US SOUTHWEST

Freeport CEO urges US aid to boost copper output

BY FRÉDÉRIC TOMESCO

United States mining giant

Freeport-McMoRan (NYSE: FCX) is calling on the Trump administration to sweeten incentives for domestic copper producers and cut permitting times to help offset weak metal grades, CEO Kathleen Quirk says.

While U.S.-based miners enjoy lower tax rates compared with other jurisdictions, copper grades in the U.S. make investing in new domestic operations less attractive, Quirk said in an interview. Copper mines in the U.S. often have grades of about 0.3%, compared with 1% or more elsewhere, she said.

“We have a challenge in the U.S. because the ore grades that we mine here are very low relative to what we mine internationally,” Quirk told The Northern Miner by videoconference in August. “Companies want to go where the higher grades are. If there are things in place that can help incentivize the production in the U.S., that would be an advance.”

With annual output of about 4 billion lb. of copper and operations in countries such as the U.S., Indonesia, Chile and Peru, Phoenix-based Freeport is the world’s largest publicly-listed producer of the red metal. Its U.S. output,

which averages about 1.4 billion lb. a year, accounts for about 70% of the refined copper that’s produced in the country.

“What we’re hoping to see more of in the future are incentives for upstream development.”

KATHLEEN QUIRK CEO, FREEPORT-MCMORAN

Unit costs

Operating costs vary greatly from country to country. While its unit costs in Indonesia are “close to zero” because the presence of a gold by-product generates substantial income, Freeport spends about $3 per lb. to produce copper in the U.S., Quirk says. And that doesn’t include the capital investments needed to start up a mine.

A recent so-called Section 232 review into copper imports, which resulted in some foreign-produced goods being taxed 50%, did provide relief for U.S.-based miners, Quirk said. U.S. President Donald Trump ended up excluding refined copper

– the most widely imported form of the metal – from his planned import tariffs, surprising market participants and analysts alike.

“When you look at our mining in the U.S., there are structural aspects that make it less economic than mining internationally,” the executive said. “So one of the things we are hoping for is for the U.S. to continue to look at policies that would help the domestic mining industry.

The Section 232 investigation provided some tariffs and incentives for the U.S. manufacturing of copper, and what we’re hoping to see more of in the future are incentives for upstream development.”

Favourable environment

Other helpful steps would include permitting reform and production tax credits, Quirk said without elaborating.

“Freeport in our view remains best positioned to benefit from 50% copper tariffs,” BMO Capital Markets mining analyst Katja Jancic said in a note following the release of the company’s second-quarter results in July. “Freeport’s U.S. operations have tailwinds that in

Toro® LH518iB Battery-electric loader

This state-of-the-art BEV loader is designed specifically for underground mining operations. Equipped with an optimal battery chemistry, the fastest battery swap on the market and a high-power electric driveline, this loader is your gateway to sustainable mining.

Toro® LH518iB Safer. Stronger. Smarter.

BY NORTHERN MINER STAFF

Fortune Bay reactivates gold assets

Fortune Bay (TSXV: FOR; US-OTC: FTBYF) has quietly built a pipeline of gold and uranium assets, waiting for the next commodities upswing. An updated preliminary economic assessment (PEA) for its Goldfields project in Saskatchewan due this year and plans to resume exploration at Poma Rosa in Mexico signal the junior is emerging from the shadows.

“The company’s been very much under the radar for a long time patiently waiting for the next cycle to begin,” Dale Verran, CEO of Fortune Bay, said. “Through that process, we’ve been very disciplined about the capital structure – we didn’t do any big raises, we went out and did some low-cost acquisitions on the uranium side.”

Fortune Bay’s core gold assets were spun out of Primero Mining in 2014. In April, the junior raised $3 million (US$2.16 million) through a non-brokered private placement to advance its gold projects. “Now we feel it’s time to execute,” Verran said.

Gold has surged over the past two years, climbing more than 30% year-over-year to around $3,340 an oz., as investors and central banks flock to the metal amid inflation concerns and global uncertainty. The rally underscores renewed appetite for high-quality gold projects while uranium is also enjoying recent gains on wider demand for nuclear power, like in India, and output constraints in Kazakhstan and Niger.

For Fortune Bay, it’s an opportune moment to advance projects in Saskatchewan and Mexico.

Goldfields

Fortune Bay’s primary Goldfields project lies 13 km south of Uranium City in northern Saskatchewan, an historic mining district with road and hydro access, nearby fuel, contractors and a commercial airport. “It’s a rare shovel-ready asset with a permit in hand,” Verran said.

The permit was supported by a feasibility study conducted in 2008.

“There’s so much data and most of the resources already indicated,” Verran said. “Moving that from PEA to PFS can be done relatively quickly, the key is to shorten that permitting timeframe so that they can keep in step and get to a construction decision as soon as possible.”

Goldfields hosts 23.2 million tonnes grading 1.31 grams gold per tonne for 979,900 oz. indicated, with 7.1 million tonnes at 0.92 grams gold per tonne for 210,800 oz. inferred. A 2022 PEA outlined average annual production of 101,000 oz. over 8.3 years, with 122,000 oz. annually in the first four years at cash costs of US$778 per ounce. Over 80% of the mineable ounces come from the Box deposit.

An updated PEA is due this year, reflecting mine optimization, design updates and higher gold prices. Baseline studies and permitting are underway, with community consultation also planned. Drilling at Frontier Lake, Golden Pond and Triangle will test resource growth potential.

“This is really a project that can be developed into a mine in the near term,” Verran said.

Poma Rosa

Fortune Bay is moving forward with community consultation for its Poma Rosa gold-copper project in Chiapas, Mexico, aiming to restart fieldwork in late 2025.

“We have been talking to the key communities and they’re very supportive,” Verran said. “But you can’t rush these processes.”

The company remains on track to formalize exploration agreements later this year.

Chiapas state, bordering Guatemala, isn’t well-known for mining, but it is rated one of the safest states in Mexico.

“The state government is very pro-investment and they’ve taken proactive steps to improve the economy since the governor was elected in December,” Verran said.

“They’re very supportive of the project.”

The Poma Rosa (formerly Ixhuatán) project was originally held by Linear Gold and Kinross Gold (TSX: K, NYSE: KGC), which outlined the historical Campamento resource and contributed to exploration before

“Fortune Bay is also developing seven lowcost uranium plays along the northern rim of Saskatchewan’s Athabasca Basin.”

Murmac Project is set to start in September.

The surveys target high-grade mineralization along the Grease River Shear Zone, a prospective corridor analogous to uranium miner NexGen Energy’s (TSX, NYSE: NXE; ASX: NXG) Arrow deposit.

Follow-up fieldwork will verify historical occurrences, map anomalies and prioritize drill targets. In August, the company announced it had secured three-year drill permits from the province.

“Work is ongoing, it’s partnerfunded, it doesn’t cost us anything, but also generates some revenues for us through management fees and option fees,” Verran said.

“Those projects retain discovery upside for our shareholders.”

Growth Trajectory

With gold projects advancing and uranium exploration underway, Fortune Bay is building momentum.

“We’re obviously bullish on gold and bullish on uranium, but going forward, our broader business model could apply to any commodity,” Verran said.

The junior’s footprint is concentrated in Saskatchewan and Mexico, but Verran noted it’s not tied to any one jurisdiction.

“It’s really where the right geological opportunity arises and where we can align our capital for best deployment,” he said.

Another vital aspect of Fortune Bay’s approach is its technical team. Verran is an exploration geologist and mining executive with over 25 years’ international experience, including project generation, discovery, and advancement in Africa and Canada. He was vice president of exploration at Denison Mines (TSX: DML; NYSE: DNN), helping discover over 31,000 tonnes of uranium.

the company’s assets were spun out into Fortune Bay. “Our predecessor worked very well with the community.”

Based on Linear Gold’s 2006 drilling program, the Campamento deposit hosts a resource of 17.6 million tonnes grading 1.84 grams gold per tonne for 1.04 million oz. in the measured and indicated category, plus 21.8 million tonnes grading 1.01 gram for 703,000 oz. inferred.

At the nearby Cerro La Mina prospect, Fortune Bay is preparing a maiden copper-gold resource. The company said no new drilling will be required and it plans to update both deposits to NI 43-101 standards once community agreements are finalized.

The Poma Rosa project shares key characteristics with some of the world’s largest porphyry systems, including FreeportMcMoRan’s (NYSE: FCX) Grasberg in Indonesia and Rio Tinto’s (ASX, LSE, NYSE: RIO) Bingham Canyon in the United States. Porphyry deposits are vast, mineral-rich systems where gold and copper are spread throughout the rock rather than concentrated in veins.

“It’s widely recognized as an exceptional geological setting,”

Verran said. “You don’t get many of these globally.”

Uranium Potential

Fortune Bay is also developing seven low-cost uranium plays along the northern rim of Saskatchewan’s Athabasca Basin, a world-class district that has seen little modern drilling. The projects are optioned, but Fortune’s team remains as operator, benefiting from its proven uranium discovery track record.

“We saw the cycle coming… we entered our uranium projects back in 2020, just before the real boom and rush in the Athabasca Basin got started,” Verran said. “Our intention is to build value out of these assets through that steep part of the curve, and then exit through project sales or other types of agreements.”

Two projects – Strike and Murmac – are optioned to Aero Energy (TSX: AEX), while the remaining five, known as the Woods Projects, are under option to private Australian company Neu Horizon Uranium. An airborne electromagnetic, magnetic and radiometric survey is underway over the Woods Projects, while a three-hole drill program at the

Fortune’s executive chairman, Wade Dawe, built several resource companies, including Keeper Resources which was sold for $51.6 million in 2008, and Brigus Gold, which was acquired by Primero Mining (TSX: P) in 2014 in an all-share deal valued at $351 million.

Fortune Bay also appointed Robert Shaw as a key technical advisor in 2021.

“He’s a very well-known North American geologist and was involved with the discovery of 40 million oz. of gold for AngloAmerican (LSE: AAL),” Verran said. “We’ve got a key team that’s built for execution on our model through this particular phase of unlocking value on our gold assets.”

With its disciplined approach, key assets, capital structure and gold on the rise, Verran said Fortune Bay has a promising year ahead.

“On an ounce-per-ounce basis, we’re undervalued relative to our peers,” he said. “We’re executing on our strategy now and that will continue to be the plan going forward – we are in it for the longterm and to build real value.”

The preceding Joint Venture Article is PROMOTED CONTENT sponsored by Fortune Bay and produced in co-operation with The Northern Miner. Visit: https://fortunebaycorp.com for more information.

GLOBAL MINING NEWS • SINCE 1915 www.northernminer.com

PRESIDENT THE NORTHERN MINER GROUP: Anthony Vaccaro, CFA, MBA avaccaro@northernminer.com

EDITOR-IN-CHIEF: Colin McClelland cmcclelland@northernminer.com

COPY EDITOR AND PRODUCTION EDITOR: Blair McBride bmcbride@northernminer.com

SENIOR STAFF WRITER: Frédéric Tomesco ftomesco@northernminer.com

WESTERN EDITOR: Henry Lazenby hlazenby@northernminer.com

PODCAST HOST: Adrian Pocobelli apocobelli@northernminer.com

ADVERTISING: Robert Hertzman (416) 898-6654 rhertzman@northernminer.com

Kathleen Plamondon (514) 917-5284 kplamondon@northernminer.com

Michael Winter (416) 510-6772 mwinter@northernminer.com

SUBSCRIPTION SALES/ APPOINTMENT NOTICES/ CAREER ADS George Agelopoulos (416) 510-5104 (Toll free) 1-888-502-3456, ext. 43702 gagelopoulos@northernminer.com

PRODUCTION MANAGER: Jessica Jubb (416) 510-5213 jjubb@northernminer.com

CIRCULATION/CUSTOMER SERVICE: (416) 510-6789 | 1-888-502-3456 northernminer2@northernminer.com

REPUBLISHING: (416) 510-6768 jmonteiro@northernminergroup.com

ADDRESS: Toronto Head Office

69 Yonge St, Toronto, ON M5E 1K3 (416) 510-6789 tnm@northernminer.com

SUBSCRIPTION RATES: Canada:

C$130.00 one year; 5% G.S.T. to CDN orders.

7% P.S.T. to BC orders

AI

EDITORIAL

to reshape

mining, but humans still hold edge

BY COLIN McCLELLAND

In the newspaper business, artificial intelligence (AI) is set to replace thousands of journalists in the coming years. We’re playing with it at The Northern Miner in a somewhat mad dash to co-opt our enemy before it kills us.

But it doesn’t write accurately all the time, and it isn’t yet able to schmooze with CEOs and visit mining projects with geologists, the type of human coverage that gives our titles an edge over competitors.

For now, it’s probably better suited to straight research and even that requires careful fact-checking. In mining, prospectors and junior miners could theoretically build an entire company using AI. Silicon Valley calls it being a solopreneur. They could divide AI’s help into six steps:

1 Collect data, generate targets – Process large datasets such as geophysics, geochemistry, drill logs and satellite imagery to identify promising areas.

2 Model prospectivity – Train AI on known deposits to predict favourable geological settings and rank exploration targets

3 Optimize exploration – Create efficient drilling programs, model mineralization and refine targets in near real time as data comes in.

4 Estimate resource, model project – Model geostatistics to improve the speed and accuracy of resource calculations and mine design.

5 Determine strategy – Analyze markets to evaluate metals demand, identify investment partners and optimize timing for staking claims, raising capital or selling assets.

6 Operate business – Streamline back-office functions such as bookkeeping, HR, and compliance; generate marketing materials; optimize investor presentations and roadshows.

Stats on AI adoption are scarce so far. Established companies are often reticent to talk about new technology for a bunch of reasons:

1 they are still trying to figure out how to use it and don’t want to seem uninformed;

2 don’t want to scare their own workers by mentioning it;

3 think it’s a fad that won’t replace boots on the ground;

4 it’s not a high priority and when they have more time they’ll assign it to someone in accounts.

The coyness was apparent when electric and automated vehicles entered the industry. After automated haulage trucks became more common – cutting costs by 20% in Australia’s Pilbara region for example, according to McKinsey in 2018 – industry analysts said executives were more forthcoming.

However, the flip side of automation’s productivity boost is its impact on the workforce. According to the Organization for Economic Cooperation and Development this year, almost 47% of jobs in the mining, energy and utilities sector in North America are at high risk of automation by 2030.

In a June report, PricewaterhouseCoopers said a substantial portion of traditional mining jobs will be augmented or replaced by technology, with remote operations employing data scientists, AI and specialists to complement field labour.

“Increased use of technology will result in more office-based work than on-site work and a reduced focus on physical strength,” PwC said in its Mine 2025 report. “The appeal of working in a high-tech industry, increased safety and greater ability to work remotely or from offices will all make mining more appealing to a younger and more diverse workforce.”

The industry’s skill shift arrives as it counts fewer graduates from post-secondary mining disciplines at any time in half a century, compounding the talent shortage.

“Mining operations that rely on machinery operators and labourers will now need to compete for workers with different skill sets, such as data analysis or artificial intelligence,” Mike Sinden, vice-president of Costmine Intelligence, said in a 2024 report. “This will create competition with non-mining industries for talent which could drive up wages.”

Indeed, tradesmen salaries are hitting $144,000 – much higher than other sectors, according to Franco-Nevada. The industry needs the image makeover to sway public attitudes after generations of mining opponents. Many still seem unaware that metals in mobile phones and every other aspect of modern life first must be mined.

Meantime, the talent gap makes it more difficult or slower for companies to adopt new technologies. Lower productivity increases costs.

Which is why groups such as the Young Mining Professionals Scholarship Fund backed by 30 mining companies is dispersing around $225,000 for students in mining-related courses in Canada.

Similarly, Franco-Nevada is offering full program annual scholarships to diverse undergraduates (women, Indigenous peoples, members of visible minorities, LGBTQ+, and persons with disabilities). See Franco-Nevada’s case for mining education on page 16.

For existing workers, it means on-the-job re-training. When introducing autonomous haulage at its Boddington gold mine in Australia, Newmont implemented a “people strategy” to reskill and redeploy haul truck drivers into new roles supporting the autonomous fleet. It recognized that while tasks are automated, employees can often be shifted into higher-skill, higher-paying jobs created by the new technology. It can be win-win. TNM

COMMENTARY

Opinion: US mineral strategy turns to Africa

BY JAMES COOPER

What do Gabon, Guinea-Bissau, Liberia, Mauritania and Senegal all have in common? They’re all countries located along Africa’s west coast.

But they’re also small; collectively, these five countries have an insignificant GDP of around $75 billion.

However, the leaders of these five countries were given a special one-on-one invitation to meet with U.S. President Donald Trump in July. This privilege hasn’t been extended to many of the world’s major economies, including U.S. allies like Australia.

So, what’s going on? The U.S. president is a busy man. He sits in the middle of a global tariff war, is attempting to negotiate peace in Ukraine and Gaza, managing an escalating Iran-Israeli conflict, all while trying to manage the break-up of one of his closest political buddies, Elon Musk!

Surely Trump has better things to do than meet with a bunch of leaders from a place he probably couldn’t put on a map! As with everything U.S. strategy-related these days, I have no doubt that this event is rooted in mineral security.

Trump wants access to the small bounty held within these little West African nations. But I think there’s far more to it than this.

You see, each of these five countries sits along the Atlantic Ocean, directly across from America.

corridor linking Central African mines to Angola’s ports.

And this critical U.S. strategy crosses both sides of the political divide, Republicans and Democrats. Last year, former president Joe Biden became the first U.S. leader (ever) to visit this backwater African nation. Such was its importance.

Quiet, major moves It’s rooted in securing America’s supply of raw materials. And gaining safe and secure access across the Atlantic Ocean.

Why is that important? Sun Tzu states in The Art of War: “Be where your enemy is not.”

And that might be the point here. With a direct link across the Atlantic Ocean, the U.S. can secure the safe passage of Africa’s mineral wealth in the event of a potential major global conflict in which shipping lanes may be threatened. We live in a period of uncertainty, and secure supply chains of raw materials are vital to keeping economies functioning.

Investment angle?

As a former geo, I’ve spent plenty of time in Africa. Most of that was in the Central African Copper Belt, which is a key part of what I believe is the core of America’s mineral strategy. I’ve seen (first-hand) the projects that will benefit as the U.S. government invests billions in securing its footprint in this part of the world. It’s set to build railways, highways, processing facilities and ports.

So, is there an investment angle here? Well, mining companies typically have to foot the cost of infrastructure themselves.

So, while there’s perhaps some mineral importance among this group of nations, I believe this has more to do with geography; their position along the Atlantic Coast.

Africa’s major mineral wealth lies somewhere in the middle. A region that hosts the world’s highest grade copper mines, but is still vastly underexplored. It’s called the Central African Copper Belt and runs through the Democratic Republic of Congo and Zambia. I once worked there as an exploration geologist.

And I believe right now, America is doing all it can to secure safe passage for the raw materials that sit in Africa’s deep heart. In fact, the U.S. has already invested billions in upgrading ports and railway lines in Angola, another nation on Africa’s west coast. America is helping to restore a major railway

Moving raw ore from the mine to global markets is a significant part of their capex build-out.

But given America’s anxiety over mineral supply, the U.S. taxpayer could soon cover much of that cost! Making it easier (and cheaper) for miners to get their raw material onto the market. That means higher profit margins for the international producers developing or actively mining in the Central African Copper Belt. There is always a select handful of beneficiaries from major government initiatives. In this case, international miners in Africa could benefit most. TNM

James Cooper is a geologist based in Australia who runs the commodities investment service Diggers and Drillers. You can also follow him on X @JCooperGeo.

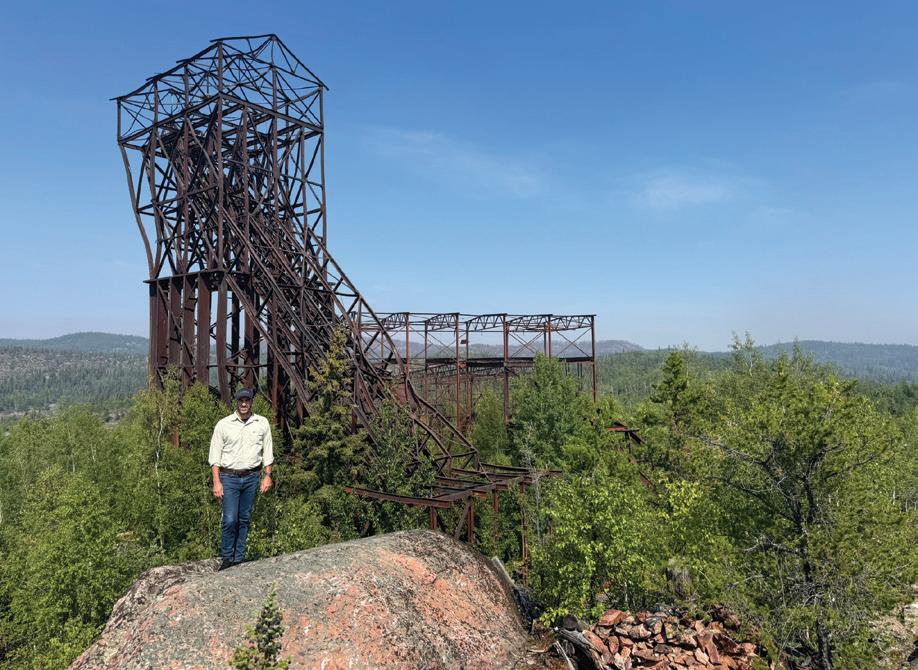

The U.S. Southwest has an industrial copper mining history going back to the 1880s. From 1972, here’s the Inspiration Consolidated mine in Arizona that FreeportMcMoRan took over in 2007 and still operates as the Miami mine.

CREDIT: U.S. NATIONAL ARCHIVES (PD)

inbrief

DEPARTMENTS

SPECIAL SECTIONS » Drill Down 9 » US Southwest 25

n Europe deals

Troilus Gold, which is developing a $1.1-billion (US$800-million) capex brownfield project in Quebec, signed a preliminary copper offtake agreement with the Aurubis smelter in Hamburg, Germany during Prime Minister Mark Carney’s trade mission to Europe.

The deal concerns a “significant amount” of Troilus’ future concentrate production at the namesake project though financial details weren’t given, the government said on Aug. 26.

Privately-held Torngat Metals is supplying rare earth oxides from its $2-billion capex Strange Lake project to magnets producer Vacuumschmelze near Frankfurt. Rock Tech Lithium, a Canadian-German cleantech company, is getting green energy. And Carney agreed with German Chancellor Friedrich Merz to deepen critical mineral ties across supplies, R&D and mining funding.

A week earlier, Swedish specialty steel producer Swebor agreed to fund a $100-million Ontario plant to make bullet-proof steel for armoured vehicle maker Roshel. The project is to be executed in stages over several years. Canada relies entirely on imports.

NORTHERN

n Tailings gift

The United States could meet much of its demand for critical minerals by recovering materials discarded in mining waste, according to a new study from the Colorado School of Mines.

critical minerals used in clean energy technologies, electronics and defence applications are already present in ore processed at U.S. mines and the majority end up in tailings. The key question is how to improve waste recovery techniques to make them economically viable.

The school said additional research, development and policy incentives will be needed to make large-scale recovery worthwhile.

Recovering less than 10% of the cobalt already mined and processed but lost to waste streams would be sufficient to supply the entire U.S. battery market. For germanium, reclaiming under 1% from existing zinc and molybdenum operations would eliminate the need for imports altogether.

MINER STAFF

NORTHERN

n Ammo dump

Critical minerals services company M2i Global and flight management software provider Volato Group are spearheading a public-private initiative for America’s first Strategic Mineral Reserve on the world’s largest ammunition storage site.

The storage is to be located at the 585-sq.-km Hawthorne Army Depot, about 350 km northwest of Las Vegas, the companies said Aug. 21. They plan to focus on storing, refining and distributing critical minerals such as gallium, graphite and copper, which are vital for the manufacturing

of defence systems, semiconductors, batteries and electric vehicles.

The project is supported by the Nevada Governor’s Office of Economic Development, the Department of Defense, its Defense Logistics Agency and the Department of Energy.

NORTHERN MINER STAFF

n Mars boffins

Scientists have spotted on Mars what could be a previously unknown mineral linked to the kind of sulphaty gunk that clogs tailings ponds on Earth.

The unusual ferric hydroxysulphate, identified near the vast Valles Marineris canyon by a spacecraft in orbit, hints that the red planet’s surface is still chemically active. It offers a planetary cousin to the problematic waste minerals Earthlings grapple with in mine operations. Sulphates often build up in acidic drainage and coat tailings pond walls.

The finding, published Aug. 5 in Nature Communications by a team led by Janice Bishop of California’s SETI Institute, revealed a spectral signature unlike anything catalogued on Earth. Laboratory work suggests it formed in hot, oxygen-rich conditions and shed water as it crystallized – conditions that could once have sustained microbial life.

“The material formed in these lab experiments is likely a new mineral due to its unique crystal structure and thermal stability,” Bishop said.

NORTHERN MINER STAFF

WHY MOST US COPPER COMES FROM THE SOUTHWEST

By Blair McBride

Copper mining in the four southwestern states of Arizona, Nevada, New Mexico and Utah produces almost all of the United States' red metal output. In 2024, almost two-thirds of the total came from Arizona alone. The region's dominance in copper production is based on several factors. Geologically, the four states lie within the red-metal rich Laramide porphyry copper province, also known as the Arizona-Sonora Copper Belt. In addition, a long history of copper extraction – dating back to the late 19th century – has helped establish mining infrastructure, institutional knowledge and culture around copper. Finally, favourable weather and topography allow for year-round mining. The Northern Miner takes a look at the Southwest states' share of production in 2024 and their top-producing mines.

depth | US SOUTHWEST

Apache fight vs Resolution Copper reshapes land talks

INDIGENOUS | Critical minerals race rubs against rights

BY ANDREW SEALE

Experts warn the legal battle over the Resolution Copper project in Arizona could alter how miners negotiate with Indigenous communities about disputed lands in the Southwestern United States.

The planned copper mine, a 55-45% joint venture between Rio Tinto (ASX, LSE, NYSE: RIO) and BHP (ASX: BHP), would violate a sacred site where Western Apaches have held ceremonies for generations, according to opponents the Apache Stronghold, an advocacy group made up of members of the San Carlos Apache Tribe of southeast Arizona and conservationists.

They obtained a temporary injunction in August from a lower-level court blocking the mine for now, but a Supreme Court decision this year not to schedule the case had strengthened the federal government’s control over its land and made it harder for sacred sites to be used as a defence against projects, experts said.

“The Supreme Court’s initial refusal to hear the case is a tragic

departure from its strong record of defending religious freedom for all,” Joseph Davis, legal counsel for Apache Stronghold, told The Northern Miner. “But there is still time for the court to reconsider the case.”

Huge project Resolution is one of the largest undeveloped copper deposits in the world, capable of supplying over a quarter of U.S. demand for decades. The partners have invested more than $2 billion (C$2.76 billion) in

JOINT VENTURE ARTICLE

exploration, engineering, and community engagement.

U.S. President Donald Trump met with BHP CEO Mike Henry, outgoing Rio Tinto CEO Jakob Stausholm and his replacement Simon Trott, then got riled up on his Truth Social platform. Trump called the court “Radical Left,” adding: “3,800 Jobs are affected, and our Country, quite simply, needs Copper — AND NOW!”

The CEOs outlined to Trump “the enormous potential of this project to provide domestic copper and other critical minerals for decades to come,” Stausholm posted separately.

At the centre of the legal battle is the transfer of Oak Flat — Chi’chil Biłdagoteel in Apache — which has been the site of four-day comingof-age rites for young women for decades. The dispute over Resolution dates to 2014, when Congress authorized a land swap as part of a defence spending bill signed by then-president Barack Obama, giving Resolution Copper rights to Oak Flat.

The land transfer hinged on an environmental impact statement,

Vista Gold cuts Mt Todd capex

released in January 2021 during the closing days of the Trump administration, but the Biden administration pulled its approval in March 2021, temporarily freezing the transfer.

Apache Stronghold sued that year, arguing the project breaches constitutional protections and the Religious Freedom Restoration Act (RFRA), which bars the government from imposing a substantial burden on religious practice unless it can show a compelling interest pursued by the least restrictive means.

Lower courts, including the Ninth Circuit Court of Appeals — which hears federal cases from nine western states — have consistently ruled in favour of the government and mining companies. However, the temporary injunction Aug. 18 came through just hours before the transfer was supposed to have been granted.

Substantial burden

The Ninth Circuit’s temporary appeal gives the court time to review the merits of the Apache

BY NORTHERN MINER STAFF

Earlier this year Vista Gold (TSX: VGZ; NYSE-AM: VGZ) signed five confidentiality agreements over the space of six weeks on its Mt Todd open-pit gold project in Australia’s Northern Territory.

Now the company expects even more interest in the project after slashing initial capital spending by 59% from $1.03 billion (C$1.42 billion) to $425 million in a smaller scale development prioritizing grade over tonnes.

An updated feasibility study in July evaluated the economics of cutting throughput to 15,000 tonnes per day from the 50,000 tonnes per day envisioned in a 2024 feasibility study.

“We decided to evaluate ways to significantly reduce the capex, make the project easier to build –something more attractive in the Australian mining landscape – and settled on 15,000 tonnes per day,” says Frederick Earnest, Vista’s president and CEO. “The smaller operation represents a paradigm shift in the way the company looks at the project.”

45% return

Mt Todd would generate a posttax net present value (NPV) at a 5% discount rate of $1.1 billion and an internal rate of return (IRR) of nearly 28% at a base case gold price of $2,500 per ounce. At spot gold of $3,300 per oz. the NPV jumps to $2.2 billion and the IRR to almost 45%. The payback period in the base case is 2.7 years, falling

to 1.7 years at spot prices.

“It’s a 10.6-million oz. deposit and is exciting because it has the potential to be the most financially rewarding project I’ve ever worked on,” Earnest says. “There is an opportunity to create wealth for shareholders in a magnitude I have never participated in as a manager in this industry.”

Average annual production in the mine’s first 15 years is estimated at 153,000 oz. grading 1.04 grams gold per tonne and 146,000 oz. grading 0.97 gram gold over its 30-year mine life. All-in sustaining costs in the first 15 years are pegged at $1,449 per oz. and average $1,499 per oz. over the life-of-mine.

“The all-in-sustaining costs are quite middle of the road for Australia operations as is the capex,” he says. “One of the things that pleases me the most is that it is a very credible study and the numbers are achievable.”

‘Right-sizing’

In addition to “right-sizing” the project, Earnest says, Vista “rightscoped” it by raising the reserve cut-off grade to 0.5 gram gold. That increased the average reserve gold grade from 0.77 gram gold to 0.97 gram gold at the Batman deposit.

“With Mt Todd being such a large deposit, we have the luxury of raising the reserve cut-off grade,” he explains. “We felt that a smaller, high-grade reserve would be more appreciated in the market and that there would be greater

value placed on the project.”

Mt Todd currently hosts proven and probable reserves of 171.9 million tonnes grading 0.94 gram gold for 5.2 million contained ounces. The reserves include ore that was left on the historic heap leach pad, which will be re-processed at the end of the mine’s lifespan.

Importantly, Mt Todd has all major permits it requires for a larger 50,000 tonnes per day mine. While these permits will need to be amended for the smaller throughput, Vista doesn’t see that as a risk.

“It would stand to reason if you have permits for 50,000 tonnes per day and you’re proposing 15,000 tonnes per day in a new footprint there shouldn’t be a lot

that needs to be done,” he says.

Larger option

Vista, with a market capitalization of about $128 million, notes that the option to build it bigger is still there.

“We’ve not sterilized or walked away from the potential to build it larger,” Earnest says. “We’ve preserved the space and layout in the plant to make sure there is room for additional crushers and mills, so the project can be expanded in the future.” Management hopes to have greater clarity over Mt Todd’s future development path over the next six months. Options the board is considering are to joint-venture the project, sell it, or build it themselves with contract miners.

Measured and indicated resources stand at 340.4 million tonnes grading 0.83 gram gold for 9.1 million oz. contained gold and another 57.1 million inferred tonnes grading 0.78 gram gold for 1.43 million ounces.

Decade’s work

Vista acquired Mt Todd, 250 km southeast of Darwin, out of receivership in 2006. It then spent a decade engineering and designing a large project that it thought would be attractive to senior producers.

“But with the rising gold price senior producers have higher tolerance for operating risk than development risk, which is why they are acquiring other producers,” he says.

“ Record high gold prices and a smaller initial investment make Mt Todd even more attractive now, says Earnest, who recalls struggling to operate mines in the Andes when gold was trading at US$250 per ounce.

“If you told us then that we’d live to see a gold price ten times that, we would have said, no that’s impossible,” he says. “Now many of the lending banks have midterm gold prices of US$4,000 per oz. in the next two or three years. So, there’s even more incentive to build Mt Todd.”

The preceding Joint Venture Article is PROMOTED CONTENT sponsored by Vista Gold and produced in co-operation with The Northern Miner. Visit: www. vistagold.com for more information.

indepth | US SOUTHWEST

Juniors test lithium waters in Arizona, New Mexico

BATTERY METALS | Higher costs, lower commodity prices weigh

BY ANDREW SEALE

Beyond some higher-profile projects in Nevada, juniors in Arizona and New Mexico are quietly advancing early-stage lithium plays from claystones and oilfield brines.

The battery metal is emerging as a critical focus for the United States as it works to build secure domestic supply chains for electric vehicles and cut dependence on imports from China and South America. The Southwest — spanning Nevada, Arizona, New Mexico, Utah and Texas — hosts a mix of claystone, brine and geothermal-linked deposits that rank among the nation’s most promising undeveloped resources.

Favourable state policies, access to new battery manufacturing hubs, and a range of deposit types are drawing heightened exploration interest to the region. The big barrier is capital expenditures, Federico Gay, principal analyst of lithium at Benchmark Mineral Intelligence, said from London.

“Depending on how deep the resources are located, it’s expensive, even at an exploratory level, to develop these projects,” he told The Northern Miner by email. “At current prices, it’s tough to get the necessary funds.”

Big Sandy High capital expenditures, permitting delays and weak prices are taking a toll. In August, Australian junior Arizona Lithium (ASX: AZL) announced it was exiting its namesake state through the sale of its Big Sandy lithium project and Lithium Research Center to project partner Navajo Transitional Energy for US$5 million (A$8 million).

“We are now focused on our near-term production project — the Prairie lithium brine project in Canada,” Paul Lloyd, managing director of Arizona Lithium, said in an interview by email.

Last August, a federal judge granted a temporary restrain-

In Memoriam:

“Depending on how deep the resources are located, it’s expensive, even at the exploratory level, to develop these projects.”

FEDERICO GAY, BENCHMARK MINERAL INTELLIGENCE

ing order that froze exploration drilling at the Big Sandy site after the Hualapai Tribe challenged the Bureau of Land Management (BLM)’s approval. This February, the company withdrew its approved stage three exploration plan to address stakeholder objections before deciding to sell the project altogether.

J. Graham Eacott

It is with deep sorrow that we announce the passing of J. Graham Eacott, a respected leader in the mining and financial industries, whose career spanned more than four decades and touched countless lives, on July 19, 2025 at the age of 83 after a long illness. Known for his unwavering dedication to excellence and his generous mentorship, Graham leaves behind a legacy of innovation, integrity, and service.

A native of the United Kingdom and a graduate of Manchester University with a Bachelor of Science in metallurgy, and later earning a Master of Science in industrial metallurgy and management techniques from the University of Aston in Birmingham, Graham distinguished himself early in his career in operational roles. His professional path led him across several continents, from copper mining operations in Zambia to the boardrooms of Canadian mining companies.

Mr. Eacott was a registered professional engineer (PEng) in Ontario and a graduate of the Canadian Securities Course. After a tenure as a base metals analyst in the investment industry with Scotia Capital, Merrill Lynch, and Maison Placements, his career included significant leadership positions in Royal Oak Mines Inc., where he was vice president of investor relations from the company’s formation through its development into one of Canada’s leading gold producers. He worked with a distinguished team to build Royal Oak and spent significant amounts of time traveling in Europe and the United States visiting significant Royal Oak shareholders on a regular basis.

Graham also served as a director, officer and advisor of Century Mining Corp., Tamerlane Ventures Inc., GGL Resources Corp., New Carolin Gold Corp. and Jaeger Resources Ltd. His roles included investor relations, corporate governance, and compliance, including serving as interim board chair and audit committee chair.

Graham will be remembered not just for his remarkable achievements but for his kindness, humility, and willingness to help others rise. He is survived by his family, including his wife Irena, daughter Karen and grandson Giles. Friends and colleagues will cherish his memory and strive to honor his example.

Direct extraction

Deep brine deposits demand costly drilling and pump testing, while most projects will require capital-intensive plants for direct lithium extraction (DLE). This process collects lithium ions from brine more efficiently and less resource-intensively than current mining and evaporation pond methods.

Add in remote-site infrastructure needs and protracted permitting timelines, and early-stage developers can face tens of millions of dollars in costs before proving up a resource.

There have also been pricing headwinds. Battery grade lithium carbonate hit a record high of about $86,000 per tonne in late 2022 but dropped to around $8,300 in June. August saw a moderate rebound to $10,525 per tonne near press time.

“At the moment, the situation in the U.S. is more optimistic for large projects,” Gay said. “Smaller projects might find it tough to get the funds to secure moving these projects forward.”

Smackover

Whether Arizona and New Mexico become the next lithium hotbeds may depend less on geology than on what happens 1,500 km east in Arkansas’s Smackover Formation.

A joint venture between Standard Lithium (TSXV, NYSE-A: SLI) and Norwegian state oil company Equinor is operating a field pilot to produce battery-grade lithium carbonate on-site.

“I think it will depend on the

success of the Smackover,” Gay said. “If it happens, Arizona is likely one of the next top targets.”

Arizona

Despite Arizona Lithium’s exit, the state is promising, Gay said. Arizona’s lithium-rich clays and brines, shallow deposits and arid climate make it a strong candidate for DLE.

“The Big Sandy deposit is an interesting one, with lithium content of roughly 98 parts per million, which is decent for a project of the characteristics,” he said. “It is highly likely we won’t see lithium commercial production from Arizona this decade, but there are deposits and conditions — infrastructure, O&G developments, etc — that can considerably raise the interest of developing lithium projects in the state.”

Last January, Vancouver-based junior Ameriwest Lithium (CSE: AWLI) cleared a major hurdle in acquiring approvals necessary for a first stage drilling program at its Thompson Valley lithium project in Arizona. However, it is still in the permitting stage.

New Mexico

New Mexico’s lithium potential is anchored in salt flat basins such as the Alkali Flat–Lordsburg system, where brine targets lie near highway, rail and geothermal infrastructure. The state also straddles the Permian Basin, a major source of oilfield-produced water that the U.S. Department of Energy says could yield recoverable lithium and

other critical minerals.

With DOE-backed research at New Mexico Tech, formally known as the New Mexico Institute of Mining and Technology, and access to both brine and geothermal resources, the state is emerging as another test bed for direct lithium extraction.

On the ground, Vancouverbased Lancaster Resources (CSE: LCR) controls the 21-sq.-km Alkali Flat lithium-brine project near Lordsburg and secured key permits last year, including a drill permit from New Mexico and BLM approval for its first stage plan of operations.

Arizona Lithium holds 291 BLM claims, covering 25 sq. km at its Lordsburg project in New Mexico. The basin features layers of clays, silts and sands, mirroring the sedimentary profile of Nevada’s Clayton Valley, one of the U.S.’s most prolific lithium-producing basins and a benchmark for brine extraction.

Untapped potential

“Apart from exploratory results, we do not know much about these projects,” Gay said.

He points out that early-stage players are targeting deposits near known projects.

“They are likely going to gain knowledge about these deposits, hoping for a sale,” Gay said. “In some cases, they are successful, but it is unlikely, short to mid-term, that they will develop the projects themselves.”

2025 drill down records

Wesdome tops peers with bonanza hit in Quebec

GOLD | Australia scores most results among best holes

BY FRÉDÉRIC TOMESCO

Australia dominated the global ranking of best gold assays this year to June 30 with six holes in the top 10 and nine in the top 20 — but it was a Canadian miner that bested all rivals with a bonanza hit at midyear. Assays are ranked according to grade multiplied by length.

Wesdome Gold Mines’ (TSX: WDO; OTCQ-X: WDOFF) drilling program at its Kiena property in Val-d’Or, Que. is starting to pay dividends — big time.

Hole N127-7035 in the Kiena Deep zone cut 2.9 metres grading 2,349.88 grams gold per tonne from 76.6 metres depth, Wesdome said June 25. That was enough for a score of 6,815 and first place in The Northern Miner’s top 20 best gold assays for this year’s first half.

Wesdome CEO Anthea Bath said the completion of new underground drill platforms at Kiena last year has significantly expanded the company’s reach, improved drill angles and provided access to targets that were previously unavailable to drill from underground.

By midyear, the company had completed about 21,000 metres of

exploration drilling at Kiena, whose underground operation already produces gold. Toronto-based Wesdome expects to churn out between 90,000 and 100,000 oz. at the property in 2025 — almost half of its overall target of 190,000210,000 ounces.

Exploration work “is progressing exceptionally well,” Bath said in the statement. “Drilling year-to-date

has confirmed the validity of our geological models, further reinforcing the potential to expand existing resources.”

Garden Gully

Coming in at No. 2 was hole NGGRCDD974 at New Murchison Gold’s (ASX: NMG) Garden Gully project in Australia, which intersected 0.28 metres grading

17,563.69 grams gold per tonne from 251.4 metres downhole, according to an April 30 statement from the company. That gave it a score of 4,918.

Located in Western Australia’s prolific Murchison gold district, close to numerous operating mines and within 200 km of five gold processing facilities, Garden Gully is part of a 677-sq.-km land package

BME’s AXXIS™ range – Silver, Titanium, and CEBS – delivers world-class electronic initiation trusted by mines across five continents.

Built for precision, safety, and sustainability, AXXIS™ empowers engineers and blasters to achieve consistent, high-performance blasts –even in the most demanding conditions.

• AXXIS™ Silver – Proven reliability for quarries and mid-sized mines.

• AXXIS™ Titanium – Advanced control with best-in-class safety and data capabilities.

• AXXIS™ CEBS – Centralised blasting with unmatched scale and efficiency.

With AXXIS™, you don’t just initiate blasts –you initiate progress.

that includes the Abbotts Greenstone Belt.

The project has multiple gold prospects along the belt, the most advanced of which is Crown Prince. A November 2024 update for Crown Prince showed 1.51 million indicated tonnes grading 4.6 grams gold per tonne for contained metal of 226,000 oz., and 693,000 inferred tonnes grading 2.4 grams gold for contained metal of 53,000 ounces.

The total updated resource, at 279,000 oz. of contained metal, represents a 16% increase from a February 2024 estimate, according to the company.

Gwalia mine

Third on the list was a drill result from Genesis Minerals (ASX: GMD) at Western Australia’s Gwalia mine. Hole UGD2504 intersected 0.4 metre grading 10,800 grams gold per tonne from 374.5 metres depth, Genesis said in an April 8 statement. That gave it a total score of 4,320.

Gwalia, which Genesis acquired from St. Barbara in mid-2023, is Australia’s deepest underground

2025 drill down records Hycroft Mining leads results this year

SILVER | Past-producing sites emerge with high grades

BY BLAIR MCBRIDE

Our TNM Drill Down features highlights of the top 20 silver assays of the year to June 30. Drill holes are ranked by silver grade times width.

Drilling in three far flung parts of the world has returned the best silver assays.

Hycroft Mining (Nasdaq: HYMC) topped the results from its namesake past-producing site in Nevada. Aftermath Silver (TSX: SSRM) was second with results from its resource-stage Berenguela project in Peru. Aya Gold & Silver (TSX: AYA) was third with results from its producing Zgounder mine in Morocco.

Hycroft Mining Hole H24D-6018 at Hycroft’s site cut 21.2 metres grading 2,359 grams gold per tonne from 306.6 metres depth, for a grade times width value of 50,025, the company reported on Jan. 14.

The intersection, which pierced the Brimstone zone, was the best hole drilled at the site in more than 40 years, Alex Davidson, Hycroft’s vice-president of exploration, said in January. It was among drill results that confirmed the continuity of a high-grade silver trend at Brimstone, located on the east side of the gold-silver pit in northwest Nevada. Production happened intermittently between 1983 and 2021, when operations were suspended due to cost difficulties.

Drill results including hole H24D-6018 have made Hycroft consider developing a smaller highgrade mine for the initial stage of sulphide mining. During the first half of this year it has advanced metallurgical and engineering work.

Last month, Hycroft started a 14,500-metre drill program leading into next year with two rigs. It aims to expand and advance the highgrade discoveries at Brimstone and Vortex, south of Brimstone.

The company plans to complete a technical study with economics in the fourth quarter.

Hycroft hosts 819.1 million measured and indicated tonnes grading 0.4 gram gold per tonne and 13.68 grams silver for 10.58 million oz. gold and 360.66 million oz. silver, according to a 2023 technical report. Inferred resources total 268.17 million tonnes at 0.39 gram gold and 11.14 grams silver for 3.35 million oz. gold and 96.11 million oz. silver.

Aftermath Silver

Hole AFD100 at Aftermath’s Berenguela silver-copper-manganese project returned 156 metres grading 290 grams silver per tonne from surface, for a grade times width value of 45,240. That hole, reported on Feb. 27, was drilled into the Eastern zone at the project in southeastern Peru, about 200 km northeast of Arequipa.

The result was from the second stage of a 5,200-metre drilling program designed to define the zone’s margin of mineralization while converting inferred resources to indicated and measured.

Berenguela hosts 40.17 million measured and indicated tonnes grading 78 grams silver for 101.2 million contained oz., according

SILVERTOP 20

to an initial resource from 2023. Inferred resources total 22.28 million tonnes at 54 grams silver for 38.8 million oz. silver. Mining took place at Berenguela from 1913 until 1965, during which about 454,000 tonnes of ore

were mined from underground and open pit operations. That amounts to just 1.2% of the 2023 resource, Aftermath said.

The company plans to complete a preliminary feasibility study for Berenguela this year.

Aya Gold & Silver Hole ZG-RC-24-277, in the East zone at Aya’s producing Zgounder silver mine in west-central Morocco cut 17 metres grading 2,425 grams silver from 33 metres depth, for a grade times width value of 41,225, the miner reported on Jan. 7.

The hole, among 34,809 metres drilled as part of last year’s exploration program, revealed the potential to increase high-grade ounces in and around Zgounder’s pit, CEO Benoit LA Salle said in a release.

The result came just one week after Aya declared commercial production at Zgounder. The mine produced more than 1.04 million oz. in the second quarter. It’s targeting 5 million to 5.3 million oz. for 2025.

Zgounder hosts 8.5 million proven and probable reserves grading 257 grams silver for 70.8 million oz., according to a 2022 technical report. The mine has a $373-million post-tax net asset value (at a 5% discount), a 48% internal rate of return and an 11-year life.

Aya is about one-third into its 25,000-metre drill program in and around Zgounder this year. Another 100,000 to 140,000 metres of drilling are planned for the Boumadine project, about 385 km east of Zgounder. The company has budgeted $25 million to $30 million for exploration and development.

Aya plans to publish an updated resource estimate for Zgounder in the fourth quarter.

BY COLIN MCCLELLAND

The Northern Miner’s list of top 20 copper drill results in this year’s first half reflects the strong exploration momentum in the Andes of Chile and Argentina, as well as Mongolia which all boasted long high-grade intercepts.

Ranked by grade-times-interval – a measure that emphasizes both grade and thickness – the first half of 2025 was led by a handful of long runs of moderate copper mineralization rather than short, spectacular spikes.

Entrée Resources (TSX: ETG) tops the ranking at the Hugo North Extension (HNE) deposit within the Oyu Tolgoi joint venture in Mongolia. Hole EGD189B cut 552 metres grading 2.3% copper from 1,226 metres depth, giving it the highest grade-times-interval of the period. The company called the EGD189B result “some of the best we’ve received since HNE deposit drilling restarted in 2022.”

Entrée also reported underground hole UGD807C, which intersected 456 metres at 1.19% copper from 205 metres. Continued work at HNE remains a priority in 2025, Entrée said. The drilling is intended to help plan future mine planning alongside Rio Tinto’s (NYSE, LSE, ASX: RIO) underground expansion schedule at Oyu Tolgoi, one of the world’s largest copper-gold operations.

The Entrée/Oyu Tolgoi joint venture property has 40 million tonnes of probable reserves grading 1.5% copper, 0.53 gram gold per tonne and 3.6 grams silver, for 1.34 billion lb. copper, 676,000 oz. gold and 4.61 million oz. silver, according to a 2021 feasibility study.

Oyu Tolgoi is owned 66% by Rio Tinto and 34% by Mongolia; Entrée holds a participating interest in the Hugo North Extension within the broader complex.

NGEx Minerals (TSX: NGEX; US-OTC: NGXXF) occupies the next positions from its Lunahuasi project in San Juan province, Argentina. Hole DPDH027 ranks highly by grade times interval on the strength of its length, returning

2025 drill down records

Long Andean intervals dominate

COPPER | Projects in Mongolia, Chile, Argentina lead assays

Lengthy moderate cores scored higher than short spiky ones

about 1,619 metres at 0.52% copper from 386 metres depth.

Two other Lunahuasi holes also place near the top of the list, reflecting a pattern of multi-hundred-metre runs with copper grades that score well once length is factored in. The company’s plan is to keep stepping out and to prepare for further drilling aimed at expanding the Lunahuasi footprint within the

Vicuña District.

Stage three drilling at Lunahuasi “has rapidly expanded the minimum north–south, east–west and vertical distances of the mineralized volume to well over one kilometre,” NGEx President and CEO Wojtek Wodzicki said in May. “This unique combination of high grades and sig-

Advancing Novador Gold Project in Quebec TSX: PRB

projectupdates

Industry revival radiates from Southwest

URANIUM | Price, government tailwinds push new projects

BY BLAIR MCBRIDE

Decades after the United States’ large-scale uranium mining industry mushroomed in Utah and New Mexico in the 1950s, the industry is returning to its Southwest roots in a revival spurred by economic and political currents.

Arizona, Colorado, New Mexico, Texas and Utah are seeing the release of new uranium resources, permit fast-tracking and production and processing starts after an industry downturn of several years.

“[Uranium] producers were for the most part out of business, meaning their deposits were closed and mines were on care and maintenance for the greater part of 10 years,” John Ciampaglia, CEO of Sprott Asset Management, told The Northern Miner in an August interview. “And in the last three years, the industry is basically trying to create a supply response in reaction to the price and demand signals that it’s seeing. So that’s really positive.”

Though the U.S. imports the majority of the uranium it consumes, this return of uranium activity to the states where the industry began after the Second World War represents efforts to align domestic supply with rising demand for nuclear. Those efforts are supported by tailwinds pushing the uranium sector in the U.S. including higher spot prices, government support for nuclear energy and uranium mining and increasing data centre demand for atomic power . Renewed Southwest exploration Among the most recent developments in the Southwest is Global Uranium and Enrichment’s (ASX: GUE; US-OTC: GUELF) initial resource for its Maybell project in Colorado in July. Uranium was mined intermittently near Maybell from the 1950s until the 1980s.

“In the last three years, the industry is trying to create a supply response in reaction to the price and demand signals that it’s seeing.”

JOHN CIAMPAGLIA CEO, SPROTT ASSET MANAGEMENT

The company’s Maybell estimate is the second largest initial hard rock uranium resource in the Southwest and the most significant uranium development in Colorado since Denison Mines’ (TSX: DML; NYSE: DNN) Topaz operation closed in 2009.

The (Australian rules) JORC resource outlines 3.2 million inferred tonnes grading 849 parts per million (ppm) uranium oxide (U3O8) for about 6 million lb. U3O8

“[The resource] confirms that the Maybell uranium project remains a substantial uranium district in the

a release. “These results not only validate our exploration target but also highlight the significant potential to substantially increase upon this maiden resource.”

Global’s resource is based on a 25-hole, 3,200-metre drill program done last year. It confirms highgrade mineralization in the sands of the productive Browns Park Formation. In the past, the district yielded about 5.3 million lb. U3O8 at an average grade of 1,300 ppm.

Global Uranium’s exploration target at Maybell ranges between 4.3 million lb. and 13.3 million lb. U3O8, at grades between 587 ppm and 1,137 ppm, derived from a historic database of more than 3,000 drill holes.

Hard rock peers

Energy Fuels‘ (TSX: EFR; NYSE-A: UUUU) Bullfrog project in Utah follows Maybell in regional size with 10.5 million lb. U3O8. while its La Sal complex in Utah hosts 4.2 million lb. U3O8

ppm U3O8, but above La Sal’s 400 ppm U3O8

Speaking generally, Ciampaglia said the uranium industry is focused on discoveries that were made more than a decade ago but low uranium prices gave miners little reason to develop them.

“Now companies are finally submitting environmental reviews, permits, permit processes, and they’re raising capital in anticipation of building mines,” he said.

Return of production

Domestic production of uranium exceeded 10 million lb. U3O8 annually from the 1950s until well into the 1980s, peaking at 43.7 million lb. U3O8 in 1980, according to the U.S. Energy Information Administration (EIA). But imports from other countries like Canada, Kazakhstan and Australia began to overtake domestic output in 1990, until American production

declined to a low of 174,000 lb. U3O8 in 2019.

Output has been slowly rising since then, increasing to 200,000 lb. U3O8 in 2022 then down to 50,000 lb. U3O8 in 2023, and then shooting up to 700,000 lb. U3O8 last year.

In-situ recovery (ISR) mining in Wyoming has accounted for most U.S. production over the last several years, but since last year’s first quarter, output has shifted to sites in the Southwest, EIA data show.

That production has been filled by EnCore Energy’s (Nasdaq, TSXV: EU) Alta Mesa and Rosita ISR facilities in Texas, which had both been idled for more than a decade, and Energy Fuels’ White Mesa Mill in Utah. Energy Fuels’ La Sal Complex mines in Utah, which were put into care and maintenance in 2019, restarted in 2023 and its Pinyon Plain underground mine started fresh production around the same time.

After the three mines ramped up output in 2024, they produced 151,000 lb. U3O8 in this year’s first quarter and surged to 665,000 lb. U3O8 in the second quarter, with Pinyon Plain dominating.

The Rosita plant restarted in November 2023 after it was idled since 2008 due to low uranium prices, and Alta Mesa restarted in June 2024.

Permit pluses

Meanwhile, the Trump administration’s efforts to accelerate development permitting have given traction to uranium projects in the region.

Most recently, Laramide Resources’ (TSX: LAM) Crownpoint-Churchrock and La Jara Mesa projects in New Mexico were granted FAST-41 covered status by the U.S. Permitting Council in late May. Also in New Mexico, private developer Grants Energy’s Precision ISR project also joined the fast track.

Earlier in May, the United States Department of the Interior approved Anfield Energy’s (TSXV: AEC; US-OTC: ANLDF) VelvetWood uranium and vanadium mine in Utah, making it the first project to be greenlit under an accelerated 14-day environmental review timeline. The site, where those metals were mined from 1979 until 1984, was recognized due to its existing infrastructure which would create less of an environmental footprint than new construction.

While the permitting boosts are spurring exploration and development, Ciampaglia noted that most of the U.S’ key deposits have already been mined, and it could be challenging to bring new discoveries to market.

“With uranium mining, the permitting process is very long, you’re dealing with a radioactive material. There are more complexities than other types of mines,” he said. “But the will is there, the government incentives are there. We have clarity around policy. This is a really good opportunity for production in the U.S. to revive itself, but it’s going to take time.” TNM

— With files from Henry Lazenby

projectupdates

Arizona Sonoran tests stock highs on royalty trim

COPPER | Targets 2029 output at Cactus

BY HENRY LAZENBY

Arizona Sonoran Copper (TSX: ASCU; US-OTC: ASCUF) is pressing its Cactus copper project in Arizona toward an updated resource and prefeasibility study (PFS) by year-end while cutting project royalties and shoring up funding.

Given the company’s development momentum, shares in the Casa Grande, Ariz. and Torontobased company appear to be undergoing a re-rating. Its TSX stock nearly doubled this year to an all-time high of $2.75 apiece before easing to $2.67 near press time for a market capitalization of about $474 million (US$342 million).

President and CEO George Ogilvie says the market move, at roughly 0.3 times price-to-net asset value, still leaves “substantial runway for a further re-rating”, but doesn’t mean the team can relax. It’s gearing up for first copper cathode in 2029 with plans to organize financing next year, Ogilvie told The Northern Miner by phone in August.

“We plan to open the data room in the fourth quarter, work through lenders over the next 9 to 12 months and aim to announce project debt in the second half of 2026,” Ogilvie said. “Once debt is in place, we’ll look at the equity component and move to a final investment decision in late 2026 or early 2027.”

Investor appetite for U.S. copper development was also highlighted on Aug. 13 when Mitsubishi agreed to buy 30% of Hudbay Minerals’ (TSX, NYSE: HBM) Copper World project for $826 million, a peer transaction in Arizona. That followed Hudbay’s strategic investment in Arizona Sonoran.

lion, management said.

The buy-down follows Royal Gold’s February purchase of a pre-existing 2.5% NSR on part of Cactus for US$55 million.

A busy financing calendar has helped fund the de-risking work.

430 million inferred tonnes at 0.4% total copper for 3.8 billion pounds.

Arizona Sonoran plans to update the mineral resource followed by a PFS before year-end, with a definitive feasibility study to follow soon after. The roughly 40,000-metre infill program supporting the PFS has been completed and results are expected over the coming months.

Market observers point out that Arizona Sonoran is well positioned ahead of the upcoming milestones. Despite analysts expecting the initial capital cost will go up in the PFS relative to the PEA capex of US$668 million, Ogilvie maintains that the capital cost will remain comfortably below US$1 billion.

This makes Cactus “one of the lowest capital intensity copper development projects globally,” Haywood Capital Markets mining analyst Pierre Vaillancourt wrote in an Aug. 1 note.

“Hudbay’s strategic investment in January – after four months of due diligence – was a huge validation,” Ogilvie said. “They don’t put upwards of $30 million into a company unless they expect significant returns.”

Gathering momentum

So far this year, Arizona Sonoran has reduced the net smelter return

(NSR) royalty on Cactus to 2.5% from 3.2%. It completed a 0.6% royalty buy-down in August for total cash payments of US$8.91 million to subsidiaries of Royal Gold (Nasdaq: RGLD) and Elemental Altus Royalties (TSXV: ELE; US-OTC: ELEMF). Royal Gold’s interest fell to 2% (from 2.5%) for US$7 million and Elemental Altus’ to 0.5% (from 0.7%) for $1.91 mil-

In June, Arizona Sonoran closed a $51.75-million bought deal at $2 per share. The company said the net proceeds are expected to fully fund it through a potential final investment decision at Cactus as early as the fourth quarter of 2026.

Hudbay maintained a 9.9% stake in July by exercising pre-emptive rights through a $5.8 million private placement. As a result, Arizona Sonoran now has about $85.4 million in cash and 177.6 million shares outstanding. The company also closed a November 2024 Nuton placement, seeing the Rio Tinto (ASX, LSE: RIO) venture investing $3.1 million.

Studies and timeline

A 2024 PEA outlines average production of 116,000 short tons of copper cathode per year for the first 20 years, an after-tax net present value, at 8% discount, of $2.03 billion and a 24% internal rate of return at $3.90 per lb. copper, with initial capital outlay of $668 million over two years.

A July 2024 resource underpins the study. It outlined measured and indicated resources of 574.1 million tonnes at 0.6% total copper for 7.3 billion lb. contained copper and

While there is no formal talk of a buyout yet, the analyst suggests that Hudbay maintaining its stake in the company during the most recent financing, and that three companies have signed non-disclosure agreements with access to Arizona Sonoran’s data room points to high interest in the asset. Rio Tinto did not participate in the recent financing but still maintains its investor rights.

Next steps

Early results from the Parks/Salyer deposits confirmed continuity. It includes long mineralized runs such as 391 metres grading 0.7% total copper from 226.8 metres deep in hole ECM-299 (with higher-grade enriched intervals) and 465 metres at 0.7% from 162.2 metres deep in ECM-289.

Metallurgical column work indicates recoveries that meet or exceed assumptions used in the 2024 PEA, Ogilvie said. Enriched material columns project 90% soluble copper extraction under best-practice “heap efficiency” assumptions versus 85% in the PEA. The team also trialed a Wirtgen SM 280 surface miner in the historical Cactus West pit. Preliminary results exceeded modelled throughput and cost expectations.

Ogilvie says the project’s trump card lies in benefitting from private-land status and a state-led regime. Major permits based on an earlier study are in hand. The company further cites 87% local support from October 2024 polling of Casa Grande residents.

donedeals

Peabody nixes $3.8B Anglo deal

COAL | Blames April fire damaging mine

BY MINING.COM STAFF

Anglo American’s (LSE: AAL) efforts to streamline its business have hit a major roadblock after Peabody Energy (NYSE: BTU) scrapped a $3.8-billion (C$5.27-billion) deal to acquire its Australian metallurgical coal assets.

The deal collapsed after a fire at Anglo’s Moranbah North mine in Queensland, which Peabody argued constituted a “material adverse change,” a contractual clause that allowed it to withdraw.

Anglo strongly disputes that interpretation and said Aug. 19 it will initiate arbitration to claim damages for wrongful termination.

The blaze, triggered by high gas levels in April, halted operations at Moranbah North, one of the most valuable mines included in the package. Peabody maintains that the incident had longterm material impacts and attempted to renegotiate terms. When talks failed, the company

pulled out, also canceling plans to on-sell one of Anglo’s mines to an Indonesian buyer.

Anglo countered that there was no lasting damage to equipment or infrastructure, and that progress was being made toward restarting the mine. CEO Duncan Wanblad said he was “very disappointed” by Peabody’s decision but stressed that other bidders had shown strong interest in the assets during the sales process.

Shares in Anglo American closed less than 1% higher in London at £21.45 apiece on the day while Peabody Energy fell 3.5% to end at $16.50 each in New York. They were at £21.72 and $16.79, respectively, near press time.

Anglo restructuring

Anglo American’s coking coal operations produce about 16 million tonnes a year and generated nearly a fifth of the group’s earnings last year. Their sale had been billed as the simplest step in a wider restructuring designed to concentrate on copper and iron ore, following the

spinout of its platinum group metals unit and efforts to find a buyer for De Beers.

The coal sale was seen by investors as a key test of Anglo’s ability to generate cash and deliver on its divestment strategy after rebuffing a $49-billion takeover approach from BHP (NYSE, LSE, ASX: BHP) last year. Instead, the company is heading into arbitration that analysts say may drag on until 2026, forcing it to revisit the sale process at a time when coal prices have softened.

For Peabody Energy of St. Louis, the $3.8-billion acquisition was meant to lift its position in steelmaking coal. Analysts had warned the deal looked rich, noting the price was nearly twice Peabody’s market capitalization when the agreement was signed.

“Each side is confident in its own position from a legal perspective,” Jefferies analysts said in August, noting that a protracted arbitration could weigh on both companies’ share prices. TNM

M&A SHORTS

> Hudbay Minerals’ (TSX, NYSE: HBM) shares skyrocketed to their highest level in more than a decade after it sold a 30% stake in its fully permitted Copper World project in Arizona to Mitsubishi for $600 million (C$826.1-million).

The agreement, announced on Aug. 13, secures a long-term partner for Hudbay and sharply reduces its upfront funding needs. Mitsubishi is to pay $420 million at closing and an additional $180 million within 18 months.

The company will also fund its pro-rata share of future capital costs, deferring Hudbay’s first capital contribution until at least 2028 and trimming its expected outlay to about $200-million based on prefeasibility study estimates.

“We note the significant premium paid by Mitsubishi for their stake in Copper World,” Canaccord Genuity analyst Dalton Baretto said in a note, calling the development positive as he raised his overall net asset value for Hudbay by 16%.

Hudbay shares in Toronto jumped 19% to $16.14 apiece, where they remained near press time, for a market capitalization of $6.38 billion. The stock last touched such a high level in 2011.

BY CECILIA JAMASMIE

> China’s Ganfeng Lithium and Switzerland-based Lithium Argentina (TSX, NYSE: LAR) agreed in August to merge their assets in Argentina’s Salta province into a single largescale lithium operation.

The new joint venture, to be known as PPG, combines Ganfeng’s Pozuelos–Pastos Grandes project with Lithium Argentina’s 85%-owned Pastos Grandes and 65%-owned Sal de la Puna projects. Ownership will be split 67% for Ganfeng and 33% for Lithium Argentina. The duo already work together at the Cauchari-Olaroz mine in Jujuy province.

The merged operation plans a hybrid production model that combines direct lithium extraction with traditional solar evaporation. It aims to produce up to 150,000 tonnes per year of lithium carbonate equivalent in three stages of 50,000 tonnes each.

The $1.8 billion (C$2.48 billion) already invested covers wells, pilot evaporation ponds, production facilities and accommodations for over 2,000 workers. Ganfeng will also provide a $130-million, six-year loan to Lithium Argentina. BY

CECILIA JAMASMIE

> Blue Moon Metals (TSXV: MOON; US-OTC: BMOOF), a Vancouver-based junior advancing the Nussir copper project in Norway, has secured at least $140 million (C$194 million) in financing from Hartree Partners and Oaktree Capital to fund early works. The capital package comprises a $25-million bridge loan already in place, followed by a $50-million senior secured term loan, a $70-million precious metals stream, and up to $20 million in equity for further development and execution, Blue Moon said Aug. 20.

The financing to cover engineering, long-lead equipment, underground development and working capital is spearheaded by Hartree, a global energy and commodities trading house, and Oaktree, a Los Angelesbased asset manager with $205 billion under management and a stake in Hartree.

Nussir, which has been designated an EU strategic critical raw material project, is a rare new low-cost copper project under pre-construction targeting a September 2027 startup.

BY COLIN MCCLELLAND

eye on australia

Boom drives rising costs for Aussie producers

GOLD | Labour often cited, strategies differ

BY KRISTIE BATTEN

As Australian gold producers set forecasts for their 2026 performance, a clear trend has emerged that sets them apart: costs are expected to rise even as non-gold miners predict lower expenses.

Shares in sector leader Northern Star Resources (ASX: NST) were heavily sold off in July after the company said all-in sustaining costs (AISC) for the fiscal year to June 30 could jump between 6% and 25%, or A$2,300 (US$1,477) to A$2,700 an oz. from A$2,163 per oz. in the previous year.

“Unfortunately, we’re not seeing costs plateau, and that pressure still remains and you’re seeing that across the sector,” Northern Star managing director Stuart Tonkin told reporters. “We haven’t really seen the relief that was expected when nickel and lithium projects were paused or wound down. If anything, gold has picked up that and then some and so that’s just added to the pressure.”

Tight labour markets, higher contractor and service rates, and inflation in energy and consumables are pushing AISC for gold steadily higher. Unlike bulk commodities or battery metals, where project slowdowns and weaker prices have tempered cost pressures, steady gold production and high margins have kept demand for skilled labour and key inputs strong, leaving operators with little room to contain expenses.

Labour pains

Tonkin said the main sticking point was labour, where the company was seeing a 3-4% increase in costs for fiscal 2026.

“With the service providers, we’re seeing more than that because they have stale contracts that might have been formed a few years ago, and there’s been that build-up,” he said.

Evolution Mining (ASX: EVN) guided AISC costs of A$1,7201,880 per oz. for fiscal 2026, up from A$1,572 an oz. this past year. The guidance factored in 4% inflation, equating to A$105-125 per ounce. According to the company, around half of its cost base is labour.

While Western Australia producer Ramelius Resources (ASX: RMS) hadn’t reported next year’s forecast by press time, managing director Mark Zeptner said wages may increase 4% to 5% when 12 months ago it was more like 3%.

“It’s probably really a goldbased boom and iron ore is ticking up as well,” Zeptner said in August on the sidelines of the Diggers & Dealers Mining Forum in Kalgoorlie. “Everyone in the gold space seems to be either expanding

their projects or restarting projects and we’re the same, so there’s potentially a bit of stress coming into the labour market.”

Zeptner suspected it may add around A$100 an oz. to Ramelius’ AISC, which were A$1,551 an oz. for fiscal 2025, allowing the company to retain its position as a lowcost producer.

“I don’t think it’s anywhere near as bad as it was when inflation was double digits, but it has ticked up a bit,” he said.

Higher-cost production

Westgold Resources (ASX, TSX: WGX) in August set cost guidance at A$2,600-2,900 per oz., higher than last year mostly due to increased hauling costs instead of labour, Managing Director Wayne Bramwell said. The company trucks its ore as far as 180 km from the Fortnum mine to the Meekatharra plant in Western Australia.