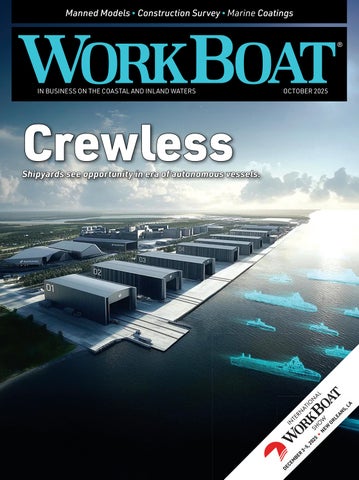

Crewless

Shipyards see opportunity in era of autonomous vessels.

DECEMBER3-5,2025▬ NEWORLEANS,LA

Located in northeast Florida — two nautical miles from the Atlantic Ocean — BAE Systems has recently enhanced its shipyard capabilities by 300% to haul and repair vessels. This expansion enables us to deliver faster turnaround times and more efficient maritime operations, supporting the complex needs of our East Coast and Caribbean customers. Contact us to learn how we can help you stay ahead of the tide.

baesystems.com/commercialshiprepair

FEATURES

14 Focus: Dam Right

$770 million chamber project will support 13,000 jobs.

16 Focus: Starting Small

Mariners hone their skills aboard scale model ships.

26 Cover Story: Sector Shift

Shipyards focus their attention to national defense.

32 Construction Survey

A list of vessels under contract, under construction, or delivered in the past 12 months.

BOATS & GEAR

18 On the Ways

• MBARI adds flagship research vessel • Retractable towboat delivered to Golding Barge Line • Bay Weld builds tour boat for Juneau • Tractor tug launched for McAllister Towing • Irish-built pilot boat delivered to Miami • Shaver Transportation’s new ship-assist tug launched • Hopper dredge delivered to Great Lakes Dredge & Dock • Demonstrator uncrewed vessel christened • SAFE Boats wins fireboat contract • Steel cut for cutter Icarus • Moran Towing’s new tug goes to work in New York • Port Houston orders hybrid-electric tour boat.

42 Slick Talk

The right paint protects from the elements.

46 Bridging the Gap

New DoD opportunities could open for maritime tech suppliers.

NEWS LOG

6 Trump administration deals blows to offshore wind industry

6 New class of Coast Guard cutters named.

6 US will accelerate pace of offshore oil and gas leasing.

6 LNG bunkering guidelines updated

8 On the Water: Ready, set, throw.

8 Inland Insider: Falls overboard continue to concern industry.

9 Energy Level: Energy transition kicked down the road by reality.

9 Insurance Watch: Are you protected from employee lawsuits?

11 Legal Talk: Where there’s a will…

12 Captain’s Table: Coast Guard cyber overwatch.

10 Health, Safety, and Environment: NSMV program over the hump.

12 Credentialing Insight: New tools offer credential status checks.

2 Editor’s Watch

50 Port of Call

55 Advertisers Index

56 WB Looks Back

SAVE THE DATE

Spread the News

Attend any maritime conference, and you’ll likely hear about the workforce challenges that continue to plague nearly every corner of the industry, from shipyards and their suppliers to the crews aboard vessels. A common refrain is that the maritime sector, which so often operates outside the public eye, needs to do a better job of telling its story. The thinking goes: if young people are exposed to the maritime world and the opportunities it offers, they’ll be more likely to pursue careers within it, helping to alleviate the industry’s workforce woes.

Like any industry facing a demographic cliff, maritime needs to cultivate interest, and good storytelling is one way to start.

Right now, though, most of the maritime news that hits the mainstream is overwhelmingly negative. Accidents, disasters, controversies. The Ever Given became a household name and a viral meme when it ran aground and blocked the Suez Canal in 2021. But how many Americans know the names of the new training ships being built for the nation’s state maritime academies? How many even know they exist?

It’s a strange contradiction: an industry that keeps the global economy moving is mostly unseen until something goes wrong. That lack of visibility comes at a cost. If the public doesn’t see the maritime world as relevant, and young people don’t see a place for themselves in it, how can we expect them to step up as future workers, policymakers, or innovators?

There are plenty of people in the

Eric Haun, Executive Editor ehaun@divcom.com

U.S. workboat industry who are eager to tell their stories. Shared with the right audience, they might even inspire someone who has never set foot on a boat to consider a future on the water.

But there are also many — perhaps more than ever — who prefer to remain in the shadows. For some, it’s a matter of operational security or business strategy, an effort to maintain competitive advantage. That’s understandable. But it’s also a missed opportunity.

As part of the maritime trade press, I strive to stay objective. But I’ll admit I’m biased on this one. I want to see more of these stories brought to light, not just for the sake of our pages, but for the future of the industry.

EXECUTIVE EDITOR Eric Haun / ehaun@divcom.com

SENIOR EDITOR Ken Hocke / khocke@divcom.com

SENIOR ASSOCIATE EDITOR Benjamin Hayden / bhayden@divcom.com

SENIOR ASSOCIATE EDITOR Kirk Moore / kmoore@divcom.com

CONTRIBUTING WRITERS

Tim Akpinar • Jonathan Barnes • Capt. Alan Bernstein • Stephen Blakely Dan Bookham • G. Allen Brooks • Bruce Buls • Capt. Eric Colby • Casey Conley

Michael Crowley • Jerry Fraser • Nate Gilman • Pamela Glass • Capt. Arnie Hammerman Craig Hooper • Joel Milton • Richard Paine Jr. • Chris Richmond

DIGITAL PROJECT MANAGER / ART DIRECTOR Doug Stewart / dstewart@divcom.com

ADVERTISING ACCOUNT EXECUTIVE S

Mike Cohen 207-842-5439 / mcohen@divcom.com

Kristin Luke 207-842-5635 / kluke@divcom.com

Krista Randall 207-842-5657 / krandall@divcom.com

Danielle Walters 207-842-5634 / dwalters@divcom.com

ADVERTISING COORDINATOR

Wendy Jalbert 207-842-5616 / wjalbert@divcom.com

Producers of The International WorkBoat Show and Pacific Marine Expo www.workboatshow.com • www.pacificmarineexpo.com

PRESIDENT & CEO Theodore Wirth / twirth@divcom.com

VICE PRESIDENT Wes Doane / wdoane@divcom.com

PUBLISHING OFFICES

Main Office 121 Free St., P.O. Box 7438, Portland, ME 04112-7438 207-842-5608 • Fax: 207-842-5609

McDermott Light & Signal

Dredge Lights

Meets 2 mile requirement for marking of dredge pipelines

Solar Marker Lights

1 to 3 mile visibility for aids to navigation and applications such as buoys, docks, barges, and temporary lighting

Permanent mount LED lighting for bridges, docks, and barges

Navigation Lights

For vessels greater or less than 50 meters Certified to meet UL 1104 and Subchapter M Platform Marker

Solar or battery powered barge navigation lights for unmanned barges per UL1104

Regulatory Buoys

Available for all applications

*Available with or without lighting*

Trump administration deals blows to offshore wind industry

In a sweeping escalation of its campaign against clean energy, the Trump administration has delivered a series of decisive blows to the U.S. offshore wind industry, triggering widespread alarm among investors, state leaders, and energy advocates. In August, President Trump ordered the abrupt halt of work on the nearly nished Revolution Wind project off Rhode Island, invoking “national security” concerns to stop the $1.3 billion offshore wind farm, now 80% complete. The decision forced the project’s developer, Ørsted, to reevaluate its legal options as its share price plunged.

Simultaneously, the administration has launched efforts to block US Wind’s $6 billion Maryland Offshore Wind Project by seeking to vacate the project’s federal permit — a move that some industry observers warn could weaken investor con dence and affect energy planning.

These actions follow an executive order issued earlier this year that paused all new offshore wind leases and licensing. The order has drawn criticism from clean energy proponents who argue the moves are politically motivated and could hinder the country’s energy transition.

The Trump administration defends its position by citing economic, environmental, and national security concerns. Of cials argue offshore wind projects could harm marine ecosystems, raise consumer costs, and interfere with maritime and military operations. Trump has also questioned the reliability and appearance of offshore turbines, framing his opposition as support for traditional energy and national interests.

Democratic leaders from Rhode Island and Connecticut have denounced the Revolution Wind halt, calling it shortsighted and harmful to both economic and environmental goals. They assert that hundreds of long-term union jobs and electricity for more than 350,000 homes are now imperiled. State attorneys general and environmental groups have launched lawsuits, alleging the administration’s moves out procedural and legal norms.

Meanwhile, the broader offshore wind supply chain — from shipbuilders to cable manufacturers — is facing increased uncertainty, with multiple projects delayed or canceled and expected investments now in question.

— Eric Haun

News Bitts

New class of Coast Guard cutters named

TheCoast Guard announced that its new fl eet of waterways commerce cutters (WCC) will be designated the Chief Petty Offi cer class. Each cutter will be named in honor of a Coast Guard chief petty offi cer. The WCCs — which are being constructed at Birdon ’s Bayou La Batre, Ala., shipyard — will replace the Coast Guard’s aging river tender fl eet, used for maintaining aids to navigation, ensuring the safe movement of goods, energy, and materials across U.S. waterways.

US will accelerate pace of offshore oil and gas leasing

The Department of the Interior is rolling out a long-term schedule for off shore oil and gas lease sales as directed by the One Big Beautiful Bill Act (H.R. 1). The plan includes at least 30 lease sales through 2040 in the Gulf of Mexico, which President Trump has renamed the Gulf of America, as well as six lease sales in Cook Inlet through 2032. The schedule represents a major shift from former President Biden’s administration, which had planned historically few drilling rights auctions.

LNG bunkering guidelines updated

Eff

ective July 24, the Coast Guard has updated guidelines for Coast Guard captains of the port overseeing the bunkering of liquefi ed natural gas and other alternative marine fuels. Superseding the 2015 policy, this update addresses regulatory gaps surrounding non-petroleum fuels and supports the maritime industry’s shift toward lower carbon emissions. The policy encourages risk-based assessments over prescriptive rules, urging collaboration with harbor safety committees and requiring fuel suppliers to submit detailed bunkering proposals and risk assessment plans.

President Trump ordered an abrupt halt to construction of the 80% complete Revolution Wind offshore project off the coast of Rhode Island.

On the Water

Ready, set, throw

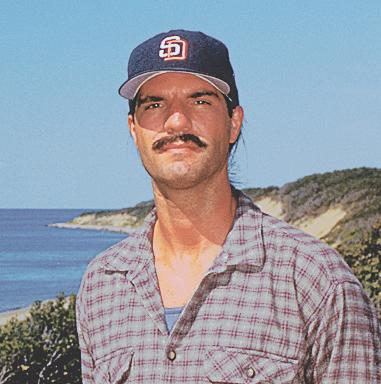

WillBY JOEL MILTON

Joel Milton works on towing vessels. He can be reached at joelmilton@yahoo.com.

we be putting out a line?” This is a frequent question posed to tug captains and mates by deckhands before doing assists. My standard answer, given before we even get close to beginning a job, is simple and consistent: “I don’t know, and it doesn’t matter.” This isn’t a flippant or “gotcha” answer. It’s a practical necessity.

Why don’t I know? Maybe because my counterpart on the tug and barge we’re assisting doesn’t yet know. Why doesn’t it matter? Because whatever the plan is, it can change quickly — and being prepared for a range of possibilities is essential.

Inland Insider

Falls overboard continue to concern industry

TheBY PAMELA GLASS

Pamela Glass is the Washington, D.C., correspondent for WorkBoat. She reports on the decisions and deliberations of congressional committees and federal agencies that affect the maritime industry.

inland industry is taking a deeper dive into improving crew safety, as falls overboard continue to be the leading cause of mariner fatalities onboard barges.

In July, the American Waterways Operators (AWO), which represents the tugboat, towboat, and barge industry, released a comprehensive report examining causes of falls and recommending prevention strategies. Meanwhile, in August, inland companies across the country participated in a “Falls Overboard Safety Standdown Day” in which crews and company leaders discussed safety procedures and safe deck behavior, and reviewed the use of buddy systems, personal protective equipment, and fall restraints.

According to data collected by AWO and the Coast Guard, falls overboard are the top cause of crew fatalities in the tugboat, towboat, and barge industry, with 84% of overboard incidents involving slips, trips, or loss of balance at night or near unguarded vessel edges. The second leading cause (26%) was distraction or lack of situational awareness.

Most falls occurred on barges, as opposed to tugs and towboats, equipment, or facilities, and happened to both new

So, the answer is always this: be ready ahead of time for whatever might foreseeably happen, without prompting, and don’t ever be surprised by a curveball. They might want a line — or not. They might start with no line and then have us put one out mid-evolution. Or the other way around. Or we might put out a line, work, take it back in, switch locations or sides, and then put it back out again. It might be on either side — or both. It might be single-part or double (two-part). Lastly, the personnel on the barge or ship may — or may not — throw down a heaving line.

What exactly does it mean to be ready? It’s not complicated. Have at least two lines on deck, coiled neatly for immediate deployment. If you know ahead of time that a two-part line will be used, then pre-rig it; otherwise, be ready to quickly go either way without delay. Have heaving lines — plural — ready to go. That means ready to pick up and throw immediately from where you stand. Not hanging on a hook on the back deck. Not stowed for sea in a locker. Not in a tangled ball somewhere. Not decoratively coiled for hanging on a rail. Ready. To. Throw. Got it?

Now apply this principle to every other deck evolution where seconds can count, and you’re on your way to becoming a real professional.

and experienced mariners, mostly deckhands, according to the AWO report. Between 2012 and 2024, a total of 118 falls overboard were reported, with the most occurring in 2024 (20), followed by 2023 (12) and 2022 (12).

The industry has made big strides in reducing fatalities, due largely to a partnership between operators and the Coast Guard over the past few decades, but falls overboard continue to be a problem. AWO President Jennifer Carpenter, noting that the industry is “the safest mode of freight transportation in the United States,” said operators are committed “every day to doing better.”

The report identifies a common hazard that contributes to falls on all vessel types: the lack of effective barriers and other controls to guard the perimeter edge of vessels. This is a common hazard on unmanned barges.

The AWO report offers a multilayered approach to solutions tailored to a range of operations and vessel types, and extends guidance for integrating these strategies into a company’s safety management system. These include use of interior gunwales for transit rather than unguarded perimeters; hands-free mooring systems that raise or lower a barge while locking without crew intervention; installation of guardrails, restraint systems and scaffold board; use of non-stick deck coatings and visual alerts; improved de-icing procedures, training for situational awareness and crew fatigue, and expanded use of fall restraint systems and horizontal lifelines.

Improvements can also be made to future vessel design and construction by making walkways wider, relocating inboard working areas, and adding remote drafting and gauging devices that prevent the need for crew to access the edge of a barge for drafting or surveying.

Energy Level

Energy transition kicked down road by reality

BY G. ALLEN BROOKS

G. Allen Brooks is an energy analyst. In his over-50year career in energy and investment he has served as an energy security analyst, oil service company manager, and a member of the board of directors for several oilfield service companies.

Energy analysts are increasingly concerned about the oil and gas industry's ability to discover new resources. This shift comes as projections now assume a delayed arrival of peak oil, reflecting growing global resistance to rapid decarbonization efforts that often overlook societal costs.

Evidence of this pushback is widespread, as public resistance to solar and wind projects continues to grow. Intermittent renewable power has become an increasing operational challenge. Additionally, the economic burden of renewable energy subsidies has led many governments to dismantle incentive programs — most notably in the United States, where the recently enacted One Big Beautiful Bill Act curtails or bans such subsidies. The economics of unsubsidized renewable energy now present a fresh challenge.

Global energy demand is surging, forcing utilities to extend the life of aging power plants to maintain grid reliability. At the same time, soaring electricity use from data centers and AI is driving growth not seen in decades. In response, utility executives are reassessing grid flexibility and planning how to ensure sufficient supply.

Energy consultancy Wood Mackenzie revised its forecast due to a delayed energy transition, and it is now projecting that peak oil will occur well after 2030. The firm estimates that this delay will increase oil demand by 5%, adding 100 billion barrels by 2050. This projection aligns with the levels of oil consumption seen during the 2010s. While the scenario may reflect a balance between idealism and current realities, long-held demand outlooks from ExxonMobil and Chevron are increasingly being echoed by other forecasters and industry players.

The concern is whether the oil and gas industry has the capital and expertise to uncover sufficient new resources. Every major international oil company has announced increased exploration and production spending, with some making highly promising discoveries. These finds suggest the issue is not a shortage of oil, but the effort and investment required to locate and develop it.

The world is now realizing that if the oil and gas industry fails to deliver these new supplies in a timely manner, we could face another oil price “super spike” — similar to the one in 2008, when prices neared $150 per barrel. Such a spike would disrupt global economies, drive inflation higher, and push more people into “energy poverty.” That risk may be greater than that of a delayed energy transition.

Insurance Watch

Are you protected from employee lawsuits?

ABY CHRIS RICHMOND

Chris Richmond is a licensed mariner and marine insurance agent with Allen Insurance and Financial. He can be reached at 800-439-4311 or crichmond@allenif.com.

s a business owner, your employees are an important part of your operation. Depending on their job description, your employees may be covered under your Workers’ Compensation, United States Longshore and Harbor Workers’ Compensation Act, or Jones Act policy.

But what protects you, as the employer, when one of your employees makes a claim against you? Unless you have employment practices liability insurance (EPLI), you may be left with no coverage

EPLI is used to cover claims made against an employer by an employee for discrimination, wrongful termination, sexual harassment, or retaliation. While these are the most common types of claims, others can include failure to promote, invasion of privacy, defamation, or negligent evaluation.

One of the more important aspects of this type of coverage is defense costs, which, as you can imagine, can mount quickly. Unfortunately, most EPLI policies include defense costs within the policy limits. In other words, your defense can eat up a significant portion of your total liability limits before any judgment is awarded.

Because of this, you should consider higher limits; often, the premium increase for an additional $1 million in coverage is minimal.

Those covered under an EPLI policy include your employees, management, and your directors and officers. An endorsement can be added to the policy to also include third-party coverage, which provides protection against claims made by nonemployees.

One area that employers should keep in mind is the potential for claims related to the accessibility of their websites. Your EPLI policy may offer some coverage here, but only if you have third-party coverage. This can provide protection for potential claims made under the Americans with Disabilities Act.

EPLI can often be attached to a workers’ compensation policy, a directors and officers policy, or written as a standalone policy. Limits can vary, so be sure to compare coverages.

Whichever way you obtain it, EPLI is an important part of your risk management strategy — and one that can prove to be very useful in our increasingly litigious society. If your agent has not brought this up, be sure to give them a call and ask for a quote.

Health, Safety, and Environment

NSMV program over the hump

BY RICHARD PAINE JR.

Richard Paine, Jr. is a licensed mariner and certified maritime safety auditor with over 25 years of maritime industry experience. He is currently a senior VP at the Hornblower Group and can be reached at rjpainejr@gmail.com.

Over the summer, Marad celebrated the completion of the third newly constructed national security multimission vessel (NSMV) from Hanwha Philly Shipyard. The State of Maine, which will call home at Maine Maritime Academy, now joins the Empire State VII (State University of New York Maritime College) and Patriot State (Massachusetts Maritime Academy) as the latest completed vessel in the ve-vessel eet. The series’ remaining two vessels will serve Texas and California maritime academies in the coming years.

Now that we are over the halfway hump in the construction of these vessels, the broader maritime industry is poised for signi cant change. This transformation will begin at our maritime academies, where future U.S. merchant mariners will gain rsthand experience with modern vessel operations. Over the next two to three years, the industry will see a wave of graduates entering the workforce who will have had direct exposure to state-of-the-art vessels — unlike their predecessors, who often began their careers aboard outdated training ships.

These next-generation graduates from maritime colleges and academies will be well-positioned to help shape the future of the U.S. Merchant Marine. They bring with them not only fresh energy, but also a deeper understanding of modern maritime technologies, strengthening the overall pool of U.S. mariners. The success of any maritime operation begins with its most critical asset: a skilled and knowledgeable crew. With the introduction of these vessels, the U.S. is beginning to see the initial return on its investment — an investment not just in ships, but in the future of its maritime workforce.

As the saying goes, a rising tide lifts all boats, and with the U.S. government’s commitment to maritime education and the introduction of the NSMV eet, there is hope that the trajectory of U.S. shipping will continue to rise.

Legal Talk

Where there’s a will…

BY TIM AKPINAR

Tim Akpinar is a Little Neck, N.Y.-based maritime attorney and former marine engineer. He can be reached at 718-224-9824 or t.akpinar@verizon.net.

Today’s commercial mariners must maintain a variety of documents to keep their jobs. These include Merchant Mariner Credentials, Standards of Training, Certification and Watchkeeping certifications, Transportation Worker Identification Credential, licenses, and endorsements. But there’s another document that’s probably just as important, although most of us prefer not to think about it. Here’s an example of one used by a famous sea captain many years ago.

It reads (paraphrased): “I, Capt. John Smith, being sick in body but of perfect mind and memory, thanks be given unto Almighty God therefore, make and ordain this my last will and testament, June 21, 1631…” You read that correctly. This was written in the 17th century by Capt. John Smith. Yes, even

legendary sea captains had wills.

For readers who don’t have one, don’t panic. It isn’t the end of the world. Famous figures such as Abraham Lincoln, Howard Hughes, Jimi Hendrix, and Pablo Picasso died without wills. However, having one can make things significantly easier for loved ones. Without it, most states follow a legal order: assets typically go to a surviving spouse, then to children, then parents, then siblings, and so on.

There are several myths on this subject. For instance, it’s sometimes believed that in dire settings, such as a sinking ship or a battlefield, holographic wills — handwritten with no witnesses — are universally acceptable. In reality, not all states accept them, and such documents can raise legal concerns and a high level of scrutiny. Imagine a deckhand’s “will” leaving half his belongings to a chief engineer who was present in his final moments — especially if he had a family back home. That would certainly arouse a court’s suspicion.

Formal requirements of a valid will can vary by state. In most cases, the person making the will (called the testator) usually needs to be 18 or older. Many states require two witnesses who are disinterested (meaning they don’t stand to inherit from the will). Wills don’t have to be complicated. While estate planning can involve trusts and tax strategies, a simple, one-page will is far better than having nothing at all.

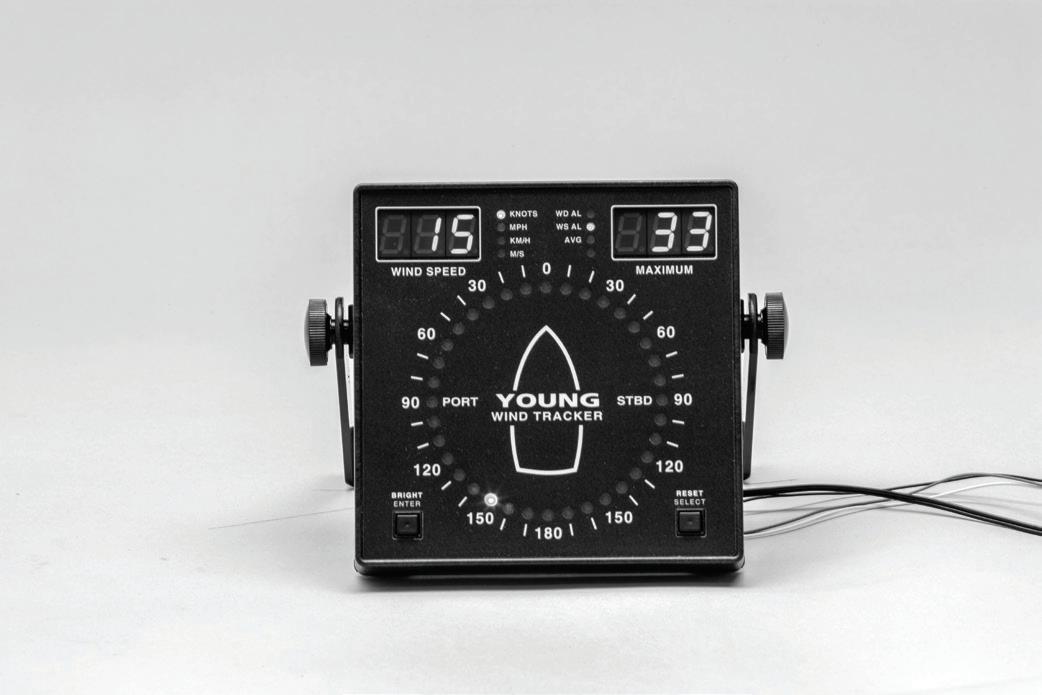

REL I A B I L I T Y F OR THE S E A S A H E AD

WEATHER SENSORS BUILT FOR THE HARSHEST MARINE ENVIRONMENTS

Captain’s Table Coast Guard cyber overreach

IwasBY CAPT. ALAN BERNSTEIN

Alan Bernstein, owner of BB Riverboats in Cincinnati, is a licensed master and a former president of the Passenger Vessel Association. He can be reached at 859-292-2449 or abernstein@bbriverboats.com.

surprised that the Coast Guard’s Final Rule on Cybersecurity went into effect on July 16. After many months of public comments and waiting, I was lulled into believing that the Coast Guard might delay implementation of the rule or even, at best, decide that small passenger vessels do not pose a material cybersecurity risk to the maritime transportation system at large.

It was easy for me to arrive at this hopeful assumption. In the proposed rule, the Coast Guard cited the Colonial Pipeline cyberattack, which shut down the fuel supply to the East Coast in 2021, as one of the prime risks the maritime industry needed protection from. While this may be true for large, technologically complicated companies and facilities, it is hard for me to imagine that small marine businesses such as mine, with low-

Credentialing Insight

New tools offer credential status checks

BY NATE GILMAN

Nate Gilman, president of MM-SEAS USCG Licensing Software, uses his hawsepiping experience to support mariners and workforce development. Connect on LinkedIn.

Delivering a long-awaited solution for mariners and employers, the Coast Guard’s National Maritime Center (NMC) has launched two new web-based, self-service tools for credential verification and application status checks.

The July announcement comes as welcome news after the permanent shutdown of the USCG Homeport portal in April left the industry without a digital means to verify credentials.

This development directly addresses the significant operational challenges created by the decommissioning of previous online services. The new tools restore vital functionality, moving the industry away from the temporary, less efficient methods of phone calls and direct emails that have been in place for the last few months.

The Mariner Credential Application Status tool provides

tech vessels and small facilities, could ever pose a cyber risk to the U.S. maritime system.

Interestingly, some marine insurers have commented that cyber risks are low for small passenger vessel companies. They contend that cyber criminals are looking for large companies offering high financial returns. Passenger vessels just don’t fit into that category.

In fact, my small company has never experienced a cyberattack, and in the unlikely event that we encounter one, I feel adequately prepared with a good plan. This is not a hollow claim, as I already have a cybersecurity safety net in place through my Coast Guard-approved Passenger Vessel Association (PVA) Alternative Security Program (ASP). The ASP requires that I conduct vessel and facility risk assessments that, among other stringent security reviews, include a thorough examination of potential cyber exposures. As a result of this planning, I have contingencies in place to cope with the unexpected cyber probe.

Additional government regulation, such as this cyber rule, means more costs and increasing administrative burdens for small businesses like mine. I agree with the PVA, which has advocated that ASP participants should not be required to submit updated cyber guidance until the next update of five-year security plan renewals. This will help ensure that the cyber final rule can be smoothly and effectively implemented and will help avoid inefficient regulatory overreach.

mariners with status updates on their MMC applications via e-mail, and the Mariner Credential Verification tool allows employers and other stakeholders to verify a mariner’s credentials and medical certificate.

Both tools are available on the NMC website, and the data is updated on weekdays by 8 a.m. EST. To use the tools you must enter a mariner’s last name and mariner reference number. The results are automatically emailed to the email address provided.

This is a significant step forward from the temporary setback the industry faced earlier this year. The previous system’s cancellation forced employers into a manual verification process with the NMC, which was limited to five mariners at a time and subject to delays. These new self-service tools are a step in the right direction to alleviate the administrative burden on mariners, employers, and the NMC alike.

For mariners, this means a faster, more transparent process for tracking their application progress, allowing them to get to work more quickly.

For employers, it restores the ability to conduct swift and efficient crewing and ensure regulatory compliance, keeping vessels operating without delay.

While these tools mark a major improvement, the NMC Customer Service Center is available for questions or assistance. The center can be reached Monday through Friday, 8 a.m. to 5:30 p.m. EST, via live chat on the NMC website, by email at iasknmc@uscg.mil, or by phone at 1-888-IASKNMC (427-5662).

Dam Right

$770m lock chamber project will support 13,000 jobs, Corps predicts.

By Ken Hocke, Senior Editor

Three hundred times a month, commercial vessels on the Ohio River, largely barge tows, lock through the Montgomery Locks and Dam’s two chambers on their way to or from the Port of Pittsburgh. Built in the 1930s, the structure is the poster child for being ridden hard and put up wet, and the Army Corps of Engineers, tasked with keeping traf c moving through the nearly century-old structure, has done a Herculean job of keeping traf c owing as ef ciently as it does.

Continuing to perform maintenance and rehabilitation piecemeal brings risk and carries steep economic consequences. A single year-long closure at Montgomery could cost nearly $150 million and force shippers to reroute cargo to more than 100,000 railcars or 400,000

trucks — signi cantly increasing emissions, congestion, and costs.

But even the agency’s best efforts can’t stay ahead of the decay while moving the Montgomery Locks and Dam into the future. A drastic change was needed, and that change has come in the form of the Montgomery Lock Chamber Project.

As it now stands, “It’s one of the hardest locks to make,” Shane Checkan, a western rivers pilot and general manager of Industry Terminal & Salvage Co., Industry, Pa., said during a media tour of Montgomery in August. The tour was organized by the Waterways Council Inc., a trade group that advocates for a modern and ef cient inland waterways transportation system.

In short, the object is to strip the concrete retaining wall from one side of the auxiliary chamber and lay a new, larger chamber over the top of the auxiliary’s

footprint. The project involves replacing the 56'x360' auxiliary chamber at Montgomery — that can only lock through one barge at a time — with a new 110'x600' lock that can lock through multiple barges at once.

REHAB AND EXPAND

The Montgomery Locks and Dam were built between 1932 and 1936 to gain increased control over the water level in the navigation pool upriver of the dam.

Late last year, the U.S. Army Corps of Engineers Pittsburgh District awarded a $770 million contract to a joint venture between Trumbull Corp., Pittsburgh, and Brayman Construction Corp. of nearby Saxonburg, Pa., to build a new primary lock chamber at Montgomery. The project is part of the Biden administration’s Bipartisan Infrastructure Law.

Hocke

Demolition of the auxiliary chamber wall continued in August ahead of the construction of a larger primary chamber.

According to the Corps, the modernization effort addresses aging infrastructure that is increasingly at risk of failure.

Construction activities began this spring with the removal process of the existing auxiliary lock chamber. River traffic continues to use the current primary lock while construction is underway. Once completed, the new chamber will address the industry’s need for larger infrastructure capable of handling modern commercial barges.

“This is one of the main benefits of receiving bulk funding at the outset,” Jenna Cunningham, the project’s resident engineer, said earlier this year.

“Because we’re using a single contractor with a base-plus-options structure, we’re minimizing the need for repeated mobilization, separate contract awards, and long procurement timelines.”

The current primary chamber can lock through nine barges at a time, while the existing auxiliary chamber can only handle one at a time. So, the choice of which chamber to close during construction was obvious, said Chris Dening, project manager for the Corps’ Pittsburgh District.

“That would be almost like shutting down the whole system,” he said. “The auxiliary chamber is the problem. Can only fit one barge at a time in there.”

About 12 million tons of goods move through Montgomery annually. A failure of the locks could cause severe disruptions, including an estimated $180 million economic impact from a one-year closure, according to the Corps.

To prevent that, the Bipartisan Infrastructure Law allocated over $1.5 billion to the Upper Ohio Navigation Project, which includes the modernization of locks at Montgomery, Dashields, and Emsworth along the Ohio River. The Montgomery project is the most significant and the most expensive, representing the largest Bipartisan Infrastructure Law-funded initiative in Pennsylvania.

Corps officials told the media group that the project is bringing significant employment benefits to the area. The Corps estimates that the construction of the new Montgomery lock chamber alone will support over 13,000 jobs,

Montgomery Locks & Dam

while the broader Upper Ohio Navigation Project is expected to create more than 28,000 jobs during construction and 5,300 jobs annually upon completion.

Dening said the Montgomery locks are the oldest and smallest that service the Port of Pittsburgh. Everything downstream is twice as big, with 1,200' capacities. Montgomery’s 360' auxiliary chamber creates a bottleneck for vessels transiting in and out of the port. “They’re coming up on 100 years old at this point. They’ve seen a lot of wear and tear,” he said. “They were rehabbed in the eighties, and that was to extend their life another 25 years. So, if you do the math on that, you know we’re in overtime.”

CONCRETE

Once the old retaining wall is removed, workers will build a coffer dam around the old auxiliary dam, drain it, then lay the new chamber over the auxiliary’s old footprint.

Since the initial contract award, contractors have installed temporary field offices, erected fencing and power infrastructure, constructed new stormwater drainage systems, and have begun demolishing the lower guard wall. The contractors have started constructing the foundations for batch plant equipment.

As of August, the project was less than 10% complete. Most of the work has been preparing for the creation of the new lock. That lock will be made of concrete — lots of concrete.

In fact, the Corps determined it would be more practical and cost-effective to build a dedicated on-site plant to produce the large volume — more than 400,000 cu. yds. — of specialized concrete needed for the project, rather than trucking it in. Building the batch plant on-site, along with a quality assurance and control lab, enables the contractors to mix at least 150 cu. yds. of high-quality concrete per hour and will minimize logistical delays.

The road to the river already has its share of potholes. The number of trucks needed and the wear and tear on the roadway they would cause made trucking in the cement both physically and financially impractical. Road improvements are part of the Corps’ future plans.

“This is a generational investment,” said Cunningham. “It’s about modernizing our navigation infrastructure in a way that’s smarter, more reliable, and sustainable.”

Along the middle lock walls, contractors are installing inclinometers — long, vertical instruments that detect subtle shifts in the earth.

“These inclinometers are designed to measure any horizontal movement of the wall during and after construction,” Andrew Aceves, a geologist with the Corps’ Pittsburgh district, said in June. “Each one is installed in a cored shaft that extends several dozen feet along the lock wall, with outer casings secured to ensure long-term integrity.”

More than 50 inclinometers will continuously monitor the lock wall during construction to alert engineers to any movement by providing real-time updates through an automated system. The system is essential for preventing unintended structural shifts and ensuring industry vessels can continue to lock through during construction.

“This project shows you what the Corps can do with a large construction project,” said Col. Nicholas Melin, district commander. “It really represents the way the Corps wants to do big projects, and our mission is to deliver for the nation at or under budget.”

The project is scheduled for completion in 2033.

Ken Hocke

The narrow auxiliary chamber at Montgomery can only lock through one barge at a time.

Starting Small Mariners hone their skills aboard scale model ships.

By Stephen Blakely, Contributor

How do professional mariners learn to handle huge, oceangoing ships? For some, the educational voyage goes through a small freshwater pond near Cape Cod.

Just 10 minutes north of the Massachusetts Maritime Academy (MMA) campus on Cape Cod Canal is Great Herring Pond, 300-plus acres of generally shallow water that is home to the academy’s collegiate sailing and rowing center.

Docked between the rowing shells and one-design daysailers are four fully functional 1/25th-scale ships — manned models — based on big commercial vessels:

• A 37' model (Massachusetts) of a 925' very large crude carrier called the Antigun Pass.

• Two 36.5' models (Bay State and Patriot State) of 912' U.S. Navy combat stores ships, recon gured as containerships.

• A 24.6' model (Boston) of the American Phoenix, a 616' product carrier.

All are powered by electric motors (from 1-4 hp) and fully loaded with water or brick ballast so they sit as low in the water as possible, with draft ranging from 18" to 26". Each model

handles exactly the same as the ship it’s patterned after, which means they go slow, are hard to turn, slow to stop, and subject to all the same complex physics and hydrodynamic forces that bedevil any big vessel on the water. Two electric winches at the bow allow for anchoring practice, and remote-controlled tugboats are used in docking and undocking exercises.

About 10 times a year, MMA holds a ve-day, graduatelevel class that takes six active professional mariners (pilots, masters, mates, navigational of cers) out in the models, giving them real-life continuing education in shipping control, navigation, and safety, so they can grow their certi cations and advance in the industry. Since the training program started in 2002, some 1,200 mariners have graduated from the course.

MMA, other maritime academies, the U.S. Navy, and the shipping industry all depend heavily on sophisticated computer simulators for primary navigational training. Manned models supplement that by providing working mariners a unique opportunity to experience, in representative, small vessels at safe speeds, exactly how big ships react on the water to various situations they will encounter at sea.

Manned model training allows mariners to safely experience how big ships react to various situations they will encounter at sea.

Stephen Blakely

“What sets this program apart from a traditional simulator class is that students train in actual models — underway, in the water,” said Capt. Michael Burns, director of the program since 2008 and an MMA graduate with thousands of sea miles under his keel. “You can feel the wind in your face. You can feel the model moving beneath you.”

MMA’s course, funded by tuition and support from the Boston Marine Society — the oldest association of sea captains in the world — is one of two manned-model ship training programs in the United States and seven in the world (in France, Britain, Poland, Australia, and Panama). The other U.S. program is offered by the industry-funded Maritime Pilots Institute (MPI), which has four 1/25th-scale ship models at its Port St. Tammany base in Bush, La., along with remote-controlled tugs. MPI also offers research simulation and expert maritime consultation in support of pilot activities. Neither program receives government funding and is therefore unaffected by recent federal spending cuts.

THE MMA PROGRAM

MMA has carefully mapped out different parts of Great Herring Pond with red, green, and yellow buoys, as well as floating docks, which the model fleet uses in a wide variety of training exercises including shallow water, deepwater, and narrow channels. Students practice close-in passing and overtaking scenarios (to experience how vessels interact with each other); turning; rafting with an anchored ship; docking both upwind and downwind; anchoring. Inevitably, there are a few harmless mishaps (groundings and minor collisions).

Each model holds two or three students, sitting above and behind a professional pilot who drives the boat. The students act as pilots, quietly ordering rudder and engine changes, which, as maritime procedure requires, are acknowledged and repeated by the helmsman. They can be a strange sight for the summer vacationers who share Great Herring Pond.

“I like to say it’s the most fun you can have at two knots,” joked Capt. Robert

MMA’s

McCabe, a 1990 graduate of MMA, currently a Boston harbor pilot and one of the manned-model instructors. “It’s a great course for professionals. You get to do things you can’t do at sea.”

Classroom instruction precedes each exercise, and students go through a rigorous exam at the end of the course. The lead instructor is Capt. Robert Blair, a Massachusetts state pilot for the past 43 years who covers the waters from Boston north. Blair starts with a refresher of the venerable laws of physics that govern how objects move through water: Archimedes’ principle of buoyancy (circa 246 BC,) Newton’s laws of motion (1687), Bernoulli’s principles of fluid dynamics (1738).

“We’re dealing with the physics of motion and the hydrodynamics of what vessels are going to do and why they’re going to do it,” he explains. He describes the constantly changing “3-D force field” that surrounds moving ships as they displace water, and how those forces can push vessels apart or pull them together, depending on where the positive and negative pressure zones happen to be on a passing hull at any given time. Students then pilot to the models to experience these forces at work on the water.

Riding along in the Massachusetts recently, I witnessed a classic display of those physics when the Bay State passed to port a tad too close.

Just as predicted in the classroom, positive pressure from Bay State’s bow wave pushed our stern away, causing our bow to pivot even closer to the pass-

ing ship. Then, as Bay State moved up, negative pressure at the bow of the Massachusetts pulled the Bay State into and across our bow, resulting in a collision. Both models came to a dead stop, the containership perfectly T-boned amidships by the bow of the crude carrier. This would be twisted metal, possible injury or death, and big money in real life, but the models didn’t even get scratched.

Back in class, Blair made the most of the collision’s teachable moment. “I can sit up here and draw pictures, but out on the water, that T-bone, there it is! Plain as day, these forces are real. You have to recognize and deal with them.”

He added, “If you’re gonna have an accident, this is the place to do it.”

I also witnessed some excellent boat handling and “precision docking” skills. The best was when one student in the Massachusetts came upwind of a dock, dropped and “dredged” the port anchor for several dozen yards; swung into the wind and dropped the starboard anchor; and then dropped back on the V-set of both anchors into a perfect stern-to Medmoor (short for Mediterranean mooring) right off the end of a narrow dock.

Pure grace and artistry, executed in the longest, heaviest, and least maneuverable of all the models in the fleet.

It was clear, having sat in on the course, that the students who take it are both experienced and clear-eyed about what it takes to succeed.

Brian Sarapas, a senior dynamic positioning officer on a drillship, took the course to earn his chief mate license. Currently a second mate, he focuses on keeping the ship stationary at sea but has done voyages in the past and hopes to return to them. “Right now, I do ship handling, but in a much different way. This class was terrific at knocking off the cobwebs,” he said.

Pedro Flores, a masters on the cruise ship Viking Mississippi running between New Orleans and St. Paul, Minn., claims to have “the best job on the Mississippi River,” but wants to grow his skills and be ready if opportunity knocks. “I absolutely loved this course. It’s an invaluable experience for anyone looking to advance their careers,” he said.

Stephen Blakely

manned model courses bring classroom lessons to the water, said lead instructor Capt. Robert Blair.

ON THE WAYS

CONSTRUCTION ACTIVITY AT WORKBOAT YARDS

MBARI’s new flagship is built to explore

For the team at the Monterey Bay Aquarium Research Institute (MBARI), Moss Landing, Calif., the goal is to push the boundaries of oceanographic research.

That mission re ects the vision of the institute’s founder, David Packard, who encouraged a culture of curiosity and outside-the-box thinking. “Take risks. Ask big questions. Don’t be afraid to make mistakes; if you don’t make mistakes, you’re not reaching far enough,” the late Silicon Valley innovator and ocean philanthropist once told MBARI.

Primarily funded by the David and Lucile Packard Foundation, the nonpro t oceanographic research center can pursue studies that traditional

funding sources might avoid, giving MBARI an independent spirit and the ability to explore less-charted areas of ocean science.

But when it came time to design and build its new state-of-the-art research vessel, MBARI was forced to contend with several constraints, including its small homeport in Moss Landing Harbor, which limited the size of the vessel that could be built, according to Kaya Johnson, MBARI’s director of marine operations.

MBARI engaged naval architecture and marine engineering rm Glosten, Seattle, to design a vessel that would suit its unique needs.

Delivered in March was the David Packard, a 164'x42'x18'6" vessel with a

12' draft — small enough to t into the harbor yet large enough to pack in the desired cutting-edge scienti c instrumentation.

“Vessel design is all about tradeoffs; you can’t always have your cake and eat it too,” said Will Moon, a naval architect principal at Glosten, who spent three years on-site as the owner’s representative during the vessel’s construction at Freire Shipyard, Vigo, Spain. “If permitted, we would have made the vessel 33 feet longer, given the desired capability of the vessel, scienti c complement, and operational needs.”

Instead, Glosten and MBARI had to get creative and work together to engineer a solution. To compensate for the

Joe Gomez / MBARI

MBARI’s new flagship research vessel, David Packard, arrives at the institute’s research facilities in Moss Landing, Calif., on March 31.

shorter length, the vessel’s height and beam were increased, which impacted stability. This was addressed with a weight-saving aluminum deckhouse for the top two decks and 25 tons of xed ballast, said Moon. A stabilization system from Quantum limits roll when the vessel is idle.

Central to the new vessel is the Doc Ricketts, MBARI’s agship remotely operated underwater vehicle (ROV) capable of diving to 4,000 meters, said Johnson, noting the need for a hangar to house the vehicle, a launch and recovery system (LARS) to deploy it, a control room for piloting, and a workshop for repairs.

The 10,500-lb. Doc Ricketts is launched through a side door using a MacGregor overhead traveling crane. The door, which has independently operated upper and lower sections, allows the lower half to remain closed during ROV deployment, keeping the hangar drier and safer during typical 12-hour missions. “From a scienti c standpoint, the heart of this vessel is the hangar with Doc Ricketts,” said Moon. “But the David Packard is not a one-trickpony.”

The vessel is also con gured to support autonomous underwater vehicle (AUV) launch and recovery with the ship’s MacGregor KN-75 knuckle-

COMMITTED TO LIFTING EVOLUTION

boom main crane. A dedicated, always-attached docking head with a constant-tension winch holds the AUV in place during launch and recovery off the port side. The vessel’s 170º articulating A-frame, CTD (conductiv-

ity, temperature, and depth instrumentation) davit, hydrographic winch, and ROV winch are also from MacGregor.

“We’re trying to learn more about marine life and environments in our backyard in Monterey Bay, but we also

Glosten

Glosten’s Will Moon spent three years in Spain overseeing the construction of the David Packard at Freire Shipyard as the on-site owner’s representative.

ON THE WAYS

want to take studies that we’ve done here to other places and broaden our operational area,” said Johnson. “We don’t quite know where that’s going to take us down the road, but we want to push the envelope of science and engineering developments in the deep sea.”

The aft deck is designed to support a wide range of missions, with direct access to the wet lab and hangar. It features standard 2'x2' bolting grid on the working decks, multiple ttings for

ISO containers, various power receptacles, connections for science seawater, gray water drains, and other services to support future deployments. “Unlike the Western Flyer,” MBARI’s previous, smaller research vessel, “we wanted to also have some general oceanographic capabilities to put things on the aft deck and deploy off the stern or with other equipment,” said Johnson.

That exibility extends below deck, too, said Moon. The wet lab has re-

BOSTON’S MARINE FACILITY

movable, insulated tables with ambient and cold seawater taps for studying deep-sea creatures, and there’s a cold room for sample storage.

“The ability to rapidly switch missions during a deployment … is essential for MBARI to make the most of their new asset,” said Moon. “We therefore segregated alternative science missions into areas with dedicated equipment.”

The ship has ample network capacity and redundant power to handle future computational loads. To support the vessel’s advanced computer systems, there are 14 network racks installed onboard and over 18 miles of copper and ber network cables. The vessel achieved DNV (Det Norske Veritas) Cyber Secure Essential (+) notation for all essential equipment, dynamic positioning, and the closed-circuit TV system. David Packard is the rst U.S.agged vessel to have this notation, said Johnson.

The hull is designed to house the latest scienti c transducers, with reserved space and dedicated cable conduits to the transceiver room for future installations.

Scienti c instrumentation includes a Kongsberg EM-304 multibeam survey system, Kongsberg/Simrad EK80, single-beam survey system, Teledyne RD Instruments Ocean Surveyor acoustic doppler current pro ler, Kongsberg sonar synchronization unit, Sonardyne Ranger 2 ultra-short baseline with HPT 5000 acoustic and telemetry transceiver and 7950 through-hull transceiver deployment machine, Kongsberg Seapath 380 acoustic navigation and tracking system, and Teledyne Benthos UDB 9400 acoustic modem.

The instrumentation signi cantly inuenced the design of the vessel’s hull form, Johnson explained. “We didn’t want to have a big bulbous bow due to bubble sweep-down of our acoustic sensors under the hull,” he said. “We wanted to make sure we’re getting really accurate data for mapping and for our echo sounders.”

Bubbles generated on the ocean’s surface and pulled down beneath the ship can wreak havoc on the instru-

mentation, and the addition of centerboards or gondolas to mitigate this interference was not possible due to the draft restriction. “We used a hull optimization process — running thousands of computational uid dynamics simulations — to minimize resistance while also directing bubbles away from the transducers,” said Moon. “The result was a curvy hull that not only performed well hydrodynamically, but also proved highly effective at keeping the bubbles at bay.”

The unique design has already proven effective, with the vessel com-

pleting successful mapping surveys off the coast of Oregon in July.

Because the traction winch system, gym, and computer laboratory below the main deck have a large footprint, the machinery spaces are tight, said Moon, noting that the layout of equipment and planned removal routes were carefully planned — a move that paid off sooner than expected. “All three alternators had to be replaced before the vessel even left Spain, due to a manufacturing defect,” said Moon. “Plenty of chain falls were required, but no cutting of the hull or deck was needed

for extraction and re-installation.”

When designing the vessel, efciency was also a priority. The vessel’s diesel-electric propulsion system includes three 629-ekW-rated MAN D2862 LE427 variable-speed generators meeting EPA Tier 4 and IMO Tier III emissions standards. The engines are tted with waste heat recovery to provide heat for the accommodations, laboratories, and hangar, as well as for potable water.

The vessel features a pair of Schottel SRP-260 L-drive units, 4-bladed 5'9"-diameter nibral propellers in

ON THE WAYS

nozzles, with 530-kW RAMME permanent magnet motors. There is also a single ZF Marine 3000 RT bowthruster with 300-kW motor that, when retracted, operates in a tunnel and, when deployed, operates as a nozzled thruster.

The electrical system consists of ABB Onboard DC Grid operating at 1,000VDC, with ship service power at 480, 208, and 120VAC. Shore power is set up with two 400-Amp service for zero emissions at the home port.

The David Packard has an operational range of 4,000 nm at 10 knots cruising speed, with a top speed of 11.5 knots and a 21-day endurance. The vessel has accommodations for 12 crew and 18 scientists, mostly in double staterooms, with shared heads.

— Eric Haun

Retractable pilothouse towboat delivered to Golding Barge Line

Steiner Shipyard, Bayou La Batre, Ala., has delivered the 94'x34'x12' retractable pilothouse towboat Gage Golding to Golding Barge Line Inc., Vicksburg, Miss. The new towboat is an addition to the Golding eet, not a replacement.

Designed by the shipyard and Sterling Marine, Fairhope, Ala., Gage Golding is powered by a pair of Tier 4 Caterpillar 3512 diesel engines from Pucket Machinery, Gulfport, Miss. The Cats produce 2,800 hp overall and are connected to Sound Propeller 88" wheels on 8" shafts through Reintjes WAF 773 marine gears from Karl Senner, Kenner, La.

“The entire Golding Barge Line team is very proud of this new vessel. It was put together with care and expertise,” said Austin Golding, the company’s president and CEO. “The team at Steiner Shipyard are professional, detail focused and innovative. We are excited to put this boat to work and see how it stacks up against our other vessels. So far, the crew loves it and is proud of its performance.”

The new boat’s steering system and

engine alarms are from Gulf Coast Air & Hydraulics, Mobile, Ala.

Ship’s service power comes from two John Deere-powered 4045 gensets from Stanley Parts and Equipment, Channelview, Texas.

Tankage includes 36,000 gals. of diesel fuel; 5,000 gals. potable water; 800 gals. lube oil; and 2,950 gals. diesel exhaust uid.

On deck are two Patterson Manufacturing deck winches and one Schoellhorn-Albrecht Machine Co. capstan, and around the outside of the hull is Schuyler fendering.

Crew quarters include 10 bunks, two full baths and one half-bath, plus four staterooms for the wheelmen and deck crew.

The electronics suite features two Furuno radars and a GPS, four ICOM

radios, and Starlink

Gage Golding was delivered in July and is U.S. Coast Guard certi ed, Subchapter M. — Ken Hocke

Bay Weld delivers sightseeing vessel to Juneau

Bay Weld Boats, Homer, Alaska, has delivered a new aluminum catamaran built for Juneau Whale Watch. The vessel, designed specically for whale-watching operations in Southeast Alaska, is the latest addition to the company’s eet.

The 49'6"x17'6" vessel, Icy Bay, is a single-level vessel with capacity for 49 passengers and two crew. Designed in-house, the newbuild marks the fourth Bay Weld vessel delivered to the Alaskan tourism company.

Steiner Shipyard

Steiner Shipyard delivered the 94'x34'x12' retractable pilothouse towboat

Gage Golding to Golding Barge Line.

Bay

Weld Boats

The Juneau Whale Watch fleet. The Icy Bay marks the fourth vessel Bay Weld Boats has delivered to the Alaskan tourism company.

Bay Weld’s general manager and lead designer, Brad Conley, told WorkBoat that an important factor behind the Icy Bay’s design was not just passenger comfort or performance, but business ef ciency. For operators like Juneau Whale Watch, he explained, the economics of each passenger seat drive the entire decision-making process.

“The point about those 49-passenger boats is the ef ciency around having the outboards,” Conley said. “There’s a sweet spot in performance and efciency with those outboards… For these businesses, it all comes down to, what does it cost them to buy that seat? Because then, they know how many times they have to ll it to pay for it.”

According to Conley, Bay Weld did extensive research into vessel size and propulsion combinations before settling on the 49-passenger model powered by quad Suzuki outboards. “That size boat, that number of people, with that propulsion: it was the lowest cost per seat of any combination we studied,” he said. “These [tourism] companies, the faster they can [recapture] their cost, the easier the decision becomes.”

Conley described the 49-passenger Subchapter T boat as a “magic place” in the regulatory and economic balance for operators. “Once you go bigger or lower passengers, you start running into regulatory changes with safety gear and whatnot. But right there, to be able to do that with outboards, it’s the cheapest propulsion you can get,” he said.

Bay Weld said the main cabin is arranged with forward-facing bench seating and a full-length center aisle, with boarding access provided through fore and aft side doors on both port and starboard. The Icy Bay features a large forward viewing deck and rooftop deck, reached by port-side stairs from aft to maximize passenger visibility.

Bay Weld noted that the total 1,200 hp produced by the quad Suzuki 300B outboard package allows the catamaran to cruise at 28 knots. Propulsion is supported by Solas stainless steel propellers and Sea Star electronic power steering. Fuel capacity is 500 gals. Electronics include dual Garmin

GPSMAP 8610xsv displays for chart plotting, depth sounding, and radar; Garmin GMR HD radar dome; dual Garmin VHF radios; Garmin AIS 800 receiver; aft-view video cameras; and an owner-supplied ICOM UHF radio.

The vessel is constructed of 5086 aluminum with ¼" hull plating and 3/16" sides. Bay Weld noted the vessel is designed for passenger visibility and ef ciency, including wraparound walkways and a wet bar snack area.

The centered pilothouse offers 360º visibility, a full-width helm with dual navigation screens and control panels, and aft bench seating for crew. Sliding side doors and aft-view cameras provide additional operational awareness, the boatbuilder said. Passenger comfort is supported by dual diesel forced-air furnaces in the main cabin and a dedicated furnace in the wheelhouse. Amenities include an enclosed head on the aft deck.

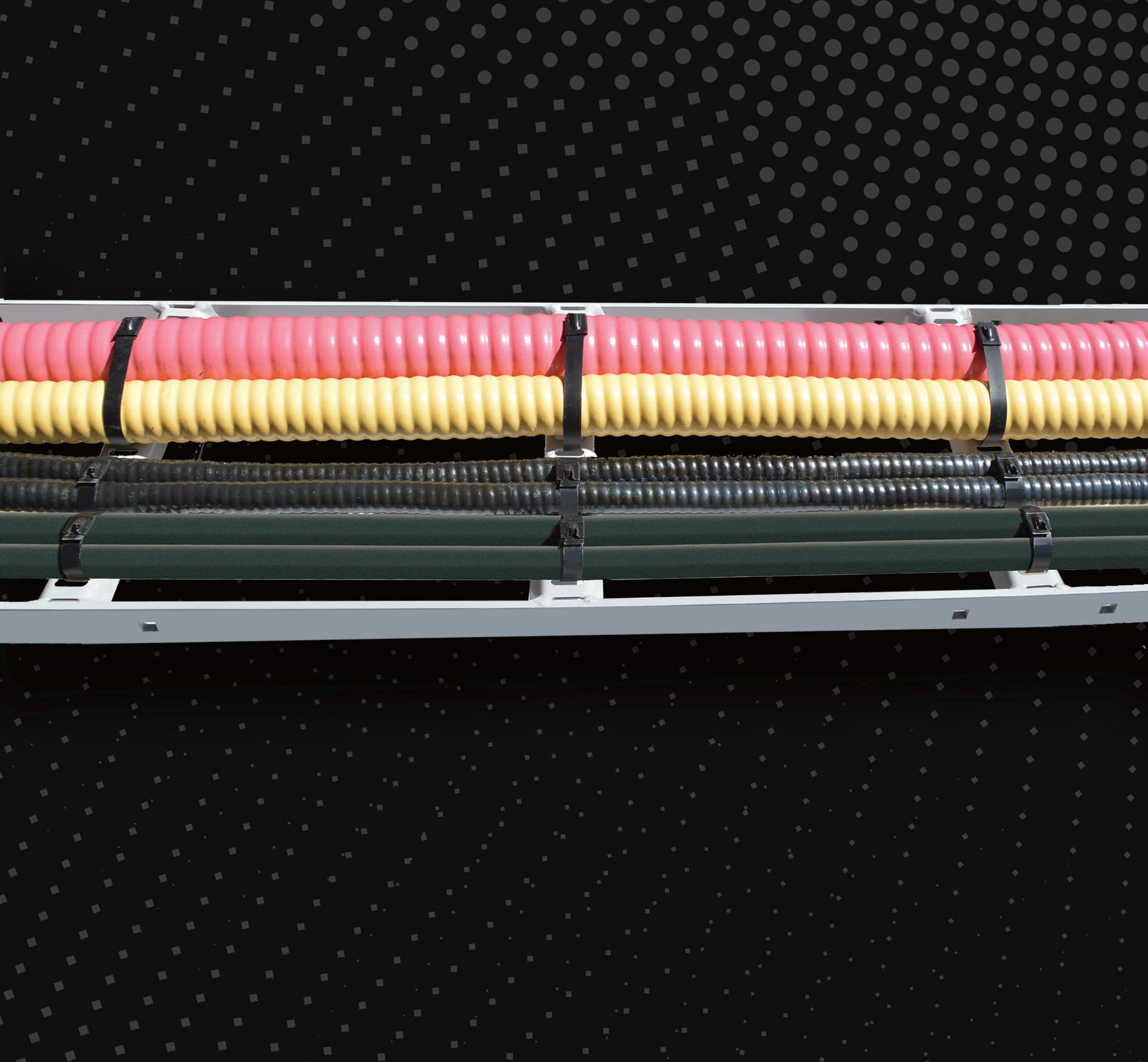

GEAR FAILURE DOESN’T WORK FOR THE UNITED STATES NAVY.

For commercial marine applications, gearbox failure isn’t an option either. Philadelphia Gear created Onsite Technical Services™ (OTS) to support all our marine customers, including the U.S. Navy and Coast Guard, to install, rebuild, and maintain critical rotating equipment anywhere they go.

Get Navy-trusted OTS for your commercial marine vessels: Visit PhilaGear.com/Commercial today.

ON THE WAYS

BOATBUILDING BITTS

Washburn & Doughty Associates Inc., Boothbay, Maine, has launched a new tractor tug for McAllister Towing and Transportation Co. Inc., New York. The 93'x38' Gerard McAllister offers 6,770 hp and a bollard pull of 84 tons. It features a pair of EPA Tier 4 Caterpillar 3516E engines that power Schottel SRP 490 FP Z-drive units.

Safehaven Marine Ltd., Cork, Ireland, has launched Miami, an Interceptor 48 pilot for the Biscayne Bay Pilots for pilotage operations at the Port of Miami in Florida. The boat is powered by Scania DI 13 500-hp engines and runs at an operational speed of 25 knots. Capable of transporting seven pilots and crew on Grammer shock mitigation seats, Miami features an air-conditioned cabin with 30,000-btu air handlers mounted high up in a roof molding, allowing efficient cooling for Florida’s hot climate.

A new ship-assist tug being built for Shaver Transportation Co., Portland, Ore., has been launched ahead of its scheduled delivery later this year. The 79'x40'x17' Robert Allan Ltd.-designed RApport 2500 tug Heather S is being built by Diversified Marine Inc., also of Portland. The tug’s hull was constructed by another Portland yard, Gunderson Marine & Iron. The tug’s two EPA Tier 4 Caterpillar 3516E main engines will each deliver 3,500 hp at

1,800 rpm, powering Berg MTA 628 azimuth thrusters. The vessel is expected to be able to reach a speed of 12 knots and provide a bollard pull of 100 tons.

Great Lakes Dredge & Dock Corp., Houston, has added another Jones Act–compliant hopper dredge to its fleet with the delivery of the Amelia Island The vessel was designed by C-Job Naval Architects, and built by Conrad Shipyard, Morgan City, La. The 346'x69'x23' dredge carries 16,500 total hp and features two 31’6” trailing suction pipes capable of dredging depths up to 100'. The vessel has a hopper capacity of 6,330 cu. yds. and is equipped with EPA Tier IV engines and generators.

Serco Inc., Herndon, Va., has christened the USX1 Defiant, a demonstrator vessel for the Defense Advanced Research Project Agency’s NOMARS (No Manning Required Ship) program. The 240-metricton unmanned surface vessel was built at Nichols Brothers Boat Builders, Freeland, Wash., and completed construction in February. The vessel is designed to operate autonomously for extended periods without an onboard crew, which keeps crewmembers out of harm’s way.

SAFE Boats International, Bremerton, Wash., has been awarded a contract to construct a new fireboat

Shaver Transportation’s new tug, Heather S, is scheduled to be delivered from Diversified Marine this year.

Shaver Transportation

The William E Moran is among the largest and most powerful tractor tugs in the Moran fleet. Moran Towing

The pilot boat Miami was built in Ireland for the Biscayne Bay Pilots.

Safehaven Marine

Gerard McAllister is the sixth in a series of new tractor tugs built by Washburn & Doughty for McAllister Towing.

McAllister

for the City of Bremerton Fire Department. The new vessel will be a custom-built 33' full-cabin fireboat equipped with a 1,000-gpm fire pump, mounted aft to meet ISO standards. The boat will feature a drop bow for shore access and twin Mercury 400-hp outboards.

Austal USA, Mobile, Ala., held a ceremony to mark the official start of construction on the second U.S. Coast Guard Heritage-class offshore patrol cutter to be built at its facility. The 360'x54'x17' vessel, USCGC Icarus (WSMM 920), is part of a series that could include up to 11 cutters under a $3.3 billion contract.

The new escort and shipassist tug, William E Moran — among the largest and most powerful vessels in the Moran Towing Corp., New Canaan, Conn., fleet — has entered service in New York. Built by Master Boat Builders Inc., Coden, Ala., and designed by Robert Allan Ltd., the 6,770-hp RApport 2800 series vessel measures 92'x40' and delivers over 80 metric tons of bollard pull.

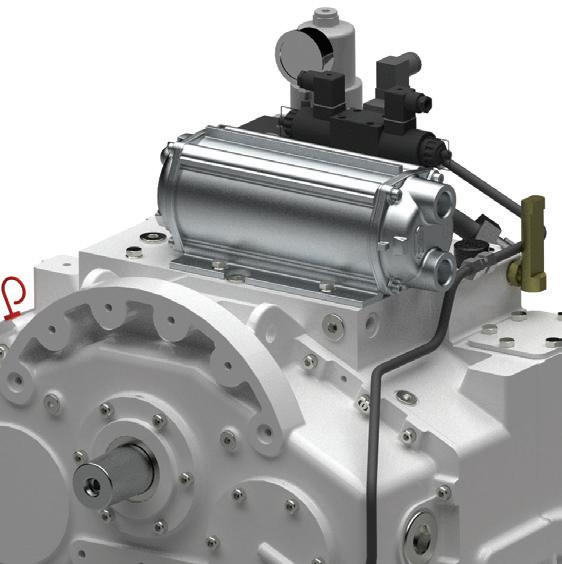

Incat Crowther’s U.S. office has been selected to design Port Houston’s new hybridelectric tour boat, which will be built by Breaux Brothers Enterprises Inc., New Iberia, La., for scheduled delivery in 2026. The 73'x28' aluminum catamaran will be equipped with a Twin Disc battery-hybrid propulsion system featuring two 265-kW propulsion motors that will drive fixed-pitch propellers through Twin Disc MGE-5065 SC gearboxes.

Shipyard owner and president, Eric Englebrecht, also noted that the Alaskan market is distinct from other regions. “You see this all over the country,” he said. “There are these little market sectors of passenger boats, all Coast Guard inspected, all built to

similar requirements, but very different applications…The Alaskan market is unique in what we’re doing up here compared to some of those other passenger operations.”

The Icy Bay was delivered in July.

— Ben Hayden

Sector Shift

Shipyards focus their attention to national defense.

By Ben Hayden, Senior Associate Editor

This year has been a whirlwind for U.S. shipbuilding, with policy moves and federal attention shifting the industry’s focus. With offshore wind projects stalled and investment declining, America’s shipyards are now looking to a more dependable customer: the Department of Defense (DoD).

Federal investment and policy moves have reset priorities across the industry, redirecting resources toward rebuilding domestic shipbuilding capacity and accelerating production of both traditional naval assets and new autonomous vessels.

The push has been visible on several fronts, including a presidential executive order, the reintroduction of the bipartisan Shipbuilding and Harbor Infrastructure for Prosperity and Security (SHIPS) for America Act, and the creation of the White House’s Of ce of Shipbuilding

(recently moved from the National Security Council to the Of ce of Management and Budget). For the rst time in a long time, the maritime sector is receiving sustained national attention.

“This is certainly a fascinating time,” said Ted Williams, Senesco Marine president and a 31-year Navy veteran. During a July visit to the North Kingstown, R.I., shipyard, Williams discussed with WorkBoat the stark imbalance in global maritime capacity. “Forty- ve thousand commercial cargo-carrying vessels; 200 U.S.- agged,” he said. “China right now has a larger Navy than we do… out-building us from a navy, military perspective, ve-toone, [and] from a commercial perspective, 10-to-one.”

That imbalance has spurred Washington to act. President Trump’s executive order pledged billions for new naval capacity and unmanned surface vessels. The order outlined a Maritime Action Plan (MAP) led by the Maritime Administration (Marad), pairing yard investment

tain resiliency in the U.S. maritime industry. While the full plan is still in development, the order lays out its framework and interim milestones. Broadly, it will focus on three areas:

• proposals for nancial incentives and subsidies to support shipyards,

AUTONOMOUS WARSHIPS

“That’s really where the future of shipbuilding is right now,” Williams said of national defense. His vision mirrors World War II–era output. “If I had the workforce, I could put out one a week. It goes back to the Liberty ship days. Nationwide, we were putting out one a day,” he said.

with workforce support and new demand signals for U.S.- ag shipping.

“Rectifying these issues requires a comprehensive approach,” the order read, “that includes securing consistent, predictable and durable federal funding, making United States- agged and built vessels commercially competitive in international commerce, rebuilding America’s maritime manufacturing capabilities, and strengthening the recruitment, training and retention of the workforce.”

A central provision of the executive order sets a 210-day deadline (Nov. 5) for a multiagency effort to create a MAP providing a clear strategy with actionable steps to restore and sus-

• acquisition reforms and regulatory adjustments,

• and a series of strategic initiatives, including workforce development.

Still, shipbuilders face steep obstacles. A February Government Accountability Of ce report identied two major challenges — infrastructure and workforce — echoing concerns raised by shipyard leaders. Many shipyards rely heavily on subcontractors and green card holders to meet staf ng needs. It’s not uncommon for shipyards to print out construction plans and memos in multiple languages. But new Pentagon cybersecurity requirements (Cybersecurity Maturity Model Certi cation) set to take effect in 2026 will soon restrict work access for noncitizens, further tightening the labor pool.

Williams said autonomy may be the best route forward. “The best way, in my opinion, to resolve this discrepancy is autonomy. Medium, 150- to 200foot vessels with the right speed, fuel, and cargo capacity,” he said. “Imagine you get 100 or 500 of these to work in a hive around a carrier. The power and capacity of that is amazing.

“A carrier is $12 billion,” he added. “If that helps defend a carrier, you just saved money.”

But Williams acknowledged time pressure. “Adm. Phil Davidson told Congress that by 2027 China will be ready to invade Taiwan. Right now, we would lose that war. The Navy is asking us — industry — to get vessels on the water by 2027. They should have asked us two years ago,” he said. “It’s happening, and we’re talking to companies right now to build proto-

Saronic Technologies photos

A rendering of Saronic Technologies’ 150' autonomous warship Marauder, currently under construction in Franklin, La.

Saronic Technologies is revitalizing the Franklin, La., shipyard it acquired from Gulf Craft by investing in new facilities and expanding its workforce.

Senesco Marine's arc welder, purchased with a Small Shipyard Grant, can weld two 40'x40' plates together in about 90 minutes. It would take a person three to four days to do the job.

types. Senesco is perfectly positioned as a Tier II shipyard to build these medium vessels all day long.”

Blue Water Autonomy secured $50 million in Series A financing to advance the development of its first full-scale, long-range autonomous vessel for planned deployment in 2026.

The new push for 150' autonomous naval vessels would require production adjustments, Williams said. He estimated that if he were to increase operations to a workforce of 1,000 to 1,200 people, the yard “would work three shifts, probably seven days a week, and just bang them out,” he said.

Williams displayed a rendering of a planned 400,000-sq.-ft. shipbuilding hangar superimposed on an aerial photo of Senesco’s property. If the shipyard were to secure a substantial DoD contract, the proposed facility could support a dozen production lines, he said, each stacked three vessels deep, moving steadily through construction.

“They’re not complex, because they’re unmanned,” he explained, noting that the absence of piping, heads, and galleys would further shorten delivery times.

Senesco is one of many companies — including both established and emerging shipbuilders — eyeing opportunities in the growing market for uncrewed and autonomous vessels. Companies already active in this space include Bollinger Shipyards, Lockport, La.; Austal USA , Mobile, Ala.; Nichols Brothers Boat Builders , Freeland, Wash.; Swiftships, Morgan City, La.; Metal Shark , Jeanerette, La.; and BlackSea Technologies, Baltimore.

In August, Blue Water Autonomy, Boston, announced it had raised $50 million in Series A (venture capital) nancing, following a $14 million seed round in April.

The funding will support the development and deployment of its rst full-scale, long-range autonomous ship in 2026.

SHIPBUILDING RECONFIGURED

In Texas, a newer player is betting that a reimagination of the shipyard itself is the key to American maritime resurgence. Dino Mavrookas, president and founder of Saronic Technologies, spoke with WorkBoat about the company’s rapid growth, its attention-grabbing investment rounds, and shipyard operations. In February, the company closed its Series C (growth capital) funding round

Ben Hayden

Blue Water Autonomy

at $600 million, valuing the Austin-based tech firm at $4 billion.

Mavrookas, a former Navy SEAL, founded Saronic in September 2022 with the aim of “redefining maritime superiority for the U.S. and our allies around the world, starting with defense, but expanding into commercial,” he said. The company’s first projects were three small autonomous boats, which Mavrookas said launched in the first two years of his starting the company.

That momentum has led Saronic to expand its operations and product line, advancing from the six to 24 initial builds to today, constructing a large autonomous warship in its recently acquired Franklin, La., shipyard.

Mavrookas said that the 150' Marauder-class vessel, currently under construction in Franklin, is slated for

launch by the end of the year. He emphasized that the vessel is not a retrofit, but a purpose-built autonomous ship designed from the keel up.

“All of that is fully vertically integrated,” he stated, noting that hardware and software development run in parallel within the company. “That’s really how you build autonomous vessels at scale. You need the hardware and the software co-developed alongside each other so that they can integrate and be produced at scale. Unless you do that together, the production line never really works in complete harmony.”

The approach includes control over electronic components, supply chain partnerships, manufacturing, integrations, software, and autonomy development, he said. According to the company, this structure allows for faster

unmanned surface vessel, Aug. 13. The vessel was built by Nichols Brothers Boat Builders, in Freeland, Wash.

Baltimore-based BlackSea Technologies builds uncrewed surface vessels, including the 15'8"x5'8" GARC (global autonomous reconnaissance craft), for the Navy.

DARPA

U.S. Navy

iteration cycles and more ef cient scaling of production.

After acquiring the Gulf Craft yard in April, Saronic invested heavily to revive what had been a agging operation, said Mavrookas. “We acquired the yard in under 45 days, we retained 100% of the workforce,

and in less than 60 days after the acquisition, we more than doubled the workforce,” he said. “We stepped in, and we offer job security, excitement, and mission back into a yard where the capacity for our industrial base in this country was literally going to zero.”

The company plans to spend more than $500 million on upgrades at Franklin and billions more on a nextgen facility, Port Alpha, beginning in 2026. Unlike most legacy yards, the focus will be on modularity, automation, and scale.

a subsidiary of BioMicrobics, Inc. Longest Lasting, Best Performing MSD’s PERIOD!

www.SciencoFAST.com solutions@sciencofast.com

Mavrookas said vessel anatomy will dictate shipyard operations, as well as the company’s plans to overcome an industry-wide workforce shortage.

“Our ships, even our 150-foot ship, have seven or eight major movers. It has the jets, the engines, the fuel tank, the bowthrusters, sensors, a really large computer, and then whatever the payload is, that’s essentially it,” he said. “So you’re stripping 85 to 90% of the complexity out of the design right up front… You have this design for a manufacturing concept that underlines everything we build.”

roudl made in the U.S. .