November 2025

Product Podcast – November

Stay up to date on the latest features, enhancements, and key announcements, all in a quick, convenient format you can listen to anytime, anywhere.

Podcast Series

South Africa – Constitutional Court ruling on parental leave

On 2 October 2025, South Africa’s Constitutional Court handed down a landmark judgment in Van Wyk and Others v Minister of Employment and Labour, reshaping parental leave for all parents. The Court confirmed defects in the Basic Conditions of Employment Act and issued interim rules with immediate effect while Parliament amends the legislation. Read the Constitutional Court case page (judgment link):

Van Wyk and Others v Minister of Employment and Labour

What’s changed (effective immediately)

Universal parental leave (shared): If both parents are employed, parents (biological, adoptive and commissioning) are jointly entitled to “four months and ten days” of parental leave (aggregate). The entitlement (after any pregnancy-related or immediate post-birth parental leave) may be split as they choose (concurrently, consecutively, or a mix), but each parent must take their portion in a single consecutive block. If they cannot agree, it must be split as close as possible to half each, to be completed within four months from the birth/placement/adoption date.

Single employed parent: Where only one parent is employed, that parent may take the full period of at least 4 consecutive months of parental leave.

Adoption & surrogacy: Parental leave due to adoption starts on placement by court or on the adoption order, whichever occurs first; two commissioning parents (surrogacy) share four months and ten days in total

Who is deemed a parent?

A person is deemed to be a party to a parental relationship if they have assumed parental rights and responsibilities over the child as contemplated in the Children’s Act, 2005. Under the Court’s interim shared parental leave regime, adoptive and commissioning parents fall within “parent” for the purposes of parental leave without any child-age condition in the interim text. The original BCEA wording in s25B remains in force until Parliament amends it.

Before and after birth: A pregnant employee may start parental leave up to four weeks pre-expected birth, or earlier if medically necessary. No female employee may work for six weeks after birth unless medically certified fit. These periods count toward the total parental-leave allocation

Notice: Employees should give written notice at least four weeks before leave (one month for adoption/commissioning leave), unless not reasonably practicable.

Parliament has a fixed window (36 months) to amend the BCEA. The interim regime above applies immediately.

What should employers do next?

Update policies and handbooks to reflect the shared 4 months + 10 days regime, eligibility for all parent types, and notice requirements. Please reach out to a labour lawyer for legal advice as needed. Adjust payroll configurations to align with the updated policies.

UIF reporting

We are awaiting clarification on how this will influence UIF statutory reporting. Once we receive clarification, further communication will follow and any required system changes will be implemented.

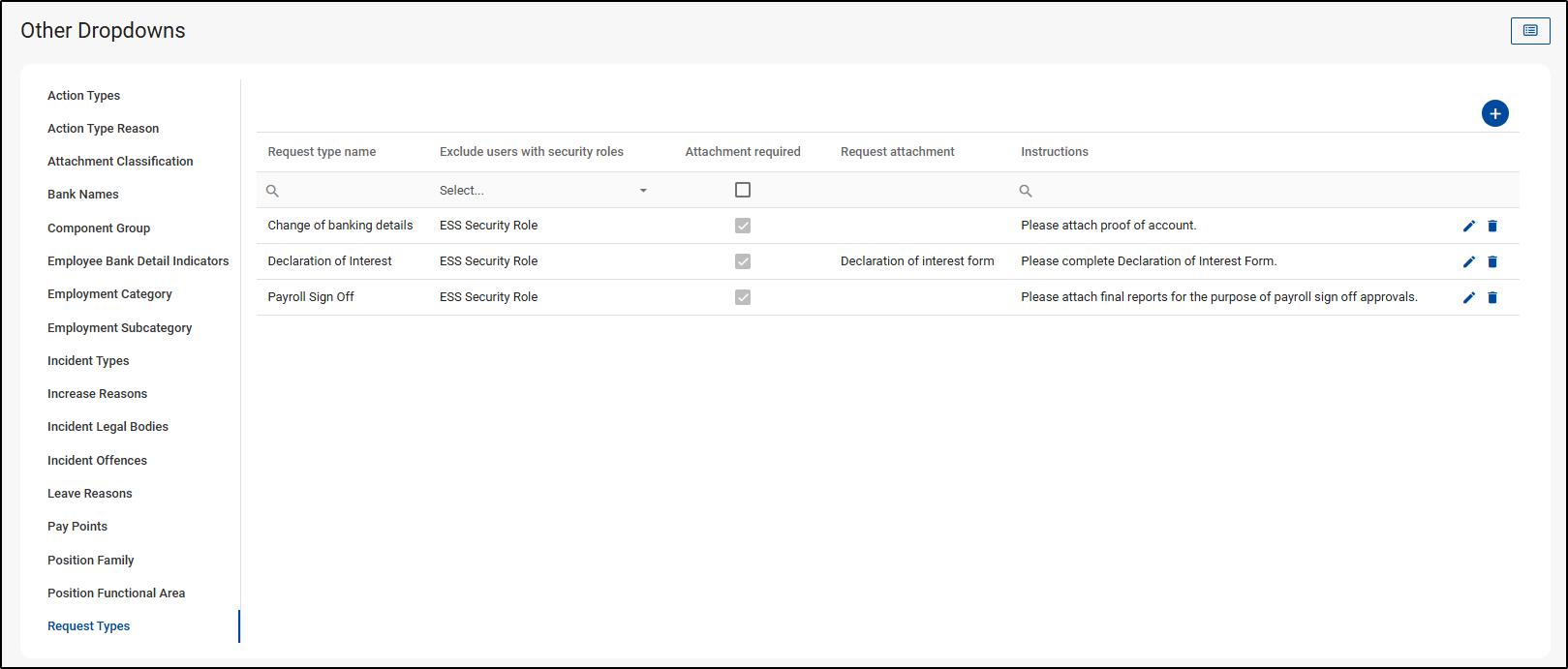

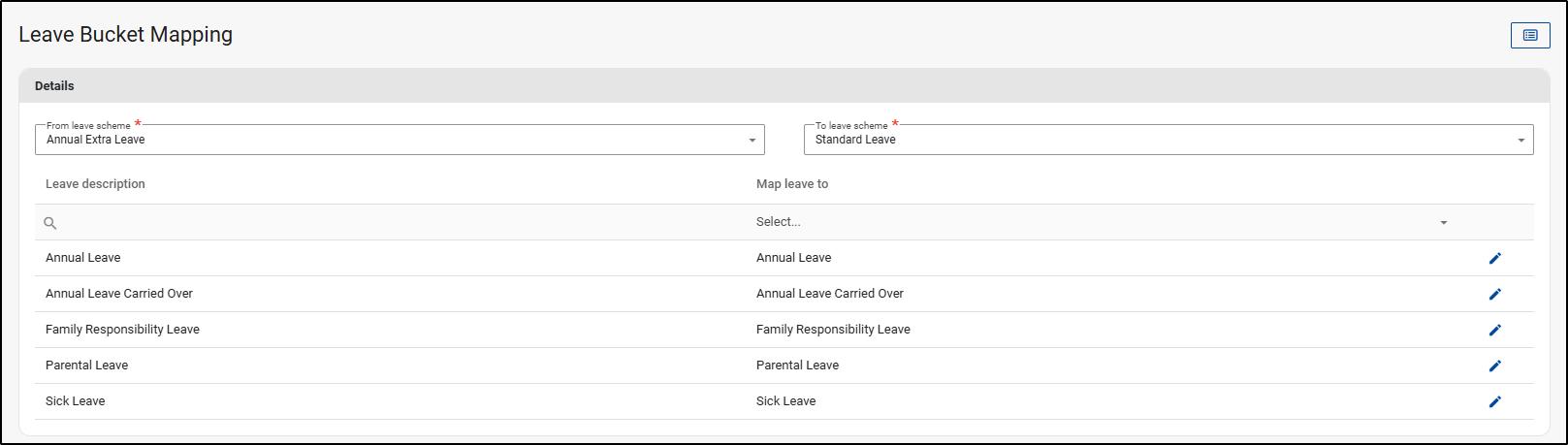

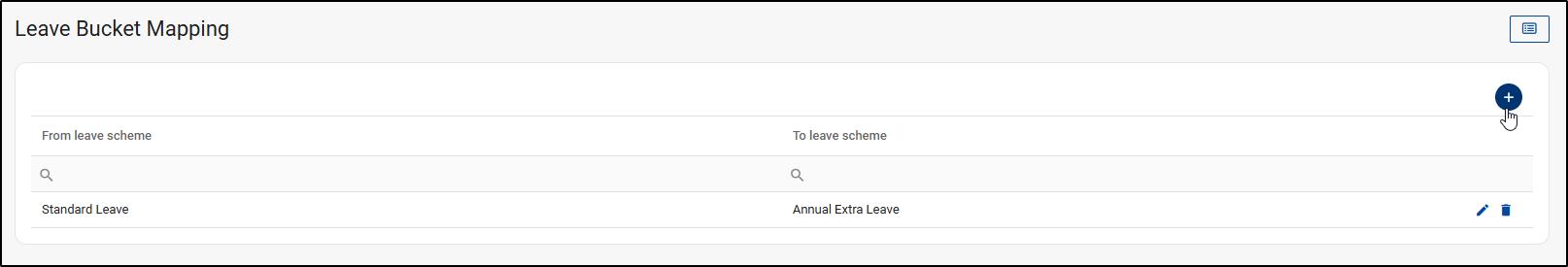

NextGen Screen Conversions

With our ongoing NextGen screen conversion project we’ve converted several screens this year. The Other Dropdowns and Leave Bucket Mapping screens have been converted to NextGen.

Other Dropdowns

Leave Bucket Mapping

Significant screen conversion enhancements across both screens:

Improved Search & Filter Capabilities – Enjoy faster, more efficient record location and management with our new, standardised grid layout that features advanced search and column filtering.

API Endpoints – Streamline your integrations and automation with our newly released API endpoints for each screen

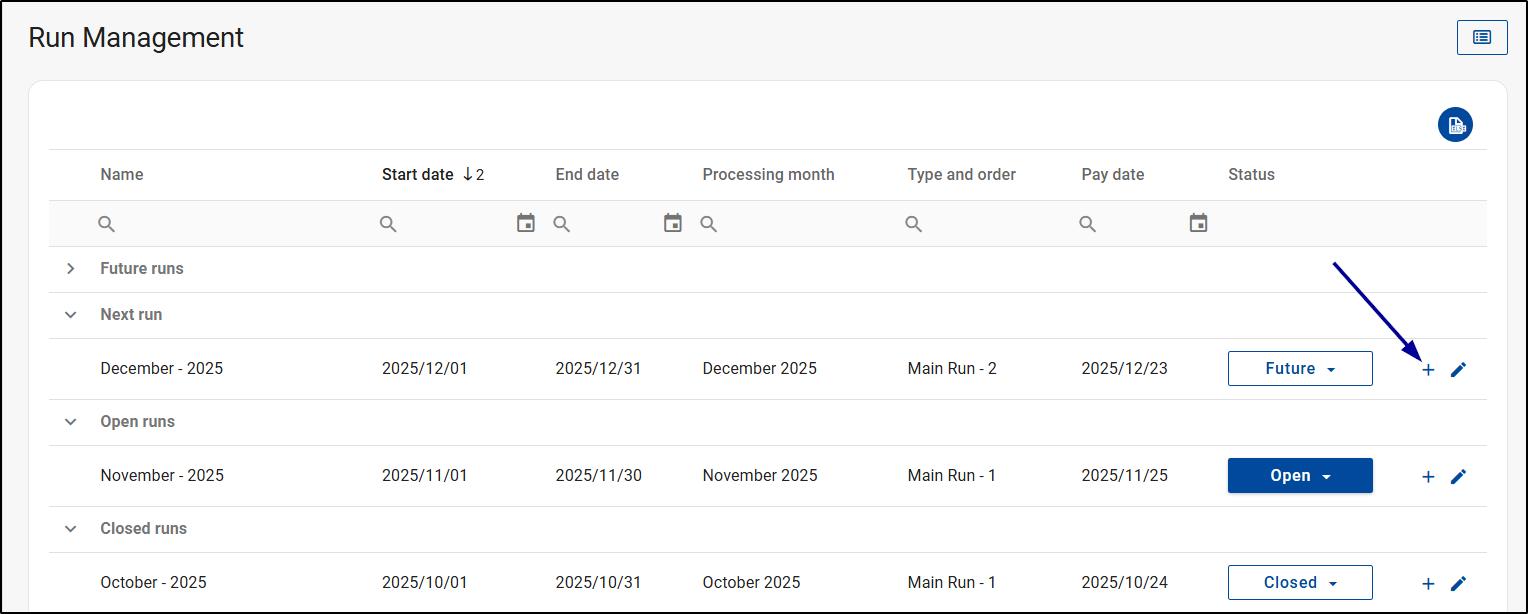

Run Management Updates

Reinstate sequential run closure validations

Following the conversion of the Run Management screen earlier this year, we introduced validation restriction changes to allow additional flexibility over how administrators manage their payroll. We’ve revised these restriction changes so that the system will enforce sequential run closure for most users, ensuring payroll integrity. However, certain users with advanced permissions can bypass these restrictions when necessary.

The following users will have advanced permissions that can bypass restrictions:

- Bureau Users

- Business Partner Top-level Agency users (Config > Security > User Profile)

- Company-Level Super Users (Config > Security > Security Role)

These users can:

- Close runs in any order, regardless of run order number or pay date combination.

- Create and manage backdated interim runs, even after the main run is closed.

- Adjust run order, including placing interim runs before already closed runs within the same pay period

All other users will be restricted in this regard and will not have these advanced capabilities.

Link Interim Runs to the next Future Main Run

Previously, the system didn’t support linking interim runs to future main runs limiting users from setting up interim runs in advance. The Run Management screen now allows interim runs that fall before a Main Run to be linked to the next future Main Run. Once the current Open Run is closed, the system will automatically open the next available interim run rather than defaulting to the next Main Run.

Link Interim Runs to the next Future Main Run

Previously, the system didn’t support linking interim runs to future main runs limiting users from setting up interim runs in advance.

The Run Management screen now allows interim runs that fall before a Main Run to be linked to the next future Main Run. Once the current Open Run is closed, the system will automatically open the next available interim run rather than defaulting to the next Main Run.

Please note the following specifications and restrictions: Only order numbers before the Main run’s order are available. The Main run’s order cannot be moved before any of its linked Interim runs. The order of linked Interim runs cannot be moved after the Main run.

Coming Soon

Dynamic Form Builder – Ability to add attachments

You asked, we listened!

Based on feedback from customers and recent User Group sessions, work is underway on an enhancement to the Dynamic Form Builder for the ability to add attachments.

What’s new?

You can now include file uploads directly within your custom onboarding forms to attach essential documents like copies of IDs, proof of bank details, SARS documents and more as part of the onboarding process.

Why it matters

Traditionally, HR teams could only upload these documents after creating an employee profile in the system. With this update, attachments can now be collected and uploaded upfront and this will extend to the E-Onboarding feature meaning employees can provide uploads themselves on their new hire form!

Feature Spotlight

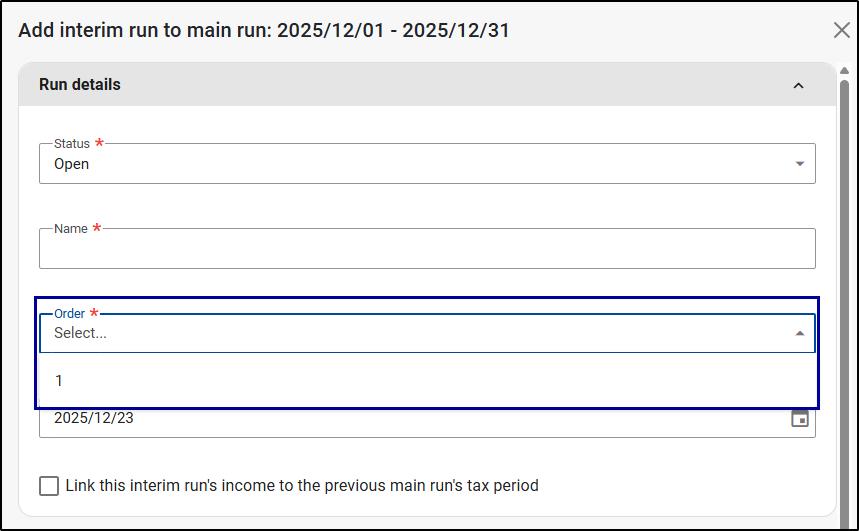

E-Onboarding

E-Onboarding is a game-changing feature designed to simplify and accelerate the process of capturing new employees’ details during onboarding. With customisable New Hire forms and a collaborative workflow between HR and New Hires, you can streamline data capture, reduce administrative overhead and ensure a smooth onboarding experience from day one. This streamlined process replaces manual methods with a more intelligent onboarding approach.

The E-Onboarding flow follows these steps:

For more on E-Onboarding or for a demo, visit our website and related KB articles.

Mauritius

Fair Share Contribution and company car benefit October 2025

The Mauritius Revenue Authority (MRA) has issued a Circular to Employers (6 October 2025) setting out changes that affect payroll. The Circular (i) amends the valuation of the company car benefit with effect from 1 October 2025, and (ii) confirms the collection of the Fair Share Contribution (FSC) via PAYE for income earned from 1 July 2025.

Legislative summary of changes

Revised company car benefit valuation

- The taxable benefit value for company cars provided to employees is amended from 1 October 2025.

- The valuation now depends on both the car’s cost and its engine capacity (or type, in the case of electric vehicles).

Fair Share Contribution (FSC) via PAYE

- The FSC is a new tax measure introduced by the Finance Act 2025, requiring high-income earners to contribute an additional 15% tax on the portion of leviable income above Rs 12,000,000 per income year.

- Notably, the MRA Circular instructs employers to withhold FSC through PAYE, i.e., monthly payroll deduction on a cumulative basis.

- The FSC applies to income earned from 1 July 2025 and is a temporary measure for income years 2025/2026, 2026/2027, and 2027/2028.

Clarifications on FSC collection (legal context)

- The Finance Act 2025 introduced FSC for individuals (ss. 16B-16C) and amended s.93(1) (PAYE).

- However, s.93(1) refers to FSC ‘under section 16E’, a section that does not exist. Meanwhile, s.16C(2) says FSC is payable on filing the individual’s return.

- Until now, the law prevailed, pending any official communication or publication from the MRA, meaning the FSC is payable on assessment and not via payroll.

- The MRA Circular is an official guidance document, but not legislation and cannot amend the law on its own.

- Implementing FSC withholding via payroll aligns with the MRA’s stated position and day-to-day administration, which is generally prudent for compliance and helps avoid large year-end liabilities for affected employees.

- Monthly collection smooths cash flow for high earners and keeps employers aligned with the authority’s expectations.

- The Circular provides a monthly cumulative FSC threshold table and instructs employers to apply PAYE at 15% on the portion of cumulative chargeable income above the threshold.

Given Mauritius’s strict approach to taxing statutes, we recommend collection via PAYE as set out in the Circular, whilst remaining alert to any further official publications or legislative amendments. Employers may exercise flexibility in implementation, taking into account risk appetite and legal advice.

Additional information and resources

Click here to access the official publication.

Please refer to release note 96839, titled New Fair Share Contribution component, and update to the company car benefit for more information.

Should you have any questions regarding the Mauritius – Fair Share Contribution and company car benefit, please feel free to visit our Support page for more ways to get in touch, or email us at

Office: + 27 11 305 1940/1

Email: info@axiomatic.co.za

Website: www.axiomatic.co.za