FIT TO FLY

THE NEW REGULATIONS AND CHALLENGES OF PILOT INTOXICATION

BY PHIL LIGHTSTONE

Are you fit to fly? A burning question, especially for professional pilots, flight crews and other aviation licence holders. In the good old days, intoxication focused on alcohol as defined by the adage eight hours bottle to throttle. However, that has been changed in the Canadian Air Regulations (CARs) to 12 hours. In recent years, the movement to the legalization of recreational and medicinal marijuana (cannabis) has brought aircrew addictions into the limelight. In 2017, the then Minister of Transport, Marc Garneau, asked all airlines operating in Canada to confirm that their safety protocols are up to date, including measures designed to confirm pilots’ fitness to fly. This was a reaction to an intoxicated pilot boarding a Canadian aircraft. The top eight Canadian airlines have all since confirmed that they have proper safety protocols in place to deal with alcohol and drug testing.

Professional pilots, think of four bars ATP, create an image in the public minds of an individual who attracts great respect, is highly trained and built up to exhibit extreme professionalism. An image which is often projected to their friends, family and co-workers. For pilots drinking on the job, individuals on the flight crew team, may choose to advise their employer that they are not willing to work with that pilot. This could launch an investigation by the pilot’s employer, which could put the huge investment into their four bars at risk, compromise their reputation and open a Pandora’s box of legal issues. An accident or incident could launch investigations by the regulators and insurance companies.

In August 2023, a United Airlines pilot showed up at the airport

for a transatlantic flight under the influence of alcohol and was handed a six-month suspended prison sentence by a French court as reported by Le Parisien. The French media outlet reported that the pilot had a blood-alcohol level of 0.132 per cent, more than six times the legal limit for pilots in Europe and three times that of the Federal Aviation Administration’s (FAA) limit. Lawrence Russell Jr. was arrested on charges under the U.K.’s Railways and Transport Safety Act of 2003, which states that a pilot is unfit to fly when impaired by alcohol or drugs. The law sets a maximum allowable blood-alcohol limit at 0.02 per cent, among other regulations. According to the U.K. law, aircrew found guilty can face penalties including a fine and up to two years in prison.

Lyle Prouse in 1990 became the first commercial pilot sent to prison for flying while intoxicated. He was a Northwest Airlines pilot when he was charged under a 1986 federal law aimed at cracking down on drug abuse in the transportation industry. Prouse was fired, lost his FAA licenses, imprisoned and went sober. He eventually regained his FAA licenses, was rehired by Northwest Airlines and pardoned by President Bill Clinton. He then wrote a book about his journey entitled Final Approach – Northwest Airlines Flight 650, Tragedy and Triumph, published in 2011 ($23.52 on Amazon.ca).

The FAA’s data shows there are at least a handful of alcohol violations every year among commercial pilots who fly for airlines or charter operations. The number of alcohol violations among pilots over the last 20 years has ranged from five in 2013 to 25 in 2019. According to the FAA, there were seven pilot alcohol violations in

Working in multi-person flight crews provides a cockpit buddy system, but ultimately the concern of losing a licence can deter pilots from disclosing issues. PHOTO:

2022. The FAA states that a pilot will be removed from an aircraft if their breath alcohol concentration level is 0.04 or greater. The FAA’s bottle-to-throttle time is eight hours before flight. Some airlines have stricter requirements.

From the CARs perspective, three sections govern pilots regarding fit to fly, including: 602.01.1, which reads no person shall operate an aircraft in such a reckless or negligent manner as to endanger or be likely to endanger the life or property of any person; 602.02, an operator of an aircraft shall not require any person to act as a flight crew member or to carry out a preflight duty, and a person shall not act as a flight crew member or carry out that duty, if the operator or the person has reason to believe that the person is not, or is not likely to be, fit for duty; and 602.03, no person shall act as a crew member of an aircraft (a) within 12 hours after consuming an alcoholic beverage, (b) while under the influence of alcohol, or (c) while using any drug that impairs the person’s faculties to the extent that the safety of the aircraft or of persons on board the aircraft is endangered in any way. Clearly, the operator of the aircraft has a duty of care under CARs to ensure that the pilot and aircrew are fit to fly.

Transport Canada (TC) reports: “If for any reason a person believes that they are not, or are not likely to be, fit for duty, then they shall not act as a flight crew member nor carry out preflight duties – nor be assigned by the air operator to these duties. CARs also prohibit the exercise of privileges associated to a Canadian Aviation Document if the holder falls in one of the circumstances described in Subsection 404.06(1) (a) that could impair a holder’s ability to exercise those privileges safely (e.g. the holder suffers from an illness, injury or disability).”

Each airline has strict rules about pilot and crew behaviour before and during flights. This includes drinking outside of the TC, FAA or airline guidelines and taking medication that may compromise the safety of passengers and other crew members. This applies to prescribed drugs as well. Intoxicated pilots would hopefully be prevented from operating the aircraft by fellow crew members who are obligated by law and company policy to protect the safety of passengers. But the nuisances in the airline world, with the protection afforded by the pilot unions, complicates an environment of free and open communications. Airlines have procedures in place to identify pilots with possible substance abuse problems. Help is available for these individuals, especially if they admit their problem and ask for assistance before impairment incidents occur. Airlines conduct random employee urine testing with and

without cause to help protect passengers and other crew members.

The use of recreational and medicinal cannabis is another hot topic, which historically TC struggled to deal with. When the Federal government legalized cannabis, it updated the criminal code to ensure that the law was crystal clear as to the use of cannabis by aircrews. During an aviation medical, TC’s current Civil Aviation Medical Examination Report asks: Alcohol or substance abuse (yes or no); current medications (prescriptions or OTC); and weekly alcohol intake (units). TC has

a 28 day cannabis consume before you fly rule. The 28-day policy is based on existing CARs which require pilots, flight engineers, and air traffic controllers to be fit for duty and free of the effects of any drugs or medications.

Following the legalization of cannabis, TC undertook an extensive policy review and consultation to determine the most effective means of ensuring aviation safety about impairment overall, including cannabis. Information regarding TC’s cannabis policy in aviation can be found on the regulatory’s website via the headers aviation/

Call Levaero Aviation, your nearest Authorized Pilatus PC-24 Sales Centre for further information on +1 905 6722000.

general operating flight rules/ better pilot decision making/ cannabis legalization. Subsection 320.14(1) of the Criminal Code of Canada also prohibits operation of conveyance while impaired by alcohol or drugs, aircraft being included in the definition of conveyance. Substance Use Disorder (SUD), including the use of substances such as alcohol, cannabis and cocaine, is disqualifying for aviation medical certification under CARs. In cases of SUD, where treatment and recovery have been successful, applicants may be considered on a caseby-case basis. It is important to note that the legality of a substance does not imply safety in the aviation environment. Aside from alcohol and cannabis, many prescription drugs, overthe-counter, and natural health products are prohibited for aviators. This is consistent with existing CARs sections 602.02, 602.03 and 801.01 which require fitness for duty, and that no person shall act as a crew member of an aircraft, air traffic controller, or flight service specialist while using or under the influence of any drug that impairs the person’s faculties to the extent that aviation safety is affected.

Aviation personnel, although not inherently dishonest, may avoid volunteering information which may affect their medical certification during a CAME medical interaction. This behavioral thinking could be amplified with the individual’s livelihood tied to the CAME interaction and the present situation at TC. The CAME handbook provides guidance regarding the applicant interaction: “They will, however, respond to direct questions and will sometimes provide a CAME much more information than the CAME expects if the CAME convinces them that their prime interest is keeping them at work. Sometimes they have problems that may affect their medical certification that they would like to discuss with someone of good will. Of particular importance in the interview is any suggestion of

substance abuse, mental instability, lack of insight or inappropriate reactions. The CAME has an opportunity to decide whether this is the type of person with whom you would fly or to whom you would entrust your family. Substance Abuse/ Dependence: Disqualifying. Once ‘recovering’, an individual assessment is required to assess risk of relapse. Restricted category may be recommended. Continued abstinence is the key to medical recertification.” Most if not all CAMEs will report the interaction to TC.

Chris Nowrouzi, President and CEO of FLYGTA Airlines, believes that the Canadian aviation industry has a high level of responsivity (as a whole) and during the life of FLYGTA, has yet to find an intoxicated aircrew member report for work. “My experience working at Toronto Airways at the Toronto Buttonville Airport and as a flight instructor, we drilled into the minds of new pilots the perils of drinking before and during flight,” says Nowrouzi. “The maturity of Canadian pilots combined with the buddy system inherent in the cockpit, ensures that our pilots are doing the right thing.”

Anthony Norejko, President and CEO of the Canadian Business Aviation Association, reports: “We need a safe, modern, quick and equitable resolution process delivered by TC. The current process, tied to aviation license holders’ ability to earn a living, inherently causes an individual with a substance abuse problem or medical prescription dependency or other medical problem [which might medically disqualify them] to go underground and not disclose medical issues to their CAME.”

The 28-day cannabis issue illustrates the need for TC to implement long-term studies and determine the impacts from an aviation perspective required to make changes to the rule. However, the current funding and staffing issues faced by TC suggests that this will not be a priority.

Cannabis usage creates other problems for Canadian pilots. It

is a U.S. Federal offence to possess Cannabis when crossing the border. Canadian pilots and cannabis users holding FAA licences may be offside when undergoing a FAA medical examination. The FAA requires pilots to report drug and/or alcohol related motor vehicle actions (MVA) to the agency’s Security and Hazardous Materials Safety Office, Regulatory Investigations Division.

The Code of Federal Regulations at 14 C.F.R. § 61.15(e) requires all Part 61 certificate holders to send a written report to the FAA within 60 calendar days of any drug and/or alcohol related MVA. These reports are commonly referred to as notification letters. Failure to send

The current process causes an individual with a problem to not disclose medical issues.

a notification letter within 60 days to the FAA’s Security and Hazardous Materials Safety Office is grounds for: Denial of an application for any certificate, rating, or authorization issued under this regulation for up to one year after the date of the motor vehicle action; suspension or revocation of any certificate, rating, or authorization issued under this regulation. The 28-day rule practically dictates that professional flight crews do not partake in the use of cannabis.

TC is considering a new licence within the RPAS Category (Level 1 Complex). In Canada, drone and radio controlled model aircraft came in scope to CARs. Radio controlled model aircraft enthusiasts are in the midst of the cultural transition from being unregulated, beyond conventional safety codes set down by the Model Aeronautics Association of Canada (MAAC), the Academy of Model Aeronautics (AMA), and local R/C flying clubs. In the good old days, beer and

flying R/C aircraft went hand in hand during hot summer days. MAAC’s safety code states: “No member shall operate any category of model while under the influence of alcohol/cannabis or other judgment impairing drugs.” In the fall of 2023, TC issued a “What We Heard Report Regulations Amending the Canadian Aviation Regulations (RPAS – BVLOS and Other Operations): Canada Gazette, Part I Consultations”. TC received many comments during the consultation period about the new RPAS medical standard showing concern about the process being too strict. There were some comments that raised issues with the fitness of crew members provision, more specifically on pilot impairment. Stakeholders suggested that revisions or further clarity should be provided on the use of cannabis while operating an RPAS. All TC guidance material will be updated before coming into force to provide clarity.

TC reports: “The CARs exist to ensure safe and efficient operations within the aviation sector. TC appeals to each individual and aircraft operator to be responsible and diligent in their commitment to the regulations. It is important to emphasize that contravention can lead to significant safety issues and trigger the suspension (or cancellation) of a Canadian Aviation Document. It can also trigger judicial penalties or administrative enforcement actions, such as monetary penalties set out in Subsections 103.08(1) and (2) of the CARs.” Safety is a shared responsibility. The cockpit buddy system creates an environment where members of the flight crew have an opportunity to determine the fitness to fly of their buddy. The majority of pilots are responsible people. The process to create a licence holder weeds out immature and irresponsible personalities. As with many things in life, it is about the exception and not the norm. Stay informed about the regulations and the latest best practices and share them in your local flying communities. | W

PARTY AT MR. PORTER’S

INSIDE AN INDUSTRY DEFINING YEAR OF TRANSFORMATION AND AMBITIOUS EXPANSION FOR PORTER AIRLINES

BY DAVID CARR

Ayear has literally flown by. In February, Porter Airlines marked the first anniversary of Embraer E195-E2 jet service out of Toronto’s Pearson International Airport (YYZ). Last year, Mr. Porter, the airline’s raccoon mascot, invited a few hundred friends to a house party at a repurposed event space at the popular Toronto Brickworks to celebrate. A pleasing jumble of evergreen, sheds and brick perfect for an urban raccoon. Before British DJ’ing phenom Marsh took to the stage, Wings had a sit down with Kevin Jackson, Porter’s then Chief Commercial Officer, in Mr. Porter’s spacious living room to talk about the year past and what to expect in 2024. (One of the first developments of the New Year, Jackson was appointed President, to oversee Porter’s daily business matters and operations.)

There has been much to celebrate. By December, Porter had doubled the size of its fleet to 58 airplanes, with a matching number of Embraers and De Havilland Dash-8 400s; entered into a transformational tie up with Air Transat; and placed an order for another 25 E195s, bringing its confirmed jet fleet to 75 within a few years, with increased capacity to open routes to Mexico and the Caribbean on the horizon. By the fall, Porter will have added new crew bases for its jets in Ottawa (YOW), Vancouver (YVR) and Montréal (YUL), where it is also building a passenger terminal at the newly rebranded Montréal Metropolitan Airport (YHU, formerly Saint-Hubert Airport) in partnership with Australian-based Macquarie, the world’s largest infrastructure asset management company. When the new terminal opens in 2025, Porter will operate out of both YHU and Montréal Trudeau International (YUL) using both jets and De Havilland Dash-8-400 turboprops.

Porter is bullish on Montréal and will launch new daily service to Calgary, Edmonton and Vancouver this spring. “We think our approach to Montréal can be just like our approach to Toronto where we are successfully serving two airports, YYZ and Billy Bishop [YTZ],” Jackson said. “They have different purposes and a different catchment area. [YHU] will be the most convenient option for half of the city. A lot of passengers will gravitate toward that airport.”

Clearly, Porter’s North American expansion has benefitted by WestJet’s and, to a lesser extent, Air Canada’s domestic retreat into their east and west corners. Jackson cautioned about reading too much into that. “WestJet’s exit from eastern Canada just cemented where Porter already was in the marketplace. Even when WestJet was in every single market we served in the east, we were the number two carrier after Air Canada. With the Embraers and the trans-Canada market, we have advanced, so far, out of Toronto and Ottawa. You are now seeing us do that out of other markets and will open deeper into the west as we take on additional aircraft.”

Since launching E195 service on February 1, 2023, Porter has introduced jets on approximately 30 North American routes from a dozen Canadian cities, including Los Angeles, San Francisco and Miami. Porter expects to increase capacity by more than 100 per cent in 2024, as more Embraers arrive. In May, the airline will start E2 service between Toronto and Saskatoon. “We are delivering service and amenities that are unmatched in the industry for economy

travellers,” Jackson said.

The E195 is the flagship of the Embraer family of E2 jets. Porter is the only North American airline to fly the airplane, and the largest operator of the type. “The jet is exceeding our expectations, especially in terms of fuel burn,” Michael Deluce, the company’s chief executive said. As a private company, Porter does not publish financials or load factors, but reports that customer satisfaction with the jet network is at 93 per cent. Two-by-two seating by eliminating the dreaded middle-seat being the most popular feature, along with free WiFi and complimentary beer, wine and snacks.

The jet fleet will eclipse the Dash-8s in 2024, and Porter has not ruled out adding turboprops. “As we build up the hubs in eastern Canada, the Dash-8 fleet gives us opportunities to create more feed and build connectivity across eastern Canada,” Jackson says. Porter has Dash-8 bases at its Billy Bishop Airport headquarters, Thunder Bay (YQT), Halifax (YHZ) and Ottawa.

Ottawa was Porter’s first destination when it launched in 2006, and now rivals Air Canada and Chorus (operating as Air Canada Express) as YOW’s busiest carrier. It operates up to 35 daily flights with a mix of E195 and Dash-8s, and is the only airline to offer year-round, coast-to-coast connectivity. YOW is also the only airport outside of Porter’s Toronto hub to fly transborder with Dash-8 service to Boston and Newark. “Passengers are coming into Ottawa and connecting on the E195,” Jackson says. “As we start to intersect the fleets in Montréal and Halifax, the same thing will happen.”

Where the fleet will not intersect, at least for 2024, is Toronto. Despite a convenient rail link between downtown and YYZ, transferring Dash-8 passengers from YTZ would be too much of a hassle. “We are mixing passengers across the two fleets, but we won’t mix them from the Island. It’s just not competitive,” Jackson insists. “We will eventually bring the Dash-8 to Pearson. Right now, as we acquire slots [at YYZ], we are dedicating them to the jets.”

Last June, the Canadian government gave Toronto’s waterfront airport a long-awaited boost, announcing $30 million to build a U.S. customs preclearance facility that will put the airport on an equal footing with YYZ when it opens in 2025. Preclearance will

Kevin Jackson in January 2024 was named President of Porter Airlines, where he has been for the past 11 years, after executive positions with America West Airlines and US Airways.

PORTER’S HOUSE

open YTZ to American airports that do not maintain U.S. customs and border protection facilities, including New York La Guardia (LGW) and Washington Ronald Reagan (DCA). “We’re still working through the cost structure of bringing U.S. preclearance to Billy Bishop. That is the last step in the process,” Jackson says. “We are very interested in serving markets like La Guardia and DCA from downtown Toronto. But there are other smaller markets within reach of Billy Bishop that we also can’t serve without preclearance. This will create growth opportunities from the Island.”

In December, Porter announced a strategic partnership with Alaska Airlines, offering seamless connections between eastern Canada and the U.S. west coast through Alaska Airlines hubs in Los Angeles and San Francisco. “Airlines are always looking for strategic partnerships. We are always looking to connect with other partners,” Jackson says. So far, it has been tough sledding.

The Alaska Airlines agreement is Porter’s sixth since entering into a deal with Qatar Airways in 2012. A regional eastern network, largely based out of YTZ has been a drawback. Jets and an aggressive North American expansion have made Porter a more attractive catch for foreign tails. But it is a ‘feeder network strategy’ with Air Transat that the airline believes will be the game changer.

The joint venture builds on an earlier code share that is estimated to have put an additional 60,000 passengers on Air Transat flights since 2022. Combined, Porter and Air Transat will serve more than 80 destinations across a global network extending from Vancouver to Northern Africa and as far south as Peru, creating a “third force” Canadian international airline that can compete on a stronger footing with Air Canada, Rouge and WestJet.

For most of 2024, Porter and Air Transat will collaborate on route planning and schedule integration to build a feeder network out of its YYZ and YUL hubs. “Porter is in the midst of disrupting the North American market through a significant continental expansion that will only be amplified by this alliance,” said Deluce in a statement. “The flow of passengers on both carriers means

that Porter will be able to develop a more robust network by increasing flight frequency on key domestic and transborder routes, and entering into new markets with less point-to-point traffic.” Porter estimates that 15 to 18 per cent of Air Transat passengers will connect onto a Porter flight.

With the arrival of its twenty-ninth jet in December, Porter doubled the size of its fleet in 12 months, during the worst pilot shortage in modern Canadian aviation history. Canada is short approximately 5,000 pilots according to John Gradek, a former Air Canada executive and lecturer at McGill University’s Aviation Management program. Compounding the shortage, more Canadian pilots are applying to U.S. airlines, where hefty wage hikes have widened the pay gap.

Traditionally, regional airlines have been feeders for mainline carriers. The so-called fishing grounds. A lot has changed since the pandemic. Including thousands of experienced pilots heading for the exits and an 80 per cent plunge in newly certified commercial pilots from 2020 to 2022. Flight school graduates are bypassing the regionals and heading straight for the flight decks of mainline carriers. Despite the E195 and Dash-8 aircraft sharing ramp space at YUL and YOW, Porter in 2024 remains two airlines; a regional airline largely anchored at YTZ, and a fast-growing mainline carrier. The Dash-8 fleet will play a vital role supplying experienced pilots to the Embraers and Porter has a revamped recruitment and retention strategy to attract recruits to the turboprops.

The airline has implemented the highest compensation package for Dash-8 pilots in Canada. As a further incentive, pilots flying the Dash-8 for other airlines are given credit for years of service on the type, meaning they don’t have to restart their career flying for Porter. “Our pool of pilots is quite strong,” Jackson points out. “One of the reasons for that is pilots want to fly for airlines that are growing. What Porter can promise new pilots is you can make your way to the left seat of a jet faster than any other airline in Canada.”

The state of Canada’s airline industry was fluid throughout 2023, when Porter introduced jet service. Passenger traffic was roaring back from a prolonged COVID hibernation. Ultra-lowcost carriers (ULCC) like Flair and Canada Jetlines were planning to double and triple fleet sizes to meet demand as industry analysts wondered aloud how many added airline seats the market can absorb. Since then, WestJet has wound down its ULCC subsidiary Swoop and Lynx Air was shuttered by the start of March. But Porter has pursued a different business strategy to redefine the economy cabin, with lower fares and more amenities, for the 90 per cent of passengers who fly economy. It is a model that transferred smoothly from turboprop to jet.

“Everything was new for us,” Jackson remarks, looking back. “It was a transition to jets. A switch to more congested Pearson. It was the first time the E195-E2 was introduced to North America and it began a period of unprecedented growth.” | W

Porter in February 2024 outlined plans to add three Embraer E195-E2 crew bases across Canada for more than 350 pilots and flight attendants at Ottawa International Airport (YOW), Montréal-Trudeau International Airport (YUL) and Vancouver International Airport (YVR).

HIGHLIGHTS FROM HELI-EXPO

DEVELOPMENTS IN THE ROTARY WING INDUSTRY AS HAI PIVOTS TOWARD NEW FORMS OF FLIGHT

BY JON ROBINSON

The Helicopter Association International has been in operation for more than 70 years and today describes itself as supporting more than 1,100 companies and 16,000 professionals in over 65 countries. Its members collectively operate more than 3,700 helicopters and remotely piloted aircraft accounting for around 2.9 million operational hours per year. It is a matter of no small consequence that on February 27, 2024, Helicopter Association International (HAI) changed its name to Vertical Aviation International to better represent all forms of vertical flight.

The name change will also be reflected by a rebrand of the HAI’s annual conference, moving from Heli-Expo to Verticon, taking place next year in Dallas, Texas. The news kicked off this year’s Heli-Expo, which was quickly ramped up by massive framework agreements from The Helicopter Company of Saudi Arabia with Airbus

and Leonardo. The Helicopter Company (THC), which will forever change aviation in the Middle East, made a deal for up to 120 Airbus helicopters of various types to be delivered over the next five to seven years. Part of the deal includes a firm order for eight H125s along with 10 H145s that are converted options from an earlier contract, which will initially bring THC’s total Airbus fleet to 60, 25 of which are in service today.

Owned by the Public Investment Fund, THC was established in 2019 as part of the Vision 2030 strategy to activate new sectors in Saudi Arabia, including the creation of an entire new ecosystem for aviation and transport services across the kingdom. Airbus’ relationship with THC began in 2020 with an order for 10 H125s.

At Heli-Expo 2024, THC also cemented a relationship with Leonardo by placing an order for 20 AW139 intermediate twinengine helicopters and signing another multi-year framework agreement for more than 130 Leonardo aircraft, a mix of AW109s, AW169s, AW139s and AW189s.

Arrival of the first 20 AW139s, which will be used primary to strengthen EMS and search and rescue in Saudi Arabia, are expected to be carried out in 2025 and

2026. THC currently operations 47 aircraft. By the time all these firmly ordered AW139s are delivered, THC will have around 50 AW139s.

Leonardo at Heli-Expo also continued its push into the single-engine, light helicopter sector with news that Metro Aviation, a prime privately owned HEMS operator in the United States, signed a distributor agreement for the AW09 helicopter. After beginning life in 2009 as the Marenco Swisshelicopter SKYe SH09, Kopter was purchased by Leonardo in 2020 which made its rebrand to the AW09 in April 2021 as the third of five planned prototypes moved the platform closer toward certification, now expected in 2025.

“I first saw the 09 prototype in 2017 and have been excited about bringing it to the U.S. market since then,” said Mike Stanberry, President and CEO, Metro Aviation. After reaching a deal to develop aircraft interiors and supplemental type certificates for the AW09 at Heli-Expo 2023, Metro in 2024 made a commitment for 30 units that will translate into preliminary sales contracts. Leonardo states the total number of preliminary sales contracts for the AW09 will soon exceed 100 units globally. The helicopter maker

The Helicopter Company was established in 2019 as part of Saudi Public Investment Fund’s strategy to activate new sectors. Here the company is flying an H145 and H135, models helping to form a massive agreement with Airbus for up to 120 aircraft, in addition to the operator’s new deal with Leonardo for 130 helicopters.

PHOTO: AIRBUS, THE HELICOPTER COMPANY

HELI-EXPO

in 2023 made a powerplant switch for the AW09 from the Honeywell HTS900 for the Safran Arriel 2K.

Bell Textron at Heli-Expo signed its first Bell 525 purchase agreement with Equinor, which aims to take delivery of 10 such aircraft beginning in 2026 for North Sea offshore operations. The Bell 525 is a next-generation aircraft highlighted by its fly-by-wire flight controls and fully integrated vehicle health monitoring. Bell explains the 525 drive system architecture is also precedent setting with all highspeed drives removed from the main rotor gearbox to incorporate independent and redundant reduction and accessory drive gearboxes. “The Bell 525 technology provides a generational leap forward and will revolutionize offshore oil and gas operations,” said Danny Maldonado, Bell’s Chief Commercial Officer. Bell 525 production is ongoing in Texas.

Bell also leveraged the Heli-Expo platform to introduce Chinook Helicopters of Abbotsford, BC, as an authorized Bell 505 dealership serving western Canada. Founded in 1982, Chinook is described by Bell as a global large-scale leader in helicopter and fixed-wing training. The company has served students from more

than 68 countries. “Bell and Chinook will work towards continued growth for the Bell 505 in Canada while providing regional Ab Initio and advanced rotorcraft training to potential Bell 505 operators in the region,” said Lane Evans, Managing Director, North America, Bell Textron.

Airbus Helicopters wrapped up HeliExpo 2024 with 155 commitments, including 40 firm orders from customers worldwide. In addition to its agreement with THC, Airbus HEMS provider DRF Luftrettung of Germany ordered up to 10 H145s and U.S. operator HealthNet Aeromedical Services added four H135s to its all-Airbus fleet. DRF Luftrettung is one of the largest air rescue organizations in Europe, operating more than 50 Airbus H135 and H145 helicopters at 40 bases.

Other Heli-Expo highlights for Airbus included Niagara Helicopters placing an order for six H130 helicopters, confirming a full fleet renewal for the tourism company based in Niagara Falls, Ont. Each year, the company welcomes more than 100,000 customers from around the world, providing a nine-minute, 27-kilometre tour over Niagara Falls. Airbus during Heli-Expo noted its global fleet in 2023 achieved three-million flight hours.

For the Airbus H125, StandardAero, in partnership with Thales, is set to provide kits and installations of what the company describes as the world’s first full 4-axis autopilot specifically engineered for H125 helicopters, starting this June. Based on the Thales Compact Autopilot System, this new solution, commercially known as StableLight, is described by StandardAero as transforming the flight control experience of the H125 with its stability augmentation that works without feedback in the control sticks. Features of StableLight include stabilized climb flight attitude recovery, auto pull-up terrain avoidance, and auto hover.

Another big change in the helicopter world came at Heli-Expo 2024 when David Smith was named CEO of Robinson Helicopter Company, succeeding Kurt Robinson. Smith had served as Robinson Helicopter’s VP of Operations, coming to the California company in 2023 after spending most of his career with Bell Textron. The last leadership transition at Robinson Helicopter occurred in 2010 when founder Frank Robinson retired and Kurt Robinson was named CEO. Smith becomes the third person to lead the aviation company over its 50-year history. | W

Leaders from Chinook Helicopters of Abbottsford, British Columbia, and Bell Textron celebrate news of a new dealership partnership for western Canada centred around the Bell 505 and Chinook’s expertise in training and aircraft service as an Approved Maintenance Organization.

ADVANCES IN CONNECTED AVIATION WATCHES

HOW PILOTS CAN LEVERAGE WEARABLE TECHNOLOGY FOR A BETTER FLYING EXPERIENCE

BY PHIL LIGHTSTONE

There is something cool about being a pilot or a devoted aviation enthusiast. It’s a lifestyle thing, which many aviators wear as a badge of honour. After all, there are very few of us in the world. Many

student pilots rush out to acquire their first pair of aviator sunglasses, that Maverick look. Next on their shopping list is a watch. Smartwatches continue to grow in popularity, especially with aviator, who can now leverage a range of useful apps. Equipped

with GPS, WiFi, cellular, Bluetooth and a variety of sensors, combined with software (apps), the newest generation of smartwatches open up exciting capabilities. While there are many brands of smartwatches, from an aviation perspective, Apple’s WATCH lineup and Garmin’s D2 Mach 1, D2 Mach Pro and D2 Air X10 are focused on aviation. Critical to any smartwatch is access to aviation apps.

Garmin has been manufacturing aviation focused smartwatches since 2013 (D2 Pilot), but its first GPS-enabled watch was the Forerunner 201 announced in 2003. Based upon Garmin’s propriety operating system, the company’s watches are designed from the ground up to integrate with Garmin Pilot and receive flight plans, while supporting iOS and Android smartphones. Garmin has had a variety of legacy watches, such as Marque. Its current aviation focused smartwatches include top-ofthe-line Garmin D2 Mach Pro (51 mm at $1,889 and 47 mm at $1,619), Garmin D2 Mach 1 (starting at $1,619) and its less expensive D2 Air X10 ($739).

The Garmin D2 Mach 1 sports a titanium case with the choice of either a fine Italian leather strap or a titanium bracelet. The watch is equipped with a 1.3-inch AMOLED display (33 mm), which is designed to operate in sunlight-rich environments like aircraft cockpits. Battery life is from one day to 14 days, depending on the mode which the watch is placed into. Expedition mode delivers up to 14 days. I fly with the smartwatch in GPS ONLY mode and have found that the smartwatch will routinely deliver 11 days between charges. Part of Garmin’s battery success is the physical size of the D2 Mach 1. It’s a chunky watch that has a lot of weight in the hand, which I like. I believe that Garmin provides better battery life by simply putting a larger battery into the case.

In late October 2023, Garmin released its newest aviator watch, the D2 Mach 1 Pro. The Pro builds upon the Mach 1, sporting: a titanium bracelet and silicon strap; 1.4-inch (51 mm) AMOLED display; display resolution of 454 x 454 pixels; battery life up to 25 days (10 days always on); weights 126 grams; and 32 GB memory. Sensors include SATIQ, pulse OX, blood OX, compass and thermometer with Bluetooth, ANT+ and WiFi connectivity.

The Pro is equipped with a flashlight (white and red light) with varying white light intensities, a strobe function and red light for cockpit operations. A new feature called Red Shift Mode, changes the entire watch interface to shades of red to help preserve your eyesight during night operations. The ECG app allows users to record their heart rhythm and check for signs of atrial

A Night Mode feature has been added to the Apple ULTRA which turns the watch display to a vivid red, perfect for night flights.

fibrillation (AFib). Users can take a 30-second ECG recording and view the results immediately on their smartwatch and, optionally, later in the Garmin Connect smartphone app. With a larger dial (screen), apps are easier to read with more data. As with most computer technology, bigger is better, but with CPU tech living on your wrist, one size does not fit all.

To configure and manage the Garmin watch, there are several core apps: Garmin Connect; Garmin Pilot; Garmin IQ; Garmin Database Manager; Garmin Express; and FlyGarmin.com. Download Garmin Connect onto your smartphone (Android and iOS) and the user’s guide. Turn on the watch by pressing the LIGHT button (top left). The watch will boot up and recognize that it needs to be setup. A few questions will be asked and you can answer with either buttons or the touchscreen. Once the watch is setup, open Garmin Connect to complete customization of the watch. It will pair itself using Bluetooth to your smartphone. The watch can use WiFi to download data. I found it easier to input the WiFi SSID and password information using the Connect app rather than directly onto the watch. Next, use FlyGarmin.com to begin the navigation database update process and don’t forget to setup a Favorite Airport.

The D2 Mach 1 Pro includes all the preflight, in-flight and postflight features that pilots have come to know and trust from the D2 series, including a worldwide aeronautical database, HSI, Direct-to and moving map, all available without a phone connection. Pilots can stay informed with easy access to NEXRAD3, METARs, TAFs and MOS4 weather reports, alongside custom weather alerts and non-weather alerts like time, distance, altitude and a fuel timer. You can use the wrist-based Pulse Ox sensor to monitor blood oxygen levels and barometric altimeter for altitude alerts. And in case of an engine related issue, the D2 Mach 1 Pro can show the best glide speed, estimated glide distance and time, along with a bearing pointer to the nearest airport and a list of alternate airports.

Flight logging is a breeze with the D2 Mach 1 Pro, which automatically starts tracking flights on takeoff, then automatically transfers the date, duration, total flight time and route to the user’s flyGarmin.com logbook. Pilots can connect with the Garmin Pilot app to seamlessly transfer flight plans to the watch and view the list of waypoints included in their route. Additionally, for pilots operating a Garmin PlaneSync equipped aircraft, the D2 Mach 1 Pro can be used to access the aircraft dashboard

to view status information, including fuel, electrical, database and location information while away from the aircraft.

In October 2023, Apple announced WATCH ULTRA 2, WATCH SERIES 9 and iPhone 15. The WATCH line up consists of ULTRA 2, SERIES 9 and SE. ULTRA 2 is its premier watch and SE is entry level. ULTRA 2 is a beefier watch as compared to WATCH 9 or earlier models. Made from titanium, it sports a 49 mm titanium case, which is water resistant to 500 metres and IP6X dust resistant. The case incorporates a sapphire crystal and a larger Digital Crown, which makes using the watch easier, especially when wearing gloves.

On the righthand side of the watch are the familiar Digital Crown and Side Button, with a depth gauge and a three microphone array. On the lefthand side of the watch is a new Action Button (in International Orange), dual speakers and a siren. ULTRA 2 is designed to operate in temperatures from -20C to 55C. Battery life has been improved providing up to 36 hours of battery life under normal use. With low power settings enabled, however, up to 72 hours of use can be expected (a coming-soon feature).

ULTRA 2’s built-in siren emits an 86 decibel sound pattern to aide in attracting search and rescue personnel. The siren can

be heard up to 600 feet away to help attract searchers as they get closer to you.

What makes ULTRA 2 even more attractive to aviators is a 3,000 nits alwayson Retina display. The bigger and brighter display will be more cockpit friendly than previous Apple WATCH versions. A Night Mode feature has been added which turns the display to a vivid red, perfect for night flights. Incorporating its new S9 SIP processor, Apple has enabled a Double Tap Gesture capability. With a new double tap gesture, users can easily control ULTRA 2 using just one hand and without touching the display. Users can tap the index finger and thumb of their watch hand together twice to quickly perform many of the most common actions. Double tap will also open the Smart Stack from the watch face, and another double tap will scroll through widgets in the stack.

Apple has three different bands available with ULTRA 2: Alpine Loop, Trail Loop and Ocean Band. A big change with WATCH 9 and ULTRA 2 is a dual constellation GPS. Previous Apple WATCH versions had an L1 GPS chip, which worked well when the watch had a clear line of sight to the sky. Apple has added a new L5 GPS chip which enables advanced signal processing, providing a more consistent signal in environments

Part of Garmin’s battery success is the physical size of the its watches like the D2 Mach 1, which sports a titanium case with the choice of either a fine Italian leather strap or a titanium bracelet.

like dense cities, improving accuracy and delivering more precise metrics.

Apple WATCH 9 and ULTRA 2 have two improved sensors: an accelerometer good to 256G and gyroscope. These two new sensors enable a distress feature, called

Reach your Aviation Goals

Learn from the Experts

For over 35 years, AeroCourse has been a leader in advanced aviation training in Canada. We provide advanced aviation training and develop and publish manuals and workbooks both hard copy and digital to assist pilots gain the knowledge they require for their IFR and ATPL. We offer IFR and ATPL seminars, IFR online courses, and hold specific advanced aviation courses inconjunction with airlines, colleges and flight schools. Our instructors are professional pilots and flight examiners with thousands of hours experience. We pride ourselves on high quality materials and training.

The skills, dedication and expertice of our instructors set them apart. They have an incredible knowledge base and have broad expeience, flying for Canada’s top airlines. They are dynamic and enthusiastic. Having exceptional instructors, ensures a productive learning environment and contributes to our student’s success

Crash Detection. With the built-in microphones, new sensors and advanced algorithms, Crash Detection can detect a car crash and initiate an Emergency SOS call using the cellular capability of WATCH or the cellular/satellite capabilities of iPhone. (iPhone 14 and 15 is needed for satellite connectivity.)

Aviation APPS which operate on WATCH are limited as compared to iPad and iPhone. WATCH compatible apps are installed using the WATCH app on an iPhone. Simply download and install iPhone compliant APPS like AeroWeather Pro onto your iPhone. Then open the WATCH app on your iPhone and scroll down to AVAILABLE APPS. Press the INSTALL button beside the APP. A short list of WATCH compatible aviation apps include: LakeHorn’s AeroWeather PRO, AeroAltitude, Metar Plot for Apple Watch; ZuluTime; LogTen; Sporty’s E6-B; WatchMETAR; Altimeter for Aviators; and MyFlightBook. Aviation Mobile Apps LLC has a bundle with myE6B, METARS Aviation, FAR AIM, Holding Pattern Computer, GPS Coordinate Converter, Time Calculator for Pilots; Aithre Connect. Available apps also include MyRadar, Windy, PlaneWatcher, FlightAware and Flightradar24, to name a few. Do not forget Apple’s Blood Oxygen,

SUSTAINABLE AVIATION FUELS NEED A PUSH IN CANADA

This is a critical time for the aviation industry when it comes to decarbonization and reducing its carbon footprint with lasting measures. Canada has an opportunity to be a leader in the production of sustainable aviation fuels (SAF) that will provide economic and environment benefits in every region of the country.

The House of Commons Natural Resources Committee’s study “Canada’s Clean Energy Plans in the Context of North American Energy Transformation” is a timely one, given the impact that the U.S. Inflation Reduction Act (IRA) has had on the clean energy landscape in North America. Canada has a lot of catching up to do when it comes to biofuels as the U.S. have not only already and steadfastly demonstrated the desire but have put in place measures to ensure that biofuel production and usage is supported. The IRA provides generous incentives to SAF producers in the form of a $1.75 USD per gallon ($0.62 CDN cents per liter) production tax credit.

A consortium of 60 airlines operating in Canada and 45 key stakeholders including ATAC, suppliers, aerospace manufacturers, airports, finance, and academia, created the Canadian Council for Sustainable Aviation Fuels (C-SAF), with the “mission to accelerate the deployment of SAF in Canada, and to ensure that the sector remains competitive as it transitions to a net-zero future, while at the same time creating new economic opportunities for Canadians”. The C-SAF recommends that the Canadian government act immediately to implement the industry’s recommendations to ensure that there is a future for made-in-Canada SAF.

The goal is to request that the federal government introduce a SAF incentive to stimulate production investment in Canada and to allow Canada’s biofuels industries to compete against the US. SAF incentives are a critical element of a robust and comprehensive sustainable aviation policy to be further developed jointly by government and industry. The next federal budget is expected in the early Spring. As uncertainty over future revenues from renewable fuels production remains a high barrier to investment, C-SAF are asking for a revenue certainty mechanism to be introduced within this budget to provide greater certainty to investors for a defined period of time, drive

investment in SAF production in Canada and to provide a transparent way to close the price gap.

ATAC fully supports the C-SAF recommendations as follows and that they be put in place immediately as concrete measures:

1. Implement refundable investment tax credits at a rate of 50% for SAF production facilities.

2. Create a production tax credit (PTC) with a ten-year horizon equivalent to the one in the United States.

3. If a PTC is not possible, Canada should introduce commodity price contracts for the difference or a revenue certainty mechanism to support SAF production and boost its uptake, providing certainty to both airlines and SAF producers.

4. Allow for a book and claim mechanism for SAF use in Canada that will enable the benefits of SAF regardless of which airport the airline refuels at.

C-SAF wants to build a SAF market in Canada to create new future-proof economic opportunities while decarbonizing the aviation sector and enhancing energy security. We want to ensure SAF availability in Canada, ensure sector competitiveness, limit impact on air passenger and cargo consumers, and ensure regulatory certainty. At present, SAF is the only proven way to decarbonize aviation significantly. Other technologies are not ready, and if the net-zero emission target for aviation by 2050 set by the Federal Government is to be met, immediate action is required. Currently, there is no SAF production in Canada and the price of SAF is untenable so even meeting the current goal of 10% SAF use by 2030 is very doubtful unless aggressive Government of Canada actions and support are undertaken at this time. Serious investments are required if we are to secure an adequate domestic supply of SAF. Canada must be self-sufficient and competitive with the US in terms of SAF. The price gap with conventional aviation fuel must be closed if industry can support this important emissions-reducing national effort.

ATAC, an active member of C-SAF, fully endorses this industry led initiative and calls on the Government to actively engage in supporting this effort by implementing C-SAF’s recommendations without delay.

John McKenna President and CEO

Air Transport Association of Canada

SEPTEMBER 7, 2024 Holiday Inn Burlington Hotel and Conference Centre

The one-day Canadian General Aviation Conference is designed to provide General Aviation pilots and aircraft owners, as well as flying enthusiasts and aspiring aviators, with access to leading suppliers and organizations of the sector, showcasing their newest technologies and services under one roof.

For sponsorship and exhibitor information, please contact:

By Mike Mueller |

An aerospace strategy for Canada

Developing jobs and economic opportunity for the future

For more than 80 years, Canada punched above its weight in the global aerospace arena, thanks in large part to the innovative and collaborative efforts of industry, coupled with support from a longstanding partnership with government, and most importantly political will to ensure Canada held a place of leadership among the global aerospace supply chain. Predictability and long-term planning are two essential ingredients of any successful nation engaged in the aerospace industry in any substantial way. Both of which have been lacking over the years and, as a result, Canada has seen investment in R&D for aerospace diminish with a sense of uncertainty.

Much of that perception changed at our most recent Aerospace on the Hill event in mid-2023. During the annual Ottawa lobbying event, in response to a question in Parliament, Canada’s Minister of Innovation, Science and Industry, Francois-Philippe Champagne expressed his willingness to collaborate with the industry in crafting an industrial aerospace strategy for Canada.

This signifies a crucial turning point, with the stakes for Canada having never been higher. Canada’s aerospace industry is not merely a contributor to our economy; it is a powerhouse, generating $27 billion in GDP, with more than 80 per cent of manufacturing revenues (approximately $18.7 billion) stemming from exports in 2022.

These are significant numbers, but in the absence of a supportive regulatory environment and clear commitment from government on an industrial aerospace strategy for Canada, we’re merely scratching the surface of our potential, allowing other nations to seize the opportunities in front of us.

Forecasts indicate, that over the next decade, there will be demand for 40,000 aircraft, countless numbers of UAVs and other aerospace products, worth billions. Canada has a distinct advantage as it is part of a select group of countries capable of manufacturing an aircraft from nose to tail and certifying it. Yet, labour shortages and resource limitations for certification at Transport Canada continue to impede our progress.

Civil aviation continues to be a pillar of

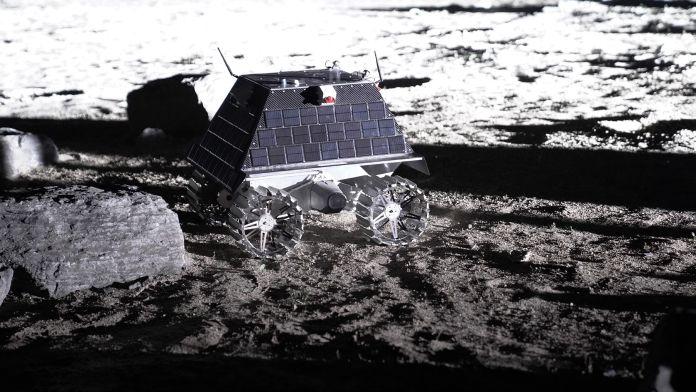

Canadensys and its partners are building the Canadian lunar rover to explore the Moon.

the economy. A greater alignment and integration with space and defence will lead to advancements in satellite-based navigation, remote sensing for weather forecasting, and air traffic management systems, ultimately improving safety and efficiency.

The global space economy is another area that presents significant opportunity to showcase Canada’s aerospace prowess. While Canada’s contributions in satellite communications, Earth observation, and robotics are substantial, generating billions annually and employing thousands of Canadians from coast to coast, according to the Space Foundation’s 2022 report, the global space economy reached $469 billion in 2021, with Canada failing to reach the top five among countries in ‘SpaceTech’.

The aerospace sector also plays a pivotal role in defending our boarders and national interests, supplying critical technologies to the Canadian Armed Forces. While the industry’s commitment to enhancing defence capabilities for the safety of all Canadians remains steadfast, with defence activity representing 17 per cent of total Canadian aerospace revenues in 2020, collaboration between civil aviation, space and defense is paramount to provide the predictability

needed to better support impending defense projects and deter evolving threats.

Considering the more than 600 aerospace companies spanning every corner of the country, with more than 200,000 workers, an industrial aerospace strategy for Canada is a must-have. It is our blueprint for growth, economic prosperity and national security. By aligning policies, investments, and opportunities through a comprehensive strategy we can leverage our competitive advantage and unlock our potential for world-class ideas.

Looking ahead to the Farnborough International Airshow in July, we agree with the Minister when he stated that we have an opportunity to take a Team Canada approach, to showcase to the world that Canada is open for business and ready to seize opportunities, with a strategy that positions Canada, its aerospace industry and workforce for all opportunities. It is critical to have government, academia and stakeholders working together to ensure our country is well positioned to take advantage of the opportunities that go along with the demand for clean technology and advances of future mobility. With an industrial aerospace strategy, we will have what it takes to compete. We have little time to waste. | W

Mike Mueller is the CEO of the Aerospace Industries Association of Canada.

THE SKY’S THE LIMIT

With over 500 aerospace and defense companies in Alberta, Calgary is an emerging centre of aviation excellence and innovation. When it comes to your career, set your sights on Calgary. aerospace.calgaryeconomicdevelopment.com