JJ Foodservice has introduced self-service kiosks at all 12 branches and is giving in-store customers access to online-exclusive deals for the first time.

Previously, only preordered collections benefited from these savings. Now, with kiosks available nationwide, walk-in customers can enjoy faster service and

better prices at the touch of a screen.

“The best way to save at JJ was to order online in advance – but that meant counter customers were missing out,” said chief operating officer Kaan Hendekli. “Now, they can enjoy the same savings in-branch with our quick easy-to-use kiosks.”

In what is claimed to be a UK first for the convenience and foodservice wholesale sector, the kiosks have already processed more than £575,000 in orders within the first month of going live.

“The response has been fantastic. The kiosks are making shopping even easier, saving customers time, reducing costs, and improving convenience nationwide,” said Hendekli.

AF Blakemore & Son has announced that Steven Nuttall joined the company as chief financial officer on 6 May. He replaces Ian Kellett, who retires at the end of May.

Nuttall (pictured) most recently served as group CFO at fresh goods business Flamingo Group. His previous roles included interim CFO at Asda and finance director at Co-op Food.

In his new post, he will join the AF Blakemore (AFB) board and be responsible for finance, property, IT and procurement.

Blakemore’s CEO Carol Welch said: “I want to thank Ian for his leadership in the significant transformation of our financial rigour, improved processes and systems

during his time with us.

“As Ian steps away I’m absolutely thrilled to have Steven join the AFB team. He will bring a wealth of retail leadership and financial expertise with a strong track record in business profit growth, strategy, and talent development, making him instrumental as we continue to pursue our long-term future growth objectives.”

Dunsters Farm has acquired Lancashire-based wholesaler Ralph Livesey for an undisclosed sum.

Established in 1920 as a stall on Preston Market, Ralph Livesey now has depots in Preston and Bolton and supplies education caterers, hospitality venues and independent retailers across the north of England.

The move strengthens Dunsters Farm’s fresh produce offering as Ralph Livesey is recognised for its regional focus and excellence in fresh produce.

“Bringing Ralph Livesey into the Dunsters Farm family is a significant step forward for us,” said Dunsters Farm MD Hannah Barlow. “Their reputation for highquality fresh produce, customer loyalty and regional knowledge is second to none.

“What makes this especially exciting is how naturally our businesses fit together. Both of us started life in the North West: Ralph Livesey with a market stall on Preston’s Flag Market and Dunsters with my grandad’s milk round in Bury. We’ve both grown organically by listening to our customers and staying rooted in our communities.

“We’re proud to be fully

independent and welcome another like-minded business into our family, one that shares our commitment to quality, sustainability and local sourcing.

“As a member of the Caterforce buying group we also benefit from the strong collective power of the network, which helps us continue to offer the best price to our customers across the North and Midlands.”

Ralph Livesey MD Andrew Christian added: “This wasn’t just about finding a buyer – it was about finding the right fit. Dunsters Farm really stood out.”

Christian is staying on at the business, and the Ralph Livesey name will be kept for the moment. “As we move forward, we’ll continue to explore the best way to present the combined offer to customers,” said Barlow.

Dunsters Farm is working with the 120 Ralph Livesey employees during the integration, and all four depots (two for each wholesaler) are operating as normal. “As with any growing business, we’ll continue to evolve our structure over time to best support our long-term success – with service remaining at the heart of that,” said Barlow.

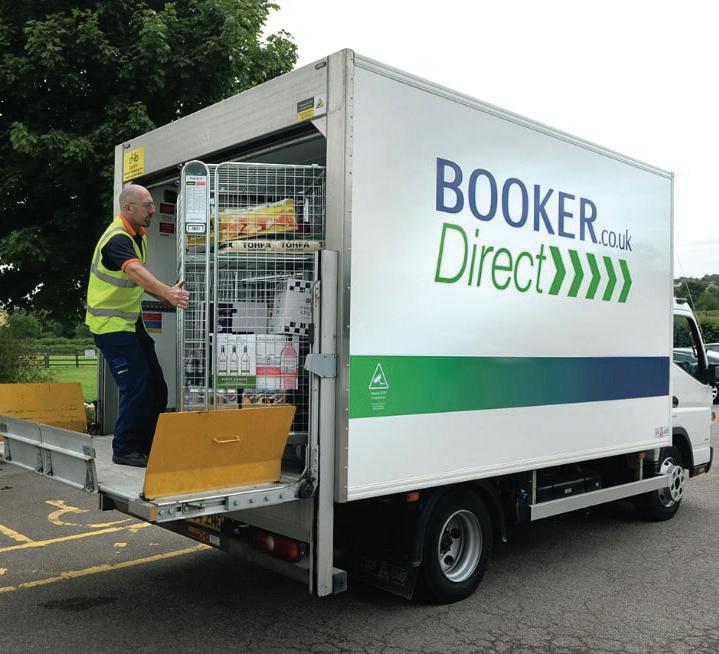

Booker’s overall like-for-like sales declined by 1.8% to £8.99 billion in the 52 weeks ended 22 February 2025.

The results reflect an ongoing decline in tobacco sales (-8.8% to £1.69 billion) and lower Best Food Logistics volumes (-5.1% to £1.44 billion) due to ‘weaknesses in parts of the fastfood market’.

However, Booker did see 0.9% like-for-like growth in core retail to £3.23 billion, supported by a further 566 net new retail partners in the year, taking the total to just under 8,000.

“Whilst the independent convenience sector is seeing some trading softness, Booker’s symbol brands performed strongly, supported by our targeted promotional plans and improvements in availability,” said the trading statement. “Booker retail customer satisfaction continued to improve, with gains year-on-year.”

There was also a 2.1% like-for-like uplift in core catering to £2.62 billion. This was “driven by stronger volumes, as customers responded well to our value campaigns throughout the year, with prices now locked on over 700 products until June 2025,” said the trading statement.

“Customer satisfaction levels remained high, growing year-on-year, and availability improved even further

to circa 98% by the end of the year.” Booker availability is an internal measure, based on the customer’s online order versus delivered.

In June 2024, the group acquired Venus Wine & Spirit Merchants, enabling Booker to offer its on-trade catering customers an even larger selection of spirits, wines, lagers, ciders and ales.

“The integration of Venus is progressing well, and we are continuing to expand the

customer base, with strong progress towards increasing its geographic presence,” said the trading statement. A new Venus distribution hub opened at the Makro branch in Manchester.

In other news, Booker is transitioning from plastic to cardboard trays for its catering-sized packs of Farm Fresh Mushrooms.

Switching to cardboard trays is predicted to remove over 280 tonnes of plastic from Booker’s supply chain annually, as well as resulting in easier handling and less transport packaging.

The removal of all elastic bands from trays is a change that is forecast to save more than 900,000 bands per year.

The Wholesale Group has launched a new foodservice own-brand range, Chef Assured.

There is a core range of high-quality foodservice products for everyday use, supported by two subbrands: Chef Prestige, a selection of premium ingredients, and Chef Hygiene, providing cleaning, hygiene and janitorial solutions.

The range, which comprises more than 300 products, includes bestselling items from both Confex and Fairway Foodservice’s ownbrand ranges, CORE and Fairway Assured. These have been rebranded.

The Wholesale Group has a ‘vigorous’ new product development plan for 2025 and beyond to ensure the range reflects upcoming trends and remains relevant and fresh.

“Industry research consistently highlights the importance of a strong own-brand

range for foodservice wholesalers and operators, so we are delighted to launch the Chef Assured range which builds on the successful foundations of CORE and Fairway Assured,” said Coral Rose, co-chair of The Wholesale Group.

“At the heart of the Chef

Assured range is value, quality and purpose. Every single product in the range has earnt its place based on sales and customer feedback and consistently performs under pressure.

“We have developed the range utilising our members’ extensive industry knowledge and expertise to provide one trusted brand offering three professional solutions for all kitchens.”

The launch of Chef Assured will be supported by a full promotional calendar and a ready-to-use toolkit of sales resources and marketing materials to drive awareness and engagement.

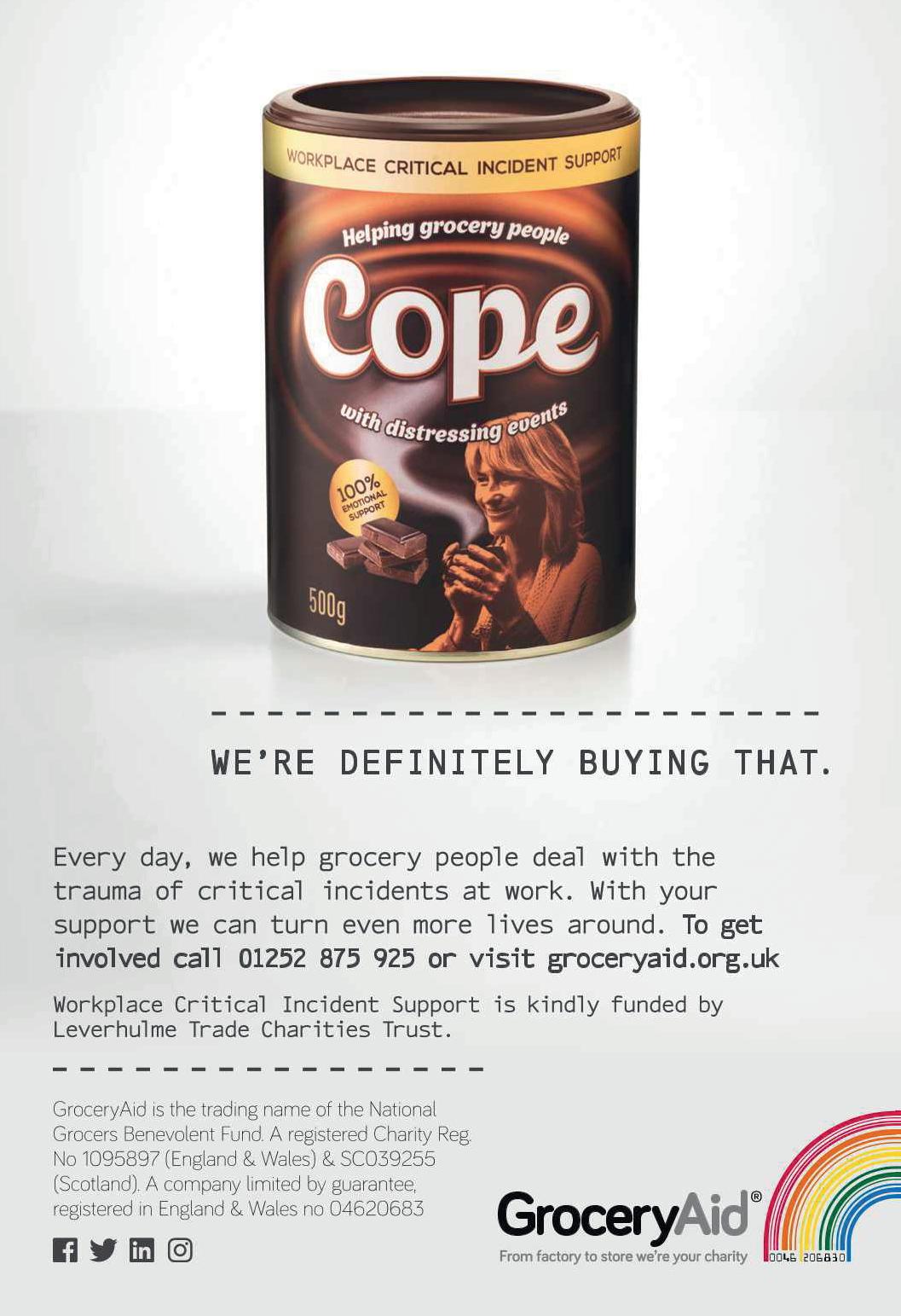

Sugro has announced its official partnership with the Alice Charity.

Established in 2011, Alice Charity supports vulnerable and disadvantaged families across Stoke-on-Trent and Newcastle-under-Lyme.

Having recently backed the Alice Charity’s 2025 Easter Appeal, Sugro was inspired to make Alice Charity its charity of choice and support the cause on a longer-term basis. Sugro has accordingly committed to making monthly donations. It will also support seasonal campaigns at key points during the year and take part in volunteering opportunities.

SPAR Scotland has unveiled a new vehicle livery to celebrate its success at the 2025 Achievers awards.

SPAR Scotland was named Symbol Group of the Year for the third consecutive year and was also awarded highly commended for Best Marketing Initiative and runner-up for Best Delivered Operation – Retail.

The new livery supports CJ Lang & Son’s ‘Discover SPAR Scotland’ retailer recruitment campaign, launched last month. This is running for at least six months and highlights the benefits of partnering with SPAR Scotland and CJ Lang.

The initiative includes B2B PR, digital and advertising activity and encourages independent retailers to explore new opportunities –including attending the SPAR

Scotland Trade Show in Aviemore on 25 September.

The Achievers livery joins a new livery featuring independent SPAR retailer Saleem Sadiq of SPAR Renfrew, which has become one of the most awarded independently-owned symbol stores in Scotland.

In other news, the Relex

demand planning and forecasting platform is now live across CJ Lang’s supplier network and on track to be fully operational in all 115 company-owned stores by the end of June. As part of this development, CJ Lang is to roll out supplier forecasting – a key step in improving product availability.

Hull-based wholesaler

Turner Price has promoted four senior team members to its board of directors.

Steve Potter has been promoted from operations controller to operations director. Tracey Shillito, formerly head of sales north, and Jason Watkins, previously head of sales south, have both been appointed as sales directors. Tom English has been promoted from head of marketing & e-commerce to digital & marketing director.

Collectively, the newly appointed directors have nearly 60 years of experience with the wholesaler.

They join MD Paul Brittain and commercial director Craig Andrews on the board. These appointments have

been made less than a year after Turner Price joined the Caterfood Buying Group in July 2024.

In addition to the boardlevel promotions, the company has strengthened its senior leadership team with two further promotions.

Gemma Scholes, who first joined Turner Price in 1996, has been promoted from senior buyer to head of buying, while Liz Watson has become head of finance, having previously served as the company’s financial accountant.

Brittain commented: “I am delighted to welcome Steve, Tracey, Jason, and Tom to the Turner Price board. Their deep understanding of our business and wealth of experience make them invaluable members of the leadership team. Each has played a crucial role in our recent success, and their continued contributions will be vital to our future direction.

“I am equally pleased to recognise Gemma and Liz, whose promotions reflect the strength and depth of talent within our organisation. At Turner Price, we are passionate about nurturing our people, and these appointments demonstrate our commitment to developing future leaders from within.”

Birchall Foodservice has promoted Gill Smith to managing director. She replaces Justin Birchall, who has taken on the role of chief executive.

Smith (right) has been with the firm for 18 years. She started as an accounts assistant and progressed to her most recent position of finance director, which she held for over eight years.

In addition, Birchall Foodservice has promoted Nicola Watson to commercial director. Watson has worked for the wholesaler for more than 20 years, beginning as business services manager before taking on the role of operations director in 2016.

Steve Chadwick has also been promoted – from regional sales manager to head of sales & marketing. He has been with the firm

for over 11 years.

Birchall commented: “We are thrilled to announce these promotions within our leadership team.

“Gill, Nicola and Steve have each demonstrated exceptional dedication and leadership skills, making them the perfect fit for their new positions. I am confident they will lead our business to new opportunities and further strengthen our position in the foodservice market.”

Brakes is now stocking a new range of ice cream products under the Sides brand from the YouTube phenomena the Sidemen.

The Sidemen, which have more than 22 million followers on YouTube, already successfully run Sides restaurants, where the ice cream range was trialled.

Crafted at Beechdean’s facility in Cheshire, the range features flavours inspired by fan-favourite treats, including Marshmallow Cake, Chocolate Brownie Fudge Cake, American Style Cookie, Cookies & Cream Cookie, Chocolate & Vanilla Cone, and Stracciatella Stick.

The agreement with Brakes sees the brand given national distribution, making the ice cream range available to foodservice businesses across the country for the first time.

Caterforce is making additional investment in its ownbrand range, with more than 50 new products set to be launched over the coming months.

Currently worth more than £85 million in annual sales, the Caterforce ownbrand portfolio comprises five bestselling ranges, providing more than 400 products across all categories for all out-of-home settings.

Chefs’ Selections is the original own brand consisting of over 350 versatile ingredients and ready-toserve products, while the Premium Collection has been curated to provide the highest quality products with visual appeal for operators to elevate their offering.

Roast440 coffee offers a range of single origin and blended coffee beans and filter coffees, while Eden Grove is a range of 100% pure juice from concentrate, ideal for hospitality settings as well as the on-trade.

CleneGuard provides professional cleaning and

hygiene products for all settings.

“In addition to the 50 new lines we are launching this year, our in-house technical team is looking at how we can continually improve and enhance existing products by refining ingredients to ensure they meet school compliance and HFSS regulations,” said Joanna Halucha, head of own brand buying and technical.

“We have also ensured that our range of own-brand products align with our sustainability goals, as 100% of our packaging is now in unbleached cardboard.”

Caterforce’s quarterly trends guide is supported by own-brand recipes created by its development chef.

In addition, Brakes has revamped its premium icecream range with the introduction of an exclusive selection of gelatos and sorbettos from Hackney Gelato and Jude’s.

There are 13 Hackney Gelato varieties in a 4.5-litre format, including Sea Salted Caramel Gelato – winner of a 3 Star Great Taste.

The new 4.75-litre Napoli range from Jude’s includes Bubblegum flavour, which is naturally coloured with spirulina, and a Speculoos Caramel Biscuit variant.

Fresh Direct – part of Sysco –has introduced 25 new products as part of its ‘Taste Like Summer’ launch.

British produce spearheads the list of new lines. For example, the range of premium tomatoes from Isle of Wight Tomatoes has been extended with Mixed Heritage Tomatoes.

Managing director Andy Pembroke said: “We’ve launched more than 80 new fresh produce products in the past year, providing a wealth of menu opportunities to thousands of caterers.”

Parfetts has appointed Cheryl Hope as trading director. She joins the business from Unitas, where she led the trading team for three years.

Hope (pictured) replaces Gurms Athwal, who has left the business.

She reports to joint MDs Noel Robinson and Guy Swindell, and brings a wealth of experience to the role, having held senior positions at AF Blakemore & Son,

BAKO Northwestern, Iceland and Co-op.

Hope said: “Parfetts has a fantastic reputation with retailers, suppliers and the wider industry. It is great to join the team and support the national expansion plans through strong, collaborative supplier relationships. The employee-ownership model of the company sets it apart from the rest of the industry.”

In the year to 30 June 2024, Parfetts saw turnover increase from £646 million to £696 million, and wholesale gross margins rose from £50.5 million to £56 million. The number of employees went up from 910 to 944.

Parfetts said that the rise in sales came from the existing estate as well as the Birmingham branch that opened in March 2023.

Inter Fresh Produce has joined Sterling Supergroup.

Based in Carlisle, Inter Fresh Produce is a wholesaler of fresh produce and dairy products, primarily serving the hospitality and catering industry across Cumbria, South West Scotland, and the Yorkshire Dales.

Founded in 2016 by the current managing director William Box, the company began primarily dealing with fruits and vegetables, but over the years has expanded its product range to include a wide range of dairy goods

After nearly a decade of supporting the next generation of young college chefs through its sponsorship of the Student Chef Challenge, the Country Range Group has now turned its attention to schools with its own brand – Country Range –being announced as a headline sponsor for the 2025/2026 Springboard FutureChef competition.

Springboard FutureChef is the UK’s leading schoolbased cooking competition, engaging with over 25,000 young people annually across England, Scotland, Wales and Northern Ireland.

Graham Caldwell, CRG marketing manager, said: “The Springboard FutureChef competition is a truly exceptional initiative and, as a long-term supporter of food

education and training, the exciting sponsorship aligns perfectly with our mission to empower the next generation of culinary professionals and strengthen the hospitality industry.”

In addition to Country Range being the headline sponsor, the group’s wholesale members will have the opportunity to offer mentorship and professional development opportunities for young participants and schools in their regions.

and ambient items. It supplies a variety of establishments such as schools, restaurants, hotels, nursing homes and independent stores.

Box said: “Inter Fresh is dedicated to making a strong start within the Sterling Supergroup and will be looking to roll out as many products from the Sterling Caterers Essentials range and build the brand throughout the region to existing customers as well as prospects.”

Daniel Larkin, chief commercial officer of Sterling Supergroup, added: “We are delighted to welcome Inter Fresh Produce to the Sterling Supergroup community. As a forward-thinking business, they bring fresh ideas and great potential.”

Following the publication of a comprehensive guide for KeyStore retailers ahead of the single-use vaping ban, which takes effect on 1 June, JW Filshill is now making the information available to all retailers using an AI (artificial intelligence) programme.

In recent weeks, the Glasgow-based wholesaler has issued the guide – compiled by category manager Derek Cowan – to its customers in PDF format. Filshill’s business development managers have also been working closely with KeyStore retailers to advise them on how to prepare for the forthcoming legislation.

Filshill’s CEO Simon Hannah – a qualified AI trainer – is leading his company’s drive to help customers and suppliers leverage AI for

mutual benefit across data analysis and business processes.

The AI bot called Vapora is simple to use – any retailer can ask a question by sending an email to vape.questions@filshill.co.uk and the bot will reply instantly with the answer. Retailers can also ask for a list of compliant products and advice on how to dispose of noncompliant stock.

SCAN HERE TO GET A FREE POS KIT

In an exclusive interview with Cash & Carry Management, UniCo’s founder Ash Khan explains the rationale behind the launch of the new buying group and outlines its objectives.

UniCo – a members-owned buying group dedicated to ‘revolutionising’ the fast-food and quick service restaurant (QSR) industry – has been launched.

With a collective turnover of £500 million, the membership comprises Eagle Foods, Euro Food Group, Fresco Foodservice, Giro Food, Major Foods, MS Foods, N&B Foods, and The Pentagon Food Group.

All eight are founding members of UniCo, which stands for United Cooperative Food Group, and Pentagon’s CEO Ash Khan (pictured) is the organisation’s CEO and chairman.

Khan told Cash & Carry Management’s managing editor Kirsti Sharratt what makes UniCo stand out in an already crowded buying groups sector.

Why did you decide to launch the new group?

Our members are all from a QSR and fast-food wholesale background, and these members have directly or indirectly created a multi-billion-pound industry over the last 40 years, which today contributes significantly to the UK economy with millions of jobs in this sector.

I feel that these wholesalers have been under-represented in the industry, and with their participation in buying groups such as Sugro and Unitas, they have been in the shadows of other members who are dominating the FMCG industry or mainstream foodservice sector.

Our members are actually operating in a unique space, and we recognised the need for a dedicated group that could address the unique challenges and opportunities within this sector, providing a unified voice and a stronger negotiating power in an industry which is highly fragmented.

Who is heading up the group and who is on the board?

I am currently heading up the group as the CEO and chairman (founder). The board includes key representatives from our founding members, ensuring that we have a diverse and experienced leadership team guiding UniCo.

When exactly was the group formed, and did you all know each other beforehand?

UniCo was officially formed on 19 April 2025, and many of us knew each other beforehand through various industry connections and collaborations.

Do you have any membership fees? Yes, there are membership fees, which are structured to ensure that we can provide the best possible services and support to our members.

What are your objectives, and do you have plans and targets for the first year?

Our primary objectives are to enhance the purchasing power of our members, streamline supply chain operations, and foster long-term strategic partnerships with suppliers.

For the first year, we aim to recruit additional members, achieve significant cost savings for our members, and establish UniCo as an inclusive leading force in the QSR and fast-food sector.

As we continue to grow, our aim is to achieve a collective turnover of £1 billion.

What services do you offer your members?

UniCo offers a range of services including collective purchasing, access to a vast network of suppliers, logistical support, market research, training, and networking opportunities. Our goal is to provide comprehensive support to help our members grow and succeed.

Do you have a central office or are the operations based at one of your members?

UniCo will be operating from a new HQ in Stoke-on-Trent from July 2025, but for now we are using our members’ facilities across the estate.

Do you have any events planned for the coming year?

We have several events planned, including our Annual General Meeting (AGM)

a Eight founding members

a £500 million collective turnover

a National distribution capability

a 20 Regional Distribution Centres, strategically located for optimal coverage

a 1.2 million sq ft warehouse space

a 150,000 pallet ambient storage

a 15,000 pallet cold storage

a 400 multi-temperature vehicles

a 2,000 suppliers offering a wide range of products

and various networking and training sessions for our members. We are also organising a UniCo trade event where we will be inviting all our suppliers, members and the customers we serve in the QSR and fast-food sector.

What is UniCo’s USP?

UniCo’s USP lies in being the UK’s first and only QSR and fast-food focused buying group. We offer a unique combination of collective purchasing power, industry-specific expertise, and a member-owned structure that ensures all

decisions are made in the best interests of our members.

How have suppliers responded to the formation of the group?

The response from suppliers has been overwhelmingly positive. Many suppliers see the value in partnering with a unified group like UniCo and are eager to work with us to provide the best products and services to our members.

Since you announced the launch, have you had any wholesalers approach you to join the group?

Yes, we have received interest from several wholesalers who are keen to join UniCo and benefit from our collective purchasing power and industry expertise; we will be announcing further members in the coming weeks.

Why should other QSR and fast-food wholesalers sign up to UniCo?

UniCo is committed to fostering a collaborative environment where our members can thrive. We believe in the power of unity and are dedicated to supporting our members every step of the way.

Our focus on the QSR and fast-food sector sets us apart and positions us as a leader in this industry. Together, we are set to achieve new heights and redefine the industry standards.

For more information on UniCo, email memberservices@unicogroup.co.uk or visit unicogroup.co.uk.

‘I

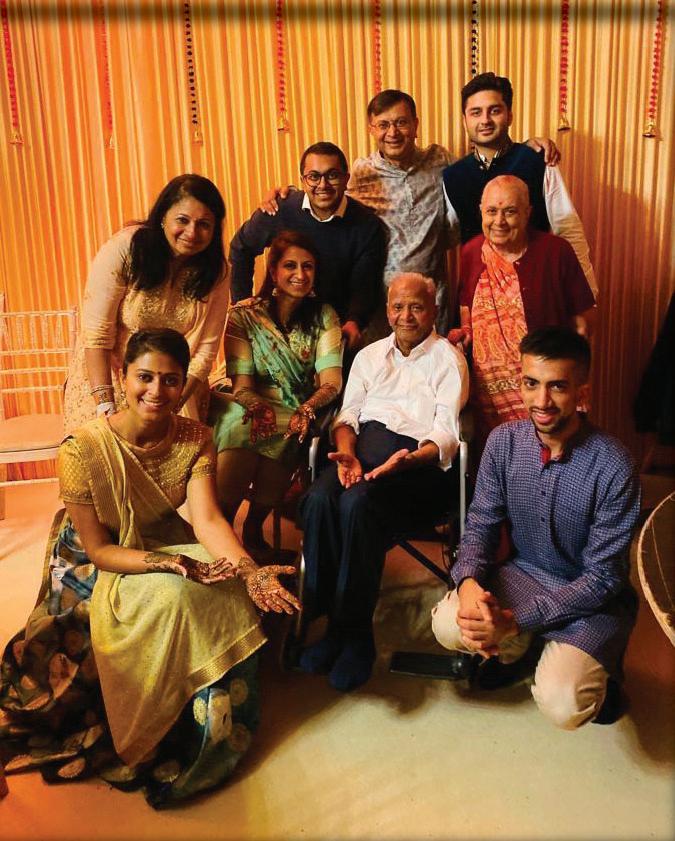

What have been your biggest achievements in work and outside work?

Being involved in the opening of three depots since joining Dhamecha in 2022. It’s been extremely rewarding to see the completion of the projects first-hand and to work closely with our operations director, Garry, who was leading the renovations of the Nottingham and West Bromwich depots and the new build of Liverpool.

Outside of work, my greatest accomplishment is my philanthropic involvement. I’m passionate about giving back, whether it’s through sponsoring children’s education in India or volunteering as a governor at my local school to support the community.

Who has been the biggest inspiration to you?

My father and grandfather. I have a personal admiration for my grandfather and his brothers for taking the risk to move to the UK from East Africa and subsequently sacrificing everything to start the family business in 1976. He taught me the importance of being fair and seeing the best in everyone. He had a heart of gold and I try to live life in a way that would make him proud. My father continues to inspire me, not just

because of his continued passion and drive for the business, but also for his ethics, cultural values and dedication to philanthropic causes. I’m fortunate that we live and work together so I get the opportunity to constantly learn from him.

What were your ambitions when you were growing up?

When I was younger, I wanted to be a footballer; unfortunately my dream fell apart at the tender age of six when I was clearly nowhere near good enough! I wanted to work in politics at one point in time, but I don’t think I could handle the bureaucracy. I worked in various roles in consulting and finance after graduating but ultimately knew that I wanted to join the family business.

What are your interests outside work?

I love football, good food and wine. I’m an Arsenal season ticket holder so I regularly attend the games. I also love to travel and explore new places; my wife and I like to opt for more adventurous holidays such as skiing or hiking trips.

How would you describe your personality?

I’d like to think I’m easy-going and take things in my stride; I tend not to get

flustered. As a family business we’re lucky that we can be agile and make decisions quickly…my father always says no decision is worse than the wrong decision! I also strongly believe in the importance of relationships and treating people fairly; as a business we’re lucky to be surrounded by great people who have shown incredible loyalty to the company and it’s important to recognise them and their hard work.

What is your favourite book and music?

Two of my favourite books are Shoe Dog by Phil Knight and The Ride of a Lifetime by Bob Iger. Both were inspirational in telling their respective personal and professional journeys as well as leadership styles. Music-wise I’ve always been a big fan of house music, so anything with a good beat!

If you won a holiday, where would you go and who would you take with you? I would go to Patagonia with my wife. We visited Torres del Paine National Park in 2023 and it was a magical place.

What would people be surprised to know about you?

I’ve played a football match at Wembley Stadium…just not with England! I won a charity auction to play a game, which was a once-in-a-lifetime experience. CCM

Anand Dhamecha studied Management at the London School of Economics and Political Science in 2013, but prior to going to university, he undertook an internship at Accenture where he worked as an analyst for eight months. After graduating, he rejoined Accenture for a few years, working on various strategy and innovation projects within financial services. In 2019, he joined HSBC’s in-house consulting division before moving to a smaller challenger bank in 2020. He joined Dhamecha in January 2022.

Which drinks categories are performing particularly well at the moment?

We are approaching our second summer season since we started, and we’ve enjoyed really strong sales over the past six months of colder, typically tougher trading periods. As we look over the forecasts prepared with our customers and their demands in mind, we are seeing a massive projected demand in sales of cola drinks as well as energy drinks.

During the warmer weather, which categories tend to see the highest uplifts in demand?

Typically drinks which are used as mixers or incorporated into other beverage servings in bars etc always outperform other categories. These are colaflavoured drinks, fruit-flavoured drinks and energy drinks.

Has there been any exciting NPD from suppliers so far this year?

NPD is crucial, in my opinion, to keeping the business interesting because you do get into a robotic approach of selling the same specification of soft drinks day in, day out. Recent NPD has included Pepsi Cream Soda and Strawberries ‘N’ Cream

Midlands-based Westo Direct Wholesale was established in 2023, and from the first sale of a few cases of cola to today selling well over 1520 truck loads every week, it has become a soft drinks specialist serving customers nationwide.

“We call ourselves the wholesaler’s wholesaler because we bridge the gap between wholesalers and suppliers by providing a reliable, friendly, fast and cost-effective service,” explains managing director Tom Thomas.

The wholesaler will shortly launch a new digital ordering app. www.westodirect.co.uk

flavours, which we have seen a lot of demand for, as well as additions from the Fanta brand such as the new limited-edition Tutti Frutti flavour, which has also seen initial demand amongst our customer base.

The National Convenience Show and the UK Food & Drink Shows held in April were a fantastic opportunity to view the latest NPD and taste the flavours firsthand. These events are a recommended must-add to anyone’s calendars for next year – the shows are brilliant and a great chance to immerse yourself!

How important is price in the drinks category at present?

Price is, and always has been, crucial in the drinks category, and as a specialist soft drinks wholesaler, our customers rely on us to ensure they can remain competitive and at the forefront in their respective regional areas for each SKU we supply. This poses a challenge to our team and one that we face more in the months leading up to the summer.

With the recent price increases at the start of the year from pretty much all suppliers, we had to act fast and plan strategically with our customers to minimise the impact to their business with us and also their onward trade with their own customers.

Ultimately, consumers are the decision-makers in the supply chain who dictate the performance of each SKU on the retailer’s shelves, and with the rise of discounters, there is even more pressure on independent wholesalers like ourselves to offer the best, lowest prices to our customers. I would say we’ve done a pretty good job this year so far in keeping our prices competitive and our customers happy!

What advice do you give to your customers to maximise sales and profits of drinks during the summer months?

From the start of the year, we integrate planning with our customers, putting in place order forecasts and volume analysis to understand what they need from us in the coming months of unprecedented sales and demand.

Put simply, my best advice to a customer is, stock up! This is because once the warmer weather hits, they become one of hundreds of customers we serve that need stock as soon as possible.

The only way we can meet their expectations is if they work with us at the start of the year to plan, predict and put in place a supply strategy that aligns with their targets for the summer. We can then place orders with our suppliers to ensure we are well prepared.

Drinks suppliers have been active in introducing new products, limited editions and promotions to boost sales opportunities this summer for wholesalers and retailers.

There is plenty going on in the drinks market, with innovation in all categories tempting consumers to try new products in addition to their favourites. Wholesalers aware of trends, such as the focus on moderation, can help their customers offer a range that fulfils consumer demand – whatever the weather this summer.

In 2024, the total soft drinks market increased in value by 8.8% (Circana). However, while soft drinks in the symbols and independents channel also achieved growth, it was by less than half the rate at 2.8%, demonstrating the potential for additional sales with the right range, merchandising and promotions.

A strong supporter of the wholesale and independents/symbols channel, AG Barr has added two limited editions to its Irn-Bru Xtra range.

Available for eight weeks from this month, the Legends Editions comprise two unique mystery flavours, Nessie Nectar and Unicorn Tears. They are being backed by a £2 million out-ofhome and social campaign, reaching 70% of all 16-34 year-olds in the UK.

Kenny Nicholson, head of Irn-Bru brand, says: “Innovation plays a really

important role in the success of the soft drinks category. In fact, without NPD, the category would have lost out on £228 million worth of sales – which is a 3.4% share of the total market (Circana).

“Irn-Bru Xtra has a proven track record in delivering flavours that appeal to shoppers. Our Wild Berry Slush and Raspberry Ripple, which launched in April last year, became a top five take-home and drink-now soft drinks innovation, despite only being available in market for eight weeks. They also added incremental sales, with just over a third (34%) of people who purchased them being new to the category (Dunnhumby).

“We’re aiming for even bigger and better with this launch. We want to grab shoppers’ attention, create fun in store and get shoppers, and retailers, talking about the category. Our two Legends will definitely do that.

“The flavours, Nessie Nectar and Unicorn Tears, are both genuine consumer descriptions of the taste of our iconic Irn-Bru, but we’ll be leaving shoppers guessing on what the flavours actually are, as shoppers tell us they like the intrigue. Rest assured, the essence of IRN-BRU is there, with a legendary flavour twist.”

A full range of impactful PoS materials is available for retailers to drive sales.

Other activity from AG Barr includes the introduction of a new campaign for Rubicon, designed to drive shoppers to soft drinks chillers throughout the summer.

As part of the brand’s annual £7 million investment, the ‘Big Flavour Behaviour’ campaign is running until July, reaching 90% of 16-34-year-olds 11 times on average.

The campaign has four different adverts, each one spotlighting a key flavour within the range – Rubicon Sparkling Mango and Passion as well as Rubicon Spring Orange & Mango and Black Cherry Raspberry.

The adverts are running on TV, digital and social media and are being backed by outdoor advertising in the UK’s biggest cities, along with impactful double-decker bus wraps. Events and sampling also form part of the campaign, with 10 DJ events taking place in May and June.

Rubicon shoppers are also in with a chance of winning festival tickets, fashion and music subscriptions until 30 June. Shoppers can enter by scanning the QR code on PoS which takes them to a promotional website where they can enter the product barcode and batchcode from their purchased pack. They are instantly told if they are a winner.

Rubicon is growing by 9.2% and added £2 million to the category last summer – a higher uplift than any other brand (Circana).

Also from AG Barr, Boost has unveiled the next stage of its ‘There’s a Boost for That’ campaign, reinforcing the message that there is a Boost for any occasion where shoppers are in need of an energy pick-me-up.

Backed by a £2 million brand investment, the campaign is running until July. Now in its second year, it showcases how Boost’s Energy, Sports and Iced Coffee drinks can meet a range of different energy needs, such as work concentration, gym performance or simply to push past an afternoon slump.

The adverts are running on cinema, social media, Spotify and video-ondemand partnerships with Sky, Netflix and ITVX as well as high-impact outdoor advertising in London and Northern Ireland.

Boost is also driving trial and awareness with more than 350,000 samples distributed during May and June in highfootfall commuter locations, university halls and at fitness events. The brand is also partnering with fitness app, Strava, daring the millions of users to take the Boost 5K challenge.

Adrian Hipkiss, head of functional brands at AG Barr, says: “We know from last year that our ‘There’s a Boost for That’ campaign resonates with shoppers and delivers for retailers and we expect it to drive increased demand for the brand. We encourage retailers to get prepared with full range availability, whilst also making use of our impactful PoS.”

Kingsley Beverages UK has launched two new ‘fizzy pops’ – Kingsley Berry Twist and Kingsley Cherry Cola. The drinks are available in two-litre bottles with an rsp of 80p.

Jumping on the back of the ’90s nostalgia trend – and capitalising on the popularity of similar products in the soft drinks category –Kingsley Beverages UK hopes to help consumers find the sweet spot between value and flavour with its new launches.

Chris Bradshaw, UK managing director, says: “We are mindful that the cost-of-living crisis is still impacting our shoppers, particularly when it comes to purchasing treats and non-essential items. We also know Gen Z are more budget-conscious and therefore driving up the ‘value ownbrand’ market.

“As we head into spring/summer occasions and gatherings, we believe Kingsley soft drinks – particularly our latest variants – will compete with similar, more expensive, products in the category on taste. Our price point allows shoppers to experience great flavour at an accessible price.”

Booker symbol groups are running two major drinks promotions this spring: the Beer & Cider Festival (starts 19 May for eight weeks) and the Wine Festival (started 28 April for three weeks).

Available across Premier, Londis, Family Shopper and Budgens, both festivals will showcase a selection of top drinks alongside exclusive deals and NPD.

The Wine Festival features popular wines, including brands like La Vieille Ferme and I Heart Prosecco, and retailers benefit from exclusive promotions, discounted multipacks, and strong margins on key lines.

Colm Johnson: ‘These events are a great opportunity for retailers to offer exclusive deals.’

Of the 170 lines available, exclusive selections for Booker’s symbol group customers include Andrew Peace Masterclass and Wairau Cove.

The Beer & Cider Festival will feature popular beers and ciders. Premier and Family Shopper retailers will offer more than 200 lines across lager, ale, craft, cider, and premium drinks, including regional brands. Special deals will run on a variety of premium beverages, with multipack bundles for several brands. Strong margins will be offered on key lines, including premium pints and 440ml cans.

Booker’s Retail managing director Colm Johnson says: “These events are a great opportunity for retailers to offer exclusive deals, boost sales, and introduce consumers to new favourites.”

YOU CAN BELIEVE IN YOU CAN BELIEVE IN STOCK THE STUFF OF LEGENDS BEFORE THEY’RE GONE

Radnor Hills has joined forces with Go Ape for a second year to run its ‘Fuel the Fun’ promotion on Radnor Fizz.

The on-pack partnership offers the chance for shoppers to win tree top adventure vouchers. Running until the end of October, there are plenty of chances to win the weekly prize of a Go Ape voucher. To enter, consumers scan the QR code on the promotional bottle and enter the draw.

Go Ape is one of the largest outdoor adventure companies in the UK with 37 sites offering a range of activities from high ropes to segways.

Radnor Fizz, the UK’s leading school compliant drinks brand, contains real fruit juice, all natural flavourings and no added sugar. It comes in a 100% recyclable bottle that is made from 30% recycled material.

There are six flavours –Apple, Forest Fruits, Tropical, Orange & Mango, Sour Cherry and Strawberry – and a bottle counts as one of the recommended five-a-day.

The ‘Fuel the Fun’ promotion is running on four-packs of Tropical, Forest Fruits and Apple flavoured Radnor Fizz as well as single bottles of each flavour.

Fuel the Fun is being supported with a social-first campaign including TikTok, sampling and tasting events at Go Ape locations with Radnor brand ambassadors, and a series of social competitions and giveaways.

Chris Butler, marketing manager at Radnor Hills, says: “We were so pleased with how well our on-pack Fuel the Fun promotion went last year that we wanted to continue it in 2025. Some partnerships are so good they deserve a sequel.

“We love running promotions for our customers, to add value and to give Radnor Fizz lovers the opportunity to keep naturally hydrated whilst also enjoying fun activities out in the fresh air.”

Carlsberg Britvic has brought back Tango Blast for another limited period. Inspired by the Tango Ice Blast flavours, Raspberry Blast and Cherry Blast are available now across the convenience channel in a ready-todrink 500ml bottle (rsp £2.15).

Tango is now worth £113 million in retail sales value and growing by 7.6% (Nielsen). Tango Blast contributed to almost half of Tango’s overall growth over the past year.

Tango Raspberry Blast and Cherry Blast are available in the convenience channel for six months. To amplify this in the wholesale channel, the products come in Tango Blast printed cases, helping to increase stand-out in-depot.

Also from Carlsberg Britvic is the new Lipton Kombucha range. The innovation promises a ‘delicious burst of flavour and variety’ for new drinkers to the category and existing kombucha enthusiasts.

One in four Brits now rely more on their local convenience store than any other retail outlet, and more than a third of Brits consider local convenience stores an essential part of daily life, or even a ‘lifeline’ (Opinium).

The consumer survey also revealed that, on average, people now visit their local convenience store five times a month, spending an average of £14.90 per visit.

The research was conducted by Coca-Cola as it recognises the importance of convenience stores and their bosses, and celebrates its 125th anniversary in Great Britain.

Convenience is one of Coca-Cola’s most longstanding and important retail channels, with the CCEP portfolio delivering more than £317 million worth of sales in convenience in the last year (Nielsen).

Two important factors with the potential to drive shopper behaviour are Coca-Cola’s 125th anniversary and ‘Made in GB’ credentials (97% of Coca-Cola products sold in the UK are made here).

Two-fifths of respondents to the survey (41%) said they’re more likely to buy a brand that has a strong British heritage and over half (55%) prefer to buy items manufactured in the UK – hence the ‘Made in GB’ displayed on Coca-Cola bottles and cans.

Additional research conducted by Coca-Cola within the convenience retail community found that, to stay competitive, more than half (54%) say they’ve taken steps to improve the in-store experience they offer, while 36% now offer online delivery (Lumina).

Stephen Moorhouse, general manager of CCEP in GB, says: “Convenience stores have been at the heart of their communities for generations, and Coca-Cola has proudly stood alongside them throughout that journey.

“As we mark 125 years of Coca-Cola in Great Britain, this research highlights the resilience and adaptability of local retailers – many of whom are finding new ways to meet evolving shopper needs.

“At CCEP, we’re committed to supporting these vital businesses, helping them grow, innovate and continue serving as a lifeline to the communities they know so well.”

Lipton Kombucha is available in Strawberry Mint, Raspberry and Mango Passionfruit flavours, in 250ml single cans (rsp £1.99) and multipacks of four (rsp £4.99).

Carlsberg Britvic reports that the kombucha market has been growing rapidly at 39% since Covid and is now valued at an £33 million (Nielsen).

Ben Parker, vice president sales off-trade at Carlsberg Britvic, says: “We know how popular the kombucha trend is and believe Lipton has created a product that can introduce even more people to the category and its benefits. As a brand, we are in a good position to grow an exciting category.”

The launch is being supported by a new campaign ‘Kombucha-cha-cha’, as well as out-of-home advertising, PR, social media, disruptive marketing in stores and sampling.

Red Star Brands has reintroduced Sparkling Ice Black Raspberry sparkling flavoured water with no added sugar. It has an rsp of £1.60.

Made with natural fruit flavours, carbonated water, antioxidants and vitamins D, B6 and B12, HFSS-compliant Black Raspberry contains 12 calories per bottle.

“We’re seeing increased consumer interest in fruity flavoured fizzy water which is being fuelled by a strong

Elbrook Cash & Carry has been rebranded as Drinks Wholesale Group.

emphasis on both functional health and taste,” commented Clark McIlroy, managing director of UK distributor Red Star Brands.

Black Raspberry was part of the original Sparkling Ice line-up and has been re-introduced in response to consumer demand.

It is being supported by an ‘Anything But Subtle’ marketing campaign across PoS materials and social media.

Black Raspberry is the sixth flavour in the range. It joins Strawberry Watermelon, Kiwi Strawberry, Orange Mango, Pink Grapefruit and Cloudy Lemon.

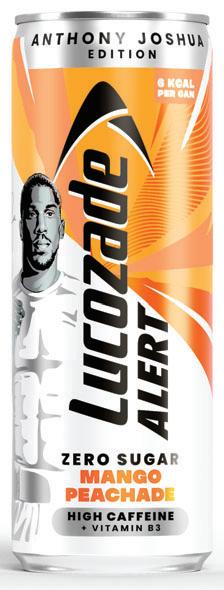

Zero-sugar stimulation drinks are growing by 27% (Nielsen) and Suntory Beverages & Food GB&I has introduced Lucozade Alert Mango Peachade Zero Sugar –Anthony Joshua edition into this space.

The new 250ml (standard and 75p PMP) and 500ml cans feature the boxer on the front, and the launch is being supported with marketing investment, including a social campaign and in-store PoS.

Aoife McGuigan, head of category expansion, comments: “This limited-edition energy drink is set to create a real buzz with boxing fans and shoppers alike, to help drive a knockout season of sales for our retailers and keep consumers coming back for more.”

As the signpost to the energy category, Red Bull Energy Drink 250ml is the original and sells more packs than any other single-serve soft drink. In fact, it is now the No.1 packaged food and drink product by units sold in the UK (Nielsen).

“Although core skus are important and should be well stocked regularly, we also need to make space for NPD to drive excitement, trial and value into the category,” says a company spokesperson. “The key to success is ensuring each brand has its fair share on shelf and NPD introduced from the brands that work well within this space.

As part of the change, which was effective on 14 April, the business has unveiled a new logo. However, the company has assured its customers and suppliers that its core services, values and leadership will remain unchanged, with all existing agreements, partnerships and operations continuing without interruption.

Based in Mitcham, Southall and Croydon, the wholesaler stocks in excess of 8,000 products and supplies various types of trade customers including convenience stores, pubs, bars and restaurants.

“This name change represents more than just a new look – it’s a symbol of our evolution and ambition,” said a company spokesperson.

“Drinks Wholesale Group Ltd embodies the power, reach, and modern spirit of our business as we continue to grow and serve our customers with excellence.”

In 2022, Elbrook Cash & Carry was sold by former owner and director Frank Khalid for an undisclosed sum to family friends Ajit and Sanmeet Chawla.

“Innovation has been vital to the success of energy drinks growth this year, with particular engagement around new flavours, which has helped broaden the category’s appeal to new groups of shoppers, where taste was previously a barrier. As a result, 96% of all NPD growth came from flavoured energy over the last 12 months (NIQ),” the spokesperson adds.

Continuing its track record of successful flavour innovation, Red Bull recently announced the introduction of Summer Edition White Peach.

With each Summer Edition helping to add significant growth to the overall Red Bull Editions portfolio, the company hopes that the latest limited edition continues the trend of introducing new shoppers and incremental value to the category.

is worth more

Taste remains the brand in GB and

“Editions have driven fast growth for the category, accounting for nearly a third of all functional energy flavoured growth this year (Nielsen),” says a company spokesperson.

Red Bull Summer Edition White Peach is available in 250ml plain and £1.65 price-marked cans as well as Sugarfree 355ml can and 250ml can four-pack.

Coca-Cola ready-to-drink is described as perfect for casual get-togethers, pre-drinks or nights in with friends. It is designed to appeal to Gen Z and millennial consumers looking for simplicity, flavour and heritage in one can.

The launch builds on growing demand in the alcoholic ready-to-drink space, which is now worth £631 million in GB (Nielsen) and has been the fastest-growing alcohol category globally over the past five years (IWSR).

CCEP has already taken its Coca-Cola (with and without sugar) and Sprite brands into the RTD category. Absolut Vodka & Sprite was the No.1 new ready-to-drink product in 2024, while Jack Daniel’s & Coca-Cola Original Taste is the No.1 ready-to-drink SKU in GB (Nielsen).

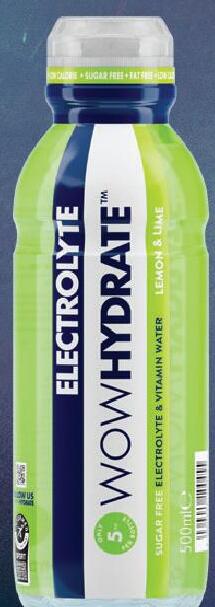

WOW Hydrate is a sports drink brand offering a choice of electrolyte drinks and vitamin-enriched protein water that is completely sugar free. With electrolytes for enhanced hydration or protein for post-workout recovery, there are four ranges – Electrolyte, Electrolyte Pro, Protein and Protein Pro – and six flavours.

iPRO has announced the renewal of its long-standing partnership with the Royal Navy Rugby League for a further three years.

Through this renewed partnership, iPRO Hydrate will remain readily available across Royal Navy sports sites.

iPRO Hydrate, which is also the Global Hydration Partner of parkrun, provides a hydration drink designed to optimise athletic performance and recovery.

Made with natural ingredients, including electrolytes, vitamins and minerals, iPRO Hydrate aids rehydration, prevents fatigue, and supports overall wellbeing without artificial flavours or colours.

Cold brew is a £10 million drinks category in the UK that is predicted to climb beyond £29 million by 2027, and disruptor Unconform has introduced three vegan brews that blend Arabica beans with nootropics.

The products are Flat White with Ashwagandha, Ginkgo Bilboa & Vitamin 12, Salted Caramel Latte with Inulin and Turmeric, and Mocha with Niacin & Biotin.

Unconform is a ‘1% for the planet’ member, which means 1% of the business’s annual revenue supports meaningful environmental causes.

Coca-Cola and Bacardi have teamed up to bring one of the most iconic bar calls – Bacardi & Coca-Cola – into the readyto-drink category for the first time in the UK.

Available in sleek 250ml cans at an rsp of £2.30, Bacardi &

‘The biggest risk is going out of stock’

Nestlé reports that water accounts for 30% of category sales in the total market, but only 16% in the symbols and independents channel; matching the category share would deliver more than £1 billion of sales growth (Circana).

Research shows that 80% of the population are not drinking enough water and 73% of people agree that being optimally hydrated is important for mental performance (Mintel).

“With water being one of the healthiest ways to hydrate, it is important to make sure that it is visible and accessible to shoppers,” says a Nestlé spokesperson. “Water drinkers will buy from the chiller, but don’t forget that 45% of people choose to drink ambient water in convenience (Lumina), so floor stacks and till displays are a great way to drive sales.”

During the 17 weeks of summer 2024, soft drinks in convenience saw a 15% rise compared to the prior 17 weeks (February-May) period, which demonstrates a great opportunity for independents to maximise sales this summer.

“Warm weather will lead to more impulsive purchases in this channel, with water seeing the greatest uplift (+32%) in summer last year, ahead of carbonates and energy drinks. Last year, carbonates grew by 10%, energy by 16% and water leading the category with 27% (Circana). The hotter it gets the higher the sales increase, but when it’s really warm the biggest risk is going out of stock and losing sales,” says the spokesperson.

In summer 2024, Nestlé Pure Life was the fastest growing of the top 10 water brands in convenience excluding major multiples, with value sales growth of 67% (Circana).

The supplier says that its must-stock SKUs are Nestlé Pure Life 12 x 500ml, and 15 x 750ml.

This latest launch is being supported by a shopper marketing strategy, with a range of PoS materials including chiller dump bins, gondola ends and digital shelf strips, available to convenience retailers via My.CCEP.com.

There will also be a summer marketing campaign across social media, checkout promotions, out-of-home advertising and sampling at music festivals and sporting events.

Elaine Maher, associate director, alcohol ready-to-drink at CCEP GB, says: “Bacardi & Coca-Cola builds on the natural synergy between two globally iconic brands – Cola-Cola is the world’s most popular cola (Nielsen), while Bacardi holds a quarter share of the growing global rum market (IWSR).

“With over a century of heritage, this serve is already one of the world’s most recognisable bar calls. Bringing it into the ready-to-drink space meets strong consumer demand for trusted, convenient choices without compromising on quality.”

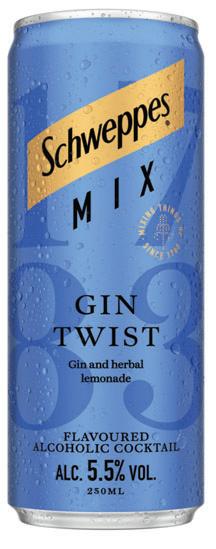

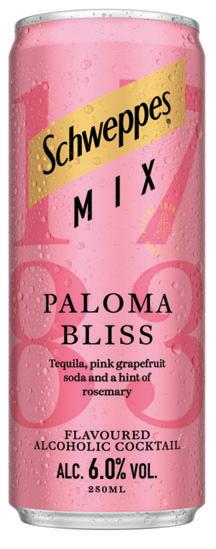

Also new from CCEP are two cocktails that have brought Schweppes to the ready-to-drink cocktail category for the first time. The Schweppes Mix range features two distinctive serves in 250ml cans: Gin Twist – a crisp, citrus-forward blend with a clean, refreshing finish – and Paloma Bliss – a bold balance of grapefruit and tequila.

Targeted at the pre-party drinks-at-home occasion, where 65% of ready-to-drink consumption takes place (Mintel), Schweppes Mix offers a flavour-led alternative to wine and prosecco, helping to attract new consumers to the category.

CCEP is supporting the launch with a suite of Schweppesbranded point-of-sale kits via My.CCEP.com, all designed to maximise visibility and drive trial at the chiller. With 82% of shoppers preferring a cold drink when consuming immediately (One Pulse), placing Schweppes Mix in chillers throughout store will be key to success, advises the company.

Campari Group’s new ready-to-serve 9% abv Aperol Spritz fills a gap in the market, capitalising on the fact that Aperol Spritz is the UK’s No.3 cocktail in the on-trade (CGA).

“As well as the irresistible convenience of pre-mixed cocktails, shoppers really love buying into NPD, says a company spokesperson.

Other activity from the company includes a new label design for Magnum Tonic Wine, and a new recipe for Crodino, which now has just 20 calories in each bottle.

Booker has secured exclusive distribution in the convenience sector for Wray’s 43, a new limited-edition white Jamaican Rum from J Wray & Nephew.

A blend of unaged Jamaica white rum with notes of rich fruits, charred pineapple, and molasses, the NPD has an abv of 43% and is distilled and bottled in Jamaica.

David Morrison, deputy master blender at J Wray & Nephew, says: “The launch of Wray’s 43 is an exciting new exploration for us. We have listened to our community and are providing rum lovers with a fresh way to experience the tropical flavours of Jamaica rum whilst staying true to the product’s authenticity.”

“With 17.4% of drinkers abstaining from alcohol and 45.9% moderating their units (Kantar), it’s clear to see why the no-and-low category is in growth,” says the spokesperson. “The ‘zebra striping’ trend – which sees drinkers alternating between alcoholic and non-alcoholic drinks to keep their intake balanced – means that anyone who’s buying drinks might also pick up something from your no-and-low range. It’s a great time to expand.”

Malibu, the world’s No.1 white rum-based coconut liqueur (IWSR) available from Pernod Ricard UK, has enlisted the help of multi-award-winning actor Brian Cox to encourage people to ‘Clock Off’ and ditch overwork.

This comes on the heels of a new survey (One Poll) that revealed that 79% of workers across the UK, US, France, Germany, Greece, Italy and Spain regularly work overtime. Topping the table is the US, with the average worker clocking 60 hours of unpaid overtime per month, and the UK came in second with 40 hours per month.

Cox features in a new advert, sporting a bold pink suit and vintage roller skates. At exactly 17:01 pm he checks his watch, comes to his senses, and leaves the boardroom. He then skates down the boardwalk, inviting passersby to

#1 MALIBU IS THE SPECIALITY DRINK IN THE OFF TRADE MA I S S PEC DRIN K O FF

Source: NIQ Data MAT to 05.10.24 MALIBU CONTINUES TO TACKLE PLASTIC POLLUTION IN PARTNERSHIP WITH PLASTIC BANK.

The UK Deposit Management Organisation (DMO) will oversee the operation of the Deposit Return Scheme (DRS) in England, Northern Ireland, and Scotland from October 2027.

Further to the Scottish Wholesale Association’s and the FWD’s search for a wholesale representative to sit on the DMO board, Richard Booth (pictured), former Bestway trading director, was nominated to take up this position. Other directors include Jonathan Kemp, former commercial director of AG Barr and current director of Radnor Hills. Also on the board are representatives of Tesco, Lidl, Heineken and CCEP.

The board will be responsible for navigating the complexities of setting up a DRS that works for all of the market. One of the challenges is the Welsh Government’s decision to pull out of the four-nations DRS scheme – it plans to develop its own scheme independently from the rest of the UK.

The SWA and FWD will be involved in the key areas that need industry consultation.

clock off with him and release their summer selves. The advert ends with Cox sitting back in his bespoke office-style recliner on the beach, with a Malibu Pina Colada in hand.

Alison Perrottet, brand director for Pernod Ricard UK, comments: “Our mission is to make Malibu synonymous with summer, and as we all start to experience longer evenings and more sunshine, we’re reminding everyone of what’s important… Clocking Off!

“This is just the start of a whole host of activities we have planned throughout the summer months as part of the No.1 coconut rum in the UK’s ‘Do whatever tastes good platform’, which includes tapping into happy hours, sampling, and impulse activations for our ready-to-drink cans.”

Also from Pernod Ricard, there’s a fresh new look for French aperitif Maison Lillet.

Josh McCarthy, brand director at Pernod Ricard UK, says: “Consumers love the new bottle, as proven by our research, where the new pack not only delivers improved brand visibility based on its modernity but also stands out versus our key competitors.

“Following our recent collaboration with Netflix hit Emily in Paris, we think our new bottle propels Lillet to the heart of spritz occasions for our stylish audience. To ensure no one misses out, we’ve secured our biggest ever footprint in both the on and off-trade this summer.”

Pallini Limoncello, the No.1 Limoncello brand in the world by volume and value, with a global market share of about 15%, has appointed Proof Drinks as its exclusive UK distributor.

With 150 years of family history, Pallini is renowned for its premium limoncello, crafted in Italy using handpicked Sfusato Amalfitano lemons from the Amalfi Coast.

The Limoncello Spritz is now the fastest-growing spritz serve (+7pp), driven by increasing demand for unique flavour experiences and the expanding day-trade opportunity that spritzes fulfil, reports the company.

Thatchers is not only the fastest growing cider maker in symbols and independents, it is also the fastest growing fruit cider brand, fastest growing no/low cider brand and the fastest growing premium cider brand in wholesale (NIQ).

“Thanks to 120 years of experience and an expertly crafted cider range, family-owned Thatchers Cider are adding more volume and value than any other cider producer,” reports Martyn Birks, head of off-trade wholesale.

“Cans continue to be the go-to format for convenience, accounting for 60% of total cider spend,” he adds. “As people prepare to host family and friends over the warmer months, the larger packs do particularly well. We recommend stocking up on 10 packs of Thatchers Gold, which will be backed once again by a largescale ad campaign that smart stores can capitalise on.

“We’re also seeing the category impacted by retailers who have yet to review their cider fixture to reflect modern cider drinkers. When they are only stocking brands which have declined in popularity, they are losing out on possible sales. Simply updating to brands that customers are looking for and are willing to pay for, like Thatchers, can increase rate of sale and drive cash in the till.

“Make sure you have Thatchers Gold, Haze, Blood Orange and Juicy Apple mid-packs ready for the warmer weather, supported by bottles of Katy, Vintage and Zero to ensure you have something for all cider drinkers.”

year, with 67% volume growth for its 500ml can range (TWC).

The company recently launched Thatchers Juicy Apple, a refreshing, easy-drinking cider. “It’s already growing the category more in the last 12 weeks than any other brand launched in the last 12 months. In fact, it sold 70% more than the No.2 ranked brand! What’s more, early indicators show that it is appealing to younger adults and people coming to the cider category for the first time,” says Birks.

Thatchers has harnessed new channels to talk to younger audiences in ways that resonate with them, from working with leading content creators across digital channels to social media and YouTube, and investing in advertising on streaming services and video on demand.

“This is all going to continue to drive demand for Thatchers Juicy Apple, giving wholesalers and retailers the chance to capitalise on the high-profile campaign by putting Juicy Apple front and centre,” says Birks.

Crumpton Oaks is the No.1 value cider brand in the impulse channel (Nielsen), and Aston Manor has introduced two new flavours – Strawberry and Berry – to its Crumpton Oaks range.

Both variants have an abv of 4% and come in pint cans with an rsp of £1.50. They cater to a third (33%) of cider shoppers who prefer to buy cider in single-serve cans (Mintel).

The launch comes in response to the booming popularity of flavoured cider, with 40% of cider consumers now on the look-out for new flavours (DRAM). Berry flavours currently hold the largest share of the cider category (Simpsons), with flavoured cider sales in the value sector growing by 11% MAT (Nielsen).

In addition, with 66% of cider drinkers mainly drinking cider during the warmer months (Mintel), Crumpton Oaks Strawberry and Berry variants are expected to be a hit with customers this summer.

Natalie Marshall, trade marketing manager at Aston Manor, says: “Cider is a ‘go to’ drink for many, particularly as the weather warms up, and we know that consumers are always on the look-out for brand new flavours to try.

“We’re confident that Crumpton Oaks Strawberry and Crumpton Oaks Berry will offer that unbeatable taste of a refreshing fruit cider throughout spring and summer.”

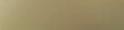

Knights Cider continues to dominate the convenience channel as the No.1 alcohol brand driving volume growth in cider (Nielsen). Knights has achieved 72% growth year on

“At Aston Manor, we pride ourselves on delivering great tasting ciders on a budget. As household budgets continue to be stretched, we’re determined to offer consumers maximum taste without breaking the bank,” says Marshall.

“By offering a well-rounded cider range that includes strong performers like Knights, Crumpton Apple, and the new Crumpton Oaks flavours, cash & carries can help their retail customers capture the summer market,” she adds.

Westons Cider is giving away a luxury holiday for up to four people to either Iceland, Hanoi, Kenya or Marrakesh. In honour of the cider maker’s 145th anniversary, there will also be over 145 summer-themed prizes up for grabs – one for each day of the competition – including bottle coolers, beach towels and speakers.

Running until August, the ‘Win a Luxury Escape’ promotion will be available on 14 million bottles and 4.5 million multipacks of Henry Westons in all retail channels. The competition will be supported by out-of-home and video-ondemand brand advertising throughout the period.

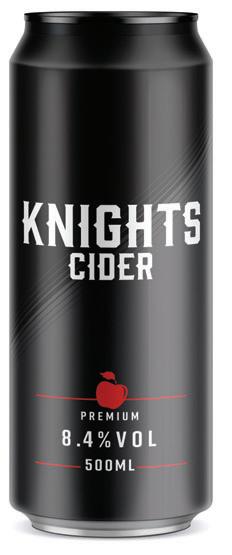

Brothers Cider, which will again be the Official Cider of Glastonbury Festival, has enhanced both the packaging and formulations of its ciders.

New-look cans feature more impactful fruit flavour illustrations and text; a ‘Naturally Fruity Cider’ banner to emphasise that the products contain only natural fruit flavours; and a ‘Born in Somerset. Raised at festivals’ banner to underpin the brand’s longstanding association with festivals.

To reflect the redesigned cans and increase the brand’s on-shelf presence, trade cases are now offered as shelf-ready packs.

Modifications to formulations provide fuller fruit flavours and a more appley taste overall. The abv levels remain the same.

It is 30 years since Brothers Cider was first served at Glastonbury, and the company’s Festival Apple Cider will again take centre stage at the 100-bar, five-day event, with other flavours in the range also being served on site.

To amplify the tie-in with Glastonbury, Brothers Cider is offering can purchasers the chance to win tickets to the sold-out event plus hundreds of other festival-themed items. Consumers enter the instant-win competition by scanning a QR code. The promotion runs until 31 May.

The UK beer category is worth £5.27 billion in the total market, with impulse, including convenience and independent stores, accounting for £1.3 billion of this total amount (NIQ).

The beer category is stable in value in the UK year on year, but volumes are declining by 2.1% (NIQ). Heineken UK delivered £39 million worth of growth to the beer category in 2024, led by Birra Moretti, Heineken and Cruzcampo.

“As tastes change and evolve, we have noticed that more customers, across all demographics, are keen to explore new styles of beer, including a growing interest in world lagers,” points out Alexander Wilson, category & commercial strategy director. “This is where innovation from familiar brands comes into play, as people are gravitating towards NPD from brands they know and trust – such as Birra Moretti’s new Sale di Mare variant.”

The low & no alcohol category has continued to attract new drinkers: 42.8% of drinkers (21.2 million) have said they are moderating their alcohol consumption in the past 12 months, an increase of 2.2 million drinkers since 2016 (Kantar). The alcohol-free category is also the fastest growing (14.6% compound annual growth rate), with an over-index with Gen Z and millennials.

Carlsberg Britvic is aiming to capitalise on this growth with the introduction of 1664 Bière 0.0% in the off-trade, following a successful launch in the on-trade at the beginning of 2025.

1664 Bière 0.0% is available in 6 x 330ml sleek cans with an rsp of £4.75.

Joining Carlsberg Britvic’s strong roster of low & no alcohol beers, ranging from Carlsberg 0.0 to Erdinger Alkoholfrei, 1664 Bière 0.0% draught has gained positive traction in the on-trade, with nearly 500 outlets already pouring. This is being further supported with a standalone branded fount for 1664 Bière and 1664 Bière 0.0%.

Carlsberg Britvic is supporting 1664 Bière 0.0% with a multi-million-pound marketing campaign across TV, out of home, social and digital display.

Dharmesh Rana, director of marketing for premium brands at Carlsberg Britvic, says: “As consumers look to moderate their drinking across different occasions, whether that’s out with friends or at home with family, it’s essential that brands provide great-tasting options that don’t compromise on flavour or sophistication.

“1664 Bière 0.0% is a perfectly balanced, flavourful and eminently sippable beer and we’re confident that this brand can go head-to-head with the market leader.”

Wilson also highlights the increasing demand for lower alcohol products. “As a result of the duty changes that came into effect in August 2023, and in line with the ongoing consumer demand for moderation in the alcohol category, we are seeing sales growth for beers that have an abv of 3.4%. We believe that this trend for moderation is here to stay.”

Last year, BrewDog identified a gap for a great-tasting mid-alcohol lager that not only met the demand for more sessionable-strength beer but also delivered value to shoppers. With its 3.4% abv making it a more affordable option, BrewDog Cold Beer is a crisp, cold lager.

“With more consumers focusing on moderation or even abstention, 43% are reducing the alcohol content of the drinks they consume, and this does not show signs of slowing (Vypr). This has led to a generational shift, with almost 40% of 18-25s not drinking alcohol at all versus 22% in 2019,” says Caitlin Brown, off-trade category development executive.

“The number of people looking to moderate alcohol consumption is similar in size to the number who consume alcohol once a week (77%) (Vypr). As a result, alcohol-free sales in the 12 weeks to 1 September grew by 17.5% value (Circana).

“Well-known, established brands such as BrewDog, which holds two of the top 10 sellers within alcohol-free beer and continues to evolve and improve its alcohol-free range, as well as product quality, will be key to this success.”

During the summer months, consumers generally reach for easy-drinking, refreshing beers that do not leave them overly full or sluggish, Brown observes. Since its nationwide launch at the start of the year, Wingman (4.3% abv) has tapped into the growing session-IPA occasion and is now the fastest growing craft beer brand (Circana).

Meanwhile, to celebrate its 18th year, Punk IPA is offering a £10 meal and pint with every purchase of promotional multipacks, available until June.

While the total value of sales in the premium ale market is down 6.4% in the past year, Hobgoblin has seen a rise in value sales of 13.9%, reports Carlsberg Britvic.

A new addition to the range is Hobgoblin Amber (abv 4.5%) in four-packs of pint cans and single 500ml bottles.

Jo Marshall, director of marketing for ales and craft, says: “Hobgoblin Amber is a refreshing and tasty ale which offers drinkers a new flavour experience.

“Amber is the best performing ale style in the market and Hobgoblin is the best performing premium ale brand, with our market share having increased from 10% of total premium ale to 12.17% in the past year (Nielsen).” CCM