baesystems.com/commercialshiprepair

As I write this month’s editor’s note from the sidelines of the IPF offshore wind conference in Virginia Beach, Va., I'm noticing that the atmosphere feels markedly different from that of recent years.

WorkBoat has covered the U.S. offshore wind sector from the early days in Rhode Island and the rst purpose-built American offshore wind vessel, Atlantic Wind Transfers’ crew transfer vessel the Atlantic Pioneer, then viewed as a controversial selection for this publication’s Signi cant Boat of the Year honors.

Of course, attitudes have evolved since then, and the offshore wind industry has made signi cant, hard-won progress — evident in milestones like the launch of commercial-scale wind projects and the development of a new domestic supply chain that spans 40 states, according to a report published in January by the Oceantic Network trade group, hosts of IPF — the International Partnering Forum — which bills itself as the leading gathering for the American offshore wind industry.

WorkBoat’s pages have chronicled the industry’s build-up, with particular focus on U.S. marine industry involvement. Oceantic Network reports that 21 shipyards across 12 states have been involved in offshore wind, with more than 50 dedicated vessels ordered or retro tted to date.

U.S. offshore wind has also experienced its share of ups and downs, marked by frequent stops and starts. Recent events have introduced signicant uncertainty about the future of this

Eric Haun, Executive Editor ehaun@divcom.com

sector, shifting the mood at this year’s IPF after several years of optimism and progress. Still, it’s not all doom and gloom. Despite the challenges, one thing remains clear: marine industry players, including shipbuilders, vessel operators, and supply chain partners, are committed to staying the course as the U.S. offshore wind industry ghts on to navigate its latest setbacks. There’s simply too much at stake — the promise of clean, renewable energy, high-paying jobs, and signi cant economic development — to let years of hard work, innovation, and $40 billion in offshore wind industry investment go to waste.

EXECUTIVE EDITOR Eric Haun / ehaun@divcom.com

SENIOR EDITOR Ken Hocke / khocke@divcom.com

CONTENT EDITOR Benjamin Hayden / bhayden@divcom.com

CONTRIBUTING EDITOR Kirk Moore / kmoore@divcom.com

CONTRIBUTING WRITERS

Tim Akpinar • Jonathan Barnes • Capt. Alan Bernstein • Stephen Blakely

Dan Bookham • G. Allen Brooks • Bruce Buls • Michael Crowley

Jerry Fraser • Nate Gilman • Pamela Glass • Arnie Hammerman

Craig Hooper • Joel Milton • Richard Paine, Jr. • Chris Richmond

DIGITAL PROJECT MANAGER / ART DIRECTOR Doug Stewart / dstewart@divcom.com

ADVERTISING ACCOUNT EXECUTIVE S

Mike Cohen 207-842-5439 / mcohen@divcom.com

Kristin Luke 207-842-5635 / kluke@divcom.com

Krista Randall 207-842-5657 / krandall@divcom.com

Danielle Walters 207-842-5634 / dwalters@divcom.com

ADVERTISING COORDINATOR

Wendy Jalbert 207-842-5616 / wjalbert@divcom.com

Producers of The International WorkBoat Show and Pacific Marine Expo www.workboatshow.com • www.pacificmarineexpo.com

PRESIDENT & CEO Theodore Wirth / twirth@divcom.com

VICE PRESIDENT Wes Doane / wdoane@divcom.com

PUBLISHING OFFICES

Main Office 121 Free St., P.O. Box 7438, Portland, ME 04112-7438 207-842-5608 • Fax: 207-842-5609

MAGAZINE SUBSCRIPTION INFORMATION cs@e-circ.net • 978-671-0444 (Monday-Friday, 10 AM – 4 PM ET)

David Clark Company is proud to be a part of “Project Perfect Storm ” - selected as the boat crew communications provider for the new 11.5-meter, high-tech RHIB Offshore Interceptor from Ocean Craft Marine.

David Clark Marine Headset Systems are transforming the way crews communicate on board high speed patrol boats and interceptors. Noise attenuating headsets and system components provide outstanding reliability and comfort, while reducing crew fatigue from prolonged exposure to wind and engine noise. Call 800-900-3434 (508-751-5800 Outside the USA) to arrange a system demo or visit www.davidclark.com for more information.

“ The {David Clark} wireless headset system has been a game-changer... enhancing crew coordination and overall communication capabilities, while increasing crew situational awareness and effectiveness, making it a must-have for professional boat operations.“

Todd

Salus, VP of Operations, Ocean Craft Marine

The U.S. Trade Representative has scaled back a proposal to impose port fees of up to $1.5 million per call on China-built ships. Instead, starting in mid-October 2025, a fee of $50 per net ton will be implemented, increasing by $30 annually over three years. To avoid raising U.S. export costs and burdening consumers with up to $30 billion in added costs, the USTR introduced a tiered approach: ships built in China but owned by non-Chinese companies will be charged $18 per net ton, with annual increases of $5 over three years.

Asweeping executive order issued by President Trump on April 9 aims to rebuild the U.S. shipbuilding industry and push back on what he described as China’s grip on global shipping.

Trump told reporters the U.S. would be spending “a lot of money on shipbuilding” to restore American capacity in the sector.

The order calls for signi cant federal investment in U.S. shipyards and the maritime workforce, and outlines a new Maritime Action Plan to be coordinated by the Transportation Department’s Maritime Administration. The plan includes the establishment of a Maritime Security Trust Fund, shipbuilding tax incentives, and the launch of strategic commercial eet programs.

Labor and industry groups acclaimed the new promise.

“For nearly half a century, our nation’s maritime industry has steadily declined due to neglect, underinvestment, and unfair competition driven by China and other adversaries,” said Roland Rexha, secretary-treasurer of the Marine Engineers Bene cial Association (MEBA). “Today’s action is a decisive move to reinvigorate U.S. shipping and address serious national security concerns.”

In 2023, U.S. shipyards accounted for just 0.1% of the world’s new ship construction, while China built more than 50% of the global total. China currently operates a eet of more than 7,800 merchant ships, compared to the U.S. eet of 185.

Matthew Paxton, president of the Shipbuilders Council of America, said the new Maritime Action Plan and nancial tools laid out in the executive order will allow shipbuilders to begin reversing decades of decline.

“A strong U.S. shipyard industry is essential not only for our economic security but also for our homeland and national security,” he said. “President Trump’s executive order demonstrates a clear commitment to reenergizing our nation’s shipyards, and U.S. shipbuilders stand at the ready.”

The administration says the new plan will prioritize building a strategic commercial eet, encourage private investment, and streamline federal coordination across maritime initiatives.— Kirk Moore

TheCoast Guard is seeking information from U.S. and international shipyards into the feasibility of building a new class of medium icebreaking cutters for Arctic duty – and delivering them within three years of starting construction.It’s the latest in a push by both the Trump and Biden administrations to speed up U.S. capabilities in the High North to meet Russian and Chinese eff orts advancing their interests in the Arctic.

Trump administration’s proposed 2026 budget would cut Department of Commerce funding by over 25%, eliminating NOAA’s Oceanic and Atmospheric Research (OAR) program and targeting other climate, ocean, and fi sheries eff orts. OAR’s funding would drop by $485 million to $171 million, eff ectively dissolving it as a line offi ce, according to an April 11 OMB document shared with NOAA staff. The plan would also eliminate funding for all climate, weather, and ocean labs and cooperative institutes, shifting Commerce’s focus to energy and trade.

BY JOEL MILTON

Joel Milton works on towing vessels. He can be reached at joelmilton@yahoo.com.

To competently, professionally “deck” on a conventional tug doing harbor and short coastwise work requires a particular seamanship skillset. Line-handling is critical. This includes throwing and taking in mooring lines from tugs and barges, making and breaking tows, assembling tows of multiple barges, and everything in between. While it certainly isn’t rocket science, there’s more to it than meets the untrained eye, and it still requires a nimble mind to visualize what needs to happen and execute properly without injury.

A few months back, a new trainee deckhand arrived on board, and although he claimed some previous maritime experience,

AfterBY CRAIG HOOPER

Dr. Craig Hooper is the founder and CEO of the Themistocles Advisory Group, a consulting firm specializing in maritime and national security strategy. He has been a keen observer of navies and coast guards for over two decades.

decades of disappointment, America’s conventional shipbuilding industry has been slow to act upon the array of pro-shipbuilding initiatives flowing out of Washington. Despite strong and sustained bipartisan support for the maritime industry from both Congress and the administration, industry is still wary, betting the federal government’s maritime focus is just a passing fad.

Caution is warranted. In a complex industry, where capitalintensive industrial investments are generally built to last centuries and are paid back over decades, shipbuilders desperately need solid, long-term contracts that don’t evaporate or change over time. But, with maritime technology in flux and the economy uncertain, guaranteed multi-ship contracts are hard to find.

Some new tech-infused shipbuilders, juiced by investor capital and poised to build smaller craft, are rushing in, undeterred by the fact that the U.S. government has a checkered history on the waterfront. Virtually every big U.S. shipbuilder in business today can ruefully point to billions in capacity

that experience had little value on the tug’s deck. He was, in most respects, starting from scratch. He knew no knots or how to splice a simple three-strand line. The able seaman (AB) he was on watch with attempted to teach him some simple knots and how to make an eye splice with three-strand — the fundamentals of deck seamanship.

The trainee, oddly enough, was disinterested in learning those fundamentals. The reason: He had apparently already decided that he wanted to be a captain and that those things were beneath the position. When pushed by the AB to make some effort he declared that if he ever did have to really do those things he would simply “TikTok it or watch YouTube videos” to learn how. And that was that.

It’s a hell of a philosophy to have for a beginner trying to make his way successfully into a demanding new job that is unlike any other. Why learn anything when you can just outsource or crowdsource it to the internet whenever you run into trouble because you don’t know what to do? No need for mental discipline, critical thinking, and problem solving. Just click.

This is what we’re dealing with now, more and more. Excessive, compulsive use of social media destroys the ability to focus and feeds this bad attitude at nearly every turn.

expansion or shipyard modifications that were done with the promise of future work — work that eventually evaporated.

These missteps don’t often make headlines. They’re slowmoving disasters, stretching out over years.

Governmental tinkering can trip up startups. More than a decade ago, Austal USA — then the brash new shipbuilder of the day — sized its new shipyard to address the government’s stated requirement of 55 littoral combat ships (LCS). Between 1999 and 2009, the young Australia-based company took big risks for the contract, plowing some $227 million in current dollars into the shipyard. But the massive LCS fleet that Austal’s newly-built shipyard was crafted to support quickly vanished. First, the LCS program was evenly split between two shipyards, only to be cut and cut again. Austal ended up with orders for just 19 LCSs, and the organization has, over the past decade, struggled to get over the U.S. government’s initial “bait-and-switch”.

These abrupt shifts in emphasis echo though the industrial base for decades.

In Maine, Bath Iron Works is still struggling to recover from the 2008 truncation of the Zumwalt-class destroyer program. Shortly after buying Bath Iron Works in 1995, General Dynamics began retooling its old-school shipyard to handle the big, new vessel, reorienting everything from the yard’s workforce to the shipyard’s layout so the site could efficiently build an expected fleet of 32 destroyers. After two decades of work, and an investment of at least $675 million in today’s dollars to build a high tech “Ultra Hall” and “Land Level Transfer Facility” sized for the big new destroyers, the Zumwalt program collapsed. Bath ended up only producing

three of the newfangled ships. And now, 15 years later, the storied shipyard is still fighting to reconstitute its legacy Arleigh Burke-class destroyer production line. Other countries do things differently. In some cases, shipyard improvements come with an enormous governmentbacked orderbook. King Salman International Complex for Maritime Industries and Services, the largest shipyard in the Middle East and North Africa region, was built around longstanding guaranteed contracts. Almost 10 years ago, the largely state-owned companies of Saudi Aramco and Bahri ordered 20 rigs and 52 new vessels from the nascent shipyard, guaranteeing a $10 billion off-take. That deal is still solid,

and the shipyard is marching through the government-backed backlog. That’s the type of long-term buy-in the U.S. government has been unwilling to make in the maritime industry.

Even if technological, economic, and geopolitical changes are driving uncertainty into the maritime sector and forcing America to hedge its bets, the U.S. government could do worse than follow the national shipbuilding strategies of Australia, Britain, and Canada. These efforts might break the rigid rules of capitalism a bit, sending Federal Acquisition Regulation aficionados to the fainting couch, but they do commit governments to send steady work to shipbuilders, allowing them to deploy resources in a

BY NATE GILMAN

Nate Gilman, president of MM-SEAS USCG Licensing Software, uses his hawsepiping experience to support mariners and workforce development. Connect on LinkedIn.

The Office of Merchant Mariner Credentialing has clarified key details regarding its policy that exempts eligible military personnel from Merchant Mariner Credential (MMC) fees, providing necessary information for applicants navigating the process. The underlying policy, CG-MMC Policy Letter 03-24, became effective Nov. 4, 2024, and eliminates standard MMC application fees, including evaluation, examination, and issuance costs, for qualifying service members.

This Military Fee Exemption applies to members currently serving on active duty in any uniformed service (Army, Navy, Air Force, Marine Corps, Space Force, Coast Guard, National Oceanic and Atmospheric Administration Corps, U.S. Public Health Service) and members of the Selected Reserve components as defined in the policy letter. The exemption directly supports historic and new executive orders aimed at easing the pathway for military personnel into the maritime industry.

To qualify, applicants must submit documentation with their MMC application package that verifies their eligible status. The policy letter lists several acceptable documents,

measured fashion over time. This national-level approach is good for the entire industrial ecosystem. Upstream suppliers remain assured of a steady demand signal, and new entrants can, if they meet certain benchmarks, get a book of business. And, with a strong foundation, healthy national shipbuilding networks can flex in response to need. This is what the Trump administration’s executive order for the maritime industry seems to be driving toward. But, to get shipbuilders and shipyard suppliers to invest billions into improvements or new shipyards, Washington must put up billions for guaranteed shipyard work as well.

including active duty orders citing Titles 10 or 14, a history of assignments (HOA), a Transcript of Sea Service, or a valid active duty military ID, such as a common access card (CAC). Utilizing these standard documents simplifies the process, as applicants no longer need to obtain a specific, separate fee waiver memo from their command, which could previously be difficult for some personnel to acquire.

The Office of Merchant Mariner Credentialing clarified the timing requirements associated with these documents. For most standard forms of proof like orders, CACs, or HOAs, the document’s original issue date is not critical; the document simply needs to effectively demonstrate applicants hold the required qualifying status when they submit an application. The policy only imposes a specific recency requirement on one type of document: if an applicant uses a letter or memo from their command or personnel office as proof of status (as outlined in paragraph 5.c.8 of the policy letter), that specific letter must be dated within 180 days prior to the application submission date.

The policy also clearly defines the eligibility window based on the applicant’s service status. Individuals qualify for the exemption if they hold the required active duty or selected reserve status on the date their MMC application is submitted. Additionally, the policy includes a provision for recently separated individuals: those whose qualifying status ended can still receive the military fee exemption if they submit their MMC application within 180 days following their date of separation. This 180-day look-back period provides a practical timeframe for veterans transitioning out of service to apply and benefit from the exemption. Understanding these documentation and timing rules allows eligible military members and recent veterans to accurately prepare their applications and take advantage of this costsaving measure.

CBY G. ALLEN BROOKS

G. Allen Brooks is an energy analyst. In his over-50year career in energy and investment he has served as an energy security analyst, oil service company manager, and a member of the board of directors for several oilfield service companies.

rowley’s new liquefied natural gas (LNG) carrier highlights the need to update the Jones Act. The ship will carry Gulf Coast LNG to Puerto Rico under a long-term supply contract to power generators for the island’s challenged electricity grid. It will deliver cheaper domestic gas to an island dependent on expensive, imported LNG.

“The entry into service of American Energy marks a significant step for fuel supply reliability in Puerto Rico for our energy grid, which will greatly benefit our people,” said Puerto Rico Gov. Jenniffer González-Colón. The ship’s 130,400-cu.-meter capacity will provide enough LNG with each voyage to serve 80,000 homes for a year.

The step is significant for Crowley, a privately held, U.S.owned and -operated logistics, marine, and energy solutions company, and a milestone for the domestic shipping industry.

The 900' American Energy was previously the Liberianregistered Intan (formerly the Puteri Intan, built in 1994). Crowley purchased the 31-year-old steam turbine vessel, refurbished it, and reflagged it to work under a 1996 provision of the Jones Act. The provision reads: “May issue a certificate of documentation with a coastwise endorsement for a vessel to transport LNG or liquified petroleum gas to Puerto Rico from other ports in the U.S., if the vessel is a foreign-built vessel built before Oct. 19, 1996.”

Puerto Rico receives an exemption but must rely on an aging ship, while New England continues to pay high prices for foreign LNG each winter. Without a similar waiver, delivering cheaper domestic gas to New England would require building a costly U.S.-flagged and -crewed LNG carrier. Cheaper gas but a higher transportation cost solves nothing.

Anticipating a rise in LNG imports, the U.S. built 16 LNG carriers in the late 1970s and 1980s, but regulatory changes and the shale gas boom largely eliminated the need for imports — except in New England. Today, only a few of those carriers remain in operation.

The Trump administration recognizes the need for fundamental reforms and stimulus to revive the U.S. maritime industry. Limited shipbuilding capacity poses a national security risk, as building Navy warships takes years — leaving the U.S. trailing China’s expanding fleet. A miniscule commercial fleet leaves the U.S. vulnerable to supply boycotts and extortion during conflict. These unacceptable risks can only be rectified over time and with a concerted effort to rebuild the U.S. maritime industry.

UncertaintiesBY PAMELA GLASS

Pamela Glass is the Washington, D.C., correspondent for WorkBoat. She reports on the decisions and deliberations of congressional committees and federal agencies that affect the maritime industry.

emanating from the Trump administration’s erratic and unprecedented trade policies have caused new anxieties and business uncertainties for the barge industry.

In April, a trade war led by President Trump’s drive to level the global trade playing field spiked U.S. tariffs on imported goods to the highest levels in a century and sent the world economy and stock markets into chaos. After an immediate uproar, the president delayed most tariffs until July but kept a 10% rate on most countries while piling more penalties on China. Meanwhile, China responded with similar levies on trade with the U.S. and has moved to increase its soybean purchases from Brazil, a big competitor to U.S. farmers.

Tariffs in any form worry barge operators because they can hurt demand and pricing of barged commodities like export grains and coal and hike prices for vessel spare parts made overseas or manufactured with imported materials, and they increase the cost of building new vessels.

Just before the tariffs were announced, a separate trade initiative aimed at challenging China’s dominance in shipping raised concerns across the maritime industry, including among inland operators that transport goods to and from U.S. ports.

On Feb. 27, U.S. Trade Representative Jamieson Greer, the administration’s top trade official, announced a set of recommendations to counter China’s maritime and global shipbuilding ambitions. The most controversial of these would impose fees of up to $1.5 million on Chinese-built, -operated, or -flagged ships arriving in U.S. ports, and assess fees on vessels manufactured elsewhere if they are operated by carriers with fleets that include Chinese-made vessels.

The proposal is supported by many labor unions, steel companies and members of Congress who say fees will help revive the U.S. shipbuilding industry. But it has met very strong opposition from domestic retailers, importers, exporters, manufacturers, maritime companies, seaports, and international shippers and shipowners who predict the fees will raise prices for consumers and business and lead to major shifts in the nation’s port and transportation industries.

Barge operators would be swept into the economic fallout, especially those hauling export coal and soybeans to U.S. ports where the cargo is loaded onto Chinese-built vessels. They are most concerned that many foreign ships will bypass U.S. ports to avoid fees and head to ports in Canada or Mexico, and that demand for U.S grains and coal will collapse as China buys from other world producers.

BY CHRIS RICHMOND

Chris Richmond is a licensed mariner and marine insurance agent with Allen Insurance and Financial. He can be reached at 800-439-4311 or crichmond@allenif.com.

Passenger vessel operators have many options when it comes to risk management for their operations. While many of these are focused on board the vessel, one that is often overlooked occurs before a passenger ever steps aboard the boat. By incorporating ticket terms and conditions onto the passage fare that your passengers are purchasing, you can add an additional layer of risk management. By adding terms and conditions at the time of a ticket purchase you help limit your vessel’s liability for certain risks such as injury to passengers. You may not be able to have all liability waived; you will still need to comply with maritime law. But informing your passengers that by purchasing the passage ticket they accept and understand that travel at sea can be potentially dangerous could be one additional

BY RICHARD PAINE, JR.

Richard Paine, Jr. is a licensed mariner and certified maritime safety auditor with over 25 years of maritime industry experience. He is currently a senior VP at the Hornblower Group and can be reached at rjpainejr@gmail.com.

Throughout my career, I’ve developed and implemented a range of management systems to mitigate business, operational, and enterprise risks. When properly executed, these systems improve performance and deliver fiduciary benefits. They can range from simple to complex, targeting areas such as quality assurance, environmental and energy management, and physical or information security. In the maritime industry, the most common focus is on safety management systems (SMS).

Safety management systems can vary in design, as their requirements differ across sectors of the industry. They may be set by international standards such as IMO and ISM Code, ISO 45001 Health and Safety, regulatory standards such as Subchapter M and towing safety management systems or just

defense for you should a claim become messy.

Another benefit could be controlling time limits and specify legal jurisdiction. Being able to manage potential litigation can minimize legal expense as well as the inconvenience of fighting a lawsuit long distance. You will be thankful you have established this should a passenger who cruised with you in Boothbay, Maine, file a claim in their hometown court in Houston.

Terms and conditions should also clearly state your refund policy should a trip have to cancel or become delayed. You can control many things on your boat, but you cannot control the weather. Including a force majeure clause that details situations where you are not liable for cancellations due to events outside of your control.

It goes without saying that you should consult a professional when preparing this. An admiralty attorney would be able to draft this document to suit the type of trip that you are running and to make sure that you are abiding by the state and federal laws that you are operating under.

Risk management comes in many forms. Proper terms and conditions on your boarding pass can be just as important as the life jackets that you keep on board. When creating a risk management program for your business, use all the options available, and use a trained professional to help develop this.

a system built around best management practices. However, there is one extremely important piece that is needed to foster the real goal of an SMS, which is to have a thriving safety culture, and that starts and ends with leadership.

The word leadership can mean different things to different people, but when it comes to building successful safety cultures, I want to be specific: I’m referring to top leadership those in charge, the individuals who set the tone and make the final decisions. They include owners, general managers, CEOs, board members, and seagoing vessel masters.

A safety culture is different than an SMS. An SMS may include operating procedures, emergency procedures, and training. It includes audits, records, and documentation supporting lines of safety communication through designated duties and roles. However, sometimes, we think of an SMS as the fix to the general question of “how do we make our business safer?” The truth is that organizations with the most compliant SMS can still have subpar safety cultures because they lack true top-level leadership.

The beauty of safety culture is that it doesn’t have to be complex. Top leaders simply need to beat the drum for making safety a priority. This means offering both verbal and tangible support for safety programs, policies, and the workforce behind them. They are responsible for setting and tracking goals to drive performance, recognizing employees who support safety, and holding those who don’t accountable. Improving safety doesn’t require complexity or high costs — just full commitment from the top.

tion to replace the aging eet,” said Townsend.

Eymard Marine Construction & Repair, Harvey, La., delivered the 67'6"x28'x9'6" push tug Soaring Eagle to Colonial Oil Industries Inc., Savannah, Ga., at the end of 2024.

Bob Kenyon, president and chief operating of cer at Colonial Group, said Soaring Eagle and its tank barge, CTOW 320, represent a major advancement for Colonial’s marine division and a strategic investment in the company’s marine fueling and towing capabilities.

CTOW 320 has a 32,000 bbls. capacity, 12 compartments, four segregations, and the ability to carry various fuels and cargoes. The vessel also represents the company’s continued commitment to reducing its environmental impact.

The Entech-designed twin-screw Soaring Eagle’s main propulsion comes from two Caterpillar C32 diesel engines each producing 800 hp at 1,800 rpm. The Cats connect to Sound

Propeller stainless steel, 4-bladed 68"x57"wheels through Twin Disc MGX-5321 marine gears with 5.96:1 reduction ratios. The tug draws 8' fully loaded. The propulsion package gives the tug a running speed of 10 knots.

Soaring Eagle is primarily working between Charleston, S.C., and Jack-

sonville, Fla. Tankage includes 18,512 gals. fuel; 4,500 gals. water; and 453 gals. lube oil.

Another combination of tug and barge was delivered to the Tennessee Department of Transportation. What TDOT did here was build a new towboat — the 48'x18'x6'4" Summitt — and connect

Norsap Towboat Chair

The ultimate in comfort, functionality and mobility. The Norsap Towboat chair, from the 1500 series, was developed for inland marine operations with a 5 wheeled base and footrest ring. See the full suite of Norsap seating solutions in stock now at Imtra.

Barge operators took delivery of 36 new inland tank barges in 2024, a 38% increase over 2023’s total of 26. The combined capacity of the barges delivered rose nearly 90% to 922,000 bbls., up from 484,000 bbls. in 2023, according to Criton Corp.’s River Transport News (RTN).

Despite the year-over-year increase, the newsletter said new tank barge construction activity is at historic lows.

“There’s a lot of pent-up demand for replacement barges,” said Sandor Toth, RTN’s publisher. “Companies are putting more money into maintenance of their current equipment because the price of new barges is too high. They’re putting their money into workarounds.”

In 2023, much of the new equipment delivered was in the 10,000-bbl. capacity class, but 2024 saw 30,000-bbl. barges return to prominence. Mississippi River/Gulf Coast barge operators took delivery of 28 new 30,000-bbls. tank barges last year. Clean product barges accounted for 22 of the barges while heater-equipped barges accounted for the remaining six. Meanwhile, in 2023, barge operators took delivery of eight 30,000-bbl. barges. Six were built for clean product service while the remaining two were equipped with heaters, according to RTN. “The price of steel and the tariffs are adding to the owners’ reluctance to build new,” said Toth.

On the dry side, new hopper barge construction activity hit 395 new jumbo hopper barges for the Mississippi River system in 2024, an increase of 16% from 2023.

While new hopper deliveries were up for the second year in a row, shipyard activity remained relatively subdued last year and was well below levels that were hit prior to 2017. As recently as 2016, new hopper deliveries were near 1,000 before plunging during the following year and remaining at relatively low levels, according to RTN

High barge prices, combined with rising interest rates, have acted as one of the largest drags on the hopper construction sector over the past few years.

While steel prices are still relatively high by historical standards, prices for plate steel appear to have moderated somewhat in 2024. This moderation may have helped push 2024’s new hopper delivery total higher, the newsletter reported.

RTN’s surveys identified a total of 11 barge companies building new hopper barge equipment in 2024, up from 10 companies constructing new hopper

barges in 2023. Several of the companies that purchased new equipment did so primarily to lease to others.

The two most prolific shipyards building jumbos were Arcosa Marine Products, Madisonville, La., which built 262 and Heartland Fabrication, Brownsville, Pa., which built 133. “Since the closing of Jeffboat, I think we’re seeing a little more pricing power for the shipyards,” said Toth.

Curtin Maritime, Long Beach, Calif., recently completed a repower of the Lindsay C, an Invader-class tug built in 1975 by J.R. McDermott & Co., Morgan City, La. Between 1974 and 1977, Crowley Maritime commissioned 25 Invader-class tugs at the McDermott yard, building a eet that would become known for its speed and towing capabilities.

The design was originated by Philip F. Spaulding & Associates, Seattle, a rm that later became Nickum & Spaulding and eventually Elliott Bay Design Group. The Invader-class shows a distinct West Coast in uence intended for heavy-duty ocean towing operations.

Curtin Maritime purchased the Lindsay C in response to customer demand for faster barge transit times, according to the company’s vice president of operations, Chase Henderson. “They came to us and said, ‘You need to gure out the fastest possible solution… Get the fastest boat possible,’” said Henderson. “At that point, it was a pretty obvious

answer of, well, the fastest boats in the U.S. eet are Invader-class tugs, and it’d be a good match with the dimensions, draft, and overall displacement of the barge.

“We bought the boat in November of 2023, we had a PO [purchase order] for the engines cut in December, and then we started all the engineering,” Henderson said. “We’ve got a lidar laser scanner in house, so we scanned the engine room to do 3D modeling and then started working on the engineering with a naval arch rm to make sure everything could t. We did a bunch of pre-engineering. And then we pulled the boat out of service in October 2024. Engines showed up in December, so the repower took about ve months, which included a drydocking for propeller work and installation of a new sea chest.”

Originally out tted with two EMD 20-645-E5 engines producing a total of 7,200 hp, the Invader-class are “highspeed towing boats” said Josh Ellis,

Curtin’s senior vice president of marine transportation.

Ellis sailed on various Invader tugs during his 20-year tenure at Crowley before joining Curtin in 2023. “They’re known for both their free running speed, and towing big barges at speed,” Ellis said.” He provided an example of their capabilities, suggesting barge tonnage maxed out around 20,000 tons. “A 730-foot-by-100-foot barge, drawing 12 feet — that’s what they would tow making 10 knots,” he emphasized.

Curtin performed the repower inhouse, navigating several complex engineering challenges. The original engines were replaced with new GE 8L250 engines, requiring substantial recon guration of the engine beds, heat rejection, and coupling, ventilation and exhaust systems. “We had to reengineer the engine beds for alignment and everything, making sure that they were strong enough, going from a V-style engine to an inline engine,” Curtin’s engineering manager, Andy Taylor, noted.

Additionally, cooling system modications were extensive. The old engines required so much cooling capacity that nearly the entire bottom of the boat was taken up by channel coolers. The new Wabtec engines use a separate circuit cooling system with both jacket water and an aftercooling system.

Ellis spoke to the improved ef ciency in the engine room design and ddley space. “How it’s set up now, it’s almost like it should have always been built that way. Everyone who’s been on an Invader [and] comes into the Lindsay now is like, ‘Wow, this is so much nicer,’” he said. The new GE 8L250s offer roughly three additional feet of space in front of each engine.

“You can actually have a dance party down there now,” Taylor joked.

Despite the engines’ smaller frames, inverse weight differences between each engine had to be carefully balanced. “The EMDs were around 35,000 pounds each, and the new GE engines are closer to 60,000 pounds each,” said Taylor. “Going from 20 cylinders down to eight, you just gain that much more mass in the cylinder block.”

sion and fabricating an adapter plate to fit. Curtin’s carpenters also completely rebuilt the wheelhouse, including a full rewire with primarily Furuno electronics, Rose Point ECS with Hatteland screens, and a new modern alarm system.

When asked about the 50-year-old vessel’s hull condition, Ellis emphasized the rolled-plate steel that comprises it. “You can go down to reduce scantlings and still run them,” he said of the tug design, before noting that building an Invader-class design today would ring in around $38 million. “Those boats are just over-built. In comparison, you just couldn’t afford to build a modern one,” he said, highlighting the 1.25" steel cap rail on the bulwarks.

The 136'2.5"x36.5'x19'2" Lindsay C completed sea trials in late March and is returning to active duty at the time of this writing in April. “She wrapped up sea trials last week. We had some things to button up, but she’ll be getting back underway for another job this weekend,” Henderson concluded.

– Ben Hayden

Moose Boats, Vallejo, Calif., has delivered a M2-36 model catamaran to the Santa Barbara Harbor Patrol. The new 36'x13'6" vessel is designed to serve multiple functions, including law enforcement, fire response, and

Nichols Brothers Boat Builders, Freeland, Wash., won a contract to build two 400-passenger battery-electric ferries for San Francisco Bay Ferry. The 142'1"x34'9" Subchapter K catamarans will operate at 25 knots on routes connecting Oakland and Alameda with San Francisco. The vessels will each feature four independent azumithing Hydromaster Series E propulsion units with 625-kW drives and a scalable 1,603kWh Echandia energy storage system. Incat Crowther will lead vessel design, with electrical engineering support from Ockerman Automation Consulting Wärtsilä North America will serve as electrical propulsion system integrator.

Ingram Marine Group held a christening ceremony in Nashville for the David North, a new four-decked, welded-steel, USCG Subchapter M-compliant towboat in a series of 10. Designed by Ingram, Main Iron Works, Houma, La., and Ashraf Degedy, PE, the 69'x30' design is powered with twin Caterpillar Marine Tier 3 diesel engines and Reintjes gearboxes, John Deere generators, and Michigan Wheel propellers. The live-aboard vessel features a 33' eye level and has capacities of 12,000 gals. of fuel and 4,600 gals. potable water.

Washburn & Doughty Associates, Inc., East Boothbay, Maine, delivered the 93'x38' Isabel McAllister, a new tractor tug for McAllister Towing., New York. The 6,770-hp vessel features a pair of EPA Tier 4

emergency medical services, operating throughout Santa Barbara harbor and coastal waters.

The M2-36 is equipped with twin 300-hp Suzuki outboard engines paired with contra-rotating dual stainless-steel propellers. The vessel is also outfitted with a Volvo Penta diesel engine powering a firefighting system capable of delivering up to 1,500 gpm through two TFT monitors, handline discharges, and a 5" supply discharge.

“We’ve been planning this boat for the last three years. We’ve been saving up for it for the last 10, and during those last three we’ve been going through all the different specs we wanted on the platform to make it as effective a search and rescue fireboat as we could come

Caterpillar 3516E engines that power Schottel SRP 490 FP Z-drive units, 99-kW John Deere 4045 AFM85 EPA Tier 3 generators, Markey Machine winches on the bow and stern, as well as CAT C18 fire pump and Fire Fighting Systems monitor with 6,000-gpm foam injection capability. The newbuild, classed by ABS as an A1 Maltese Cross Low Emissions Vessel, has a certified bollard pull of 81.3 metric tons.

Massport Fire-Rescue in Boston has taken delivery of Marine 32, a 43'4"x12' Metal Shark 38 Defiant NXT aluminum fireboat built in Jeanerette, La. The boat is powered by twin 550-hp Cummins QSB 6.7 diesel inboards and features Twin Disc MG-5065SC gears and HamiltonJet HTX30 waterjets with AVXexpress electronic controls. The vessel is equipped with twin 1,500-gpm fire pumps and a CBRNE (chemical, biological, radiological, nuclear, and high-yield explosives) crew protection system.

The Canaveral Pilots Association launched its new pilot boat in Florida’s Port Canaveral. The 38'x12' boat was built by North River Boats, Roseburg, Ore., and is powered by twin Mercury 5.7L, V10 400XXL Verado outboards. A Side-Power 100/185T bowthruster provides enhanced maneuverability. The boat’s electronics package includes Furuno radar, GPS, and a 3D multibeam sonar. The boat is equipped with a Teledyne FLIR M364 thermal imaging camera, Ocean3 fendering system, and an EZ Puller 500-lb.-capacity rescue davit.

Working on the waterfront requires a commitment to safety. As a leading USL&H provider, we take that commitment seriously. That’s why each year we celebrate our members with the strongest safety cultures in the business. Congratulations to our 2024 Safety Award winners.

AAA United States, Inc.

Amherst Madison, Inc.

Amplify Energy Corp.

Austal USA, LLC

Barton & Gray Mariners Club, LLC

Basin Marine, Inc.

Bay Bridge Texas, LLC

BWC Terminals

Carlisle & Bray Enterprises

Cabrillo Boat Shop

Collins Machine Works

Conrad Shipyard

Continental Heavy Civil

Donjon Marine Co., Inc.

Eastern Shipbuilding Group, Inc.

Elite Workforce, LLC

Employer Solutions Staffing Group, LLC

Evansville Marine Service, Inc.

Global, 1st Flagship Company

Gulf South Services, Inc.

Gunderson Marine & Iron

Hughes Bros., Inc.

Integrity Staffing Services, Inc.

JAG Marine Group

Johnny Morris’ Wonders of Wildlife Foundation

Manson Construction Co.

Marine Group Boat Works, LLC

Marisco, Ltd.

Middle River Marine, LLC

Motive Power Marine, LLC

Nationwide Skilled Trades, Inc.

Prime Time Coatings, Inc.

Quigg Bros., Inc.

Resilient - USA, LLC

Rio Marine

Sause Bros., Inc.

Hyde Shipping Corporation

South Florida Container Repair, LLC

Svendsen’s Bay Marine

The Quality Companies, LLC

Tidal Transport & Trading USA, Ltd.

TREO Staffing

TT Mile 183, LLC; TT Mile 237, LLC

a division of James Marine, Inc.

Union Maintenance Corp.

White River Marine Group, LLC

By Ken Hocke, Senior Editor

President Donald Trump signed an executive order earlier this year aimed at rebuilding the U.S. shipbuilding industry. Rebuild? Tier II shipbuilders have been producing aluminum and steel military and commercial workboats for decades, while a few Tier I shipyards have been building mostly warships.

The order calls for federal investment in American shipyards and the maritime workforce and outlines a new Maritime Action Plan to be coordinated by the Maritime Administration. The plan includes the establishment of a Maritime Security Trust Fund, shipbuilding tax incentives, and the launch of strategic commercial eet programs.

But Tier II shipyards like Austal USA, Mobile, Ala., Main Iron Works, Houma, La., Silver Ships, Theodore, Ala., Birdon, Bayou La Batre, Ala., and Steiner Shipyard, also located in Bayou La Batre, didn’t need a proclamation from Trump to update, expand, and modernize their facilities. These processes were underway or proposed before he took of ce again.

“We will be ramping up,” said Sandra Armstrong, Birdon’s commercial manager, about the company’s new shipyard in Alabama. “We’re not worried about tariffs.” (Armstrong was referring to the president’s on-again, off-again tariffs on aluminum and steel.)

There are many Tier II shipyards on the West Coast, East Coast, and Great Lakes that have plans for or are already expanding, updating, and modernizing their facilities. The focus on the above yards comes about because of WorkBoat’s recent visit to South Alabama and South Louisiana.

Austal USA started construction for the company’s newest nal assembly facility last summer. The infrastructure expansion on the south side of Austal’s current waterfront facility will include a new assembly building, waterfront improvements, and a new shiplift system.

Scheduled to be complete and fully operational by summer of 2026, the project continues the expansion at Austal USA that began in March 2021 with the groundbreaking of the steel panel line.

The latest expansion will include a new assembly bay for the erection of large steel modules for Navy and Coast Guard ships, including the offshore patrol cutter (OPC) and TAGOS-25 programs.

The new, approximately 400'x480' building will cover four and a half acres and provide more than 192,000 sq. ft. of new covered manufacturing space. It will consist of three bays enabling erection of the OPCs and the Navy’s TAGOS-25 ocean surveillance steel ships as well as provide exibility to manufacture modules for submarine and other surface ship programs.

There’s also a new submarine module manufacturing facility (MMF 3) that will add 369,600 sq. ft. of indoor manufacturing space purpose-built to manufacture submarine modules.

In addition to MMF 3, a new nal assembly building to manufacture Navy and Coast Guard surface ships is under construction. When complete the two new facilities will add over 600,000 sq. ft. of indoor production area and add 2,000 new jobs in the region. The shipyard currently has about 3,300 workers.

“The module construction process is essentially the same for aluminum and steel,” said Neil Seddon, Austal’s director, production.

Main Iron Works has earned its reputation as a premier shipbuilding and repair yard, especially when it comes to towboats, tugs, and barges. The yard nished a 10-boat contract for Ingram Marine Group, Nashville, Tenn., in January. It is currently building new boats for a diverse list of customers including TradeWinds Towing (two), New Orleans; Weeks Marine (three), Cranford, N.J.; Robbins Maritime, Norfolk,

Va.; and Dann Marine Towing, Chesapeake City, Md. Main Iron also builds and services a lot of barges for Kirby Corp., Houston.

To stay up with the jobs already in the shipyard, and those scheduled for the future, Main Iron continuously updates its current equipment and adds new facilities when necessary “The latest expansion was the climate-controlled blastand-paint building,” said Lloyd Guidry, the yard’s project manager. “The next will be a blast-and-paint building, for piece blasting, to get the workers out of the weather.”

Silver Ships has expanded its operations to a second location. A new engineering facility and manufacturing warehouse is located less than one mile from the original 95,000-sq.-ft. facility and headquarters. The expansion adds 16,500 sq. ft. to its manufacturing process and creates an additional 18,500 sq. ft. of additional out tting space in the original location.

“Adding a second manufacturing location is a natural progression of our team’s work to support the growing workboat segment,” Steven Clarke, Silver Ships’ CEO, said of the project. “Facility expansion to meet the demands of the market is necessary to achieve the quality and deliver timelines of our customers.”

Birdon America was awarded a $1.187 billion contract in 2022 to design and build 27 waterways commerce

cutters — 16 river buoy tenders and 11 inland construction tenders — for the Coast Guard.

The new tenders were originally going to be built at Bollinger Shipyards, Lockport, La., but that collaboration didn’t work out and Birdon held a ribbon-cutting ceremony in December 2024 for the shipyard it bought from Louisiana-based Metal Shark in Bayou La Batre.

The company is pouring more than $35 million into the facility, anchored by an automated welding system (AWS) bought with Small Shipyard Grant money. The AWS will be the nucleus of the yard’s new 65,000-sq.-ft. fabrication building. “The people here are true shipbuilders,” said Armstrong.

Steiner Shipyard has a healthy backlog of repair work and is currently building two 94' retractable towboats for Golding Barge Line Inc., Vicksburg, Miss., and two 130’x35’ towboats for Florida Marine Transporters, Mandeville, La.

“We are hoping to widen our Travelift slip to accommodate vessels 44 feet in width,” said Greg Marshal, the yard’s project manager. “We are upgrading our bag launch slip to accommodate larger vessels. The repair yard is up and running fully.”

The total number of newbuild (under contract, under construction, or delivered in the past 12 months) workboats listed in WorkBoat’s Annual Construc-

tion Survey for 2023-2024 was 925. The year before the number was 690. And those numbers are low. The actual numbers are unknown because some yards provide partial lists and some boatbuilders don’t participate at all. In addition, there are quite a few IDIQ (inde nite delivery, inde nite quantity) contracts throughout the industry. Those are counted as a single boat until the exact number is known.

What the survey doesn’t list are the annual repair and regulatory drydockings which number in the thousands. So, the Tier II shipbuilding industry is holding up its end, Mr. President.

By Casey Conley, Correspondent

back in 1999, Bisso Towboat Co. put the rst azimuthingsterndrive (ASD) tugboat into service on the Lower Mississippi River. Over time, the Luling, La., towing company added another and another.

The company’s president, Scott Slatten, set a goal along the way to build an entire eet of ASD ship-assist tugboats. Bisso reached that milestone late last year with the delivery of the 96’x38’ Mr. Brian from Main Iron Works, Houma, La.

The 5,000-hp tugboat is based on a proven Castleman Maritime design that’s been re ned with each successive delivery. Mr. Brian is Bisso’s 10th ASD tug and its sixth new delivery in nine years. It replaced the conventional tugboat Scott T. Slatten built in 1995.

“We have invested in our equipment and our people, and I feel a lot better about our company moving forward,” Slatten said. “We have realized our dream to have a eet that is all ASD tugs.”

Fleet renewal projects like this one have accelerated in recent years as tugboat operators on all three coasts replace

older equipment with newer, higher performing tugs. Regulatory changes such as the arrival of the U.S. Coast Guard Subchapter M inspection regime hastened vessel retirements. Covid-era in ation and supply-chain snags made older tugboats more expensive and challenging to maintain.

Plenty of other operators are running a similar playbook to modernize their equipment. The Great Lakes Towing Co., Cleveland, which operates ship-assist tugs from Duluth, Minn., to Buffalo, N.Y., is perhaps the best example. The company’s eet of historic single-screw “G tugs” (for the letter emblazoned on their stacks) has supported ore, coal, and grain shipments throughout the region for more than a century.

That once prodigious eet of G tugs has fallen to just 24, working primarily in smaller ports throughout the Great Lakes. They’ve largely been replaced by nine Cleveland-class tugboats built

in-house by Great Lakes Shipyard in Cleveland over the last seven years. New York, delivered in fall 2024, is the most recent of the 64'x24', 2,000-hp tugs to enter service.

All nine Cleveland-class tugs are based on the Damen Stan 1907 ICE platform. Construction will wind down on Puerto Rico, the 10th and nal tugboat in the series, this fall.

“While some operators have opted to retro t older vessels to comply with these regulations, the cost and complexity of such upgrades have led many to invest in new, regulation-compliant tugboats instead,” said Gregg Thauvette, executive vice president, operations, for The Great Lakes Towing Co.

“This push for modernization is evident in shipyards across the country,” he continued. “Tugboat construction has been robust, with many yards reporting steady orderbooks.”

Few tugboat builders have been as R�p�d� 2�0�-� All-Electric Yarding Tug

consistently busy over the last decade as Master Boat Builders, Coden, Ala. Its recent deliveries included the 86'x36', 5,100-hp tugboats Mary Jane Moran and Patricia B. Moran for Moran Towing, New Canaan, Conn., as well as tugs for Suderman & Young Towing and Bay-Houston Towing, both of Houston.

Bay-Houston marked the arrival of the 7,000-hp May Louise in March 2025 with a christening that also celebrated the George M, which entered service in 2020. Both tugboats were built to the Robert Allan Ltd. Z-Tech 30-80 series design. The 98.5'x42.6' May Louise, powered by two Caterpillar 3516E engines driving Schottel Z-drives, delivers 85.48 metric tons of bollard pull ahead and almost 78 metric tons astern.

“These remarkable vessels are a testament to the collaboration and dedication of so many,” Kevin Lenz, vice president, marine, for Bay-Houston, said during the christening. “From naval architects

to mariners, pilots, and industry leaders, we celebrate the people who bring these tugs to life and ensure the success of our ports and economy.”

Not to be outdone, Suderman & Young welcomed the similarly powerful Z-Tech 30-80-series tugboat Artemis from Master Boat Builders. The powertrain on the 98.5'x42.6' Artemis also features Cat 3516E Tier 4 engines turning Schottel drives. It is out tted with a Markey DEPCF-48S winch on the bow and rated FiFi Vessel Class 1 for extensive off-ship re ghting capabilities.

In South Texas, Signet Maritime added a second Robert Allan Ltd.-designed Advanced Rotortug (ART) to its Corpus Christi eet. The 103'x45.5' Signet Capella, built in Pascagoula, Miss., by Signet Shipbuilding & Repair, works alongside Signet Sirius handling some of the largest product tankers to call on American ports. These 7,725-hp beasts were the rst commercial vessels

in the U.S. developed entirely using a 3D design process.

Capella is powered by three MTU 12V4000 Tier 4 engines turning three Kongsberg Z-drives. Like other ARTs, Capella features two Z-drives forward and a third aft along the centerline. The arrangement provides exceptional power, maneuverability and escort prowess compared with a traditional ASD tugboat.

Shipyards on the East and West coasts also turned out several noteworthy tugboats this year. Washburn & Doughty, East Boothbay, Maine, delivered the 86'x36' Paul T. Moran and George James Moran to Moran Towing in summer and fall 2024, respectively. The 5,100-hp tugboats designed by Crowley Engineering Services are powered by twin Tier 4 Caterpillar 3512E engines paired with Kongsberg Z-drives.

Brusco Tug & Barge, Longview,

Wash., updated its West Coast ship-assist eet with the arrival of the 65'x32' Rascal and Rowdy. These 3,000-hp tugs were built by Diversi ed Marine of Portland, Ore., using the Robert Allan Ltd. RAscal 2000-D design.

Key features on Rascal and Rowdy include two Cat C32 Tier 4 engines, Berg MTA 522 Z-drives and multiple tiers of Schuyler Cos. fendering on the bow. Bollard pull is a hearty 42.5 tons, the highest ever for a Robert Allan Ltd. tugboat of this size.

The year ahead should bring a host of additional deliveries for operators such as McAllister Towing, Shaver Marine, and Foss Maritime, all of which operate large eets in busy and competitive ports. Tugboats under construction at Eastern Shipbuilding for Foss will be among the rst tugs designed to meet California Air Resources Board (CARB) emissions regulations. The rst delivery is expected in 2026.

der three nautical miles be zero-emission by January 2026.

Phase one of WETA’s zero-emission plan includes three 150-passenger, battery-electric ferries being built by All American Marine (AAM), plus up to three 400-passenger vessels. In April, Nichols Brothers Boat Builders, Freeland, Wash., was awarded a contract to design and construct two of the 142'1"x34'9", 400-passenger ferries. Incat Crowther will lead the design of the larger vessels, with electrical engineering support from Ockerman Automation Consulting

Both ferry designs will feature Hydromaster azimuth thrusters and a scalable energy storage system integrated by Wärtsilä North America. The AAM ferries will contain Echandia battery systems capable of propelling the 96'x26'x6' aluminum catamarans at speeds up to 24 knots. The concept vessel for the AAM ferries was initially developed by Aurora Marine Design, San Diego. However, Teknicraft Design, Auckland, New Zealand, re ned and expanded on the concept and will serve as naval architect on the project.

“We decided to take our time and spend about a year with Wärtsilä designing this system so that it would be well-integrated,” Murphy said. The rst AAM delivery is expected in early 2027. Future phases of the plan will depend on securing additional funding and progress in energy storage technology.

Jefferson Steamboat Co., a McAllister Towing subsidiary. Designed by Gilbert Associates, the ferry is powered by twin EPA Tier 4 EMD 12 ME 23B diesels, each producing 3,000 hp.

“The Long Island has been engineered with the environment in mind,” said Fred Hall, Bridgeport vice president and general manager. “In 2024, the company took over 500,000 vehicles off the highways on both sides of Long Island Sound thus becoming a substantial and integral part of transportation

WETA is also evaluating alternative technologies. In 2023, it leased the Sea Change, a hydrogen-powered passenger vessel built by AAM and owned by Switch Maritime. “We learned the most about how ripe hydrogen is from a supply-chain standpoint,” Murphy said. Challenges included cost variability and the limited availability of green hydrogen. “It’s absolutely going to have to be green for us to be able to operate a vessel like this and call it a zero-emission service.”

Eastern Shipbuilding Group delivered the 303'x52' ferry Long Island in December to the Bridgeport & Port

solutions in our area.”

Senesco Marine, North Kingstown, R.I., is preparing to deliver two hybrid ferries — one for Maine State Ferry Service and another for Casco Bay Island Transit District. “They are the rst-ever hybrid ferries in the Northeast,” said Senesco Marine president Ted Williams.

In November, Senesco launched the Capt. Almer Dinsmore, the rst hybrid-electric-diesel ferry in Maine. It will carry 250 passengers and 24 cars

For commercial marine applications, gearbox failure isn’t an option either. Philadelphia Gear created Onsite Technical Services™ (OTS) to support all our marine customers, including the U.S. Navy and Coast Guard, to install, rebuild, and maintain critical rotating equipment anywhere they go.

Get Navy-trusted OTS for your commercial marine vessels: Visit PhilaGear.com/Commercial today.

between Rockland and Vinalhaven. The ferry features a BAE Systems HybriGen power and propulsion system, with two 600-hp Caterpillar C-18 diesels and 150-hp electric boost motors. Senesco is also nalizing Battery Steele, a 599-passenger hybrid-electric ferry designed by Elliott Bay Design Group It will replace the 36-year-old dieselpowered Machigonne II in Casco Bay.

In September, the U.S. Department of Transportation’s Federal Transit Administration announced nearly $300 million in ferry grants funded through the Bipartisan Infrastructure Law. Of 18 grants across 14 states, eight support electric ferries and charging systems. The program is part of what the administration of President Joe Biden called “the largest investment in public transit in the nation’s history.”

Washington State Ferries (WSF) is adjusting its own hybrid-electric transition. In March, Gov. Bob Ferguson announced the state would pause a $100 million program to convert up to three Jumbo Mark II-class ferries to hybrid-electric propulsion. The decision prioritizes returning the system to full service by this summer, with 18 vessels operational — the most since 2019.

largest in the eet and contribute 26% of WSF’s emissions.

The Wenatchee conversion is underway at Vigor’s Harbor Island shipyard in Seattle. The vessel is expected to return to service by early summer with hybrid-electric capabilities. The Tacoma and Puyallup conversions are on hold. The decision follows delays, cost overruns, and challenges integrating the new propulsion systems into existing hulls.

The Wenatchee project is now at least $36 million over budget.

The program was originally awarded to Vigor, LLC, Portland, Ore., in 2023, and included converting the Wenatchee and Tacoma, with a $50 million option for the Puyallup. These 460'2"x90' ferries, each capable of carrying 2,500 passengers and 202 vehicles, are the

By Eric Haun, Executive Editor

Forbarge operators on America’s inland waterways system, there’s never a dull moment. The past 12 months have been no exception, with dangerously low and high water levels, lock delays and closures, and market uctuations. These are just “normal headwinds,” Kirby Corp. CEO David Grzebinski said on Jan. 30, in the company’s earnings announcement for the full year and fourth quarter of 2024.

nature and the economy.

Inland barge utilization and pricing have steadily increased since the historic lows of the Covid-19 pandemic, according to Kirby Corp., the leading operator of inland tank barges in the U.S.

The construction of new barges — including open and covered dry barges, as well as tank barges — has been increasing in recent years, though it remains below the long-term average due to the persistently high cost of building.

Additionally, a lack of available inland towing vessel tonnage, especially for newer and more powerful boats, indicates a tightening market, Marcon International, Inc., wrote in its December inland pushboat market report, which said 96 new U.S.- agged towing vessels were registered in 2024.

“We anticipate positive market dynamics due to limited new barge construction. The demand softening we saw in the re nery sector in the fourth quarter is starting to improve and barge utilization rates are rming up,” said Grzebinski. “We expect our barge utilization rates to be in the low to mid90% range for the year with continued improvement in term contract pricing as renewals occur throughout the year.”

Across the sector, utilization rates for inland barges remained high throughout 2024, according to the Marcon report. “Day rates have shown improvement, with spot market rates increasing in the high-single digit range year-overyear and term contract renewals seeing similar increases.”

The U.S. barging sector — which carries 4% of the nation’s freight tonnage, according to the U.S. Department of Transportation — has long been adept at navigating these challenges, keeping the ow of petroleum, coal, farm products, and other commodities moving at a steady pace despite frequent curveballs thrown by mother roudl made in the U.S. .

Meanwhile, in ationary pressures, mariner shortages, and rising equipment costs continue to challenge the barging sector, as they do across the entire U.S. maritime industry.

The Marcon report warns that sweeping moves by the new administration — slashing agencies, canceling contracts and grants, and imposing tariffs on major trade partners — are stirring volatility that could upend 2024’s trends. Analysts say demand for inland transportation may take a hit, with utilization and day rates likely to follow.

Still, the outlook is positive.

WRDA 2024 also delivers a boost to U.S. ports by raising the depth thresholds for federally funded dredging. The Army Corps of Engineers can now fully fund maintenance dredging and 75% of construction dredging for projects up to 55’ deep, allowing ports to accommodate larger vessels and remain globally competitive.

The law authorizes $10.7 billion for 21 new projects, including ood control in Louisiana and New York and Everglades restoration. It also continues a decade-long streak of bipartisan water resources bills, offering long-term stability for critical infrastructure planning.

“WRDA 2024 makes much needed reforms at the Corps of Engineers to streamline processes, reduce cumbersome red tape and get projects done faster,” Rep. Sam Graves, R-Mo., chairman of the House Transportation and Infrastructure Committee, said in a statement in December.

By Eric Haun, Executive Editor

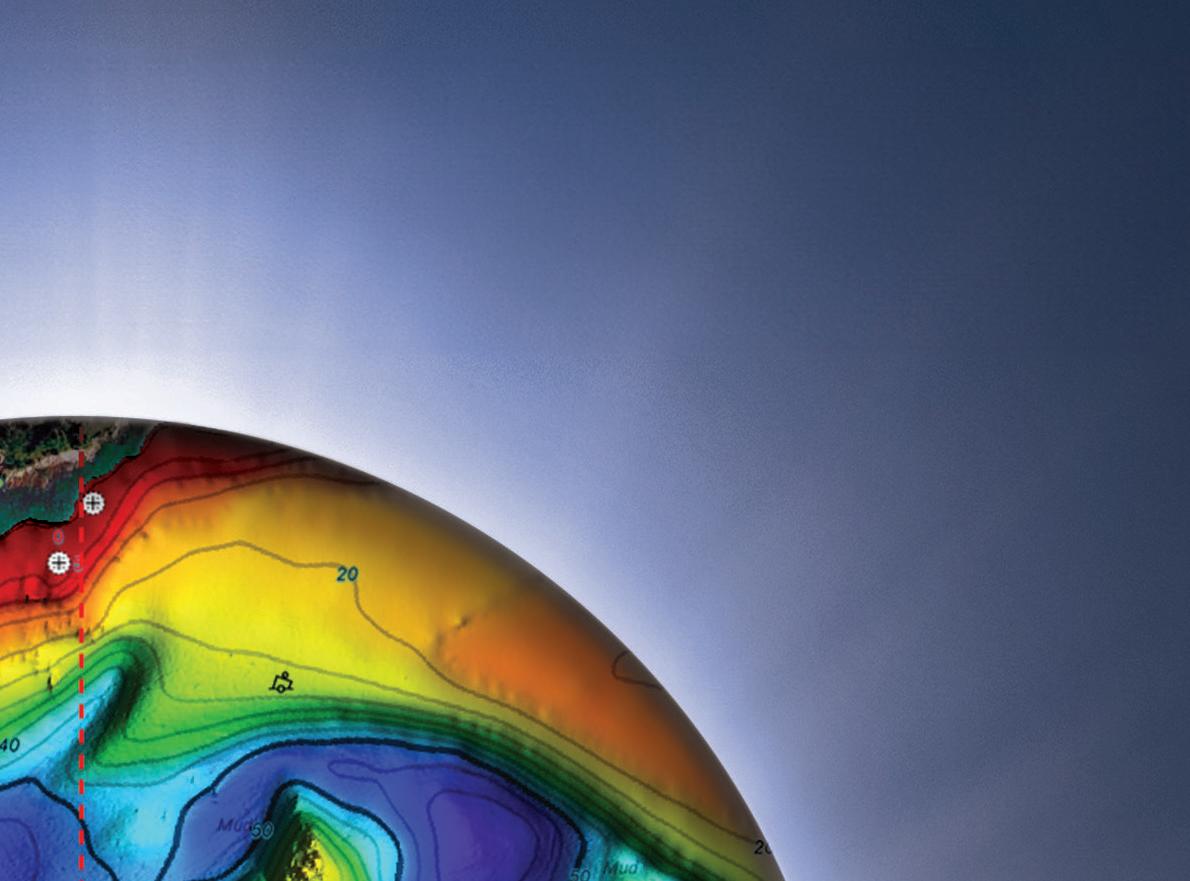

Amidat demand forecasts, political uncertainty, and rising costs, oil and gas producers in the U.S. Gulf of Mexico, also known as the Gulf of America, have seen little incentive to green light new projects, instead focusing on developments that have already been sanctioned.

U.S. energy use is expected to dip in the near term, according to the Energy Information Administration (EIA), which also sees shifting global trade policies and oil production trends cooling demand for petroleum products through 2026. The result: at production and a downward revision in oil price forecasts.

2025, down from 2.0 Bcf/d in 2023.

Of the Gulf’s 12 new elds that started producing during 2024 or are expected to in 2025, seven are subsea developments that tie back to existing oating production units (FPU), while ve of the new elds will produce through four new FPUs. According to the EIA, the development of these new elds has been suf cient to offset the natural production decline of legacy projects in the Gulf, meaning increased spending toward new project development is not needed in the short term amid at and declining demand forecasts.

The EIA forecasts Gulf crude oil production to average 1.8 million barrels per day (b/d) in 2024 and 1.9 million b/d in 2025, compared with 1.9 million b/d in 2023, while natural gas production is expected to average 1.8 billion cu. ft. per day (Bcf/d) in both 2024 and

Einar Michel, supply chain senior analyst at Rystad, said political uncertainty as well as in ation and increased nancial costs have created a “wait and see attitude” among exploration and production operators in the Gulf. “Offshore EPCI [engineering, procurement, construction and installation] spending in 2024 was lower than what was observed in 2023, and in 2025 even less is expected,” he said.’

the world’s only two eighth-generation units, according to Westwood data.

“Several units are poised to roll off charter this year without follow-up jobs lined up yet. This pending drop-off in activity is steep and could see the region’s utilization rate decrease to 70%,” Edralin wrote. “The last time U.S. Gulf drillship utilization was this low was in mid-2018, which was during the extended global industry downturn.”

A combination of rising project costs, persistent supply-chain delays, and a shrinking pool of active operators is driving the short-term dip, according to Edralin. Since 2015, the number of exploration and production operators has dropped from 17 to nine, as companies shift to onshore portfolios, merge, or exit offshore drilling entirely.

“While the second half of 2025 will be challenging for U.S. Gulf drillships that roll off charter, most are expected to ride out the rough waters in anticipation of more work in 2026 and a return to tight utilization,” Edralin wrote.

Cinnamon Edralin, Americas research director at Westwood Global Energy Group, wrote in March that several factors are contributing to decreased demand for drillships in the U.S. Gulf eet, which has seen strong utilization (above 90%) since mid-2021. The region’s total drillship supply is 23, including three sixth-generation units, 18 seventh-generation units, and

In terms of vessel utilization and charter rates, 2024 was largely positive for most offshore vessel types working the Gulf as the recovery wave following the Covid-19 pandemic continues, said Rystad’s Michel.

Other regions such as Europe have seen newbuilds ordered and enter the market, but this hasn’t been the case in the U.S., where the cost to construct new Jones Act-compliant vessels is seen

as too high. This situation is leading to an aging eet and declining vessel supply toward 2030 and, potentially, room for market consolidation, according to Michel. “It will be interesting to see if there are any signi cant consolidations, mergers, or acquisitions in the U.S. Gulf during 2025,” he said.

Vessel reactivations increased in the U.S. Gulf region throughout 2023 and 2024, and Michel noted that it’s likely most vessels capable of returning to service have already done so or are in the process of being reactivated.

“Offshore construction vessel [OCV] demand [in particular] has been increasing and is expected to remain high over the next few years,” said Michel. “However, PSV [platform supply vessel] demand is stabilizing in 2025 before the decline in active offshore platforms causes a slow decline in demand toward 2030. Today’s market conditions are more uncertain than previously anticipated.”

Over the coming 12 months, Michel expects rates for anchor-handling tug supply vessels and PSVs to stabilize and slightly decrease while OCVs rates will keep increasing, but at a reduced rate.

In addition, turbulence in the U.S. offshore wind market could have an impact on the oil and gas sector. “The reduction in offshore wind demand would free up more vessels to work in oil and gas, especially offshore construction vessels which are needed in both markets.”

In April, the U.S. Department of the Interior initiated the development of the 11th National Outer Continental Shelf (OCS) Oil and Gas Leasing Program, launching a years-long planning process that could shape the future of offshore energy production.

The Bureau of Ocean Energy Management (BOEM) will soon gather input

from stakeholders, including industry, environmental groups, and coastal communities.

The new program will eventually replace the current 10th OCS Program (2024–2029), which includes only three planned lease sales in the Gulf of Mexico. The Interior Department, under the direction of President Trump’s Unleashing American Energy executive order, aims to expand domestic oil and gas production by reversing previous drilling bans and fostering energy independence.

“Under President Donald J. Trump’s leadership, we are unlocking the full potential of our offshore resources to bene t the American people for generations to come,” Secretary of the Interior Doug Burgum said in a press release.

Industry groups support the move, citing the offshore sector’s signi cant economic impact — contributing $33

billion annually and supporting nearly 400,000 jobs. The National Ocean Industries Association emphasized that a stable leasing program promotes investment, innovation, and energy security.

As part of this effort, BOEM is updating its planning areas to re ect changes in jurisdiction. A newly established High Arctic area off Alaska will be added as the 27th of cial OCS planning area, and adjustments to existing area boundaries will also be made.

By Kirk Moore, Contributing Editor

The U.S. offshore wind industry was rocked less than 100 days into the new Trump administration, with aggressive moves by the White House to shut down Equinor’s Empire Wind project off New York and ongoing political pressure on Trump of cials to do even more.

“Approval for the project was rushed through by the prior administration without suf cient analysis or consultation among the relevant agencies as relates to the potential effects from the project,” Interior Secretary Doug Burgum wrote in an April 16 memo directing the Bureau of Ocean Energy Management (BOEM) to halt construction activity.

Citing President Trump’s Jan. 20 executive order calling for a broad review of all offshore wind power projects in federal waters, Burgum wrote that the construction halt will remain pending review to “address these serious de ciencies.”

the administration to take dramatic action against the project, one of ve East Coast wind installations where developers with approvals under the Biden administration have proceeded despite hostility from Trump.

Planned as an array of 54 turbines between shipping approaches to New York Harbor, the 810-MW project recently started with subsea rock installation on the turbine sites, and pile-driving for foundation installation expected in May.

Project opponents furiously lobbied

Trump’s Inauguration Day order on wind power noted that “nothing in this withdrawal affects rights under existing leases in the withdrawn areas.” But it also demanded “a comprehensive review of the ecological, economic, and environmental necessity of terminating or amending any existing wind energy leases.”

The BOEM stop-work order showed wind power advocates and opponents alike how far the Trump administration will go. While obeying the order, Equinor said it is looking at its legal options.

Renewable power advocates warned the Trump administration will chill all energy investment with sudden U-turns.

“Halting construction of fully permitted energy projects is the literal opposite of an energy abundance agenda,” said Jason Grumet, CEO of the American Clean Power Association. “With skyrocketing energy demand and increasing consumer prices, we need streamlined permitting for all domestic energy resources. Doubling back to reconsider permits after projects are under construction sends a chilling signal to all energy investment.”

Empire Wind is one of the earlier East Coast offshore wind plans, with

an 80,000-acre lease sold by BOEM for $135 million in 2016. It’s also been a longtime target of commercial shermen in New York and New Jersey, who warned the project could prevent trawl and scallop sheries near the apex of the New York Bight.

Jerry Leeman, CEO of the New England Fishermen’s Stewardship Association, welcomed the stop-work order.

“NEFSA applauds Secretary Burgum for pressing pause on the Empire Wind project, which regulators rushed to approve over the objections of working commercial shermen and their families,” said Leeman. “We hope and expect the new administration will end the era of special treatment for foreign developers industrializing America’s sheries.”

Two days before Burgum’s order, the Government Accountability Of ce (GAO) issued a long-awaited report on the Interior Department’s oversight of offshore wind development. The study was requested by Republican members of Congress who opposed the Biden administration’s push to approve projects.

It’s not quite the slam-dunk critics hoped for. In consulting a panel of 23 experts assembled with the National Academies of Sciences, the GAO outlined that “offshore wind energy development has various potential positive and negative impacts in several areas.”

Offshore wind power can replace some fossil fuel energy sources, reduce greenhouse gas emissions and improve

public health with improved air quality. An October 2024 analysis predicted wind projects planned in the Atlantic and Gulf of Mexico could reduce U.S. greenhouse gas emissions by 5% by 2035, according to the GAO summary.

The report goes on to list cautions and caveats, including potential effects on “marine life and ecosystems, including through acoustic disturbance and changes to marine habitats.”

While wind development may bring new jobs and investments, “it could disrupt commercial shing to varying degrees … (and) affect radar system performance, alter search-and-rescue methods, and alter historic and cultural landscapes.”

Critics have raised all those points for years, and increasingly focused on trying to link offshore wind development to whale deaths. The GAO paper does little to counter the National Oceanic and Atmospheric Administration’s (NOAA) position that “there are no known links between large whale deaths and ongoing offshore wind activities.”

Save the East Coast, an opposition group based in New Jersey and New York, is trying to make their own case with help of a study that disputes NOAA’s blaming of large ship strikes and shing gear entanglement for whale deaths.

“General ship traf c has nothing to do with whale deaths, nothing at all,” said Apostolos Gerasoulis, a computer scientist who developed an advanced geospatial tracking system to analyze vessel traf c and whale strandings from New England through the New York Bight and Virginia.

A retired Rutgers University professor, Gerasoulis was a co-creator of Teoma, an Internet search engine that powers Ask.com. He was at his seasonal home on Long Beach Island, N.J., in 2023 when “I heard they were going to put turbines in the ocean out here.”

Activist groups were calling attention to humpback whale strandings and suggested survey vessels were involved. Gerasoulis said he started looking at Automatic Identi cation System data and obtained data on humpback strandings from NOAA.

The system Gerasoulis dubbed LUNA charts Automatic Identi cation System tracks, distilling ship speeds and mileage covered, and reported marine mammal mortalities. He contends the ndings correlate New York Bight strandings to “intense offshore wind survey activity.”

“It’s been proven that sonar can affect whales,” said Gerasoulis. “With these results here, we show causation.”

In an April 15 letter to NOAA Gerasoulis wrote “our research has shown statistically signi cant increases in whale and dolphin mortalities directly correlating with the initiation and escalation of offshore wind geophysical surveying and construction activities. These ndings clearly demonstrate a severe and previously under-acknowledged impact of offshore wind projects on marine mammals.”

Gerasoulis is working to have his ndings published in a peer-reviewed journal. It could be another volley in attempts to block wind projects.