Junta choppers seize more gold from Barrick in Mali | 8

BY HENRY LAZENBY

BOCA RATON, FLA.

Rick Rule has an axiom for mining investors facing turbulent markets: “You are either a contrarian or you’re going to be a victim.”

This dictum set the tone early last month at the Rule Investment Symposium in Boca Raton, Fla., where mining investment veterans debated the arithmetic driving today’s resource sector bets amid rising inflation, ballooning government debt and tightening capital conditions.

Now is precisely when investors should look at mining, argues Rule, the renowned mining financier who has managed hundreds of millions in investments and shaped the sector for over four decades. He says that even with economic uncertainty and the growing U.S. federal debt, which now exceeds $36.6 trillion (C$50.3 trillion) and increases by at least $2 trillion each year, there are good opportunities for contrarian investors.

“When your outgo exceeds your income, your upkeep becomes your downfall,” he said, citing a short poem learned early in his career to underline his point about unsustainable spending.

For Rule, mining — particularly in gold and critical minerals — represents an ideal hedge as inflation erodes the purchasing power of the U.S. dollar. Rule compares

“When your outgo exceeds your income, your upkeep becomes your downfall.”

RICK

the current era to the inflationary 1970s, when gold prices skyrocketed 30-fold. “The spenders owe it to the savers,” Rule said. “There are more spenders than savers. You do the math.”

‘Day of reckoning’ Other industry heavyweights at the conference tempered Rule’s bullish contrarianism with a strong dose of realism.

Frank Giustra, another accomplished resource investor who is CEO of Fiore Group, agreed gold is critical in this environment but warned the risks are escalating for the very reason that Rule cites as an opportunity: America’s growing debt problem.

“There will be a day of reckoning and it’s coming faster than any-

one can possibly imagine,” Giustra told The Northern Miner in an interview.

He sees this showdown materializing through a potential crisis in U.S. Treasury markets, where investors could revolt, pushing yields dramatically higher and stoking financial instability.

“Politicians have a Sophie’s Choice,” Giustra added, saying they must either drastically reduce non-discretionary and military spending — “which means not getting re-elected” — or maintain the status quo and continue down a path of “fiscal irresponsibility.”

Access risks

SCP Resource Finance Chair Peter Grosskopf further toned down Rule’s enthusiasm, highlighting significant risks, especially regarding capital access.

“Junior miners are having trouble raising funds, especially those below a $500-million market cap,” Grosskopf said. “Banks have backed away significantly from smaller miners and exploration-stage companies.”

Grosskopf also underlined that inflationary pressures are sharply increasing operational and capital

This state-of-the-art BEV loader is designed specifically for underground mining operations. Equipped with an optimal battery chemistry, the fastest battery swap on the market and a high-power electric driveline, this loader is your gateway to sustainable mining.

Toro® LH518iB Safer. Stronger. Smarter.

NAME: Matthew Hastings

TITLE: Principal Geologist, Corporate Advisory Consultant

COMPANY:

SRK Denver

BY NORTHERN MINER STAFF

In mining, one wrong move can cost millions. From overpriced acquisitions to poorly timed divestments, companies have eroded shareholder value or triggered reputational fallout by misjudging the real worth — or risk — of an asset.

That’s where independent, technically grounded corporate advisory becomes critical.

SRK Consulting is stepping into this space with deep geological insight and boardroom-level strategy — helping mining companies make smarter, data-backed decisions.

The Northern Miner Group’s Devan Murugan sat down with Matthew Hastings, Principal Geologist and Corporate Advisory Consultant at SRK Denver, to hear how his team helps miners avoid costly mistakes.

Devan Murugan: SRK is best known for its multi-disciplinary expert teams and technical reporting — but what does your corporate advisory team actually do that’s different from traditional consulting?

Matthew Hastings: We do our best to leverage that deep technical expertise that we do have in-house and marry that with being able to communicate things at an executive level. And that’s not something that’s always easily found in the mining industry. You have plenty of excellent competent technical experts, but being able to distill complexity into a consumable executive level of communications is challenging. We are doing our best to leverage that and be able to sell that as a service.

In an industry as capitalintensive and high-risk as mining, the cost of a wrong turn — be it in project sequencing, permitting risk, geological assumptions, or capital deployment — is measured in billions of dollars and years of time. So, with those as the stakes, even world-class teams benefit from a second set of eyes — particularly when those eyes belong to professionals who’ve helped guide many mining companies or investors through similar inflection points over more than half a century.

A strong independent consultant partnership in corporate resource strategy can enhance disclosure quality and bolster confidence with investors/ board, especially during critical mine development stages or portfolio augmentation. Our involvement is often seen as a quality signal, increasing institutional trust in the underlying technical narrative.

DM: We’ve seen mining companies overpay for assets, or sell too soon. How does SRK help boards and executives avoid those strategic missteps?

MH: Players in the industry will tend to spend money when the market is hot and conserve when it is down, although the best deals don’t necessarily follow those trends. Companies can get stuck in a very myopic view of what their strategy needs to be and not necessarily be willing to change that based on market conditions. They make decisions in M&A or actual internal project development that maybe aren’t going to be a good fit for what the market’s currently doing.

Sometimes these companies know their business very well but don’t necessarily know everybody else’s business. SRK has that depth and breadth to see what a lot of others are doing and understand the bigger picture. Within the bounds of confidentiality, we can advise our clients and share what has worked, what has not worked, and provide an independent view of things as they are.

DM: Can you walk us through how SRK assesses whether an asset is truly aligned with a company’s long-term goals — beyond just the numbers?

MH: That really starts with understanding who the client is. In my experience just over the last few years, there are many companies, not just mining companies, who depend on or have significant interest in the resources sector, either at the asset level or the enterprise level. They often find themselves having to deal with critical decisions that need to be made

from everything from a global portfolio view to a relatively minor asset budgeting level. And they’re dealing in some cases with partners or other groups who may have more knowledge and expertise in the space. They may not have mining as a core competency. Their partners may have a vested interest in a different outcome. They may not be getting all the information they need to fit with their business.

So we need to be able to distill complexity that may exist in the resources sector, the risk, that capital intensity that may be hard for others to understand, bring that back to them and help integrate that with their corporate strategy or decision-making process.

DM: That doesn’t necessarily mean that there’s a deficit within that company when it comes to analyzing these things, does it?

MH: A decision to bring in independent corporate advisors tends to be a sign of strategic discipline and maturity. Athletes, even elite athletes all have coaches. They know how to go play the game, but everybody needs help sometimes.

In this case, it’s really getting that independent view of what the asset can and cannot be.

Internal teams can develop blind spots, especially when legacy thinking, political interests, perceived permitting/social constraints, or sunk cost fallacies dominate decision-making.

The worst case is you challenge your assumptions and you find out that they’re right. That you’ve

“Companies know their business very well but don’t necessarily know everybody else’s business. SRK has that depth and breadth to see what a lot of others are doing and understand the bigger picture ”

— MATTHEW HASTINGS , PRINCIPAL GEOLOGIST, CORPORATE ADVISORY CONSULTANT, SRK DENVER

spent the money and you’re still on the same page going the same direction as you were, with a bit more confidence.

Best case, you find out you need to shift, you need to pivot away from a direction you are going which would’ve resulted in less value to shareholders or more risk to the project. And sometimes that outside technical expertise can be the challenge that knocks that loose in a decision-making process.

DM: How does your team bring ESG risk — often hidden or overlooked — into the decisionmaking process for M&A or capital planning?

MH: ESG risk is not novel in the mining industry. We’ve been exposed to it and have dealt with it for a long time, but it is certainly a focus currently in how things are being looked at. From my perspective, it’s using ESG risk as a way to weight decisions that are being made. The real risk in environmental, social or governmental interactions in the mining industry can sometimes get moved to the back burner. It needs to be right up front.

You can have corporate communications processes. You can have investment-driving processes. You can just have outright misunderstanding of what those risks are. So, bringing ESG into an appropriate level within a risk-based decisionmaking process is key, in my opinion. It’s not something you bolt on to the end.

DM: You work across many jurisdictions. How does SRK’s global footprint, and technical depth, give your clients a competitive edge in strategy?

MH: If we go back to ESG, for example, it’s key that you have local expertise familiar with the situation on the ground from an environmental permitting/social standpoint. It’s a good example of why that global footprint matters. You need to have somebody who is deeply familiar with the culture, the heritage, the current events of the place you are working.

Having that global bench to rely on and being able to apply that expertise is helpful for disciplines beyond ESG. As we get into the technical aspects of projects, SRK has such a broad presence across a number of technical disciplines that it’s hard to find another independent company that has 50-plus years of history and 1,300plus people globally who can step in on any problem that needs to be solved.

I am always impressed when I ask around and find that we do have someone somewhere who is an expert in the weird and wonderful engineering or science I am trying to find.

DM: Matt, thanks very much indeed for talking to us.

The preceding joint venture is PROMOTED CONTENT sponsored by SRK and produced in co-operation with The Northern Miner. Visit. www.srk.com for more information.

GLOBAL MINING NEWS • SINCE 1915 www.northernminer.com

PRESIDENT THE NORTHERN MINER GROUP: Anthony Vaccaro, CFA, MBA avaccaro@northernminer.com

EDITOR-IN-CHIEF: Colin McClelland cmcclelland@northernminer.com

COPY EDITOR AND PRODUCTION EDITOR: Blair McBride bmcbride@northernminer.com

SENIOR STAFF WRITER: Frédéric Tomesco ftomesco@northernminer.com

WESTERN EDITOR: Henry Lazenby hlazenby@northernminer.com

PODCAST HOST: Adrian Pocobelli apocobelli@northernminer.com

ADVERTISING: Robert Hertzman (416) 898-6654 rhertzman@northernminer.com

Kathleen Plamondon (514) 917-5284 kplamondon@northernminer.com

Michael Winter (416) 510-6772 mwinter@northernminer.com

SUBSCRIPTION SALES/ APPOINTMENT NOTICES/ CAREER ADS

George Agelopoulos (416) 510-5104 (Toll free) 1-888-502-3456, ext. 43702 gagelopoulos@northernminer.com

PRODUCTION MANAGER: Jessica Jubb (416) 510-5213 jjubb@northernminer.com

CIRCULATION/CUSTOMER SERVICE: (416) 510-6789 | 1-888-502-3456 northernminer2@northernminer.com

REPUBLISHING: (416) 510-6768 jmonteiro@northernminergroup.com

ADDRESS: Toronto Head Office

69 Yonge St, Toronto, ON M5E 1K3 (416) 510-6789 tnm@northernminer.com

SUBSCRIPTION RATES: Canada:

C$130.00 one year; 5% G.S.T. to CDN orders. 7% P.S.T. to BC orders 13% H.S.T. to ON, NL orders 14% H.S.T. to PEI orders 15% H.S.T. to NB, NS orders

U.S.A.: C$172.00 one year Foreign: C$222.00 one year GST Registration # 809744071RT001 (ISSN 0029-3164)

BY COLIN McCLELLAND

The closure in July of the Point Lake part of the Ekati complex in the Northwest Territories is the latest blow to Canada’s Far North diamond industry. Owner Burgundy Diamond Mines left open the possibility of resuming openpit operations at some point, but has laid off hundreds of workers in a foreshadowing of the gem’s local demise.

Diamond mining has accounted for about 30% of the NWT’s economy. It was a good three-decade or so run. But now Snap Lake is closed, Diavik is supposed to shut next year and Gahcho Kué may last until 2030. Though Burgundy said last year Ekati could run until 2040 with underwater and underground mining, the company is working on a new outlook right now and it’s bound to include wider market considerations.

Globally, the diamond market is in disarray. Cheaper synthetic stones are gaining market share. Younger buyers are increasingly skipping traditional diamond engagement rings and luxury spending is forecast to fall in China.

Revenue has plunged at giants Alrosa and De Beers. Anglo American is trying to sell the latter while Botswana is angling for a controlling stake in the company that accounts for about a quarter of its economy. Gem Diamonds, Petra Diamonds, Lucapa and Lucara are all down on most metrics.

“Prices have stabilized and we are through the worst of the trough.”

—Diamond expert Paul Zimnisky

Industry expert Paul Zimnisky nevertheless expressed optimism in late July even though stone prices have sunk 40% since their all-time highs in early 2022, according to his global rough diamond index.

“Year-to-date, prices have stabilized and we are through the worst of the trough,” Zimnisky told The Northern Miner by email from New York where he’s based.

“In the case of Burgundy, it’s important to remember that Point Lake was the first diamondiferous kimberlite discovered in the NWT in the early 90s and it wasn’t put into production until this year. So there is ostensibly a reason why it wasn’t put into production earlier. It’s also important to note that Burgundy is continuing to mine at the Misery underground operation.”

Also good for a positive take is Caitlin Cleveland, the NWT Minister of Industry, Tourism and Investment who’s also the Minister of Education, Culture and Employment. There may be concerns in communities about the diamond mines but Cleveland says Premier R.J. Simpson’s government is working with local critical mineral ventures to shorten timelines and bend ears in Ottawa to secure funding.

“We have all sat down with those proponents and had the opportunity to ask them, you know, what do you need? What’s your timeline? How do we move the timeline up? How do we work together?” she said by phone from Yellowknife.

The territory’s leading projects include Fireweed Metals’ Mactung, the world’s largest high-grade tungsten project, the Yellowknife lithium project by Li-FT Power, and Fortune Minerals’ Nico project, the biggest primary cobalt deposit in the western world. There are also two brownfield zinc-lead sites preparing for restarts: NorZinc’s Prairie Creek and Appian Capital’s Pine Point being redeveloped by Osisko Metals.

From the plight of diamonds to the deep blue sea, another mining sector in disarray but looking to right its ship, or at least its submarine, met in Jamaica as the Miner went to press. The International Seabed Authority is trying to wrangle rules for this new frontier.

But U.S. President Donald Trump issued an executive order in April instructing U.S. agencies to fast-track seabed mining permits – enabling The Metals Co. to apply for licences under U.S. law and bypass the ISA’s worldwide regulatory authority.

The likelihood of getting a deal in Jamaica for the US$20-trillion global opportunity is not about environmental issues – it’s about who’s poised to mine and who isn’t.

The situation pits the U.S., China, Russia, India, Japan and South Korea against laggards the U.K., Mexico, Peru, New Zealand and others, Amer Hage Chahine and Ilya Epikhin at consultants Arthur D. Little told The Northern Miner by email from Dubai.

“If the mining code is not agreed, it’s reasonable to assume that the U.S will start mining without the code, followed by China and others,” Chahine and Epikhin said. “Several local country-specific regulations different from each other will prevail – turning the sector into an unregulated wild hunt for resources.”

Back in the Northwest Territories, ministers and potential miners are on their own hunt, for financing that is.

“We have a lot of juniors that operate up here, and so making sure that they have access to the capital in order to move projects forward is critically important,” Cleveland said. “We’ve had the opportunity to sit down with the federal minister and go through those projects and we’re really grateful for how interested they are.”

From Voyage to the Bottom of the Sea to Ice Station Zebra, from nodules to lichen-covered hinterlands, these are the new frontiers for mining projects right now.

“We get pretty excited when we get to talk about them and really push for them,” Cleveland said. “We’ve got a lot of cool rocks in the territories.”

BY JAMES COOPER

This has been some decade and we’re only halfway through!

It began with a global pandemic; planes stopped flying, and governments locked us inside our homes. A clue to what would come.

By early 2022, war had broken out in Ukraine, destabilizing energy security across Europe and Asia.

But by then, a new word was haunting global markets: inflation. In response, central banks across the West led a damaging rate-hiking regime that was unprecedented in its aggression.

As a result, a mini-bank collapse occurred in the U.S. But those spot fires were quickly extinguished. The crisis didn’t spread.

Then, in 2024, the world was struck by the attempted assassination of the former U.S. president, Donald Trump. But volatility was far from over.

When Trump returned to the presidential office in 2025, the global economy was struck down again, with uncanny parallels to the Covid-19 panic.

Trump thumped nations across the globe with threats of triple-digit tariffs. A major blow given that the U.S. is the world’s largest and most crucial consumer economy.

But that’s the decade we’re living in today, and we’re only halfway through! Barely a month passes by without another major historical event taking place. No doubt, this has been a blockbuster time to be alive.

Decade not finished yet If you agree that risk remains the recipe for the remainder of this decade, then resources should be your focus. You see, commodities are not part of the psyche of regular investors, yet.

This is a market brimming with value. And that’s precisely what you should be steering towards in a period of ongoing volatility.

Unlike the boom of the early 2000s, mining stocks are far from making front-page headlines. There’s no talk of the outrageous salaries in Australia’s mining sector. No market commentary covering windfalls for property investors in mining towns like the Pilbara or Kalgoorlie.

And there’s absolutely no rush among large-cap producers to grab hold of smaller mining outfits. And that’s despite gold trading at record prices.

Conditions today are far from the frenzied hype of the last mining boom. But that’s changing, gradually, at first.

As mentioned, gold hit and advanced into new all-time highs last year. Silver and platinum shot into multi-year highs in July. Copper tested its all-time highs in early July. Base metals, like zinc, titanium and aluminium, remain elevated and ready to follow copper’s lead should it breach this historic top.

This is what the early stages of a major commodity bull market look like. Yet, the narrative remains quiet on all things commodities. Mining juniors barely have a heartbeat, trolling around multi-year lows. Stuck within a technical bear market. Investor psyche for mining stocks remains muted.

So, brace yourself

The early 2000s were described as unprecedented, a boom that could never repeat. But then something unprecedented did happen.

The downturn years that followed, from 2013 to 2021, punched the wind out of the industry. Investments reached historic lows, from oil and gas, copper to gold. Resources were unloved. Retail and institutional investors trashed the entire commodity sector.

Meanwhile, U.S. stocks flew on the back of low interest rates. But this decade has marked the slow, gradual recovery of commodity prices. Why? Well, commodities tend to relish volatility.

Higher commodity prices are historically linked to inflation, trade uncertainty, geopolitical risk and war—and that’s the signature of the 2020s. We’re witnessing the gradual return of the old economy. Investors are being re-awakened to the idea of tying wealth to real assets.

That’s what volatility does. But as investment returns to the old economy, it’s important to remember that the big miners have grown enormously fat from the work undertaken more than 15, 20, and sometimes 30 years ago. Reaping the benefits of the last capex boom but spending little on replacement reserves, since. Depleting assets

Addressing the problem of a lack of new supply won’t come quickly or easily. Major miners have grown lazy, risk-averse and reluctant to spend money on project development or exploration. The commodity sector has endured a decade of investment malaise.

But this historical era of underinvestment can only have one outcome: buy-outs. As the desire to buy new projects finally returns, I suspect bidding will be fierce among the cashed-up majors who’ve benefited from steadily rising commodity prices this decade. Lack of investment over the last decade will drive capital into the small handful of projects that have advanced. And that’s where investors have an opportunity to speculate.

At my paid readership group, I’ve focused on mining stocks and developers looking to deliver the next generation of deposits. Companies that have worked hard against the trend of capital flowing out of this sector, but positioning themselves for a tidal wave of capital that will inevitably flow back in. And I believe we’re entering that phase right now.

Capital will eventually catch up to rising commodity prices and

The Association for Mineral Exploration (AME) in British Columbia has named Todd Stone, a veteran provincial politician and software startup founder, as its new president and CEO. He takes office Aug. 5.

Stone served as a provincial legislator representing Kamloops — South Thompson for almost 12 years. He held the cabinet posts for transportation and infrastructure as well as emergency management. Stone also served as Deputy Government House Leader.

Before he was first elected in 2013, Stone in 1999 founded iCompass Technologies, where he served as president and CEO. The company developed software for workflows and streamlined processes used by some 500 municipalities across North America. New York-based Diligent bought iCompass for an undisclosed amount in 2018.

“I’m inspired by AME’s mission and legacy of protecting a prosperous landscape for mineral exploration that promotes economic growth in British Columbia, respects Indigenous rights, and ensures environmental sustainability,” Stone said in a statement.

Stone didn’t seek re-election in the 2024 provincial election, but has remained an active voice, appearing on political panels and radio talk shows. Stone, now in his early 50s, served the BC United party, which was known as the BC Liberals until 2023.

“The world needs British Columbia’s mineral resources, and AME has a vital role to play working on behalf of our members — big and small — with government and First Nations to ensure British Columbia is positioned as the leading mineral exploration jurisdiction,” he said.

The world’s deepest marathon is to be run this October in an unprecedented challenging environment: 1,120 metres below sea level in one of Europe’s deepest mines.

The event, set inside Boliden’s Garpenberg zinc mine in Sweden, will see 60 amateur runners from around the world compete underground with the aim of breaking two world records and raise over £1 million (US$1.34 million) for charity.

The mine, to a depth of 1,302 metres – more than four times the height of the Eiffel Tower – will test the mental and physical limits of every participant.

Organized by high-tech metals company Boliden, personal development group BecomingX, and the International Council on Mining and Metals, the marathon intends to showcase more than athletic endurance. It’s a celebration of human resilience and a statement on the transformation of the mining industry.

“This will be a true test,” said Bear Grylls, co-founder of BecomingX. “Running a marathon is tough, but doing it 1,120 metres below sea level, in total silence and darkness, will push participants to their limits.”

Council CEO Rohitesh Dhawan said the event underscores how far mining has evolved. He noted runners won’t be in the dangerous, dark tunnels of the past as mines like Garpenberg, with strong safety and sustainability, can now host an event of this scale.

NORTHERN MINER STAFF STAFF

Wayne Kindrat, President of contractor Cobra Mining, observes mineralization underground at Blue Lagoon Resources’ recently opened Dome Mountain gold mine in northwestern British Columbia, in July.

Market conditions were blamed after Burgundy Diamond Mines halted part of its Ekati complex in the Northwest Territories and Impala Platinum confirmed it would shut its northern Ontario mine next May.

“Several hundred” workers and contractors have been laid off, Burgundy communications manager Ariella Calin told The Northern Miner. “With global diamond prices at record lows, at this time the Point Lake project is proving to be sub-economic.”

Implats, as it’s widely known, first said in February it was considering closing the Lac des Iles palladium mine. It employs about 750 workers 90 km northwest of Thunder Bay. The news comes even as prices for the metal have surged 47% this year to $1,279 per oz. by press time.

“The business is not generating the cash flow required,” spokesperson Emily Robb said by email.

Point Lake is to be maintained to allow for a rapid restart should market conditions improve, Calin added.

The suspension comes as all three active diamond mines in N.W.T. face eventual shutdowns. Rio Tinto’s Diavik mine is scheduled to close in 2026, while De Beers’ Gahcho Kué mine is expected to operate until 2030.

Ekati’s long-term future remains uncertain. The mines are located hundreds of kilometres northeast of Yellowknife and are accessible only by air or seasonal winter roads.

BY NORTHERN MINER STAFF

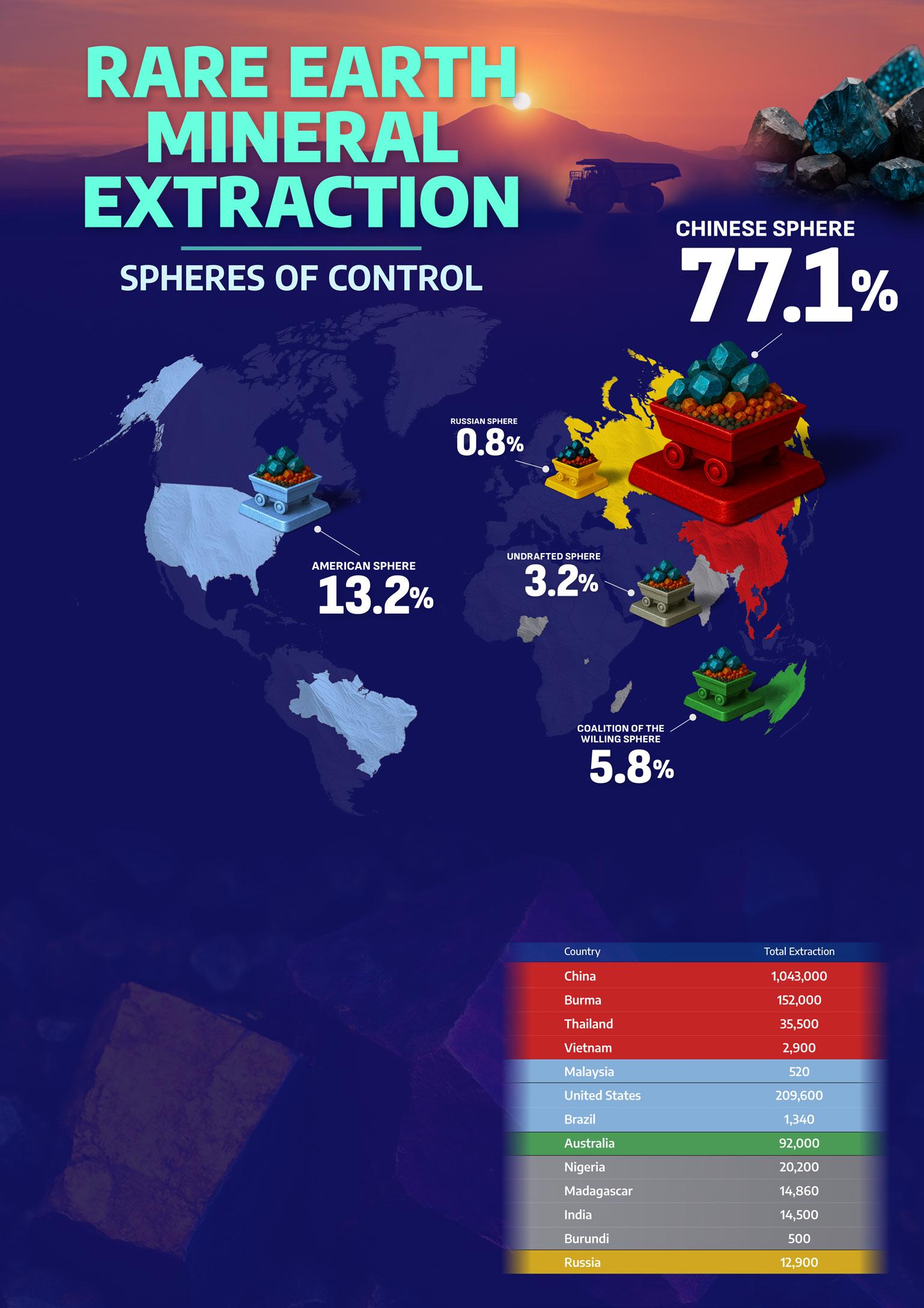

The second edition of our Rare Earths series breaks down global extraction at the mine level, country by country. It then regroups those nations into five geopolitical spheres of control: the American Sphere, Chinese Sphere, Russian Sphere, Coalition of the Willing, and the Undrafted.

While the first Installment showed the American Sphere holding 25% of global reserves and the Chinese Sphere 53%, this update shows a stark imbalance in actual output. The Chinese Sphere dominates mine-level extraction, generating a staggering 77% of the world’s rare earth production.

SHARE OF TOTAL GLOBAL RARE EARTH MINERAL EXTRACTION (2020 –2024 TOTAL | TONNES)

costs, squeezing margins and making project economics riskier.

“Speculative money isn’t flowing as easily as before,” he told The Northern Miner

Monetary anchor

A macroeconomic panel added global context for conference goers. It included Giustra, financial analysts Jim Rickards from Paradigm Press, Grant Williams, who publishes “Things that make you go Hmmm…”, and Nomi Prins of Prinsights Global. They discussed how the U.S. woes compare to changes in global trade and monetary systems.

Since the U.S. sanctioned Russia’s central bank in 2022, emerging markets have been increasingly motivated to reduce their dollar dependence, Williams said.

“All these countries who’ve been good actors within the dollar sphere for many years now see the dollar becoming less convenient,” he said.

Prins underlined the aggressive gold buying of central banks as evidence of waning dollar confidence. Central banks have added record amounts of gold to reserves in recent years, with China and some Middle Eastern countries standing out.

“Gold is now a new monetary anchor,” Prins said, “to backstop reserves as fiat currencies erode.”

Structurally challenged Central banks are expected to continue their gold accumulation, which Giustra called “covert buying.” He suggested China likely held 10 times the gold it officially reports.

Rickards challenged widely held views on central banks selling U.S. Treasuries. Rather than indicating a rejection of U.S. bonds, the sales are happening because they can bring in cash immediately amid global dollar shortages, he said.

But the panelists all agreed that the U.S. faces deep structural challenges.

America could lower its debtto-GDP ratio, Rickards argued, as it did after World War II when fiscal discipline, infrastructure investments and expanding energy pro-

BY HENRY LAZENBY IN BOCA RATON, FLA.

The Rule Symposium on Natural Resource Investing last month in Boca Raton, Fla., provided an opportunity to measure the industry pulse. Executives from various resource companies visited The Northern Miner’s video booth and shared insights about their projects and strategies.

Vizsla Silver (TSX, NYSE: VZLA), led by CEO Michael Konnert, showcased its Panuco silver project in Sinaloa, Mexico. After consolidating the district and drilling 400,000 metres, Vizla found the world’s largest undeveloped highgrade silver resource.

The project’s 2023 preliminary economic assessment outlined strong economics, including a net present value of $1.5 billion (C$2 billion) and an internal rate of return exceeding 100%.

“For a silver project that’ll be producing 20 million oz. silver per annum, those economics are just

duction all contributed to drive growth. Giustra is skeptical that the feat can be repeated in 2025.

“Where are you going to put all these treasuries?” he asked. He suggested that requiring investors to purchase government debt might become necessary.

As a hedge against turmoil, the panelists unanimously favour the yellow metal.

“Gold is your hedge against all human stupidity,” Giustra quipped.

Danielle DiMartino Booth, CEO of QI Research and a former adviser to Federal Reserve Bank of Dallas President Richard Fisher, echoed these sentiments. Gold is a protection against broader social and economic unrest as national unity is put under increased stress when states such as Florida and Texas openly consider economic sovereignty, she said.

As inflation cuts into buying power, fiscal gaps will widen and alliances will shift and change, DiMartino Booth said. Because of this, tangible assets like gold and key minerals will be safer for investors.

Despite gold’s allure, mining-related investments are anything but risk-free.

A “looming maturity wall” of debt among resource companies could trigger defaults, Grosskopf warned. This risk, combined with rising interest rates from America’s fiscal problems, means inves-

incredible,” Konnert told the Miner Vizsla just finished a $100-million financing. This will help the company ramp up silver production by 2027, the executive mentioned. McEwen’s (NYSE, TSX: MUX) expansion of the Fox Complex

tors need clearer paths to cash flow, robust project economics and manageable debt levels.

Despite these cautions, some opportunities remain highly attractive. Successful contrarian investors must carefully choose well-managed companies with proven assets, disciplined management and strategic minerals central to the energy transition, Rule said.

Giustra echoed this focus on strategic commodities, noting gold’s re-monetization and growing importance to central banks. Gold’s reclassification on July 1 as a Basel III Tier One asset makes it essential for global financial stability.

Now more than ever, quality matters, Grosskopf stressed.

“The market is differentiating between quality and speculative projects,” he said.

Rule’s symposium highlighted a critical reality for mining investors: the rewards are significant, but risks have never been higher. As debt burdens climb and inflationary pressures persist, successful mining investments will require discipline, rigorous analysis and a willingness to act when others hesitate.

Rule put it this way: “When other people panic, you’ve got to pounce.” TNM

in Ontario will lower costs, chief owner Robert McEwen said. He labeled it a significant step in the company’s growth.

“We’re producing gold, which is money, and we’ll produce copper, which is a critical mineral that sup-

ports the modern world,” McEwen said.

Another project — Los Azules in San Juan, Argentina, which is being developed by the company’s 46%owned McEwen Copper unit, is one of the largest undeveloped cop-

in

is expected soon.

BY CECILIA JAMASMIE

Mali’s military government seized over $117 million worth of gold from Barrick Mining’s (TSX: ABX; NYSE: B) Loulo-Gounkoto mine in July, days after junta leader Colonel Assimi Goïta signed a law allowing himself to stay in power indefinitely.

State helicopters landed unannounced at the site and removed roughly 35,000 oz. of gold or slightly over one tonne. It’s the latest escalation in bitter dispute between the Canadian mining giant and Mali’s ruling junta, which has controlled the country since a 2021 coup.

Mining at the site near the border with Senegal, 400 km west of Mali’s capital, Bamako, has been sus-

pended since January. It was then that authorities initially seized three tonnes of gold and blocked export authorizations. In response, Barrick initiated international arbitration through the International Centre for Settlement of Investment Disputes (ICSID).

“I want to reaffirm Barrick’s commitment to Mali, even as we navigate extraordinary and unprecedented challenges,” CEO Mark Bristow said July 10. “While we continue to engage constructively with the government of Mali, the ICSID process provides the legal certainty and international oversight necessary to resolve this dispute definitively.”

Loulo–Gounkoto accounted for 578,000 oz. or roughly 15% of Barrick’s total gold production in 2024. TNM

August 2022

March 2023

Preliminary audit findings air on national TV, criticize the mining sector but omit industry responses. Analysts say report was biased and flawed.

October 2023

The government launches a review of existing mining contracts, led by the same audit group,raising conflict-of-interest concerns. The 2023 code doesn’t legally apply to preexisting contracts, including Barrick’s. Barrick offers to transition to the new framework, if exemptions can preserve project viability. It submits several proposals, but the Renegotiation Committee refuses to engage.

October 2024

Junta say Barrick owes about $512 million in back taxes and dividends. The company pays $83 million and outlines a path to resolve disputes. Authorities release detained employees.

December 2024

Barrick initiates ICSID arbitration claiming violations of its legal rights.

February 17, 2025

To secure its employees’ release, Barrick signs a memorandum of agreement, is to pay $438 million. The government doesn’t countersign and escalates tensions by asking a local court to place the mine under provisional administration

June 16, 2025

The Bamako Tribunal of Commerce appoints Soumana Makadji as provisional administrator for at least six months. He indicates plans to resume gold exports and restart operations.

Mali’s Minister of Economy and Finance orders an audit of the mining sector. Inventus Mining, run by former Barrick staff, and Mazars Senegal, run the audit through 2022 and 2023.

08/23 August 2023

Mali adopts a new mining code without consulting the industry, despite repeated calls for inclusive dialogue.

Late 2023–2024

Barrick makes successive concessions during talks, while Mali increases demands. In parallel, authorities launch investigations and detain local Barrick staff.

November 2024

Four more employees are arrested and remain in detention. Authorities also issue arrest warrant for Barrick’s CEO.

Nov. 14, 2024: Mali blocks gold export authorizations, halting Barrick’s shipments.

January 2025

Authorities seize over three tonnes of gold. Barrick suspends Loulo-Gounkoto operations. Negotiations briefly resume later in the month, but the Renegotiation Committee backtracks

May 29, 2025

The company asks the arbitration tribunal of the World Bank to intervene in the local legal proceedings

July 2025

06/25

Arbitration hearing on provisional measures is scheduled for late July.

July 7, 2025: Local appeal heard regarding the employees’ detention, months late.

July 10, 2025: Government helicopters land unannounced at Loulo-Gounkoto, seizing over a tonne of gold, likely for sale by the provisional administrator.

July 16, 2025: Malian court denies Barrick appeal to release detainees.

‘Almost no surveillance’ of Eagle leach pad

YUKON | Receiver sets Aug 6 for bids

BY BLAIR MCBRIDE

Victoria Gold wasn’t paying enough attention to the Eagle mine heap leach pad before its catastrophic landslide in Yukon last year, an accident investigator says.

The carelessness was a major contributor, Mark E. Smith, a member of the Independent Review Board (IRB) and a geotechnical engineer, said at a news conference on July 8 in Whitehorse.

“[Eagle] had almost no surveillance,” he said. “We think the bar should be vastly higher than this site. But honestly, the practice in the industry isn’t high enough. We need better surveillance of these facilities across the board.”

Smith spoke less than one week after the IRB released its final report into the causes of the heap leach accident on June 24 last year. The board concluded that a precise combination of factors also including poor drainage of the heap leach pad, fine-grained ore and too much pressure and weight caused the heap to collapse.

Sale process

Now receiver PricewaterhouseCoopers has set an Aug. 6 deadline to accept initial bids to buy Eagle mine with the goal of selecting a winner by the end of the year.

Whether a formal public inquiry is held into the accident may depend on the government reviewing the board’s report, a territory official said.

Asked whether the lack of surveillance of the heap leach pad was a cost-cutting measure, Smith responded that it could have been, though he didn’t assign any blame.

“How can we connect the dots between that and the failure?” he asked. “I don’t have any real insight into anybody’s motive here, but it’s unquestionable that some things could have been done better.”

So far, the territory has authorized PricewaterhouseCoopers for $220 million in spending on the site while the expense of proper procedures ahead of time would have been negligible, the investigator said.

“The cost burden that’s now been put on the Yukon taxpayers for the Eagle failure would fund all of our recommendations on every mining project that will ever be proposed in the Yukon,”

“Some things could have been done better.”

MARK E. SMITH, ENGINEER, INDEPENDENT REVIEW BOARD

MEMBER

Smith said. “Cost wise, it’s nothing in comparison.”

The landslide released millions of tonnes of ore and at least 280,000 cubic metres of cyanide-containing solution beyond containment. Victoria Gold was put into receivership last August and clean-up of the site has been ongoing since then.

Heap leach failures are statistically rare if all safety measures are carefully followed, Smith said. Still, he noted that the Eagle accident was among two last year out of six failures in heap leaching’s 45-year history that were the most catastrophic. The other accident last year was at SSR Mining’s (TSX, Nasdaq: SSRM; ASX: SSR) Çöpler gold mine in Turkey, where nine people died in the landslide.

“[SSR’s] survey data showed they were on the path to failure about four days before the failure, probably too late stop [it], but not too late to take protective actions against the people that ultimately died,” Smith said.

There was potentially a twomonth window to stop the accident at Eagle if deformation of the slope due to increased irrigation with solution in April 2024 was noticed sooner.

“I would like to think that would raise a red flag, and somebody would’ve looked deeper,” he said. “If they had seen that data and then turned those sprinklers off, it may have stopped the failure completely.”

The board wasn’t asked to attach costs to its recommendations and recommending a public inquiry based on its conclusions wasn’t part of its mission, Smith said.

“Nobody asked us to opine on that,” he said. “It depends on the purpose of the inquiry. If it’s to place blame for financial liability, then that falls into the civil litigation. If it’s to create a more robust mining industry, that’s our recommendations.” TNM

ALASKA | Insider sales fuel concern

Northern Dynasty Minerals (TSX: NDM; NYSE-A: NAK) lost more than $900 million in market value over two days in July as insider selling stoked concern that efforts to reverse a veto on the company’s Pebble mining project in Alaska might be stalling.

Chairman Robert Dickinson and Vice-President of Engineering Stephen Hodgson were among a group of company insiders that disclosed stock sales during the week of July 14. That knocked the company’s shares down 29% in Toronto trading to $2.23 apiece on July 17. Earlier, they posted their largest intraday drop since 2020.

The stock lost an additional 38% to $1.39 each the following day after Northern Dynasty said it had filed a motion in Alaska’s federal district court seeking a summary judgment briefing schedule with respect to its pending litigation over the Environmental Protection Agency (EPA) veto of Pebble during the Biden Administration.

Northern Dynasty ended the week with a market capitalization of just under $750 million. A mere two days earlier, the company was worth $1.69 billion.

“While discussions with the EPA have taken place, we have not reached a settlement,” CEO Ron Thiessen said in a statement issued July 17. “As such, today we asked the court to set a briefing schedule for summary judgment motions, as we now believe that will be the quickest, most direct avenue to get the veto removed.” Vancouver-based Northern Dynasty has been looking to develop its Pebble project, touted as one of the world’s largest copper-gold-molybdenum resources, for more than two decades. However, the proposed mine has faced stern local opposition and undergone a protracted period of review due to its location within the Bristol Bay watershed, where some of the world’s largest sockeye salmon fisheries reside.

POTASH | Capital costs jump near 30%

BY COLIN MCCLELLAND

BHP (ASX, NYSE LSE: BHP) says first production from its showcase Jansen stage one potash project in Saskatchewan will be delayed by at least six months to mid-2027, with capital costs climbing as much as 30% to $7.4 billion (C$10.1 billion).

The world’s largest listed miner had originally planned to begin output at the project by the end of 2026. BHP attributed the $1.3–$1.7 billion increase in costs to changes in design and scope, inflationary pressure and construction productivity falling short of expectations.

“Given potential for additional potash supply coming to the market in the medium term, and as part of our regular review of the sequencing of capital projects under the capital allocation framework, we are considering a twoyear extension for the execution of Jansen stage two,” BHP said July 18 in a statement.

“While discussions with the EPA have taken place, we have not reached a settlement.”

RON

THIESSEN, CEO, NORTHERN DYNASTY

Wetlands threat

In January 2023, the EPA used its Clean Water Act authority to block the company’s Alaskan subsidiary from storing mine waste in the area, a move that essentially killed the project. In its argument, the EPA said the mine would destroy more than 8 sq. km of wetlands.

If built, the Pebble mine would be the largest copper, gold and molybdenum extraction site in North America. A 2023 economic study estimated that it would produce 6.4 billion lb. of copper, 7.4 million oz. of gold and 300 million lb. of molybdenum, plus 37 million oz. of silver and 200,000 kg of rhenium, over 20 years.

Northern Dynasty filed two separate actions in federal courts in March 2025 in a bid to overturn the EPA’s decision. Two Alaska native villages also sued the EPA in June for the potential impacts its decision could have on the local economy.

Earlier last month, Northern Dynasty said it had begun talks with the EPA on potentially settling the ongoing litigation, a move that it believes presents “the fastest path forward” to withdraw the Pebble project veto. It also confirmed that the EPA has “asked for additional information to assist in finalizing that decision.”

Northern Dynasty says it will keep working with the relevant government agencies to resolve the issue.

“We are confident that the court will agree with our assessment that the issuance of the veto by the Biden administration was unlawful,” Thiessen said in the July 17 statement. TNM

into the fertilizer sector. The company accelerated its potash development after Russia’s invasion of Ukraine, betting on sustained higher prices amid sanctions on Russian and Belarusian producers.

Record copper

The setbacks come despite strong overall operational results, with BHP reporting record copper production of 2.02 million tonnes for fiscal 2025, at the top end of guidance. However, the company forecast output would fall to between 1.8 million and 2 million tonnes in next year due to declining ore grades at its primary Escondida mine in Chile.

Fourth-quarter production of iron ore, copper and metallurgical coal production matched BMO Capital Markets estimates.

Although BHP approved a $4.9-billion investment in Jansen stage two in October 2023, it has spent just $400 million of that to date. The second stage had been expected to begin production by mid-2029.

The cost overruns mark a major setback for BHP’s push to diversify

BHP’s Jansen potash project in Saskatchewan. BHP

“However, this is overshadowed by surprising timing/capex slips at Jansen,” mining analyst Alexander Pearce wrote in a note on the day of the announce-

ment. “Further, stage two could be delayed by two years — likely good for potash prices, but could pressure overall project capex.” Shares in BHP closed 3% higher in Sydney on the results at A$40.29 apiece and were at A$40.46 near press time. That valued the company at more than A$205 billion (US$134 billion).

The miner also posted record iron ore production of 290 million tonnes for the year, with 77.5 million tonnes in the fourth quarter alone, topping analyst expectations. In a separate update, BHP said it is reviewing options for its Western Australia nickel operations, including a potential divestment. The miner cited the business’s impact on the group’s balance sheet as it continues to assess long-term portfolio fit. TNM

ECUADOR | 2028 start a 3-year advance

BY CECILIA JAMASMIE

SolGold (LSE, TSX: SOLG) is fast-tracking the development of its primary Cascabel copper-gold project in northern Ecuador. First production is now expected in 2028, three to four years ahead of its original schedule.

The company adopted a streamlined approach of open-pit and underground development, aiming to cut time to production. SolGold will begin with open-pit mining at Tandayama-America (TAM) in January 2028, then underground extraction at Alpala by year-end. The processing plant and on-site tailings facility are also scheduled for completion by that time.

CEO Dan Vujcic, who took over earlier this year, said the accelerated plan aligns with projected copper supply shortages driven by the global shift to electrification.

“We are now in execution mode,” Vujcic said. “We have a plan that prioritizes momentum, risk management, and early returns.”

Shares in SolGold gained 5.5% to close at 7.28 pence apiece in

London on July 17, the day of the announcement, before advancing to 7.42 pence near press time for a market capitalization of £223 million (C$397 million).

Despite the momentum, SolGold continues to face financial challenges. Ongoing losses and negative cash flow weigh on its valuation, although recent governance reforms and targeted investments suggest a path to recovery.

The board has formally approved a revised Cascabel plan that includes early-stage site works, an accelerated drilling campaign, and the creation of two subsidiaries to manage SolGold’s exploration assets. One unit will oversee Cascabel and surrounding northern tenements, while the other will manage the southern portfolio, which includes the Porvenir project and sits in the same district as Lundin Gold’s (TSX: LUG; US-OTC: LUGDF) Fruta del Norte and Ecuacorriente’s Mirador mines.

Early work at Alpala is expected to enable underground access by the end of 2027, several months

ahead of the original plan. The construction timeline for the concentrator has been trimmed from 24 months to 18–21 months through modular construction and early procurement of long-lead items.

Cascabel has long been seen as a strong copper-gold asset, attracting investments from majors like BHP (NYSE, LSE, ASX: BHP) and Newmont (TSX: NGT; NYSE: NEM).

Among largest SolGold, founded in Australia and headquartered in London, says the scale of the project could position it among South America’s 20 largest copper-gold mines.

A February 2024 prefeasibility study outlines a 28-year mine with average annual ouput of 123,000 tonnes of copper, 277,000 oz. of gold, and 794,000 oz. of silver. Peak copper output is projected to reach 216,000 tonnes per year.

SolGold is also pursuing strategic changes, including its recent delisting from the Toronto Stock Exchange and a potential secondary listing on the Australian Securities Exchange. TNM

BY HENRY LAZENBY

Tudor Gold (TSXV: TUD) is taking Seabridge Gold (TSX: SEA; NYSE: SA) and British Columbia’s Chief Gold Commissioner (CGC) to court over contested tunnels at its Treaty Creek project.

The Mitchell Treaty Tunnels (MTT) are a critical part of Seabridge’s KSM project, adjacent to Treaty Creek, in northwestern B.C. KSM has a net present value (NPV) of $7.9 billion (C$10.8 billion). The MTT are to feature two parallel tunnels that pass under 17 km of terrain for the tailings management facility access road.

Tudor says the tunnels impact its exploration plans, which include recent applications for underground work in the high-grade Supercell Cell One Zone at Treaty Creek, which is still at the pre-preliminary assessment stage.

Tudor’s notice of appeal case, filed with the B.C. Supreme Court, seeks to overturn the CGC’s September decision that dismissed Tudor’s application to rescind a ‘conditional mineral reserve.’ This reserve prioritizes Seabridge’s right to build, operate and maintain the MTT without interference from Tudor.

‘Competing claim’ Tudor argues that the commissioner’s Licence of Occupation for the MTT creates a competing mineral claim, threatening Tudor’s rights on the Treaty Creek property.

But Seabridge counters that, stating it has no interest in the minerals beneath Tudor’s claims.

Tudor’s appeal is merely an attempt to force the CGC to reconsider jurisdiction, Seabridge CEO Rudi Fronk said in a statement, “and potentially cancel the reserve designation. We are confident that the judge will dismiss Tudor’s appeal.”

Heavyweight deposits

Seabridge’s KSM is one of the largest shovel-ready copper-gold projects in the world.

It has proven and probable reserves of 2.3 billion tonnes grading 0.64 gram gold, 0.14% copper, 2.2 grams silver and 76 parts per million

molybdenum in the Mitchell, East Mitchell and Sulphurets deposits. Contained metal comes to 47.3 million oz. gold, 7.3 billion lb. copper, 160 million oz. silver and 385 million lb. molybdenum.

Tudor’s Treaty Creek is also recognized as one of the largest undeveloped gold-copper discoveries. It has an indicated resource including both the open pit and underground deposits, of 730.2 million tonnes grading 0.92 gram gold per tonne 0.18% copper and 5.48 grams silver per tonne, or 1.19 grams gold-equivalent, for 21.7 million oz. gold, 2.9 billion lb. copper and 128.8 million oz. silver, or 27.9 million oz. gold-equivalent. TNM

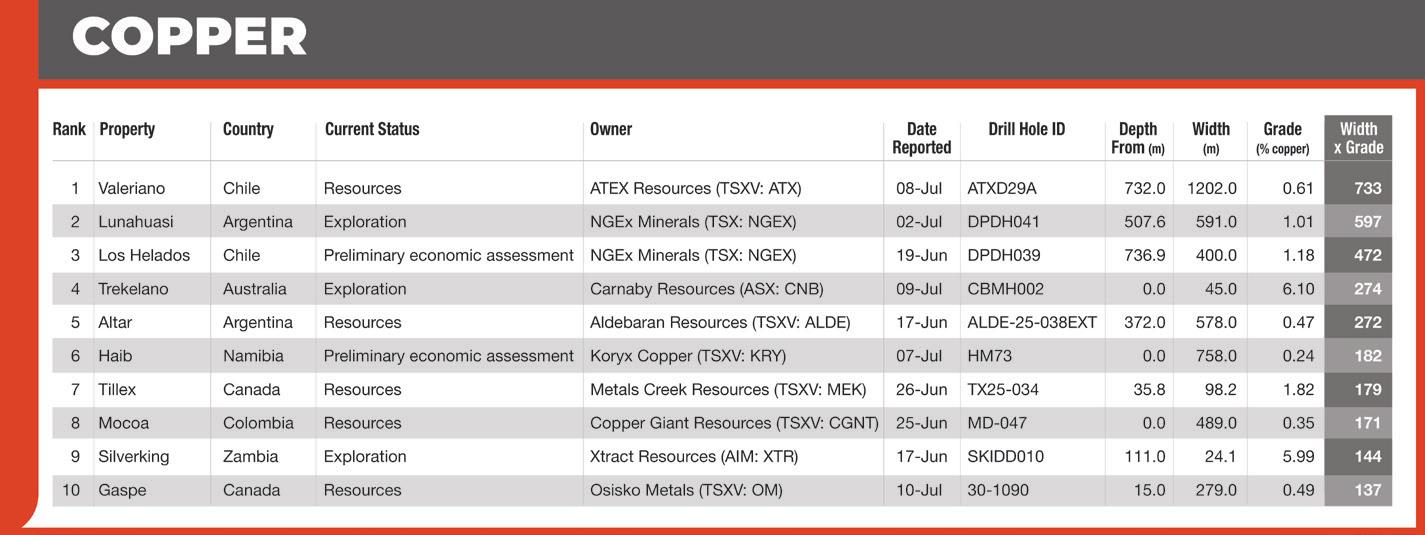

COPPER | Mine revival planned

BY FRÉDÉRIC TOMESCO

Osisko Metals (TSX: OM)

hinted new drill results could expand the deposit at its flagship Gaspé polymetallic project in Quebec after reporting drill results as high as 108 metres grading 0.84% copper and 3.35 grams silver per tonne.

That intercept, from 417 metres depth in hole 30-1090, also included 11.9 metres at 0.84% copper and 7.79 grams silver from 433 metres downhole, Osisko said July 10. Another highlight hole, 30-1081, cut 301.8 metres averaging 0.41% copper and 3.36 grams silver from 94 metres downhole.

“Today’s results show consistency of mineralization across both infill and expansion areas,” National Bank Financial mining analyst Rabi Nizami said in a note. “We anticipate the pace of exploration and news flow to accelerate during the summer months ahead, with nine rigs now actively upgrading and expanding mineralization well past the 2024 resource.”

The results, among eight holes, are part of a fully funded 110,000metre drill program that Osisko is carrying out at Gaspé. The company is working to expand the resource with a view to potentially reopen-

ing the former Noranda mine in Murdochville, about 825 km northeast of Montreal. It’s targeting permits and construction by the early 2030s, with initial capital spending estimated at about $1.8 billion.

Unconstrained resource

Gaspé hosts 824 million indicated tonnes grading 0.27% copper, 0.015% molybdenum and 1.74 grams silver for contained metal of 2.23 million tonnes of copper, 124,000 tonnes of molybdenum and 46 million oz. of silver, according to a resource released in November.

The inferred resource is estimated at 670 million tonnes grading 0.3% copper, 0.02% molyb-

ONTARIO | 18+M tonnes of metal

New initial resources for Canada Nickel’s (TSXV: CNC; US-OTC: CNIKF) deposits add almost 275 million measured and indicated tonnes to the company’s portfolio, with the Texmont deposit boasting grades higher than all its other targets in northern Ontario’s Timmins region.

Mann Central hosts 236.7 million indicated tonnes grading 0.22% nickel for 520,000 million tonnes of contained nickel, and 543.2 million inferred tonnes at 0.21% nickel for 1.15 million tonnes of metal, the company reported on July 15. Mann Central is located 23 km east of the company’s main Crawford project and 40 km northeast of Timmins.

Texmont holds 37.9 million measured and indicated tonnes grading 0.29% nickel for 109,000 tonnes of contained metal; and 57.7 million inferred tonnes at 0.25% nickel for 143,900 contained tonnes. Texmont is 36 km south of Timmins.

“The addition of these two new resources brings published mineral resources for Canada Nickel’s six Timmins area properties to 9.2 million tonnes of contained nickel metal in the measured and indicated categories, and 9.5 million tonnes of contained nickel metal as inferred resources,” Cantor Fitzgerald analyst Matt O’Keefe said in a note giving Canada Nickel a buy rating. “The expanding base underscores the largescale potential of the developing Timmins Nickel District.”

denum and 1.37 grams silver for contained metal of 1.99 million tonnes of copper, 133,000 tonnes of molybdenum and 29.5 million oz. of silver.

The project’s resource, “which is already among the largest in North America, remains unconstrained and is likely to be upgraded to measured and indicated and also expanded further” in next year’s first quarter, analyst Nizami said.

The new results “continue to confirm the large-scale potential of mineralization at Gaspé Copper,” CEO Robert Wares said in a statement. He touted “the excellent prospects for increasing the size of the known deposit towards the south.” TNM

New = old

The contained nickel discoveries in the new resources are now comparable to the total amount of Sudbury’s historical nickel endowment, Canada Nickel CEO Mark Selby told The Northern Miner by phone. The Sudbury nickel district contained around 19 million tonnes of nickel before about half was mined in the 20th century, according to a 2010 report from the USGS.

“What’s happening here in Timmins...is really the only new source of nickel that’s been discovered of any scale. This is the kind of a scale that a BHP (NYSE,

LSE, ASX: BHP) or a Rio Tinto (ASX, LSE: RIO) would ultimately want to own,” Selby said.

Canada Nickel plans to complete another three resources for its deposits by the end of the year, bringing the total to nine resources, Selby said.

Shares fall

Despite the new resources, Canada Nickel’s share price fell 1.1% to 85¢ apiece on July 15 in Toronto and were at that price as of press time, for a market capitalization of $183 million. The stock has traded in a 12-month range of 73¢ to $1.22. Selby attributed the drop to nickel being currently “out of favour.”

“That’s the overhang on the story right now,” he said. “[But] nickel will come back in favour. It’s a critical mineral.”

The new reports follow several months of milestones for Canada Nickel, including an initial resource for Mann West in June and the provincial government’s recognition of Crawford as a strategic critical mineral project. Last October, the company filed its federal impact statement for Crawford, a key step in obtaining federal permits for the project, which hosts the world’s second largest nickel reserves.

At an 8% discount rate, Crawford has an after-tax net present value of $2.6 billion (C$3.56 billion) and an internal rate of return of 18%, according to the feasibility study released in October 2023. The mine, consisting of two open pits, has an estimated capital cost of $3.5 billion. Over a 41-year life, the mine is projected to produce 3.5 billion lb. of nickel, 52.9 million lb. of cobalt, 490,000 oz. of palladium and platinum, 58 million tonnes of iron and 6.2 million lb. of chromium.

Geological footprint

Though the deposits aren’t as large as Crawford, Mann Central’s geophysical footprint at 3.1 sq. km is almost double the size of Crawford’s 1.6-sq.-km footprint. The Mann Central resource was based on 12,563 metres of drilling across 32 drill holes. Texmont was based on 44,528 metres from 144 drill holes. TNM

UTAH | Shares doubled this year

BY HENRY LAZENBY

Salt Lake City, Utah — “Sometimes you have your cake and eat it too,” Hugh Agro said as he drove site tour members up a Utah canyon toward Revival Gold’s (TSXV: RVG, US-OTC: RVLGF) heap-leach project.

Agro was referring to Revival’s dual strategy of pushing the 1.4-million-oz. Mercur gold project swiftly into production while simultaneously maintaining the advanced 6-million-oz. BeartrackArnett project in Idaho as an exploration ace up his sleeve.

A mining engineer who previously held executive roles at Kinross Gold (TSX: K; NYSE: KGC) and Deutsche Bank, Agro joined Revival in 2017 as CEO, determined to capitalize on both near-term production and longterm exploration upside.

“The Australians understand it,” Agro explained, referring to the build-and-drill approach common among Australian miners and a recent financing led by Australiabased EMR Capital. Early in July, Revival banked $15 million (C$20.4 million), at C50¢ per share, giving EMR a 6.25% stake in the company.

“They’ve invested with a toehold stake and explicit intent that the next financing rounds will support construction financing,” Agro said.

Studies planned

Revival plans to complete its pre-feasibility study and full feasibility study through 2026, secure all state permits by mid-2027, and then make its construction decision.

While Beartrack-Arnett holds a larger and more advanced resource, Mercur is closer to production because of its simpler open-pit, heap-leach design, its history as a past-producing mine and its location on patented land with infrastructure about 60 km by paved road from Salt Lake City. Mercur would be developed as an open-pit, heap-leach operation, according to a preliminary eco-

nomic assessment (PEA) issued in March.

The project has a $295-million after-tax net present value at a gold price of $2,175 per oz., producing about 95,600 oz. gold annually over 10 years. All-in sustaining costs are pegged at $1,363 per ounce.

The PEA followed a $3.7-million private placement led by Dundee (TSX: DC-A).

Revival shares have almost doubled since the start of the year, adding about C5¢ in July to C54¢ near press time for a market capitalization of about C$113 million.

In contrast, Beartrack-Arnett’s scale and sulphide component

require more complex engineering, permitting and capital investment, pushing its development timeline further out.

Carlin revival Companies such as Liberty Gold (TSX: LGD), Integra Resources (TSXV: ITR) and Perpetua Resources (TSX, Nasdaq: PPTA) are developing oxide heap-leach and sulphide deposits in the northwestern part of the Carlin Trend. Beartrack-Arnett offers longer-term scale and exploration upside to push the company towards eventual mid-tier status, Agro said.

Mercur holds the distinction of being the first Carlin-type gold deposit identified in the western United States, placing it within a region known for major mineral systems, Agro said. The Oquirrh Range hosts the famous Bingham Canyon copper-molybdenum-gold mine, the world’s largest manmade excavation, and also includes the former Barney’s Canyon gold mine and historic lead-zinc-silver areas at Ophir and Stockton.

Layered cake

Mercur’s geology is defined by alternating beds of host rock and cap rock, according to chief geologist Dan Pace.

“Think of it as a layered cake,” he explained as he excitedly jumped from one drill core box to the next to show off assays. “We’ve got these

broad horizontal layers of sedimentary rock. Every deposit needs a conduit for mineralization, a trap and a permeable medium. Here, the permeable unit is called the Mercur member, nicely mineralized and already demonstrated to contain high grades.”

Pace is optimistic that more of those high-grade pockets remain intact, since finding them would do wonders to lift the project’s economics.

Mercur’s 18,000-tonne-per-day heap-leach carries a pre-production price tag of $208 million for a 10-year mine life with average gold recovery pegged conservatively at 75%, based on Revival’s recent metallurgical testing that achieved recoveries up to 84%. The project has a strip ratio of 2.8:1.

Rince & repeat

Company director Wayne Hubert, former CEO of Andean Resources from 2006 to 2010 when it was acquired by Goldcorp for $3.5 billion, also joined the tour. Hubert had been instrumental in pulling together Mercur’s fragmented land packages, a complex effort taking nearly 12 years.

“We eventually realized Barrick Mining (TSX: ABX; NYSE: B) left perhaps a million ounces untouched here,” Hubert told the Miner. “South Mercur alone had 300,000 oz. gold more than initially thought.” TNM

BY MINING.COM STAFF

Blue Lagoon Resources (CSE: BLLG; US-OTC: BLAGF) reopened the Dome Mountain mine in British Columbia last month, more than 30 years after the last major exploration activity at the gold-silver property.

Last February, Blue Lagoon received its mining and effluent/discharge permits from the B.C. government, making it one of only nine companies to receive such approvals in the province since 2015.

The mine, 50 minutes east of Smithers in northwestern B.C., is to produce first gold in September after blasting starts a month earlier, according to Blue Lagoon.

Once the water treatment plant is fully operational, the company is targeting production of about 150 tonnes per day, totaling 55,000 tonnes annually, with an expected recovery of around 15,000 oz. of gold in the first year.

Boudler Vein

The company expects to reach full capacity before the end of the year. Mining will begin at the main Boulder Vein above the 1,290-metre level using a mechanized cut-andfill method.

Ore is to be brought to the surface and stored before being trucked to Nicola Mining’s (TSXV: NIM; US-OTC: HUSIF) mill in

Merritt under a toll milling agreement. Waste rock will remain underground. The project benefits from year-round road access and a newly commissioned water treatment plant.

Blue Lagoon remains debt-free, with the coming ramp-up funded in part through a recently closed financing of nearly $5 million (US$3.66 million). The company also has $3.6 million in the money warrants and access to an unsecured credit line from Nicola Mining.

Community engagement

Local support has been central to Dome Mountain’s revival. Four

of the 10 current site workers are members of the Lake Babine First Nation, on whose traditional territory the project is located.

As part of its agreement with the Indigenous community, the company plans to provide scholarships to train Indigenous youth for underground mining roles.

“It’s a great opportunity to learn underground for the First Nations,” Brenda Patrick, a Lake Babine Nation employee at the site, said in an interview. “There’s a great opportunity to teach our young people what underground is so we can all work together as one.”

The mine plan spans five years, focused solely on the permitted Boulder Vein area.

Blue Lagoon plans to pursue additional permits to mine deeper zones below the 1,290-metre level and expand into the nearby Argillite Vein. This next stage could significantly increase production depending on exploration results.

The mine’s existing infrastructure and regulatory progress position it well for staged growth.

The property has substantial “blue sky” potential, with 15 highgrade quartz carbonate veins identified and 90% of the 210-sq.-km

site still unexplored, chief geologist Bill Cronk said.

Legacy project revived Gold mineralization on the property dates back to the late 1800s, and considerable surface and underground work had already been completed by 1924.

Renewed exploration in the 1980s led to Noranda’s discovery of the Boulder Vein system in 1985. Underground mining occurred briefly in the early 1990s under a joint venture between Timmins Nickel and Habsburg Resources.

When operations ceased in May 1993, the mine had produced about 43,900 tonnes of ore grading 0.35 oz. (9.9 grams) gold per tonne.

The most recent project owner, Gavin Mines, held the property for 12 years, completing much of the infrastructure and underground development. More than $80 million has been spent on the project by previous owners, including Gavin Mines, Timmins Nickel, and Noranda.

Blue Lagoon acquired the project in 2020 and has focused on drilling and developing the Boulder Vein system.

Company shares traded for 66¢ apiece before press time in Toronto, for a market capitalization of $92.91 million. Blue Lagoon stock has traded in a 12-month range of 9¢ to 87¢. TNM

BY FRÉDÉRIC TOMESCO

AngloGold Ashanti (JSE: ANG; NYSE: AU) agreed to buy Canadian explorer Augusta Gold (TSX: G; US-OTC: AUGG) for about $152 million (US$111 million) in cash to further expand its Nevada footprint. Augusta shares surged.

The $1.70-a-share price represents a premium of about 28% over the closing price of Augusta Gold’s common stock on the Toronto Stock Exchange on the eve of the announcement, the companies said July 16 in separate statements. When compared with the volume-weighted average share price over the 20 days before the announcement of the transaction, the premium is 37%.

“This transaction is indicative of AngloGold’s camp-scale ambitions in the Beatty district of Nevada,” BMO Capital Markets mining analyst Raj Ray said in a note.

The proposed deal marks another step in AngloGold Ashanti’s efforts to consolidate assets in and around the prolific Beatty mining district, about 300 km northwest of Las Vegas. It follows the US$370-million ($509-million) acquisition of Corvus Gold and the US$150-million purchase of a Coeur Mining (NYSE: CDE) land package – both of which were announced in 2022.

Reward, Bullfrog Augusta’s key assets — Reward, a permitted, feasibility stage project, and the Bullfrog deposit — are adjacent to AngloGold Ashanti’s claims in the Beatty district.

“This acquisition reinforces the value we see in one of North America’s most prolific gold districts,” AngloGold Ashanti CEO Alberto Calderon said in the release.

“Securing these properties will not only solidify our leading position in the most import-

ant new gold district in the U.S., but will also improve our ability to develop the region under an integrated plan – with more flexibility, greater access, better infrastructure sharing, and cohesive engagement with all stakeholders.”

Synergies

AngloGold Ashanti’s Nevada projects include Arthur, which has an inferred resource of 12.91 million ounces, according to a 2024 reinterpretation of an earlier geological model. Engineering and study work, which includes a drilling program, is ongoing at Arthur.

North Bullfrog, another nearby project, is expected to produce an average of 76,000 oz. gold annually over the mine’s anticipated 11 years. Federal and Nevada permitting processes are under way, and a Record of Decision from the Bureau of Land Management is anticipated by the end of 2026.

Adding Augusta “gives the company some synergies with its North Bullfrog project and potential flexibility for future infra-

EQUITY | Post-tax proceeds near $3B

BY JACKSON CHEN

Newmont (NYSE, ASX: NEM; TSX: NGT) says it has netted around $470 million from selling equity stakes in Greatland Resources (ASX: GGP) and Discovery Silver (TSX: DSV) as part of ongoing efforts to generate cash for its core mining business.

In February 2024, the world’s largest gold miner announced plans to divest certain non-core assets, including six mines across Canada, Australia and Ghana, to improve its cash position and optimize its portfolio by focusing on “higher-quality, tier one assets.”

The monetization of Greatland and Discovery shares further streamlines Newmont’s equity portfolio, while generating cash

for the business, the Denver-based company said July 16.

Newmont received the shares through its divestment of the Telfer operation (along with a 70% stake in the Havieron project) in Australia to Greatland Gold and the Porcupine operation in Ontario to Discovery Silver. Following the asset sales, Newmont held about 20% of Greatland Gold and 15% of Discovery Silver.

Greatland Resources, an Australia incorporated parent, was created last month in a corporate restructuring that saw Greatland Gold stockholders exchange their shares for shares in Resources in a U.K. scheme of arrangement. Greatland Gold is a subsidiary, but the stock listing resides with Greatland Resources.

BY BLAIR MCBRIDE

Excellon Resources’ (TSXV: EXN) shares jumped to their highest level in two years on July 11 amid the company’s preparations to restart production next year at the Mallay silver-lead-zinc mine in Peru.

The miner’s $1.56-million (C$2.1million) acquisition of Mallay and the nearby Tres Cerros gold-silver exploration target from private entity Adar Mining closed June 24. Both projects are located just west of Oyón, about 220 km north of the capital Lima.

“Excellon appears to have captured lightning in a bottle,” Red Cloud Securities analyst Ron Stewart said in a note. “The potential upside provided by the mine combined with the discovery potential at Tres Cerros outweighs the execution and exploration risks associated with both Mallay and Tres Cerros.”

structural

Stock surge

at BMO said.

AngloGold Ashanti’s offer “represents a clearly superior path forward for stockholders,” Augusta Gold executive chairman Richard Warke said in the company’s statement.

Augusta shares in Toronto soared 25% to $1.66 apiece — the highest level since January 2023 — and stayed there near press time, giving the company a market value of about $143 million. AngloGold Ashanti rose 0.2% in New York to US$47.54 and were at US$50.48 each near press time, valuing the company at US$25.4 billion.

Reward has proven and probable mineral reserves of about 15.1 million tonnes grading 0.86 gram per tonne gold for 370,000 oz. contained metal. All required permits are in place to start construction. Augusta’s plan envisions an eightyear mine life with average annual production of 38,563 ounces

Excellon first announced the acquisition in November. In May, it confirmed an upsized $8-million equity financing as well as an off-take agreement, along with a $10-million loan facility with Glencore (LSE: GLEN).

Shares of Toronto-based Excellon gained more than 12% to 38¢ apiece on July 11, before settling at 35¢ before press time, for a market capitalization of $84.44 million. Shares rose 39% since the deal closed in June. Its stock has traded in a 12-month range of 8¢ to 39¢.

The deal involved the purchase of all Premier Silver’s shares in Peruvian miner Minera CRC, whose Mallay and Tres Cerros operations are located in central Peru’s prolific Miocene metallogenic belt. It also included Excellon issuing C$400,000 in shares to Premier and Excellon gaining a 1% net smelter return royalty and a 5-8% zinc and lead metals stream.

Red Cloud has initiated coverage of Excellon and given its stock

In its disclosure, Newmont said it sold about half of the Greatland Gold shares last month, realizing a 230% gain relative to their value from September, when the Telfer-Havieron asset sales were announced. It now holds approximately 9.9% of the Australian miner.

The Discovery Silver shares were sold in two tranches, one in May and one in June, for a combined 200% return from January 2025, when the Porcupine transaction was announced. Newmont is no longer a shareholder in Discovery.

$3B cash

Newmont now expects to generate $3 billion in after-tax proceeds this year from its divestiture program to support capital allocation priorities.

a buy rating with a target price of 52¢, Stewart said.

Mallay is fully permitted and was operated by Compañía de Minas Buenaventura from 2012 to 2018. It produced 6 million oz. silver, 45 million lb. zinc and 35 million lb. lead, Excellon said.

The site includes a 600-tonnesper-day flotation plant, underground development, tailings facilities and grid power access. Capital investment exceeds $115 million (C$157.35 million).

Excellon plans to rehabilitate the underground workings, conduct technical studies and do near-mine drilling towards supporting a mine restart decision in the next three to six months.

Red Cloud models a seven-year life for Mallay, producing 6.9 million silver oz. and 69,000 tonnes of base metals at an average all-in sustaining cost of $20.81 per oz. silverequivalent, Stewart said.

Mallay hosts proven and probable resources of 133 million tonnes grading 203 grams silver per tonne, 3.68% lead and 6.75% zinc, according to a JORC-compliant (Australian-rule) report from 2018. Its measured and indicated resource totals 6.7 million tonnes at 229 grams silver, 2.23% lead and 3.42% zinc and 251.8 million inferred tonnes grading 208 grams silver, 4.02% lead and 4.9% zinc.

The company plans to release an NI 43-101-compliant (Canadianrule) resource update for Mallay later this year.

Tres Cerros sits on a 20-sq.-km property adjacent to Mallay, comprising a 2.5 km-by-500metre corridor of high-sulphidation gold-silver mineralization. Sampling has returned results averaging 1.6 grams gold and 196 grams silver, with 86% of the 113 results grading higher than 1 gram gold-equivalent per tonne. Initial drilling at Tres Cerros is targeted for next year’s second quarter. TNM

The miner remains on track to deliver on its 2025 guidance, while continuing to generate strong free cash flow from its “world-class portfolio” of high-quality, long-life

Based on its U.S.-listed shares, Newmont

BY CECILIA JAMASMIE

Royal Gold (Nasdaq: RGLD) is acquiring Canadian streaming and royalty firms Sandstorm Gold (TSX: SSL; NYSE: SAND) and Horizon Copper (TSXV: HCU) in deals worth a combined $3.7 billion (C$5.04 billion).

The Colorado-based company is to pay about $3.5 billion for Sandstorm in an all-stock transaction and $196 million in cash for Horizon.

The acquisitions add 40 producing assets to Royal Gold’s portfolio, expected to deliver 65,000 to 80,000 gold-equivalent oz. this year. Based on current forecasts, this would boost the company’s 2025 production by roughly 26%.