> TOP 40 MINERS RAKED IN $176 BILLION IN 2024

> IAMGOLD: A rising star

CANADA’S CRITICAL ADVANTAGE: A NATURAL RESOURCES SUPERPOWER

PEOPLE OF THE ROCK

At SMS Equipment, we’re more than machines from trusted brands like Komatsu. Whether you’re greenfield, brownfield or operational, we’re the people beside you—today and every day—bringing industry-leading technology and expertise to your job site.

Because the right partnership makes everything possible.

MINING IN CANADA

16 Game on: Ford’s Bill 5 becomes law in Ontario. TOP 40

17 Gold-fueled growth: Top 40 miners raked in $176 billion in 2024.

28 IAMGOLD: A rising star.

32 B2GOLD in Nunavut: Canada’s newest mining friendly territory.

35 How Alamos Gold is building the next Canadian mining giant: Q&A with CEO John A. McCluskey.

38 Canada’s critical advantage: A natural resources superpower.

BATTERY MINERALS

41 Canada makes mark on global lithium stage with two top projects.

TECHNOLOGY AND SUPPLIERS: CONVEYORS, SUSTAINABILITY, MINING TIRES, AND AUTOMATION

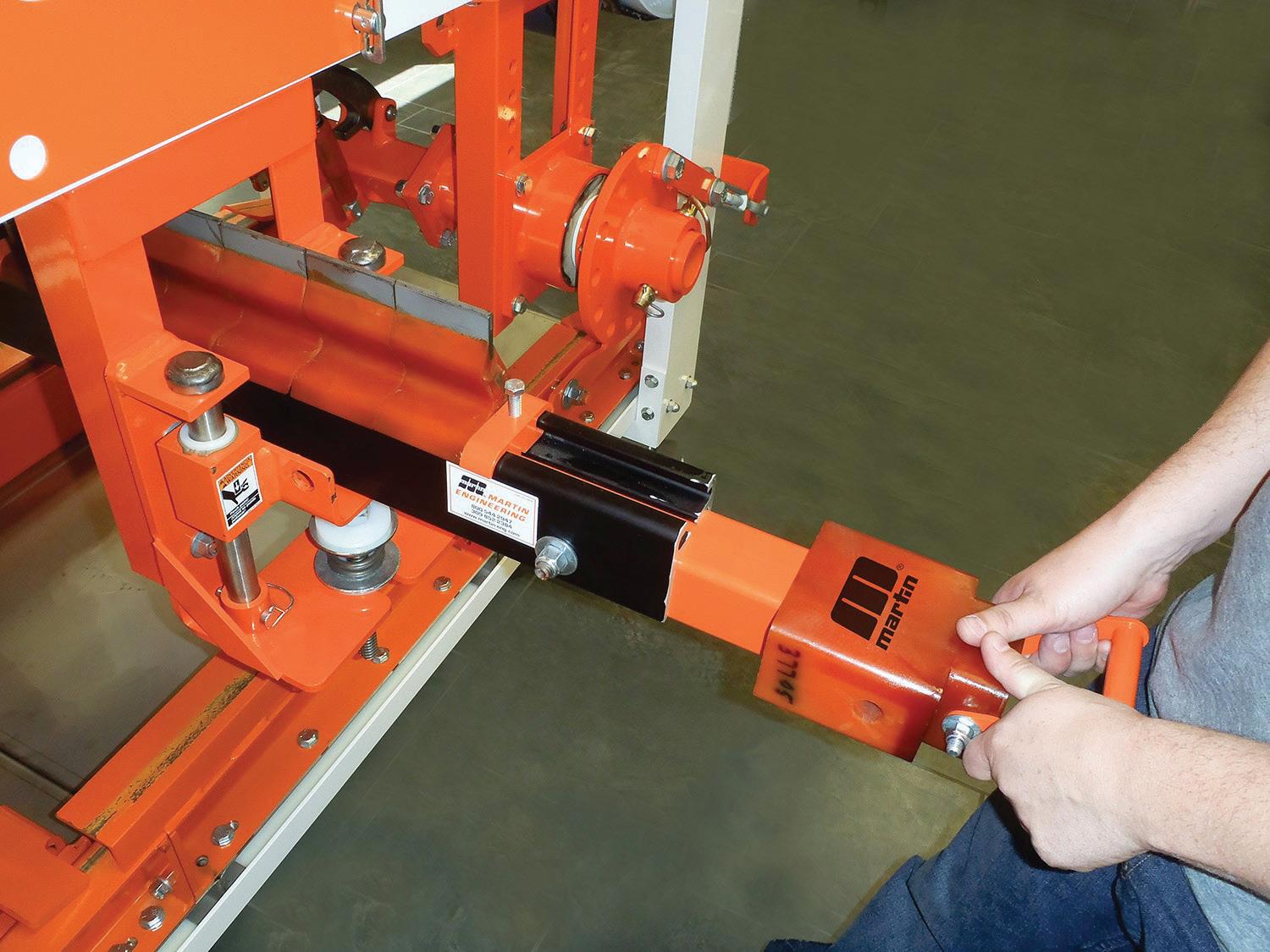

43 Conveyor safety and the return on prevention.

47 From idle to ideal: Cutting fleet emissions and risks with smart vehicle technology.

49 Sustainable solutions for end-of-life mining tires.

51 Improving measurement of clays and other parameters in process flows using online automation.

53 Mining a sustainable future: Strategies, equipment, and technology to help foster sustainable yet profitable mining.

MINING EDUCATION, TRAINING, AND WORKFORCE

55 What have you done today that did not involve a mineral? Part 4: Minerals have rights.

HISTORY OF MINING

57 People of the Rock: Inuit miners at Rankin nickel mine.

4 EDITORIAL | Top 40 mining firms show resilience amid global uncertainty.

6 FAST NEWS | Updates from across the mining ecosystem.

10 ANNOUNCEMENTS | Introducing the Technology & Suppliers Showcase: Your industry, your spotlight

12 LAW AND BUSINESS | Why the rush? What is driving the surge in 2024–2025 mining megadeals.

45 MIN(E)D YOUR BUSINESS | Deep sea mining takes the international stage. 38

Tamer Elbokl, PhD

anada’s top 40 mining companies by revenue remained strong in 2024, hold‑ ing their ground through a year of market volatility and shifting global de‑ mand. The ranking reflects the continued dominance of gold producers, supported by high prices and investor appetite for safe‑haven assets. Base metal and di‑ versified miners also performed well, aided by long-term strategies and stable global positioning. The list offers more than just financial insights — it highlights key trends shaping the sector, including consolidation, critical mineral development, and a changing regulatory landscape. As Canada works to expand its role in global supply chains, the performance of these top firms signals the mining industry’s central role in driving the national economy forward. A detailed analysis of the Top 40 companies’ revenue data, financial metrics, and a brief sector outlook can be found on pages 17 to 27 of this August 2025 edition.

Moreover, so far in 2025, the M&A deal that is expected to impact next year’s ranking is the Equinox Gold – Calibre Mining merger that was officially completed on June 17, 2025, finalizing the previously announced US$2.5 billion all‑share business com‑ bination. The deal, which received shareholder approval in early May 2025, creates an Americas-focused gold producer with flagship Canadian operations at Greenstone (Ontario) and Valentine (Newfoundland and Labrador), and positions the combined company to produce approximately one million oz. of gold annually, with upside potential reaching 1.2 million oz.

Earlier in July, the federal government announced a renewed focus on cutting unnecessary red tape, framing its planned review of all regulations as essential to unlocking Canada’s full economic potential. This objective is closely reflected in the passage of Bill C5 (the Building Canada Act), which introduces a streamlined “one project, one review” framework with legislated timelines for approvals. For Canada’s mining sector, this shift could accelerate the permitting process, reduce regulatory un‑ certainty, and improve investor confidence — particularly in advancing critical mineral projects central to the energy transition. However, the challenge lies in ensuring that faster approvals do not come at the expense of robust consultation, environmental protection, and long-term social licence. Add Ontario’s new Bill 5 to the mix, and as federal and provincial systems shift toward efficiency-focused review models, mining proponents will need to uphold strong standards of transparency and community engagement to meet regulatory expectations and maintain public trust.

This edition includes interviews with CEOs and senior executives from Top 40 companies, featured on pages 28 to 37, offering insight into recent developments and industry trends. It also contains articles on emerging mining technologies and practices, covering topics such as sustainability, recycling of mining tires, critical minerals, au‑ tomation, and more. Lastly, readers can enjoy a mining history feature by John Sandlos on page 57.

Looking ahead, the September 2025 edition will highlight notable gold projects across Canada and North America, along with innovative technologies aimed at improving efficiency and sustainability in gold mining. Editorial submissions may be sent to the Editor-in-Chief by Aug. 7, 2025.

AUGUST 2025 Vol. 146 – No. 5 69 Yonge St., Ste. 200, Toronto, ON M5E 1K3 Tel. (416) 510-6789 Fax (416) 510-5138

www.canadianminingjournal.com

Editor in Chief

Dr. Tamer Elbokl telbokl@canadianminingjournal.com

News Editor Joseph Quesnel jquesnel@canadianminingjournal.com

Production Manager

Jessica Jubb jjubb@northernminer.com

Manager of Product Distribution Allison Mein 416-510-6789 ext 3 amein@northernminergroup.com

Publisher & Sales

Robert Seagraves 416-510-6891 rseagraves@canadianminingjournal.com

Sales, Western Canada

George Agelopoulos 416-510-5104 gagelopoulos@northernminer.com

Toll Free Canada & U.S.A.: 1-888-502-3456 ext 2 or 43734

Circulation Toll Free Canada & U.S.A.: 1-888-502-3456 ext 3

President, The Northern Miner Group Anthony Vaccaro

Established 1882

Canadian Mining Journal provides articles and information of practical use to those who work in the technical, administrative and supervisory aspects of exploration, mining and processing in the Canadian mineral exploration and mining industry. Canadian Mining Journal (ISSN 0008-4492) is published nine times a year by The Northern Miner Group. TNM is located at 69 Yonge St., Ste. 200, Toronto, ON M5E 1K3. Phone (416) 510-6891.

Legal deposit: National Library, Ottawa. Printed in Canada. All rights reserved. The contents of this magazine are protected by copyright and may be used only for your personal non-commercial purposes. All other rights are reserved and commercial use is prohibited. To make use of any of this material you must first obtain the permission of the owner of the copyright. For further information please contact Robert Seagraves at 416-510-6891.

Subscriptions – Canada: $51.95 per year; $81.50 for two years. USA: US$64.95 per year. Foreign: US$77.95 per year. Single copies: Canada $10; USA and foreign: US$10. Canadian subscribers must add HST and Provincial tax where necessary. HST registration # 809744071RT001.

From time to time we make our subscription list available to select companies and organizations whose product or service may interest you. If you do not wish your contact information to be made available, please contact us via one of the following methods: Phone: 1-888-502-3456 ext 3; E-mail: amein@northernminergroup.com

Mail to: Allison Mein, 69 Yonge St., Ste. 200, Toronto, ON M5E 1K3 We acknowledge the financial support of the Government of Canada.

“ENERGY SAVINGS REPORTED IN THE RANGE OF 25% TO 60% ARE VERY ENCOURAGING AS THEY INDICATE THAT POTENTIALLY HALF OF THE ENERGY SPENT FOR VENTILATION COULD BE SAVED.”

— Vale Totten Mine

The Vigilante AQS™ accurately measures airflow and direction, wet and dry bulb temperature, gas concentration and air particulates – reducing downtime and enabling miners to return to the face sooner and safer.

Wildlands League – an urban environmentalist group – has documented that the number of mining claims registered in the Ring of Fire has skyrocketed, increasing by 66% since 2022 to over 40,000 today. The group says this is the highest number of mining claims in eight years. The group also contended that the area covered by claims has increased by 67% to cover about 850,091 ha in area. This is equivalent to be about 14 times the size of the City of Toronto or almost three times the size of the City of Greater Sudbury.

Ontario’s Ring of Fire region is one of the most promising mineral development opportunities for critical minerals in the province. It’s located about 500 km northeast of Thunder Bay and covers about 5,000 sq. km. The region has long-term potential to produce chromite, cobalt, nickel, copper, and plati‑ num. Critical minerals like these play a role in the future of low- and zero-emission vehicles and transportation. The Ring of Fire also represents significant potential for jobs, government revenues, and Indigenous partnerships. At present, the challenge is in roads infrastructure in the region and in con‑ sulting with First Nations.

Wildlands League believes this rush to claim lands is part and parcel of the current mineral claims policy as practiced in many jurisdictions, including in Ontario.

At present, Juno corp., a private company, holds the most claims in the Ring of Fire region with over 26,000 claims covering over 498,000 ha. Wyloo, also privately owned, is the second largest holder of claims in the Ring of Fire region.

NexGold Mining has received approval from the provincial cabinet and the Government of Nova Scotia has granted the Crown land lease and license for the Goldboro gold project.

The Crown land lease and license is an integral step towards the development of the project and will allow for the potential for infrastructure development on the lands for which it covers and gives the company the ability to build and operate an open pit mine, with the associated processing, tailings management and other associate infrastructure (waste rock storage, overburden storage, etc.). The lease covers an area of 779 ha, and the license covers an additional 97 ha of Crown land.

Kevin Bullock, president and CEO of NexGold, commented: “We are extremely pleased to be receiving our Crown land lease and licence for the Goldboro project and are very proud of the hard work and diligence required to achieve this. The lease includes a land package that covers both the deposit and critical infrastructure for mine development, allowing final permitting to progress. This is a significant project milestone, and a reflection of NexGold’s positive working relationship with the Government of Nova Scotia. We are also pleased that gold has been added to the strategic miner‑ als list by the province of Nova Scotia, indicating their support for the development of project’s like Goldboro in the province and how our project can be of benefit to Nova Scotians.”

The Ontario government is launching a new $500 million Critical Minerals Processing Fund to attract and support mineral capacity in Ontario.

Ontario finance minister Peter Bethlenfalvy made the announcement recently as part of the Ontario budget speech. He said: “As the government accelerates the development of critical minerals projects in Ontario, it is also working to attract historic investments to support critical mineral processing capacity here at home, to help ensure that minerals mined in Ontario will be processed in Ontario, by Ontario workers,”

At the budget announcement, Bethlenfalyy continued: “Through the fund, Ontario will provide strategic financial support for projects that will accelerate the province’s critical minerals processing capacity, offering a stable supply of critical minerals mined in Ontario, to be used in the province’s broader manufacturing base, while also capitalizing on growing global demand. The CMPF will capture greater economic value from the province’s mineral resources, by helping to ensure existing mineral processing facilities are fully utilized, as well as supporting the construction of new processing facilities in Ontario.”

He concluded: “Instead of being extracted only to be shipped to other jurisdictions for higher value-added processing, minerals mined in Ontario will be refined in Ontario. This will help create new opportunities for workers in Indigenous communities and Northern hubs such as Thunder Bay, Sault Ste. Marie, Sudbury, North Bay and Timmins. By enhancing Ontario’s processing capacity, the province can attract greater private capital investment and speed up key strategic projects across the critical minerals supply chain. A fully integrated supply chain will improve Ontario’s standing as a global leader in critical minerals, making the province a more attractive jurisdiction for investment, and a secure source of supply of critical minerals.”

With more than 80 years of magnetic expertise behind them, Eriez Suspended Electromagnets offer peace of mind, knowing your processes are protected against tramp metal. Eriez. Always the Right Choice. Protect your downstream

Building on its legacy of inno‑ vation in autonomous mining, Komatsu has accomplished a significant milestone of autonomously operating a power agnostic electric drive truck while connected to a dynamic trolley line.

Komatsu’s trolley assist system is a solution designed to help op‑ erations reduce carbon emissions, extend engine life and support the journey toward a zero-emissions future. By connecting haul trucks to an overhead power line during uphill travel, the system delivers electric power where it’s needed most, improving energy efficiency and enabling trucks to travel on grade faster when compared to standard diesel models. Integrating this with Komatsu’s FrontRunner autonomous haulage system introduces new capabilities in mining automation, enabling further fuel savings and productivity gains.

This achievement marks the first time in the mining industry’s history that power has been transferred to a moving, autonomously operated haul truck via a trolley system. The accom‑ plishment represents a critical step in Komatsu’s commitment to helping mining customers reduce emissions and enhance pro‑ ductivity through advanced electrification and autonomous.

Powermax Minerals (CSE: PMAX) announced the com‑ mencement of its phase 1 exploration work program at its Cameron rare earth el‑ ements (REE) property lo‑ cated in the Kamloops min‑ ing division in British Co‑ lumbia. The field team will mobilize to the property during the first week of May 2025.

The program will include prospecting, geological mapping, soil and rock sampling, and geophysical surveys, following recommendations outlined in the company’s NI 43-101 technical report on the property. These efforts are aimed at refining priority targets for potential future phases of exploration.

Highlights of the program include: Follow-up prospecting, mapping, and sampling in areas of elevated radioactivity and REE concentrations identified through historical and 2023 exploration activities; Ground geophysical surveying focused on three high-priority areas of interest (AOIs), designated T1, T2, and T3, characterized by strong magnetic responses and apparent conductivity within mafic granitic-gneissic rocks; Extension of geophysical surveys to delineate the full extent of the T1-T3 targets; Systematic prospecting and sampling across parallel radiometric anomalies and high-radioactivity zones identified in 2023 airborne surveys, particularly in the eastern and western portions of the property; and geological mapping and sam‑ pling across broad target areas in claims 1102761 and 1102755.

Turnkey Communications – one of Canada’s leading providers of telecommunications infrastructure and sys‑ tems integration – has selected NORCAT to ac‑ celerate the adoption and commercialization of advanced communications technologies across the global mining industry.

As part of NORCAT’s dynamic ecosystem, Turnkey will leverage its deep field experience to help mining companies and technology developers bring cutting‑edge solutions to life. With a track record of deploying complex communications systems in challenging environments, Turnkey brings valuable re‑ al-world insight that will help other companies scale and integrate their innovations effectively.

Terry Joseph, president and CEO of Turnkey Communications, said: “NORCAT has long been recognized as a catalyst for mining innovation, and we’re honoured to be part of that journey. We selected NORCAT because they offer a unique environment to help us, and the broader innovation community, close that gap. Their support, facilities, and global network of mining partners make them an ideal choice.”

Saskatchewan is Canada’s top region for mining investment thanks to its world-class resources, attractive incentives, and trusted geoscience data.

Built for those who build the industry: Welcome to the Technology & Suppliers Showcase — a newsletter created specifically for companies like yours: the manufacturers, service providers, and digital and AI innovators who keep the mining industry moving.

Why this newsletter?

Because the role of suppliers and equipment manufacturers in the mining sector has never been more critical — or more overlooked.

The mining industry is evolving rapidly — and behind every tonne of ore and ounce of gold are the suppliers, service providers, and contractors who make it all possible. From exploration technology and heavy equipment to environmental services and workforce solutions, the success of mining operations depends on a vast, interconnected network of expertise. That is why we are launching this newsletter.

In an industry where operational efficiency, safety, and sustainability are front and center, your products and services are what turn strategy into reality. Each edition of this newsletter will highlight some of the following topics:

• Product launches and technical innovations

• Profiles of companies and people making an impact

• Recent advances in mining digitalization and the applications of technology, machine learning (ML), and artificial intelligence (AI) in mining

• Tools and insights to help you grow your business

This newsletter will give mining suppliers a stronger voice and a dedicated platform — because you deserve more than a passing mention. Whether you build haul trucks, battery electric vehicles (BEVs), supply advanced sensors, or provide crit‑ ical maintenance services, this is your space to stay informed, stay visible, and stay ahead.

There is a growing need for a focused, reliable source of information about this dynamic segment of the mining economy. Too often, the contributions of suppliers and contractors get buried beneath headlines about commodities and production. We think it is time for a change. If you are part of this supply chain — or rely on it — this newsletter is for you.

Thanks for joining us. Let’s build something valuable together: Subscribe here: https://www3.canadianminingjournal.com/ newsletter-signup-technology-and-suppliers

CANADA’S LARGEST MANUFACTURER OF CUSTOM-DESIGNED WEAR SOLUTIONS

5 MANUFACTURING FACILITIES

COVERING OVER 180,000 SQ. FT.

220+ EMPLOYEES

20 COUNTRIES SERVICED

By Leanne C. Krawchuk, KC and Ivana Cescutti

The mining sector is undergoing a dramatic consolidation. From January 2024 to mid-2025, mining companies announced or closed 18 deals over $1 billion each, totalling approximately $47 billion. While mining M&A has always been cyclical, the past 18 months have marked a major shift in both the scale and frequency of large transactions. This boom surpasses the post-super-cycle peak of 2011-2012 and is on track to set a two-decade record. But unlike earlier deal activity driven by op‑ timism about rising commodity prices, this one is being fuelled by sharper pres‑ sures: geopolitical uncertainty, trade disputes, rising costs, supply gaps, strategic urgency, and the accelerating shift to‑ ward clean energy. Companies are not speculating — they are securing future output, cash flow, and critical materials in a world that is changing fast.

The following three major forces are pushing mining companies to buy rather than build:

1) The energy transition and copper’s critical role: The clean energy transition has made copper the most strategic metal of the decade. According to the International Energy Agency (IEA), the share of total demand for copper and rare earth elements (REEs) will rise significantly over the next two decades to over 40% in a projected scenario that

meets the Paris Agreement goals, driven by copper’s role in clean technologies like electric vehicles and storage, wind turbines, solar PV, electricity networks, and hydropower and bioenergy. But supply is lagging. In 2021, global copper inventories hit a 15-year low, causing prices to steadily rise ever since, hitting an all-time high of US$5.24 per pound, or US$11,552 per metric tonne, on March 26, 2025 — levels that supercharge profits for producers. Compounding the squeeze, the average timeline to open a new copper mine now exceeds 14 years. For many companies, that is simply too long to wait.

2) Rising project costs — but borrowing is relatively attractive: Major miners entered 2024 with record cash reserves. At the same time, falling interest rates reopened the debt market, allowing mining companies to borrow at rates below 5%. That matters because new mining projects are getting much more expensive. Recent brownfield projects in Latin America indicate a capital cost intensity of over US$23,000 per tonne of annual production, a sharp increase compared to historical averages. The result: This makes M&A a faster, less expensive, more certain and lowerrisk way to secure mineral resources than building new mines, and low-cost funding provides the sector with the capacity to do it.

3) Reshaping portfolios for the future: Miners are actively restructuring —

selling off older, carbon-intensive or non‑core assets and reinvesting in future‑facing materials. The result is a frenzied dash for tier-one assets and a parallel wave of divestments to pay for the shopping spree. This is partly about efficiency, but also a hedge against the depletion of high‑quality resources. Investors increasingly want exposure to clean-energy metals without a decade of development risk. Buying a producing asset offers instant and bankable cash flow and, in many cases, ESG alignment. According to EY, 76% of mining executives are making divestments, while 54% are also acquiring — fuelling deal flow on both sides.

GOLD: A SAFE HAVEN IN UNCERTAIN TIMES

Gold, a hedge against economic uncertainty and a proven cash generator, con‑ tinues to dominate global mining M&A activity, accounting for over US$26.54 billion across 62 deals in 2024 — 70% of global mining deal value. The driver is not just a lofty bullion price (averaging US$2,860/oz in Q1 2025), but gold’s unique value as a stable and reliable source of cash flow during times of volatility. Take these examples:

• Orla Mining/Newmont (March 2025): Orla’s US$850 million purchase of Newmont’s Musselwhite gold mine in Ontario vaulted it from single‑asset to mid‑tier producer overnight, unlocking immediate cash flow and accessing a skilled underground workforce. Newmont, in turn, freed up capital to focus on copper as part of its planned divestments to offload non-core assets and optimize its portfolio.

• Gold Fields/Gold Road Resources (announced May 2025): South Africa’s Gold Fields launched a US$2.39 billion acquisition of Australia’s Gold Road Resources, positioning it to eliminate inefficiencies and build critical consolidation in a booming sector.

Deals like this show that gold remains central to portfolio strength and resil ience, especially when interest rates and markets are unpredictable.

While gold may bring resilience and balance sheet strength, copper brings relevance and strategic leverage. Every part of the energy

on copper. Yet supply is increasingly con strained. Bloomberg NEF forecasts a 4.5 mil lion tonne global supply gap by 2027. This supply crunch is triggering intense compe tition for mining assets with the following:

• Low carbon intensity (renewable energy, high‑grade minerals).

• Brownfield expansion potential (less regulatory uncertainty).

This prompted a surge in copper mega deals in 2024:

• BHP & Lundin Mining JV (Vicuña) (Chile/ Argentina): US$3 billion to accelerate development of the cross-border Filo del Sol copper project.

• MMG/Cuprous Capital (Botswana): MMG’s US$1.9 billion acquisition of Cuprous, owner of the Khoemacau copper mine, having a 20 year life of mine in an emerging jurisdiction.

mpact cradles provide critical protection from the abuse of falling material within conveyor transfer points, significantly reducing damage and extending the life of the belt. Our idlers and rollers stabilize the belt while troughed low-friction bumpers eliminate hazardous pinch points and prevent potential sagging that releases dust and spillage. All to ensure superior support and system health across a wide range of belt sizes and speeds.

Lundin Mining/SCM Minera Lumina Copper Chile (Chile): Strategic stake increase by Lundin to 70% in the highlife Caserones copper mine.

Even BHP’s ultimately withdrawn US$49 billion bid for Anglo American illus trates the fierce appetite for copper assets.

Some of the largest mining transactions have been motivated by actual or pro posed strategic exits involving the sale of older or carbon intensive assets to fund critical mineral, future-facing investments: South32/Golden Energy and Resources/M Resources (Aug. 2024): US$1.65 billion divestiture of South32’s Illawarra Metallurgical Coal mine to fund its zinc expansion in Arizona.

Glencore/Teck Resources (July 2024): Glencore acquired 77% of Teck’s Elk Valley Resources steel making coal operations in July 2024 for US$6.93 billion, initially aiming to spin off its coal and carbon steel materials business. However, retention was eventually favoured by shareholders on the basis that it would enhance Glencore’s cash-generating capacity to fund opportunities in its transition metals portfolio (such as its copper growth project pipeline) and that steelmaking coal is expected to play a key role in supporting the infrastructure needed for the energy transition.

Latin America remains the epicentre of copper deal-making. S&P Global’s 2024 World Exploration Trends study shows Latin America again attracted the larg est share of global metals-exploration spending — US$3.38 billion, up 2% yearover-year — even when iron ore and

coal projects are left out. Copper remains the dominant driver of Latin American transactions, with the 2024 BHP & Lundin Mining JV deal in Chile and Argentina serving as the marquee example. But that budget is also resulting in other headline mining M&A leading to Latin America being responsible for 17% of global megadeal value:

• Coeur Mining/SilverCrest Metals (Mexico): Coeur’s C$2.3 billion cash-and-stock takeover of SilverCrest that folds the Las Chis pas low-cost silver-gold mine into Coeur’s portfolio with ex pected significant free cash flow.

• Equinox Gold/Calibre Mining merger (North America and Nicaragua): US$2.5 billion all-share transaction that forms an Americas-focused gold company expected to produce about one million ounces of gold per year.

Meanwhile, Africa is the fastest-rising arena. Supported by government roll-out of the African Green Minerals Strategy and national beneficiation mandates, the continent is quickly emerging as one of the prime targets for the development of new mines to meet the demand for copper, lithium, and other minerals. The 2023-2024 period saw a 32.4% increase in lith ium exploration allocations and a 23.6% increase in copper ex ploration allocations for the continent. Two African gold mine megadeals already added nearly US$3.5 billion to the 20242025 ledger:

• AngloGold Ashanti/Centamin (Egypt): US$2.5 billion cash-andshare acquisition that brings the flagship Sukari gold mine under AngloGold’s control, adding a tier 1 asset to its portfolio and increasing its annual gold production.

• Zijin Mining/Newmont (Ghana): US$1 billion purchase of Newmont’s open-pit Akyem gold mine operation by Zijin, expanding Zijin’s West African footprint in a country with favourable mining policies and convenient access to transportation infrastructure.

The bottom line is that while North America and Australia still log more billion-dollar closings, Latin America offers the deepest copper pipeline, while Africa delivers the fastest growth and fa vourable policy momentum, making both regions pivotal to the next wave of energy-transition mining M&A.

With mining project costs rising and approvals taking longer, greenfield projects are looking increasingly unappealing. S&P and EY both point to a future capital environment where financ ing is also harder to secure. And even where capital is available for new mine development, ESG requirements, regulatory hur dles, and stakeholder engagement processes introduce addi tional complexity, time, and unpredictability.

Acquiring existing mining assets, especially those already in production, offers a way around these risks — especially for pub lic mining companies that are under pressure to demonstrate near-term growth to their shareholders. As a result, M&A offers a faster, less risky and often more cost-effective and certain path to resource expansion.

Where outright acquisitions are not possible or practical, com

panies are teaming up through in-district partnerships. Joint ventures are the rising stars of the megadeal landscape. JV structures enable miners to share infrastructure, split costs, achieve operational efficiencies, access in-country expertise, and navigate tricky regulatory or political environments to gether. Examples include the following:

• BHP & Lundin Mining JV (Vicuña) (closed Jan. 2025): Two neigh bouring copper corridor projects in Chile/Argentina with shared in frastructure resulting in cost savings estimated at US$540 million.

• General Motors/Lithium Americas JV (Thacker Pass) (Dec. 2024): GM’s US$625 million investment in Nevada’s Thacker Pass secured it a future lithium supply and unlocked a US$2.26 billion government loan, lowering execution risk and strengthening the U.S. battery chain.

These structures are gaining traction as companies are look ing to get complex projects off the ground quickly and collab oratively, particularly in regions with underdeveloped infra structure.

Even amid tighter capital markets, significant funding continues — especially from mission-driven, long-horizon investors like sovereigns, export credit agencies, and multilateral institutions:

• A sharp increase in sustainability-linked loans, where interest rates are tied to emissions, water, or other ESG targets.

• EY flags capital availability as the top business risk for miners in 2025, often mitigated via ESG-linked financing structures.

• Sovereign and state-backed capital has been instrumental, co-in vesting in several major megadeals, reducing external debt needs and enabling bigger, riskier infrastructure linked transactions. This trend shows a broader shift — financial models are evolving to integrate climate and security objectives, leveraging public sector capital to support strategic mining developments.

The narrative behind 2024-2025’s mining megadeal wave is unmistakable: it is a catch-up cycle driven by visible supply gaps, capital surpluses, and a strategic imperative to secure fu ture-facing commodities now. Mining companies are racing to secure resources before they become scarcer, more expensive, or politically difficult to access. The options are clear: buy ti er-one assets now while financing costs are relatively attrac tive and balance sheets are strong or gamble on greenfield projects that may not deliver in time or on budget. Mining com panies are not hesitating. They are buying — and buying big.

Leanne C. Krawchuk, KC is a partner at Dentons Canada’s Edmonton office and the national leader of the corporate group, as well as a member of the firm’s national management committee. She is also a member of the Dentons Canada mining group advisory committee. Ivana Cescutti is a knowledge and legal operations lawyer at Dentons, specializing in supporting the firm’s Canadian corporate and mergers and acquisitions (M&A) groups.

Ontario’s truly “Big Beautiful” Bill 5, also called the “Pro tecting Ontario by Unleashing Our Economy Act 2025,” is now law. The government managed to pass the leg islation before the summer recess began on June 9. The bill em powers the government (among other things) to create special economic zones, which will eventually accelerate mining de velopment and create First Nations-led special economic zones such as for the Ring of Fire region north of Lake Superior.

However, environmental groups and some First Nations op posed Bill 5 despite changes by Premier Doug Ford who called it an opportunity of a lifetime. The new legislation aims to at tract investment and strengthen regional economies by acceler ating permitting and offering greater regulatory clarity — par ticularly for critical minerals like nickel, copper, and lithium.

Significant reduction of mining projects’ approval times

Permitting process for a new mine currently takes approx imately 15 years. The new bill aims to cut that time in half, speeding up development of critical mineral projects — start ing with those in the Ring of Fire.

The legislation establishes a single-window regulatory process across ministries, creating a streamlined pipeline to reduce re dundancy and simplify bureaucratic hurdles and timelines for approvals.

In response to mounting criticisms that previous processes were overly fragmented and insufficiently respectful of treaty rights and First Nations governance, explicit provisions in the bill require coordinated consultations with Indigenous com munities before proceeding. Embedding structured, prov ince-coordinated consultations can streamline engagement — but consistent and meaningful involvement remains critical.

With the U.S. imposing tariffs and sourcing critical miner als aggressively, Ontario views fast-tracked mineral approv als to protect the province and bolster North American supply chains, sending a firm message that the Ring of Fire’s resources will not slip away to global competitors.

The bill also includes stricter controls on foreign (notably Chi nese) investment in critical mineral projects, aiming to ensure that Ontario retains strategic oversight over resources.

www.b2gold.com

Founded in 2007, today, B2Gold has operating gold mines in Mali, Namibia and the Philippines, the Goose Project under construction in northern Canada, and numerous development and exploration projects in various countries including Mali, Colombia and Finland.

To be eligible for CMJ Canadian miners list, companies must meet two of the following three criteria:

1. Be domiciled in Canada.

2. Trade on a Canadian stock

3. Have a significant share of an operating mine or advanced development in

We have put extra effort into checking the eligibility of all the miners on the current list. However, we remain open to the suggestions of our readers. exchange. Canada.

THE 2024 RANKING OF THE TOP 40 CANADIAN MINING AND METALS COMPANIES BY TOTAL REVENUE (TABLE 1) REVEALS A DYNAMIC YEAR MARKED BY RECOVERY, GROWTH, AND SIGNIFICANT SHIFTS IN FINANCIAL PERFORMANCE ACROSS THE SECTOR. DESPITE GLOBAL ECONOMIC UNCERTAINTIES, GEOPOLITICAL INSTABILITY, AND ONGOING MARKET VOLATILITY, THE INDUSTRY POSTED SOLID FINANCIAL RESULTS.

TOP PERFORMER BY REVENUE: Nutrien retained its leading position with total revenues of $34.27 billion, although it experienced a 9.6% year-over-year (YoY) revenue decline and a 44.6% drop in net income, reflecting margin pressures.

STRONG TURNAROUNDS: Newmont and Barrick Gold posted substantial improvements in profitability. Newmont reversed a $3.3 billion loss in 2023 to achieve $4.63 billion in net income, driven by increased cash flow from operating activities (up 134%). Barrick Gold followed suit with a 60.5% increase in net income to $4.23 billion.

THE RISE OF THE MID-TIER PRODUCERS: Alamos Gold and several other mid tier producers demonstrated strong momentum in 2024, as reflected in the 2024 ranking compared to the 2023 ranking. Alamos climbed four positions to #17, driven by strategic growth initiatives and operational performance enhanced by the acquisition of Argonaut Gold and its largest asset: Magino gold mine.

REVENUE GROWTH LEADERS: IAMGOLD was the year’s top climber, rising ten spots, as it surged from #24 in 2023 to #14 position in 2024 ranking with a 68% revenue increase and an impressive 729% increase in net income. Other strong gainers include Alamos Gold (an increase of 33.6% in revenue) and Eldorado Gold (33.1% increase).

UNDERPERFORMERS: Companies like Teck Resources and SSR Mining experienced sharp earnings contractions. Teck’s net income fell by 87.7%, while SSR Mining’s net income sank deeper into the red, from –C$162 million to –C$483 million. It is worth noting that SSR Mining experienced the steepest decline, falling thirteen spots to #27, followed by Franco-Nevada, which slipped from #16 to #25.

The reasons for SSR Mining decline include a catastrophic mine collapse, operational shutdown, legal liabilities, and asset impairments. In February 2024, a serious heap-leach pad col lapse at SSR’s Çöpler gold mine in Türkiye halted operations. This triggered fatalities, environmental damage, regulatory shutdowns, and significant reputational and financial losses.

The Çöpler mine was one of SSR’s largest assets, and its loss sharply curtailed production volumes, revenue, and cash flow.

IN — THE COMPANIES THAT CLIMBED INTO THE 2024 LIST: The 2024 Top 40 list also welcomed three new entrants — Allied Gold, Asante Gold, and K92 Mining — reflecting evolving dynamics in the global mining sector and the emergence of new players in the gold space.

GONE WITH THE

As we expected in last year’s article, Victoria Gold (ranked #38 in 2023) fell out of the 2024 Top 40 ranking primarily because of the midyear heap-leach facility collapse at the Eagle Gold mine, which triggered several severe repercussions, including operational disruption and shutdowns that later led to receivership and financial distress, and increased cleanup and regulatory costs, which eventually resulted in sharp revenue decline and loss

of investor confidence. The catastrophic operational incident, compounded by ensuing legal, environmental, and financial consequences, forced Victoria Gold’s precipitous fall from the 2024 Top 40 revenue ranking.

Other notable departures include Argonaut Gold (#36 in 2023 ranking), Karora Resources (#39 in 2023 ranking), and SouthGobi Resources (#37 in 2023 ranking), while Orezone Gold dropped from #40 in 2023 to #43 in 2024 (officially de parting from the Top 40 but made the runners-up list). The first three companies dropped out of the 2024 Top 40 ranking be cause of a mix of operational and market-driven factors. Argo naut Gold faced significant setbacks, reporting a $333.8 million loss in Q1 2024, driven by impairments exceeding $340 mil lion on its Mexican and Magino assets. Despite initiating pro duction at Magino, revenues remained well below the Top 40 threshold. This led to the unplanned acquisition of Argonaut/ Magino by Alamos Gold during 2024.

Karora Resources delivered strong growth but was edged out as the ranking bar rose, not due to poor performance. Fi nally, SouthGobi was impacted by a downturn in coal prices, which limited revenue growth despite higher volumes and dis qualified it from the Top 40.

In mid-2024, Karora Resources completed a merger with West gold Resources, forming a newly combined Australian gold pro ducer. Under this arrangement, Karora shareholders became ap proximately 49.9% owners of the enlarged entity, while Westgold shareholders held about 50.1%. The merged company operates multiple gold mines under unified management in Western Aus tralia. Thus, while the standalone company “Karora Resources” no longer exists on its own corporate registry (has become inac tive), its core assets and operations continue to function actively as part of the combined Westgold–Karora group.

PROFITABILITY TRENDS: A notable number of companies returned to profitability or reduced losses, indicating improved operational efficiencies. B2Gold and First Quantum still posted net losses in 2024, though First Quantum’s narrowed considerably.

CASH FLOW STRENGTH: Newmont led in operating cash flow with $8.7 billion, reflecting stronger commodity prices and disciplined cost management. Barrick, Agnico Eagle, and Kinross also delivered robust operating cash flows, reinforcing their financial resilience.

Based on the 2024 Top 40 ranking by total revenue (Table 1), gold emerged as the leading primary output, driven by ele vated prices, its continued appeal as a safe haven asset, and strategic expansion by major producers. Copper maintained a significant presence, underpinned by its essential role in global electrification efforts, although profitability varied across com panies. Diversified miners contributed stability to the sector, while silver and uranium secured strong niche positions, sup ported by rising industrial and energy related demand. The dominant primary outputs were as follows:

Headquarters Ticker (TSX) Primary Output

Canada NTR Potash

U.S. NYSE : NEM Gold

Canada ABX Gold

Japan TSE : 5713 Diversified

Canada NYSE : AEM Gold

Canada TECK.B Diversified

Canada K Gold

Canada FM Copper

Canada LUN Copper

Canada PAAS Silver

Canada CCO Uranium

Canada HBM Diversified

Canada BTO Gold

Canada IMG Gold

Canada CS Copper

Canada EQX Gold

Canada AGI Gold

Canada ELD Gold

Canada OGC Gold

Canada WPM Gold/Royalty and Streaming

Canada CG Gold

Canada LUG Gold

Canada TXG Gold

Australia ASX : CIA Iron Ore

Canada FNV Gold/Royalty and Streaming

Canada FVI Silver

U.S. SSRM Gold

Canada NGD Gold

Canada CGG Gold

Canada AAUC Gold

Canada DPM Gold

Canada CXB Gold

Canada AG Silver

Canada ARIS Gold

Canada ERO Copper

Canada TKO Copper

Canada CNSX : ASE Gold

Canada WDO Gold

Canada III Copper

Canada KNT Gold

Gold was the primary output for 24 of the Top 40 companies in the 2024 ranking, underscoring its dominant position in the sector. This group includes major producers such as Newmont (ranked #2), Barrick (ranked #3), Agnico Eagle (ranked #5), and Kinross (ranked #7), reflecting the strong performance and scale of leading gold focused operations.

STRONG MARKET PRICES: Gold prices remained elevated through 2024 because of the persistent economic uncertainty, inflation hedging, and geopolitical tensions. As of December 31, 2023, the gold price closed at approximately US$2,071.80 per oz. By December 31, 2024, it had risen to about US$2,606.72 per oz. This represents a gain of US $534.92, or roughly an increase of 25.8% YoY.

SAFE-HAVEN DEMAND: Gold continues to attract investor interest as a hedge against macroeconomic instability and currency volatility.

INCREASED PRODUCTION AND EFFICIENCY: Many gold companies improved margins via cost optimization and production expansion.

M&A ACTIVITY AND PROJECT RAMP-UPS also boosted revenue (e.g., IAMGOLD’s surge reflects asset consolidation and operational improvements).

Copper producers in 2024 Top 40 include First Quantum (#8), Lundin Mining (#9), Capstone Copper (#15), Ero Copper (#35), and Taseko Mines (#36).

WHY COPPER RANKED HIGHLY ENERGY TRANSITION TAILWINDS: Demand for copper remained strong owing to its critical role in electric vehicles, power infrastructure, and renewable energy.

SUPPLY TIGHTNESS AND PRICE SUPPORT: Structural deficits in global copper supply supported pricing.

MIXED PROFITABILITY: Some copper firms (e.g., First Quantum) still reported losses because of local disruptions or cost pressures, but others like Capstone saw net income rebound.

Companies such as Sumitomo (#4), Teck Resources (#6), and Hudbay (#12) performed well because of their balanced com modity exposure (e.g., copper, zinc, coal, and gold) that helped buffer against individual commodity volatility. Teck, despite revenue gains, saw profit erosion because of the weaker coal/ zinc prices, higher costs, and the recent sale of its steel-mak ing coal business to the Swiss giant, Glencore. Teck Resources undertook a strategic exit from its steel-making coal business, completing the sale of its remaining 77% stake in Elk Valley Resources (EVR) to Glencore in July 2024 for approximately US$6.9 billion in cash. This transaction followed an earlier No

vember 2023 agreement in which Glencore acquired the majority stake at a US$9 billion valuation, with Nippon Steel and POSCO acquiring the remaining 23%. Teck spent much of 2024 restructuring and preparing to spin off its steel-making coal business. This reduced near‑term earnings contributions from a his‑ torically profitable segment and introduced transitional costs.

At IAMGOLD, we combine innovation and responsibility to build efficient, sustainable operations. By empowering people and partnering with communities, we’re shaping a stronger future together.

Notable silver producers among the Top 40 are Pan American Silver (#10), Fortuna (gold and silver; #26), and First Majestic (#33). As for uranium, Cameco ranked #11 (slight improvement from #12 in 2023 ranking) because of the strong revenue and cash flow growth driven by rising uranium prices and revived nuclear interest globally.

iamgold.com

The year 2024 was a pivotal year for mining M&A activity. The sec tor saw mega-mergers in gold, significant copper-focused deals, and strategic divestments by tier one producers. These moves re flect industry trends: commodity price strength, portfolio optimi zation, and targeted investments in future-facing metals. In 2024, several companies featured in the Top 40 ranking engaged in notable mergers and acquisitions, signaling strate gic moves that may also reshape future standings. Alamos Gold (#17) completed the acquisition of Argonaut Gold, expanding its reserve base by over 4 million oz. and increasing its annual pro duction guidance by 20%. The deal, driven by Argonaut’s under valued market position and geographic proximity of the assets, added significant value through the partially developed Magino project, which had already seen nearly $1 billion in capital in vestment. Agnico Eagle Mines (#5) continued its consolidation strategy with a $1.67 per share all-cash offer for O3 Mining, rep resenting a 58% premium and strengthening its position in Que bec and Ontario. In the copper space, Lundin Mining (#9) en tered a 50/50 joint venture with BHP to acquire the Filo del Sol copper-gold project in Argentina and Chile through Filo Corp, enhancing Lundin’s long-term growth pipeline in South Amer ica. These strategic acquisitions underscore a broader trend of consolidation among established producers, aiming to scale pro duction, secure high quality assets, and strengthen competitive positioning in an environment of elevated commodity prices.

The 2024 runners up list (see Table 2) includes companies ranked just outside the Top 40 based on total revenue, demonstrating strong performance and, in some cases, significant YoY growth. These five companies — Orla Mining, Dynacor Group, Orezone Gold, Santacruz Silver Mining, and Sierra Metals — represent emerging or recovering producers primarily focused on gold and diversified metals.

ORLA MINING saw the strongest growth among runners-up, more than doubling operating cash flow and reversing a prior-year loss. Its advancement positions it as a likely candidate for the Top 40 in 2025.

Note: Operating cash flow (OCF) margin measures how efficiently a company converts its revenue into cash from operating activities. It indicates the proportion of a company’s revenue that is turned into actual cash — a critical indicator of operational efficiency and cash-generating ability. It is calculated by dividing operating cash flow by total revenue. It helps investors understand if profits are backed by cash, as it is more reliable than net income alone (which can include non-cash items). A typical OCF margin for the mining industry is between 15% and 30%.

DYNACOR GROUP demonstrated steady growth in both revenue and profitability, maintaining its rank while improving operational efficiency.

OREZONE GOLD reported YoY increases in both revenue and net income; however, a decline in operating cash flow may suggest elevated costs or the impact of one-time expenditures. Its modest drop in ranking from #40 to #43 highlights the increased competitiveness among top‑ tier performers.

SANTACRUZ SILVER MINING made a remarkable financial turnaround, posting the highest net income among the group. Its diversified output and improved margins signal renewed strength.

SIERRA METALS returned to profitability with strong cash generation, highlighting successful operational recovery. In conclusion, the 2024 runners-up exhibited strong financial momentum, with all five companies improving revenues and four returning to or strengthening profitability. Orla Mining and Santacruz

Silver Mining stand out for their sharp earnings reversals, while Sierra Metals and Dynacor Group delivered consistent growth. Again, this cohort reflects the growing depth and competitiveness of mid-tier mining firms, several of which are well-positioned to break into the Top 40 in the coming year.

In 2024, Canada’s oilsands showed overall revenue stability with modest growth among the top producers, but a notice‑ able dip in net profitability (see Table 3):

• Cenovus Energy, Imperial Oil, and Suncor Energy led in total revenue, each generating over $50 billion.

• Despite revenue growth, all major players saw declines in net income, pointing to possible cost pressures or margin compression.

• Baytex Energy and Athabasca Oil made strong financial turnarounds, moving from losses in 2023 to solid profits in 2024.

• Revenue rankings remained unchanged,

Alamos Gold, a leading Canadian-based gold producer, is targeting to achieve one million oz of annual gold production in the long term. This success stems from developing quality assets that fuel our growth while achieving strong free cash flow generation at our low-cost, long-life operations.

signaling a steady competitive land‑ scape, but margin volatility may indi‑ cate shifting operational dynamics.

• These results reflect an industry navigating stable output and pricing but grappling with cost headwinds and efficiency challenges.

Tables 4 to 7 evaluate the financial performance of the Top 40 Canadian min‑ ers from four complementary angles: net profit margin, net income growth, operating cash flow (OCF) margin, and revenue growth. Notably, the data underscores a divide between companies thriving through efficiency, strategic growth, and robust cash generation — and those struggling with losses, operational disruptions, or declining rev‑ enues. Several mid-tier gold producers emerged as top financial performers in 2024, while former heavyweights like SSR Mining and First Quantum faced major setbacks.

TABLE 4: NET PROFIT MARGIN RANKING

This table ranks companies by net profit margin (net income as a percentage of revenue), offering insight into bottom-line profitability. High-margin companies were typically royalty/streaming firms or efficiently run mid-tier producers. The bottom-tier margins were dragged down by restructuring impairments, cost over runs, or operational incidents.

TOP PERFORMERS: IAMGOLD (52%), FrancoNevada (50%), Wheaton Precious Metals (41%), and Dundee Precious Metals (39%) led the pack, demonstrating strong cost control and profitability. Barrick and Agnico Eagle also ranked high with margins above 20%, despite their much larger revenue bases.

LOW AND NEGATIVE MARGINS: Companies such as First Majestic Silver (–18%), Allied Gold (–16%), and B2Gold (–33%) posted significant losses, pulling overall margins into negative territory.

TABLE 5: RANKING BY ANNUAL NET INCOME GROWTH (% CHANGE FROM 2023)

This table measures YoY percentage change in net income, indicating improve ment or deterioration in financial perfor mance. The most dramatic gains stemmed from companies rebounding from 2023 losses, while those with large declines faced asset-specific or strategic challenges.

HIGHEST INCREASES: Wesdome Gold Mines (+2,290%) and Equinox Gold (+1,092%) led the group, followed closely by IAMGOLD (+729%) and Fortuna (+430%),

all rebounding from previous losses or modest gains. Newmont (+239%) and Franco-Nevada (+220%) reversed large prior-year losses, showcasing major turnarounds.

SHARP DECLINES: B2Gold (–1,630%) and SSR Mining (–198%) suffered the steepest declines, along with Ero Copper (–173%) and Teck Resources (–88%), often because of restructuring, cost spikes for new projects, or operational disruptions.

This table assesses how efficiently companies convert reve nue into cash, a key indicator of operational strength. A typical healthy OCF margin for mining companies ranges from 15% to 30%; most top 20 companies exceeded that threshold, while underperformers face cash flow sustainability concerns.

TOP CASH GENERATORS: Wheaton Precious Metals (80%) and Franco-Nevada (75%) far exceeded the industry norm, reflecting their royalty-based, capital-light business models. Strong OCF margins were also posted by Agnico Eagle (48%), Kinross (48%), Lundin Gold (56%), and Alamos (49%) — indicating high operating leverage and cost control.

LOW MARGINS: SSR Mining (4%) and Asante Gold (13%) were at the lower end, signaling weaker operational efficiency or highcost restructuring.

The last table ranks companies based on their YoY revenue growth, revealing expansion or contraction in top-line perfor mance. Growth leaders either started from a smaller base or ex panded operationally, while revenue shrinkage was concentrated among companies dealing with structural or market headwinds.

Newcomers Asante Gold (+109%) and K92 Mining (+78%), as well as IAMGOLD (+68%) and Wesdome (+68%) drove growth through new production ramps or acquisitions. Newmont (+61%) and Teck Resources (+40%) saw meaningful growth owing to volume increases and commodity price recoveries.

REVENUE DECLINERS: First Quantum Minerals (–24%), SSR Mining (–29%), and Nutrien (–10%) reported significant revenue declines because of either commodity pricing, asset disruptions, or strategic divestitures.

Finally, the 2024 Top 40 financials highlight an industry recali brating amid shifting market dynamics. While some producers grappled with cost inflation and declining margins, others cap italized on favourable commodity cycles and operational dis cipline. With gold producers showing broad strength and sev eral turnaround stories emerging, the mining sector appears positioned for cautious optimism for the year 2025.

> We recognize that revenues are an imperfect way of looking at companies, as they discount the value of near-term expansions and development projects. Since the cut-off for our Top 40 can be close, we have also included a runnersup table to highlight other Canadian companies that are generating strong revenues.

> Please see also the criteria for our Top 40 eligibility, which is unchanged from past years.

> Differences in reported revenue figures between this year and last are attributable to different exchange rates used to convert U.S. dollar figures for each year and to some companies having restated prior years’ revenue. Financial results are also impacted by commodity prices and exchange rates.

> All figures in the tables are expressed in thousands of Canadian dollars.

> If needed, we use the Bank of Canada’s average exchange rate when converting U.S. to Canadian dollars: for 2024, the average was US$1.00 for C$1.3698.

> The data sets were extracted (in Canadian dollars), refined, reviewed, and analyzed by the author to the best of his knowledge using the S&P Capital IQ Pro database.

By Marilyn Scales

This year, IAMGOLD Corp. made a 10-point jump on CMJ’s Top 40 list to #14 from #24. That is a remarkable achievement for any company. To mark the achieve ment, CMJ interviewed Renaud Adams, the company’s presi dent and chief executive officer.

With over 30 years of global mining experience, Adams has retained his optimism and deep confidence in his employ ees. He has held executive positions at several gold produc ers. Among his successes was the Island Gold mine in Ontario where production doubled, reserves tripled, and operating costs dropped to make it one of the lowest cost underground mines in the Americas.

When asked what the largest contributor to IAMGOLD’s rise among the Top 40 Canadian mining companies is, he did not hesitate. “One of the most important parts of the success of this company is experience.” And he pointed to IAMGOLD’s track record at its Essakane mine in West Africa and recent turn around at its Westwood mine in Quebec.

“Second, is our people,” he added, “they have tremendous fo cus on what needs to be done.” Their strongest asset is the abil ity to plan and find potential in any property they are examin

ing. “And we have developed dedicated partnerships with our Indigenous communities.”

The latest feather in his cap is the successful development of the Côté Gold mine, now one of Canada’s largest.

“Côté is a very exciting story,” Adams told CMJ

Construction began in September 2020, as the Covid 19 pan demic got underway. IAMGOLD eventually spent $3 billion on its development over four years.

“Four years is a long time for development,” he said, “and we might have spent less if we had the normal two-to-three-year development.” But IAMGOLD was ready to move forward at Côté, despite the longer timeline.

But in 2023, when Adams joined the company as president and CEO, he believed the project would reach well beyond its potential. With first gold reported in March 2024, Adams had close watch over the ramp up, and the project reached name plate mill throughput by the end of June 2025.

Today, IAMGOLD has a stable of three producing gold mines — Côté Gold in Ontario, Westwood in Quebec, and Essakane in Burkina Faso. Guidance for this year is up to 820,000 oz. at an all-in sustaining cost (AISC) of between US$1,625 and US$1,800 per oz.

Add to that the company’s growing confidence in its exploration focus on northern Quebec, and even more success is anticipated.

The newest producer in IAMGOLD’s portfolio is the Côté Gold mine 125 km southwest of Timmins. It is also one of Canada’s largest gold mines and a model for modern, sustainable opera‑ tions. Guidance for 2025 is 360,000 to 400,000 oz. at an AISC of between US$1,350 and US$1,500 per oz. as operations ramp up.

The property is currently held 70% by IAMGOLD and 30% by Sumitomo Metal Mining.

This KCA unit can produce 200 kg per hour of screened agglomerates of ore or other products, and is available for rental or sale. A two-deck screen and delumper allow complete control of final product size. The unit meets all safety standards, and has a dust collection system for healthy operation.

IAMGOLD gained control of the property in 2012 with the takeover of Trelawny Mining, and construction began in Sep tember 2020. The open-pit mine and mill were commissioned last year after an investment of US$3 billion over four years. The first gold pour occurred in March 2024, and the project output was 199,000 oz. gold last year. Côté reached its full mill capacity of 36,000 t/d in the last week of June.

The Côté project consists of two primary zones: Côté and Gosselin, which are connected as open pits and both of which are open at depth. Let’s examine them on a 100% basis.

The larger Côté zone has proven and probable (P+P) reserves of 229.2 million tonnes grading 1.00 g/t or 7.3 million contained oz. On a resource basis (which includes reserves), the Côté zone has measured and indicted resources (M+I) of 438.5 mil lion tonnes grading 0.84 g/t or 11.8 million contained oz. The in ferred resource is 60.4 million tonnes at 0.61 g/t or 1.2 million contained oz.

The Gosselin deposit contains an indicated resource of 161.3 million tonnes grading 0.85 g/t or 4.4 million contained oz. The inferred resource is 123.9 million oz. or 3.0 million contained oz. The Gosselin deposit currently is smaller, as it was discov ered later, with an initial resource estimate in the fall of 2021. The company plans diamond drilling at Gosselin this year with the goal of upgrading resources to reserves.

Capital spending this year to operate the mine for IAMGOLD

is estimated to be approximately US$110 million, with an ad ditional US$15 million earmarked by the company to install a new cone crusher to further improve the processing circuit and set the stage for the next expansion phase.

IAMGOLD is currently working on releasing an updated tech nical report next year which will outline the Côté Gold mine as an even larger scale operation, with an increased plant size and targeting the combined resources of Côté and Gosselin. With the scale of Côté, if the processing rate increased to 50,000 t/d it would still have a potential mine life for well beyond 2045.

The wholly owned Westwood gold complex lies 55 km north west of Val d’Or, at the site of the former Doyon gold mine us ing the refurbished mill that once treated ore from the Mouska gold mine. The complex began commercial production in 2014 and is expected to operate through 2032, perhaps beyond. Guidance for 2025 is 125,000 to 140,000 oz. at an AISC of below US$1,825. That number is in line with the 134,000 oz. of gold Westwood produced last year.

Mining activities at Westwood involve both underground and open-pit mining, with the underground contributing ap proximately 1,000 t/d to the plant, supplemented with approx imately 2,000 t/d from the Grand Duc open pit. Grand Duc is scheduled to be exhausted by the end of this year, though, at current gold prices, IAMGOLD is examining the potential to ex tend mining at the pit. The mill treats about one million tonnes of ore annually and boasts a gold recovery rate of 95%.

The company estimates capital expenditures this year at Westwood to be US$70 million, the bulk of which is for under ground development, followed by mill and mobile equipment improvements.

The Westwood underground is open at depth, has P+P re serves of 2.6 million tonnes grading 11.44 g/t or 957,000 con tained oz. The Grand Duc open pit has P+P reserves of 1.4 mil lion tonnes of ore grading 1.01 g/t or just over one million con

tained oz. of gold.

The total M+I resources (including reserves) are 6.9 million tonnes averaging 7.98 g/t gold or 1.7 million contained oz. The total inferred resource totals 4.4 million tonnes grading 12.82 g/t or 1.8 million contained oz.

Essakane gold mine, Burkina Faso

The oldest of IAMGOLD’s operations is the open-pit Essakane mine (one of the largest in West Africa) which started in 2010 and has an expected mine life through 2028. It was also the company’s largest producer last year at 409,000 oz. of gold and an AISC of US$1,625 per oz. The mine is owned 90% by IAM GOLD and 10% by the Burkina Faso government.

Guidance for 2025 is 360,000 to 400,000 oz. at an AISC of less than US$1,825 per oz.

It remains to be seen whether Essakane will remain IAM GOLD’s largest producer or whether it will be overtaken by Côté this year. The guidance for both operations is the same.

Mining is expected to continue through 2028 with production av eraging approximately 400,000 oz. per year over this period. Ore will be mined from the Essakane Main zone and the Lao and Gou rouol satellite pits. With drilling contained within the fence pe rimeter of the project, IAMGOLD believes the mine life can be ex tended to 2033 and is likely to update the mine life plans next year.

The probable reserve at Essakane is 44 million tonnes in the pit, and the proven reserve is 18.9 million tonnes in stockpiles. Together on a 100% basis, the P+P reserves are 62.9 million tonnes grading 1.15 g/t or 2.3 million contained oz.

M+I resources (inclusive of reserves) are 99.9 million tonnes grading 1.24 g/t or 4.0 million contained oz. The remainder is an inferred resource of 12.6 million tonnes grading 1.76 g/t or 713,000 contained oz.

The future is hidden in Quebec

IAMGOLD is intensely interested in the Chibougamau-Chapais area of northern Quebec, which it considers a growing mining district. The area has a long history of gold and copper production going back to the mid-Twentieth Century. Infrastructure is estab lished owing to earlier mining efforts, and competition is heating up for properties in the district.

IAMGOLD’s exploration efforts are divided among the Nelligan, Monster Lake, and Anik properties. Nelligan is the primary target and the focus of current exploration efforts. It is located 45 km southwest of Chibougamau. Fif teen kilometres north of Nelligan is the Mon ster Lake property which offers an important satellite opportunity for high grade gold re sources.

The Nelligan deposit lends itself to open pit mining, and the Monster Lake deposit is suit able for underground development. Together the two projects are estimated to host over 8 million oz. of gold.

The two deposits have an indicated resource of 102.8 mil lion tonnes grading 0.95 g/t or 3.1 million contained oz. The in ferred portion is 166.4 million tonnes grading 0.96 g/t or 5.2 million contained oz.

IAMGOLD has a 13,000-metre drill program to test exten sions on strike at Nelligan and Monster Lake, both of which are wholly owned.

IAMGOLD also has an option to earn 80% of the strategically placed Anik property northeast of Nelligan. The property is 100%-owned by Kintavar Exploration. During the first quarter of 2025, IAMGOLD diamond drilled 2,100 metres, but the re sults were not yet available at press time.

The last word

Adams is confident that IAMGOLD’s exploration programs in Quebec will succeed. “It is growing quite fast,” he said. “I Think the Nelligan-Monster Lake camp has the potential to be the next 15-million-ounce resource. It is open in all directions.”

With Adams’ confidence in his people and Quebec’s resource potential, IAMGOLD will continue to be a company to watch.

Marilyn Scales is a freelance mining writer.

B2Gold continued to have a solid presence on CMJ’s annual Top 40 ranking of Canadian min‑ ers. The company’s ranking for 2024 shifted only slightly to #13 from #11 in 2023 ranking. Recently, I had the opportunity to speak with Randall Chatwin (RC), senior vice-president, legal and corporate communications, at B2Gold, to discuss the latest developments at the Goose project in Nunavut, the company’s operations in Mali, and other key updates.

With the acquisition of Sabina Gold & Silver in April 2023, B2Gold also acquired Sabina’s 100% owned Back River Gold District located in Nunavut, Canada. The Back River Gold District consisted of eight mineral claim blocks along an 80-km belt, which has now expanded to 11 mineral claim blocks. The most advanced project in the district, the Goose project, has been de-risked with significant infrastructure currently in place. The development of the Goose project opens the Back River Gold District for opportunities yet to be discovered, many of which are the subject of exploration in 2025. All project construction and development activities at the Goose Project have been completed, and on June 30, 2025, B2Gold achieved its first gold pour at the Goose Mine. The company continues to estimate and reiterate its guidance of 120,000 to 150,000

oz. for 2025 and now begin work ramping up to commercial production in the third quarter. The Goose mill has been consistently running at approximately 50% of nameplate capacity during this initial phase, as planned, and the focus during Q3 of 2025 will be to continue steady state operations and increase throughput to full design capacity in the near-term. B2Gold estimates average annual gold production for the initial full six years of operations (2026 to 2031 inclusive) to be approximately 300,000 oz. per year, based only on existing mineral reserves.

CMJ: B2GOLD IS ADVANCING OPERATIONS AT THE GOOSE GOLD PROJECT IN NUNAVUT. HOW IS THE COMPANY LEVERAGING ITS ARCTIC EXPERIENCE TO MOVE THE PROJECT FORWARD EFFICIENTLY?

RC: One of the most significant ways we are leveraging our Arctic experience is through the construction and management of the winter ice road (WIR). In 2024, we had a very successful season — bringing in all the materials needed to com-

plete construction. This year, we were able to start even earlier, on February 18th — three weeks ahead of schedule — thanks to our team’s experience in Northern Russia with Bema Gold and what we have learned in past seasons in Nunavut. The WIR was operational by mid-February 2025 with the transportation of all materials from the MLA to the Goose project site completed one month ahead of schedule in mid-April 2025. Over 4,000 loads and 80 million litres of fuel were transported over the 2025 WIR season.

ule, which is certainly attractive to the workforce. This schedule allows for better rest and recovery and has also proven to be a competitive recruitment advantage over the more common twoweek rotation.

CMJ: IT SOUNDS LIKE YOU ARE DEVELOPING BEST PRACTICES FOR ARCTIC OPERATIONS.

RC: Absolutely. We are drawing on a wealth of knowledge from our past proj-

B2Gold’s marine laydown area (MLA) in Bathurst Inlet, Nunavut. Shipments are stored at the MLA during the summer months until the winter ice road construction is completed and the materials can be transported to site. CREDIT: B2GOLD

That early start significantly reduced the risk of delays in transporting essen‑ tial supplies from the marine laydown area to the site. This includes critical in‑ puts like the 80 million litres of fuel re‑ quired to power operations for the next 12 months, upgraded mining equipment, critical spares, and all necessary reagents. Beyond logistics, our Arc‑ tic experience informs how we maintain equipment for cold-weather performance and ensure camp operations run smoothly. We use Arctic corridors between buildings to minimize outdoor exposure, and many employees operate on a three-week rotation sched-

Following the acquisition of Sabina, the MLA, located on Bathurst Inlet, was reorganized to maximize space for the 2023 sealift. Additionally, the fuel tank containment area at the MLA was enlarged to facilitate increased storage. The 2024 sealift was completed on September 30, 2024, with 10 ships and one barge having unloaded 123,000 m3 of dry cargo, ~85 million litres of arctic grade diesel fuel, and 58 additional trucks for the 2025 winter ice road (WIR) campaign. Creating career and employment opportunities in

ects, including the Bema Gold team days and our experience in Russia. Leaders like Bill (William) Lytle, our senior vice-presi dent and COO, were part of that team, and they are now mento ring the next generation of construction and project managers. That knowledge transfer is vital as many of our senior construc tion leaders start to turn over leadership roles to the next gener ation. The Back River Gold District presents a unique opportunity to preserve and pass on this Arctic expertise.

CMJ: I UNDERSTAND THAT THE CONTINUITY IS ESPECIALLY IMPORTANT GIVEN THE CHALLENGES IN ATTRACTING YOUNG TALENT TO THE MINING WORKFORCE.

RC: Precisely. On the ground, mentorship and real-world train ing is invaluable — particularly with something as essential as building the ice road, which we will have to do annually, and op erating a 4000 t/d mill in the Arctic. Every year, we need to trans port fuel, reagents, critical spares, and mining equipment — ev erything necessary to sustain the mine. So, having both current and future teams equipped with the right skills is critical.

CMJ: CAN YOU TALK TO US ABOUT B2GOLD’S RELATIONSHIP WITH THE KITIKMEOT INUIT ASSOCIATION (KIA) AND HOW YOU ARE COLLABORATING WITH LOCAL COMMUNITIES TO BUILD THE INFRASTRUCTURE?

RC: We have a strong partnership with the Kitikmeot Inuit As sociation (KIA), which is the landholder for the Goose project. We entered into an Inuit Impact and Benefit Agreement (IIBA) with the KIA in 2018, a testament to the excellent work done by the Sabina Gold team, which we have been able to build upon.

The IIBA covers Inuit employment, business development, and community support. The Goose project employed 233 Inuit proj ect personnel in 2024, but we continue to work hard to build on that success. In addition, in 2024 alone, about $205 million in ex penditures were made to 17 Kitikmeot-qualified businesses. We are working with the five communities in the region to expand employment and procurement/contracting opportunities and provide meaningful support on-site to all Inuit project personnel.

We have initiated an Inuit Employee onboarding program to help ease transition of new Inuit employees to life at site. In addition, we provide access to country foods, culturally rel evant programs, celebration of traditions, mental health sup port, and ensuring there are Inuit representatives in camp to provide support. We are working collaboratively with the KIA and communities to identify investment priorities — whether that is housing, healthcare, education, or cultural initiatives.

One example is our partnership with the Red Fish Arts So ciety in Cambridge Bay. At the community’s request, we sup ported their work with at-risk-youth by helping fund welding and art programs. Additionally, we have hosted students at our

site, giving them practical opportunities to apply their skills. It is a powerful way to align training with employment.

CMJ: THAT LEVEL OF ENGAGEMENT TRULY SETS B2GOLD APART. SHIFTING TO MALI, WHERE YOU OPERATE FEKOLA, YOUR LARGEST GOLD MINE — HOW IS THE CURRENT POLITICAL SITUATION AFFECTING OPERATIONS?

RC: Our relationship with the Malian government remains strong and has been consistent throughout the recent negoti ation period. With a Memorandum of Understanding (MoU), signed in September 2024, we reached an agreement that aligns with both the government’s goals and B2Gold and its stakehold ers’ interests. The MoU has given us a stable framework to con tinue operating the Fekola Gold Mine and expand gold produc tion at the Fekola Complex, including the Fekola regional project. We are currently working through the licensing process with the government, and so far, they are fulfilling their com mitments under the MoU, just as we are. It is important to note that the site itself has not been affected by political events, and operations have continued to run unimpeded.

Earlier in 2024, we did work through an operational issue when an excavator tipped over, which set back our stripping work in Phase VII. However, by Q3 2024, we had resolved the issue and were back on track. We have now reached the ex pected ore grade and are meeting or exceeding production budgets for the start of 2025.

CMJ: ACCORDING TO A RECENT YAHOO FINANCE ANALYST REPORT, B2GOLD IS AMONG THE TOP 13 GOLD DIVIDEND STOCKS TO BUY NOW. HOW HAVE YOU ACHIEVED THIS REPUTATION?

RC: It comes down to consistent delivery. Despite the chal lenges in Mali and building the mine at the Goose project, we have continued to meet our targets — both in terms of bud get and timeline. We poured our first gold at the Goose proj ect at the end of June 2025 and are looking forward to achiev ing commercial production at the Goose Gold Mine in Q3 2025.

Meanwhile in Mali, we have overcome the operational issues in 2024, finalized the MoU, and are now advancing the Fekola re gional expansion. The key is that we continue to deliver on our promises quarter after quarter. That builds credibility — and it is being recognized in the market. We also believe the stock remains undervalued, and as we de-risk the Goose project and bring in re gional ore at Fekola, we expect to see further positive momentum.

CMJ: GOLD HAD A STANDOUT YEAR IN 2024 — THE BEST RUN IN OVER A DECADE. WHAT IS YOUR OUTLOOK FOR THE REMAINDER OF 2025?

RC: We see ongoing strength in the gold price, largely driven by global geopolitical uncertainty. Gold continues to be a reli able safe haven investment.

That said, we take a conservative approach in our budgeting — we do not plan based on spot prices — but we certainly wel come the strong price environment and will continue manag ing our business prudently.

By Tamer Elbokl,

Young-Davidson is a low-cost, long-life operation and one of Canada’s largest underground gold mines. CREDIT:

Q: ALAMOS GOLD’S RANKING IN OUR ANNUAL TOP 40 CANADIAN MINERS IMPROVED FROM #21 IN 2023 TO #17 IN 2024, WITH ALMOST $0.5 BILLION INCREASE IN TOTAL REVENUE. WHAT FACTORS CONTRIBUTED TO ALAMOS GOLD’S TERRIFIC PERFORMANCE IN 2024?

A: Last year’s success was driven by careful planning and consistent performance. In July 2024, we completed the acquisition of Argonaut Gold, integrating the Magino Mine into our new Island Gold District. The Mulatos District also exceeded

John A. McCluskey,

CEO of Alamos Gold

expectations with production coming in above the top end of the guidance range. Our production increased 7% to 567,000 oz., and we delivered record operation and financial performance with record revenue, cash flow from operations, and free cash flow. We also expanded into Quebec through the acquisition of the highly pro‑ spective Qiqavik project. Overall, it was a year of meaningful growth underpinned by the values that make Alamos Gold a company that we are proud of.