ESG IN MINING:

> Tailings and water management

> Simplifying mine closure

> Tailings and water management

> Simplifying mine closure

> Key reforms introduced by Quebec’s Bill 63

> Gold price buoys Goldboro

AI is driving mining’s next evolution

The mining engineer’s guide to advanced scraper strainer technology

At SMS Equipment, we’re more than machines from trusted brands like Komatsu. Whether you’re greenfield, brownfield or operational, we’re the people beside you—today and every day—bringing industry-leading technology and expertise to your job site.

Because the right partnership makes everything possible.

MINING IN QUEBEC AND ATLANTIC CANADA

10 Mining in Quebec: Key reforms introduced by Bill 63.

13 New Found Gold brings the mine to the community.

15 Gold price buoys Goldboro: Nova Scotia’s newest gold producer nears for NexGold.

ESG, CLEAN MINING, TAILINGS AND WATER MANAGEMENT, AND MINE CLOSURE

18 Q & A on water management in mining with Andrea Bowie.

20 Mine water treatment operations: Bridging the handover gap.

22 Simplifying mine closure: How integration can lead to stronger results.

29 Mining waste: Creating value through thermal processing and agglomeration.

32 Underground flow control: Mine dewatering systems.

42 Mining water treatment: Photocatalysis could redefine risk and resilience.

TECHNOLOGY AND EQUIPMENT

28 Advanced technology in belt conveyor drive pulleys.

38 The role of AI in driving mining’s next evolution.

43 The mining engineer’s guide to advanced scraper strainer technology.

45 Thermal video monitoring for mining operations.

INTERNATIONAL MINING

36 Q&A with Blake Mclaughlin, vice-president of exploration at Axcap Ventures.

REBRANDING MINING

40 What have you done today that did not involve a mineral? Part 5: Who owns the minerals?

4 EDITORIAL | Carney launches fast-track reviews for major mines, but not fast enough for the industry.

6 FAST NEWS | Updates from across the mining ecosystem.

26 MIN(E)D YOUR BUSINNESS | Mining permits in Canada: Success starts with preparation.

34 MIN(E)D YOUR BUSINNESS | NI 43-101: Fixing errors in technical reports.

40

Earlier in September, Prime Minister Mark Carney named two mining operations among the first five major projects to undergo fast-track approval under Canada’s new Major Projects Office (MPO). The first is the McIlvenna Bay Foran copper-zinc mine in east-central Saskatchewan, operating in one of Canada’s richest mineral belts, which will supply critical minerals for clean energy, advanced manufacturing, and modern infrastructure. Also included is the expansion of the Red Chris copper mine in northwestern British Columbia, which will increase annual copper production by over 15% and extend the mine’s lifespan by more than a decade, while reducing greenhouse gas (GHG) emissions by over 70% when the expanded operations are in full swing. Both projects include collaboration with Indigenous Nations — the Peter Ballantyne Cree Nation in Saskatchewan and the Tahltan Nation in B.C. — underscoring the government’s emphasis on Indigenous partnership in mining operations.

These mining projects are part of a broader strategy to both build economic resilience and support Canada’s transition to clean energy. In particular, the government intends for the MPO to close regulatory and permitting gaps and ensure that financing plans are credible, so proponents can make investment decisions with greater certainty and speed. The inclusion of McIlvenna Bay and Red Chris reflects an effort to position Canada as a reliable supplier of critical minerals — like copper and zinc — that are essential for electric vehicles, renewable energy infrastructure, and low-carbon manufacturing. By fast-tracking these projects, Ottawa aims to generate jobs, stimulate local economies, and meet growing global demand, while aligning with climate targets and Indigenous rights.

The other projects referred to the MPO are LNG Canada Phase 2 in Kitimat, B.C., which would double LNG Canada’s output; the Darlington New Nuclear Project in Bowmanville, Ont. — Canada’s first G7 small modular reactor; and the Contrecœur Terminal Container Project near Montréal, which would expand the Port of Montréal’s capacity by about 60%. Together with the two mining ventures, these initiatives reflect the federal government’s priority of expediting critical energy and resource projects that underpin Canada’s transition to a net-zero economy.

Carney said the government’s strategy is to accelerate nation-building projects while maintaining standards and partnerships: “At this moment of transformative change, Canada’s new government is focused on delivering major projects to connect our communities, empower Canadian workers, and build Canada’s strength. With the first in a series of new projects, we will build big, build now, and build Canada strong,” he said.

Still, the announcement left some in the industry underwhelmed. After months of anticipation, only two mining projects made the cut, and it has taken considerable time just to reach this stage. If Ottawa is serious about making Canada a competitive destination for investment, then the so-called fast-track approval process itself must be fast-tracked. Otherwise, all the hype risks being overshadowed by frustration at the slow pace of progress.

OCTOBER 2025

Vol. 146 – No. 7

69 Yonge St., Ste. 200, Toronto, ON M5E 1K3 Tel. (416) 510-6789 Fax (416) 510-5138 www.canadianminingjournal.com

Editor in Chief

Dr. Tamer Elbokl telbokl@canadianminingjournal.com

News Editor Joseph Quesnel jquesnel@canadianminingjournal.com

Production Manager Jessica Jubb jjubb@northernminer.com

Manager of Product Distribution Allison Mein 416-510-6789 ext 3 amein@northernminergroup.com

Publisher & Sales

Robert Seagraves 416-510-6891 rseagraves@canadianminingjournal.com

Sales, Western Canada George Agelopoulos 416-510-5104 gagelopoulos@northernminer.com

Toll Free Canada & U.S.A.: 1-888-502-3456 ext 2 or 43734

Circulation Toll Free Canada & U.S.A.: 1-888-502-3456 ext 3

President, The Northern Miner Group Anthony Vaccaro

Established 1882

Canadian Mining Journal provides articles and information of practical use to those who work in the technical, administrative and supervisory aspects of exploration, mining and processing in the Canadian mineral exploration and mining industry. Canadian Mining Journal (ISSN 0008-4492) is published nine times a year by The Northern Miner Group. TNM is located at 69 Yonge St., Ste. 200, Toronto, ON M5E 1K3. Phone (416) 510-6891.

Legal deposit: National Library, Ottawa. Printed in Canada. All rights reserved. The contents of this magazine are protected by copyright and may be used only for your personal non-commercial purposes. All other rights are reserved and commercial use is prohibited. To make use of any of this material you must first obtain the permission of the owner of the copyright. For further information please contact Robert Seagraves at 416-510-6891.

Subscriptions – Canada: $51.95 per year; $81.50 for two years. USA: US$64.95 per year. Foreign: US$77.95 per year. Single copies: Canada $10; USA and foreign: US$10. Canadian subscribers must add HST and Provincial tax where necessary. HST registration # 809744071RT001.

From time to time we make our subscription list available to select companies and organizations whose product or service may interest you. If you do not wish your contact information to be made available, please contact us via one of the following methods: Phone: 1-888-502-3456 ext 3; E-mail: amein@northernminergroup.com

Mail to: Allison Mein, 69 Yonge St., Ste. 200, Toronto, ON M5E 1K3

We acknowledge the financial support of the Government of Canada.

• TOP JURISDICTIONS | Two Canadian provinces among top ten most attractive mining jurisdictions in world: Report

Saskatchewan continues to dominate Canada’s mining scene, earning a top 7th place globally in the Fraser Institute’s latest Annual Survey of Mining Companies. The Fraser Institute is an independent non-partisan research and educational organization with a free market orientation.

Newfoundland and Labrador also was among the top ten, ranking 8th place overall and sixth for policy. In terms of policy attractiveness, Alberta, Saskatchewan, and Newfoundland and Labrador are among the top ten ranked jurisdictions. Finland leads the world, with Nevada close behind.

• LANDMARK INVESTMENT | Leading mining investment commits $450M for Cariboo gold project, de-risking project

Osisko Development has entered into a credit agreement with funds advised by Appian Capital Advisory for a senior secured project loan credit facility totaling US$450 million to develop and construct its permitted, 100%-owned Cariboo gold project in central British Columbia.

The company will use the credit facility to access strategic capital and gain enhanced financial flexibility as it advances Cariboo through the next phase of pre-construction and early works milestones toward construction readiness. The facility features two tranches, which align with the project’s planned development timeline.

• MINE LIFE EXTENSION | Teck greenlights Highland Valley copper mine expansion, extends life to 2046

Teck Resources has approved the construction of the Highland Valley copper mine life extension (HVC MLE) project, advancing a multi-billion-dollar investment that will keep Canada’s largest copper mine operating through 2046. Construction is set to ramp up in August 2025, following the issuance of all major permits and an environmental certificate in June.

• HISTORIC MERGER | Anglo American, Teck strike $50B merger in decade’s top mining deal

Anglo American is set to acquire Teck Resources, Canada’s largest diversified miner, in a $50-billion all-share merger that would create the world’s fifth-largest copper producer — if regulators in Canada, the United States and China sign off. If completed, Anglo shareholders will own 62.4% of the new company, to be named Anglo Teck, while Teck shareholders will hold 37.6%.

Industry Minister Melanie Joly says Ottawa would want to see longer-term commitments to Canada’s national interest before it is approved. Executives from both companies have promised new company would be headquartered in Vancouver.

EVERGREEN® The largest international flotation wear parts manufacturer.

• Superior hydrodynamic performance = Industry-leading recovery rates.

• Maximize uptime + Fewer replacements + Reduce maintenance costs.

• Advanced compounds: High-grade rubber, polyurethane, and nylon formulations.

• Corrosion resistance: Acid- and alkali-proof construction.

• Structural advantages: Impact resistance, tear resistance, and lightweight design.

• Performance optimization: Precision balancing reduces partial loading and enhances operational stability.

• Prompt delivery, competitively priced, and emergency service is available.

EVERGREEN® Recessed chamber, membrane, vertical and plate and frame filter plates. Precision engineered, robust durability, and exacting specifications. Manufactured to fit all OEM filter press models and sizes.

Nylon, polyester, cotton + polypropylene filter cloth.

Sizes: 470mm to 4500mm. Filter cake thicknesses to 32mm.

Complete range of spare parts for all OEM models and sizes.

A definitive agreement has been announced between Venerable Ventures and the Selkirk First Nation, paving the way for the formation of Selkirk Copper Mines. This new venture will take complete control of the currently inactive Minto copper-gold mine, situated about 250 km north of Whitehorse in the Yukon.

The C$15 million transaction, structured entirely in shares, will result in the Selkirk First Nation becoming the majority stakeholder in the reorganized company.

The Minto mine, which was in operation between 2007 and 2023, was deserted and placed under the control of a receiver the previous year. The Selkirk First Nation successfully obtained the mine’s assets in June 2025 after legal proceedings and discussions with the Yukon government.

• EXPLORATION BOOST | Ontario invests $10M in junior mining exploration, boosts Indigenous

The Ontario government is injecting up to $10 million into early-stage mineral exploration with the launch of the 2025 Ontario Junior Exploration Program (OJEP). The investment aims to help junior miners and prospectors overcome the high risks and challenging conditions inherent in early exploration.

The government will also be upgrading Indigenous support. Funding for Indigenous employment and business opportunities leaps from $10,000 to $15,000 per project, on top of core program funding.

The International Council on Mining and Metals (ICMM) has released a set of tools designed to help mining and metals companies actively embed robust psychological health and safety practices into their daily routines and workplace culture. These resources empower companies to strengthen their safety culture and proactively reduce risk, all with the ultimate goal of preventing harm.

The industry has already made significant strides in managing physical risks by prioritizing safety. However, as operational demands become more intricate and workplace expectations shift, addressing psychological health and safety has become a vital, though still developing, focus. Mining and metals workers continue to face challenges such as fatigue, isolation, workplace stress, bullying, and trauma—often more frequently than in other industries.

SPONSORED POST | BY NORTHERN MINER STAFF

Dundee Sustainable Technologies (CSE: DST) has developed two innovative metallurgical processes that offer significant environmental benefits for the mining industry.

The recent tailings dam breach in the Yukon is a case in point where cyanide-laced material used to extract gold contaminated nearby waterways. But green technologies and sustainability-focused projects are helping the industry address risks earlier and build longer lasting community ties.

Earlier this year, Jean-Philippe Mai, President & CEO of DST, sat down with MINING.com’s Devan Murugan to discuss how DST’s technology can provide miners with safer and more efficient alternatives to traditional mining practices.

Devan Murugan: It’s been about 10 years since your first demonstration plant went up. That was back in 2014. What gap were you hoping to fill in the market back then? Take us through those beginnings.

Jean-Philippe Mai: We’ve been focused on developing and commercializing our process for numerous years. Starting with bench scale concepts, we moved to pilot scale in 2009-2011, then built our first industrial demonstration plant in 2015. Our objective was to provide an efficient gold extraction and recovery process as a safe, efficient alternative to cyanidation. We wanted to not only replace cyanide completely but also provide added efficiency compared to standard processes.

DM: From an elementary perspective, what miners do is extract gold using cyanide, which comes with risks. How does Dundee’s process provide an alternative?

JPM: We use a chlorinationbased approach with sodium hypochlorite and a catalytic amount of sodium

hypobromide. We leverage the fast kinetics of bromide to rapidly solubilize gold using essentially a diluted household bleach solution operating at ambient temperature and pressure. This novel chemical approach provides a very efficient way of solubilizing gold without the toxicity concerns of elemental chlorine.

DM: It’s interesting because this method not only eliminates cyanide but also reduces leaching time and waste. That’s a major benefit for mining companies, isn’t it?

JPM: Absolutely. Typical processes take 24-48 hours to solubilize gold. Our approach achieves this within 1-2 hours, providing huge benefits in throughput and plant size for equivalent capacity. We also handle contaminants like sulphur and arsenic efficiently, removing them before transferring to the CLEVR process. The CLEVR process operates in a closed loop, regenerating all effluents and generating dry stackable tailings, eliminating ponds and reducing liability and footprint.

“We wanted to develop an efficient gold extraction and gold recovery processes which provided a safe, efficient and a viable alternative to cyanidation.”

— JEAN-PHILIPPE MAI

DM: And I suppose on the other side of the spectrum, the other process that you do, the GlassLock process, is aimed at similar efficiency, isn’t it?

JPM: When developing CLEVR, we worked with refractory arsenopyrite gold ores. After decomposing arsenic compounds, we needed to stabilize the arsenic product. This led us to develop GlassLock, an arsenic stabilization process using vitrification that incorporates arsenic within a glass matrix for long-term stability. This increases efficiency in permanent stabilization while reducing associated costs of handling and stabilizing arsenic.

DM: Let’s talk about investor appeal. You’re in a space where environmental, social and governance (ESG) standards matter. What’s your investor experience been on that front?

JPM: We’re offering tools to address project challenges differently. Investors and the industry seek the right solutions for given projects. Having processes that

efficiently recover gold and properly handle contaminants like arsenic, combined with our use of proven equipment at larger scales, provides alternatives. Our novelty is in chemistry. Understanding processes like ours offers routes that can be welcomed by investors, miners, and communities.

DM: From an investor point of view, at the end of the day, it’s really about industry adoption, isn’t it? Is there momentum there?

JPM: Our industry is conservative but keen to learn about processes like ours. We’ve seen significant recent interest and ask mining companies to be curious and try us. Adoption requires proper understanding through development, test work, and engineering designs that provide data for sound decision making. Once you generate supporting technical data, both operators and investors will support it as the right thing to do.

Visit: dundeetechnologies.com for more information.

By Mira Gauvin, Jade Lemieux, and Chloé Bourque

In the last year, Quebec’s mining sector experienced significant regulatory changes. The government enacted Bill 63 (An act to amend the Mining Act and other provisions), reforming the Mining Act (c M-13.1) (the act) to reconcile mining development with other land uses and promote coexistence among users, responsible resource exploitation, and tighter environmental controls. Bill 63 received Royal Assent on Nov. 29, 2024, with most provisions taking effect immediately. Additional regulations to complete the reform are anticipated in the next year.

This article highlights some of the major changes introduced by Bill 63 and their implications for environmental protection and Indigenous rights, as of Sept. 2025.

A “mine” was defined as all surface and underground infrastructure necessary for the extraction of ore, including ore storage areas, handling areas, tailings accumulation areas, waste rock deposits, and wastewater treatment and retention ponds.

An “operating area” was defined as the area occupied at ground level by the mine. For an existing mine, as of March 23, 2018, the operating area corresponds to:

• the area authorized under section 22 and, if applicable, section 31.5 of the Environment Quality Act (c Q-2) (the “EQA”); or

• the area existing on that date if the establishment and, where applicable, its expansion did not require prior authorization under the EQA.

Modernization of terminology

Bill 63 replaces the term “claim” by “exclusive exploration right” (EER). An EER is valid for three years and may be renewed in two-year periods if conditions are met, including the exploration work of the nature and cost as determined by regulation. Bill 63 also amends the definitions of “mine” and “operation area” in section 22 of Part II of Schedule I of the Regulation respecting the environmental impact assessment and review of certain projects (c Q-2, r. 23.1) (the EIA Regulation) as follows:

Following Bill 63, a “mine” now refers to all surface and underground infrastructure that are part of a mineral substance operation, excluding surface mineral substances as defined in the act.

Following Bill 63, an “operating area” now refers to the surface area authorized under the EQA or, if there is no such surface area, the surface area occupied by the mine; if the project includes an ore treatment plant, the operation area also includes the area of the plant.

Note: These changes will affect the types of projects that will from now on be subject to an environmental impact assessment (EIA).

Bill 63 introduces significant changes regarding the rules governing the EERs. Section 9 introduces section 18.1 to the act, allowing any person who meets regulatory conditions to apply for and hold a mining right. Section 18.1 formalizes eligibility criteria to obtain a mining right, providing a regulatory framework to better regulate access to mineral resources, curb speculation, promote responsible land use, and strengthen the credibility of the mining regime for the benefit of Quebec’s economy. Section 18.1 is not yet in force and will take ef fect when the government establishes new regulations under the act.

The new section 52.1 of the act autho rizes the minister to impose conditions on holders of an EER. These may con cern the work to be performed and may be imposed notwithstanding other pro visions of the act, either for public inter est reasons, particularly to prevent or limit impacts on local and Indigenous communities or to enable prioritization or reconciliation of uses and preserva tion of the territory.

Bill 63 also amends registrar’s duties regarding the refusal of a notice of map designation. Under the amended sec tion 52, the registrar must refuse a no tice of map designation in cases includ ing where the land has been designated by a person who does not meet the con ditions set out in section 18.1 of the act. This expands the registrar’s obligation, strengthening regulatory oversight of land use for mining purposes.

Prior to Bill 63, section 101 of the act al lowed the minister to grant a mining lease without proper EQA authorization in cases where delays in obtaining such au thorization were deemed unreasonable. This “unreasonable delay” exception has been removed in the amended legislation. Bill 63 introduces a new version of section 101.0.1 of the act, granting the minister authority to impose condi tions or obligations when granting a mining lease. These conditions may be applied (i) to enable prioritization or reconciliation of land uses and preservation of the territory, (ii) for public interest reasons such as limiting im-

pacts on local and Indigenous communities, (iii) where the lease concerns land with mineral substances reserved to the province, or (iv) to maximize the economic benefits of the mining project within Quebec.

The removal of the “unreasonable delay” exception, combined with the new discretionary powers under section 101.0.1 of the act, represents a significant change in the legal framework gov-

of Part II of Schedule I of the EIA Regulation has been replaced by a new provision subjecting certain mining projects to an environmental impact assessment procedure under the EQA (EIA procedure). Under this provision, the EIA procedure now applies to

• Work required for the operation of a new mine;

• Where the operation of a mine was authorized under section 31.5 of the

Challenges with noise and dust?

For us it’s no problem.

Everything is possible. With VEGA.

date, work required for any expansion of 50% or more of the mine operation area; and

• For mines not authorized under section 31.5 of the EQA before Nov. 29, 2024, any

> work required for any expansion of 50% or more of the mine operation area.

> work required for any project to increase the maximum daily extraction capacity by 50% or more.

> work that increases the maximum daily extraction capacity of a metal ore mine to 2,000 metric tonnes or more.

> work that increases the maximum daily extraction capacity of an ore mine other than a metal ore mine to 500 metric tonnes or more.

> work required to resume the operation of a mine that underwent dismantling or restoration work after its operation stopped.

The replacement of section 22 of Part II of Schedule I of the EIA Regulation introduced by Bill 63 aims to ensure greater predictability and transparency regarding impacts on the territory. Regarding rehabilitation and restoration of the site, Bill 63 introduced the notion of “harm caused to the environment.”

As part of modernizing the legal mining framework, the government has expanded its regulatory mechanisms to, among other things, enable prioritization and reconciliation of uses and preservation of the territory and ensure greater transparency and predictability for Indigenous people regarding mining activities.

To reconcile mining activities with the Indigenous people activities, the act now allows the government of Quebec to enter agreements with Indigenous communities to determine the boundaries of a parcel of land where any mineral substance forming part of the domain of the government is reserved to the government, on the conditions fixed in the agreement, or withdrawn from prospecting, mining exploration, and operations.

Bill 63 also establishes an obligation for the minister to notify, within 60 days of the registration of an EER, any Indigenous nation or community concerned by the existence of such right. Additionally, to enhance predictability and transparency for Indigenous people, EER holders are now required to submit an annual work planning, using the prescribed form, to each affected Indigenous nation or community, at least 30 days prior to the commencement of any exploration work and, subsequently, on an annual basis for as long as the work continues. Any Indigenous nation or community concerned may also request that the holder conduct an information session concerning such annual work planning.

The annual work planning must be published on the holder’s website or by any other means authorized by the minister. Where an information session is to be held, a summary thereof must also be published.

Finally, Bill 63 grants the minister, under certain conditions, the authority to require a holder of a mining right to remove or

move, within the timeframe determined by the minister, any property or extracted ore or surface mineral substance located on the land subject to mining right to enable prioritization or conciliation of uses, preserve the territory, or for reasons of public interest, including, notably, the mitigation of impacts on Indigenous communities. Should the holder fail to comply with such a requirement, the minister may proceed with the removal or relocation at the holder’s expense.

The intent to strengthen communication, transparency, and predictability regarding mining activities affecting Indigenous communities aligns with the principles reflected in the 2024 Superior Court of Quebec decision in Mitchikanibikok Inik First Nation (Algonquins of Barriere Lake) versus Procureur Général du Québec. The Algonquin First Nation alleged that the government failed to fulfill its duty to consult regarding mining exploration activities on territory over which the Nation asserts Indigenous title or rights.

The court declared that a decision to be made under the act, whether or not to accept the designations of claims on territory subject to asserted Indigenous titles or rights known to the Crown in right of the province, engenders a duty to consult prior to the decision being made. It further emphasized that the application of the act requires a more robust approach to the implementation of the duty to consult Indigenous communities, including, where circumstances justify, distinct consultations.

Both this judgment, issued before Bill 63 came into force, and the amendments enacted through Bill 63, illustrate a distancing from the traditional free access regime, reflecting a transition towards a more inclusive framework for mining governance that considers the concerns of Indigenous communities. The Attorney General of Quebec appealed the decision on Nov. 22, 2024. The outcome of this appeal, still pending as of Sept. 2025.

Bill 63 marks a turning point in Quebec’s mining governance. By modernizing terminology, tightening eligibility, expanding ministerial discretion, and strengthening environmental and Indigenous consultation obligations, it significantly modifies the legal framework that has long characterized mining development in Quebec. While many regulatory requirements remain to be set, the direction of the reform is clear: Quebec is moving toward a more structured, transparent, predictable, and accountable regime.

As of Sept. 2025, it is our understanding that some regulations are expected in the Gazette officielle du Québec by the end of 2025, with a public comment period, their coming into force is anticipated for next year.

Mira Gauvin is a partner in Dentons Canada’s Corporate Group, with a focus on environmental law. She is also a member of the Firm’s Environment and Natural Resources and Climate Change Strategies groups. Jade Lemieux is an associate in Dentons Canada’s Corporate group in Montréal. Chloé Bourque is an associate in Dentons Canada’s Corporate group in Montréal.

There are just a handful of producing mines that sit near the Trans-Canada Highway across the country, and New Found Gold’s (TSXV: NFG, NYSE: NFGC)

Queensway could be the next one.

Located 15 km west of Gander, N.L., the highway goes right through the northern portion of Queensway, whose 110-km long strike length crosses the Appleton and JBP fault zones.

“Your Tim Hortons does not even get cold by the time you get to site. You will have a full Tim Hortons that is nice and hot,” New Found Gold’s CEO Keith Boyle said during a mid-June site visit. New Found Gold has over the last few years developed its exploration work into an initial resource, with a preliminary economic assessment (PEA) expected imminently. It has also drawn the attention of Eric Sprott, who in May increased his interest to 19% of the Vancouver-based company. New Found Gold subsequently raised $63.48 million in a bought deal financing in early June. Queensway hosts 18 million indicated tonnes grading 2.4 grams gold per tonne for 1.39 million oz. gold, plus 10.7 million inferred tonnes at 1.77 grams gold for 610,000 oz., according to the initial resource released in March.

The company’s shares traded for $1.97 apiece recently in Toronto, for a market capitalization of C$441 million. Its shares traded in a 12-month range of $1.34 to $4.98.

Your Tim Hortons does not even get cold by the time you get to site. You will have a full Tim Hortons that is nice and hot.”

Driving alongside Queensway’s Iceberg target, just north of the highway, the grey rock sits in a depression that resembles an excavated site where dinosaur bones might poke out. Iceberg and other high-grade zones such as Keats and Keats West — part of the AFZ Core resource area — were originally hidden under bogs that have since been drained. The exposed, light-grey rock at Iceberg is the result of thousands of metres of drilling.

Pointing out some examples of visible gold marked with pink tape sitting along the bottom of the canyon-like Iceberg zone, Boyle explains that most of the Queensway resource might end up in five open pits.

About 1.6 million indicated oz. would be in open pits and 400,000 inferred oz. in an underground component, which the upcoming PEA aims to better define.

“There is a really good high-grade core here,” he emphasized.

“Seventy-five per cent of our open pit ounces are in 25% of the tonnes.”

Sketching out economics

The assessment will not upgrade the resource to measured. Rather, it will “put economics” to the indicated and inferred resources by adding mine, mill, and infrastructure plans around it, Boyle said.

Citing potential concerns that the PEA’s release could lead to a drop in the company’s stock, as occurred when the initial resource came out, the CEO said there were expectations that were not met. New Found shares fell by almost one-third when the resource was released on March 25.

“I think it was just a question of properly communicating those expectations prior to that continuous disclosure and properly putting context around maybe some of the results that had been previously communicated,” he said.

Results from that program are to be included in a pre-feasibility or feasibility study that could be released towards the end of 2026, Boyle said.

Local conditions benefit

Looking further down the road, Boyle declined to say if the company would opt to produce the Queensway deposit itself or be open to an acquisition by a producer.

However, he stressed that the context of operating in Gander and Newfoundland helps the project to shine.

One factor is that the environmental assessment (EA) period for exploration projects in Newfoundland and Labrador is only 45 days

The company is currently about 11,750 metres into a 70,000-metre drill program using five rigs, most of which are focused on infill drilling of inferred resources in the pit shells at the AFZ core.

long, one of the shortest in Canada.

“That is the kind of jurisdiction that we want to do business in,” Boyle said. The company might apply for the EA towards the end of the year.

Another factor is that the relatively high unemployment rate in the Gander region could help New Found fill new roles if a mine starts up at Queensway. The rate sat at 10.6% as of last December, according to the most recent data from Statistics Canada.

“We have got that high-grade core that will allow us to look at both a small starter and then a larger operation,” Boyle said. “We have got great infrastructure. It is not hard to see the possibility that this thing, once started, could go on for many years,” Boyle concluded.

Watch a video of the visit: https://vimeo.com/1096457844?fl=pl&fe=sh Blair McBride is a writer and copyeditor at The Northern Miner.

Humans have been hunting gold since prehistoric times. In what is now Nova Scotia, the yellow metal was first observed in the mid-1800s in Halifax County and many other areas. The rush was on. By 1862, the region was — for a brief time — Canada’s largest gold district.

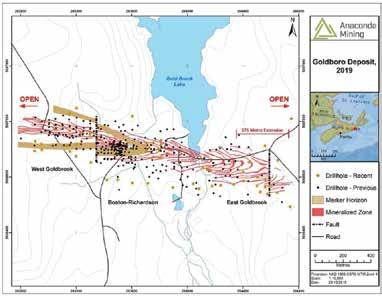

Today’s explorationists continue to advance gold projects in the region, notably the Goldboro property, 100%-owned by NexGold. The property lies 175 km east of Halifax and includes the former Boston Richardson mine and historic tailings facilities.

Thus far, the project is showing evidence that it will be successful. The fact that the gold price has more than doubled in the four years since the feasibility study was prepared will only make the undertaking more profitable.

According to the 2022 feasibility study with a gold price of US$1,600 per oz., the Goldboro property contains open pit measured and indicated resources of 16.7 mil-

1984-1988 Onitap Resources did grassroots exploration

1988 Orex Exploration acquired property

2010-12 Osisko Mining explored under option

2017 Orex becomes subsidiary of Anaconda Mining

2018 Anaconda takes underground bulk sample

2021 Anaconda completes PEA

2022 Anaconda changes name to Signal Gold

2024 Signal Gold acquired by Treasury Metals, which also owns the Goliath gold project in Ontario

2025 Treasury Metals changes name to NexGold, continues permitting Goldboro project

lion tonnes, grading 2.82 g/t gold, containing approximately 1.4 million oz. This resource, on which the feasibility study was prepared, will support the development of two initial pits. There is also an inferred resource of 975,000 tonnes at 2.11 g/t gold for 66,000 oz. A cut-off grade of 0.45 g/t was used in the calculation.

Included in the resources are proven and probable reserves totaling 15.8 million tonnes at 2.26 g/t gold, containing roughly 2.2 million oz.

NexGold is updating the resource estimate, but it was not yet available at press time. Anyone interested should check the company’s website for news of the changes.

An underground bulk sample was collected in 2018. With a cut-off of 2.40 g/t, the underground M+I resource is 5.9 million tonnes grading 6.09 g/t gold, containing approximately 1.2 million oz. The inferred portion is a further 2.2 million tonnes at 5.89 g/t gold, containing 418,000 oz. The potential has been identified for future underground development as the project matures.

What the feasibility study outlines

NexGold envisions a conventional truck-and-shovel open pit mine that will have a life of 11 years. Average gold production will be approximately 100,000 oz. per year in each of the first nine years. The expected gold recovery rate is 95.8% with an

open pit mining and the availability of local infrastructure.

Goldboro takes advantage of generous existing infrastructure. The property is accessible year-round via Route 316 from Antigonish 60 km away. The nearest power supply is only 1.6 km from the village of Goldboro. NexGold will be undertaking earthworks for pit development and ancillary buildings, accommodations, roads, power, freshwater, water treatment, and the TMF. Services and skilled labour are both available nearby.

all-in sustaining price per ounce of US$1,072 (and that was using a conservative price of US$1,600/oz.).

Development of the two pits will take a year before the 4,000-t/d processing plant begins operation. The project will ramp up to full capacity over the next six months. The pre-production year will also see the initial stage development of the tailings management facility (TMF).

The 4,000-t/d processing plant will be of conventional design and operate in two shifts per day. Three stages of crushing will be followed with ball milling followed by cyclone classification. Ball mill discharge will report to the gravity circuit designed to collect 40% of the gold. Intensive cyanidation of the gravity concentrate will follow ahead of a carbon-in-pulp (CIP) circuit. The pregnant solution will be washed from the carbon, followed by electrowinning and smelting to produce doré. After the gold is recovered, carbon will be regenerated in a rotary kiln.

Tailings will undergo cyanide destruction using the SO2/air process, followed by arsenic precipitation. Tails will be thickened before placement in the TMF.

After taxes, the project carries a preproduction capital requirement of $271 million, which should be paid back in 2.9 years. The internal rate of return is 25.5%, and the net present value with a 5% discount is $328 million. The ability to keep development costs low is due to the decision to begin with

Goldboro is nearly shovel ready. Most of the major permits and licences are in hand as is the impact benefits agreement with the local Mi’kmaw community.

Permitting is successfully underway at Goldboro. The project earned environmental approval in August 2022, mining and Crown leases in May 2025, approval of Schedule 2 amendments in July, and industrial approval in August 2025. The company filed for the necessary Fisheries Act authorization recently, and the initial feedback is positive for the project.

NexGold and the Assembly of Nova Scotia Mi’kmaw Chiefs signed a historic benefits agreement for Goldboro in December 2024. This ensures the project will advance in a mutu-

over 17.7 metres,

As for the long intersections, they include 36.7 metres at 1.60 g/t gold, 25 metres at 6.91 g/t gold, 21.2 metres at 1.05 g/t,19.7 metres at 2.79 g/t, 18,2 metres at 5.28 g/t, and 18.3 metres at 3.56 g/t gold.

The company has now traced gold over a 3.4-km strike length at Goldboro. The deepest hole was 550 metres, and it remained open at depth.

The growing exploration potential will add to the value of a solid gold mine project that has already benefited from the steep rise in the gold price.

ally beneficial manner. The agreement contains a community grants program that pays at least $1,000 to eligible organizations.

NexGold recently completed approximately 25,000 metres of diamond drilling at Goldboro. The results confirm that the project has growth potential in all directions, particularly to the west and toward the past-producing Dolliver Mountain gold mine. Geophysical surveys have defined mineralization about 1.7 km to the west of the current deposits, including near-surface mineralization.

Results from the drilling campaign have been both long and strong. High-grade assays highlighted since mid-year have included 108.76 g/t over 1.4 metres, 77.30 g/t over 1.25 metres, 67.23 g/t over 2.20 metres, 50.73 g/t over 6.7 metres, 40.09 g/t

With 50 years of experience, DUX offers a range of underground articulated four-wheel drive equipment designed to meet the needs of mining and tunnelling projects worldwide.

Contact DUX today for field-proven underground haulage, utility and scaling solutions.

By Catherine Hercus and Tamer Elbokl,

Andrea Bowie, a principal consultant at SRK Consulting with a B.Sc. in engineering chemistry from Queen’s University, has over fifteen years of experience in mine water treatment and management, water and load balances, permitting support, and remote northern operations. In this interview, she discusses challenges and opportunities in water treatment, permitting and closure, emphasizing First Nations consultation, realistic planning, best available technology (BAT), recycling and hybrid systems, cost variations, proactive modelling, clean energy, continuous community engagement, and the broader complexities of project development and water management in mining.

Q: WHAT DO YOU THINK ARE THE MAIN REASONS SOME PROJECTS ARE NOT SUCCESSFUL?

A: There are several. Two of the biggest are team experience and how consultation is handled. Engaging meaningfully with First Nations and local communities is critical. If people feel shut out of the process, opposition can delay or stop a project altogether. Too many companies underestimate the importance of relationship building.

Another challenge is being realistic about the technical and logistical difficulties of working in remote locations. Mines in Canada often deal with long distances, limited access, harsh weather, and supply chain bottlenecks.

Ignoring those realities leads to budget overruns and schedule slippage. Then, there are market conditions. In 2008, I worked on a zinc project that was well-advanced, but when zinc prices collapsed overnight, the economics no longer worked.

No matter how capable your team is, external conditions matter. Success requires strong planning, stakeholder trust, and resilience. Bringing a project through the permitting process to the construction stage is as much about credibility and persistence as technical design.

Q: DOES THE TECHNOLOGY READINESS LEVEL (TRL) FRAMEWORK IN B.C. MAKE PERMITTING MORE DIFFICULT?

A: Permitting in B.C. is demanding, and not only because of technology readiness levels. A key improvement is the Ministry of Environment’s best available technology handout, which compares treatment and management options by performance, cost and reliability. Step four favours proven technologies, giving regulators and the public confidence but creating bias against unproven ideas. Clients can move new technologies from bench tests to pilots and full-scale plants, but scaling is slow. The framework highlights what is achievable and promotes transparency.

Q: HOW LONG DOES IT TAKE TO PLAN A WATER TREATMENT SYSTEM?

A: Timelines vary. Mines in Canada are rarely near established infrastructure, and design is iterative and requires contributions from engineers, regulators, and local communities.

Smaller, straightforward systems can be designed, permitted, and built in a matter of months, particularly if they fit into existing infrastructure. Adjustments to current plants are often quicker Entirely new, complex systems — especially treatment plants built from the ground up — can take five years or more to plan and deliver.

Q: IS WATER RECYCLING COMMON IN NEW UNDERGROUND MINES?

A: Extremely common. The industry average is that about 80% of process water is recycled. In regions with a positive water balance, operators face the challenge of discharging excess water without harming receiving streams.

In arid climates, scarcity makes recycling essential. At the process level, some solutions include coarse particle flotation, tailings dewatering, and evaporation control. The goal is to close the loop as much as possible to reduce withdrawals and limit environmental impact.

Q: HOW IS WATER RECYCLED, AND HOW DO YOU FILTER OUT ANY CONTAMINANTS?

A: The answer depends on the commodity and processing methods. In most operations, water travels as slurry to the tailings facility, where some dilution occurs. In drier cli-

mates, evaporation concentrates metals and salts in the water column.

That reclaimed water may require treatment before reuse. Mill processes also contribute; for example, the thickening stage often operates at a high pH, which allows metals to precipitate out of solution. This acts as a polishing step that can make recycling more feasible.

In other cases, additional treatment is needed before water can be fed back into the mill. Each site has its own water chemistry fingerprint, which dictates treatment steps.

Q: WHEN YOU ARE PLANNING A SYSTEM, ARE HYBRID SYSTEMS MORE COMMON NOW?

A: They are becoming more common, but applications are very site-specific. In northern Canada, passive systems are rarely suitable because of climate, except as polishing steps where flows are small and water quality is already good.

We are increasingly developing in situ options, where pits or underground workings are used as reactors for treatment. This approach is particularly useful in closure or post-closure phases, when sites are not staffed year-round.

Water can be left to accumulate over winter. Then, in summer, when logistics are easier, personnel arrive to treat and discharge it at times when receiving waters can handle the load. Once treatment is done, the site can be left until the next cycle.

This seasonal strategy reduces costs, minimizes risks associated with winter access, and still meets environmental obligations.

Q: WHAT CHALLENGES ARISE IN CLOSURE AND TRANSITION?

A: Cost and logistics dominate. Operating water treatment systems post-closure is expensive. Winters bring storms, travel delays, and higher safety risks. Staffing is reduced, so efficiency is critical. Reagent delivery can be difficult. At closure, companies must maintain monitoring, treatment, and environmental sampling, often with fewer people and limited infrastructure. Optimizing the footprint and designing systems that can run seasonally or with minimal intervention is vital.

The challenge is finding approaches that are technically sound, environmentally protective, and financially sustainable for decades after mining stops.

Q: WHAT IS THE AVERAGE COST OF A WATER TREATMENT SYSTEM?

A: There is no set cost. Flow rates, layout, and chemistry matter. Reservoirs or pits cut pond expenses. Chemistry often drives cost: lime treats acidic water with metals, while selenium requires complex biological methods. Reagents increase logistical and transport burdens. Each site demands early, detailed cost assessment.

Q: HOW IMPORTANT IS FLEXIBILITY IN PLANNING?

A: It is essential. We use operational water and load balance models to simulate mine sites. These models are constantly updated as conditions change.

For example, the chemical signature of waste rock is defined from exploration samples, but once you are deeper into mining, you may discover differences that require treatment adjustments.

Technology readiness levels (TRLs), created by NASA, measure maturity from research (1-2) through development (3-5), demonstration (6-8), to adoption (9).

Our models allow us to test scenarios: different climates, different waste rock profiles, or different mine schedules. Based on the outcomes, we can recommend upgrades, new systems, or different management approaches.

Flexibility prevents surprises. Most adjustments are small course corrections, but they keep the site compliant and reduce long-term costs.

Q: DOES SRK RELY ON PROPRIETARY TECHNOLOGY?

A: No. We are consultants, not vendors. We do not sell equipment. That independence is important because it allows us to evaluate all options fairly and recommend the best fit for each site. Our only goal is to help the client find the right solution.

Q: HOW MUCH MONITORING CAN BE REMOTE?

A: Remote technologies have improved, but people are still needed on site. Equipment can fail — sensors get stuck, floats jam — and only physical presence can resolve those issues.

Compliance monitoring also requires samples to be collected and analyzed on a schedule, often weekly or monthly. Downstream monitoring is also essential.

Most operating mines already have staff on site, so water treatment monitoring fits into existing responsibilities. Remote systems are helpful, but they cannot fully replace people.

Q: IS CLEAN TECHNOLOGY A BIGGER FACTOR NOW THAN A DECADE AGO?

A: Yes, awareness of sustainability has grown significantly. Ten years ago, clean power was often considered optional. Now, it is an expectation to be considered during project design.

We are seeing more projects integrate renewables, though feasibility depends on geography and cost. Remote sites still need fuel backups, and even renewable projects rely on mined materials. But public and investor expectations are clear: companies must show they are minimizing emissions and environmental impacts. Clean technology is no longer a side consideration — it is central to project design and community acceptance.

Q: DOES SRK PROMOTE CONSULTATION WITH LOCAL COMMUNITIES?

A: Consultation is central to project development. At SRK, Canadian teams act as technical experts, explaining risks and uncertainties, attending meetings, responding to requests, and providing transparent analysis of environmental outcomes. This builds trust, especially with First Nations, who have experienced mining’s impacts — from gold rushes to abandoned sites. Skepticism is understandable. Today, emphasis is on sustainable projects and reclamation, with First Nations directly involved. Without consultation, projects rarely succeed socially or environmentally.

Catherine Hercus is a freelance writer.

By Jeff Coombes

teams, rather than leaving them to inherit instability. An Operations contract prior to Handover reframes transition as proactive risk management, making accountability part

Treating mine water treatment operations handover as a defined phase of operational risk reframes how mining projects move from construction into operation. Instead of leaving stability to chance, this approach integrates O&M di-

Designing for stability, not just completion: tuning systems for seasonal flows and variable water quality before they stand alone.

• Building continuity into the process: transferring operational control decisively, with clear definitions of success for transition, documentation, and trained staff.

• Making data actionable: applying monitoring, automation, and adaptive process controls from the outset to shorten the path to compliance.

Closing the accountability gap: ensuring performance, training, and compliance are managed, not assumed.

The payoff is faster process validation, fewer compliance risks, and stronger trust with regulators, stakeholders, and communities.

delivery and operational results, reinforcing ESG commitments. Regulators gain confidence that compliance will not falter during the transition. Communities see proof that environmental promises are being met from the first day of operation.

Recognizing handover as an operational risk and managing it deliberately with structured water treatment plant operations and maintenance services turns a blind spot into a moment of competitive advantage, helping mines reduce costs, strengthen credibility, and accelerate the path to long-term reliability.

• Scoped operations and maintenance (O&M) plans defining uptime targets, compliance protocols, and escalation paths in advance.

Readiness reviews that expose gaps in staffing, systems, and SOPs before they turn into incidents.

Phased handovers with decision gates that support internal

Handover risk is predictable — preparation decides whether it turns into a setback or a strategic advantage. Addressed head-on, it becomes the moment to prove compliance, build trust, and give operations teams the confidence to run effectively from the start.

Jeff Coombes, M.Sc., B.Comm., is the manager of strategic development at Integrated Sustainability.

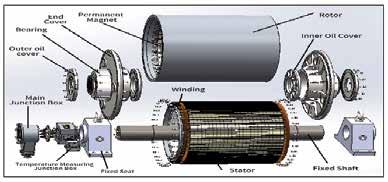

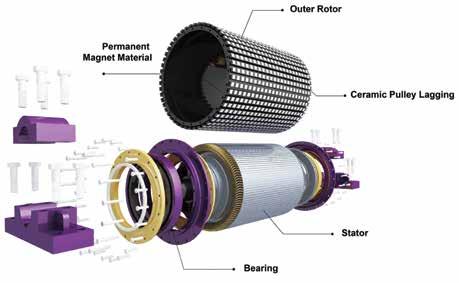

JASUNG® PMDD Permanent Magnet Direct Drive Belt Conveyor Pulleys

JASUNG® PMSM Permanent Magnet Synchronous Motors For Pumps, Ball Mills, Fans . . .

PMDD eliminates the need for motor, coupling, gearbox and pulley.

• Reduce energy requirement by up to 25%.

• Reduce maintenance and downtime up to 80%.

• Reduce space requirement by up to 70%.

• System transmission efficiency can exceed 96%.

• High startup torque, even at low speeds.

• Reduce vibration and noise to below 80 dB

• Simpler installation without concern for alignment.

• X-P rated with fully sealed (IP66) protection against dust and humidity.

PMDD

• ≤2400mm diameter

• 750 to 3000mm length

• X-P sealed design

• 0.8 to 6m/s speed

• 11 to 2000kw power

• ≤5000 tph transfer

1. The PMDD pulley structure: the stator and the outer rotor. The stator is composed of an iron core and windings, while permanent magnets are embedded on the outer rotor. The stator generates a rotating magnetic field that interacts with the magnets on the outer rotor, driving the rotor to rotate as required.

2. Disc - caliper brake and pulley backstop systems.

3. Efficient cooling systems: water or air cooling. Patented Internationally

Closing a mine is never an easy task. The amount of work needed to meet regulatory requirements can be daunting, particularly where the requirements may not be clear.

It is a difficult economic, technical, political, and labour-intensive task to accomplish, one made even more difficult when rigorous planning and preparation has not taken place in the months and years leading up to the mine’s end of operational life.

Application of regulatory minimum is often the default level of closure effort. But regulatory minimum is rarely enough as regulations change to meet evolving societal expectations, leaving you in a state of constant catch up over closure timeframes.

There is, however, a better way; one that provides effective and efficient closure, focused on the material aspects and provides for clearer conversations with impacted stakeholders. By integrating mine closure considerations throughout operations, making it part of everyday processes and activities, better overall closure outcomes, including business outcomes, can be achieved.

Establishing integrated practices

We have seen numerous regional and global documents created to provide guidance for mining companies on what needs to be done to create good integrated mine closure practices. These documents, including the International Council on Mines and Metals (ICMM)’s Planning for Integrated Mine Closure Toolkit, are a valuable resource for establishing a starting point. However, these documents are not without their own challenges. The following three key issues emerge:

• The guidance is ambiguous, as it often identifies what is required but not how, when, or who.

• Individual business drivers are often considered contrary to good practice closure requirements, confounding efforts to gain the internal attention that closure risks so often pose to the business.

• Good practice guides might promote an aspirational, but idealistic and potentially unachievable, end point. Each of these presents its own unique challenge for integrating mine closure practices. However, none of these are challenges that cannot be overcome with a strong, simple plan in place.

Developing a site-specific framework is the starting point for a

successfully integrated mine closure plan. Using the existing resources available, such as the ICMM Toolkit, will ensure the plan is thoughtful, considering site-specific needs and identified risks.

Start by using the tools that provide direction on the what and the how, and adapt them to suit your company, site, and context. Take the necessary time to develop internal processes that will then connect the what to the who and when. Creating a RACI (responsible, accountable, consulted, informed) chart will provide clarity on who is responsible and accountable for specific closure processes and actions. Where possible, integrate into existing processes, so closure is not seen as an add on — often incorporating closure is a minor stretch of existing considerations rather than something completely different.

Then, develop your company or site-specific criteria, also known as design basis. For example, what does “safe closure” for a tailings facility mean in terms of factors of safety and level of residual geotechnical and geochemical risk for your company or site? And what more is then required to achieve responsible closure?

Not all companies will have the internal expertise needed to execute every facet of an integrated mine closure plan. Obtain the needed strategic and technical subject matter expertise for assistance to get the plan right. Investing in setting up the structures, frameworks, limitations, boundaries, and technical basis for design specifications will lead to an executable closure planning process that achieves objectives and delivers outcomes. Clear frameworks and requirements will help the company avoid overspending on deliverables that might need to be reworked.

When mine closure is not effectively planned or executed, it can impact reputation, company credit rating, and can divert free cash flow funds from growth projects over decades and beyond. This is the case both for timed and untimely closures. The risk of not being prepared, with a solid plan in place, can have a significant impact on the future success of the business, making integrated closure planning completely consistent with overall business drivers.

Integrate closure into every life cycle phase and every discipline and task on site, where everyone is applying entire life of the asset considerations to everything they do, and start this integration early. Key performance indicators (KPIs) associated with integrated mine closure should reward eliminating risk across the entire lifecycle of assets and maintaining asset value

rather than short-term wins. Integrated closure can add value to the business, including economic, and there are plenty of examples available in the public domain, e.g., in the Anglo American Mine Closure Toolbox, which is freely available for reference.

There are also ways for closure professionals to approach the integration conversation that can yield successful outcomes with a site or corporate management team. One method is to raise awareness of closure risks, costs, and opportunities using the plethora of case studies that exist in the public arena. Another is to frame closure challenges and opportunities in the language that most resonates with the audience. For example, if risk is the company business language, focus closure as a risk.

Also, focus on materiality; immaterial closure considerations can become “noise” in a busy project or operational environment. Focus on the material risks and material liabilities as effort here will yield the biggest value. This approach helps simplify what closure concerns/actions need to be addressed in the short term, while building buy-in and consensus throughout the operation or company.

Almost all jurisdictional mine closure regulations include a vague pathway to relinquishment, usually looking something like the following:

1. Prepare a closure plan.

2. Get the closure plan approved.

3. Execute the closure based on the existing plan.

4. Obtain sign off from the regulator.

5. Surrender the mining tenure.

One problem: this is rarely played out, for many reasons. These may include increasing regulator risk aversion largely based on a growing liability from legacy sites being held by governments, or older sites starting to show signs that the closure solutions applied at the time are not as effective or durable as expected. And the regulations themselves can often be put in the same ambiguous box as good practice guides. The actual steps in the process are often undefined, or there are uncertain post-relinquishment management protocols or unclear guidance to arrive at agreed financial provision for residual risk.

So, what can we do about it? There are two key steps to take: First, be informed AND be realistic. Understand the regulatory environment and precedent, what sites have relinquished,

how their site compares to yours in all contexts, and how clear the pathway is in the regulations. Start discussions with regulators about what a pathway to relinquishment really looks like. What are the exact requirements and criteria to be met? It is never too early to start having that conversation. Second, if it is realistic, conduct high level scenario planning to understand the effort and cost of achieving relinquishment at your site. What would it take, technically and economically, to be able to relinquish the site? What would need to change? What would the regulatory minimum look like? What are the risks and opportunities left for the company? What does a scenario of meeting all your sustainability related commitments look like? And what does a closure scenario controlling material risks in the long term look like? Which of these scenarios is achievable within the resources of the company?

This process will help you identify a realistic closure strategy and will help frame internal and external future conversations. It will help you be aspirational while understanding your plan B. None of this is easy. It takes effort. It takes resources. It takes informed management. But so does mining. The effort is worth it. The work supports the reduction of liability, facilitates effective closure of the site, and provides for a positive legacy. And throughout the effort, be open, honest, transparent, collaborative, informed, and most of all, passionate and persistent. Because while a perfect closure may not exist, good ones most definitely do!

Kim Ferguson is the director of mine closure for WSP’s global mining and metals business.

A nnounced July 2025 with a phased mine plan ase 1 production in 2027

Tier 1 Jurisdiction (New foundl and & L abrador) with Excellent Infrastructure

Ranked top 10 jurisdiction globally (Fraser Institute)

Significant

from

th Acquisition of Maritime Resources to create multi-asset near-term gold producer

Strong new Management and Board

Experienced team of mine builders and mine operators

Supportive Shareholder Base and Strong Treasury Guiding Path to Production

Mining projects in Canada, whether focused on base metals or critical minerals, must navigate a complex regulatory landscape. With global demand rising, the country has positioned itself as a key supplier of the metals and minerals needed for electrification and clean technologies. Governments frequently promise to fast-track projects to secure Canada’s role in the global value chain, creating the impression that projects can move quickly from exploration to production. Understanding how these regulatory processes unfold is essential for any company hoping to succeed.

In practice, the reality is far less flexible. Regardless of political rhetoric, permits remain mandatory at every stage, and regulatory standards remain rigorous. Even projects labelled as strategic must meet the same social and environmental requirements as any other. The true path to acceleration does not lie in shortcuts but in preparation: identifying requirements early, investing in robust baseline studies, and building trust with communities from the outset.

Regulatory compliance starts from the earliest phases of exploration. Activities such as constructing access roads, establishing camps, or initiating drilling all require approvals, and overlooking these obligations can cause cascading delays that may stall a project for months.

To avoid these setbacks, companies need a comprehensive roadmap. This means identifying all necessary authorizations, from the first drill hole to full-scale production, while also planning and executing studies and engaging environmental specialists immediately.

Baseline studies are the foundation of environmental and

social assessments. They establish the conditions that exist before a project begins and provide a benchmark for measuring impacts. Without reliable data, companies cannot credibly demonstrate that their mitigation strategies will protect ecosystems or communities. These studies must be thorough, seasonally aligned, and closely integrated with project design.

Timing is critical. Certain ecological information, such as fish spawning, bird migration, or vegetation cycles, can only be collected at specific times of the year. If these windows are missed, additional fieldwork may be required, delaying projects and adding costs.

Equally important is proactive engagement with communities. Transparent communication, responsiveness to concerns, and flexibility in project design are key to establishing positive relationships with both local and Indigenous communities. Engagement is not simply a procedural step but a core component of project success.

Communities expect their viewpoints to be taken seriously and reflected in project decisions. For example, companies may need to adjust mine layouts to avoid culturally significant sites, protect wildlife corridors, or reduce environmental risks. When businesses demonstrate good faith and genuine responsiveness, they are more likely to secure the trust and support necessary for a project’s social licence to operate.

Proactive engagement also reduces the risk of conflict. Rebuilding relationships after they have been damaged is far more difficult, and costly, than building trust from the start. By investing early in engagement, companies create space for long-term partnerships that can extend beyond a single project, benefitting both stakeholders and communities.

Political announcements about accelerating approvals can often lead some to believe that requirements are being relaxed. In practice, it is the opposite. Legal standards remain stringent, and, in many respects, are expanding to address new priorities such as climate disclosure, biodiversity protection, and more robust Indigenous participation.

Governments are changing process efficiency, not the rules themselves. Federal, provincial and territorial regulators are working to reduce duplication and align frameworks more closely.

• British Columbia has modernized its Environmental Assessment Act, embedding cumulative effects analysis and stronger Indigenous participation.

• Ontario has linked its Critical Minerals Strategy with federal objectives, emphasizing early engagement and electrification goals.

• Québec has updated Directive 019 to set higher standards for water management, emissions control, and site rehabilitation.

At the federal level, the Impact Assessment Agency continues to require comprehensive project reviews. Even those labelled as strategically important must undergo rigorous scrutiny. The recent launch of the new Major Projects Office (MPO) introduces a streamlined review process for projects designated as being of national interest. The goal is to consolidate reviews under a single evaluation and reduce approval timelines to a maximum of two years.

However, only projects that are formally recognized as national priorities will benefit. All other projects must proceed through the standard federal review process, which may lead to potentially longer timelines, as regulatory capacity shifts toward MPO priorities.

This makes preparation more critical than ever. Companies that submit complete applications, strong studies, and well-documented consultation records are better positioned to avoid costly delays. Regulatory frameworks are evolving constantly. Staying ahead of these changes, and ensuring compliance, requires continuous monitoring and expert guidance.

Key takeaways

Companies that succeed are those that approach permitting as a strategic priority. Best practices include the following:

• Map every required permit early: Developing a clear roadmap prevents surprises and ensures approvals are sequenced efficiently.

• Invest in robust baseline studies early: Comprehensive environmental and social data provide the foundation for credible assessments and meaningful consultation. The earlier these studies begin, the stronger the foundation for project design.

• Engage communities from day one: Building trust is far easier than repairing relationships. Continuous and transparent dialogue demonstrates credibility and good faith.

• Integrate disciplines: Engineers and environmental specialists must collaborate throughout the project life cycle. Even small design changes can trigger new regulatory requirements.

• Commit to early investment: Resources allocated upfront

reduce the risk of major delays later. In the mining sector, where timing is decisive, early preparation is the true accelerator.

• Monitor regulatory shifts: Rules and expectations evolve quickly. Staying ahead requires continuous monitoring and expert guidance.

The bottom line

Canada’s critical minerals ambitions depend not on shortcuts but on foresight and discipline. Environmental protection, Indigenous consultation, and rigorous permitting standards remain at the heart of project development, as they should.

For companies, the path forward is clear: success comes from preparation, integration, and collaboration. By investing early in strong baseline studies, meaningful consultation, and adaptive project design, companies can navigate Canada’s regulatory framework with fewer setbacks and greater efficiency.

In the race for critical minerals, the decisive advantage belongs not to those who cut corners but to those who plan. By aligning with regulatory expectations and building strong community partnerships, companies can transform Canada’s mineral wealth into projects that deliver value for investors, communities, and the country.

Stéphanie Blondin is a senior environmental professional at BBA Consultants, and Andréanne Séguin is a senior advisor, social acceptability at BBA Consultants.

This article examines the technical principles, structural features, and application effectiveness of the patented Jasung permanent magnet intelligent direct drive pulley system, designed to reduce maintenance costs and improve energy efficiency compared with traditional belt conveyor drive pulleys. The system consists of a permanent magnet direct drive pulley and an intelligent variable frequency drive (VFD), achieving deep integration of machinery, electricity, and software.

The core of the system is the permanent magnet direct drive pulley, which adopts an outer rotor permanent magnet synchronous motor structure. Its technical features are as follows:

1. Integrated structure: The pulley body serves as the motor rotor. Permanent magnets (UH-grade NdFeB) are embedded into the inner wall of the pulley, which is laminated from silicon steel sheets, forming the rotor magnetic field.

2. Fixed stator: The main shaft acts as a fixed component, fulfilling the function of the stator. The stator core (laminated silicon steel sheets) and three-phase windings are fixed to the main shaft, generating a rotating magnetic field when energized.

3. Drive and control: The matching intelligent VFD supplies symmetrical three-phase alternating current. Through precise field-oriented control (FOC) strategy, it drives the pulley (rotor) to rotate, thereby enabling the start-up, speed regulation, operational protection, and condition monitoring of the conveyor belt.

4. Specifications: 11 kW to 2000 kW drives. 0.8 to 6 metre per second belt speeds. ≤2400 mm diameters. ≤5000 t/h. X-P sealed design.

This revolutionary design fundamentally replaces the traditional multi-stage transmission chain composed of motors, reducers, couplings, fluid couplings, and mechanical pulleys.

1. Energy efficiency improvement: By eliminating mechanical losses in multi-stage transmission (such as gear meshing, windage, and friction losses), the system’s transmission efficiency is significantly enhanced. Measured data show that its comprehensive efficiency can exceed 96%. Compared to traditional gear transmission systems, it achieves an energy consumption reduction of 18% to 25% under equivalent working conditions.

2. Maintenance cost optimization: The simplified structure directly leads to a significant reduction in maintenance requirements. The primary maintenance focus is on bearing lubrication, with a maintenance cycle extended to 20,000 operating hours. It avoids routine tasks such as reducer oil changes, gear wear replacement, fluid coupling maintenance, and alignment adjustments. Application cases in bulk material handling sectors such as ports, mining, and grain processing demonstrate that customers’ comprehensive maintenance costs can be reduced by over 35%.

3. Enhanced reliability: The removal of vulnerable components reduces the failure rate, significantly shortening unplanned downtime. The fully sealed (IP66) protection design ensures long-term operational reliability in harsh industrial environments such as dust and humidity.

The Jasung permanent magnet outer rotor direct drive pulley system provides an efficient and reliable power solution for belt conveyor drives through its electromechanically integrated design. Engineering application data confirms its significant advantages in improving energy utilization efficiency, reducing lifecycle maintenance costs, and enhancing system reliability. This represents a significant advancement in belt conveyor driving technology suitable for continuous conveying applications.

Bob Spicer is the managing director of 2SP Solution Providers Inc. www.2SP.ca

Avenues in recovering and creating value through thermal processing and agglomeration

Growing recognition of the potential value locked in tailings and mine wastes has spurred renewed interest in how these materials can be recovered or repurposed. With demand for minerals rising, ore grades declining, and environmental risks from tailings storage becoming more pressing, the industry is beginning to see these wastes less as liabilities and more as untapped resources. Several emerging avenues, particularly those leveraging thermal processing and agglomeration, are showing promise in transforming mining byproducts into sources of critical minerals or materials useful in construction and agriculture.

Several factors are converging to make tailings and other mining-related wastes increasingly attractive resources for minerals and material inputs.

a. A Substantial resource: Mining waste has been produced for as long as mining has occurred. The quantity of tailings continues to grow every year by an estimated 7 billion tonnes globally. With many of these sources containing valuable components, this growing waste represents a potentially major source of already mined, readily accessible minerals and metals. Such resources could be essential in taking the pressure off finite virgin resources, many of which are already strained.

b. Growing demand for minerals and metals: The constant advancement of technology, paired with clean energy pursuits, among other factors, continues to drive demand for various metals and minerals to unprecedented heights, making every possible resource critical to meeting demand.

c. Risks of tailings: The risks associated with the storage of tailings and other mine waste are well-documented, with a growing catalog of disasters prompting calls for a global response and resulting in the Global Industry Standard on Tailings Management (GISTM).

d. Declining ore grades: Ore grades have long been in decline as high-grade, surface-level deposits become depleted.

e. Improved recovery technologies: Advancements in extraction have made mineral recovery more efficient than ever,

leading many miners to revisit old tailings piles previously considered economically unviable owing to their low grades.

Waste from the mining and mineral processing industry covers a diverse range of materials and conditions, all with varying physical and chemical attributes; tailings ponds, overburden, and process waste all hold potential value. This diversity across sources and forms translates to the need for an equally diverse approach to valorization, with promising opportunities in both recovering value and reprocessing materials for beneficial reuse.

The potential value that these wastes hold varies significantly across types, but everyone agrees: the value is there; it is just a matter of retrieving it at a cost that makes sense. Old mine sites previously considered too low grade to economically process with the time’s technology cover the gamut from gold to copper, nickel, and even lithium and rare earth elements (REEs).