FOOD LAW

PG. 9 + CHEERS TO NEW FLAVOURS PG. 25 THE EVOLUTION OF NON-ALCOHOLIC BEVERAGES

PG. 9 + CHEERS TO NEW FLAVOURS PG. 25 THE EVOLUTION OF NON-ALCOHOLIC BEVERAGES

Canadian chocolatiers defy high raw material costs PG. 14

Urschel designs and manufactures high capacity, precision food cutting machinery designed for rugged production environments.

Sanitary and dependable in design. Rely on Urschel cutting solutions to effectively process all types of products.

The Urschel global network of sales and support has expanded. Urschel Canada is now open in Ontario with full coverage throughout Canada.

Contact Urschel Canada to learn more: 647-910-5017 | canada@urschel.com

JUNE/JULY 2025 • VOL. 85, ISSUE 3

Reader Service

Print and digital subscription inquiries or changes, please contact Angelita Potal, Customer Service

Tel: 416-510-5113 Fax: 416-510-6875

Email: apotal@annexbusinessmedia.com

Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

ED ITOR | Nithya Caleb ncaleb@annexbusinessmedia.com 437-220-3039

ASSOCIATE ED ITOR | Ojasvini Parashar oparashar@annexbusinessmedia.com 416-510-5206

ASSOCIATE PUBLISHER | Kim Barton kbarton@annexbusinessmedia.com 416-510-5246

MEDIA DESIGNER | Alison Keba akeba@annexbusinessmedia.com

ACCOUNT COORDINATOR | Barb Vowles bvowles @annexbusinessmedia.com 416-510-5103

AUDIENCE DEVELOPMENT MANAGER | Anita Madden amadden @annexbusinessmedia.com 416-510-5183

GROUP PUBLISHER/VP SALES | Martin McAnulty mmcanulty@annexbusinessmedia.com

CEO | Scott Jamieson sjamieson@annexbusinessmedia.com

Publication Mail Agreement No. 40065710

Subscription rates

Canada 1-year – $86.65 per year

Canada 2-year – $127.45

Single Issue – $15.00

United States/Foreign – $163.15 All prices in CAD funds

Food in Canada is published 6 times per year by Annex Business Media. Occasionally, Food in Canada will mail information on behalf of industry related groups whose products and services we believe could be of interest to you. If you prefer not to receive this information, please contact our Audience Development in any of the four ways listed above.

Annex Privacy Officer

Privacy@annexbusinessmedia.com 800-668-2384

No part of the editorial content of this publication can be reprinted without the publisher’s written permission @2025 Annex Business Media. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or the publisher. No liability is assumed for errors or omissions.

Mailing address

Annex Business Media

111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1 Tel: 416-442-5600 Fax: 416-442-2230

ISSN 1188-9187 (Print) ISSN 1929-6444 (Online)

As I write this, the whole country is bracing for a complete stop to work by the Canadian Union of Postal Workers (CUPW). The last strike, held during the busiest time for mail services in November-December 2024, cost small companies over $1 billion in lost revenue and sales, according to the Canadian Federation of Independent Business (CFIB). More than 60 per cent of small firms faced challenges to cash flow due to delayed invoices and cheques as well as higher delivery costs. That strike, which lasted 32 days, stopped when the federal government ordered an end to work stoppage. The then government appointed an industrial inquiry commission (IIC) to review the issues in Canada Post’s collective bargaining dispute with CUPW, as well as the company’s broader challenges. It also urged Canada Post and CUPW to continue negotiations. Sadly, no agreement has been reached & when the collective agreement expired May 22, CUPW stopped overtime work across Canada.

Another strike would be devastating for small businesses. Per CFIB, more than three-quarters (79 per cent) of small business owners rely on Canada Post services to do business.

“We are at a critical time for the country with small businesses grappling with massive uncertainty created by trade tensions with the United States and China. Small business confidence

in the economy is at a near historic low,” said CFIB president Dan Kelly. “We cannot afford another threat to our economic stability, and we can’t keep finding ourselves back in the same spot with an unreliable supply chain and an important service again not being available to small firms.”

The strike comes at a critical moment for the postal system. Since 2018, Canada Post has recorded more than $3 billion in losses before tax.

In the final IIC report, Commissioner William Kaplan said, “Canada Post is facing an existential crisis: It is effectively insolvent, or bankrupt. Without thoughtful, measured, staged, but immediate changes, its fiscal situation will continue to deteriorate.”

Nevertheless, Commissioner Kaplan believes there is a way to preserve Canada Post as a vital national institution. He made the following recommendations:

• phase out daily door-todoor letter mail delivery for individual addresses, establish community mailboxes where possible and maintain daily delivery to businesses;

• lift moratoriums on rural post office closures and community mailbox conversions;

• hire part-time employees to assist with volume and pay them the same rates as regular

Nithya Caleb

employees, as well as provide access to pro rata benefits, or payments in lieu, and pension;

• introduce dynamic routing to reflect volumes to avoid trapped time and overtime; and

• amend the time-consuming approval process for postage increases.

“If implemented, these changes may return Canada Post to some degree of financial sustainability so it can continue the Universal Service Obligation – for both letter mail and parcels – but in a manner that reflects the 2025 realities of disappearing letter mail and a highly competitive parcel delivery environment. The world has changed, and both Canada Post and CUPW must evolve and adapt. Merely tinkering with the status quo is not an option,” he said.

Structural changes to preserve Canada Post are the need of the hour. As it is, many companies are contemplating moving their business to another mail services provider. If this strike goes ahead and continues for a long time, the switch would be permanent. Canadians deserve a national mail carrier that can provide stable, on-time, efficient and affordable deliveries. I hope Canada Post and CUPW would accept IIC’s recommendations and work to ensure a long-lasting postal service.

Nithya Caleb ncaleb@annexbusinessmedia.com

Dr. Amy Proulx

icrobial testing of products is a time-consuming, costly, but necessary activity for food manufacturers. Companies require the selection of microbial testing protocols, both for day-to-day hold-and-test and positive release for production and for developing an incident plan. In food safety, incident planning is always a worthy activity. The moment you have an incident is not the time to plan an investigation.

With most food products, risk assessment can help identify pathogens and organisms of interest. Risk assessment can be done by reviewing the Canadian Food Inspection Agency (CFIA) and U.S.-based recall databases. Generative AI summaries can be used with caution as they are often misleading, missing important pathogens or overextending into organisms that are not particularly relevant.

Once microbial species are identified, many food products have typical protocols for analysis. The Health Canada Compendium of Analytical Methods and the U.S. Food and Drug Administration Bacteriological Analytical Methods Manual provide most of the reference methods used in Canada.

Microbiology testing labs can offer advice on optimised analytical procedures because they usually handle products for a large range of clients. Labs for food analysis should be accredited with ISO 17025, Testing and calibration laboratories, and specifically for the types of tests you need. ISO 17025 is quite important, as it requires labs to participate in performance testing, which evaluates the competency of personnel, equipment calibration,

quality control and traceability on analyses. In the case of a recall or other incident, insurance may require lab testing to be performed by ISO 17025-certified labs. Global Food Safety Initiative (GFSI) programs also ask for it.

fulfils an important role in hold-and-test positive release, where the product does not leave the control of the company until it tests negative for pathogens. For short shelf-life products, it is beneficial to have results in hours instead of a couple of days.

Companies should have protocols on file for reference, as they can provide interesting information on sampling best practices. Health Canada protocols are available for free. However, you must email them. FDA protocols are also available for free. Private analytical organisations charge a nominal fee for a copy of their protocols.

A well-designed plan will save time and worry during microbial contamination incidents.

As for asking for advice from CFIA, while their staff usually do not advise companies on best practices, the agency does routine directed testing and publishes the results publicly. These protocols provide insight into best practices for microbial screening for organisms of concern.

Rapid testing, which often relies on a validated proxy for full microbial growth, may require additional microbial culturing and enumeration methods. Rapid tests often rely on the detection of microbial proteins or antigens using lateral flow devices or enzyme-linked immunosorbent assays (ELISA). PCRbased DNA analyses are also very fast compared to traditional microbiology. Each of these assays has limitations. Within each protocol, there’s typically a decision-making process. If the rapid test identifies the presence of a pathogen of concern, this is followed immediately by a microbial culture method. Rapid testing

Often, I hear from companies if it is necessary to track Total Plate Count (TPC), Aerobic Colony Count (ACC) or Total Yeasts and Moulds (TYM) as part of microbial testing protocols. These organisms are not a food safety issue but are indicative of general food hygiene. There are a few food products with standards of identity that limit the maximum amount of total bacteria. Tracking generic organisms can show trends when tracked with statistical process control charts. A good chart can show when variation in these organisms is normal or ‘common cause variation’ versus atypical or ‘special cause variation’. These charts can be quickly evaluated using the Nelson Rules to determine trends.

As an addendum to a recall plan, a microbial incident plan can help with rapid response and decision making.

Planning for microbial testing and incident response supports quick and effective action during recalls or contamination events. It’s worth taking time to review procedures to optimise for best performance.

Dr. Amy Proulx is professor and academic program co-ordinator for the Culinary Innovation and Food Technology programs at Niagara College, Ont. She can be reached at aproulx@niagaracollege.ca.

William Bjornsson

ecent regulatory and policy changes from Health Canada introduce new compliance considerations for food manufacturers, as they relate to the use of essential oils, oleoresins, and natural extractives in food products, among other substances.

On December 18, 2024, Health Canada published its final Regulations Amending Certain Regulations Concerning Additives and Compositional Standards, Microbiological Criteria and Methods of Analysis of Food. One of the significant changes in these amendments was the removal of exemptions that previously excluded certain botanically sourced substances from the definition of a food additive under the Food and Drug Regulations (FDR).

finished food.”

food additive is defined as “any substance the use of which results, or may reasonably be expected to result, in it or its by-products becoming a part of or affecting the characteristics of a food,” subject to certain enumerated exemptions. Previously, based upon a plain reading of the definition, natural extractives, oleoresins, and essential oils were exempted as food additives, regardless of their role in food products. As a result of these new amendments, these substances, when used for a nonflavouring or nutritive, technical effect in food, now fall squarely within the scope of the food additive definition.

In Canada, food additives must be used per the Lists of Permitted Food Additives (LPFA). An often-lengthy

premarket approval is required for any new food additive or new food additive use. A food is considered adulterated if it contains a food additive that is not used in compliance with LPFA. However, since the coming into force of the amendments, and as of April 2025, no new essential oils, natural extractives, or oleoresins have been added to LPFA, raising uncertainty about the regulatory status of some formulations that have remained unchanged for years, even in absence of any health or safety concerns.

Adding to the complexity, Health Canada has stopped issuing Letters of No Objection (LONOs) for food processing aids and incidental additives. Processing aids are not defined by regulation. However, Health Canada policy describes a processing aid as a “substance that is used for a technical effect in food processing or manufacture, the use of which does not affect the intrinsic characteristics of the food and results in no or negligible residues of the substance or its by-product in or on the

While these letters were not mandatory because of the partial overlap of the definition of food additive and processing aid (both substances are used to impart a technical effect), LONOs provided a level of clarity for manufacturers by confirming that the use of a given substance would not be regulated as a food additive. With LONOs being discontinued, companies may find it more difficult to distinguish, with certainty, between food additives and processing aids, particularly given the ambiguity around what constitutes ‘negligible residues’ for processing aids. These regulatory and policy changes were implemented without significant transition periods, and the combined effect of these changes is that some manufacturers may now need to quickly reassess whether commonly used ingredients are compliant under the revised framework. In some cases, reformulation or a formal submission to Health Canada for food additive approval may be required. In other cases, whether reformulation will be required is less obvious. For example, with the food additive exemption for natural extractives, oleoresins, and essential oils now removed from FDR, it is unclear how Canadian regulators may treat an ingredient that is added for, or simply by its nature has, multiple functions in a food product. In any case, these changes have quickly added new considerations for food manufacturers.

William Bjornsson is a partner in the Ottawa office of Gowling WLG, specialising in food and drug regulatory law. Contact him at william.bjornsson@gowlingwlg.com

Anti-obesity medications, especially GLP-1 agonists, are becoming increasingly popular. The global anti-obesity drugs market size is estimated to grow from USD 12.8 billion to USD 104.9 billion by 2035, at a CAGR of 21.1%. The market is currently dominated by GLP-1 agonists, due to their ability to mimic the glucagon-like peptide 1 (GLP1) hormone.1 GLP-1 is a naturally occurring hormone that stimulates insulin secretion and may suppress appetite, promoting satiety.

More than half of the adult global population are forecasted to be overweight or obese by 2050. 2

GLP-1 interest goes beyond people currently taking GLP-1 medications. There are different groups of people seeking GLP-1 support:

• People who want to support GLP-1 naturally for satiety

• People currently taking GLP-1 medication who want to support their digestive health (Gastrointestinal discomfort is the most common side effect of GLP-1 drugs since they slow down both gastric emptying and transit time.3)

• People coming off or who have stopped GLP-1 medication and want to support satiety and maintain weight loss

No matter the type of consumer, certain areas of the diet need to be prioritized: nutrient density, protein and dietary fibre.

There is interest in food and drink products that support GLP-1 users, with 16.25% of U.S. respondents expressing interest in such products.4 Furthermore, 42.85% of respondents agree that foods intended for GLP1 users can help the average person.5 These food and beverage products should be nutrient dense, high in protein and fibre, and low in sugar.

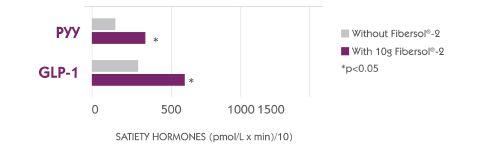

Fibersol® is a soluble prebiotic fibre that helps you create GLP-1 companion products.

As a digestion-resistant soluble dietary fibre backed by over 30 years of extensive clinical research, Fibersol® presents a promising path to promoting satiety and boosting GLP-1 when consumed at 10g with a meal in healthy individuals.6

Source: Ye, Z. Arumugam, V., Haugabrooks, E., Williamson, P., and Hendrich, S. 2015. “Soluble dietary fiber (Fibersol®-2) decreased hunger and increased satiety hormones in humans when ingested with a meal,” Nutrition Research. 35: 393-400.

10g of Fibersol® with a meal may delay hunger 10g of Fibersol® with a meal may stimulate appetite-regulating hormones 10g of Fibersol® with a meal may increase GLP-1 as part of a normal physiological response in healthy individuals 10g of Fibersol® with a meal may increase satiety perception

Looking to develop a product that promotes satiety, GLP-1 and is low in sugar? Clinically backed Fibersol® provides nutritional and functional benefits.

Fibersol® can support metabolic health as studies have shown that Fibersol® reduces blood glucose and insulin response following a meal in healthy adults. In addition to the beneficial effects on GLP-1, satiety and blood sugar, Fibersol® provides other positive wellness impacts:

• Triglycerides: Fibersol® helps maintain healthy triglyceride levels

• Slowly fermented

• Well-tolerated

• Prebiotic fibre

Fibersol® adds dietary fibre with little to no impact on taste or texture and can maintain or improve desired attributes in virtually any application.

• Improves mouthfeel in low- or no-sugar products

• Balances flavor profiles

• Excellent binding properties

Ready to create your GLP-1 companion product? Clinically backed Fibersol® gives consumers tasty, fibre-full, welltolerated foods and beverages with physiological and potential GLP-1 support and satiety benefits. www.fibersol.com/wellness-benefits/glp1-and-satiety

Lavina Gully

unctional food is having a moment. More people are reaching for products that do more than satisfy hunger, whether it is for boosting energy, aiding recovery, sharpening focus, or supporting immunity. And nowhere is that shift more obvious than in sports nutrition.

Not so long ago, sports performance products were built for a very specific crowd—elite athletes, gym regulars, anyone serious enough to tolerate gritty powders and snacks that tasted, well, functional, to put it generously. But now, those same products are fuelling one of the fastest-growing segments in functional food.

According to the Canadian Food Innovation Network’s (CFIN’s) new Foodtech in Canada: 2025 Ecosystem Report, the country is poised to become a global leader in functional food innovation. Canada’s functional food and beverage market is projected to hit $19.2 billion by 2026, and sports performance products are a major contributor. In 2023, hydration products alone grew by more than 50 per cent, with performance and energy enhancers also experiencing a big bump in sales, according to data from Spins.

Rethinking performance

What consumers expect from performance nutrition is changing. It’s no longer just about what fuels the next training block, but what supports longevity and healthspan. Cardiovascular health, inflammation control, and cognitive endurance are becoming central to how consumers evaluate functional products.

A compelling example of that crossover appeal is Calgary-based startup Haskalife, which is working with concentrated haskap berry extracts—rich in anthocyanins and

polyphenols shown to support blood flow, reduce inflammation, and improve vascular function. Originally developed with general wellness in mind, haskap extracts are now finding traction in sport-specific use cases. A recent study linked its consumption to delayed fatigue and improved running performance. Other bioactive compounds—like rhodiola rosea and mushroom extracts—are being explored for their ability to support neuroplasticity and mental stamina to aid both athletic performance and overall longevity.

This convergence is a sign of where the category is headed: performance products built as much for long-term health and cognitive resilience as for race-day results.

As sports nutrition becomes part of more people’s daily routines, the expectations around functionality are shifting. Peak athletic performance is still a key piece of the puzzle, but consumers are also seeking products that support energy, recovery, and resilience in the broader context of everyday life.

The recent growth of Montreal-based Näak is illustrative of this trend. Unlike most endurance fuels, which rely on refined dextrose and sucrose to efficiently deliver carbohydrates, Näak blends in sources like apple and sweet potato. The brand also added plant-based protein to its purees and drink mixes as a response to research showing that including protein alongside carbs can help sustain energy, reduce GI issues, and support recovery during long efforts.

Other companies, such as Endurance Tap and Krono Nutrition, are taking a similar approach. Both prioritise clean, simple formulations, often built around

Canada’s signature endurance fuel: maple syrup. Together, these brands are helping define a uniquely Canadian approach to sport performance: one rooted in functionality, holistic nutrition, and the natural strengths of local ingredients.

This focus on recognisable, whole-food ingredients doesn’t preclude cutting-edge innovation. Rather, it can be seen as one part of a broader push toward better-functioning products. Hydrogels are a notable example of novel ingredient development. Featuring inputs like sodium alginate and pectin alongside carbohydrate mixtures, these products form a gel in the stomach that reduces GI distress—a notorious pain point for endurance athletes—all without slowing absorption.

As performance nutrition improves and expands beyond traditional athletic use, it’s being reimagined to support a broader spectrum of goals—sharper focus at work, better recovery after long days, and sustained health over a lifetime.

This evolution is opening major innovation opportunities—especially in Canada, where a strong research ecosystem, diverse ingredient base, and rising demand for evidence-based products create ideal conditions for growth. The future of the category is shifting toward products that support the full spectrum of how people live, work, and play.

Lavina Gully is regional innovation director for B.C. and Yukon for the Canadian Food Innovation Network (CFIN), which funds transformative foodtech projects, stimulates collaboration, and fosters a community of F&B professionals.

Andreas Duess

or Canadian food processors, particularly medium-sized and smaller enterprises, the stakes in adopting AI and data-driven innovation have never been higher.

Major consumer packaged goods players, such as Procter & Gamble, leverage the power of AI, creating substantial and compounding competitive advantages. In partnership with Accenture, P&G has developed ‘Human + Machine’ systems that accelerate product innovation and market growth.

Nestle and Unilever have similarly integrated advanced AI solutions into their operations, enhancing everything from supply chain efficiencies to product innovation driven by real-time consumer insights.

Yet, when I speak to Canadian food businesses, particularly SMEs, adopting comparable technology often feels very distant from their everyday struggle for profitability amid increasing market complexity. But in 2025, AI proficiency isn’t optional, it’s a matter of survival.

Many companies continue to rely on traditional methods, frequently driven by intuition rather than analytics. They struggle to understand, fund, and implement AI-driven solutions that larger competitors already consider standard practice.

The newly created federal Ministry of Artificial Intelligence, led by first-time MP Evan Solomon, is offering help. With the mandate to accelerate AI adoption and digital innovation within Canadian businesses, the ministry’s focus is to address this critical technological gap.

Our economic future depends on Canadian businesses’ ability to compete internationally. Integrating AI-driven processes is now essential to achieve sustained competitive growth.

Consumer insight represents an accessible entry point for many companies. In our work, we’re using AI in ways that would have been science fiction only a few short years ago. One example is AI-powered virtual consumer panels, which deliver an 88 per cent overlap (on average) with human panels, but at a fraction of the cost. Plus, it’s available around the clock.

The key to success lies in choosing manageable initial projects that deliver clear ROI while building internal capabilities and a culture centred on AI adoption. This approach allows companies to develop AI competency one step at a time, while delivering measurable business results.

Canadian food businesses stand to benefit significantly from this newly created governmental focus but must position themselves to capitalise on these opportunities. Planned government tax incentives and increased investments in AI training and commercialisation specifically target SMEs, offering crucial support to businesses otherwise challenged by cost or complexity.

This represents a significant opportunity to bolster Canadian food businesses’ global competitiveness.

Currently, in working with Canadian food manufacturers, we see forward-thinking companies successfully taking initial AI adoption steps, beginning with focused consumer data analysis and solid data policies. This pragmatic, incremental approach delivers measurable boosts in productivity and profitability today and future-proofs their operations for years to come.

Andreas Duess is an expert in AI, data, and consumer packaged goods. As co-founder of 6 Seeds, he helps CPG brands accelerate product development using AI. His email ID is andreas@6seedsconsulting.com.

— BY OJASVINI PARASHAR —

Ontario-based Amir Quality Meats’ story is that of a family’s dedication to quality, tradition, and community. As one of Canada’s largest independent processors and distributors of Zabiha Halal meats, the company has grown from a small butcher shop to a multi-facility operation serving clients across nine provinces. It operates three facilities—a 20,000-sf processing plant in Brampton, Ont.; a 15,000-sf slaughterhouse in Arthur, Ont.; and another 45,000-sf processing plant in Brampton, which was acquired recently.

This third-generation, family-run business takes pride in upholding halal principles and ensuring every product meets Canada’s food safety and ethical standards. The company’s vertical integration—from raising animals to processing and distribution—allows them to have tight control over their products’ quality.

I spoke to Sherry Aziz, CFO of Amir Quality Meats, about the company’s evolution and the state of the halal meat industry in Canada. Aziz was 12 years old when her family immigrated to Canada from Guyana, South America. After spending 16 years in the banking sector, she took on a leadership role at Amir Quality Meats.

As a female leader in the manufacturing industry, she emphasizes the importance of purpose-driven business practices and community engagement.

What led you to switch careers and join the food industry?

SA: My father ran a meat distribution company. In 2006, I decided to take a break from my career and joined my father’s business. He operated a small distribution company supplying halal meat, primarily chicken, to local butcher shops in the Greater Toronto Area (GTA). I saw an opportunity—a gap in the market for enhanced food [safety] programs [in the halal meat sector]—and decided to stay and grow the business. In 2010, I launched Amir Quality Meats to address this gap, focusing on added-value products and strong food safety programs.

How did Amir Quality Meats transition from a small butcher shop to a large enterprise?

SA: Family-owned and operated, we have been in the halal meat processing and distribution business for over 30 years. Originally founded as a local halal butcher, our predecessor company provided halal meat, fish, and groceries to numerous small meat stores that serviced the GTA’s

Muslim population. After 20 years of operating as a small butcher shop, we transformed our business in response to a request from a large restaurant chain. They faced [food-safety related] challenges with their current halal supplier and came to us with specific requirements. Meeting these requirements demanded significant investment and adaptation. We conducted thorough research and visited farms and abattoir facilities across Canada. After months of collaborating with a new supplier, we calibrated processes to meet stringent food safety and halal standards. This experience led to the founding of Amir Quality Meats and highlighted the absence of Muslim-owned certified halal suppliers in the foodservice industry.

Over the past 30 years, we have leveraged this customer-centric approach to build a business that serves our community and aligns with our values.

What was your initial vision for Amir Quality Meats?

SA: I felt strongly about food safety and how we presented ourselves. When people walk into our company, they should not think they’re entering a typical meat distribution facility. Cleanliness and adherence to halal principles were extremely important to

me. My vision was to create a workplace and product that employees and customers could take pride in.

How has the company grown since its inception?

SA: We started with a 3,000-sf facility in Mississauga, Ont., and, over time, expanded to 6,000-sf. Today, we operate a federally regulated processing plant of 20,000-sf in Brampton. In 2022, we acquired a slaughterhouse in Arthur, allowing us to become a vertically integrated [company] and better control our supply chain.

How did your banking career influence your approach to entrepreneurship?

SA: My banking career instilled discipline and a focus on processes, which became invaluable when building Amir Quality Meats. However, the entrepreneurial spirit runs in my family—my father always ran his businesses, and that ambition inspired me.

What advantages does vertical integration bring to Amir Quality Meats?

SA: Vertical integration allows us to control our supply chain, ensuring consistency and quality. While our Arthur facility is currently provincially

regulated, we aim to achieve federal status by 2026, making us fully integrated.

What sets Amir Quality Meats apart from other halal meat producers?

SA: We are the first federally licensed, vertically integrated halal meat company in Canada with a Class A primary processing facility. Additionally, as a female-led, Muslim-owned company, we bring a unique perspective and commitment to excellence.

How does Amir Quality Meats prioritise food safety?

SA: Food safety is central to our identity. We exceed industry standards through rigorous internal audits, certifications like SQF, and unannounced inspections. Our head of food safety ensures we remain ahead of client expectations.

Does Amir Quality Meats use robotics or automation in its production?

SA: Yes, we employ technologies like water jet machines and automated deboning lines to improve efficiency. Continuous improvement is a core part of our philosophy.

What is a key operational challenge for Amir Quality Meats?

SA: Labour shortages remain a significant challenge, as manufacturing isn’t seen as glamorous work. We’re advocating for policy changes to support the industry and investing in employee retention through benefits, events, and recognition programs.

What strategies do you use to retain employees?

SA: We offer competitive benefits and vacation packages and organize events like barbecues, luncheons, and year-end galas to foster a supportive work culture.

What are Amir Quality Meats’ CSR initiatives?

SA: We actively support food banks and organizations like Second Harvest to address food insecurity. Sustainability and giving back are integral to our mission.

What unique challenges have you faced as a female leader in manufacturing?

SA: Work-life balance is a significant challenge. Lack of mentorship and the burden of proving oneself are additional hurdles. Unlike men, women often face skepticism in leadership roles.

How can we increase the ratio of women in manufacturing?

SA: We need to measure and track progress to ensure fair practices. Representation can only improve if we set measurable goals and work towards them.

What advice do you have for young women entrepreneurs?

SA: Believe in yourself and your passion. Don’t give up, even when things get tough. Learn from your mistakes and use them to grow.

Give yourself a break during tough times. Always believe in yourself and stay focused on your dream, even if it gets hard. Don’t be afraid to fail. My greatest lessons came from when I made the biggest mistakes. I learned from them, and I made my business stronger. So, don’t be afraid to fail.

Amir Quality Meats exemplifies how a family-owned business can combine tradition, innovation, and ethical practices to achieve success. From its humble beginnings as a local butcher shop to becoming one of the leaders in Canada’s halal meat industry, the company remains dedicated to halal principles, food safety, and community engagement. The story of Amir Quality Meats is not just about business growth, but also about the power of values, vision, and resilience.

How confectionery makers are pivoting to keep sales flowing despite record high cocoa prices — BY

TREENA HEIN —

When the cost of your main raw ingredient soars, you must pivot, and this is exactly what Canadian chocolate companies have been doing for many months.

“The rise in cocoa prices is definitely one of the most significant challenges the industry is facing right now,” says Noah Pinsky, president of Galerie au Chocolat in St. Laurent, Que.

Lawrence Eade, president of Purdys Chocolatier in Vancouver, explains that about a year ago, cocoa prices had soared 400 per cent above normal, three times the historical 20-year average.

“Most cocoa comes from Ivory Coast and Ghana,” he says. “Production there has grown, but about seven years ago, the governments of these countries started throttling supply by limiting export and limiting the number of replacement seedlings. Then, they had four years of terrible growing seasons with droughts, floods and the spread of the swollen shoot virus.”

Daniel Poncelet (owner and chocolatier at Daniel Chocolates in Vancouver) adds that heavy speculation from hedge funds was also a factor in causing the cocoa price to jump.

According to Pinsky, the cocoa price pressure is forcing many chocolate makers, especially smaller or independent ones, to make tough decisions about product variety, prices and more.

“Longer term, I think this will reshape parts of the industry,” he says. “It could accelerate consolidation, with larger players better equipped to navigate pricing swings and secure long-term supply contracts. On the flip side, it might also spark more innovation, whether in sourcing models, alternative ingredients or value-added formats.”

In the meantime, Pinksky adds (in alignment with other feisty Canadian chocolate sector leaders) that while today’s market environment is challenging, “it’s also an opportunity to reinforce who we are.”

Like most other firms, Galerie au Chocolat is not lowering its quality, which is deeply valued by its customer base.

“We’re also making sure to communicate the craftsmanship and Canadian-made story behind our products, which resonates strongly with our customers,” says Pinsky.

At the same time, he and his team continue to carefully consider which products to highlight in their marketing and how they are positioned. They’re placing a stronger focus on sales channels that tend to be less price-sensitive, such as corporate gifting and premium retail.

“We’re also leaning more into formats and pack sizes that offer strong perceived value,” Pinsky adds, “and we’re exploring efficiencies in other areas of the supply chain to help offset the raw material increases.”

Poncelet is also keeping leaving his quality at Daniel Chocolates untouched.

“As a result, we had no other choice than raising our prices for all of our products,” he reports. However, customers have expressed their understanding of his situation and that they want to support him.

“We are very happy to hear that,” he says.

Purdys Chocolatier has also increased their prices. Since today’s customers are more aware of quality, they are willing to pay for it, says Eade, and they also recognize that the price gap between lower-quality chocolate and high-quality Purdys chocolate isn’t that large. Additionally, the vast majority of Purdys products are purchased as gifts, so customers are willing to splurge a little to create a special connection.

“Our customers are very loyal,” Eade says. “Our target market is 35-45-year-old moms. They buy our chocolate for their children’s teachers, dance instructors etc., and also for family.”

Anna-Engel Lebiadowski, owner and head chocolatier at Le Chocolatier in Canmore, Alta., is also taking the same approach.

“Our strategy focuses on staying true to our commitment to quality, transparency and customer education,” she says. “Rather than reformulating products, we have expanded our chocolate tasting experiences to bridge the gap between different levels of chocolate knowledge. These tastings allow us to tell the story behind the cocoa industry, diving into ethics, global cocoa news and how these changes impact everyone from the farmer to the final chocolate lover. By empowering customers to discern the difference between craft, single-origin chocolate and mass-produced alternatives, we are building stronger loyalty and appreciation.”

Lebiadowski is happy to report the response has been very positive.

“Customers who participate in tastings become more engaged and supportive,” she explains, “and are more willing to invest in quality once they understand the deeper story.”

At the same time, Le Chocolatier has introduced slightly smaller product options to meet a range of price points and put more thought into overall product offerings and corporate gifts.

Purdys Chocolatier also markets through fundraising programs, and these are thankfully going strong.

“You can easily start a campaign on our website where people can order under that account and a percentage goes to your cause, a larger percentage if more is sold,” says Eade. “We give back millions of dollars a year to communities and organizations through these programs. There are typically about 5000 of them running at Christmas time.”

There are also two new Purdys’ products, one being Dubai Bark, launched this past March in select shops and online.

“We can’t keep it on the shelves,” says Eade. “It’s a really incredible product combining pistachio paste and kataifi pastry flakes in chocolate. It was originally created as a bar in Dubai, but we made a bark.”

The other new product is Dark Chocolate Dates (with roasted coconut, almond or cashews), launched at the end of February to coincide with the start of Ramadan.

Over the long term, Lebiadowski believes Canada’s chocolate sector will become even more focused on quality, ethics and transparency.

“There will likely be a sharper divide between mass-market chocolate and craft chocolate, with artisan makers who empha-

size storytelling, education and authenticity emerging stronger,” she says. “If we continue to invest in consumer education and transparency, this moment could truly help the Canadian craft chocolate industry thrive.”

Pinsky has similar thoughts.

“For Canadian chocolate makers specifically, I believe there’s an opportunity to lean into quality, traceability and storytelling,” he says. “Consumers are increasingly looking for brands they trust, with a strong local identity and a clear commitment to ethical sourcing. That’s something we do well here in Canada, and if we stay focused on that, we can come out of this stronger.”

Lebiadowski adds that the recent tariffs imposed by the U.S. have prompted many Canadian consumers to look inward, seeking Canadian-made chocolate products to fill the gap left by U.S. imports. She sees this shift in consumer preference as an opportunity for Canadian specialty chocolate makers to strengthen their presence and connect more deeply with customers.

Purdys will also continue to highlight the made-in-Canada angle.

“‘Buy Canadian’ has been around for a while, but it’s very strong

now,” says Eade. “People realize they don’t have much power to affect trade and tariffs, but they can support Canadian businesses with their dollars. I think permanent shifts in buying patterns may emerge.” He concludes that in the end, “people want something to cheer them up and to celebrate social connection. We will continue to provide that like we have for 118 years, through wars, recessions and more.”

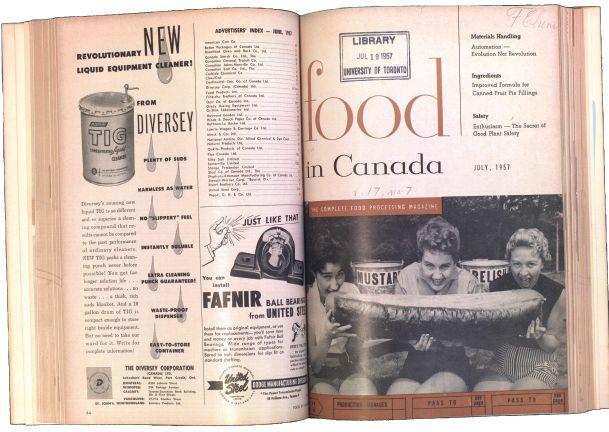

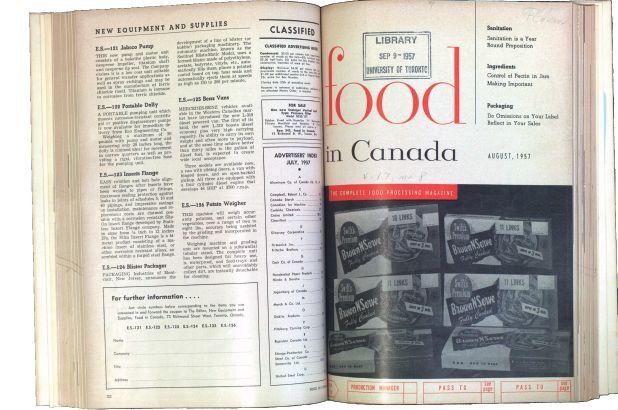

From fish sticks to Tetra Paks, F&B manufacturers introduced Canadians to several new products

— BY FOOD IN CANADA STAFF —

We continue our 85th anniversary coverage. In this issue, we focus on the period between 1954 and 1967. This era witnessed significant advancements in packaging, refrigeration technology that enabled imports of frozen foods from the U.S., meat processing techniques and food safety methods.

Meat & poultry

In 1957, the combined total per capita consumption of all meats in Canada was 142.5 lb, seven per cent higher than the 1946-1950 average and 20 per cent above prewar consumption.

In 1958, the Agricultural Stabilization Act was passed. It provided mandatory support prices on cattle, hog, and lamb, equal to not less than 80 per cent of the most recent 10-year average.

Also in 1958, Canada Packers installed a carbon dioxide immobilizer in support of their hog killing operations. This was the first immobilizer to be installed in Canada. Additionally, Sky-Line Farms installed a system in its chicken processing plant north of Toronto that could kill, clean, chill, and package 25,000 birds a day.

In the 1960s meat inspection systems were expanded due to an unfit meat situation. By May 1962, 253 meat plants were brought under federal inspection.

In 1965, Food and Drug officials advised the industry that bacon packages were deceptive. The industry was given time until January 1, 1966, to remedy the situation or be faced with ‘appropriate action’ by Ottawa. In 1966, Ottawa announced that new cartons for bacon will show at least two-thirds of the length of the contents and the full width of at least one strip of bacon.

In 1967, Canadian meat production topped 3 million lb for the first time.

In 1956, the government of Canada permitted an increase in the vitamin content of milk. It also allowed the addition of Vitamin A to butter. In 1957, the Food and Drug Directorate ruled that butter could be advertised as an excellent dietary source of Vitamin A, and advertising claims could be made that fluid milk, skim milk, evaporated milk, condensed milk and cheese are excellent dietary sources of protein. The two per cent partly skimmed

milk was introduced into Canada in 1957 and became hugely popular.

In 1961, Quebec legalized the sale of margarine and other butter substitutes.

As a result of a 12 per cent a lb consumer subsidy placed on butter in early 1962, the sale of butter increased over 50 million lb in the following 12 months. The net result of the program found household consumption of butter increasing by an average of nearly 4 million lb a month compared to the previous year. In 1964, this subsidy was reduced by 1 cent a lb.

Around the same time, there was a reduction in dairy operations. Between 1940 and 1963, the total number of butter plants decreased by 42 per cent to 753; cheese plants dropped from 985 to 172;

and the number of milk distributors fell from 910 in 1959 to 800 in 1963.

Imports were overshadowing domestic production of candies. Almost negligible before the war, annual candy imports hit 25.5 million lb by 1956.

In 1962, Lee-Cliff Products, a Montreal-based division of Pfizer Canada released Limmits, a two-biscuit meal for weight control.

As is the case today, the majority of Canada’s fish was exported in the 1950s. In 1955, exports were valued at $128.8 million with 71 per cent of this total being absorbed by the U.S. The value-added products market was developing at that time. A notable product was fish sticks, and the industry produced 5.4 million lb of that in 1957.

In 1961, Bill-86 was passed. It allowed large Canadian fishing vessels to fish up to 3 mi off the East Coast. Previously, the limit was 12 mi. In 1964, Canada established a 12-mi territorial fisheries limit. Only countries that had historical fishing rights in Canada were allowed to fish inside this area.

In 1956, the government of Canada dropped excise tax on soft drinks, which was 30 per cent in 1949. Soft drinks with low sugar content were also launched in the 1950s.

There was also a movement away from draught beer to bottles. In 1945, 32.4 per cent of the beer consumed in Canada was in draught form. By 1960-61, draught consumption had dropped to 20.6 per cent and packaged beer accounted for 79.4 per cent of the market.

In the early 1960s, the brewing industry moved completely away from glass floats to compact pint bottles. Cans became the dominant packaging format for soft drinks. In 1964, 3 million cases of canned soft drinks were sold.

Canned beer was sold for the first time in Ontario in 1965.

The beginnings of Canada’s first food irradiation unit, a short-lived venture, were seen in 1958. The commercial division of Atomic Energy of Canada indicated that research has progressed to the point where it was now economically feasible to preserve potatoes using irradiation. The division offered to consult with interested parties regarding the establishment of such a treatment facility.

In 1963, 2 tons of potatoes, irradiated by gamma rays from cobalt-60, were shipped to remote weather stations in the Canadian Artic.

In 1964, the Canadian Nuclear Association said fruits don’t have to be in season to be on the average shopper’s list, thanks to irradiation. In 1966, Canada established its first commercial food irradiation plant at Mont St. Hilaire, Que. First-of-itskind in the world, Newfield Products was equipped with a large cobalt-60 irradiator, a lab, and a warehouse capable of storing 15 million lb of potatoes. Sadly, the company went into receivership in 1967.

The 1950s saw an increase in frozen fruit & vegetable imports from the U.S. Prior to 1951, Canada was producing 100 per cent of all frozen fruits sold here. In 1956-57, 60 per cent were imported. Similarly, imports of frozen vegetables from the U.S. were 58.5 per cent of the domestic market in 1956-57.

In 1961, improvements in refrigeration techniques and the growth of frozen products resulted in sales of $130 million. Nationally, frozen food sales were four per cent of total food volume, and imports of frozens represented 50 per cent of total Canadian consumption. In 1964, Canadian Pacific introduce a one-piece moulded plastic cargo container, billed as a world’s first. The container was equipped with temperature controls capable of refrigerating or heating its cargo whether on highway, piggyback, or in a ship’s hold.

The Tetra Pak aseptic container was launched in Canada in 1959. Common in

Europe at that time, Maypole Dairy Company, Toronto, was using these containers to package coffee cream in individual pre-portioned containers for institutional use.

A few other packaging firsts for Canada. A fishing company in the Maritimes began using a boil-in-bag vacuum package for fish fillets. The pouch was made of a lamination of polyethylene and Mylar film.

Several innovations aimed at creating tamper-proof packages. One such was a moulded closure cap designed to protect a bottle’s contents as well as keep the cap permanently attached to the container.

The frozen food industry was increasingly using polyethylene bags to package free-flowing items like peas, beans, corn, mixed vegetables, etc.

Another far reaching packaging development occurred in 1959 when Dr. C. A. Morrell, director, Food Directorate, Department of National Health and Welfare, wrote a letter to industry leaders in which he said, “…the basis of our philosophy in considering food labels is that the common name of the article and the net contents of the package should not be less clearly and prominently shown than any other information given on the labels, with the exception only of the brand name or trade name. The consumer has the right to know what kind of food is offered, how much of it the package contains, by whom it is made, and in particular cases other information such as the presence of artificial colour or preservatives, and so on.” This initiative resulted in a massive redesign of food labels in Canada.

In the 1960s, DuPont of Canada tested a new package for milk in Montreal. Called ‘Clair-Pak,’ milk was packed in three one-quart plastic pouches overpackaged in a flexible film bag.*

* This article was written using data sourced from previous issues of Food in Canada

Bring your signature pizza to the Chef of the Year Competition, see how it stacks up and vie with other pizzerias to win a trip to compete at the Las Vegas Pizza Expo! It’s free to pizzerias and their teams!

A voyage of brewing and innovation — BY

Watching a hockey game, around the dinner table, relaxing on the cottage dock or in the company of family and friends at a barbeque and savouring a cold beer is a part of Canadian culture. More often than not the beer in hand is a Labatt brand. The company is, in a word, iconic.

Labatt Breweries of Canada is one of the country’s oldest and most established beverage companies. It was founded in 1847 in London, Ont., by Irish immigrant John Kinder Labatt (a founding partner, Samuel Eccles, was bought out in 1855). His son John, who took over the company upon John Kinder’s death in 1866, took the brewery to new heights. He was responsible for introducing an India pale ale (IPA), now commonplace on store shelves, to the Canadian market in the 1870s. By the time he died in 1915, Labatt was the largest brewery in Canada.

John and Hugh Labatt, grandsons of John K. Labatt, launched Labatt 50, Canada’s first light ale, in 1950. Labatt 50 would be Canada’s best-selling beer for the next three decades. Another iconic beer followed in 1951 with the launch of a Pilsener lager, Labatt Blue, named for the colour of its label and— as the brew was launched in Manitoba—support of Winnipeg’s Canadian Football League (CFL) franchise, the Blue Bombers. For most of the 1980s, Labatt Blue was Canada’s best-selling beer.

The last two decades of the 20th century saw rapid changes to the company.

“In 1980, Labatt brewed and distributed Budweiser in Canada for the first time at our Edmonton brewery. Then, in 1998, we entered into a lifetime licensing agreement, making Labatt the official brewer and marketer of Budweiser and Bud Light in Canada,” said Hannah Love, senior director of com-

ANDREW HIND

—

munications at Labatt Breweries of Canada.

There was an ownership change as well. In 1995, Labatt Breweries of Canada was acquired by Interbrew, which later merged with Ambev in 2004 to form InBev, and subsequently merged with Anheuser-Busch in 2008 to create Anheuser Busch InBev.

Today, Labatt Breweries boasts a portfolio of more than 70 beers including Bud Light, Busch, Corona, Michelob Ultra and Modelo Especial, ready-todrinks including Cutwater, Mike’s Hard and Nütrl, and non-alcoholic products including Budweiser Zero and Corona Sunbrew 0.0 per cent. Labatt markets its drinks across the globe.

Labatt operates seven breweries nationwide: in St. John’s; Halifax; Montreal; London, Ont.; Edmonton, Delta, B.C.; and Creston, B.C. Over the past decade, Labatt has invested more than $1.1 billion into its operations and Canadian communities, driving economic growth while expanding its brewing capabilities.

“With more than 3,500 employees working in our breweries, distribution centres, warehouses, sales teams, and corporate offices, we are proud to have a strong presence from coast to coast,” said Love.

Pride of place, and a bond with communities and customers, ensures that Labatt has always looked to make a meaningful impact in communities across Canada. It began early, with a donation of 1,000 lb

Labatt operates seven breweries across Canada, located in the provinces of Newfoundland, Nova Scotia, Quebec, Ontario, British Columbia and Alberta.

of flour to a London, Ont., soup kitchen during a deep economic depression in 1859. Labatt has supported Canadians when they need it most.

Throughout the COVID-19 pandemic, Labatt shifted production of beer to make 100,000 bottles of hand sanitiser, donated 225,000 cans of clean drinking water to the City of Toronto’s shelter programs, and provided support to Food Banks Canada. The company’s Disaster Relief Program has donated a million cans of safe drinking water to Canadian communities in times of crisis, such as during the 2016 Fort McMurray wildfire, the 2018 flooding in New Brunswick, wildfires in British Columbia in 2021, and when Hurricane Fiona hit Nova Scotia in 2024.

Toronto’s engineering department to create a hub for analytics and artificial intelligence and with the 2021 introduction of a B2B app, Bees, to the Canadian market.

“We’ve had positive feedback following the introduction of Bees, our proprietary B2B e-commerce platform, a one-stop shop that allows small to medium-sized retailers to browse through products, place orders, arrange deliveries, and manage invoices, all in one place and right in the palm of their hands,” said Love. “Through Bees, Labatt is building a B2B ecosystem that transforms the traditional sales model by using technology to turn customer issues into growth opportunities, ultimately putting customers at the forefront.”

Labatt has proudly brewed beer for Canadians since 1847, continuously evolving to meet changing consumer preferences. 1847

Labatt is also proud of its partnership with Canada’s agricultural sector. When John Bender Labatt founded the company, he used only Canadian products in the manufacture of his beer. That policy continues today with every Labatt beer being 100 per cent made with premium Canadian barley.

You can’t survive in the competitive Canadian brewing industry, let alone remain at the top, without being innovative. John Kinder Labatt embraced all the technological innovations of the Industrial Revolution to create a modern brewery, and that impulse to innovate has remained a part of Labatt’s DNA since. Labatt’s innovations include the introduction of the first twist-off cap on a refillable bottle in 1984 and a patented method for making ice beer that resulted in Labatt Ice.

Today, Labatt is evolving into a tech-forward company with the establishment of the Labatt Impact Lab in partnership with the University of

The drinking tastes and preferences of the public are always shifting. Traditional favourites—Labatt Blue, for example, so ubiquitous it almost screams Canadiana—remain stalwarts in terms of both sales and brand recognition, but new beverages have been joining the Labatt portfolio. The low to no alcohol category is seeing an increased demand.

“We launched Budweiser Zero in Canada in September 2020,” said Love. “This non-alcoholic beer features 0.0 per cent alcohol, zero sugar, and 50 calories per 341 ml serving. It’s been very popular, and we have also seen the sales for Corona Cero take off.”

The success of these beers has encouraged Labatt to expand its non-alcohol portfolio with the addition of Busch De-Alc, a new de-alcoholized option (0.4 per cent ABV), this year. “This launch is part of Labatt’s ongoing expansion into the growing market for mindful drinking,” said Love.

“The other area that is rapidly expanding is

Labatt is evolving into a tech-forward company, embracing innovation in every facet of its operations, from brewing to customer interaction.

the ready-to-drink category,” Love continues. “Our Cutwater expertly mixed cocktails have become so popular that we are introducing new flavours later this year. We are also driving innovation in the ready-to-drink space with products like SVNS Hard 7UP in partnership with PepsiCo Canada, which was launched last year. We’ll continue to look for opportunities in this growing area, marking a significant expansion of our Beyond Beer portfolio.

The on-again, off-again tariff war with the United States has generated uncertainty, causing companies to scramble to adjust. Labatt is not immune. But as a company that has been shaping Canadian culture for decades, Labatt appreciates it has a special role to play. Canadian consumers are looking to locally made options, spurning those from south of the border. Labatt expects a surge in demand for its beer, now and for the foreseeable future, and is preparing its breweries to meet this need. As it approaches its 180 th anniversary, Labatt continues to redefine what it means to be a brew-

ing company. It has survived prohibition, two world wars, a depression, the global pandemic, an ever-evolving landscape, and now a trade war with Canada’s closest neighbour and trading partner. Through these trials and tribulations, Labatt has never strayed from its course, remaining focused on providing its customers with the best beverages and, in recent years, sales have gone global, proudly representing Canada on the world stage.

“Labatt has proudly brewed beer for Canadians since 1847, continuously evolving to meet changing consumer preferences,” said Love. “This includes continuing to produce the beer brands Canadians love like Budweiser, Bud Light, Stella Artois, and Corona while expanding and diversifying beyond our traditional beer portfolio to include non-alcoholic options, craft beer offerings like Mill Street, and ready-to-drink canned cocktails like Cutwater. Rather than shy away from the growing demand for variety and innovation in the beverage industry, we seek to drive it,” Love said.

BY KAREN BARR

Consumers across Canada are starting to drink less alcohol. With awareness of the negative health impacts of alcohol, there is increased social acceptance for choosing not to drink. Then there are the sober curious who are looking for alternatives, if not abstinence.

According to Nielsen, between 2023 and 2024, the non-alcoholic beverage market showed impressive gains by an increase of 24 per cent, with sales soaring up to $199 million. Beer, which dominates 76 per cent of overall sales, experienced a growth of 23.3 per cent.

To compete in the beer marketplace, companies now strive to unveil new seasonal flavour profiles. However, as more consumers across Canada seek alternatives to alcoholic beverages, whether through moderation or abstinence, there is also growing demand for new products, ranging from wines to spirits. Let’s explore this evolution in non-alcoholic beverages.

Phillips Brewing & Malting in Victoria, B.C., started brewing full-flavoured craft beer in 2021. Later, the iOta non-alcoholic craft beer label was created, sparked by the idea that great-tasting beer did not have to be defined by its alcohol content. While it is still brewed the same way, the alcohol is removed.

“Our customers tend to range quite a bit, from completely sober to just cutting back,” says Mackenzie Aird, associate

brand manager, Phillips Brewing & Malting, non-alcoholic and spirits portfolio.

“We’re finding there’s a plan for high-quality non-alcoholic beers for a variety of folks. Whether that’s post-hike, out for dinner, or just relaxing after work, customers are reaching for great-tasting craft non-alcoholic beers.”

Their two top-selling non-alcoholic beers are Hazy IPA and Pilsner. “Our Hazy IPA is low on bitterness and full of citrus and juicy fruit notes. Our house malted barley lends a hand in creating a smooth sip and helps carry that tropical hazy pro-

file,” explains Aird. “Our Pilsner pours pale straw and has an easy, effervescent mouthfeel. The body is light and maltdriven. On the finish, smooth German hop notes complement this even-keeled and delicious Pilsner.”

Phillips Brewing & Malting’s iOta Blackberry Lemon Ale is another non-alcoholic craft beer with blackberry flavours and a hint of tart lemon.

“The main inspiration for Blackberry Lemon Ale was British Columbia’s

blackberry season. A local summer staple, Vancouver Island is chock-full of ripe blackberries every July. We wanted to create a non-alcoholic beer that was reflective of the very islands on which it was crafted. Lemon adds just the right amount of citrus and tart notes to really bring together the flavour profile,” Aird says.

When describing how non-alcoholic flavoured beers are made, Aird says, “The process isn’t too far off from how we make our other beers, with the additional ingredients added during the mash process. We also have a new seasonal non-alcoholic beer, a peach wheat ale, to release [later] this year.”

Ones, a non-alcoholic winery in the Okanagan Valley, B.C., opened in 2022. While some non-alcoholic wines use vinegar as a base, Ones only uses grapes that have gone through the fermentation process. Fermentation is key to unlocking the rich, classic notes of true wine character and flavour. Ones reduces the alcohol in its wines to exactly 0.5 per cent. This results in a texture close to regular wine and enhances aroma, mouthfeel, and a balanced finish for the drinker.

As a brand, Ones isn’t as sweet as other non-alcoholic wines.

“Alcohol (or ethanol) is one component of traditional wine but plays a big role outside of intoxication. It provides mouthfeel and can play a role in how flavours are perceived. When alcohol is removed, there is a void. Many non-alcoholic producers add sugar to fill this void. At Ones, we don’t want sugar to mask the natural

expression of the grapes and the terroir of the Okanagan Valley. We know this may not suit everyone’s preference, but we are committed to producing a quality product that doesn’t take shortcuts,” says Tyler Harlton, co-owner of Ones.

“I love cocktails, but hate hangovers,” says Bob Huitema, president and founder of DistillX Beverages, producers of Sobrii non-alcoholic drinks. “I wanted a viable alternative to alcohol without compromising on taste or palate experience. I design my spirits as a viable alternative. And an alcohol replacement. The highest compliment I can receive is when I am told consumers can’t taste the difference between a cocktail made with alcohol and one made with Sobrii.”

In keeping with the healthy vibe of non-alcoholic spirits, Sobrii, which means sober in Latin, contains zero sugar, zero preservatives, and zero calories. Huitema was first interested in the botanical nature of gin.

“I was able to macerate the botanicals, which enabled me to play with the flavours and not the ethanol,” he says.

Sobrii 0-Gin is one of Canada’s first distilled non-alcoholic spirits made with classic gin botanicals.

Consumers or bartenders can substitute Sobrii for gin in most cocktail recipes or custom, unique creations.

“I like my non-alcoholic gin mixed with a low-sugar ginger beer. And I might cut up a jalapeño to add to it,” Huitema explains.

Sobrii 0-Tequila was inspired by arti-

Canadians across all demographics now embrace mindful drinking for various reasons.

sanal tequila and mezcal distilleries in Mexico. The taste and heat are achieved by infusing agave, a traditional tequila ingredient, with jalapeño, black pepper, coriander, and Canadian ginseng. In cocktails, Sobrii 0-Tequila replicates the taste of alcoholic versions and can be substituted in most tequila cocktail recipes.

When asked about the ratio of the substitution when using a non-alcoholic spirit to replace an alcoholic spirit, Huitema said, “Taste is subjective, so it will depend on individual preference. Most of our drink recipes call for 1 or 1.5 ounces, which are standard spirit portions.”

Last year, the company launched a revised smoky formulation of the non-alcoholic tequila. It also produced the Classic G&T, which is made with 25 per cent Sobrii 0-Gin.

The new Sobrii Zero Paloma is reminiscent of the classic Paloma.

“When I eat Mexican food, I always reach for the pre-mixed Paloma,” says Huitema. It’s made with agave immersed in grapefruit, and has a spicy, smoky flavour. Two more products are about to be launched: a 0-Whiskey and a 0-Rum.”

Reaching for non-alcoholic alternatives—whether it’s beer, wine, or spirits— is no longer just a trend tied to Dry January. It reflects a broader, more permanent shift in consumer preferences. Canadians across all demographics now embrace mindful drinking for a variety of reasons. With increased health and wellness knowledge, many consumers strive to achieve a more balanced lifestyle. With the shift in marketplace demands, the non-alcoholic beverage sector is here to stay.

The equation is simple: when you factor in what truly matters—safety, high resale value, and long-term efficiency—Subaru solves your fleet needs with precision. It’s not just smart, it’s mathematically sound. For results that add up, the solution is Subaru.

(ds)

Driver Safety

(tco)

Total Cost of Ownership

(hrv)

High Resale Value

(esm)

Expert Service and Maintenance

(tco) + (ds) + (esm) + (hrv) =

fleet