Kitwave Group increased revenues by 20% to £602 million and profit before tax by 40% to £24.9 million in the 12 months ended 31 October 2023.

Gross profit margin rose to 22% during the year, while adjusted operating profit increased by 49% to £32 million. There was £30.3 million net cash generated from operations.

In the past year, Kitwave commenced construction of a new 80,000 sq ft distribution centre to fully integrate the group’s South West operations, with completion scheduled for Autumn 2024. In addition, the company acquired Wilds of Oldham, a

composite family-run drinks wholesaler, and incorporated it into the existing foodservice on-trade business, HB Clark, in November 2023.

CEO Paul Young, who will be replaced by the current chief operating officer Ben Maxted when he retires in March after 35 years with Kitwave, said: “The strong performance continues to deliver growth with sustained momentum achieved throughout FY23. All our divisions have continued to grow while managing well the inflationary pressures in their cost base that existed throughout the year.

“The successful integration of WestCountry [acquired

Adams Foodservice has reaffirmed its commitment to expansion with the appointment of Cash Patel as wholesale sales manager.

Patel joins the company from Millennium Cash & Carry’s central distribution business.

Mohammed Kola, finance director at Adams Foodservice, expressed confidence in Patel’s capabilities, highlighting his extensive industry expertise and alignment with the strategic objectives of the company in the wholesale domain.

Kola also emphasised that Patel’s appointment reflects Adams Foodservice’s dedication to enhancing its presence and performance within the wholesale market.

Established in 1985, Adams Foodservice has grown from being a local grocery store to operating nine specialist foodservice cash & carries across the UK. The Bradford-based familyowned wholesaler has a turnover of over £80 million and serves a variety of customers. It also has its own logistics business.

Adams Foodservice joined Confex earlier this year.

in December 2022] into the Foodservice division demonstrates the value of our buy-and-build philosophy, with the group continually assessing acquisition opportunities to combine with our

initiatives to drive organic growth.

“While we have now acquired and successfully integrated 13 businesses since 2011, the board believes there remain a large number of opportunities available to us in what is a fragmented delivered wholesale market in the UK.

“In addition to acquisitions we also seek operational improvement. The new distribution centre is an example as it will be key to increasing the efficiency and capacity of the group’s South West operations.”

Young concluded: “We are confident of another positive trading period in 2024.”

Bidfood has released its latest Pub Kitchen Club guide, ‘Unleashing Your Menu’s Potential’ in which it explains how focusing on premiumisation and adding value will attract more customers and encourage spend.

More than 600 pubs permanently shut their doors in 2023, resulting in a 10.4% drop in sites since March 2020 (CGA & Alix Partners). Besides having to operate in a tricky market, still recovering

from the pandemic, pubs must adapt constantly to meet the ever-changing demands they face from consumers.

Featuring detailed insight and advice from Bidfood’s culinary development chefs, ‘Unleashing Your Menu’s Potential’ offers publicans tips on how to leverage the premiumisation trend and the small tweaks and special touches they can make to stand out from the crowd.

The guide shares ideas on engineering a more profitable menu, product recommendations and a bank of recipes.

Joe Angliss, head of customer marketing, said: “We hope the launch of ‘Unleashing Your Menu’s Potential’ will inspire pub operators and arm them with the tools they need to increase footfall and ultimately margin, to help better secure their future.”

Sysco has announced plans to create its largest depot in Europe – in Hemel Hempstead – designed to offer a nextgeneration service to foodservice businesses across London and the South East.

Sysco is initially investing $100 million in the new 475,000 sq ft site, which will be the first in the UK to benefit from the complete suite of technology and proprietary software currently in use at Sysco’s wholesale distribution operations in the United States. It is scheduled to be fully operational by the beginning of 2026.

As well as the benefits in customer service that the technology brings, the new premises will add significant additional capacity to the existing network in the South East and aligns with Sysco’s ambition for growth in Great Britain.

The introduction of the depot will allow Sysco to store a more comprehensive range of fresh, frozen and ambient products locally, providing a faster response to customer demand.

Sysco will spend the next 18 months adapting the former Amazon site in Hemel Hempstead to make it suitable for foodservice operations. This will include the introduction of frozen and chilled areas and sustainability improvements.

Paul Nieduszynski, CEO ofSysco GB, said: “The new Sysco London depot is a next-generation site, unlike anything we’ve seen before. As the largest Sysco site in Europe, it will offer a more comprehensive service to independent customers in London and the surrounding areas.

“The combination of scale, cutting-edge technology, range and service will set a new standard for foodservice wholesale in the UK.”

Over the next 10 years, the new site will help to

contribute to the creation of 850 jobs.

In other news, Sysco GB has partnered with Nutritics to introduce its Foodprint solution for Brakes customers, bringing carbon labelling within the reach of thousands of food firms across the UK.

Foodprint, the fully automated environmental impact scoring system for the hospitality and foodservice sector, allows customers to track, manage and publish the water and carbon impact of their menus and will become part of Brakes’ Virtual Chef concept.

The new tool can be used to develop more sustainable menus and shared with an increasingly engaged consumer audience, empowering them to make choices based on the impact of a particular dish.

Glasgow-based wholesaler JW Filshill has restructured its sales and development team with the internal promotions of Shirley Ruane and Elaine Feeney to the newly-created positions of sales managers.

Ruane, who has been with the business for eight years as regional development manager, has assumed responsibility for the west of Scotland and northern England territories. She also takes charge of Filshill’s click & collect operation.

Meanwhile, Feeney, who joined the business nearly four years ago, has responsibility for the east and north of Scotland territories, including the islands.

Announcing the news on

International Women’s Day, Craig Brown, chief sales & marketing officer, said: “This is the perfect time to announce these appointments and celebrate the success not just of Shirley and Elaine in progressing their careers with Filshill but also the many other inspirational women within our business.

“We are an inclusive, welcoming wholesaler and embrace diversity across all areas of the business and we have worked hard to send out a strong message that Filshill is a modern employer that offers career progression to those who want to challenge and develop themselves, regardless of gender.”

Booker Retail Partners has renewed its partnership with Rontec for a further five years, supplying the Shop’N Drive estate across the country.

Rontec chairman Gerald Ronson said: “As one of the leading players in the UK forecourt industry, we are pleased to extend our relationship with Booker Retail Partners. We have worked with them across our network since 2015.”

Booker CEO Andrew Yaxley added: “Shop’N Drive was the first national forecourt chain we supplied, and as they head towards their 60th anniversary, we look forward to offering them the best choice, price and service for many years to come.”

Direct Traders and Jambo Supplies have joined Sugro.

Based in Brentwood in Essex, Direct Traders has been trading since 2012, supplying a wide range of food and non-food products to the hospitality sector.

Nadeem Iqbal, director of Direct Traders, said: “This partnership marks an important milestone for us, as it will empower us to better serve our valued customers by providing access to a wider range of high-quality products and resources at competitive prices.”

Jambo Supplies is based in Aylesbury and has over 30 years of trading history, supplying a wide range of nonfood products, including over-the-counter medicines, haircare and skincare, to C&Cs and delivered wholesalers.

Joining Sugro marks a step towards Jambo Supplies’ ambition to expand its stock of confectionery, crisps & snacks, soft drinks, groceries and toiletries.

In other news, Sugro has partnered with Add Vision to provide members and their retail customers with digital signage solutions, including PoS screens, menu display boards, window display screens, and indoor and outdoor LED screens.

Pilgrim Foodservice, of Boston, Lincolnshire, is set to open a new depot in Colchester this spring, enabling the family-run wholesaler to expand its operations across Essex, Suffolk and London.

The £3 million project includes demolition of two existing structures, allowing for the construction of a new purpose-built warehouse with seven loading docks.

The new Colchester depot forms part of the company’s £11.5 million investment strategy, which also includes recruiting and developing its people, upgrading operating systems, and enhancing facilities at the company’s Boston site. In addition, the wholesaler is renewing and expanding its fleet.

The Colchester depot is expected to create over 20 jobs locally; these include a depot manager role as well as Class 2 HGV drivers.

MD Charles Bateman said: “The opening of our first satellite depot marks another step forward for our growth plans. The addition of this depot will support our

vision and ensure we continue to provide our customers with the finest products and first-class customer service.”

In other news, six Pilgrim Foodservice employees participated in Peterborough’s Big Sleep Out event, raising more than £3,500 for two good causes and increasing awareness of homelessness.

Hancocks in Portsmouth has been relaunched following a six-figure investment in the premises, while the company’s depot in Avonmouth, Bristol, has benefited from a fresh new look.

The Portsmouth depot was closed from 22 December to 7 January for the major renovation, which included improvements to the floors, roof, heating, offices, IT systems and decor. A relaunch event was held on 29 February.

Both the Portsmouth and Bristol stores are now laid out in a familiar supermarket format, with directional signs on top of all aisles.

There are clearer signs, branded aisles and specialist areas to provide easier instore navigation. These feature bestsellers, multi-buy

options, new products, vegan sweets and kids novelty. Larger brands also have dedicated sections.

Current deals can be found from the QR code on the welcome board or in the sweet deals area near till points, alongside a large clearance section.

Customers can also find some try-before-you-buy lines and ‘look what’s in the box’ products.

The Bristol depot is the

second Hancocks store to undergo a refurbishment and the Portsmouth depot is the third. Hancocks is hoping to roll out the improvement plan to all of its 14 stores.

In other news, World of Sweets has become exclusive distributor for the energy drink Sneak. Launched in 2018 in the UK and US, Sneak is particularly popular with the gaming community and now claims the direct-toconsumer No.1 slot.

JJ Foodservice has opened a new branch in Wimbledon, London.

Designed with a focus on sustainability, the facility boasts solar panels and electric warehouse vehicles. The site includes a 33,965 sq ft warehouse and 3,950 sq ft of modern offices, and is the 12th branch in the company’s growing UK network.

Customers can place orders online for delivery or same-day collection.

Chief operating officer

Kaan Hendekli said: “Our expansion into Wimbledon has not only created new jobs but is also providing the community with access to fresh, frozen, ambient and chilled products, alongside packaging and cleaning solutions, all at wholesale prices.”

Branch manager Mehmet Direkoglu added: “This branch is not just a business venture; it’s a commitment to supporting local needs.”

In other news, JJ has launched 12 dedicated

microsites to cater to various foodservice sectors, including pubs, hotels, schools, hospitals and care homes.

The microsites enable shoppers to discover products and services tailored to their specific business needs.

Coinciding with the launch, the wholesaler has introduced a ‘World Food Asia’ range to target South, East and Southeast Asian menus. Products range from Thai jasmine rice and Udon noodles to bao buns, banana leaves and Japanese egg plant. Over 30,000 brochures are being distributed to prospective customers.

In recognition that education and care sector chefs are under continued cost pressures, the Country Range Group has launched a new Catering Essentials brand.

Available via the group’s 13 independent wholesale members, the Catering Essentials brand aims to provide a range of essential products at low prices.

There are initially 15 products deemed crucial to kitchens in the cost sector, but more lines will be added this summer. The initial lineup includes store cupboard items such as tomato ketchup, mayonnaise and baked beans, freezer products such as frozen peas, mixed vegetables and beef burgers, and classic sweets like Chocolate Fudge Cake and Victoria Sponge Cake.

Harlech Foodservice is to open a new depot at Carmarthen as part of a £6 million expansion plan. The premises will be open by Easter.

The wholesaler, which has other bases in Criccieth, Chester and Merthyr Tydfil, will be creating a total of 150 new jobs, with 15 of them at the new site.

Harlech has already appointed Nick Sullivan as regional sales manager for the patch. He was previously head of sales for Bidvest Foodservice, and in total he spent 23 years with Bidfood.

Harlech is also in the process of recruiting five field sales staff and nine drivers to work in the area.

Opening the new

Carmarthen depot was spurred by the company’s growth over the past three years – it has seen sales increase from £32 million to around £50 million, with profit at an all-time high of more than £2 million.

Managing director David

Cattrall said that the company is keen to respond to the challenges faced by hotels, pubs and restaurants with next-day deliveries and ‘aggressively competitive’ prices.

Harlech has extended its ‘Trust Our Prices’ campaign,

slashing prices and undercutting its competitors by up to 38%.

The company announced the price drive at its two-day Food Expo for trade customers at Venue Cymru in Llandudno where record sales topped £1 million.

One hundred lines have been added to Harlech’s price comparison package as part of its ‘Trust Our Prices’ initiative, with 390 top-selling lines now benchmarked against competitors’ prices.

Cattrall said: “We’ve done the price comparisons so our customers don’t have to, and we’re nearly 40% cheaper than the biggest foodservice company in the UK and 15% cheaper than our biggest rival in Wales.”

Bestway Wholesale has added more than 1,500 lines to the range available to delivered, collect and online customers. It has also enhanced its online customer journey.

At depot level, it continues to focus on listing regional lines as part of its strategy to respond to retailers’ local community demands.

MD Dawood Pervez said that Bestway has also been reviewing its Best-one ownlabel and will be making announcements soon about the range, “giving further opportunity to retailers”.

In other news, Bestway

Retail has entered into a new long-term partnership with Penny Petroleum, the fifth largest independent petrol forecourt operator in the UK.

Over the last three years the partnership between Bestway Retail and Penny Petroleum has been focused on optimising the offer to 11 forecourts and retail stores. The new agreement sees a further 57 stores joining Costcutter.

As part of the agreement, Penny Petroleum will be rebranding its sites to Penny on the Move.

a More than 800 retailers are expected to attend Bestway’s Retail Showcase 2024, which will take place at the Coventry Building Society (CBS) Arena on 15 May.

Parfetts achieved a 6.7% rise in turnover to £646 million in the year ended 30 June 2023. Operating profits were up by 51% from £5.6 million to £8.5 million.

The employee-owned wholesaler has rewarded staff over the year with a record 10% pay rise and an overall 14% bonus.

The wholesaler attributes the success to focusing on increasing customers’ profits

through developments in its retail offering, relevant product ranges including the Go Local own label, and more frequent promotions.

The profits will be invested back into the business with the continued expansion of its delivery network, depot operations and symbol estate.

In other news, Parfetts has expanded the capabilities of its app, which now sees 15,000 users per week.

The app uses artificial intelligence (AI) to anticipate retailers’ requirements and suggest the most appropriate products and best offers.

Users can scan barcodes to load products straight into the shopping basket from the shelf. Parfetts has seen online orders increase by almost 10%.

Regal, a wholesale distributor of paper, household, grocery, janitorial, toiletries and health & beauty products, has revealed a fresh new look as a key part of its ambitious growth plans.

In addition, the company has appointed Jon Hunt in the newly created role of commercial director to spearhead growth in the distribution channel.

Hunt (below) was previously sales director at VBites which entered administration

in December 2023 due to a declining vegan market but he primarily spent his career leading the wholesale and foodservice channels during an 18-year spell at Kellogg’s and Upfield. Other roles in the food and drink industry include commercial positions at All About Food.

Regal owner and MD Chris Hughes said: “This is an exciting time for Regal and I’m sure Jon will be a great asset to the business in achieving our ambitious growth strategy and in developing the sales and marketing teams.”

Regal is also collaborating with a number of suppliers in the household, professional and health & beauty categories to offer a broader and more competitive range.

Most recently, it has announced a partnership

with Reckitt Pro Solutions to distribute its global brands –including Finish, Dettol and Cillit Bang – within the wholesale and professional channel, with a particular focus on HoReCa sites and operations.

Established in 1984, Regal started life by supplying paper products to independent retailers in Merseyside.

The business has grown considerably since then and now supplies thousands of customers with a wide variety of branded goods and distribution services, turning over more than £20 million per year.

Regal operates from a 45,000 sq ft warehouse and distribution centre in Bromborough, Wirral.

awards last month.

Scotland’s most innovative, forward-thinking and resilient wholesalers were recognised last month at the Scottish Wholesale Achievers awards. The top suppliers were also honoured, in acknowledgement of the importance of strong and progressive business relationships.

Some 520 guests attended the Achievers awards dinner, hosted by TV sports presenter Amy Irons, at the O2 Academy Edinburgh.

Now in its 21st year, Achievers is organised by the Scottish Wholesale Association and highlights excellence across all sectors of the wholesale industry.

SWA chief executive Colin Smith said: “Achievers has evolved since its launch 21 years ago and I am proud that it remains one of the premier wholesale industry events in the UK.

“We stand out because Achievers has retained its clear point of difference as the only awards scheme for the wholesale industry that has an independent judging panel. It is this transparency, and our willingness to listen to feedback from wholesalers and our supporting suppliers alike, that gives us a high standing in our sector.”

He continued: “Of course, without our suppliers there would be no Achievers and that is why this prestigious event is as much for them as it is our wholesalers. It’s all about people and collaboration.

“I’ve spoken before about how resilient wholesale is and you don’t need me to remind you of the challenges we have faced in recent years –and more recent issues that certainly don’t make running a wholesale business any easier.

“So, it’s only right that we celebrate our industry – whether it’s retail, hospitality, tourism, sustainability, economic transformation, or health and wellbeing – with the SWA’s wholesale and supplier members but also our colleagues and partners from across industry, and from within the Scottish Government.” CCM

Great Place to Work: Costco Wholesale

Best Cash & Carry: United Wholesale (Scotland), Queenslie

Best Delivered Operation – Retail: CJ Lang & Son

Best Symbol Group: SPAR, CJ Lang & Son

Best Delivered Operation – Foodservice: Faílte Foods

Best Licensed Wholesaler: United Wholesale (Scotland)

Best Innovation: Bidfood

Community Service Award: CJ Lang & Son

Sustainable Wholesaler of the Year: Booker

Best Marketing Initiative: Brakes

Employee of the Year: Paul Ellwood, Faílte Foods

Rising Star of Wholesale: Kelsey Brannan, Brakes

Wholesale Local Food Champion: Mark Don, Braehead Foods

Best Advertising Campaign: Tennent’s ‘Raised in Scotland – OOOFT’

Best Overall Service: JTI

Best Foodservice Supplier: Mrs Tilly’s Supplier Sales Executive of the Year: Tiffany Emmett, Budweiser Brewing Group

Local Supplier of the Year: Clootie McToot

Project Wholesale: AG Barr

At the Unitas trade show and awards held earlier this month, Cash & Carry Management caught up with the group’s managing director John Kinney.

How has Unitas performed in the past year?

2023 was another great year for Unitas and its members. We continue to outperform the market in all the channels that our members operate in:

a Retail value +7.2% versus market +3.35%

a Foodservice +21.8% versus market +5.4%

a On Trade +7.5% versus market -0.6%

What have been Unitas’ most recent developments and what’s coming up?

Everything we do is to create a fitter, fairer and faster organisation for all of our members.

Helping our members reduce operating costs is one of Unitas’ strategic pillars and working in an exclusive partnership with Auditel we’re delighted to have just announced the many cost saving services available now from Unitas Procurement Services.

Our members now have access to a free to use, no obligation service that can negotiate them rates on overhead purchases including energy supply, stationery and agency staff. Early trials have been incredibly positive, with United Wholesale (Scotland) reporting savings of over £20,000 a month.

We will continue to focus on growth through value, through our own-label offering, stronger branded promotions, and competitive PMPs with an acceptable shared margin.

We’re also supporting members with a number of different services including central invoicing to boost efficiency, simplify operations, and improve speed

and accuracy. Our supply chain optimisation programme will aim to unlock value chain benefits for all and drive efficiency through the line, improving margin and cash flow and product availability for our members.

How well has Local Living been received by your members?

The response to Local Living has been incredible so far. It is really important to us that we provide our members with a strong range that meets their needs on both value and quality. We created Local Living in collaboration with them for that reason.

We’re still in the transition phase, with 90 Lifestyle SKUs being moved into Local Living, and early sales are very encouraging.

We’ll be doubling the range this year, backed by a six-figure marketing investment.

With all the movement in the buying groups sector, how confident are you that Unitas will be able to retain existing members and attract new ones?

Supporting our members to grow their business is at the heart of everything we do at Unitas. We pride ourselves on being a true champion of independent businesses. The incredible growth figures we’ve talked about show that our strategy is working.

We’re not on a recruitment drive for new members right now; our focus for 2024 is to keep improving what we’re doing for current members. We will continue to work with them to help them compete effectively in their marketplace, because we’re stronger together.

You have said that Unitas is able to provide the most competitive trading terms and promotions in the industry. How do you measure this?

Our scale as the biggest buying group allows us to negotiate competitive trading terms and provide valuable promotional support to members. We continually monitor the market place to ensure our members are receiving the best deals.

It is imperative for our wholesalers to trade competitively during these challenging economic times – this allows them to provide the right range and deals for their customers which not only drives footfall through cash & carries but also increases orders across their ordering platforms.

You seem to have had a big shake-up of the head office team. Why did you feel this was necessary?

Over the last few years, we have repositioned Unitas to become a truly member-centric organisation, putting the members at the heart of all that we do to drive improved and incremental revenues.

In the last three years we have seen a 35% increase in the revenues returned to our members, testament to how working together makes us stronger, more effective, and more efficient. Our people are our greatest asset and this performance has been delivered by ensuring we have the very best people in our organisation. CCM

Parfetts, RD Johns and Wilds Premier Drinks Distributor were the big winners at the Unitas Connect Awards, claiming the Retail, Foodservice and On Trade Wholesaler of The Year 2023 titles.

Pricecheck International Brand Partners took home both the Standard/Specialist Wholesaler of the Year accolade and the award for Digital Innovation.

Unitas’ annual celebration of its members’ and suppliers’ achievements over the previous year took place during connect24, the group’s biggest ever trading event, held at the Liverpool Exhibition Centre. Over 650 people attended the awards dinner, which was hosted by television presenter Stephen Mulhern.

The scheme was renamed the Connect Awards for this year to emphasise successful partnerships with the Unitas Support Centre and the services it offers to wholesalers and suppliers.

Other wholesaler winners included Lomond the Wholesale Food Company in the Environmental & Sustainability category.

The evening’s only individual award, Members’ Employee of the Year, went to Dee Bee Wholesale’s impulse buyer Lewis Dyson. Described as a rising star by his company, the judges said Lewis ‘demonstrates the skills and ability to thrive as an innovative leader in wholesale, and a comprehensive understanding of what makes our sector unique’.

Among the suppliers rewarded for

their work with Unitas members were Heineken UK, which won both the Licensed and On Trade Supplier of the Year awards. KP Snacks received the Impulse Supplier trophy, while the prize for Grocery Supplier of the Year went to Nestlé Food & Beverages.

The evening also saw special recognition given to four stalwarts of the wholesale sector: Jason Stocker of Nestlé, Steve Pugh of Heineken UK, Arthur Yule of Ceuta, and Jitu Dattani of Dhamecha.

Unitas managing director John

Kinney told the attendees: “It’s been amazing to have over 800 people in the halls today, doing deals, discovering new lines and making new connections.”

He added: “Tonight’s awards celebrate the best of last year’s connections – it’s these partnerships between our members, our suppliers and the brilliant team we have in our Support Centre that set the template for success in wholesale.”

The evening raised £23,000 for Bluebell Wood Children’s Hospice in Sheffield. CCM

What have been your biggest achievements in work and outside work?

One achievement I am particularly proud of in my role at Freemans Event Partners is succeeding in building high performing and collaborative teams. Developing people from within, bringing external experience and melding this altogether is something that can make a huge difference and has always been a key area of focus for me.

The Covid-19 pandemic decimated the events business and Freemans Event Partners operated with a skeleton crew to keep the business afloat. In 2021, while the world was reopening, we were given six weeks to put on the biggest ever Formula 1 British Grand Prix. I was extremely proud of our team who rose to the challenge and delivered operational excellence in really difficult circumstances.

Personally, my biggest achievement is my three exceptional daughters who have become strong independent women.

Who has been the biggest inspiration to you?

In the business world, the first senior director I worked with, Diane Carter, taught me what hard work was about in

the retail trade. She was hard on me for the right reasons, as she knew I had it in me. From a personal point of view, my parents are my real inspiration. My mum battled through adversity, and I lost her at a young age, and my dad raised three energetic boys as a single parent while juggling his own career. I have so much admiration for both of them.

What were your ambitions when you were growing up?

I wanted to be either a barrister or a history teacher. I firmly believe that learning from the past can help us make better decisions for the future. As it turns out, I started my career at Sainsbury’s when I saw an advert at the back of the newspaper for a logistics position. This year is my 30th anniversary of leaving university and starting my career. Since then, I have worked with most product categories but my passion has always been wines & spirits, and I have met some amazing people along the way. I truly believe I have the best job in the world!

What are your interests outside work?

For the past 30 years, I have always been on the road. However, my wife, children, close family and friends are

the most important part of my life. I have the same friends from when I was 12 years old. My passion is cooking, which comes from 20 years in the wine industry, and I make a mean paella. My secret ingredient is good wine for the pan and a few glugs for the cook!

How would you describe your personality?

I’m an approachable, honest, very personable and business-driven individual. I also think trustworthiness is key to building strong relationships. It is my view that work should be fun – it is where you spend a large part of your life so whatever you choose, you need to make sure you enjoy it.

What is your favourite film, book and song/piece of music?

Film: The Jungle Book as it evokes fond memories from my childhood growing up in Africa. Book: The Prize by Daniel Yergin – a history of the world through the acquisition of oil. Piece of music: Just The Way You Are by Billy Joel. It was my wedding day song with my wife.

What would people be surprised to know about you?

I was born in Zambia (I am clearly a Pom now though!) and I used to be a pretty proficient water polo player. CCM

After graduating from the University of the West of England with a degree in Social Science & History, Tim Hobbs took a logistics job at Sainsbury’s in 1994. Since then, he has worked in a number of sales and procurement roles for international FMCG and start-up businesses across the globe. These include Hardy’s Wine, Constellation Europe, Accolade Wines and Enotria. Hobbs joined Freemans Event Partners in 2021 in his current role of director of foodservice. Based in Gloucester, Freemans is a Confex member.

Money may be tight for shoppers but affordable treating is being embraced in convenience, showing encouraging growth in both sweet and savoury segments.

Snacking continues to be a vital category for the convenience channel, with PMPs, flavour extentions and healthier options driving an exciting pipeline of NPD and merchandising options to help retailers make the most of the opportunities.

In the sweet snacking segment, pladis highlights the need for wholesalers to ensure they are stocking new incremental purchase boosters alongside established best-sellers.

“For wholesalers, striking the perfect balance for biscuits involves juggling the timeless classics that consistently fly off the shelves and creating space for exciting new releases that will help retailers ignite those spur-of-themoment purchases,” says Aslı Özen Turhan, chief marketing officer. “Just last year the category surpassed the £3 billion mark for the first time and it’s a pivotal area for wholesalers to master, valued at £273 million in convenience alone (Kantar).

in snack pack and sharing pouch formats. At the premium end, this year has seen the introduction of McVitie’s Victoria Chocolate Orange Dreams and McVitie’s Victoria Chocolate Creations Gifting Pack.

“We take immense pride in the fact that McVitie’s products dominate five out of the top 10 bestsellers in convenience, featuring classics like McVitie’s Milk Chocolate Digestives, McVitie’s Jaffa Cakes, McVitie’s Milk Chocolate Hobnobs, McVitie’s Original Digestives, and McVitie’s Rich Tea. With £1 out of every £4 spent on a top 10 brand, wholesalers who aren’t keeping pace with the latest products might be missing out on a significant sales opportunity,” says Özen Turhan. “However, it’s really all about balance and it is equally vital to allocate space in depot for NPD to inject excitement into the category.”

Fox’s Burton’s Companies UK has also launched NPD to cater to on-the-go and sharing formats with its Fox’s Party Rings Choc Minis multipacks for lunchboxes and portion-controlled treating and the Fox’s Fabulous Chocolatey Indulgent Centres for big night in luxury affordable treating.

‘For wholesalers, striking the perfect balance involves juggling the classics that consistently fly off the shelves and creating space for new releases that will help retailers ignite those spur-of-the-moment purchases’

Aslı Özen Turhan, pladis’ chief marketing officer

An NPD pipeline plays a significant part in the ongoing strength of the McVitie’s brand in the biscuits category. “As the leading biscuit brand in the UK, McVitie’s should be front of mind for depot managers when making stocking decisions. Our biscuits are a household staple for more than three-quarters of UK households and our line-up of top sellers, coupled with a consistent flow of demand-driven new products, is what sets us apart,” says Özen Turhan.

In the past year the NPD included McVitie’s White Chocolate Digestives – available in a convenience-exclusive £1.99 PMP – and McVitie’s Jaffa Cakes Rockin’ Raspberry.

Catering to the on-the-go market, McVitie’s Digestives Milk Chocolate Minis were introduced

“Our responsible approach is important as a manufacturer of leading treat brands. We will continue to offer a variety of products in a range of formats that help our consumers make responsible choices and enable them to enjoy treats as part of a balanced diet. We believe that a focus on portion control and responsible treating is the best approach,” says Colin Taylor, trade marketing director.

Fox’s Rocky now has an Orange variant in its line-up and the brand is worth just under £30 million. With every Rocky bar coming in at less than 100 kcal, the message that responsible treating is a manufacturer priority is evident.

The stubborn continuation of economically challenging times is also shaping shopper choices and supporting the growth in sweet biscuits. “Shoppers in the UK have shown that they see the value in biscuits, as we have seen in the growing ‘premium treat’ segment, which is worth £297 million a year and growing by 16% year on year (NIQ/Kantar). Shoppers are looking for an affordable luxury and biscuits provide an accessible treat,” maintains Taylor.

St Pierre Group is also highlighting premium affordable treating as a route to sales growth. Last year saw the introduction of its St Pierre Belgian Waffles.

“St Pierre’s new products are driven by insight, in response to the huge role premiumisation is playing in the bakery category, and the demand for premium products that is now being felt across all sub-sectors,” says Louise Reynard, customer development director.

“Waffle consumption increased in 2020 with the arrival of lockdown and greater demand for variety in breakfast and at-home snacking. Those consumers are still looking for elevated meals, and our new St Pierre Belgian Waffles will appeal to the increased number of adults looking for indulgence.” The range comprises Belgian Waffles with Butter and Belgian Waffles with Chocolate Chips, now available in a multipack.

“Depending how their depots are laid out, wholesalers should stock our products in the dedicated bakery section, and, if possible, dual site them in fresh food sections with other ‘eat now’ items. For maximum impact, wholesalers should put our brand power to work in their depots with our merchandising material and on their customer-facing websites with our branding,” advises Reynard.

“At the same time, wholesalers’ development teams should encourage their retailer customers to take cues from foodservice and approach the hot drinks machine and the bakery fixture as a food-to-go destination.”

Mars Chocolate Drinks and Treats has capitalised on the Maltesers brand to draw consumers to the sweet snacking segment. Maltesers Cake Bars have a retail sales value of £3.9 million per year and this figure looks set to increase with the recent launch of Raspberry Maltesers Cake Bars.

The NPD joins the Milky Way, Galaxy and Galaxy Caramel cake bars already on the shelves.

“We believe that the strength of the Maltesers brand is attracting new shoppers to the cake bar aisle,” says Michelle Frost, general manager. “We are confident that our new Raspberry Maltesers Cake Bars will continue to add incremental growth to the category.”

Crisps and savoury snacks are a staple of the convenience channel, worth £1.4 billion in sales (Nielsen). The versatility of the category has aided the 17.9% growth and enables convenience retailers to utilise multiple merchandising opportunities. In addition, many suppliers have worked to include a comprehensive HFSS-compliant range that can overcome the recent restrictions and appeal to the increasing demand for mindful snacking.

Pladis has seen strong sales of its £81.8 million Jacob’s Cheddars range (Nielsen), boosted by the addition of Jacob’s Cheddars Red Leicester and Jacob’s Cheddars Cheese & Pickle. “Cheese-flavoured snacks in particular are a key flavour profile for savoury snacking enthusiasts. Our research indicates that Cheddar-based flavours consistently achieve strong purchase levels, making them a pivotal choice for retailers aiming to engage and delight shoppers and therefore a must-stock for wholesalers,” says Aslı Özen Turhan, chief marketing officer.

“Our Jacob’s Cheddars Red Leicester has seen an impressive 62% of Cheddars shoppers exclusively choosing this flavour since its launch, emphasising the significance of introducing flavour extensions to boost incremental sales for the category.”

KP Snacks has long been investing in the healthier snacks segment and its current media campaign continues this work. The activity, to highlight the flavour credentials and low calorie count of its Hula Hoops Puft range, runs until mid-July across out-of-home and social media channels.

“As a responsible snacks manufacturer, KP Snacks is committed to providing permissible products for consumers,” says Dayna Riordan, brand manager.

The Hula Hoops Puft brand, which has a current value of £9.3 million, is now available in a Cheese & Onion variant.

In the same healthier snacking segment is KP Snacks’ popchips brand, which is also benefiting from media investment. The campaign, which runs until the start of April, is forecast to reach 41 million people.

Formulating snacking products to be HFSS-compliant has been a priority for many manufacturers. Kellanova is expanding its Pringles line-up with a new, trend-led Hot range, with the majority of the NPD being non-HFSS.

The five variants are Flamin’ Cheese, Mexican Chilli & Lime, Smokin’ BBQ Ribs, Kickin’ Sour Cream and Sweet Chilli. Only the Sweet Chilli variant is not HFSS compliant. The new offering is replacing the Pringles Sizzl’N sub-brand, which was launched in 2021.

“We know our shoppers love spicy flavours, as we saw with our Sizzl’N range. Pringles Hot is the next evolution and allows retailers to capitalise on the demand for more spicy offerings,’’ says Beth Johnson, senior activation brand manager.

Envis Snacks is also bringing punchy flavours to bold consumers with the launch of Crunchips X-cut Red Chilli and Crunchips X-cut Sour Cream scheduled for May.

“As always, we will be focusing our efforts on maintaining good availability on our best-selling lines so that wholesalers and retailers can be sure they will be available and can concentrate on getting appropriate new lines to help drive incremental sales and maintain shopper interest,” says Andy Brown, director.

He adds: “Wholesalers can preorder now to be ready to maximise the incremental sales these lines are sure to offer.”

The supplier has already added new lines to the Lorenz brand with Curly Mexican – the spicy version of the best-selling Curly Classic – and Crunchips Roasted BBQ Sauce.

PepsiCo has unveiled non-HFSS NPD: the Walkers Sensations range is now available in Mature Cheddar & Chilli Chutney and Crushed Sea Salt & Black Peppercorn variants.

“This is in line with our target that 30% of snack sales come from non-HFSS products and an additional 20% from products sold in portions of 100 kcal or less by 2025. This forms part of PepsiCo Positive, our strategic end-to-end transformation plan with health and sustainability at the centre,” says Wayne Newton, senior marketing director.

In other news, the Walkers Hero 25 PMP SKUs are moving from cases of 15 to cases of 18. “PMPs continue to be of great importance to convenience retailers. For a long time, this format has been the catalyst for growth in the savoury snacking category,” says Mike Chapman, head of wholesale.

Fairfields Farm has an extensive range of premium crisp flavours, all of which are vegan, gluten-free and dairy-free. The supplier uses home-grown potatoes and seasonings created from natural flavourings, satisfying the increasing consumer demand for responsible sourcing.

Varieties range from classics such as Cheese & Onion and Lightly Sea Salted to meaty meat-free flavours including Roast Rib of Beef, and Bacon & Tomato.

For Tayto Group, the high protein content of its Mr Porky and Midland Snacks pork snacks is proving to be a draw for consumers. “Pork snacks deliver on high protein demand and on taste. With a rich flavour and a crunchy texture often lacking in other meat snacks, they are the perfect on-the-go high protein snacking choice, ideal for that mid-afternoon slump, a pre or post-workout snack or simply along with an evening drink,” says Matt Smith marketing director.

“With 20.7g of protein and only 0.1g of carbs per 35g pack, Crispy Strips are the protein-packed porky snack. Consumers rate them 8.9/10 for taste (TRIY IT), and Crispy Strips received a Great Taste Award, proving that they really deliver on taste.”

Tayto’s Golden Wonder brand is driving sales with the £1 price point highlighted on a large selection of its portfolio. The extensive £1 PMP range – kept at this price as a marketing strategy – now includes Saucers. The 3D lattice snacks are available in Barbecue and Prawn Cocktail flavours.

The supplier advises wholesalers to meet the increasing popularity of low price-point PMPs, which continue to attract shoppers in the convenience channel with the assurance of value at a time when money is tight. As well as the £1 PMP for sharing snacking, Golden Wonder has an entry-level 35p or ‘2 for 60p’ PMP multibuy range.

Meanwhile, Marmite has teamed up with Tayto Group to launch a new Marmite-branded portfolio of crisps and snacks. Marmite Crisps (65g) and Tortillas (70g) are both available as £1.25 sharing PMPs.

Smith commented: “We are delighted to be working again with such an iconic British brand and are we are especially excited to be bringing Marmite tortillas to the convenience channel ahead of this product being available in other channels.” CCM

Now in its seventh year, the prestigious CCM Chefs’ Own-Brand Awards is run by Cash & Carry Management magazine, in association with the Craft Guild of Chefs.

We know the care and passion that goes into creating a successful own-brand. It doesn’t just happen by magic: development chefs and supply partners work hard to bring exceptional products of excellent quality and great value to market – products that are driven by customer need and provide innovation in many categories.

These awards give cash & carries and delivered wholesalers whose own-brand products hit the mark the recognition they deserve, with endorsement from the Craft Guild of Chefs – the leading chefs’ association in the UK – who conduct the judging in blind tastings.

Entries are open for products in all categories at a cost of £130 plus VAT per product, with one free for every 10 products entered.

The closing date for entries is Friday 12 July 2024. The products must be delivered on the date and to the delivery address that will be confirmed on receipt of your entry. Judging will take place in August and the winners will be announced at a prestigious awards lunch on Tuesday 7 January 2025.

For further information, contact Martin Lovell on 01342 712100.

Best Innovation of the Year – Savoury

Best Innovation of the Year – Sweet

Are your own-brand theproducts best in foodservice?

Afternoon Tea: scones, cakes, sweet bakery, muffins, doughnuts, cookies, traybakes

Antipasto

Bakery: baguettes, artisan, bread, rolls, petit pain, burger buns, hot dog rolls, dough balls, tortillas, bagels, ethnic bread, savoury hand-held, pies, pasties

Baking

Biscuits

Butchery: poultry, beef, pork, lamb, game

Butter, Fat, Spreads

Canned: vegetables, beans, tomatoes, fruit, fish, meat, lentils, pulses, noodles

Cereals

Cheese

Children’s Selection

Chocolates, Mints, Petits Fours

Cleaning Products

Cooking Sauces

Crisps & Popcorn

Delicatessen: sandwich fillings, salads, pesto, dips

Desserts: sponge puddings, crumbles, tortes, gateaux, trifles, pies, tarts, flans, pancakes, crepes

Egg Products: omelettes, tortillas, souffles, quiches, Yorkshire pudding

Fish & Seafood: fishcakes, scampi, breaded fish, battered fish

Fork Buffet: canapes, Oriental, buffet bites, mini desserts

Frozen Vegetables & Fruit

Gluten-Free

Gravies, Stocks, Bouillons, Jus

Hot Beverages: tea, coffee, hot chocolate

Ice Cream, Sorbet, Gelato, Frozen Yogurt

Are your own-brand theproducts best in foodservice?

Packaging & Disposables: cups, cutlery, plates, napkins, take-away containers

Pizza & Pasta

Plant-Based Foods

Potato Products: baked, chips, fries, mash, hash browns, wedges, croquettes

Preserves

Processed Meats: bacon, cooked meats, sausages, stuffing

Ready Meals: British, Indian, Mexican, Americas, Middle East, Oriental, Italian, pies, bakes, vegetarian/vegan

Rice

Sauces & Condiments: portion packs, bulk

Seasonal Products (Christmas, Easter, etc)

Soft Drinks: carbonates, still, juices

Soup

Spices & Seasonings

Street Food

Vegan

Vegetarian

Wines, Beers, Spirits

Yogurts

Please note that this list is not exhaustive: let us know if you would like any other categories to be included.

To enter, send a list of the products you wish to enter and the category for each product to mail.winlove@btconnect.com or complete the online entry form at www.cashandcarrymanagement.co.uk

Closing date for entries: 12 July 2024

We will then contact you with information about the next stage

The household cleaning and laundry categories are areas where wholesalers can rely on expert advice from well-established market experts to boost their sales.

While household cleaning and laundry products may not be the obvious choice for convenience top sellers, the category can flourish if merchandised correctly.

DCS has been serving the laundry and household category for 30 years and offers a product range recommendation through its corerange.com website.

“Household and laundry shoppers are looking for products that do the job properly, first time,” says Matt Stanton, head of insight. “Brand loyalty is higher than in many other grocery categories, and, despite the fact that some shoppers are trading down to cheaper products in response to the cost-of-living crisis, the leading brands still have majority share in most categories. Therefore, retailers can maximise sales by stocking the leading household brands.

“As space in convenience stores is often extremely limited, we recommend covering as many shopper need

Spend in laundry and household cleaning

Consumer demand should be considered when allocating space to laundry and cleaning products:

a Laundry detergents: £37.3 million

a Dish care: £22 million

a Fabric enhancers: £14.7 million

a Specialist cleaning and disinfectant: £11.1 million

a Household cleaning: £9.9 million

a Bleach & toilet: £9.1 million

Source: Nielsen

states as possible before doubling up on product options. In this way, retailers can maximise the number of happy shoppers and grow shopper loyalty, as long as they stock the topselling SKU for each need state.”

‘Brand loyalty is higher than in many other grocery categories. Retailers can maximise sales by stocking the leading brands’

Matt Stanton, head of insight, DCS

DCS advises wholesalers and retailers to stock PMP formats in cleaning and laundry products where possible. “Not all consumers understand that the cost-toserve model means convenience stores generally need to be slightly more expensive than supermarkets, so a good range of PMPs is important to give shoppers price confidence,” Stanton says.

“87% of retailers are worried about the cost-of-living crisis affecting their shoppers and 78% of retailers think PMPs demonstrate good value for money to shoppers (TWC). 62% of retailers say PMPs mean they don’t need to think about what price to set (Lumina).”

Stanton recommends that wholesalers take into consideration the habits and needs of convenience shoppers when selecting their product range. “Household products overindex with top-up shoppers on both planned and distress missions. Many shoppers are planning their shopping trips more rigorously than they were before the pandemic, as it helps them manage their budget and spend their money more efficiently,” he explains.

“Planned top-up missions account for 19.8% of all convenience store shopping trips while distress missions account for 11.5% (Lumina). Retailers should therefore stock a full range of household and paper products to maximise basket size with planned top-up shoppers.”

With the category covering a huge array of products, and the size limitations of a typical convenience store, it’s important that wholesalers offer the right range for maximum sales. “Seven out of 10 cleaning occasions are ‘quick clean’. Trigger sprays and wipes are the most convenient formats, so make sure you’re stocking the leading products – Flash with Bleach PMP £2.49, Flash Bathroom PMP £2.49, Flash Kitchen PMP £2.49 and Dettol multi-surface wipes,” he says.

Essity brand Plenty has received a Product of the Year accolade for its Plenty Flexisheets Tubeless. The product, launched in May last year, is a more environmentally-friendly option with no cardboard tube to recycle and less plastic in the packaging. It also has a 40% increase in absorbency and maintains its strength when wet.

“These achievements underscore our commitment to innovation, quality and sustainability, and we are proud to provide consumers with products that make a difference in their lives,” says Ruth Gresty, regional marketing director.

Unilever has added two new variants to the Domestos Power Foam range. Domestos Power Foam Toilet & Bathroom Floral Burst and Domestos Power Foam Toilet & Bathroom Limescale Remover are available in 450ml and 650ml packs.

The January launch has been supported with a disruptive marketing campaign, including TV, in-store point-of-sale materials and PR activity.

“Domestos has the highest brand awareness in the toilet and bleach segment as the market leader and is perfectly positioned to continue delivering growth and innovation to the cleaning aisles. We’re excited to build on a successful first year for Power Foam with our new Floral Burst fragrance and Limescale Remover variants,” says Rachel Rose, Domestos brand manager.

In the laundry segment, there have been mixed fortunes in performance, with the laundry additive market declining by 7% in volume but increasing by 8% in value, indicating that shoppers are reducing their frequency of purchase. However, Robinson Young has drawn on its wealth of experience in the market to ensure the continuing success of its ACE brand. The range has seen 9% growth in volume and 3% growth in value (Nielsen).

‘Cleaning has become one of the biggest online trends, due not only to the pandemic but also to the social media craze of influencers’

Michael Robinson, MD, Robinson Young

“This strong performance for ACE is not only attributed to the great performance and value of the products but the brand also benefited from investment in 2023 in advertising and media spend to raise awareness, which will continue through 2024 and onwards,” explains Michael Robinson, managing director.

“In 2023, that investment saw targeted advertising campaigns on public transport and bus stop shelters across the UK driving the ACE message of great performance and incredible value.

“The ACE range of products has also been supported by one of the big trends of recent years, which is continuing into 2024.

Cleaning has become one of the biggest online trends, due not only to the pandemic but also to the social media craze of influencers like Mrs Hinch and Lynsey ‘Queen of Clean’ sweeping across the UK,” he points out.

The brand growth has been driven by the expansion of the Ultra range with the introduction of ACE Ultra for Colours. The new formulation has improved the stain-removing power of ACE for Colours even on cool washes, which is increasingly important as consumers try to restrict their energy usage amid high electricity costs.

“Research conducted by Vypr in 2022 highlighted the second most important driver for purchase is price and, at a time when consumers’ budgets are tight, ACE is on average 48% cheaper compared to other stain remover brands,” says Robinson.

“In 2024 we expect there to be a continued focus by households on their budgets and looking for products that not only deliver great value but great performance as well. The ACE range is launching products in 2024 which will help to reduce waste and continue to drive ACE forward by ensuring that products offer consumers great value for money and great performance.”

CCM

FareShare

fights hunger and food waste by redistributing surplus food to 9,500 frontline charities and community groups in the UK.

“ When you have a full belly, it makes a huge difference to your overall wellbeing. We have really brought the community closer together, and we literally wouldn’t be able to do any of it without FareShare.Ellie

Phillips, Matthew’s House

”

We believe that good food should go to people, not waste.

We take edible surplus from right across the food and drink industry and get it to people in need.

Give us food and make a real difference to people in need.

Or visit:

Scan:

fareshareuk.com/FDM

Energy is a key convenience category, accounting for a third of soft drinks sales, and wholesalers and retailers need to be aware of the must-stocks that are driving profit.

Energy is a valuable category for retailers, worth nearly £2 billion and a significant fixture for independents. Suppliers continue to innovate and promote, encouraging further growth from a category that is already reflecting a sales uplift of 25% in the convenience channel, with last year’s figures showing more than three million energy shoppers.

Soft drinks sales saw growth of £213 million in 2023 versus the previous year (Nielsen) and there were more energy drinks shoppers purchasing in independents & symbols. The contribution of the sports & energy category in the channel overtook colas as the top category in value share within the total market for several weeks last summer.

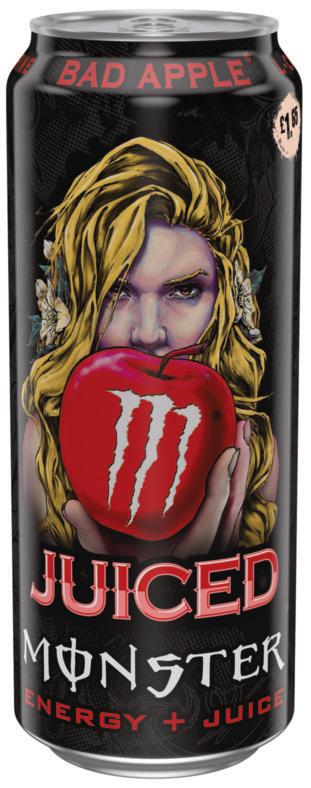

This year Coca-Cola Europacific Partners (CCEP) has expanded its energy offering with an addition to the Monster Juiced line-up. Monster Juiced Bad Apple is available in plain and PMP formats.

“Every year our Juiced launches are among the best performing NPDs, in terms of value sales, in energy drinks thanks to their big flavour profile that really pack a punch, and we’re confident that Bad Apple will be right up there,” says Helen Kerr, associate director of portfolio development.

Known among shoppers and retailers alike for its category-leading innovations, the Monster brand is a must-stock for wholesalers and retailers with its huge presence in the energy drinks category – now worth more than £1.96 billion to retailers in GB (Nielsen).

“With innovation key to increasing sales, stocking up on the latest launches that are going to capture consumers’ attention is key,” says Amy Burgess, senior trade communications manager. “Despite the emergence of new innovations, traditional energy drinks still remain popular, with Monster Original remaining our flagship offering. This underscores the importance of maintaining a robust core product range alongside stocking new launches.”

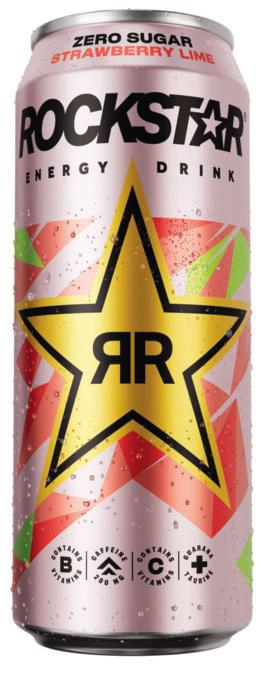

Britvic’s Rockstar Energy range has undergone a rebrand that includes refreshed packaging and an integrated marketing campaign to increase brand awareness. The newly designed cans were rolled out last month and feature simplified branding and enhanced graphics on zero-sugar varieties.

‘Traditional energy drinks remain popular. This underscores the importance of maintaining a robust core product range alongside stocking new launches’

Amy Burgess, CCEP’s senior trade communications manager

“More than half of energy drinks’ innovation sales over the last year have come from Monster’s NPD (NIQ), which has helped us grow our value sales by a massive £111 million (Nielsen).” Monster Zero Sugar –arguably Monster’s biggest innovation in 20 years – was introduced last year.

This year’s launch of Monster Juiced Bad Apple has been supported with PoS materials and downloadable digital assets for in-store impact. Currently, Monster Juiced Mango Loco is the top-selling flavoured energy drink, worth almost £80 million.

The Monster brand is driving more value and volume growth than any other brand in the energy drinks category and is now worth more than £613 million.

“The rebrand comes at an ideal time to help retailers capitalise on the strong sales performance of energy drinks. We can now better showcase our line-up of innovative flavours, offering shoppers a range of options, including those looking for zero-sugar alternatives,” says Adrian Howe, brand manager. “This progress follows Britvic’s Healthier People strategy, reformulating our drinks to remove calories with no compromise on taste or quality.”

The brand overhaul has brought the Rockstar range into a cohesive brand, removing sub-brands and displaying flavours more prominently to attract a wider audience. The appeal of low and no-sugar flavours is reflected in the growth of 29.7% in low-sugar options compared to 14.7% growth for standard (Nielsen).

The accompanying marketing campaign spans social media, digital advertising, out-of-home media and sampling events. New packs feature QR codes offering consumers the chance to win free tickets to O2 Academy venues nationwide through a weekly draw.

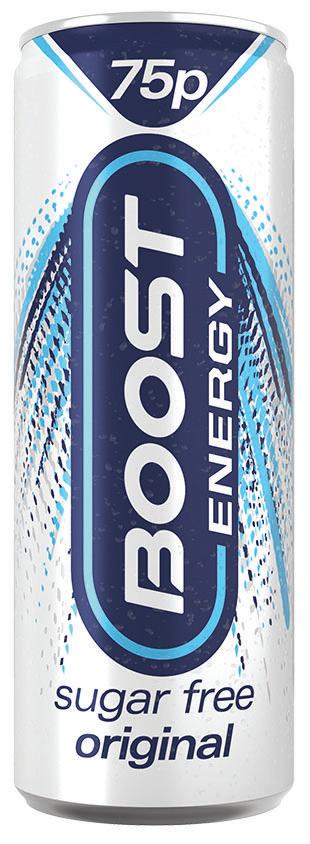

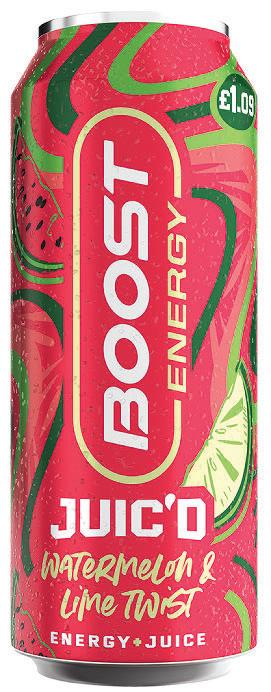

Boost Drinks continues to prioritise wholesaler support and relationships to ensure that the convenience channel doesn’t lose out on the flourishing energy category.

“In terms of how we see our range of energy drinks benefiting our customers, they should prioritise stocking Boost as a leading brand within the soft drink category, and one which provides a diverse range of affordably priced-marked pack formats, flavours and take-home offerings. This will ensure retailers are meeting the needs of their core consumer groups, resulting in trusted relationships with their customers while guaranteeing maximum profits can be made,” says Adrian Hipkiss, commercial director.

“The range of flavour profiles and pack sizes on offer from Boost allows consumers to rely on us as a brand that caters to an array of consumption moments, whether on the move or stocking up to enjoy at home.”

The supplier is proactive in the category all along the supply chain, ensuring that wholesalers have access to the merchandising and pricing options that enable them to make the most of the energy drink category.

“While we are dedicated to developing a range which appeals to consumers, we are also committed to being a transparent and collaborative partner to wholesalers and retailers, a core belief that inspired the ‘honest broker’ approach that Boost is founded on – a belief that in order to help retailers achieve the best sales, open, honest and collaborative interactions are essential.

“As such, we’re constantly monitoring the ever-evolving retail landscape and consumer trends so we can advise across all touch points, including which products our partners should be stocking and how they should be marketing them, to ensure the best success for their business,” Hipkiss explains.

Red Bull is another manufacturer recommending that retailers and wholesalers ensure that their offering covers a breadth of formats and variants. With the category remaining in growth, suppliers must ensure that the availability of their core range is maintained while a pipeline of NPD continues to draw new shoppers and expand sales opportunities.

“The major growth opportunity for retailers in 2024 is through capturing and engaging shoppers that are entering the energy category by having the right range available. In 2023, 45% of the GB population bought an energy drink (+12% versus last year), so there is growing opportunity to engage and trade up shoppers at the soft drink fixture (Kantar),” says a Red Bull spokesperson.

“Energy flavours have continued to grow in popularity –last year 71% of shoppers new to energy drinks bought a flavoured product, so they are a key part of the category to drive penetration.”

With this in mind, Red Bull has looked at current trends when selecting its latest addition to the Red Bull Editions range. From this month, the Summer Edition, with the taste

of Curuba & Elderflower, is available to tap into the evergrowing demand for flavoured energy – with 41% more flavoured energy drinks sold per store in the last two years alone.

“Increasingly consumers are looking for variety in flavours, with 85% agreeing that they want to try new and unusual flavours in energy drinks, which has contributed to the success of Red Bull flavours in 2023,” explains the spokesperson. Last year’s Summer Edition with the taste of Juneberry was the most successful launch to date and has now joined the line-up as The Blue Edition.

While Red Bull recognises the importance of a low-sugar offering in the energy category, the manufacturer stresses the importance of maintaining a comprehensive full-sugar range as well.

“Health becomes deprioritised during cost-of-living periods, with consumer confidence and health closely linked. Making sure retailers have the right choice, both full-sugar and sugar-free, is key to ensure they meet the needs of consumers at all times,” the spokesperson continues.

“Red Bull Sugar Free brings an older and more affluent shopper to the category who is different in profile to the average energy drink shopper, so is key to catering to different shopper groups. Having full-sugar and sugar-free options on shelf is important as increasingly shoppers are buying across both – last year 32% of shoppers bought both a full-sugar and sugar-free energy drink (+3pts versus last year; Kantar).”

Suntory Beverages & Food has introduced NPD that straddles its Lucozade Sport, Energy and Alert sub-brands. Now available are Lucozade Alert Blue Rush standard 500ml and £1 PMP 500ml can formats, Lucozade Energy Blue Burst 500ml and 900ml bottles in price-marked and non-PMP variants, and Lucozade Sport Blue Force 500ml standard and PMP bottles and non-PMP multipack formats.

Both sport and energy drinks are growing ahead of the soft drinks category and the demand for flavoured NPD is a significant contributing factor.

As a deliberate marketing strategy the supplier has left it for consumers to discern the flavours of the three new additions. The launch is supported with a range of instore PoS across wholesale and convenience, as well as a shopper-facing campaign during April to drive awareness and create demand at launch.

Barr Soft Drinks has seen the benefits of its expanding flavoured energy portfolio in the convenience channel. “One in three soft drinks sold in convenience stores is an energy drink, with big can energy driving the category growth at 17% (IRI),” reports Jonathan Kemp, commercial director. “Growth in flavoured energy is linked to consumer needs changing, and shoppers are looking to the category to be exciting and varied to keep them engaged.

“The current economic landscape and subsequent costof-living concerns have resulted in almost 30% of consumers looking for lower cost alternatives. Financial pressures have also driven demand for own-label products to record levels across many categories (IGD). However, energy is bucking the trend as 97% of sales are from brands, showing that branded energy drinks remain the clear choice for shoppers,” he continues.

The manufacturer has invigorated the Scottish energy drinks category with its PWR-BRU brand. “The energy market in Scotland is a fast-growing sector, delivering one-third of

How well do energy drinks sell in your soft drinks fixture?

The top-selling lines are energy drinks; flavoured energy is doing particularly well at the moment. We’ve merchandised our fixture to reflect this.

What are your best-sellers?

Red Bull Original and Monster.

Who is your key demographic?

Mostly working class and self-employed. It used to be mainly male shoppers but now men and women are both regularly shopping the energy drinks section.

total soft drinks category growth (Circana); however, only 25% of shoppers currently buy energy brands so there is still huge growth potential (Kantar),” says Kemp. The range comprises Diablo Cherry, Origin Original, Maverick Berry and Dropkick Tropical. The 500ml cans are available in plain and price-marked formats.

Rubicon RAW has also been performing well in the category, with last year’s Apple & Guava variant selling over a million cans. “The energy drinks market remains one of the most profitable for retailers and Rubicon RAW has quickly established itself as a must-stock brand within it. Selling more than 35 million cans since launch, it’s become the second most successful innovation launch within soft drinks,” says Kemp. “A third of Rubicon RAW sales are from new entrants to energy, while 70% of RAW shoppers are making it a repeat purchase (IRI).” CCM

Has there been any stand-out supplier support or activity over the past year?

Not for us – we’re a new shop and haven’t yet found significant sales support from

manufacturers. Red Bull has come in and there is online support from Britvic but the best way I’ve found to access the manufacturers is through attending the NEC trade show. The popularity of energy drinks has soared – and I have more than 20 years in the retail industry – so supplier contacts and up-to-date information on the category is important.

Is there any recent NPD that you are particularly excited about?

The new Monster flavour, Bad Apple. Also, we do well with the Red Bull Editions flavours.

Vijay Ponnusamy, Costcutter, Great Bromley

As the weather finally starts to warm up, it’s important that retailers and wholesalers are prepared for the current consumer trends shaping the soft drinks category.

The soft drinks fixture is undergoing several changes at the moment for retailers. Along with the notable growth in the energy category, other sub-segments are gaining traction in the chillers.

Ready-to-drink (RTD) iced coffee is a growing area in convenience as shoppers look for a refreshing pick-me-up.

Boost Drinks has seen 19% value growth in its 250ml iced coffee range, which features Caramel Latte, Mocha, Double Espresso and Caffe Latte varieties.

‘We know that the ready-to-drink iced coffee category is growing rapidly, providing a huge opportunity for retailers to draw customers in and maximise sales’

Adrian Hipkiss, commercial director, Boost Drinks

“We know that the ready-to-drink iced coffee category is growing rapidly, providing a huge opportunity for retailers to draw customers in and maximise sales,” says Adrian Hipkiss, commercial director. “To successfully capitalise on this trend,

retailers and wholesalers should provide enough space to allow for future growth in the category and stock fast-growing brands such as Boost.”

CCEP also covers a broad range in the RTD iced coffee category and its Costa range caters to a variety of tastes. “The chilled coffee sector has become an established part of the soft drinks category and is in 12.5% value growth in independent convenience,” says Amy Burgess, senior trade communications manager.

“Costa Coffee RTD is the fastest-growing major brand within this, up 46% in value within independent convenience and now worth £24 million across total GB (Nielsen).”

The range comprises Latte, Flat White and Frappé variants with a choice of sweetness, caffeine levels and coffee flavours. The full line-up is HFSS-compliant and the branding benefits from the popularity of the Costa Coffee chain.

Recognising the importance of price transparency in the convenience channel, CCEP launched PMP formats of the Costa Coffee Latte and Caramel Latte RTD ranges.

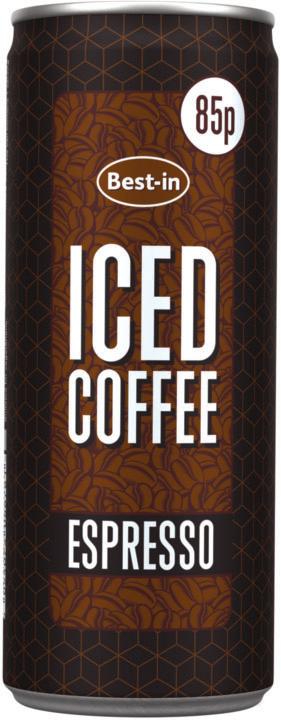

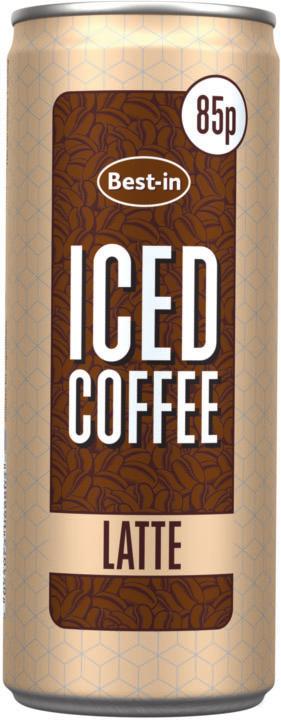

Seeing the growing potential of the category, Bestway Wholesale introduced its own-brand latte, cappuccino and espresso RTD range.

“Since the launch of these products we have seen impressive sales that are on par with other well-established competitors and brands in our depots,” says Kenton Burchell, group trading director. “We are offering a price-marked pack at 85p, which offers a lower price point versus competitors. We’ve seen a phenomenal initial response from customers.”

He adds that the manufacturer does not sacrifice taste for value, with the high-quality ingredients crafted into a satisfying blend that is reflected in the encouraging sales figures.

In addition, Best-In Espresso won the Iced Coffee category at Cash & Carry Management’s CCM Chefs’ Own-Brand Awards last year – an accolade that cements its popularity. “Sales are continuing to grow rapidly and the range is already securing top performance versus established brands,” Burchell adds. CCM

Tobacco is a category that particularly benefits from wholesaler knowledge, from supplier NPD and PoS opportunities to consumer trends and recent legislation. There is a lot to navigate, so offering thoughtful category guidance to your customers is key.

Adult smokers are tipping the scales towards value in the current economic climate. Suppliers are focusing on their value proposition without compromising brand quality in the tobacco category.

In the accessories segment, Republic Technologies is adding to its sustainability credentials with the launch of OCB Authentic Real Rice Papers. The papers are available in slim and slim & tips formats, with 32 papers per pack. OCB Rice Papers are organic and chlorine-free, made from a blend of rice and organic hemp that delivers a premium rolling and slow-burning experience in natural brown paper.

The accessories category is a strong performer at a time when value is often a crucial factor for consumers. The fastestgrowing sector is rolling papers, appealing to adult smokers looking to cut costs without making major lifestyle changes.

“Shoppers are more demanding than ever, looking for quality and value in every purchase,” points out Gavin Anderson, sales & marketing director.

“Top quality products, displays and innovation are important, complemented by broad availability and distribution, but the importance of a competitive price point should not be underestimated.”

Imperial Tobacco also increased its presence in the rolling segment recently with the Rizla Classic King Size Combi variant, helping wholesalers to capitalise on the growing demand for natural rolling papers with the added benefit of papers and tips in one pack for convenience. With an rsp of £1.30, the new line includes 32 unbleached king size papers and tips.

The demand for value is also evident in the cigars segment, where a value increase of 3.2% (IRI) is largely down to cigarillo sales. “Cigarillos are now worth over £111 million in annual sales and are responsible for very nearly half of total cigar volume sales,” reports Nataly Scarpetta, marketing manager at Scandinavian Tobacco Group.

“Our Signature Action brand is currently the fastest growing cigarillo, experiencing sales growth of over 41% versus the same time last year.” The Signature brand has recently benefited from a packaging update with full colour on all sides.

Scarpetta continues: “The ongoing cost-of-living crisis has certainly bought into sharp focus the importance of value in the tobacco category. That said, the value trend has certainly been around the cigar category for quite some time now, which is

evidenced by the success of our Moments Blue brand. In fact, our Moments 10s packs are the biggest brand in the value segment and are well-known among tobacco-selling retailers as a popular choice among those customers who are looking to save money.”

While value is now high on the list for most consumers, cigars is still a segment that benefits from brand loyalty. STG advises wholesalers and retailers to ensure that their selection caters to longstanding shoppers who have an established preferred brand.

“Cigar smokers typically prefer to stick to high quality, established brands which they know and trust, so stick to stocking the top performing brands which you know, and your customers love, such as Signature Blue – which is the UK’s best-selling traditional cigar and a must-stock for any tobacco retailer,” says Scarpetta.

Events and occasions are also sales opportunities in the category. “Whether it’s Christmas, Easter, Father’s Day, or just a summer party or family celebration, many regular cigar (and cigarette) smokers will turn to a larger cigar to enjoy as a treat or part of their celebrations when they have more time to enjoy it.

“Our Henri Wintermans Half Corona is easily the UK’s best-selling medium/large cigar. The brand has a rich history that dates back to the 1800s and should always be part of any cash & carry’s cigar offer,” she adds.

Another selling point for cigars is the range of flavours available. This has been an added draw since the menthol ban but it is not only peppermint that appeals. STG’s Signature Red Filter brand is currently the UK’s best-selling aromatic filter cigar, with a vanilla flavour that’s proving very popular, according to the company. The flavoured subcategory is particularly prevalent in the miniature segment, where wholesalers and retailers are advised to have goodquality options in stock.

In the cigarette category, Imperial Tobacco also highlights the importance of established value options. “We’ve seen shopper demand for value gain momentum as a result of the

cost-of-living crisis and we’re now seeing the lower priced tiered products account for the largest proportion of tobacco sales,” says Yawer Rasool, consumer marketing director UK&I.

“For example, the sub-economy segment now makes up for 63% of factory-made cigarette sales, while the economy segment accounts for just over a half (56%) of RYO, and these segments are showing strong growth at 3% and 5% year-on-year respectively (ITUK).”

‘The need for value products is going to continue to be a dominant trend in the category for some time so wholesalers need to make sure they can cater for this demand by stocking the right product offering’ Yawer Rasool, Imperial Tobacco’s consumer marketing director