MONEY MATTERS

Surviving market declines

By Craig Popp CFA

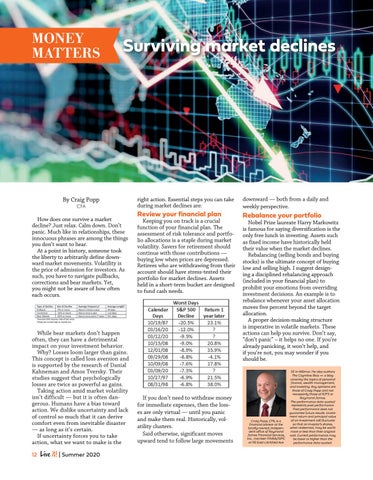

How does one survive a market decline? Just relax. Calm down. Don’t panic. Much like in relationships, these innocuous phrases are among the things you don’t want to hear. At a point in history, someone took the liberty to arbitrarily define downward market movements. Volatility is the price of admission for investors. As such, you have to navigate pullbacks, corrections and bear markets. Yet, you might not be aware of how often each occurs.

While bear markets don’t happen often, they can have a detrimental impact on your investment behavior. Why? Losses loom larger than gains. This concept is called loss aversion and is supported by the research of Danial Kahneman and Amos Tversky. Their studies suggest that psychologically losses are twice as powerful as gains. Taking action amid market volatility isn’t difficult — but it is often dangerous. Humans have a bias toward action. We dislike uncertainty and lack of control so much that it can derive comfort even from inevitable disaster — as long as it’s certain. If uncertainty forces you to take action, what we want to make is the 12

Live it! | Summer 2020

right action. Essential steps you can take during market declines are:

Review your financial plan

Keeping you on track is a crucial function of your financial plan. The assessment of risk tolerance and portfolio allocations is a staple during market volatility. Savers for retirement should continue with those contributions — buying low when prices are depressed. Retirees who are withdrawing from their account should have stress-tested their portfolio for market declines. Assets held in a short-term bucket are designed to fund cash needs.

If you don’t need to withdraw money for immediate expenses, then the losses are only virtual — until you panic and make them real. Historically, volatility clusters. Said otherwise, significant moves upward tend to follow large movements

downward — both from a daily and weekly perspective.

Rebalance your portfolio

Nobel Prize laureate Harry Markowitz is famous for saying diversification is the only free lunch in investing. Assets such as fixed income have historically held their value when the market declines. Rebalancing (selling bonds and buying stocks) is the ultimate concept of buying low and selling high. I suggest designing a disciplined rebalancing approach (included in your financial plan) to prohibit your emotions from overriding investment decisions. An example is to rebalance whenever your asset allocation moves five percent beyond the target allocation. A proper decision-making structure is imperative in volatile markets. These actions can help you survive. Don’t say, “don’t panic” – it helps no one. If you’re already panicking, it won’t help, and if you’re not, you may wonder if you should be.

Craig Popp, CFA, is a financial advisor at the locally-owned, independent office of Raymond James Financial Services, Inc., member FINRA/SIPC at 115 East Litchfield Ave

SE in Willmar. He also authors The Cognitive Bias — a blog covering the topics of personal finance, wealth management, and investing. Any opinions are those of Craig Popp and not necessarily those of RJFS or Raymond James. The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.