Barrick Mining and Newmont CEOs

BY HENRY LAZENBY COLORADO SPRINGS , COLO.

Ayear of record bullion prices has the gold sector talking less about buying ounces in takeovers and more about finding them in their midst.

At the Mining Forum Americas last month in Colorado Springs, the industry’s biggest producers, streamers and would-be builders struck a rare consensus: stick to tier-one assets, keep balance sheets clean and let grade, margins and jurisdiction do the heavy lifting.

Franco-Nevada (TSX, NYSE: FNV) set the tone. CEO Paul Brink framed gold’s long run – about 9% a year against the U.S. dollar – as the backdrop for selective growth and shareholder returns. Wheaton Precious Metals (TSX, NYSE: WPM) echoed the message, citing how early-stage streaming can de-risk transactions without bloating operators’ capital plans.

Barrick Mining (TSX: ABX; NYSE: B), Agnico Eagle Mines (TSX, NYSE: AEM) and Newmont (NYSE: NEM; TSX: NGT) each pressed the case that the next leg of production will come from a smaller set of better mines.

“We’re not interested in growing for the sake of growing,” Brink said. “Our mantra is to grow profitably... and we’re just as happy to return cash to shareholders.”

Franco sold 463,000 gold-equivalent oz. last year and sees “plenty of gas in the tank” from non-producing assets even though they have no output forecasts yet. He joked that a restart at Cobre Panamá would have the team “drinking champagne for a month” because the company invested nearly US$1.4 billion (C$1.94 billion) before the mine’s sudden closure nearly two years ago.

Another cycle

However, even with gold setting a new record above $3,780 near press time, miners face a range of obstacles, from permitting delays and rising construction costs to

unpredictable politics in host countries. Gold majors have made similar vows to be disciplined in past bull markets, only to chase growth through costly deals such as Barrick’s 2011 acquisition of Equinox Minerals at the height of the copper boom, or Newmont’s $10-billion purchase of Goldcorp in 2019, which left investors underwhelmed by the returns.

Some see partnerships and creative financing as ways for developments to succeed. Wheaton CEO Randy Smallwood described the company’s $300-$400 million (C$413 million – C$550 million) stream tied to Barrick’s pending Hemlo sale in Ontario as both validation capital and due-diligence ballast.

“Having a streamer come in and support the M&A side should help give confidence,” he said, calling Hemlo a “top notch asset” with room to run. Wheaton’s outlook calls for output to hit about 800,000

gold-equivalent oz. by 2027 and, by its internal profile, 1 million by 2031. “I’m confident we get there before then,” Smallwood said.

Former Barrick CEO Mark Bristow leaned into discovery, calling Nevada’s Fourmile “quite simply, the greatest gold discovery of this century” and a “generational” project.

An updated study released Sept. 16 points to a 25-year mine producing 600,000-750,000 oz. gold a year at all-in sustaining costs of roughly $650-750 per oz., using a $2,500 per oz. gold price base case. Capital costs would range from $1.5-1.7 billion.

“Think about what that means for the upside,” Bristow said. “Results are pointing to a doubling of ounces by the end of this year.”

The growing copper contribution from Reko Diq in Pakistan and the Lumwana super-pit expansion in Zambia may see Barrick grow gold-equivalent output about 30% by 2029, he said.

Agnico stays the course

Agnico Eagle Mines’ CEO Ammar Al-Joundi distilled his message to four points: the business is performing, five major projects should add 1.3-1.5 million oz. of annual production starting in 2030, exploration is “exceptional” with 121 rigs currently turning and focus beats fads.

“We’re not going to do anything crazy,” he said, adding the company is not considering a competing

This state-of-the-art BEV loader is designed specifically for underground mining operations. Equipped with an optimal battery chemistry, the fastest battery swap on the market and a high-power electric driveline, this loader is your gateway to sustainable mining.

Toro® LH518iB Safer. Stronger. Smarter.

Freshly processed copper cathode bundles weighing 4,500 lb. each sit waiting for shipment at Gunnison Copper’s Johnson Camp Mine in southeast Arizona. See site visit story on p.11.

Canadian Prime Minister Mark Carney named Newmont’s Red Chris copper-gold mine expansion in British Columbia and Foran Mining’s McIlvenna Bay copper project in Saskatchewan to a federal fast-track list.

The initiative is part of a new Major Projects Office intended to cut the permitting timelines that often delay mines, pipelines and energy projects for more than a decade. Carney said that streamlined approvals will help spur investment and jobs while bolstering supply chains for critical minerals. The prime minister didn’t state dollar amounts of potential government investment in the projects.

Red Chris, which Newmont operates in joint venture with Imperial Metals, has an estimated capital cost of about $2 billion (C$2.77 billion) for its underground block cave expansion. Foran’s McIlvenna Bay project may cost C$368 million to build. It could average the equivalent of 65 million lb. of copper annually over an 18-year operation.

New Found Gold is acquiring Maritime Resources in a deal valued at about $292 million (US$212 million) that would create a multi-asset gold producer in central Newfoundland.

The combined company would bring together New Found’s Queensway project, due to start production in 2027, with Maritime’s Hammerdown project, which aims to begin output this year, the companies said. The two projects, 180 km apart, are expected to benefit from shared

Barrick Mining shocked markets on Sept. 29 with the abrupt resignation of president and CEO Mark Bristow, who departs without explanation after nearly seven years at the helm.

Bristow, who steered Barrick since its 2019 merger with Randgold will be replaced on an interim basis by Mark Hill, a veteran executive overseeing the miner’s Latin American and Asia Pacific regions. Hill took charge immediately as the board launches a global search for a permanent successor with the help of an external firm.

Bristow’s tenure included the integration of Randgold, $6.7 billion in shareholder returns and a $4-billion cut in net debt. But his record was overshadowed by a drawn-out dispute with Mali over the Loulo-Gounkoto gold complex, once Barrick’s largest African mine.

The leadership shake-up drew surprise on Bay Street. TD Securities analyst Steven Green called the news “unexpected”, adding that investors will view Bristow’s exit with mixed emotions.

infrastructure including Maritime’s Pine Cove mill and the Nugget Pond hydrometallurgical plant.

The deal comes at nearly a one-third premium to Maritime’s recent share price and 56% more than its July 30 close, the day before the companies signed a letter of intent,

Newmont, the world’s largest gold miner, said Sept. 29 that CEO Tom Palmer will retire later this year, with chief operating officer Natascha Viljoen set to take over on Jan. 1, 2026.

Palmer, who took the top job in October 2019, said it was the right time to step aside after nearly 40 years in the mining industry, including 12 with Newmont.

Under Palmer, Newmont completed a string of transformative deals, including the takeover of Canada’s Goldcorp, the creation of the Nevada Gold Mines joint venture with Barrick, and the $17-billion acquisition of Australian miner Newcrest, which cemented Newmont’s global dominance.

BMO analyst Matthew Murphy said in a note that he doesn’t view the leadership change as especially surprising given Viljoen’s recent promotion to president. The timing with Bristow’s departure from Barrick on the same day is also “entirely coincidental,” he added.

BY MINING.COM STAFF

New Found CEO Keith Boyle said on a conference call. Once the deal is complete, New Found shareholders will own about 69% of the combined company, while Maritime holders will have about 31%.

NORTHERN MINER STAFF

GLOBAL MINING NEWS • SINCE 1915 www.northernminer.com

PRESIDENT THE NORTHERN MINER GROUP: Anthony Vaccaro, CFA, MBA avaccaro@northernminer.com

EDITOR-IN-CHIEF: Colin McClelland cmcclelland@northernminer.com

COPY EDITOR AND PRODUCTION EDITOR: Blair McBride bmcbride@northernminer.com

SENIOR STAFF WRITER: Frédéric Tomesco ftomesco@northernminer.com

WESTERN EDITOR: Henry Lazenby hlazenby@northernminer.com

PODCAST HOST: Adrian Pocobelli apocobelli@northernminer.com

ADVERTISING: Robert Hertzman (416) 898-6654 rhertzman@northernminer.com

Kathleen Plamondon (514) 917-5284 kplamondon@northernminer.com

Michael Winter (416) 510-6772 mwinter@northernminer.com

SUBSCRIPTION SALES/ APPOINTMENT NOTICES/ CAREER ADS

George Agelopoulos (416) 510-5104 (Toll free) 1-888-502-3456, ext. 43702 gagelopoulos@northernminer.com

PRODUCTION MANAGER: Jessica Jubb (416) 510-5213 jjubb@northernminer.com

CIRCULATION/CUSTOMER SERVICE: (416) 510-6789 | 1-888-502-3456 northernminer2@northernminer.com

REPUBLISHING: (416) 510-6768 jmonteiro@northernminergroup.com

ADDRESS: Toronto Head Office

69 Yonge St, Toronto, ON M5E 1K3 (416) 510-6789 tnm@northernminer.com

SUBSCRIPTION RATES: Canada:

C$130.00 one year;

5% G.S.T. to CDN orders.

7% P.S.T. to BC orders

13% H.S.T. to ON, NL

U.S.A.: C$172.00 one year Foreign: C$222.00 one year GST Registration # 809744071RT001 (ISSN 0029-3164)

BY COLIN McCLELLAND

Quebec’s mining sector is at once thriving and uncertain, a duality that reflects the global forces reshaping commodities and the local policies that aim to manage them.

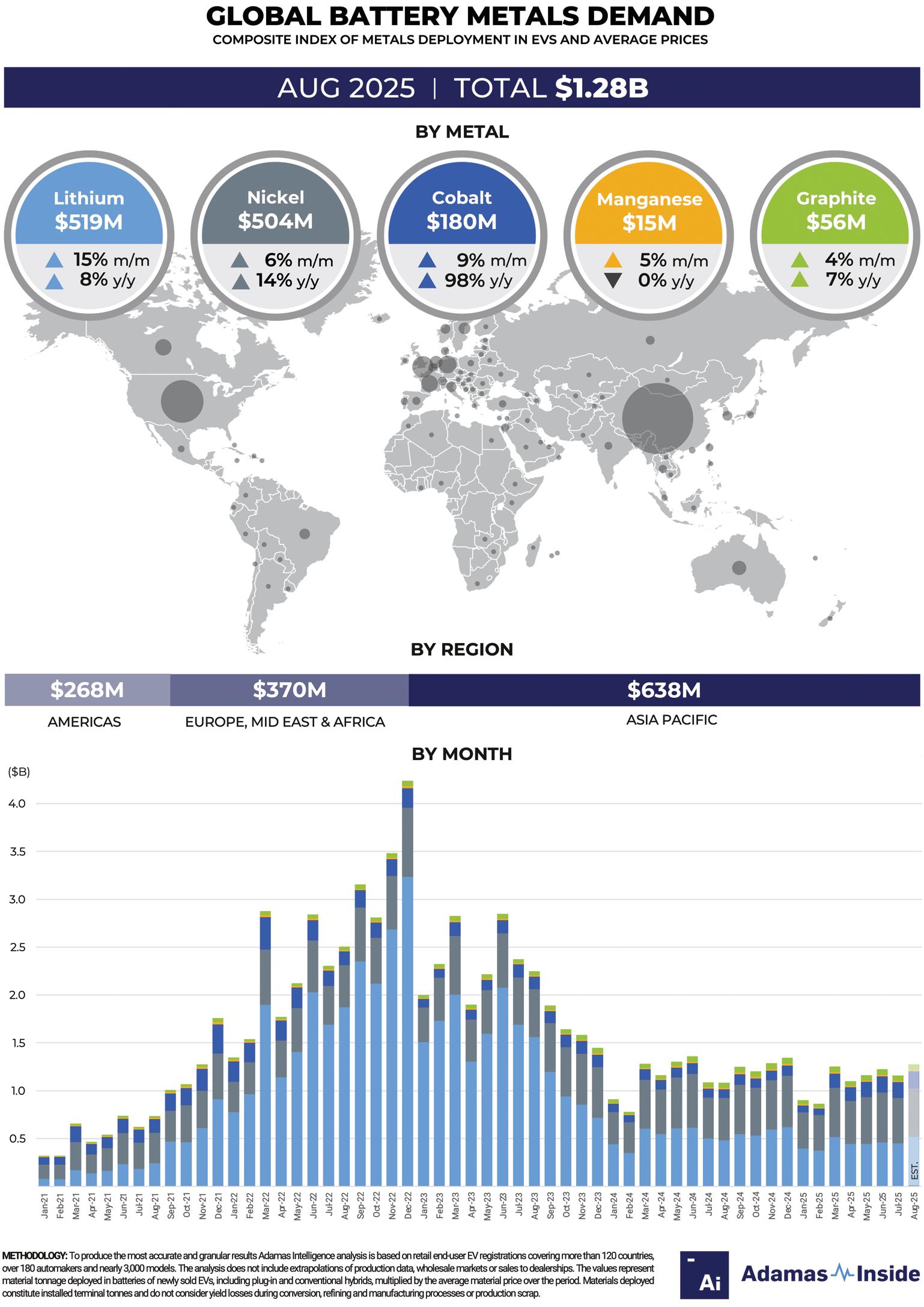

The province has long prided itself on being one of Canada’s mining powerhouses, with deep roots in gold, iron and base metals. Today it is attempting to rebrand itself as a hub for critical minerals that feed the auto sector’s push toward electrification. But the province faces a harder road than anticipated.

The most glaring setback has been the collapse this year of Northvolt’s plans for a multi-billion-dollar battery plant near Montreal. The company was held up as a crown jewel of Quebec’s battery supply chain strategy, promising to connect local lithium and graphite output with downstream processing and assembly.

Its failure underscores how difficult it is to lock in industrial users when the economics of EVs remain fluid and when government subsidies alone cannot sustain projects in the face of global competition.

Even Quebec’s aluminum industry, long a pillar of its resource economy, faces uncertainty as American tariffs threaten to undercut the advantage of cheap hydropower. See the impact on page 6.

Critical mineral currents

Still, the shift toward lithium and graphite is real, and it has diversified a mining economy long synonymous with gold and iron ore. Companies are drilling across the Abitibi for spodumene and developing graphite deposits along the North Shore. The provincial government has rolled out incentives and funding to attract downstream processing, hoping to create a vertically integrated sector that appeals to automakers.

The logic is clear: Quebec has abundant hydropower, a skilled workforce, and proximity to the U.S. market. Yet the volatility of these commodities raises a caution flag. Lithium prices soared during the early stages of the EV boom, only to collapse as new supply met a slower-than-expected take-up in sales. Read how the province plans to cope on page 34.

Graphite has seen similar swings, with Chinese producers dominating exports and manipulating flows through quotas and tariffs. For miners in Quebec, the promise of critical minerals is undeniable, but so too are the risks of being whipsawed by geopolitics and Chinese policy.

Good as gold?

Gold, by contrast, remains Quebec’s stalwart. With prices setting records above $3,700 per oz., producers in the Abitibi and James Bay regions are enjoying windfalls. Agnico Eagle’s Canadian Malartic, Eldorado’s Lamaque, and a host of juniors drilling new zones show that Quebec remains one of the world’s great gold camps.

But the question lingers: how long can the boom last? Gold’s surge is being driven by extraordinary factors — geopolitical instability, central bank buying, and investor demand amid doubts about fiat currencies. These are powerful forces, but they are also unpredictable. If interest rates shift or global tensions ease, the metal could just as easily lose its lustre.

Quebec’s miners know this history well, having seen cycles of prosperity and collapse before. The challenge is to seize today’s high prices to strengthen balance sheets and advance projects, while avoiding the overreach that so often follows a bull market. That’s the thrust in our page one story by Henry Lazenby, gauging the mood among majors at conferences in Colorado.

Policy proving ground

On the policy front, Quebec has distinguished itself as one of Canada’s more efficient jurisdictions for permitting. The province has a long mining history and a regulatory framework that is comparatively clearer than those in Ontario or British Columbia, where projects have languished. Yet even here, companies complain of delays, particularly in securing environmental approvals.

That frustration may be easing somewhat judging by how the CEOs of Osisko Metals and Troilus Gold are greeting federal help on their large projects. See pages 31 and 33 in our special section on the province this month. And see some of its past 100 years ago on page 42 with our Blast from the Past feature pulled from the archives of The Northern Miner in its 110th year.

Looking forward, read our Montreal-based Senior Writer Frédéric Tomesco’s excellent backgrounder on Quebec’s new Minister of Natural Resources, Jean-François Simard, on page 35.

Mining politics

Simard faces a few challenges beyond the Northvolt vacancy. There’s the province’s fall in a global ranking and a premier accused of being out of touch with mining regions by the outgoing minister who promptly resigned from the ruling party. But the premier has pledged to cut environmental red tape as he tries to boost flagging support for elections due within exactly a year from now.

Quebec’s mining sector today is emblematic of the wider industry’s paradoxes. It offers promise as a North American alternative to Chinese-dominated supply chains, but faces the reality that markets for lithium and graphite are not nearly as stable as for gold or copper.

Gold may carry the province through the current cycle, but the real test

will be whether Quebec can translate its critical minerals ambitions into a durable, competitive industry. TNM

BY JAMES COOPER

Areader recently introduced me to an interesting idea: a firm in the United States is looking to “tokenize” unmined gold resources.

Here’s the pitch from the company ‘NatGold’ (emphasis added):

“The junior mining sector –once the speculative engine of the gold industry – has lost its fuel. Permitting is a brick wall. Capital has moved on. And promising projects are turning into stranded assets before they ever get a chance to deliver.

“Even for those who succeed, the value often arrives too late – or at too high a cost. For most? The path ends before it ever truly begins. That’s why we created NatGold. It’s a rigorously structured model –built with legal, engineering, and blockchain-grade security at every layer.”

First of all, I have no affiliation with this outfit. I just thought their pitch reflects the common catchcry from the junior mining sector: “The model that once funded discovery is dead.”

Amid bullish conditions in the precious metals market, gold juniors aren’t gaining traction or investor interest. That’s effectively starving them of the capital needed to continue exploration or develop new deposits.

Filling the

With its tokenizing strategy, Natgold is perhaps filling the longlost void for the junior miners, pioneering a new funding model outside the traditional stock market.

Many blame the lack of interest in junior mining stocks on the overwhelming focus on new-age investment themes like crypto, meta, and AI. According to them, the tech sector has sucked speculative capital away from the junior miners.

But NatGold has perhaps hit on something important here. It’s finding common ground between crypto speculators and explorers needing capital.

In the token space, NatGold joins a few other companies like Madison Metals which has proposed a token system for future uranium production, and the Frank Giustra-backed Streamex that aims to turn gold assets into tradable tokens.

The process of creating a digital token on a blockchain to represent the value of a real-world asset, in this case unmined gold, sounds straightforward. But here, we are not dealing with an easily measurable asset. Deposits are hidden below the surface.

The dilemma is that measuring mineral resources is an arcane discipline. It’s also hidden behind a curtain of industry jargon. No two deposits are alike, so how do you value that as a token?

For example, resources fall into

different categories depending on how well geologists perceive the deposit. We call it resource estimation, a geological model that moves through different levels of confidence that’s built around the number of drill holes.

Imagine an early discovery made by an exploration company: There might be five or six drill holes spaced over two or three hundred metres, leaving a lot of unknowns in the model.

At this early stage, geologists can only make vague guesses as to how many ounces might sit below the surface. They sketch in the gold from one drill hole to the next drill hole and assume that it runs evenly from one point to the next.

But that involves huge assumptions. A drill hole might be 5-10 cm wide. In addition, gold deposits rarely ‘drift’ evenly from one spot to the next. Nature is inherently unpredictable. Faults, pinching and swelling, shear zones, or any number of geological variations often trash any early assumptions made by an exploration company.

Boiling it down

More drilling means fewer gaps, which means less room for optimistic, sometimes creative assumptions on a resource’s size.

That’s why the industry has designed standards, like the JORC code in Australia that classifies a deposit into categories. That way, investors can at least gain some confidence in how many ounces, pounds or tonnes a company has guessed it owns.

But it’s still tenuous. Even when a company claims it has “de-risked” its project through extensive infill drilling it’s still a long way from a certain outcome. This is why financial analysts have such a dilemma in valuing junior mining stocks.

Resources are difficult to define. Even with extensive amounts of infill drilling, there’s no guarantee that what geologists have measured reflects the reality of what the miners actually find. Gold, especially, is inherently unpredictable.

Is tokenizing the answer?

In terms of introducing a new crowd of investors to the opaque world of exploration, then certainly. That could unleash a wave of fresh capital for cash-starved juniors.

But for investors, the ultimate prize remains just as allusive, valuing a junior mining stock won’t become any easier. Speculating on a token or buying a share in an explorer won’t make an ounce of difference.

The only way you can bend the odds in your favour is to get a handle on geology so you can at least exercise some due diligence over company reports. The stuff that matters, not what they teach you at uni! TNM

James Cooper is a geologist based in Australia who runs the commodities investment service Diggers and Drillers. You can also follow him on X @JCooperGeo.

BY NORTHERN MINER STAFF

Canada’s mining, metals, oil and gas industries remain pillars of the national economy, but the workforce behind them is aging fast. Years of bust cycles and waning interest in the trades have left the sector short of talent, a gap now colliding with surging demand and the so-called “grey tsunami.”

“We lost a lot of the labour force 10 years ago and there hadn’t been jobs to replace them,” said Heather Exner-Pirot, director of the Natural Resources, Energy and Environment program at the Macdonald-Laurier Institute, an Ottawa-based public policy think tank.

However, the resource industry is entering a period of growth, fuelled by increased demand for critical minerals and governmentbacked investments in the sector.

In the first quarter of 2025, nominal GDP from natural resources climbed to $358 billion (US$259 billion), equal to 12% of Canada’s economy. That same quarter, real GDP for the extractive industries grew 2% compared to the overall economy, which rose just 0.2% in the quarter — underscoring the sector’s outsized role in exports, jobs, and regional investment.

More than 100,000 new workers will be needed by 2035 to replace retirees and sustain growth, the Mining Association of Canada projects.

The industries underpin exports, anchor regional employment, and offer some of Canada’s top-paying jobs. Rising global demand for critical minerals and an aging workforce are creating both pressure and opportunity, while scholarships and Canadian training programs are opening doors for the next cohort of resource workers.

“These are foundational sectors that support so many other parts of the economy,” Exner-Pirot said. “The Canadian economy could not sustain itself without exporting resources.”

The footprint of mining, metals, and energy extends far beyond the mines and rigs. Communities, trade networks, and innovation hubs all depend on the activity generated by these sectors, underscoring why Canada’s resources remain critical to the country’s economic future, ExnerPirot said.

Economic cornerstone

Canada’s resource sector has long powered the national economy. Mining and metals built export markets through the 20th century, fueling industrial growth and the expansion of rail, road, and port networks. Oil and gas discoveries in Alberta and Saskatchewan in the 1940s and 1950s transformed local economies, creating high-wage jobs and funding infrastructure and public services.

The industry’s reach and output remain substantial. According to Statistics Canada’s most recent data, natural resources contributed $464 billion to Canada’s GDP in 2023 – roughly 21% of the economy – and supported more than 3 million

jobs, or 15% of the workforce. Resource exports generated $377 billion, nearly half of the country’s merchandise trade.

According to the Mining Association of Canada, more than 200 mines operate across Canada, yielding over 60 minerals and metals, including Saskatchewan potash and uranium, Northwest Territories diamonds, and Manitoba cobalt, nickel, and zinc, not to mention gold and copper from Ontario, Quebec and British Columbia.

Positioned for growth

Global demand for low-carbon technologies and renewable energy is set to send critical mineral production soaring. The International Energy Agency (IEA) projects demand for minerals in energy technologies will top 40 million tonnes annually by 2030, up from just 7 million tonnes in 2020.

Canada is poised to grab a larger share of that market. More than 130 mining and processing projects are planned or under construction across the country over the next five years, with a combined value exceeding $117 billion, according to Natural Resources Canada.

Government support, including $700 million in investments, has boosted key critical mineral output 15%, with a 20% target set for 2030.

Oil and gas remain a

“There’s this cultural notion that mining’s this very antiquated dirty, profession.”

cornerstone of domestic and export markets. Canada’s oil sands output is expected to hit 3.5 million barrels per day this year, supported by capital investment climbing to $39.7 billion.

Expansions in infrastructure, including the Trans Mountain pipeline, are boosting export capacity and accelerating development across the Western Canadian Sedimentary Basin.

The stage is set for Canada to expand both its resource output and its economic footprint, creating jobs, supporting regional economies and cementing the country’s role in supplying the global energy transition.

With production and investment on the rise, the resource sector is generating not just economic output but also career opportunities. Analysts say demand for skilled workers will grow alongside exploration, processing and critical mineral projects, creating openings across mining, metals, and oil and gas. Canada’s aging workforce adds urgency to hiring. As veteran workers retire, companies are actively seeking engineers, geologists, technicians, and operators, along with specialists in emerging areas like automation, digital mining and sustainable energy integration.

These sectors are evolving rapidly, and the demand for skilled,

and geologists Canada’s resource economy requires.

Feroz Shah was the first recipient of Franco-Nevada Corporation’s Diversity Scholarship in 2021, which supported his fouryear bachelor’s degree in mineral engineering at the Lassonde Institute of Mining, University of Toronto.

“The series of opportunities I’ve had since then is just remarkable,” Shah said. “My first summer, I got to go to Alberta and work out West. My second summer, I was out in northern Labrador working for Rio Tinto at their iron ore operation. That third summer, I was down south working with Freeport-McMoran in Arizona.”

Shah, who won first place at the 2024 Canadian Mining Games in Sudbury for his speech on how to attract top talent to mining, said the industry is dogged by an outdated reputation. He argues the roles are as diverse and technologically innovative as those in other industries.

“There’s this cultural notion that like mining’s this very antiquated, dirty profession,” Shah said. “But people who have already worked in it know it’s not.”

Advanced learning

Canada’s mining, oil and gas education pipeline continues to feed the sector with engineers, geologists, technicians and skilled operators. Programs combine classroom learning with hands-on fieldwork, co-op placements and industry partnerships, increasingly focusing on digital mining, automation and sustainable resource practices.

trained workers is only going to accelerate, Exner-Pirot said.

“It is becoming more attractive for young people that people aren’t as naive or ideological about resource extraction.”

Growth and impact

For young Canadians entering the workforce, the resource industry offers not just jobs, but long-term careers with opportunities for growth and impact.

“Oil and gas and mining are very high-paying sectors,” she said. “The wages will often be triple the median Canadian wage.”

According to data compiled by The Northern Miner, median wages in mining outpace most skilled trades. Miners earn roughly $40 an hour, ahead of electricians, plumbers, and millwrights, while mining engineers command a median $52.88 per hour – on par with software engineers and higher than their electrical, civil, and mechanical counterparts.

“You are making good money and can afford to have your own house and a family,” Exner-Pirot said. “Those are fundamental things in human society, and it seems like the trades and resource extraction are becoming more attractive for that route.”

Key opportunity

To meet the looming workforce needs, the industry is investing in programs that turn students into the skilled operators, engineers,

The University of British Columbia, Queen’s University, Laurentian University, McGill University, the University of Toronto, the University of Calgary and the British Columbia Institute of Technology host some of the country’s top mine engineering and mineral processing programs.

New roles are emerging as both mining and petroleum operations modernize. At UBC, the Data Sciences Institute is digitizing geological data to optimize mineral processing, showing how analytics and automation are becoming core to resource extraction across mines and oilfields alike.

Meanwhile, roles such as remote operations specialists and mine robotics engineers are on the rise, reflecting the sector’s pivot toward tech-driven, more efficient and safer operations.

As Canada’s resource sectors expand, the spotlight is on the people who will drive the next wave of growth. Scholarships, hands-on programs and techforward training are shaping a generation of engineers and specialists ready to meet the sector’s evolving challenges. They’re illustrating what’s possible for young Canadians entering mining and oil and gas.

The preceding Joint Venture Article is PROMOTED CONTENT sponsored by Franco-Nevada and produced in co-operation with The Northern Miner.

Visit: https://www.franco-nevada.com for more information.

By Blair McBride

Quebec is the heart of Canada's aluminum industry, hosting eight of the country's nine smelters. The industry exports $10.8 billion worth of the metal annually. After producers such as Rio Tinto, Alcoa and Alouette import bauxite from Jamaica, Brazil and Guinea they process the ore into aluminum. The United States has been the top purchaser of almost all of Canada's aluminum production, and about 75% of its imported aluminum comes from Canada. But with U.S. tariffs on Canadian aluminum rising from 10% to 25% and then to 50% in June, producers last spring began shipping more of the metal to Europe to avoid financial losses. Those shipments jumped to about 50,000 tonnes from April to June, more than half of last year's total in just three months. The Northern Miner takes a peek at how much aluminum has been diverted to European markets and how that compares with pre-tariff-period sales.

AWARDS | Harquail, Lindsay, McLeod-Seltzer, Morrison to be enshrined in January

BY NORTHERN MINER STAFF

The Canadian Mining Hall of Fame is excited to welcome four new members who will be celebrated at the annual gala dinner and induction ceremony on Jan. 8, 2026, at the Metro Toronto Convention Centre. The Northern Miner is a proud co-founding member of the Hall of Fame along with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), The Mining Association of Canada, and The Prospectors & Developers Association of Canada (PDAC). Details about the event, along with tables and tickets available for purchase, can be found at: www.mininghalloffame.ca.

David Harquail (b.1956)

David Harquail is widely recognized for his clear strategic thinking, steady leadership and commitment to principled business practices. Throughout his distinguished career in mining finance, he has earned a reputation for combining technical expertise with a vision grounded in ethics, transparency and value creation. His approach to leadership has elevated the organizations he has led and

Catherine McLeod-Seltzer (b.1960)

Catherine McLeod-Seltzer is one of Canada’s most influential figures in the international mining and exploration industry, having built a remarkable career defined by vision, leadership and results. McLeod-Seltzer was born in 1960 in Vancouver into a multi-generational mining family where she was immersed in the industry from an early age, living in mining communities such as Stewart, B.C., and Pine Point, N.W.T. After completing high school in West Vancouver, she earned a bachelor of business administration from Trinity Western University in 1984, setting the foundation for what would become a pioneering path in mining finance, making her mark in what was a male-dominated industry. She began her career at Yorkton Securities, quickly establishing herself as a standout in capital markets. In 1991, she took an open-

shaped the culture and direction of global mining itself.

As CEO from 2007 to 2020, and current Franco-Nevada board chair, Harquail has overseen substantive value creation for shareholders. In 2007, he led Franco-Nevada in its initial public offering, raising $1.2 billion in what was the largest mining IPO in Canadian history. With a business model focused on royalties and streams on properties with strong exploration optionality, the company’s value appreciated to a market capitalization of more than $50 billion with 18 consecutive years of dividend increases paying out almost $4 billion to shareholders.

David was born in Toronto into the mining exploration business. His father, James, worked directly for one of the world’s greatest mineral explorers, Thayer Lindsley, founding multiple exploration companies on the Toronto and Vancouver stock exchanges.

Harquail’s early summers were spent on sites across Canada, and he would go on to earn a degree in geological engineering specialized in exploration from the University of Toronto, followed by an MBA from McGill University.

Harquail began his career with stints in mining consulting, bank-

ing at Yorkton’s office in Santiago, Chile – the start of her long-standing involvement in South American mining. It was there she met geologist David Lowell, and together they founded Arequipa Resources, with McLeod-Seltzer as CEO at age 32. Under her leadership, it was publicly listed and went on to discover the Pierina gold deposit in Peru,

ing and corporate development. In 1987, he joined Seymour Schulich and Pierre Lassonde at Beutel, Goodman and Co. where he managed the precious metals funds. In parallel, from 1988 to 1996 Harquail was CEO of Redstone Resources, a public subsidiary of Franco-Nevada. In 2002, Franco-Nevada merged with Newmont Mining and Normandy to form the world’s largest gold company. Harquail relocated to Denver as head of Newmont Capital, later serving as executive vice-president. In 2007, Newmont sold its royalty assets and Harquail returned to Toronto to relaunch the new Franco-Nevada.

Throughout his career, Harquail has given back to the industry. He was an active volunteer for CIM, serving as chair of the 1994 CIM Convention and the Management and Economics Society, and has been a director at PDAC. Post BreX, he was a member of the 19982000 OSC-TSX Mining Standards Task Force that called for the creation of the 43-101 standards. He served as chair of the World Gold Council from 2017 to 2020 when the new GLDM ETF was launched and the Responsible Gold Mining Principles were adopted.

Equally significant is Harquail’s philanthropic legacy. He has served on many non-profit boards and his family foundation has committed more than $30 million to charitable causes. Major gifts include the Harquail Centre for Neuromodulation at Sunnybrook Health Sciences in Toronto, advancing cutting-edge treatments for brain-related conditions, along with a landmark gift to the Harquail School of Earth Sciences and its Mineral Exploration Research Centre (MERC) at Laurentian University in Sudbury.

David Harquail has redefined what it means to lead in mining –proving that innovation, integrity and generosity can shape a lasting and responsible legacy.

later sold to Barrick Gold (now Barrick Mining) for $1.1 billion in 1996.

Over the course of her career, Catherine has raised more than $750 million in exploration capital and played key roles in building and selling companies valued at over $4 billion. Her influence can be seen in the success of Francisco Gold, Peru Copper, and Miramar Mining. With partner Eira Thomas she moved on to diamonds, creating Stornoway Diamond, which developed Quebec’s first diamond mine. Catherine and Eira went on to start Lucara Diamond with Lukas Lundin. Lucara’s Karowe Mine in Botswana has produced some of the world’s largest diamonds.

Since 1999, McLeod-Seltzer has held several board positions and served as chair of Bear Creek Mining, leading community-forward projects in Peru and Mexico. She joined the board of Kinross Gold in 2005, becoming independent chair in 2019. She went on to become a director of Teck Resources.

McLeod-Seltzer’s commitment to philanthropy is evident in her sup-

Don Lindsay is one of Canada’s most respected and impactful business leaders, known for shaping the mining industry through a rare combination of strategic vision, operational excellence, and a deep commitment to social and environmental responsibility. Over the course of an exceptional 17-year tenure as president and CEO of Teck Resources, he transformed the company into a global force in copper and coal, guiding it through major economic cycles while keeping sustainability and community at the heart of its growth.

Born in Toronto in 1958, Don holds an honours bachelor of science in mining engineering from Queen’s University and an MBA from Harvard Business School. His early career in banking was equally impactful. As president of CIBC World Markets, he pioneered Canada’s first mining-focused investment banking group, revolutionizing how the financial sector supported the resource industry and positioning CIBC as a global leader in mining finance.

When Lindsay took the helm at Teck in 2005, the company was valued at $8 billion. Under his leadership, Teck grew to a market capi-

port and participation on boards for organizations like the Union Gospel Mission, The Fraser Institute, and BC Children’s Hospital.

She has consistently combined strong business acumen with a deep commitment to sustainability, governance and social impact. Her leadership has championed local community partnerships and Indigenous engagement and created empowerment initiatives for women in mining.

A recipient of numerous accolades, including being named one of Canada’s Most Powerful Women by the Women’s Executive Network, Mining Person of the Year by The Northern Miner, one of the 100 Global Inspirational Women in Mining, and the Award for Significant Board Contribution by the Association of Women in Finance, McLeod-Seltzer remains a role model and mentor for future generations. Her legacy is defined not only by financial success but by raising the standard for leadership in mining – a standard built on integrity and inclusion.

talization of $22 billion, returned nearly $9 billion to shareholders, and increased its copper reserves from 2.5 million to 19 million tonnes – ensuring a 70-year reserve life based on 2022 production levels. Key acquisitions like Aur Resources and Fording Canadian Coal made Teck a leader in critical minerals, and one of the world’s largest exporters of metallurgical coal. Equally transformative was his work on environmental, social and governance (ESG) performance. Long before ESG became a mainstream focus, Lindsay embedded sustainability and social responsibility into Teck’s operations. Teck initiatives, such as The Zinc Alliance for Child Health and programs like Copper and Health, have reached more than 140 million people globally and influenced international policy on public health and infrastructure. Under his guidance, Teck earned recognition as one of the most sustainable mining companies in the world. As chair of the International Council of Mining and Metals (ICMM), Lindsay spearheaded the development of the Global Industry Standard on Tailings Management, a standard that changed the safety and quality of tailings management in the industry.

Lindsay has chaired many industry organizations, such as the International Zinc Association, Business Council of Canada, and board of governors for the World Economic Forum’s mining and metals subgroup. He remains active as chair of Manulife Financial and sits on the board of directors at BHP. He also served as chair for the 2025 Invictus Games in Whistler and has led major philanthropic efforts, including a $200 million campaign for BC Children’s Hospital.

Lindsay has been recognized with numerous honours, including the Order of British Columbia, multiple honorary doctorates and lifetime achievement awards from the mining and business communities. His career stands as a testament to the power of combining business excellence with social responsibility.

BY HENRY LAZENBY Colorado Springs, Colo.

Barrick Mining (TSX: ABX; NYSE: B) says its new Fourmile project in Nevada can be developed without new processing plants while the company keeps returning cash to shareholders.

Fourmile could become one of the largest new gold mines in the Americas, with potential annual output of 600,000–750,000 oz., according to a preliminary economic assessment issued last month. It would be perhaps second only to the nearby Carlin–Cortez complex, also part of the Nevada Gold Mines (NGM) joint venture with Newmont (NYSE: NEM), where Barrick is operator.

Initial capital is pegged at about $1.5–1.7 billion (about C$2-C$2.3 billion), with a cost of sales of about $850–$900 per oz. and a life-ofmine all-in sustaining cost (AISC) of about $650–$750 per oz., Barrick said.

“Fourmile is the generational discovery of the last 100 years,” Barrick’s outgoing president and CEO Mark Bristow told The Northern Miner last month on the sidelines of the Mining Forum Americas. The location beside the Carlin–Cortez complex means Barrick “doesn’t have to build a whole mine” because “the infrastructure is already there.”

The proximity of the complex’s roasters and autoclaves is part of how Fourmile’s economics could improve over time, Raymond James mining analyst Brian MacArthur said in a note in September. Ground conditions, metallurgy and the potential for resource increases also add to the appeal, MacArthur said.

Cash-positive

The updated case “has gone down very well,” said Bristow. He’s positioning the deposit to anchor Barrick’s next leg of growth while keeping the balance sheet in a net-cash

stance. The company plans to complete a feasibility study around 2029.

The company is also spending $1 billion to finish the Goldrush project at NGM to deliver about 400,000–450,000 oz. annually from 2028.

Fourmile keeps getting better with every update, according to BMO Capital Markets analyst Matthew Murphy, who sees significant net asset value upside.

“Barrick continues to grow the exploration target and outline a major gold asset with very robust economics,” Murphy said in a Sept. 17 note. “Extensive drilling is still required; however, every update on this asset gets better and current indications present significant upside potential.”

Barrick shares in Toronto rose about 13% to C$48.94 apiece in the four days after the Fourmile study was released before easing to C$47.12 near press time, for a market capitalization of C$80 billion. Like many gold majors, they’ve been in 13-year-high territory for most of September as bullion prices set records.

As of Dec. 31, Fourmile resources were 3.6 million indicated tonnes at 11.76 grams gold for 1.4 million oz. of the yellow metal, and 14 million inferred tonnes at 14.1 grams gold for 6.4 million ounces. The resource covers only one-third of the known extent of the orebody, Bristow said.

Bristow linked Fourmile to a larger “growth wedge” that includes the company’s Pueblo Viejo in the Dominican Republic, Goldrush, the Lumwana copper Super Pit in Zambia and the Reko Diq project in Pakistan.

In Africa, Barrick has been trying to negotiate with the Mail junta for months after talks about the Loulo-Gounkoto operation following a new mining code broke down. The regime detained employees, seized

|

tonnes of gold and appointed an administrator to run the mine. Barrick started international arbitration through the World Bank, shuttered operations and dropped the mine from its outlook until at least 2028.

“Our focus is on the release of the people that have been held hostage in country and a resolution to

the conflict,” Bristow said in the interview. Near-weekly discussions with the authorities are continuing, but the impasse has “cost the country north of $600 million,” he said. It’s “way north of what they tried to shake us down for. So it doesn’t make sense to continue.”

In Zambia, the Lumwana Super Pit build is “ahead of schedule,”

and at about today’s copper price “is self-funding out to the end of next year,” Bristow said. The most recent quarterly results report reiterates a step-up to about 240,000 tonnes of copper a year from 2028.

Non-core assets

In North America, the recent sales of the Hemlo mine in northern Ontario and Barrick’s Donlin interest in Alaska, both for more than $1 billion, reflect a focus on tier-one scale and cost structure, Bristow said.

Hemlo “was never going to be a core asset,” he said, describing it as complex and high cost, and arguing it needed a more entrepreneurial, geology-led niche owner.

Barrick has done well on asset disposals to-date, BMO’s Murphy says. “We expect sequential improvement in operating results in the second half,” he said in a Sept. 18 note. He lifted the company’s share price target to C$38. Other asset sales – such as the Tongon mine in Côte d’lvoire – are possible. Reuters in July reported China’s Zijin Mining as a front-runner in the sale process at a price of “up to $500 million.”

“Tongon is non-core and for sale,” Bristow said. The process remains open, he added.

Barrick is also active on the fundraising front.

Financing for the $6.6-billion Reko Diq project in Pakistan is “very close,” with a target of finalizing a deal in “the next month or two,” the CEO said.

Barrick is working with 11 multilaterals development banks and export-credit agencies. This group includes the International Finance Corp., the Asian Development Bank, the U.S. Export-Import Bank, Export Development Canada and Japan’s Bank for International Cooperation. Strong demand could increase the debt size, the executive said.

District-scale copper-gold skarn-porphyry system in Southern Peru

Target-rich land package with full infrastructure and growth potential

9+ years of trusted community partnerships supporting long-term progress

Management has a track record of discoveries and monetization

Upcoming catalysts aligned with strong metals demand outlook

The goal is a 50/50 debt-equity structure, Bristow said. While acknowledging a vocal local anti-mining community, he said the company is focused on local hiring and suppliers. Both leading political parties in Pakistan support the project agreements, he said. These were first negotiated during a previous administration and signed under the current government of Prime Minister Shehbaz Sharif.

Major discipline

Barrick’s growth pitch leans on discipline – a philosophy that Bristow implemented while running a tight ship at Randgold.

“We’re running this business like a business,” he said, arguing Barrick has offset divestments with organic adds and avoided dilutive equity all while returning $6.7 billion to shareholders since the merger six years ago.

“We’ve paid dividends all the way through from 2019, we’ve invested in capital programs, and our balance sheet is still net positive cash,” Bristow said. “We’re not just feeding the quacking ducks, which is often what the mining industry does.” TNM

BY NORTHERN MINER STAFF

Around the world, mining companies are under growing pressure to use resources more efficiently and reduce waste.

Every truckload of ore that doesn’t end up as tailings means less impact on the environment, lower costs and better returns for investors.

That’s where the idea of pre-concentration comes in –separating what’s valuable earlier in the process, before it even reaches the plant.

Mining.com’s Devan Murugan sat down with Adrian Dance, principal metallurgist at SRK Consulting, to help us understand how this works, and why independent assessment matters.

Devan Murugan: Mining companies everywhere are talking about pre-concentration. For those outside the industry, what does that actually mean –and why does it matter for miners?

Adrian Dance: As a mineral processor who’s been in the industry for 30-odd years, I’m very aware of how things can be improved and how we need to change our mindset. For those who aren’t familiar with typical mineral processing, the first stage normally involves grinding material to a very fine size, which consumes a lot of power and water. Consequently, once the material is ground fine, any portion not recovered goes to a tailings storage area –the large tailings ponds we typically see.

The idea behind preconcentration, or coarse beneficiation, is to separate some of the waste before applying all that energy, power and water to slurry it. We aim to increase the grade of the material and reject waste, which reduces the size of the plant needed to produce the same amount of metal. What excites me is this is one of the few tools available to reverse the growing trend of lower grades being processed, as well as the more challenging metal recoveries that projects –and the wider industry –are facing.

DM: Right now, how are most companies handling ore material, and where do you see the gaps or inefficiencies in those approaches?

AD: The normal response from the industry to lower grades and perhaps lower metal recoveries is to increase the size of the plant, processing more material to achieve economies of scale. But this doesn’t really take advantage of the recent growth in ore body knowledge that we now have.

We’re getting more and more measurements and data, potentially applied through AI, along with other detailed methods to better understand our ore bodies. Should we be processing these materials through a single flow sheet, through a single plant, or should we in fact be doing it differently? We now have the high density of data we need.

In fact, when we call material “ore” –which is sent to the plant and defined as any material that can be processed economically –it is not all created equal. It is a mixture of high-value material

with a portion of dilution or waste that has made its way into the process. What we’re doing with pre-concentration is segregating and isolating these different value streams before we process them. By knowing the material more precisely, we are adding to the knowledge of the ore body itself. It’s about exploiting the information we have and creating a more nuanced, sophisticated way of processing – not simply sending everything to one plant and ultimately ending up in the tailings pond.

DM: SRK emphasizes its independence in evaluating preconcentration opportunities. Why is it so important for miners to have an unbiased assessment rather than relying solely on equipment vendors?

AD: SRK Consulting prides itself on being independent – a group of consultants with deep expertise across a wide range of disciplines. This independence is particularly valuable for clients exploring pre-concentration, bulk sorting or particle sorting. At present, most of the expertise sits with equipment manufacturers. They have long experience in knowing what works and what doesn’t, but their background is not always rooted in mining. Much of their expertise comes from recycling or other sectors where similar sensors have been applied. That’s why we see real value in offering mining projects and operating mines an independent perspective – experience and knowledge that puts the client’s interests first. Our approach is to assess whether there is any economic opportunity before moving to testing. Preconcentration does not always add value, and in many cases it simply isn’t the right fit. So, the first step is to ask: is there a chance to add value here? Only once that’s clear do we recommend testing. We call this “sizing the prize.” With that understanding, mining companies can then move forward confidently to work with equipment manufacturers –now with the context and insight that allows the technology to be applied far more effectively.

DM: Ore grades are falling and metallurgical recovery is getting harder. From your perspective, what are the biggest challenges

“We aim to increase the grade of the material and reject waste, which reduces the size of the plant needed to produce the same amount of metal. ”

— ADRIAN DANCE , PRINCIPAL METALLURGIST AT SRK CONSULTING,

miners face when upgrading ore, and how does pre-concentration help address them?

AD: It’s something I’ve been very passionate about through my involvement in past mine-to-mill projects and looking at how feed to the plant can be improved. Traditionally, that has focused on the size of the material. Now we’re approaching it from a different perspective –the grade of the material by size.

What we don’t have much information on as processors, despite doing this for hundreds if not thousands of years, is where the metal of interest actually occurs at a coarse size, say two inches or larger. At that scale, is the metal present in only some of the particles, or is it in all of them? We usually don’t know, because to determine grade we pulverize the sample –and in doing so, we destroy that information.

That’s why we are now focusing on how the material presents itself right after it’s crushed to the coarsest size possible. Is the gold concentrated in the fines? Is it associated mainly with the softer material? Truly understanding how the material presents itself at a coarse fraction is new territory. And with advances in sensors such as X-ray Transmissive technology, we can now see inside particles to determine where the metal is.

DM: How is SRK incorporating less-intrusive sensor-based testing into its toolkit, and what are trade-offs?

AD: What we’ve done is look at the types of samples typically available to the industry — and in early-stage projects, that’s often very limited. Usually, only half drill-core samples are on hand. The question is: how can we work within those constraints to deliver reliable information on ore characteristics in the most economic way possible?

We’ve developed a lab technology that can take relatively small samples and still reveal a great deal — how hard the ore is, how it will break, where the metal goes, and whether it’s amenable to sensor sorting. Importantly, this approach is not disruptive to the normal metallurgical evaluations or how companies currently study their ore bodies. By removing hurdles, we make this type of evaluation practical and accessible.

Traditionally, sensor-sorting tests require anywhere from 500 kilos to two tonnes of material. While this produces excellent technical results, it often adds little value for companies because the sample is too large and composite to provide meaningful insight. Our focus is different: instead of one massive test, we run dozens of smaller-mass samples. This approach highlights variability

within the deposit and gives companies a much clearer picture of their ore body.

DM: There’s often a perception that new metallurgical methods are expensive. How does SRK’s approach to testing — smaller, more targeted samples — make the process more cost-effective for miners?

AD: We’ve now gone as far as purchasing our own sensor unit so that we can carry out this work independently and as costeffectively as possible. But nothing we’re doing is unique — any commercial lab could apply the same process. We’re also happy to share the protocol, which is fairly novel in this industry. We’re not hiding behind licensing costs. Instead, our goal is to reduce the cost of each test so that companies can run tens, even dozens upon dozens of samples, and truly understand how things vary.

DM: Adrian, that’s where we’ll leave it. Thanks for your time.

AD: Thank you, Devan

The preceding Joint Venture Article is PROMOTED CONTENT sponsored by SRK and produced in co-operation with The Northern Miner. Visit: www.srk.com for more information.

BY HENRY LAZENBY Beaver Creek, Colo.

Canadian dealmaker Frank Giustra says the age of paper gold is ending as Brics nations stand up a parallel financial system that routes around the U.S. dollar and prizes deliverable metal.

“We’re now, believe it or not, in the era of hard money,” Giustra said Sept. 9 in a conversation with Alex Deluce of the Ontario-based bulletin Gold Telegraph at the Precious Metals Summit. “If you own paper gold, you do not own gold. When the crunch comes, it will not be there.”

China and partners among the Brics (Brazil, Russia, India, China and South Africa) nations are building a system to mirror Western finance. It spans payments, ratings and swap lines – all outside the dollar. It downplays paper gold, products like gold exchange-traded funds, sovereign gold bonds and gold futures that represent a stake in gold’s value without physically possessing the metal.

Giustra, a Canadian Mining Hall of Fame member, cited yuan-forgold convertibility on the Shanghai Gold Exchange, new physical-delivery vaulting in Hong Kong and more warehouses abroad.

“It basically puts (global financial messaging network) SWIFT back into the stone age,” he said.

De-dollarization

Record bullion prices in September underscored Giustra’s argument that physical gold is eclipsing paper contracts as the true measure of value. With central banks hoarding metal and governments testing non-dollar payments, the shift points to a world where gold miners with scalable ounces and low costs stand to benefit while traditional currencies and leveraged financial products come under strain.

U.S. President Donald Trump using tariffs as a political weapon has sped a global split into rival trading camps. Half the world is pushing trade and savings towards

non-dollar channels, the serial entrepreneur said.

“A lot of people think the administration is playing 3-D chess,” said Giustra, a financier known for founding Wheaton River Minerals and helping launch Goldcorp into a major producer. “I just don’t see it.”

A key Brics plank, he said, is the cross-border central bank digital currency pilot often called mBridge. It was launched by China, Hong Kong, Thailand and the United Arab Emirates with Saudi Arabia recently joining. Members settle in local currencies rather than dollars. Against that, he set out a U.S. path that leans on dollar stablecoins, digital tokens backed by short-term treasuries.

“MBridge and stablecoins are competing forces,” Giustra said. Stablecoins create “a way to stuff additional treasuries into virgin pockets that never existed before.”

In his scenario, if enough debt is inside those reserves, Washington could devalue the dollar, knocking holders of cash and dollar stablecoins while pushing hard assets like gold and metal producers higher.

Miners’ fillip

If physical delivery increasingly sets the clearing price, bullion premiums (the additional cost above benchmark spot prices that buyers must pay to secure real, deliverable

ounces) and mine supply become the real constraints. It favours producers with scalable ounces and low costs while challenging leveraged paper products, Giustra said. For investors, custody, convertibility and geopolitics matter as much as interest rates.

Heavy public debts and politics point to lower short-term rates, higher long-term yields and the return of quantitative easing or yield-curve control to cap borrowing costs – weakening fiat currencies versus physical gold, he said.

“Fiat currencies in general are in their death throes,” Giustra said. “There is a global monetary reset coming. How it manifests itself, who knows, and whether it’s done peacefully or with a war, who knows.”

‘National security’

If the dollar’s reserve role slips, he added, the U.S. could face inflation, higher rates and a lower standard of living. “It’s a national security issue.”

Giustra framed the stablecoin-and-devaluation path as a scenario, not a forecast. MBridge remains a pilot and policy choices in Washington and Beijing will determine how far and how fast any shift runs.

“Everybody’s scrambling to get physical gold onto their own territory,” he said. “This time is going to be chaotic.” TNM

BEAVER CREEK | Retail heat hits risky juniors

BY HENRY LAZENBY Beaver Creek, Colo.

Flush crypto firms and gold miners are driving industry M&A in a competitive market where the number of discoveries has slid by more than half, this year’s Summit heard.

Hong Kong-based Tether, the company behind USDT, the world’s largest U.S.-dollar-pegged stablecoin (digital tokens backed by short-term Treasuries), is investing $100 million (C$138.5 million) in equities of streaming companies.

New York hedge funds and cryptocurrency firms are investing $30 million or $50 million into mining projects, Michael Gray, partner at Vancouver-based Agentis Capital Mining Partners, said on a panel with Peter Bell, managing director of research at Canaccord Genuity.

“We’re seeing flows of capital from big sources,” Gray said. “The velocity of capital has really changed in the last three to six months.”

In past gold bull markets, influential financiers like Eric Sprott often validated junior projects and drew in capital. Today, with producers flush from record bullion prices and crypto firms benefiting from non-dollar investors, the balance is shifting. Buyers have the cash to drive deals, paying larger premiums for world-class projects they need to replace reserves while largely ignoring weaker assets, even at discounted prices.

Meantime, explorers reported just three new finds in the past 12 months of more than one million oz. gold, down from an average of seven in 2013, the analysts said.

Add a market that only reliably invests in the rare projects with drill hits of more than 250 grams gold per metre and you have a bull market inflated by record bullion prices where capital can accrue fast, but ounces are scarce.

“It does feel like an exceptionally upbeat period,” Bell, a former Newmont (TSX: NGT; NYSE: NEM) geologist and hedge-fund manager, told the conference. He described new retail enthusiasm –right down to an anecdote of a Muskoka dock builder who could rattle off junior company names and drill details.

“It’s the kind of interest you wouldn’t have seen a couple of years ago,” Bell said. “People are going from not being in the sector to being right in the most-risky part.”

Bell’s data show that drill results with more than 250 gram-metres of gold consistently spark short-term share price gains, while weaker intercepts produce random reactions. But he cautions that high-grade hits don’t guarantee a mine. Deposits that have gone into production since 2020 occupy the same grade-tonnage space as those still stranded. What separates them is complexity – whether the geology, metallurgy and geometry can be quickly drilled into a coherent resource.

For investors, Bell argues that a ≥250 gram-metre result should be seen as a trading signal rather than a mine plan. The stronger long-term indicator is when discoveries can be drilled rapidly into a resource, suggesting continuity and simplicity in the mineralization.

“The more an operation is run efficiently, like a factory, the more profitable it’s likely to be,” he said. Complexity also shows up in financing. Bell noted that projects needing layered deals like streams and often signal deeper challenges, while top-tier projects attract simpler, cheaper equity.

Bigger budgets from new investors, Gray argued, change the geology.

Companies can sustain the momentum from a big discovery with steady assay releases, clear updates and site access for investors, Gray said. His data show explorers averaged equity gains of 365% in year one and 80% in year two post-discovery, before performance tapered in later years.

If one theme shapes M&A, it’s scarcity. There are only a few tier-one or near-tier-one gold projects worldwide. These are the kind capable of producing roughly 300,000 oz. a year for 15 years – the lower half of the all-in sustaining cost curve of less than $1,000 per oz. where seniors focus their shopping.

Single-asset producers holding such large-scale projects have delivered outsize equity gains over the last year, outpacing junior indexes, gold and even Bitcoin. Higher gold prices could expand the list of tier-one projects by allowing miners to take in broader, lower-grade zones where ore geometry supports bulk mining, Gray said.

“We’ve seen a pretty steady pace of decent holes,” Bell said. “But it takes a lot of money to make these things happen and you want to be in the right things, not the wrong things.”

| Firm sets sights on Abitibi region

BY HENRY LAZENBY

Colorado Springs, Colo.

Gold Royalty (NYSE-A: GROY) has started generating free cash flow and is focusing on Quebec’s Abitibi region for its next growth spurt, executive chairman and CEO David Garofalo says.

The company is using its cornerstone royalties at Agnico Eagle Mines’ (TSX, NYSE: AEM) Canadian Malartic Odyssey underground complex in Quebec, plus Iamgold’s (TSX: IMG; NYSE: IAG) Ontario-based Côté as well as the Ren deposit at Goldstrike held by the Barrick (TSX: ABX; NYSE: B)and Newmont joint venture Nevada Gold Mines to underpin a long runway of growth.

Meantime, Gold Royalty’s Quebec exposure highlights a focus on tier-one jurisdictions. With free cash flow now rolling in, the company is positioning itself as a consolidator in the fragmented royalty space and aims to pay down debt ahead of considering shareholder returns.

“We’re over the hump into free cash flow,” Garofalo told The Northern Miner on Sept. 16 at Mining Forum Americas. “Odyssey is a keystone for us.”

Quebec anchor Gold Royalty’s Quebec weighting is deliberate, the CEO says. The company holds a 3% net smelter return (NSR) royalty on Odyssey North, most of East Malartic and parts of Odyssey South/Norrie – plus a 1.5% NSR on the nearby Midway project to the east.

At Odyssey, Agnico is transitioning the Canadian Malartic mine from Canada’s largest gold open pit to one of the country’s most conse-

quential underground operations.

First ore via ramp from the top of the East Gouldie deposit is expected in the second half of next year, with first ore via the hoisting shaft about 12 months later. A shaft extension and a second shaft are under study to add capacity.

That Quebec backbone fits Gold Royalty’s house view: prioritize tier-one jurisdictions with rule of law and contract enforceability.

“Our business is a stack of contracts,” Garofalo said. “You want to be where paper is protected.”

Balance sheet first

That buoyant free cash flow will be earmarked first for debt reduction, the CEO said. A $40-million (C$55.7 million) unsecured convertible debenture, which matures in 2028, will become callable by Gold Royalty in late 2026.

“They’re deeply in the money, so we can effectively force conversion

at the end of next year,” he said of the bonds.

The company also expects to repay short-term borrowings – representing about one-third of its $75-million revolving credit facility – out of free cash flow by the end of next year. Garofalo calls the facility Gold Royalty’s “credit card” for quick transactions.

“We expect to be completely debt-free by the end of 2026,” Garofalo said. “At that point we’ll actively contemplate returns of capital, whether buybacks or a dividend – whatever makes most economic sense.”

Gold Royalty’s corporate costs average about $7–8 million a year, while gold-equivalent ounces are projected to grow sharply to 30,000 oz. from already-owned assets.

“Our costs are largely fixed,” the CEO said. “As volume grows – and if gold prices cooperate – every incremental dollar drops through.”

Besides the big growth drivers of Odyssey, Côté and Ren, several smaller contributors are strengthening the base.

Aura Minerals’ (TSX: ORA; Nasdaq: AUGO) Borborema mine in Brazil and DPM Metals’ (TSX: DPM) Vareš mine in Bosnia and Herzegovina – where Gold Royalty holds a copper stream – have both entered production, with the operators contemplating expansions, Garofalo said.

He also pointed to Orla Mining’s (TSX: OLA) South Railroad project in Nevada, which is advancing through permitting, and to organic royalty-generation successes such as Blackrock Silver’s (TSXV: BRC; US-OTC: BKRRF) Tonopah West, which Gold Royalty staked in 2021 and farmed out last year for cash plus a royalty.

“That could be in production before the end of the decade – warp speed by mining standards,” he said.

Why royalties?

Garofalo calls the royalty model “free optionality”: top-line NSR exposure fully paid with no capital calls, direct leverage to the gold price and operator-funded growth.

He cites roughly $200 million per year of exploration on ground covered by Gold Royalty’s agreements in recent years – spending that the company doesn’t fund – alongside the model’s scalability.

Even with about 14 employees,

Gold Royalty can manage hundreds of assets across the Americas, smoothing risk without diluting upside.

“There’s no practical cap on how many royalties you can manage with a small team, as opposed to a major that can only manage effectively a set number of mines.”

The royalty space remains fragmented and periodically ripe for consolidation when equity markets reward scale. That’s a playbook Gold Royalty followed in 2021 by rolling up peer Ely Gold Royalties, to add the Ren royalty package and a larger U.S. pipeline.

It also merged with Abitibi Royalties and Golden Valley Mines to secure its Quebec exposure at Canadian Malartic/Odyssey – all of which bolstered near-term cash flow and scale.

While the company remains more than 90% gold-focused, it is comfortable in polymetallic systems such as gold-copper porphyries and volcanogenic massive sulphide camps, where its team has deep operating experience.

“We have royalties in three of the five biggest producing gold mines in North America,” Garofalo said. “We have a foundational, cornerstone element to our portfolio that’s really the envy of our peers in the small-cap universe and it means we’ll have an annuity from those assets for decades to come.” TNM

GOLD | Miner dodges regional unrest

BY HENRY LAZENBY Colorado Springs, Colo.

Endeavour Mining (TSX: EDV; LSE: EDV) is shifting from capital-intensive expansion to grow through efficiency and productivity, as CEO Ian Cockerill works to lift West African output by 30% by 2030.

Despite periodic coups and conflict flashpoints across the Sahel, West Africa’s major gold belts have stayed largely insulated from disruption at established mines. Endeavour has navigated the noise by keeping deep ties with host governments and communities, structuring negotiated exits from noncore assets and working within country “conventions” as codes evolve, Cockerill said.

At the heart of the London-based company’s growth is the Assafou gold project in Côte d’Ivoire. Endeavour aims to complete a definitive feasibility study by early next year. If approvals go through, construction may begin in the second half of 2026, and the first gold could be produced in 2028.

“From discovery to first pour will be under eight years,” Cockerill told The Northern Miner last month of the Mining Forum Americas. “West Africa’s permitting cadence and established supply chains help compress timelines.”

Endeavour’s Toronto-listed shares closed at C$56.78 near press time, off the 12-month high of C$58.44. They have gained 68% in the past year, giving the company a market capitalization of C$13.7 billion ($9.8 billion).

‘Secret sauce’

The biological oxidation (BIOX) circuit at Senegal’s Sabodala-Massawa complex is running roughly 10% above its 1.2-million-tonneper-year nameplate capacity, Cockerill said. That’s after workers rebalanced feed to about 80% fresh refractory ore and 20% transitional material, from an earlier ore mix of roughly 70%-30%, respectively. They also rerouted flotation underflow to the carbon-in-leach plant to “scavenge” additional ounces.

“That’s the secret sauce,” Cockerill said. “BIOX is now working the way it should – and we’re looking to make it sweat a bit more.”

Endeavour is set to bring in higher-grade oxides and fresh ore to the Sabodala-Massawa mill while advancing the Karakunda and Guruma underground mines. First material from these mines is expected by late 2027 and into 2028.

“We want to replace low-grade stockpiles,” Cockerill said. “The undergrounds are good grade oxides that help the whole flowsheet.”

Free cash

First-half output hit 647,000 oz. gold at an all-in sustaining cost (AISC) of $1,281 per oz. (C$1,773.90). That’s up 3.6% from $1,237 per oz. in the same period last year.

Record gold prices have helped Endeavour generate significant amounts of cash. Free cash flow reached $879 million over the past 12 months. That’s equivalent to $687 per oz. produced, a yield exceeding 17%, Cockerill said.

“We don’t want to be the biggest,” echoing recent pledges by senior producers to adhere to discipline amid record metal prices. “We want to be mid-range in volume but high value.”

IAN COCKERILL CEO, ENDEAVOUR MINING

The company declared a record dividend of $150 million for the half-year period, supplemented by $69 million in share buybacks. Total shareholder returns reached $338 per oz. of gold produced, highlighting a commitment to strong investor returns, Cockerill said.

“We run Endeavour as both a growth and yield story – funding exploration and new builds inside a conservative leverage guardrail, then handing excess back through dividends and buybacks so investors get paid while the pipeline advances,” the executive said.

Portfolio upgrade

In Côte d’Ivoire, Endeavour aims to combine several satellite pits at Ity into a “super-pit.” Cockerill believes this will allow for bigger equipment, lower mining costs and more stable output of just over 300,000 oz. per year.”

In Burkina Faso, drilling at Houndé is exploring deeper extensions of Vindaloo Main. This could

support an underground mine in a few years. Early results show promising widths of about 6 grams of gold per tonne, the executive noted.

Cockerill framed the program as the latest turn of Endeavour’s portfolio-upgrade strategy. The company’s internal “magic box” favouring long-life, low-cost mines has seen it sell shorter-life, higher-cost operations over the past decade. That includes Boungou and Wahgnion in Burkina Faso – transactions he stressed were negotiated sales, not nationalizations.

“It takes as much effort to manage a tough mine as a good one,” he said. “We focus on the good stuff.”

Part of that focus includes Mana in Burkina Faso, which has transitioned to a pure underground operation. With high costs and a short mine life compared to other company assets, Mana is an outlier in Endeavour’s portfolio – though strategically useful, the CEO said. Operating the mine helps employees gain underground expertise for

Sabodala-Massawa, Houndé and eventually, Ity.

“Even with a contractor, you need to know what good looks like,” he said. “Mana gives us that muscle.”

Organic growth

Endeavour’s exploration engine also helps the company’s cost profile – “just under 21 million oz. discovered at about $25 per oz. over nine years,” with reserve grades averaging nearly 1.8 grams per tonne, Cockerill said. Orebody quality, and not scale, is what drives value, the CEO stressed.

“We don’t want to be the biggest,” he said, echoing recent pledges by senior producers to adhere to discipline amid record metal prices.

“We want to be mid-range in volume but high value.”

On the policy front, Endeavour has agreed to Burkina Faso’s move

from a 10% to 15% state free carry in its 2024 mining code update. In Côte d’Ivoire, he characterized a proposed royalty and ownership review as a “green paper” – a discussion document – with expectations that existing project conventions will be respected.

Senegal, he added, has signalled no immediate changes.

The company assigns a public-affairs lead to each country. This keeps communication open with all levels of the administration. The goal is to create good outcomes while protecting investments.

“People call it risk; I call it challenges with outsized returns if you manage them,” he said.

“We’re a rare combination in gold – we offer growth and a yield,” Cockerill said. “While we build the next leg, we’re improving the plants we have, bringing on underground ounces and keeping the dialogue tight in our countries. That’s how you protect margins and the social licence to operate.”

BY BLAIR MCBRIDE

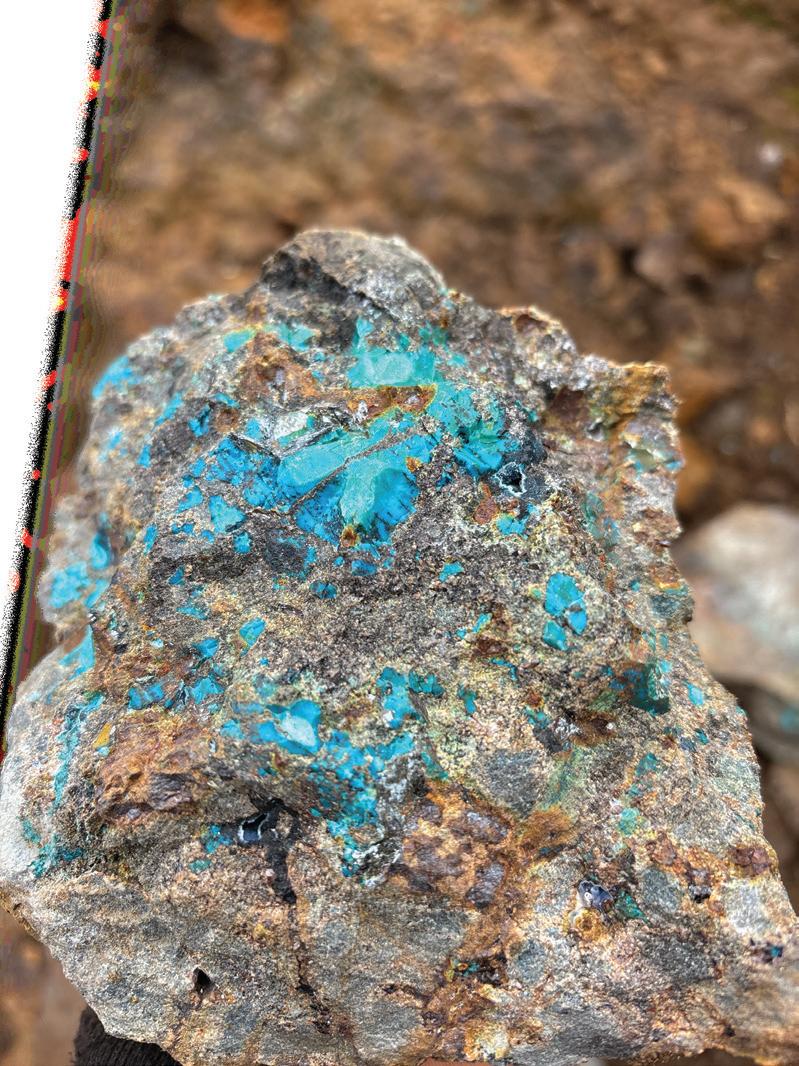

Gunnison Copper’s (TSX: GCU; US-OTC: GCUMF)

namesake deposit and Johnson Camp Mine (JCM) sit at two intersections, literal and metaphorical.

Nestled among rocky, rolling hills dotted with cacti and other desert vegetation, the two sites are on either side of Interstate 10. And its Sept. 3 production start pivoted the company to its planned use of ground-breaking copper processing.

The milestone of pure copper cathode at JCM made Gunnison the United States’ newest red metal producer, and it will be the first to use the sulphide leaching technology of Rio Tinto’s (NYSE: RIO) venture partner Nuton later this year. Gunnison’s property is located about 105 km east of Tucson.

“This is the world’s first commercial scale construction of [Nuton] technology,” CEO Stephen Twyerould told The Northern Miner on a site visit last month. “It has the potential to fundamentally change sulphide processing, in the U.S. and elsewhere. I’ve got mates in Australia who are constantly saying, ‘I can’t believe you guys are building the first one.’”

Newest copper producer

Gunnison is located in the most prolific copper region of Arizona, itself churning out almost twothirds of the country’s red metal. It joins other copper producers in the state’s southeast such as Freeport McMoRan Sierrita mine, (TSX: CS; ASX: CSC) Pinto Valley

GMEXICOB) Mission Complex.

But one of JCM’s defining features is how much Nuton’s tech changes the landscape for copper mining, explained Robert Winton, Gunnison’s senior vice-president of operations.

“Sulphide ore is [normally] crushed, concentrated in a mill, smelted, refined, then finished copper,” Winton said, gesturing at JCM’s enormous heap leach pad as haul trucks delivered ore - in the distance.

“[In] the Nuton process it’s mined, crushed, heap leached, then solvent extraction and electrowin-