MANUFACTURING GEOMETRIES

FEATURES

14 Manufacturing geometries

18 The spice of printing life

Hitting a tipping point for when inkjet becomes a critical production tool

2 1 DIA on short-run packaging

Greater Toronto’s printing community gathers for a digital packaging push

DEPARTMENTS

GAMUT

5 News, People, Calendar, Installs, Globe, Archive

Technology Report

22 Short-run finishing

Understanding the intriguing growth and position of print catalogues 14 21 30 18

Why 3D printing can influence most any category of discrete manufacturing

One of the printer’s greatest tools continues to attract attention for speed, value and flexibility

New Products

26 Detailing the newest technologies from Aleyant, Beta, Epson, HP, Kernow, OKI, Rioch, Sun Chemical and Tilia

MARKETPLACE

29 Industry classifieds

SPOTLIGHT

30 Mitchell Leiman, VP of Strategy and Corporate Development, Cimpress

COLUMNS

4 Jon Robinson

Critical manufacturing

The Canadian Manufacturing Coalition provides an outline for growth

CHRONICLE

11 Nick Howard

Film, plates and everything

DuPont becomes a powerhouse making hundreds of discoveries for print

SALES

12 Dave Fellman

Teach the kid, not the lesson

Before selling solutions to potential clients, first listen to their problems

DEVELOPMENT

13 Domtar Blueline

Still a smart marketing choice

ISSN 1481 9287. PrintAction is published 10 times per year by Annex Business Media. Canada Post Publications Mail Agreement No. 40065710. Return undeliverable Canadian addresses to: Circulation Department, 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1. No part of the editorial content in this publication may be reprinted without the publisher’s written permission. © 2018 Annex Publishing & Printing Inc. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or publisher. No liability is assumed for errors or omissions. All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of this publication. Printed in Canada. January / February 2018

COVER IMAGE DESIGNED BY KRASUL.

Critical manufacturing

Ioften count myself lucky to have the support of a media company committed to editorial investment. Support that allows me to investigate strategy and innovation in the business world, and to look beyond backward agendas that can turn serious issues into obtuse observations. This luxury, if you will, provided the opportunity to take a serious look at the current state of 3D printing to see if it is more applicable for the traditional printing world more than any other discrete manufacturing sector.

The Canadian Manufacturing Coalition sent a letter to Canada’s Finance Minister suggesting that lowering the top marginal personal income tax rate to 31 percent from 33 percent would help attract and retain talent, potentially avoiding a brain drain like the country experienced in the 1990s.

From a technological standpoint, there is little doubt 3D printing – additive manufacturing – will have a significant impact on printing, based on the fact that many of its most-predominant suppliers are well positioned to apply years of research and development to the 3D sector. This became front and centre in mid2016 when HP – one of the world’s inkjet pioneers – launched its Multi Jet Fusion platform with the idea of disrupting a 3D sector that has not truly taken off yet. HP has since forged 3D printing relationships with companies like BMW Group, Jabil, Johnson & Johnson, and Nike.

In an October 2017 article called HP Multi Jet Fusion 3D Printer Redefines 3D Printing, Chris Fay of 3Dprintingindustry. com explains, “Perhaps even more impressive than warp printing speeds of 30 million drops per square inch – or 340 million voxels – per second is the Jet Fusion 3D Printer’s ability to print continuously. Not only is this printer working up to 10 times faster than its closest competitors in the 3D market like FDM and SLS, but it’s also outperforming them in total throughput thanks to a closed loop printing and post-processing system. Fast-cooling capabilities with multiple build units allow for high-volume continuous printing and decreased time lapsed from concept to part.”

A handful of powerful printing technology suppliers like HP have intellectual property – even beyond jetting highvalue fluids through nano-size nozzles –to shift the direction of additive manufacturing. The true impact on printing companies, however, will come in areas like parts sourcing for million-dollar presses and post-press equipment, as well as direct application within more automated factories of the future. There are opportunities for select printers with fitting business models to provide consumer-level 3D printing, but it is unlikely to be a serious pursuit for most relative to investments in areas like distribution and communications management.

3D printing, much like the maturation of technologies now driving Industry 4.0, in the application of processing power to capital equipment, will be a positive for

printing companies in their ability to source parts for machines in a more economical manner. Particularly in the vast geography of Canada, printers will embrace the ability to have an exacting press part – rare or otherwise – delivered to their door in a manner of hours instead of days.

3D printing does not pose a direct threat of displacing print work like digital mediums have in some applications, even if it holds the potential to wipe out specific manufacturing classifications much like desktop computing destroyed thriving typesetting and film infrastructures. The greatest 3D printing pressure on the foundation of manufacturing, however, will relate to understanding its implications of regional or international trade versus localized sourcing – New World distribution in connected economies.

This is not a new threat to Canadian manufacturing as highlighted in a January 2018 letter from the Canadian Manufacturing Coalition to Bill Morneau, Federal Minister of Finance, noting capital investment and foreign direct investment have fallen, resulting in weakened productivity and global competitiveness, and fewer innovations. As detailed in the February 2018 issue of Electrical Business (a media brand also owned by Annex Business Media), the letter points to several measures for boosting investment and growth.

Some of these measures include: Reducing Federal and Provincial general corporate taxes to a combined 20 percent; expanding and improving the Accelerated Capital Cost Allowance depreciation rules to mirror new U.S rules; introducing an Investment Tax Credit on purchases of new equipment and software of between 10 and 15 percent to help companies, especially SMEs, improve cash flow and offset the impact of the low Canadian dollar on the cost of buying foreign machinery and equipment; and introducing a “patent box” innovation support that would reduce taxes on profits from new products and product mandates, similar to Quebec and Saskatchewan.

Canadian Manufacturing Coalition, explains Electrical Business, also looks at lowering the top marginal personal income tax rate to 31 percent from 33 percent to attract and retain talent – and avoid a similar brain drain that plagued Canada’s economy in the 1990s. Attracting and retaining top talent, and providing equal pay (see Adobe’s groundbreaking initiative, page 6), are critical issues for the health of Canadian printing.

Editor Jon Robinson jrobinson@annexweb.com

Contributing writers

Zac Bolan, Wayne Collins, David Fellman, Victoria Gaitskell, Martin Habekost, Nick Howard, Neva Murtha, Abhay Sharma

Publisher Paul Grossinger pgrossinger@annexbusinessmedia.com 416-510-5240

Associate Publisher Stephen Longmire slongmire@annexbusinessmedia.com 416-510-5246

Media Designer Lisa Zambri lzambri@annexbusinessmedia.com

Circulation Manager Barbara Adelt badelt@annexbusinessmedia.com 416-442-5600 ext. 3546

Circulation Angie Potal apotal@annexbusinessmedia.com

Tel: 416-510-5113

Fax: 416-510-6875 or 416-442-2191

Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1 COO

Ted Markle tmarkle@annexbusinessmedia.com

President & CEO Mike Fredericks

Subscription rates

For a 1 year subscription (10 issues): Canada — $42.00 Canada 2 year— $69.00 United States — CN$74.00 Other foreign — CN$144.00

Mailing address

Annex Business Media 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1 printaction.com

Tel: 416-442-5600

Fax: 416-442-2230

Annex Privacy Officer Privacy@annexbusinessmedia.com 800-668-2384

PrintAction is printed by Annex Printing on Creator Gloss 80lb text and Creator Silk 70lb text available from Spicers Canada.

ISSN 1481 9287 Mail Agreement No. 40065710

JON ROBINSON, editor

We acknowledge the [financial] support of the Government of Canada.

Isabelle Marcoux, Transcontinental Inc.’s Chair of Board of Directors, was inducted into the Women’s Executive Network (WXN) Hall of Fame in Toronto. This recognition follows her three career nominations by WXN – in 2010, 2012 and 2016 – as one of Canada’s 100 Most Powerful Women. The induction focuses on Marcoux’s professional and philanthropic accomplishments, helping to drive Canada’s largest printing company. She has been Transcontinental’s Chair of the Board since February 2012. Beginning in 2004, she served as VP of Corporate Development responsible for the strategic planning process and mergers and acquisitions. Before joining Transcontinental, Marcoux was a lawyer at McCarthy Tétrault.

Jones Packaging received the 2018 Corporate Icon Award from the London Chamber of Commerce for demonstrating excellence in the community’s economic progress. “[Jones] grew its roots in London as a regional manufacturer of drug boxes and specialty drug labels until 1920, when founder Henry Jones established Jones Box and Label based on Dundas Street East,” noted award organizers. Jones today, under fourth generation ownership, describes itself as a provider of integrated printed and contract packaging solutions including intelligent packaging, folding cartons, labels, leaflets, pouching, blistering, vial filling and secondary packaging. In addition to its European operations, Jones controls two manufacturing locations (London and Brampton) and two distribution centres in Canada, totalling nearly 270,000 square feet with more than 300 employees.

Tony Gagliano, Executive Chairman and CEO of St. Joseph Communications, won the Edmund C. Bovey Award for Philanthropy in the Arts at the Business for the Arts Awards. This program is Canada’s top recognition of individuals and businesses who show outstanding support of arts and culture through philanthropy, volunteerism and partnership. Gagliano was recognized in large part for his work in the transformation of the Art Gallery of Ontario (AGO) and the foundation of Luminato, Toronto’s Arts Festival.

TC Transcontinental of Montréal will stop printing the San Francisco Chronicle newspaper effective April 2, 2018. The company reached an agreement to transfer its printing operations in Fremont, California, to Hearst, which owns the San Francisco Chronicle. TC Transcontinental will receive a cash payment of US$42.8 million from Hearst as compensation for the early termination of their printing agreement, for the sale of some of its printing equipment, and for services to be rendered as part of a Transitional Service Agreement. TC Transcontinental reached a 15-year agreement to print the newspaper in 2006 and in 2009 began production at the newly built, $230-million, 338,000-square-foot plant in Fremont. TC Transcontinental maintains ownership of its Fremont plant, renting the facility to Hearst until the end of 2024.

ModusLink

Global Solutions, which is controlled by Steel Partners Holdings, completed the acquisition of privately held IWCO Direct, one of North America’s largest producers of data-driven direct marketing, for US$476 million in cash. IWCO Direct, which becomes a wholly owned subsidiary of ModusLink, will continue to be run by Jim Andersen, who has been CEO since 1999. For the last 12 months through October 2017, IWCO Direct had net revenue of US$470.6 million, while ModusLink had net revenue of US$417.8 million. IWCO Direct claims to hold North America’s largest platform of continuous digital print technology.

Graphic Packaging Holding Company completed the combination of Graphic Packaging’s existing businesses with International Paper’s North America Consumer Packaging business. Graphic Packaging owns 79.5 percent of the combined company and will be its sole manager. International Paper owns 20.5 percent. Graphic Packaging has assumed US$660 million (all figures in U.S. dollars) of International Paper debt and concurrently has amended and restated its senior secured credit agreement. On a combined basis, Graphic Packaging is now one of the world’s largest integrated paper-based packaging companies with $7.4 billion of projected revenue and $1.2 billion of projected EBITDA post-synergies.

Avanti Computer Systems moved into a new office on Consumers Road in North York, Ontario, expanding its footprint. This is the

The recent ground-up development of its Avanti Slingshot technology is described by the company as the most open industry MIS solution to run multiple lines of business like large format, print and mail workflows.

Mitchell Press of Burnaby, BC, became one of 14 printing companies around the world to receive Kodak’s 2017 Sonora Plate Green Leaf Award. The program, now in its fourth year, recognizes printers whose products, services and operations set an example for sound operational initiatives that reduce their environmental impact. All of winning printers also use Kodak Sonora Process Free Plates.

fourth move in the past 10 years for the software developer, focused on providing print MIS solutions since it is was founded in 1984.

Apex International, described as the world’s largest anilox roll manufacturer, expanded its existing distribution relationship with Anderson & Vreeland Canada. Starting in January 2018, A&V Canada became Apex North America’s exclusive sales and support partner for all Canadian provinces for the anilox market. A&V has serviced the Quebec and Eastern Canadian provinces for the last 12 years for Apex.

Muller Martini takes over the perfect binding and bookline business from Kolbus, which also includes the service and spare parts business for Kolbus systems installed worldwide. Kolbus is setting its focus on packaging and case making, parts manufacturing and its foundry business.

Bell and Howell acquired the assets of Gunther International to expand its mail-inserting portfolio. This move follows Bell’s purchase of Sensible Technologies one year ago and the recent introduction of CX Touchpoints, an omni-channel communications platform. Gunther is a manufacturer of high-volume, software-driven mailing systems for insurance and banking industries.

Isabelle Marcoux, Chair of the Board, Transcontinental.

Tony Gagliano, CEO, St. Joseph.

Warren Lichtenstein, Executive Chairman, ModusLink.

Sean Sawa, Sales Director, A&V Canada.

Ramesh Ratan, CEO, Bell and Howell.

Stephen McWilliam and Patrick Bolan of Avanti.

Pantone, a wholly owned subsidiary of X-Rite, named PANTONE 18-3838, Ultra Violet, as the Pantone Color of the Year for 2018. Described by the company as a dramatically provocative and thoughtful purple shade, PANTONE 18-3838 Ultra Violet communicates “originality, ingenuity, and visionary thinking that points us towards the future... suggests the mysteries of the cosmos.” For the first time, Pantone will also release limited editions of Pantone Color of the Year 2018 Formula Guides (US$165) and Fashion, Home + Interiors Color Guides (US$215) for designers, to enable them to more easily integrate Ultra Violet into their workflow.

eStruxture Data Centers has acquired The Gazette’s former printing facility in Montréal, with plans to create a brand new, 30 megawatts power capacity data centre. The Québec-based company explains this $150 million investment will allow it to pursue growth with a world-class infrastructure and unique proximity to downtown Montréal. The 156,000 square-foot building, located on Saint-Jacques St. in Notre-Damede-Grâce, was left vacant since The Gazette closed its facility in 2014. Upgrading and expansion work was to begin immediately, with the new data centre, eStructure’s second in Montréal, set to open in mid-2018.

revenue growth. The program will be led by Joe Stramel, who has worked for companies like MAN Roland and Komori. The group will work with printers to foster new revenue streams with services like EDDM, Printer Bridge (W2P), large format and more.

Adobe of San Jose, California, states that it has achieved equal pay between men and women in the United States, describing it as an important milestone in the company’s ongoing efforts to create an innovative and productive work environment for all employees. Women are now making $1.00 for every dollar earned by male employees in the U.S., explains Adobe, up from 99 cents a year ago. As previously announced, nonwhite employees are earning as much as white employees. The company is poised to achieve pay parity in India, its next largest employee population, early this year.

Sun Chemical increases the prices for its offset inks, coatings and consumables in North America, effective February 15, 2018. The company explains the move is based on recent price increases for a variety of raw materials like carbon black, oil and pigments. Prices will vary depending on the product line, according Sun Chemical, but in general most prices will go up by a percentage in the high single digits.

McDonald’s by 2025 plans to use renewable, recyclable or certified materials in all of its packaging, with a preference for Forest Stewardship Council certification. The restaurant giant also plans to recycle guest packaging in 100 percent of its locations. McDonald’s has 37,000 restaurants in more than 100 countries serving 69 million people each day.

4over launched its new Strategic Print Advisory Program to help commercial printers generate

ance will go toward the acquisition of equipment and the company’s move to a new plant, as well as for the acquisition of software and hardware for on-demand digital printing.

Baldwin Technology Company, which develops process automation technologies, consumables and services for the print, packaging, textile and corrugated industries, has acquired QuadTech Inc. from its parent company, Quad/Graphics. Baldwin adds all of QuadTech’s technology and locations across the Americas, Europe, China, Japan and India. Headquartered in Sussex, Wisconsin, QuadTech maintains a global sales and service operation to sell its automated control systems in more than 100 countries. Baldwin plans to integrate QuadTech within two of its existing divisions, including Web Printing Controls and PC Industries. The resulting global platform is to operate as Baldwin Vision Systems. Karl Fritchen, current QuadTech President, is to lead the new Baldwin segment.

Imprimerie Gauvin Ltée of Gatineau, Québec, has been granted $800,000 in financial assistance in the form of a repayable contribution through Canada Economic Development’s Quebec Economic Development Program (QEDP), within the larger framework of the Government of Canada’s Innovation and Skills Plan. Gauvin is a family company that has been in the printing business in the Gatineau region for 125 years. More specifically, the printing company produces softcover books and is a significant player in short- and medium-book print runs. Imprimerie Gauvin has more than 200 client-publishers of varying sizes across Canada, the United States and Europe. The financial assist-

Canon, in a report produced by 24/7 Wallstreet, was the printing industry’s leading patent recipient in 2017 with 3,285 patent grants from the U.S. Patent and Trademark Office. Canon has placed among the top five companies granted U.S. patents for the 31st consecutive year. Based on numbers from 24/7 Wallstreet, which included subsidiaries to calculate final numbers, four other companies commonly recognized as having primary ties to printing placed in the research group’s list of Top 50 Innovative Companies in the World for 2017. 24/7 Wallstreet placed Canon fifth on its list, followed by Seiko Epson at No. 25 with 1,406 patent grants, Ricoh at No. 30 with 1,145, Xerox at No. 33 with 1,026, and HP at No. 35 with 984. IBM took the number one spot with 9,043 patents granted in 2017.

Mark Hischar, Chairman, APT, and CEO, KBA-North America.

NPES made two significant re-branding moves in January, including a name change that will see the not-forprofit group renamed as the Association for Print Technologies (APT). The association also designated its PRINT brand as the name for its annual trade show moving forward, which effectively ends the use of the Graph Expo name. First introduced in 1968, the permanent move toward PRINT comes as APT is now the exclusive owner and producer of this trade show, scheduled to next run from September 30 to October 2, 2018, at McCormick Place South in Chicago, Illinois.

APT also introduced a new staff department called Community & Industry Development. This initiative is being spearheaded by industry veterans Ken Garner, formerly of Idealliance and NAPL, who joins APT as Vice President of Business Development and Industry Relations, and Julie Shaffer, formerly of Idealliance and PIA, who becomes Associate Vice President of Program and Community Development.

Todd Coleman, President and CEO of eStruxture.

John Woolley, Business Leader, PC Industries (left to right); Herman Gnuechtel, Business Leader, Web Printing Controls; Brent Becker, President & CEO, Baldwin; and Karl Fritchen, President, QuadTech.

Digital Imaging Association announced its executive board for the year ahead, which includes: President, Jason Hamilton, Hughes Decorr; First VP, Paul Tarvydas, Tsus4; Second VP, Larry Stewart, KBR Graphics; Secretary/Treasurer Mark Norlock; and Past President, George Sittlinger, Maracle Press. Directors include Jim Dickson, Xerox Canada, Ray Fagan, Heidelberg Canada, Andrea Leven Marcon, Spicers Canada, Stephen Longmire, PrintAction magazine, Paul McCarthy, HP Canada, Mike Millard, Ellis Packaging, Ed Rooney, R.R. Donnelley, Dino Sinnathurai, Cober Evolving Solutions, Randall Stevenson and Bob Weller.

James Rowley becomes President of Glenmore Custom Print + Packaging based in Vancouver, BC. He previously served as General Manager from late 2012, helping to establish the family company as one of Western Canada’s premier printing operations. Founded in 1981, Glenmore now has more than 130 employees and is one of Canada’s most prominent independent custom print and folding carton manufacturers, while also venturing into roll label printing and continuing its high-end offset litho work. Rowley was named PrintAction’s Emerging Leader of the Year in 2017.

Nick Gaudry joins Huge Paper, one of Canada’s leading privately owned distributors of plastics and papers aimed at digital printing, as Managing Partner for the company’s newly created Ottawa East Region. The addition of Gaudry follows the December 2017, appointment of Mark McCaw as Senior Digital Substrate Specialist for Huge’s Dry Ink Performance division. In May 2017, Tom Dack was tapped to lead Huge’s expansion into southwestern Ontario.

velopes, before he took a position to represent CCL Labels, where he specialized in the pharmaceutical field.

cent role, he served as VP of Sales and Marketing with Clearwater Paper, a firm with more than 3,300 employees in the United States. He had been with Clearwater for more than 33 years.

Leta Wood becomes Chief Innovations Officer for HP’s Digital Solutions Cooperative (Dscoop). She is the former Global Strategic Relationship Manager at HP and has been in the industry for 23 years. Dscoop in late January was set to launch a new online community platform, designed to connect creatives and marketers to printers and projects. It is to feature thousands of print projects, including production details, technological innovations, and results for building brand awareness, market growth and consumer loyalty.

CALENDAR

February 21, 2018

DIA Seminar: Cyber Security Spicers Canada, Vaughan, ON

February 22-24, 2018

Graphics of the Americas Fort Lauderdale, FL

March 10-12, 2018

South China International Exhibition on Printing Import & Export Fair Complex, Pazhou, Guangzhou, China

March 18-21, 2018

TAGA Conference

Sheraton Inner Harbour Hotel, Baltimore, MD

March 22-24, 2018

Sign Expo 2018

Orlando Convention Center, FL

May 1-2, 2018

InPrint USA

Palmer House Hilton, Chicago, IL

Sheryl Sauder in December became Sales Manager, Central Region, for Supremex, one of North America’s largest envelope manufacturers with a growing interest in packaging and specialty products. The company has facilities in seven Canadian provinces and three facilities in the U.S., employing more than 800 people. Sauder most recently served as Chief Visionary Officer of Toronto’s Mi5 Print & Digital Communications Inc. She was with that printing company in various executive roles, including CEO and VP of Sales, since 2012.

Michelle Johnson becomes Marketing Manager for SA International (SAi), a software developer for the sign-making, wide-format printing and CAD/CAM for CNC machining industries. She joins SAi from wide-format printer and plotting cutter manufacturer – and SAi OEM partner – Mutoh America, where she held the position of Marketing Manager for the past seven years.

Gordon de Savoye joins Printer’s Parts & Equipment as its Ontario Region Sales Representative. Founded in 1973, Printer’s Parts is one of Canada’s leading suppliers of graphic arts equipment, consumables and parts, representing brands like Xante, Ideal/ MBM and Roland DG among others. de Savoye’s sales career began in Ottawa, representing Globe En-

Richard Dreshfield joins KBA-North America as Senior VP of Sheetfed Sales, based in Dallas at the company’s headquarters, to oversee its entire North American sheetfed sales team. He has been involved in the printing industry for more than three decades in various sales and marketing management positions. In his most re -

Richard Peereboom becomes President of C&P Microsystems, a division of Colter & Peterson after its purchase in 2003. He joined C&P in 2009 as Sales Manager for Latin America. He replaces Jeff Marr, who is reducing his work schedule but will remain as CFO of Colter & Peterson. Microcut retrofits are designed to work with nearly any brand, a major reason why the company has almost 35,000 installations worldwide.

May 15-18, 2018

Charlie Brown becomes the Labels and Packaging Solutions Manager for Screen Americas. His industry experience of more than 30 years covers both the customer and production sides of printing and packaging. Prior to helping a printing organization implement production inkjet printing, he worked for a major retail grocery chain in charge of its in-plant printing operations. At Screen, he will help lead growth around the Truepress Jet inkjet press.

Jerry Sturnick becomes VP and GM of Plockmatic Document Finishing, a subsidiary of Rochester-based Plockmatic Group, controlled by parent company Plockmatic International AB in Stockholm, Sweden. He will lead the sales, technical support and logistics teams supporting dealers and OEM customers in North America, covering all in-line and off-line solutions sold under the Plockmatic and Morgana brand names. Sturnick spent 40 years with Xerox, including the past 20 years as its Worldwide General Manager of Finishing Solutions within the Graphic Communications Group.

FESPA 2018 Global Print Expo Messe Berlin, Germany

June 6, 2018

PrintForum Trade Show & Conference International Centre, Miss., ON

June 14, 2018

DIA Golf Tournament

St. Andrew’s Valley Golf Club, Aurora, ON

June 19-20, 2018

2018 Print & Packaging Legislative Summit Washington, DC

September 26-27, 2018 Label Expo

Donald E Stephens Convention Center, Chicago, IL

September 30-October 3, 2018

PRINT 2018

McCormick Place, Chicago, IL

October 18-20, 2018

SGIA Expo

Las Vegas Convention Center, NV

October 24-28, 2018

All in Print China

New International Expo Center, Shanghai, China

April 11-13, 2019

Graphics Canada International Centre, Miss., ON

June 16-26, 2020

drupa 2020

Dusseldorf, Germany

INSTALLS

Innovative

Design & Print of Millbank, Ontario, completed the installation of a Kodak NexPress NX3900 digital press. Featuring long-sheet capabilities, the company’s new 5-colour press reaches speeds of up to 120 pages per minute with the ability to run sheet sizes of up to one metre (39.37 inches) in length. The NexPress is compatible with more than 800 qualified substrates.

Imprimerie BBM, based in Laval, Quebec, installed a Kodak Achieve T800 platesetter and converted to Kodak Sonora XP process-free plates. The imaging system is pictured with Kodak’s Rino Rufolo, prepress operators Joanie Pauzé and Korine Lavallée, and Christian Boisvert, BBM President.

Friesens of Altona, Manitoba, installed a Heidelberg Speedmaster XL-75-5+L press with coating, pictured with operator Jorge Caceres. The 110-year-old printing company focused on books and packaging employs around 600 people in more than 250,000 square feet of space.

ARC Document Solutions’ Calgary, Alberta, location added a Seal 62 Pro D laminator, pictured with Joyce Wong and GBC’s David Hayes. Earlier in 2017, GBC installed a Seal 65 Pro MD at ARC’s location in Burnaby, BC. ARC, formerly American Reprographics, has approximately 170 service centres throughout North America, in addition to European locations.

Groupe dpi of Drummondville, Quebec, installed two Agfa inkjet systems, including a Jeti Titan HS and a Jeti Ceres 3200, pictured with President Pierre Pepin. Founded in 1974, the company, with more than 70 employees, focuses on providing turnkey display graphics solutions.

Printing Icon of Scarborough, Ontario, added a Duplo DPB500 perfect binder, pictured with owner John Gnanasekar and Brett Kisiloski, Sales Manager of PDS. Owned by Readers Legacy Canada ULC, Printing Icon specializes in corporate communications and advertising collateral.

Saudi Arabian packager builds with Rapida

Noor Carton, a packaging producer from Dammam in Saudi Arabia, opened up its new plant in 2015 and has since been producing work on two Koenig & Bauer Rapida 106 coater presses, including one with five colours and the other with six colours. Noor Carton is a member of the Salman Group, which operates not only printing plants serving the commercial and flexo segments, but also companies for medical and IT products.

“It is an exciting challenge to plan a printing plant from scratch. For the Saudi Arabian market and for the target group of Noor Carton, productivity and integration were essential aspects,” said Noureddine Amalou, MENA Sales Manager, Koenig & Bauer. “Many very long repeat jobs are printed, which is why all the presses are configured with automatic non-stop pile changing and extended logistics. The vision is to automate board transport from the stores, via the printing press and die-cutting machine, through to shipping to the customer.” Amalou also points to Noor’s new TouchTronic console, in how it provided familiarization for operators, as well as tools such as automated colour measurement and control based on optical densities and Lab values.

Noor’s production model was based on existing Koenig & Bauer partners in Europe, noting labour costs are increasing in the Middle East and must be taken into account for major investment projects.

Cartonéo adds Esko robotics

Cartonéo is a 100-year-old French printing company based in the Jura Mountains. It specializes in the manufacture of point of sale (POS) and point of information (POI) materials from flat and corrugated cardboard. Its customers come from sectors like the food, automobile, cosmetics, wine and spirits and pharmaceutical industries. The group’s plan is to further develop its POS business, which includes investing in new Esko workflow and a Kongsberg C66, Esko’s largest robotic cutting table. Esko explains this makes Cartonéo the first company in the world to invest in its robotics cutting technology.

In addition to following the trend of producing small quantities of POS materials for special events and to customize by location, Cartonéo explains its customers were asking for POS materials made from thick cardboard or plastic. To respond to the new requirements, Cartonéo invested in an HP Scitex 11000 wide format printer and then the Kongsberg C66 for finishing POS products within extremely tight deadlines and in small quantities.

The great grandmother of Edmond Perrier, the current Cartonéo Chairman, founded the company in 1897 in Saint-Claude, an area described as the pipe capital of the world. The company would eventually begin wrapping wooden toys and employ about 50 people. Perrier’s father ultimately moved into corrugated cardboard in the 1950s. Perrier has led the company since 1991 and it was his decision to equip the facility with offset printing and lamination. Today, the Cartonéo group has three locations and employs about 130 people.

“We can now cut a wide range of new materials such as plastic or very thick cardboard, which means that we can produce honeycomb or triple wall corrugated products, and even make cardboard furniture,” said Edmond Perrier. “We are beginning to grow in these markets, which are new for us; and we have already signed several contracts as a result of these new capabilities.”

MasterMail upgrades Xeikon in Netherlands

MasterMail in late August 2017 completed the installation of a Xeikon 9800, which replaced the company’s existing Xeikon 9800 press. MasterMail offers its clients a modular set of services in the creation and processing of direct mail, including copy writing, graphic design, personalization and production, in addition to mailing optimization. Along these lines, MasterMail developed a product called DM Box, where it visually presents concise knowledge about direct mail along with practical tools like a colour wheel or a marker to review and revise text.

“We are growing every year; and on a national level, the sector is also recording growth,” said Danielle Vanwesenbeeck, Business Manager, MasterMail. “Since e-mail boxes are now overflowing, it once again leaves room in physical letter boxes for marketers to get their messages across. We see it as complementary to other channels in reaching the consumer. Especially focused, original and striking direct mail scores today. It also keeps the attention for longer, in comparison to email messages, which are often not read or retained.”

Vanwesenbeeck continues to explain press stability is a critical factor in the direct mail segment: “It is not unusual for us to receive files in the morning, and by the end of the day, we must deliver the material to Bpost for distribution.”

As it nears full commercialization, the first delivery of an HP PageWide C500 press took place in late December at Carmel Frenkel. The converter company is based in Caesarea, Israel, and primarily supplies packaging work for food and beverage industries. The PageWide C500 runs 1.3 (W) x 2.5 (L) metre-sized boards at up to 75 linear metres per minute.

Pictured left to right: Abdalah Al-Hareri, General Manager of Al-Kharafi Saudi Arabia; Baker Al Nasser, General Manager of the Salman Group; and Noureddine Amalou, MENA Sales Manager at Koenig & Bauer.

Edmond Perrier with Cartonéo’s new Kongsberg C66. MasterMail

Danielle Vanwesenbeeck.

GLOBE

15 years ago

Developing Digital Colour: TrendWatch Graphic Arts Forecast reports that “digital colour printing is poised to take off again.” Printed impressions on production process colour printers are expected to grow from 7.2 billion in 2000 to more than 27.3 billion in 2004. Placements are expected to grow almost 19 percent in the same period. Digital colour copiers, digital colour network printers and, most recently, direct imaging (DI) presses are moving from niche markets, such as quick printing and in-plant printing shops to the mainstream of commercial printing.

Since Heidelberg and Kodak introduced the NexPress at Print 01, they have already sold more than 80 worldwide. Xerox continues its R&D strategy with the introduction of the iGen3 and EA colour toner technology, which the company claims could reduce the cost per copy by as much as 50 percent.

The Xerox iGen3 was first introduced under the project name of FutureColor by CEO Anne Mulcahy, who became Chairperson of the Fortune 500 company in 2002.

20 years ago

Pressroom of Tomorrow: Significant technology trends affecting the printing industry, according to David Spindel of Xerox, are the incredible growth of the World Wide Web, high-speed colour scanning, parallel architectures for digital front-ends, the growth of thermal/inkjet/low-end lasers, the integration of workflow into prepress, and Java.

Spindel cited a number of political trends, including the privatization of government agencies, the deregulation of telecommunications, the information implications of the end of the Cold War, and the endorsement by the U.S. government of the Internet.

9k

For Sale (January 2003 classified ad): HP Designjet 800ps 42” with internal Postscript 3 RIP purchased in Jan 2001 very little use. Must sell –asking $9,000.

25 years ago

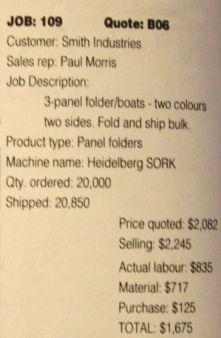

Is the History of a Job Worth More Than the Present: What’s involved with maintaining a computerized job history system? It entails little more than permanently keeping the information from job dockets or job sheets on your computer rather than deleting it when the job is done. This way you can print out or view all of the details on a job that was produced last week, last month last year, or even in the last decade. What makes this possible is that the cost of computer storage has dropped like a stone in the last two years. A company with 30 employees doing 250 jobs a month can now store all of its job history data for a full year on a 20 megabyte hard disk. To store 10 years worth of information, you need a hard disk that now costs less than $1,500. In fact, no matter how big your plant is, even if you print telephone books, you can still store all your information on a normal PC with a couple of $3,000 jumbo hard disks. Truly Amazing.

$1.6B

CCL Industries Inc. (January 2003) will acquire the label-printing business of Britain’s Jarvis Porter Group, a deal estimated to be worth $16 million. It will create one of North America’s largest packaging companies with around $50 million in annual revenue. CCL had revenues of approximately $1.6 billion in its last fiscal year.

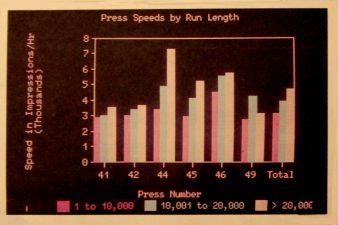

Output varies according to many factors, including the length of the run. A good estimating system takes that into consideration in its standards.

With Job 109 data, a couple of things should jump out immediately: The customer ordered 20,000 copies, but 850 overs were shipped; and the customer was billed $163 more than was quoted. Note that the extra $163 accounted for almost one-third of the total profit of $570. How was the extra cost justified to the customer?

25 years ago

Desktop Colour Proofs in Seven Minutes: A device being marketed by 3M Canada’s Printing & Publishing Systems is claimed to provide high quality 11.7 x 17.2-inch continuous tone colour proofs in as little as seven minutes using PostScript files from Macintosh Computers. The new Desktop Color Proofing System consists of a thermal dye sublimation printer and 3M proprietary software that controls the printer from a Mac terminal. The printer/proofer creates four colour images with dyes on a specially coated paper or transparency stock. Jobs from most standard design and page layout application (Adobe Illustrator, Aldus PageMaker and QuarkXpress) may be queued up on the computer and processed in sequence into three choices of colour targets.

$40K

For Sale (January 1992 classified ad): Planeta offset press 20” x 28”, single colour. Excellent condition. High feeder, $40,000.

More than 280 graphic arts professionals attended the R&E Pressroom Conference learned that printers must go digital to remain competitive. That means operating computer-to-plate systems efficiently to realize cost savings and using digital printing technology to become more than a printer.

Film, plates and everything

Part II, DuPont grows into a chemical giant with hundreds of printing discoveries

By Nick Howard

In 2014, DuPont was noted as the world’s fourth largest chemical company based on market capitalization, according to The Financial Times. Three years later, on August 31, 2017, this chemical giant merged with The Dow Chemical Company to create DowDuPont Inc., the world’s largest chemical company in terms of sales.

DowDuPont brings together two science-based companies that hold leadership positions in the Agriculture, Materials Science and Specialty Products industries. These positions now form three independent DowDuPont companies. Based on DowDuPont’s 2016 financial statements, the Material Sciences division, which includes packaging and specialty plastics, performance materials and coatings, and industrial intermediaries, generated pro forma net sales of US$37 billion.

DuPont continues to operate as a subsidiary of DowDuPont and in January 2018 it was named a Top 100 Global Innovator by Clarivate Analytics for the seventh consecutive year. The report, “based on proprietary data, recognizes corporations and institutions around the world that are at the heart of innovation.”

Some of DuPont’s newest innovations include: Intexar, smart clothing technology for sports and wellness; Temprion thermal management materials for electronic applications; CRISPR-Cas plant breeding technology; Pioneer brand Qrome high-yielding trait technology; HOWARU Shape, a probiotic formula clinically proven to reduce waist circumference; and the SYNERXIA Thrive Fermentation System, a yeast and enzyme solution with higher yield for ethanol producers.

From these most recent innovations alone it is easy to gain a picture of the research impact created by DuPont, which has been one of the printing industry’s quiet providers of foundation technologies. As described in Part I, DuPont grew its position primarily as a gunpowder supplier based on its 1802 founding in Delaware. By the time America entered the Great

DuPont has been one of the most influential printing technology companies for centuries, making a major impact with its films, related processing chemicals, and its Dycril plate.

War in 1917, DuPont was able to produce one million pounds of it in a single day. But the company continued to look for exciting new markets and in the early 1990s found potential in printing and packaging.

Everything for the printer

In the early 1900s, a Swiss chemist by the name of Jacques Brandenberger, was hard at work trying to develop a protective cover for tablecloths. He experimented with the tree by-product cellulose. By 1911, Brandenberger had fashioned a machine to produce this new material and decided to call it Cellophane. DuPont, looking to expand its product lines quickly purchased the American rights and in 1924 the first American production rolled off a casting machine in Buffalo, NY. Cellophane proved to be a huge success. All sorts of uses were found – many in the printing and packaging industry, from bread and candy wrappers to pastry boxes with windows, the list was endless. Cellulose also led to the rise of graphic arts films, which brought DuPont another revenue source that was rapidly growing.

With so many scientists and researchers on staff soon DuPont labs exploded with hundreds of new discoveries and inventions. Most were directed at solving problems and others, such as Nylon, were discovered by accident. Printing was an industry of material needs and innovation looking desperately for new ways to exploit substrates such as Cellophane. DuPont was happy to oblige. By the early 1960s, a phenomenal new printing plate called

Dycril was invented and overnight this exposable photopolymer plate relegated heavy lead stereos to the graveyard. Along with the stereo went all the heavy casting equipment and flong used to make them. Newspapers quickly saw the benefits of a super-lite material that would reproduce better and save labour.

Dycril was a metal back material that also made its way onto the sheetfed press. In 1964, Dycril was eclipsed by an even better DuPont product called Cyrel. Today, Cyrel holds a top position in the graphic arts world. Flexography and letterpress applications driven by Cyrel are numerous. Developing Mylar (in the early 1950s) certainly didn’t hurt either. Most of us still use it for packing and it was key for stripping back when film was king of consumables.

The list is also long when we consider the amount of consumable products that have been invented or developed by DuPont. How can anyone forget the Cromalin proofing system? This 1972 process used all sorts of materials from toner powders to Mylar. A Cromalin proof was very expensive. However, with so much going on outside the world of print and with further technological changes that would reduce the materials printers use, DuPont sold off most of its graphic arts portfolio to Agfa in 1996. DuPont decided to hold onto its most profitable Cyrel line.

For well over 100 years, DuPont has been a labyrinth of businesses. So big that they were forced to break themselves up in 1912 spinning off part of its black powder business to new entities Hercules Powder and Atlas. What began as a friendly collaboration turned into much more when, in 1914, DuPont first invested in General Motors. By 1929, DuPont controlled one third of GM. This caught the eye of the anti-trust commission and, by 1961, DuPont had sold off all of its GM stock.

To the rest of the world, DuPont is best known as the inventor of such products as Freon, Teflon, Neoprene, Orlon, Tyvek and Kevlar. But to the printing community, the company left a lasting legacy of chemistry, film and plates. DuPont made print better and cheaper to produce and in the end also made us a lot of money. With its 2017 merger with Dow Chemical complete, DowDuPont is a US$73 billion operation that started with a simple walk in the woods.

NICK HOWARD, a partner in Howard Graphic Equipment and Howard Iron Works, is a printing historian, consultant and Certified Appraiser of capital equipment.

nick@howardgraphicequipment.com

Teach the kid, not the lesson

that helps you to refine your teaching strategy.”

In other words, she said, “you have to teach the kid, not the lesson.” To put this idea in sales training terms, you have to sell the customer, not the printing company. Ask yourself if are you doing that or if are you locked into a presentation style, as opposed to a consultative selling style.

By David Fellman

Let them talk

ou can learn a lot when you let them talk” – My wife said that as were sipping cocktails before dinner one night. She’s a 4th Grade teacher, and she was referring to her students, specifically in terms of what they need in order to get to the next level of their educational development.

“Too many teachers just teach,” she said. “They present the lessons and the kids either get it or they don’t. It works better when you engage the kids in the conversation. That way you can tell whether they’re getting it or not, and if not, you often learn why they’re not getting it, and

I know that you’re proud of your company and its capabilities, your offset and digital presses, and the ability to print brochures and catalogues and add QR codes on anything from postcards to posters. What you need to know is that I’d rather talk about my stuff than listen to you talk about yours. If you don’t let me do that, I’m probably going to start tuning you out pretty quickly. And here’s something else you need to know. I can do that without showing you that I’m not really listening to what you’re saying. So here’s the question, are you communicating if you’re talking and not really listening?

On the other hand, if you let me talk, we can have a conversation. That’s what happens when you ask a question, listen to my answer, maybe ask another question, listen to that answer, and only then tell me how you think your very cool capabilities can help me to address whatever

“Decreased turnaround times means we can go from 400 to over 500 jobs a month without adding staff.”

problem or opportunity we’re talking about. Too many salespeople throw their solution out into the void without determining if there’s a problem or an opportunity in the first place. That’s jargon, not selling.

Make them talk

Here’s still another thing you need to know. If we’re thinking about a situation when you’re talking to someone else’s customer, you really need them to have problems – or at the very least, opportunities that their current supplier is not helping them to recognize and capitalize on. If they have no problems, why would they stop buying from the other printer?

I define prospecting in a number of ways. One of them is the search for dissatisfied customers. If you can find some other printer’s dissatisfied customers, you’re well on your way to developing a new happy customer of your own. But it’s not always easy, because many of them don’t want to admit that they’ve made bad decisions. And many of them cling to the status quo, and that can include sticking with an imperfect supplier (the devil you know is better than the devil you don’t know) or ignoring new marketing strategies or opportunities (if it ain’t broke, don’t fix it).

When you’re prospecting, the status quo is your enemy. And the first step toward defeating that enemy is to identify and understand it. That may mean getting beyond letting them talk to a point where you actually make them talk.You do that by asking good, provocative questions and then by resisting a temptation to talk again if an answer is not immediately forthcoming.

ANY ROI IN A PRINT MIS?

For many shops, the answer is “Yes”. But what about yours?

At Avanti we’ve helped hundreds of printers significantly improve profitability with our award-winning JDF-certified Print MIS.

Avanti Slingshot helps you deliver more jobs, in less time, with the confidence in knowing that every aspect of your shop is integrated into one powerful Print MIS platform. IS THERE REALLY

Is there an ROI for YOUR shop with a Print MIS? Download the FREE ebook at offers.avantisystems.com/roi-ebook

Have a question about Print MIS ROI? #AskAvanti avantisystems.com/askavanti 1.800.482.2908

Salespeople that reach out within five minutes are 100 times more likely to qualify the prospect, according to Hubspot. Doubtful that seeking an introduction to a prospect from a common connection is worth the time? Eighty-four percent of B2B decision makers kick off their buying processes with referrals. 84%

1:30 PM

A very successful and talented salesperson once told me that sales conversations often get to the point where the next one to talk loses. “I had to learn,” he told me, “not to let the people I was trying to sell to off the hook. Asking the questions was easy. The hard part was waiting for the answer. But once I learned how to do that, I found they often told me everything I needed to know.”

Here’s the moral of this story: Education is all about the kid. Selling is all about the customer. If that’s the way you’re selling, you’re in pretty good shape. If it’s not, however, your strategy needs some serious adjustment.

By the way, I also define prospecting as the search for people with a good attitude. “I’m happy to talk with you” is a good attitude. “The devil you know” is not, nor is “if it ain’t broke, don’t fix it.” Don’t ever forget that when you encounter a bad attitude, you have to change it. Otherwise, they’ll be fighting you rather than thinking about working with you.

DAVE FELLMAN is the president of David Fellman & Associates, a graphic arts industry consulting firm based in Raleigh, NC, USA. He is a popular speaker who has delivered keynotes and seminars at industry events across the United States, Canada, England, Ireland and Australia. He is the author of “Sell More Printing” and “Listen To The Dinosaur.” Visit his website at www.davefellman.com.

Still a smart marketing choice

The intriguing growth and position of printed catalogues continues to gain traction

By Domtar Blueline

In the not-so-distant past, printed catalogues were the top choice for marketers to showcase their goods to captive audiences. But along came online shopping, bringing with it an all-new dimension to consumers’ purchasing paths, along with digital marketing tools to drive purchasing behaviour. Yet even the most compelling digital marketing methods haven’t dampened the power of printed catalogues. In fact, instead of disappearing, printed catalogues have only gotten smarter, more targeted, more strategic and just flat-out cooler – making them true rock stars in the marketing mix.

Our brains love print

In 2015, the U.S. Postal Service Office of Inspector General worked with Temple University neuroscientists to conduct a study using fMRI brain scans to compare participants’ responses to digital and physical media. The study showed that paper advertising activates the ventral striatum – the part of the brain that assigns value and desirability to featured products – more than digital media. Increased activity in the ventral striatum can signal a greater intent to purchase.

Our cognitive connection with print is great news for marketers. Many savvy brands recognize the power of print’s multisensory experience. According to a 2015 study by Mequoda, 69.6 percent of adult Americans had read an average of 2.91 print magazine issues in the 30 days prior to being surveyed. It seems that consumers still love a good printed piece to hold in their hands.

Bridget Johns, current head of marketing and customer experience at Retail Next, noted in a 2015 interview that “catalogues are being geared more towards content over product. It’s very much about the styling and the lifestyle and the connection to the brand.”

Printed catalogues have become profoundly more creative. A mix of products, narratives, photos and other creative content provides consumers with unique

Blueline notes 25 percent of printed catalogues trigger a Website visit, and 33 percent trigger a visit to a retail store, according to a Canada Post study.

and inspiring ways to connect with brands on a sensory level.

Converse offers an app that allows consumers to virtually try on shoes, by pointing their phone at their foot. Northern Lighting, a Nordic company specializing in the design and manufacture of luxury in-home lights, invites consumers to see lighting on the table or floor by using AR paired with a printed brochure.

Print marketing makes money

69.6

According to work by Mequoda, 69.6 percent of adult Americans read an average of 2.91 print magazine issues in the 30 days prior to being surveyed. It seems that consumers still love a good printed piece to hold in their hands.

IKEA, known for affordable home goods, uses its printed catalogues to showcase articles on how furniture isn’t just furniture; rather, it facilitates a way of life. The catalogues often include interviews with IKEA furniture designers, allowing readers to better connect with the product and the company. With this type of newfound creative and editorial stance, marketers use these so-called magalogs –a blend of magazine-like editorial content and traditional catalogue information –less as immediate sales tools and more as brand opportunities for their customers.

Multichannel shopping is the new standard in the retail experience. Customers who engage with a brand through multiple channels are the most sought-after by savvy retailers. Printed catalogues encourage multichannel consumer behaviour. Twenty-five percent of printed catalogues trigger a Website visit, and 33 percent trigger a visit to a retail store, according to a Canada Post Study. Print creates natural connections with multiple points in the buying experience, leading consumers online to product reviews and brand Websites, or to shop from an app on their phone. The use of augmented reality (AR) has enhanced printed catalogues by allowing the once-static space to deliver a digital experience.

IKEA pioneered the trend by offering an app for consumers to virtually try out furniture from the catalogue. Today, many retailers are following their lead.

Gone are the days of generic mass mailing. Today, printed catalogues have become targeted and strategic. With the help of customer data, printed catalogues now can be customized to include items an online shopper may have viewed but not purchased. Mailings also can be sent specifically to buyers who have previously made online or in-store purchases. Customer data can also alert brands to sales opportunities, such as birthdays, anniversaries or new-home purchases. Nordstrom, for example, chooses to select a few key pieces to advertise in its printed catalogues. With the Nordstrom app, readers can shop the item online, get additional information on sizes and colours and even access styling details. Catalogue mailings triggered by data collected from these actions can then be highly customized, allowing for more meaningful and personal connections with consumers at exactly the right time. There’s nothing quite like a beautiful printed piece to imply permanence and credibility. Neiman Marcus, a brand synonymous with luxury, reinforces its high-end status by making an aggressive statement with its annual holiday catalogue, which features outrageous, overthe-top fantasy gift offerings like a Valkyrie private plane and a limited-edition Infiniti sedan. More and more, retailers are turning to the powerful brand engagement only print can offer by crafting printed catalogues that are meant to be perused, enjoyed and even displayed on the coffee table.

Marketers know that each medium in a marketing mix has to contribute to the growth of the brand. Print is a proven performer, leading the way in many buyers’ journeys. About 92 percent of consumers get ideas for household shopping trips from printed flyers they receive in the mail, according to a Canada Post study. Catalogues engage the reader, create an experience and build brand loyalty – and they instigate purchases. For marketers who seek to tell a well-rounded brand story, it’s an exciting time to explore print. With its proof of cognitive engagement and sales funnel performance, print has found a powerful place in the consumer buying experience and continues to be a force to be reckoned with.

SOURCE: DOMTAR NEWSROOM.

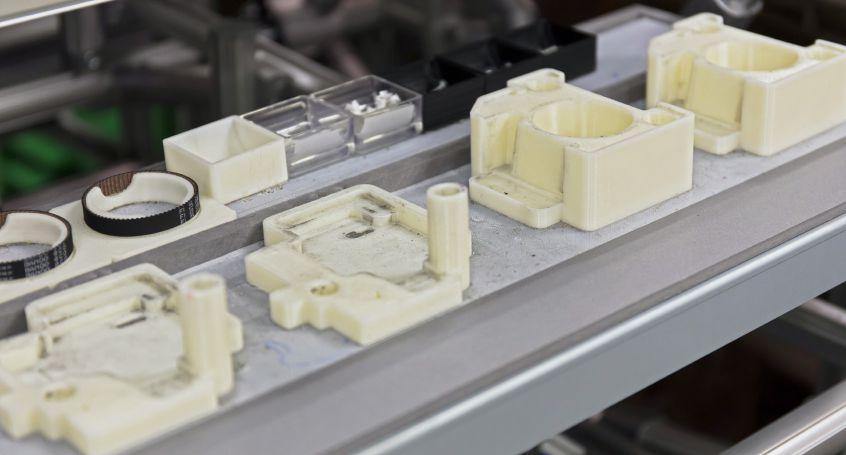

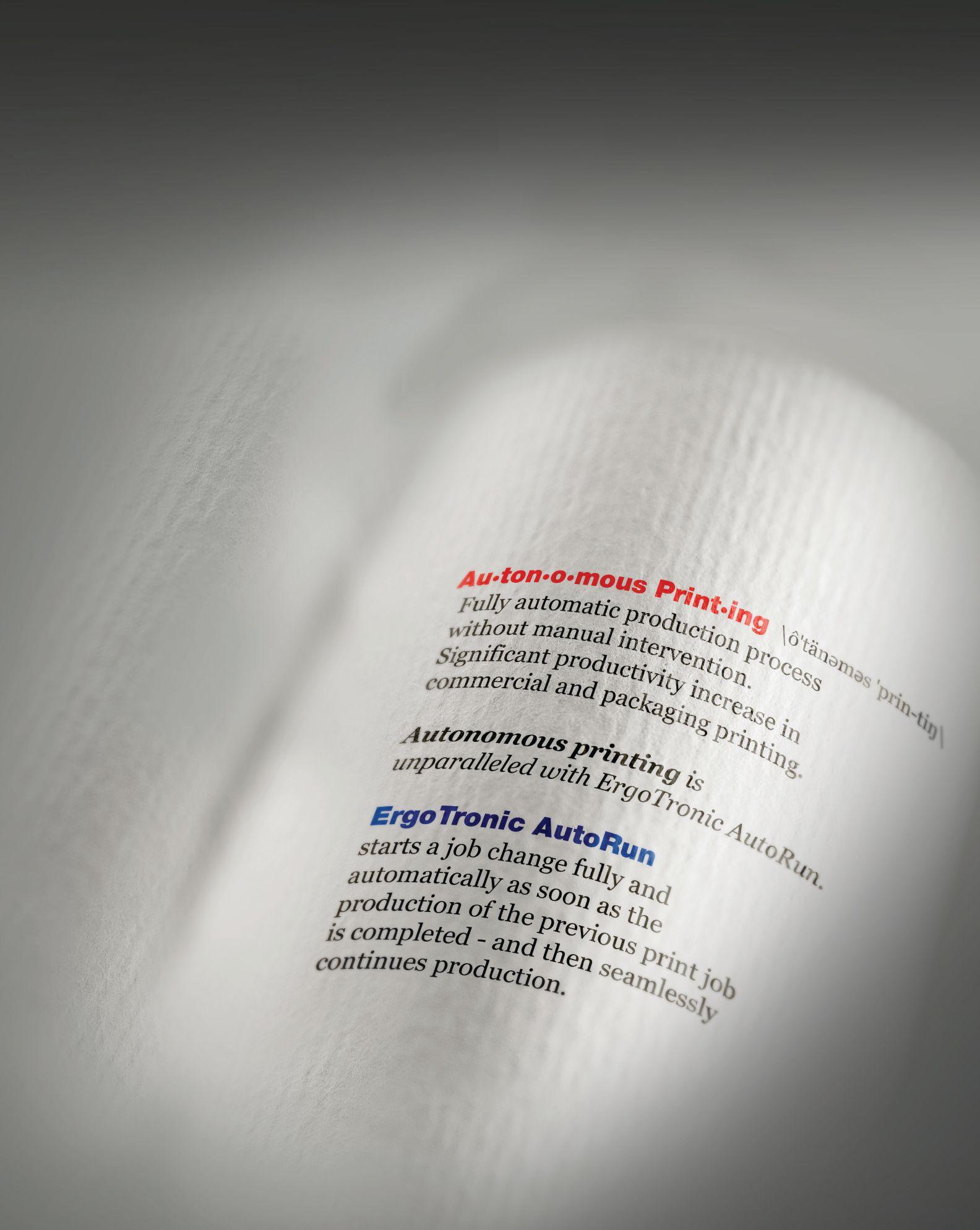

This 3D printed structure was a prototype design done by Krasul on one of HP’s first Multi Jet Fusion printers. Design News explains the Krasul project shows how HP’s multi-agent printing process, by placing specific colours at the voxel level, can enable colour gradients throughout a part. The same process can also print different mechanical properties like elasticity variations throughout a part via transforming agents.

MANUFACTURING GEOMETRIES

3D printing begins to move past consumer hype into industrial design and onto the production floor, as manufacturing and logistics companies plan for significant changes to their business models

By Jon Robinson

Financial institution ING in late-2017 reported the current trajectory of 3D printing could result in one-quarter of world trade being wiped out by 2060. This was its Scenario I, in which 3D printing continues to evolve at an annual growth rate of 19 per cent, with the possibility of locally 3D printed goods cutting trade by 40 percent. Scenario II presented by ING considers an accelerated growth rate in 3D printing of 33 percent, which would wipe out two-fifths of world trade by 2040. ING’s analysis also predicts, that at current growth rates, conservatively half of all manufactured goods will be printed in 40 years. These long-term predications cannot possibly consider all future sup -

ply-and-demand variables, of course, but today 3D printing constitutes less than one percent of global manufacturing revenue. Wohlers Associates, an independent consultancy specializing in 3D printing research, estimates 3D printing will eventually capture five percent of the global manufacturing capacity, which would make it a $640 billion industry (all figures in U.S. dollars). A 2016 report called 3D Printing: The Next Revolution in Industrial Manufacturing, published by logistics giant United Parcel Service (UPS), estimates today’s 3D printing market to be worth anywhere from $7 billion to $9 billion, predicting it could reach $21 billion by 2020. Consultancy firm McKinsey estimates the 3D printing market will grow to reach anywhere from $180 to $450 billion by 2025. The range of these growth predictions

largely comes from the inability to fully understand how massive corporations –with the ability to shift markets – might alter their manufacturing models to leverage 3D printing. It is unlikely that 3D printing will predominately replace – or even penetrate – mass production processes in several product sectors, but it does hold the potential to touch most any category of discrete manufacturing. IT research firm Gartner estimates 10 percent of all discrete manufacturers will be using 3D printers by 2019 to make parts for the products they sell or service.

Watching 3D grow

Based on an early 2017 survey by Sculpteo, with respondents from consumer goods (17%), industrial goods (17%), high tech (13%) services (9%) and healthcare sectors (7%), 57% of all 3D printing work done is in the first phases of new product development, which speaks to reducing time-tomarket for new products.

3D printing is currently best suited for making complex, small-batch products, as illustrated by its heavy usage for prototypes and parts.The UPS report describes parts production as the fastest-growing application of 3D printing, specifically functional parts at 29 percent and prototypes at 18 percent. In November 2016, UPS invested in a company called Fast Radius to launch a new logistics model for parts production via 3D printing.

Fast Radius’ primary production facility is now located in what it describes as the world’s largest packaging facility, UPS WorldPort (Louisville, Kentucky), which also serves as the logistics giant’s global air hub. Fast Radius explains this “strategic end-of-runway location” provides it with up to six hours of additional production time versus using a near-site location, typically controlled by a thirdparty. 3D printing will likely experience growth under a service-bureau model as technologies mature, in terms of both function (speed and quality) and cost. More manufacturers and product companies will also change their business models to install 3D printing systems.

Research released in 2017 by IT consulting firm Gartner shows interest in establishing in-house 3D printing capabilities is “rapidly gaining traction.” Gartner predicts 40 percent of manufac-

turing enterprises will establish what it calls 3D printing Centers of Excellence (COE) by 2021, pointing to existing industrial-scale efforts by Boeing, Johnson & Johnson, Rolls Royce and Siemens. In September 2016, Fortune.com reported 3D-print startup Carbon received $81 million from a group of investors, including GE Ventures (General Electric), BMW Group, Nikon and JSR, as an extension of a $100 million funding round in August 2015 led by Google Ventures.

In December 2017, Yahoo Finance reported Carbon closed on $143 million of a new funding round to accelerate its global expansion. “Once completed, this round will bring the Silicon Valley-based company’s total raise to a whopping $422 million and reportedly boosts its valuation to a mighty $1.7 billion,” writes Beth McKenna. “To provide some context, the two largest publicly traded pure-play 3D printing companies, Stratasys and 3D Systems, have market caps of $1.14 billion and $1.13 billion, respectively.”

The prospects for 3D printing growth are buoyed by venture-capital investments with the participation of established companies like UPS, which holds the world’s largest network of distribution centres. Billed as The Global Platform for Part Production , Fast Radius enables companies to manage the design, engineering, prototyping and production of end-use parts. Its in-house 3D printing capabilities are supported by partnerships with third-party providers of traditional parts manufacturing techniques like metal extrusion, CNC machining and injection molding.

3D printing can help reduce the use of expensive processes to create tools, molds and modifications for production lines. In 2017, imaging giant Ricoh began replacing some of its traditional metal tooling with lightweight 3D printed jigs and fixtures for a large-format-printer assembly line in Japan, where an operator typically handles more than 200 parts a

Ricoh’s 3D printed jigs and fixtures boost assembly line productivity, as the company assembles electronic components using a 3D printed fixture produced in anti-static ABS plastic.

day. Ricoh is specifically assembling an electronic component using a 3D printed fixture produced in anti-static ABS plastic on a Stratasys Fortus 900mc printer.

“Because we are producing an enormous number of parts, it takes a lot of time and effort to identify the right jigs and fixtures for each one. This manual process has become even lengthier as the number of components grows, requiring that an operator examine the shape, orientation and angle of each part before taking out a tool and placing it back in its original fixture,” explained Taizo Sakaki, Senior Manager of Business Development, Ricoh Group. “[Now] we are able to customize the tools according to the part and produce them on demand, which is helping us restructure and modernize our production process.” Sakaki explains Ricoh would typically outsource machine cut tools that could take two weeks or more to produce. Ricoh’s operators can now determine the shape and geometry of a fixture that corresponds to its associated part through 3D CAD software and 3D print it in one day.

“Prototyping is the reason 3D printing exists, because there is nothing better to make one-offs particularly if it is a small part with high detail,” said Stephen Nigro, VP, Inkjet and Graphic Solutions for HP Inc., which launched its Multi Jet Fusion products in 2016. HP – an inkjet printing pioneer – plans to disrupt the 3D printing market with this new high-speed, relatively low-cost platform. HP explains on a current high-cost, high-quality laser sintering machine, for example, 1,000 gears would take at least 38 hours to fabricate, while those same 1,000 gears could be produced within three hours on Multi Jet Fusion technology.

UPS shared a telling quote from an engineer/senior industrial designer at a consumer electronics company: “Our prototype turnaround time reduced from three to six months to two to three weeks. Time-to-market for new products re -

PHOTO COURTESY RICOH

MADE-TO-ORDER. MADE TRUE.™

Gemini’s new generation of deep-dimensional formed plastic letters and logos

Form your ideas faster and easier with a 3D solution that’s versatile, affordable and durable. Our formed letters and logos are made-to-order and deliver stronger margins for you with unsurpassed value for your sign customer. And with Gemini, it’s guaranteed for life.

FREE formed sample and information:

geminisignproducts.com/formed 800-538-8377

duced by 40 to 60 percent. 3D printing is viewed as an enabler here for expanding into new markets. We initially used it once a week, but now it’s used daily.” UPS explains the next big 3D printing opportunity for consumer electronics is in smartphones, which comprise an estimated 35 percent of total consumer electronics sales.

Responses from 61 producers of 3D systems when asked what global customers use the printers for.

Responses from 61 producers of 3D printers asked what their global customers use the printers for, including 11 per cent of 3D printers sold to train engineers or for research purposes. Source: Wohlers Associates report 2017, 3D Printing and Additive Manufacturing State of the Industry

with established companies like UPS, which holds the world’s largest network of distribution centres. Billed as The Global Platform for Part Production , Fast Radius supports its 3D printing capabilities with third-party providers of techniques like CNC machining and injection molding.

Making 3D fit

3D printing can reduce the use of expensive processes to create tools, molds and modifications for production lines. In 2017, industrial imaging giant Ricoh began replacing some of its traditional metal tooling with lightweight 3D printed jigs and fixtures for an assembly line in Japan, where an operator typically handles more than 200 parts a day. Ricoh is assembling an electronic component using a 3D printed fixture produced in anti-static ABS plastic on a Stratasys Fortus 900mc printer.

“Because we are producing an enormous number of parts, it takes a lot of time and effort to identify the right jigs and fixtures for each one. This manual process has become even lengthier as the number of components grows, requiring that an operator examine the shape, orientation and angle of each part before taking out a tool and placing it back in its original fixture,” explained Taizo Sakaki, senior manager of business development, Ricoh Group. Ricoh would typically

As early adopters, the consumer electronics and automotive industries each contribute 20 percent of the total 3D printing revenue, according to UPS, with aerospace following closely behind. Mercedes-Benz Truck in 2017 began its first 3D-printed spare parts service, allowing customers to 3D print more than 30 different spare parts for cargo trucks. Logistics giant DHL, in its own 2017 3D printing report, explains hundreds of millions of spare parts from across all industries are kept in storage. DHL used data from Kazzata – an online marketplace for 3D printed parts –to estimate the share of excess inventories can exceed 20 percent.

SOURCE: WOHLERS ASSOCIATES, 3D PRINTING AND ADDITIVE MANUFACTURING STATE OF THE INDUSTRY 2017.

outsource machine cut tools that could take two weeks or more to produce, but its engineers can now determine the shape and geometry of a fixture through 3D CAD software and 3D print it in one day.

manufacturing at 20 sites in four countries and more than 50,000 3D-printed parts are flying on both commercial and defense programs.”

47%

47% of companies surveyed by Sculpteo saw a greater ROI on their 3D printing investments in 2017 compared to 2016.

He also points to how GE Aviation’s new Advanced Turboprop engine design converted 855 conventionally manufactured parts into 12 3D-printed parts, resulting in 10 percent more horsepower, 20 percent fuel savings, a shorter development cycle and lower design costs.

43%

Wohlers Associates found the use of 3D printing for parts production grew from virtually zero in 2003 to 43% ($1.8 billion) of global 3D-printed product and service revenue by 2014. 3D-printed parts are currently being used most for functional parts (29%), prototypes (18%) and visual aids (10%).

“[3D printing] may never be as efficient as a 3-story stamping press at banging out ribbons of metal into panels, but, in one shot, 3D printers can form complex – indeed impossible-to-make – parts that a press could never solve,” wrote Pete Basiliere, Research VP at Gartner, which first used its highly regarded Hype Cycle Report to analyze 3D Printing in 2016. “Our Predicts research highlights three industries –medical devices, aircraft and consumer goods – that are making significant strides in implementing advanced manufacturing practices enabled by 3D printing. To a significant extent, the experiences of these industries can be applied to all manufacturing industries.”

Gartner research predicts 75 percent of new commercial and military aircraft will fly with 3D-printed engine, airframe and other components by 2021 – “After 20 years of use, Boeing has additive

Basiliere also describes how Airbus is utilizing 3D printing in the construction of its airplanes, having already introduced more than 1,000 3D-printed parts in its A350 model. In 2016, Airbus unveiled a completely 3D-printed drone called Thor consisting of 50 3D-printed parts and two electric motors, explains Basiliere – “This aircraft, which is four metres long and weighs 21 kg, was constructed in just four weeks.” Lockheed Martin in 2017 announced it is using 3D printing for titanium satellite components, reducing cycle times by 43 percent and costs by 48 percent.

“Prototyping is the reason 3D printing exists, because there is nothing better to make one-offs particularly if it is a small part with high detail,” said Stephen Nigro, VP, inkjet and graphic solutions for HP Inc., which began launching its Multi Jet Fusion products in 2016 to disrupt the 3D printing market with a high-speed, relatively low-cost platform. HP explains on a current high-cost, high-quality laser sintering machine, for example, 1,000 gears would take at least 38 hours to fabricate, while those same 1,000 gears could be produced within three hours on Multi Jet Fusion technology. UPS shared a telling quote in its 2016 report from an undisclosed senior industrial designer at a consumer electronics company: “Our prototype turnaround time reduced from three to six months to two to three weeks. Time-to-market for new products reduced by 40 to 60 per cent. 3D printing is viewed as an enabler here for expanding into new markets.” UPS explains the next big 3D printing opportunity is in smartphones, which comprise an estimated 35 per cent of total consumer electronics sales.

As early adopters, the consumer

The evolution of 3D printing is poised to generate new applications with DHL pointing to 4D printing, as developed at MIT, which adds the dimension of change to 3D-printed objects: “4D-printed items can self-assemble and adjust shape when confronted with a change in their environment like temperature. Imagine water pipes that shrink or expand depending on water flow, or tires that adapt to wet surfaces and change back to their original size and pressure when the roads are dry again.” The potential of 4D printing or similar market-boosting innovations is supported by the ability to print electronics under conditions similar to 3D printing.

electronics each total to UPS, closely in 2017 parts

3D print parts

DHL, printing of millions storage.

ta — printed share

20 per “[3D cient at banging panels, can ble-to-make never search its highly to analyze 1).

“Our three aircraft are making plementing practices

Gartner cent aircraft engine, ponents use,” additive four 3D-printed commercial He pointed Advanced converted ufactured parts, horsepower, a shorter design printing 3D-printed of its noted pletely consisting two which 21 kilograms, four

CALLING ALL PRINTERS

THE SPICE OF PRINTING LIFE

For many commercial printing leaders, inkjet has reached a tipping point as the process becomes a relevant, quality production tool, initiating a third wave of technological change

By Alec Couckuyt

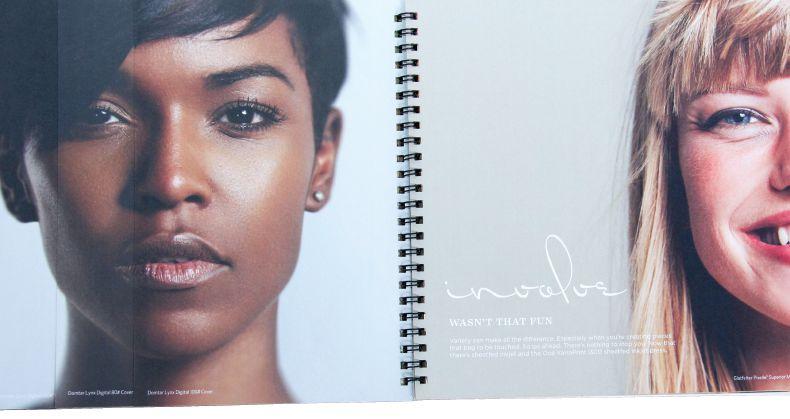

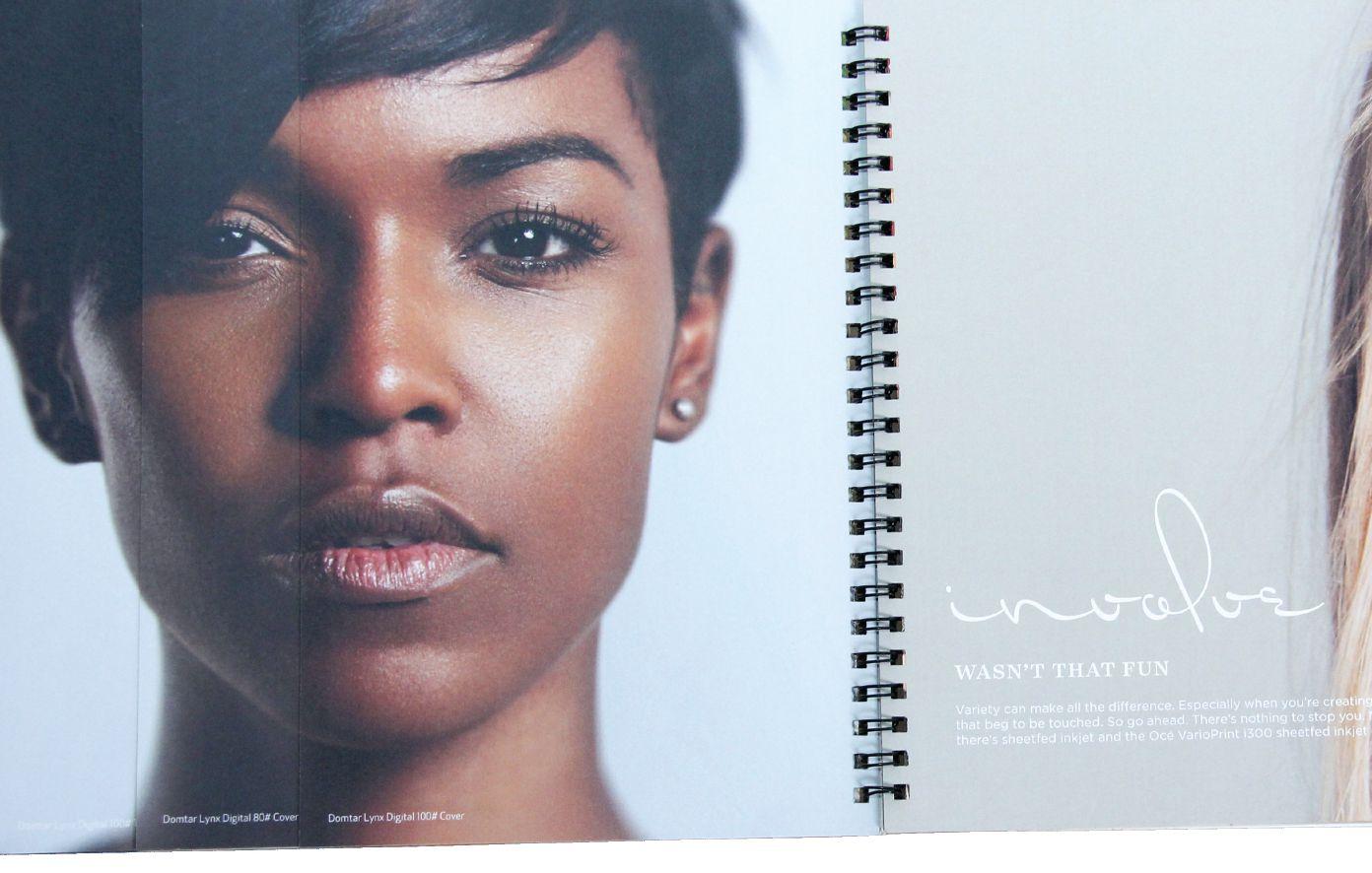

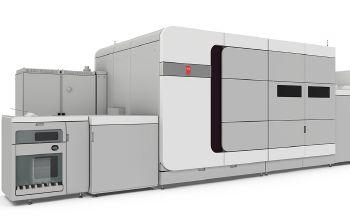

Variety, The Spice of Life Media catalogue, is a Canon-produced self-promotion project using 15 different papers to highlight the media versatility of the Océ VarioPrint i300. First introduced in Canada in 2016, this production-strength sheetfed press is equipped with iQuarius technology to enable inkjet printing at high speeds. It is designed to bridge the gap between the application flexibility of toner presses, the efficiency of offset sheetfed presses, and the economy and productivity of web-fed systems. It enables print providers to handle new and diverse applications with an eye toward productivity and profitability – benefits all inkjet press makers are leveraging.

Canon’s Variety project also highlights the use of Océ VarioPrint i-Series’ optional ColorGrip technology, which enables

Variety, The Spice of Life Media catalogue, was produced in a 10,000-piece run by Canon Canada to highlight the inkjet effectiveness of its Océ VarioPrint i300 system.

printing on a wider range of media, expanding the application range. ColorGrip enhances the image quality on papers not designed for inkjet. It expands the media range to include some coated offset stocks.

Production inkjet jobs can now include a variety of coated, uncoated and treated stocks and the printing system automatically adjusts the print parameters for each media type on a sheet-by-sheet basis. ColorGrip and iQuarius, and of course the VarioPrint i-Series, are unique to Canon, but the movement toward commercial-printing relevance by new generation inkjet technologies from other leading vendors is becoming a reality in the offset-dominated world of printing. The Variety project highlights that the days when inkjet presses could not effectively print on coated offset stocks are gone. Gone are the days when the quality of inkjet was considered almost there. And gone are the days when commercial print-

1M

While a highperformance engine oil has to cope with up to 6,000 rotations per minute (rpm), an inkjet fluid has to cope with the equivalent of more than 1 million rpm.

ers once felt like they had to ask that million-dollar question, offset or inkjet?

Waves of change