INTENSE DIGITAL

Short-run print enhancement

PRODUCTION INKJET

Why commercial printers should invest

NEW PRODUCTS

Detailing digital innovation

SPICE OF PRINTING LIFE

The arrival of inkjet

Short-run print enhancement

PRODUCTION INKJET

Why commercial printers should invest

NEW PRODUCTS

Detailing digital innovation

SPICE OF PRINTING LIFE

The arrival of inkjet

The emergence of enhancement and embellishment technologies are generating new possibilities for print to capture the attention of marketers and higher margins for commercial operations

By Jon Robinson

InfoTrends estimates approximately 30 percent of the total colour pages printed in North America and Western Europe, or nearly 1.8 trillion pages, currently receive some form of special effects enhancements or embellishments. These statistics are pulled from a 2016 report called Beyond CMYK: The Digital Print Enhancement Opportunity , coauthored by Jim Hamilton of InfoTrends, who explains this relates to a range of value-add special effects like spot or flood coatings, adding a Pantone colour, metallic inks, opaque whites, fluorescents, security features or any number of CMYK+ features.

The vast majority of these 1.8 trillion enhanced pages are printed offset and

finished with conventional methods. In fact, the report found that 46 percent of enhanced offset printed material requires two or more enhancements. There has been recent growth in digitally printed pages receiving enhancements because most toner-press makers now provide a fifth station for inline treatments, but Hamilton estimates this is applied to less than 10 percent of all digital pages and less than three percent of total production colour digital pages receive special effects.

Hamilton also points to the recent uptake in offline digital enhancement systems introduced from companies like Scodix, Konica Minolta (MGI), Duplo and Steinemann to apply spot gloss, dimensional,

Fully configured Scodix presses can run up to nine applications like this example of Scodix Foil, as well as Sense, Spot, Metallic, VDE/VDP, Cast&Cure, Crystal, Braille and Scodix Glitter.

foil and other effects. Beyond CMYK estimates, however, the digital print enhancement market (both inline and offline) only amounts to about nine billion pages annually. “That may seem like a lot, but it’s just a tiny sliver compared to the total 1.8 trillion print-enhanced colour pages produced each year,” Hamilton explains. “The conclusion is pretty clear. There is a significant growth opportunity for digital print enhancement processes.”

The opportunity in digital enhancement outlined by Hamilton helps to describe two of the three strategic pillars leading the development and commercialization of Scodix technology. Founded in 2007 by Eli Grinberg and Kobi Bar, Israel-based Scodix introduced its first digital enhancement system in 2010 and then caught the attention of the printing world at drupa 2012 for its unique application of polymers to enhance print – both offset and digital pages.Today, these polymers can be used in nine different or combined enhancement applications on three system platforms including the Scodix S, Scodix Ultra and the recently introduced 41-inch Scodix E106. The Value Category, as described in large part by Beyond CMYK’s research

focus, was Scodix’ initial push to the market in 2012 based on the ability to apply spot textures on a page through what are now branded as Sense polymers. Scodix’ introduction of a digital foil enhancement module in late-2015 supported its existing value-add approach, but also introduced a Cost Replacement Category of commercialization for the system maker. The third strategic pillar is referred to by Scodix as the Dream Category, which relates to a printer’s ability to attract completely new work based on enhancing pages.

Scodix’ value and dream categories are often hard to quantify because numbers will shift based on the application being produced, run length and a printer’s sales ability with enhanced pages. Cost replacement, however, provides printers with solid numbers in their application of digital foil relative to the costs of insourcing or outsourcing such analogue work.

“Scodix is building a story about how they have grown and it is closely linked to the availability of what we call digital foil,” says Christian Knapp, owner of Torontobased CMD Insight, who serves as the Canadian agent for Scodix.

“[Texture] is very interesting but somewhat limited in its application and adoption by the market. Once Scodix brought out digital foil they opened up the parameters completely… and they experienced substantial growth simply because the market realizes digital foil fits the cost replacement model and that is what most commercial, and in fact other, printers are going for.”

Approximately 150 Scodix systems were sold during drupa 2016. There are more than 50 Scodix installations currently in North America and now more than 250 worldwide. Knapp believes the technology has moved past the early adopter stage, when printers were initially intrigued by texture, into an early majority phase. “Any return on investment calculations for a commercial printer require, on the one hand, to reduce costs in their business and, on the other hand, offer new technology. And digital foil together with texture, what we call Sense printing, gives us that ability,” Knapp says, relating to the set-up time of traditional hot and cold foiling methods suitable only for long runs, and the direct costs of outsourcing. The ability to apply digital foil naturally fits with the digitaliza-

tion of prepress and presses, as most commercial printers today face a higher number of daily print-work transactions.

“Once you go from that product life cycle early adopter to early majority, people are starting to look at that in much more detail,” Knapp says. “Now the calculators come out and people need to justify their investments and let’s face it these machines are not inexpensive.”

Knapp explains a base Scodix Ultra system, onto which modules can be added, sells for approximately US$600,000 and the foiling unit is around US$150,000, resulting most often in a machine set up for around US$750,000 all in. “In calculations for customers, I have been able to justify the investment on the foiling unit alone within less than 12 months,” he says, noting the ROI on many full systems can be done in the range of 24 to 28 months. “That is fairly aggressive for a product that is not a small investment.”

might make five percent margin so there is $500,000 on a $10 million turnover,” he explains. “Now take the Top 10 percent of your customers and convert that with value-added processes such as Scodix digital foil and digital embossing. For that $1 million, if your profit number is now, to simplify things, 50 percent, you are making $500,000 profit on that volume.”

Founded in 2007 by Eli Grinberg and Kobi Bar, Israelibased technology veterans of the graphic arts industry, Scodix now has more than 250 installations worldwide.

Knapp explains by maintaining the remaining $9 million of turnover at five percent margin, which is about $450,000 profit, and adding the Scodix profit from VIP clients, a printer might generate around $950,000 for the same $10 million business turnover. “In that example, if you wanted to make $950,000 profit on a five percent margin for a conventional business you would have to produce about $19 million in sales. We all know how difficult it is to grow a commercial print business from $10 million to $19 million.”

In addition to the cost replacement models that help drive Scodix ROI calculations, Knapp also points to the value-add category where printers can simply charge more for print work when it is enhanced. He explains that traditional coating is actually more of an enabling technology relative to true page enhancements applied through systems like those built by Scodix. “Coating enables you to participate in the market, but you cannot really add that much value. Because at that level there is a market price that is highly fought over and there are lot of competitors in this segment,” Knapp explains. It is rare for an offset press to be sold today without a coating unit and coating holds as much customer expectation as sharp CMYK work, as much as service provides client loyalty but not necessarily a premium price. When discussing value-add, Knapp is directly referring to profit contribution for a printer based on page enhancements. He provides the example of a printing company that generates $10 million turnover, which is a suitable revenue number for Canada’s majority of small- to mid-sized printers. “If you are a good printer, well regarded, and have high productivity, you

The example of achieving 50 percent margin on Scodix print work would certainly need to be adjusted depending on how it is being applied and for what select clients. A high margin figure, however, is not unrealistic for enhanced print.

“Special effects printing can be a profitable endeavour,” wrote Hamilton, based on the Beyond CMYK report. “According to InfoTrends’ research, print buyers will pay premiums in the range of 24 to 89 percent for digital print enhancements over

The Canadian print industry is changing. It’s no longer about compromise but about saying ‘yes’ to your customers. It’s about adapting and seizing new opportunities. Canon will work with you to overcome challenges, exceed your customer expectations, and explore bold new ideas and cutting-edge techniques. Plus, with one of the widest digital printer portfolios in the industry, dedicated support and a unique heritage in imaging technology, we’re able to push boundaries, offer pioneering solutions and challenge the pre-conceptions of print to

Inkjet colour production presses that bridge the gap between the application flexibility and efficiency of sheet fed presses and the economy and productivity of web fed systems, without compromising quality.

This award-winning series of UV flatbed printers combine a true flatbed printer design with optional roll-to-roll capability making almost any application possibility a reality.

A new breed of fast, high-productivity, web fed inkjet presses combining the vibrant colours of offset with the variable-data versatility of digital printing.

Featuring UVgel technology, this roll-to-roll printer, is excellent for both indoor and outdoor graphics. It delivers a large color gamut, breakthrough productivity, low running costs and innovations in automation for consistent print quality and higher uptime.

CMYK-only work. Interestingly, many buyers expressed a willingness to pay a higher premium for special effects than printers believed they would pay.”

Knapp points to three third-party studies that suggest a premium margin for enhanced print comes in at anywhere from five to 40 percent.

The California Institute of Technology (Caltech) conducted an experiment in which the end user price sensitivity was tested in respect to tactile print enhancement. The researchers concluded that price increases are possible by adding softtouch tactile features to packaging whereby brands could raise prices to end-users by up to five percent.

The British Royal Mail looked at measuring user interaction with direct mail back in February 2015 in a survey called Private Life of Mail, which included looking at the effects of tactile printing on a reader’s emotional responses. The study states: “Multi-sensory stimulation seems to alter the way the brain processes messages – often making processing quicker, which is key for driving emotional response to messages or brands.” The Royal Mail’s study found that a sense of ownership over a printed item derived from sight and touch translates into a 24 percent increase in value.

media. Researchers found the motivation response created by direct mail is 20 percent higher and even better if it appeals to more senses like vision and touch. “Physical fills a much-needed, and very human, sensory deficit in the virtual world, where we spend most of our time these days...The most important renaissance in advertising has gone largely unnoticed,” wrote Deepak Chopra, CEO of Canada Post, in a guest column for The Globe and Mail about the study.

“We have a number of instances where people are charging $30 for 500 business cards, for example,” says Knapp. “Business cards are a dead giveaway market for this type of technology, compared to maybe only $10 for a conventional, standard CMYK business card.” He explains Scodix is currently focused on five target markets where it can add value: Commercial print, Web-to-print (such as business cards), folding-carton convertors (based on the introduction of the 41-inch Scodix E106), book publishing and photobooks.

24%

A Royal Mail study called “The Endowment Effect,” which looked at a consumer’s sense of ownership over a printed item derived from both sight and touch, found the addition of touch to traditional print translates into a 24 percent increase in value.

In early 2017, Canada Post –through True Impact Marketing – produced its own study called A Bias For Action that used brain imaging and eye-tracking technologies to see into the brains of people interacting with physical (direct mail) and digital (email, display) advertising media. The researchers developed two integrated campaigns featuring mock brands, applying the same creative and messaging across both physical and digital media formats. The 270 participants were later given memory tests to assess their recall of branded material.

True Impact Marketing found that it takes 21 percent less thought to process direct mail over digital messaging, and that the paper product creates a 70 percent higher brand recall – that our brains process paper media quicker than digital

The cost of polymer, explains Knapp, is always a point of discussion with printers when doing ROI calculations, especially as it relates to value-add, but he does not see it as a significant factor. “We encourage them to not put down too much polymer, because you will then lose the uniqueness, the ability to make this page standout,” he says. Knapp explains the worldwide average of Scodix polymer usage per page on a B2 sheet, 28 x 30 inches, is somewhere in the range of seven percent. “That is fairly low and the cost for a page produced like this is then in the range of 12 to 15 cents U.S. So that is actually not that much, especially if you can sell every one of those pages for a dollar or more, $5 – it depends on the application.”

The third pillar of commercialization for Scodix, beyond value and cost-replacement, is referred to by the company as the dream category, based on a printer’s ability to increase sales outside of existing product offerings and clients. “It doesn’t fly very well in the hard-nosed business world of com-

mercial printers,” says Knapp, who began his printing career by spending more than two decades selling offset technologies. “We mention it to people because we know this happens, but in a return on investment calculation it is very difficult to quantify.”

It is logical, however, that opening up VIP clients to enhanced print with texture and foil can help attract more of their offset or digital printing work, while at the same time provide a route into new accounts through differentiation. This is also fuelled by the development approach of Scodix based on the fact that most of its research effort is put toward polymers to expand beyond its current nine applications, which are branded as Sense (texture), Foil, Foil on Foil, Spot, Metallic, Glitter,VDP/VDE, Braille, Crystals and Cast&Cure.

Knapp explains Scodix views itself as chemical company more so than just a hardware company, engineering platforms to leverage new polymers and applications. “The future may well have polymers with a specific light frequency that reacts or they may taste or smell,” he says. “There are so many markets where a unique polymer or application would have great benefits. Think of security, foods, packaging in general. There are lots of applications that this technology will go to in the future.”

The polymers are a major differentiator for Scodix in the market relative to traditional inks and coatings, as well as the growth in new electrostatic inks for fifth and sixth imaging units. Knapp explains, “Scodix always determines the ideal and right polymer for the print job. Its modular [system] philosophy is application specific to what the end user needs and it is a very open R&D-centric company.”

Knapp continues to explain the use of polymers also provides an advantage for the vast majority of commercial printers who produce work-and-turn jobs, because Scodix jobs can be processed quickly with efficient drying. He also points to Scodix’ machine build, weighing around 9,500 pounds, and the registration accuracy of the systems as advantages.

“The underlying theme for Scodix, has always been to make printers more profitable,” says Knapp. “That is how I see their differentiation. I can talk technical Olympics for hours if that is what we need to do, but in the end it really comes down to providing tools for printers to be successful.”

Variety, The Spice of Life Media catalogue, was produced in a 10,000-piece run by Canon Canada to highlight the inkjet effectiveness of its Océ VarioPrint i300 system.

For many commercial printing leaders, inkjet has reached a tipping point as the process becomes a relevant, quality production tool, initiating a third wave of technological change

By Alec Couckuyt

Variety, The Spice of Life Media catalogue, is a Canonproduced self-promotion project using 15 different papers to highlight the media versatility of the Océ VarioPrint i300. The Variety project highlights that the days when inkjet presses could not effectively print on coated offset stocks are gone. Gone are the days when the quality of inkjet was considered almost there. And gone are the days when commercial printers once felt like they had to ask that million-dollar question, offset or inkjet? If the question is no longer offset or inkjet, then what should printers ask themselves and their suppliers when considering capital investment for the present and future health of their businesses?

In order to figure this out, I began tapping into my years of experience in this ever-evolving industry. Over the past 30 years, I’ve had the privilege to work for companies such as Agfa in Belgium, Germany and Canada; Transcontinental Printing at its large-scale plants in both Canada and the United States; Symcor – one of North America’s largest transactional printers in Canada; and, for the last 10 years, with Canon Canada.Throughout my career, I have been able to witness firsthand the many waves of technological change in our industry.

During my career, the first significant wave of change started with the introduction of the Macintosh computer in the mid-

1980s, the subsequent digitization of prepress, and ultimately the launch of Computer-to-plate technologies – the latter largely pinned on Canadian-led development. This digitization of print basically eliminated many vertical processes like typesetting, imposition, colour separation and plate-making.

The wave of digitization in print created a business shift, allowing – if not forcing – printers to create a more streamlined process to move directly from file preparation to plate-making. The industry underwent massive consolidation because of digitization. I remember Agfa buying Compugraphic and soon after Hoechst – and subsequently how dramatically the graphic arts dealer network changed across the country.

The second wave of change started in the mid-1990s with the introduction of the first rudimentary standalone digital presses and digital inkjet print heads. Print jobs exceeding million-plus run lengths started to disappear and we entered into versioning and personalization. I remember installing the first one-inch Scitex inkjet heads on our half-web offset presses and the acquisition of our first Xeikon digital colour press at Yorkville Printing, owned by Transcontinental.

During this wave, we also saw the evolution of toner-based platforms (cut-sheet and continuous-feed marvels) in an adjacent industry. The transactional printing industry was dealing with large amounts of variable data coming off mainframes, printing transaction records on preprinted offset shells. At that time, transaction printers only printed in black-and white, no colour, and obviously all variable.

As the millennium year 2000 approached, transaction printers

and commercial printers were operating in divergent spaces, serving different verticals.

We installed our first high-volume inkjet presses in 2008 in Toronto and Montreal at a leading transactional printer. These full-colour inkjet web presses ran 22-inch wide rolls of paper (52 inches in diameter) at speeds of nearly 500 feet peer minute. Massive amounts of transaction data and CMYK colour data were processed on the fly, now driven by powerful servers. More importantly, the introduction of printing full colour in a “white paper factory” model eliminated the need for pre-printed offset shells. This dramatically impacted overall efficiencies, including warehousing and logistics.

Inkjet printing fundamentally reshaped the transactional printing segment of the industry. Early adopters of this technology gained a major competitive advantage, captured considerable market share, and – again – market consolidation ensued. Inkjet had evolved but was not ready for commercial printing – not yet. But the once distinctive lines between transaction and commercial printers began to blur.

For many in the commercial printing world, drupa 2016, also dubbed Inkjet 2.0, was the tipping point for when inkjet became a relevant, quality production tool, initiating the third wave of change. The demand for short runs, full colour, quick turnarounds, and variable print work increased exponentially as the need for long print runs decreased substantially. Since the turn of the millennium, maturing toner-based, cutsheet production platforms fulfilled these initial print consumer demands for short-run, full-colour print. Their inherent limited production speed and higher cost structures, however, limited the type of applications one could profitably take on.

The current generation of inkjet presses have now eliminated these production limitations and are breaking down cost structure barriers. Additionally, the range of capabilities and the quality output of inkjet presses make them suitable for at least 80 percent of all commercial printing work. But these are not the primary advantages of inkjet, they are a given. The single mostimportant attribute of inkjet is the capability of producing relevant printed products.

Inkjet is not just a technological evolution or change, above all it is the cornerstone in helping printing businesses stay relevant in a changing world of omni-channel communications – a world flooded by print, e-mail, apps, text, any number of smartphone capabilities, Web, streaming, virtual reality, etcetera. Inkjet gives commercial printers the tools to mass produce customized and personalized integrated print pieces almost instantaneously, and to be an integral part of the omni-channel communications sphere.

The ultimate question commercial printers should ask, therefore, is how do inkjet and offset fit into my business model and enhance the relevance of my offerings within the world of omnichannel communications. These are indeed exciting times for an exciting industry.

ED PIERCE

Four technology leaders from Canon, Fujifilm, Komcan and RISO describe why commercial printers should

Product Marketing Manager, Fujifilm North America, Graphic Systems Division

Why is it important for commercial printers to consider an inkjet press?

EP: As run lengths continue to decline, regardless of the reason whether it be inventory cost driven or targeted marketing driven, it becomes increasingly difficult to provide a quality product at a price that is profitable for the print provider. As run lengths decrease, the expectation of quality does not decrease along with it. Toner technologies only go so far and production inkjet drives it home beyond the capabilities of a toner device.

This should also be considered an opportunity for commercial printers. By staying ahead of the curve and investing in new technology that addresses this need; will put the printer in a much better competitive position to attract and win this book of business that is not a trend but rather a new reality in the market. With the integrated technologies of the J Press 720S the print provider can produce a smaller initial quantity and reprint in a week, a month and so on the exact same quality and colour of the initial print run by simply calling up the same job with the same media profile and hitting the print button. There are no plates, there is not running up to colour and there is no extra labour required to reproduce a simple reprint order.

EP: The Fujifilm J Press 720S was not only the first B2/half-size production inkjet press brought to market, it is now in its second generation and the most widely adopted B2 inkjet press with over 100 installations globally.

The J Press 720S uses the industry benchmark Fujifilm Dimatix Samba print heads along with Fujifilm’s cloud-based ColorPath SYNC colour management, Fujifilm VIVIDIA aqueous pigment inks,VERSA Drop jetting technology and proprietary screening algorithms to deliver what many describe as better than offset quality printed output. And by running standard coated and uncoated offset stocks, the commercial printer and print buyer do not have to change the stocks they use or purchase stocks that carry a premium cost.

EP:: There is still a perception in the market that production inkjet has yet to achieve offset quality. At least in the case of the J Press 720S from Fujifilm, this market need has been met. Commercial printers tend to look at their current book of business when considering the purchase of a production inkjet press and plugging these numbers into their ROI. The reality is that just about all printers that have adopted production inkjet technology have achieved new business with their investment.

BR: The primary shortfalls of digital printing technologies have been twofold, Volume and Quality. You can maybe have one, but not the other. With production Inkjet, we are seeing that elevated crossover point, and unmatched quality in the digital space.

We have also come to a point with traditional tonerbased digital equipment, that quality and other factors such as substrate limitations, and post-press application, are limiting. Inkjet bucks all of those and allows for A) high level of quality, B) continually increasing crossover point, C) substrate freedom, in some cases, and D) post-press durability.

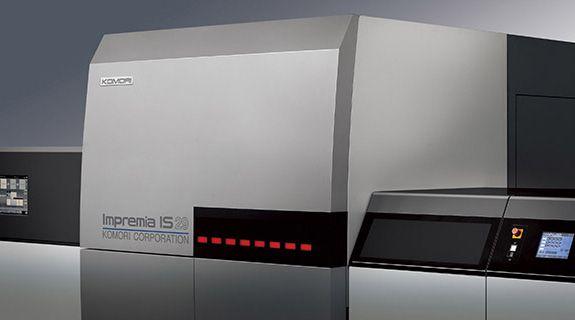

The larger format of Komori’s IS29, 23 x 29 inches, allows for 50 percent more up per press sheet, at 8.5 x 11 inches, without sacrificing press speed.

BR: The Komori IS29 is a leader in all four aspects of quality, low to higher volume printing, substrate freedom, and post-press durability. The larger format, 23 x 29 inches, allows for 50 percent more up per press sheet, at 8.5 x 11 inches, without sacrificing press speed [3,000 sheets per hour].

Print quality produced by the IS29 is fantastic. Colour consistency throughout the run is solid. Perfecting, UV curing, substrate freedom, including off-the-shelf non-porous substrates, and litho based sheet transport with excellent register, make the IS29 an excellent investment, while maintaining the digital advantages, such as full colour variable. The crossover point is rising.

Invigorate your print operations with Ricoh’s ultra-reliable production printing systems and market leading service & support. Our cutting edge technology delivers outstanding colour consistency, quality and speed so you can handle the big jobs and quick turnarounds with precision. And with a wide range of size, media as well as our market leading service and support team, Ricoh has the machine you need to meet your printing demands – and grow your business.

For more information, talk to a Ricoh printing systems representative today. Expand your production printing horizons.

Pro C5200 Series

High productivity and image quality

Versatile

Pro C9200 Series

Exceptional print quality and outstanding reliability

Best in Class Media Handling

Pro VC60000

High productivity, image quality and durability

Next-Gen Continuous Feed Inkjet

5th Station Technology Series

High productivity and image quality

Expanded application support

Best in Class Media Handling

5th colour station for White, Clear, Neon Yellow, Neon Pink, & Invisible/Security Red Toners

BR: Preconceptions regarding quality exist because previous incarnations of inkjet technology had shortcomings. This is no longer the case and inkjet printing has now surpassed quality levels seen in the toner world.

Further, the cost of introduction has been an objection heard in the market. The same price objections that were heard when toner based technologies, CTP, or even the Linotype machine came out. Technologies, while in their infancy, are expensive. No different than DVD players, VCRs or 8 Tracks. Inkjet, however, is past the infancy stage, and even past the toddler stage; and as such, improvements are being made, turning these objections obsolete.

ANDRE D’URBANO Director of Dealer Sales, RISO Canada

The RISO GD9630 offers improved 5-colour output at prices of around $100,000.

Why is it important for commercial printers to consider an inkjet press?

AD: For years the print consumer has been told that colour is more expensive. To this day we have organizations that are forced to limit or ban the use of colour as it is deemed a luxury. Inkjet allows those on a budget to shift a majority of their monochrome printed material into the colour arena but at an affordable price. Colour inkjet has a cost of 1 to 2 cents per page and can be sold at 4 to 6 cents per page, a far cry from the 10 to 15 retail cents for colour toner. The end user gains in increased colour printing while the print shop benefits from the higher margins of inkjet compared to monochrome toner.

is currently your company’s best

AD: RISO offers production, colour, cut-sheet printing at a speed of 9,600 letter-size pages per hour. The GD9630 offers improved 5-colour output at the low cost that is expected from inkjet. The RISO solution is one of the few – if not the only – high-speed, cut-sheet production devices priced at about $100,000 or less. It is the least expensive way to dip your toe into the inkjet waters. If a print shop has seen the demand for inkjet grow but cannot justify the investment of some of the larger devices in the market, RISO will provide the shallow financial ramp needed to get in the game.

What key challenges still exist for production inkjet?

AD: Inkjet quality has and continues to be widely accepted by end users everywhere. The challenge comes from those selling inkjet printers along with those at the print shop level who need to sell inkjet printed material to their clients. These are the ones with a

critical eye and some cannot get past anything less than toner that is baked onto coated paper. The fact is that there are many nonprofit organizations convinced that colour is out of reach. They have for years been told that a colour image will cost more. As such, they revert back to monochrome. A print shop that prints 60 percent monochrome and 40 percent colour annually can easily transfer half that monochrome work to colour inkjet as it is more affordable than toner.

ALEC COUCKUYT Senior Director PPS,

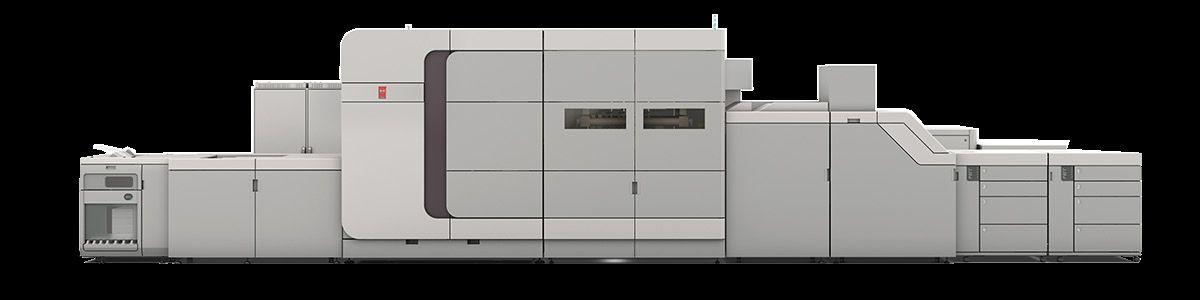

The scalable Océ VarioPrint i300is equipped with Canon’s PRISMAsync controller tohandle a range of production needs.

is it important for commercial printers to consider

AC: In this rapidly evolving communications industry the commercial printer is faced with five critical dynamics: 1. Shorter run lengths, 2. Faster turnaround times, 3. Increasing job complexity like variable content/images, 4. Expansion of products and services offerings like data management, commercial print, display graphics, fulfillment, and 5. Relentless pressure on cost avoidance. Inkjet technology gives the commercial printer an additional critical tool to stay on top of these dynamics and make print highly relevant.

AC: The answer has to be twofold – one press does not fit all. If the commercial printer deals with a high number of different types of short run jobs with fast turnaround, an ability to print on a wide range of media, including coated offset, the answer is the VarioPrint iSeries, our highly productive inkjet cutsheet colour press. If the commercial printer’s requirements are based on higher volumes, variable content/images the answer is the ProStream. This 22-inch-wide web press with a native 1,200 x 1,200-dpi multi-level droplet modulation, runs at 80 metres per minute, prints on coated offset media, with a monthly duty cycle of 35 million impressions, and a colour gamut beyond offset.

key challenges still exist for production inkjet adoption?

AC: The two biggest challenges a commercial printer faces today are 1) The clear understanding of ink consumption, in order to properly estimate job costs, and 2) The understanding of what paper media a specific inkjet press can print on. It is essential for the commercial printer that during the discovery phase the vendor clearly defines these two aspects.

Zünd’s Over Cutter Camera OCC captures all points in a maximum area of 3.2 x 3.2 metres.

In April, Zünd displayed its new Over Cutter Camera OCC, which allows the company’s cutting systems to more quickly process printed materials. Zünd explains the fully automated OCC takes a single shot to capture all register marks at once, in a matter of seconds. The Over Cutter Camera OCC captures all points in a maximum area of 3.2 x 3.2 metres (126 x 126 inches) and can be added to any Zünd G3 cutting system. With the Over Cutter Camera OCC, Zünd is providing what it describes as an expansion to the traditional method of sequential register-mark capture with an ICC camera. Sequentially capturing register marks to determine position and possible distortions of printed graphics is time consuming, explains the company, particularly in applications that require a lot of them.

The OCC system is powered by Zünd Cut Center ZCC and takes one image to register all marks visible in the working area. ZCC subsequently compensates for any distortions and Zünd explains the processing begins almost immediately. Even after a material advance, no user intervention is required. The OCC automatically captures all register marks after each advance, which helps create maximum productivity. With the Over Cutter Camera, Zünd explains even the step of manually guiding the camera to the initial

reference point becomes obsolete. For automatic QR-code file retrieval and high precision, Zünd continues to offer the ICC camera which captures each register mark one by one.

The Fifth Imaging Unit, standard on both Nexfinity and NexPress ZX machines, enables the use of 10 different inks

Kodak in March 2018 introduced its new Nexfinity sheetfed toner press platform, which builds from its NexPress systems, with availability scheduled for spring 2018. The new platform is built with Dynamic Imaging Technology (DIT), a patented Kodak technology for digital printing. DIT technology applies algorithmic adjustments to specific areas of an image, explains Kodak, which optimizes image quality and consistency based on the image content in each area. Kodak explains this imaging technology produces crisp text, hard lines, soft skin tones, and beautiful skies on the same page.

The Fifth Imaging Unit, standard on both Nexfinity and NexPress ZX machines, enables the use of 10 different inks for special applications, gamut expansion, and multiple surface finishes. It only takes 15 minutes to switch in a new Fifth Imaging Unit ink, according to Kodak, compared to one hour or more on competitive devices. Depending on the job, four different CMYK ink sets are available and easily switchable with both Nexfinity and NexPress ZX.

When used in combination with different types of fuser rollers, an even wider choice of look and feel is available for any

given job. Not only is the standard CMYK gamut larger than the conventional offset gamut, explains Kodak, you can match 92 percent of Pantone colours within a Delta E of 3 by using red, green or blue in the Fifth Imaging Unit.

Ricoh in April is introducing enhancements to its fifth-station technology for its toner presses. This includes improved colour stability, explains Ricoh, based on updated auto calibration with inline sensors, and improved registration with an auto adjustment function. In addition, Ricoh explains it fifth-station technology offers a wider scope for value-added print applications with a new ability to print white plus CMYK in a single pass, enhancing impact, for example, on coloured media substrates. The new fifth-station enhancement also introduces an invisible red toner, which is ideally suited for a range of entry-level security applications. The recently launched neon pink toner, as well as white, clear and neon yellow toners complete a range of fifth-station colour options.

Productivity is increased on the new models with an ability to reach speeds of up to 95 ppm or 85 ppm, plus auto duplex long sheet production of up to 700 mm, and simplex up to 1,260 mm. Image quality is enhanced with 2,400 x 4,800 dpi. As well, the new systems handle a wider range of medias of up to 360 gsm at rated speeds. The new models also provide inline finishing options like the GBC eWire Binder, BDT Banner Sheet LCT, and a Plockmatic banner sheet stacker.

Introducing the new OnsetM

Fujifilm is setting the industry on fire with the new OnsetM. This new B1 for mat inkjet printer is robustly designed to produce a high quality, shor t run solution for the offset, screen, and industrial print markets. Jetting 7 picoliter droplets of Fujifilm Uvijet inks through FUJIFILM Dimatix printheads, the OnsetM produces vibrant colours, smooth gradients, and fine text that rivals an of fset print. And with a throughput of up to 200 B1 boards/sheets per hour of ever ything from paper to plastic, the OnsetM can give you the edge you need to take on jobs you never thought possible.

To learn more visit FujifilmInkjet.com/OnsetM

HP in March 2018 commercially released new ElectroInk Fluorescent Green,Yellow and Orange for its HP Indigo 12000 HD press, which is its Series 4 larger format press platform with more than 700 units installed worldwide. The High Definition Imaging System for the B2-sized HP Indigo 12000 HD doubles image resolution, explains the company, delivering sharper, smoother, finer print. HP explains this allows print service providers to surpass offset quality and open new digital possibilities in high-end commercial and photo applications. The press’ all-new High Definition Imaging System uses 48 parallel laser beams and high screen sets of up to 290 lines per inch. HP Indigo ElectroInk Vivid Pink and HP Indigo ElectroInk Vivid Green are a new set of brighter inks for high-end photo applications like wedding photography.

The iGen 5 can provide an extended gamut to achieve up to 93 percent of Pantone colours, with 2,400 x 2,400-dpi imaging.

In October 2017, Xerox released a White Dry Ink for the fifth print station of its iGen 5 press. With the addition of White Dry Ink to the iGen 5 platform, print providers can apply spot effects to produce printed pieces with more physical look and feel. Xerox’s White Dry Ink features the ability to print White Dry Ink only, as white layers under or over CMYK. The company claims it provides strong brightness and opacity that is achievable in a single pass of white. The iGen 5’s automated multi-pass mode can also be leveraged to produce up to two layers of white. Additional layers of white can be manually printed for custom applications. The iGen 5 press can provide an extended gamut to achieve up to 93 percent of Pantone colours, with 2,400 x 2,400-dpi imaging. It leverages what the company labels as Object Oriented Halftoning, Xerox Confident Colour, and Auto Density Control.

The Xeikon CX500, with a web width of up to 520 mm (20.47 inches), is designed for larger sized labels.

Xeikon in October 2017 introduced the new Xeikon CX500 digital label press, which the company describes as its first press based on a new generation dry toner platform. It is scheduled to be commercially available in 2018.

The Xeikon CX500, with a web width of up to 520 mm (20.47 inches), is designed for larger sized labels, labels requiring an opaque white or an extended colour gamut. It also features full rotary printing technology and speeds of up to 30 metres per minute (98 feet per minute).

The wider web of Xeikon CX500 is part of the company’s dry toner Cheetah Series aimed at the high-end self-adhesive label market. Xeikon explains it also complements the narrow-web CX3 press introduced in 2015. Like the Xeikon CX3, the CX500 runs on Cheetah toner, which is based on Xeikon’s ICE technology and is designed specifically to cope with the higher speeds.

PrintOS Marketplace is aimed at a range of presses like HP Indigo, HP PageWide and HP Scitex.

In April, HP unveiled its PrintOS Marketplace, described by the company as a new solutions community for the HP PrintOS cloud-based print production operating system. Designed to provide tools for printers using HP technologies, Marketplace will offer production and design tools and services from both HP and third parties. Opening this summer, Marketplace will be open to any vendor to offer subscription-based apps for PrintOS members

that help HP customers automate production, expand offerings and grow business. Today, PrintOS has 5,400 printing providers subscribed to the system, including owners of HP Indigo, HP PageWide Industrial and HP Scitex presses. OneFlow System Systems and HYBRID Software are the first two partners enrolled in the PrintOS Marketplace.

The Océ VarioPrint i300 press with iQuarius MX inks has achieved Fogra 51 certification.

Canon introduced new iQuarius MX inks for the Océ VarioPrint i-series of sheetfed inkjet presses. Scheduled to be available from April 2018, these third-generation inks for the VarioPrint i-series have been specifically developed to meet the needs of working with offset coated papers for highquality printing.

The new Océ iQuarius MX inks, explains Canon, enable the application of higher ink coverage on a range of offset coated stocks, which in turn extends the platform’s range to more demanding applications like higher quality books, manuals and direct mail. Océ iQuarius MX inks are used in combination with the company’s ColorGrip inline paper conditioning technology to optimize ink adhesion and absorption. The original iQuarius ink for the Océ VarioPrint i-series will now be branded as Océ iQuarius MP ink (Multi Purpose), to distinguish it from the new iQuarius MX (Media Extended) version, allowing customers to choose the appropriate level of ink performance for their applications. For current Océ VarioPrint i-series customers, MX-upgrades will be made available on request.

In April, Konica Minolta Business Solutions introduced the WEBjet 200D and WEBjet100D continuous feed inkjet presses. The company explains the printing systems are the result of a three-way marketing, distribution and servicing partnership between itself, Super Web and Mem-

jet. The presses will be officially launched in the spring of 2018. Manufactured by Super Web and leveraging Memjet printhead technology, both continuous feed inkjet printers will target high-speed and high-volume applications in the transaction, direct-mail, publishing and in-plant business sectors. The WEBJet line, which comes standard with rollstand and stacker, will complement Konica Minolta’s existing cut-sheet toner and inkjet products.

Standard Horizon’s CRF-362 comes configured with seven selectable fold patterns and six selectable cover creasing patterns.

system was capable of producing nine different applications and the Scodix Ultra2 is designed to provide more flexibility, quality and productivity. Users of the Scodix Ultra Pro will be able to upgrade to the Scodix Ultra2 sometime this year. Scodix first introduced the Scodix S system in 2012, followed by the Scodix Ultra. Today, close to 300 Scodix systems are installed worldwide.

Scodix explains the Ultra2’s entire print engine has been changed to provide high accuracy of print and cost effectiveness, supported by fast switching between polymers, with improved print quality and material flow. The Scodix Ultra2 includes five ink tanks.

In April, Ricoh unveiled what it describes as enhanced inks for the Pro VC60000 platform, which also includes the recently introduced Pro VC40000 model, within its continuous-feed inkjet portfolio. The company explains this ink introduction “greatly expands” the range of media that can be used on these VC-branded inkjet systems. The new Ricoh Pro VC60000 inks, explains the company, are designed to streamline printing directly to traditional offset coated papers, making the entire production system more versatile and economical.

Ricoh continues to explain these new inks hold an improved adhesion that allows for faster printing speeds with coated papers. The pigment-based technology is also described as improving durability, water fastness and print-head reliability. Introduced in February 2017, the Ricoh Pro VC40000 operates at speeds of up to 120 metres per minute, allowing it to produce more than 100,000 letter images per hour. It also supports paper from 40 to 250 gsm, which Ricoh explains allows for application possibilities from lightweight books to high-coverage postcards.

The Standard Horizon CRF-362 creaser/ folder is designed to handle creasing and folding of digital colour output across a

range of lightweight and heavyweight stocks, coated or uncoated. Creasing and folding can be done in one pass for applications like restaurant menus, greeting cards, book covers and marketing collateral. The CRF-362 comes configured with seven selectable fold patterns and six selectable cover creasing patterns for binding, including spine, hinge, and flap creasing. Capable of up to 10 crease lines on a sheet, the system uses an impact scoring technology that aims to eliminate or minimize cracking of the stock or printed image. Set-up and changeovers like fold pattern, creasing number, and up/down crease selection can be achieved through its colour touchscreen. The system can handle paperweights of up to 400 gsm for creasing without folding (350 gsm with folding) and sheet sizes of up to 14.33 x 34 inches. It reaches speeds of up to 5,000 sheets per hour with one crease and one fold.

Scodix Ultra2 uses new adaptive LED process controls for a curing process with improved accuracy.

Scodix in December 2017 introduced the new Scodix Ultra2 Pro Digital Enhancement Press with Foil Station, describing the system as “the ultimate multi material platform.” The existing Scodix Ultra Pro

Introduced in January 2018, OKI explains its Pro8432WT produces HD-quality colour transfers for textile and hard substrates, up to 11 x 17 inch format, as well as promotional materials. To this end, it leverages a straight paper path for flexible media handling. The printer features white toner technology with solid opacity and CMY colour. It can handle transfers for 100 percent cotton, cotton blends or polyester. Running at nine pages per minute for tabloid-size full-colour transfer, or 16 ppm for letter-size, reaching 1,200-dpi resolution.

Duplo’s DDC-810 Digital Spot UV Coater creates raised textures.

In April 2017, Duplo launched its DDC810 Digital Spot UV Coater, which utilizes inkjet technology and gives images depth and raised textures with a gloss varnish –described by the company as elevated spot UV embellishment. It features a CCD camera recognition system ensuring imageto-image registration and PC Controller software. The DDC-810 is designed for short-run applications. It can process up to 21 sheets per minute (A3) and paper weights from 157 to 450 gsm (coated paper).