LOCKDOWN DREAMS

06 MENTAL HEALTH

VACC launches new ‘FineTune: Supporting Mental Health in Automotive’ program to assist auto business owners and staff

08 WAGE PENALTIES

New legislation now allows for massive fines and up to 10 years’ jail time for wage theft incidences

09 TOUGH LAWS

New industrial manslaughter laws now have up to 25 years’ jail penalties for non-compliance

11 SHIFTING VALUES

The ‘convenience is king’ mantra may be on the wane, thanks to the new normal that Coronavirus has brought

12 FREE MEDIATION

The Victorian Small Business Commission is offering free mediation to support fair tenancy negotiations

13 PAYING THE PRICE

The Essential Services Commission has released a report stating many small businesses are paying over the odds for gas

16 WAGE INCREASE

The Fair Work Commission has handed down new pay rates for various awards. Make sure you know your obligations

18 DIGITAL AFFAIR

VicRoads has announced an extension to its e-Certificate roadworthy trial. Here’s how you can get involved

20 32 FE ATURES

20 BIG CHAIR

Co -authors of a new book on the demise of car manufacturing, John Wormald and Kim Rennick, say the writing was on the wall years ago

26 LOCKDOWN CITY

Australian business owners are reeling from the effects of the necessary government lockdowns. What does it mean for automotive operators?

32 VERY SENSITIVE

From tyres to entire cars, sensors are collecting our data and we’re never going to get it back

38 HIGH ROLLERS

When the world gets back to normal post-COVID-19 these are the cars the top end of town will be driving

48 TECH TALK

Toyota Camry Hybrid basic procedures: safe service plug removal, jump starting and more

54 SERVICE DIRECTORY

Find everything from the latest products to the best business services you need all in one place

56 BUSINESS INDEX

Drive your business forward by taking advantage of the VACC alliance partner deals and assistance at your fingertips

The Bendix Ultimate 4WD Brake Upgrade Kit with advanced brake pads and rotors, braided lines and a host of ancillary items is the ultimate brake upgrade for the latest 4WD vehicles such as Ranger and Hilux.

Contents

2 × Ultimate Brake Rotors

1 × Set of Ultimate 4WD Brake Pads

1 × Vehicle Set Ultimate Brake Hose

1L Heavy Duty Brake Fluid

1 × Can Bendix Cleanup

1 × Tube Ceramasil Brake Parts Lubricant

1 × HD touring case

Installation details

ULTIMATE 4WD BRAKE PADS

FEATURES: BENEFITS:

This comprehensive kit includes specially compounded high performance CERAMIC material brake pads for increased stopping power in extreme conditions plus the latest Bendix Ultimate Rotors designed and developed specifically for Australia’s demanding conditions.

Ceramic Material Low Dust, Low Noise, while providing high temperature stability and excellent fade resistance

Mechanical retention system

backing plate MRS technology used in commercial vehicle brake pads, for improved pad attachment strength, for heavy duty operating conditions

Designed for Slotted Rotors Works best with slotted rotors, delivers confident stopping in all conditions

ULTIMATE 4WD ROTORS

FEATURES: BENEFITS:

Diamond Tip Slot Allows gasses to escape in heavy duty driving, delivering consistent output

Better self cleaning for off road conditions

High Carbon Metallurgy Noise damping, thermal conductivity, improved durability and increases brake performance & stopping power

SwiftFit Protective zinc coating which is ready to fit

Pillar Construction

Improved thermal stability

ULTIMATE BRAKE HOSE

FEATURES: BENEFITS:

Braided line with protection sleeve

Meets SAE J1401

Delivers a firm brake pedal, that won’t over expand under high pressure

Compliant to international design standards, won’t affect warranty

Designed to fit Fits your application without any modification

FOCUS ON MENTAL HEALTH

Beneath the COVID-19 pandemic is another quiet emergency affecting Australian families, communities, and Australian workers – the mental health epidemic.

The statistics, always confronting, tell the story. If you know 10 people, one of them will suffer depression or anxiety in any given year. If you know five people, one of them will suffer depression or anxiety at some period in their lives. And one-in-five will suffer a drug or alcohol disorder over their lifetime.

Suicide is now twice the national road toll. Trades-based industries, like the automotive industry, have among the highest incidence of depression and suicide (The Little Blue Book of Mental Health – Alcohol and Drugs Awareness Australia - ADAA).

All Australians are touched by the mental health epidemic in some way. It touches so many of us, it demands our attention, and for people in business, the financial uncertainties and risk to livelihoods and wellbeing of the current coronavirus situation will be creating special challenges.

Work stress, overwork, burn-out, unreasonable behaviours, bullying and intimidation are identified factors in depression and anxiety, and can place individuals at elevated risk of depression, anxiety and self-harm. Given people spend one third of their lives at work, the workplace has an important role to play in looking after their mental health and wellbeing so that all can thrive personally and professionally.

In an effort to address these challenges in automotive businesses, VACC has been successful in gaining funding through WorkSafe’s WorkWell Mental Health Improvement Fund.

WorkSafe’s WorkWell program aims to support employers and business leaders to make mental health and wellbeing a priority in their workplace by providing access to resources, funding and knowledge sharing.

The Fine Tuning Automotive Mental Health program is available to workplaces in the Victorian automotive industry. Through this program, VACC will work with business owners and leaders to decrease the risk of mental injury and

improve the mental health of workers (including team leaders and business operators) in the automotive industry by facilitating change management practices.

To achieve this, VACC facilitators will visit workplaces and assist businesses to identify risks to mental injury in their workplaces, identify workers most at risk such as younger and ageing workers, and support them to develop positive policies and practices to improve workplace cultures and drive systems level change. Members are encouraged to get involved by registering their expression of interest at finetune@vacc.com.au

David Dowsey

MANAGING

David Dowsey

03 9829 1247

Pia-Therese Hams DESIGNERS

Faith Perrett, Gavin van Langenberg 03 9829 1159

VACC adheres to its obligations under National Privacy Principles legislation. Information on products and services contained in the editorial and advertising pages of this magazine does not imply the endorsement of any product or service by VACC. Australian Automotive is copyright and no part may be reproduced without the written permission of VACC. Advertisers and advertising agencies lodging material for publication in Australian Automotive indemnify the VACC, its directors, Board, employees, members, and its agents against all claims and any other liability whatsoever wholly or partially arising from the publication of the

and without limiting the generality of the foregoing, indemnify each of them in relation to

libel,

of

infringement of copyright, infringement of

or

of

titles, unfair competition, breach of

practices or fair

legislation, violation of rights of privacy or confidential information or licences or royalty rights or other intellectual property rights, and warrant that the material complies with all relevant laws and regulations. This publication is distributed with the understanding that the authors, editors and publishers are not responsible for the results of any actions or works of whatsoever kind based on the information contained in this publication, nor for any errors or omissions contained herein. The publishers, authors and editors expressly disclaim all and any liability to any person whomsoever whether a purchaser of this publication or not in respect of anything and of the consequences of anything done or omitted to be done by any such person in reliance, whether whole or partial upon the whole or any part of the contents of this publication. Advertising accepted for publication in Australian Automotive is subject to the conditions set out in the Australian Automotive rate card, available from editor@australianautomotive.com

Connect with VACC

Wage theft legislation passed

VICTORIA is set to introduce laws establishing criminal penalties for employers – including up to 10 years’ jail – who are found to have dishonestly withheld wages, superannuation and other employee entitlements. Additionally, offences will capture employers who falsify employee entitlement records and fail to keep employment records.

While the Victorian Automobile Chamber of Commerce supports the government taking action to improve

Australia’s Industrial Relations system, it has questioned certain aspects of the approach, including the duplication of state and federal statutory authorities to investigate and prosecute underpayment and record-keeping breaches.

The move will make Victoria the first state in Australia to pass laws establishing criminal penalties for employers. Those found guilty will face:

Fines of up to $198,264 (individuals)

Roadworthiness remains a concern

VEHICLE safety and maintenance must remain at the forefront of every motorist’s mind as Australia’s workforce begins to get back on the road again.

A recent poll, conducted in Victorian Automobile Chamber of Commerce (VACC) member workshops, revealed up to 50 percent of vehicles inspected had one or more roadworthy issues. The most common faults identified were:

Tyres (wear and using the wrong type or size)

Brakes (undersize rotors or discs)

Suspension (modified components)

Structure (accident damage)

Lighting (ineffective, wrong direction or non-functioning globes)

Seatbelts (non-compliant).

In another Chamber survey, 25 percent of the nearly 2189 vehicles inspected failed a basic five-point safety check (brakes, windscreens, seatbelts, tyres and lights).

With the average age of a vehicle being 10.4 years and VicRoads issuing nearly 50,000 defect notices annually, VACC is reminding Australian motorists – particularly those

Fines of up to $991,320 (companies) 10 years’ jail.

T he Wage Inspectorate of Victoria will be established as the new statutory authority with powers to investigate and prosecute wage theft offences, with the Victorian Government maintaining the aim is not to vilify employers who make honest mistakes. The new laws do not come into effect until mid-2021 to give businesses time to prepare

whose vehicles have remained dormant during the last few months – that local automotive businesses are open and offering their expertise, including safety inspections and regular servicing. Financial stresses and difficulties are affecting many people across the country, but it is important that automotive remains an essential service and a priority.

Furthermore, in a bid to better protect Australia’s 15 million motorists, VACC is calling on the government to revisit the case for introducing annual roadworthy testing.

Industrial manslaughter penalty now 25 years jail

WORKPLACE manslaughter is now a jailable offence in Victoria. Therefore, it is essential business owners are aware of what the new rules, which came into play 1 July, mean for their business and employees, and of what compliance measures they need to adhere.

The change introduces the offence of workplace manslaughter as an amendment to the existing Victorian OHS Act 2004. As a result of the amendment, a person must not engage in negligent conduct that breaches an applicable safety responsibility under the current OHS Act, which is owed to another person and causes the death of that person. Employers found to have negligently caused a workplace death now face fines of up to $16.5 million and individuals up to 25 years in prison.

The amendment does not cover employees. Employees who fail to meet their safetyrelated obligations under the Victorian OHS Act could, as previously, be charged with reckless endangerment, which imposes a maximum financial penalty of $3.2 million

and a maximum jail term of five years.

The workplace manslaughter offence applies to:

organisations (including bodies corporate, partnerships, unincorporated bodies and unincorporated associations) self-employed persons (sole traders); and officers of employers.

Officers of a company, sole traders and partnerships (in addition to the employer) could be separately liable where they are negligent by failing to take reasonable steps on workplace safety to prevent fatalities, including managing mental injury that leads to suicide.

The term ‘officer’ of a body corporate, unincorporated body or association or partnership has the meaning given by Section 9 of the Corporations Act.

Under this Act an officer means: (a) a director or secretary of the corporation; or

SRO ‘Drive-away deals’ guide

INFORMATION about calculating the dutiable value of new and used motor vehicles sold as ‘driveaway deals’ from 1 July 2020 is now available on the State Revenue Office (SRO) website.

The purpose of the Drive-away deals 2020-21 bulletin is to provide guidance when calculating the dutiable value of new and used motor vehicles, where the date of registration or transfer is on or after 1 July 2020. It includes advice on key factors when calculating the dutiable value of a motor vehicle that is subject to a ‘drive-away deal’. Information in reference to Luxury Car Tax (LCT) and duty payable on demonstrators and used vehicles is also included.

Licensed Motor Car Traders should note that the LCT threshold was increased to an indexed threshold figure of $68,740 for 2020/21, and the fuel-efficient car limit for the 2020/21 financial year is $77,565.

Business owners operating under a Dealer Management System should ensure that any necessary adjustments are made to reflect this change.

To learn more, head to the SRO. Visit sro.vic. gov.au/publications/drive-away-deals-2020-21. Alternatively, contact the SRO directly by calling 13 21 61 or email contact@sro.vic.gov.au

(b) a person:

(i) who makes, or participates in making, decisions that affect the whole, or a substantial part, of the business of the corporation; or

(ii) who has the capacity to affect significantly the corporation’s financial standing; or

(iii) in accordance with whose instructions or wishes the directors of the corporation are accustomed to act (excluding advice given by the person in the proper performance of functions attaching to the person’s professional capacity or their business relationship with the directors or the corporation).

For more information, head to the WorkSafe website. Visit worksafe.vic.gov.au/tougherlaws-safer-workplaces

Industry welcomes franchising reforms

THE Victorian Automobile Chamber of Commerce (VACC), along with its national body, the Motor Trades Association of Australia (MTAA), has welcomed the government’s move to implement new regulations for new car franchised motor dealers.

Officially announced by the Minister for Industry, Science and Technology, Karen Andrews, the introduction of the reformed regulations for new car retailers aims to even the playing field between car manufacturers and franchise dealers, with the latter historically being left vulnerable to manufacturer demands. Industry bodies will remain in close contact with dealer members, in order to monitor the effectiveness of the new regulations and gather feedback. VACC will continue its dialogue with government, using its resources and research

VACC Technical has changed

VACC Technical Services has launched into a new era of product offerings that will change the automotive technical information game in Australia.

VACC has signed a multi-year deal with the famous British-based Haynes Publishing Group, bringing to market a suite of products, unsurpassed in Australia, under the banner of VACC MotorTech.

VACC MotorTech brings together VACC’s proven Tech Online, Times Guide, Tech Estimate, Tech Advisory Service and Tech Talk products with the might of Haynes’ international know-how, to provide an enormous (and evergrowing) amount of technical service and repair information to subscribers.

Available now for subscription are three ‘bundles’: Diagnostics, Service & Repair, and Maintenance. These new products are positioned at an unbeatable price and VACC members receive generous discounts of up to 50 percent.

Haynes is best known in Australia for its Haynes manuals that have been in print since 1965 and have sold over 200 million copies worldwide. However, they

online products, designed for automotive professionals under the HaynesPro brand.

Until the agreement with VACC, HaynesPro products have not been available in the Australian market in such affordable and convenient packages.

The HaynesPro products include:

• HaynesPro Manuals AllAccess Cars allows access to all Haynes manuals online, providing step-by-step repair and service information, along with extra details not published in the hard copy versions. The Haynes OnDemand video tutorials – available for many of the most popular models – are the ultimate aid to getting vehicles correctly serviced and repaired.

• HaynesPro WorkshopData Tech contains extensive maintenance information like repair times, timing belt and chain replacement procedures, capacities, wheel alignment, torque specification and over 100,000 high-quality technical drawings.

• HaynesPro WorkshopData Electronics and Smart includes the VESA guided diagnostics system, wiring diagrams for most vehicle systems, fuse and relay locations, earth point and control unit locations, TSBs and known fixes.

The agreement between VACC and Haynes provides automotive business owners new options and easy access to repair information and vehicle repair times not available previously, in bundles to suit every business’s needs.

Visit: motortech.com.au to learn more.

Shifting values

The road ahead may be full of surprises

to a new way of life – including how we interact with others, work, buy and even how we choose to move around.

Government restrictions may be changing

in many parts of the country, but community concerns about hygiene and health remain. Consequently, some Australians are re-evaluating how they plan to travel from A to B. Results of a recent Carsales survey suggest that car ownership may see a spike, as people become less comfortable with the idea of public transport and ride-share services post-Coronavirus. Of almost 3,000 Australians surveyed, 45 percent of non-car owners admitted their primary transport preferences had changed. Additionally, 38 percent of non-car owners were ‘definitely’ likely to consider buying. But it’s not only motorists rethinking their options, dealers – like many auto businesses

across the country – are taking a holistic view of the situation and adapting in order to provide the best, safest service possible. Owning a car was once seen as a symbol of freedom and wealth for many Australians, although in recent years there has been a value shift with the emergence of subscription services and a ‘convenience is king’ mentality. However, it does seem like Australians may be seriously reconsidering. It will be interesting what other societal changes begin to reveal themselves, and how it will shape Australia into the future.

VACC CEO, Geoff Gwilym voices his opinion each week in the motoring section of Friday's Herald Sun. You can also read his pieces at vacc.com.au/blog

Free mediation for small business owners

AS part of the Andrews Government’s Commercial Tenancy Relief Scheme, designed to support COVID-19 affected tenants and landlords, the Victorian Small Business Commission (VSBC) is providing free mediation to support fair tenancy negotiations.

The mediation support measure is set to provide many Australians with

invaluable practical advice and help during this difficult time. Demand is high. As of 23 March, the VSBC had already reported 1,200 inquiries about commercial leases, with 81 percent concerning rent relief and the National Cabinet’s commercial leasing code.

The Minister for Small Business said that if tenants and landlords were

unable to reach an agreement, the Victorian Small Business Commission was on hand to assist both parties in reaching a fair outcome.

Commercial tenants and landlords needing help and wanting to uptake the free mediation service are advised to email the VSBC at enquiries@ vsbc.vic.gov.au or call 13 8722.

Bruce Parker awarded OAM honour

HEADMOD Group Managing Director and Chairman, Bruce Parker has been awarded an Order of Australia Medal (OAM) in the General Division in the Queen’s Birthday Honours.

A well-known industry figure and long-standing VACC member, Mr Parker was officially recognised “for service to the community and the automotive industry”.

As the founder of the country’s largest engine remanufacturing company, which includes HM GEM Engines, Nason Engine Parts and Premier Machinery and Components, throughout his years in the industry Mr Parker has dedicated himself to not only building successful businesses, but also investing in the future of automotive by training apprentices and employing people with disabilities. In recognition of his hard work and dedication, he has received the Prime Minister’s Employer of the Year Award on several occasions.

Soldiers and their families. Additionally, Bruce co-founded the Michael Parker Foundation, which provides support and offers educational opportunities to

underprivileged children in Australia, East Timor and Nepal. For more than 15 years Mr Parker has been a volunteer supporter of the Victorian Police initiative Hand Brake Turn, developed in order to support young Australians wanting to explore work pathways after experiencing challenges throughout their early life.

In addition to his community work, Mr Parker is a respected and involved industry figure, being a past VACC Divisional Chairman and former President of the Australian Engine Reconditioners Association. He has also been an active contributor in the South East Business Network (SEBN) and South East Melbourne Manufacturing Alliance (SEMMA). On behalf of members and the wider automotive industry, VACC congratulates Mr Parker on his Queen’s Birthday Honour.

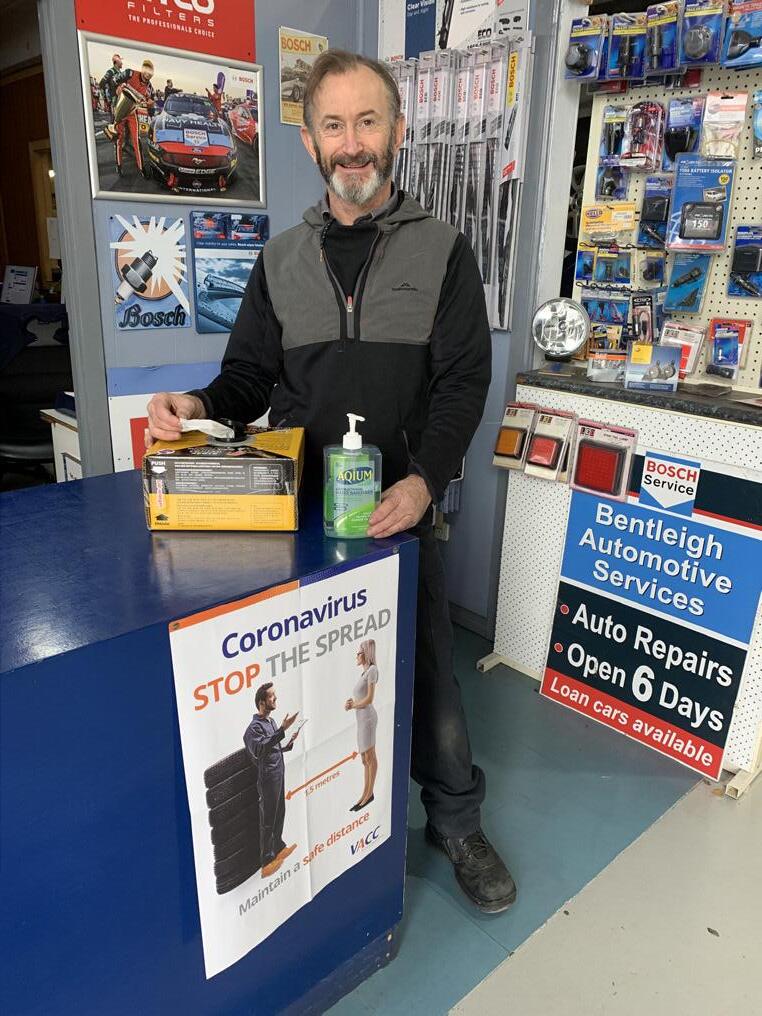

Business as usual

WORDS John Khoury

THE easing of restrictions in most areas across the country - though not Melbourne - due to the Australian Government’s measures to flatten COVID-19 infection rates, has come as welcome news for an industry sector highly impacted by the pandemic.

Automotive workshops, considered an essential service through the staged shutdown restrictions, have remained open and focused on keeping their staff safe while also keeping the motoring public and essential workers safe and on the move.

There are so many incredible stories of VACC members adapting to the challenges with many taking advantage of VACC’s advice and government stimulus packages.

When signs of the outbreak took hold in Australia, workshops across the country quickly implemented measures to keep their staff and customers safe. These included adhering to the government’s social distancing guidelines, regular cleaning and sanitising of workplaces and customers’ vehicles, contactless servicing models which limited customer interaction, and utilising digital and social platforms to market their businesses, effectively allowing for adequate communications with client bases. While many businesses have suffered, some more so than others, the resilience of the automotive service and repair sector has been exceptional and is expected to bounce back strongly once the Australian economy gathers momentum.

Global trends from past financial crisis indicate the automotive aftermarket has

been typically the most recession-resistant part of the automotive industry, as it is dependent on the size of the car parc rather than new vehicle sales. New-car dealers have been most affected with a 48.5 percent decline in sales over the same time last year. With international travel restrictions likely to remain in place for the foreseeable future, consumers will quickly turn to the vast domestic holiday destinations Australia has to offer. This means more vehicles on the road that will require ongoing maintenance and repairs.

According to research conducted by McKinsey & Company, during the lockdown phase in China they experienced an 80 percent drop in light vehicle usage and an 85 percent drop in the use of public transport. Once the restrictions eased, consumers returned to their previous levels of vehicle usage. However, the use of public transport remained relatively low due to public concerns. Workshops also experienced high demand from customers who had delayed maintenance and repairs of their vehicles. The downturn in vehicle sales will have a knock-on effect to the average age of vehicles, which is currently 10.4 years. This is predicted to rise in the short term, in turn translating to older cars requiring more repairs and maintenance. One thing is for certain, the automotive aftermarket will bounce back as it always has, albeit with a re-evaluated sense of purpose and business operation model.

Small businesses paying the price

VICTORIAN small business customers could enjoy big savings – potentially $24 million across the market – simply by switching from default contracts.

The latest Victorian Energy Market Report, which reviews data from January to March 2020 and is published by The Essential Services Commission, has revealed that 10,000 small business gas customers have remained on their retailers’ default option and are consequently paying the highest rate on the market.

The state energy regulator found that by taking action and switching to lower market offers, Victorian small business customers could pocket savings in

the ballpark of $2,400 per annum.

“Small businesses could be experiencing bill stress during this challenging period and these potential savings could provide some welcome relief,” said Commission Chief Executive, Dr John Hamill.

Many small business customers are feeling the impact of COVID-19 and are already seeking payment assistance from their retailer, therefore the Victorian Energy Market Report findings are a timely reminder that it pays to make the effort to review energy options.

As well as identifying saving opportunities, the report also flagged some positive updates, with disconnection levels continuing to drop.

“Disconnections are down 11 percent compared to 2018/19 and down 33 percent compared to 2017/18,” revealed Dr Hamill.

Additionally, during the reporting period, the Commission issued penalty notices to two energy retailers, which resulted in payments to customers totalling $333,995 for wrongful disconnection.

Businesses are encouraged to contact their energy retailer now and identify the best available options.

The Victorian Energy Market Report can be accessed on The Essential Services Commission website. Visit: esc.vic.gov.au

Austruck looks back to the future

reflect on milestones, and VACC CEO Geoff Gwilym visited Michelle Sellars, Director of Austruck Bodies and Trailers, to do just that.

Now boasting a broad range of services including curtain siders, trailers, car carriers, colorbond vans, dog trailers and insulated van work, the business has adapted throughout the years to meet demand and has changed a lot since it was first established in 1988 by Michelle and Harry Sellars, who has since retired but Michelle still keeps him involved. However, what has remained a constant is the team – which has over 100 years of combined experience and includes Michelle’s two sons – commitment to quality craftsmanship.

From the very beginning, Michelle had a knack for building things. “I loved using my hands.” So, after attending Chelsea Primary School, she enrolled at Aspendale Technical School. The passion for automotive was there, and so was the value placed on earning an income and building a career, even in those early days. She came from “a hands-on

toward body making seemed quite natural. “I used to build go-karts from the age of 13... I was into motorbikes; my family has always been into that type of stuff. So, from there I sort of thought, ‘where is the money?’ I remember my father telling me, there’s money in welding.”

Eager to gain some workplace experience, in March 1975 Michelle began working at Boon Truck Bodies, and was soon doing everything from welding to spray painting to sheeting. “I would do all the overtime, I just loved building... I said, look I just want to learn everything.”

Still only 15, she quickly gained a good reputation and, after six months, took the opportunity to join the departing Boon co-director, Bert Dinnage, who had decided to go out on his own and establish Style Truck Bodies. It was certainly a change of scenery, “I went from a great big factory, into a factory with nothing and I took my welder with me from home,” recalls Michelle. Reflecting on the following 10 years, Michelle has good memories. She learnt a lot and had the opportunity to work with her good friend Colin

Michelle’s experience within a start-up held her in good stead for when she decided to start working for herself. Originally, she began by helping her father and brother in their businesses. She was out of body making for about two years, before moving into contract work – building bull-bars and fitting tailgates among other projects.

“I actually made more money doing contract work than I did after starting my business,” says Michelle, reflecting on the 1988 move into her first shed. She had bought two-anda-half acres in Langwarrin, which included a house and shed, and set-up shop. The work was mainly based around little tray trucks and glass cutting, and after six months, the decision was made to invest in a larger space, a factory in Seaford. Business was booming, and soon Austruck was ready to expand again. By this time, the team was specialising in glassing equipment and truck bodies, and would soon branch out to start building bigger glass work, “the biggest you can basically build,” says Michelle.

able to rely on re-build work – the COVID-19 pandemic saw to that.

Michelle’s ability to innovate in times of need has played a crucial part in the business’ continued success.

“We have had to change heaps. I looked at the COVID-19 situation and thought ‘we’ve got to make some major changes’ and it’s got to be done now.” By mid-April the business had gone down to a fourday week. The unpredictability of the times has proved testing, the team seeing a spike in June, which changed the work schedule again.

Post-Royal Commission, Austruck has felt the ramifications first-hand, as “finance has been so difficult for our customers.” Then came the tragic fires earlier this year, reminiscent of the 1990s blazes, although this time around struggling businesses weren’t

“If we had that crystal ball, it’s broken. We can’t see into tomorrow and I always believe that you live each day in the now – you work with what you’ve got today.” And in some ways the team has been lucky, with orders from Christmas coming in.

“Trucks have been held up and we’re only just starting to get some of them now.” Although it still isn’t the workflow they’re used to, Michelle guesses the drop-off sits at 30

percent. Ever-changing restrictions have also impacted employers and staff morale across the sector, and Michelle has utilised the VACC Industrial Relations department and resources to ensure she makes the right moves to safeguard employees, and also the business. What the post-COVID-19 future holds remains unknown, however both Michelle and Geoff agree that one thing is clear, diversity within the industry is the key to not just survival, but success. It’s true, automotive is facing some unprecedented challenges, but long-standing concerns remain just as relevant. As an active member of the Chamber’s networking group, Women in Automotive (WinA) – which provides a place for women working across the industry to network, feel supported and grow – Michelle is passionate about getting the word out. Over the years, attitudes within automotive have evolved but the number of women entering the industry has not risen. And Austruck can certainly testify to that; of the 70-odd people Michelle has trained, only five have been women. She believes that “getting women into the workshop is making ground, and we need to make ground”. Michelle has come a long way since she held her first welder at 13 years old, the business has come a long way since that small Langwarrin shed – and it seems like the industry, even in the face of great change and many challenges, is making positive moves too. “It’s amazing what change has come through over the years, and… what it’s going to be like in another 50 years.”

Industrial Relations Rehaul

PRIME Minister, Scott Morrison is pursuing a post-Coronavirus industrial relations compact by September 2020, the move set to result in the most ambitious workplace relations changes since the Accord of the 1980s.

The Attorney-General will oversee five working groups to negotiate a package to promote jobs in five key areas:

Austruck Director, Michelle Sellars

VACC CEO, Geoff Gwilym

WHEN Castrol last year announced an extension to their strategic partnership with Renault DP World F1 Team, it ensured Castrol would continue to provide advanced engine oil, gear and hydraulic oils, greases and brake fluid to the Team until at least the end of 2024. The announcement though went even further, with the news that Groupe Renault had formally appointed Castrol as its aftersales’ global service fill engine oil lubricants partner from 2020. Underpinned by a Renault Castrol jointbranded product range – available exclusively to Renault dealers – this expanded partnership provides a platform for Renault drivers to benefit from the successful cooperation already in place through the existing motorsport technical association.

Expanding the partnership

With a strong technical partnership now in place across service fill and Formula 1, this broader alignment will allow both parties to push technological boundaries both on and off the track. In combination with Castrol, one of the world’s leading lubricants brands, Groupe Renault intends to build a strong foundation that will enable Renault customers and dealers to enjoy the best service and products, while relentlessly pursuing their Formula 1 ambitions.

“Castrol is an industry leader in its field with a rich heritage in motor racing and feeder series. A partnership of this scale and length underlines the desire to write a common history,” explains Cyril Abiteboul, Renault Sport Racing Managing Director.

Auto annual wage increase

THE Fair Work Commission has awarded an annual wage increase of 1.75 percent to be phased in over three separate operative dates based on award groups.

The Fair Work Commission awarded a 1.75 percent increase to all minimum award rates of pay based on a 38-hour week.

Taking into account current economic circumstances, the Annual Wage Bench departed from its normal approach of awarding a minimum wage increase across all awards effective from a common operative date of 1 July 2020.

In this decision, the Annual Wage Bench split the increase across three award groupings to become operative on three separate dates. For the automotive industry the relevant operative dates of the increase are: Clerks - Private Sector Award 2020

The minimum award wage increase applies from the first full pay period commencing on or after 1 November 2020.

Manufacturing and Associated Industries and Occupations Award 2020

The minimum award wage increase applies from the first full pay period commencing on or after 1 November 2020. This award only applies to businesses that prior to 29 May 2020 were covered in Section 2 of the Vehicle Manufacturing, Repair, Services and Retail Award 2010.

Vehicle Repair, Services and Retail Award 2020

The minimum award wage increase applies from the first full pay period commencing on or after 1 February 2021.

The Federal Minimum Wage will increase as set out below:

Current Federal Minimum Wage

$19.49 p/h

$740.80 p/w

New Federal Minimum Wage

$19.84 p/h

$753.80 p/w

All other minimum award rates of pay will also increase by 1.75 percent per week from the above dates.

As the wage increase will apply to minimum award rates of pay only, the minimum wage increases will be fully absorbed into any existing over-award rates of pay. Proportionate increases will flow on to junior employees and employees to whom training arrangements apply (apprentices and trainees), employees with a disability and casual employees.

To learn more, head to the FairWork website. Visit, fairwork.gov.au

Change lanes to MTAA Super

VicRoads roadworthy e-Certificate trial extended

THE introduction of an online roadworthy system, to improve efficiency across the board for consumers, License Vehicle Testers (LVTs), Licensed Motor Car Traders (LMCTs) and VicRoads, has been a key agenda item in VACC advocacy efforts for some time.

The VicRoads roadworthy e-Certificate trial was launched in December 2018 with 55 participants and, to date, there have been well over 55,000 certificates issued. This system facilitates an increased level of regulatory compliance, important

data gathering and improves the security and safety of the broader vehicle fleet in Victoria. Additionally, it reduces red tape for consumers and LVTs, while enhancing end-to-end business efficiencies for LMCTs when retailing a vehicle.

Over the past few years VACC, through its LVT industry focus group, has been working collaboratively with VicRoads to ensure the system is fit-for-purpose and has even led an education program – holding member briefings across metro and regional Victoria.

VicRoads has advised that it has Ministerial approval to extend the program to all LVTs who wish to participate in the trial. VACC thanks the former Minister, the Hon Jaala Pulford MP, for giving the green light on the roll-out to continue without interruption during the COVID-19 situation.

VACC encourages members who would like to participate in the program to contact John Khoury, VACC Industry Policy Advisor on 03 9829 1153.

Tax in the time of COVID

AUSTRALIANS have experienced unprecedented challenges so far in 2020, and the Australian Taxation Office (ATO) has put together specific COVID-19 related support and guidance to make the tax process as easy as possible, especially as many people’s circumstances have changed, including their type of income and/ or ability to claim new deductions.

Key COVID-19 related topics addressed:

Income changes (JobKeeper and JobSeeker)

Stand down payments

Early access to superannuation

Working from home expenses

Protective clothing

Clarity on work travel

(home to work).

“We know many of our clients and their agents will have questions about how different types of income and expenses may affect their obligations this year. We’re helping to make sure people know how to get it right,” said Assistant Commissioner, Karen Foat.

“We have published information on our website to help you get it right when lodging this year, including the Tax Time Essentials page which is a one-stop-shop for the things that are a little different this year and how they impact your return.”

It is recommended that business owners take the time to review ATO resources, whether they plan to lodge their own return or opt to work with a trusted agent.

Head to the Australian Taxation Office website. Visit ato.gov.au

JOHN WORMALD AND KIM RENNICK

AUTHORS IN THE BIG CHAIR

In a new book, National Policy, Global Giants – How Australia Built and Lost its Automotive Industry, authors John Wormald and Kim Rennick analyse the life cycle of Australia’s automotive history and its shifting relationship with the government that supported it. Based in the UK, Wormald is managing partner and co-founder of Autopolis, which specialises in strategic assignments for the global automotive industry. He is co-author of two books about the automotive industry and previously worked for Booz Allen Hamilton, Renault, and the Boston Consulting Group.

Rennick is Autopolis’ partner in Australia, consulting in the fields of governance, directorship and leadership. He has co-authored submissions and papers for the Australian Productivity Commission, the Australian Competition and Consumer Commission, and various state and federal government inquiries.

What prompted you to write the book?

Wormald: It came from our involvement with FAPM (Federation of Automotive Products Manufacturers). In 2004 we started working with them regarding the future of component manufacturers and that led us to talk to people to try to understand the local industry.

Rennick: We also did a lot of work with the auto-makers, Ford, Holden, Toyota, and Mitsubishi during those projects. We were interested to see how the industry formed here.

Wormald: It’s an unusual circumstance to be able to look at the birth, growth, life, decline and eventual death of a complete industry. We had a broad view of the industry and clearly there were difficulties. We became concerned that the attempts to keep the industry going were costing a lot of money, getting less and less effective, and the facts were not being faced. We were particularly concerned about ACIS (Automotive Competitiveness and Investment Scheme), and notably the ATS (Automotive Transformation Scheme) – it claimed to be a transformation, but a transformation to what? A viable future state for the industry was never defined. There’s a certain amount of ‘I told you so’ in the book, but that’s not what we are trying to say. We wanted to document the situation.

What did you find?

Wormald: It was a great success initially. Holden became a national icon, Ford to some extent also and the industry functioned very well while the market was protected, but there was a change of policy. (Politicians) had to open-up everything, go for globalisation, free market, give Australian consumers more choice and that, in retrospect, was incompatible with preserving the industry given that it was so sub-scale. That is why we wrote a ‘front-end’ about the structure, development and functioning of the global industry, and the enormous scale it is driven to, to put the Australian sector in context. The fact is Australia got relatively smaller and smaller, to the point of non-viability.

Rennick: Protection was being stripped away just after Europe hit its stride in a global sense. The big German manufacturers came onsong big time in the early to mid’70s and that happened just before we took all the ‘fences’ down.

Wormald: (Prior to establishing a car industry) Australia didn’t want to go on being purely an exporter of commodities, which at the time was sheep wool, sheep meat and wheat. There were strategic concerns about being defenceless if the Japanese ever got naughty again, or somebody else.

The feeling that you must be more than a commodities exporter has come around again (due to the COVID-19 pandemic). This was a very valiant effort that didn’t work in the end, and the problem hasn’t gone away. Our view is it’s legitimate for government to support certain sectors, particularly new and developing ones, but you better be damn careful about which ones you pick. You try to pick ones in which you have some sort of natural comparative advantage and some chance of achieving a sustainable position. As it turned out automotive wasn’t one, even though it had a good run.

Rennick: One comment we make in the book is that when the 1948 Holden was released the population of Australia was around 7.5 million, a minuscule population spread over a mighty big land, yet various governments encouraged Ford, General Motors and Chrysler to set up here. The Australian industry was essentially, what I call, a blacksmith operation, a cobbler’s shop. If you wanted a new front wishbone for an FJ Holden, you’d just take a large hammer down to the forge and hammer one into shape. That’s how cars were (built) then – it’s a bit of an exaggeration – but you get the National Policy, Global Giants – How Australia Built and Lost its Automotive Industry by John Wormald and Kim Rennick is published by Cambridge University Press (above right)

idea. Cars have moved on in terms of complexity and sophistication, and therefore the cost of development has risen. Australia might have been able to supply a small market with a cobbler’s product, but there’s no way it could make a product for the global market.

Has the reason for making Australian cars passed?

Wormald: Yes, I think it has. The idea that you had a specifically Australian product, adapted to Australian conditions, worked very well at the start, especially as it was possible to take American designs more-or-less off the shelf and adapt them progressively, but Australia has changed. Most driving is pretty suburban, it’s similar to what you’ll see in any developed country, so the idea of a distinct Australian product would be an expensive and unaffordable luxury now, unless you could find some sort of niche. We tried to float the idea of only having one manufacturer with some sort of product that would be uniquely Australian in today’s context. The obvious candidate would have been to buy Land Rover. The Range Rover is a genuinely niche product, is upmarket, and fits with Australia. It would have created a distinct identity.

Rennick: There was a real change in Australia, too. I remember, when I was a young lad in the ’60s, whenever a new model Holden was released there would literally be people lined up around the block to look at it in a dealership. In the ’70s, in particular during the Whitlam years, Australia really opened up, took a far more international view, was becoming far more prosperous and people didn’t like the idea of driving the old Holden around the block.

Wormald: I think, particularly in developed economies, the enthusiasm for (new model releases) has, to a degree, faded. The industry hasn’t

more price pressure. It just became an industry which was not very attractive for Australia to try to compete in. In a way, the end was inevitable. Our feeling was that there was a lot of self-delusion and frankly, a lot of public money thrown at it, which might have been better used for other purposes.

What were some of the other challenges for the Australian industry?

Rennick: It was undone by bad timing as much as anything else. Virtually every manufacturer in Australia failed when its parent got into deep strife, Toyota being the obvious exception. One of the reasons Ford failed in Australia is that they tried to make an Australiaonly model, so there was zero sharing

of any of their models with any other Ford in the world. They had to amortise all their design and engineering costs over a miniscule product run. Even in the heyday of Ford, they sold maybe 70,000 a year. There is no way you can develop an up-to-date product with those sort of sales. Holden was different in that it established quite a remarkable position in GM which would have led them onto greater things had GM not gone bankrupt in the GFC. Had the GFC not happened they would have been exporting Pontiacs and Chevys into the US. Mitsubishi failed because the parent behaved so badly, Leyland and Chrysler similarly. Wormald: The industry is over competing on the product offering; everybody must have a wider and wider range of every vehicle manufactured. This bloats their costs, then you renew the product more frequently, which crushes your sales price. You try to maintain a list price, but people ask for more and more discount because there is so much competitive pressure in the market. The fleet market also became increasingly important, which is where vehicle manufacturers go when they want to generate volume, but they always regret it because professional buyers negotiate down on price, so it was a very dangerous sector to rely on. Manufacturers tend to have a break-even point that is much too high. The gross margins are too thin, the fixed costs are big, so they are absolutely desperate for volume all the time. They try to pull away from fleet buyers and concentrate on the retail market where the margins are better but then the volumes fall, the pressure returns, and they are unable to resist the temptation of chasing

John Wormald

Kim Rennick

fleet sales. It’s like when you wake up on Sunday morning with a terrible hangover saying ‘God, I’m never going to drink again’, then next Saturday night… This is not an easy industry to be in. Additionally, Australia’s official or implicit preference for buying Australian in the fleet sector went away with novated leasing. We went through this in the UK years ago – companies were expected to buy a British manufactured car but, as soon as people could choose their company car, they chose something else.

People seem to think the end happened over night, but it looks like it’s been coming since about 1980 when Chrysler fell over.

Wormald: You’re right. There were rumblings from early on that things were not entirely well.

Rennick: The carmakers knew, if they were in strife, all they had to do was make enough noise, pick up a baseball bat, go to Canberra, wallop the crap out of the politicians and they would get some money. For years, both political parties just rolled over.

Wormald: The industry historically, and not just in Australia, has been very good at saying to government, ‘I’ll come in and invest if you give me some support and if you don’t continue that support we’ll pull out and look at the job losses’. This terrifies politicians, particularly if you’re an MP in a constituency where an assembly plant or component suppliers are threatened. The industry knows how to apply pressure. (The decision to cease government support) should have happened long before the Abbott government. In a way, the Abbott government was honest. It said, ‘This simply can’t go on’. There may have been union bashing, there were political parts to it, but in a way, it was recognition that this couldn’t go on. I was interested in GM’s response. As soon as Joe Hockey made those statements in the House (of Representatives), bang, GM came back with, ‘Oh well, we’ve been let down. Australia is an impossible place to compete in. It’s an overly competitive market. It’s too expensive to produce in’. It was as though they had those answers teed up and were just looking for an excuse. The Abbott government gave them that excuse.

In the book you talk about the efficiency of Japanese carmakers and relate it to US and Australian manufacturers.

Wormald: The Japanese invasion happened when I was working at Renault. We sent people to visit the Japanese factories and we found some

quite extraordinary things, like changing the dies on the press line in 10 minutes whereas it took us 36 hours. They simply learned how to perfect and balance the production process. It wasn’t a matter of technology or hardware, it was a matter of organisation, something I think was very deeply rooted in Japanese culture. The development of the Just in Time (inventory system) – lean production – was their advantage. They were disadvantaged on scale compared to the Europeans or Americans, but they made this great leap in balancing production processes. For example, because a press has a much faster cycle time than an assembly line, (traditionally) you would churn out large volumes of pressed parts, stock them, switch to another press part, run up a stock of that and then you would draw on those stocks. You had a huge pile up of inventory and if there was something wrong with one of the parts, you would run up a huge number of defective parts and then you would find your assembly line was stopped.

Rennick: Under the American system, if they had a stack of parts that were found to be faulty, it was in the interest of the line worker to just put it onto the car and let it go, because if you stopped the line for whatever reason, you would be lucky to have a job at the end of the day.

Wormald: Instead of churning out stuff and shoving it down the line to the next stage, the Japanese ran the

presses and changed the press dies quickly and they only produced parts as the next stage needed it. That had enormous economic cost and quality advantages, but it was not an easy thing to learn culturally because it required a completely different relationship between management and the people on the shop floor. It was quite alien to the American, Henry Ford mass-production approach.

Japanese cars took a long time to gain widespread acceptance, but they changed the industry.

Wormald: Japanese cars were boring, but they worked. For manufacturers like Porsche, image and technical differentiation matter, but if you’re in the volume market, the cars are all much the same: the add-ons matter more than the base car. I think the industry, for a very long time, grossly overestimated the extent to which cars are sold on styling and emotional appeal in the volume car market. Most people are concerned with something that’s economical, reasonably fuel efficient and above all, cheap and reliable – it gets you there. The Japanese, and the Koreans later, hit that. They hit an unsatisfied demand.

You also talk about the impact of women.

Rennick: I’ve got a set of car magazines from the ’50s and they always talk about the man buying the car. The ads were aimed purely at the masculine

side of the business and the women were always an adornment to the car.

Wormald: That has totally changed in Europe. More women buy cars than men; they are the majority in the car-buying market. Most of them don’t have an interest in the car itself, it’s a tool, a means, that’s all it is. That changes things profoundly.

The British industry also faded away. Are there similarities with what happened in Australia?

Wormald: There are some similarities. The British car industry survived while the market was protected. The kiss of death was Britain joining what’s now the European Union, which dropped the tariff barriers. (Prime Minister) Ted Heath said, ‘We need to be in this otherwise our exports will be constrained.’ What I think he failed to realise was dropping those tariff barriers opened the British market to a lot of imports. The British industry produced some interesting and sometimes some bizarre products and the standards of quality were not terribly good. There was a certain arrogance, a certain assumption that there’s a great attachment to the national product, but when it was put to the test, people bought something from Europe. There is something of

that in Australia, relying too much on the traditional attachment to the distinctly Australian car. That’s one of the points we make at one stage in the book – the writing was on the wall early (because) people were rushing to buy boring Japanese and eventually Korean ‘econoboxes’. I put one little jibe in the book about an industry review – why did (the Productivity Commission) only talk to the fleet market, which basically responded, ‘Well, yes, as long as there is Australian product we’ll go on buying your cars.’ Nobody, evidently, ever thought of interrogating the (retail) consumers, or the dealers who would have seen what was going on. There was a lot of complacency here, and in Britain.

Rennick: Maybe another problem is that the makers here had very close relationships with their respective parent and they really took their running orders from the parent lock, stock, and barrel. When (Prime Minister Ben) Chifley had the proposals from GM and Ford, the Ford one implied a co-contribution from the Australian government in terms of funding, ongoing finance and equity, and therefore control, whereas GM said, ‘We don’t want anything from you, we will have total control of what we do here.’ If Australia had gone

for the Ford proposal and managed that control, well it might have ended up differently. The pre-war Menzies government had the idea of setting up an Australian manufacturer but theirs was going to be totally Australian owned, totally Australian run. It was going to be run by ACI – Australian Consolidated Industries, so there was a real mutual interest. There was never a mutual interest with GM and Australia or similarly, with Ford or Toyota. They just stayed here for their pleasure and pulled the plug when they wanted to.

Had it been granted a stay of execution, would COVID-19 have shut down Holden?

Wormald: That’s a very good question. Yes, absolutely. All (of GM’s) peripheral operations would have to go. During the GFC with the GM bankruptcy, ‘Uncle Sam’ was supportive but at a real price. They had to cut marginal brands, they had to close assembly plants in North America and they also had to get tough with the union. The UAW was a very big force and extremely protective of its members. Anything that was marginal, loss making, doubtfully profitable in the future, would be ruthlessly cut off. I really don’t think Holden would have had a chance of surviving that.

Business support every step of the way.

Whether you’re starting, running or growing your business, CommBank, proud Alliance Partner of VACC can help you do business your way.

Dedicated support for your business

To help you take your business to the next level, VACC members can benefit from direct access to a dedicated CommBank Relationship Manager and team of specialists who will work with you through every stage of your business life cycle. You’ll also receive 24/7 Australian based phone support for all your business banking needs.

Business products and solutions

VACC members may be eligible to access the latest innovative business banking products and solutions with preferential pricing applied to make it easier for you to do business. These include:

• No merchant joining fee

• Same day settlement every day of the year^

• Daily IQ - free business insights tool with CommBiz and NetBank

• Business Loans and Asset Finance

• Overdraft Facilities and Bank Guarantees

• Free business financial health checks

To find out how CommBank can help you do business your way, contact VACC on 03 9829 1152 or email marketing@vacc.com.au and they’ll put you in touch with a CommBank Business Banking Specialist

Where the streets have no cars

With communities in lockdown and fewer cars on our roads, Australia’s automotive aftermarket industry has already taken a sizeable hit from COVID-19, with the likelihood of more pain to come

WORDS Ged Bulmer

Anyone who ventured onto one of Melbourne’s streets during April and May couldn’t help but be struck by the eerie silence and near total lack of traffic in Victoria’s usually buzzing capital.

Having witnessed the impact of coronavirus (COVID-19) in China and Italy, Australians thankfully took seriously messaging about staying home and social distancing, and within a few weeks we saw a flattening of the virus growth curve. Meanwhile, similar scenes of empty city streets around the world reminded us that this is a global pandemic, with far reaching

operator Transurban saw a 17 percent drop in traffic on Melbourne’s CityLink in March.

50 and 60 percent fewer collisions respectively in the US cities of Seattle and San Francisco during the months where government coronavirus restrictions were in place there, so it’s possible to extrapolate a significant reduction here.

The lockdowns and reduction in kilometres travelled also mean many people have delayed essential servicing and other repairs. The Australian Automotive Aftermarket Association (AAAA) said that 83 percent of automotive service and repair workshops nationally reported a decrease in revenue, and 50 percent of these businesses experienced a downturn greater than 30 percent.

“When people aren’t getting their vehicle serviced or repaired, that results in wider implications for businesses that make, sell and distribute brakes, oils, engine parts, tyres, etc – a sector itself that employs an additional 360,000 people,” said AAAA Chief Executive Officer, Stuart Charity.

A survey by AAAA found that Victoria was the most affected state, with 61 percent of workshops experiencing a 30 percent or more decline in revenue. Nationally, metropolitan workshops have been hardest hit with 56 percent experiencing a 30 percent or more revenue reduction compared to 40 percent regionally.

AAAA CEO, Stuart Charity

Another impact of COVID-19 has been a rapid increase in the number of Australians shopping online, and it’s likely that the same dynamic is afoot in the automotive aftermarket sector. Australia Post’s delivery data shows an 80 percent increase in online shopping over the eight weeks to 15 May, compared to last year. McKinsey reports that in the US more consumers are now shopping for parts online, a trend that’s likely to be emulated here. On the other hand, changes that could help offset the reduction in business, due to reduced vehicle kilometres travelled, is a huge fall in the number of people using public transport due to health concerns, and the collapse in the domestic aviation industry. Both are likely to lead to greater use of personal vehicles which could drive positive outcomes for VACC member businesses. However, the drastic decline in new-car sales will have an impact on the broader aftermarket long into the future. According to VFACTS, just 59,894 vehicles were sold during May, a 35.3 percent reduction compared to May 2019. Meanwhile, June sales figures showed a slight hint of a recovery. But anecdotally, the Coalition’s Instant Asset Write-off Scheme seems to have had a positive impact on new-car sales, with the scheme’s recent extension to 31 December welcomed by the Motor Trades Association of Australia (MTAA). MTAA CEO, Richard Dudley said the decision to extend the initiative means many small businesses which were wavering on making a purchase due to doubts over delivery before 30 June will now go ahead. Throwing forward to 2025 and beyond, when many of this year’s new vehicles come out of their manufacturer warranty periods, the reduced sales will be felt in a reduction in the number of

the independent aftermarket. A more positive view is that people holding onto vehicles longer equates to an older fleet requiring more servicing and repairs.

The McKinsey report found that the lightvehicle aftermarket has typically been the most recession-resistant part of the automotive industry. Its size primarily depends on the size of the car parc, rather than new-vehicle sales. When economic pressure causes drivers to delay purchasing new cars, repairs on their current (and older) vehicles become even more vital.

Acknowledging the uncertainty ahead, McKinsey conducted modelling to see how the world economy might evolve in the months ahead. In the more optimistic scenario, which is closest to the Australian experience, a strong public-health response succeeds in controlling the spread of coronavirus; policy responses partially offset economic damage; a banking crisis is avoided;

and global GDP recovers in the fourth quarter of 2020. In the more pessimistic scenario, the virus resurges, business activity slows or ceases, and global GDP does not recover until late 2022.

Applying these forecasts to the US and Europe, they came up with optimistic aftermarket revenue declines of three to five percent for the US and five to seven percent for Europe. The pessimistic view was 12 to 15 percent decline for the US and 15 to 17 percent decline for Europe. While none of which is necessarily accurate for Australian operators, it provides some guidance on the likely scenario here. What we can budget on, according to McKinsey, is slower long-term growth, probable viral resurgence, and a muted global recovery that occurs in stages. Social distancing and remote working is also likely to be part of our world for the foreseeable future, meaning continuing low vehicle kilometres covered. On the positive side, McKinsey sees higher use of personal vehicles in lieu of public transport; low fuel prices encouraging vehicle use; and average vehicle age increasing as people delay new-car purchases due to economic uncertainty.

MTAA CEO, Richard Dudley

SMART POWER

SAVE ON YOUR ENERGY BILLS WITH OUR MEMBER EXCLUSIVE OFFER

Simply send Smart Power a copy of your current bill and they will do a comparison with VACC's approved electricity providers.

Smart Power, a leader in the Energy Management industry, are offering a free comparison to evaluate your current energy bills.

Smart Power's comprehensive energy management team ensures businesses achieve energy efficiencies, accurate reporting, saving you time and money.

Their independent, expert advice can provide you with the tools to be more efficient, sustainable and achieve the best possible overall productivity for your organisation.

Get in touch now to claim this limited time offer!

Contact Daniel Ellul from VACC Marketing by phone 9829 1152 or email dellul@ourauto.com.au

VACC

Vehicles as sensor platforms

WORDS Paul Tuzson

We’re watching you

Almost everybody in the automotive world is familiar with sensors. Lambda, coolant temperature, oil pressure, knock, MAP, MAF, speed, tyre pressure and others are all well known. But these days there’s even more to the story. All sorts of things can be monitored, and everything can be logged. Even more importantly, all the logged data can and will be transferred from your car to other interested parties, with a variety of consequences.

Sensor systems can determine several things besides the conditions they’re designed to monitor directly. The latest tyre pressure sensors provide a good example of how secondary inferences can be derived from directly sensed primary data. Tyre pressure sensors have been mandatory across the EU since 2014 in the name of increased safety, reduced fuel consumption and lower CO2 emissions. While not mandatory in Australia, these will eventually be compulsory here.

So far, tyre pressure sensors have been relatively bulky components fitted in conjunction with valve stems. They are powered by small disc-type batteries that have relatively significant mass, despite their diminutive size. Newer types will utilise thin film technology, which we covered last edition. This will allow such sensors to be embedded directly in the cases of tyres where they can gather a wider range of data.

A company called IEE is developing this embedded sensor technology and says these new ‘intelligent tyres’ will be able to sense internal and external temperatures, tread depth, road condition, axle load and wheel alignment. As such technology becomes available, every tyre on Earth will be numbered and monitored from manufacture to end-of-life. But why?

While tyres are essential for the modern world, they’re also a big problem. We all know that, but we just don’t think about it much. Tyre manufacturing consumes both resources in enormous measure and

A company called Yanfeng is developing a customisable vehicle interior called Active Space. The interior space is captured by a nearinfrared stereo camera and utilises gesture analysis and smart surfaces for input (far left). Tyres with embedded thin-film sensors are an example of how sensed data can be analysed to create data not directly sensed (top left). Embedded thin-film sensors will do much more than notify drivers of under-inflated tyres (above left). Retreading tyres will help reduce ugly and environmentally damaging dumps like this (above)

energy in copious quantities. End-of-life disposal is also an issue. Maximising service longevity and re-use (by retreading) will be important to minimise environmental impact. Also, thin-film tyre-embedded technology can generate power for thinfilm sensors by piezoelectrical means. Aside from the directly sensed data mentioned above, all sorts of other things will be inferred from the primary data, like driving style and habits, speed, attention to maintenance schedules, etc. These will all be logged and transferred back to a central server somewhere. Now many of these things, like speed, will be directly detected by other dedicated sensors. However, anyone who’s thought about it knows that wildly excessive speed is not the only form of dangerous driving. If wheel speed sensors show that speed is under the limit, yet heat and stresses in the tyre tread are excessive and coupled with a high slip angle, a quick cross-reference to steering angle input will show that a car is being driven on the edge. So, to be clear, the systems to which automotive sensors are connected will create secondary data. But we won’t mind, we never do. We’re like frogs in water slowly coming to the boil, wondering why things are getting so hot. Apart from sensors that monitor things like tyres, suspension, drivetrain and engine, cars of the not-too-distant future will have a whole new range of in-cabin biometric sensors that monitor occupants. Of course, many of these systems exist now in nascent form, at least, but there will be more, and they’ll be more advanced. First, all cars will have driver identification, whether drivers like it or not. This is for vehicle personalisation. Also, when fully autonomous vehicles are on the road and offering Transport as a Service (TaaS), it will be imperative to record who has been in a car. This is because some people do unspeakable things when they can remain anonymous. Certainly, most people are fine and decent, but it only takes one to leave an unpleasant reminder of their presence. In a TaaS car the sole, or primary, occupant will be known because of booking and payment information. However, cars will also know exactly how many people are in the vehicle, their age, weight, size, and more. This information is needed for tailoring the vehicle accident restraint system to each occupant. In fact, there will likely be 3D maps of each occupant, along with vital sign sensors that monitor health and well-being.

Numbering and logging every tyre made will feed into the Internet of Things. This is the underpinning of what’s known as Industry 4.0, in which the service life of components remains linked to manufacturing (left). Data could be stored in the car itself and then provided when pulled by external authorities. This would provide a massive distributed server system with excellent redundancy. Watch this space (below). Facial recognition applies nodes to various features and then tracks how they move relative to each other (right)

If a biometric sensing system detects that a driver is suffering, or is about to suffer, a health problem, like a heart attack or stroke, the car will act appropriately. A fully autonomous vehicle will take an occupant suffering a medical episode to hospital, or to the closest ambulance (which will already be making its way to the patient).

The car of the not-toodistant future will also have aids like gesture recognition and hands-off wheel detection, which will be a factor for activating autonomous mode. No more accidents when wrestling with something that ideally shouldn’t be taking your attention. There will be unattended child detection, drowsiness detectors, distraction detectors (both already available) and

emotion detection. IEE describes all of this as The Car as a Wellness Oasis. It’s all brilliant and useful technology. So, how is all of this, particularly emotion, to be sensed? Well, it turns out that ordinary CCD cameras can be built to notice all sorts of things, like facial expressions. These, as we all know, indicate emotions. Images of faces produced by such cameras have position indicating nodes overlaid on them and as facial features move, the nodes move with them. Analysing the movements of the nodes in relation to each other allows the system to determine if the subject is smiling, frowning, laughing, showing revulsion, anger, surpise, fear and other emotions based on the movements of the nodes. This type of analysis can also indicate distraction and drowsiness. None of this is particularly new. Research in the field has been going on for years. What will be new is the way the data will be processed and used in fully connected vehicles.

Cameras can also be used to take our pulses by analysing changes to the light reflective properties of small portions of our skin. These changes to reflectivity occur because of fluctuations in blood flow caused by heartbeat. This will be linked to the entertainment we’re consuming at the time. It’s interesting that online games offer heart rate monitors that are fully intertwined with game play. It’s suggested that this provides a more immersive experience, but an equally important reason is to gather data about how players react to features within the game. This will feed into product development.

Voice is another emotional indicator, but it’s even more than that. Analysis of the way we speak is used as a form of unique identification around the world. However, speech pattern analysis can also reveal much more about us, like level of education, financial position, and social standing. Cars of the future will listen to us and analyse the pronouns, metaphors, tenses, and many other factors we use to come up with a comprehensive view of what we are and what we like. This will also feed into product development and likely spending preferences. Also, keep in mind that data gathered from cars is just one part of the digital classification scheme in which we are enmeshed. Siri, Alexa, our phones, and an increasing number of other listening devices will continue to form the backbone of such data-building systems. Our cars will be another of those devices. Let’s shift gear and talk about China to see where all of this is leading. China is in love with biometric sensing, particularly facial recognition technology.

STOP PRESS

Melbourne has been locked down again. This seems like the appropriate strategy. The question is, if the government could simply control cars trying to leave the affected areas, or others trying to enter such areas, would they? We think yes. Again, this would probably be a good thing to do but once a government is in the habit of controlling transport in that way would it be more likely to do it on successive occasions for less valid reasons? We think yes. They sure would in China, Russia and many other places besides.

In China, signing up for a mobile phone contract now requires a compulsory face scan (above right). The iris provides a very reliable means of personal identification, however, obtaining a scan generally requires conscious participation from the subject (below). Mass surveillance systems like China’s Smart Eyes will ensure compliance with state orders like the Stay at Home Directions associated with Coronavirus. In fact, this will ensure compliance with any state dictum (bottom right)

By now, most people have probably heard of the Chinese mass surveillance system known as Sharp Eyes, often referred to as Black Shield after the dystopian work of fiction with the same name. Sharp Eyes is an indiscriminate mass public surveillance system that spies on all its citizens through a network of over 600 million cameras. The system observes behaviour and adjusts a social score attached to each person observed. Acts judged as positive for society increase scores. Those seen as socially negative deduct points. The system can also identify individuals by the way they walk. It also reads vehicle number plates. China has a lot of people, which makes it impossible to analyse the data gathered by manual means. So, the Sharp Eyes camera network is backed by artificial intelligence (AI). We’ve covered AI in previous issues. People who accrue positive scores receive discounted bills and have their faces put up on public bulletin boards for all to admire. Those who have low scores also have their images posted for all to see. They also have more difficulty getting loans, finding accommodation, and even traveling. The Chinese government says the system is not used for political oppression but there appears to be testimony to the contrary. It is hard to believe but most Chinese seem to approve of the system.

Smart Eyes tracks vehicles, so it can monitor all aspects of society. It is our contention that China will use fully-connected vehicles to directly restrict physical movement when it deems such measures appropriate (top). All the data generated by the Internet of Things will require massive server storage capacity. The major players in surveillance, both East and West, are building such capacity (above). Companies are trailing all sorts of approaches to secure server storage. Microsoft is investigating the idea of underwater servers at sea. Cooling should

Most Westerners think they would never support such a system. The only problem is that we do, and heartily. Every time we post something on social media, we help to build a data-defined version of ourselves on a server somewhere. All the media we absorb, all the things we buy and all the places we go will eventually feed into our digital profile. Much of it already does. Also, this constantly updated, involuntary digital adjunct to our ‘real’ selves will be aware of