PLUS

The circular economy

Sustainable investment and partnerships needed P. 14 Spotlight

Ward Steward, director of production operation, Sticker You P. 12

PLUS

The circular economy

Sustainable investment and partnerships needed P. 14 Spotlight

Ward Steward, director of production operation, Sticker You P. 12

Recent action plan aims to protect 30 to 50 per cent of the world’s forests by 2030 P. 7

New Products

Products and solutions from Domino, Mutoh America, Herma, Edale, manroland, UPM Raflatac and Screen P.16

Editor

Kavita Sabharwal-Chomiuk

kchomiuk@annexbusinessmedia.com

437-220-3039

Associate Publisher

Stephen Longmire

slongmire@annexbusinessmedia.com

416-510-5246

Media Designer

Graham Jeffrey gjeffrey@annexbusinessmedia.com

Account Coordinator

Alice Chen

achen@annexbusinessmedia.com

416-510-5217

Circulation Manager

Beata Olechnowicz

bolechnowicz@annexbusinessmedia.com

416-510-5182

Circulation

bolechnowicz@annexbusinessmedia.com

Tel: 416-510-5182

Fax: 416-510-6875 or 416-442-2191

Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Group Publisher

Diane Kleer

dkleer@annexbusinessmedia.com

COO

Scott Jamieson

sjamieson@annexbusinessmedia.com

Annex Business Media

111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1 printaction.com

Tel: 416-442-5600 • Fax: 416-442-2230

Tarsus Group, the organizer of Labelexpo/Brand Print Americas 2020, has confirmed new dates for its shows, which were originally scheduled to take place Sept. 15-17, 2020, at the Donald E. Stephens Convention Center in Rosemont, Ill. The shows have been rescheduled for March 23-25, 2021, and will take place at the same location. A virtual conference will precede the shows, taking place during the originally scheduled September dates, allowing the region’s industry to stay connected amid the COVID-19 pandemic.

Group Packaging Inks has implemented a North American price increase for its solvent-based business to alleviate raw material cost increases. The price increases

will apply to all Flint Group Packaging Inks products sold in Canada and the United States, and will take effect July 15, 2020.

Supply across a number of raw material categories has tightened as costs have risen due to a more constrained market. Solvent costs, particularly isopropyl alcohol, have climbed to a level that mandates the company pass along a portion of the increase, says the company in a press release. In addition, the market has seen significant cost increases in other raw materials, including polyamides, resins and carbon black.

Flint Group says local sales representatives will be reaching out to all its customers to discuss how the price increase will impact each business.

R. R. Donnelley & Sons Company (RRD) has announced that it has shifted some of the production at its packaging facilities in Greensboro, N.C. and Reynosa, Mexico to create single-user paper face shields to help limit the spread of COVID-19. The company is currently able to produce approximately one

million pieces per week by completely automating the production cycle.

The shields offer a cost-effective solution for businesses where interpersonal engagement is necessary, particularly “essential” workers, including those that are employed in the retail and grocery, restaurant and food-

service, manufacturing, civil service, hospitality and travel industries.

RRD’s face shields are intended to be used as a standalone personal-use face shield, for either a single user or single use. The shields cover the entire facial area and can be custom printed with branding and messaging and are

made from recyclable 18pt solid bleached board (SBS) with a 4-5mm polystyrene plastic film to cover the face.

Alon Bar-Shany has left his role as general manager of HP Indigo, HP’s labels, flexible packaging, folding carton and commercial division. BarShany had been with HP for 25 years, and has led HP Indigo since 2004.

Haim Levit has been appointed HP Indigo’s general manager, effective immediately. Industry veteran Levit brings 25 years of print experience to the role, most recently leading the worldwide go-to-market for HP’s Industrial Graphics organization.

In his time with HP Indigo, Levit has held a wide range of leadership roles ranging from global procurement manage-

ment, NA supplies business management and NA business director, vice president and general manager for HP’s

Americas Indigo and Page-

Wide Web Press, before moving into the graphics industrial organization.

Levit and his family currently reside in Boston, Mass., and will be relocating to Israel over the summer.

Screen Americas will be relocating in fall 2020 to a new, larger North American headquarters in Elk Grove Village, located outside of Chicago, Illinois. The campus will be housed in a new construction, state-of-the-art technology park and will include an equipment staging and shipping depot, increased office space and a Customer Experience Center.

The HQ’s Customer Experience Center will provide Screen Americas with a complex for comprehensive demonstrations and training. It will also allow the company to handle future growth due to its planned launch of additional new Print on Demand (POD)

technology offerings within the company’s portfolio of label and packaging solutions, as well as its high-speed continuous feed solutions for the commercial print, direct mail, transactional and publishing markets.

To support the company’s growth, Screen’s service and sales teams will be expanded, including the addition of service and product support technicians working with dedicated sales and product manager teams, along with further capital investments in advanced service technology and delivery solutions.

Pickering, Ont.-based Ellis Packaging recently invested in its fourth Koenig & Bauer Iberica Optima 106 K die cutter. “Since the installation, we’ve seen our net output, which factors in press speed, makeready times, and down time, improve by an impressive 25-30 per cent. Due to the significant improvement in our productivity, we’ve seen a major increase in the amount of savings because we’re not running the die cutters in overtime,” said Cathie Ellis, president.

Hub Labels, based in Hagerstown, Md., has announced the recent acquisition of a new silicone and hot melt adhesive coater from Longueuil, Que.-based ETI

Converting Equipment to support the linerless label market segment. This acquisition makes Hub Labels the only print facility in the United States to have two silicone and hot melt adhesive coaters to create linerless labels, which are ideal for skin pack trays. Hub Labels added a second coater to provide additional security for its linerless customers. The new equipment features a coat-weight monitoring system that can read both film and paper substrates. The monitoring system also allows for personalization for each customer and job so the precise coat-weight necessary for each application can be met.

Jones Healthcare Group, an advanced packaging and medication dispensing solutions company, recently invested in a new, custom-built Koenig & Bauer Rapida 106 eight-colour press for its London, Ont. facility. The company says the press will increase its production capacity, flexibility and efficiency through highly automated technology and speeds of up to 18,000 sheets per hour. The custom press is equipped with a state-of-the-art QualiTronic PDFCheck system for automatic, 100 per cent inline inspection against client-supplied PDFs at high resolution, as well as Koenig & Bauer’s Sheet Ident system for colour and quality control, which help ensure packaging meets the rigorous standards of the health sector. The Rapida 106 will arrive at the company’s London facility this summer and is expected to be operational in October.

A recent initiative aims to protect 30 to 50 per cent of the world’s forests by 2030

By Kavita Sabharwal-Chomiuk

In recent years, online shopping has become more and more prevalent for consumers to conveniently meet their purchasing needs. One issue that has arisen from this boost in e-commerce is the massive amount of packaging required to ship online orders from warehouse to consumer.

This increase in paper-based packaging has been wreaking havoc on the world’s forests, wildlife and climate. In an effort to reduce the impact to ancient and endangered forests—especially those that are high-carbon and high-biodiversity-value forests—one not-for-profit environmental organization, Canopy, recently launched an initiative and action plan targeting the

protection of 30 to 50 per cent of the world’s forests.

In 2017, 245.8 million metric tonnes of paper packaging was produced, including a high percentage made from trees logged from vital, high-carbon value forests and endangered species’ habitats. By 2025, that number is slated to grow by over 20 per cent, which conflicts with the International Panel on Climate Change and International Union for Conservation of Nature 2030 imperatives for resolving the climate and biodiversity crises.

“[E-commerce] already has a massive footprint, and that footprint is continuing to grow quite aggressively,” says Nicole Rycroft, founder and exec-

utive director of Canopy. And, she adds, those figures don’t include the over-450-million tonnes of paper that is produced each year, of which more than half is also included in packaging.

Recently, discussions about reduction have focused on single-use plastics in packaging, resulting in a market shift to paper packaging products and a greater impact on forests. According to Canopy, 30 per cent of the climate

solution relies on forest conservation. It is also the key to protecting species and preventing future epidemics.

Canopy’s Pack4Good initiative was launched in October 2019 and has now teamed up with 22 major companies—representing 71 brands and $66 billion in annual revenues, including Stella McCartney, prAna and Telus—to

help prevent the world’s ancient and endangered forests from ending up as shipping boxes and single-use packaging.

“We’re cognizant that packaging has been going through a bit of a zeitgeist moment in recent years,” notes Rycroft. “As companies and governments have been grappling with the environmental impacts of plastic packaging, we wanted to ensure that there wasn’t a situation of unintended consequence created with these companies and governments, in that as they tried to resolve plastic pollution, they were exacerbating the impacts on forests.”

According to TAPPI, 57 per cent of all the paper made in the world goes into packaging. And according to Smithers, an increase in e-commerce, along with the amount of packaged consumer goods in the food and beverage industry, has led to a 2.5 per cent annual increase in paper packaging.

Rycroft notes that apparel brands are responsible for over 50 per cent of B2C e-commerce, and many brands use just as much, if not more, fibre in the packaging that underpins their businesses as they do in the actual apparel that they sell.

“Our launch of Pack4Good was really to seek to ensure that we’re enabling brands to have a holistic

approach to addressing their packaging impacts,” says Rycroft. “Most of the brands that we work with already have plastic packaging commitments in place. And this is kind of a complimentary or synergistic strategy for them to ensure that they’re not trading in one environmental problem for another.”

The brands that have committed to Pack4Good have vowed to increase the use of recycled fibre, smart design and next-generation solutions throughout their packaging supply chains. Pack4Good’s partners are committed to ensuring that by the end of 2022, all their packaging is free of fibre from ancient and endangered forests; is designed to reduce material use; maximizes recycled and alternative next-generation fibres, such as agricultural residues; and uses FSC-certified paper when virgin forest fibre continues to be used.

“We started working with some of them to expand their commitments, which have been really focused on viscose and rayon fabrics, to include packaging. It was just a natural extension of conversations that we were already having and expansion of relationships that were already in existence,” says Rycroft. In addition to working with brands, Canopy works with next-generation technology entrepreneurs to

provide alternatives to conventional wood-based technologies.

“Our requirement of the technology entrepreneurs that we work with is that they are price-competitive with conventional wood or wood-based technologies and that they’re at least equivalent in terms of the technical performance,” notes Rycroft. “Those alternative fibres perform equivalently, and they can be incorporated back into the recycling stream.”

After identifying the need for an action plan about 18 months ago, Canopy went into a period of deep research, analysis and scenario-mapping. They found that forests are identified as 30 per cent of the climate solution, and 80 per cent of the world’s terrestrial biodiversity depends on forest ecosystems for their existence. In January 2020, Canopy released Survival – A Pulp Thriller, its 2030 blueprint for the

ramp-up of next-generation solutions to this forestry crisis.

“This is a turnaround decade,” says Rycroft. “We were really pleasantly surprised, after doing the analysis and in the mapping of scenarios within Survival, just how viable this pathway is. If we’re to protect 30 to 50 per cent of the world’s forests by 2030—which, even to us, initially sounded a little bit crazy—then how do we actually get there? Is it even possible? Survival made us feel very confident that it actually is possible, and that it’s affordable to this scale to change.”

According to the action plan, in order to eliminate ancient and endangered forests from the pulp supply chain, 324 alternative fibre and recycled paper mills must be built (or retrofitted) globally, while 7.52 million hectares of new forests must be planted for fibre. Nearly 17 million tonnes of ancient and endangered forests will need to be removed from the supply chain through

reuse, efficiency and reduction initiatives by major purchasers or forest products. In addition, protected or restored forests must not be used for fibre farms.

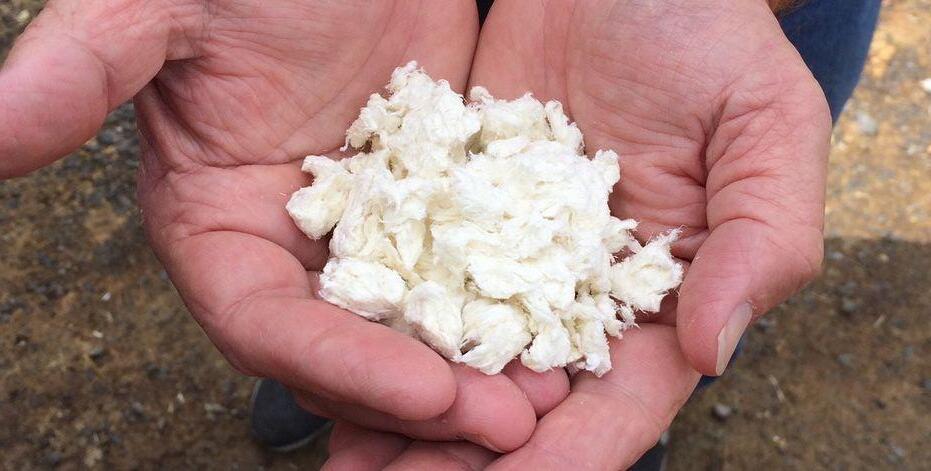

As part of the action plan, Survival found that alternative agricultural fibres could be used in place of forest fibre in paper and packaging products to reduce the impact to forests globally. Alternative fibres include agricultural residues such as straw leftover after the

food grain harvest, or microbial cellulose, which can be grown on food waste. According to Survival , prior to the 1800s, paper was made from annual plant fibres, cotton rags and flax/linen. While many parts of the world shifted to using trees, some countries, including India and China, never stopped producing paper from agricultural fibres. Over the past decade, cleaner and more efficient technologies have been developed to convert alternative fibres,

“Our reflection with pulling [the action plan] together was that there is no single silver bullet.”

which are currently being disposed of or burned, into paper and packaging at scale. These fibres include wheat straw residues; sorghum straw residue; flax and hemp straw residue; sugar cane bagasse residue; pineapple leaves; bamboo; and fibre-specific crops, such as miscanthus and switchgrass.

While the technology required to make this a reality is not rampant, agricultural fibre pulp mills are beginning to be built around the world. For example, Columbia Pulp, located in Washington State, is the first commercial-scale wheat straw pulp mill in North America since the last one closed in the 1960s. This is just one of a dozen such ventures.

W hen asked about the lessons

Canopy learned while putting its

action plan together, Rycroft noted that we actually have more than enough fibre to make this goal a reality. “The projections that are included in here are very conservative. We wanted to make sure that we didn’t inadvertently trade in one environmental disaster for another, that we were stripping off so much straw after the food grain harvest that farmers were then going to have to use more fertilizers on their soil,” she says.

Rycroft adds that the projections are based on rigorous assumptions around how much organic matter needs to be left on the field to maintain the organic integrity of the soil. “In spite of that, there is more than enough fibre both for the paper and

packaging side as well as waste clothing on the manmade cellulosic viscose supply chain side,” she says.

Canopy aims to have agricultural fibre products certified by the Roundtable for Sustainable Biomaterials to ensure sustainable removals, the maintenance of soil carbon and other social and environmental factors for sustainable agriculture are met. According to Survival, “practices that regenerate soil carbon or avoid carbon emissions, for example diverting crop residue from traditional burning or the planting of fibre-specific crops that fix carbon on degraded soils, can be certified through to the end product”.

The action plan indicates a total investment of $68.8 billion between 2020 and 2030 will allow for consumption reduction, building mills to pulp alternative fibres, increasing recycling capacity and planting new trees to prevent the use of wood from ancient and endangered forests.

Canopy says Survival outlines a tangible plan and concrete targets for shifting the pulp sector away from its reliance on forest fibre.

“I think our reflection with pulling this together was that there’s no single silver bullet,” says Rycroft. “There are multiple pathways and technologies for us to be able to achieve this vision. Demand side players—the brand, customers and printers—all have a really important part to play in it, as do the producers on both sides, as well as enablers like the investment community in government, both in terms of permitting, and the mobilization of capital, to make this kind of infrastructure transition.”

Although Rycroft notes that there isn’t one simple answer to protecting forests, here is proof that there are ways to reduce the impact packaging has on forests by up to 50 per cent.

Click here to learn more about the action plan, Survival: A Pulp Thriller.

– Zünd Board-Handling System BHS150 for industrial-level automation

– Ultimate non-stop productivity with 1.5m stack height, automatic job retrieval, D3 dual-beam production capacity

– Explore Zünd packaging solutions, from prototyping to industrial-level production

m

Last summer, Canadian e-comm startup and customized die-cut sticker company StickerYou opened its first retail location in Toronto, describing it as the world’s largest sticker store. Here, Ward Stewart, Director of Production Operation, shares how he helped implement smart workplace management that resulted in substantial production efficiency.

PA: Can you tell us about StickerYou?

WS: StickerYou is an innovative company that produces custom die-cut sticky products, including stickers, labels, decals, temporary tattoos, iron-on transfers, badges and patches. Customers can use our online stickermaker to create custom stickers and other products in any size,

any shape and any quantity, or they can work with our design team to create the perfect design for their needs. StickerYou was the first company in the world to offer the ability to

customize stickers – and later, temporary tattoos – online. What really makes us special is that we offer customers the ability to customize the design with no minimum order. It’s a revolutionary concept for the printing industry.

what the production department already did well; and which members of the existing staff were ready to take on leadership roles.

PA: Since joining the company, you oversaw changes that have doubled label capacity and resulted in a 60 per cent reduction in late orders. How did you accomplish this?

WS: Initially, we needed to change the culture within the department from that of a startup to a full-fledged production operation managed by key personnel. I recruited more full-time skilled personnel, rather than continuing with a majority staff of part-time operators, which had presented many challenges to smooth daily operations. Over the next 60 days, the primary focus was to identify a few things: Whether the production management structure supported the company’s current and projected future needs;

We moved from a traditional production management style with one individual in charge to a team of three key production staff managing the day-today in print operations (for pre-production needs, such as QC, order management, file preparation/adjustments, shipping and KPI reporting), print production (departments that handle the daily execution of printed orders, scheduling staff over rotating shifts and production planning with department leads), and technical services (managing all equipment to prevent extended downtime, monitoring daily equipment performance, improving production knowledge of software and equipment use and identifying future equipment needs/purchases).

Next, we implemented a dedicated fulfilment and shipping department to monitor order quality, counts and to meet on-time shipping. From there, we stopped moving staff through multiple

departments and had them focus on one key function instead, which improved daily efficiencies by more than 20 per cent. We improved our knowledge of equipment capabilities, particularly around print speed, cutting time and daily staff performance by department, giving us greater insight on how to process orders, the amount of labour required per shift, and what role automation could play in each department as we grow. As well, we refined our daily production meetings to focus on lean manufacturing principles that look at waste and real-time order management to meet the diverse demands placed on scheduling and staff management. This has impacted customer satisfaction by improving print quality and dropping the number of late orders from almost 28 per cent down to 0 per cent daily.

PA: How is the state of the print industry?

WS: It’s in a period of constant transi-

tion. A lot of what is happening in terms of equipment and material development is based on how to make things faster, of better quality and customized to the market’s changing desires. What will drive this in the future is customer service, even more so than price. At a certain point, you can’t make things more cheaply — the added value for consumers will be their experience with the company, and a major part of that is their experience with customer service. It will be as much about how they get the product as the quality of the product itself.

WS: Some of the biggest challenges in the printing industry are turnaround time, environmental concerns, product cost, and innovating new customizable products. Printing companies can combat these challenges by keeping prices at a level that satisfies both the consumer’s and business’s

appetite to buy, positioning print as a complementary component to digital by demonstrating a solid ROI and highlighting the fact that most audiences better retain information if they receive it in printed communication.

As for environmental concerns, moving to a customizable product offering while continually innovating or refining products can be a step in the right direction and help alleviate concerns. Building strong partnerships with product and equipment vendors is also key, as is developing our collective knowledge of market needs through research. By keeping an eye on what might be coming next for the print industry, you can devise plans to adapt to future shifts and changes in the industry.

PA: Why do you think print continues to be relevant in a digital future?

WS: The belief that print is dying is no longer an accurate assessment of the industry and probably won’t be true for

many years, if at all! Consumers and businesses of all sizes will always rely in some form or another on printed communications due to the changing buying habits of the purchasing market. Even with the growth of online shopping, consumers or businesses are always in need of hard copy products, whether that’s a sticker, packaging or a piece of mail. What will continue to change is the technology and materials used to print those items and the order size (quantities) printed for each order. Based on what we’re seeing from our new retail store, consumers want to use/buy printed matter that is offered in a customizable option, created with their own design and at quantities they desire in an on demand basis with faster turnaround. Print will clearly evolve, but I don’t think it will ever die!

This interview has been condensed from the original version, which can be found on PrintAction.com.

investment and partnerships are needed to make it a reality

By Ian Lifshitz

Think about the last item you purchased and threw away; did you consider where said product would end up once it went in the trash? In our age of mass consumption, we are producing waste at alarming rates, but this trend is changing – consumer desire is radically shifting to more sustainable practices. Consumers are vocalizing how they expect the companies they engage with, including the brands they patronize, to collaborate and provide products and services that help promote an eco-friendly way of life and contribute to the circular economy.

When considering a sustainable path forward, organizations would be remiss not to consider the role suppliers play driving sustainable production. Ultimately, the supply chain economy is part of one interconnected ecosystem, where end products have longer lifespans and the ability to re-enter the cycle for reuse. With this in mind, sustainable supply chain development requires holistic strategy to achieve results.

Many companies are working to blend the circular economy with the bio economy to ensure that a sustainable closed system forms as the corner-

stone of their operations. The combined approach examines how a sustainable product process can leverage compostable and recycled materials, resulting in less waste production and smarter use of renewable materials.

Alignment with the circular bio-economy encourages industrial symbiosis and a clear move away from the takemake-waste approach to manufactur-

ing. It means finding opportunities to change how we do things while maintaining the benefits we derive from ecosystems.

Supporting a green supply chain from start to finish can make a big difference in developing sustainability initiatives. Green supply chains must support a global industry with responsible business practices by protecting

forests, peatlands and biodiversity, and working in harmony with local communities.

Companies across the globe have undertaken this new consumer demand, radically transforming their business practices to become industry leaders in their respective fields. From implementing satellite technology to track logging operations to developing new packaging systems, companies are heeding the call to action. Businesses are always looking into innovations that could play an integral role in sustainability mandates.

For example, since 2016, Asia Pulp & Paper (APP) has been in a strategic partnership with MDA, a Canadian company helps businesses leverage technology to provide transparency and customer assurance that their products are produced sustainably.

MDA’s spaceborne RADARSAT-2 radar imaging sensor images through clouds to enable proactive and persistent monitoring of forest cover loss in

When considering a sustainable path forward, organizations and decision-makers would be remiss not to consider the role suppliers play driving sustainable production.

conservation areas through its Forest Alert Service (FAS), which could stem from planned jobs, natural loss stemming from disasters and illegal encroachment on conservation land.

Industries across the board are also looking for ways to directly reduce their carbon footprints. From reducing water usage to cutting greenhouse gas emissions, companies are moving in the right direction. The pulp and paper industry has seen such changes over the past 10 years. Companies are also investing vast resources to ensure their power consumption comes from renewable energy sources, some even going as far as using their own by-products as fuel itself. APP uses

by-products including palm shell, biogas and sludge waste, and through implementing such practices, has been able to shift 54 per cent of its energy consumption to renewable sources.

The takeout industry has been exponentially growing over the past 10 years and with it, has created a substantial issue of waste. With more food deliveries comes more packaging and the need to ensure that businesses and consumers are able to find sustainable options. As consumer demand for sustainable products continues to rise, businesses are adapting their supply chains and processes to ensure that they provide sustainable, recyc-

lable and fully compostable solutions. Responding to this increase in demand, APP developed the Bio Natura Foopak line of products, replacing plastic and foam packaging with a fully sustainable and compostable product made from lightweight virgin paper alternatives. Innovations like this allows the food industry to continue to meet demand sustainably.

In order for the circular economy to become the new business norm, both sustainable investment and partnerships are unliterally needed.

Ian Lifshitz is Vice President of Sustainability & Stakeholder Relations at Asia Pulp & Paper Canada.

Herma has added a variable labelling height option to its InNo-Liner system to implement linerless technology. The labels can be applied to the top of shipping cases of different heights that are fed to the applicator in any sequence. The production model transfers the non-sticky label to a tamp pad, which is equipped with a box height sensor. Micro-atomized water activates the adhesive on the label and the linear transfer unit moves the tamp pad with the activated label to the required labelling height for the next case in the line. The InNo-Liner system will be commercially available in October 2020.

Herma has added a variable label height option to its InNo-Liner system.

Manroland Varioman

manroland Goss’ Varioman line of presses have been specially developed for packaging printing and are designed to meet new environmental and recycling requirements. The printing technology is based on the offset printing process. The register accuracy of the offset solution provides standardized 6- or 7-colour systems (ECG, or Expanded

Colour Gamut). This eliminates ink changes, as well as the washing agent and ink consumption. In addition, it allows shorter changeover times. Varioman presses with electron beam curing consume a lower amount of energy compared to conventional hot air based drying. In addition, its high-performance ink curing provides a printed product surface that is already scratch-resistant and glossy, and often no further coating layer is required. The electron beam ink can remain wet in the unit, saving the need for daily cleaning, which results in less ink waste, and a reduced amount of cleaning agents used.

Raflatac Rêverie 2

UPM Raflatac has launched Rêverie 2, a new premium collection of high-end labelling materials for wines, spirits and craft beverages. The collection features a variety of FSC-certified materials (FSC-C012530) from sustainably managed forests and materials made from 100 per cent recycled content and other controlled sources. The recycled materials used helps brand owners reach their own sustainability targets.

The Rêverie 2 collection includes:

• UPM Raflatac Jazz Ice Premium-FSC – a light, textured design with ice-bucket performance.

• UPM Raflatac Jazz Silver Ice Premium-FSC – an iridescent version of Jazz Ice for labeling white, rosé and sparkling wines.

• UPM Raflatac Ronda PCR Ice Premium-FSC – an elegant material made from 100 per cent recycled content with an optimal level of whiteness and embossing properties, with ice-bucket performance.

• UPM Raflatac Rust – a super-premium material that communicates authenticity and craftsmanship and is suited for spirits, craft beer labels or red wines.

• UPM Raflatac Sabrage Blanc de Blancs Ice Premium – a premium, highly elegant material suitable for high embossing and debossing, combining the tactile properties of cotton fibers with ice-bucket performance.

Edale Ltd has launched its latest addition to its FL range of flexographic presses, the FL1 Prime. The FL1 Prime is built on the fundamentals of Edale’s FL3, and is designed to give customers affordable label printing with minimal waste. The target market is businesses that want a logical replacement or addition to the older mechanical presses used within the narrow web printing market or do not require the advanced automation of the FL3.

The FL1 Prime features a width of 350mm, servo-driven technology as standard and the Uniprint printhead design geometry, as well as pre and auto-register. The modular, upgradable Prime has the option to install EZ Reg and EZ Die as well as LED UV curing.

Screen Graphic Solutions has finalized the development of the PacJet FL830, a new high-speed, water-based inkjet system designed for the flexible packaging market. The FL830 is set to be launched in March 2021.

The new printing system can handle media up to 830 mm (32 in) wide at speeds of up to 75 metres per minute (246 feet per minute). It is also capable of printing at a resolution of 1,200 dpi using CMYK and white water-based inks that conform to relevant food safety regulations.

Mutoh America has launched a new 300mL ink pack size for

Mutoh America Inc. has launched a new 300mL ink pack size for MS41 inks that are compatible with 1641SR and 1682SR XpertJet printers.

The PacJet FL830 was designed for the flexible packaging market.

The PacJet FL830 can be used for promotional to production applications. It can also responsively tackle small lot jobs under 4,000 metres. Currently, the system handles both PET and OPP media and Screen is working to further expand compatibility based on industry requirements.

The Greenguard Gold-certified inks can be used for prints placed in sensitive areas, such as hospitals, health care facilities, daycare centres and more. They feature excellent weather resistance, abrasion resistance and chemical resistance, and can last up to three years in an outdoor setting without lamination.

The inks provide improved dot gain in high-density areas, and are available in four or seven colours in 1,000mL or 300mL bags. The inks have a two-year shelf life from the date of manufacture.

Domino launched its X630i, its first digital inkjet product offering for corrugated box printing, during a virtual launch event on June 16. Domino also launched a new ink set based on novel water-based ink technology.

“The single pass Domino X630i digital inkjet press has been designed for everyday corrugated production, allowing corrugated box printers to maximize productivity and efficiency, and minimize cost, ink consumption, and waste,” said Matt Condon, business development manager at Domino. “It will enable them to profitably develop short and medium run market opportunities, facilitate new streams of business, and provide a more complete range of capability for their customer base.”

M o re p ro fi t f ro m your cur rent fl ex o p ress ?

We kn ow i t ’s ha rd to believe . It really is as amazing as it sounds. The Illumina UV-LED retrofit curing system from Fujifilm expands production capabilities while reducing energy costs up to 94% – all on your existing flexo press. With the rapidly growing number of installations, the system has increased running speeds up to 70%. And, when