IN BUSINESS ON THE COASTAL AND INLAND WATERS

Data flow is modernizing inland transport.

your ship repair process:

Located in northeast Florida — two nautical miles from the Atlantic Ocean — BAE Systems Jacksonville Ship Repair applies competence, efficiency and integrity to its projects. With the opening of our 25,000-ton shiplift, we have expanded our capacity and capabilities, enabling us to enhance our maritime operations and reinforce our position as a trusted leader in the industry. Contact us today to discuss how we can support your goals.

baesystems.com/commercialshiprepair

12 In Business: Harlem Rocket

Tour-boat venture will showcase famed neighborhood.

16 Vessel Report: Push and Pull

Ocean tug operators focus on solidifying existing fleets.

24 Cover Story: Data Way

Tracking tech makes life easier for barge operators.

20 On the Ways

• Houston Pilots debut next-gen launches • LeBeouf Bros. christens 120' pushboat • Three survey vessels delivered to Army Corps • Metal Shark builds CTV for A-O-S • First of 11 new towboats delivered to Hines Furlong • Birdon partners with C&C Marine to construct landing craft • New towboat for Jack Tanner • Catalina Express orders ferry •Crescent orders tug from Blakely BoatWorks.

28 Clean Power

From hydrogen to methanol, next-gen marine fuels are here.

6 S. Korean, American shipbuilders partner to build US containerships

6 Canal Barge acquired by investment firm

6 Car carrier sinks in the North Pacific.

6 Maritime Partners to buy Centerline Logistics

7 On the Water: When rank masks risk

7 Capital Corridors: Maritime prosperity zones adrift in red tape.

8 Captain's Table: Navigation anxiety on our waterways.

8 Credentialing Insight: ATB/ITB sea time credit updated.

9 Inland Insider: Towing industry seeks regulatory relief.

10 Insurance Watch: Loss control is your friend.

10 HSE: Environmental reporting regulations on the rise.

11 Legal Talk: Can a vessel's crew be personally liable?

11 Energy Level: Offshore industry keeps oil production growing.

Slow to change. Race to the bottom. Stuck in the past. Set in their ways. Behind the times. Behind the curve.

These are some of the phrases I’ve heard used to describe the U.S. inland towboat and barge industry.

Yes, this sector leans heavily on tradition and tends to be risk-averse — and for good reason. With thin pro t margins and safety on the line, caution is essential. Plus, river shipping is already among the most ef cient modes of commodity transport.

But let this edition serve as evidence that the labels above fail to tell the entire story.

Barging companies on the U.S. inland waterways system are embracing new technologies to streamline operations and boost ef ciency even further. Is the pace of change comparable to Silicon Valley’s breakneck speed? Not quite. But certainly credit is due.

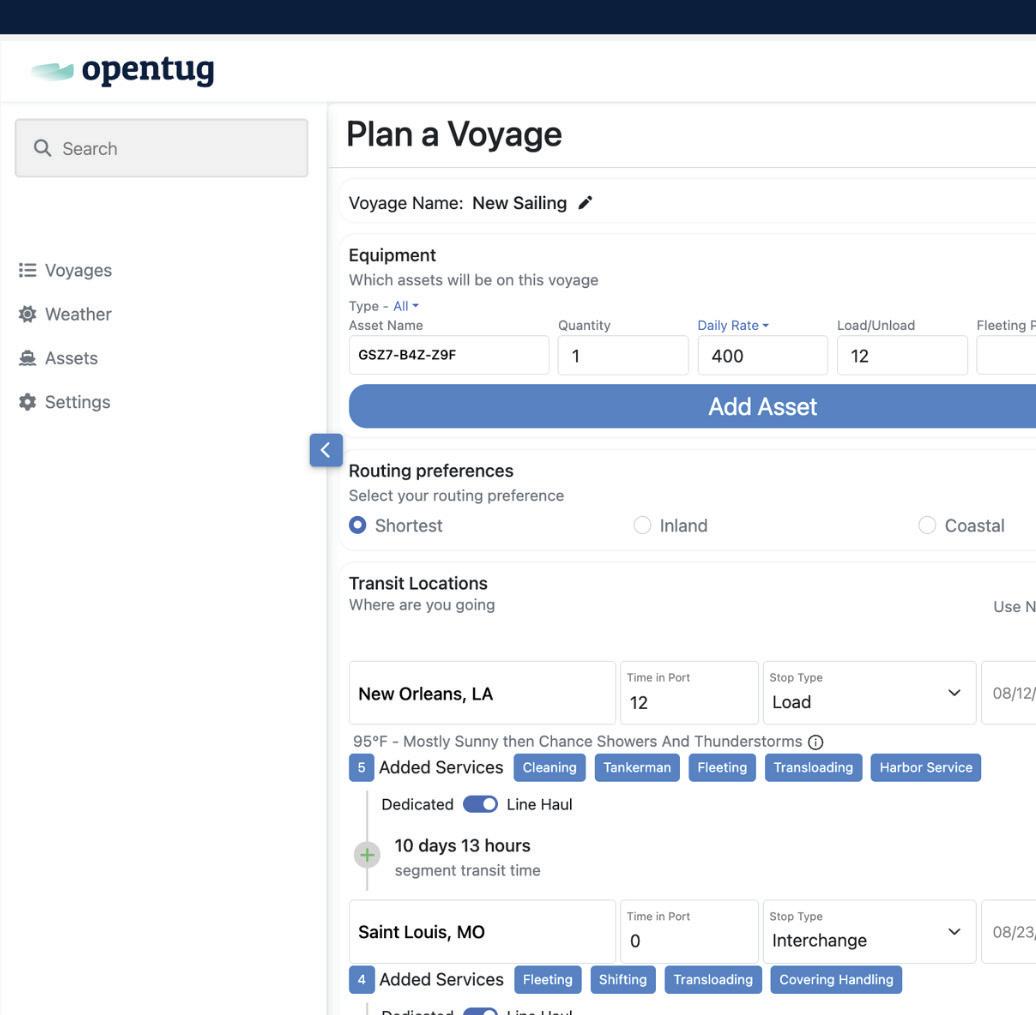

Maritime-focused tech companies like OpenTug — which provides software solutions to help shippers, barge operators, and terminals optimize freight movement, improve communication, and increase visibility — are leading the industry’s digital shift. The key lies in building a product that works and demonstrating how it bene ts users. Senior Editor Ken Hocke explores this topic in our cover story.

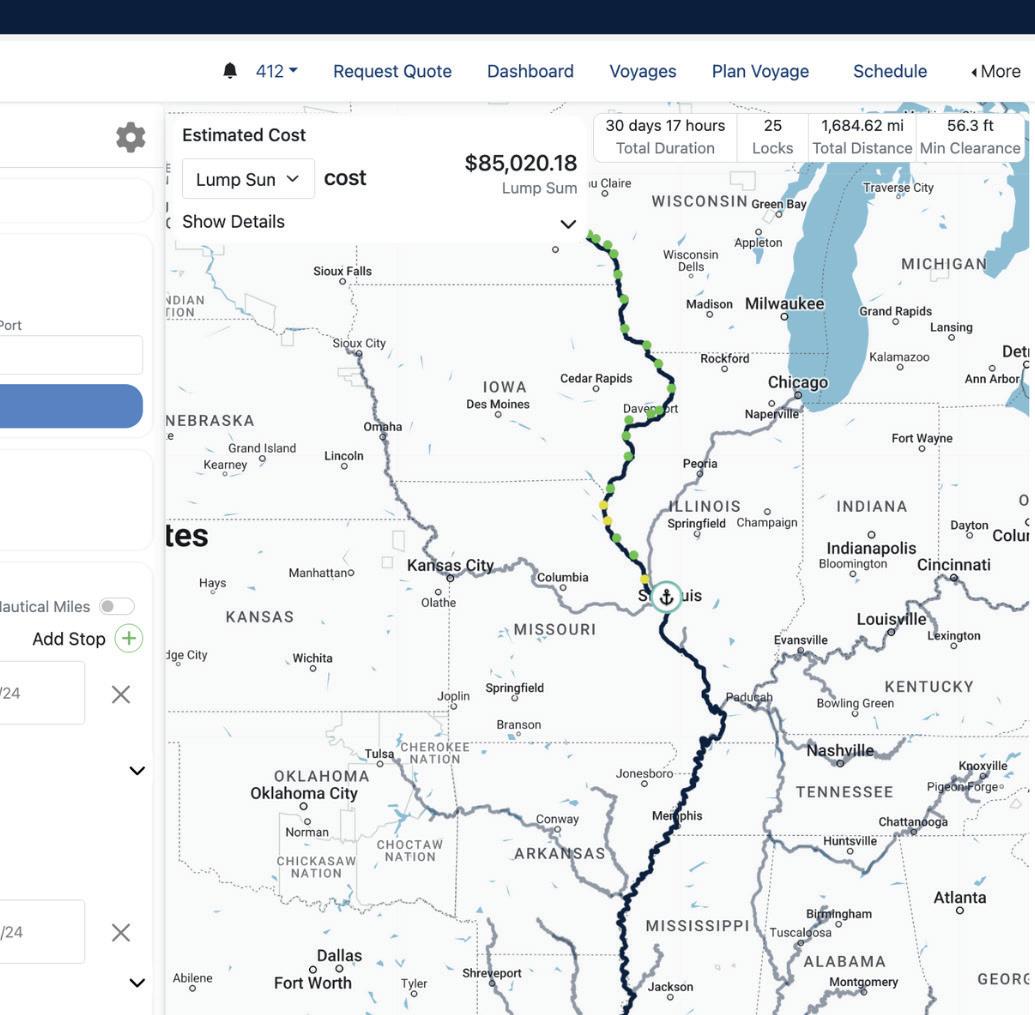

Elsewhere, marine nancing rm Maritime Partners — a pioneer in its own right — has been working with another innovator, naval architects Elliott Bay Design Group, to develop a groundbreaking vessel named Hydrogen One, the world’s rst tow-

Eric Haun, Executive Editor ehaun@divcom.com

boat designed to run on a cleaner-burning methanol-to-hydrogen propulsion system. WorkBoat correspondent Casey Conley covers this effort and several other groundbreaking projects in this month’s feature on alternative fuels.

And that’s just the beginning. Across the inland waterways, towboat operators are adopting predictive maintenance and remote monitoring systems, advanced navigation technologies, and next-generation safety equipment.

Taken together, these efforts show that the inland maritime sector isn’t stuck — it’s evolving, deliberately and pragmatically. Change may not come overnight, but it is happening — slowly but surely.

Crews on board tug and tow boats, fire/rescue craft, offshore service vessels, patrol boats and other workboats must perform a variety of complex operations. Wind noise, loud engines and pounding through rough waters can make boat crew communication extremely challenging.

David Clark Marine Headset Systems offer clear communication and rugged reliability in the harshest marine environments, while enhancing the safety and situational awareness of boat crew members.

Call 800-900-3434 (508-751-5800 Outside the USA) to arrange a system demo or visit www.davidclark.com for more information.

EXECUTIVE EDITOR Eric Haun / ehaun@divcom.com

SENIOR EDITOR Ken Hocke / khocke@divcom.com

SENIOR ASSOCIATE EDITOR Benjamin Hayden / bhayden@divcom.com

SENIOR ASSOCIATE EDITOR Kirk Moore / kmoore@divcom.com

CONTRIBUTING WRITERS

Tim Akpinar • Capt. Alan Bernstein • Dan Bookham • G. Allen Brooks

Bruce Buls • Eric Colby • Casey Conley • Michael Crowley

Jerry Fraser • Nate Gilman • Pamela Glass • Arnie Hammerman

Craig Hooper • Joel Milton • Richard Paine, Jr. • Chris Richmond

DIGITAL PROJECT MANAGER / ART DIRECTOR Doug Stewart / dstewart@divcom.com

ADVERTISING ACCOUNT EXECUTIVE S

Mike Cohen 207-842-5439 / mcohen@divcom.com

Kristin Luke 207-842-5635 / kluke@divcom.com

Krista Randall 207-842-5657 / krandall@divcom.com

Danielle Walters 207-842-5634 / dwalters@divcom.com

ADVERTISING COORDINATOR

Wendy Jalbert 207-842-5616 / wjalbert@divcom.com

Producers of The International WorkBoat Show and Pacific Marine Expo www.workboatshow.com • www.pacificmarineexpo.com

PRESIDENT & CEO Theodore Wirth / twirth@divcom.com

VICE PRESIDENT Wes Doane / wdoane@divcom.com

PUBLISHING OFFICES

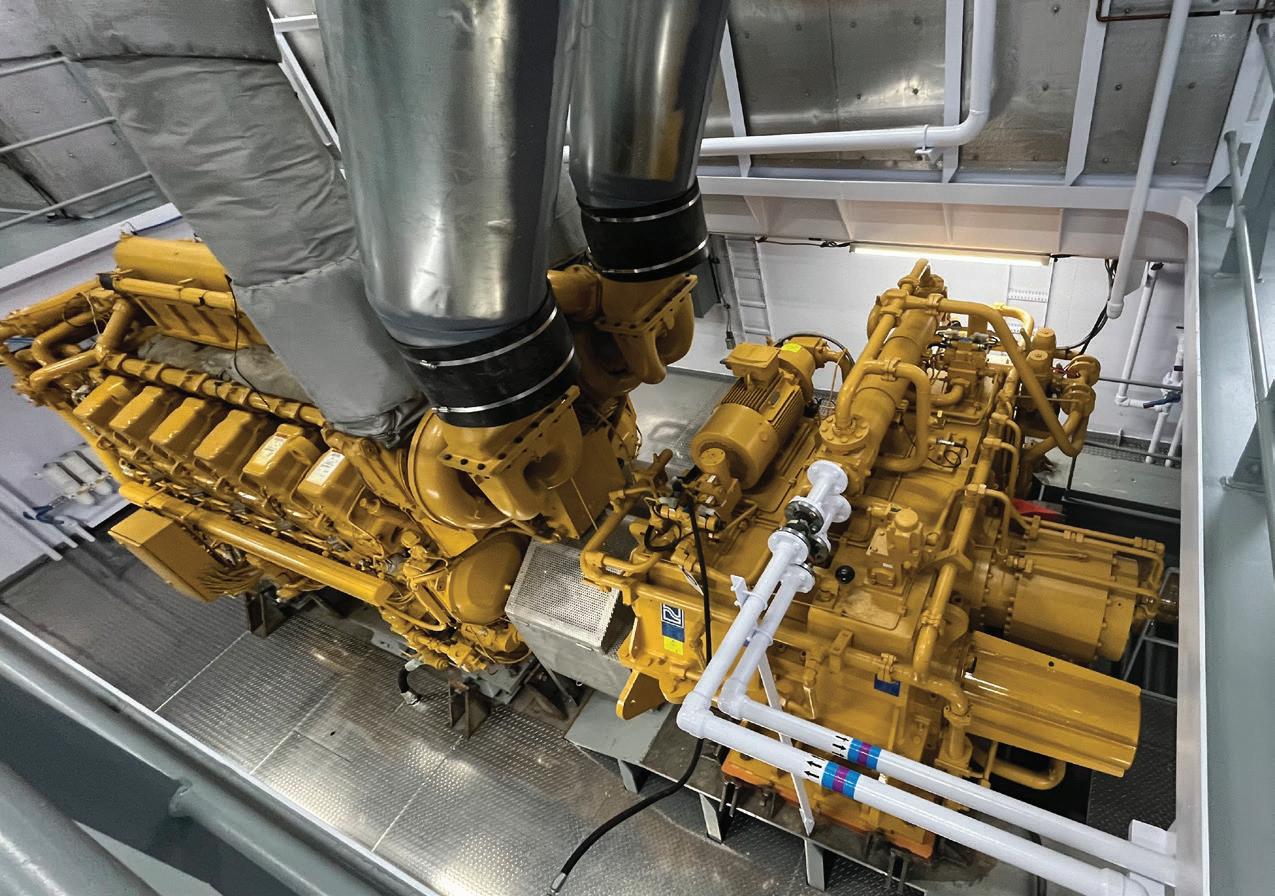

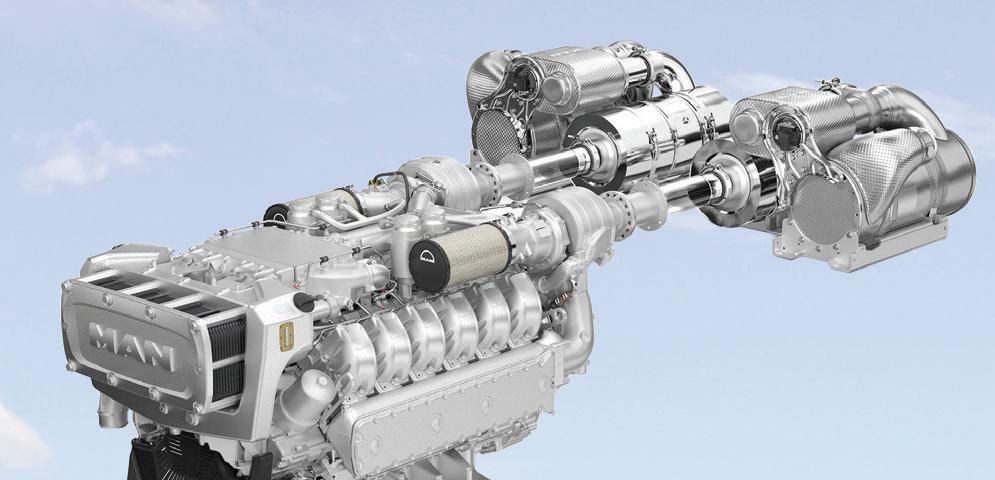

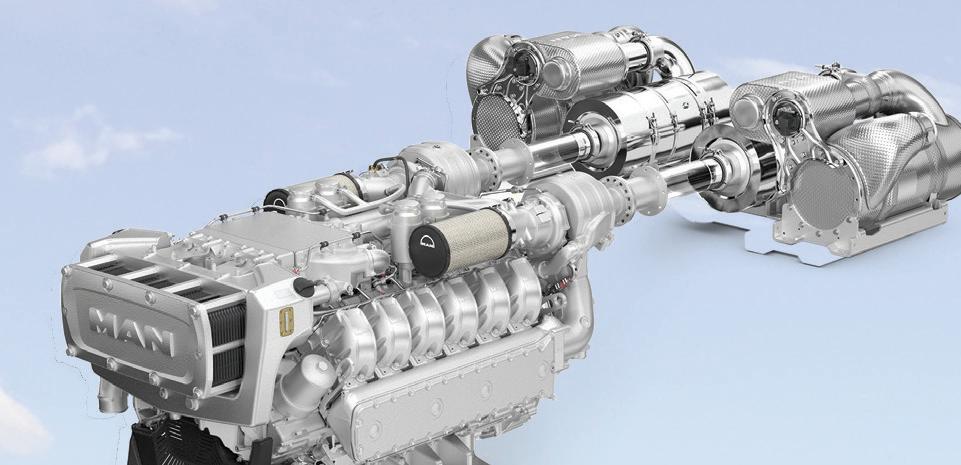

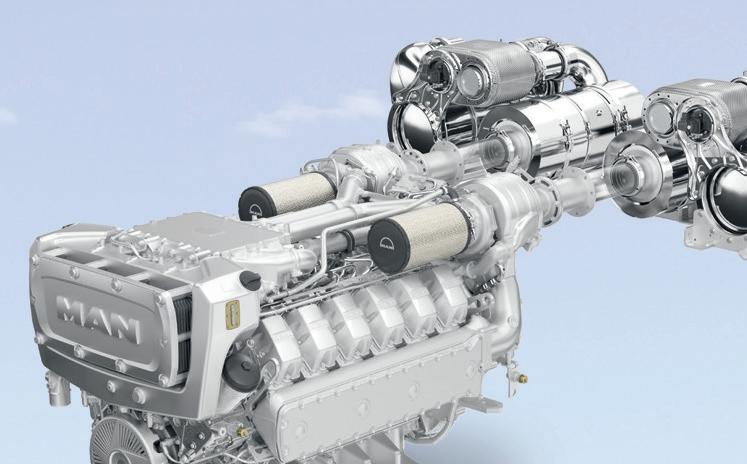

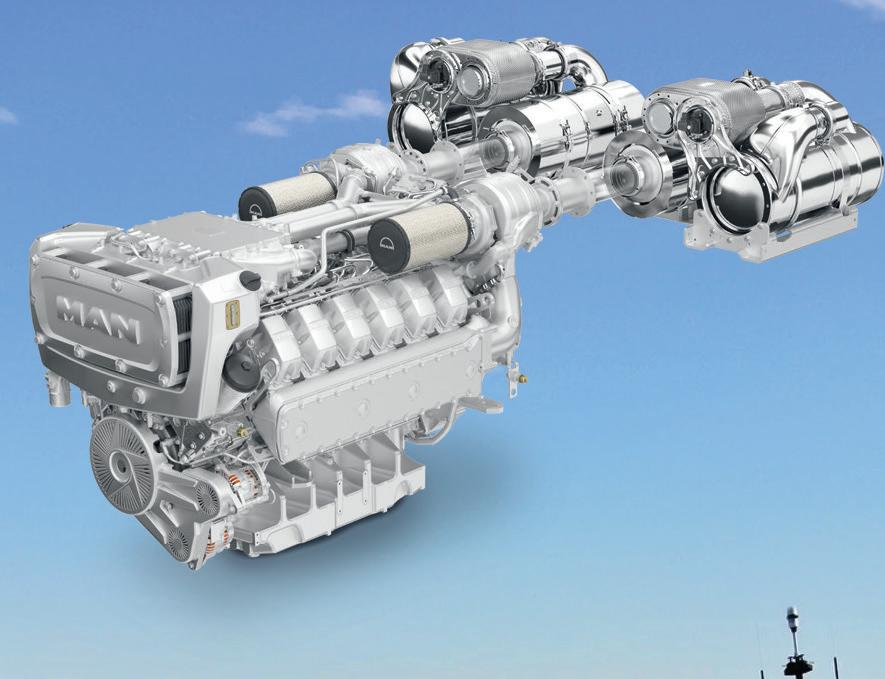

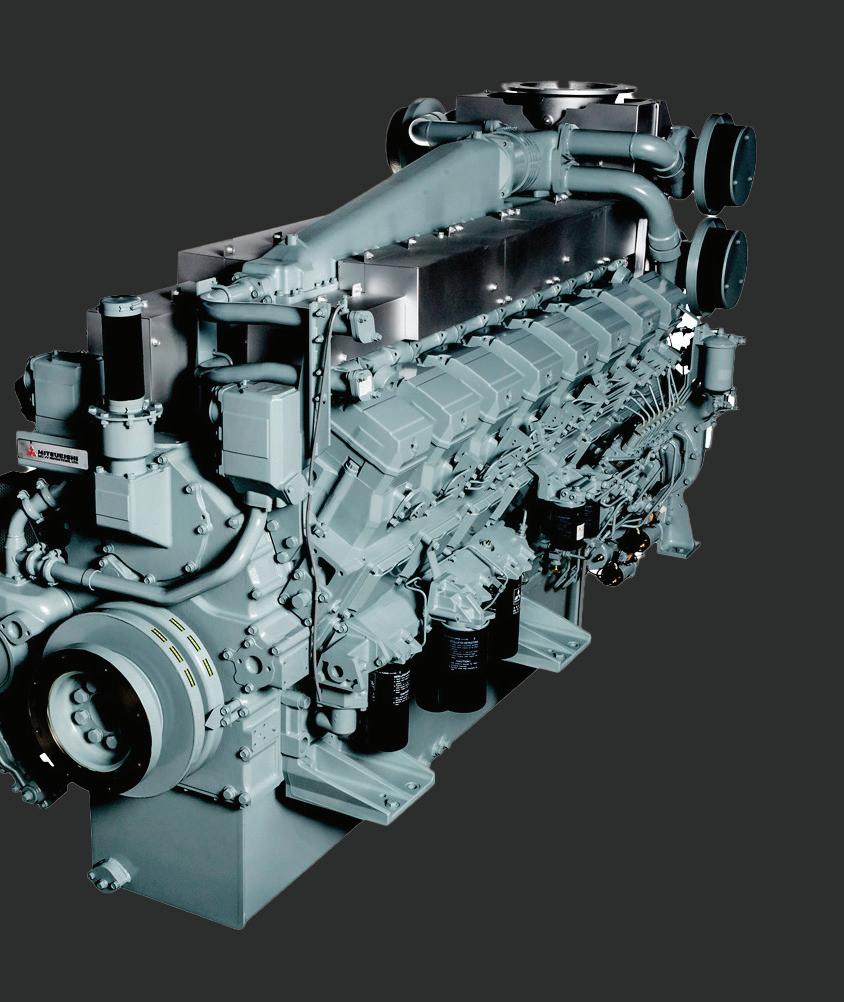

Workboat Engine

MAN D3872 LE V12

30L displacement available with SCR or DPF+SCR system

Workboat Engine

MAN D2862 LE V12

24L displacement available with SCR or DPF+SCR system

Reliable Power. Built for the Job.

Our marine engines deliver dependable performance across a wide horsepower range—perfect for tugs, crew boats, and work vessels of all kinds. Designed for tough conditions, they offer maximum uptime, fuel efficiency, and low emissions without sacrificing power. Sustainable. Durable. Ready when you are. For more details, explore www.manengines.com, www.man-engines.com, or www.performancediesel.com.

*Golden Gate Pilot Boat powered by MAN D2862LE SCR engines.

fi rm Redwood Holdings , Baltimore, has agreed to acquire the familyowned Canal Barge Co. Inc., New Orleans. Financial terms were not disclosed. The transaction, which is expected to close in the third quarter of this year, pending customary closing conditions and regulatory approvals, pairs Canal Barge with Marquette Transportation Co. LLC, Paducah, Ky., which Redwood purchased in May 2024. The two companies will now operate under the same corporate umbrella.

South Korean shipbuilding conglomerate HD Hyundai Co. Ltd. is partnering with Edison Chouest Offshore (ECO), Cut Off, La., to construct large, oceangoing vessels in the U.S.

The agreement, signed at ECO’s headquarters on June 19, will see HD Hyundai provide design support, equipment procurement, construction technology, and partial ship block manufacturing for shipbuilding projects at ECO’s Tampa Ship facility in Tampa, Fla. The partners plan to build liqueed natural gas dual-fuel containerships by 2028 before expanding into areas such as icebreakers, naval vessels, and cranes, HD Hyundai said.

The partnership comes as the U.S. pushes to rebuild its domestic shipbuilding capabilities. In April, President Donald Trump signed an executive order aimed at reviving U.S. shipbuilding and reducing China’s grip on global shipping. Later that month, lawmakers reintroduced the Shipbuilding and Harbor Infrastructure for Prosperity and Security (SHIPS) for America Act, and its companion bill, the Building SHIPS in America Act, calling for regulatory reform, expanded cargo preference, workforce development, and tax incentives to spur ship construction and expand the U.S. merchant eet.

The U.S. has constructed less than 1% of commercial ships globally, while China has built about half, an increase from just 5% in 1999, according to the think tank Center for Strategic and International Studies. From 2022 to 2024, only three 3,600 TEU-class containerships were ordered by U.S. shipping companies, according to analysts Clarkson Research

Several leading shipbuilders from allied nations are expanding their presence in the U.S., including South Korea’s Hanwha, which acquired Philly Shipyard, Philadelphia, in 2024, and Canada’s Davie, which is acquiring shipyards in Texas to construct icebreaking vessels.

HD Hyundai’s growing U.S. footprint includes recent agreements with the nation’s largest builder of naval ships, Huntington Ingalls Industries, Newport News, Va., and key defense contractor Fairbanks Morse Defense, Beloit, Wis., as well as academic partnerships with the University of Michigan and Seoul National University to cultivate a new generation of naval architects and marine engineers. — Eric Haun

Afire-stricken car carrier capsized on June 23 and sank approximately 450 miles southwest of Adak, Alaska. The Liberianregistered Morning Midas was transiting from Yantai, China, to Lázaro Cárdenas, Mexico, when it caught fi re on June 3. The blaze quickly grew out of control, forcing all 22 crewmembers to abandon ship. No injuries were reported. The 600'x103'5" ship was carrying 3,048 total vehicles, including 70 fully electric and 681 hybrid vehicles, as well as 350 metric tons of marine gasoil and 1,530 metric tons of very-low-sulfur fuel oil.

fi nancing fi rm Maritime Partners LLC, New Orleans, has reached a deal to acquire marine transportation company Centerline Logistics Corp., Seattle, from its principal investors, which include Macquarie Capital , Sydney, and Steve Kadenacy, co-founder and managing partner at Silverbox Capital , Austin, Texas. Financial terms were not disclosed. The transaction remains subject to customary closing conditions, including regulatory approval, and is expected to close in the third quarter of this year.

BY JOEL MILTON

Joel Milton works on towing vessels. He can be reached at joelmilton@yahoo.com.

Last month, I introduced the aviation term “experience gradient” to describe the gap in experience between a pilot and first officer. The steeper this gradient — that is, the greater the difference in experience — the less likely the junior member of the cockpit crew is to challenge the captain when errors in judgment, action, or inaction occur. The same dynamic exists in maritime transportation, and the consequences can be just as severe, if not quite as spectacular or quick to unfold. It’s the awareness of this important dynamic — shaped by decades of accidents and disasters —that eventually led to the parallel development and adoption of crew resource manage-

Maritime prosperity zones adrift in

AmericanBY CRAIG HOOPER

Dr. Craig Hooper is the founder and CEO of the Themistocles Advisory Group, a consulting firm specializing in maritime and national security strategy. He has been a keen observer of navies and coast guards for over two decades.

mariners cheered in early April as President Trump introduced “maritime prosperity zones.” Included as part of the much-ballyhooed Restoring America’s Maritime Dominance executive order, maritime prosperity zones are intended to “incentivize and facilitate domestic and allied investment in United States maritime industries and waterfront communities.”

With stipulations for regulatory relief and favorable terms for capital investment, these new maritime prosperity zones will be a real help in unlocking new facilities and refreshing old waterfront shipbuilding infrastructure.

It sounds great. But the details are a mess.

First, the laws supporting the executive order are in flux. The legislative backing for the executive order was opportunity zone legislation from the Tax Cuts and Jobs Act of 2017, which means, in essence, that maritime prosperity zones can only be established in impoverished harbor zones that meet the lowincome criteria necessary to qualify as an opportunity zone.

That makes no sense.

Maritime prosperity zones need to be placed in the most

ment training in aviation and bridge resource management in the maritime industry. The differences are few, and the goals are identical: to avoid another Tenerife airport disaster, a runway collision between two 747 jumbo jets at the cost of 583 lives, in part attributable to reluctance to question a captain.

There is more than one type of experience gradient. In addition to the gradient between individuals, each person also has their own gradient relative to overall experience — measured in terms of time, diversity, and quality. A captain of seven years (or well more) might have a steep gradient relative to the mate with just one, but there’s far more to it than that. Where have you been, what have you done, in what kind of environments? There are many variables, each with its own relative weight, and all experience is not of equal value. Depending on the circumstances, a mate may, in some cases, have more relevant experience than the captain.

What’s even rarer than a mate who has the knowledge, judgment, self-confidence, and willingness to risk possible job or career repercussions by challenging and/or correcting an errant captain? That would be a captain with the self-confidence, selfawareness, and humility to be able to accept feedback gratefully and gracefully for the greater good.

strategically sensible areas of the country, and in waterfront areas that may have real, unmet potential. The forthcoming Shipbuilding and Harbor Infrastructure for Prosperity and Security (SHIPS) for America Act allows for that kind of strategic leeway, designating the Marad administrator to be the primary designator of maritime prosperity zones.

But the SHIPS Act is still mired in Congress, and waterfront stakeholders can’t afford to wait.

An opportunity zone refresh is contained in the One Big Beautiful Bill Act, but it leaves waterfront stakeholders with a tricky bureaucratic challenge.

The executive order directs the commerce secretary to define the qualifying parameters for a maritime prosperity zone, but again, maritime prosperity zones may only be targeted to census zones that meet certain poverty or geographical criteria.

There’s no guarantee that the secretary of commerce’s definition of a maritime prosperity zone will align with how states define and select their opportunity zones.

The administration has some work to do before it identifies new maritime prosperity zones. Poverty should not define an area’s eligibility to serve as a maritime prosperity zone. Strategic potential and maritime utility should be the leading factors in identifying sites for future maritime prosperity zones, with poverty levels relegated to a far less important discriminator.

The maritime prosperity zone concept is a great idea that risks being run aground by sloppy execution. Mariners — not economists — should be identifying maritime prosperity zones. Going forward, it would be a real shame to penalize potentially ideal shipbuilding sites because they’re on the wrong side of an arbitrary median income cut-off. It’s time to pick good sites and support them.

BY CAPT. ALAN BERNSTEIN

Alan Bernstein, owner of BB Riverboats in Cincinnati, is a licensed master and a former president of the Passenger Vessel Association. He can be reached at 859-292-2449 or abernstein@bbriverboats.com.

Coast Guard Northeast (formerly District 1) this spring sought public comments on its proposed plan to “modernize” the existing aids to navigation (navaids) program. In doing so, the Coast Guard intends to initially remove 350 navaids from New York to Maine. This represents about 6% of the federally maintained navaids in that district. This busy Northeast region will apparently be the Coast Guard’s first test ground for a range of technological additions to physical aids to navigation.

Many traditionalists in the maritime industry are in a state of high anxiety because of this announcement. There are still mariners who rely heavily on physical navaids to navigate in poor weather and rough seas. These individuals have most likely learned to navigate without the benefit of electronics

TBY NATE GILMAN

Nate Gilman, president of MM-SEAS USCG Licensing Software, uses his hawsepiping experience to support mariners and workforce development. Connect on LinkedIn.

he U.S. Coast Guard has announced an updated interpretation regarding sea service credit that will significantly impact mariners working on articulated tug barges (ATB) and integrated tug barges (ITB). This revision represents a positive step forward, aimed at supporting mariner career progression and streamlining regulations for those holding unlimited tonnage endorsements.

Effective immediately, mariners who already hold an unlimited tonnage officer endorsement and are seeking a higher-grade unlimited endorsement (such as third mate to second mate, second mate to chief mate, or chief mate to master) will now receive day-for-day credit for sea time.

This credit applies specifically when their sea time is served on ATBs and ITBs that meet two conditions: they

and are resistant to casting off the old tried-and-true methods. They recognize the pitfalls of relying too heavily on electronics and are suspicious of looming cyberattacks and computer crashes.

Some younger mariners will be comfortable with electronic navigation solutions. They don’t know a world in which GPS and AIS do not exist. These individuals are very confident operating in an electronic environment and most likely will embrace virtual navaids. Some mariners straddle both generations and have comfort levels with physical navaids as well as electronic ones.

Finally, there is the Coast Guard, which faces the rising costs of building, maintaining, and crewing buoy tenders. They are additionally challenged by the never-ending tasks of placing, replacing, and repairing navaids. In doing so, the Coast Guard must also balance the needs of all mariners and constantly changing waterways.

Anyone concerned about maintaining maritime safety must be involved in this conversation. Change is inevitable, but it must be reasonable and measured. My recommendation, after many years as a licensed mariner, is to go slow and identify navigation areas to target first to iron out any bugs before broadening the program to other zones. We may find that some areas of the country are more conducive to modernization than others.

operate exclusively as a composite unit, and they possess a total tonnage above 1,600 gross registered tons.

This updated interpretation acknowledges that when an ATB or ITB operates as a single, composite unit, the experience gained by mariners is equivalent to that on other large, single-hull vessels.

To properly claim this day-for-day credit, your service must be accurately documented on your sea service letter. In the letter, the operating company must clearly state that the ATB or ITB operated exclusively as a composite unit during the specified service period and the total tonnage for both the tug and barge should be written next to each sea service entry for mariners with unlimited officer endorsements.

It is recommended that the following statement be included below the sea service entries, depending on if it’s an ATB or ITB: “(Vessel name) is an ATB that operates exclusively as a composite unit.”

Mariners with pending applications or those who have received “awaiting information” letters that this new credit may affect should be proactive and provide an updated sea service letter that clearly states the vessel operates exclusively as a composite unit.

While this interpretation adjustment is a welcome development that will help make sailing on ATBs more attractive to unlimited officers again, it also highlights existing limitations. The barriers to mariner career progression under 46 CFR 11.211(d) are still in place for mariners who

do not hold an unlimited deck officer endorsement and are working to advance their careers on ATBs that operate exclusively as a composite unit.

The logic underpinning this positive change — recognizing the functional equivalence of a composite ATB/ITB to a single vessel — establishes a strong foundation. Industry is hopeful that the Office of Merchant Mariner Credentialing will take this opportunity to further recognize the value of all mariners

working on ATBs that operate exclusively as a composite unit. The industry supports refining the language to include all ATBs and ITBs operating exclusively as a composite unit, regardless of specific tonnage thresholds or the mariner's current license level, for day-for-day credit.

Such a comprehensive interpretation would further simplify credentialing and provide clear pathways for mariners to reach the wheelhouse while pursuing a career aboard our nation’s ATB

Inland towing industry seeks regulatory relief

BY PAMELA GLASS

Pamela Glass is the Washington, D.C., correspondent for WorkBoat. She reports on the decisions and deliberations of congressional committees and federal agencies that affect the maritime industry.

The inland towing industry is asking the Trump administration to drop or modify a host of existing federal regulations or policies that it says are negatively impacting towing operations.

The nine-page wish list was submitted to the White House Office of Management and Budget (OMB) in response to the agency’s nationwide call for industries to suggest ways to reduce regulatory burdens on their businesses.

This deregulation initiative is part of an executive order issued by President Trump in January that directed federal agencies to rescind “unlawful regulations and regulations that undermine the national interest.” A White House fact sheet said, “Overregulation stops American entrepreneurship, crushes small business, reduces consumer choice, discourages innovation, and infringes on the liberties of American citizens.”

In a letter sent to OMB in May, the American Waterways Operators (AWO), which represents the towing industry, offered recommendations for deregulation that touch on vessel inspection, marine casualties, navigation safety, cybersecurity, pollution control, and mariner credentialing.

“This list is inclusive of regulations we recommend for rescission because their costs exceed their benefits, they are outdated, or they impose unreasonable burdens on towing vessel and barge operations,” AWO said in its submission. “This list also includes recommendations for regulatory modifications and clarifications that would have a deregulatory effect.”

AWO’s “action items” include:

• Reducing annual vessel inspection fees for inspected towing vessels.

• Eliminating requirements that a copy of a Towing Safety

fleet. This would continue to support the Coast Guard’s stated goals by facilitating career progression for an even wider range of skilled mariners throughout the industry.

The Coast Guard’s proactive step in this area is a testament to its responsiveness to industry needs, and the maritime community anticipates future developments that will enhance the efficiency of the merchant mariner credentialing system.

Management System Certificate that shows compliance with Subchapter M regulations, and certificates of inspection must be kept onboard, and instead allowing these documents to be maintained in electronic form.

• Dropping the requirement that towing operators using the Towing Safety Management System option be randomly selected for external audits, a rule that “significantly limits operational flexibility, imposes unnecessary costs on operations and third-party organizations, and arguably results in less consistent safety oversight.”

• Clarifying a requirement for high bilge level alarms to indicate where these alarms should be located on vessels.

• Modifying the definition of a “major marine casualty” that has been defined by Congress at $2 million or more in property damage but has not yet been updated by the Coast Guard, which applies a far lower threshold of $500,000 to trigger notification to the National Transportation Safety Board. “This exposes vessel operators to costly and burdensome investigations that do not meet the legal threshold.”

• Delaying implementation of minimum cybersecurity requirements on U.S. vessels to give operators more time to train personnel, and exempting barge fleeting facilities from minimum cybersecurity requirements, as these operations are located in rural areas with little infrastructure, electricity, or internet access.

• Reducing frequency of cybersecurity drills, which are now required at least twice a year.

• Reconsidering the requirement for mariners with national towing vessel officer endorsements to take firefighting training because these officers are responsible for managing the crew’s response to a fire, not fighting it.

• Updating Coast Guard chemical drug testing regulation to permit testing of oral fluids as well as urine testing, which would offer more flexibility to vessel operators.

• Eliminating requirements for seagoing, uncrewed, unpowered barges to meet the numeric ballast water discharge standard because most of these vessels are towed on wires, have no crew, and can’t be retrofitted with ballast water treatment systems.

AWO says the list was based on recommendations from the group’s executive committee.

AlocalBY CHRIS RICHMOND

Chris Richmond is a licensed mariner and marine insurance agent with Allen Insurance and Financial. He can be reached at 800-439-4311 or crichmond@allenif.com.

shipyard we work with was recently visited by the loss control manager from the insurance company that writes its United States Longshore and Harbor Workers’ Compensation Act (USL&H) coverage. This was a good visit all around. Although the yard and the insurance company have had a longstanding relationship, recent losses required the insurer to make several large payouts, resulting in a premium increase for the shipyard. This is not good all around. USL&H premiums are based on payroll and the types of work employees perform. The larger the workforce, the more a company pays. Loss experience is then factored in. The more claims you have, the higher your premium will be. It’s easy to forget about past claims — until you expe -

BY RICHARD PAINE JR.

Richard Paine Jr. is a licensed mariner and certified maritime safety auditor with over 25 years of maritime industry experience. He is currently a senior VP at the Hornblower Group and can be reached at rjpainejr@gmail.com.

Over the past two decades, the maritime industry has placed greater emphasis on environmental conservation than at almost any other time in its history. This shift has driven advancements in green technologies, including cleaner-burning Tier 3 and Tier 4 engines, reusable and bio-based fuels, hybrid dieselelectric and fully electric systems, as well as alternative energy sources like ammonia, hydrogen, solar, and wind. Many of these innovations — some supported by federal and state funding — have also led to new environmental reporting regulations. Two of the most anticipated new reporting regulations originate from California: Senate Bill (SB) 253, the Climate Corporate Data Accountability Act, and SB 261, the ClimateRelated Financial Risk Act. Both are supported by the California Air Resources Board (CARB) and target companies that

rience a serious case of sticker shock when the premium notice arrives.

For many years, the mindset at many yards has been to “get the job done” — a phrase often seen as a mark of a strong work ethic. But it’s just as important to include the word “safely.” And the expense of a claim does not stop at medical bills. The indirect costs a yard incurs from a claim due to work stoppage, extra paperwork, corrective actions, time lost to injuries, etc., can add up to an additional 66% of unseen costs to your business.

At our local shipyard, the loss control manager presented a spreadsheet covering five years of claims. It detailed the injured body part, the job being performed, and the cost associated with each incident. A subsequent tour of the yard found spots for the safety director to focus on to help prevent future accidents. Suggested changes were made, and a follow-up visit in four months was scheduled.

The insurance company’s loss control manager recognized this long-term relationship and provided valuable (and free) guidance to the insured shipyard to help reduce injuries at the workplace. The hope is that a safer work environment will lead to fewer accidents, fewer claims, and ultimately, lower USL&H premiums. The money saved can be invested elsewhere — clearly, a win all around.

do business in California. SB 253 applies to companies with annual revenues exceeding $1 billion, while SB 261 applies to those exceeding $500 million. Notably, these bills are designed to extend beyond operations within California, requiring large companies to report environmental data from their broader, global operations.

Each bill differs slightly in focus and is still undergoing finalization by the state. Among its provisions, SB 253 will require companies with annual revenues of $1 billion or more to report their Scope 1 and Scope 2 greenhouse gas emissions in 2026, based on 2025 data. In 2027, reporting will expand to include Scope 3 emissions, covering 2026 outputs. (Scope refers to the derivation of emissions.) SB 261, modeled after the European Task Force on Climate-Related Financial Disclosures (TCFD), will require applicable companies to submit climate-related financial risk reports by Dec. 31, 2025. Public education efforts and clarifications around specific provisions of both bills are ongoing.

In addition to California’s Senate bills, there is a growing trend across the U.S. toward requiring both public and private companies to report their environmental impact. Several other states — including Colorado, Illinois, New York, New Jersey, and Washington — have begun introducing their own environmental reporting frameworks. As with any new regulation, there will likely be a period of debate and adjustment before these measures are either implemented or set aside. However, it is increasingly clear that the U.S. is moving toward a broader, more comprehensive environmental reporting model for businesses.

BY TIM AKPINAR

Tim Akpinar is a Little Neck, N.Y.-based maritime attorney and former marine engineer. He can be reached at 718-224-9824 or t.akpinar@verizon.net.

Arecent oil spill in California’s Marin County has drawn attention because a tug captain became personally liable for damages. The incident occurred in 2021, when the tug Hunter lost propulsion while towing American Challenger, a 90' decommissioned commercial fishing vessel. The fishing vessel ran aground in a remote area, resulting in a $14 million cleanup action. Although the tug captain has since passed away, his estate was subsequently pursued for damages. Mariners might wonder how personal liability could arise in such a scenario. Historically, the vessel owner or insurance carrier picks up the tab in an incident, whether it involves damages to a bridge or injuries to a passenger. Traditional maritime law does not call for deckhands and mates to pass

OneBY G. ALLEN BROOKS

G. Allen Brooks is an energy analyst. In his over-50year career in energy and investment he has served as an energy security analyst, oil service company manager, and a member of the board of directors for several oilfield service companies.

would think that the offshore industry would be cratering with oil prices having fallen from the $70s for a barrel into the $60s. Various rig data trackers, however, show little change in offshore drilling activity over the past year.

The percentage of active rigs in the U.S. Gulf has increased slightly this year, mainly due to the retirement of older rigs, which is the normal fleet winnowing process. This sustained activity reflects the long-term nature of the offshore industry. Producers believe oil prices as not likely to crash and will provide profit opportunities at current levels.

The good news for the U.S. is that total Gulf oil production is expected to increase in 2025 and 2026 from 2024. The slight projected increase, 230,000 barrels per day or a 1.7% increase, lifts total Gulf output to 13% of the national supply.

On the other hand, the Energy Information Administration projects a slight decline in Gulf natural gas output this year and next, though offshore natural gas output supplies only 1% of U.S. marketed production.

around a hat and ask shipmates to kick in for bridge repairs or hospital bills for the passenger. So, what’s different here?

To understand how personal liability arose here, we need to look at another oil spill, the one involving Exxon Valdez in March 1989. In response, Congress enacted the Oil Pollution Act (OPA) of 1990, under which each “responsible party” is liable for removal costs and damages resulting from the discharge or the substantial threat of discharge of oil.

Attorneys for the captain’s estate raised the argument that the captain was not a “responsible party.” However, a federal court held otherwise, concluding that the captain was an operator. The court referred to the OPA, where an “operator” is someone who directs or controls the movement of a vessel.

What is the personal impact of being a “responsible party” in this grounding? It means being on the hook for cleanup costs in the recovery of about 14 cu. yards of oiled debris, 400 to 760 gals. of mixed oily water, and 50 gals. of hydraulic fluids. The U.S. estimates it incurred about $14,258,062 in costs related to its response.

Ordinarily, employees are not personally liable in most workplace settings. They can sometimes be personally liable if their conduct was egregious or they acted outside the scope of their employment. However, those principles are set aside here, where liability arises under the terms of a specific law.

Have lower oil prices offset the president’s “drill, baby, drill” mantra? Many think the phrase calls for more working rigs and a supply surge. However, that view clashes with Trump’s push for lower oil prices to ease consumer inflation, lead to lower interest rates, and boost economic activity.

Drill, baby, drill means unshackling the petroleum industry from red tape and permitting hurdles, preventing shut-in or under-exploited resources from reaching the market.

The reversal of the Empire Wind stop-work order showcases the real meaning of drill, baby, drill. No sooner did Interior Secretary Doug Burgum reverse the order than Williams Companies announced its permitting process for two pipelines to deliver natural gas into New York. The impetus for building the Constitution and Northeast Supply Enhancement Project to bring more gas into New York and potentially New England was a reported decision by Gov. Kathy Hochul to grant permits that were previously withheld. High electricity prices have sparked her concession.

A more expansive energy market will increase demand and oil and gas prices, but it will take time. Higher gas prices will come from increased electricity consumption from data centers, increased use of artificial intelligence, and a doubling of liquefied natural gas exports over the next few years.

Prices are rising despite the perception of an adequately supplied global oil market. West Texas Intermediate prices have reached their highest level since April.

Commodity headwinds are shifting to tailwinds for the oil and gas industry. The offshore support industry should be cheering.

Tour-boat venture will showcase New York’s famed inner-city neighborhood.

By Eric Colby, Correspondent

Two New York entrepreneurs are taking a unique approach to helping locals and visitors discover Harlem’s hidden cultural and gastronomic gems by water. Their company purchased a 100-person tour boat and had it retro tted at Derecktor Shipyards’ facility in Mamaroneck, N.Y. The boat is named the Hazel N. Dukes, and the company operating it is called Harlem Rocket LLC, a subsidiary of Paradise Express Ferry

Co-founder and CEO Garry Johnson, an architect, has a background in real estate and construction, with more than 30 years’ experience creating

affordable housing in urban communities. Johnson attributes his interest in the maritime domain to his stepfather, who served in the Navy.

Johnson’s business partner, Michael Preston, is co-founder and vice president of government affairs and customer experience. He brings a background in entertainment, theater management, and organizing largescale festivals.

“We saw a natural t with what we’re looking to do with tourism development on the waterfront and bringing large numbers of people onto the vessel,” said Preston. “Once you bring a waterfront operation to a waterfront area, it improves the value of that waterfront.”

Johnson and Preston found the vessel that would become the Hazel N. Dukes on the hard in Panama City Beach, Fla., where it had worked as a dolphin tour boat. It’s a 57'x16' V-bottom that was designed and built by Yank Marine Inc., Tuckahoe, N.J., constructed as part of a series of large, open tour boats that continue to operate in the U.S. and internationally.

Harlem Rocket commissioned Micah Tucker and his company, Tucker Marine, Bayville, N.Y., to manage the re t. Tucker, a naval architect, had previously spent 10 years running Derecktor’s Bridgeport, Conn., yard.

“She was well-built,” said Tucker. “Cosmetically, the boat was in rough shape, but overall, it was in good shape and a candidate for a re t.”

The boat was built with cold-molded construction that features epoxy resin and berglass over wood. While some boats in the Yank series were built with a raised helm, the Hazel N. Dukes’ centrally positioned operating station is basically on the same level as the deck. A new aluminum helm station was added during the re t.

Hazel N. Dukes was designed with a variable deadrise bottom and is propelled by straight-shaft inboards. A pair of rebuilt, naturally aspirated Detroit Diesel 8V92s power the boat to a top speed of about 30 knots, though most tours will be run at slower speeds.

Electronics supplier Raymarine sponsored the re t with a modern electronics suite including a virtual-realitybased navigation system that gives a full heads-up display of the charted course and the vessel’s position on it.

The primary components in the Raymarine suite included Axiom Pro 12 RVX and Axiom Pro 16-S multifunction displays, a Cyclone 4' 55-watt radar, the Evolution EV400 Power Pilot Pack autopilot with a hydraulic drive. Cameras included a Teledyne FLIR M300C marine unit, and the radio is a Ray73 marine VHF with a hailer, spare handset, and loudspeaker/foghorn. All required cabling and hardware were included.

The boat’s rated capacity is 100 passengers, and it’s expected to go into service in early July, operating on the Hudson River out of New York’s West Harlem Piers at W. 125th St.

During the re t, Johnson and Preston took neighborhood kids to see the work at various stages. “We put them on the vessel as it was being overhauled, and they couldn’t fathom the size of it,” said Preston. “Then getting up on the boat and seeing the deconstruction and construction, they saw this boat, and now they’re going to see it put back together. They’re excited. The community and the industry are excited in New York because a lot of people have heard about the Harlem Rocket coming to fruition.”

Once Harlem Rocket is open for business, the Hazel N. Dukes will offer two tours that run at multiple times per day. Ticket prices are $40 for adults and

$30 for children. An evening cruise will start with complimentary champagne for adults over the age of 21, and tour guides will point out culturally important sites in Harlem’s history.

When the tours end, visitors will be encouraged to patronize local restaurants

and retail stores. “This is marketing, hospitality, customer service engagement,” said Preston. “We are looking to have these young people involved in the historic presentation and development of this business.”

Three years ago, Paradise Express

Ferry was designated by New York’s Department of Small Business Services as the city’s rst Minority Business Enterprise in the maritime operations eld. Harlem Rocket aims to expose local youth to opportunities in the maritime industry. “People see boats, ships, tugs, and barges go by every day,” said Johnson. “They have no clue that those are viable careers and opportunities.”

Added Preston, “We have a motto: ‘A kid can’t be what a kid can’t see.’”

Harlen Rocket received more than 500 applications for seasonal positions, including both onboard and shore-based jobs. Johnson and Preston hosted four group sessions for 315 candidates, with up to 50 people per session attending presentations about the company and their future plans. After narrowing down

the pool, follow-up interviews were conducted via Zoom

“No [previous] employer had ever given them a presentation about their business and why [it] was important,” said Johnson. “No one had explained to them that we can’t do it without them.”

www.SciencoFAST.com solutions@sciencofast.com

Some of the deckhands for the summer 2025 season are experienced hands who have other on-deck gigs, but many on the shoreside staff come from myriad educational and professional backgrounds, ranging from medicine to academia to entertainment.

made in the U S a subsidiary of BioMicrobics, Inc. Longest Lasting, Best Performing MSD’s PERIOD!

“We had one kid from SUNY Maritime who wanted to go into pier operations as a supervisor,” said Johnson, noting other shoreside operations employees are from the local maritime high school.

“Many of them have good clarity about why this is important,” said Preston.

Johnson and Preston have interests in expanding to other locations, potentially placing additional boats in those areas or operating Harlem Rocket yearround by moving the Hazel N. Dukes to a warmer location in the off-season.

“I think a lot of our people would ask, ‘Can I go?’” said Preston.

Johnson said that as the company looks to grow its eet, he wants to look at diesel-electric hybrid and other reduced-emissions propulsion systems.

“As we expand our eet and we add a vessel in Harlem or another city, you want to be able to move off the dock using electric and move down river on ef cient diesel,” he said. “We’re going to continue down the pathway to create more environmentally friendly vessels for the communities we want to work in because it makes sense to do so.”

For future newbuilds, Harlem Rocket plans to work with Tucker, who has experience designing and building multihull hybrid and electric vessels. Johnson understands that the shoreside infrastructure is not in place to support all-electric propulsion, but that it could be an option when the proper charging capacity is in place.

With construction costs high, operators focus on solidifying existing fleets

By Casey Conley, Correspondent

estern Towboat Co., Seattle, has a versatile eet of harbor and oceangoing tugboats that tow a little bit of everything in Puget Sound and beyond. The company has a new Titan-class oceangoing tugboat, Northern Titan, under construction at its shipyard facility along the Lake Washington Ship Canal.

Once complete, Northern Titan will be the company’s eighth Titan-class tug in service, joining the other 120',

6,000-hp vessels in the series towing cargo barges between Seattle and Whittier, Alaska.

“We are planning to most likely start another Titanclass tug in the rst quarter of 2026,” said Capt. Russell Shrewsbury, the company’s vice president. “Our work demand has been really high. Now we just need to keep training and adding quali ed crews to help us accomplish our customers’ workloads.”

Oceangoing tugs like Western’s Titan-class are the

semitrucks of the sea. From drum winches on the aft deck they tow petroleum products in tank barges and construction equipment, chemicals, and containers perched atop deck barges. These tugs support oil and gas exploration, offshore wind, and increasingly, private space operators. And yet, new construction in this corner of the towing industry has been dormant in recent years despite an aging eet.

According to broker Mar-

con International Inc., some of these trends are re ected in the secondary market. The number of tugboats for sale globally and in the U.S. has fallen sharply in recent years, and the average age of vessels hitting the market is now approaching 33 years.

Western Towboat’s Titan-class oceangoing tug is currently under construction.

“Despite some appetite for older vessels requiring repowering to meet stringent [California Air Resources Board] regulations, the high cost of shipyard work often makes such investments challenging,” Marcon noted last fall in its towing industry report. “Owners are increasingly turning to their existing eets for candidates for major overhauls to meet regional demand.”

The cost of older equipment is rising. But like a homebuyer wary of a xer-upper at today’s prices, operators are scrutinizing the costs associated with bringing older tugs into their eets. “This scarcity is driving up prices for available assets, although paying $1 million or more for a tug requiring repowering remains dif cult to justify,” the Marcon report noted.

The oceangoing tugboat market was busy not long ago. Over the last decade or so, Sause Bros. Ocean Towing Co. Inc., Coos Bay, Ore.; Kirby Corp., Houston; Dunlap Towing Co. Inc., La Conner, Wash.; and Western Towboat all built new seagoing tugboats to bulk up their eets. Vane Brothers Co., Baltimore, completed not one but two separate classes of model bow tugs that can push or pull fuel barges.

The net result of all that building last decade is a relatively stable market with

suf cient towing equipment for the type and volume of work available, according to Frank Manning, president of shipbuilder Diversi ed Marine Inc., Portland, Ore.

“I think everyone was trying to get ahead of the Tier 4 requirement for oceangoing tug applications,” said Manning. “With Tier 4, there is the added fear of requiring urea for most engines available on the market.”

The rapid rise in new construction costs has also put a damper on the market for newbuild oceangoing tugs. Those higher build costs coincide with a steep rise in borrowing costs and the capital needed to service a loan on a long-term towing asset. Day rates for these assets, in many cases, have not risen in tandem with higher costs.

“The cost to construct a new vessel is just way too expensive,” said Shane Guidry, chairman and CEO of Harvey Gulf International Marine LLC, New Orleans. “Secondly, even if you took on the risk of constructing a vessel at 50% more than what the industry has built vessels for in prior years, oil companies are not willing to pay the day rate you need to service the debt and make a return investment.”

Outside of new construction, there have been some notable projects to repower or overhaul oceangoing tugboats in recent years. Curtin Maritime Corp., Long Beach, Calif., recently completed a full repower of the Invader-class tugboat Lindsey C

The Invader-class tugs built at McDermott Shipyard, Morgan City, La., in the mid-1970s earned a reputation among mariners for their speed and performance, particularly in rougher seas. The Lindsey C repower project, which required extensive reengineering, replaced the two 3,600-hp EMD main engines with Wabtec 8L250s delivering 3,350 hp each.

Dawn Services LLC, Harvey, La., recently refurbished the 22-year-old former Corbin Foss, which had been laid up in Pascagoula, Miss., for some time. The 150' vessel, newly named Capt. John J. Charpentier in honor of the company’s founder, delivers 8,200 total

horsepower and 108 tons of bollard pull.

The eet of Crowley Maritime Corp., Jacksonville, Fla., which at one time included 25 Invader-class tugboats, has evolved into a more diverse mix of

Inaddition to a new tug, Capt. Russell Shrewsbury, vice president at Western Towboat, is eagerly awaiting another piece of new equipment: A 1,100-ton drydock. Snow & Company, a next-door neighbor to Western Towboat in Seattle’s Ballard neighborhood, should deliver the structure later this year.

The new drydock, Western Hauler, will operate from Western Towboat’s shipyard facility along the Lake Washington Ship Canal, where the tug Northern Titan is being built.

Shrewsbury, a third-generation co-owner with his brother Ross and sister Kristin, said the drydock will have a huge impact supporting the company’s fleet, giving it greater control of its business and freeing it from reliance on outside shipyards for haul-outs. Western Towboat’s

ocean-towing vessels and capabilities. It has four dedicated Invader-class tugs that continue to handle oceangoing tows between Florida and Puerto Rico, along with a combination of Ocean-, Alert-,

18 oceangoing tugboats will be a primary beneficiary.

“This new dock will allow us to make emergency repairs and Subchapter M inspections when we want between our scheduled runs to Alaska,” said Shrewsbury. “The schedule is everything with this dock. We will not have to disrupt boat and crew schedules like we do now, taking available spots at local docks.

“The other big factor is cost. We will be able to perform our own work at our own yard, expediting our drydocking time,” continued Shrewsbury. “It should be a huge game changer for us.”

The Western Hauler has a bargelike bow and can operate as a heavy-lift platform. “Like anything we design and build at Western Towboat, it needs to be like a Leatherman tool of maritime ability to perform multiple duties in an economical package,” said Shrewsbury.

— C.Conley

and Titan-class vessels. Taken together, the company continues to operate one of the most capable ocean-towing eets in the U.S.

John Ara, vice president of sales and chartering for Crowley Shipping, said that the eet includes the four Oceanclass tugs, all of which are rated DP1 or DP2, re ecting their dynamic positioning capabilities, while delivering 150 tons of bollard pull. It also counts three Alert-class prevention and response tugs. The Alert-series tugs, each boasting 130 metric tons of bollard pull, previously supported tanker escorts from Valdez, Alaska.

“The Ocean class is performing project towing all over the world and some scrap tows. They are very versatile. Of the U.S.- agged tugboats that are true tugboats, they are the only ones with DP,” said Arad. “They perform tandem tows, triple tows, and even quadruple tows for some big offshore oating production units.”

The Alert-class tugs are supporting offshore wind development along the East Coast, primarily towing barges between shoreside facilities and the wind turbine sites over the horizon. Crowley also has chartered a limited number of tugs to boost its capabilities supporting the offshore wind sector.

Earl W. Redd, which earned accolades in the mid-2010s as the rst EPA Tier-4 rated oceangoing tugboat, has operated under charter to Saltchuk’s Foss Maritime Co., Seattle, which operates it from the East Coast supporting offshore wind projects at various stages of development.

With WorkBoat+, you’ll receive exclusive access to news, reports, twice-weekly weekly newsletter, and archives. Sign up here

The 5,364-hp boat was originally built for Tug Construction LLC, Portland, Ore., which has been rebranded as Ursa Major Marine Holdings LLC. The company is currently building two Robert Allan Ltd.-designed ship-assist tugs at Diversi ed Marine and is monitoring other markets for possible new

construction, according to Manning. Young Brothers LLC, a Saltchuk subsidiary in Hawaii, was another early adopter of Tier 4 propulsion for its Kapena class of ocean-towing tugboats designed by Damen Shipyards Group The company, which moves cars, containers, and all manner of other cargo

between the Hawaiian Islands, has acquired the 5,000-hp Mount Baker and Mount Drum tugs from Kirby Offshore Marine. Young Brothers also took delivery last year of the 265' barge Kalohi and the 365' barge Naulu from Conrad Shipyard, Morgan City.

Signet Maritime Corp., Houston, and Harvey Gulf are among the companies that have assets supporting SpaceX, Hawthorne, Calif., and Blue Origin, Kent, Wash., two leading companies in private space exploration. Contractual agreements limit what these companies can share about the work. But videos shared on social media show Signet Warhorse III towing a droneship as well as a rocket booster for SpaceX, and Harvey Gulf’s versatile Harvey Stone performing similar tows for Blue Origin.

Towing companies involved in these unique operations declined to comment on their work, and Blue Origin and SpaceX did not respond to inquiries.

Whether you’re powering an offshore service vessel, a passenger vessel, or an inland pushboat, Louisiana Cat has the right engine for your hard working fleet. We focus on you, the customer, and the reliability, safety and profitability of your business. Let us help you navigate every waterway. Visit us online to request an engine quote for your next project: www.LouisianaCat.com/Marine.

The Houston Pilots Association, Deer Park, Texas, is one of the busiest pilotage services in the U.S. Its two new boats from Breaux’s Bay Craft, Loreauville, La., — the 80'x21' San Jacinto, delivered in May, and sister vessel Juan Sequin, scheduled for delivery later this year — feature several innovative design elements.

Each boat is powered by three MAN D2862 LE 438 Tier 4 engines supplied by Performance Diesel. The engines are rated at 1,200 hp apiece and paired with Twin Disc MGX-5204SC gears and triple HamiltonJet HTX47 waterjets. Gulf Coast Filters supplied the fuel polishing system, and Driveline Service of Portland supplied one steel and two composite cardan shafts.

Capt. Billy Kern, third executive officer, is in charge of boat operations and crew and said the Houston Pilots have been “very happy” with the MAN engines aboard its two station boats, Bayou City and the Houston, leading the group to choose the same manufacturer for its new launches. “We wanted continuity for our maintenance and repairs,” he said. “We’re trying to streamline our maintenance process. And we wanted fuel

The San Jacinto and Juan Sequin are among the first EPA Tier 4 pilot boats, and the first in the U.S. with the MAN three-engine setup, according to Kern. Initially, the pilots were hesitant to try the configuration, he said, “but we figured out that running those three engines, but not running them at full power, has given us about four knots faster than our old boat, but burning less fuel.

“We had a clause in our contract that we wanted to be able to operate that boat at 30 knots at or around 80% load,” said Kern, noting that the compact MAN engines weigh less than offerings from other manufacturers in a similar horsepower range. “We run about a 10- to 12-mile stretch from shore out to our bar vessel, and we wanted to be able to make that run in under an hour — really about 40 minutes — due to the frequency of our traffic here in the port and the number of pilots that are working at any time. [The speed] helps us speed up the process and stay on schedule.”

Sporting an inverted deep-V hull, the San Jacinto surpasses the contract’s speed requirement, cruising at 32.5 knots at 1,950 rpm and 80% load, with a top

speed of 37.5 knots. The boat consumes 43 gals. of fuel per hour, per engine, with 2,200 gals. fuel capacity.

The San Jacinto features water-cooled exhaust systems on the main engines with selective catalytic reduction systems mounted in the overhead designed by Soundown, and three 145-gal. stainless steel tanks for diesel exhaust fluid. The boat is also equipped with a fixed CO2 system installed in the engine room, including two 100-lb. CO2 bottles with automatic engine shutdown and vent closure, along with a manual pull located in the machinery space that was supplied by Total Safety and installed by Burner Fire Control

A Seakeeper 40 stabilization system significantly improves the boat’s stability and crew comfort, especially when operating slowly or at idle. “The boat already rides great. Breaux designed us a really great hull and size for what we need, but a lot of times, the boat’s moving slow, or waiting for a pilot, or just hanging out offshore. That Seakeeper just keeps the boat so stable,” said Kern.

The vessel is outfitted with HamiltonJet’s AVX controls. “Our 15-year-old boat, the Yellow Rose, was a jet boat with Hamilton jets so it’s very similar controls, just the technology has gotten better and a little more user-friendly,” said Kern. “There’s a mouse pad there now with kind of a docking mode, if you will. You just move this mouse wherever you want the boat to go, and it does it. It’s pretty amazing.”

The San Jacinto has a standard wheel like any other vessel, but its NorSap 1700 captain’s seat by IMTRA has a joystick control on the left armrest. “[A helmsman] can sit back and control the steering with their left hand and then control the buckets with their right hand, so they don’t even really have to leave the chair.”

Additional seating includes nine shock-mitigating NorSap 1600 reclining seats. The boat has sleeping accommodations for four, a galley kitchen, a 100-gal. freshwater tank, and an Ahead Sanitation Systems device. The ceilings are marine-grade plywood covered with black vinyl upholstery by Sterlings

Upholstery. The cabin is aluminum covered with marine-grade acoustic plywood and finished with PlasTEAK flooring.

“We tried to steer away from the yacht-like finishes. We’ve done that in the past on one of our other boats. It looks great and it’s beautiful, but we decided to go minimal, which did cut down on some weight,” said Kern. “And for maintenance purposes, it’s very simple for our shore gang crew to get to any wiring, plumbing, whatever they need to address. They can have everything apart — paneling or trim work, anything like that — with just a screwdriver.”

Onboard systems are powered by dual Northern Lights M944T3FG 38-kW three-phase generators. An HVAC system supplied by Advanced A/C & Electric consists of two four-ton Dometic chillers (variable speed) and titanium condenser coils with five air-handling units. The engine room overhead, forward bulkhead, and crew quarters were insulated by EEG Marine. Mist eliminators and blowers were furnished by Centek Industries. Electronics were supplied and installed by Rio Marine, including three Delta19 multiple-display monitors, Furuno 1518 radar, two Cobham SAILOR 6248 VHF radios, Furuno FA170 AIS transponder, Furuno FE-800 echo sounder, Furuno LH5000 loudhailer, Furuno GP170D DGPS, Furuno SC-70 SAT compass, ACR Globalfix V5 EPIRB, and Teledyne FLIR thermal and visible imaging cameras.

According to the builder, the stability of both overhead and forward bow boarding allows for safe transport of maritime pilots to and from ships that they are piloting, as well as a rescue SeaLift rescue system located on the stern of the boat.

The vessel features fritted laminated glass with integrated defrosters installed on the forward three windshields and the forward two side windows by B&G Glass. Custom SeaDeck flooring from Castaway Customs Texas adds traction underfoot and provides a clean aesthetic finish on the walk-around deck and boarding area. All logos, name, and

American Offshore Services, North Kingston, R.I., has taken delivery of its fourth crew transfer vessel, the 99'x36'8" Gamekeeper, built in Louisiana by Metal Shark

The aluminum G-class catamaran, which can carry up to 24 passengers, is powered by four Volvo Penta D13-700 DST main engines with IPS900 Q2 propulsion drives, two in each hull.

Hines Furlong Line, Nashville, Tenn., has taken delivery of the Donny Mudgett, the first of 11 vessels in its newbuild program. Built by Intracoastal Iron Works, Bourg, La., the 78'x34' towboat is powered by three Mitsubishi Tier 3 S6R2-Y3MPTAW engines, each rated at 803 hp at 1,400 rpm. Laborde Products is supplying all 27 Mitsubishi engines for the series, which includes five triple-screw and six twin-screw vessels. Construction is split between Intracoastal Iron Works and Eymard Marine Construction & Repair, Harvey, La.

Birdon, Denver, has partnered with C&C Marine and Repair to build two prototype landing craft for the U.S. Marine Corps at C&C’s Belle Chasse, La., shipyard. Commissioned by the Marine Corps Warfighting Laboratory under the Force Design modernization initiative, Birdon is designing and building two 150'x30'x4'11" ancillary surface craft-medium to inform future capabilities, tactics, and procedures.

Jack Tanner Towing Company, Havana, Ill., has added the new 1,368-hp Super Tiger-class workboat Miss Hazel to its fleet. Built by Serodino Inc., Chattanooga, Tenn., the vessel is powered by twin Mitsubishi S6R engines from Laborde Products that each deliver 684 hp at 1,800 rpm. The propulsion system includes Twin-Disc MG-5222 gears from Great Lakes Power, 5" sleeved shafts, and 52" Rice Propulsion 4-bladed propellers.

Catalina Express, Long Beach, Calif., has ordered a 160' low-emission, renewable diesel-powered passenger ferry. Designed by Incat Crowther, Lafayette, La., and to be built by Marine Group Boat Works, San Diego, the new ferry will form part of the Port of Los Angeles’ $31 million Los Angeles Marine Emission Reduction project, funded by the California Air Resources Board.

Crescent Towing and Blakeley BoatWorks, Mobile, Ala., are extending their partnership with the construction of a new Tier 4 Z-drive tugboat. Designed by Crowley Engineering Services, the 92'x38' vessel will have a 19' draft. It will be the third in a series of 6,000-hp tugs built by Blakeley for Crescent. The series’ second vessel, Kentucky, is scheduled to be delivered later this summer.

home port were designed and installed on reflective material by Lipari Sporting.

The Houston Pilots hired a third-party company, Valkor, Houston, to oversee the builds and “be a second set of eyes,” said Kern. “They’ve given us a lot of positive feedback about what they witnessed and the product that we’ve received from Breaux.”

With the San Jacinto now in service and the Juan Sequin on the way, the Houston Pilots plan to decommission the 25-year-old Swath design pilot boat Lone Star, while the 15-year-old Yellow Rose will be overhauled and operated as a backup vessel or fifth boat in the pilots’ fleet, said Kern. — Eric Haun LeBeouf Bros. christens

LeBeouf Bros. Towing, Bourg, La., christened the 120'x34'x11' pushboat Capt. Mark Delesdernier Jr. in a ceremony that took place on the New Orleans riverfront on June 14. LeBeouf accepted delivery of the vessel from Steiner Construction, Bayou La Batre, Ala., on May 30.

Designed by Farrell & Norton Naval Architects, Newcastle, Maine, and Fairhaven, Mass., with a 9' draft, the pushboat’s main propulsion comes from two Cummins QSK-50M diesels, each producing 1,800 hp at 1,800 rpm and connected to 88"x91", 4-bladed Hung

Shen wheels in Harrington Marinedesigned Kort nozzles through Reintjes WAF773 marine gears with 7:1 reduction ratios. Cummins Midsouth, Kenner, La., supplied the engines, and Karl Senner, also of Kenner, provided the marine gears and Aventics controls. The steering system was supplied by Gulf Coast Air & Hydraulics Inc., Mobile, Ala.

Ship’s service power is the responsibility of twin Cummins QSB7-DM gensets, each sparking 125 kW of electrical power.

In his remarks during the ceremony, Capt. Mark Delesdernier Jr. summed up how he felt about his namesake in one sentence: “This boat beats anything I’ve ever seen.”

Tankage includes 60,000 gals. of fuel, 27,000 gals. fresh water, and 2,600 gals. lube oil.

Lebeouf Bros. was founded in the 1940s and purchased by the Gonsoulin family in 1968. It is now owned and operated by Richard “Dickie” Gonsoulin and his son, Jon Gonsoulin.

“Being in the boat business is not the easiest choice in the world to make,” said Dickie Gonsoulin. “You got to love it. And we’ve been fortunate.”

Wheelhouse Electronics, Paradis, La., supplied the electronics suite for the new pushboat, which has accommodations for up to eight.

Jon Gonsoulin said marine companies have to be aware of industry changes to keep up. He said several years ago he bought six of the Cummins QSK-50-M

engines in anticipation of building new in the future, including the Capt. Mark Delesdernier Jr. “I paid $250,000 apiece for them then. Today those engines are valued at about $800,000.” — Ken Hocke

Silver Ships Inc., Theodore, Ala., delivered three new survey vessels to the U.S. Army Corps of Engineers, Savannah (Georgia) District, on June 10. The vessels, from Silver Ships’ Freedom and Explorer series, were dedicated and launched in a commissioning ceremony on June 12.

The new boats will support navigation efforts in Georgia waterways, surveying channel conditions, monitoring dredging activities, and detecting underwater obstacles.

The vessels will transport staff and equipment to project sites, including Savannah Harbor, Brunswick Harbor, and the 161-mile stretch of the Atlantic Intracoastal Waterway along Georgia’s coast.

The survey vessels are named in honor of three U.S. Army soldiers who sacrificed their lives during their service: Staff Sgt. Dustin Wright, Sgt. 1st Class John C. Beale, and Sgt. Tyrone Lanard Chisholm.

“The U.S. Army Corps of Engineers, Savannah District, is pleased to receive these brand-new vessels that we will use to perform hydrographic surveys, strengthening our commitment to precision, safety, and stewardship of our nation’s waterways,” said Col. Ron Sturgeon, the Corps’ Savannah District commander. “We’re proud to name each vessel after a local member of our military who has made the ultimate sacrifice for our nation. It’s an extraordinary honor to have their Gold Star families attend the commissioning ceremony.”

The Wright will support critical missions, including surveys to assess channel conditions, monitoring dredging activities, and underwater obstacle detection. The Freedom 26 vessel is purpose-built to meet the demands of the district’s mission and is outfitted with state-of-the-art equipment.

The Beale will be used to perform

hydrographic surveys on waterways where a more compact draft vessel is required, including inshore surveys before and after dredging, as well as tasks related to the district’s three dams and lake projects. The Freedom 20 vessel can mount newer technology for multibeam and side-scan sonar surveying, which was not possible on the district’s legacy vessel.

The Chisholm is an Explorer 24 vessel designed for surveying and other missions. The 27' boat includes an enclosed center console, a single 250-hp Yamaha outboard and is a landing craft vessel, making it ideal for missions involving bridging land and water. All three vessels will be homeported along the Savannah River at the Coastal Projects Of ce, Savannah District, South Atlantic Division.

“Silver Ships, Inc. is proud to support the U.S. Army Corps of Engineers, Savannah District, through the design and construction of three custom workboats tailored to enhance the district’s

operational capabilities. The Corps carries out a broad range of critical responsibilities, and these vessels provide valuable support across their diverse mission set,” Collin Carithers, project manager at Silver Ships, said in a statement.

“The construction of these boats — Wright, Beale, and Chisholm — was a

true team effort, and we are extremely pleased with the nal results. These vessels are built to serve reliably and effectively for years to come and are sure to become integral assets across the Savannah District, honoring the families of their distinguished namesakes,” said Carithers. — Kirk Moore

A leader in designing and building custom aluminum vessels for over 75 years.

Creativity to meet the unique needs of various industries—specializing

Marine logistics are designed to make life easier for barge operators.

By Ken Hocke, Senior Editor

Let’s get organized.

An inland barge company that has 2,500 barges and 150 towboats needs to know where these assets are along the inland waterways system at any given time. And if it’s a barge carrier with only 50 barges and 10 towboats, it’s just as important.

Whatever the numbers, there are a lot of moving parts operating along multiple rivers and canals, owing through numerous states. In other words, a logistical problem within the dreaded supply chain.

And the last thing operators want is to not have answers to customers’ inquiries about where their cargo is or when it’s going to reach its destination.

“We can use data so we don’t have to say we don’t know how long it will take to get where it’s going,” said Mike Baldwin, co-founder, OpenTug, a platform designed to increase ef ciency and growth in the marine transportation market. “We can consolidate all data on one platform.”

Suppose there’s a problem locking through somewhere on the Upper Mississippi, and tows are stacking up like rushhour traf c. “You have to make sure the customer knows that as soon as possible,” said Baldwin. “That’s when we’re most valuable, by our providing instant noti cation.”

Baldwin said if deviating from its original route is a possibility for a tow, the more information available, the better.

“If you switch and you can say this is how long it’s going to take, then the carrier and the shipper can make more informed decisions based on the information given,” he said.

OpenTug, based in Seattle, was founded in 2019 on the belief that marine transportation doesn’t have to be complicated.

The company’s “tools” are designed to help customers work more ef ciently — working smarter, not harder.

The company exists within the U.S. barge industry with the goal of making cargo moves easier and more methodical for barge owners and operators. A shipper can go to the OpenTug website and nd out which barge companies have what equipment available, instead of having to go to individual barge

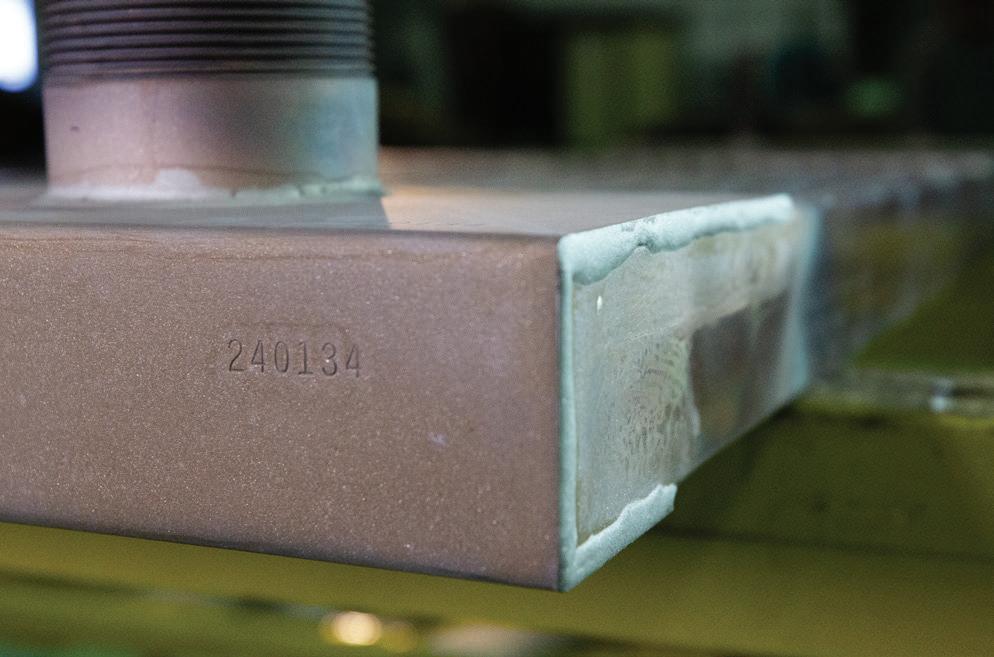

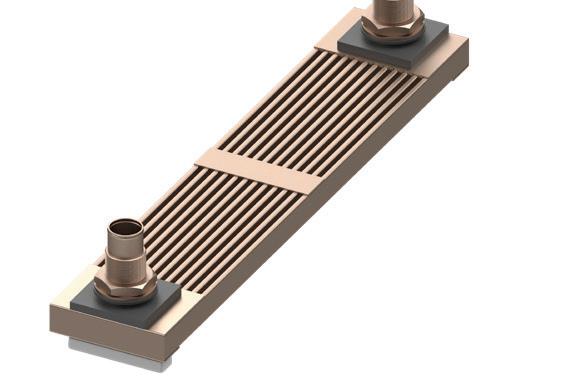

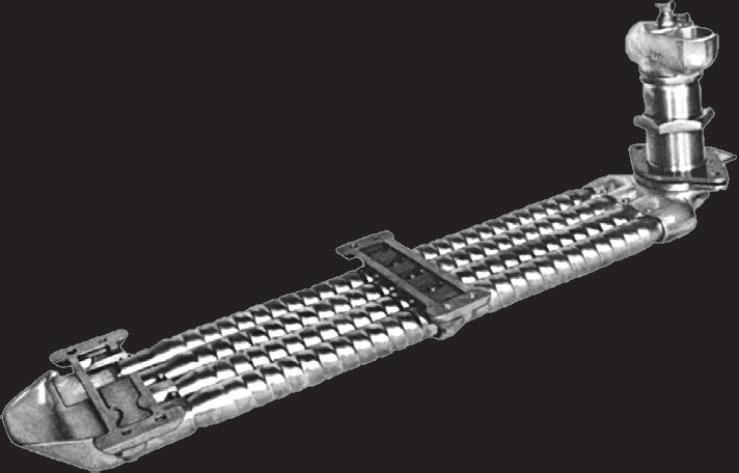

A tracking device installed on Lebeouf Bros. Towing’s 297'x54'x12', 30,000-barrel tank barge Gonsoulin 553 provides real-time location, ETA updates, and voyage reporting.

companies’ websites. OpenTug does the legwork and puts it all in one place. “I ask potential customers, ‘Where are your gaps? How are you giving your customer more visibility into where their cargo is moving?’” said Baldwin.

For shippers and agents, the OpenTug site offers online booking and booking management, ling of competitive bids from previous bookings, progress transparency, and document tracking and shipments.

For barge operators who employ people to gather this type of information and put it in a spreadsheet, those

people can now put more of their efforts into planning instead of data gathering. “We’ve worked with a lot of barge companies,” said Baldwin. “We offer them a chance to do more planning and less managing. It’s more about time prioritization.”

It’s all to increase provider utilization and customer satisfaction, resulting in lower acquisition costs for providers and more competitive pricing for customers.

“We are creating a system that will align our goals with the operators,”

Jason Aristides, OpenTug’s co-founder and director, told WorkBoat in an interview from 2023. “This system will allow more cargo to be moved by technology, which can do it cheaper and cleaner. And it can bene t the U.S. supply chain.”

Baldwin said Aristides got the original idea for OpenTug when he was working for Foss Maritime and observing how many empty barges were being moved along the West Coast to Alaska and back.

OpenTug makes its money by charging customers for the platform. Its monthly baseline rates are based on eet size.

For that fee, a company gets a customized program that can include a specialized booking portal, made-toorder forms, direct integration with the website and the customer relationship management platform, in-app mes-

saging, e-mail management, and le integration.

In addition, there are charges for speci c add-ons. For example, OpenTug prices per tracker/per asset, and it charges for its arti cial intelligence (AI) tool BargeOS Autopilot as an add-on.

As far as quoting, route planning, and cost-estimations tools, OpenTug offers instant quote generation based on the customer’s input, a drag-and-drop function for route adjustments, data feedback to help improve quoting and scheduling, access to real-time weather — lock, port, and terminal data, AI email nomination and ordering, and data analytics for forecasting as well as analyzing

historical and current data.

And perhaps the most important tool of all — tracking. The customer gets to track its vessels and barges while underway; AIS location monitoring; minute-by-minute ETA, delay, and status updates; demurrage tracking; automated daily position reporting, historical voyage reporting; and standard and customized dashboards.

As mentioned, for customers who include the BargeOS Tracking and Autopilot service, OpenTug bills these as a service per asset tracked, instead of selling tracking devices themselves. This helps its customers by allowing OpenTug to handle the installation and

support of the devices and reduces upfront capital costs.

This spring OpenTug secured a $2.2 million strategic investment led by venture capital rm TMV, New York. The funding round brings OpenTug’s total capital raised to $5.3 million.

The money is intended to bolster OpenTug’s agship products, BargeOS and LinerOS, which provide automation, real-time tracking, and optimized coordination for the inland and coastal barge sector. With the additional funding, OpenTug plans to further integrate AI and operational optimization into its platform, enhancing visibility and efciency in maritime freight movement.

“Waterborne freight is the future,” Aristides said in a statement announcing the outside funding. “This investment validates our progress and the enormous potential in digitalizing marine logistics. With TMV’s support, we’re committed to transforming freight transportation from major coastal ports to the smallest inland terminals.”

The money will also support hiring initiatives in engineering, product development, and customer success, company officials said.

BargeOS is software specifically designed to increase efficiency and visibility in tug and barge operations by enhancing customers’ booking, quoting, and tracking abilities.

For shippers, BargeOS offers shippers accurate cost estimation tools to make informed nancial decisions, route planning, exible route adjustments, integrated tracking and updates, and data-driven cost insights. The software can also point out “where you are having the most struggles,” said Baldwin, and increase customers’ “accessibility to data.”

The software can also use quoting and tracking to monitor both a shipment’s status and cost, analyze custom data insights, optimize future quotes, review past voyages, and produce accurate, data-driven quoting.

With the use of tracking devices, a barge company can provide its

ASeptember 2023 presidential memorandum of understanding (MOU) from the Biden administration called for the elimination of four Snake River dams that the MOU said contributed to the near extinction of 13 salmon and steelhead fish populations that return each year to the Columbia Basin from the Pacific Ocean to spawn.

Supporters of the Biden MOU say the fish are important to local tribal health and sovereignty and to basin ecosystems, and the declines are affecting southern resident orcas off the coasts of British Columbia, Washington, and Oregon. The orcas eat the salmon.

The 2023 agreement was between the federal government and four Lower Columbia River tribes — Confederated Tribes and Bands of the Yakama Nation, Confederated Tribes of the Umatilla Indian Reservation, Confederated Tribes of the Warm Springs Reservation of Oregon, and the Nez Perce Tribe, as well as the states of Oregon and Washington. The tribes want the dams removed.

Opponents argue that the dams support river navigation for maritime barge operations, passenger vessels, irrigation, and emissions-free hydropower for nearby communities and should be maintained.

On June 12 of this year, President Trump issued his own MOU on the subject that reads in part, “…I hereby revoke the Presidential Memorandum of September 27, 2023. Further, within 15 days of the date of this memorandum, the Secretary of Energy, the Secretary of the Interior, the Secretary of Commerce, and the Assistant Secretary of the Army for Civil Works under the direction of the Secretary of the Army (heads of departments) shall take all appropriate steps to withdraw from the Memorandum of Understanding filed on December 14, 2023, in the Columbia River System litigation, National Wildlife Federation v. National Marine Fisheries Service, 3:01-cv-640-SI (D. Or.), Dkt. 2450-1 (MOU).”

The order cancels the Biden administration’s “Restoring Healthy and Abundant Salmon, Steelhead, and Other Native Fish Populations in the Columbia River Basin” presidential memorandum from less than two years ago.

“This move by the Trump administration to throw

customers with accurate updates, designed to build trust through transparency, reduce operational costs, again, through efficiency, and support business growth. “Better data involving barge costs and delivery allows companies to ultimately move more barges,” said Baldwin. “And having that data all in one place saves time.