded proportionately.

“It will also incentivise members to drive compliance in joint ventures with our suppliers, which we know is the key to building mutually beneficial relationships. This new model will help to drive the right behaviours and will be vital to unlocking future investment and sustainable growth for members individually and for the group as a whole.”

The Unitas connect25 event also included awards for members and suppliers, with the following wholesalers all winners: a Retail Member: Parfetts a Foodservice Member: Fáilte Foods a Standard & Specialist Member: Regal Wholesale a On-Trade Member: Small Beer

a Member’s Employee: Jay Gore, Robinsons a Rising Star: Lee Bindley, Regal Wholesale a Environment & Sustainability Award: JW Filshill a Digital Innovation Award: Direct Line Supplies a Diversity, Equity & Inclusion Award: Wanis International.

Four executives from Booker are among the mentors who will take part in the WiW Speed Mentoring event on 2 May at Convene in London. They are commercial director Sheila Gallagher, head of supply chain transformation Trudy Wilson, retail development controller Abbie Hackwell, and sales director – catering Nikki Watts.

‘Work Happy’ is WiW’s theme for 2025, and topics to be covered at the Speed Mentoring event include building trust, strategic thinking, boundary setting, stakeholder management and emotional intelligence.

Kitwave Group saw revenues rise by 10.2% to £663.7 million in the year to 31 October 2024. In like-for-like terms, revenue grew by 5%.

Adjusted operating profit was up by 6.3% to £34 million, and gross profit margin also increased – by 0.4% to 22.3% during the year. Profit before tax was £22.5 million.

CEO Ben Maxted commented: “Kitwave has delivered another strong full-year performance. We have met full-year market expectations, achieved organic growth and expanded our operations, particularly in our Foodservice division.

“The Group had a clear plan for FY24 to invest for growth in three key areas: IT, delivery infrastructure and strategic mergers & acquisitions opportunities. The successful execution of this plan saw new warehouse technology enhancing operational efficiencies, a new state-ofthe-art storage and delivery facility in the South West, and three acquisitions

completed, which have significantly increased the scale of the group’s UK network.”

The three acquisitions were: WLG (Holdings), a family-run drinks business in Oldham, in November 2023; Total Foodservice Solutions, based in the North of England, in March 2024; and Creed Catering Supplies, based in the south of England, in September 2024.

Other developments during the last financial year included Kitwave joining Country Range Group in July

2024, and significant investment in fleet, with £1 million in new vehicles and £13 million through right-of-use vehicle replacement, resulting in over 150 new vehicles that are Euro 6 compliant.

Maxted said: “Importantly, the group continued to deliver growth and maintain its high levels of customer service, resulting in achieving over 98% satisfaction in customer service excellence levels. This is testament to our operations model and the commitment of our team.”

Country Range has extended its range of dough balls with a larger 340g product.

One of the most popular products in the group’s portfolio, dough balls can be used in a myriad of ways across the catering and hospitality sectors.

The new Country Range Dough Balls come frozen in a pack containing 30 x 340g pieces.

Rachel Porter, marketing manager, said: “Dough balls are such a fantastic ingredient for caterers of all sizes as they are great for portion control and only need to be thawed before use for pizza perfection and so much more.”

The Más+ by Messi hydration drink will be exclusively available in the convenience sector at SPAR stores in England, Wales and Scotland until the end of March.

Following its surge in popularity in the US, the drink co-founded by the world’s most decorated footballer Leo Messi is being launched in the UK.

It comes in a 500ml bottle with an rsp of £2.50.

a Miami Punch – inspired by the city where Messi and his family live and home of Messi’s current and next chapter at Inter Miami CF.

a Limón Lime League –honours the time Messi spent playing in the UEFA Champions League, a cup he won four times.

In addition, SPAR has secured a six-week symbol group exclusive for the launch of Reese’s Peanut Butter White Bar.

The four varieties are inspired and curated by Messi and the milestones of his career:

Más+ by Messi includes an electrolyte complex, vitamins and minerals but no artificial colours, sweeteners or caffeine. There is 1g of sugar and 10 calories per bottle.

a Berry Copa Crush –inspired by the many trophies, including the World Cup, that Leo has lifted in his career.

a Orange d’Or – inspired by Messi’s record eight wins of the Ballon d’Or (Golden Ball in French) trophy.

The deal, which started on 20 February 2025, means that SPAR stores across Scotland, Wales and England have exclusive access to the NPD for the six-week period. The 90g bar is available at a promotional price of £1.50 (rsp £2.10).

Parfetts has taken another step toward its sustainability goals with the installation of a 400kWp rooftop solar PV system at its Birmingham depot.

Completed in partnership with Solarcrown Commercial (SCC), this development brings Parfetts’ total installed solar capacity to over 1.6MW across its depots. Its target is to install 2MW of solar energy across its network.

By integrating solar PV systems, Parfetts has already generated 1.9MWp of renewable energy, reducing 350 tonnes of carbon emissions.

The Birmingham depot installation is a crucial part of this larger initiative, with SCC having already completed projects at Aintree, Anfield, Sheffield, and Stockport, and further installations planned for Somercotes and Middlesbrough.

Brakes claims to have become the first major wholesaler to introduce enhanced welfare standards for its own-brand fresh primary chicken range.

The development provides chicken with 20% more space to move around and perch, allowing them to express more natural behaviours. In addition, the birds now have more access to enrichments including straw bales, perching areas, items to peck at and more natural light.

Brakes currently sells more than 40 own-brand fresh British chicken lines, all of which are produced in the UK under the Red Tractor scheme.

The new standards reduce the stocking density

from the industry standard 38kg/m to 30kg/m.

At the same time as introducing the new standards, Brakes has worked with its suppliers to implement an internal camera monitoring system on broiler chicken farms, which operates 24/7 and helps to ensure that the required standards are maintained at all times.

LWC Drinks, the UK’s largest independent drinks wholesaler, has announced an acceleration in its sustainability drive, along with the launch of its ‘headline ESG commitments’.

Centred on five key pillars – climate, facilities, operations, marketing & communications, and people – these new commitments provide a clear roadmap for how LWC intends to reduce its environmental impact, operate more responsibly, and drive sustainability across the drinks industry.

Each commitment also forms a crucial part of the company’s newly defined pathway to net zero by 2050.

Notable commitments include:

a 25% reduction in Scope 1

& 2 GHG emissions by 2030 a Engagement with top 20 suppliers to reduce Scope 3 GHG emissions by 25% by 2035

a Accreditation achieved by 2026 a Pilot HVO [hydrotreated vegetable oil, sometimes also known as renewable diesel] at key depots with bunded tanks by 2026

a Electrify all warehouse equipment by 2030 a 2% of annual profit donated to charity partners.

LWC has also unveiled a Green Ambassador programme, the launch of a new internal Sustainability & ESG Hub, plus the appointment of a new sustainability lead. These developments follow the continued roll-out of

solar arrays across LWC sites, its road-mile reduction partnership with Asahi, and the formation of its Sustainability Committee in 2024.

As LWC continues to grow, its focus on and investment in sustainability forms a key part of its expansion strategy. BREEAM certification now features highly in LWC’s considerations for all new depot purchases and developments, ensuring that efficiency, environmental impact, and sustainability best practices are embedded from the outset.

Ebrahim Mukadam, MD at LWC, said: “We have set our goals, supported them with robust action plans and are formally holding ourselves to account.”

In the year to date, The Wholesale Group has added 11 new wholesale members, bolstering its annual group turnover to £4.52 billion.

The new members span both retail and foodservice, and take the group’s total wholesale depots to 257 which represents more than 13.7% of the total UK wholesale market.

“The Wholesale Group continues to go from strength to strength since its inception at the beginning of the year,” said Tom Gittins, joint managing director.

“We firmly believed that the formation of a buying group centred around service and focused on independent wholesalers would create a growth platform for the future, and wholesalers have responded with 11 new members choosing to join us in our first few weeks.”

The new recruits include Café Deli in Croydon, McCartney Foodservice in Boston, Consort Frozen Foods in Burgess Hill, and Ewood Foods in Accrington.

“We are delighted to be joining The Wholesale Group as we continue our next chapter of growth,” said Stephen Sutcliffe, owner of Ewood Foods.

Nisa has appointed Brogan Cook (right), former head of convenience projects at Morrisons, as delivery lead.

In her new role, Cook will spearhead the implementation and mobilisation of corporate customer projects for the wholesale arm of Co-op.

She brings over a decade of experience in retail leadership and will be instrumental in the delivery of new accounts into Nisa, as the business looks to propel its growth and expansion into new markets.

At Morrisons, Brogan was responsible for the transformation and delivery of the strategic wholesale programme which saw her develop and implement new business routes for growth.

Katie Secretan, Nisa’s director of sales & retail, said: “We’re at a pivotal moment for our Co-op’s wholesale business, with ambitious growth targets in place, and Brogan’s proven track record in convenience and franchise operations, as well as her strategic leadership, will be invaluable.”

“As part of the group, we are looking forward to collaborating with other likeminded family wholesale businesses, and we welcome the opportunity to further future-proof our business with the group’s bespoke digital marketing support, powerful own-brand range and the access it provides to more than 400 supplier partners.

“The huge benefits offered by the group, including a share of the profits and no membership fees, meant that it was an easy decision to make for our future success.”

The 11 recruits will attend The Wholesale Group’s first trade show in Cheltenham on 20 March 2025.

Gittins said: “It is clear that independent family wholesale is thriving and has found a true home with The Wholesale Group. We remain the only buying group with no membership fees and a share of the profit for every member – a unique selling point which has proved to be compelling in the current market.”

The Wholesale Group, which was created on 1 January 2025, has brought together the membership of Confex and Fairway Foodservice buying groups.

Time Wholesale Services has signed up to b2b.store’s ProConnect platform to increase engagement levels with its customers.

The Unitas member will use the WhatsApp platform to communicate special deals and discounts to customers.

Managing director Sony Bihal was impressed by how b2b.store had created a WhatsApp business API service that is tailored to the food and drink wholesale sector.

“We’d seen a lot of talk about the impact WhatsApp is having in the sector and felt ProConnect was the best option for Time to do this with,” said Bihal.

“It’s important for us to work with b2b.store, who

have experience in getting the best results for similar businesses and a clear vision for how to further develop the product to have an even greater value for us in the future.

“Our initial strategy is to share promotions with our customers, but with the roadmap that b2b.store shared with us, we’re excited by what else we could use our WhatsApp channel for further down the line too.”

b2b.store’s WhatsApp services are also used by Bestway and Sugro.

Glasgow-based wholesaler Lomond: The Wholesale Food Co – along with its Cake division – has attained B Corp status.

The certification recognises Lomond’s commitment to balancing purpose and profit, ensuring that it meets the highest standards of social and environmental impact.

“We have been advised that we are the only food wholesaler in Scotland to

achieve B Corp status and only the third wholesaler in the entire UK to do so!” said a company spokesperson.

Anne McDonald, director of technical/health & safety at Lomond, was credited for her hard work and dedication in helping Lomond to reach the milestone.

“Together, we’re not just about great food – we’re also about making a positive impact on the world,” added the spokesperson.

United Wholesale Scotland (UWS) has promoted Naeem Khaliq to licensed director.

Formerly symbol group controller, Khaliq (pictured) has been with UWS for 27 years.

Commenting on his appointment, he said: “I’m thrilled to announce my new role as licensed director.

“Since joining United in 1988, I’ve been fortunate to grow within the company, gaining all-round experience across wholesale, retail, marketing and trading.

“From my early days working at our Maxwell Road depot during weekends and holidays while at school and then uni, to my first full-time position at United as wines & spirits buyer in 1994, I’ve built a deep understanding of this industry.

“Since then, I’ve held several key roles at UWS including impulse buyer, head of

marketing, several stints as head of symbol retail, and a few other side roles, all of which have shaped my expertise.

“I’m excited to bring this wealth of experience to my new role and to drive innovation and growth in our licensed category.

“I’m looking forward to collaborating with colleagues, supplier partners, and industry peers as we build on the strong foundations already in place.”

Fast-food wholesaler F Jones (Colwyn Bay), which trades as F Jones Food Service, has joined Sugro UK.

Founded in 1993, with roots dating back to 1931 as a fish supplier, F Jones Food Service is a family-owned wholesale business in Wrexham, North Wales.

With a turnover of £11 million, the company serves over 1,000 customers from its 15,000 sq ft warehouse and operates a fleet of 12 vehicles.

The delivered wholesaler offers a range of soft drinks, ambient groceries and disposable packaging items to service restaurants, takeaways and caterers.

Jon Roberts, managing

director of F Jones (Colwyn Bay), said: “F Jones Food Service, a family-run business, is currently undergoing a huge growth plan, so with Sugro’s unique buying and marketing capabilities, now feels like the right time for F Jones Food Service to become a member and

accelerate its growth.”

In other news, Sugro UK has expanded its procurement services for members with the addition of Xpress Fuel as a new partner.

Xpress Fuel offers cost savings on fuel via fuel card transactions and bulk fuel discounts.

Recognising the need to address climate change, it also provides carbon offsetting options on all of its fuel cards and bulk purchases. Customers who choose to reduce their carbon footprint in this way receive a monthly certificate outlining their contributions to environmental preservation.

According to Sugro, its members will be able to save an average of between 10% and 15% on fuel by using Xpress Fuel cards across their delivery and sales fleet. In addition, bulk fuel deliveries across a number of fuel and lubricant product types offer a more streamlined process for members to purchase at competitive pricing.

JJ Foodservice has introduced its first own-brand product for Japanese restaurants.

Rice Majestic Sushi Rice is a premium Japanese-style short-grain rice, priced from £16.99 for a 10kg bag.

Baris Kacar, chief product officer, said: “This sasanishiki rice has excellent texture and consistency, holding its shape perfectly for sushi and traditional Japanese dishes.”

JJ Foodservice has also introduced a smaller pack size for its Thai Majestic Hom Mali rice, catering to smaller businesses and home cooks.

Creed Foodservice has added Caribbean Jerk sauce to its allergen-free Kitchen ’72 sauce range.

The new Caribbean Jerk sauce features sweet and smoky notes, with herbs and spices including nutmeg, cinnamon, chillies, pimento and paprika along with onion, garlic and tomatoes. It is available in one-litre bottles, in singles and packs of six.

One hundred members of staff at James Hall & Co had their professional development recognised at the firm’s Achievement Awards.

The event saw current and former apprentices from right across the business rewarded for their effort and endeavour.

Employees who are developing skills through the company’s internal Leadership Academy were also acknowledged for their commitment to learning as part of a programme that is future-proofing the business.

In other news, James Hall & Co has announced that an insight-driven programme on the future of convenience retail is the focus of its annual retailer event – this year branded SPAR Inspire.

To be held on 10 April at Harrogate Convention Centre, SPAR Inspire will bring together current and prospective SPAR independent retailers with James Hall & Co’s G&E Murgatroyd

company-stores division to share ideas and initiatives.

Keynote speakers include Andrew and Dominic Hall, joint managing directors of James Hall & Co, and recently appointed MD of SPAR UK, Michael Fletcher, who will discuss SPAR’s focus areas in the UK market.

Another speaker will be SPAR independent retailer and Northern Guild member Bhavesh Parekh, who will highlight the progress of his business since joining SPAR through its association with James Hall & Co in 2016.

Retailers will be able to

engage with 58 big-brand suppliers at a tradeshow, and James Hall & Co will also exhibit its brands, including Cheeky Coffee, Fazilas, Ann Forshaw’s, and Clayton Park Bakery. In addition, SPAR brand products will be on show.

One retailer will win up to £10,000 worth of stock – this incentive is designed to encourage retailers to engage with the suppliers and take advantage of the deals on offer at the event.

There will also be an Inspiration Hub where retailers can catch up.

Mevalco, the Bristol-based importer and wholesaler of Spanish fine foods, has announced a collaboration with The MAZI Project – the Bristol youth-led charity that nourishes vulnerable 16-25 year-olds through food.

The MAZI Project supports care leavers and young asylum seekers, as well as young people recovering from homelessness or fleeing domestic violence.

Not only does The MAZI Project educate the next generation in food culture and health, but it also empowers young people by helping them learn the trade and find

job opportunities in the catering industry.

Mevalco is supporting the hard work of The MAZI Project volunteers by supplying some quality Spanish food ingredients and giving time to the cause.

Chef & development manager Sam Sohn-Rethel is heading the collaboration for Mevalco.

The best businesses and individuals in the Scottish wholesale channel were recognised and rewarded for their excellence at the Achievers awards – now in their 22nd year.

Scotland’s best wholesalers were honoured last month at the Achievers awards, which have retained their clear point of difference as the only awards for the wholesale industry that have an independent panel to scrutinise and verify every aspect of the judging.

Some 560 guests attended the awards dinner, hosted by sports presenter Eilidh Barbour at the O2 Academy Edinburgh.

Now in its 22nd year, Achievers is organised by the Scottish Wholesale Association and highlights excellence across all sectors of the wholesale trade.

Multiple winners included Unitas member United Wholesale (Scotland) which picked up Best Delivered Operation – Retail; Best Cash & Carry for its depot at Queenslie in Glasgow; Best Licensed Wholesaler – Off-Trade; and Best Marketing Initiative for its ‘Spin to Win’ concept.

Other Unitas members that were victorious included Fáilte Foods (Great Place to Work), JW Filshill (Sustainable Wholesaler of the Year), and Lomond Foods, whose purchasing co-ordinator Megan Smith won Employee of the Year and Wholesale Local Food Champion.

Meanwhile, in the inaugural Wholesale Driver of the Year category, winner John Martin of Braehead Foods was described as ‘one in a million’ and a ‘true credit to his team and the industry’.

SWA chief executive Colin Smith commented: “The people who work in wholesale are the glue that binds our food and drink industry together – be it those who work in partnership with our producers and suppliers or those who help support, develop and deliver into the local retailer, hotel, school or hospital.”

He added: “Every wholesaler, every supplier – be they local or national, large or small – are an essential cog in Scotland’s complex food and drink supply chain. That’s why is it more important than ever that we celebrate their success and recognise everything they do to ensure that food and drink reaches our plates and tables.” CCM

Best Cash & Carry: United Wholesale (Scotland), Queenslie, Glasgow

Best Delivered Operation – Retail: United Wholesale (Scotland)

Best Symbol Group: SPAR Scotland, CJ Lang & Son

Best Delivered Operation – Foodservice: Brakes Scotland

Best Licensed Wholesaler – OffTrade: United Wholesale (Scotland)

Best Licensed Wholesaler – OnTrade: Inverarity Morton

Best Marketing Initiative: United Wholesale (Scotland)

Employee of the Year: Megan Smith, Lomond Foods

Rising Star of Wholesale: Matt Farmer, Brakes Scotland

Wholesale Local Food Champion: Megan Smith, Lomond Foods

Wholesale Driver of the Year: John Martin, Braehead Foods

Great Place to Work: Fáilte Foods

Best Innovation: Lynas Foodservice Sustainable Wholesaler: JW Filshill

Local Supplier of the Year: Taylors Snacks

Best Overall Service: AG Barr

Best Foodservice Supplier: AG Barr

Supplier Sales Executive of the Year: Craig Barr, AG Barr

Project Wholesale: AG Barr

Best Advertising Campaign: Irn-Bru ‘Mannschaft’

Lifetime Achievement: Jonathan

Kemp and Ian Johnstone, AG Barr

For the first time in the history of Achievers, one supplier won all of the awards it was able to enter. That supplier was AG Barr, and it could not have been more thrilled with its success.

For Achievers 2025, there was a grand total of 46 individual wholesale executives involved in scoring and judging the supplier categories, so the fact that AG Barr won all the awards it was permitted to enter* is no mean feat.

The participation of the wholesale executives ranged from sponsoring and judging award categories to sending in scores for the highly respected Best Overall Service and Best Foodservice Supplier awards.

These latter accolades involve Scotland’s wholesalers firstly nominating their top suppliers and then voting each month over a four-month period for the service provided by the shortlisted companies.

This year, AG Barr won Best Overall Service with a score of 46.15 out of 50, ahead of JTI on 45.75 and Imperial Tobacco on 45.08.

For Best Foodservice Supplier, AG Barr scored 46.85 out of 50, with Taylors Snacks runner-up on 44.29, and Unilever Food Solutions and Vegware joint highly commended on 43.00.

AG Barr also shone in the Project Wholesale category, which focuses on wholesale-tailored activity from suppliers. The judges this year were David Howe of Bestway, Ernie Miller of Mark Murphy Dole, and Grant Scrimgeour of Yules. They were ‘bowled over by the

quality of entries’ and in any other year, the joint runners-up (Swizzels and Tennent’s) would have won this award.

However, AG Barr’s ‘The Great Transition’ – its project to move all of the sales from Barr Direct into the wholesale industry – put so much into wholesale (£17 million in Scotland alone) that no other supplier could challenge the outstanding success of the project.

The individual supplier award, Supplier Sales Executive of the Year, was

claimed by Craig Barr. He was described by the judges as ‘absolutely dedicated to his company and customers’.

The fifth and final victory for AG Barr was for Best Advertising Campaign: its Irn-Bru ‘Mannschaft’ Euros 2024 advert won ‘by a landslide’.

Commenting on the company’s clean sweep, business unit controller Samantha Talbot said: “Everyone at AG Barr was absolutely delighted to win all of the supplier awards that we could enter. This phenomenal success demonstrates the power not only of our business and brands, but most importantly our people. We are also hugely grateful for all the support we receive from wholesalers as we work together in this fantastic industry.”

On top of the five established supplier awards, Jonathan Kemp, former commercial director of AG Barr, and his soonto-retire colleague, business unit director Ian Johnstone, were presented with Lifetime Achievement awards in recognition of their valued contribution to the wholesale industry over many years.

* The Local Supplier of the Year award –which AG Barr could not enter – was won by Taylors Snacks.

PROJECT WHOLESALE

we want to say a massive to all of our customers for your continued support and ongoing close relationships during 2024, helping to deliver our success in winning: Let’s continue our relationships into 2025 and beyond!

BEST ADVERTISING CAMPAIGN (MANNSCHAFT)

BEST FOODSERVICE SUPPLIER

SUPPLIER SALES EXECUTIVE OF THE YEAR (CRAIG BARR)

BEST OVERALL SERVICE

In his first interview since taking charge at Sterling Supergroup, CCO Daniel Larkin spoke to Cash & Carry Management’s Kirsti Sharratt about his plans to elevate the organisation.

Sterling Supergroup has largely flown under the radar for a couple of decades, but with chief commercial officer Daniel Larkin (right) now leading the organisation, that is already changing.

Cash & Carry Management spoke to Larkin about how he is elevating the group’s presence in the market place and adding further value to its services for both members and suppliers:

You joined Sterling Supergroup in February 2017 as a buyer. What roles have you had since then, and what did you do before moving to Sterling?

After leaving college, I worked at JJ Foodservice for four years, latterly as procurement manager. That gave me the tools to become a buyer at Sterling Supergroup. In the interim, I spent five-and-a-half years with Fuerst Day Lawson, an international food ingredient specialist.

Here at Sterling Supergroup, I progressed from buyer to head of group purchasing early in 2024; later in the year I was appointed chief commercial officer (CCO). In this capacity, as well as managing our head office team of six people, I oversee all purchasing operations for the business and work closer than ever with our members.

My journey has been one of continuous growth and learning, and I am dedicated to driving Sterling Supergroup forward.

How many wholesalers are members of Sterling Supergroup and what is the combined buying power?

We have 33 members with a combined £500 million turnover. Our membership includes new recruits Golden Glen and Mason Food Service. Based in Northern Ireland, Golden Glen is key wholesaler and distributor to the fast-food industry, while Mason Food Service is located in Leicester and delivers to a wide range of catering and foodservice businesses.

What are your plans and priorities for the group?

Our members are our top priority, and we see them as much more than numbers. Since becoming CCO I’ve met with each of our 33 members either in person or virtually, with many being visited at their own warehouse.

To ensure that our members’ unique needs and group expectations are met, we actively engage with them on an individual and group level. This personalised approach allows us to understand and better support our members, ensuring a strong sense of community and trust.

As we look to the year ahead and beyond, Sterling Supergroup’s goal is to drive growth through knowledge, technology, and purchasing power. Growth is essential, whether achieved by enabling our members to thrive using the tools provided by Sterling Supergroup or by increasing our membership base.

This expected growth benefits our members and strengthens the overall value of Sterling Supergroup to our suppliers.

Are there any immediate changes you have already made/plan to make?

At this year’s Spring Show earlier this month, for the first time we offered our members an exclusive gift – a discount voucher to use on Sterling Caterers Essentials products. We offered up to £500 on any new item or one not purchased by the member in 12 months.

Over the past six months, we’ve introduced more than 20 new Sterling Caterers Essentials lines. Like the rest of the range, these are essential products at exceptional prices. Our members can explore and purchase these new additions and hundreds of other lines with complete confidence.

We will also be investing in technology. By implementing advanced technologies we will streamline operations, improve member service, and enhance our market read. Using new data information alongside our already strong

relationships will ensure Sterling Supergroup is best positioned to lead our members and drive sustainable growth for the future.

In addition, our monthly member meetings have recently been transformed by offering detailed insight into Sterling Caterers Essentials’ performance and introducing supplier presentations. This knowledge sharing allows us to build on our forward-thinking approach to foodservice and keeps us on top of market trends.

How important is the Sterling Caterers Essentials range and are you planning to develop it further?

The principle of Sterling Caterers Essentials is to offer essential products at exceptional prices. This range currently includes nearly 300 items. In the past six months, we have successfully introduced 20 new product lines and are actively discussing adding more. This continual expansion ensures that our range remains dynamic and responsive to market demands.

Each product within the range has earned the confidence of our members’ customers. Our portfolio continues to grow in terms of the number of lines requested by members, and the total spend also increases year on year. This is a testament to the consistent quality and value that our products deliver, which has been recognised in the last year with multiple industry awards.

Our members have the flexibility to

choose from this extensive selection based on their specific needs, without any obligation to take all products. However, we encourage them to take advantage of as many products as possible to maximise their benefits and offer reliable and affordable options to their customers.

With all the movement in the buying groups sector, how confident are you that Sterling will be able to retain existing members and attract new ones?

Change is a constant in the buying group sector, driven by technological advancements, shifting consumer demands, and competitive pressures.

With nearly 60 years of experience, we at Sterling Supergroup are confident in our ability to navigate these changes by being proactive and adaptive in our strategies.

We prioritise strengthening our relationships with both members and suppliers individually and leveraging datadriven insights as well as staying aligned to industry developments.

This approach not only helps us retain our existing members but also puts us in a strong position to capitalise on new opportunities.

By having a collaborative and forwardthinking approach, we ensure that our group remains attractive and valuable, leading to sustained growth and success.

Our commitment to these principles will naturally result in a bigger and stronger membership base.

What do you see as the strengths of Sterling Supergroup? Does Sterling have a USP?

Our USP starts with our organisation being not for profit, meaning that all our profits go back to our members, and this is combined with our buying power, six decades of experience, and extensive award-winning Sterling Caterers Essentials product range.

The group’s size and structure give it the speed and agility needed to respond to market fluctuations.

Regular video calls and in-person meetings and close communication between members and the head office result in a powerful, informed team that can quickly adapt to any change.

By leveraging these strengths, the group will continue to provide value to its members, ensuring long-term success and growth well beyond our 60th anniversary next year.

How do you intend to elevate Sterling Supergroup’s presence in the market place?

We are enhancing our marketing and branding efforts for Sterling Supergroup and our Sterling Caterers Essentials range.

We have begun implementing a new marketing strategy and are excited about the opportunities this will bring. Our new approach focuses on enhancing brand perception and providing valuable marketing tools to our members.

We’ve reviewed and expanded our brand guidelines, setting a solid foundation. Key initiatives include strengthening our brand image through consistent messaging, launching a redesigned website, and participating in industry discussions.

The Sterling Supergroup board is made up of the following members:

a Nigel Chadd of Chadds/Foodsmiths

a Ali Alleyassin of ELC UK

a Gary Hannah of Hannah Foods

a John Whitechurch OBE (chairman) and Yan Whitechurch of J&R Foodservice

a Andrew Jefferson of MKG Food Products

a Andrew Reid of Reids Foodservice

We already run a monthly promotional programme, and we’re also developing marketing tools including our new image library, and enhancing our event portfolio. Additionally, we’re preparing for our 60th Anniversary in 2026 with special events.

These efforts aim to elevate our brand and deliver tangible benefits to our members.

What events do you have coming up for members and suppliers this year?

Our Spring Show, held earlier this month in Nottingham, was one of our biggest events yet, offering a wealth of opportunities to create and build on strong partnerships. This exhibition was an excellent warm-up for the year, leading up to our flagship event on 24-25 September, our 59th Annual Conference & Exhibition, which will be in Gloucestershire.

We are particularly excited about our second Annual Awards, which will take place during the gala dinner at our Annual Conference. This event will recognise and honour the achievements

and contributions of our members and suppliers. Last year’s inaugural awards were well received, motivating even more participation this year. It provides a fantastic opportunity to network, celebrate successes, and inspire one another.

These events provide invaluable opportunities for suppliers to showcase their products to our membership and network with members in one place.

Do you have any other initiatives to further strengthen your relationships with suppliers?

One key initiative is the recognition of our Flagship Partners. This scheme was introduced in 2022 and is offered to 16 suppliers. We will not offer this status to more than 16 suppliers as it is designed to elevate who we consider to be our very best suppliers. These trusted suppliers are celebrated for their exceptional service and are highly regarded for their quality of both products and services.

Looking ahead to next year, what’s on the agenda?

We are excited to celebrate Sterling Supergroup’s 60th anniversary in 2026. This milestone marks six decades of experience and knowledge, and we will announce our celebrations in the coming months.

We are eager to share this achievement with all our members and suppliers throughout the year, using this momentum to propel us into the next decade of success. CCM

A well-chosen RTD coffee range can be a sales booster for wholesalers and retailers.

As the weather warms up, ready-to-drink (RTD) iced coffee is an ideal option for convenience retailers in appealing to shoppers looking for a refreshing pick-me-up.

Last year, Carlsberg Britvic unveiled a collaboration between Jimmy’s Iced Coffee and Myprotein.

Available in Original and Caramel flavours, the RTD contains protein-enriched milk and has 5.6g of protein per 100ml, as well as being HFSS-compliant.

According to Carlsberg Britvic, the launch is helping retailers to expand their on-the-go beverage offering, while tapping into the UK protein market, which is estimated to reach over £438 million in 2024 (Mordor Intelligence).

“There is significant opportunity for retailers to drive footfall in store and maximise sales with a RTD protein drink solution such as the Jimmy’s and Myprotein collaboration,” said a company spokesperson.

Arla Pro offers a range of Starbucks products for wholesalers in the RTD coffee category. These include Starbucks Doubleshot Espresso (regular and no added sugar) in 200ml cans, as well as a Tripleshot Espresso in a 300ml can.

In the 250ml glass range, Starbucks Frappuccino variants include Coffee, Vanilla, Caramel, Caramel No Added Sugar, Cookies n Cream, and Mocha.

Meanwhile, a multiserve format comprises a 750ml pack of Starbucks Skinny Latte No Added Sugar, Cappuccino, Caramel Macchiato and Caffe Latte. CCM

‘I am result-driven’

What have been your biggest achievements in work and outside work?

I don’t think I have achieved my biggest aspiration yet. There is always the next big thing in the business world. It is a natural cycle to constantly move on to the next goal and try to achieve it.

Success comes with many sacrifices and cumulative efforts. I must praise our present and past employees for their hard work and my wife, Stran, and two daughters for their enormous support.

Like everyone else, I have had ups and downs in life. Most of the time, you can’t avoid asking yourself what the outcomes could have been had you done things differently, but I think the ultimate achievement, from a personal point of view, is to be happy with where you are.

Who has been the biggest inspiration to you?

Any person who pays attention to details is my purest form of inspiration. It can be anyone: a good speaker, a timely gesture, an extremely polite person, a good player in sports competitions or a good musician. It all depends on how you interpret all the small things around you. They can guide you to have affection for what you want to be and what you want to happen in your life.

What were your ambitions when you were growing up?

Long-distance train driver because of my passion for travelling. Also, I wanted to be a chef, a musician in a folk band and a lecturer at university.

What are your interests outside work?

I am a devoted music fan of all kinds, but less so jazz. I enjoy long walks everywhere and travelling in the city, parks or the town. At my best, I am invested in history, astronomy and philosophy, and I enjoy the excellent company of my friends and family around a dinner table.

What has been the biggest challenge you have faced?

The period of COVID-19. I couldn’t speak of it without mentioning my late partner Hasan. He was the captain who stayed in the office and sailed through with our brave and hard-working colleagues. Outside of work, the biggest challenge for me was probably geography and the weather in Britain when I first moved here. I grew up in a little town 10 miles from the Mediterranean coast in Turkey. Over time, despite the lack of sun, I started loving Britain, so this is the country I miss most when travelling in different parts of the world.

How would you describe your personality?

People say that I’m a calm person. I avoid judging things on the surface and reacting immediately to situations. I try to ask questions first and ask again if I’m not satisfied. I am motivated and resultdriven. I hardly give up if I see a chance for something to happen or if something has value.

What is your favourite film, book and song/piece of music?

Freddie Mercury and then Amy Winehouse. I remember a book I read when I was young – All Quiet on the Western Front by Erich Maria Remarque. Watching the movie recently reminded me of how I enjoyed the author’s style. It is still relevant almost a hundred years later.

If you won a holiday, where would you go and who would you take with you?

I couldn’t stop laughing when I read this question. I would take my family with me, but that would cause a massive conflict because everyone has their favourite places, such as Bora Bora, Africa, Antarctica. But we can all agree on one destination, which is Greece.

What would people be surprised to know about you?

I’ve been known to make the best scones and serve an excellent cream tea. CCM

After graduating from university in Turkey with a Bachelor of Business Administration in Political Science and Government, Niyazi Uludag went straight into the wholesale sector, working as the regional director for a national distributor. Simultaneously he took a Master’s in Economics. He then moved to London because he had worked with many multinationals in Turkey, inspiring him to discover life abroad. He joined RA Trading in 2000 and became a director in 2010.

Energy drinks remain strong performers for wholesalers and convenience retailers, who need to ensure that their soft drinks fixtures reflect consumer trends and preferences.

The energy drinks category contributes nearly half of drink-now soft drinks growth and is the secondlargest segment in soft drinks (Circana). Fruit flavours are growing twice as fast as non fruit flavours (Circana) and there is still room for further growth with the right ranging and merchandising.

AG Barr has seen significant growth in its Rubicon RAW range, which is outperforming the total category and is growing three times faster than its closest competitors.

The big-can energy drinks feature 20% fruit juice, natural caffeine and B-vitamins. The vibrant can design is reflected with eye-catching PoS materials to create in-store theatre and attract shoppers to the fixture.

Summer is a key sales period for the flavoured energy segment, with many consumers looking for fruity refreshment. In preparation for this, the Rubicon RAW line-up has two new additions: Berry & Grape and Peach & Apricot. Launched last month, the limited-edition variants are tapping into the growth in mixed flavours within the energy category.

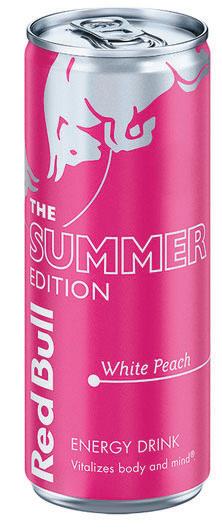

Red Bull has launched its highly anticipated Summer Edition flavour for 2025. The Summer Edition White Peach is available to the convenience channel this month in 250ml plain and £1.65 price-marked cans, 355ml Sugarfree can, and 4 x 250ml multipack. This latest addition follows Red Bull Winter Edition Iced Vanilla Berry.

With flavoured energy continuing to drive entry into the category, and a white peach variant attracting younger consumers, the initial reception to the innovation has been positive. “For Red Bull, NPD has been largely incremental, with nearly half of shoppers that bought into the Editions flavour range being new to the Red Bull brand, acting as a gateway to the core range,” says a company spokesperson.

With the increasing number of health demands in the soft drinks category, a sugar-free offering is now a vital part of any range. Red Bull has expanded its choice in this area with Red Bull Zero. Whereas Red Bull Sugarfree is a no-sugar offering with a distinct flavour profile, Red Bull Zero has been formulated as a sugar-free imitation of the Red Bull Original taste. Red Bull Zero comes as a 250ml plain and PMP, 355ml can, 473ml can, 4 x 250ml multipack and 8 x 250ml multipack.

‘For Red Bull, NPD has been largely incremental, with nearly half of shoppers that bought into the Editions flavour range being new to the Red Bull brand’

Red Bull spokesperson

In terms of stocking chillers, Red Bull recommends that retailers devote half of their soft drinks fixture to the sports and energy category, bearing in mind the significant attraction of flavoured energy to both current and new shoppers in the category.

Formats are also important. The original 250ml can is ideal for on-the-go consumption and should be in the chiller, while multipacks are a popular take-home option. For larger cans, one in three Red Bull drinkers are likely to consume these later in the day. The Red Bull Energy Drink 355ml is linked to gaming, studying and socialising, while the Red Bull Energy Drink 473ml can is the preferred option for meal occasions.

For value, price-marked packs continue to perform favourably in the convenience channel, giving shoppers confidence that they are not being overcharged. It’s also important for retailers to know the demographic of their energy drink shoppers. For example, Red Bull Sugarfree brings an older and more affluent shopper to the category, while the Editions shopper tends to be younger (Kantar). Health and wellbeing is the top priority for one in four consumers (NIQ), while 75% take health into consideration (Appinio).

CCEP recently expanded its Monster Juiced range with a new variant. Monster Juiced Rio Punch is available in plain and price-marked 500ml cans and 4 x 500ml multipacks.

The Monster Juiced range is now worth more than £290 million in Britain and has delivered almost £37 million in additional value sales over the past 12 months. Monster Juiced Mango Loco is the No.1 flavoured energy drink in value sales (NIQ).

The Monster Juiced Rio Punch NPD combines the flavours of papaya, vanilla ice cream and blackcurrant, inspired by a Rio de Janeiro dessert.

“Shoppers love the bold, flavour-packed Monster Juiced range, which is up 18.1% in value (NIQ). Every year our Juiced launches are among the top-performing launches in energy drinks,” says Helen Kerr, associate director of commercial development. “We’re confident Rio Punch, which is already one of our top sellers in the US, will continue that trend and we’re excited to see how retailers bring the launch to life in store.”

The eye-catching can design features the green and yellow of the Brazilian flag and references many related elements. These striking visuals can be enhanced with PoS materials and digital assets.

Carlsberg Britvic has focused on the low and no sugar market for its Rockstar Energy range, which saw a reformulation to reduce sugar in its core range in 2022 and has since produced sugar-free flavoured energy innovation such as Zero-Sugar Blueberry. With berry flavours worth £63.8 million (Nielsen), the trend is one that retailers and wholesalers need to be aware of.

The brand has also added another flavour to its line-up with the addition of Rockstar Energy Zero Sugar Peach last month. The NPD features a ‘two for £2’ multibuy promotional mechanic, as well as plain packs.

A redesign for the range has also made the brand a more cohesive and recognisable line-up.

“The redesigned 500ml Rockstar Energy cans feature a simplified look and feel, with enhanced graphics, particularly on the zerosugar varieties, to align with consumer preferences,” explains Ben Parker, vice president sales – off-trade. “By streamlining the Rockstar Energy range and prominently displaying the diverse flavour offerings available, the brand is positioned to attract a wider audience and maximise sales opportunities for retailers.”

With a number of manufacturers capitalising on the popularity of flavoured energy, there are an increasing number of SKUs jostling for room in the chiller.

“Rockstar Energy’s updated packaging showcases its range of flavours, making it even easier for shoppers to spot their favourite on the shelf. This increased flavour visibility, combined with the brand’s eye-catching design, can help Rockstar Energy effectively stand out on crowded retail shelves,” Parker continues.

The notable growth of functional energy is also worthy of extra chiller space, with shoppers pursuing healthier options and looking for specific benefits. Purdey’s Natural Energy three-strong range comprises sparkling fruit and botanical blends with B vitamins. “Investing in natural energy alternatives is key to future-proofing growth in the energy drinks market,” says Parker.

The supplier advises retailers to engage Gen Z consumers with relatable partnerships and promotions. Wholesalers should be aware of campaigns such as the multi-year partnership between Rockstar Energy Drink and select Live Nations festivals in the UK.

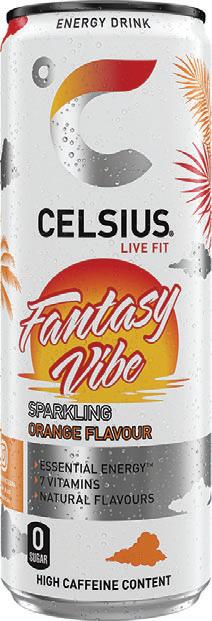

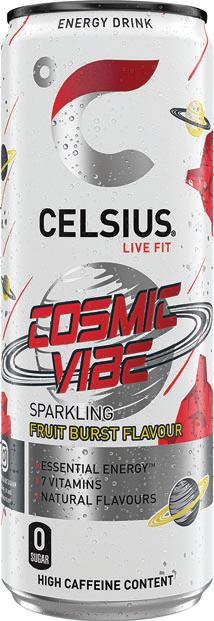

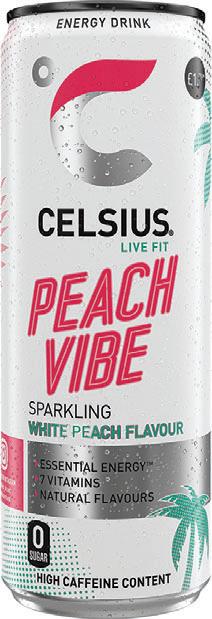

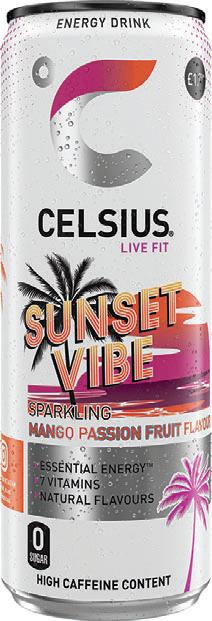

New to the UK energy drinks market is Celsius. Distributed by Suntory Beverage & Food GB&I, the functional stimulation brand is already established in the US market and intends to raise brand awareness in the UK with activations including F1 campaigns and collaborations with noteworthy brand ambassadors.

Designed to support the body’s natural functions while limiting fatigue, Celsius contains fruit flavours and vitamins C, B12, B6, and B5, with no added sugar.

The current line-up comprises Peach Vibe, Fantasy Vibe (orange), Cosmic Vibe (exotic) and Sunset Vibe (mango & passionfruit). All four variants come in 355ml cans, pricemarked at £1.79 and in plain packs (rsp £1.85).

“Celsius is already generating huge momentum in the health and fitness channel, and we’re ready to take that momentum with this exciting brand to even more customers and consumers across the UK,” says Alpesh Mistry, sales director at Suntory. “Stimulation continues to grow rapidly and we have huge ambition to make the USA’s fastest-growing energy brand the UK’s fastest too.”

Also from Suntory is new Lucozade Sport Ice Kick – a collaboration with England football player Jude Bellingham.

With zesty citrus flavours, the new sports drink features Jude Bellingham on the front of pack to drive stand-out in the chiller.

Lucozade Sport Ice Kick comes in both standard (rsp £1.75) and £1.50 price-marked 500ml bottles as well as 4 x 500ml multipacks.

A suite of impactful PoS is available to help retailers and wholesalers maximise sales. CCM

The snacks category continues to drive footfall and impulse purchasing in the convenience channel, with suppliers looking at younger shoppers to increase sales.

The convenience channel is one where the impulsefocused snacks and biscuits category continues to play a major role. The category can tie into multiple fixtures and continues to see innovation and diversification. With an increasingly adventurous consumer palate, there is still room for growth.

While the £1 billion savoury snacks category in convenience (Circana) is strong – up by value although down by volume – the convenience channel is facing the challenge of reduced footfall as consumers head to the supermarket for value. Tayto Group’s Golden Wonder £1 PMP range continues to reassure shoppers of value. Golden Wonder Transform-A-Snack £1 PMPs are growing particularly strongly (+17%, Circana) and all variants – Saucy BBQ, Spicy, Cheese & Onion and Beef – now come in a £1 PMP.

“Golden Wonder has seen its successful £1 offer working well, with sales up 22% year on year (Circana),” says a company spokesperson. “Sharing PMPs remain the core of the category, having been the main driver of growth (50% in the last four years), but this has slowed as many brands moved above £1. In contrast, having remained at £1, Golden Wonder continues to outperform total snacks (+13%), showing how important value is in a market where household budgets remain under pressure (Circana).”

Next comes some NPD from the supplier, following the launch of Marmite snacks. After a positive reception for these, Tayto is expanding this line-up next month with Cheese & Marmite Puffs, available in a £1.25 PMP.

“Cheese and Marmite on toast is a go-to for Marmite fans and so this a very familiar flavour. It will also bring new consumers into the brand as those that are less sure about Marmite are more likely to try it when paired with cheese,” says Matt Smith, marketing director.

More flavour innovation comes from premium British snack maker Burts Chips, which has launched a new variant in its hand-cooked crisps range. The Herb Roasted Chicken flavour features real chicken with sage, parsley, rosemary and thyme.

“With chicken consistently being the top savoury meat profile for spring/ summer launches in the UK over the past three years, we anticipate strong demand for this new flavour,” says Sas Horscroft, head of marketing. “The combination of herbs and roasted chicken will not only meet the expectations of existing customers but also attract new ones.”

The NPD is available in 40g bags and sharing 150g bags.

Snack brand Takis has added to its rolled tortilla chips range with a Blue Heat variant. This chilli and lime flavour combination is particularly attractive to younger consumers, who are fuelling the 9% value sales growth in the ‘heat’ segment.

“Gen Z are leading the way with this and becoming more adventurous in their snack options,” explains Becky Allan, marketing manager. “Takis Blue Heat has already seen incredible success in international markets, garnering a huge following. With its unmatched intensity across heat, flavour and visual appeal, this new launch is set to resonate strongly with UK consumers and drive further growth within the category.” The range includes the ideally positioned £1.25 PMP, always a popular option for the convenience channel.

Envis Snacks is another supplier with a range catering to the trend-led flavour options, which it combines with a focus on the wholesale and convenience market. “We work closely with wholesale partners to ensure we have great availability for retailers, offer a very long shelf life to reduce wastage and make sure that our case sizes are always suitable and at the right price points,” says Andy Brown, director.

The bestseller in the wholesale channel is the Crunchips X-cut range, which offers both 75g bags and 130g bags. “Our overall aim is to offer some differentiation in the range to drive incremental sales,” he adds.

With this approach, the supplier has increased its portfolio with two more 75g variants. The Sour Cream and Kebab variants respond to the increasing demand for interesting flavours, as well as sitting at the attractive £1.25 price point.

“We are constantly looking for new products and ways to help wholesalers and convenience stores add incremental sales to complement core ranges and, as such, are pleased to be able to bring some new and wholesale/convenience exclusive on-packs to the market this year,” says Brown.

Further activity from Envis Snacks sees the first-ever on-pack initiative on Lorenz lines, with 15% extra free available on the four bestselling 130g variants – Paprika, Chilli & Lime, Cheese & Onion and Salted. The promotion starts in May, with orders being taken from the end of this month.

‘We work closely with wholesale partners to ensure we have great availability for retailers, offer a very long shelf life to reduce wastage and make sure that our case sizes are always suitable and at the right price points’

Andy Brown, director, Envis Snacks

‘Make it simple to shop’ – Tayto

Wholesalers can support their customers not only with range advice but also merchandising tips. Tayto suggests the following for the snacking category:

Given the importance of savoury snacks as an impulse purchase and footfall driver, independent retailers should make sure that snacks are highly visible on shoppers’ main route to the till.

Shoppers are time and cash poor, so merchandising should be focused on helping them make quick decisions. Think about missions, such as home entertaining or an evening in front of the TV. Site snacks with other categories on the same mission to increase basket size. For example, place sharing snacks near beers, wines and spirits to capture the big night in mission and impulse snacks near chiller units with sandwiches and cans to capture the lunchtime grab & go.

For independent retailers where PMP snacks account for 79% of sales (Circana), merchandising by price point makes it easier to shop. Sharing PMPs account for 63% of sales (Circana) and so having a strong range of both £1 and £1.25 PMPs is essential – but group each price point together to make it easier to shop the fixture quickly.

While sharing PMPs are key to success, don’t ignore the significant footfall that can be driven by having a tight range of impulse snacks. Again, PMPs are essential and should cover an entry price point as well as a range of proven impulse snacks.

Also offering an on-trend range with some heat is new snack brand Palse from House of Britannia.

The brand offers a three-strong range of Jalapeno, Salt & Vinegar and Paprika 50g £1.19 PMPs. All the products are HFSS compliant and sit within the healthier snacking category – they are a source of protein, low in saturated fat and high in fibre.

The better-for-you segment is seeing significant growth as consumers become more health-conscious. Affordable snacking in this sub-category is a major opportunity for wholesalers and retailers. Focusing on the wholesale and convenience channel, the launch of Palse is being led by industry stalwarts Jason Stocker (ex Nestlé) and Al Gunn (ex Boost Drinks).

Last month, PepsiCo began an on-pack promotion on Frazzles, Chipsticks and Cheetos in partnership with Merlin Entertainments. The family-themed promotion offers 5,000 prizes, including tickets to Thorpe Park, Sea Life aquariums and Alton Towers resort.

“Families are at the heart of this promotion,” says Wayne Newton, senior marketing director. “With Merlin Entertainments’ attractions offering an unmissable draw for families, and snacks that are perfect for all ages, retailers who stock the participating packs of Frazzles, Chipsticks and Cheetos will be well positioned to take advantage of a promotion that’s sure to drive both sales and footfall.

“The inclusion of PMPs in the promotion offers great value for customers, making it an even more attractive option for those looking for affordable days out.” The promotion, supported by shopper marketing activity, runs until 30 July.

Meanwhile, NPD from the manufacturer in the snacks category includes a new Doritos variant responding to the spicy snacking trend. Doritos Dinamita, a rolled tortilla chip, was a convenience-exclusive launch in February and also taps into the pricemarked popularity with its 65g £1.25 PMP.

“We know that Gen Z are driving the demand for bold and exciting flavours, so we have been on a mission to support retailers in catering to these shoppers through our Extra Flamin’ Hot brand – effectively working to future-proof the category with new and innovative offerings,” says Rob Pothier, head of marketing, portfolio campaigns.

While NPD is an undeniable sales driver, it should be viewed as supplementary to a strong core range. “Shoppers continue to value brands they know and love within this category, so we’re seeing shoppers seek out not only familiar brands but their favourite flavours, too,” says senior sales director Nic Storey. “It’s therefore key that cash & carries are stocking a strong core of best-selling products.

“NPD also has a really important role in driving interest and excitement within the category, but the key to success is supplementing this with a strong core that will cater to independent retailers looking to drive repeat sales.”

In the savoury biscuit segment, innovation comes from pladis with its Jacob’s Mini Cheddars brand. The line-up has been extended with two new variants: Jacob’s Cheese & Red Onion Mini Cheddars and Jacob’s Cream Cheese, Garlic & Herb Mini Cheddars, both available in 6 x 23g multipacks and a 90g £1.25 PMP.

“These new additions are designed for younger shoppers seeking bold, trending flavours, which in turn drive incremental sales,” say Kate Stokes, marketing manager.

“These launches are available in two distinct formats to drive penetration within a whole host of occasions. The classic multipack of six, as well as a single-serve convenience channel PMP to help independent retailers boost volumes, mean shoppers can enjoy new varieties on-the-go, in their lunchbox or while snacking at home,” she points out.

KP Snacks also highlights the importance of a pricemarked offering within convenience, especially in the current economic climate.

“PMP formats have seen significant growth in recent years and will stay increasingly relevant as the cost of living remains high. PMPs offer consumers great value for money, with clear pricing reassuring shoppers that they’re getting a good deal. Worth £324 million (Nielsen), the PMP format is popular within crisps, snacks & nuts, with 57% of impulse shoppers buying PMPs (Lumina),” says Stuart Graham, head of convenience and impulse.

“KP Snacks is growing at 2.5%, with an extensive PMP portfolio offering a range of snacks at a variety of prices to suit all budgets and occasions.”

While the continuing squeeze on household budgets does affect footfall and spending in convenience, there are distinct opportunities for the snacking category that come with it.

Recessionary trends are seeing the increasing prevalence of the big night in – where sharing format snacks play a large part – as well as the growing popularity of packed lunches, where multipacks are an integral part of the offering. In addition, people are looking for affordable treats and lunch uplifts, and this demand can be met with a good meal deal range.

The manufacturer is constantly updating its portfolio and a recent addition includes the Americanthemed Flamin’ Fajita and Grilled Cheese flavours in the McCoy’s Epic Eats sub-range.

“We are committed to bringing innovation to the category with our NPD strategy, anchored in insight and delivered in a range of formats to bolster retailer sales,” Graham says. “Shoppers are always looking for new and differentiated products, and retailers can capitalise on this by stocking a strong core range with a complementary offering of NPD, creating variety and engaging shoppers.”

Promotional activity from the supplier has included the return of the Pom-Bear brand to TV this month. This boost to brand awareness follows the launch of Cheese and BBQ variants last year.

The £35 million brand (Nielsen) is aiming to tap into the familyfriendly positioning of the snack with an advert. “We’re thrilled to see the brand returning to TV with an advert that reflects the joy of family snacking occasions,” says Rachel Horrell, senior brand manager. “The advert has been really well received by consumers, creating a sense of warmth and happiness that has driven an uplift in sales.”

Protein snacks are increasingly popular and LSI’s Jack Link’s brand is the ambient meat category leader, tripling its retail sales value in the past five years and driving overall category growth (Nielsen).

“Jerky and biltong are among the fastest-growing snack categories, worth over £40 million in total grocery, and have doubled in value over the last five years. There is significant potential for growth, with fewer than 10% of households currently buying them,” says Shaun Whelan, convenience/ wholesale and out-of-home controller.

“Jack Link’s Beef Jerky Original 25g has the highest rate of sale in the category, offering a smaller, entry-level product to attract new buyers.”

While the segment’s target market is predominantly male 16-45 with active lifestyles and interest in fitness, sports and gaming, high-protein snacks are increasingly popular as a lunchtime or afternoon snack to provide an energy boost.

“Place Jack Link’s alongside other savoury snacks like crisps and nuts to highlight its healthier positioning and encourage trade-up purchases,” Whelan advises. “Jack Link’s represents a high growth, high profit opportunity for convenience retailers, driven by its strong category leadership, consumer appeal and long shelf life.”

For increasingly bold taste preferences, especially among Gen Z, there are also Sweet & Hot and Teriyaki variants, along with Biltong and Ham Snack. “For Jack Link’s we are on a mission to drive category awareness and product trial to attract more shoppers, driving category growth and investing more than £2.5 million over two years into media and sampling at fitness and gaming events,” he adds.

“We are using social media very heavily to help build category awareness. It’s undeniable that social media plays a huge role in everyday life, shaping people’s beliefs and consumption behaviours. This is especially true for Millennials and Gen Z.”

The brand has had a redesign to increase standout and encourage trade up. “The new design created for both the Beef Jerky and the Biltong promotes the high-quality aspect of the product, reflecting category trends in craftsmanship and functional nutrition benefits in a contemporary and appetising way,” Whelan says.

LSI’s Peperami brand is a recognised fixture in chilled meat snacking and will continue to drive category growth this year with heavyweight TV advertising. In addition, the PMP and multibuy mechanics particularly appeal to convenience shoppers.

“We ensure our Peperami PMP products are affordable for convenience retailers by supporting them with promotions and case sizes to keep the price points at the recommended retail prices,” says Whelan. “

In the biscuits segment, Mondelez is boosting spirits this spring with its belVita promotion that includes the chance to win a trip to Finland.

“The promotion is the perfect pick-me-up for shoppers looking for uplifting options in-store and seamlessly mirrors belVita’s ‘positive energy’ brand identity and messaging,” says Susan Nash, trade communications manager.

The promotion is running on much of the range, including belVita Soft Bakes,

• Provide Great POR‘s

• Add Incremental Sales

• Taste Fantastic

belVita Duo Crunch and belVita Breakfast. As an additional bonus for retailers, there is a prize draw on the snackdisplay trade website to win goodies for staff and store. Prizes include Amazon vouchers, stock and a Mondelez team member running an in-store sampling experience.

Another notable promotion is the partnership between Oreo and the new Minecraft movie.

Embracing the playful nature of both brands, this collaboration enables consumers to enter a world of play. The cookies are embossed with symbols that can be scanned to access a themed AR online experience.

Fox’s Burton’s Companies UK also highlights opportunities for ranging and merchandising in the sweet biscuits category. While the everyday treats segment remains the core opportunity and needs to be well represented in the convenience retailer’s range, other missions and needs are driving growth in areas such as big cookies, up 18% in value to £131 million (NIQ/Kantar).

Mini biscuits are another dynamic growth area, with 14% compound annual growth over the past five years, reflecting an increasing preference for portability and portion control.

“We’ve had some amazing partnerships in the past, from Xbox to Batman, so we hope this partnership excites fans just as much. We can’t wait to see them taste, play and win,” says Perrine PierrardWillaey, marketing director Europe.

The biscuit segment is diversifying as people look to fuel an on-the-go lifestyle. “We are seeing consumers looking for a range of snacks, with a trend among some consumers of replacing meals with snacks as they take advantage of being out and about more frequently,” says Nash. “We can anticipate that breakfast and brunch options that can be taken out of home for easy and convenient on-the-go consumption will continue to grow this year.”

’Biscuits should be a core part of any retail food and drink offer, and any retail range needs to cover both take-home and on-the-go missions to meet all potential need states and occasions, while delivering on taste’

Susan Nash, Mondelez’ trade communications manager

The belVita brand is not the only part of the portfolio performing strongly. Oreo is the world’s No.1 biscuit brand, and Cadbury Fingers and Cadbury Time Out are in value growth. Meanwhile, in the savoury biscuit segment Ritz has the topselling savoury cracker (Nielsen).

“Biscuits should be a core part of any retail food and drink offer, and any retail range needs to cover both take-home and on-the-go missions to meet all potential need states and occasions, while delivering on taste,” Nash concludes.

There is also an increasing seasonal merchandising opportunity for products beyond traditional gifting tins and boxes. “We are seeing increasing engagement from shoppers and retailers in events like Halloween for mini biscuits, Valentine’s – think Jammie Dodgers’ heart shapes – plus Easter and Ramadan. These occasions have clear value to shoppers and retailers, and are a vital opportunity for sweet biscuit brands to engage in our national culture,” says Colin Taylor, trade marketing director.

“Sweet biscuits are very much not in their own little bubble, as there are clear connections with other categories around the store that retailers can develop: hot drinks, ice cream, marshmallows, greetings cards and so much more.

“We also see sweet biscuits increasingly in friendly competition with other categories,” says Taylor. “Some of the switches into biscuits have been driven by an increased cost of living, making shoppers compare value across categories, and biscuits often come off well. Other moves have simply been sparked by choices opening up. Food-to-go is a good example, with very few single portion biscuits historically appearing in onthe-go areas. We now see biscuits like Jammie Dodger Giant appearing in meal deals, and retailers should tap into this cross-category promotional opportunity.”

In the big cookies segment, the Fox’s Cookies range has seen 24% year on year growth, with sales of £43 million (NIQ/Kantar). The format is ideally suited for the convenience channel as big cookies are often an impulse purchase for immediate consumption.

“Sweet biscuits have remained an affordable indulgence for many of us throughout volatile economic times, with the category trading well on nostalgic family favourites,” says Taylor.

“The drivers of this success have included new products, but also above-the-line campaigns for Maryland Cookies and Jammie Dodgers. A significant level of promotional support in partnership with customers has also helped our biscuits to stand out in store, while offering great value to customers.”

While the tobacco category remains a high-value one for convenience retailers, low-value products are increasingly a focus for both suppliers and consumers.

In the tobacco category, suppliers continue to support convenience retailers and wholesalers at a time when ever-tightening budgets and new legislation are shaping consumer behaviour.

In the combustible tobacco category, value is a key driver – particularly in the factory-made cigarette (FMC) segment. Imperial Brands increased its portfolio accordingly with the addition of the value Paramount brand.

“With products in the economy and value pricing tiers now worth 72% of all FMC sales, it’s clear that sales in this category are very much driven by the demand for value,” says Andrew Malm, UK marketing manager.

“With more consumers looking for ways to reduce spending amid soaring household costs, we’re seeing a categorywide shift towards lower-priced propositions.”

In roll-your-own (RYO) tobacco, the rising appeal of 30g packs of rolling tobacco – which make up 70% of all RYO sales – led to the launch of Golden Virginia Amber Blend in a 30g zip-click pouch. “The first addition to the Golden Virginia range since 2009, GV Amber Blend is helping retailers to meet the needs of smokers seeking a high-quality RYO product at a value price point,” Malm notes.

Meanwhile, in the papers category, value-savvy consumers are increasingly migrating from king size to combi formats due to the added value and convenience they offer, he points out. “Alongside this, we’re also seeing growing demand for unbleached papers as consumers seek out papers with a more natural look,” he adds.

To help wholesalers tap into this trend, Imperial recently introduced a Rizla Classic King Size Combi variant. This includes 32 unbleached king-size papers and tips (rsp £1.40).

Tobacco accessories continue to perform strongly for convenience retailers, where there has been 14.3% year-onyear growth. The market is valued at over £417 million and Republic Technologies boosted its eco credentials in the £121 million papers and the £82 million filters segments (IRI) thanks to brands such as OCB and Swan.

Its latest addition is Swan Just Paper Filters, said to provide an experience similar to traditional cellulose acetate filters but with a lower environmental impact.

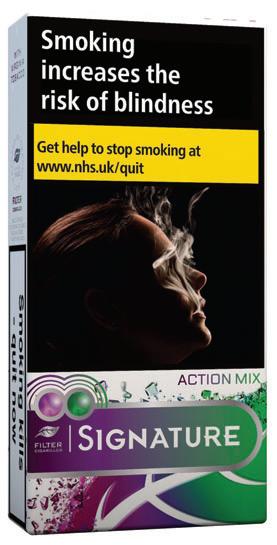

In the cigars category, STG has launched Signature Action Mix cigarillos. The 10-packs contain two capsules and combine the flavours of Berry and Mint. With an rsp of £5.85, they offer consumers value while retaining an attractive retailer margin.

“Our sales force will be targeting over 10,000 convenience stores in the coming months to talk to them about the launch, as well as offering them branded merchandise,” says Prianka Jhingan, head of marketing.

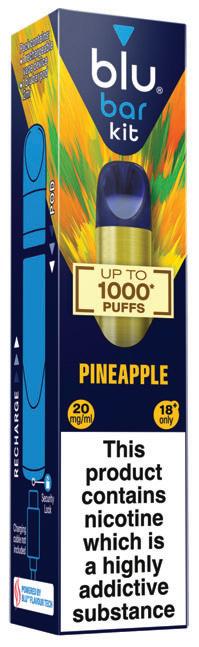

Next-generation products in the tobacco category are set to change again, as the vape industry prepares for the forthcoming disposables ban. Around 75% of consumers plan to switch to a pod system, so wholesalers and retailers have an opportunity to help with the transition.

“Wholesalers will play a pivotal role in assisting their retail customers to adjust to a new vaping landscape. In addition to creating the blu bar kit, designed to deliver an alternative purchasing option to disposables, Imperial will continue to support a sector that wants to protect sales and remain compliant post-ban,” says Andrew Malm, UK marketing manager at Imperial Brands.

The blu bar kit features a rechargeable, slimline and lightweight device that uses replaceable pods to deliver up to 1,000 puffs per pod. Currently available in four flavours, Imperial is adding 11 new pod flavour options in the first quarter of 2025.

PML has expanded the TEREA Pearls capsule range, designed to be used with the IQOS ILUMA. The two new variants are Riviera Pearl Raspberry Rose and Provence Pearl Grape with Menthol. Both enable adult nicotine users to switch between a tobacco blend and a flavour with a click.

Global nicotine pouch brand NOIS is looking to increase its distribution through new partnerships. The supplier provides impactful PoS materials to support its White Line lower nicotine content pouches, Black Line higher nicotine content pouches and Mini Line compact pouches.