CStoreDecisions

LEGENDARY FLAVORS, IRRESISTIBLE TEXTURES ARE YOUR SHELVES READY?

No matter what your customers are craving, the CORN NUTS® Brand has a flavor to satisfy.

the CSD Group

EDITORIAL

VP EDITORIAL — FOOD, RETAIL & HOSPITALITY

Danny Klein dklein@wtwhmedia.com

EDITOR-IN-CHIEF Erin Del Conte edelconte@wtwhmedia.com

SENIOR EDITOR Emily Boes eboes@wtwhmedia.com

ASSOCIATE EDITOR Kevin McIntyre kmcintyre@wtwhmedia.com

EDITOR EMERITUS John Lofstock

CONTRIBUTING EDITORS Rick Hynum Charlie Pogacar

CONTENT STUDIO

VP, CONTENT STUDIO

Peggy Carouthers pcarouthers@wtwhmedia.com

WRITER, CONTENT STUDIO Ya’el McLoud ymcloud@wtwhmedia.com

WRITER, CONTENT STUDIO Drew Filipski dfilipski@wtwhmedia.com

SALES TEAM

SENIOR VP OF SALES & STRATEGY

Matt Waddell mwaddell@wtwhmedia.com (774) 871-0067

KEY ACCOUNT MANAGER John Petersen jpetersen@wtwhmedia.com (216) 346-8790

SALES DIRECTOR Patrick McIntyre pmcintyre@wtwhmedia.com (216) 372-8112

SALES DIRECTOR Mike Peck mpeck@wtwhmedia.com (917) 941-1883

PORTFOLIO MARKETING MANAGER Jane Cooper jcooper@wtwhmedia.com

CUSTOMER SERVICE REPRESENTATIVE Annie Paoletta apaoletta@wtwhmedia.com

CREATIVE SERVICES VP, CREATIVE DIRECTOR Matthew Claney mclaney@wtwhmedia.com

CREATIVE DIRECTOR Erin Canetta ecanetta@wtwhmedia.com

LEADERSHIP

CHIEF EXECUTIVE OFFICER Matt Logan mlogan@wtwhmedia.com

CHIEF OPERATIONS OFFICER George Yedinak gyedinak@wtwhmedia.com

CHIEF REVENUE OFFICER Scott Kelliher skelliher@wtwhmedia.com

VP OF MARKETING Annie Wissner awissner@wtwhmedia.com

SENIOR VP, AUDIENCE GROWTH Greg Sanders gsanders@wtwhmedia.com

EVENTS VP, EVENTS Deena Rubin drubin@wtwhmedia.com

EVENT MARKETING SPECIALIST Emma Paul epaul@wtwhmedia.com

EVENTS MANAGER Jeannette Hummitsch jhummitsch@wtwhmedia.com

CStore Decisions is a three-time winner of the Neal Award, the American Business Press’ highest recognition of editorial excellence.

EDITORIAL ADVISORY BOARD

Nate Brazier, CEO

Stinker Stores • Boise, Idaho

Robert Buhler, President and CEO

Open Pantry Food Marts • Pleasant Prairie, Wis.

Herb Hargraves, Chief Operating Officer

Sprint Mart • Ridgeland, Miss.

Bill Kent, Chairman and CEO

The Kent Cos. Inc. • Midland, Texas

Nick Triantafellou, Director of Marketing & Merchandising

Weigel’s Inc. • Knoxville, Tenn.

Dyson Williams, Vice President

Dandy Mini Marts. • Sayre, Pa.

NATIONAL ADVISORY GROUP (NAG) BOARD (RETAILERS)

Greg Ehrlich, (Board Chairman) President

Beck Suppliers Inc. • Fremont, Ohio

Joy Almekies, Senior Director of Food Services

Global Partners • Waltham, Mass.

Jeff Carpenter, Director of Education and Training

Cliff’s Local Market • Marcy, N.Y.

Richard Cashion, Chief Operating Officer

Curby’s Express Market • Lubbock, Texas

Ryan Faville, Director of Purchasing

Stewart’s Shops Corp. • Saratoga Springs, N.Y.

Cole Fountain, Director of Merchandise

Gate Petroleum Co. • Jacksonville, Fla.

Kalen Frese, Director of Merchandising

Warrenton Oil Inc. • Warrenton, Mo.

Joe Hamza, Chief Operating Officer

Nouria Energy Corp. • Worcester, Mass.

Beth Hoffer, Vice President

Weigel’s • Powell, Tenn.

WTWH MEDIA, LLC

1111 Superior Ave. Suite 1120 Cleveland, OH 44114 Ph: 888-543-2447

SUBSCRIPTION INQUIRIES:

To manage current print subscription or for a new subscription: https://cstoredecisions.com/cstore-decisions-subscriptions/

SUBSCRIPTIONS: Qualified U.S. subscribers receive CStore Decisions at no charge. For others, the cost is $80 a year in the U.S. and Possessions, $95 in Canada, and $150 in all other countries. Single copies are available at $9 each in the U.S. and Possessions, $10 each in Canada and $13 in all other countries.

CStore Decisions (ISSN 1054-7797) USPS Publication #5978 is published monthly by WTWH Media, LLC., 1111 Superior Ave., Suite 1120, Cleveland, OH 44114, for petroleum company and convenience store operators, owners, managers.

Periodicals postage paid at Cleveland, OH, and additional mailing offices.

POSTMASTER: Send address changes to CStore Decisions, 1111 Superior Avenue, Suite 1120, Cleveland, OH 44114. GST #R126431964, Canadian Publication Sales Agreement No: #40026880.

CSTORE DECISIONS does not endorse any products, programs or services of advertisers or editorial contributors. Copyright© 2025 by WTWH Media, LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, or by recording, or by any information storage or retrieval system, without written permission from the publisher.

David Land II, Director of Marketing

The Kent Cos. Inc. • Midland, Texas

Brent Mouton, President and CEO

Hit-N-Run Food Stores • Lafayette, La.

Lenny Smith, Vice President

Crosby’s • Lockport, N.Y.

Dyson Williams, Vice President

Dandy Mini Marts • Sayre, Pa.

Hussein Yatim, Vice President

YATCO • Marlborough, Mass.

Vernon Young, President and CEO

Young Oil Co. • Piedmont, Ala.

Supplier Members

Kyle May, Director External Relations

Reynolds Marketing Services Co. • Winston-Salem, N.C.

Todd Verhoven, Vice President of Sales

Hunt Brothers Pizza • Nashville, Tenn.

Steve Yawn, Director of Sales

McLane Company Inc. • Temple, Texas

CStoreDecisions

Shaping the Future

IT’S THAT TIME OF YEAR AGAIN when we celebrate young executive excellence in the convenience store industry. As we reviewed the influx of nominations for this year’s 40 Under 40, I was struck by the inspiring stories many nominators shared about the commitment, drive and ingenuity of today’s young leaders. At a time when public perception of Gen Z and millennials can sometimes underestimate their capabilities or their work ethic compared to older generations, CStore Decisions’ 40 Under 40 highlights the exceptional talent, leadership and innovation these generations bring to the convenience retail industry. Next-generation leaders are raising the bar, bringing renewed energy and tech-savvy awareness, and they’re not afraid to go against the status quo as they look to elevate their companies. As you get to know this year’s class of 40 Under 40, I hope it leaves you feeling excited and hopeful for the future of this great industry.

GOODBYE 2025

Looking back on this year, we saw ongoing consolidation across the industry as well as major players moving into new operating areas. Technology adoption across the industry increased at a rapid pace, and more retailers started considering how to leverage artificial intelligence (AI). We saw more c-store retailers investing in or upgrading their foodservice operations to meet evolving customer expectations. As inflation rose and customers sought value, retailers put more focus on loyalty programs and personalized rewards, with many chains launching new or enhanced programs and mobile apps. At the same time, rising costs put pressure on margins, prompting retailers to focus on operational efficiencies, often leveraging AI and automation to drive results. On the tobacco and nicotine front, we saw a reprieve in federal regulations but ramped up legislative activity on the state and local levels with the rise of state product directories for legal vape products. And that’s just to name a few of the trends that have been shaping the industry this year.

LEAPING INTO 2026

Throughout this December issue, c-store retailers weighed in on the trends they’re watching as we look toward 2026 across areas such as pizza, technology and tobacco.

In this month’s article, “The 2025 Pizza Power Report,” we see that c-store pizza is holding its own against offerings from quick-service restaurants and pizzerias despite an increasingly competitive landscape. Customer demand for pizza is high, and there’s a push for limited-time offerings and innovative flavors. Editors from pizza magazine PMQ share their insights on the pizza landscape as a whole while CStore Decisions Associate Editor Kevin McIntyre talks with c-store retailers Casey’s and Crosby’s to share how retailers are appealing to today’s pizza customers.

In the article, “What’s Ahead for Retail Tech in 2026,” retailers and experts discuss the retail tech trends they’re tracking heading into the new year, including AI, leveraging data, retail media and computer vision, among others. One thing is certain, retailers can’t afford to ignore the tech evolution happening now.

I wish everyone a happy holiday season and a wonderful new year. As you look to 2026, don’t forget to mark your calendars for the CStore Connections conference, April 19-21 in Jacksonville, Fla. We have more than 40 c-store retailer speakers and discussion leaders who are set to delve into topics like AI, boosting foodservice profitability, future-proofing your chain, strategies in the face of changing competition and so much more. Learn more and view the agenda at CStoreConnections.com

Erin Del Conte

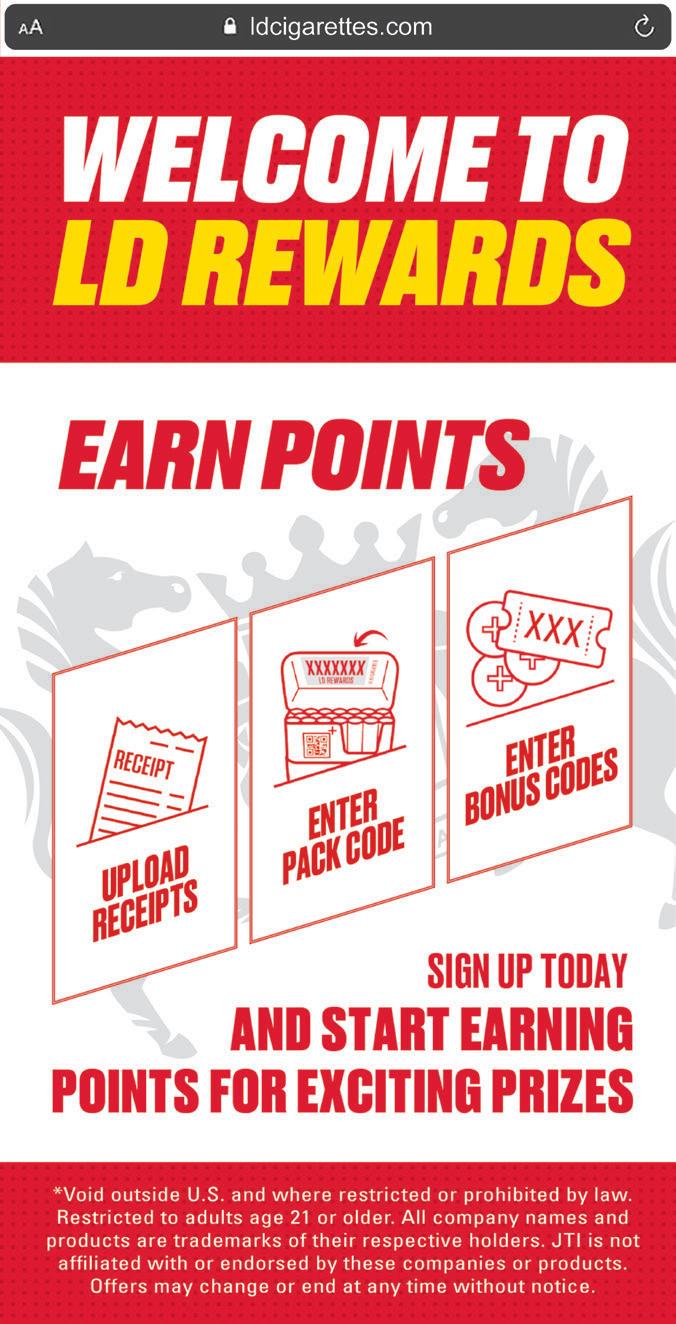

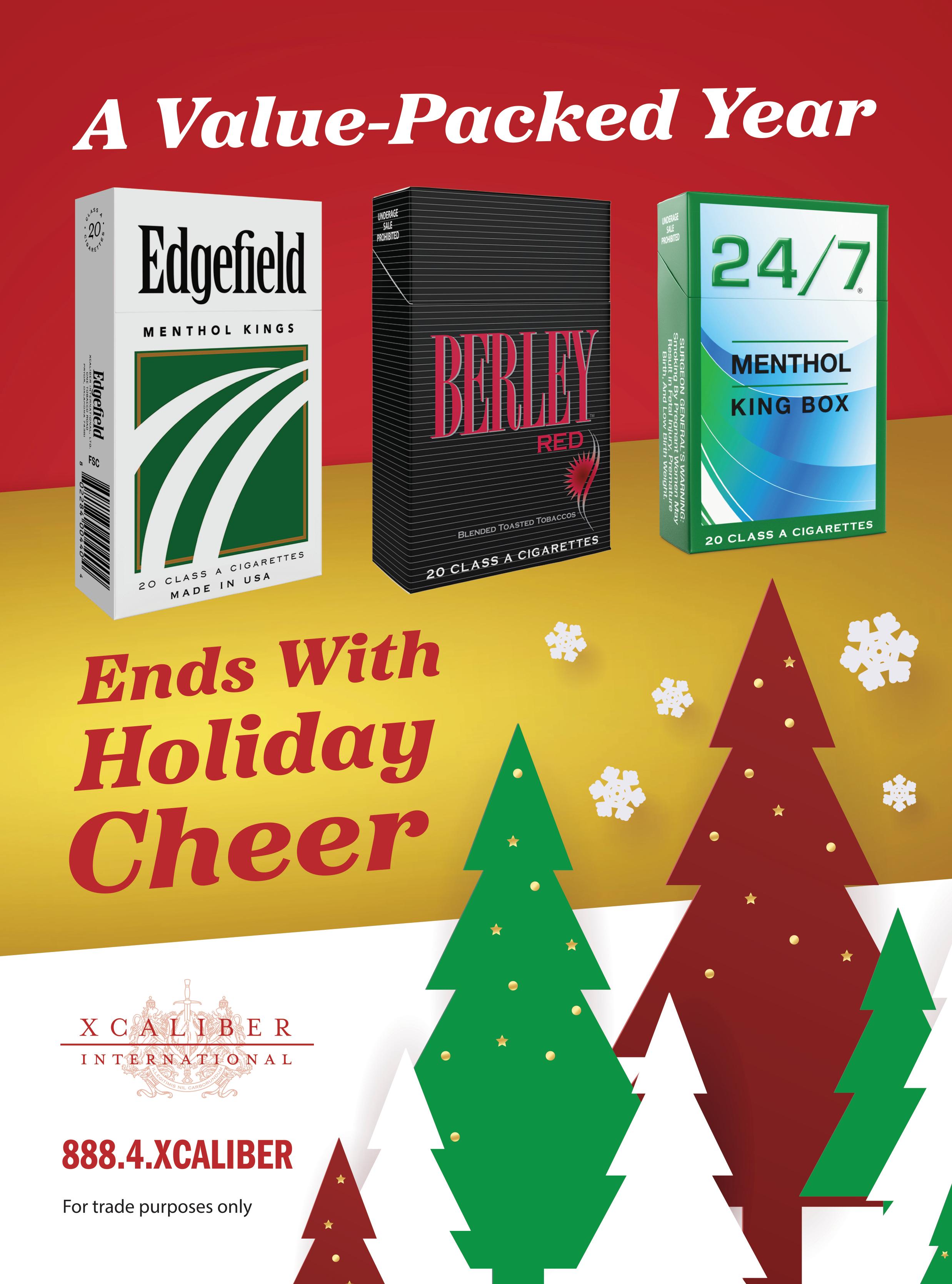

WARNING: This product contains nicotine. Nicotine is an addictive chemical.

QUICKBITES

NEW YEAR, NEW FOOD

As consumers head into 2026, retailers must rise to new expectations and trends.

TRENDING FORWARD

Over half of Americans identify as adventurous eaters. According to Nestlé:

• Nuanced flavors are growing in popularity. Consumers will start shifting toward “swangy” (spicy, sweet and tangy) and “swavory” (spicy, sweet and savory).

• Smoother textures will shape the new year. Creamy textures are on 45% of menus, and “velvety” mentions on social media surged 40% quarter over quarter.

• Ninety percent of Gen Z and millennials are seeking new food and beverage flavors, “the wilder, the better.”

• One in four consumers are interested in globally inspired coffee drinks, and one in five coffee drinkers crave whipped toppings on beverages.

STEERING TOWARD WINE

Consumers are overall most interested in innovations with wine, among beverage trends tested, according to Datassential. Top trends include fruit wines, natural wine, wine cocktails, wines from unique international areas, dessert wines and flavored wine.

• Women are more likely to be drawn to many types of wines and sustainable offerings.

• Men are more likely to be drawn to spirit-based beverages and sweeter offerings such as highbrow Jello shots and functional sodas.

Source: Datassential, “2026 Future of

STILL YOUNG

2025

As consumers redefine what it means to be young, c-store foodservice brands need to respond with relevance in 2026. According to Mintel, questions brands should be asking are:

• Which attributes resonate with those seeking balance between long-term wellness and present-day fun?

• How can we meet the evolving needs of consumers rather than old clichés?

• Which competitors are owning this category, and what do these consumers see in them?

12-MONTH WATCH

Consumer taste trends are constantly evolving, with variety a high priority heading into 2026. Trends to watch over the next year include:

• Indulgent

• Texture satisfaction

• High nutritional value

• Fiber rich

Source: Mintel, “2026 Global Food and Drink Predictions,” October 2025

BEVERAGES ON TAP

Offerings that blur the boundaries of traditional alcoholic beverages can appeal to consumers, and awareness of these is growing.

• 67% of consumers are interested in wine cocktails.

• 62% of consumers are interested in tea-based alcoholic beverages.

• 58% of consumers are interested in functional sodas.

• 56% of consumers are interested in carbonaed cocktails.

Source: Datassential, “2026 Future of Drink Preview Report,” October 2025

Source: Mintel, “2026 Global Consumer Predictions,” October 2025

Source: Nestlé, “Cooking Up 2026: The Weird, ‘Swangy’ and Layered Trends Taking Over the Kitchen,” November 2025

Drink Preview Report,” October

LEADERS TO WATCH

CStore Decisions celebrates the 2025 Class of 40 Under 40, who are standing out for their leadership, dedication, ingenuity and impact.

A CStore Decisions Staff Report

AS THE CONVENIENCE STORE INDUSTRY continues to evolve amid ongoing consolidation, shifting labor dynamics, the rapid expansion of foodservice, accelerating technology adoption and increasing regulatory pressures, the role of young executives and next-generation leaders has never been more important. Bringing new perspectives, digital fluency and an agile mindset, today’s rising leaders are driving transformation, strengthening company culture and positioning their organizations for sustained growth and long-term success. On the pages that follow, CStore Decisions introduces the 2025 Class of 40 Under 40 Leaders to Watch.

The 40 Under 40 is an annual list of the convenience store industry’s young executive leaders who have been responsible for helping to advance their business in a significant way within the past 12 months. 2025 marks the 10th anniversary of this prestigious list. CStore Decisions has been celebrating next-generation talent for a decade and counting.

The following 40 young executive retailers represent some of the most promising rising leaders at their c-store chains today. They come from chains of all sizes across the U.S. and include a range of titles, including category manager, director of merchandising and vice president, among others.

This year’s 40 Under 40 were honored in a virtual gala on Dec. 2.

The official nomination period for the 40 Under 40 runs from Aug. 1 to Sept. 20. Watch for e-blasts from CStore Decisions requesting nominations.

And now, introducing the 40 Under 40 Class of 2025:

ERIC ARNOLD, 38

Senior Category Manager

Company: Road Ranger

Headquarters: Schaumburg, Ill.

Number of Stores: 54

C-Store Banner Name(s): Road Ranger

Years with the Company: 11

Eric Arnold’s career in the industry started in 2014 when he joined Road Ranger as a merchandiser. The role required a keen eye for detail, strong organizational skills and the ability to work efficiently in a fast-paced environment. As he grew in his role, he knew he had a passion for retail and a desire to make a positive impact on customer experience. He looked for opportunities to learn more about consumer behavior, market trends and effective merchandising strategies. This, combined with hands-on experience, allowed him to consistently exceed sales targets and contribute to the overall success of the store. Over time, this led Arnold into category management, which allowed him to take on more responsibility within the company. Those experiences naturally led him to his current role as a senior category manager.

What is the biggest issue facing convenience stores today? “Rising costs from inflation and tariffs as well as adapting to consumers shifting their preferences.”

MIKE CAPUANO, 34

Senior Category and Business Analyst

Company: Beck Suppliers

Headquarters: Fremont, Ohio

Number of Stores: 31

C-Store Banner Name(s):

FriendShip Kitchen Years with the Company: 3

Mike Capuano began his career as an epidemiologist, which provided him with a unique perspective on uncovering patterns and insights that inform public health decisions — a skill that would prove to be essential throughout his career at Beck Suppliers. Capuano eventually realized that his passion for data-

informed strategy extended beyond healthcare, leading him to transition into retail analytics, which is a field where he can apply those analytical foundations to better understand consumer behavior and support data-driven business growth. Colleagues at Beck noted that Capuano has been instrumental in growing and understanding the business, working closely with both operations and marketing and even managing several categories, which have since grown in unit sales and margin.

What do you think today’s young executives bring to the table? “They bring a tech-first mindset, viewing technology as a strategic driver of innovation, efficiency and competitive advantage.”

JESSICA CATANZARO, 39

VP of Purchasing

Company: Green Valley Grocery

Headquarters: Las Vegas

Number of Stores: 86

C-Store Banner Name(s): Green Valley Grocery Years with the Company: 6

Jessica Catanzaro spent 11 years as a buyer for Wynn and Encore before joining Green Valley Grocery (GVG) as the director of purchasing. She was subsequently promoted to VP of purchasing. Here, Catanzaro leads the pricebook manager and director of purchasing for beer, wine & spirits, overseeing 86 locations across Nevada. She ensures product availability, inventory optimization and seamless store openings while driving profitability through strategic profit and loss management, financial analysis, pricing and promotions. She secures competitive contracts, rebates and vendor agreements that deliver cost savings and exclusive partnerships. She achieved record-breaking results, delivering the highest margin in company history at 35% while driving monthly revenues to an unprecedented $11 million. Her strategic leadership, datadriven decision-making and vendor partnerships have set a new benchmark for profitability and operational excellence. What project or innovation are you most looking forward to in 2026? “I’m most looking forward to featuring new top-selling products made without artificial colors or ingredients that still deliver great taste.”

BRYN CAVANAUGH, 23 Marketing Manager

Company: Walters-Dimmick Petroleum

Headquarters: Marshall, Mich.

Number of Stores: 66

C-Store Banner Name(s):

Johnny’s Markets

Years with the Company: 1

Cavanaugh studied marketing and psychology at Albion College and was a digital marketing intern at Gordon Food Service. During her senior year, she was connected with Johnny’s through her school’s Career and Internship Center. Cavanaugh was drawn to the team culture, the company’s values and the opportunity to help shape the brand while growing her understanding of the business and the industry. Colleagues described her as the No. 1 team player with top-notch dedication, noting she is the future of the industry and the company. She develops her skills by working side by side with others, even if the project is not related to marketing. What is the biggest issue facing convenience stores today? “One challenge for the industry is meeting shifting customer expectations, as shoppers want welcoming experiences with personalization and hospitality, not just speed.”

Bryn

CRYSTAL CLEMENTS, 38

Category Manager, Center Store and Private Label

Company: Stinker Stores Inc.

Headquarters: Boise, Idaho

Number of Stores: 95

C-Store Banner Name(s): Stinker Years with the Company: 16

Crystal Clements began her career at Stinker Stores in 2009 on the evening shift at her local shop. At the time, she was just looking for a temporary job but quickly realized how interested she was in understanding the daily operations and ins and outs of the business. In 2011, when Stinker purchased 14 stores, Clements took on a new role as a store manager. From there, she managed multiple locations, built out teams, trained staff, opened new stores and even contributed input to new store designs. In

2017, Clements was looking for her next challenge and joined the pricing department in Stinker’s main office. She spent two years in the role refining systems and gaining analytical experience before entering the category management space and eventually taking control of overseeing private label operations.

What do you think today’s young executives bring to the table? “(They are) enthusiastic, innovative and technologydriven go-getters with a passion for delivering exceptional hospitality.”

MIKE CLIFFORD, 36

Vice President

Company: Clifford Fuel

Headquarters: Marcy, N.Y.

Number of Stores: 22

C-Store Banner Name(s): Cliff’s Local Market Years with the Company: 15

Mike Clifford started working for the family business after college, aiding in an array of different areas as he learned the industry. He settled in as the category manager for several years and now oversees the entire convenience store operation. Clifford is a third-generation member of the business. His grandfather Jack Clifford started the company; his father, Jim Clifford, is the president; and his brother, Jimmy Clifford, is also a VP. His colleagues described him as a people-first leader with a continued focus on serving the needs of local communities and customers. His team has achieved many successes through his leadership, and they look forward to many years more.

What is the biggest issue facing convenience stores today? “The rapid changes within the workforce and technology.”

JUSTIN COALDRAKE, 33

Senior Director Omnichannel Guest Experience and Media

Company: Casey’s

Headquarters: Ankeny, Iowa

Number of Stores: 2,900+

C-Store Banner Name(s): Casey’s Years with the Company: 2

Before joining Casey’s in January 2024, Coaldrake spent seven years at Hy-Vee in various leadership roles across supply chain technology, e-commerce and retail media. At Casey’s, he has been a driving force behind the chain’s digital transformation. He leads a broad and critical portfolio: customer relationship management and loyalty; e-commerce; digital guest experience; data and analytics; media strategy; and Casey’s Access, the chain’s rapidly growing retail media network. He also manages key agency relationships and cultivates strategic partnerships with top-tier vendors. Colleagues said he brings a rare blend of entrepreneurial spirit and corporate expertise and that his impact has been “nothing short of transformative.” In fiscal year 2025, his strategic shift in media mix and audience segmentation drove a 2.8% increase in total sales, 108% growth in media-driven sales, a 102% increase in media-driven traffic and a 32% boost in return on investment.

What project or innovation are you most looking forward to in 2026?

“Continue finding innovative ways to leverage our data to deliver personalized value and frictionless experiences to our guests.”

CHARLYSE DAVIS, 35

Southern Regional Manager

Company: Louisiana Truck Stop and Gaming LLC

Headquarters: Bossier City, La.

Number of Stores: 9

C-Store Banner Name(s): Louisiana Truck Stop and Gaming LLC

Years with the Company: 4

Charlyse Davis originally worked in the riverboat gaming industry until the COVID-19 pandemic disrupted her role there. She started with Louisiana Truck Stop and Gaming (LTSG) as a route technician/collector four years ago, but soon after she left to accept a position at the post office during peak season. Davis then returned to LTSG as a casino manager. At her one-year anniversary, she was promoted to regional manager for LTSG’s five casino locations and three of its convenience store locations. She has been in her current role since May 2022. Her colleagues noted her willingness to learn and grow in a new business area highlights her perseverance, quick learning and leadership qualities.

What is the biggest issue facing convenience stores today? “The biggest issue facing convenience stores is staffing, finding quality people and building a quality team.”

DUANE DUPPONG, 34

Store Leader

Company:

The Hub Convenience Stores

Headquarters: Dickinson, N.D.

Number of Stores: 5

C-Store Banner Name(s): The Hub Years with the Company: 5

Duane Duppong, after spending his entire career in the foodservice industry, joined The Hub Convenience Stores in 2019 as food service leader. He has since worked his way up to become a store leader, where he has embraced the new roles and responsibilities that come along with the promotion. Duppong’s colleagues noted that he has grown significantly as a leader over the past five years, transitioning from a back-of-house employee to a peoplefocused leader. He has been instrumental in advancing the company’s foodservice program while remaining deeply committed to the community he serves. Duppong serves as the president of the Hazen Chamber of Commerce, and he also serves on the Hazen Community Development Board.

What do you think today’s young executives bring to the table? “New and fresh ideas that are tailored to younger generations.”

AMIRANOUR EL-NEMR, 26

Executive VP, Graphic Designer

Company: Nouria Energy

Headquarters: Worcester, Mass.

Number of Stores: 319 c-stores, 90 car washes

C-Store Banner Name(s): Nouria Years with the Company: 2

Amiranour El-Nemr, a second-generation leader at Nouria, began her career as an intern with the company while she was still in college, where she worked in the marketing department. It was in this role where she discovered her passion for graphic design — a key aspect of her position today. After graduating, she joined the team full time and initially focused on growing the brand’s social media presence. Over time, her role evolved to include in-store signage, offering her an avenue to connect with guests each day. Today, El-Nemr collaborates across departments to streamline communication and ensure that the brand’s message and values are represented accurately across its extensive network. Colleagues noted that she has not only elevated Nouria’s brand presence, but she has become an integral part of Nouria’s success story.

What do you think today’s young executives bring to the table? “I love that young executives bring a new perspective and a fresh energy. In a fast-paced digital world, it is so important to adapt but still make connections with guests.”

ASHLEY EVANS, 35

Fresh Food & Dispensed Beverage Manager

Company: bp

Headquarters: Louisville, Ky.

Number of Stores: 1,566

C-Store Banner Name(s): ampm, Thorntons and TravelCenters of America

Years with the Company: 10

Ashley Evans began her career at bp on the ground floor as an assistant manager at Thorntons before quickly rising through the ranks to become a general manager across several locations. Her leadership and results-driven mindset eventually brought her to Louisville, Ky., where she was promoted to regional manager — a role which provided her with hands-on experience and an inside look at the complex world of multiunit management. With this experience in her back pocket, Evans transitioned to the fresh food team as a project manager, where she led kitchen program rollouts. From there, she moved into a category manager role, where she was able to blend her operational experience with strategic thinking and culinary expertise. In October 2024, Evans was able to combine her extensive industry experience across all three c-store banners — ampm, Thorntons and TravelCenters of America — after being promoted to oversee assortment, pricing and product development for these brands.

What do you think today’s young executives bring to the table? “I think young executives bring fresh perspectives, digital fluency and purpose-driven leadership — challenging tradition with data, innovation and collaboration to keep organizations agile, relevant and people focused.”

MADISON EVERETT, 32

Director of Category Management

Company: EG America

Headquarters: Westborough, Mass.

Number of Stores: 1,500

C-Store Banner Name(s): Cumberland Farms, Fastrac, Kwik Shop, Quik Stop, Loaf N’ Jug, Certified Oil, Tom Thumb, Minit Mart, Turkey Hill, Sprint Years with the Company: 11

Madison Everett started her career as a marketing intern with Cumberland Farms. After earning her marketing degree, she accepted a full-time role and rose through the ranks, from coordinator to category specialist, senior category manager and now director of category management at EG America. Today, Everett leads the packaged beverage, alcohol and dairy categories, overseeing a portfolio exceeding $850 million in annual sales and guiding a team of six in managing the company’s top gross profit–generating categories. Under her leadership, EG America has executed some of its largest and most data-driven category resets, reallocating space by customer purchasing behavior to improve productivity and sales performance.

Everett is passionate about mentoring future leaders and fostering collaboration across teams and vendor partners to drive innovation, efficiency and growth. She is known for lifting up others and setting a powerful example of resilience, vision and leadership.

What project or innovation are you most looking forward to in 2026? “I’m most looking forward to leading the 2026 space-to-sales optimization project, redefining how we allocate beverage, alcohol and dairy sets based on true customer purchasing behavior.”

DEIRDRE FAY, 27 Systems and Process Manager

Company: EG America

Headquarters: Westborough, Mass. Number of Stores: 1,500

C-Store Banner Name(s): Cumberland Farms, Fastrac, Kwik Shop, Quik Stop, Loaf N’ Jug, Certified Oil, Tom Thumb, Minit Mart, Turkey Hill, Sprint Years with the Company: 6

Deirdre Fay began her career as a food safety intern with Cumberland Farms, which is now owned and operated by EG America. In the role, Fay developed an interest in regulation by learning how to interpret and apply food code variations across multiple states and banners. She has held several roles at EG America, including quality assurance technician and health and safety specialist, which served as the foundation for her current role as systems and process manager, which contributes to the development of regulated food and occupational procedures at EG America. Colleagues noted that Fay is committed to excellence and plays a significant role in shaping the health and safety department at the company. Fay is a member of several committees, including the Institute of Food Technologists and the New York Institute of Food Technologists. What do you think today’s young executives bring to the table? “The willingness to share our different perspectives while thoughtfully looking at established norms and traditions.”

RYAN GARNER, 34

Senior Retail Category Manager

Company: Warrenton Oil Co.

Headquarters: Truesdale, Mo.

Number of Stores: 58

C-Store Banner Name(s): FastLane Convenience Stores

Years with the Company: 7

Upon graduation from college, Ryan Garner became a director of marketing, overseeing three roller skating rinks. Upon his move back home to St. Louis, he became the general manager of a multispecialty health clinic. After a couple of years, fate led him into the convenience store industry with Warrenton Oil Co. Garner began as a “jack of all trades,” serving as the brand coordinator. He worked within operations, marketing

and merchandising, helping where he was needed. After a couple of years, he was elevated to the position of senior retail category manager where he oversees several categories (grocery, health & beauty, liquor, wine, propane and ice). He is known for being a company-first leader and culture champion and for his relationship-building skills.

What is the biggest issue facing convenience stores today? “The c-store has become less financially convenient to the consumer due to increasing costs.”

ELYSE GESMONDI, 36

Field Food Service Manager

Company: Global Partners

Headquarters: Waltham, Mass.

Number of Stores: 337

C-Store Banner Name(s): Wheels, Alltown, XtraMart, Alltown Fresh, Honey Farms, Jiffy Marts, Millers, T-Bird, P&H Truck Stop

Years with the Company: 13.5

Elyse Gesmondi holds 19 years of experience in the foodservice and c-store industries. She began her career on the front lines — from making homemade bagels at a local grocery store to working as a host, server and barista at a few restaurants. In 2012, Gesmondi joined Global Partners as a cashier. She progressed through roles, including assistant manager, kitchen manager and store manager, becoming known for her leadership, team development and crossfunctional collaboration. For the past three years, Gesmondi has worked on Global’s field foodservice team, supporting operations across the Connecticut and New York regions. She assisted in the launch of two core menu locations in Connecticut and Massachusetts and the transition of two former Subway franchises in Virginia to Global’s core foodservice concept. Her role covers kitchen support, sales analysis, staff coaching, beverage innovation and food safety.

What project or innovation are you most looking forward to in 2026?

“I’m really excited about projects that focus on improving workflow and efficiency in foodservice operations. Streamlining prep processes, enhancing training systems, and optimizing product rotation and freshness are areas where innovation can make a big impact.”

KAYLA HALL, 36

VP of Human Resources

Company: Refuel Operating Co.

Headquarters: North Charleston, S.C.

Number of Stores: 240

C-Store Banner Name(s): Refuel

Years with the Company: 3

Kayla Hall joined the convenience store industry just over three years ago after spending the majority of her career at Starbucks, where she primarily focused on operations and training. She began her c-store career at Refuel as the director of training engagement, where she discovered her passion for both human resources (HR) and the convenience store industry as a whole. During her time at Refuel, Hall earned her Society for Human Resource Management certification and expanded her expertise in compensation and talent acquisition, among other areas. She has now served as VP of HR for more than a year. Hall is known for rolling out impactful initiatives that celebrate team members, with colleagues noting that she has assembled a top-notch team that is deeply committed to enriching the lives of employees.

What do you think today’s young executives bring to the table? “Young executives bring passion, innovation and the courage to challenge the status quo.”

CODIE HARRELL, 28

Assistant Controller

Company: Weigel’s Stores Inc.

Headquarters: Powell, Tenn.

Number of Stores: 86

C-Store Banner Name(s): Weigel’s Years with the Company: 2

Codie Harrell began her career at Weigel’s in 2023 as a financial accountant after earning dual bachelor’s degrees in accounting and business, plus a Master of Business Administration with a focus in strategic management. This foundation gave her a strong mix of both technical expertise and big picture thinking. After gaining experience in financial reporting, reconciliation and process improvement, Harrell was promoted to accounting manager, where she helped lead a team

and streamline processes. Harrell now serves as assistant controller, where she oversees broader financial operations and supports strategic decision-making at a higher level. Harrell is known by colleagues as an up-and-comer within the organization who is passionate about everything that she does.

What do you think today’s young executives bring to the table? “Young executives bring a new perspective and strong drive for innovation.”

ETHAN HENDERSON, 35

Chief Construction Officer

Company: Major Oil

Headquarters: Birmingham, Ala.

Number of Stores: 8

C-Store Banner Name(s): Joltz

Years with the Company: 1

Ethan Henderson gained his knowledge within regulation and code while a lieutenant firefighter overseeing fire inspections and plan review in Altoona, Wis. He transitioned to the private sector as a regulatory specialist for a large above ground storage tank manufacturer, U-Fuel Inc., where he developed technologies and approaches that would allow for a holistic retail fuel option to operate entirely above ground. After U-Fuel, he served as the chief operating officer and later the CEO of AMS Energy. During his time at AMS, he worked with the Major Oil group extensively. Their vision for technology and a tenacity to get things done aligned with where he saw the industry going, and he joined the team as the chief construction officer, where the technology and skills he had been developing were all allowed to be utilized at capacity.

What is the biggest issue facing convenience stores today? “In my view, energy-transition uncertainty is a major risk for convenience retailers: uneven electric vehicle adoption, volatile incentives and mandates, grid constraints and tariffs, and competing low-carbon fuels have created a period of minimized margins throughout the downstream energy sector.”

HALEY HOLSAN, 35 VP of Operations

Company: GPM Empire LLC

Headquarters: Dallas

Number of Stores: 2,500

C-Store Banner Name(s):

Parent company GPM Investments has 25+ banners including fas mart Years with the Company: 3

Haley Holsan began her career at GPM Empire in 2015, when the company was known as Empire Petroleum Partners, as an administrative assistant. From there, she worked her way up to the inside sales and customer service team until 2018, when she switched gears to serve as a lead area sales specialist for Sunoco. Then in 2019, Holsan transitioned to a new role as a dealer business consultant for SEI Fuel Services before reuniting with the company now known as GPM Empire in 2022 as a regional sales manager. She was promoted to her current role of VP of operations in 2025. Holsan is known for being a resultsdriven leader with deep knowledge of the industry, with colleagues noting that she is passionate about developing highperforming teams and mentoring the next generation of leaders.

What do you think today’s young executives bring to the table? “By growing up in one of the booming technology eras, young executives possess the innate skills to be innovative and resourceful in a way that was not possible before.”

DAVID JACKSON, 35

Director of Digital and Loyalty

Company: Kwik Trip

Headquarters: La Crosse, Wis.

Number of Stores: 900

C-Store Banner Name(s):

Kwik Trip, Kwik Star, Stop n Go, Tobacco Outlet, Kwik Spirits

Years with the Company: 19

David Jackson began his career at Kwik Trip just days after turning 16, working in the retail stores throughout high school and college. After earning a degree in business administration and marketing, he transitioned into the marketing department as a secret shopper where he evaluated the company’s stores across the Midwest. Over time, Jackson took on additional responsibilities in social media and digital marketing. In 2018, he was entrusted with leading the development of Kwik Trip’s first rewards program, supported by a suite of technologies including a mobile app, loyalty engine and other digital tools. Today, he leads a team of over 20 talented professionals across social media, paid digital, loyalty, e-commerce and marketing analytics.

What is the biggest issue facing convenience stores today? “The biggest issue facing convenience stores today is the robust competition we face across multiple industries, including quick-service restaurants, grocery, coffee, paired with the need to invest in technologies across all parts of the business to stay relevant against this competition.”

FARRIS JAMAL, 31

Director of Merchandising

Company: CPD Energy Corp.

Headquarters: Poughkeepsie, N.Y.

Number of Stores: 80

C-Store Banner Name(s): Chestnut Market

Years with the Company: 16

Farris Jamal grew up in convenience stores; he is a second-generation member of his family business. Some of his earliest memories are visiting locations with his father. Front facing cooler shelves was his favorite thing to do as a kid. Those small moments sparked a lifelong connection to the business that would later become his career. At 14, Jamal started working in the South Road store in Poughkeepsie, N.Y. By high school, he was managing a store during his breaks, which gave him early experience leading a team and understanding what it takes to run a successful operation. When he went to college, he took on a role as an internal field auditor to help strengthen loss prevention efforts. After graduation, he became a territory manager overseeing 13 stores, which gave him a broader view of the business and the opportunity to work closely with store managers. Later, Jamal stepped into foodservice and helped create the in-house grab-and-go program. That experience led him deeper into merchandising, where he found his passion. Today, as director of merchandising, he’s proud to work with a top-notch team of territory and store managers who share the same drive for excellence that’s been part of Chestnut Market since the beginning.

What is the biggest issue facing convenience stores today? “Increasing costs and labor/staffing issues.”

EMILY JENKINS, 31

IT Administrator

Company: Southwest Georgia Oil Co. Headquarters: Bainbridge, Ga. Number of Stores: 81

C-Store Banner Name(s): SunStop Years with the Company: 2

Emily Jenkins began her career as a computer technician at the local school district, where she advanced to director of IT. In 2023, Jenkins joined Southwest Georgia Oil Co. as an IT administrator, quickly learning the convenience store industry and positioning herself as an expert in store security and point-of-sale systems. Jenkins has gone above and beyond to meet store employees and managers and build relationships with

them. Because of this, she is often the first call they make when challenges arise. Her approachable nature and understanding of the day-to-day store operations have made her indispensable to the team. She is known for bringing a fresh perspective and innovative ideas that continue to enhance SunStop’s operations and support its mission to brighten every moment.

What project or innovation are you most looking forward to in 2026? “Artificial intelligence-driven technology for our camera systems.”

GOOD THINGS COME IN THREES

GAME® LEAF GIVES CUSTOMERS WHAT THEY WANT

In 2015 Game Leaf was introduced as part of the Garcia y Vega portfolio of cigars, revolutionizing the Rolled Leaf cigar category. Now, as part of our 10th anniversary celebration, we’re reintroducing Game Leaf with colorful, eye-catching, consumer-tested 3-cigar packaging designed to bring Rolled Leaf customers more of what they want.

AVAILABLE AT 3 FOR $2.19 TRIAL PRICING AND SAVE ON 3

3 REASONS FOR 3-PACK SALES

In 2024, the 3-pack was the only Rolled Leaf format to show volume growth, along with a 5.7% increase in share of the market.

While all other Rolled Leaf formats showed velocity declines in 2024, the velocity for 3-packs rose by 15%.

Rolled Leaf 3-packs were added to shelves in over 9,700 c-stores in 2024, an 11% increase in store count over 2023.

3 REASONS TO GO WITH GAME LEAF

Game Leaf is able to build on the tremendous brand equity of Game, the #1 selling Natural Leaf cigar in the US.

Game Leaf’s commitment to quality and stringent quality standards—from broadleaf crop selection through manufacturing—ensure the best quality Rolled Leaf cigar available.

Consumers equate the Game Leaf brand with the Garcia y Vega tradition of quality and craftsmanship, as Garcia y Vega has been making Natural Leaf cigars since 1882.

PAOLO KAREH, 24

Pricebook Administrator

Company: Kayrouz Petroleum LLC

Headquarters: Westborough, Mass.

Number of Stores: 40+, 11 corporate

C-Store Banner Name(s): KP Market, KP Market & Liquors, KP Travel Centers

Years with the Company: 6

Paolo Kareh has been around the business from a young age. His uncle Pierre is a partner in a few stations, and his father Paul operates a station. Kareh has performed many roles, including gas attendant, cashier, store manager and now pricebook administrator. During college, he stayed involved in the business while pursuing business and database internships/projects. He graduated with a double major in computer science and accounting. He implemented PDI Enterprise into all of the company’s operated stations, where he solely built out the company’s pricebook and PDI retail aspect from scratch. Since then, Kareh continues to update, maintain and troubleshoot the retail system along with installing the system into any new and acquired stores. Although his main job is handling the retail system itself, he gives his input on retail and operational matters.

What is the biggest issue facing convenience stores today? “Establishing the identity you want consumers to instantly recognize and associate with your brand. You must follow market trends but remain innovative enough to stand out from the endless competition. Consistency and quality in your services and products retains loyalty while attracting new business.”

ALEX KUPPER, 35

Category Lead Tobacco & Other Services

Company: bp US Convenience

Headquarters: Louisville, Ky.

Number of Stores: 1,566

C-Store Banner Name(s): Thorntons, ampm, TravelCenters of America

Years with the Company: 10

Alex Kupper originally pursued a career in the NFL after college before connecting through a career development program with Thorntons. After a 30-minute interview, he immediately became hooked on the convenience business. He began as an assistant category manager and was promoted to category manager, followed by senior category manager and now category leader. In his current role he leads tobacco, gaming, car wash and other services for all bp retail banners including bp, Thorntons, ampm and TravelCenters of America. Kupper has established a strong rapport with supplier partners to grow sales and profits. Colleagues pointed to his strong commitment to excellence and ability navigate the changing tobacco landscape while delivering exceptional value to guests. What project or innovation are you most looking forward to in 2026? “I’m looking forward to the formation of a Food & Drug Adminstration clearance process (for tobacco and nicotine products) that can inhibit consistency and reliability to the manufacturers to deliver less harmful products to market that meet consumers’ needs and demand.”

BILLIE LENTZ, 25

Marketing, Communications and Recruitment Manager

Company: Legacy Cooperative Headquarters: Bisbee, N.D. Number of Stores: 4

C-Store Banner Name(s): Legacy Cooperative — Cenex Years with the Company: 1

Billie Lentz graduated from North Dakota State University in 2022 with a degree in agricultural economics. After working in the marketing department of a Fortune 100 company, she made the leap to move back to her hometown and started from scratch as the marketing, communications and recruitment manager at Legacy Cooperative. Legacy Cooperative serves the north central North Dakota region through grain, agronomy, retail and energy services. One of her proudest accomplishments to date has been launching and growing the c-store social media platforms and connecting with customers through sharing fuel and in-store offerings. Legacy Cooperative is deeply connected to the agriculture industry. Lentz finds it fulfilling to serve its members and grow value together. What is the biggest issue facing convenience stores today? “The biggest issue convenience stores are facing in rural areas is employee recruitment and retention.”

KENDRA MEYER, 37

VP, Real Estate

Company: Casey’s

Headquarters: Ankeny, Iowa

Number of Stores: 2,900+

C-Store Banner Name(s): Casey’s Years with the Company: 8.5

Kendra Meyer has spent her entire career in real estate, with a strong focus on commercial real estate — particularly convenience stores. Over the years, she has held a variety of roles, including asset management, retail development and leadership positions. In her current role as VP, real estate, she combines strategic vision with execution to grow Casey’s store footprint. She is responsible for the management of a robust real estate pipeline, execution of the company’s strategic new-to-industry growth plan, and oversight of approximately 200 leases and property divestitures. Her leadership supports Casey’s growth across a 19-state region, as she drives the chain’s strategy to add 500 stores by 2026. She leverages a data-driven market attractiveness scale, oversees negotiations for new locations and land divestitures, and guides a high-performing team. Her contributions have positively impacted Casey’s growth, operational excellence and organizational culture. Colleagues noted her strategic vision, innovative leadership, and commitment to team and community development. What project or innovation are you most looking forward to in 2026?

“I am excited to leverage emerging technologies to further streamline processes and unlock new efficiencies, allowing more time to focus on meaningful, highimpact work.”

ROHIT MISHRA, 28

Senior

Pricing Analyst

Company: Sheetz Inc.

Headquarters: Altoona, Pa.

Number of Stores: 800

C-Store Banner Name(s): Sheetz

Years with the Company: 4

Having attended grad school for industrial engineering, Rohit Mishra has a strong interest in analytical thinking and problem-solving. He started with Sheetz as an intern in 2020 and established himself as a leader on the retail pricing team. Mishra has moved Sheetz forward using his data science skills to refine the way the company looks at fuel sales and gallons. He noted he was fortunate to join a team that valued both creativity and calculated risk-taking alongside analytical rigor. Starting out as an analyst in a small, nimble and highly cross-functional team allowed him to rapidly grow his skillset and build a holistic understanding of the fuel business. Over time, he became engaged with the challenge of thinking at both macro and microeconomic levels — where global geopolitics can be just as influential as local consumer behavior. He also created an internal analyst group called DARTS that helps standardize the way the company looks at data and to provide mentoring/ support for new analysts.

What project or innovation are you most looking forward to in 2026?

“Excited about our loyalty program innovations that will enhance the value we deliver to customers.”

NEELY MOREMAN, 28

Associate Category Manager — Food Service, Bakery and Supplies

Company: Yesway

Headquarters: Fort Worth, Texas

Number of Stores: 447

C-Store Banner Name(s): Yesway, Allsup’s

Years with the Company: 3.5

Neely Moreman began her career at Yesway as a merchandising intern and extended her summer internship throughout her final semester of college. She was promoted to merchandising coordinator a few weeks prior to graduation. In this role, she managed all reporting and administrative tasks for the foodservice team along with managing the supplies category. After two years, she was promoted to associate category manager, where she took on a larger role with the

foodservice team, continued to manage store supplies and began managing the bakery category. Moreman has learned much in her three-and-a-half years at the company. She is truly looking forward to taking on even more challenges and further growing in her career at Yesway. What is the biggest issue facing convenience stores today? “As c-stores grow in market share, one of the greatest challenges we face as an industry is learning to serve convenience customers in new ways that c-stores haven’t previously served them, through new services and products.”

SAMANTHA OVERMOHLE, 38

Senior Category Manager, Maverik

Company: Maverik

Headquarters: Salt Lake City

Number of Stores: 840

C-Store Banner Name(s): Maverik, Kum & Go

Years with the Company: 10

Samantha Overmohle began her career with Maverik in a category management role a decade ago. In 2019, she advanced to the role of senior category manager, where she oversees the nonalcoholic beverage portfolio. During her time at Maverik, she has navigated the chain through pivotal moments like the COVID-19 pandemic, Maverik’s acquisition of Kum & Go and the integration of two corporate entities into a unified organization. Overmohle was the first category manager to successfully operate across both the Maverik and Kum & Go banners, with colleagues noting that her pioneering work laid the foundation for how Maverik now approaches dual-brand strategies. She is consistently involved in senior-level planning meetings, contributing to the rebrand strategy, pricing models and product mix optimizations. Overmohle is known for shaping Maverik’s category strategy, influencing cross-banner operations and inspiring the next generation of leaders. Colleagues noted that she is a “guiding light” for what modern retail leadership should look like.

What do you think today’s young executives bring to the table? “Young executives are open to quick pivots and bring a more global perspective to leadership.”

OLIVIA PARKER, 31

Outreach and Communications Manager

Company: Parker’s Kitchen

Headquarters: Savannah, Ga.

Number of Stores: 104

C-Store Banner Name(s): Parker’s Kitchen Years with the Company: 5.5

Olivia Parker started her career in New York City working in luxury fashion e-commerce. As the pandemic hit, she moved to Savannah, Ga., and joined Parker’s as an in-store recruiter. From there, she transitioned into corporate recruiting and eventually grew into her current role, where she manages all company communications and leads her community partnerships and charitable giving initiatives. Parker is part of the second generation of the business. Her father, Greg Parker, is the founder and executive chairman of the company. Parker’s colleagues noted her ability to humanize the company brand and her passion, talent and commitment to take the company to new heights.

What is the biggest issue facing convenience stores today? “One of the biggest issues facing convenience stores today is finding and retaining reliable staff while balancing rising operational costs and evolving customer expectations for speed, technology and fresh options.”

GAREK PETERS, 28

Administrative Director

Company: Pete’s Corp.

Headquarters: Parsons, Kan.

Number of Stores: 52

C-Store Banner Name(s): PETE’S Years with the Company: 9

Garek Peters, a second-generation member of the business, graduated from Pittsburg State University in the fall of 2020. He began his career with PETE’S as a part-time maintenance tech while going to school. After graduation, he became a store manager, followed by a district supervisor role overseeing multiple stores. He then was able to job shadow multiple roles across the company, which included field work and at the home office in Parsons, Kan. He saw payroll, human resources, auditing, project development, technology, safety, marketing and all facets of the business from a high-level standpoint. Peters has been in his administrative director role now for over two years and works closely with the project

manager on all projects. This includes, but is not limited to, new-to-industry stores, store renovations, concrete work and fueling facility upgrades. Peters is known as an energetic and innovative thinker, who is driven to improve the business and support the industry.

What is the biggest issue facing convenience stores today? “Intense competition moving into territory and the cost of labor.”

SARAH PINGREE, 28

Product Development Manager

Company: 7-Eleven

Headquarters: Irving, Texas

Number of Stores: 86,000 globally, 13,000 in U.S. and Canada

C-Store Banner Name(s): 7-Eleven Years with the Company: 4.5

Sarah Pingree began her career with 7-Eleven nearly five years ago and has worked her way up the ladder through creative thinking and a process-driven approach to innovation. Pingree has applied her operational expertise to her current role on the private brands team, where she currently drives product development strategy for beverages. In the past year alone, Pingree has led the launch of 27 new products and opened

five white space areas within the beverage portfolio. Colleagues have noted that Pingree is gifted both as an innovator and a leader, serving as a central figure in 7-Eleven’s product development pipeline where she is known for her ability to navigate complexity, build consensus and keep teams focused. Pingree is also a member of 7-Eleven Young Professionals, where she contributes to talent development, cultural engagement and peer mentorship.

What do you think today’s young executives bring to the table? “Today’s young executives bring fresh perspectives, visionary thinking and a strong focus on innovation and purpose-driven leadership.”

NICHOLAS REED, 29

Category Manager

Company: Pilot Co.

Headquarters: Knoxville, Tenn.

Number of Stores: 659 in U.S.

C-Store Banner Name(s): Pilot, Flying J, One9 Years with the Company: 8

Nicholas Reed started out as a college summer intern working for Pilot within the merchandising department. He was fortunate enough to land a full-time opportunity with the company once he graduated from Miami University. He started off as an entry-level coordinator on the grocery team (pre-packaged food) and cut his teeth learning category management on that side of the business. Reed worked his way up to the role of category manager on the grocery desk and then had the opportunity to shift over to cooler (all packaged beverage) earlier this year. He is known for his collaborative mindset, openness to partnership and commitment to leveraging insights to drive performance.

What is the biggest issue facing convenience stores today? “Increased competition from within and outside the industry.”

NICK RIEMER, 29 Manager of Fuel Construction and Infrastructure

Company: H-E-B

Headquarters: San Antonio

Number of Stores: 266

C-Store Banner Name(s):

H-E-B Fuel, H-E-B Fresh Bites Years with the Company: 3

Nick Riemer graduated from Northern Illinois University with a mechanical engineering degree. Following graduation, he moved to Texas when he was offered a job as a construction estimator for a fuel system contractor, where he was tasked with building up the company’s construction capabilities. It was during this time where Riemer discovered his passion for the c-store industry, driving him to educate himself about the industry and participate in many different retail operator projects. One of such projects was for H-E-B, where he now oversees all forecourt and fuel design decisions. This past summer, Riemer obtained his professional engineer license. Colleagues have noted that he is a forward-thinking leader whose vision and drive has delivered measurable results for his team, his industry and his community.

What do you think today’s young executives bring to the table? “Nontraditional ideas that may challenge the status quo.”

JACK RILEY, 25

Marketing Manager

Company: Weigel’s Stores Inc.

Headquarters: Powell, Tenn.

Number of Stores: 86

C-Store Banner Name(s): Weigel’s Years with the Company: 2

Jack Riley’s journey with Weigel’s began when he was in college at the University of Tennessee, during which he was a part of the American Marketing Association and was selected for the AMAze group, where students collaborated on real-world client projects. Riley’s assigned client was Weigel’s, and he would develop the branding for what has become a signature food offering for the chain — Dippin’ Chicken. Because of the impact of the project, Weigel’s hired him as a data analyst intern before he transitioned to the role of marketing manager. Today, Riley oversees a wide range of marketing initiatives, from the MyWeigel’s loyalty program to digital strategy, segmented campaigns and even wearing the mascot uniform.

What do you think today’s young executives bring to the table? “Young executives bring community to the convenience industry. We understand the power of technology and data, but we bring a renewed sense of care for our neighbors. We will not only drive growth but we have the potential to heal and change the world.”

ERIN STAPLETON, 39

IT Product Manager

Company: RaceTrac Inc.

Headquarters: Atlanta

Number of Stores: 829

C-Store Banner Name(s): RaceTrac and Raceway

Years with the Company: 6

Erin Stapleton joined RaceTrac in 2019 in the employee experience group in the human resources (HR) department. During the COVID-19 pandemic, she learned to adapt and grow her skills in other HR areas, which led her to a role as an HR business partner. After nearly three years in HR, she took her skills in relationship building, organization and strategic partnership to the special projects team as a project manager and eventually a senior manager of that team. As senior manager,

she played a key role in developing standardized processes and templates RaceTrac now uses to manage projects. Her last project was focused on bringing on a new point-of-sale system, which piqued her interest in IT. She recently made the switch to a newly created IT product management role for store systems and is looking forward to creating processes and managing the innovation in this space. What project or innovation are you most looking forward to in 2026?

“Bringing Potbelly into our family of companies!”

MICHAEL TARNOW, 34 Environmental Compliance Manager

Company: Southwest Georgia Oil Co. Headquarters: Bainbridge, Ga. Number of Stores: 81

C-Store Banner Name(s): SunStop Years with the Company: 4

Michael Tarnow brings an incredibly unique background to the c-store industry. Tarnow began his career as a U.S. Navy Corpsman for approximately 12 years, where he also earned two bachelor’s degrees in the process. He has worked as a research technician for a limnology lab and a county health inspector, which both widened his knowledge and provided him with more experience in leadership roles. Today, as environmental compliance manager at Southwest Georgia Oil, Tarnow’s responsibilities span a wide range of critical tasks from ice sampling and tank monitoring to regulatory compliance and much more. According to colleagues, Tarnow differentiates himself through his relentless drive, intellect and determination to understand and master the c-store industry. Tarnow is known as a true team player who isn’t afraid to roll up his sleeves and tackle the hands-on work that environmental management requires. What do you think today’s young executives bring to the table? “Innovative concepts to push businesses to the next level.”

KYLE TOOLEY, 30

Category Manager, Center of Store

Company: Tooley Oil Co.

Headquarters: Sacramento, Calif.

Number of Stores: 17

C-Store Banner Name(s): Mixx Market

Years with the Company: 5

Kyle Tooley is a third-generation member of his family business Tooley Oil Co./Mixx Market. His grandfather (Mick) started the company in 1978. His father (David) and uncle (Michael) are currently co-presidents. Tooley grew up in the stores, and after a few years outside of the industry, he officially joined the family business in 2020. Over the last

five years, Tooley has held numerous roles, from acting as area manager to running the chain’s loyalty program and mobile app to managing its foodservice program to overseeing categories. In 2024 he also successfully helped with the rebrand of the retail chain from Tooley Oil to Mixx Market.

What project or innovation are you most looking forward to in 2026?

“More smaller players gaining market share.”

TOM TURNBAUGH, 38

VP — Finance & Accounting

Company: Rutter’s

Headquarters: York, Pa.

Number of Stores: 92

C-Store Banner Name(s): Rutter’s

Years with the Company: 5

Tom Turnbaugh spent the first eight years of his working career at Foot Locker in Camp Hill, Pa. In his eight years there, he held five different positions, ranging from financial analyst to senior management prior to his departure. Turnbaugh came over to Rutter’s as the director of financial planning and analysis (FP&A) in the heart of the COVID-19 pandemic in June 2020. Since joining Rutter’s, he’s served as director of FP&A, senior director of FP&A, senior director of accounting and finance and finally his current role of VP of accounting and finance. His colleagues commended his work ethic and leadership and noted that he’s not afraid of a challenge.

What is the biggest issue facing convenience stores today? “Continuing to find new and innovative ways to differentiate your business while navigating state and county restrictions.”

J’LYN WASH, 29 Senior Accounting Supervisor

Company: 7-Eleven Inc.

Headquarters: Irving, Texas Number of Stores: 86,000 globally, 13,00 in U.S. and Canada

C-Store Banner Name(s): 7-Eleven Years with the Company: 6

J’Lyn Wash joined 7-Eleven as an accounting coordinator contractor after graduating from Texas Woman’s University. In this role, Wash supported development projects and cross-functional teams. Wash later transitioned to the digital team, where she contributed to store accounting development for 7NOW and Marketplace before being promoted to staff accountant. She now serves as senior accounting supervisor for the banking team, where she applies her unique insights from her diverse experience. Colleagues noted Wash boasts exceptional technical expertise and also an uncanny ability to lead through complexity, in addition to prowess in leadership, problem solving and a commitment to operational excellence. Wash now oversees revenue accounting for more than 10,000 stores across the U.S. and Canada.

What do you think today’s young executives bring to the table? “I believe young executives bring an open mind and willingness to challenge the status quo.”CSD

The 2025 Power Report

As customers demand innovation from pizza, limited-time offers, unique menu additions and bold flavors are shaping the future of the c-store pizza segment.

Kevin McIntyre •

Associate Editor

AS RETAILERS FACE RISING COSTS, increasingly discerning consumers and economic uncertainty, it is now more important than ever to double down on foodservice — a c-store category that has been growing exponentially over these past few years. C-stores are giving quick-service restaurants (QSR) a run for their money, and operators should be looking to pizza as a strong, cost-effective and popular option for customers looking for a quick bite.

This battle between QSR and convenience is nothing new, but it is starting to lean more in the favor of c-store retailers as consumers are seeking out more budget-friendly offerings while c-stores ramp up foodservice efforts to match those of QSRs.

Customer satisfaction, according to the PMQ Pizza DELCO Repot, is neck and neck, with c-stores coming in just 1% behind large pizza chains and edging out

mid-sized chains in that same category.

Another category c-stores have been excelling in is taste ratings, which notched a response of 86% in the PMQ Pizza DELCO Report, beating out both large and mid-sized pizza chains.

Bruce Reinstein, partner at Kinetic12, a management consulting firm focused on foodservice, noted that c-store retailers have a “big advantage over QSRs because you can be pumping your gas while they’re cooking your pizza.”

In other words, convenience stores are uniquely positioned to capitalize on just what the name suggests — convenience.

Once customers are in the store, however, retailers must have a solid plan in place when it comes to menu variation, product quality and marketing.

“The nice thing about pizza is that it’s more profitable than any other item,” said Reinstein. “The other thing is, it lends itself to bundling. There’s a great

opportunity, especially in a c-store where there are a lot more (offerings) than a QSR, so they can bundle it in really unconventional ways.”

TRENDS AND FLAVOR PROFILES

The c-store pizza customer in 2025 is demanding, above all, innovation. Led by Gen Z, the new generation of consumers is especially attracted to non-traditional offerings and strong, bold flavors from around the world.

There is certainly still demand for traditional pizza, but according to Reinstein, the way to win over younger customers is with unique and unusual menu items.

“If you want to appeal to the younger consumer, you can’t do it with cheese pizzas and pepperoni pizzas,” he said.

To capitalize on the non-traditional consumers, Reinstein suggested getting creative and monitoring customer feedback and return rates.

Casey’s has evolved its offerings from staples such as cheese and pepperoni to Breakfast Pizza and innovations like BBQ Brisket and Taco pizzas.

“Anything with bold flavors is in. … So that’s why you’ll see pizzas (with international flavors); we’ve seen Asian pizzas for a while, but you’re also going to see pizzas from all over the world,” he continued.

Customers are also seeking out different styles of pizza, including Detroit style, which Reinstein noted has been especially hot in 2025.

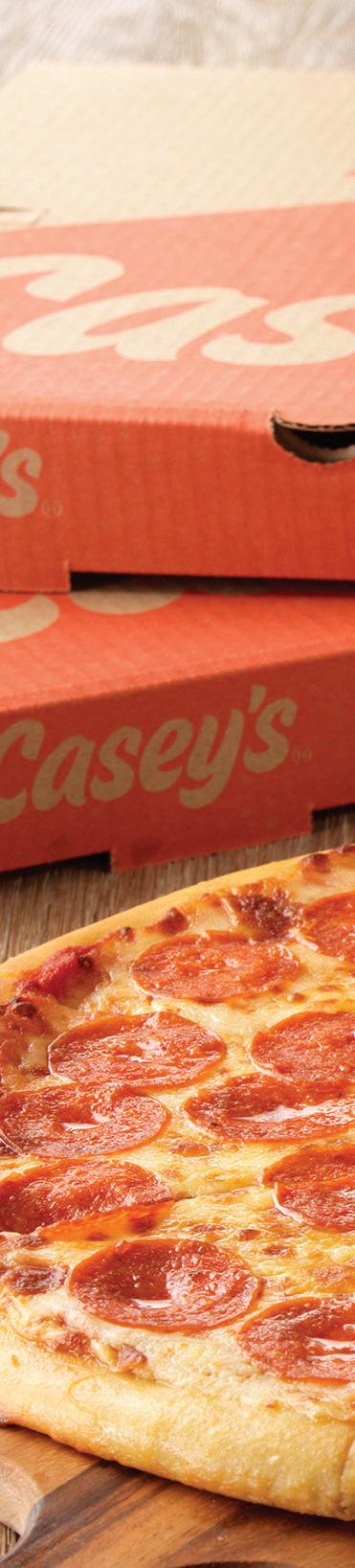

A PIONEERING FORCE

When it comes to c-store pizza, it is impossible to ignore Ankeny, Iowa-based Casey’s, which has long touted the title of the fifth-largest pizza chain in the U.S. Casey’s pizza program marked its 40th anniversary this year, beginning at just a few stores with a handful of menu items, according to Brad Haga, senior VP of prepared food and dispensed beverage at Casey’s, which operates over 2,900 stores in 19 states.

Over the years, said Haga, the chain

has evolved its offerings from classic staples to Breakfast Pizza and bold innovations like BBQ Brisket and Taco pizzas.

“Every step of that journey has been shaped by our guests’ feedback, who inspire the fresh ideas that define Casey’s pizza today,” Haga continued. “One thing that hasn’t changed in these 40 years is that we still make our dough from scratch every day, in every store, and it truly delivers a superior experience.”

Casey’s is proud of being a hometown pizza joint, with two-thirds of its store network located in rural communities.

When it comes to its menu, the company leans on not only the opinions and feedback of its customers, but also its team of culinary experts. Casey’s has built a team of employees with backgrounds in the culinary arts, kitchen operations, food safety and science who “continually innovate, experiment and perfect new recipes in our test kitchens,” said Haga.

“We have thousands of pizza makers in our stores across the country who bring Casey’s pizza to life in every store, every day,” he continued. “Some of their own innovations even make it onto our menu as part of an annual internal pizza competition, where pizza chefs from our stores go head to head with their wildest, tastiest creations.”

THE CASEY’S CUSTOMER IN 2025

While pizza innovation may be a key customer demand, Casey’s top seller is still pepperoni. The differentiator for Casey’s, however, is its dominance across the breakfast daypart.

Casey’s breakfast pizza is a top seller for the retailer, but it is not the only standout offering. The company’s limited-time offers (LTO) continually drive in-store sales, providing “a powerful way to introduce new flavors, get real-time feedback from our guests and keep our

A Look At The Pizza Competition Landscape

CStore Decisions’ friends at PMQ share a snapshot of what pizzerias are experiencing.

Rick Hynum and Charlie Pogacar • PMQ Magazine

ABOUT 15 YEARS AGO, Domino’s shocked the pizza industry with a frank admission: “We know our pizza sucks.” That ad campaign, in which the chain owned its flaws and unveiled a new and improved recipe, was a watershed moment in pizza history. Not only did it turn around Domino’s fortunes in dramatic fashion, it marked the beginning of Domino’s shift to a “tech company that sells pizza” — setting it on the path to becoming the world’s largest pizza chain. Since then, it has reportedly tripled its domestic sales and grown its U.S. store count by 42%.

Granted, some independent pizzerias still look down their noses at chain pizza. But millions of consumers around the country disagree, judging by the continued explosion of chain locations nationwide. And the fact is, the leading brands have stepped up their game this year in terms of menu innovation, from Domino’s Parmesan Stuffed Crust Pizza to Pizza Hut’s Crafted Flatzz and Papa Johns’ Garlic 5-Cheese Crust.

Simply put, chain pizza keeps getting better. The same goes for “gas-station pizza.” And, for that matter, frozen pizza. Faced with a higher level of competition and the same economic tumult that made 2024 a hard slog, some operators might feel like they’ve been holding on for dear life this year.

“Well, don’t let go,” said Michael LaMarca, master franchisor of Master Pizza, headquartered in Mayfield Village, Ohio. He just opened Master Pizza’s 14th store in mid-October. And he’s exactly the kind of clear-eyed optimist this year’s Pizza Power Report calls for.

“… The restaurant industry is definitely having some turbulent times with higher costs and the labor market,” LaMarca said. “But what makes pizza stand out more than other segments, I believe, is that pizza is in really high demand right now. I

think the outlook is strong and positive.”

The fact that customers want pizza any way they can get it (including from convenience stores) speaks to its perennial and widespread appeal. According to the American Bakers Association’s 2025 Bakery Playbook, 86% of Americans have eaten pizza or flatbread in the past year. Among Generation Z consumers, more than 40% said they eat pizza most days, every couple of days or at least once a week. And not just for lunch or dinner — they crave it for breakfast or as a snack across dayparts.

“Pizza is so beloved,” LaMarca said. “People have a passion for pizza. You can go to any Facebook group and ask, ‘What’s your favorite pizza?’ and 500 messages will come up, with people arguing back and forth. You don’t see that with hamburgers or steaks.”

According to IBISWorld’s “Pizza Restaurants in the U.S. — Market Research Report,” in June 2025, U.S. pizza restaurant revenue will reach $49.5 billion this year. Illustrating LaMarca’s point about pizza’s rising popularity, more non-pizza restaurants are adding it to their menu, striving to improve their margins and to meet consumer demand for customizable and social foods. “Still, de mand for pizza restaurants has persisted, despite and somewhat because of the high inflation and economic uncertainty … and the number of piz zerias continues to rise,” the report stated.

Even so, LaMarca con ceded, looking at your bottom line can give you a headache. “Sales are pretty strong, but costs are up with labor and cost of goods sold. One of the prevailing challenges

right now is profitability.” There’s a lingering perception among customers that pizza should always be cheap, he said. “In fact, flour, tomatoes, cheese — these are expensive commodities. Twenty years ago, the margin was a lot bigger. To operate your business now, you have to be lean and mean to even (achieve) 2-3% profitability.”

On that front, a mid-2025 report from Restaurant365, a restaurant management platform, offered a sobering analysis. The report reflected input from 5,000-plus restaurateurs across all segments. And 89% of respondents said their labor costs shot up this year, while 91% said their food costs were up. Those respondents also fretted over how federal tariffs could further raise food costs. Sixty-four percent anticipated their food costs will rise between 1-10% due to tariffs alone, while 29% expected increases in the range of 11-25%. Seven percent are bracing for food cost hikes of 26% or more.

Casey’s leans on the opinions and feedback of its customers as well as its team of culinary experts for the menu. The chain also considers current trends, such as spicy snacks, which gave rise to Casey’s Chorizo Breakfast and Jalapeño Popper pizzas.

menu fresh and fun,” said Haga.

Casey’s is always keeping an eye on flavor profile trends, combining feedback from customers with research and local insights to create pizza offerings that are geared specifically to their communities.

“As an example, spicy snacks are having a moment, and Casey’s is keeping pace with the trend, delivering bold, crave-worthy flavors in the pizzas we launch like our Chorizo Breakfast and Jalapeño Popper pizzas,” noted Haga.

In November, the chain introduced two new specialty pizzas — an elevated FourCheese Pizza and the Sweet Heat Pizza, which features Italian sausage, pepperoni and a drizzle of Mike’s Hot Honey.

“Pizza and Casey’s are synonymous. It is what we’re known for and a key pillar of our continued growth. Our quality and taste are second to none, and we are always seeking new ways to make our pizzas even better,” Haga concluded.

CRAFTING CROSBY’S MENU

Another dominating force in the cstore pizza game is Lockport, N.Y.-based Crosby’s, which operates 88 stores in New York and Pennsylvania. Crosby’s pizza program began with an acquisition of an 11-store chain in Hamlin, N.Y., and has taken off at a rapid pace since.

At the time, Crosby’s pizza format fol-

lowed the industry standard, with the kitchen tucked away in the back of the store out of view of customers. Today, the chain completely flipped the script, and stores now feature glass-top units that are visible right when you walk in, offering customers the chance to watch their food being prepared right in front of them.

One thing that has never changed about Crosby’s pizza program, however, is the quality of its ingredients.

“We have made it a point to make sure everybody knows that we’re using fresh ingredients,” said Jeff Russell, director of food service at Reid Petroleum Corp., parent company of Crosby’s. “We’re not pulling a frozen wrapped pizza out of a freezer and just throwing it into (an oven). We are handmaking pizza every day.”

Crosby’s pizza ingredients are cut daily and never frozen. The chain uses live yeast dough, fresh sauce and fresh cheese. With top-of-the-line ingredients and an in-store emphasis on foodservice operations, the focus then shifts to crafting a unique and innovative menu that hinges on, above all, variety.