WESTWORDS

MARCH 2024

I AM WEST USA

CATHY

CUPP

FROM MY MEMORY OF EARLY REAL ESTATE FROM BROKER BOB STEPHENS

4 SECRETS TO MAKE YOUR OPEN HOUSE A SUCCESS FROM WISE AGENT

FIRST-TIME HOME BUYER TIPS FROM AMERICAN HOME SHIELD

FEBRUARY MARKET STATS

2024 COMMITTEE

WEST USA CARES MEMBERS

MARCH CALENDAR

CATHY CUPP

WHAT PEOPLE ARE SAYING...

You need to meet Cathy. She is the Best of the Best. Not knowing much about real-estate, she took all the pressure of me. She brought in a competent home inspector, did all the paperwork, and emailed me important information at 11pm at night. She works long and hard for her clients and puts her heart into her work. She set me up in my perfect dream house. Every morning with my cup of coffee, I go to my deck on the 14th tee box and watch the sun come up. On a personal note, ask Cathy about her resume. Thanks C.C.!

My wife and I had the pleasure of working with Cathy Cupp to find our new home. Finding the exact right fit for us has been a journey and we've been grateful to have Cathy's guidance. We had some difficult requirements and changed our priorities a few times, but Cathy showed us patience and never gave up on finding us the right home. (My wife and I actually set a new in-house record with the agency for the number of MLS listings we viewed online!) Thankfully, Cathy was able to work with us to narrow down our search and give priority to the features and details that really mattered to our family. We found the perfect home at the right price and closed in a few days. Thank you so much, Cathy!

We met Cathy at an open house. Wow! What a gracious lady! So very helpful and makes the process less stressful because she’s so caring. Goes the extra mile for sure. Explains things so well. Has a big, compassionate heart for people and she SHOWS it! Doesn't just use words, she's proving it by her actions. She's very honest so we had no worries that she'd be doing us wrong! She's totally trustworthy! We recently decided to purchase a second home in AZ and are currently under contract. We used Cathy as our agent and she’s been amazing and so helpful. She’s the BEST!

I AM

TENACIOUS • THOROUGH • EMPATHETIC • ADVOCATE • DETAIL-ORIENTED 1 YEAR

BROKER BLOG FROM BOB STEPHENS

FROM MY MEMORY OF EARLY REAL ESTATE

I was licensed in 1973 and worked at 2 brokerages but soon followed Fred Lamm over to Century 21 Northwest about 1975 where he was the manager. Later, maybe about 1978, a fellow named ROD PURCELL was advertising that he would only charge, I think 1% or maybe it was the co-broke—I am not sure. There were some Brokers and salespeople that would not work with him and made it clear that they would not, even though it was in the MLS. Soooo, he sued, I believe it was AAR regarding this perceived notion that he had to be in line with everyone else. HE WON, but did not want anything except probably legal fees and settled for what is now on every listing that you use.

COMMISSIONS PAYABLE FOR THE SALE, RENTAL OR MANAGEMENT OF PREMISES ARE NOT SET BY ANY BOARD OR ASSOCIATION OF REALTORS OR MULTIPLE LISTING CONTRACT SERVICE OR IN ANY MANNER OTHER THAN BY NEGOTIATION BETWEEN THE BROKER AND THE OWNER.

BUT, prior to this, a different memorable event happened in 1974 called RESPA—REAL ESTATE SETTLEMENT & PROCEDURES ACT! This was a far reaching act which affected Brokers a lot and business mostly with Title companies. One of the questions that arose was, “Are title companies buying your business by providing donuts and coffee at sales meeting”? But now, many businesses want to co-advertise with you and that is permissible, IF everyone pays their fair share of the advertising and distribution of the material. REMEMBER, you must be able to prove it, if called upon by HUD to provide the receipts for the advertising and, I suppose, IRS.

Around 1980, Brokers began to recognize “Buyer representation." I tried to get my broker to recognize it a couple of years sooner, but he declined. I saw it

happening soon and could not understand why it was not recognized and done for buyers many years ago. Prior to a very big lawsuit filed in Minnesota against a broker from Edina, all agents that actually worked on listings in the MLS for buyers, were called “subagents” of the sellers broker. I recall a letter we received from 1 broker in the area I worked and he copied to all brokers. If he got any offers from someone representing the buyer, he would not even present it to his sellers. This was very wrong! As I knew would happen, some brokers began representing buyers only and we were off and flying to how it should have always been handled. There is still an entry on ARMLS listing forms that says “sub agent”, to enter the commission they will be paid.

Way back around 1980, I often wondered WHY commissions in real estate sales were figured as a percentage of the sales price. In studying these thoughts, this was a compelling one by comparison. Usually, agents took listings using a figure of approximately 6% of the sales price. Let’s use 6% as my example for a $100,000 sale, the fee would be $6000. If 2 brokers participated in this and shared evenly, it would figure to be $3000 for each broker. Now then, we will sell a higher priced home for $500,000 and the brokers fees would increase to $15,000 each.

Think about it—exactly the same job executed by both brokers on both homes with a 400% increase in the fee. Now, let’s say that I, as listing broker, offer a 2.5% co-broke. That’s when the buyer’s broker goes wild and says they will not work for that and get screwed out of $2500 and only get paid $12,500. BUT, on the $100,000 home, they are willing to work for $3000 for doing the exact same job. Somehow—3% is burned in their brain.

QUESTIONS, CONTACT: Managing Broker, Bob Stephens | 602.942.4200

4 SECRETS TO MAKE YOUR OPEN HOUSE A Success

WITH WISE AGENT

Open houses stand as a time-honored tradition. They not only offer potential buyers the opportunity to explore properties firsthand but also allow real estate agents to make personal connections with visitors - turning them into promising leads. But how can you ensure your open house is a success? HERE ARE FOUR SECRETS:

Promote Your Open House Effectively

SOCIAL MEDIA CHANNELS

Post engaging content on Facebook, Instagram, or LinkedIn, along with highquality photos or videos of the property. Remember to post about your open house in community groups on social media, too.

UTILIZING

TARGETED ADS

Targeted ads can help you reach more relevant audiences. Consider investing in Google Ads for a wider reach or Facebook and Instagram ads targeting users based on their location and interests.

Design Professional Open House Flyers

GET STARTED WITH FLYER TEMPLATES IN YOUR CRM

If you're ready to create visually appealing and informative flyers for your open house in a few minutes, try the real estate flyer templates in your CRM. They make the process of designing promotional materials much easier so you can focus on attracting more potential buyers to your property.

POSTCARD INVITES

Sending open-house postcards to all the neighbors makes a significant impact and is fairly inexpensive. With your CRM, it's quick and easy to choose a neighborhood and send open-house postcards to all the neighbors with just a few clicks.

TIPS FOR PRINTING FLYERS FOR YOUR OPEN HOUSE

• Think about how many people you expect to attend the open house. Consider factors like the size and location of the property, as well as the demographics of your target buyers.

• It's always a good idea to have extra flyers on hand in case more people show up than you anticipated.

• In addition to printed flyers, consider creating a digital version that you can use for online promotions or email campaigns.

Use QR Codes for Easy Sign-In & Virtual Staging Experiences

SIMPLIFY THE SIGN-IN PROCESS

Instead of using a sheet of paper, visitors can scan a QR code located at the entrance. This will take them to your open house sign-in page and prompt them to provide their contact information from their phone. This not only saves time but also allows multiple people to sign in at once if several visitors show up at the same time.

Master the Art of

ENHANCE PROPERTY VIEWING WITH VIRTUAL STAGING

QR codes can also be used to enhance property viewing through virtual staging. By scanning QR codes linked to different areas of the house, potential buyers can be transported into a digitally staged environment right from their smartphones. This immersive experience allows them to visualize the property's potential without the need for physical staging.

UTILIZING QR CODES FOR BOTH SIGN-INS AND VIRTUAL STAGING GIVES YOU TWO MAJOR BENEFITS:

• Efficient Data Collection: Collecting visitor information becomes faster and more streamlined.

• Improved Buyer Engagement: Buyers are more engaged

Emails provide the opportunity to send detailed information, including property specifics, additional pictures, or even a personalized thank-you note. With your CRM, you can schedule automatic email sequences, customize your messages with dynamic content, and track open rates and click-throughs for performance insights.

Email Follow-Up

FIRST-TIME FIRST-TIME

HOME BUYER TIPS

No matter what stage of life you’re in, buying your first home is an exciting step! Home ownership can be rewarding both personally and financially. Gone are the days of paying a landlord—you can finally lend your style and hard-earned finances to a new place. But before you start the process of looking at homes, there are some things you’ll want to consider. Here are some first-time home buyer tips to help prepare you for your purchase.

GET YOUR FINANCES IN ORDER

You may be asking yourself “What do first-time homeowners need?”

A decent credit score and a down payment are number one. Find your credit score—there are free reputable sites online—and take steps to improve it, if necessary. The higher the score, the less you pay in interest.

The next step for first-time home buyers is to determine how much you can comfortably afford to spend on a house and stick to your budget. Most lenders use a debt-to-income ratio that includes your mortgage, property taxes, and homeowners’ insurance, representing roughly a third of your monthly gross income. Most types of loans for first-time home buyers are set up as a 30-year repayment term.

Decide how much of a down payment you can afford to make. Requirements vary, but about 10 to 20 percent of the home’s price is generally needed as a down payment to qualify for the best mortgage rates (Federal Housing Authority loans require less).

LOCATION, LOCATION, LOCATION

Looking at that mansion by the sea, the apartment in the city, or a home in the suburbs that your kids can grow up in? Some good advice for first-time home buyers is to consider your current and future space needs if you plan to stay in your home long-term, school districts, work commuting times, and proximity to activities and places that you enjoy.

Another savvy move is getting pre-approval from your lender. This helps you understand exactly how much you have available to spend and shows sellers that you are a serious buyer.

Finally, don’t forget about the possibility of free money. There are lots of federal grants for first-time homeowners that may help you purchase your new home. Check grants available in your state to see if you qualify. There are many tax breaks for first-time homeowners too, like mortgage credit certificates, and tax benefits that all homeowners can take advantage of. To qualify as a first-time home buyer, you must not have owned a home in three years—so if you’ve purchased before, don’t consider yourself disqualified. Some disqualifications of grants or tax benefits may be based on income or tax liens, defaulting on a government loan, or foreclosure.

You may find your dream home, but living in it could take a toll if it doubles your commute time.

Need some more location advice before you buy? Spend some time shopping, dining, or visiting nearby attractions in the areas you are considering living in to see if you feel comfortable and “at home” there.

RESEARCH YOUR OPTIONS & KNOW YOUR DEAL-BREAKERS

After you’ve determined your budget, decide what type of home you want. Do you want a single-family home with a yard, a condominium, or a mobile home? Do you want new construction or an older model?

Decide how much work you are willing to put into your home. Are you interested in renovating an existing home, or do you want your home to be move-in ready?

THINK AHEAD

After you find a great home and you’re ready to buy, you'll want to start thinking ahead for the future. Getting a home inspection is a wise move to help uncover any issues or problems with the home that may require repairs. It will also help you become more familiar with the house and property.

But home inspections can only prevent so much. Having an American Home Shield home warranty can help protect you from being hit with

What home styles do you like? If you prefer a craftsman home over modern architecture, be sure to tell your real estate professional during your initial meeting to save time.

In addition to knowing how many bedrooms and bathrooms you’d like to have, think about other needs and preferences, such as a fenced-in yard for pets, a separate dining room for entertaining, a garage, or outdoor storage.

high costs of home system and appliance breakdowns soon after moving into your new home. Adding a home warranty can be especially beneficial for first-time buyers who may be stretching themselves financially to afford the down payment, monthly mortgage payments, and moving costs. If a home system or appliance breakdown is covered and it can’t be repaired, American Home Shield will replace it for you. A home warranty is a great way to protect your budget and peace of mind.

Derek Riley, Market Manager 480-286-1996 • derek.riley@ahs.com

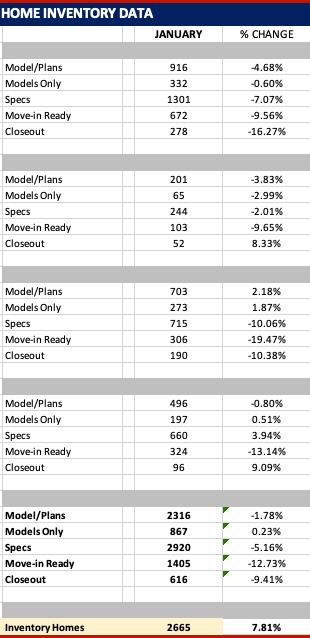

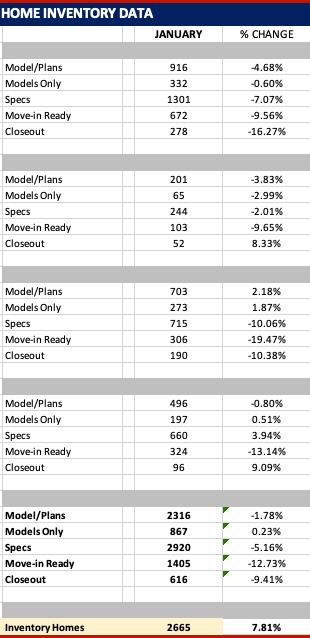

TODD MENARD'S MARKET STATS

FEBRUARY

2024 MARKET STATISTICS

2024

WEST USA CARES COMMITTEE MEMBERS

BRENDA FOUTS SURPRISE OFFICE

JULIE GROVE AHWATUKEE OFFICE

MARYLEA ROTH ARROWHEAD OFFICE

LISA LANHAM GOODYEAR OFFICE

LYNN SCHEPP SCOTTSDALE OFFICE

BRIAN MORI SCOTTSDALE OFFICE

DONNA LEEDS CHAIRPERSON AHWATUKEE OFFICE

MIA ROMAIN SECRETARY NORTH PHOENIX OFFICE

BRENDA FOUTS SURPRISE OFFICE

JULIE GROVE AHWATUKEE OFFICE

MARYLEA ROTH ARROWHEAD OFFICE

LISA LANHAM GOODYEAR OFFICE

LYNN SCHEPP SCOTTSDALE OFFICE

BRIAN MORI SCOTTSDALE OFFICE

DONNA LEEDS CHAIRPERSON AHWATUKEE OFFICE

MIA ROMAIN SECRETARY NORTH PHOENIX OFFICE

9:00am - 10:00am / Webinar

West USA Weekly Podcast

10:30am - 12:00pm / Zoom

West USA Agent Orientation

9:00am - 10:00am / Webinar

West USA Weekly Podcast

9:00am - 4:00pm / Zoom

ProStart Session 1 (3 Days)

10:00am - 11:30am @ Scottsdale O ce

Mastermind Meeting with Great American Title

9:00am - 3:00pm / Zoom

REACT

10:00am - 12:00pm @ Surprise O ce Surprise O ce Meeting

9:00am - 12:00pm @ Chandler O ce

9:00am

10:00am - 11:00am @ Goodyear O ce Goodyear O ce Meeting

1:00pm - 4:00pm @ Chandler O ce LIVE CE CLASS: Section 8 Housing (3Hrs Fair Housing)

9:00am - 12:00pm / Zoom

FREE REMOTE CE CLASS: Duties to Clients and Customers (3Hrs Commissioner Standards)

9:00am - 3:00pm / Zoom REACT

10:00am - 12:00pm @ Scottsdale O ce

Cromford 101 Training

1:00pm - 4:00pm @ Chandler O ce Chandler Media Day

9:00am - 12:00pm / Zoom

FREE REMOTE CE CLASS: Agency and Industry Related Issues (3Hrs Agency Law)

9:00am - 4:00pm / Zoom

ProStart Session 1 (3 Days)

10:00am - 11:30am @ Scottsdale O ce

Scottsdale O ce Meeting

4:30pm - 6:30pm @ Ajo Al’s

Arrowhead Happy Hour

9:00am - 10:00am / Webinar

West USA Weekly Podcast

9:00am - 4:00pm / Zoom

ProStart Session 2 (4 Days)

10:00am - 11:00am @ Chandler O ce

East Valley PM Meet Up

9:00am

9:00am - 12:00pm @ Mesa O ce

LIVE CE CLASS: To Be or Not To Be Paid, That is the Question (3Hrs Contract Law)

10:00am - 11:30am @ Chandler O ce Scripts and Objections

10:30am - 11:30am @ Ahwatukee O ce

Ahwatukee O ce Meeting

10:00am - 11:30am / Zoom Coaching Essential Learning

MONDAY TUESDAY WEDNESDAY THURSDAY FRIDAY 01 04 05 06 07 08 15 11 12 13 14 22 18 19 20 21 29 25 26 27 28

FREE

LIVE CE CLASS: MHCA Mobile & MFG Home Contracts (3Hrs Contract Law)

- 4:00pm / Zoom ProStart Session 1 (3 Days)

- 3:00pm / Zoom REACT 10:30am - 11:30am @ Arrowhead O ce Arrowhead O ce Meeting 10:00am - 1:00pm @ Scottsdale O ce LIVE CE CLASS: Corporations, LLC’s & PLLC’s (3Hrs CE Legal Issues) 9:00am - 4:00pm / Zoom ProStart Session 2 (4 Days) 10:00am - 1:00pm @ Scottsdale O ce LIVE CE CLASS - Disclosure and the Law (3Hrs Disclosure Law) 2:00pm - 4:00pm @ Goodyear O ce Goodyear Media Day 4:30pm - 6:30pm @ BJ’s Goodyear Social Hour 9:00am - 4:00pm / Zoom ProStart Session 2 (4 Days) 9:00am - 12:00pm @North PHX O ce LIVE CE CLASS: 1031 Tax Exchange (3Hrs Legal Isues) 9:00am - 12:00pm / Zoom FREE REMOTE CE CLASS: High Fiduciary Representation (3Hrs Fair Housing) 9:00am - 4:00pm / Zoom ProStart Session 2 (4 Days) 10:00am - 11:00am @ Chandler O ce Chandler O ce Meeting 10:00am - 11:00am @ Goodyear O ce Property Managers Roundtable 4:30pm - 6:30pm @ State 48 Brewery Surprise Happy Hour 9:00am - 10:00am / Webinar West USA Weekly Podcast 9:00am - 12:00pm @ Chandler O ce LIVE CE CLASS: Negotiation Styles and the AAR Contract (3Hrs Contract Law) 10:00am - 1:00pm @ Surprise O ce LIVE CE CLASS - Advanced Contract Writing (3Hrs Contract Law) 11:00am - 12:00pm @ North PHX O ce Mastering Multi-Unit Transactions 10:00am - 11:00am @ Stapley Center LIVE CE CLASS: How to Create Fillable SPDS (1Hr General CE) 10:30am - 11:30am @ North PHX O ce North Phoenix O ce Meeting 2:00pm - 3:30pm @ Scottsdale O ce Trusted Advisor University with the Cromford Report and Tina Tamboer 9:00am - 12:00pm / Zoom FREE REMOTE CE CLASS: Mastering the AAR Residential Purchase Contracts (3Hrs Contract Law) 9:00am - 12:00pm / Zoom LIVE CE CLASS: Landlord Tenant Act (3Hrs LEgal Issues) 10:00am - 11:00am @ Goodyear O ce Goodyear Monthly Coaches Meeting 10:30am - 11:30am @ Stapley Center Mesa O ce Meeting 2:00pm - 3:00pm @ Goodyear O ce Transacation Coordinator Meeting

SPONSORS

MARCH 2024

BRENDA FOUTS SURPRISE OFFICE

JULIE GROVE AHWATUKEE OFFICE

MARYLEA ROTH ARROWHEAD OFFICE

LISA LANHAM GOODYEAR OFFICE

LYNN SCHEPP SCOTTSDALE OFFICE

BRIAN MORI SCOTTSDALE OFFICE

DONNA LEEDS CHAIRPERSON AHWATUKEE OFFICE

MIA ROMAIN SECRETARY NORTH PHOENIX OFFICE

BRENDA FOUTS SURPRISE OFFICE

JULIE GROVE AHWATUKEE OFFICE

MARYLEA ROTH ARROWHEAD OFFICE

LISA LANHAM GOODYEAR OFFICE

LYNN SCHEPP SCOTTSDALE OFFICE

BRIAN MORI SCOTTSDALE OFFICE

DONNA LEEDS CHAIRPERSON AHWATUKEE OFFICE

MIA ROMAIN SECRETARY NORTH PHOENIX OFFICE