SURFACE MINING

> Unlocking open-pit value

> Quiet giants

> Let’s talk tailgates

Blasting into the future of mining

Electrification, automation, and digitalization of mining drills

SURFACE MINING

12 Unlocking open-pit value.

14 Quiet giants: How electric machines can redefine surface mining.

28 The mining of tomorrow is here now: Advanced sample scanning enhances human expertise.

DRILLING AND BLASTING

16 From drill to detonation: Blasting smarter in surface mining.

22 Breaking new ground: Electrification, automation, and digitalization of mining drills.

24 Optimizing development drilling at Haile gold mine.

26 Blasting into the future of mining.

34 Subsurface imaging: The rise of new drilling technologies.

37 Revolutionizing tunnel development: Synthetic diamond technology for mining and infrastructure applications.

LOAD AND HAUL

29 The hidden cost of transporting equipment.

31 Let’s talk tailgates.

DEPARTMENTS

4 EDITORIAL | Breaking new ground: How technology is redefining surface mining. 6 FAST

AND

| Updates from across the mining ecosystem.

| Safeguarding your royalty interest: A primer on strategies.

www.canadianminingjournal.com

Breaking new ground: How technology is redefining surface mining

Automation, electrification, digitalization, and artificial intelligence (AI) are the key forces driving the transformation in surface mining, which is an industry traditionally defined by massive equipment and bulk earthmoving operations. Technological innovation is reshaping surface operations from drilling to hauling. The pursuit of greater efficiency, safety, and sustainability is pushing surface mining into a new era, defined less by horsepower and more by intelligence. What was once a field defined by physical intensity is evolving into an environment where digital fluency and data-driven thinking are essential.

Autonomous equipment is no longer experimental — it is operational. Driverless haul trucks, semi-autonomous drills, and remotely operated dozers are becoming integral parts of the fleet. These systems not only reduce human exposure to hazardous environments but also optimize cycle times, fuel usage, and maintenance schedules. The adoption of digital technology allows mining teams to create real-time, dynamic models of their entire operations. Additionally, as the mining industry faces mounting pressure to decarbonize, electrification is moving from aspiration to application. Battery electric and hybrid equipment — such as haul trucks and drills — are being deployed to reduce diesel consumption, lower emissions, and meet ESG targets. Finally, integrated data platforms are transforming how mines operate, connect, and optimize. With sensors embedded throughout the operation — from blast holes to processing plants — AI and machine learning (ML) models can now predict outcomes, detect anomalies, and recommend actions in real time. For example, AI can be applied to optimize blasting outcomes, reduce oversize material, and improve fragmentation.

As the digital transformation gains momentum, there is a growing emphasis on environmental accountability. Mines are adopting real-time monitoring systems for dust, vibration, and water quality, while leveraging drones and satellite imagery for progressive rehabilitation and compliance tracking. These tools not only support regulatory reporting but also help build trust with surrounding communities and stakeholders, especially First Nations.

Surface mining is becoming faster, smarter, and cleaner. As operations become increasingly data-centric and automated, the role of human expertise is also evolving — from direct control to strategic oversight and systems integration. In this new landscape, success will go to those who embrace innovation — not just in tools, but in mindset. The surface may still be the same, but what lies beneath is changing fast.

In this issue, we cover several topics related to surface mining on pages 12 to 16, and 28, with a special focus on drilling and blasting in articles on pages 16 to 19, 22 to 27, 34, and 37.

Additionally, in our load and haul section, we shed some light on recent advances in equipment transport.

Finally, in our August 2025 issue, we rank the “Top 40 Mining Companies in Canada” by revenue alongside an exclusive interview with a Top 40 CEO. The issue also includes featured reports on top development projects and material handling: conveyors, crushers and screens. Editorial contributions can be sent directly to the Editor in Chief before July 2nd.

JUNE/JULY 2025

Vol. 146 – No. 4

69 Yonge St., Ste. 200, Toronto, ON M5E 1K3 Tel. (416) 510-6789 Fax (416) 510-5138 www.canadianminingjournal.com

Editor in Chief Dr. Tamer Elbokl telbokl@canadianminingjournal.com

News Editor Joseph Quesnel jquesnel@canadianminingjournal.com

Production Manager Jessica Jubb jjubb@northernminer.com

Manager of Product Distribution Allison Mein 416-510-6789 ext 3 amein@northernminergroup.com

Publisher & Sales Robert Seagraves 416-510-6891 rseagraves@canadianminingjournal.com

Sales, Western Canada George Agelopoulos 416-510-5104 gagelopoulos@northernminer.com

Toll Free Canada & U.S.A.: 1-888-502-3456 ext 2 or 43734

Circulation Toll Free Canada & U.S.A.: 1-888-502-3456 ext 3

President, The Northern Miner Group Anthony Vaccaro

Established 1882

Canadian Mining Journal provides articles and information of practical use to those who work in the technical, administrative and supervisory aspects of exploration, mining and processing in the Canadian mineral exploration and mining industry. Canadian Mining Journal (ISSN 0008-4492) is published nine times a year by The Northern Miner Group. TNM is located at 69 Yonge St., Ste. 200, Toronto, ON M5E 1K3. Phone (416) 510-6891.

Legal deposit: National Library, Ottawa. Printed in Canada. All rights reserved. The contents of this magazine are protected by copyright and may be used only for your personal non-commercial purposes. All other rights are reserved and commercial use is prohibited. To make use of any of this material you must first obtain the permission of the owner of the copyright. For further information please contact Robert Seagraves at 416-510-6891.

Subscriptions – Canada: $51.95 per year; $81.50 for two years. USA: US$64.95 per year. Foreign: US$77.95 per year. Single copies: Canada $10; USA and foreign: US$10. Canadian subscribers must add HST and Provincial tax where necessary. HST registration # 809744071RT001.

From time to time we make our subscription list available to select companies and organizations whose product or service may interest you. If you do not wish your contact information to be made available, please contact us via one of the following methods: Phone: 1-888-502-3456 ext 3; E-mail: amein@northernminergroup.com

Mail to: Allison Mein, 69 Yonge St., Ste. 200, Toronto, ON M5E 1K3

We acknowledge the financial support of the Government of Canada.

Tamer Elbokl, PhD

THE RIGHT PARTNERSHIP MAKES EVERYTHING POSSIBLE.

At SMS Equipment, we’re more than machines from trusted brands like Komatsu. No matter your project, we’re the people beside you— today and every day—bringing industry-leading technology and expertise to your job site.

Because the right partnership makes everything possible.

• EXPLORATION GROUNDWORK | Integral Metals starts phase 1 exploration at its KAP project

Integral Metals has engaged GeoCraft Geological Services to conduct phase 1 exploration activities on the company’s KAP Project, located in the Sahtu region of the Mackenzie Mountains in the Northwest Territories. Integral is an exploration stage company, engaged in mineral exploration for critical minerals, including gallium, germanium, and rare earth elements.

This initial phase sets the groundwork for targeted drilling planned later this year, with particular interest in following up on historical exploration which demonstrated zinc-lead mineralization, including high grades of gallium and germanium, which are critical metals known for their roles in advanced electronics and renewable energy technologies.

Paul Sparkes, CEO of Integral Metals, said: “We’re excited to kick off phase 1 exploration at the KAP Project alongside the experienced team at GeoCraft.”

• NEW TECH | Avonlea unveils new tech to transform lithium extraction

•

BEST

Avonlea Environmental Technologies

– a leader in eco-innovative industrial technologies – announced the launch of Cavitek, an innovative new technology that promises to transform lithium extraction through advanced cavitation science. With the global demand for lithium surging due to the rise of electric vehicles and renewable energy storage, Cavitek introduces a faster and more energy-efficient method of lithium mining.

At the heart of Cavitek lies a patented process harnessing controlled cavitation—a phenomenon where a localized pressure drop within a liquid causes the formation of microbubbles. These microbubbles become unstable and implode upon themselves releasing intense energy, at the molecular level in the form of high temperature and high-pressure shock waves, imposing powerful physical and chemical interactions.

Douglas Brett, president at Avonlea Environmental Technologies, said: “We’ve engineered a platform that applies science at the molecular level to drive real-world industrial transformation. Cavitek is not only a leap forward for the critical mineral extraction sector but also a win for sustainability— delivering unprecedented efficiency without compromising environmental stewardship.”

•

FIRST ESTIMATE | Abasca Resources releases inaugural mineral resource estimate for Loki Flake

Abasca Resources has unveiled the inaugural mineral resource estimate (MRE) for its Loki Flake graphite deposit at its Key Lake South (KLS) project near regional infrastructure which services Cameco’s Key Lake operation. The project is located on a 23,977-ha exploration project in the Athabasca Basin region in northern Saskatchewan, about15 km south of the former Key Lake mine and current Key Lake mill.

The graphite MRE denotes a major milestone for the project and positions Abasca to play a significant role in contributing to North America’s secure supply chain of graphite.

The MRE has the following highlights: Total Inferred Resource: 11.31 Mt of Graphite at an average grade of 7.65 % Cg, contained graphite: 0.86 Mt, and a cut-off grade: 2.78 % Cg.

RESULTS | Troilus Gold reports single best intercept at Southwest zone of project

Toronto-based Troilus Gold announced positive drill results from its 2025 drill campaign at the Troilus copper-gold project in north-central Quebec. The program is focused on identifying and delineating higher-grade mineralization. The results reported today include the best intercept drilled to date in the southwest zone based on linear grade (grade x width). These results confirm the continuity of higher-grade material within the phase 1 reserve pit, which covers years one to five of the mine plan.

These first reported results include Troilus’s single best intercept in the history of drilling at the Southwest, in terms of linear grade. Drill hole SW-25-688 returned 2.44 g/t gold-equivalent over 56 metres from the primary ore shoot on which the phase one pit is centered and surpasses the previous strongest result from the southwest of 1.56 g/t gold-equivalent over 73 metres in hole TLG-ZSW20-189.

Justin Reid, CEO of Troilus Gold, commented, “We are very encouraged by the latest results from the southwest zone, which will be the first area mined when production begins. Hole SW-25-688 returned the highest linear-grade intercept drilled to date in this zone, highlighting the continuity of wide, high-grade mineralization in the core of the deposit. Additionally, SW-25-679 encountered strong near-surface grades that could further strengthen the early years of the mine plan. As the campaign progresses, we look forward to sharing more results that continue to improve confidence of the block model, de-risk the early production years, and enhance the overall development plan for the Troilus project.”

CREDIT: AVONLEA ENVIRONMENTAL TECHNOLOGIES.

CREDIT: ABASCA RESOURCES.

CREDIT: INTEGRAL METALS.

Troilus copper-gold project. CREDIT: TROILUS.

Harvest Gold announced it successfully received all required government / ATI permits, providing the company latitude for selecting drill targets in the northern and central areas of the Mosseau project. The project spans 147 claims totaling 7265.88 ha (72.66 sq.km). The project is located just east of Lebel-sur-Quévillon, Quebec.

The company has prioritized targets in the northern area. The company’s geological team has finalized targets in the central area. This team expects that process to be completed within the next two weeks. Harvest Gold continues to work with government regulatory authorities and First Nation communities

• CONSTRUCTION | Foran Mining reports first quarter construction progress for McIlvenna Bay

Foran Mining provided a construction update on its McIlvenna Bay project in Saskatchewan. As of the quarter ending March 31, 2025, the project continues to advance steadily, with significant progress made across key areas of development. Foran Mining is a copper-zinc-gold-silver exploration and development company.

The company has announced that overall construction progress reached 32%, with major ongoing work across the process plant, underground mine development, fresh air raise excavation, main electrical transformer station earthworks, coarse ore bin earthworks, truck shop, emergency vehicle storage building, tailings storage facility, permanent administrative building and camp expansion. Foran also stated that commercial production remains on track for H1 2026, aligned with previous guidance.

The company also said key structural milestones achieved include completion of primary steel installation and enclosure around the SAG and ball mills, initiation of roof panel installation, and progress on the process building foundations for secondary structural steel, wall panels and roof panels. Overhead crane installation and flotation equipment foundation work also continued. Detailed engineering is 92% complete, with a forecast to reach 95% by the end of April 2025.

to ensure proper consultation and compliance with all environmental and operational requirements.

Harvest Gold, president and CEO, Rick Mark, stated: “This set of government approvals clears the path to drilling in late spring/early summer. Our team has worked diligently to secure these permits and now turns to finalizing drill targets at Mosseau, which are being identified through an extensive compilation of historical data and Harvest Gold’s recent geological and geochemical surveys. This marks a significant milestone for the Company as it advances exploration efforts to unlock the potential of our flagship Mosseau project.”

• MINING LAWSUIT | Xatśūll First Nation launches legal challenge against B.C. for approving Mount Polley mine expansion

Xatśūll First Nation has filed a judicial review with the Supreme Court of British Columbia against the province’s minister of mining and critical minerals, the minister of environment and parks, the provincial deputy permitting officer, major mines offices and the Mount Polley Mining Corporation to overturn two provincial decisions authorizing Mount Polley Mining to raise the height of the dam at the tailings storage facility.

Xatśūll First Nation is a First Nations government that is part of the larger Secwepemc (Shuswap) nation, located in the Cariboo region of British Columbia near Williams Lake.

The First Nation is alleging provincial decision makers allowed this work to proceed without an environmental assessment, which is legally required in the circumstances. In addition to the judicial review, Xatśūll will also seek an injunction, which will be filed in the coming days, preventing construction of the dam raise until the court process is concluded.

The camp at Foran Mining’s McIlvenna Bay polymetallic project in Saskatchewan. FORAN MINING PHOTO

Aerial view of Mount Polley tailings dam breach in August 2014. IMAGE COURTESY OF BUSINESS IN VANCOUVER.

FAST NEWS

•

NEW COMPANY | Commerce and Mont Royal merge to create a Quebec-focused critical minerals company

Commerce Resources has entered into an agreement with Mont Royal Resources to merge the two companies. The merger will create a Quebec-focused critical minerals explorer and developer, combining Commerce’s Ashram rare earth and fluorspar project and Eldor niobium project with Mont Royal’s Northern Lights lithium project. The new critical minerals developer and exploration company will have a strong focus on rare earths, fluorspar, niobium and lithium exploration.

The newly combined entity will be dual listed on the TSX VentureExchange (TSXV) and the Australian Securities Exchange (ASX), enhancing access to capital and liquidity. The merger also unites

experienced leadership teams with strong track records in capital markets, project development, and operations.

The companies involved have listed the following rationale for the merger: The deal will create a complementary exploration asset package at Mont Royal’s Northern Lights project, covering an area of 536km2 in the Upper Eastmain Greenstone belt, offering lithium, copper and gold potential; and achieving a dual listing on the ASX and TSXV, which aims to attract a broader range of investors for the Merged Group, increase liquidity and greater ability to raise capital.

• PROJECT REVIEW | Impact Assessment Agency accepts public comments on approved James Bay lithium project

The Impact Assessment Agency of Canada (IAAC) is accepting public comments as part of its post-decision phase for the James Bay lithium mine project. The project is for a lithium mine located east of James Bay and the Eastman Cree community in Quebec. As proposed, the James Bay lithium mine project would have an estimated mine life of 15 to 20 years and produce on average 5,480 tonnes of ore per day. The project would include an open pit mine and concentrator facility, tailings, waste rock, ore and overburden storage areas, as well as related infrastructure.

This comment period cannot change the project’s approval. It strictly applies to certain proposed amendments to the decision statement that already resulted in an approval.

Galaxy Lithium – the project proponent – became subject to certain legally binding conditions when the project was approved back in 2023. Galaxy Lithium must comply with these conditions throughout the life of the project, including advising IAAC of any proposed changes to the project that may result in adverse environmental effects.

Since then, the company has submitted information to IAAC proposing project changes. The proponent wishes to adjust the location and configuration of certain waste rock piles.

MINE CONSTRUCTION AND MAINTENANCE

Noah Rain Builders…tackling extreme conditions in remote locations, overcoming tough terrain and weather to build essential infrastructure safely and efficiently. Effectively and efficiently maintain operational mines to ensure smooth flow of production and operations. www.noahrainbuilders.com

• WOMEN IN MINING | Top three mining companies recognized for advancing women in the industry in 2024

In a groundbreaking achievement for advancing gender equality in the mining industry, Artemis Project announced its top three mining companies in Canada for their exemplary commitment to gender-responsive procurement (GRP) in 2024.

These companies are recognizing and accessing innovative talent through their supply chains, driving diversity and cutting-edge solutions within the industry. Their exceptional leadership in embedding gender equity into procurement policies, building an inclusive supply chain, and creating new opportunities for women-owned businesses sets a powerful example for the entire sector.

The top three companies honoured for their progressive practices are: Eldorado Gold, New Gold , and Rio Tinto

These companies were selected after an evaluation process based on key criteria, including, the extent of their outreach and partnerships with Artemis Women-Owned Businesses, and the measurable impact of their initiatives in fostering gender equality within their supply chains.

Heather Gamble, CEO of Artemis Project, said, “These companies are setting a powerful example of how the mining industry can tap into innovative, specialized talent while advancing gender equality.”

Commerce Resources’ Ashram rare earths project in Quebec.

By Samantha Weng, Simon Grant, Jane Helmstadter, and Ali Naushahi

Safeguarding your royalty interest: A primer on strategies

Royalty financing is a well-recognized alternative to traditional types of financing in the mining world. It is an attractive means for companies to obtain capital for projects without share dilution, increasing leverage, or relinquishing operational control. For investors, the returns can be significant, but so can the risks. The question of how best to protect royalty interests from potential downsides is therefore ever-present.

The predominant legal issue concerning royalties, according to Barry Barton, author of “Canadian Law of Mining,” is ensuring the royalty binds subsequent property owners. Royalty holders want their interests to be enforceable against successors of the royalty grantors, increasing the lifespan of the investment and therefore profitability (or its prospect). How-

ever, the law has not always been straightforward on what is required to achieve this.

Structuring a royalty interest

Generally, structuring a royalty interest as a property interest rather than a contractual interest increases the likelihood that the royalty and associated obligations will bind successors. At law, an interest in land typically runs with the land through ownership changes, whereas a contractual interest is a personal right enforceable only against the original grantor. This “land interest versus contractual interest” distinction is often at the heart of the dispute in insolvency proceedings involving assets subject to royalties — highlighting the importance of characterization.

Structuring a royalty interest as a property interest rather than a contractual interest increases the likelihood that the royalty and associated obligations will bind successors.

Royalty holders in Canadian common law jurisdictions cannot assume that their royalties are, by default, interests in land that will survive property transfers — even if that is the parties’ expectation. When creating such interests, royalty holders must be guided by, among other things, the two-step measure endorsed by the Supreme Court in “Bank of Montreal versus Dynex Petroleum Ltd.” and ensure that: (i) the royalty agreement clearly expresses the participants’ intent that the royalty constitutes a property interest, and (ii) the interest out of which the royalty is carved is an interest in land.

Royalty agreements, according to Barton, should unambiguously incorporate legal provisions that enhance the probability that the royalty will “run” with the land, such as the following: (i) language granting or reserving a royalty interest in the real property; (ii) a complete list and legal description of the properties subject to the royalty; (iii) the right to register a notice of interest on title; and (iv) a prohibition against property transfers unless the transferee expressly assumes the royalty and related obligations.

A caution from the court

caveat of its interest against the relevant properties with the applicable land title office or ministry. This registration will establish the priority of interest in the properties against subsequent interests of third parties, and the act of notifying the public may also be seen as evidence that the royalty is intended to bind new property owners.

Ontario law does not preclude courts from granting vesting orders conveying land to purchasers free and clear of encumbrances such as royalties. However, the Court of Appeal for Ontario said in “Third Eye Capital Corporation versus Dianor Resources Inc.” that “it is difficult to think of circumstances in which a court would vest out a fee simple interest in land.”

The Ontario Superior Court of Justice cautioned in “St. Andrew Goldfields Ltd. versus Newmont Canada Ltd.,” that “royalties and royalty agreements are unique and have to be read with care.” To safeguard one’s royalty interest — regardless of type — the agreement must be thoughtfully crafted, moving beyond the incorporation of some “magic words” and give due regard to, at a minimum, all the facts of the transaction, the type of interest out of which the royalty derives, each party’s intention and objective, potential future disputes, and clarity in drafting. If a litigant later challenges whether the royalty runs with the land, the expressed intention of the contracting parties should at least guide the court in adjudicating the dispute.

Once an agreement is entered into, the royalty holder should, where possible and as soon as practicable, register a notice or

In “Dianor,” although the holder’s gross overriding royalties — which were deemed by the Court to be between a property interest and a contractual interest — were

extinguished by the motion judge erroneously and not reinstated on appeal, it was primarily owing to the company’s failure to appeal the initial ruling within the legislatively prescribed timeframe. This is another reminder to royalty holders to stay vigilant in safeguarding their interests.

Samantha Weng is an associate; and Simon Grant, Jane Helmstadter, and Ali Naushahi are partners at Bennett Jones LLP in Toronto.

Samantha’s practice centres on the acquisition, disposition, financing, and leasing of commercial properties throughout Ontario. Simon advises on a broad range of financing and lending matters, with an emphasis on complex cross-border financial transactions. Jane advises clients on a full range of domestic and cross-border purchase and sale, property development, financing, asset management, leasing, and JV transactions. Ali practices corporate and securities law, with an emphasis on corporate finance, M&A, and mining.

Establishing the triangle of trust: Creating the necessary dialogue

By Peter Bryant

In our last column, we emphasized the significance of establishing a triangle of trust that includes companies, the government, and Indigenous communities, creating a shared vision of prosperity with all stakeholders and owners. But in a world of such low trust and high tension, how can we go about creating the necessary dialogue between the government, communities, and companies? What does this look like from a practical standpoint? While this type of co-created shared value is relatively a new way of thinking for companies across the minerals value chain, there are some examples we can look to that can provide an approach. One is the Development Partner Institute’s (DPI) Responsible Sourcing Coalition (RESCO), launched in late 2019 in partnership with The Rockefeller Foundation. To date, this remains one of the few, if not the only, value chain, multi-stakeholder/owner dialogues that bring all voices to the table, particularly community and Indigenous (at both the provincial and country level) perspectives. This international coalition is focused on responsible sourcing and was a result of a special dialogue hosted at the Rockefeller Foundation’s Bellagio Center, where the group came together to discuss a vision for responsible sourcing, strengthen the understanding of each stakeholder’s challenges and priorities, learn from attempts to standardize sustainability efforts in other sectors, and align on a pathway for the minerals sector. This dialogue involved breaking down the different stakeholder motivations and expectations, including mining companies, Indigenous communities/owners, government, investors, downstream companies, and more. Representatives from each group shared perspectives. This ultimately resulted in a set of workstreams to develop a vision and set of principles for responsible sourcing that provide flexibility, allowing for the variations of each commodity and jurisdiction. Key to the success of this approach was clearly defining roles for each stakeholder in the conversation and ensuring there was equal representation across those groups. Radical transparency is critical in these dialogues, and that can only be achieved by giving participants freedom and protection to express their views openly. Creating a safe environment for what can at times be difficult conversations is key, as is ensuring that one group is not dominating the conversation or bringing forth a prescriptive solution. Government can play a key role here in establishing the “sandbox” (environment) with the appropriate guardrails, so that discussions consider the unique aspects of each project and its jurisdiction but still adhere to a co-created set of principles.

While this is a good example of how to convene on a global level, there are several models we can look to build upon that are specific to Canada. The First Nations Major Projects Coalition is an active and important driver of these key dialogues in the Canadian territories and should be looked to as a model for how to bring different stakeholder groups together in a productive way while speaking truth to power. Not only do they advocate for ownership in major mining projects, but they bring a value-driven approach to bringing together stakeholders from the government and the private sector, advancing major projects around issues like clean fuels, responsible sourcing, and transportation corridors, among others.

International policy changes, like the adoption of Free, Prior, and Informed Consent (FPIC), are important. Equally important are national efforts and legal frameworks that provide stronger protections and greater autonomy for Indigenous communities over their resources, leveling the playing field for the key stakeholder group — owner — that has long been neglected. In Canada today, there are over 50,000 Indigenous-owned resource management companies, and the mining industry in Canada has become the largest private-sector industrial employer of Indigenous peoples and partner of Indigenous businesses, with over 500 active agreements between companies and communities.

Governance models that enable Indigenous communities to make decisions over resource management and incorporate their knowledge and perspective in policies are giving them an even stronger voice in these dialogues. Indigenous-led resource management boards, such as the Nisga’a Nation in B.C., is a great example. These protections and policies are important elements to ensure that each stakeholder that comes to the table to align on a vision of prosperity is empowered and therefore can engage in open dialogue. At the heart of these efforts must be the core values of communication, coordination, and collaboration. As the demand for critical minerals becomes more urgent than ever before, it is key that the players that can affect progress and the necessary development trust one another and are aligned on a shared vision of success.

Peter Bryant is a managing director and board chair of Clareo and the co-founder and chair of the Development Partner Institute. Lana Eagle is an Indigenous relations strategist and a member of the Whitecap Dakota First Nation. She is currently on the board of the Prospectors and Developers Association of Canada (PDAC).

By Kabelo

Unlocking open-pit value through holistic approach from operations to life-of-mine (LOM) planning

Surface (open-pit) mining is constantly under increasing pressure of cost efficiency owing to deeper mines, increased waste handling, and related strip ratios. Broader challenges such as declining ore grades, rising operational costs, and heightened stakeholder expectations are forcing operators to rethink how to maximize value from their assets.

And while both local optimization of parts (including drill and blast, loading, hauling and processing in the short-term) and sequential optimization (cutoff grade optimization, ultimate pit limit, and sequencing) remain sine qua non to any successful open-pit endeavour, truly moving the needle in this area means recognizing the value in simultaneous optimization at both operational and strategic levels.

However, achieving this goes beyond localized and siloed optimizations, instead requiring a holistic approach to open-pit mining that connects tactical execution with long-term planning to achieve sustainable outcomes. To maximize value, mining companies must critically consider, identify, and solve for a complex array of operational imperatives while implementing sustainable solutions derived from a life-of-mine (LOM) planning lens.

Waste management as a strategic challenge within operations

Firstly, effective waste management remains a critical issue for open-pit mining. As mines move more material to access ore, they face the dual challenge of balancing higher material movement with technical and operational constraints, alongside financial pressures.

An increased environmental, social, and governance (ESG) focus is also elevating waste management beyond a simple operational task. A survey by EY found that 44% of mining executives believe waste management will represent the most scrutinized ESG element from investors in the mining and metals sector in 2025, emphasizing the importance of transparent reporting on waste generation and management efforts. By proactively addressing these operational realities, mining companies can mitigate risks, reduce liabilities, and enhance their reputation in an increasingly competitive landscape.

More than ever, operational efficiencies in waste management are emerging as measurable proof points to underscore cost efficiency and the strengthening of brand reputation among stakeholders. It can also serve as a reflection of an organization’s sustained commitment to environmental obligations.

At the operational level:

Unlocking immediate value through operational discipline

To unlock near-term value, some miners are using tools like value driver trees (VDTs) to identify which operational levers offer the highest impact. These typically include areas such as drill and blast, loading, and hauling. By mapping out value pathways, VDTs help site teams focus efforts on where they matter most.

In addition to performing traditional analyses like reconciliation and compliance, there is an increasingly sophisticated pool of tools at a miner’s disposal to visualize the impact of the VDT and simulate different scenarios, quantifying trade-offs,

Leeka, Daniel Morales, and Theresa Sapara

The Bingham copper mine is an open-pit mining operation extracting a large porphyry copper deposit southwest of Salt Lake City, Utah. CREDIT : ALLEN/ADOBE STOCK

and supporting decision-making. These tools connect operational performance with financial outcome, making improvement opportunities clearer and more actionable.

Starting at the operational level creates visible wins, builds internal momentum, and lays the groundwork for broader strategic initiatives. It helps teams provide the value of change with real results on the ground.

At the strategic level: Simultaneous optimization

The incorporation of advanced simultaneous optimization tools into LOM planning offers another compelling avenue for open-pit activities, providing opportunities to enhance operational efficiency and maximize asset value. Certain software solutions currently available in the market look to leverage stochastic modeling to generate optimized production schedules that align with evolving market conditions and resource availability. By leveraging the simultaneous optimization of when, where, and how to process material, these tools enable operators to make informed decisions that significantly increase the net present value (NPV) of their assets.

Not to be forgotten and equally important is the strategic allocation of capital which also plays a determining role in open-pit mining, ensuring investments are directed toward high-impact initiatives that drive both short-term gains and long-term sustainability. Miners can even avail themselves to tools that specifically facilitate the optimization of capital decisions like capacity increases through equipment acquisition or the honouring of ESG key performance indicators (KPIs) like decarbonization.

Future-proofing mining operations through innovation and strategic alignment

The current economic landscape is exacerbating many of the challenges inherent in open-pit projects. That is why the industry must proactively address the challenges of productivity, cost efficiency, and waste management to remain competitive. By adopting a systems-level approach that harmonizes technical performance with financial outcomes, mining companies can unlock new value in their operations.

Moreover, the integration of advanced diagnostic tools can further enhance operational efficiency and support long-term sustainability goals. These modern digital platforms provide insightful dashboards focused on KPIs, enabling data-driven decision-making that enhances productivity and reduces costs. These tools are specifically designed to help companies identify operational bottlenecks, optimize resource allocation, and simulate operational scenarios to forecast outcomes, ensuring that every decision is backed by robust data to maximize openpit productivity.

By embracing a comprehensive suite of operational and strategic tools, mining companies can navigate their open-pit operations, ensuring they are well-equipped to meet future demands while maximizing their value proposition. Ultimately, proactive management of these issues will enable miners to thrive in a competitive market, allowing for growth.

Kabelo Leeka, Daniel Morales, and Theresa Sapara support the Americas Metals & Mining Centre of Excellence at EY.

QUIET GIANTS:

How electric machines can redefine surface mining

There has been much written about the transition of underground fleets from diesel to electric. Largely, the impetus for this trend has been credited to the decrease in ventilation costs and impact on workers’ health inherent with battery electric equipment. These adoption pressures do not exist in surface mining in the same way but still, surface mining is on the cusp of a major transformation as electrification moves from the underground to the open pit. The diesel-dominated fleets that have powered surface operations for decades are now facing different pressures to evolve, driven by a mix of regulatory, economic, environmental, and social forces. Electrification is now emerging as a strategic priority for surface operators looking to future-proof their assets, reduce costs, and meet increasingly ambitious emissions targets. With proven technologies rapidly maturing over the last decade and innovative companies stepping into the space, the path forward is becoming more defined, and Canada has a significant role to play.

The motivations for electrifying surface fleets are multi-faceted but reducing carbon emissions is chief among them. Governments around the world, including Canada, are enforcing stricter emissions regulations, and major mining companies are setting aggressive net-zero goals in response to investor pressure and stakeholder expectations. Electrification offers a direct means of addressing Scope 1 emissions, particularly from haulage and support vehicles, which collectively represent a large share of a mine’s carbon footprint. However, transitioning to battery electric equipment is not just about optics, it is about aligning core operations with climate policy and staying ahead of tightening regulatory frameworks. Beyond compliance, cost efficiency is a powerful driver of electrification in surface mining. According to a report 2021 by Coencorp, diesel fuel alone can account for 3% to 10% of a mine’s total operating expenditure, and it is one of the largest operating expenses for mines. Battery electric vehicles (BEVs), while still carrying a higher upfront capital cost, can deliver

significant savings over their lifespan. With fewer moving parts than internal combustion engines, BEVs are cheaper to maintain, require less downtime, and eliminate the need for large quantities of fuel and lubricants. When paired with renewable energy sources for charging, they offer a stable and often cheaper energy profile that can give firms a valuable edge in increasingly competitive commodity markets.

Electrification also addresses growing expectations around worker health and community safety. Diesel particulate matter (DPM) has long been a concern in mining environments, and reducing emissions at the source creates healthier conditions for operators and maintenance staff alike. DPM remains a significant health concern in open-air surface mining operations owing to its fine particle size and chemical composition. Despite the open environment, workers are still at risk of inhaling these particles, which can penetrate deep into the lungs and enter the bloodstream. Quieter electric vehicles reduce noise pollution, improve working conditions, and strengthen relationships with nearby communities. In regions where mines coexist with Indigenous communities or environmentally sensitive areas, BEVs offer a pathway to reduced environmental disturbance, which can ease permitting and support the long-term viability of a site.

Operationally, BEVs have begun to prove their worth. Electric drivetrains offer instant torque and smooth acceleration, which can improve productivity in key tasks like hauling and earth moving. In a recent blog post, electrification expert Eric Zeng noted that electric mining trucks can experience a 40% boost in acceleration during loaded starts and a 25% increase in climbing speed compared to their diesel counterparts. Also, with fewer points of mechanical failure, BEVs contribute to higher fleet availability, and they integrate well with emerging technologies such as automation and fleet telematics. These advantages are particularly valuable as mines confront growing skill shortages and seek to optimize operations through digital transformation. Despite these benefits, challenges remain. Battery capacity

Cat 793 XE Early Learner battery electric trucks recently began testing and validation at global customer sites. CREDIT:

continues to limit the deployment of BEVs in surface haul trucks, and the infrastructure required to support fast charging at scale is not yet widely available. Solutions like the ABB eMine

FastCharge or Eaton’s Green Motion EV chargers are aiming to solve this issue and there will be undoubtedly more high-tech innovation in this space soon. Remote sites with limited grid access will also need creative solutions including microgrids, hybrid systems, and modular charging stations to make electrification feasible. Cold-weather performance is another hurdle, particularly in northern regions where batteries may lose efficiency and require robust thermal management systems. That said, progress is being made on all fronts, with OEMs, utilities, and mining companies collaborating to overcome these barriers. Canada, with its history of innovation in underground mining and electrification, is playing a leading role in this transition. Companies based in mining hubs like Sudbury are leveraging their underground expertise to tackle the surface challenge. Among them is MacLean Engineering, a well-established OEM that has made significant inroads with battery electric solutions in underground environments. With the launch of its

new surface mining division, MacLean is extending its electrification know-how to open-pit operations, eventually offering a suite of purpose-built support vehicles and engineering solutions tailored for surface applications.

MacLean’s move into surface electrification reflects a broader industry trend: the recognition that decarbonization is not a luxury but a necessity. Drawing on decades of experience designing rugged, mine-ready vehicles, MacLean is well-positioned to support operators looking to electrify support fleets, from service trucks to water carts to personnel carriers. Their entry into this space is timely, offering mining companies a credible, Canadian-made alternative as they plan for a low-emissions future. As surface mines begin the long transition away from diesel, partnerships with experienced OEMs will be essential in making the shift efficient, safe, and economically viable.

The electrification of surface mining is no longer a theoretical aspiration; it is a practical strategy gaining real traction. With compelling benefits across cost, safety, environmental performance, and social license, the case is becoming clear. While technical and logistical hurdles persist, they are shrinking with every new deployment and demonstration project. Thanks to creative engineering and a strong commitment to innovation, Canada is helping to power the next phase of surface mining as a clean, quiet, and electric endeavour. The only question that remains is how fast operators are willing to make the leap.

Steve Gravel is the manager of the Centre for Smart Mining at

FROM DRILL TO DETONATION: Blasting smarter in surface mining

Advances in technology — artificial intelligence (AI), automation, digitalization, and electrification — are revolutionizing Canada’s mining industry. Blasting, an integral part of hard rock mining, has recently seen innovations that allow for explosives to be detonated remotely. Explosive companies that provide surface blasting for open-pit operations help mining companies to conduct more efficient and safe blasts which can result in reduced explosive costs, more ore, and increased revenue. Several global explosives companies work in partnership with mining companies to provide their signature blasting services.

BME Canada’s AXXIS Silver

With over 40 years of global experience in blasting and explosives, BME established BME Canada in 2019 — now operating from an office in Val Caron and a manufacturing plant at Nairn Centre in Ontario.

BME’s electronic detonator technology dates to 2010 with its initial introduction of the AXXIS GI, followed by the AXXIS GII in 2015. In 2021, BME launched AXXIS Silver — its new detonator technology which was specifically designed for quarries and small mining operations. Key features include advanced electronic initiation for accurate timing and sequencing, programmable delay intervals for optimal fragmentation, and remote monitoring and initiation capabilities.

AXXIS Silver is designed for up to 1,600 detonators per blast. The AXXIS Silver Logger communicates with each detonator to program it with the desired initiation time. The detonators are programmable at one-millisecond intervals up to 15 seconds, which allows for more complex blast designs. The ASIC technology delivers high accuracy of less than one millisecond at the maximum firing time for consistent quality blasting, resulting in better overall blast performance.

BME Canada’s value-added initiatives and blast optimization solutions include blast audit and assessments, predictive modelling for blast performance, blast simulation tools, blast impact and performance measurements, and integrated compliance tracking and reporting.

The benefits of the AXXIS Silver include ease of use for the operator; reduced downtime at firing stage; decreased ground vibrations and fly rock, thereby minimizing the impact on surrounding structures; improved blast fragmentation that enhances downstream processing efficiency; and increased safety through remote detonation and real-time monitoring.

BME Canada can help mining companies reduce their environmental impact by optimizing the entire blasting process from charge placement to detonation timing, ensuring regulatory compliance and improving operating costs and efficiency by minimizing explosive usage to gain maximum yield.

Tom Dermody, international technology & field services

proven its success in various regions worldwide. This innovative approach not only simplifies the blasting process, but it also greatly enhances overall productivity and profitability in the mining sector.”

Dyno Nobel’s Nobel Fire

Dyno Nobel is a global leader in the commercial explosives industry with origins dating back to the 1860s. The company operates several magazine sites across Canada for the storage and distribution of explosives and blasting products.

manager at BME, says, ”We are excited to share how our AXXIS Silver electronic initiation system can truly make a difference for Canadian mines looking to enhance their operational efficiency and boost revenue. By leveraging advanced detonator technology, mines can achieve superior blast fragmentation, yielding high precision in each blast. Already, this system has

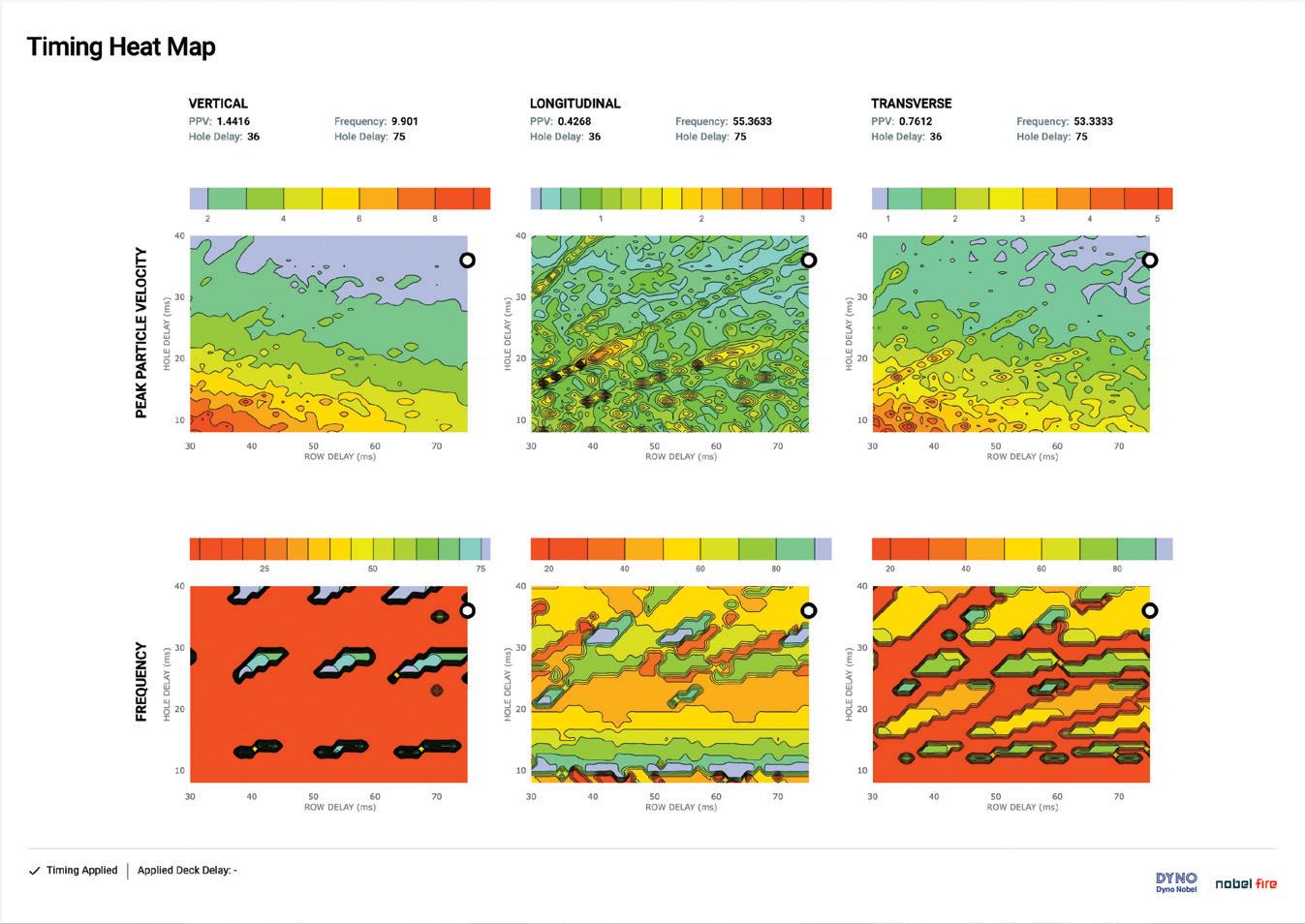

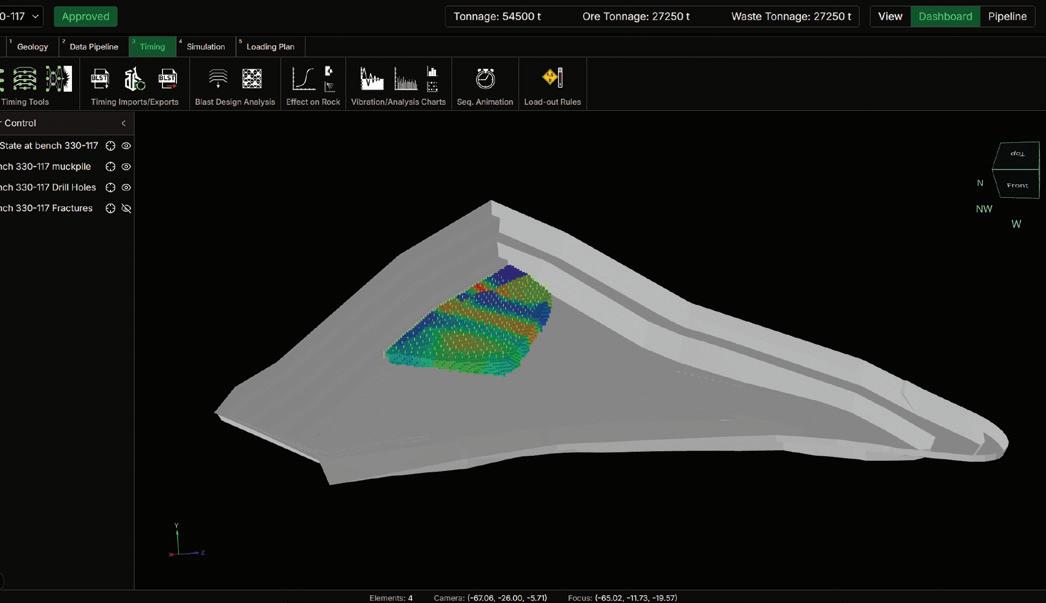

Nobel Fire is Dyno Nobel’s centralized data and blasting software platform. It connects with existing operations systems to store and analyze blasting data in one place. It enables blast design and analysis using some of the industry’s most powerful modeling tools:

• Advanced Vibration Prediction (AVP) is a blasting vibration prediction tool that accounts for variability in blasting for industry-leading accuracy.

• Vibration Timing Optimization (VTO) is a signature waveform convolution engine that helps identify blast timing pairs that help control vibration.

• Fracture Density Model (FDM) is a physics-based fragmentation modeling tool that works through an automated calibration process for extreme accuracy.

• Geological Element Movement (GEM) is a physics-based ore/waste dilution prediction model and heave modeling tool that predicts cast-blasting results.

The Nobel Fire mobile app integrates with delivery systems including EC200, EC300, and Universal Control System (UCS). Available on iOS and Android tablets, it allows users to add real-time drill and blast data to analyze and monitor the blasting process.

AXXIS Silver Hardware. CREDIT BME CANADA

Nobel Fire Modelling. CREDIT: DYNO NOBEL

Nobel Fire VTO Heatmap. CREDIT: DYNO NOBEL

DRILLING AND BLASTING

Nobel Fire generates comprehensive blast reports that meet regulatory requirements and provides post-blast analysis and dashboarding to assess trends in explosives usage and performance. Mining companies can compare designed blast parameters with actual blast results for analysis and optimization.

Nobel Fire supports the integration of existing models from industry-leading 3D tools and CAD programs for advanced blast design and analysis. In the future, users will be able to upload drone flight imagery to create photogrammetry models within the software.

Nobel Fire provides everything an operation needs to improve its blasting activities in one easy-to-use platform. Its tools offer industry-leading accuracy and allow for fine-tuning before blasts. Because the platform is designed for interoperability, Nobel Fire integrates seamlessly with existing digital ecosystems.

energy consumption, and explosives costs.

In a case study, Dyno Nobel’s DynoConsult team worked with a metal mine to safely and effectively blast near existing structures to free three million tonnes of ore worth $72 million.

Braden Lusk, Dyno Nobel’s chief technology and marketing officer, says, “Nobel Fire is the foundation for how we are rethinking the role of digital tools in blasting. It is built to grow with our customers by supporting smarter designs, seamless data integration, and better decision-making from the drill to the mill.”

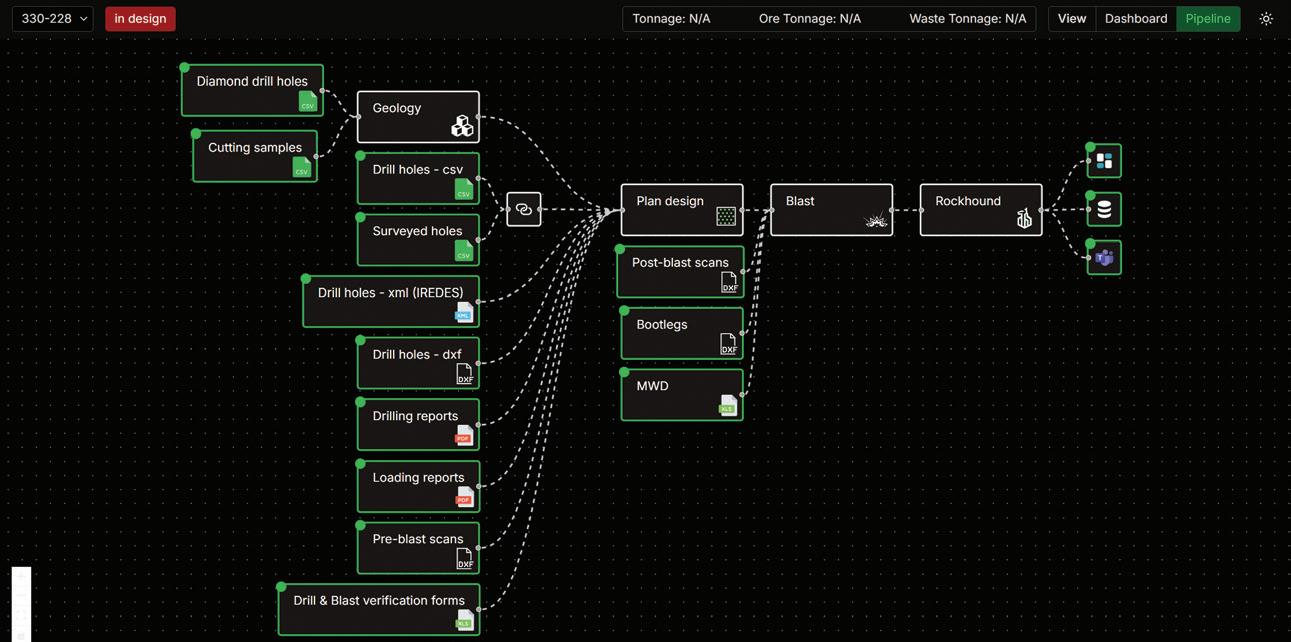

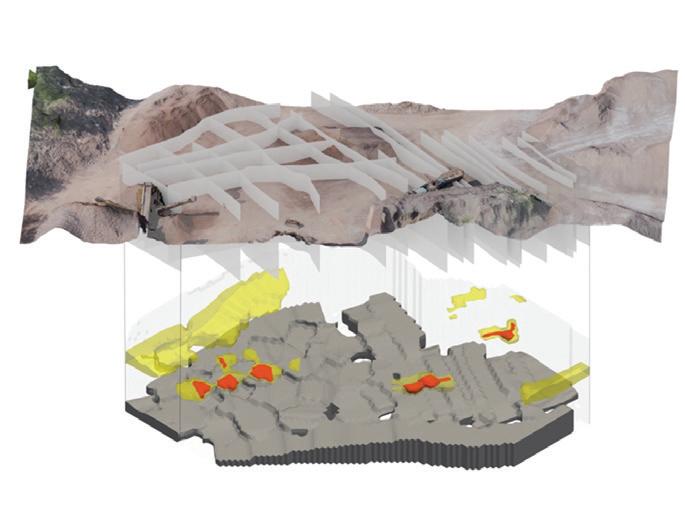

Hexagon’s Drill & Blast

Since 1992, Hexagon has been a leader in digital reality solutions. The company’s Canadian presence includes divisions in Vancouver (mining), Calgary (autonomy and positioning), and Oakville (manufacturing intelligence).

Hexagon’s Drill & Blast (D&B) integrates software and hardware to help mines measure and improve the D&B process. Benefits can include reductions to emissions, material waste,

The platform ensures an effectively executed drillhole and blast design, accurately accounting for geology and geometry, machine-guided, high-precision drills, proven fragmentation analysis, and blast monitoring that minimizes loss and dilution.

Included is MinePlan Blast, a rapid design utility for creating and storing templates, completing bootleg analysis and creating safety exclusion zones for equipment and personnel based on actual terrain in a 3D environment.

To manage blast design and optimize fragmentation, Hexagon Split’s image processing technology measures particle-size distributions from mine to mill.

Hexagon’s autonomous drill control system, Drill Assist, applies AI to analyze downhole drilling conditions, resulting in precise drilling parameter adjustments while protecting the drill rig and associated consumables.

Hexagon’s Blast Movement Monitoring (BMM) provides accurate ore location information via Blast Movement Monitors. BMMs combine sensors and software to ensure that post blast,

Blast Movement Monitoring (BMM). CREDIT: HEXAGON

Drill Assist. CREDIT: HEXAGON

the mine knows where its orebody moved to. BMMs move with the blasted material, producing data that accurately reflects measured movement, resulting in redefined ore boundaries. Software calculates the post-blast 3D movement location of the ore polygons, outputting new dig lines. Production teams can dig in the precise location of the ore and waste, recovering all the planned resource and achieving the pits’ true value.

Hexagon’s Blast Movement Intelligence (BMI) is an AI-powered 3D solution that provides high visibility into ore dilution for informed ore and waste delineation post-blast. It produces an accurate block model of the muck pile and ultimately maximizes yield.

Hexagon’s partner, IDS GeoRadar, offers IBIS-FB, a remote sensing monitoring system based on microwave interferometry technology. IBIS-FB integrates standard vibration monitoring systems, delivering highly accurate remote broad area measurements of ground vibrations.

Jeff Loeb, senior director of new ventures at Hexagon, says, “As ore grades decline, mines are digging more earth for less ore. Improving ore recovery by just 1% can mean millions of dollars. Hexagon Drill & Blast addresses the small and com-

reliably and safely. This technology eliminates the need for downlines and surface connecting wires, significantly enhancing safety by removing people from hazardous areas. WebGen uses low-frequency magnetic waves to communicate with each primer, ensuring precise and controlled blasting operations.

WebGen offers many advantages for open-pit mines. It enhances flexibility in pit planning and mine scheduling, allowing for more efficient and adaptable operations. The system reduces misfire zones and eliminates firing window variability, ensuring precise and controlled blasting. By minimizing the impact of lightning production delays and eliminating the risk of lightning-induced explosion hazards in loaded blast holes, WebGen significantly reduces operational downtime.

Additionally, WebGen improves safety by reducing the interaction between heavy vehicles and initiating systems, lowering exposure to bench hazards. With WebGen, there is no tie-in process, no misfires from wire damage, and it reduces inventory, making operations more streamlined and cost-effective. The technology also increases blasted inventory, reduces the need for resources on the bench, and cuts down on stemming costs and backup practices.

pounding errors that can lead to costly consequences. It empowers Canadian mining companies with a data-driven feedback loop, calibrated to increase profit from every blast through increased throughput, reduced energy consumption, and minimized ore loss.”

Orica’s WebGen

Orica, one of the world’s leading mining and infrastructure solutions providers, has been simplifying bench operations for mining companies for 150 years.

WebGen is Orica’s signature wireless initiating system. This innovative blasting technology allows new and better ways of mining to improve coal recovery in steeply dipping coal seams or increased vertical advance rates in hard rock. Operations are simplified and eliminate the need for downlines and surface connecting wires.

WebGen is the world’s first truly wireless initiating system, communicating through rock, air, and water to initiate blasts

In Canada, at the Musselwhite gold mine, the implementation of WebGen led to a 15% increase in ore recovery and a 10% reduction in blasting costs. The mine also reported improved safety conditions owing to the wireless initiation system. Similarly, at the Sierrita mine in Arizona, WebGen enabled the preloading of multiple benches during storm seasons, effectively mitigating lightning risks and improving operational efficiency. The wireless technology eliminated the need for extensive wiring, saving time and minimizing the risks associated with traditional wired systems.

Nigel Pereira, vice-president of commercialization, says, “WebGen has fundamentally changed the way blasting can be approached, offering new techniques and mining methods that were previously unimaginable. This system enhances safety by preventing accidental detonations from lightning strikes, eliminates possible interactions with surface connectors, and reduces exposure hours to hazardous areas such as under high walls.”

By leveraging these new advances in technology, Canadian mining companies can move toward a future where their mining operations are cleaner and more efficient while also reducing their explosives costs and increasing their ore production and revenue.

Diane L.M. Cook is a freelance mining writer.

WebGen 200: A.L. Blair Construction’s Moose Creek quarry (open pit). CREDIT: ORICA

ULTRA-LOW ZINC TECHNOLOGY:

REVOLUTIONIZING MINING EQUIPMENT PROTECTION

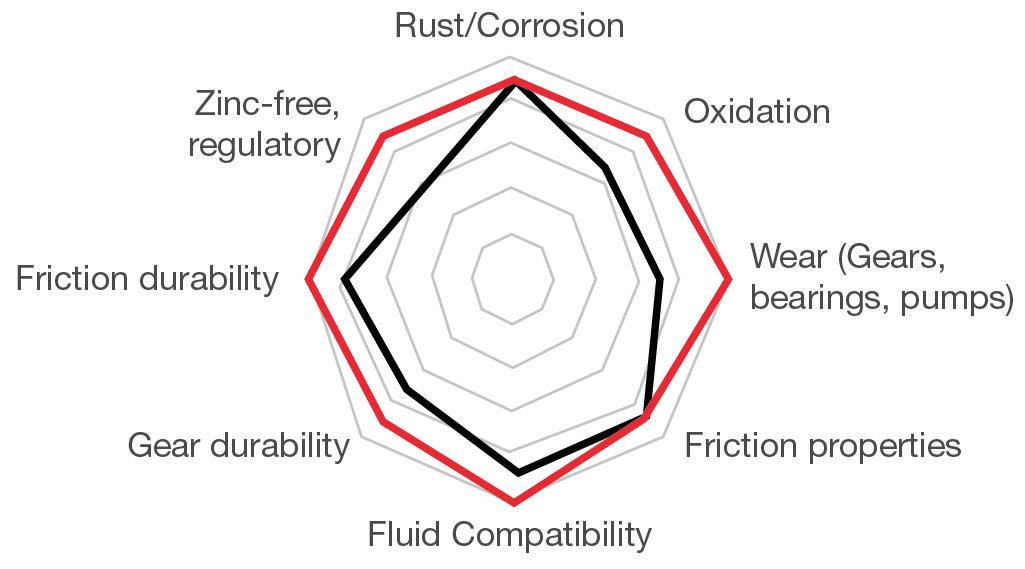

While zinc-based additives, often found in traditional transmission drive-train oils, have long been used to enhance performance, recent evolutions in the regulatory landscape for this technology have raised questions about its long-term function. As environmental and operational standards continue to evolve, regulatory bodies are pushing for lubricants with lower metal-based additive content to minimize ecological impact while still delivering uncompromised performance. In response to these changing regulatory requirements, nextgeneration ultra-low zinc lubricants with lower metal-based additive content are now emerging, offering a groundbreaking alternative that meets industry needs without the drawbacks of conventional formulations.

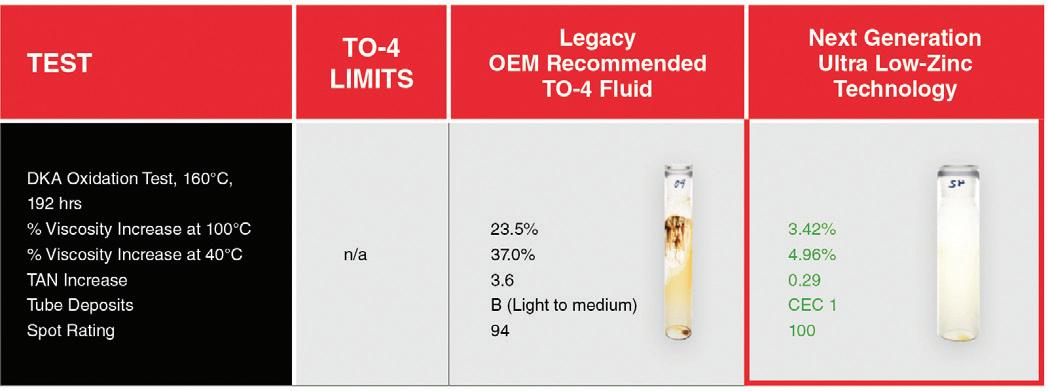

Caterpillar’s TO-4 specification has long served as the industry benchmark for lubricants used in heavy-duty mining equipment, ensuring optimal performance in transmissions, final drives, and hydraulic systems. While this specification has historically been met using conventional products, ultra-low zinc technology is now proving to not only meet the TO-4 specification but significantly outperform conventional lubricants in durability, efficiency, and environmental impact. The shift towards this next-generation formulation marks a major advancement in lubricant science, promising longer service intervals, improved wear protection, and enhanced sustainability.

THE EVOLUTION OF HIGH-PERFORMANCE LUBRICATION SYSTEMS

For mine managers, every operational decision impact productivity, safety, and profitability. Equipment downtime can translate to lost revenue, increased maintenance costs, and disruptions to tightly scheduled operations. Lubrication, therefore, is far more than just routine maintenance – it is a fundamental factor in maintaining peak fleet performance and ensuring the longevity and protection of high-value machinery.

Ultra-low zinc technology is redefining heavy-duty lubrication by leveraging polyphosphate film technology while eliminating the need for traditional zinc-based additives. Both traditional and next-generation anti-wear mechanisms involve the formation of polyphosphate films. In traditional systems, zinc atoms act as “carriers” that then disperse back into the fluid as the

polyphosphate film forms on metal surfaces. Next-generation fluids create a similar polyphosphate protective film without the need for the zinc carrier atoms.

This evolution in formulation is not merely theoretical; it has been rigorously validated through both bench and field testing. Ultra-low zinc technology has demonstrated clear advantages, including:

• Superior Wear Protection: Enhances the durability of gears, bearings, and hydraulic systems under extreme operational conditions.

• Improved Oxidation Resistance: Provides superior oil stability and component protection, even in high-humidity and extreme-temperature environments.

• Optimized Friction Control: Offers smoother, more consistent clutch and brake performance, reducing shudder and improving operator control.

The limitations of traditional zinc-based lubricants are becoming more apparent, particularly as the industry demands higher levels of efficiency and reliability. The Mining industry is under ever-increasing pressure to supply the global community with critical natural resources, and a higher level of efficiency and performance is now being demanded of their lubricants. Additionally, the metallic content of ZDDP complicates disposal

and contributes to ecological concerns, making ultra-low zinc an attractive alternative for companies looking to meet sustainability goals. Mining is a 24/7 operation with no room for unplanned downtime. Every piece of equipment is pushed to its limits, making the choice of lubricant a strategic investment in long-term productivity and profitability.

Resistance to Oxidation

Whether in industrial machinery, automotive transmissions, or heavy-duty mining equipment, gears operate under extreme loads. High performance lubricants can mean the difference between seamless performance and catastrophic breakdown, making the selection of the correct oil a strategic priority for mine operators.

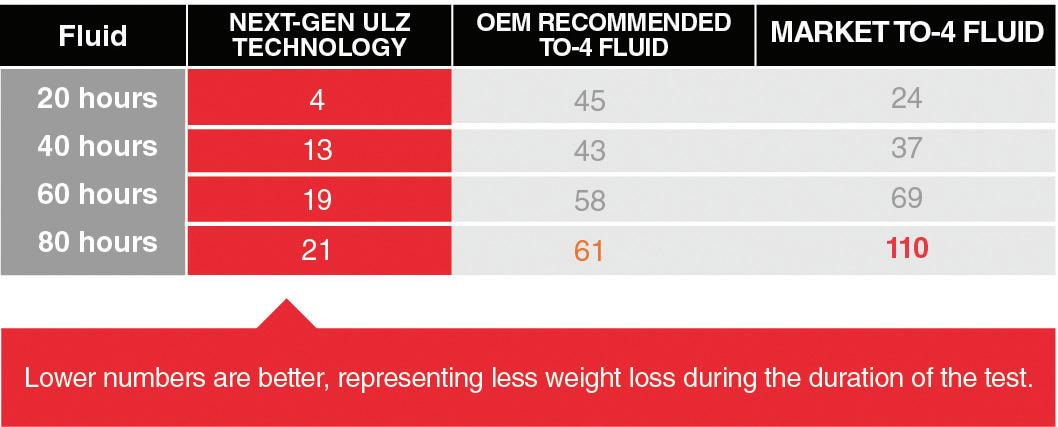

Well-established testing methods continue to validate that nextgeneration formulations outperform traditional zinc-based chemistry in terms of wear resistance, friction durability and oxidation stability. One of the most reliable industry tests for assessing lubricant performance under extreme conditions is the D4998 FZG Test.

TEST?

The D4998 FZG Test is used to evaluate lubricants for gear wear protection. Conducted according to ASTM D4998, this test evaluates wear via gear weight loss at steady state test conditions (load, temperature, and speed).

Think of it as the ultimate stress test for lubricants. When using a specialized FZG test rig, lower wear values indicate that the fluid has performed better in terms of gear durability and protection.

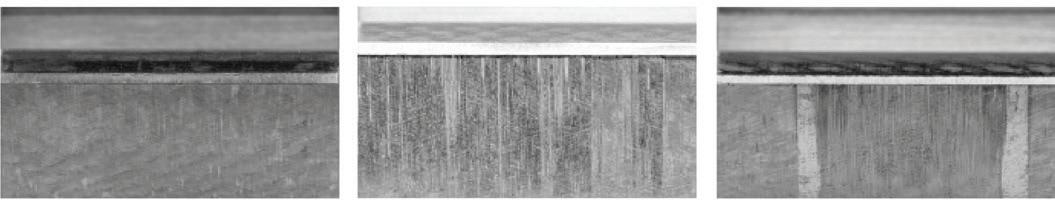

With the test duration now extended from 20 hours to 80 hours, with measurements taken at 20-hour intervals, the results were clear: next-generation ultra-low zinc technology significantly outperformed all benchmark fluids evaluated. After extended FZG Gear Wear testing, gear teeth treated with ultra-low zinc

Transmission Drive Train Oil remained in excellent condition, demonstrating superior wear resistance compared to legacy technology. The proof is undeniable – next-generation ultra-low zinc technology offers enhanced protection for critical gears under severe loads.

Ultra-low zinc technology is more than just a response to regulatory shifts – it is a transformative leap forward in lubrication science. As the mining industry continues to push the boundaries of efficiency, reliability, and sustainability, advanced lubricants play a crucial role in ensuring equipment longevity and reducing operational costs.

For mine managers seeking a competitive edge, ultra-low zinc technology presents a real opportunity to raise their game. And in an industry where every minute of uptime counts, the right lubricant isn’t just an operational necessity – it’s a strategic investment. Ultra-low zinc technology is on it’s way to redefine the standards of heavy-duty lubrication.

TOMORROW STARTS TODAY... ARE YOU READY?

Extended D4998 FZG test duration

Extended D4998 FZG pictures: Zoomed in Tooth Wear

Breaking new ground:

Electrification, automation, and digitalization of

mining drills

The relentless pursuit of greater efficiency, enhanced safety protocols, and a reduced environmental footprint is necessitating a profound transformation within the mining industry. At the forefront of this evolution lies the modernization of mining equipment, particularly drill rigs, through the integration of advanced technologies. Electrification, automation, and digitalization are no longer distant aspirations but tangible realities reshaping drilling operations, promising significant impacts on operational expenditures, overall productivity, ecological responsibility, and the well-being of the workforce.

One of the most significant shifts underway is the industry’s move away from traditional diesel-powered machinery towards electric alternatives. This transition is propelled by several factors, including increasingly stringent environmental regulations aimed at curbing emissions, a growing ethical imperative for sustainable practices, and the compelling prospect of long-term cost advantages.

Electric drill rigs present a compelling value proposition compared to their diesel counterparts. Their most obvious advantage lies in the elimination of exhaust emissions at the point

of operation, contributing to a cleaner and healthier working environment for operators. Furthermore, the inherent simplicity of electric motors translates to reduced mechanical wear and tear, leading to less frequent maintenance schedules and a corresponding extension in the operational lifespan of the equipment. This increased uptime directly contributes to enhanced productivity. Economically, electric power often proves to be a more stable and ultimately less expensive energy source than diesel fuel, promising substantial cost savings over the long term.

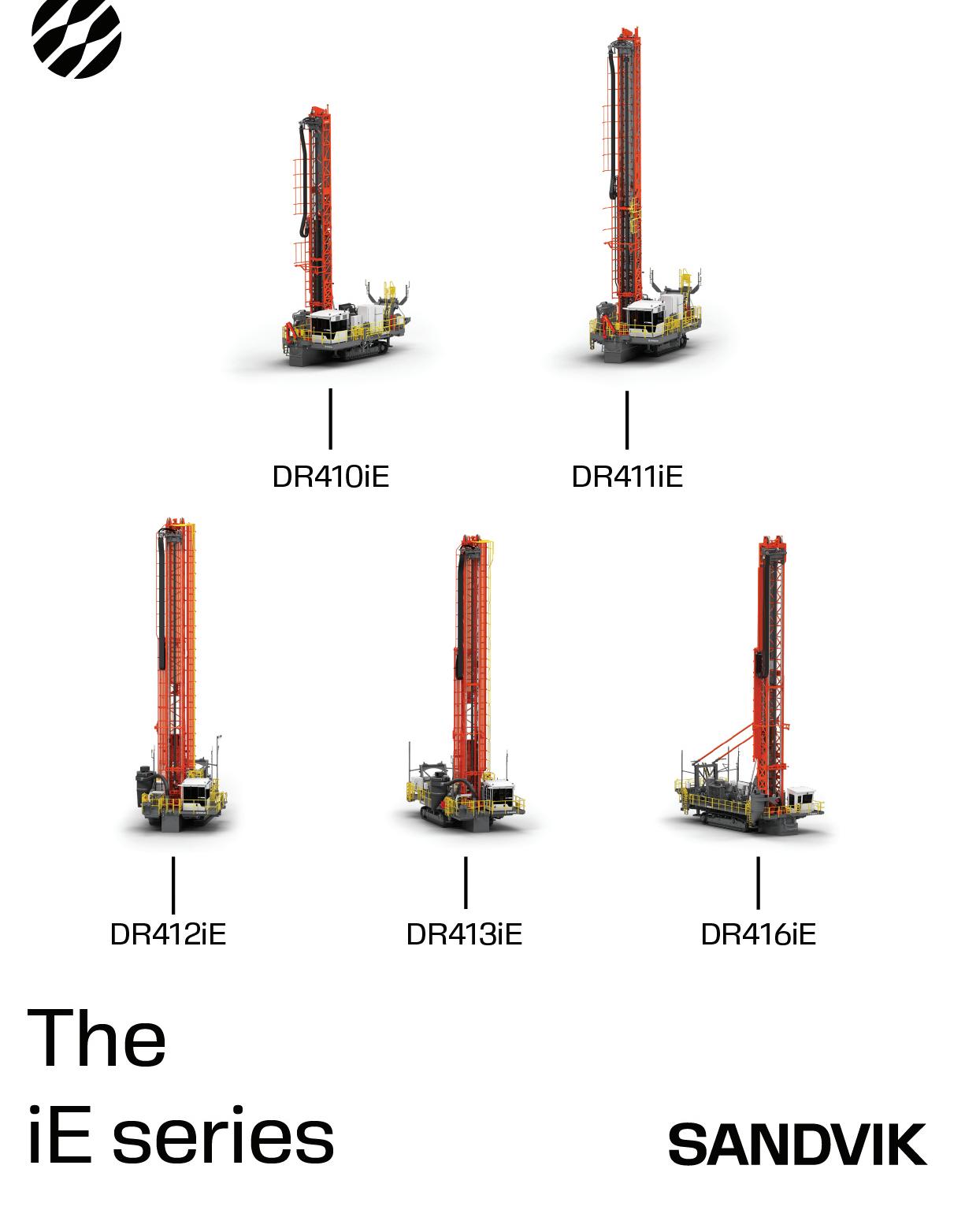

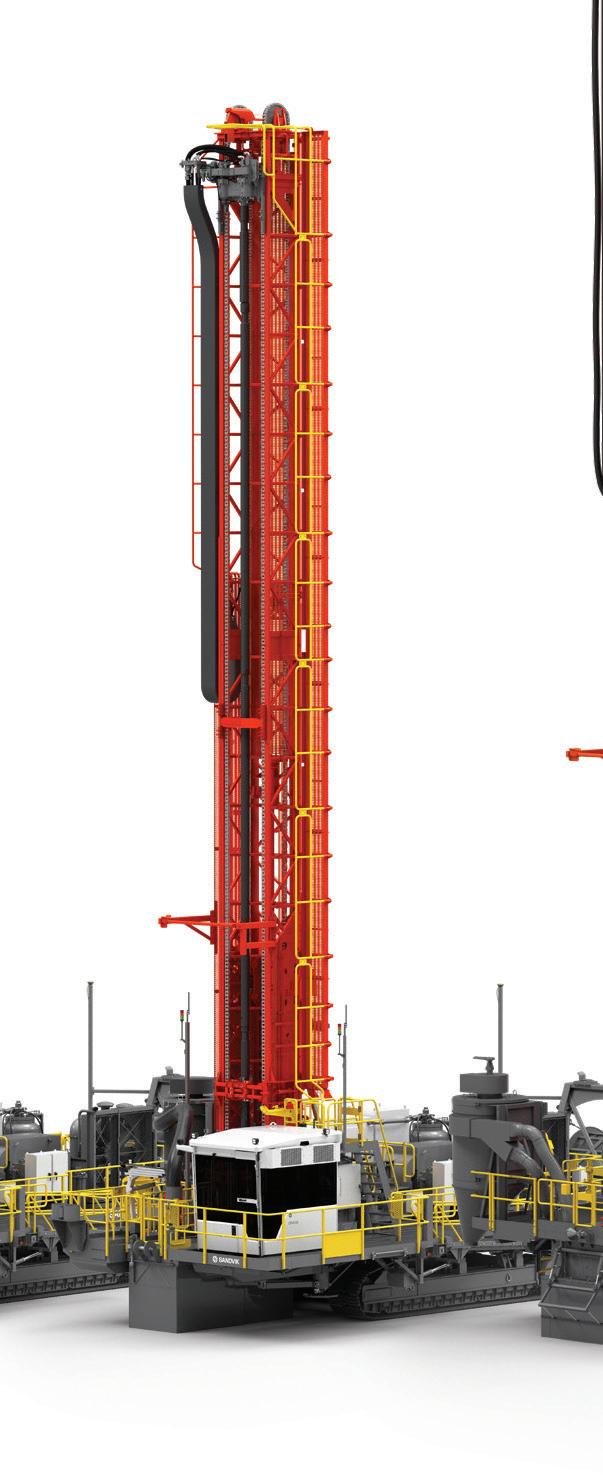

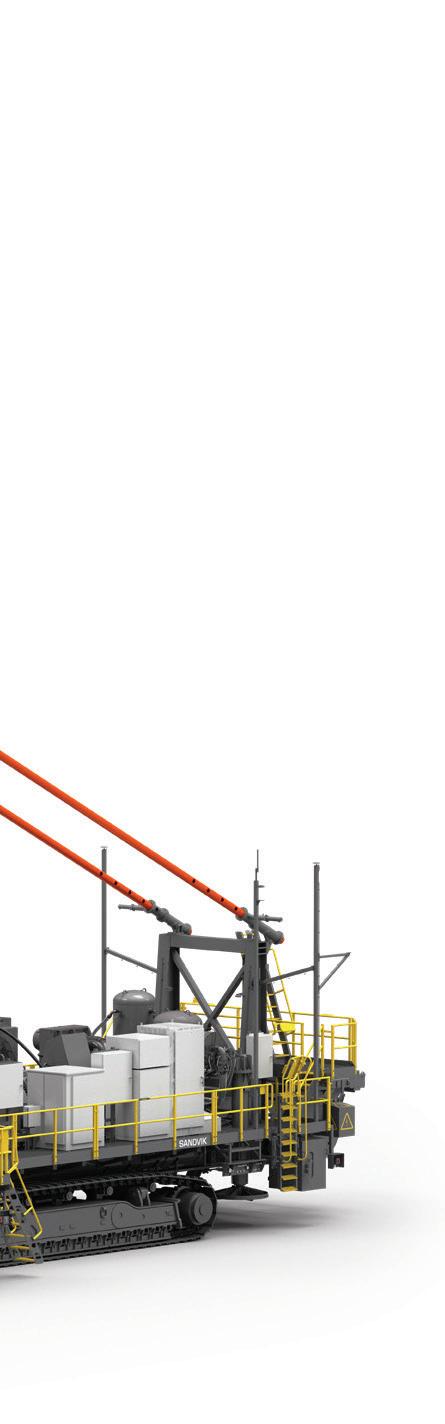

Recognizing this paradigm shift, companies like Sandvik are actively deploying electric drill rig solutions tailored to meet these evolving demands. It is estimated that electric-powered drills currently constitute 15% to 20% of global sales for the surface drilling market, a figure projected to reach the 30% mark soon. Sandvik’s commitment to this electric future is evident in the launch of its electrically powered iSeries rigs, including models like the DR416iE, and the subsequent expansion of this fleet to include the DR413iE, DR412iE, DR411iE, and DR410iE.

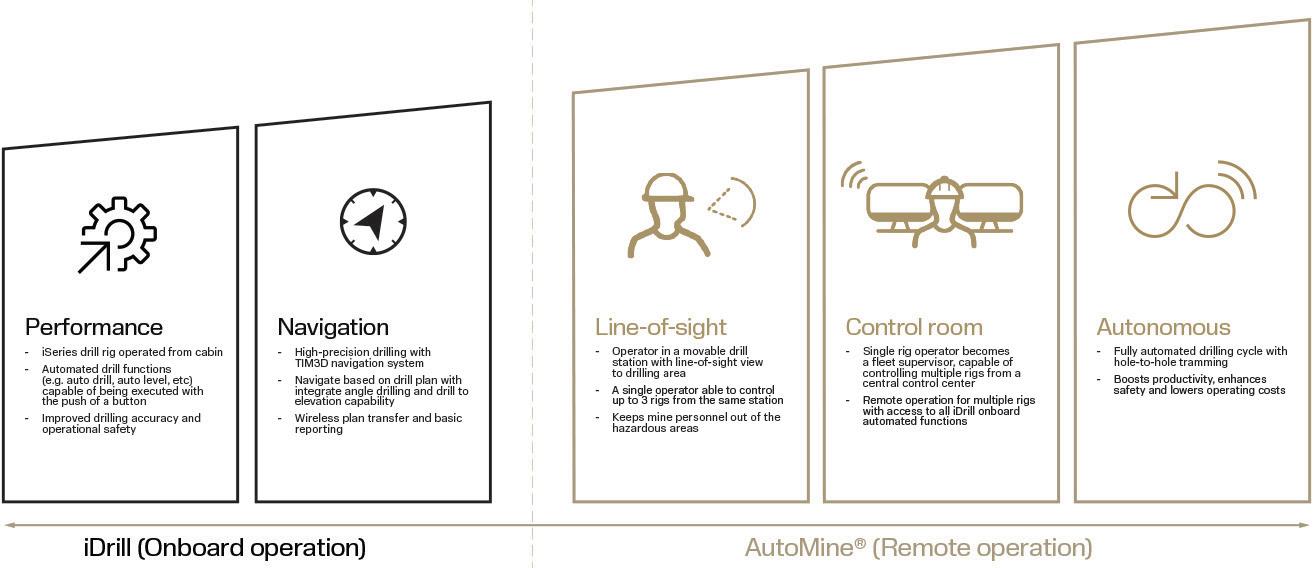

The rapid integration of automation technologies into mining operations is complementing the electrification trend. Automated drill rigs offer a powerful means of mitigating the inherent risks associated with manual drilling tasks, significantly enhancing worker safety by reducing or eliminating human intervention in potentially hazardous zones. Beyond safety, automation also unlocks substantial gains in efficiency and productivity. Through continuous, around-the-clock operation and the optimization of drilling parameters, autonomous systems can consistently outperform manual operations.

Sandvik has positioned itself as a frontrunner in the realm of automated drilling solutions. Their iSeries drill rigs are equipped with advanced features such as onboard automation features and remote operation capabilities. These functionalities not only bolster safety by removing personnel from the immediate drilling environment but also enhance efficiency by minimizing downtime associated with manual interventions and ensuring optimal drilling performance. With a strong focus on data analytics and automation, iSeries drills empower mining operations with a crucial competitive edge by driving more informed decision-making, streamlining operational workflows, and ultimately boosting productivity.

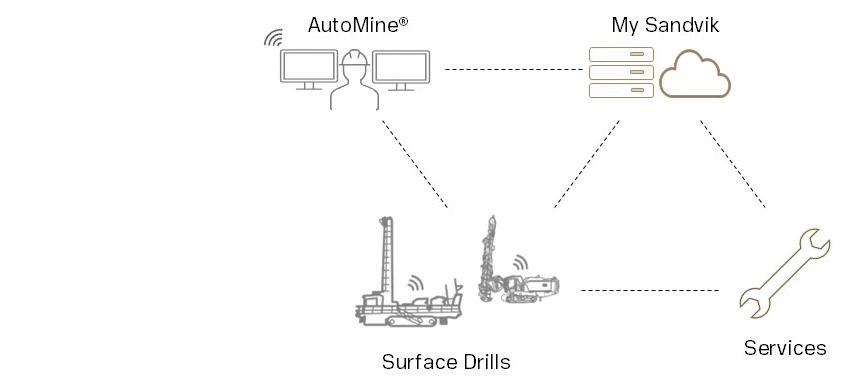

Central to Sandvik’s automated drilling capabilities is the DRi operating system. Built upon Sandvik’s Intelligent Control System Architecture (SICA), the DRi platform offers several key advantages: a unified platform that streamlines maintenance, updates, and troubleshooting across all iSeries drills; enhanced automation capabilities, providing a robust foundation for advanced functionalities like fully autonomous drilling; a strong

focus on digitalization, facilitating comprehensive data collection, storage, and analysis for optimized operational insights; seamless integration with other mining systems, enabling a holistic view of the entire mining ecosystem; and an open architecture that supports integration with third-party software and hardware. This common development platform accelerates the rollout of product improvements across the entire iSeries rotary solution portfolio. DRi empowers operators with real-time data access, while also simplifying operator training through a consistent control system interface across all iSeries drill models.

platform.

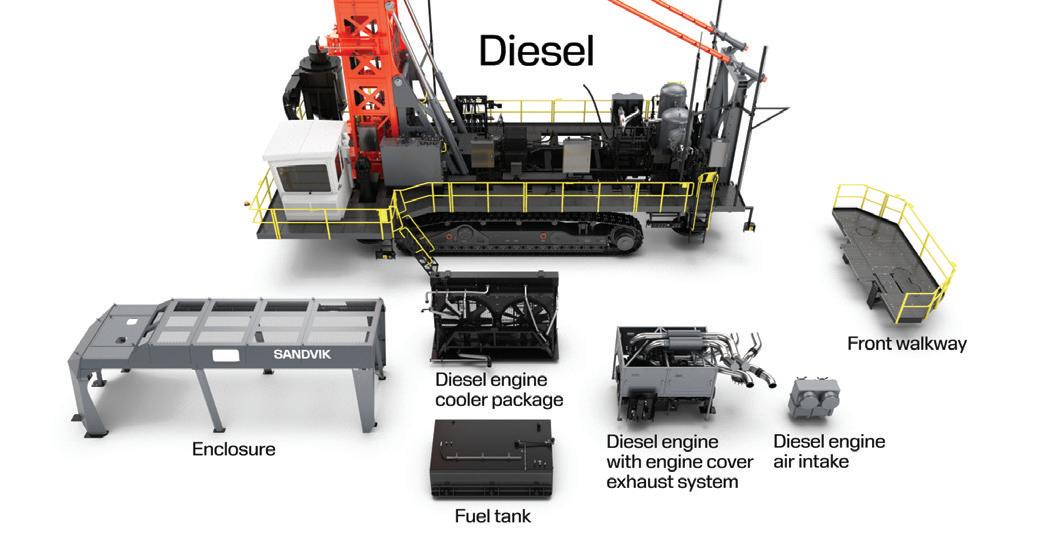

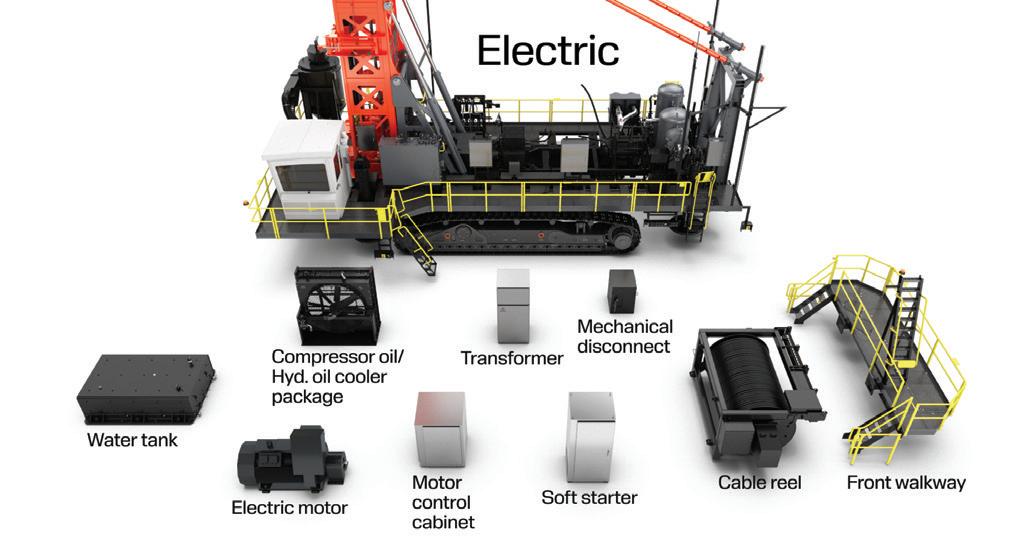

Another characteristic of modern drill rig design is the adoption of modularity. Sandvik’s modular approach offers significant benefits in terms of flexibility, maintainability, and long-term sustainability. Modular rigs can be readily customized and upgraded, allowing mining operations to adapt their equipment to evolving site conditions and operational requirements. Maintenance and repair are simplified as individual components can be quickly replaced or serviced, minimizing

overall downtime. Modular design also plays a crucial role in facilitating the transition towards electric-powered equipment. Sandvik emphasizes that their new modular designs are specifically engineered to ease the shift from traditional diesel to electric rotary blast hole drills, promoting a more sustainable future for the industry. This modularity allows for the easier integration of electric power units and provides a flexible framework for future electric drill rig development.

The intelligent utilization of data is crucial in optimizing drilling operations. Sandvik’s solutions underscore this principle, characterized by My Sandvik Onsite. Built upon Sandvik’s OptiMine technology, My Sandvik Onsite leverages time-stamped data to generate detailed reports on equipment utilization, operational status, productivity levels, and overall equipment health. The insights derived from this data can be used to refine drilling parameters, enhance operator training programs, and optimize mine planning strategies, leading to significant improvements in both productivity and profitability.

The convergence of electrification, automation, and digitalization is not merely a trend but a fundamental shift reshaping the future of drilling in the mining industry. These technological advancements are driving a holistic transformation, enabling mining companies to achieve greater operational efficiency, minimize their environmental impact, and foster more sustainable practices. As the mining industry continues to navigate evolving demands and increasing societal expectations, these technological innovations will undoubtedly play an increasingly critical role in ensuring a sustainable and efficient path forward.

Nellaiappan Subbiah is the global product manager, rotary drills, at Sandvik.

Sandvik rotary drill rig diesel modular

Sandvik rotary drill rig electric modular platform.

Sandvik digital solutions.

Sandvik rotary drill rig scalable automation offering.

Optimizing development drilling at Haile gold mine

At Haile gold mine in South Carolina, OceanaGold is transitioning from surface to underground mining — a shift that brings new challenges in training, workflow, and technology adoption. Haile is the only active gold mine east of the Mississippi River, and notably, 85% of the workforce is drawn from the surrounding region. While this community-first model strengthens ties to the area, it also presents a unique challenge: South Carolina does not have a long history of underground hard rock mining. That means upskilling is essential — not only to ensure productivity but also to guarantee safety and long-term success underground.

To support this transition, Hexagon partnered with OceanaGold to trial and implement the Development Optimizer system, a technology designed to improve drilling precision to reduce overbreak, underbreak, and face dishing in underground development.

The challenge

Development drilling is the foundation of all underground advancements. Operators must drill a precise pattern of blast holes to create a tunnel of specific shape and size. Deviations, whether too wide (overbreak) or too narrow (underbreak), can increase cycle times, require rework, and increase costs.

This challenge is especially pronounced in manual drilling environments, where success is heavily reliant on operator skill and training. Without consistent guidance, even experienced crews can struggle with repeatability. Inherently complex underground conditions amplify these challenges, often leading to inaccurate and inconsistent drilling. The result is poor blasting outcomes, unplanned overbreak, face dishing, and reduced advance — all of which slow development, increase haulage volumes, and inflate costs. The net effect is a lower net present value for asset owners and tighter margins for contractors.

At Haile, these issues were already surfacing. Overbreak rates averaged 16.9% prior to the trial — well above the ideal target of under 10%. Operators were using analog Sandvik DD421 and DD422i jumbos in a “bolt-bore” configuration, meaning the same rig is used for drilling, bolting, and scaling. This multi-purpose use supports flexibility and capital efficiency, but prevents the use of fixed onboard navigation sensors, which can be damaged during bolting.

Without digital guidance, drill alignment relied heavily on manual processes and operator judgment — introducing variability and reducing repeatability.

The solution: Development Optimizer System

Hexagon’s Development Optimizer is an OEM-agnostic alignment system that equips each boom with a removable, wireless sensor called the “Optibox.” Paired with a ruggedized tablet and Hexagon’s CORE Web platform, the system provides real-time alignment feedback and shift-to-shift drill performance insights. It enables operators of all experience levels to drill accurately to design — delivering more consistent blast outcomes for every cut. The result is improved fragmentation, reduced overbreak, and increased rate of advance. Importantly, it is designed to support the operational realities of bolt-bore rigs, with sensors removed prior to bolting to prevent damage.

Trial scope and results

At Haile, a structured three-week trial was conducted in late 2024 using a dedicated Sandvik DD421 jumbo. Six operators participated, each receiving in-cab coaching and working through a standardized competency checklist. Haile’s engineering team surveyed each development cut post-blast to measure overbreak and assess profile accuracy.

The following results were compelling:

• Overbreak was reduced by 35.6%, from 16.9% to 10.8%.

• Drill alignment improved, with operators consistently staying within tolerance.

• Rework and re-drills were reduced, while scaling and bolting became more predictable.

Quantifying the impact

One way to ground these improvements is in material movement. Across Haile’s three-jumbo fleet, approximately 12,000 development cuts are planned annually. By reducing overbreak from 16.9% to 10.8%, the site avoids an estimated 2,973 tonnes of excess material over the course of a year, representing roughly 225 fewer loader buckets moved annually. It is a small change in percentage but a meaningful operational impact. Less waste means reduced fuel consumption, fewer haulage cycles, and more available equipment time, resulting in faster, more efficient development overall.

Without digital guidance, drill alignment relies on manual processes and operator judgment. This can introduce variability and reduce repeatability.

CREDIT: HEXAGON

Implementation and adoption

Following the trial, Haile expanded Development Optimizer across its full fleet of three jumbos. The rollout followed a hands-on training model. Hexagon’s team returned to site, spending three to five in-cab sessions with each operator. This hightouch approach prioritized face-to-face coaching over remote support, and each operator worked through a structured competency checklist to ensure confident, independent system use.

Adoption, in this context, goes beyond installation — it is about embedding the tool into daily operations until it becomes second nature.

That shift was already beginning to show underground, as is obvious from the following quotes from jumbo operators:

“I like that it stays aligned with your backsights, so I do not have to get out of the cab to make sure my booms are facing the right direction.”

“It saves time marking up when you only need one backsight. It is very useful for making sure the perimeter holes are parallel.”

“I am impressed with the precision of the sensor — after drilling a tight burn, none of the holes intersected.”

These early indicators of operator trust suggest that the system is beginning to take root. When drillers use it without prompting it and engineers begin integrating the data into planning workflows, true adoption is underway.

As with any operational change, it takes time, but the foundations at Haile are firmly in place.

Expanding the approach: Production Optimizer

While the Development Optimizer system focused on improving accuracy and repeatability during lateral advance, Haile has also taken steps to improve production drilling.