Premium beam blades for 96% of fitments, designed for Australia

Advanced frameless design for superior performance

WIPERS SAFETY CHECK

No matter the weather, ensure your wipers are inspected before you hit the roads!

tr icopr oduc ts.com.au

Tailored wipers that ensure a perfect match for your vehicle, maximising performance and ease of installation

TRICO’S UNMATCHED QUALITY

Trico are the only wipers tested to 3 x OE standards (1.5m cycles)

WIDE PRODUCT RANGE

Trico wipers fit more vehicles than anyone else!

SCAN THE QR CODE to find the right wipers for your vehicle and check out our new website

17 Policy shift

From supporting local manufacturing to controlling imports, the government decisions that reshaped an entire industry.

18

Driving change

Stephen Lester shares insights from his dynamic 20-year journey across four countries and multiple automotive giants.

24

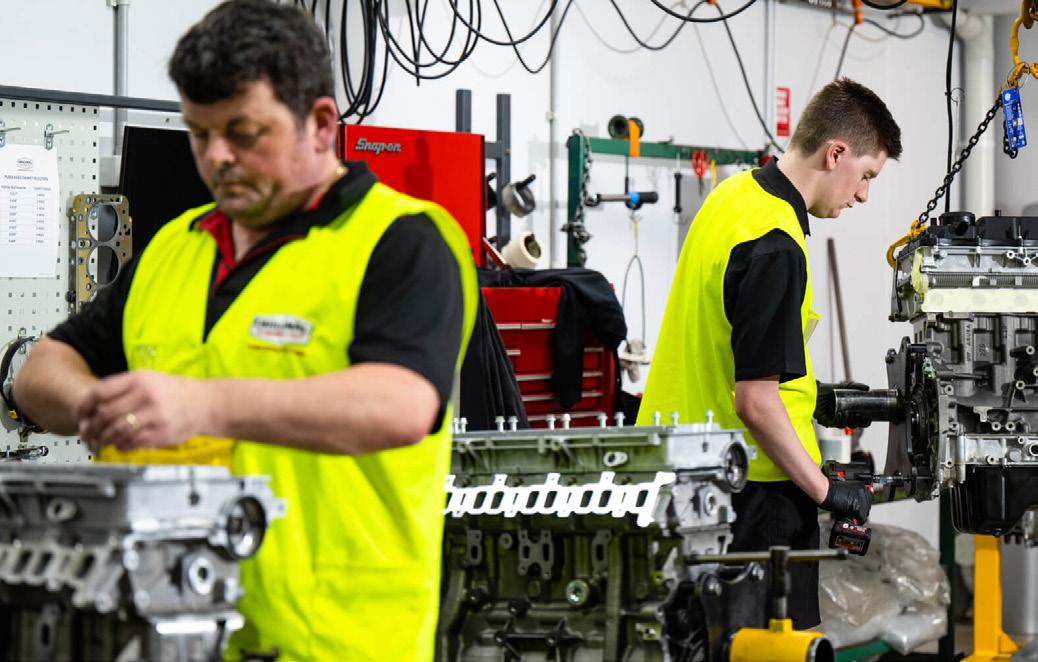

Hands-on

Automotive apprenticeships delivers long-term careers, and financial independence—all without the HECS debt. 27

50 year members

We celebrate Junction Tyre & Auto Services and Lonsdale Street Auto Electrics who have dedicated half a century of service to Victoria’s automotive industry

32

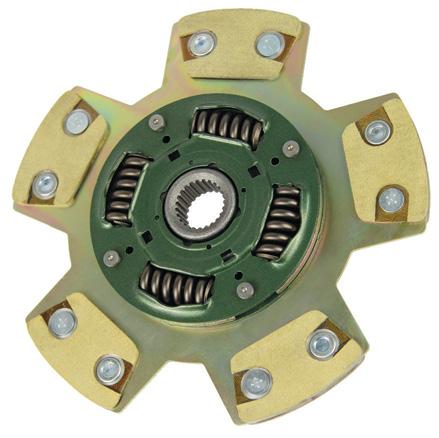

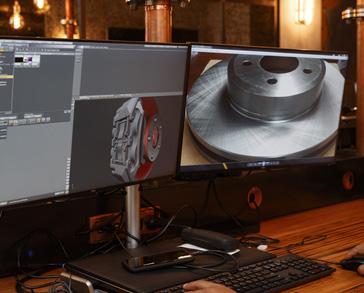

The circular engine

Original Engines Co is proving that the future of automotive sustainability is about revolutionising how we use what we already have 36

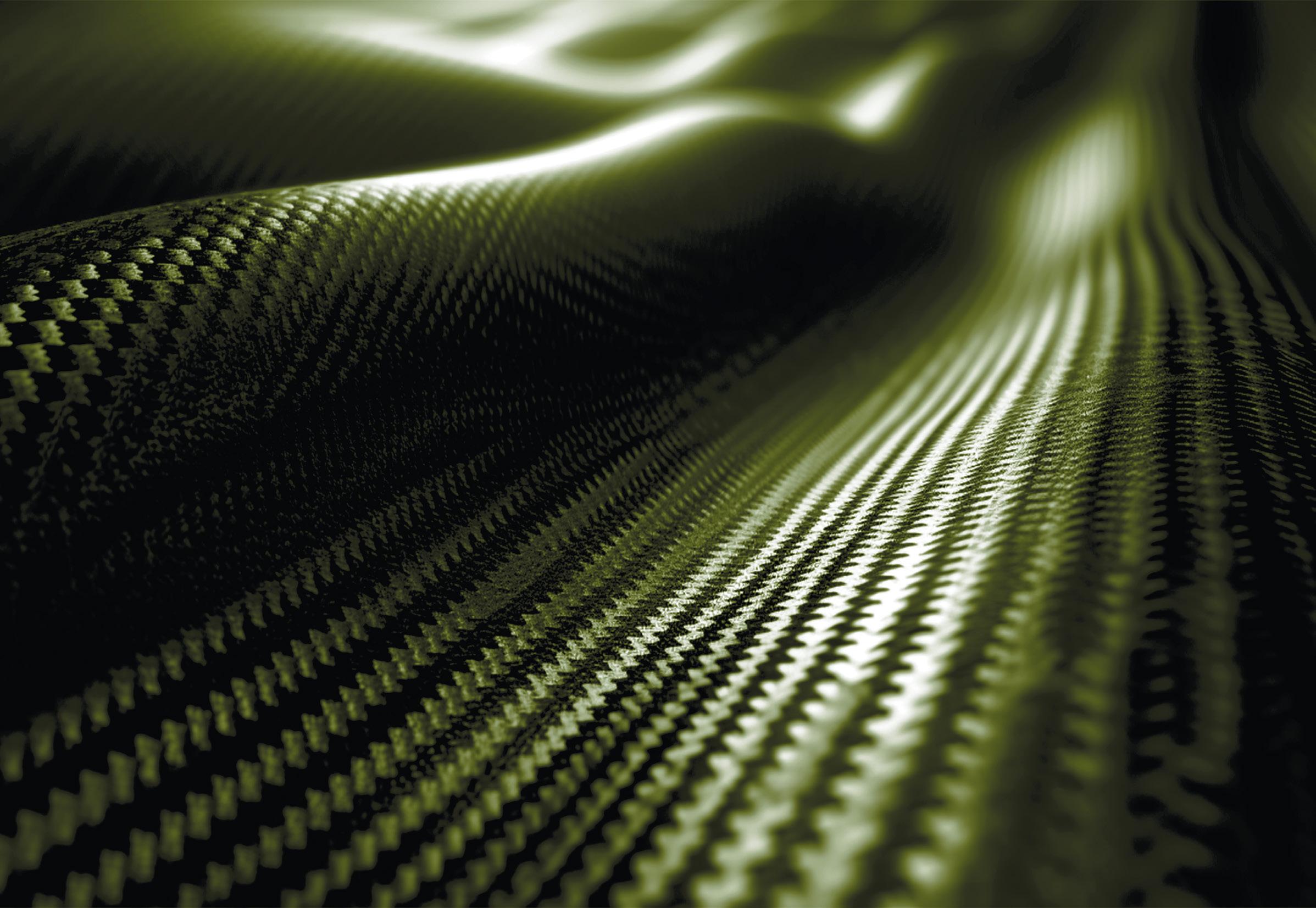

The materials gold rush

The Australian automotive industry has witnessed the most dramatic shift in materials thinking since Henry Ford discovered assembly lines. 43

VACC leads the charge

VACC positions itself at the forefront of industry safety initiatives with the launch of the Automotive Industry Guide for Electric Vehicles – Guide

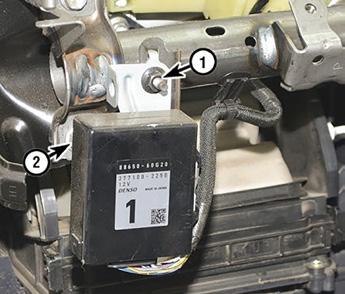

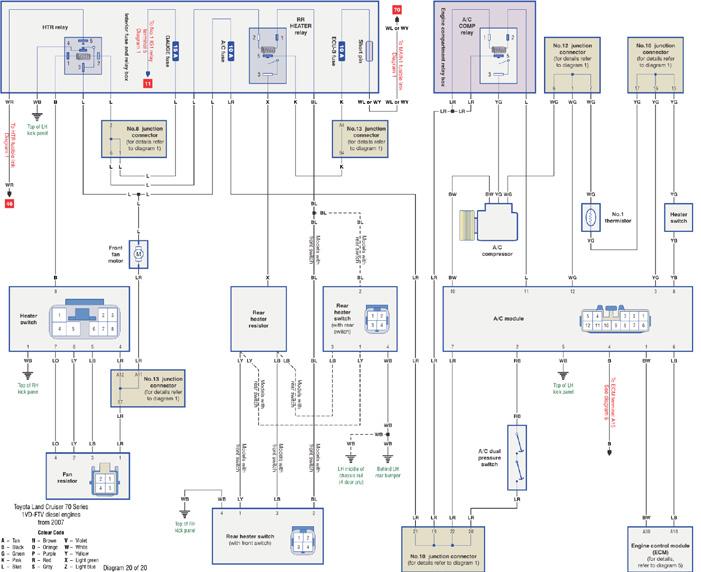

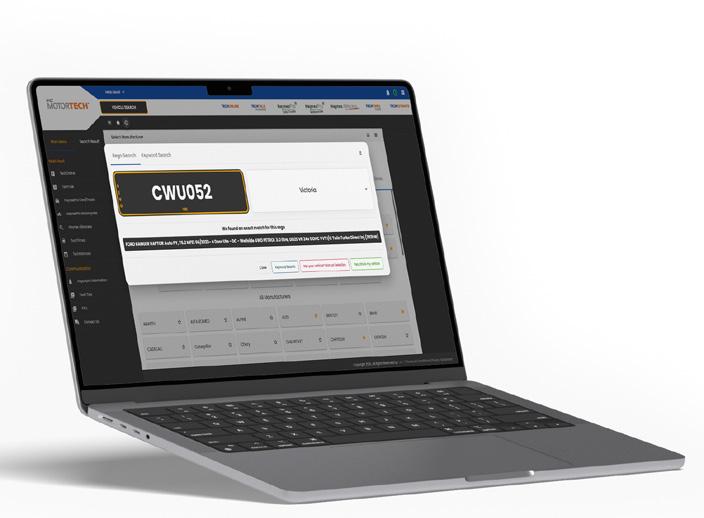

48 Technical

We take a look at the Toyota Prado sub-tanks and jet pumps and the Toyota Landcruiser A/C Relay

60

The last word

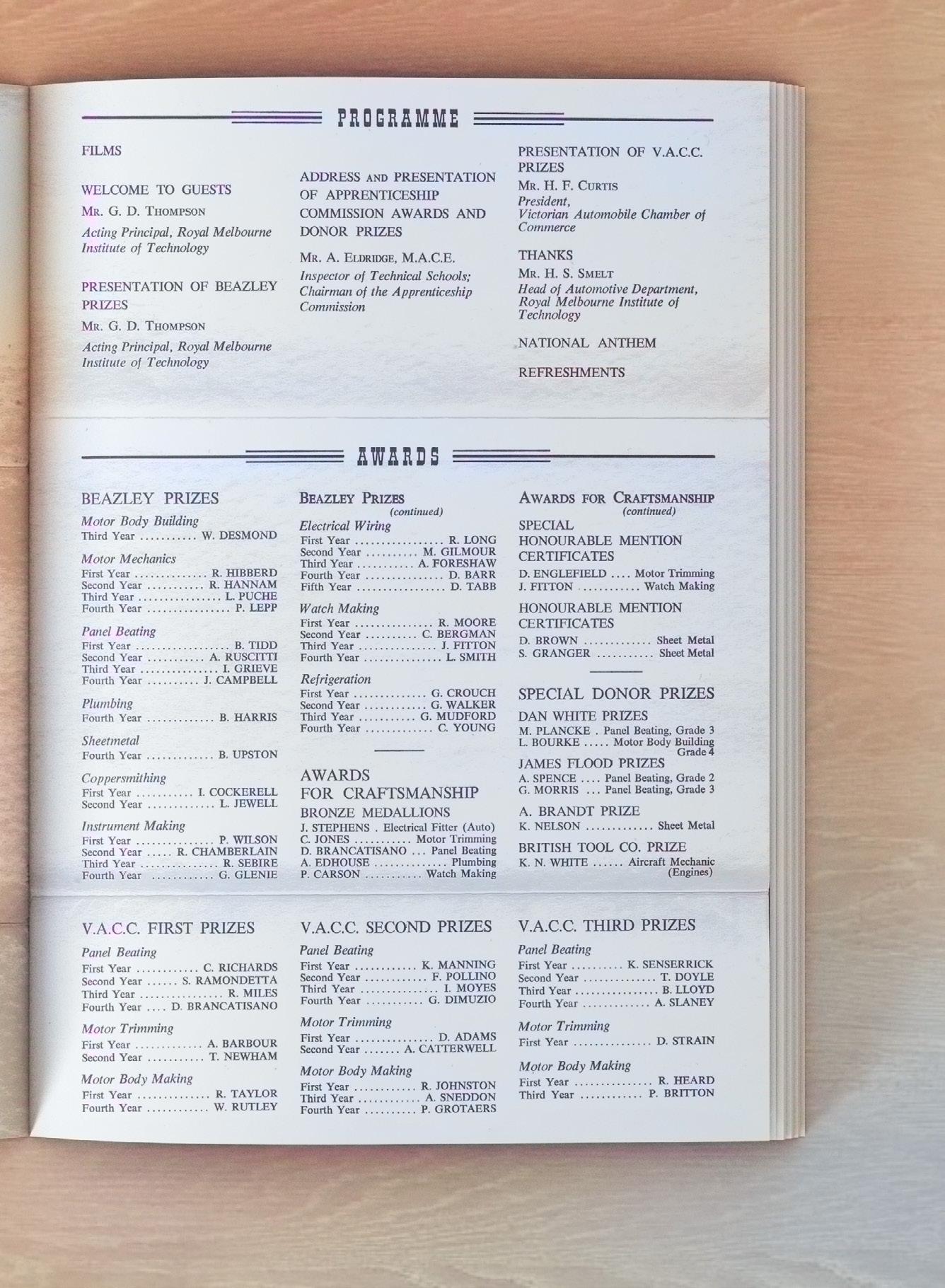

The Royal Melbourne Institute of Technology Apprentice Awards night Programme from June 1965 63

Celebrating AIA

See all the award winners from the 2025 Automotive Industry Awards and the VACC and TACC Apprenticeship Awards.

Peter A. Jones Chief Executive Officer

As we look to the future of our industry, one word defines the path forward: sustainability. This theme is no longer an abstract ideal or a long-term aspiration. It is present-day; one that speaks not only to our environmental responsibilities but also to the long-term viability of our businesses, our workforce, and our role in a rapidly evolving economy.

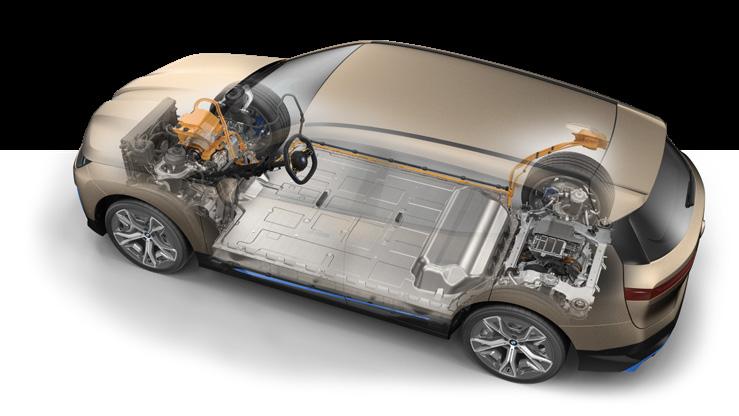

The automotive industry has been a cornerstone of innovation, employment, and mobility in Victoria and Tasmania. With the July 1 introduction of the New Vehicle Efficiency Standard (NVES), the federal government has made clear the direction of travel: a future shaped by more electric, hybrid, and hydrogen-powered vehicles. The shift to low- and zero-emissions transport is not coming—it is here.

We welcome this change but do so with our eyes wide open to the challenges and opportunities it presents. The NVES outlines an ambitious vision to accelerate the adoption of new energy vehicles, develop supporting infrastructure, and position Australia as a player in the global clean mobility market. For our members, this means significant change in how we operate, how we train, and how we future proof our businesses.

Environmental sustainability in automotive is not just about the vehicles we service and sell. It is about the entire value chain: from manufacturing and supply to disposal and recycling. It’s about improving workshop energy efficiency, reducing waste and emissions, and contributing to a circular economy.

Many of our members are already innovating in these areas, showing leadership by investing in cleaner practices, sourcing greener products, and embracing technologies that lower environmental impact.

Sustainability is also about business resilience— ensuring that our workshops, dealerships, service centres and support industries continue to thrive through the next wave of disruption. It means preparing our businesses for the inevitable rise in hybrid and electric vehicles (EVs), understanding the implications for service schedules, safety protocols, and customer expectations.

The powertrain of the future is no longer combustion alone. The skills required to diagnose, maintain and repair vehicles is evolving, and this requires ongoing investment in equipment and training. This is not a challenge for tomorrow. Already, EVs make up an increasing share of new vehicle sales and by 2030, that percentage of total sales will be significantly higher.

We have taken decisive action to support our members on this journey. Earlier this month, we launched the first of a two-part EV Guide for Motor Repairers, with the second volume due in the coming months. This guide provides practical, accessible information on how to prepare your workshop for hybrid and electric vehicles—from workplace safety to tool requirements to upskilling staff. It also sets out compliance responsibilities and highlights the best pathways for training and accreditation.

Additionally, we are working closely with government and education providers to ensure that training for apprentices and qualified technicians keeps pace with technological change. Our recent submission to the Motor Vehicle Repair Industry (MVRI) Code Review included the following points: expanding the Code’s coverage to include emerging technologies such as electric vehicles (EVs), hybrid systems, and advanced driver assistance systems (ADAS), is essential to future-proof the MVRI framework and ensure it remains relevant as the automotive sector evolves.

“The shift to low- and zero-emissions transport is not coming—it is here.”

We are also advocating for funding and incentives that help members update their facilities, upgrade diagnostic equipment, and access upskilling opportunities. Too often, the burden of change is placed on industry, without adequate support. We believe that a sustainable automotive future must be a shared responsibility.

Just as important is helping customers understand these changes. The vehicles on our roads are changing, and with them, consumer behaviours and expectations. We must be ready to educate our customers, the differences in servicing EVs, the changing nature of warranties, and the real-world costs and benefits of owning a low-emissions vehicle. This is where the trust and relationships that independent repairers and dealerships have built over decades become a strategic advantage. Use it. Lead with it.

We are committed to being both a source of truth and a source of support. We are here to provide clarity amid complexity, certainty in the face of change, and solutions that help your business not only survive, but thrive in this changing environment.

But we cannot do it alone. Sustainability is a collective endeavour. It requires you to be proactive, informed and open to innovation. It means reviewing your business model, assessing your training needs, and beginning the transition now, not later. It also means telling us what you need. Your feedback, insights, and lived experiences help shape the policies we fight for, the training we deliver, and the assistance and tools we share.

The future of our industry is electrified, connected and clean. But most importantly, it is sustainable, in every sense of the word.

We are advocating for funding and incentives that help members update their facilities, upgrade diagnostic equipment, and access upskilling opportunities.

MANAGING EDITOR

Karla Leach 03 9829 1247 vaccautomotive@vacc.com.au

SUB-EDITOR

Andrew Molloy

DESIGNERS

Faith Perrett Gavin van Langenberg 03 9829 1189 creativeservices@vacc.com.au

CONTRIBUTORS

John Caine, Andrew Molloy, Rod Lofts, Bruce McIntosh, Imogen Garcia Reid, Daniel Hodges, Paul Tuzson

CORPORATE PARTNERSHIPS

John Eaton 0407 344 433 jeaton@ourauto.com.au

PRESIDENT

Craig Beruldsen

CHIEF EXECUTIVE OFFICER Peter Jones

Official publication of the Victorian and Tasmanian Automotive Chambers of Commerce 650 Victoria Street, North Melbourne VIC 3051 03 9829 1111 ABN 63 009 478 209

omissions contained herein. The publishers, authors and editors expressly disclaim all and any liability to any person whomsoever whether a purchaser of this publication or not in respect of anything and of the consequences of anything done or omitted to be done by any such person in reliance, whether whole or partial upon the whole or any part of the contents of this publication. Advertising accepted for publication is subject to the conditions set out in the VACC Automotive rate card, available from vaccautomotive@vacc.com.au 57,

any

In today’s competitive automotive landscape, attracting and retaining skilled talent has become more challenging than ever. For many companies, the answer lies in developing the next generation through apprenticeships, but success depends on becoming an employer that apprentices want to work for.

Apprentice employers of choice create positive and rewarding experiences for their apprentices, with retention to completion as the primary focus. It’s not just about offering a training place; it’s about nurturing talent that will drive your business forward for years to come.

Building the foundation for success

Create a positive and supportive work environment that goes beyond the workshop floor. Encourage open communication from day one, providing constructive feedback every week rather than waiting for formal reviews. Recognition matters enormously; celebrate their achievements, no matter how small they might seem. Most importantly, show genuine interest in your apprentice’s life outside the workplace. This human connection often makes the difference between someone who completes their programme and someone who thrives in it.

Treat your apprentice with fairness and equity across all aspects of their experience. When apprentices perceive fairness in promotions, resource allocation, and day-to-day treatment, it contributes to a positive and equitable work environment. Remember, they’re watching how you

treat other employees; it’s a preview of their future with your company.

Investing in proper development

Develop a robust training programme that combines practical experience with proper mentorship. Put in place an on-the-job learning experience supported by a suitable mentor who genuinely wants to see them succeed. Offer variety in their work that aligns with their Training Plan, ensuring they achieve the skills and knowledge your business requires, whilst keeping

well-being. Remember, they’re adapting to the world of work for the first time—a little flexibility goes a long way in helping them settle in successfully. The bottom line benefits

Being an employer of choice ultimately reduces the cost of doing business. Your company will attract, develop, and retain motivated, skilled, and loyal employees who understand your specific way of doing things. In the automotive industry, where technical expertise and company culture are paramount, this

"Employing apprentices is about building the foundation for your company’s future success."

them engaged and challenged.

Offer clear career development opportunities from the outset. Discuss pathways for advancement within your company and be transparent about what their role might look like after completing their apprenticeship. This forward-thinking approach shows apprentices they have a genuine future with your organisation, not just a temporary training placement.

Embracing modern work practices

Offer flexible work arrangements where possible within your workplace constraints. Flexible arrangements allow apprentices to balance their work and personal commitments better, leading to reduced stress and improved overall

approach develops talent that’s perfectly aligned with your business needs.

The long-term growth and success of any automotive business rely on its employees to continually develop and upskill. Employing apprentices isn’t just about filling immediate skills gaps; it’s about building the foundation for your company’s future success.

When you become an apprentice employer of choice, you’re not just training tomorrow’s workforce; you’re creating tomorrow’s leaders who will drive innovation and excellence in your business for decades to come.

Nigel Muller Training and TACC Contact autoapprenticeships@vacc.com.au

for more information.

The VACC IR team has observed a significant increase in ‘wage theft’ allegations by former employees, as part of unfair dismissal and general protections claim proceedings, in what appears to be a deliberate strategy to undermine the credibility of their former employer.

Members are reminded that the ‘wage theft’ amendments to the underpayment provisions of the Fair Work Act 2009 (FW Act) commenced on 1 January 2025. The offence carries criminal sanctions for employers who intentionally engage in conduct that results in an employee not receiving their full wages on or before pay day – and applies in relation to employee entitlements (including superannuation) under the NES, modern awards and

enterprise agreements, but not to ‘over-award’ contractual entitlements provided under a common law employment contract.

Members should note that intentionality is the key component of the ‘wage theft’ criminal underpayment offence. Intentionality is established in relation to the authorisation or permission to commit the offence, is the key component of the offence, if it is proved that: the board of directors or body that exercises the executive authority of the employer intentionally engaged in the conduct or expressly, tacitly or impliedly authorised or permitted the commission of the offence

a ‘high managerial agent’ (e.g. senior manager) of the employer intentionally engaged in the conduct or expressly, tacitly or impliedly authorised or permitted the commission of the offence and the employer cannot prove that it exercised appropriate diligence to prevent their conduct a corporate culture existed within the employer that directed, encouraged, tolerated or led to non-compliance with the contravened law; or the corporation failed to create and maintain a corporate culture requiring compliance with the FW Act. Importantly, this means that an employer may be considered to have committed the offence

even if they didn’t deliberately mean to underpay employees.

In addition to employers, other persons (including individuals or other corporate entities) can also be prosecuted under ‘related offence provisions’ for their conduct.

Employers, including small businesses, face penalties of up to 10 years’ imprisonment and/or a maximum fine of 5,000 penalty units (currently $1,650,000) for an individual and 25,000 penalty units (currently $8,250,000) for a body corporate (or 3 times the amount of the underpayment, if greater).

The Fair Work Ombudsman (FWO) will be primarily responsible for investigating the new criminal

offence and will then refer matters to the Commonwealth Director of Public Prosecutions or the Australian Federal Police for prosecution where appropriate. Voluntary Small Business Wage Compliance Code

Following its declaration by the Minister for Employment and Workplace Relations on 6 December 2024, the Voluntary Small Business Wage Compliance Code (the Code) confirms firstly, that if the Fair Work Ombudsman (FWO) is satisfied that a small business employer (i.e. less than 15 employees) has not intentionally failed to pay an applicable amount to an employee in full on or before the day it is due for payment, than it must not refer the matter for criminal prosecution; and secondly, that compliance with the Code does not prevent the FWO from taking civil action in relation to the conduct.

Members are reminded that there is no requirement under the Code for a small business to proactively report any underpayment to FWO. Members are encouraged to contact VACC’s IR team prior to engaging with the FWO.

An employer who self-reports conduct that it considers to be a criminal underpayment offence (i.e. an intentional underpayment) can request to enter a cooperation agreement with the FWO. A cooperation agreement is a written agreement between the FWO and a person (i.e. individual, corporate entity) which provides protection from potential criminal prosecution – but not civil prosecution. In essence, a cooperation agreement is therefore analogous to the ‘enforceable undertakings’ currently used by the FWO in civil penalty proceedings, except they only relate to resolving the issue of criminal liability.

In practice, cooperation agreements may also be used by the FWO to secure the cooperation of individuals who might be privy to evidence that would assist in proving wage theft offences against

Workplace Relations

an employer or senior director of an employer in a manner not dissimilar to immunity agreements used by other regulators such as the ACCC. It is important to note that as cooperation agreements relate to intentional underpayments, FWO will not enter into a cooperation agreement with a person who has ‘unintentionally’ underpaid an employee Members are strongly encouraged to contact VACC’s IR team and/or seek independent legal advice prior to requesting a cooperation agreement from the FWO.

Regardless of the size of their business, the focus for all employers should be on ensuring that they have appropriate processes in place – and if a pay issue arises, being able to demonstrate that you have been proactive in resolving the issue as quickly as possible and have taken reasonable steps to ensure that the issue does not arise again. To establish and maintain a culture of compliance, VACC recommends that members ensure: reasonable steps are taken to work out correct pay rates and entitlements (e.g. VACC Wages Guides), including through contacting VACC’s IR team for assistance as needed they stay up to date with changes in workplace laws (e.g. VACC IR Bulletins)

payroll staff are sufficiently trained, with refresher training provided as needed any areas of potential vulnerability are appropriately addressed, including that completed timesheets are received by payroll in a timely manner before pay run regular payroll audits are conducted Members seeking further advice or assistance, including in relation to training and compliance audits, are encouraged to contact VACC’s Workplace Relations team on 03 9829 1123 or ir@vacc.com. au. In addition, further guidance on the Code is available here.

Contact ir@vacc.com.au for more information.

The Victorian Automotive Chamber of Commerce (VACC) continues to be a strong and consistent voice for the automotive industry, working closely with government officials, ministers, senior bureaucrats, and regulators to ensure the voice of our members’ is heard. Whether in face-to-face meetings, formal consultations, or detailed policy submissions, VACC is firmly focused on achieving outcomes that protect and promote the interests of its members and the broader automotive sector.

Over recent months, VACC has been particularly active in representing members’ interests, responding to a range of government consultations and contributing evidence-based recommendations to shape policies that affect daily business operations. These advocacy efforts reflect VACC’s ongoing commitment to supporting more than 5,000 automotive businesses across Victoria and Tasmania.

Some of the key submissions made in recent months include:

A detailed response to the draft Motor Vehicle Insurance and Repair Code of Conduct, seeking fairer and more transparent relationships between repairers and insurers.

A response to the Review of the Professional Engineers Registration Act (2019), emphasising the need for appropriate distinctions between disciplines and avoiding unnecessary red tape for automotive engineers.

A strong response to the Essential Service Commission on accident

towing, storage and salvage fees, seeking fair storage and salvage fees in line with raising costs and other Australian jurisdictions.

• Engagement with Victoria’s Energy Safety Review, advocating for EV technician classification that recognises the existing automotive training frameworks and qualifications.

A submission on Victoria’s Fair Fuel Plan, cautioning against measures that would impose additional burdens on fuel retailers.

VACC also made a submission to the Productivity Commission’s National Competition Policy Analysis 2025. We argued that occupational licensing, and really any regulation, should only be introduced when there is a clear and valid reason. It is important for the Government to avoid adding unnecessary red tape and extra rules that increase business costs, unless truly needed. Good policy is based on evidence, and aims to reduce duplication and simplify compliance. Instead of making things harder for Victorian employers—especially small businesses—regulation should focus on practical outcomes that support industry growth while keeping compliance as simple as possible.

VACC has also raised concerns about the potential impact of any proposed new licensing frameworks on skills

Dr Imogen Garcia Reid Industry Policy

development and workforce capacity. Deloitte Access Economics research commissioned by VACC reveals that among 456 surveyed businesses, 1,800 automotive job vacancies were advertised in 2024, but only 700 were filled — a 38 per cent fill rate. VACC has argued that introducing new licensing requirements could further hinder recruitment, especially at a time when skilled workers are already in short supply.

VACC also works through the Motor Trades Association of Australia to ensure that Victorian and Tasmanian perspectives are considered at the national level. This collaboration ensures that industry voices are heard across multiple jurisdictions and that policy development is consistent with the needs of automotive businesses.

As the automotive industry adapts to technological change and evolving consumer expectations, VACC remains focused on securing a policy environment that enables innovation, supports business growth, and maintains high safety and service standards. Through ongoing consultation, research, and member engagement, VACC continues to strive for improved outcomes for our members and industry as a whole.

Reach out to policy@vacc.com.au for more detail.

As Tasmania’s automotive industry navigates one of the most significant transformations in its history, our island state finds itself uniquely positioned to become a world leader across multiple automotive sectors. At TACC, we’ve presented an ambitious yet achievable roadmap to the incoming government that could see Tasmania punch well above its weight on the global automotive stage.

We’re not just keeping up with the rest of the world; we can lead it. With over 400 member sites employing 7,500 Tasmanians across twenty automotive sectors, our industry represents a significant economic force ready to embrace change whilst maintaining our commitment to excellence.

The foundation of this transformation lies in skills development and training infrastructure. The closure of TasTAFE’s Campbell Street facility last December, whilst challenging, has catalysed discussions about creating worldclass training facilities that could serve as international benchmarks. Our proposal for a $15 million infrastructure programme spanning four regional campuses would establish specialised learning hubs, from body repair and refinishing in Devonport to cutting-edge automotive electrical systems in Hobart.

We’re already seeing unprecedented growth with 840 apprentices in Certificate III programmes and 150 VET students preparing for automotive careers. The new government can build on this momentum and create training facilities that rival those globally.

Road safety presents another leadership opportunity. Tasmania’s mature vehicle fleet, averaging 13.3 years compared to the national 10.6 years, offers unique insights into vehicle longevity and maintenance.

Our proposal for comprehensive roadworthy inspection systems could establish Tasmania as a pioneer in vehicle safety standards, particularly given community support with 81 per cent of RACT survey respondents backing enhanced safety inspections.

Perhaps most exciting is Tasmania’s potential in the transition to zero and low-emission vehicles (ZLEVs).

could establish new benchmarks for environmental stewardship.

What’s particularly encouraging is the collaborative approach evident throughout our submission. The 2023 Automotive Industry Compact between TACC and the previous government demonstrated how industry-government partnerships deliver results. This model of cooperation could be expanded under the new administration.

"We’re not just keeping up with the rest of the world; we can lead it."

With our state’s renewable energy advantages and commitment to net-zero emissions, Tasmania could become Australia’s electric vehicle hub. However, this requires careful orchestration between government policy and industry capability.

The transition to ZLEVs isn’t just about selling electric cars—it’s about creating an entire ecosystem of charging infrastructure, specialised servicing capabilities, and alternative fuel development. Our recommendations include transitional support for businesses investing in new technologies, consumer incentives, and infrastructure development that could position Tasmania as a ZLEV innovation centre. We’re also addressing emerging challenges with characteristic innovation. The Motor Vehicle Insurance and Repair Industry (MVIRI) Code of Practice represents an opportunity for Tasmania to lead in consumer protection standards, whilst sustainable solutions for end-of-life tyre management

Bruce McIntosh TACC Manager

We’re not asking the government to solve our challenges for us, we’re offering to work together on solutions that benefit everyone. The automotive industry is fundamental to Tasmania’s economy, and we’re ready to help the new government position our state as a global automotive leader.

From our perspective at TACC, we see an innovative, adaptable, and forwardthinking industry. Our members are already investing in new technologies, upskilling their workforces, and preparing for the future. We now need a government partner who shares our vision and ambition. With our combination of renewable energy resources, skilled workforce, and innovative industry leadership, Tasmania has all the ingredients necessary for automotive excellence. The question isn’t whether Tasmania can compete globally; it’s whether the new government will seize this opportunity to lead. We stand ready to make that vision a reality.

You can contact Bruce at tacc@tacc.com.au

Neway Wheel Repairs is a family owned-and-operated company spanning three generations of knowledge and class-leading experience, servicing the automotive industry with trusted craftsmanship since 1950. We use state of the art equipment to remanufacture your wheels back to OM standard.

Business disputes are an unfortunate reality in the automotive industry. Whether it’s a disagreement with a supplier over defective parts, a payment dispute with a customer, or a contractual issue with a service provider, these conflicts can quickly escalate and damage relationships if not handled properly.

The VACC Business & Consumer Affairs department receives frequent enquiries from members facing such challenges. Whilst many business owners instinctively consider heading straight to the Victorian Civil and Administrative Tribunal (VCAT) or the courts, there’s a more cost-effective and collaborative approach worth considering first.

VCAT and the civil courts remain viable options for resolving business disputes, but they come with significant drawbacks. These are decision-making bodies that deliver final, binding judgements, meaning someone wins and someone loses. The process can be expensive, timeconsuming, and often damages business relationships beyond repair. Whilst VCAT and courts sometimes order parties to attend mediation or compulsory conferences, by this stage, positions have typically hardened and costs have already mounted.

Before escalating to formal legal proceedings, consider applying to the Victorian Small Business Commission (VSBC) for mediation. Unlike VCAT, the VSBC doesn’t determine who’s right or wrong. Instead, their trained mediators guide disputing parties

towards mutually acceptable solutions that preserve business relationships and avoid the winner-takes-all outcome of court proceedings.

The VSBC offers preliminary assistance and low-cost mediation services. Applications can be submitted through their website at vsbc.vic.gov. au, making the process accessible and straightforward for busy automotive business owners.

The mediation process follows a structured yet flexible approach designed to encourage open communication and creative problemsolving. Upon arrival at the mediation venue, each party pays a modest fee and signs confidentiality agreements, ensuring discussions remain private. Parties begin in separate breakout rooms where the mediator introduces themselves and conducts initial private discussions, allowing each side to express their concerns freely.

The mediator then brings both parties together in the main mediation room, explaining the process and inviting each side to present their position. Throughout the session, the mediator asks clarifying questions and ensures all communication flows through them rather than directly between the disputing parties. Following these initial presentations, the mediator separates the parties again, moving between rooms to explore potential solutions, clarify positions, and identify opportunities for compromise until either a settlement is reached or it becomes clear that mediation won’t resolve the dispute.

If successful, mediation concludes with written settlement terms that all parties sign. These agreements are legally binding, providing the same enforceability as court orders but achieved through collaboration rather than adversarial proceedings. Should one party later breach the settlement agreement, the other can request a certificate to apply to VCAT for enforcement, but this scenario is relatively rare given the collaborative nature of reaching the original agreement. If mediation fails entirely, parties haven’t lost anything beyond the modest mediation fee and a day’s time. They can obtain a certificate allowing them to proceed to VCAT, having demonstrated their good faith effort to resolve the matter amicably.

After observing the VSBC mediation process over several years, VACC strongly endorses it as a practical, cost-effective, and genuine pathway for resolving business disputes. The collaborative approach often preserves valuable business relationships that litigation would destroy, whilst achieving outcomes that work for everyone involved.

For automotive businesses facing disputes with suppliers, customers, or service providers, mediation through the VSBC represents a smart first step— one that could save significant time, money, and stress whilst maintaining the professional relationships essential for long-term success in our interconnected industry.

John Caine Business and Consumer Affairs Email jcaine@vacc.com.au for consumer affairs guidance.

From supporting local manufacturing to controlling imports, the government decisions that reshaped an entire industry.

Australia’s car industry looks completely different today than it did just a few years ago. The New Vehicle Efficiency Standard (NVES) that started this year isn’t just a new rule, it’s the result of many government decisions, both here and overseas, that have transformed how we buy and drive cars.

Australia used to build cars, with manufacturing employing thousands of workers. However, by 2017, the final three brands with local operations; Ford, Holden, and Toyota had shut down their local operations, making us entirely dependent on imported vehicles. This massive change forced the government to rethink its approach. Instead of supporting car manufacturing, politicians had to figure out how to manage a market where every vehicle was imported. The challenge became: how do you influence an industry you no longer control? The answer came when the Labor Party won the 2022 election. The new government, led by Anthony Albanese, decided Australia needed rules about how much pollution cars could produce, something the previous government had refused to do. Transport Minister Catherine King pointed out that Australia was “embarrassingly” behind, being “one of only three developed nations without fuel efficiency standards,” along with Russia and Iran.

This political shift led to concrete action. In June 2024, Parliament passed the NVES with straightforward rules: car companies must ensure their vehicles don’t produce more than a certain amount of pollution. Starting this year, the average across all cars a company sells must be no more than 141 grams of CO2 per kilometre. By 2029, that drops to just 58 grams. Companies that exceed these limits pay penalties, $100 for every gram over the target, per car sold. For a popular ute that produces too much pollution, this could mean up to $15,000 in penalties per vehicle, paid by the vehicle importer.

The federal government also created supporting incentives. Electric vehicles under $89,332 are exempt from fringe benefits tax, making them more affordable as fleet vehicles, and also committed $500 million to build electric vehicle charging stations across the country. However, these federal initiatives operate alongside a confusing patchwork of state government policies. Each state has its own ambitions, which have added an extra layer of complexity.

International developments also pushed Australia towards stricter emissions rules. European countries have had strict emissions rules since 2020, giving us access to cleaner cars already being made, while US tariffs on Chinese EVs redirected those

manufacturers to markets like Australia. The new emissions standard operates as federal law across Australia, managed by the Department of Infrastructure, with penalties handled by the competition watchdog. However, success depends on the cooperation of the states. Federal emission rules work best when states provide charging stations and purchase incentives. When states withdraw support unexpectedly, it can undermine the national plan.

The government must review these rules in 2026 to decide what happens after 2029. Many expect even stricter targets, possibly requiring all new cars to be electric by 2035. This timeline matches Australia’s commitments in international climate agreements and helps maintain good relationships with trading partners who are also moving towards cleaner transport. The transformation reveals a profound shift: Australia may have lost its car factories, but gained direct government control over market access and pricing. For industry professionals, this demonstrates that regulatory frameworks now matter as much as traditional market forces. Understanding policy trajectories has become crucial to understanding customer preferences in Australia’s governmentshaped automotive landscape.

Stephen Lester, CEO of Cox Automotive Australia and New Zealand, shares insights from his dynamic 20-year journey across four countries and multiple automotive giants. From leading Nissan Australia to steering digital transformation at Cox Automotive, Lester reflects on the evolving landscape of mobility, the power of people-centric leadership, and the challenges and opportunities shaping the future of the industry.

From BMW Group Canada to Infiniti, Nissan Australia, Stellantis, and now Cox Automotive, you’ve experienced the automotive industry from multiple angles across four countries. How has this diverse international exposure shaped your leadership philosophy, and what’s been the most transformative lesson from your 20-year journey?

Ultimately all businesses are about their people, and the overarching role of an executive is to create the right environment for them to excel and to grow.

It was important to me when I arrived in Australia in 2017 to lead Nissan Australia that I learned as much as I could about my new home, as quickly as I could. Australia and Canda are similar in most of the big ways, but different in many of the smaller ones.

For example, I had to learn to talk less about hockey and more about AFL! This may sound like a small thing and in some ways it is, but it’s an important way to enmesh yourself in a culture, to not just be someone who’s disconnected and here for a brief stint.

In terms of transformative lessons derived from my international experience, I think fundamentally you learn that some things are almost universal, or at the very least widespread. It’s about understanding the culture of the business that you’re a custodian of, about developing or extending big picture strategies

and the tactics needed to get there, and perhaps most importantly giving your team the freedom to execute within certain parameters.

It’s particularly important to empower people to be open to taking risks, and fostering a culture that supports innovation and trying new things. And if those things don’t work, move on and take away the lessons! Ultimately, this fosters a Can Do mindset.

You’ve transitioned from traditional OEM roles to now leading Cox Automotive in ANZ. What drew you to step away from the manufacturer side, and how do you view the role of automotive technology companies in reshaping the industry ecosystem?

Leading Cox Automotive in Australia and New Zealand since 2022 has been an intensely rewarding challenge, and one that presents a number of differences to automotive OEMs in terms of targets and overarching goals.

For one thing CAA is more of a business-to-business operation, today servicing the remarketing needs of OEMs, dealers, fleets, lenders, insurers among myriad others - although we of course do have public customers at the weekly Manheim auctions.

Cox Automotive is also a US-market leader in retail data and software solutions, developing an array of products to help dealers handle things like

customer leads, valuations, inventory management and fixed operations customer experience.

Technology companies only become more important in today’s digitised world, particularly as dealers shift towards an omnichannel approach that blends the physical and digital realms at all customer touchpoints. The evolution of our industry means that while demand for private vehicles remains as high as ever, the way people interact with their preferred brands is changing rapidly, and so too are their expectations. It’s on us to stay ahead of the curve.

From your vantage point, having worked across the entire automotive value chain, where do you see the greatest opportunities and the biggest resistance to digital transformation in Australia and New Zealand?

Firstly, automotive OEMs and dealers have made some major changes in how they operate over the past few years, but there’s always scope for progress and improvement.

It’s hard not to say that artificial intelligence represents the greatest opportunity, particularly in terms of how it can help people be more productive in their roles and for businesses to be more consistent.

One example that comes to mind is the degree to which AI can be harnessed to handle repetitive and time-consuming tasks such as booking in initial customer appointments and engaging in proactive follow up down the line. AI can handle a lot of this grunt work, freeing your people up to focus on the bigger-picture stuff they do best. We have also introduced a lot of automation into the Manheim backend, for things such as vehicle check-ins and performance data analysis. This hasn’t reduced headcount directly, but it has certainly given a few of our people a more pleasant and less repetitive daily working experience!

example, while we still offer unique in-person physical auctions, the live streamed simulcasts and focus on

social media marketing content have opened up a raft of opportunities for the way we remarket cars.

After more than two decades in the automotive world, what still excites you most about coming to work each day? Is there a particular aspect of the industry that continues to surprise or inspire you?

This industry is always changing. If we look at the market today we are seeing the rise of protectionist policies in the US and Europe, the staggering growth of the Chinese market, the massive rollout of EVs, and the push towards driverless cars. In Australia we are of course living in a new paradigm with the New Vehicle Efficiency Standard too.

The thing that I find most powerful and interesting about Cox Automotive is that, across our vehicle, industrial and salvage channels, we work daily with the entire automotive ecosystem from OEMs and dealers, to fleets, insurers, lenders and more.

It’s important not to understate the importance of the fleet sector - private fleets, government fleets, and leasing companies - when it comes to the industry’s uptake of lower-emitting vehicles for

example, and it’s also vital to consider downstream issues such as residual values of these assets.

In terms of surprises, I think the thing that really grabs you about the Australian market is the sheer competitiveness. Some 80-odd brands chasing 1.2 million new vehicle sales and more Chinese competitors on the way, we really are quite unusual in this sense.

Living and working across such diverse markets, from Canadian winters to Australian summers, you’ve seen firsthand how geography shapes automotive needs. How do these regional differences influence your thinking about sustainable mobility solutions for Australia and New Zealand?

Australia and Canada are both large and relatively sparsely populated, despite the rather divergent weather conditions!

Sustainable mobility, let’s look at EVs: They really need to meet the requirements of customers and not the other way around. While most Australians are urban dwellers, the spirit of adventure and the call of the outdoors shapes vehicle sales here in a huge way.

Cars are ultimately an aspirational purchase most of the time, and new technologies need to factor this in.

Having witnessed the sustainability journey across multiple markets, Canada, Europe, and now ANZ, which region do you think is getting the sustainability transition right, and what lessons should the Australian automotive industry be learning?

The goal of any CEO should be to relinquish the title leaving the company in a stronger and more secure position.

In some ways Australia is a world leader, for example our embrace of rooftop solar is commendable. In other ways, for example EV market share, we are a little behind where some similar regions are.

The New Vehicle Efficiency Standard is something that other parts of the world have had in one form or

another, although the Australian example aims to do a lot of ‘catching up’ in a relatively short amount of time. It’s probably not optimal to home in on one country or another, ultimately it wouldn’t be right to just follow the lead of China, or Norway, or the US. Australia has its is the fact that our Manheim auction business in the UK and US is very much a wholesale dealer-facing operation, whereas here we also sell to private buyers. That means we are interfacing with a broader base, perhaps.

"I think there is a way to work with customers to fulfill their needs that is somewhat universal. People are ultimately people."

own distinct challenges and opportunities ahead of it.

But it’s important for policy makers and industry advocates to cast their eyes far and wide to see policies that are having the desired effect. And this is one advantage we have at Cox, a global view with business in the United States and Europe to draw on.

Policies such as new and used EV subsidies, government-funded charging networks, the ongoing development of businesses to service and repair electric vehicle batteries et cetera, all spring to mind.

You’ve built your reputation on developing strong customer relationships across very different automotive cultures. How do Australian and New Zealand automotive customers differ from those in Europe and North America, and how has this influenced your approach at Cox Automotive?

You might say that the Aussie and New Zealand character is relaxed and friendly, with a pretty good approach towards work-life balance.

There’s naturally a difference in terms of scale comparing, say, Australia and the US, and this manifests for example in the fairly tight-knit automotive industry here. Everyone sort of knows everyone, because in the grand scheme we aren’t a huge market.

One tangible difference that does come to mind

However my ethos of servicing customers isn’t particularly tethered to geography. I think there is a way to work with customers to fulfill their needs that is somewhat universal. People are ultimately people. Looking ahead five years, you’ll have been leading Cox Automotive ANZ through what many consider the most transformative period in automotive history. What do you want your legacy to be, and how do you hope the industry will remember your contribution to this pivotal era?

Our 500-plus person team at Cox Automotive Australia and New Zealand have worked really hard over the past few years to transform the business with innovation, digitisation and automation where appropriate, without losing the terrific culture we have.

The goal of any CEO should be to relinquish the title leaving the company in a stronger and more secure position to handle the bumpy road ahead. I’m confident that the strategy we have taken to home in on the core businesses here, to streamline and refine our positioning in the market, will do just that.

I also hope people remember me as that nice Canadian who tried to learn and understand the Australian market deeply. I tend to think that’s somewhat self-evident, since I have lived here for eight years with my family and have no plans on leaving!

Some 80odd brands chasing 1.2 million new vehicle sales and more Chinese competitors on the way.

Cleanaway is Australia’s largest waste management provider and proud new VACC partner. With convenient locations across Victoria and Tasmania, we can build customised, competitive waste solutions for your automotive business, including:

General waste

Commingled recyclables

• Paper and cardboard

• Steel/aluminium cans and plastic

Liquid and hazardous waste

• Used mineral oil and oil filters

• Oily water, oily rags and other hydrocarbons

• Grease trap

• Pit and sump cleaning

Workshop and parts waste

Parts washer services

Industrial service capabilities

Call us today on 13 13 39 and mention VACC or visit our website.

The automotive industry’s sustainability journey has taken another significant leap forward with Viva Energy’s ambitious tyre-recycling project at its Geelong Refinery. In a move that could transform how Australia handles its mounting tyre waste crisis, the energy company has partnered with Canadian recycling specialist Klean Industries to develop a facility capable of processing 80,000 tonnes of used tyres annually.

This isn’t just another recycling story; it’s a glimpse into the circular economy that’s rapidly reshaping automotive manufacturing. The proposed facility would extract three valuable products from discarded tyres: recovered carbon black for use in new tyre production, steel for metal recycling, and, crucially, biogenic pyrolysis oil that can be processed into low-carbon fuels.

“We’re essentially turning automotive waste into automotive fuel,” explains Lachlan Pfeiffer, Viva Energy’s Chief Strategy Officer. “By transforming end-of-life tyres into valuable resources, we’re not only reducing waste but also pioneering new paths for low-carbon fuel production.”

The timing couldn’t be more critical. Australia generates millions of used tyres annually, with many ending up in landfills despite containing valuable materials. The automotive industry

has been grappling with this challenge for years, making Viva Energy’s initiative particularly welcome news.

What makes this project especially compelling is its integration with existing infrastructure. Rather than building an entirely new processing chain, the facility would feed biogenic pyrolysis oil directly into the Geelong Refinery’s existing operations. This co-processing approach demonstrates how established facilities can adapt to support sustainable practices without massive capital overhauls.

Klean Industries brings proven expertise to the partnership, having successfully implemented similar technologies globally. Their track record in converting waste tyres, non-recycled plastics, and other materials into valuable resources aligns perfectly with the automotive industry’s push towards sustainability.

The project represents more than environmental benefits – it’s about economic transformation. CEO Jesse Klinkhamer from Klean Industries notes they’re “poised to transform used tyres into sustainable products that fulfil the growing demand for sustainable low-carbon fuels and raw materials.”

Viva Energy is already testing the waters, importing tyre pyrolysis oil produced using Klean’s technology to prove the concept at scale.

This practical approach – testing first, then scaling up – reflects the industry’s increasingly sophisticated approach to sustainability initiatives.

The Geelong project fits into a broader pattern of innovation at the refinery. Recent months have seen announcements of projects utilising alternative feedstocks from soft plastics, tallow, and used cooking oil. This diversification strategy positions the facility as a hub for circular economy activities rather than just traditional refining.

For the automotive industry, this development signals a maturing approach to sustainability. Rather than viewing waste as an inevitable byproduct, companies are increasingly recognising it as a valuable resource. The tyre-recycling initiative demonstrates how cross-industry collaboration can create solutions that benefit manufacturers, consumers, and the environment simultaneously. If successful, this project could serve as a blueprint for similar initiatives across Australia and beyond, potentially revolutionising how the automotive industry approaches end-of-life vehicle components. It’s innovation born from necessity, driven by environmental imperatives, and executed with commercial pragmatism – precisely what the industry needs.

"If successful, this project could serve as a blueprint for similar initiatives across Australia and beyond."

Whilst some university graduates face shrinking job prospects and the threat of AI, automotive apprenticeships continue to deliver practical skills, long-term careers, and financial independence—all without the HECS debt. University is often marketed as the golden ticket in today’s career landscape. But for many young Australians, it’s a promise that’s failing to deliver. University graduates in industries such as business, media, and general science are leaving with degrees, debt, and little more than a place in the queue, facing competition from AI-powered systems already replacing roles in administration, customer service, and even research assistance. Meanwhile, an apprentice mechanic in their early twenties might already be qualified, earning full wages, and taking on supervisory responsibilities in a growing business.

The statistics tell the story. In a 2025 Digital Information World survey, 37 per cent of employers said they would prefer to hire AI over a new graduate for entry-level tasks. In a recent news.com.au report, a 24-year-old receptionist in Sydney named Katherine shared how she and her entire team were replaced by a voice-response AI system at a medical practice, just before Christmas. By contrast, the automotive industry isn’t automating its people, it’s crying out for them.

The trade that AI can’t touch Modern vehicles are complex machines, blending mechanical systems with smart sensors, onboard computers, and electric drivetrains. The notion that a robot or AI could replace a skilled technician remains a fantasy, for now and for the foreseeable future.

Whilst AI can assist with diagnostics or service reminders, it cannot get under a bonnet, remove a seized bolt, or explain a repair to a worried customer. It cannot test drive a vehicle or recalibrate a camera-based lane assist system. And it certainly cannot diagnose a rattling suspension or fluid leak using real-world intuition.

That’s why a qualified automotive technician remains one of the most protected roles in Australia’s evolving workforce.

Four years ahead

Let’s examine the numbers. A university student studying for a Bachelor of Media or a generic business degree might spend three to four years in full-time study, accumulating $50,000 to $75,000 in HECS debt, and an automotive apprentice is earning from day one. Over the same period, they’ll have been trained, paid, and often promoted. Many are debt-free by 22. Some have purchased their first car. A few have even saved for a deposit on a home.

And they’re not stopping there. Many qualified techs go on to upskill in diagnostics, high-voltage systems, manufacturer programmes, or business management.

For example, Jake, 23, from Geelong, finished his apprenticeship last year and is now undertaking a Certificate IV in Automotive Management whilst running the diagnostics bay at his local dealership.

“A lot of my mates are still at uni, one’s even working part-time in retail whilst finishing a psychology degree,” he says. “Meanwhile, I’m earning full-time, doing what I love, and learning more every week.”

In demand, everywhere

The demand for automotive technicians isn’t merely local; it’s national. With growing shortages across metropolitan and regional areas, skilled tradespeople can find work almost anywhere.

The skill set travels: workshop experience, safety knowledge, and problem-solving abilities are portable between sectors and internationally.

As the EV transition gathers momentum, the demand for high-voltage-qualified technicians is set to rise sharply. Whilst university-trained engineers will help build new systems, qualified technicians’ll keep them on the road.

Skills for life, not a single job

Automotive apprenticeships teach far more than mechanical skills. They develop work ethic, time management, customer service, and responsibility. Apprentices learn to work under pressure, solve problems in realtime, and follow safety and environmental standards. These are human skills—future-proof, adaptable, and in demand across industries.

Unlike industries such as law, accounting, or customer service, where AI now handles significant portions of work—technicians don’t face that same

threat. As one workshop owner in Melbourne said recently: “You can’t ask a chatbot to replace brake pads or diagnose a driveline vibration. You need someone who’s been trained, hands-on, and knows how to think through a problem.”

"In the age of AI, choosing a trade such as automotive technology isn’t merely a plan B. It’s an innovative, secure, and future-focused path."

When university isn’t the right fit

None of this is about disparaging university education. For some career paths, it’s essential. But for many school leavers, it’s not the best or most realistic choice, especially if the end goal is financial stability, real skills, and steady employment.

In fact, a growing number of university graduates are retraining in trades. The National Centre for Vocational Education Research (NCVER) reports that over 9,000 students per year with university qualifications enrol in trade apprenticeships after completing their degrees. Don’t just learn: Earn, grow, and succeed In the age of AI, choosing a trade such as automotive technology isn’t merely a plan B. It’s an innovative, secure, and future-focused path. It offers the chance to earn whilst you learn, grow with real-world experience, and build a career that cannot be replaced by a line of code.

So, if you’re weighing up the future, and wondering where your ambition can take you, consider the tools, the technology, and the trade that drives the nation.

An automotive apprenticeship might just put you in the fast lane.

The demand for automotive technicians isn’t merely local; it’s national.

Since 1955, Bendix has been a cornerstone of Australia’s automotive landscape, celebrating a remarkable 70-year journey that exemplifies homegrown innovation and manufacturing excellence. From humble beginnings in a former explosives plant in Ballarat, Victoria, this pioneering company has become one of the nation’s most trusted automotive suppliers.

What began as Mintex Limited with just 30 employees producing brake linings has transformed into a sophisticated operation employing 120 skilled workers. Bendix’s commitment to Australian manufacturing remains unwavering, making it one of the few automotive aftermarket businesses that still proudly produces locally while retaining critical sovereign knowledge and supporting regional employment.

The company’s golden era coincided with Australia’s automotive manufacturing boom. In 1967, it secured exclusive contracts with General Motors Holden and subsequently supplied Ford, Toyota, Mitsubishi, Nissan, and Chrysler. This extensive original equipment heritage established Bendix as the industry’s benchmark for quality and reliability. Bendix’s innovative spirit shines through decades of strategic investment. The development of home-built ‘Troika’ presses solidified their manufacturing leadership, while the 1990s saw the establishment of Australia’s first fully equipped noise analysis laboratory. Recent installations include specialised grinding equipment enabling complex brake pad geometries, ensuring Bendix continues to set industry performance and noise reduction standards.

Precise towing control that’s easily interchangeable between tow vehicles, trailers and caravans.

Bendix has diversified beyond traditional brake components, adapting brilliantly to changing market conditions. Their Ultimate 4WD™ range serves recreational off-roaders, Ultimate+™ targets performance vehicles, and the company has expanded into electric brake controllers and motorcycle applications. This adaptability has enabled Bendix products to reach over 40 countries worldwide.

For VACC and TACC members, Bendix represents more than a supplier; they’re a valued partner offering seven decades of proven expertise, local manufacturing capability, and unwavering commitment to Australian automotive excellence. Their story exemplifies the innovation and resilience that continue to drive our industry forward.

Plug ‘n’ Play

Easily interchangeable between vehicles and towables

Precise braking control

Safe and tough

Install – remove – install. It’s easy

Recently, VACC Chief Executive Peter Jones had the honour to present a 50-year membership plaque to Martin and Monika Sanchez of Lonsdale Street Auto Electrics, recognising half a century of dedicated service to Victoria's automotive industry.

The business journey began in 1972 when Martin's parents, Cesar and Renata Sanchez, established their auto electrical workshop at 53 Lonsdale Street, Dandenong. Twelve-year-old Martin grew up alongside the business, learning the trade from the ground up.

The enterprise expanded in 1978 with a second site at 75 Lonsdale Street, and diversified into tram work during its early years. However, Renata's plea in the late 1980s brought Martin into the family business, with his father's first lesson being speedometer repairs.

Martin's passion for commercial vehicles led to a strategic relocation in 2000 to their current Park Drive premises. Despite initial concerns about the facility's size, the workshop now overflows with cars, trucks, and buses—a testament to the business's growth.

During Peter's visit, Martin conducted an extensive tour of the bustling workshop, showcasing specialised trucks and buses undergoing repairs, intricate instrument restoration work, and technicians installing speed limiting devices into forklifts. The diverse workload demonstrated the business's adaptability across multiple automotive sectors.

When discussing memorable projects, Martin revealed his favourite vehicle was a 1926 Monza spec Bentley—yet another testament to the workshop's capability to handle both vintage classics and modern commercial vehicles.

After marrying Monika, who brought Mercedes-Benz experience to the partnership, the couple purchased the business in 2010, maintaining the original Lonsdale Street Auto Electrics name.

"The game is always changing, and diversity has protected the business," Martin explains. Their services now encompass vehicle electronics, interlock device installations, and instrument repairs across multiple vehicle categories. Martin's industry commitment extends beyond his workshop, having served 25 years on VACC's Auto Electrical Division committee. "I've been happy to contribute to the information network and put back into the industry that has fed my family for 50 years," he reflects.

The presentation highlighted business longevity, generational dedication to automotive excellence, and industry participation.

"The game is always changing, and diversity has protected the business."

CareSuper has been supporting the motor trades for decades. Following our merger with Spirit Super late last year, we’re now stronger than ever. Today, we’re a $56 billion fund with over 550,000 members. This means more investment power, competitive fees and strong long-term returns. Our commitment to the motor trades remains unwavering. From our roots as MTAA Super, built by the motor trades for the motor trades, we’re continuing that legacy as CareSuper.

In a Melbourne factory where precision meets purpose, Original Engines Co is proving that the future of automotive sustainability doesn't necessarily lie in revolutionary new technologies – it's about revolutionising how we use what we already have. At the heart of their operation lies a commitment to circular economy principles that challenge the automotive industry's century-old "take-makewaste" mentality. Rather than accepting that failed engines become scrap metal, Original Engines Co. intercepts them at their "end of first life" and transforms them into premium remanufactured products that often exceed original specifications.

circular advantage

Operating under circular economy principles means Original Engines Co saves approximately 65% of original engine cores from scrap whilst using 85% less energy than new manufacturing. In 2024 alone, this approach prevented 1.02m kilograms of CO2 emissions and conserved 2.7 million litres of water across their 1760 remanufactured engines. But the circular approach extends far beyond the workshop floor. The company has replaced harsh petrochemicals with environmentally friendly alternatives, implemented sophisticated

"Their innovative positive filtered air system exemplifies circular thinking. It continuously cleans and circulates air through the facility while improving environmental impact and worker safety."

The circular economy operates on three fundamental principles: eliminating waste and pollution, circulating products and materials at their highest value, and regenerating natural systems. Original Engines Co. has built its business model around these concepts, creating what Managing Director Colin Doherty describes as "a truly closed-loop industrial process." When a worn engine arrives at their Kilsyth facility, it enters a meticulously planned circular pathway. Every component is systematically disassembled, cleaned, and inspected. Parts meeting standards are restored using state-of-the-art equipment, whilst those beyond repair are responsibly recycled through vetted partners. The result is an engine that captures the original materials and the embodied energy from initial manufacturing. "We're not just rebuilding engines," explains Doherty. "We're demonstrating that you can keep materials in use for as long as possible whilst maintaining the highest quality standards. It's the essence of circular thinking."

water treatment systems that capture and recycle contaminants, and established comprehensive recycling programmes for everything from cardboard to metal waste. Their innovative "Australian-first" positive filtered air system exemplifies circular thinking. It continuously cleans and circulates air through the facility while improving environmental impact and worker safety. Even their oil rags are washed, reused, and recycled weekly.

Leading the automotive circular movement What sets Original Engines Co. apart as leaders in the automotive circular economy isn't just its environmental achievements; it's how it's proven that circular principles enhance rather than compromise business performance. Its remanufactured engines don't simply match OEM specifications; they often exceed them, backed by comprehensive warranties demonstrating absolute confidence in its circular process.

The industry has recognised this leadership.

"Our remanufactured engines don't simply match OEM specifications; they often exceed them."

Original Engines Co has claimed Best Automotive Business at the Automotive Industry Awards for two years, validating their circular approach and inspiring other automotive businesses to reconsider their own linear practices.

"Operating under circular economy principles means we're not just solving today's problems," notes Doherty. "We're building resilience for the future whilst creating genuine value for our customers and the environment."

The bigger circular picture

Research shows that while renewable energy can address about 55% of required carbon reductions, the remaining 45% is locked in products and materials, exactly where circular economy principles make their greatest impact.

Original Engines Co. demonstrates that significant environmental gains don't always require

new technologies; sometimes, they require smarter thinking about existing resources. Their approach resonates with increasingly environmentally conscious consumers.

Recent studies show that 64% of consumers believe businesses must embrace circular economy principles, and 57% want to learn more about companies' circular initiatives.

As the automotive industry faces mounting environmental pressures, Original Engines Co. offers a compelling blueprint for transformation. They've proven that circular economy principles aren't just ecological imperatives, they're business advantages that create value whilst eliminating waste.

In an industry built on forward motion, Original Engines Co. has discovered that sometimes the most progressive step is learning to go in circles.

"Operating

under circular economy principles means we're not just solving today's problems."

"We're building resilience for the future whilst creating genuine value for our customers and the environment."

There was a time when suggesting that a luxury car manufacturer use recycled fishing nets in its vehicles would have gotten you escorted out of the building. Today, that same idea might land you a keynote slot at an industry conference.

The automotive industry has undergone its most dramatic shift in materials thinking since Henry Ford pioneered the assembly line. Recycled materials are no longer an environmental extra— they’re now a strategic business imperative worth hundreds of billions of dollars. Forward-thinking companies are leaving slower competitors behind.

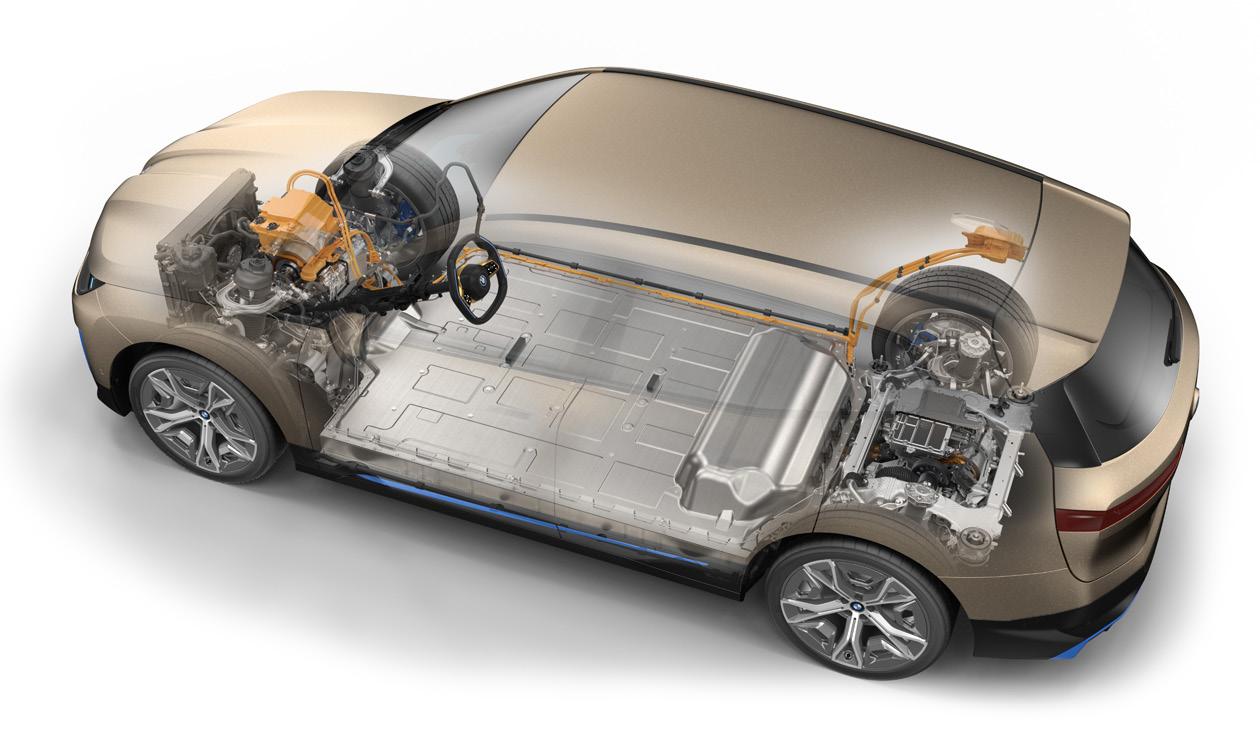

This isn’t environmental activism dressed up as business strategy. BMW uses recycled fishing nets and ocean plastics in injection-moulded parts. Ford incorporates 250 recycled plastic bottles into every vehicle, reusing 1.2 billion bottles annually. Mercedes-Benz achieves 96% material recovery at its Kuppenheim battery recycling plant. These are not pilot programs, they’re profit centres delivering measurable returns.

The global automotive recycled materials market is projected to reach $216.9 billion by 2031, growing at 12% annually. For Australian automotive professionals, this signals a fundamental shift in how value is created across the vehicle lifecycle.

When waste became wealth

Automotive recycling once meant salvaging usable parts from wrecked vehicles and sending the rest to scrap. That “build, sell, dispose of” model worked when raw materials were cheap and regulations minimal.

Those days are gone. Today’s automotive leaders are discovering that waste streams represent tomorrow’s competitive advantages. BMW’s Recycling and Dismantling Centre now supports a global network of 3,000 businesses across 23 countries. What began as environmental compliance has evolved into sophisticated value extraction operations delivering significant cost savings and new revenue streams.

BMW uses 30% recycled materials in manufacturing today, targeting 50% by 2030. Mercedes-Benz is aiming for 40% secondary raw materials per vehicle by the same date. Volvo plans to use 25% recycled plastics in all its vehicles by 2025—not just for environmental reasons, but for cost efficiency, supply chain resilience, and regulatory compliance.

The New Economics of Materials

Instead of viewing materials as single-use inputs, leading manufacturers now treat components as assets to be recovered and redeployed.

“Chemical recycling technologies now enable closed-loop plastic recovery.”

Consider aluminium. It boasts a 97% recycling rate and uses 95% less energy compared to virgin production. BMW incorporates up to 50% recycled aluminium in some components, cutting CO2 emissions by up to 85%—for example, in Mini Countryman wheels. Ford’s closed-loop aluminium recycling saves $6 million each month, processing 20 million pounds of material annually and achieving an 85% recycling rate for vehicle parts.

local material recovery and reducing reliance on imports.

Accenture estimates automotive companies could unlock $400–600 billion in additional revenue from circular economy business models by 2030. Chemical recycling technologies are closing the loop on plastics, while BMW’s partnership with BASF aims to remove crude oil entirely from plastic components.

French-based Materi’act, a sustainable materials company, is targeting €2 billion in revenue by 2030 with products that cut carbon emissions by 85% compared to conventional materials.

Australia’s circular advantage

Australia presents unique opportunities for recycled materials leadership. Traditionally, geographic isolation created supply chain risks. Circular economy strategies flip this into a competitive advantage by fostering

Australia’s New Vehicle Efficiency Standard will drive manufacturers to adopt recycled materials to meet emissions targets cost-effectively. Fleet operators are shifting focus from initial purchase price to total lifecycle cost, increasing demand for recycled components. The 500,000 end-of-life vehicles processed annually in Australia represent an underutilised source of valuable materials.

Meanwhile, Chinese manufacturers like Great Wall—whose sales grew 13.7% to May 2025—have embedded sustainability into their business models from inception, putting additional competitive pressure on traditional manufacturers.

Technology breakthroughs driving value

Advanced recycling technologies are making circularity commercially viable. BMW’s partnership with Duesenfeld achieves 95% battery recycling rates, recovering graphite and electrolytes alongside metals. In China, BMW has reduced CO2 emissions by 70% in some processes compared to using newly extracted materials.

Volvo demonstrated its commercial potential when it committed to 25% recycled plastics in all vehicles by 2025.

AI-powered sorting systems and machine learning algorithms are improving the recovery of mixed plastics and optimising dismantling processes.

Bcomp’s ampliTex flax fibre composites—used in Volvo’s EX30 and Polestar models—offer lightweight strength with a lower carbon footprint.

Industry-wide strategic shifts

Manufacturers are embedding recycled materials into long-term strategies. BMW’s “Secondary First” initiative aims for 50% recycled content by 2030. Mercedes-Benz’s Ambition 2039 plan incorporates comprehensive circular economy measures, including 96% battery material recovery at Kuppenheim.

Ford has reduced emissions by 40% since 2017, partly through its closed-loop aluminium system.

Renault was an early mover, introducing 30% recycled components in the Megane II as far back as 2014. These strategies are driving changes throughout dealer networks, service departments, and supply chains—including in Australia.

Profit opportunities beyond compliance

Recycling initiatives deliver real economic returns.

Recycling steel reduces CO2 emissions by 50–80%, aluminium recycling cuts energy use by 95%, and plastic recycling reduces reliance on crude oil.

Beyond direct savings, these systems open new revenue streams. BMW’s global recycling network supports thousands of businesses, and the company’s recycling expertise is now a consulting and technology licensing opportunity.

The World Business Council for Sustainable Development estimates the global circular

Material innovation creates entirely new revenue opportunities.

economy could unlock $4.5 trillion in new value, with automotive playing a major role.

Challenges and solutions

Adopting recycled materials presents challenges.

Quality assurance is critical, especially in safetyfocused sectors like automotive. BMW runs comprehensive testing programs to ensure secondary materials meet rigorous standards.

Circular supply chains are complex, requiring cross-regional coordination. As technology scales, recycled materials are achieving cost parity with virgin alternatives. Consumer attitudes are shifting too—luxury brands have shown that recycled content is acceptable, even desirable, when marketed as a premium feature.

What’s next

The sustainable materials market is projected to reach $211.2 billion by 2035. Automotive executives must prepare for a future where circularity is no longer optional, it’s essential.

Chemical recycling processes are now producing petroleum-equivalent plastics, while battery recycling achieves 95%+ recovery rates for lithium, cobalt, and nickel.

Chinese manufacturers who baked sustainability into their business models from the start will continue to disrupt legacy players. Revenue models are evolving, with subscription services, leasing, and recycling partnerships extending value capture beyond initial vehicle sales.

The bottom line

The transformation of automotive materials is about more than sustainability—it’s about unlocking

The revolution is here, hiding in plain sight. Every recycled fishing net becoming a dashboard component.

new forms of value and competitive advantage. For an industry traditionally focused on linear production, embracing circular thinking is now essential. Australia is well-positioned to lead in this shift. Its practical approach to problemsolving, combined with expertise in resource

“Recent market data reveals growing consumer and regulatory pressure favouring sustainable materials.”

management, creates fertile ground for circular economy leadership and export growth. Success will require collaboration across material sourcing, supply chain development, manufacturing processes, and customer engagement. Companies that view recycled materials as strategic enablers—not compliance obligations—will thrive in this new environment.

The revolution is here. Every recycled fishing net that becomes a dashboard, every aluminium wheel made from secondary material, and every battery recycled at 96% efficiency proves that yesterday’s waste is tomorrow’s profit.

As any experienced materials engineer will tell you: the most valuable resources are often the ones you’ve already paid for once.

The shift to circular economy thinking is more than a manufacturing adjustment—it represents a broader philosophical change for the automotive industry. Rather than viewing a vehicle’s lifecycle as ending with disposal, manufacturers are adopting cradle-to-cradle models. These approaches consider the value of materials not just at pointof-sale but throughout their entire usable life, including reuse, refurbishment, and recycling.

This new mindset demands innovation across all business functions. Engineers are rethinking material composition from the design stage, ensuring products are easier to disassemble and recycle. Supply chain managers are forming partnerships with recycling firms and material recovery specialists. Even marketing teams are playing a role, communicating the value of recycled materials to customers, and shaping consumer perceptions around sustainability.

The role of policy and regulation

Government policy is also accelerating the shift toward recycled materials. In addition to Australia’s New Vehicle Efficiency Standard, global regulatory bodies are implementing mandates that make circular economy practices essential rather than optional.

The European Union’s End-of-Life Vehicles Directive requires 95% of a vehicle’s weight to be recovered and reused or recycled. Similar initiatives are being considered in Asia and North America, creating a ripple effect throughout the global supply chain. Manufacturers operating in multiple markets must prepare for a landscape where material circularity is legally enforced.

Investment in recycling infrastructure is becoming a priority for both governments and private enterprises. Public-private partnerships are emerging to fund advanced recycling technologies, ensuring

“The Australian market presents unique opportunities for companies to master recycled materials strategies.”

sufficient capacity to handle the influx of end-oflife vehicles expected in the coming decades.