It takes fleets of vessels to develop offshore projects

baesystems.com/commercialshiprepair

12 Focus: California Compliance

Can operators keep up with Golden State mandates?

16 Focus: Crash Course

NOAA aids in recovery of wreckage from Potomac.

20 Vessel Report: Greener Discoveries

Next-gen research vessels embrace efficiency.

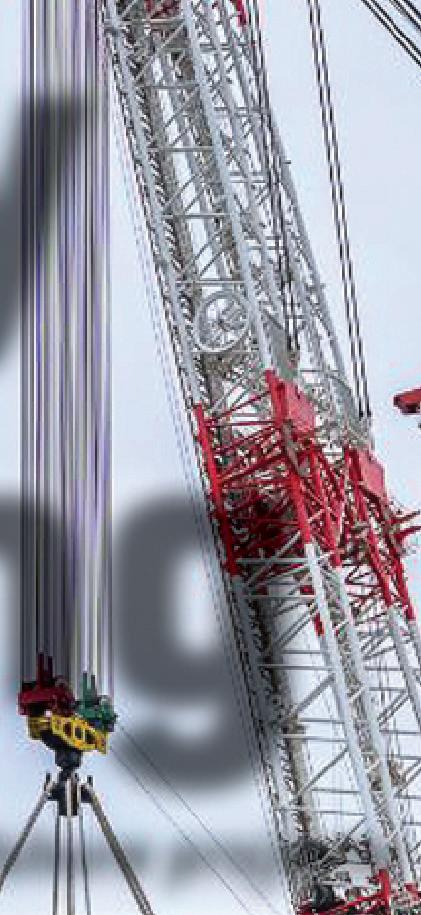

28 Cover Story: Energy Building

It takes fleets of vessels to build offshore projects.

24 On the Ways

New tug for Shaver Transportation • Navy gets amphibious hovercraft

• Electric ferries for a 'mosquito fleet' • Bollinger awarded icebreaker contract • Silver Ships delivers Marine Corps boat • Hughes Bros. gets new drydock • $8.75 million for Small Shipyard Grants

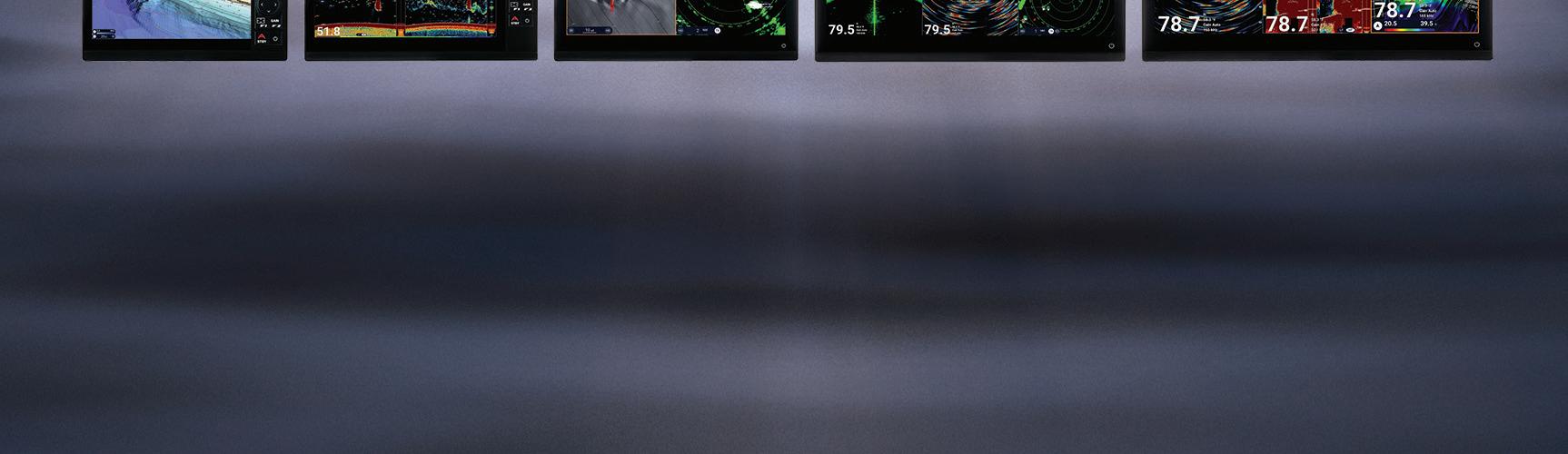

34 What's New?

Autopilot, radar highlight electronics advances.

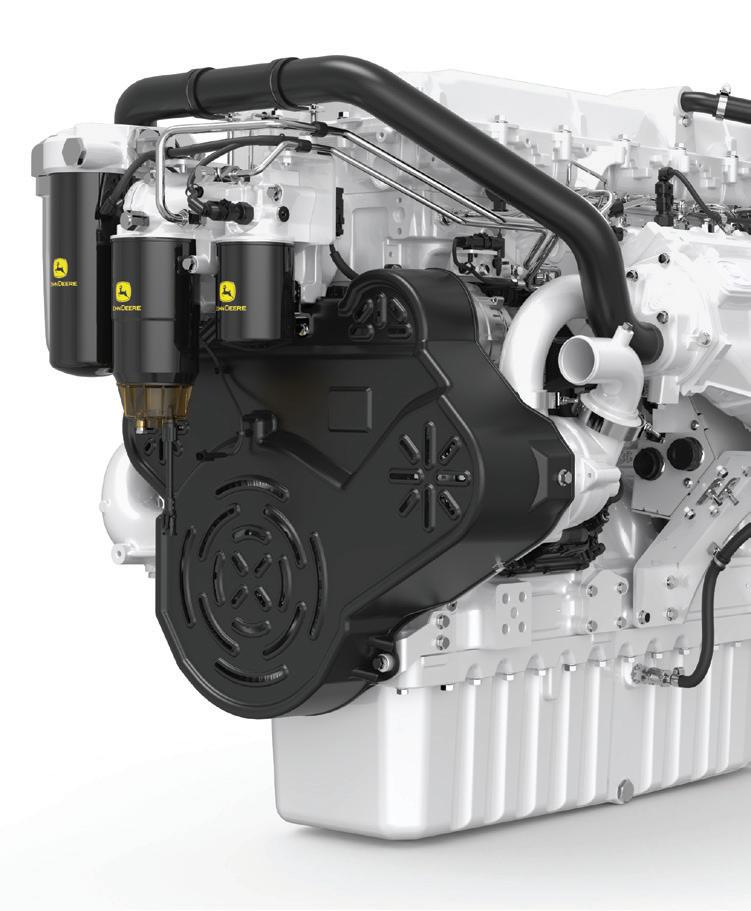

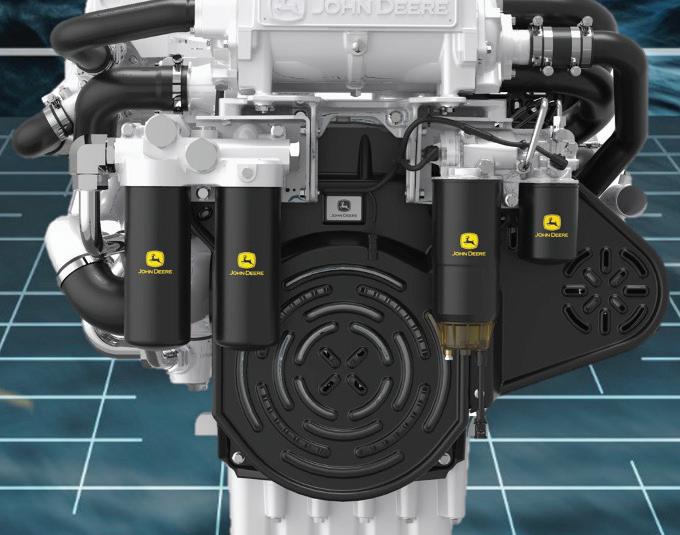

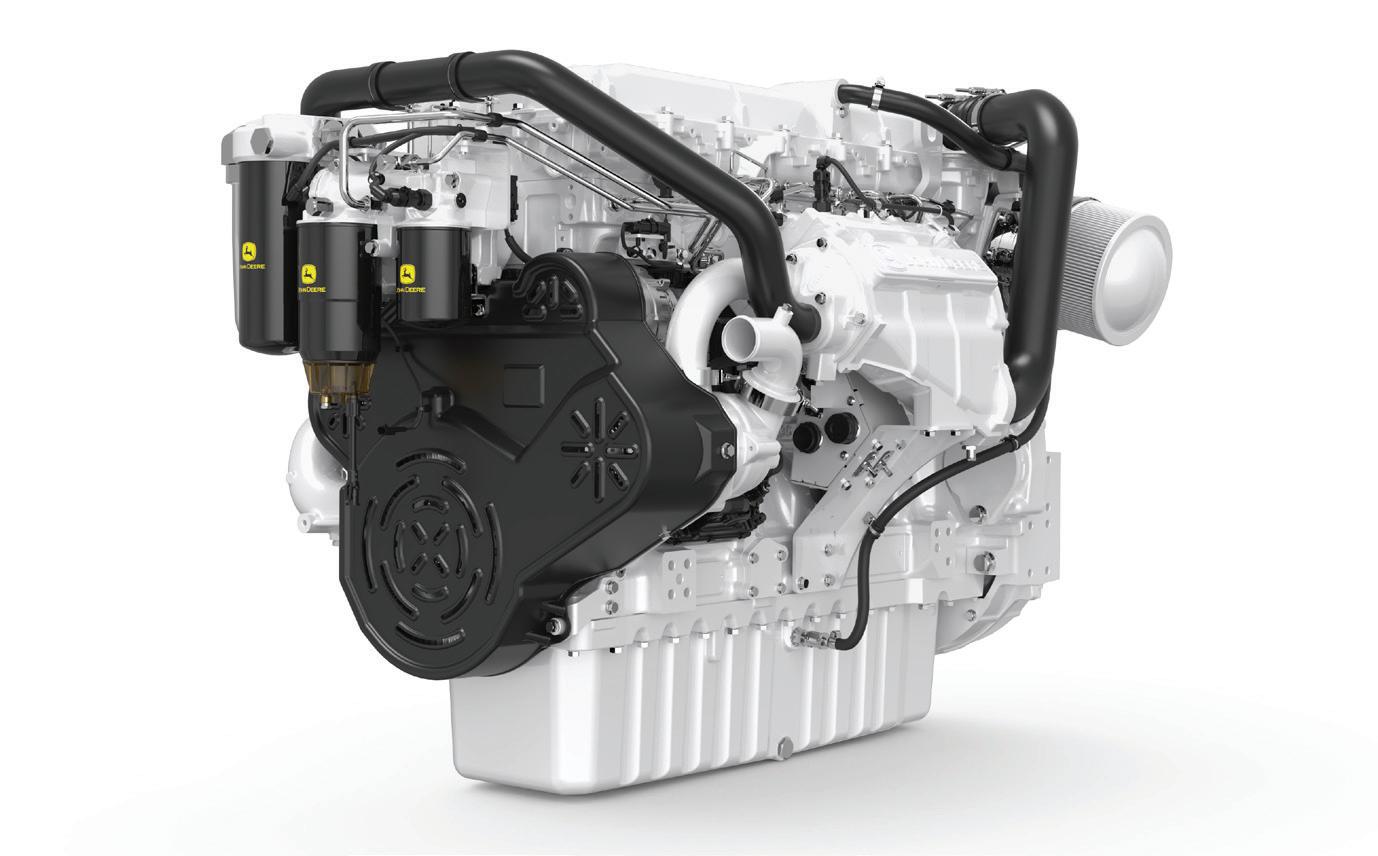

36 Dependable Diesels

New John Deere engines designed for connectivity and longevity.

LOG

11 Trump's plan to 'make shipping great again' facing headwinds

11 First 2025 tow locks through on the Upper Mississippi.

11 Navy veteran tapped for Marad administrator post.

11 Chouest acquires Norwegian subsea design firm.

6 On the Water: Mastering the lines

6 Capital Corridors: The US needs more naval architects.

7 Captain's Table: Regulatory reform has rewards and risks.

8 Energy Level: The maritime world at warp speed.

8 Legal Talk: Two allisions, two very different legal analyses.

9 Homeport: Vital digital infrastructure

9 Inland Insider: Make it or break it time for inland waterways.

10 Insurance Watch: The crucial role of hiring and onboarding.

10 Health, Safety, & Environment: Cybersecurity and AI challenges ahead.

Ithink we can all agree that the current heightened focus on U.S. shipbuilding is a great thing. For far too long, this sector has failed to receive the government support it desperately needs. Policy change is undoubtedly overdue.

But I’m worried.

The Trump agenda includes imposing fees of up to $1.5 million on Chinese-built ships entering the U.S., as well as charges of up to $1 million on eets that have ordered new Chinese ships or contain Chinese vessels.

This plan, announced by the U.S. Trade Representative on Feb. 27, aims to curb the dominance of the world’s largest shipbuilder while securing funds to rebuild America’s domestic shipbuilding industry (good!), but many warn these hefty fees would wreak havoc on American industries and supply chains (bad!).

Shipping groups, maritime interests, and a diverse mix of business players have come together to oppose the plan, arguing in a March 24 congressional hearing that the policy, if enacted, would ultimately do more harm than good.

For example, small and mediumsized U.S. ports and their local supply chains would likely feel the pain as ocean carriers reroute traf c to larger ports to avoid accumulating fees from multiple port calls. Meanwhile, larger ports – already among the world’s most inef cient – would be inundated with surging cargo volumes.

American agriculture, mining, and fossil fuel industries, too, have voiced their concerns, stating the suggested

Eric Haun, Executive Editor ehaun@divcom.com

policies punish American industries by making exports costlier and less attractive while also racking up import costs for American industries and consumers.

A more measured, phased approach could be appropriate. After all, the goal is for the U.S. to rely less on Chinese ships and more on domestically-built vessels. These new ships will take years to produce.

Or maybe, instead of imposing new fees on the nation’s maritime transportation system, the government could focus on boosting U.S. shipbuilding investment and capacity by offering positive incentives to build the new American eet.

Easier said than done, I know.

At ABS, we aren’t just keeping up with the tide; we’re setting the course. As the global class leader for offshore support vessels (OSVs), ABS offers a comprehensive suite of services and notations designed to transform your operations and support the safety of your vessels.

From hybridization and new fuels to retrofits and new construction, ABS provides solutions that help keep your vessels compliant in supporting the global offshore industry. Whether you operate OSVs, PSVs, CTVs, or WTIVs, our 160+ years of experience will help keep your fleet meeting the highest standards of safety and efficiency.

Our cutting-edge solutions and industry-leading engineering and technology knowledge enable you to navigate the complexities of modern offshore operations safely. Trust ABS to deliver the innovation and reliability you need to stay ahead in a rapidly evolving industry.

Visit www.eagle.org/offshore to learn more or send a note to globaloffshore@eagle.org to get in touch with our team.

April 28 - May 1

Virginia Beach, VA

Booth #1521

May 5 - 8

Houston, TX Booth #2543 Follow ABS

EXECUTIVE EDITOR Eric Haun / ehaun@divcom.com

SENIOR EDITOR Ken Hocke / khocke@divcom.com

CONTENT EDITOR Benjamin Hayden / bhayden@divcom.com

CONTRIBUTING EDITOR Kirk Moore / kmoore@divcom.com

CONTRIBUTING WRITERS

Tim Akpinar • Jonathan Barnes • Capt. Alan Bernstein • Dan Bookham

G. Allen Brooks • Bruce Buls • Eric Colby • Casey Conley • Michael Crowley

Jerry Fraser • Nate Gilman • Pamela Glass • Capt. Arnie Hammerman

Craig Hooper • Joel Milton • Richard Paine, Jr. • Chris Richmond

DIGITAL PROJECT MANAGER / ART DIRECTOR Doug Stewart / dstewart@divcom.com

ADVERTISING ACCOUNT EXECUTIVE S

Mike Cohen 207-842-5439 / mcohen@divcom.com

Kristin Luke 207-842-5635 / kluke@divcom.com

Krista Randall 207-842-5657 / krandall@divcom.com

Danielle Walters 207-842-5634 / dwalters@divcom.com

ADVERTISING COORDINATOR

Wendy Jalbert 207-842-5616 / wjalbert@divcom.com

Producers of The International WorkBoat Show and Pacific Marine Expo www.workboatshow.com • www.pacificmarineexpo.com

PRESIDENT & CEO Theodore Wirth / twirth@divcom.com

VICE PRESIDENT Wes Doane / wdoane@divcom.com

PUBLISHING OFFICES

Main Office 121 Free St., P.O. Box 7438, Portland, ME 04112-7438 207-842-5608 • Fax: 207-842-5609

10 AM – 4 PM ET)

Crews on board Offshore Service and Crew Transfer vessels perform a variety of complex operations.

Communication is critical to ensure the safe and efficient transport of cargo, equipment and personnel. David Clark Marine Headset Systems offer clear, reliable communications in the harshest marine environments, while enhancing the safety and situational awareness of crew members.

Call 800-900-3434 (508-751-5800 Outside the USA) to arrange a system demo or visit www.davidclark.com for more information.

BY JOEL MILTON

Joel Milton works on towing vessels. He can be reached at joelmilton@yahoo.com.

Tugs, even the most modern of tractor tugs or the pin-boat portion of an ATB, still have to be moored to docks, piers, wharves, barges, or other tugs with lines, and those lines will usually have to be thrown onto the bitts, bollards, cleats, or pilings by deckhands. They will also need to be retrieved. It seems simple enough at rst glance, and in fact it really is, except for when it isn’t.

Throwing and taking in lines is Tugboating 101 and is something of an athletic endeavor. Having adequate baseline core and upper-body strength, as well as exibility, is needed, but you don’t have to be tremendously athletic or strong to be good

Naval architects wanted

BY CRAIG HOOPER

Dr. Craig Hooper is the founder and CEO of the Themistocles Advisory Group, a consulting firm specializing in maritime and national security strategy. He has been a keen observer of navies and coast guards for over two decades.

It’s shaping up to be a great time for the U.S. maritime community. Congress will introduce the subsidy-laden SHIPS for America Act, and the administration is preparing a similarly generous presidential executive order on shipbuilding. These actions, coupled with a range of other steps, will jump-start demand for U.S. ships and force forward some massive investments in America’s maritime industrial base.

It won’t be easy. In the rush to get projects underway, the massive re-industrialization effort may run aground over a simple fact that America has far too few naval architects and marine engineers to fully exploit the opportunities ahead.

For years, America’s shipbuilders have been crying out for extra design help and struggling with technical integration challenges. Design shortfalls have consequences, and almost every government shipbuilding program has struggled. Design foibles and engineering mistakes have delayed or otherwise compromised the Gerald R. Ford-class aircraft carrier, the Constellation-class frigate, the offshore patrol cutter, the polar security cutter and others.

or even excellent at it. It’s more about technique than it is raw power. But you must have a full grasp of the speci c purposes of the line or lines, an understanding of the physics of it, an eye for the details, and an ability to learn the techniques. It can’t be done (except occasionally by luck) by frantically ailing and just trying to muscle it. I’ve witnessed many a deckhand exhaust themselves attempting to put out or, especially, take in lines because they lacked the required basic understanding. Sometimes these efforts and exertions, leading quickly to frustration, can result in joint or back injuries. Very few are successfully self-taught.

Lines will generally do whatever they’re “told” by reacting to the exact physical inputs transmitted into them via the body through the arms and hands. But if the whole process isn’t clearly understood rst, it can’t be visualized, let alone executed. If someone doesn’t understand any one part of getting the line out or in, they will almost always fail.

Deckhands can’t learn these skills by osmosis. It’s important for them to be correctly taught, because sometimes, those who aren’t eventually become mates who still don’t really know line handling. They may then become captains who still don’t know it. And then mediocrity spreads like a fungus.

The U.S. is simply not generating enough naval architects to meet production needs. With too few architects and engineers, requirements are misunderstood, technical innovations depart from the possible, and the schedule slips everywhere, as engineers struggle to develop a nal design.

To fully exploit the looming uptick in vessel demand, the nation must generate far more workers who are ready to help integrate new, low-emission technologies onto vessels, design uncrewed platforms, and tighten cost estimates. If America is unable to train new naval architects and engineers in a timely fashion, foreign shipbuilding powerhouses could help. Importing engineers might work well, or, alternatively, big foreign shipbuilders could set up training schools with the goal of supporting thriving local maritime industries.

The industry and government customers must also do their part. They must do more to recognize workforce limitations. Warship design might require simpli cation. On the commercial end, if the SHIPS Act intends to grow the strategic commercial eet from around 100 ships to 250 largely-U.S.built vessels, the new vessels probably should be restricted and limited to simple, standard, and well-characterized commercial designs out of South Korean or Japanese shipyards.

That’s hard to do. The Navy and Coast Guard love to bury their ships under requirements. The Maritime Administration, too, may begin layering on complex requirements to the next tranche of the tanker security eet, demanding a menu of specialized ships rather than add to the number of simple vessels that can be built, with little modi cation, from existing designs. That will be a problem. America lacks the suf cient talent to get the job done quickly and ef ciently.

BY CAPT. ALAN BERNSTEIN

Alan Bernstein, owner of BB Riverboats in Cincinnati, is a licensed master and a former president of the Passenger Vessel Association. He can be reached at 859-292-2449 or abernstein@bbriverboats.com.

As a mariner and small business owner, I have been closely watching the new administration. Many issues are being examined that stand to impact the maritime industry and my business. For years, small businesses have sought relief from regulators. At BB Riverboats, we estimate that we have been regulated by at least 14 federal, state, or local agencies, which has often been overwhelming for staff and crew to manage. While I am enthusiastic about regulatory reform, I am concerned that federal services supporting critical maritime transportation activities may face excessive cuts. As government programs are being evaluated for reductions, I am left with questions about which services my business can rely on. For example, will already strained Coast Guard resources be diverted to border patrol and other security related mis-

sions? Will the Coast Guard be able to properly maintain aids to navigation? Are traditional Coast Guard inspections in jeopardy? If so, what is the industry’s role in sustaining comprehensive domestic marine risk management programs?

The Passenger Vessel Association (PVA) is considering this very question. PVA members have been inspected by the Coast Guard for more than 50 years, and we have grown to value this relationship. At the same time, PVA has developed a Coast Guard-accepted safety management system, Flagship, that can be quickly and easily implemented by passenger vessel operators to ef ciently administer risk management programs should Coast Guard inspection resources be curtailed.

In fact, when using Flagship, vessel operators can expect to improve safety and risk management, regulatory compliance, and operational ef ciency. As a result, PVA is hopeful that the Coast Guard will recognize Flagship as an independent supplement to regular Coast Guard inspections, helping to preserve valuable Coast Guard resources.

While there is value in cutting fat, waste, and certainly regulation, there is tremendous risk in indiscriminately cutting government services and programs to critical industries segments such as the U.S. maritime transportation sector and to the mariners serving therein. I hope the administration will resist the temptation to focus solely on short-term budget cutting and take a long-term approach to reform.

info@tpsemarine.com

DBY G. ALLEN BROOKS

G. Allen Brooks is an energy analyst. In his over-50year career in energy and investment, he has served as an energy security analyst, oil service company manager, and a member of the board of directors for several oilfield service companies.

onald Trump campaigned last year with an agenda for actions upon his return to the presidency. In long, rambling speeches, he laid out his goals and objectives in broad terms, often ignoring the details. His election has ushered in one of the most active 100 days of policy changes of any administration. He is breaking the bureaucracy’s dishware like never before. There are no sacred cows.

In the broadest context, Trump looks at every aspect of the government’s operation and asks: Why? The question generates uncomfortable answers. Politicians defend inefficient agencies, promote continued fraud and waste, and justify actions because that’s the way it’s always been done.

The campaign’s “drill, baby, drill” mantra clashes with Trump’s wanting low energy prices, including asking OPEC to add supply to the world’s oil market. He wants a streamlined energy regulatory landscape to make it easier for producers to respond to market price signals. Leveling the playing field by eliminating preferential treatment of fuels and government subsidies allows energy physics and economics to drive results. This is the best way to meet the three requirements — affordability, cleanliness, and reliability — people want from their energy system.

Our maritime industry, including our shipbuilding capability, has received little attention over past decades. Improving this industry is critical for our national defense, which includes our risk of being held hostage by foreign shipowners.

This risk has been assessed many times in our maritime history, pre-dating the 1920 Jones Act, which led to contrary remedies being enacted. Governors are now targeting the law for its contribution to higher energy costs. Trump’s creation of the Office of Shipbuilding opens the door to serious action to address neglected economic and national defense issues, including providing career opportunities for our youth. It may eventually lead to reduced energy costs.

The geopolitical turmoil manifests in the government’s threats to levy tariffs against friends and foes unwilling to agree to more advantageous trade terms for the U.S. than the status quo. Investors worry battles over reciprocal tariffs will escalate into a global trade war, sparking an inflation uptick and increasing the odds of a recession.

However, inflation is easing, allowing central banks to reduce interest rates, accelerate growth, and create a better economy. Economists do not see these trends yet. Reaching a better future will be frustrating but worth the pain.

Two allisions, two very different legal analyses

TBY TIM AKPINAR

Tim Akpinar is a Little Neck, N.Y.-based maritime attorney and former marine engineer. He can be reached at 718-224-9824 or t.akpinar@verizon.net.

he containership Dali made news headlines when it struck the Francis Scott Key Bridge in March 2024, resulting in a catastrophic collapse of the bridge. A bridge allision that occurred about a year earlier involving the Mackinac Bridge in Michigan makes for a very different legal analysis, despite both incidents involving vessels hitting bridges.

The Dali suffered loss of propulsion and electrical power, resulting in a tragic loss of life and bridge rebuild costs estimated at around $1.8 billion. In contrast, the Mackinac Bridge accident involved an error in judging air draft, mercifully resulting in no injuries and bridge damages of $145,000.

With the Key Bridge, attorneys for the containership invoked a maritime law historically used to cut a shipowner’s losses, known as limitation of liability. To succeed in limiting liability to the post-accident value of a ship, attorneys generally argue that factors causing the accident were not within the owner’s control. The NTSB’s investigation of the Dali’s plant, electrical system, and tripping of circuit breakers is very detailed, beyond the scope of this article. However, the point is that complex propulsion/ electrical failures in general could sometimes be argued in various ways, from unseaworthiness to unpredictable event.

In contrast, a setting that points to voyage planning, as in the case of the Mackinac Bridge accident, offers less leeway in terms of arguing that something was not within the control of vessel interests — the pivotal legal issue in successfully invoking limitation. Limitation of liability was granted in the Titanic sinking, but the world was a very different place when the ill-fated White Star liner sank in 1912. I don’t think we’d see such an outcome today.

When the City of New York tried to use limitation law in the aftermath of the tragic Staten Island Ferry crash of Andrew J. Barberi in 2003 that claimed 11 lives, it was unsuccessful. This was because the NTSB felt that the accident was due to the city’s poor oversight of its ferry fleet and a failure to provide safety measures.

The point is that between two different bridge accidents that might appear similar in terms of a news headline (vessel hits bridge), the maritime laws that apply could be very fact-specific, depending on the causes of the accident.

BY TRACY ZEA

Tracy Zea is president and CEO of the Waterways Council, Inc., the national public policy organization advocating for a modern and well-maintained national system of ports and inland waterways.

For the last 11 fiscal years, Congress has provided an additional $5.1 billion above the president’s annual budget requests for the inland waterways’ construction program. Despite this significant financial investment from both the taxpayers and the users of the inland waterways, the only completed project is Olmsted Lock and Dam. There are six active navigation construction projects, five projects in active design, and eight projects awaiting funding to begin design. Fiscal year (FY) 2025 presents an opportunity for the inland waterways’ construction program. There are a total of 19 authorized construction projects that are all critical to the nation’s economy. If constructed, these projects will enable U.S. shippers to compete, both domestically and in the world marketplace. Congress, in both the House and Senate

BY NATE GILMAN

Nate Gilman, president of MM-SEAS USCG Licensing Software, uses his hawsepiping experience to support mariners and workforce development. Connect on LinkedIn.

The Coast Guard’s Homeport platform, providing access to the National Maritime Center’s Merchant Mariner Licensing Database (MMLD), is vital digital infrastructure that’s often overlooked. Its importance, and the tools it provides, became strikingly clear when Homeport experienced an unexpected public outage beginning March 4, 2025.

Two essential tools for keeping our vessels staffed within Homeport are the Credential Verification Tool and the Application Status Tool. These are crucial for ensuring a qualified workforce and maintaining maritime sector integrity.

The Homeport Credential Verification Tool allows employers to instantly confirm that a mariner has the necessary certifications to operate their vessels safely and legally. This system also helps employers validate credentials, protecting

Energy and Water Appropriations bills, provided $423 million for inland waterways’ construction in FY25. However, due to a reduction in the amount of funding provided for the Army Corps of Engineers’ program in FY25 through the continuing resolution process, inland waterways construction projects are at risk of being delayed or halted if the Corps decides to ignore inland waterways construction.

Failure to fund Montgomery Lock (Ohio River) at $205 million in FY25 will spur a backlog of construction funding of over $1 billion in FY27 alone to fund ongoing construction efficiently. Expecting $1 billion through annual appropriations in any fiscal year for this program is exceedingly ambitious. The absence of funding in FY25 will result in project cost increases and significantly delayed operational dates. There is an opportunity in FY25 and FY26 for the Corps to fund work at Montgomery Lock and Chickamauga Lock (Tennessee River) to completion, respectively, which would pave the way to ensure completion of Kentucky Lock (Tennessee River) and start construction of Lock and Dam 25 (Mississippi River) in FY27.

The Corps now has the option of funding Montgomery Lock at $205 million, setting up for success the inland waterways construction program in the future. Leaving Montgomery Lock out of the FY25 Work Plan would set the entire program back several years, perhaps even a decade or more.

against potential security threats and preventing compliance issues and penalties during Coast Guard, DNV, and American Bureau of Shipping inspections and audits.

Imagine the risk of an unverified airline pilot in the cockpit. The Homeport Credential Verification Tool mitigates similar risks on our waterways.

The Homeport Application Status Tool offers transparency for mariners pursuing career advancement, enabling them to plan their timing for employment more effectively. Additionally, crewing managers can reliably staff their vessels, knowing when approved personnel will be available. Mariner credentials are often approved in the U.S. by the Homeport Application Status Tool one to two weeks before their physical Merchant Mariner Credential arrives, meaning they can get to work sooner. This can have a big impact, because at $300 a day for an able seaman, an ordinary seaman working their way up could lose approximately $4,200 waiting for the hard copy to arrive.

Together, the Homeport Credential Verification Tool and Homeport Application Status Tool significantly improve economic security and workforce development. They allow both mariners and employers to operate efficiently.

These aren’t just technical details; they are essential for supporting a qualified maritime workforce and ensuring safe, secure waterways — a benefit for the nation. A functional Homeport and MMLD system is an investment in a stronger, safer America.

BY DAN BOOKHAM

Dan Bookham is a vice president with Allen Insurance & Financial. He specializes in longshore, offshore and shipyard risk. He can be reached at 1-800-236-4311 or dbookham@allenif.com.

Hiring and onboarding play a pivotal role in establishing a strong safety culture within an organization. By carefully selecting and training new employees, businesses can reduce the risk of accidents, injuries, and fatalities.

While the process can seem daunting for small businesses and rote and impersonal at larger entities, a well-thought-out approach to hiring, screening, onboarding, and sharing culture can pay dividends. The first step is to know what you are looking for in a candidate. Although labor markets are tight, resist the temptation to lower your standards as that marginal candidate might be the one who blows up your workers compensation or P&I experience.

Background checks are vital to the hiring process, especially in industries where safety is paramount. They can

BY RICHARD PAINE, JR.

Richard Paine, Jr. is a licensed mariner and certified maritime safety auditor with over 25 years of maritime industry experience. He is currently a senior VP at the Hornblower Group and can be reached at rjpainejr@gmail.com.

The Coast Guard is nearing the full implementation of new cybersecurity regulations that will enhance risk mitigation in response to the growing concerns of conducting maritime business in today’s digital landscape. As these new regulations can be seen as necessary to meet the ongoing operational risks facing all means of business, they also add a new function to the maritime industry, the company cyber security officer (CySO). This role, if treated to the intent of the proposed regulation, may trigger a major adjustment to how operators manage certain security risks. Historically, our maritime security has been set around physical barriers, soft targets, and deterrence. This function has been handled with some additional training, but

uncover criminal records, substance abuse issues, or other red flags that may pose a threat to workplace safety. This mitigates the risk of workplace violence, theft, or other harmful behaviors and can ensure that new hires align with the organization’s values and commitment to safety.

Candidate criteria is the next element. Look for safetyminded individuals and prioritize candidates who demonstrate a strong commitment to safety. Ensure that potential new hires align with the organization’s safety values and culture and of course verify that candidates possess the necessary skills and experience to perform their tasks safely.

Once the job offer has been made and accepted, an effective and engaging onboarding process allows you to drive home your safety culture. A comprehensive safety orientation will introduce new employees to the company’s safety policies, procedures, and emergency plans.

Job-specific safety training, tailored training for each role and emphasizing potential hazards and safety precautions, coupled with practical, hands-on training to reinforce safety knowledge and skills, can cement the elements that keep new hires safe from the get-go. Mentorship and buddy systems help teach greenhorns that safety is core to “the way things are done around here.” Finally, regular check-ins by supervisors allow for assessment of the new hire’s understanding of safety and allows them to address any concerns.

mostly with a familiar flavor to traditional operational safety. However, the CySO function adds, a function that isn’t just another hat to be worn by someone within the company.

Cybersecurity requires a deep understanding of the individuals working behind the scenes, often in unseen virtual or code-based environments. Businesses must now determine whether they need to hire information technology (IT) staff or expand existing IT departments into operational controls.

Some say that cybersecurity risks are limited in maritime operations, but this doesn’t fully reflect reality. Our daily interactions happen in cyberspace, from emails to text messages to financial payments and purchasing. Cyber threats present a constant risk, and this doesn’t even account for risks specific to vessel operations, such as AIS or GPS spoofing and hacking into remote onboard control systems.

Furthermore, the world is experiencing a significant shift as advances in artificial intelligence (AI) become integrated into everyday life. The cyber risks we face now even extend to what we read and who we communicate with. Programs like Microsoft Co-Pilot enable individuals to use AI to generate well-articulated content for emails, presentations, and professional media platforms like LinkedIn, potentially masking their own limited knowledge or experience.

AI risks are real, and we encounter them more each day. Our daily interactions include the uncertainty of not knowing what has been created with AI. In fact, this entire column was written using AI software … or was it?

First 2025 tow locks through on

Thefi rst tow of the 2025 navigation season has arrived in St. Paul, Minn., marking the start of river shipping on the Upper Mississippi. The Neil N. Diehl pasted through Lock and Dam 2 in Hastings, Minn., on March 19, pushing nine barges to St. Paul, the fi nal port to open each year due to ice in Lake Pepin. The U.S. Army Corps of Engineers St. Paul District noted that the typical fi rst tow arrival falls in the third week of March. Last year, the Joseph Patrick Eckstein reached St. Paul on March 17. The earliest recorded arrival was March 4, in 1983, 1984, and 2000, the Corps said.

The U.S. Trade Representative’s (USTR) proposal to slap heavy port fees on Chinese-made vessels arriving at American ports and use the funds to rebuild the domestic shipbuilding industry ran into rough waters at a public hearing in Washington in March.

Many leaders in the U.S. maritime industry told the agency at the hearing and in letters that the plan could hurt rather than help other sectors of the domestic industry, as well as cause major and costly disruptions to maritime shipping and global trade.

At issue is a set of recommendations announced Feb. 27 by the USTR in response to a petition led in March 2024 by ve labor unions seeking to boost U.S. steel production and jobs. It claimed that China was implementing policies and practices to bolster its shipbuilding industry to the detriment of shipbuilding in the U.S.

The USTR launched an investigation of China's trade practices and during the nal days of the Biden administration released a report citing strong reason to believe that China intends to dominate world shipping at the detriment of the U.S.

The issue was taken up quickly by the Trump administration, which announced a remedy of fees and restrictions aimed at curbing China’s maritime ambitions and promoting domestic shipbuilding.

China is the largest shipbuilder and the USTR estimates its share of the commercial market grew from less than 5% in 1999 to more than 50% in 2023, while the U.S. industry remains tiny and focuses mostly on military vessels.

Proposed actions include imposing fees of up to $1.5 million on ships arriving at U.S. ports that are Chinese built, operated or agged, and assessing fees on vessels manufactured elsewhere if they are operated by carriers with eets that include Chinese-made vessels.

New fees on Chinese-built ships and cranes entering U.S. ports are expected to be part of a wider initiative that the Trump administration plans to undertake to overhaul and revive the maritime industry.

— Pamela Glass

According to Congress.gov, the Department of Transportation said it received a nomination from President Donald Trump for U.S. Navy Capt. Brent Sadler (Ret.) to become the next administrator of the U.S. Maritime Administration (Marad). The nomination was received in the Senate and referred to the Committee on Commerce, Science, and Technology. Sadler is currently a senior research fellow at the Heritage Foundation.

TheChouest Group , Cut Off, La., has acquired Kystdesign , an Aksdal, Norwaybased manufacturer of remotely operated underwater vehicle (ROV) systems. The fi rst integrated ROV system under this partnership is already in development. The collaboration is expected to drive advancements in subsea technology, unlocking new possibilities in deepwater operations and design, according to Chouest. With this integration, Kystdesign joins Chouest’s global workforce of about 20,000. Kystdesign has grown in recent years — projected 2024 turnover approaching NOK 500 million, and its highest order backlog to date.

Can operators keep up with Golden State mandates?

By Ben Hayden, Content Editor

The California Air Resources Board (CARB) has expanded its Commercial Harbor Craft rule, imposing stricter emissions standards for a wider range of vessels operating in state-regulated waters. Initially adopted in 2008 and amended over the years, the rule applies to new and existing diesel engines on ferries, tugboats, and other commercial workboats.

The latest amendments, effective Dec. 31, 2024, require affected vessels

to run EPA Tier 3 or Tier 4 engines, with the inclusion of diesel particulate lters (DPFs) when they become commercially available. “After that date, a non-compliant vessel may no longer be operated in the regulated waters of California,” CARB stated in its nal ruling. DPFs are aftertreatment devices installed in exhaust systems to capture carbon soot particles emitted by diesel engines. These particles are then burned off in a process called regeneration,

which requires high temperatures. Marine engines, such as those used in California’s tugboat eet, operate at lower speeds, necessitating much higher burn-off temperatures — up to 1,500°F, nearly 250% hotter than those required for existing road vehicle DPFs.

No marine retro t DPFs have been veri ed to meet CARB’s Level 3 emissions reduction standards, CARB told WorkBoat in March, noting that manufacturers Rypos, Franklin, Mass.,

and Nett Technologies, Mississagua, Ontario, are working to verify their DPFs while others have expressed interest in applying for verification.

Some Tier 4 engines include DPFs in their EPA-certified configuration. Once verified, CARB said it will issue an executive order listing compatible engines.

The rule has drawn pushback from the maritime industry, which cites concerns over technology availability, repower costs, and implementation timelines. Safety concerns are also at the forefront, as operators worry DPFs could impact vessel performance and fire potential could threaten mariners’ lives. Despite this, CARB maintains that these measures are necessary to reduce emissions from harbor craft in California waters.

Maritime advocacy groups, such as the American Waterways Operators

(AWO), have voiced concerns over what they see as impractical and costly regulations that could compromise both safety and business viability.

According to AWO, one of the most pressing concerns remains the limited engagement from CARB leadership despite repeated attempts by industry representatives to establish a dialogue. AWO director of state advocacy Kyle Burleson expressed disappointment over CARB’s lack of responsiveness.

According to Burleson, the current regulatory process has not provided the same level of cooperation from CARB as the initial ruling did in 2008. Burleson noted that since joining AWO in 2022, he has seen minimal direct interaction with CARB leadership, citing zero interaction with the CARB board members responsible for creating the rule. AWO has offered CARB the opportunity to visit tugboats and observe firsthand how the rule impacts vessel operations, though these invitations

have been ignored, Burleson said.

To address some of the rule’s challenges, the industry pursued legislative relief through Assembly Bill 1122 (AB 1122). The bill sought to allow bypass devices on DPFs, ensuring that vessels could maintain full power during critical maneuvers.

“The bill is pretty straightforward. It would allow for bypass devices on DPFs so an operator could choose when to put those devices into regeneration, because that process could take up to 90% of your horsepower,” Burleson explained. “That’s not something you want happening while escorting an oil tanker, as is required under federal law in San Francisco Bay.”

In September 2023, AWO president Jennifer Carpenter told WorkBoat, “We are really prioritizing the DPF issue because it is so important to safety. That is why we are focused on working with the [California] legislature to not abolish the DPF requirement but make sure

that there are safeguards before it’s implemented.”

Despite AB 1122’s bipartisan support, Calif. Gov. Gavin Newsom vetoed the bill in October 2024, leaving operators with limited options. Safety concerns surrounding DPFs remain. “The last thing you want is to have a tugboat doing a job where it can’t have that full horsepower to stop a 1,000' cargo vessel,” Burleson said.

While res involving DPFs have been reported on trucks and school buses, no casualties have resulted. In those cases, drivers and passengers were able to evacuate to safety on the side of the road. “Mariners don’t have that option,” Burleson said. “They’re either going to become re ghters, life raft occupants, or both, and that’s certainly what we want to avoid.”

Another hurdle is the absence of CARB-approved DPFs for towing vessel engines. “Of the 27 Tier 4 engines identi ed by CARB, only four have DPFs, and none are large enough to serve as a main engine on a towing vessel,” said Burleson.

Financially, compliance with the rule poses a signi cant burden on the industry. A pre-pandemic estimate placed compliance costs at $1.3 billion, a gure likely to be higher today due to in ation and supply chain challenges, Burleson said. Shipyard availability is another concern. “There’s not a ton of shipyards on the West Coast, and they book out over a year in advance,” Burleson said. “An operator has to book their shipyard time, order their equipment,

and hope the stars align so all the work can be done in the time allotted. That’s a lot of uncertainty, and it’s really hard to run a business that way,” he said.

CARB maintains that shipyard capacity is suf cient, citing an analysis conducted during its rulemaking. “The capacity is suf cient to accommodate the volume of work resulting from the amended regulation,” a CARB representative told WorkBoat, citing Appendix E, page E-46 in the CHC ruling. “In the case where a DPF cannot be installed within the six-month window due to either shipyard scheduling issues or supply chain delays, the regulation provides an extension pathway,” the spokesperson said.

As a result of the rule, some operators are leaving California rather than attempting compliance. “From 2023 to 2024, we saw about a 15% reduction in vessels operating in California,” noted Burleson. “One of our members is talking about moving 20% of their eet out of California.”

Industry stakeholders, including agriculture groups and vessel operators, remain engaged in efforts to amend the rule. “We’re not done with this rule by any stretch,” said Burleson. “We’ve had multiple meetings with groups who are just as concerned as we are.”

Despite industry resistance, some operators are taking a proactive approach. Curtin Maritime, a marine services company based in Long Beach, Calif.,

has invested heavily in repowering its eet. Vice president of operations Chase Henderson emphasized the company’s long-term strategy. “These rules might be postponed, but they aren’t going away,” he said.

Owning a shipyard has given Curtin a compliance advantage. Within the past year, the company has repowered ve tugs, replaced 12 generators, and repowered a crane — primarily without grant funding. “We have a whole team … and all they’re doing is repowering … and getting everything into compliance,” he said. “We’re covering most of these costs ourselves … paying primarily out of pocket for all of the engines,” Henderson said.

When asked about other operators, Henderson’s remarks echoed those of AWO, noting that some operators have closed shop, downsized their eets, left the state, or sold their companies due to the inability to keep up with the regulation.

Henderson provided an example of the challenges in maintaining compliance. “We repowered a boat to Tier 3 four years ago. Last year, we ripped out the Tier 3 engines and put Tier 4 engines in,” he said. For California operators without their own shipyards, making such upgrades would be even more costly and dif cult to arrange.

Given Curtin’s nancial investment toward maintaining compliance, Henderson voiced concern over inconsistent enforcement. “We’re spending millions to update our eet, yet we see operators coming in and out of California with non-compliant vessels that aren’t registered in CARB’s database, facing no enforcement or repercussions,” he explained. “That makes it dif cult for us to compete. If CARB wants to impose these rules, enforcement needs to be uniform,” he said.

Despite the challenges, Curtin Maritime remains committed to compliance, viewing its cleaner eet as a competitive advantage. In some cases, cleaner engines have helped the company secure contracts requiring the best available emissions technology.

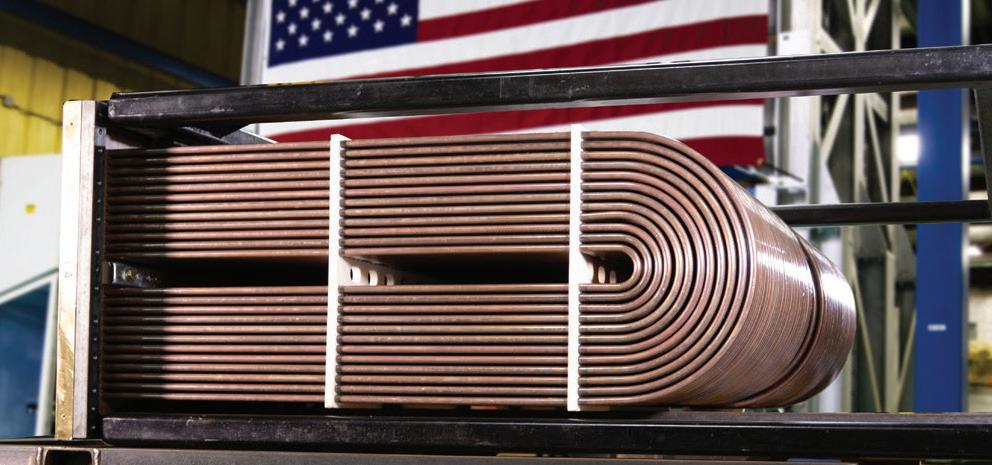

“We’re repowering as fast as we can,” Henderson said. roudl made in the U.S. .

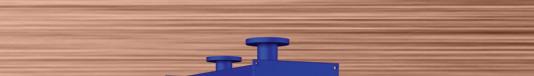

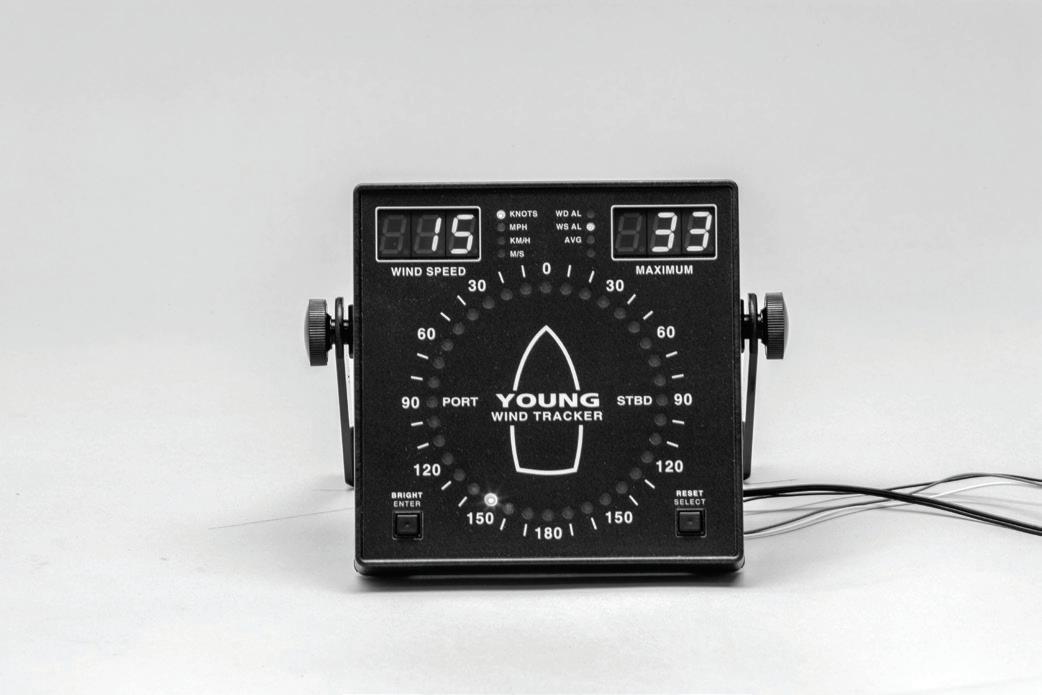

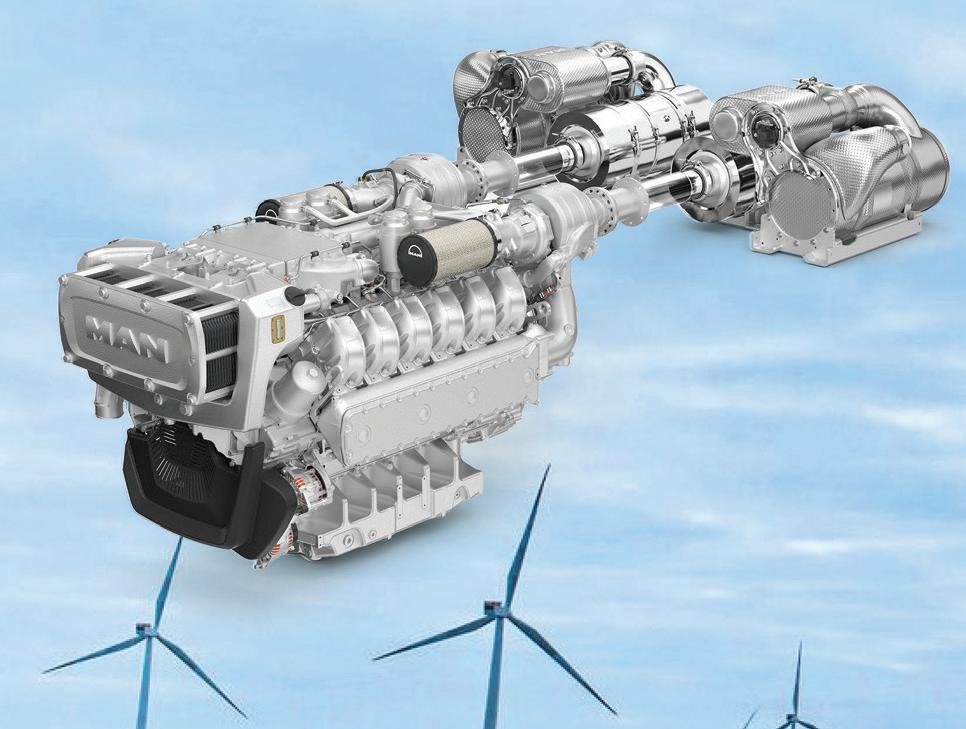

The ultimate engines for offshore applications—where sustainability meets unparalleled power. Designed with efficiency in mind, our engines deliver smooth operation while minimizing environmental impact. With unmatched power and performance, it ensures your projects stay ahead of the curve, no matter the challenge. Experience the best power-to-weight ratio on the market, making every adventure on the water safer and more reliable. For more details, explore www.manengines.com, www.man-engines.com, or www.performancediesel.com.

By Jonathan Barnes, Correspondent

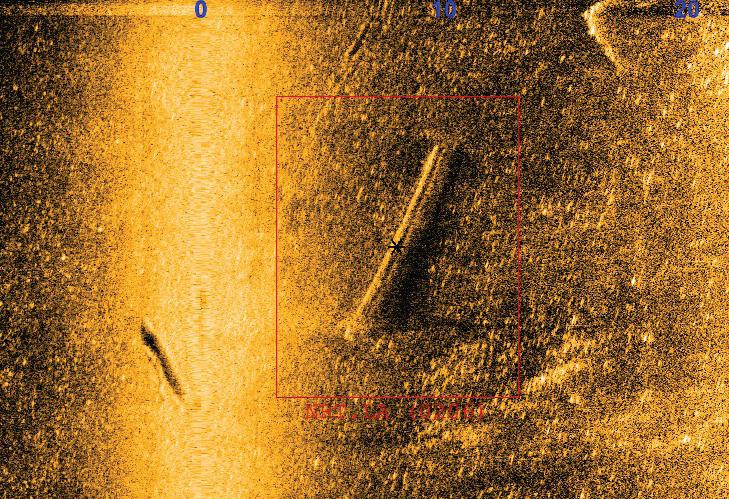

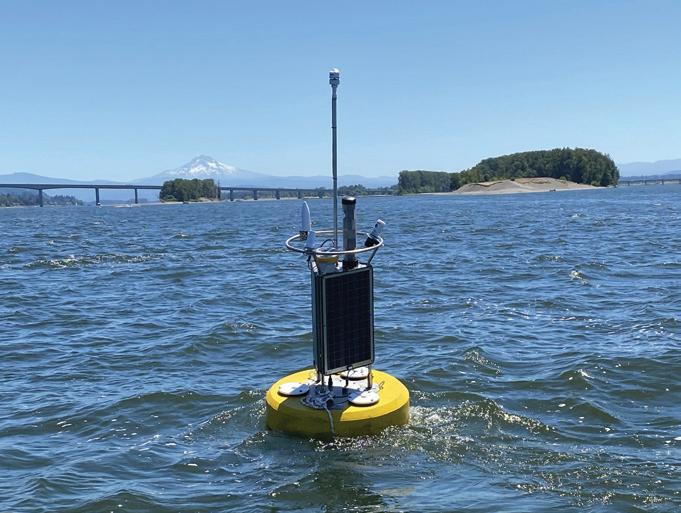

With the help of laser imaging and a water-current detecting buoy, specialists from the National Oceanic and Atmospheric Administration (NOAA) aided the rescue, recovery, and cleanup efforts after the fatal Jan. 29 midair crash of an airliner and Army helicopter over the Potomac River.

The NOAA team helped federal and local government of cials map the wreckage and ensure the river was safe to navigate. NOAA brought in a team of experts that helped in a variety of elds to smooth the effort.

The National Transportation Safety Board (NTSB) led the recovery effort and investigation. Preliminary ndings seem to indicate that the helicopter may have been traveling at the wrong elevation, according to the NTSB.

“The Black Hawk was at 300' on the air traf c control display at the time of

the collision,” NTSB of cials said in an investigation update.

While the wreckage was recovered by Feb. 11, the investigation of the crash is still ongoing and could take some time to conclude.

The crash of the American Airlines Bombardier CRJ700 passenger jet and a U.S. Army Sikorsky UH-60 Black Hawk helicopter happened near the Ronald Reagan Washington National airport, killing all 67 passengers and crew traveling in the plane and helicopter. NOAA’s National Ocean Service sent teams to help with recovery and response efforts. Due to freezing cold waters, and substantial debris in the water, the response and recovery effort was challenging, NOAA of cials said.

NOAA worked with the U.S. Coast Guard, NTSB, U.S. Army Corps of Engineers, and other local and federal of cials in search and recovery,

wreckage removal, and ensuring safe navigation. Experts from across NOAA provided valuable data and mapping to guide divers, aid salvage crews, and keep response teams informed in challenging conditions.

“NOAA’s nautical navigation products and services are critical for a safe, secure, and prosperous economy,” said NOAA representative Jasmin S. Paquet-Durand Ford. But for nautical charts and the precise tide and weather data NOAA assets provide, “maritime commerce fails,” he added. “For most U.S. industries, 50% or more of their international trade in goods travels through maritime supply chains.”

Within hours of the accident, NOAA’s patuxent navigation response Team was at the crash site. The U.S. Coast Guard and D.C. Fire Survey teams used multibeam and side-scan sonar technology to map the underwater debris eld. An additional navigation response team from Gulfport, Miss., deployed two uncrewed surface vehicles (USVs) to map shallower areas and identify wreckage.

The NOAA team included civilian hydrographers and NOAA Corps ofcers and worked with local and federal agencies to survey the river’s main channel and the debris eld. Using this data, NOAA provided a detailed sonar map of the wreckage to a graphic information system dashboard. The survey identi ed more than 50 possible targets for divers, leading them to key wreckage.

NOAA also deployed a current and meteorological buoy (CURBY), which provided responders with critical infor-

mation on water movements and conditions and enhanced crew safety and effectiveness.

While debris in the water posed risks, NOAA’s sonar surveys helped identify hazards and guide emergency teams in clearing the waterway by pinpointing obstructions that needed to be removed for safe travel. NOAA also responded to a request to conduct LiDAR (light detection and ranging) ights over the crash site and used a Twin Otter aircraft

piloted by NOAA Corps of cers to do so.

“Unfortunately, the LiDAR ight did not result in any usable imagery. We supported the recovery efforts mainly via NOAA navigation response teams, which are vessels on the water — in this case, one small boat and two uncrewed survey vessels, or autonomous survey vehicles,” said Ford.

“Once NOAA arrived on-scene, virtually all survey operations, particularly in the shallow water debris eld, was

turned over to NOAA eld units (navigation response teams). Our work fueled all salvage and dive operations for the remainder of the response, which included the support of weather and current operations provided by NOAA to support dive and on-the-water operations of salvage.”

NOAA’s Mid-Atlantic Navigation Manager was embedded at the Uni ed Command Center, and experts from the Of ce of Coast Survey, the Center for Operational Oceanographic Products and Services, and the National Geodetic Survey also helped in locating and recovering wreckage, supporting search and salvage efforts, and ensuring safe navigation. Aircraft and vessels operated by NOAA’s Commissioned Of cer Corps also were tasked with supporting operations. In addition to these efforts, the Of ce of Response and Restoration provided marine pollution and trajectory forecast support.

Most likely do not recall the last time two aircraft collided and destroyed each other and all life aboard over a body of

water. Such an incident is quite rare. Some in the aviation community called the accident essentially a freak accident — basically rarer than a lightning striking someone on a walk.

“Midair collisions, while tragic, are extremely rare, thanks to the extensive safety protocols, air traf c control systems, and the professionalism of pilots and aviation personnel worldwide. The aviation industry continuously strives to improve safety through advancements in technology, training, and regulations.

While any loss of life is devastating, it’s important to recognize the many layers of safeguards in place that make such incidents incredibly infrequent,” said John Werner, CEO, Pilot John International. “Our hearts go out to the families affected by this tragedy, and we remain committed to supporting the industry in further enhancing safety standards.”

NOAA’s Center for Operational Oceanographic Products and Services (CO-OPS) presently maintains and operates multiple six current real-time buoys, or CURBYs, said Ford. NOAA’s Of ce of Response and Restoration maintains an additional two CURBYs.

The CURBY made its rst operational debut for CO-OPS in 2019 when it was deployed near Philadelphia in support of NOAA’s Delaware Bay and River tidal currents survey.

CURBYs have since been deployed along the Paci c, Atlantic, and Gulf coasts in support of scienti c research, disaster recovery, and navigational safety.

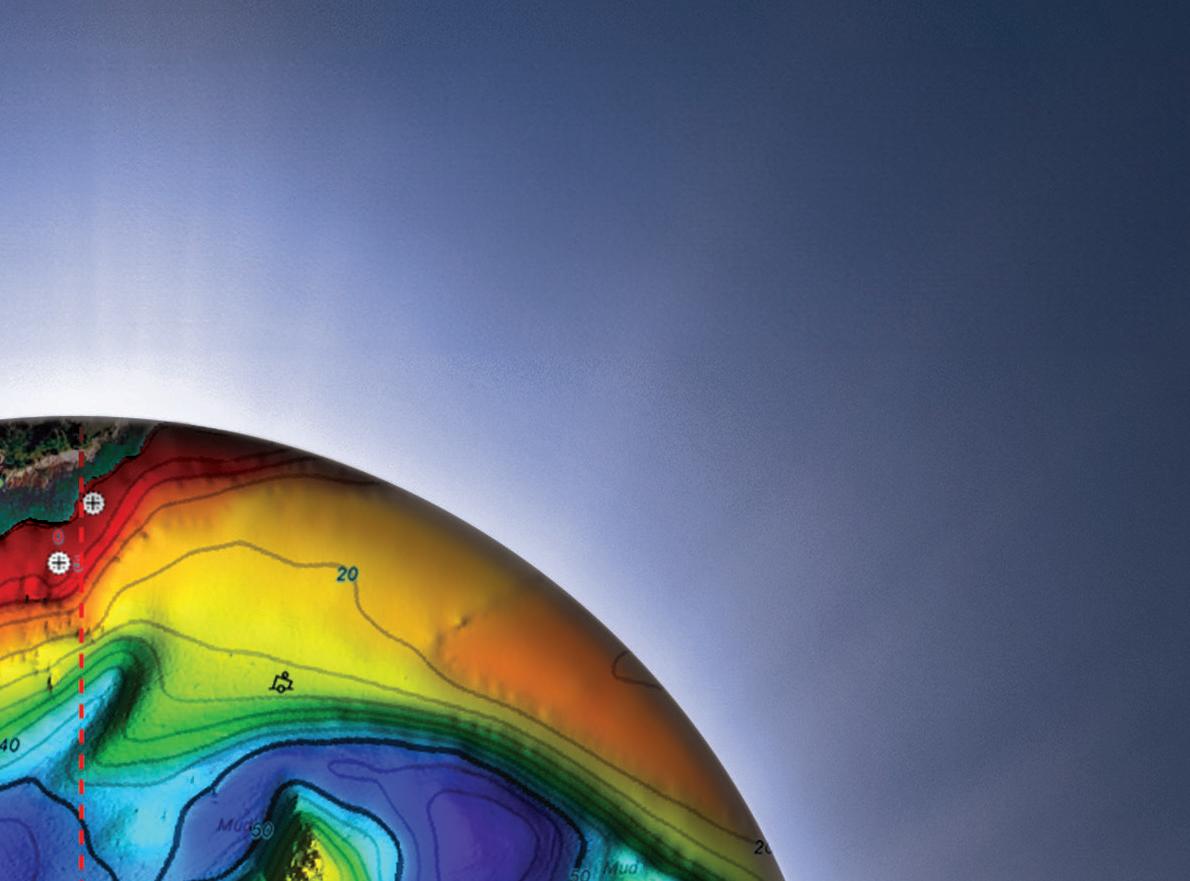

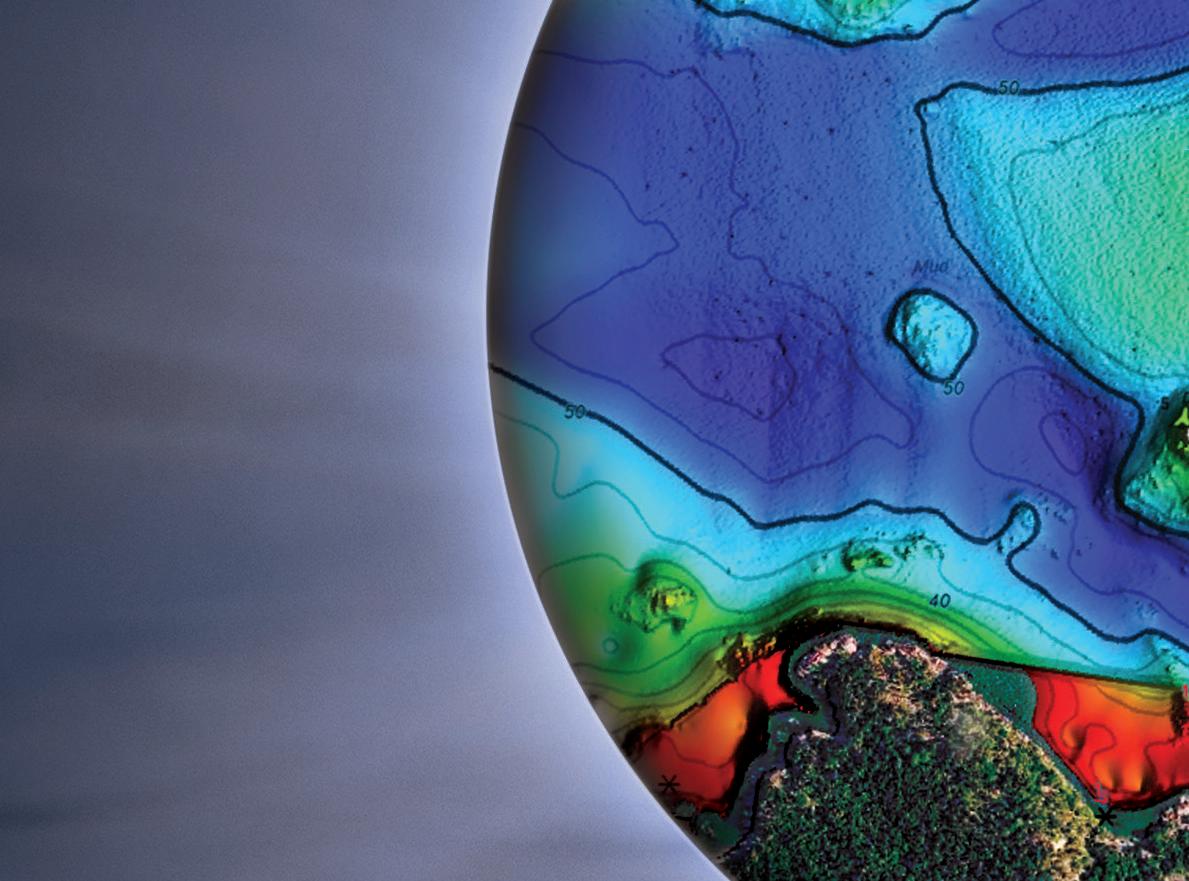

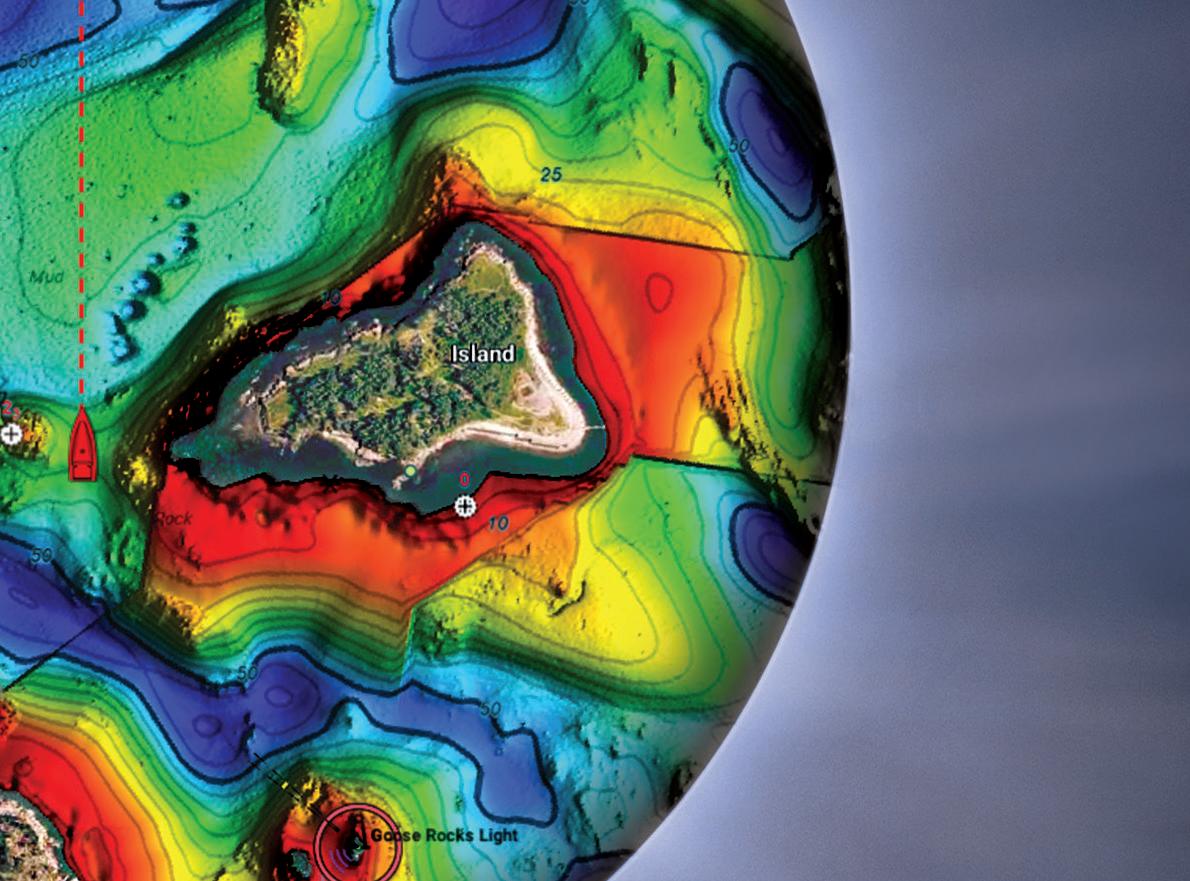

You got new charts! Explore the ocean with vibrant terrain & depth shading, using all-new TZ MAPS. Don’t just take our word for it. See for yourself. Scan here, and we’ll show you!

By Casey Conley, Correspondent

The U.S. research vessel eet is undergoing a once-in-a-generation renewal that could propel new discoveries and a greater understanding of the nation’s territorial waters.

Current projects include four deepwater ships under construction for the National Oceanic and Atmospheric Administration (NOAA), as well as three regional class research vessels (RCRV) for the National Science Foundation. Multiple catamarans in various stages of development will support exploration of coastal and inland waterways.

Although the size, scope, and mission of these ships differ, the growing embrace of hybrid propulsion is a common theme. And while the systems vary, each

promises new ef ciencies and reduced fuel consumption and greenhouse gas emissions, among other bene ts.

The largest of these new ships are under construction at Thoma-Sea Marine Constructors in Houma, La., which is building the two classes of NOAA ships, each with hybrid propulsion. The 244'x51'x22' Oceanographer and Discoverer are in the water and scheduled for delivery in 2026. Meanwhile, the shipyard cut steel on the 270'x50' Surveyor and Navigator this spring ahead of projected delivery in 2027 and 2028.

Oceanographer and Discoverer feature an efficient hull form developed by Thoma-Sea’s in-house team and its design agent Technology Associates Inc, according to Walter Thomassie, the shipyard’s managing director. Four Cummins QSK 38 Tier 4 engines anchor the diesel-electric propulsion system featuring an integrated Siemens Energy BlueDrive PlusC platform with batteries that can store 712 kWh of electrical power. That propulsion system provides power to Schottel L-drives and a Tees White Gill pump jet bowthruster.

The hybrid platform on Oceanographer and Discoverer is projected to reduce fuel consumption by about 15,000 gals. per year, with the added bene t of reducing CO2 emissions by about 5,700 tons, according to NOAA.

“We are excited about the design, because it was a different approach and we leveraged technologies we had been using for years in the commercial area,” said Thomassie. “It was challenged by the government and we had to prove it, so we are proud of the effort that went

into putting that design together.”

The custom hybrid platform installed on Oceanographer and Discoverer emerged following extensive research into NOAA’s operating profile. It incorporated NOAA’s objectives, such as the ability to reduce noise while operating in sensitive areas and minimizing wear on the propulsion system.

“Our goal was … to get the most practical bang for the buck,” said Thomassie. “We found a solution to lower fuel consumption, extend range, balance peak loading without having to crank generators and give them a feature for entering sensitive ports under battery power,” he continued, while noting the ships are “not designed for open ocean transit using only batteries, other than for short periods of time.”

Oceanographer and Discoverer will operate from Honolulu and Newport, R.I., respectively, and perform oceanographic research on marine life,

Taani, the lead ship in a new class of regional class research vessels funded by the National Science Foundation, is scheduled to deliver in early 2026 from Bollinger Shipyards. The second ship in the series, Narragansett Dawn, will follow later in the year.

climate, and ocean ecosystems, NOAA said. The vessels will join a NOAA fleet of roughly 15 ships that in 2023 averaged 30 years old.

The NOAA fleet’s average age will fall further with the delivery of Surveyor

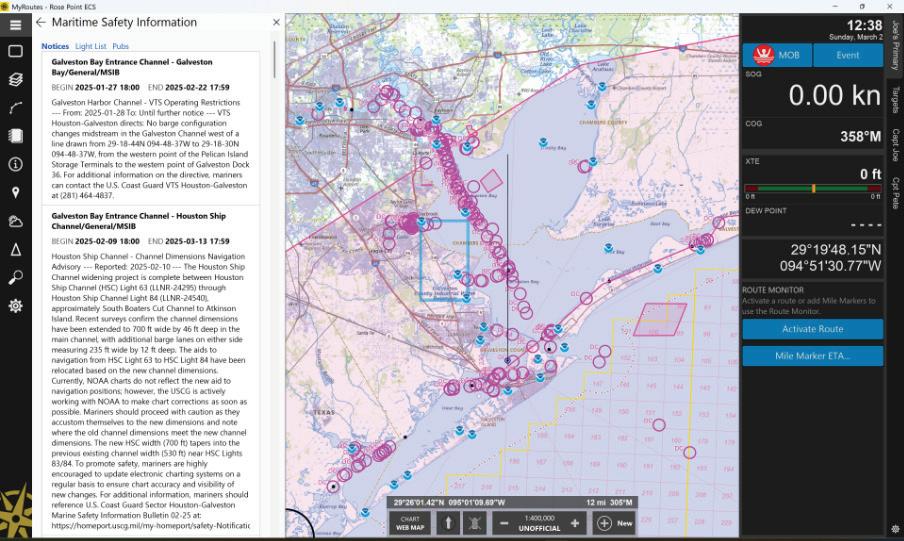

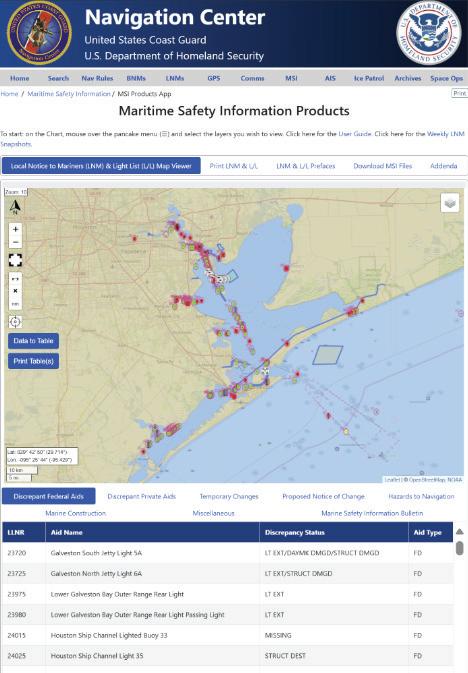

NEW FEATURES

• Lease Blocks

• NTM (USCG NAVCEN) visually represented

• USCG NAVCEN Polygon notices visually represented

• Weather Conditions with Graphical Forecast Overlays

• Replay of a VDR in the portal

and Navigator, which will primarily perform charting and ocean mapping. These vessels, awarded to Thoma-Sea through a different contract, will each have Siemens Energy BlueDrive PlusC hybrid propulsion with battery storage.

can be found here

Layers

• The ability to add marks, annotations, instructions and other .nob files to all vessels through the portal

ECS Fleet Settings

• This allows a fleet to lock down settings that should not be changed inside of Rose Point ECS

• This is managed through the portal

Sub Fleets

• Grouping vessels either geographically or by Port Captain

Vessel Data Recording Retrieval through the portal

• A Viewer in the portal can now retrieve .vdr files from vessel for incident review

Tax Zone Tracking

• Miles or Time inside or outside a zone can be reported on monthly

Odometer Reporting

• Total Nautical or Statute Miles can be reported on Daily/Monthly/ Quarterly

Fresh/Saltwater tracking

• This is another function of tracking zone movement for different purposes

API access

• A robust cloud API is under continual build to bring data to our cloud that can be queried by a fleet

• This access can also be given to 3rd party vendors like Helm or Tow Works by the Fleet (not given out from Rose Point Navigation)

Four Caterpillar 3512 Tier 4 engines will generate electricity for propulsion, research capabilities, and hotel loads.

The yard’s experience with diesel-electric propulsion gained through building vessels for the offshore oil industry informed its approach to these larger NOAA ships, Thomassie said. The system, he explained, “ nds the happy spot where all of these engines can be running at the most ef cient speed to hit the power-fuel curve where you are getting the most [power] for this given load while using the least amount of fuel.”

The three RCRVs developed through a National Science Foundation program also are nearing delivery from Bollinger Shipyards following a prolonged development cycle. Oregon State University (OSU) is overseeing the construction and transition to operations of the three 199'6"x41' ships. Glosten Associates designed the vessels, which can spend up to three weeks at sea while transiting up to 5,400 nautical miles.

Taani, the lead ship, is expected to be delivered in early 2026 followed by a year of science and operational trials to “really put it through the paces,” said Clare Reimers, an OSU professor emerita supporting the project. It will operate from Newport, Ore. Two sisterships, Narragansett Dawn and Gilbert Mason, should deliver later in 2026 and operate from ports in Rhode Island, and Mississippi and Louisiana, respectively.

Each ship features a diesel-electric powerplant that delivers

866-4-Werner WernerElectric.com/Marine

electricity for propulsion, research equipment, and hotel loads through a Siemens Energy BlueDrive PlusC system. Three Caterpillar C32 Tier 4 engines drive variable-speed Siemens generators. Siemens electric motors drive Schottel STP-1012 stern thrusters, a retractable Schottel SRP 170 propeller thruster, and ush-mounted SPJ 82 azimuthing jet thruster.

“These are Z-drive vessels, so they are going to be very maneuverable, and they will be able to maintain dynamic positioning so you can precisely sample within the ocean, particularly at the sea oor,” said Reimers.

Key maritime components on ships absolutely loaded with them include a Kongsberg dynamic positioning system that meets ABS DP1 standards, two Rapp/MacGregor winches and MacGregor cranes, A-frames and a starboard-side robotic launch and recovery system for sensors and other devices, according to OSU. Kongsberg and Simrad provided research equipment while Beier Electronics supplied the integrated bridge system that includes Furuno navigation electronics.

Multiple research ships that will operate along the nation’s coastal waters have entered service recently, and others are still under construction. Several such projects are currently

No expensive, prone to failure,

is "stand

underway at All American Marine, Bellingham, Wash.

Daniel Zech, the shipyard’s business development manager, said customers have three primary objectives when it comes to building new research vessels. Functionality and versatility are often top of mind. “Right now, it’s deck space with a large outdoor working area with the combination of overnight bunk accommodations,” he said. “That third component is fuel ef ciency.”

“For a lot of these vessels, the core mission is to support their students,” Zech added, referring to vessels built for universities. “But they are also running these vessels as a business, so the ef ciency of the hull makes for a much more appealing business case for people looking to rent the vessel.”

In February, All American delivered the 78'x26.7' aluminum catamaran North Wind to Cal Poly Humboldt in Arcata, Calif. The Teknicraft-designed semidisplacement hull cruises at 28 knots and has accommodations for 14 researchers and up to 40 daytime passengers.

This cleaner-running vessel is powered by twin 1,200-hp MAN Tier 4 engines equipped with diesel particulate lters to meet forthcoming California Air Resources Board emissions regulations. Other components include Kongsberg scienti c research electronics and Okeanus deck equipment.

All American has several other aluminum catamaran research vessel projects underway, all based upon Teknicraft designs. These include a 73' vessel for University of North Carolina Wilmington powered by Scania engines and a 63' hybrid catamaran for the Orange County Sanitation District. The hybrid platform will feature twin Cummins QSB 6.7 generators, BorgWarner batteries that can hold 588 kWh of charge, and ABB electrical architecture.

Another hybrid research vessel has already entered service in the Paci c Northwest. Last year, Snow and Company, Seattle, delivered the 50'x16' plugin hybrid catamaran Resilience for the Pacific Northwest National Laboratory (PNNL) in Sequim, Wash. It’s equipped with Volvo Penta D8 engines, Danfoss

Editron electric motors and Spear Trident batteries that can store 113 kWh of electricity, according to PNNL. Resilience also is the rst hybrid vessel in the U.S. Department of Energy eet.

A rst-of-its-kind hydrogen hybrid research vessel in development by the Scripps Institute of Oceanography at the University of California San Diego reached a key milestone last year. ABS gave approval to the preliminary design for the platform designed by Glosten. Current plans call for the ship to operate on zero-emission hydrogen fuel cells for 75% of its propulsion.

Further inland, the Lake Superior Research Institute at University of Wisconsin – Superior will soon take delivery of the 65'x24' hybrid catamaran Sadie Ann from Midship Marine in Harvey, La. Amy Eliot, the institute’s associate director, said Sadie Ann will replace the beloved, if antiquated, L.L. Smith Jr for research on Lake Superior’s frigid

waters. Sadie Ann can hold up to 49 passengers and reach 18 knots.

Incat Crowther designed Sadie Ann, which has a parallel hybrid system designed by Esco Power. The vessel is equipped with John Deere engines, Northern Lights generators and Lehmann Marine COBRA batteries that store 86 kWh of charge.

Eliot estimates the hybrid propulsion system added about $1 million to construction costs that were largely funded by private donations. But she said those costs are worth it for the operational and educational bene ts the system offers.

“It was the reduced wear and tear on the engines, the potential for payback over the life of the vessel, learning opportunities for the campus and the quiet nature of the system and what that would mean for us for both research and educational missions,” said Eliot. “All of those things had a role for why we selected the hybrid system.”

Shaver Transportation Co., Portland, Ore., is scheduled to take delivery of a new 79'x40'x17' ship-assist and escort tug, Heather S, this summer, bringing more horsepower and capability to the Columbia River.

The Robert Allan Ltd.-designed RApport 2500 tug is being built by a pair of partnering Portland shipyards. Gunderson Marine & Iron constructed the hull and launched it in March, and Diversi ed Marine Inc. (DMI) will complete the vessel, including all out tting.

“Shaver is always looking to add new technology and capabilities to our eet,” said Jon Hellberg, the company’s vice president of operations. “Adding another Tier 4 vessel was attractive as well as getting a new vessel with higher horsepower and bollard pull.”

The newbuild will be Shaver’s second Tier 4 tug, following the 8,400-hp, 112'x45'x21' tractor tug Samantha S, built by DMI in 2018.

The Heather S’s two Caterpillar 3516E main engines will each deliver 3,500 hp at 1,800 rpm, powering Berg MTA 628 azimuth thrusters. The vessel will also feature 2,156-kW John Deere 6068AFM85 auxiliary engines and a Markey DEPC 52 electric hawser winch. The tug is expected to be able to reach a speed of 12 knots and provide a bollard pull of 100 tons. It will have 20,500 gals. fuel capacity and accommodations for six crew.

Hellberg said Shaver liked the RApport 2500 design after seeing others built by DMI. The rst tug built in the U.S. to this design was constructed for Brusco Tug & Barge, Inc., Longview, Wash., and entered service in 2020 under long-term charter to Crowley, Jacksonville, Fla., in the ports of Los Angeles and Long Beach.

“The Robert Allan design is proven — a good hull shape for ef ciency and performance,” said Hellberg. “Its power, compact design, maneuverability, and great visibility from the pilothouse make it a great option for ship assist … And it ts the bill for the Columbia River.”

Upon its entry into service this fall, the tug will operate from Astoria, Ore., to

Portland, with a focus area from Portland to Longview, Wash. “Its primary duty will be ship assist into and out of berth and anchor,” said Hellberg. “It’s very capable for performing escort and emergency response work as well.”

Hellberg said a lot of effort went into the tug’s crew features — “the human design,” as he called it — with emphasis on making the wheelhouse user-friendly and the interior spaces and berthing areas quiet to reduce fatigue.

“We try to learn and get better every time we build a new boat,” said Hellberg. — Eric Haun

TheU.S. Navy recently accepted delivery of the ship-to-shore connector LCAC 112 (landing craft, air cushion), from Textron Systems, New Orleans.

Delivery of the 91'x47'10" highspeed, amphibious hovercraft follows the completion of acceptance trials and marks the of cial transfer of the craft from the shipbuilder to the Navy. During these trials, the Navy’s Board of Inspection and Survey assessed the craft’s readiness and capability to meet operational requirements.

LCAC 112 is designed with similar con gurations, dimensions, and clearances to legacy LCACs to ensure compatibility with existing well deckequipped amphibious ships, Naval Sea Systems Command reported in a statement announcing the delivery.

“This new craft will provide the Navy and Marine Corps team with unparalleled capability in amphibious warfare, ensuring we remain agile and responsive to emerging threats and global challenges,” said Angela Bonner, program manager for amphibious assault and connectors programs, Program Executive Of ce, Ships (PEO Ships).

The boat, which has a height of 25'10" with its cushion in place, can carry a payload of approximately 60 to 75 tons, transporting weapon systems, equipment, cargo, and assault personnel in various conditions, including over-the-beach operations. (The vessel’s

height is 19'2" without the 5' cushion.)

Main propulsion comes from four Vericor Power Systems ETF40B gas turbines, each producing 3,955 hp. The turbines connect to variable pitch props and aerodynamic rudders. The lift system consists of four 63" double-entry, double-discharge centrifugal lift fans.

The propulsion package can carry the vessel at a speed of 50 knots in sea state 2, 35 knots in sea state 3, and 25 knots over land. The LCAC has a range of 200 miles at 40 knots.

PEO Ships, one of the Department of Defense’s largest acquisition organizations, manages the development and procurement of destroyers, amphibious ships and craft, auxiliary ships, special mission ships, sealift ships, and support ships.

The rear deck area measures 67'x27' (1,809 sq. ft.). The design payload weight is 120,000 lbs., overload payload is 150,000 lbs., and the maximum allowable weight of the boat with payload is 389,984 lbs.

“The successful delivery of LCAC 112 demonstrates the strong partnership between the Navy and Textron Systems,” Bonner said. “This advanced craft will signi cantly enhance operations, providing a critical link in our ability to project power and support joint operations across the globe.”

Textron is building LCACs 113-125.

— Ken Hocke

Electric ferries for a ‘mosquito fleet’

Artemis Technologies and Delta Marine, Seattle, said they will use the patented Artemis eFoiler and EF-24 electric ferry design to develop a new ‘mosquito eet’ style of “smaller, more agile ferries that have recently been advocated as a practical solution to Puget

Bollinger Shipyards, Lockport, La., in March announced it has received a $951.6 million contract to proceed with building the U.S.’s first new heavy polar icebreaker in nearly 50 years. Bollinger said the contract modification advances the detail design and construction phase of the U.S. Coast Guard polar security cutter program, paving the way for the series’ first vessel, the 460'x88' USCGC Polar Sentinel (WMSP-21), to be completed by 2030. The deal was awarded by Naval Sea Systems Command. The Navy is managing the program alongside the Coast Guard through an integrated office.

Silver Ships, Mobile, Ala., has completed testing and delivery of a 39'x10' assault amphibious safety boat (AASB) for the U.S. Marine Corps and Navy, marking the 25th of 31 vessels delivered on schedule. The first hull was built and tested in under nine months after the initial contract award. Designed for shallow-water operations, the AASB has a 2' draft and a 25° deadrise to handle rough conditions. It is powered by twin 250hp Mercury SeaPro outboards, with a full load weight of 16,195 lbs. and a fuel capacity of 250 gals.

Hughes Bros., Inc., Edison, N.J., has launched and christened its newest and largest floating drydock, Michael, the first new construction drydock placed into service in Brooklyn, N.Y., in over a century, according to Hughes Bros. Designed by JMS Naval Architects, Groton, Conn., and built by Feeney Shipyard, Kingston, N.Y., the drydock measures 206' x86' x25', with 70 ' between the wingwalls. The Michael has a lifting capacity of 1,500 tons, and it can accommodate vessels up to 300 ' x64' x16', Hughes Bros. said.

In March, President Donald Trump signed into law a continuing reso-

lution that funds the government through the end of the fiscal year (Sept. 30, 2025). The legislation repeats the FY2024 Small Shipyard Grant Program funding levels and means that Congress has formally provided $8.75 million for the next round of the Small Shipyard Grant Program awards. While there are still technical questions about the potential for the sequestration of funds by the president, grant applications will be due May 14, and award selections will be announced on or around July 14.

Sound’s ferry congestion,” the vessels’ developers said in an email.

The term mosquito fleet was used to describe several different flotillas. In this case, the reference is to a fleet of small steam vessels that plied the waters of Puget Sound during the late 19th century and early 20th century. It was also used to describe the various steamboats and other small craft that served on the rivers and bays of the Oregon coast.

The 78.7'x36' EF-24 vessel will carry up to 150 passengers cruising at 34 knots and can operate for more than two hours on a single charge. Those capabilities are in line with existing regional ferry services like those operated by Kitsap Transit and King County Metro, the developers said.

Using Kitsap’s Kingston-Seattle 30-nautical-mile route as an example, the Artemis EF-24 can complete two round trips before requiring a recharge.

“This aligns well with Kitsap Transit’s existing schedule, where the ferry provides three morning return trips, followed by three more in the afternoon,” according to the developers.

With short charges during the morning and afternoon sessions, and a longer midday charge, the EF-24 can run on the current timetable, covering around 180 miles daily.

Artemis’ Megawatt Charging System can charge at a rate of 2.9 MW, up to fully charged in less than an hour. But to meet the example of Kingstonto-Seattle runs, “the vessel would only need to charge at 2 MW during the day, optimizing battery health,” the developers said.

“Developed in-house by our worldleading team of experts, our battery features cutting-edge energy density, lightweight construction and advanced thermal management, all tailored for marine environments,” according to the developers. “It integrates seamlessly with our high-efficiency electric foiling propulsion system, providing longer range and optimal performance even in harsh sea conditions.”

— Kirk Moore

Lubriplate is committed to providing you with the right lubrication for your vessel and other equipment affected by (VGP) Vessel General Permit regulations. Designed specifically for use in harsh marine conditions, these high performance, Environmentally Acceptable Lubricants (EAL)s deliver all the performance and protection you need, while maintaining compliance with regulations protecting the environment.

ATB BIOBASED EP-2 GREASE

• This versatile grease meets U.S. EPA Vessel General Permit (VGP) requirements.

• Passes U.S. EPA Static Sheen Test 1617 and U.S. EPA Acute Toxicity Test LC-50.

• ECO-Friendly and Ultimately Biodegradable (Pw1) Base Fluid – 75.2%.

• Designed for use on Articulated Tug Barge (ATB) notch interface, coupler ram and drive screws, above deck equipment, rudder shafts, wire rope, port equipment, cranes, barges and oil platforms.

• These fluids meet U.S. EPA Vessel General Permit (VGP) requirements.

• High-performance, synthetic polyalkylene glycol (PAG)-based formula.

• Non-Sheening – Does not cause a sheen or discoloration on the surface of the water or adjoining shorelines.

• Provides long service life and operating reliability, lower maintenance costs, and reduced overall downtime.

• Excellent anti-wear performance - rated as anti-wear (AW) fluids according to ASTM D7043 testing and FZG testing.

• High flash and fire points provide safety in high temperature applications.

• All season performance – high viscosity indices and low pour points.

• ECO-Friendly and Readily biodegradable according to OECD 301F.

• “Practically Non-Toxic” to fish and other aquatic wildlife according to the U.S. Fish and Wildlife Service hazard classification.

COMPLIANCE STATEMENT LUBRIPLATE ATB BIOBASED EP-2

and BIO-SYNXTREME HF SERIES HYDRAULIC FLUIDS are Environmentally Acceptable Lubricants (EAL)s according to the definitions and requirements of the US EPA 2013 Vessel General Permit, as described in VGP Section 2.2.9

Newark, NJ 07105 / Toledo, OH 43605 / 800-733-4755 To learn more visit us at: www.lubriplate.com

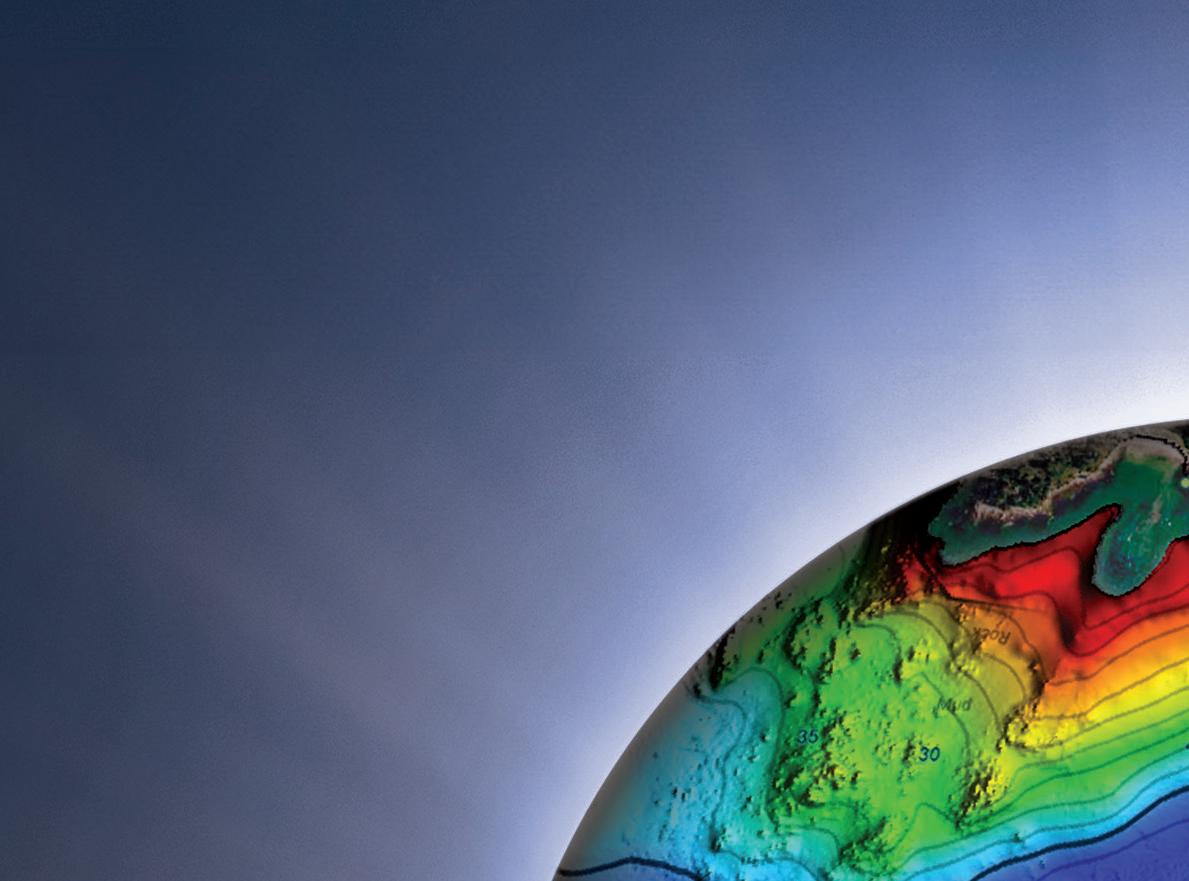

Fleets of vessels are required to develop offshore projects.

By Eric Haun, Executive Editor

It takes a lot of vessels to commission an offshore oil and gas production project. In the case of Shell’s Whale development, which recently came online in the U.S. Gulf, it required 87 vessels and four rigs, to be exact.

These numbers are according to Spinergie, a maritime tech company that provides a market intelligence platform tracking offshore vessel activity and performance. The company uses AIS data paired with machine learning and arti cial intelligence algorithms to analyze vessels’ behavior and determine their activities, such as surveying, pipe laying, or structure installation.

“We gather all this information into a platform providing market analysis, vessel performance for installation and

maintenance, and also which vessel is working for who, which kind of eet is the most utilized depending on its industry, and so on,” said Jean-Baptiste Rougeot, offshore energy analyst manager at Spinergie.

Unlike the offshore wind industry, which largely relies on the same numbers and types of vessels for project construction, with some variation for the type and size of the foundations and turbines, offshore oil and gas projects are affected by many variables that impact vessel requirements.

Before joining Spinergie, Rougeot spent 14 years installing pipeline for Subsea 7, which is to say he has an expert understanding of the speci city of offshore oil and gas development.

To get a feel for the scope of vessels required to commission a recent oil and gas project, WorkBoat asked Rougeot

about the Shell-operated deepwater Whale development, which came on stream in Alaminos Canyon Block 773, about 200 miles southwest of Houston, in January.

Whale features a Seatrium-built, four-columned semisubmersible oating production unit (FPU) installed in more than 8,600' of water. Discovered in 2017, the eld has an estimated recoverable resource volume of 480 million barrels of oil equivalent (BOE). Fifteen wells will be connected to the host via subsea infrastructure, with peak production estimated at 100,000 BOE per day.

Spinergie’s data revealed that more than 90 different rigs and vessels — including a combination of U.S.- and foreign- agged ships — were involved in developing and commissioning the project, from the initial exploration and drilling phases using rigs and platform supply vessels (PSV), to the construction phase using pipelayers, heavy-lift vessels, and anchor handlers.

In the exploration phase, three rigs — including Noble Corp.’s 620'x105' drillship Noble Globetrotter I, which made the initial discovery — were used to drill a total of six exploration/ appraisal wells between 2017 and 2022, said Rougeot, adding that one rig, Transocean’s 781'x138' drillship

Deepwater Thalassa, was used for the well developments.

“Each rig was supported by anchorhandling tug-supply (AHTS) vessels, and especially PSVs, to bring food, water, and fuel to the massive rig, and also to feed the rig with the drilling pipe,” said Rougeot.

Following front-end engineering design work, Shell announced its nal investment decision for the development in July 2021, which kicked off the next phase of the project. In September 2021, McDermott was awarded the contract to provide engineering, procurement, construction, installation, and commissioning for 30 miles of pipeline and approximately nine miles of umbilical to connect ve drill centers to the FPU.

Construction was driven by McDermott’s 652.9'x105.8' pipelayer Amazon, which deployed rigid pipe, supported by “lots of other smaller construction vessels and PSVs on the eld to feed the pipe sections,” said Rougeot. “You’ve got also some light construction vessels that were used to install the jumpers and spools.”

McDermott’s 438.3'x88.6' ex-lay vessel North Ocean 102 was used to install umbilicals to control the subsea pump, Christmas tree, and manifold from the main facilities, said Rougeot, noting the work was performed over two campaigns. Another pipelayer, Allseas’ 983.9'x133.3' Solitaire, was used for the trunkline export to the tiein point.

After the subsea components were laid, the FPU was towed out by a pair of AHTS vessels and installed by Heerema’s 505.5'x282.2' semisubmersible crane vessel Balder. “It has 6,300 tons of total lift capacity, so quite a huge vessel that is familiar to work within the region,” said Rougeot.

“Generally, your pipelayer is dedicated to light structure and laying pipe, and then if you have a very large structure — a very large, xed platform — you will have a dedicated heavy lift vessel to install it,” said Rougeot. “There are only a few vessels in the world that can do both, meaning install-

ing large structure and also pipeline, so you will generally see two vessels deployed for this kind of work.”

Notably, large construction vessels like those deployed on Whale do not need to be Jones Act-quali ed because they do not pick up materials from shore, instead relying on a eet of support vessels to feeder materials at sea. In addition, several vessel classes, including some cable and pipelay vessels, are exempt from Jones Act requirements.

To complete the FPU install, a construction vessel equipped with a remotely operated underwater vehicle was used to recover the anchor lines that had been pre-laid.

All told, four drilling rigs, three survey vessels, two pipelayers, one ex-lay vessel, one heavy-lift ship, eight construction vessels, three wellintervention/stimulation vessels, three

AHTS vessels and ve anchor handling tugs, 44 PSVs, 12 fast support vessels, and ve multipurpose vessels were deployed in support of the project, according to Spinergie data. The project required more than 5,000 vessel days.