Injectronics introduces their initial range of high-quality exchange remanufactured, ready to install hybrid batteries to suit Toyota Camry and Prius models.

Available for purchase through our distribution partners in the automotive aftermarket, Injectronics hybrid batteries are now available for delivery direct to workshops throughout Australia.

A cost-effective alternative to OEM battery packs, the program also ensures a sustainable circular economy for hybrid batteries driving the Reduce, ReMAN, and Recycle concept.

Toyota Camry 40 Series (2006-2011)

Toyota Camry 50 Series (2011-2017)

Toyota Prius Gen 2 (2003-2009)

VACC produced a FY2021 scorecard, with highlights and stats from the year. It’s inserted in this mag, so look out for it

Critical auto jobs have been left on the outer and businesses and consumers miss out, writes VACC CEO Geoff Gwilym

Australia’s automotive skills crisis worsens as business owners find it increasingly difficult to source labour

If you run a business, you’re likely to get complaints - how you handle them is make or break

VACC’s Industry Policy team is hard at work bringing about meaningful changeread the latest updates

Shane Jacobson has wise words for those buying and selling second-hand motorsdon’t get taken for a ride!

TACC General Manager, Malcolm Little looks back at the highlights of his 21-year career before he goes fishing

Cyber attacks have become increasingly common. The right knowledge and equipment is crucial, says Pitcher Partners

Local vehicle manufacturing ramps up again with a Melbourne company about to build cutting edge electric motorcycles

Burson co-founder, Garry Johnson, and Bapcor CEO and Burson alumni, Darryl Abotomey, share their business success

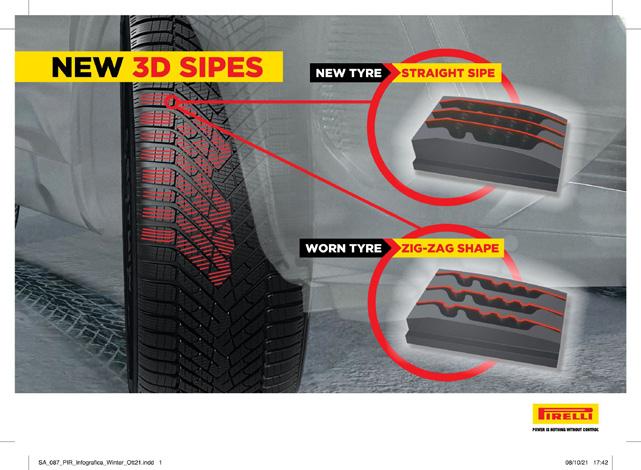

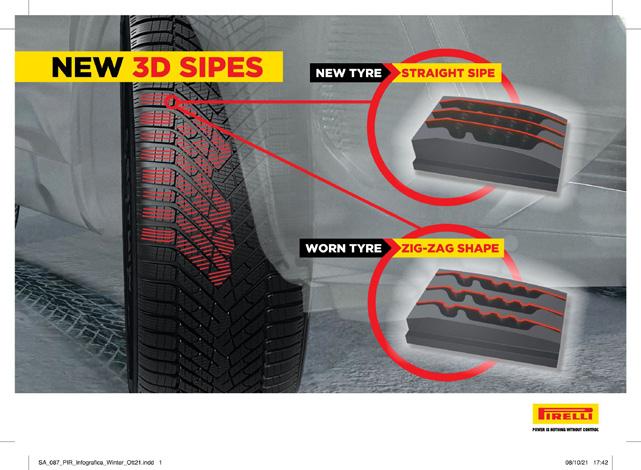

Often an overlooked grudge purchase, tyres remain incredibly important to vehicle performance

While vehicles have steadily become more complex, it’s time to get back to basics with in-car networking technology

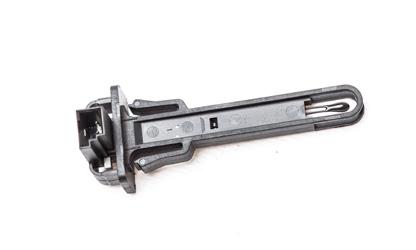

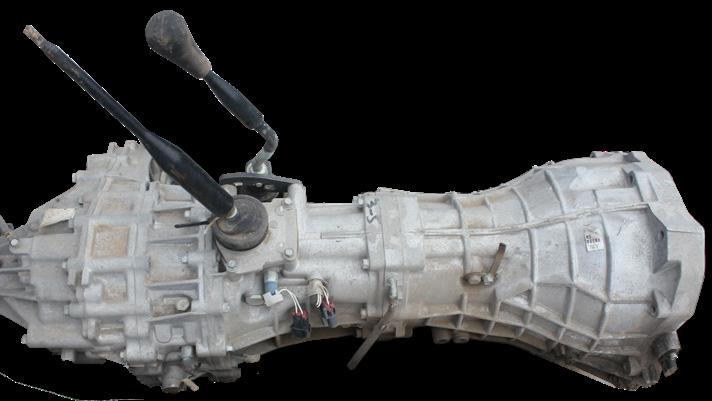

Nissan neutral switch and VW coolant pump replacement are hot tech topics this issue

Find everything from the latest products to the best business services you need all in one place

Drive your business forward by taking advantage of VACC corporate partnerships and services at your fingertips

The new auto industry

brought to you by the best in the business

Join journalist Greg Rust, motoring enthusiast Shane Jacobson, and industry authority Geoff Gwilym as we dig deep into automotive. There’ll be news and views, industry insights and trends, special guests, and plenty of laughs along the way.

So join us.

Listen and review now

THE auto industry tends to run on two types of ‘year’ – the calendar year and the financial year.

This, being the December issue, is a good time to take stock of both.

In the second year of COVID-19 and coming on top of the devastating 2019/20 bushfires (remember those?), 2021 has proved another tough year for businesses, for people’s finances, and for everyone’s mental health.

Hopefully, you, your family and staff get to take a bit of free time at the end of this year to refresh. It’ll be a chance to look backward at what life has been and forward to what it might become.

While you’re kicking back, grab the VACC Scorecard inserted into this issue of Australasian Automotive

We designed the scorecard to provide a quick snapshot of VACC’s performance during the 2021 financial year. It covers the areas of Apprenticeships and Training, Commercial, Government and Policy, Media, Research, Technical, Women in Automotive, and Workplace Relations. There are many highlights.

Did you know VACC achieved $908,984 worth of free media exposure, and that Women in Automotive now has 1,400 members?

Fine Tuning Automotive Mental Health has 167 businesses involved in its program, the Technical Department took 30,000 member calls for technical solutions, and the Workplace Relations team answered over 10,000 queries about industrial relations and OHS matters.

The Industry Policy team accomplished significant policy wins for members, supported by research and government submissions. OurAuto (VACC’s national commercial arm) achieved $2.95

million income, and VACC increased its turnover to $49 million.

Perhaps best of all is the hardworking Membership Department held on to almost 5,000 members in the most difficult trading year in most people’s memories. No matter which way you look at it, the VACC Scorecard is a good news story, demonstrating VACC staff’s commitment to delivering an amazing service to its members.

Enjoy your break and we’ll see you next year…

David Dowsey

MANAGING EDITOR

David Dowsey

03 9829 1247

editor@australasianautomotive.com

SUB-EDITOR

Pia-Therese Hams

DESIGNERS

Faith Perrett, Gavin van Langenberg

03 9829 1189

creative@australasianautomotive.com

CONTRIBUTORS

Paul Tuzson, Ged Bulmer, Geoff Gwilym, Rod Lofts, Imogen Reid, Steve Bletsos, John Caine

32,651 READERSHIP

ADVERTISING REPRESENTATIVE

Andrew Martin, Manager, Commercial Mobile: 0425 773 234

Email: amartin@ourauto.com.au PRESIDENT Mark Awramenko CHIEF EXECUTIVE OFFICER Geoff Gwilym

Official publication of the Victorian and Tasmanian Automotive Chambers of Commerce

adheres to its obligations under National Privacy Principles legislation. Information on products and services contained in the editorial and advertising pages of this magazine does not imply the endorsement of any product or service by VACC. Australasian Automotive is copyright and no part may be reproduced without the written permission of VACC. Advertisers and advertising agencies lodging material for publication in Australasian Automotive indemnify the VACC, its directors, Board, employees, members, and its agents against all claims and any other liability whatsoever wholly or partially arising from the publication of the material, and without limiting the generality of the foregoing, indemnify each of them in relation to defamation, libel, slander of title, infringement of copyright, infringement of trademarks or names of publication titles, unfair competition, breach of trade practices or fair trading legislation, violation of rights of privacy or confidential information or licences or royalty rights or other intellectual property rights, and warrant that the material complies with all relevant laws and regulations. This publication is distributed with the understanding that the authors, editors and publishers are not responsible for the results of any actions or works of whatsoever kind based on the information contained in this publication, nor for any errors or omissions contained herein. The publishers, authors and editors expressly disclaim all and any liability to any person whomsoever whether a purchaser of this publication or not in respect of anything and of the consequences of anything done or omitted to be done by any such person in reliance, whether whole or partial upon the whole or any part of the contents of this publication. Advertising accepted for publication in Australasian Automotive is subject to the conditions set out in the Australasian Automotive rate card, available from editor@australasianautomotive.com

No interest. None.

Plans

Priority Migration Skilled Occupations List

The PMSOL allows skilled migrants to enter Australia under sponsorship arrangements with employers needing labour. And let me

repair businesses nationally suffer from acute labour shortages – in regional areas it is 56.5 percent. On average, it takes auto businesses six to nine months to fill skilled positions. That’s just not good enough.

The skills shortage is affecting consumers, who now face unprecedented wait times for vehicle service and repair work, which could create unacceptable driving conditions on our roads.

The government announced an additional 22 ‘priority’ occupations, bringing the PMSOL to 41 positions. Not one is from the automotive industry.

The Federal Government says it engaged with small, medium and large employers, business leaders, and industry bodies across the economy to determine these changes. They didn’t engage with the auto industry, and I want to know why.

The automotive industry employs 384,810 people nationally in positions that keep the country moving, enabling Australian businesses to survive and thrive. What could be more critical than that?

As a matter of urgency, the Federal Government needs to update its ‘priority’ list to include general and diesel motor mechanics, motorcycle mechanics, panel beaters, and vehicle painters.

Australia could grind to a halt if it doesn’t.

As a world leading manufacturer of original equipment thermal system products, DENSO’s aftermarket range offers unique advantages to our customers.

Our premium quality range includes A/C compressors, A/C condensers, receiver driers, expansion valves and pressure switches.

and traineeships have had a long history in creating a pipeline of skilled labour for Australia’s automotive industry. However, despite the Federal Government’s financial support and incentives in recent times, it is disappointing to see the number of apprentices and trainees commencing annually has fallen substantially across key automotive trades. This is especially the case in Victoria, where some apprenticeships appear to be in free fall.

The latest statistics from the National Centre for Vocational Education Research (NCVER) show a significant decline in apprentice commencements over the past four years. Notwithstanding the influence of COVID-19, nationally there were approximately 500 fewer light vehicle apprentices that commenced in 2020 compared to 2017, a 10.6 percent reduction. For Australia’s two largest states however, the situation is considerably worse.

Chart 1 shows that for Victoria, there were almost 1,200 light vehicle mechanical apprentices commencing in 2017, compared to 760 in 2020, a drop of 35.6 percent. New South Wales has also experienced a 14.2 percent decline over the same period.

The data shows an even more dire scenario for apprentice panel beaters and vehicle spray painters. Nationally, annual commencements of apprentice panel beaters have fallen by 31.1 percent since 2017, while vehicle spray painters have fallen by 25.6 percent. At a state level, the data shows that in Victoria, apprentice panel beater commencements have fallen from 203 in 2017, to only 80 in 2020, a massive reduction of 60.6 percent (Chart 2). Commencements of apprentice vehicle spray painters in Victoria have fallen by 45.7 percent over the same period.

While not all states have experienced such dramatic falls, the declining number of new apprentices across these key automotive trades, and within our largest training markets, is a major concern. In fairness, not all automotive occupations have suffered quite as badly. For example, heavy vehicle apprenticeship numbers have been relatively stable over this period, even exhibiting a slight growth in some states and territories. However, this is little consolation given their levels are still largely insufficient in addressing current skills shortages. For decades, the industry has argued there are not enough people entering automotive trades and that a skills crisis is imminent, and this is largely supported by

the data. Contextually, there have been approximately 1.4 million vehicles added to Australia’s roads over the past four years, yet the quantity of people entering automotive trades, especially in our two largest states, has declined substantially. Under this scenario, it was highly unlikely productivity increases could avert the effects of such a large increase in the fleet of vehicles on roads over such a short time frame, and that a skills crisis was largely inevitable without a major injection of skilled migrant labour. It is also undeniable that the economic

impact of COVID-19 over the past 18 months has had a distortionary effect on the demand and supply of apprentices in automotive, as well as many other industries. In this respect, Federal Government incentives such as the Boosting Apprenticeship Commencements wage subsidy scheme, while critically important, have not had the desired impact to attract enough new apprentices into the automotive industry. This makes it all the more imperative that a serious boost to skilled permanent and temporary migration become a national priority for government.

in the automotive industry will often find themselves in situations of conflict with either a supplier or consumer. The person charged with mediating these situations should be able to deal with conflict as part of their role. Many conversations around complaints involve strong emotions. There is nothing inherently wrong with emotions/feelings, however strong emotions can interfere with listening, reasoning and communicating. Values also influence attitudes and behaviour. People are unlikely to agree to an outcome they see as fundamentally compromising or conflicting with their values. A common cause of stress in complaint handling is when the conflict becomes personal and, as a result, begins to escalate out of control.

Some common causes of this are as follows:

Dispute of the facts. For example, what went wrong? A dispute about what

people having different views about past events or circumstances is common. Another important objective to identify from the outset is whether there is any merit to be drawn from focusing on what happened in the past to cause the issue, as opposed to immediately moving forward to a solution. Of course, as an internal matter, analysis may be useful to determine if there are systemic issues involved which should be discussed with staff to ensure similar problems can be avoided in the future.

In most complaint handling situations, the aim should be to identify and address problems with the view to finding what went wrong, rather than who did the wrong. When the focus is on the ‘who’, it can lead to defensive behaviour, which decreases the chance of a cooperative approach. In turn, it increases the likelihood of aggressively defensive behaviour and polarised positions. This will likely result in harm to the relationship between the parties. Failure to distinguish between actions

can lead to problems or failures should not automatically mean such an outcome was intentional. It is an unfortunate human trait that some people assume if they experience a negative impact then that must have been the intention of the person they perceive to be responsible. Miscommunication of decisions or actions can trigger a conflict or result in the escalation of an existing conflict. And as a final thought, any actions that could be perceived as an attack on the complainant’s sense of identity and importance should be avoided. By way of explanation, people can get very defensive or take an aggressive stance if they feel issues fundamental to their sense of identity and self-worth are being attacked or challenged. Complainants who are not treated with respect, whose allegations are not taken seriously or have their ethics or competence questioned, may quickly lose sight of the core issues resulting in the resolution of the complaint becoming that much more difficult. The above article identifies the main

THE Australian Automotive Aftermarket Association (AAAA) has launched the 2022 Australian Auto Aftermarket Expo (AAAE).

Taking place at the Melbourne Convention & Exhibition Centre (MCEC) and colocated with the Collison Repair Expo (CRE), the AAAE is the nation’s only comprehensive exhibition of Australia’s $25 billion aftermarket industry. The show brings together the industry’s best and brightest, and showcases hundreds of the country’s leading companies, all under one roof between 7 – 9 April 2022. With the theme The Workshop of the Future is Here, and debuting a range of new initiatives and features, AAAE is an unmissable event. The Expo showcases the latest vehicle repair and servicing equipment, parts, tools and accessories, new technology and trends, an awards evening, plus a comprehensive training and education program.

“We are excited to move forward with our preparations for the Expo – an event run by the industry, for the industry. After a challenging couple of years for everyone, our industry is more excited than ever to come together to celebrate, learn, conduct business, and network,” said AAAA CEO, Stuart Charity.

“The automotive industry in Australia is undergoing unprecedented change driven by the complexity of the car parc, changes in vehicle technology and the changing capabilities and needs of our workforce and customers. Vehicles with advanced driver assistance systems, pass through technology, embedded

telematics, and hybrid and electric powertrains are on Australian roads today. These vehicles will need to be safely repaired and maintained for their useful life anywhere in Australia.

“AAAE 2022 will bring together experts from across the industry to provide the latest information and practical tips on how and when businesses need to adapt to these changes. The Expo aims to help visitors prepare for the future, to embrace and capitalise on the evolution of the industry, and the trends and technology that are rapidly developing.”

AAAE continues to evolve, and the launch of new initiatives builds further value for exhibitors and attendees visiting the show. The Expo features a ‘Workshop of the Future' pavilion that will include a display of state-of-the-art equipment and technology and regular presentations from industry experts covering the latest information on Workshop Management Systems, EV repair techniques, ADAS calibration, and diagnostics and tooling,

The launch of the all-new 4WD Innovation Zone is an important addition for the Expo and one welcomed by the booming 4WD sector. This dedicated area provides a unique opportunity for companies involved in 4WD modification, accessories, and tuning to promote their company through a trade only B2B platform.

For the first time, the Expo will incorporate a stand-alone seminar stage on the show floor, which will deliver a free comprehensive training and education program and enable exhibitors to showcase their latest products, technology, and service offerings to a targeted trade audience.

Other components of the 2022 Auto Aftermarket Expo include a modified and classic vehicle display area in the show concourse, celebrity appearances, interactive displays, and competitions.

“AAAE is very excited to announce Repco has thrown their support behind the show, taking out the Major Sponsor package for AAAE 2022, and we thank them for their outstanding support,” said Charity.

“We can’t wait for April to open the doors and welcome our industry back together. Visitors will have a fantastic time and arm themselves with the knowledge to thrive, ready for the exciting future that awaits.”

Visitors to AAAE 2022 can expect over 250 of Australia’s leading brands to display across 19,500-square metres of floor space. With free entry available to all members of the automotive trade, the organisers expect to see 10,000 attendees over the three-day event.

The Australian Auto Aftermarket Expo and Collision Repair Expo takes place 7 – 9 April 2022 at the Melbourne Exhibition & Convention Centre. For more information and to register, head to autoaftermarketexpo.com.au

2021 comes to a close, VACC’s Industry Policy team would like to thank members who have engaged with us throughout the course of what has been an incredibly difficult year for business. As we move towards 2022 with some renewed hope, it feels timely to share some of the policy work being undertaken by the team on behalf of members.

In September, VACC provided written feedback to Treasury’s Automotive Franchising Discussion Paper. Our submission reiterated our long-held position that commercial vehicle, motorcycle, farm, and industrial machinery franchise dealers must be afforded the same legislative protections as new car dealers.

The evidence shows very little difference between the issues faced by new vehicle dealerships –culminated in the creation of the new car dealer specific Part 5 to the Franchise Code – and those issues faced by farm machinery, motorcycle and commercial vehicle dealerships.

The sophisticated business models, capital outlays, tooling requirements, and the fact all vehicle manufacturer operations are controlled by overseas parent companies, dictates that the separate, transparent, and automotive industry-specific schedule that became operational from 1 July 2021 must apply to all automotive franchise dealer sectors.

VACC also provided a detailed response to Treasury’s Exposure Draft Legislation and Explanatory Materials regarding Unfair Contract Terms (UCTs) in September. The Exposure Draft details amendments to the Australian Consumer Law (ACL) and the Australian Securities and Investments Commission Act 2001 (ASIC Act). The proposed law will see more UCTs in standard form contracts be open to scrutiny. The new legislation is also likely to deter the inclusion of UCTs in a broader range of contracts (i.e. all financial contracts such as mortgages and insurance).

This will have a direct bearing on the 72,521 Australian automotive businesses, of which over 95 percent are small and family-owned. While VACC largely supports the UCT reforms and the draft legislation in principle, we have pressed for further clarity and improvements to how they apply specifically to automotive small businesses.

Regarding COVID-19, the VACC Industry Policy team has remained permanently engaged with both state and federal governments – persistently applying pressure to ensure our members could remain open to trade and access more equitable business support packages. VACC had a breakthrough with the announcement of the COVID-19 Hardship Fund, which saw a greater cohort of businesses able to access the support. We recognise this was still not a perfect

outcome, given the onus to meet a very high threshold of reduced turnover. Our ongoing advocacy was to have this brought in line with New South Wales, where they applied a tiered approach to the distribution of the funding.

As we fast approach the next federal election, VACC’s Industry Policy team has been working collaboratively, bringing to life VACC’s federal policy manifesto. In line with previous year’s election policy documents, the paper will outline VACC’s key automotive industry policy priorities for the next Australian Government.

REVolution: key policy priorities of the Australian automotive industry spotlights areas requiring urgent government attention in order to future proof and assist our industry. These include preparing for the transition to a Zero or Low Emission Vehicle (ZLEV) future, tax reform, COVID-19 business support, the environment, skills and training, diversity, workplace relations, occupational health and safety and red-tape reduction. We look forward to sharing this document with members as we continue to advocate on your behalf at the most senior levels of government.

In closing, I encourage all members to reach out to any member of the Industry Policy team with an issue you feel requires attention. Once again, I thank members for their ongoing contributions to VACC’s policy agenda and we look forward to reconnecting in person via member visits, briefings, and roadshows in 2022.

driving off into the sunset.

handed over the keys. They never saw the keys or the car again.

The stolen car was probably the same model, colour, and build-year as a similar car and therefore perfect to rebirth. The stolen car could also have been stripped and used for secondhand parts, or maybe a criminal gang shipped the entire vehicle overseas.

The supposed buyer arrived at the seller’s house in a stolen car and left it outside on the street.

That’s a great way to comfort someone. I mean, they’ll be right back to collect it won’t they? Afraid not.

Not surprisingly, the thief insisted they should drive the seller’s car alone. In these COVID times it’s likely the vehicle owner considered safe distancing and

We call this theft-to-order, and private sellers like you and me are vulnerable. So, let no one test drive your car without you being in the passenger’s seat.

This isn’t just to ensure the ‘buyer’ doesn’t nick off, but guarantees their mates aren’t hopping in around the corner to take your motor for the biggest fang of its life. Remember Ferris Bueller?

It’s also not a bad idea to take a photo of their licence.

To be safe, use a Licensed Motor Car Trader (LMCT) who must meet regulatory requirements to trade.

LMCTs check a car has clear title, hasn’t been rebirthed, or have security registered against it, and you benefit from a cooling-off period.

Unfortunately, the car owner in this story has had cover refused by their insurance company. So, they must rely on vision from their home security camera to track down the crook.

I have bought and sold so many cars and motorcycles over the years, and I count myself lucky I haven’t been caught out. Make sure you don’t either. Stay well and see ya on the road folks.

Head to: thegrillepodcast.com.au

TNT is one of the country’s largest providers of business-to-business express delivery services. TNT provides on-demand, time-critical door to door express delivery services for documents, parcels and freight, worldwide and locally.

TNT has an extensive regional, national and international network of warehouses, sortation hubs and depots all linked by sophisticated technology. TNT has provided the Australian market with distribution services for more than 60 years.

For more information on TNT’s services and solutions, 13 11 50 or visit tnt.com.au

AFTER 21 years in the General Manager seat at the Tasmanian Automotive Chamber of Commerce (TACC), Malcolm Little retires in December. Before he went fishing, we caught up with him to discuss the highlights of his time in charge of TACC…

How long have you worked in the automotive industry?

I joined TACC in 2000 after 18 years in the banking and finance industry – the last eight years running the leasing division of the local bank, Trust Bank. This is where I gained the connection to the automotive industry, through relationships with car dealers and heavy plant and machinery.

What inspired you to join the industry?

When I saw the advertisement for the role, I wasn’t aware of the association, but research soon led me to an understanding of the valuable part TACC has in ensuring Tasmanian members are heard and supported. Working at TACC has been varied.

I began work in October 2000. Those 21 years have flown by. I have done my best to represent the interests of members to government and consumers. Over the last 18 months, I have also managed OurAuto, the Victorian Automotive Chamber of Commerce (VACC) commercial business. That was a very interesting time working with a sales team based in Queensland, New South Wales, Victoria, South Australia and New Zealand, during COVID-19. The team has done a wonderful job maintaining sales through lockdowns, over video calls and with limited team interaction and training, while still returning an above budget result for the Chamber.

What are your proudest achievements as TACC General Manager?

The big wins started with getting all the Tasmanian new-car dealers to join TACC. They previously had their own association. Then there was the development and introduction of the Motor Vehicle Traders Act. This helped dealers and consumers, and created consistency in the new and used market. Next, after years of lobbying, was an amendment to the Duties Act that revised the stamp duty and management of demonstrator vehicles and service loan cars. This allowed dealers to provide customers with loan cars that were stamp duty exempt, saving dealer-members thousands of dollars annually and enabling them to comply with franchise agreements – with less compliance and audits from the stamp duties office.

unpaid invoices for the industry. Other achievements include member growth. When I joined, TACC had 270 members. It now has 400, which is a significant result when most associations struggle to keep members. Also, to have improved the income to TACC/VACC by introducing TACC Accreditation, Roadside Help, an awards dinner, and Apprentice Group Training. TACC now makes a significant financial contribution to VACC. None of this would have been possible without the support I have had from members, the great committees over the years and wonderful fellow staff and the support and trust of VACC management and the VACC Board.

What is the biggest challenge or change facing TACC members in the coming years?

Over the years, I have had a wish list of things I wanted changed and I am proud to say I have achieved all but one of these items, many taking years

I have done my best for members, but the new TACC Manager will bring a new set of skills and experience to the role. Engaging with members is the important part and getting to know the government representatives in various departments will help with information and smoothing the way when seeking change.

What are your closing words for the TACC team and TACC member-businesses?

I will look back fondly at my time with TACC where I have been able to make a difference for both the Chamber and members, the significance of which is far more than I could have achieved in another industry. To all the people I have worked with and the talented team at VACC and TACC, thanks for the last 21 years. TACC has been around for over 90 years, and I am certain there are many more to come.

On behalf of TACC and VACC memberbusinesses and staff, the Chamber thanks Mr Little for his service and achievements

IT may surprise you – or it might not – that 48 percent, or one-intwo, Australian workers believe their workplace is mentally unhealthy. (1)

Even allowing for distortions when sampling and gathering views as data, that bald statistic from The Work Wellbeing Project (Safe Work Australia) must surely leave any alert business manager wondering about their own ship, the views of their people and leadership. How many? They might wonder. How many here think this place is ‘doing their heads in’, that it’s mentally unhealthy? Surely not one-in-two…

That same project also surveyed organisational leaders. Unremarkably, their responses sit neatly opposite the views of their people. For instance, 71 percent of organisational leaders believe their organisation is committed to the mental health of employees but only 37 percent of those employees agree. (2)

It is an interesting phenomenon, that ‘rose coloured view’ from the top. It is perhaps true that when seated in the captain’s chair it is easier to believe things are hunky-dory – that mostly everyone shares the vision and the passion – than it is to believe one-in-two may be troubled at work. So, does it matter – this mental health thing?

The happiness quotient

Yes. While the management of mental health in the workplace is a complex area

risks like health and safety, a number of researchers have reported that a mentally healthy workplace is also more productive, and business imposts like staff turnover, absenteeism, workers compensation, and sick-leave costs can be reduced. But how do you measure happiness? How, as a manager or company principal, do you achieve it? Can it be quantified or is it just a measure of smoke, something nice but formless and indefinable?

It doesn’t mean turning the place into a playpen with slides and bean bags like some Silicon Valley nirvana, and bringing out the whistles every time there’s a birthday. However, it does mean being aware of how your people are travelling, of the workplace culture – can they speak freely without recriminations when things are not ‘right’ and whether they feel supported in their work.

The task, as managers, is to be ‘with’ your people and for your people to be ‘with’ you. If the workplace is to be a collective of shared vision, then all are participants. This means walking the talk. Managers and team leaders model a culture founded on positive behaviours and dealings, fairly recognise effort and contribution,

respectful. Top to bottom, no exceptions. It has been mentioned before, the key to maintaining energy, engagement and productivity – the shared vision for success – lies in attending to the human values. And you? How are you travelling? It has been a tough two years, perhaps the toughest for business in decades. So, while reflecting on your workplace and its mental health practices, spend a little time thinking about yourself – your own wellbeing and the wellbeing of loved ones at home. If the pressures of business are travelling home with you, it’s neither good for you, nor for those at home. So, take stock. None of us is immune to overwork, excessive hours, or chronic tension.

Reach out for help if you are carrying the weight of the business on your shoulders. Talk to your GP or to a counsellor, if there have been days you’ve felt overwhelmed or unable to sleep. Your business also needs you to stay healthy.

For more information go to finetune. vacc.com.au or call 03 9829 1130.

(1) (2): The Work Wellbeing Project 2013 (Butterworth et al; Safe Work Australia)

Words Eric Eekhof

Principal Consultant, Pitcher Partners

AS the lines of code running our cars and our automotive manufacturing plants continue to rise, so too does the threat of attacks from cyber criminals. What action can automotive operators and suppliers take to protect themselves?

Attacks on the transport sector already make up five percent of all cyber-attacks, and it is feared the number of strikes against the automotive industry will continue to escalate. Industry watchers are bound to remember the chaos a few years ago, in which Chrysler had to recall 1.4 million vehicles after a couple of hackers proved they could paralyse a Jeep while it was driving. It was a costly PR disaster for the company — and only a hint of what was to come.

Last year, as the automotive sector struggled with the pandemic, it was also dealing with a sharp rise in cyberattacks, from the disruption of Honda’s global operations due to ransomware, to reports a Russian hacker offered a Tesla employee $1 million to plant malware in the company’s Gigafactory. It sounds like the stuff of a bad TV thriller, but the reality for the sector is that vehicles, the data they collect, the safety of the people inside, and the systems on which they run are all juicy targets for those engaged in cybercrime. Every step in the supply chain, from the companies developing vehicle software,

(OEMs), to the auto shop that updates the software offers a potential entry point for malicious attack. So, what are the key cyber threats facing the sector?

The first thing to note is, with a modern vehicle running a million or more lines of code, there’s a lot that can be done to disrupt one car or an entire fleet. The biggest vector for attacks, according to vehicle cybersecurity group Upstream, lies in the servers that keep vehicles connected, including command-and-control telematics servers that not only allow owners but also hackers to lock or unlock doors, start engines and — for autonomous vehicles — drive the vehicle away.

When a white hat hacker gained access to Tesla’s entire fleet in 2017, he discovered just this kind of flaw, which not only identified the location of all Teslas, but allowed him access to the ‘Summon’ functionality that allows the cars to be driven remotely. In addition, these servers also hold critical information about customers, and groups like Toyota have seen multiple attacks to steal or reveal customer data in recent years. The second most common point of attack is the keyless fob, sensationally used to steal actor Tom Cruise’s BMW X7 a few weeks ago, with thousands of dollars of luggage, after car thieves hacked the vehicle while it was parked outside a hotel in the UK. While Australian authorities say this kind of crime is still less common than traditional

Tracker in the UK report 93 percent of the cases it deals with are now keyless thefts. The third area of risk is that of mobile apps, which can drive entertainment systems, monitor the location of trucks, measure the efficiency of fleet movements, or other uses.

A lack of regulation and consistent security here can expose data or open a gateway to other systems that can be exploited.

With so much at stake, the industry is finally taking cyber security seriously. And it is not only threats that are driving change: According to a study from IBM, 62 percent of consumers have said they would consider one brand over another if it had better security and privacy.

The first step is agreement on a new UN regulation to mitigate vehicle cyber risk, which will require manufacturers to meet clear security performance and audit requirements. This regulation will be enforced through ‘approval authority’ that will vet manufacturers.

The second step is the establishment of a new ISO standard for cybersecurity engineering for road vehicles. It is expected all manufacturers would comply with this standard for both security and commercial reasons, especially if security becomes a differentiating factor in car sales.

Both these standards are likely just the start of sweeping changes that will require every step in the automotive supply chain to improve security processes. The challenge for Australia’s automotive sector will be

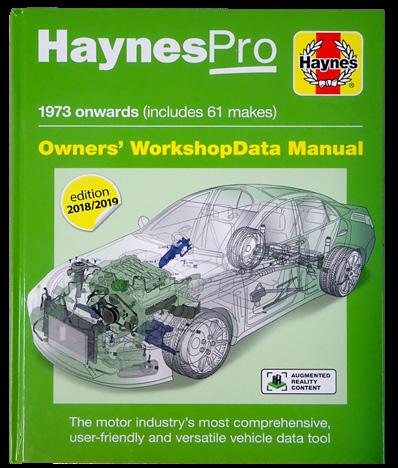

VACC Technical Services has launched into a new era of product offerings that will change the automotive technical information game in Australia.

VACC has signed a multi-year deal with the famous British-based Haynes Publishing Group, bringing to market a suite of products, unsurpassed in Australia, under the banner of VACC MotorTech.

VACC MotorTech brings together VACC’s proven Tech Online, Times Guide, Tech Estimate, Tech Advisory Service and Tech Talk products with the might of Haynes’ international know-how, to provide an enormous (and evergrowing) amount of technical service and repair information to subscribers.

Available now for subscription are four ‘solutions’: Maintenance, Service & Repair, Diagnostics and Commercials. These new products are positioned at an unbeatable price and VACC members receive generous discounts of up to 50 percent.

Haynes is best known in Australia for its Haynes manuals that have been in print since 1965 and have sold over 200 million copies worldwide. However, they

online products, designed for automotive professionals under the HaynesPro brand.

Until the agreement with VACC, HaynesPro products have not been available in the Australian market in such affordable and convenient packages.

The HaynesPro products include:

• HaynesPro Manuals AllAccess Cars allows access to all Haynes manuals online, providing step-by-step repair and service information, along with extra details not published in the hard copy versions. The Haynes OnDemand video tutorials – available for many of the most popular models – are the ultimate aid to getting vehicles correctly serviced and repaired.

• HaynesPro WorkshopData Tech contains extensive maintenance information like repair times, timing belt and chain replacement procedures, capacities, wheel alignment, torque specification and over 100,000 high-quality technical drawings.

• HaynesPro WorkshopData Electronics and Smart includes the VESA guided diagnostics system, wiring diagrams for most vehicle systems, fuse and relay locations, earth point and control unit locations, TSBs and known fixes.

• HaynesPro WorkshopData Truck includes WorkshopData Tech, WorkshopData Electronics and WorkshopData Smart. It is the most effective application from fault to fix.

The agreement between VACC and Haynes provides automotive business owners new options and easy access to repair information and vehicle repair times not available previously, in bundles to suit every business’s needs.

Visit: motortech.com.au to learn more.

Facilitators will:

• assess current workplace practices

• suggest helpful improvements

• develop an easy-to-implement action plan

• provide resources and ongoing guidance.

A virtual member visit took place – a first for VACC, with Barry James zooming Chamber CEO, Geoff Gwilym and Industry Policy Advisor, Kathy Zdravevski – to celebrate Barry James Smash Repairs’ 75-year membership milestone.

With local media also attending the workshop to mark the occasion, Barry reflected on his automotive career and shared his thoughts on key industry and body repair issues.

After leaving St Patricks College at fifteen “to go out and look for a job somewhere”, carpentry initially interested Barry. He trialled some local places but nothing stuck, and then an opportunity presented itself in automotive. “My father knew a chap called Albie who was a panel beater and had his own place near Ballarat”. So, they headed to the workshop and “Albie had a look at me and said, ‘he looks alright to me… yeah, he’s got a job.’”

After securing his apprenticeship, Barry was excited but not totally sold on the change in direction – automotive wasn’t the industry for which he aimed. “I thought, what am I going to do now? But I loved mucking around with cars and all that sort of stuff”. Barry took to the work quickly and fondly remembers his five years at that workshop. “I enjoyed my time panel beating… It was only a small shop, with about 10 of us working there. They trained me very well and I learnt a lot”. Barry attended the Ballarat School of Mines, although a lot of his skills were developed on the job. “There was a course on welding. There certainly wasn’t any course on panel beating.”

By the time Barry was 20, he had established a good reputation and felt confident to go out on his own. So, with early completion of his apprenticeship and some cab driving work to see him through, Barry set up a workshop in his backyard. The cab network proved useful in those early days. “My father was one of the leading people that had the cabs, and it worked out very well because the other cab people knew me and, of course, if they

saw a smash they might call in and tell the driver to ‘go and see so-andso and he’ll look after you’”. Similarly, Barry’s connections in the industry came in handy when a vehicle needed painting. “I used to run the work down to Hutchinson. They’d paint the panels, and I would put them all back together again”. Barry quickly built the business. “It was going very well, and we had to extend the workshop area. Over a period of time, I bought the four townhouses behind me to make more room”. At one point, Barry James Smash Repairs had 70 employees on the books and 30 to 40 cars per week. “Panel beating was so much slower in those days”. Barry explained it was “mainly a hands-on job right the way through, with some electrical things to help you along the way.” With the tools now “some jobs people can do in 10 minutes, it would have taken me 10 hours back then.”

If he was 20 today, Barry considered whether he would see panel beating as a viable career path. “It would still be ok. Depends on what you’ve done yourself. It’s important that you’ve been educated in the game in the first place... and have a fair knowledge of motor cars”. Another key ingredient to a business well-built is staff. “Having capable staff is very important. It’s much the same as today”. However, finding staff proves a challenge these days. VACC – along with its national body and state counterparts – is committed to improving the skills shortage situation in Australia. It is in discussions with government about streamlining skilled migrant intake however, at a local level, few apprentices are coming through –particularly in the body repair sector. It’s very difficult for businesses to attract and retain apprentices. “In those early days, we had to get a job. I delivered papers as a kid. The government never paid you any money. So, there were plenty of kids around looking for jobs

“A lot of times, even here, we have had young people on staff to do the job. They get here and are here a year or two, then the next thing they say is, ‘Oh, I don’t like this’ and they go and get a job around the corner. Because there’s that many jobs available. It’s very difficult to get more apprentices into the game. Pay them a higher wage, otherwise, it’s difficult,” said Barry.

Conversation inevitably turned to the topic of insurer and body repairer relationships. Love it or hate it, they are two parts of the same industry. The insurer must get the car repaired for the consumer, and the body repairer must make a living. While some workshops struggle, Barry maintains different body shops have different relationships with insurers. Barry James Smash Repairs has become something of a local institution, and Barry – to quote the Ballarat Courier – a ‘Ballarat motoring identity’. His initiative and work ethic has served his business and community well. And with son, Glen, now in the driver’s seat, its full steam ahead. VACC congratulates Barry and his team on a fantastic achievement and looks forward to seeing what the next 75 years hold.

Whether you re star ting, running or growing your business, CommBank, proud Alliance Par tner of VACC can help you do business your way D e d i c a

To help you take your business to the next level, VACC members can benefit from direct access to a dedicated CommBank Relationship Manager and team of banking specialists They ’ll work with you through every stage of your business life cycle You’ll also receive 24/7 Australian based phone suppor t for all your business banking needs.

B u s i n e s s

VACC members may be eligible to access the latest innovative business banking products and solutions with preferential pricing applied, making it easier for you to do business These include:

No merchant joining fee

Same day se�lement every day of the year^

Daily IQ - free business insight s tool with CommBiz and NetBank

Business Loans and Asset Finance

Overdra� Facilities and Bank Guarantees

Free business financial health checks

To find out how CommBank can help you do business your way, contact VACC on 03 9829 1152 or email marketing@vacc com au and they’ll put you in touch with a CommBank Relationship Manager.

EMPLOYEES who start a new job, or who change jobs, are required to nominate a superannuation fund into which the new employer deposits their super. If no nomination is made by a new employee, the employer can set up a new account for that new employee with the usual default super fund used by the employer.

Many employees do not nominate a fund, which results in new super accounts being set up every time they change jobs. Holding multiple accounts is costly for employees, as multiple superannuation accounts held with different funds result in them paying multiple sets of fees and insurance premiums.

To fix this, laws have been changed to introduced super ‘stapling’.

What you need to know

Important changes have been made to superannuation laws which may affect how employers comply with their super obligations.

The changes introduce the concept of ‘stapling’ where new employees will automatically keep their existing super fund (if they have one) when they start a new job, unless they choose a fund themselves. At the time of starting a new job, unless a new employee decides otherwise, employers will need to pay superannuation contributions into the new employees existing fund (known as a ‘stapled’ fund).

This means that if a new employee does not nominate a specific super fund to receive

their contributions, employers will no longer need to automatically create a new superannuation account in their chosen default fund for that new employee.

The changes will apply from 1 November 2021. What is ‘super stapling’?

Super stapling is the method through which the new laws create a single super account to follow people when they move from job to job. To achieve this, employees will be ‘stapled’ to a specific super fund. The result being when employees change jobs, super contributions will be paid into their ‘stapled’ fund, unless they actively nominate a different fund or choose to set up a new fund. What does this mean for employers?

From 1 November 2021, your new employees will automatically keep their existing super fund (if they have one) when they start their employment with you, unless they choose a fund themselves. This means that if your new employee does not nominate a specific super fund to receive their contributions, you will no longer need to automatically create a new superannuation account in your business’ chosen default fund for that new employee. When do the changes start? What types of employees are affected?

The new changes started from 1 November 2021 and only apply when you take on new employees. Existing employees are not expected to be affected by these changes. You must continue to

make their compulsory Superannuation Guarantee payments into the same super fund account you do today. What do I need to do?

This will depend on whether a new employee nominates their super fund.

Where a new employee makes their choice of super fund: If a new employee notifies you of their preferred fund (using the Standard Choice Form), you must make payments into this account.

Where a new employee does not make their choice of super fund: Where a new employee does not choose a super fund, you will need to log in to Australian Taxation Office (ATO) online services with the employee’s details to see if the employee has an existing super fund – their ‘stapled’ fund. If they do, you must make payments to this account.

The required employee details include:

• Tax File Number (TFN). An exemption code can be entered where an employee cannot provide their TFN, but this could result in processing delays

Full name, including ‘other given name’ if known

Date of birth

Address, if TFN not provided.

If the new employee does not have a stapled fund and doesn’t choose a fund, then you must create a new account with your nominated default super fund. Further information is available from the ATO website: ato.gov.au

Words Ged Bulmer

IN a significant milestone for Australian motorcycling, production of the first Australian designed and manufactured battery electric motorcycle will begin in Melbourne next year.

The emergence of electro-mobility is creating new opportunities for Australian automotive manufacturing, one of the latest examples of which is Savic Motorcycles which will soon begin production of a full-sized, high-performance electric motorcycle in Melbourne.

The innovative start-up recently confirmed it will move from prototype to manufacturing stage with its electrically powered C-Series café racer, following completion of a $1.83 million capital raise – which included contributions from the Victorian Government and co-investment of $657,000 from the Federal Government’s Advanced Manufacturing Growth Centre (AMGC).

“The investment from AMGC is a strong vote of confidence in our product and plans to manufacture EV motorbikes onshore,” said 29-year-old company founder, Dennis Savic.

“Now that our first production run is funded, we’re aiming to have at least 20 bikes delivered to their owners in the last quarter of 2022, before rapidly scaling up manufacturing in 2023.”

The company has run two smaller capital raises over the past four years to develop its prototype, but Savic described this latest round as “a game-changing proposition” that would fast-track progress towards a second 200-unit production run in 2023.

The funds drive was supported by grants from the AMGC and the Victorian Clean Tech Fund, as well as an R&D loan from the Victorian Government’s Invest Victoria.

Savic said the C-Series has been designed to “fulfil the promise of ethical, pollutionfree transport,” and that more than 80 percent of the vehicle, including its frame and powertrain enclosure, are made from fully recyclable cast aluminium.

firm having received 90 orders for the bike, which is available in three-variants – Alpha, Delta, and Omega – with different motor outputs, range, and performance.

“Our initial customers have proved to be incredibly loyal and have shown great faith in us and our bike during the delays we’ve experienced during the lockdowns of the past 18 months,” said Savic.

“The bike is virtually maintenance free, with owners only having to take care of the tyres, brakes and suspension, and the batteries and motor components are unlikely to require mechanical attention for the life of the vehicle,” said Savic.

Featuring classic 70s-era café racer styling and a muscular electric powertrain, the C-Series has already captured the imagination of some motorcycle enthusiasts, with the West Melbourne

All three Savic models promise the exhilarating instantaneous performance of an electric powertrain, with the top-ofthe-line Alpha boasting 200Nm of torque, a 200km riding range, and a 0-100km/h acceleration of 3.5 seconds. The lighter and more affordable Delta has a range of 150km range, while the entry level Omega can travel 120km on a single charge.

The company cites industry tests that suggest the batteries will last between 1,000 to 5,000 charge cycles – or at least 200,000km – before they require replacing, at which time they can be recycled for use in home energy storage systems.

Savic Motorcycles was one of 10 companies who received a total of $6.1 million from the AMGC Commercialisation Fund grants, which is designed to support a wide

variety of manufacturers, each falling within the Federal Government’s six National Manufacturing Priority sectors.

“Australian manufacturers are exceedingly innovative and competitive when given the right support,” said Managing Director of the AMGC, Dr Jens Goennemann.

“Savic Motorcycles is paving the way for electric mobility in Australia by leveraging the best of breed designers, engineers and manufacturing partners to deliver motorbikes of unmatched performance for local and global customers

“Savic is proof that when you embrace the entire manufacturing process from design to research and development, all the way

through to sales, there are exciting times

milestone for the eponymous entrepreneur

Dave Hendroff, who have been working electric motorcycle for the past 10 years.

2017, the bike has travelled through three prototypes and benefited from numerous advances in electrical engineering, artificial

All three Savic C-Series models feature a motor and energy storage system, with the core bike’s standard body and battery design enabling construction of the two

The bike also boasts world-class, racing-

drive belt, with the Savic team currently developing a sophisticated AI system and rider app. The development team is also about to embark on the design of a special anti-lock braking system, in conjunction with Melbourne-based Bosch Australia.

a motorcycle, it’s significantly below the price of the all-electric Harley-Davidson

Savic spoke of the challenge of designing

“With the C-Series, we wanted to recreate the distinctive pared-down style of a café racer, with clip-on handlebars, a broad ‘fuel tank’, and a vegan-leather cowled seat enabling riders to adopt a low racing stance”.

He said the main engineering challenge was weight, specifically integrating the bulky 80kg powertrain – more than one-third of the bike’s overall weight – without detracting from the lines and distinctive ‘racing’ style of the iconic 1970s motorcycles it emulates.

“We did this by casting the bike’s frame in lightweight aluminium, and incorporating the powertrain enclosure – containing the motor, the motor-controller, and a 144-volt battery pack – into the frame, as a structural chassis element”.

It’s not just the Savic’s drivetrain that is hi-tech either, the ‘cockpit’ of the C-Series features a 7.0-inch resistive touchscreen that connects riders to their bike's location and performance in real time.

In addition to a full quota of safety, performance, and battery data, the Savic’s advanced Internet of Things (IoT) capabilities are designed to facilitate the delivery of instant journey information, traffic, and weather alerts, as well as enabling riders to ‘tweak’ their bikes to suit individual riding preferences.

“The result is Australia’s first true 21st century motorbike, a testament to the emerging electric revolution, which will delight riders with its powerful performance, data smarts, and head-turning looks,” said Savic.

While the Savic Alpha is certainly quick, Savic says his new bike range is “not just for speed-merchants,” adding that by having a standard body and battery design the company has been able to affordably produce the two lighter, lowerpowered and less expensive models.

“The bike’s powerful instantaneous torque and acceleration will appeal to speedseekers, while the smooth handling and quiet operation will appeal to the most conscientious modern rider,” he said.

“With our Omega model priced at $12,990, we’re making the dream of electric motorcycling accessible to younger, more price-conscious consumers.

“The absence of gears or clutch also means the C-Series offers a much simpler, more seamless riding experience than traditional combustion motorbikes”.

Australian Good Design Awards, which handed the C-Series Alpha a Gold Award in its 2021 awards program. The Savic has also previously been featured as the title object at the entrance to the Spark climatechange exhibition at Sydney’s Australian Museum, and celebrated as one of the world’s 101 most influential motorcycles at Brisbane’s Gallery of Modern Art.

“Among those who have pre-ordered our bike are lifelong motorcyclists who say they would never previously have considered an electric bike but have been won over by the prototype’s styling and performance,” said Savic.

“Savic Motorcycles' number one priority is to play a leading role in the e-mobility revolution. We’re doing this by delivering future-proof motorcycling to riders who love the art of classic motorbikes, but want a reliable vehicle to get from A to B safely, comfortably and affordably, with zero emissions.”

The number of electric motorcycle and scooter models is gradually increasing in Australia, according to Australian electric vehicle lobby group, the Electric Vehicle Council, which lists models now available from Evoke, Fonzarelli, Harley-Davidson, and Super Soco.

and power conversion technologies.

The bike’s focus on design and technology has already been recognised by the

With the Savic C-Series soon to join that list, Australia’s long dormant motorcycle manufacturing industry is set to be jolted back to life, and when the first C-Series rolls off the production line in 2022 Victoria will once again be at the forefront of Australian automotive manufacturing

JOB CARDS BOTH LARGE AND SMALL

Bysigningthisjobcard,thecustomeracknowledgeshavingseen/recieved

alsoauthorisetheaboverepairsastheowner/agent.

CEO

Garry Johnson (the ‘Son’ In Burson), together with partner Ron Burgoine (the ‘Bur’ in Burson) set out on an automotive business venture more than 50 years ago. Their determination to succeed went on to establish Australia’s leading trade supplier of automotive parts, tools, accessories, and equipment. In 1985, Garry Johnson acquired Ron Burgoine’s 50 percent share to become the sole owner of Burson Auto Parts. After taking the company as far as Johnson and his management team could in the years to follow, it was Darryl Abotomey and his executive management team who carried the Burson Auto Parts baton to new heights. We bring them together to discuss where it all started and how this company co-founder’s legacy helped create the largest automotive aftermarket specialised company in the Asia Pacific region.

How was Burson Auto Parts born?

GJ: It all started from an idea I and my friend Ron Burgoine had about going into business together. I was the accounting and finance person and he was the sales person. The only problem was we had no money. We were looking at businesses that were for sale and I visited a business agent who advised of the re-launch of an oil additives and chemicals business to the local market. After looking at their business plan and their established sales to date through service stations interstate, we thought it had potential. So, I took out a second mortgage on my house and together with an equal contribution from Ron, we found ourselves selling oil additives and other chemical products to service stations and other automotive outlets. The fact we were now in the automotive business was by sheer fluke, we hadn’t planned it that way at all. This business opportunity came along and it fitted into our financial capacity at the time. We placed a great deal of product into service stations on consignment, so our customers only bought what they sold and we regularly replenished stock on a stand we provided using a station wagon and a van. Then we got into other products, initially with car mats, street directories and other allied automotive products we could sell when visiting our service station customers, which included some replacement auto parts. This was how we got started in the automotive parts business. We then established some cash vans to drive around Melbourne and regional Victoria, selling parts to mechanics who could just step into the back of the van and source

whatever parts they needed on a regular basis. We ended up with nine cash vans, which were received well by our service station and workshop customers. At around the same time, our aftermarket carpet mat business continued to grow and we were packaging and selling our carpet mats to K-Mart, Target and other retail stores, along with our service station customers. This became a source of solid and reliable income for us through those early years, which helped us to grow the auto parts business. We were on a weekly call cycle to our trade customers with our cash vans, but we quickly identified our customers needed hourly or bi-hourly service for parts. An opportunity came for us to take over the lease of a former Lapco warehouse in Braybrook in 1971. While we didn’t take on the existing Lapco parts business as we didn’t have a lot of money back then, we did want the lease deal and the established shelving – which came cheap. We then had our first Burson Auto Parts store, supported by a warehouse in West Heidelberg, offering faster deliveries to mechanics in the area and serving as a base for our cash vans to service other areas of Melbourne. We then took on a second store in South Melbourne and gradually acquired existing spare parts businesses to expand our store and parts delivery footprint across Melbourne and Victoria. Soon enough, we had reps out on the road as well, working hard to grow our trade business. Ron and I worked very hard in those early days. By 1985 and with a network of 13 Burson Auto Parts stores, I bought out Ron and the journey of growth continued for the company focusing

on parts and service. I went from being a mild-mannered accountant to becoming an entrepreneur seeking to strongly grow the business. I planned to float the company on the ASX in 1987, to grow it through equity rather than always being in debt but, just as I was entering into the process, there was a major stock market crash and while all the preparations and the debt that goes with the process had been committed, I took some advice from my broker and unfortunately had to pull the float. At this stage I was fortunate to be supported by two excellent people in Terry Penney in sales and Andrew Schram in purchasing. They helped me to continue our growth plan in an orderly fashion, acquiring greenfield sites and existing businesses to best serve our strong trade customer base. We were approached by groups of stores in Queensland, New South Wales and South Australia and took over these stores, re-badged them and gained some highly experienced staff in the process. We turned the performance of many of the more average stores around completely and our business was gradually becoming national. Being small and flexible, we were able to focus on improving and expanding our product range, taking care of our hardworking people and, most of all, our trade customers across the country. Our focus was always on the trade, even when our competitors turned their focus to their retail business. For us, it was all about keeping our trade customers happy. I can’t stress enough the dedication and commitment of our staff who genuinely loved working for Burson Auto Parts because, as the company grew, we always maintained the same small business culture.

Darryl, tell us about how you saw Burson Auto Parts before you became involved?

DA: I got to know Garry during my career at Repco and it was clear to see from the trade business perspective, Burson Auto Parts was whipping our backsides and that was partly due to Repco’s retail focus at the time, as Garry has pointed out. Having said that, you could always see the trade business growth that Burson Auto Parts was generating in comparison to its competitors.

GJ: Back in the early days, Repco was up there in the stratosphere, we never really thought we would ever get to that level, but as time progressed our business grew very strongly. There was a ‘club’ of established Australian parts suppliers back then who also made it difficult for us to gain direct distribution of some parts. This was integral to our trade business growth, so we managed to overcome the distribution hurdles that were deliberately placed in front of us and we were accepted as legitimate direct distributors. Garry, tell us about reaching the point of deciding it was time to hand over the reins of your company to new management.

GJ: I had almost reached 70 years of age, I was trying to be a part-time CEO and the owner, always trying to grow the company, but not wanting to take on too much debt. Certain areas of the business were getting away from our skill-set, like IT and HR. As the majority shareholder I had to assess my commitment to Burson, including my own life goals. After an emotional discussion with my fellow directors and shareholders, on 7 September 2011 I wrote a memo to our team saying my time was up and I would sell the business after 40 years at the helm. It was the saddest memo I had ever written. The company was in a strong financial position with good systems and procedures, dedicated and hardworking staff – all was in place for the right new owners to drive the company into a bigger and better future. While this was the right decision, it was still a very tough and highly emotional one for me. I absolutely loved the entire Burson Auto Parts journey, I loved the phones ringing with new and exciting opportunities, opening new stores and working with such a great team of dedicated people. Having reached a total of 92 stores, I then went through the sale process with KPMG and discussed the likely buyers. There was a New Zealand group, Private Equity, Repco, and Supercheap. I didn’t like the idea of selling the company to the opposition because I cared about my staff and the hard work they had put into this company, so I wanted a buyer who would continue the

Burson Auto Parts culture and journey we had started and built from the ground up.

DA: I’d like to quote you on what you said to me at the time about selling Burson Auto Parts to a competitor. You said you wouldn’t be able to sleep straight in bed at night if you had done that to your people – turned them over to the enemy - even though you could have earned a substantial amount more by doing that.

GJ: So, after reviewing the potential buyers I had a few coffees with Darryl as we had been friends through family connections for several years and I was impressed by his industry experience and knowledge. I told him I was struggling with the sale process. I didn’t like the proposals I had received to that point and Darryl suggested he could organise a management buy-out and would like the opportunity to present this to us. I thought about it and called my 2IC, Andrew Schram, to have a talk to Darryl and see if he liked his proposal. I bounced everything off Andrew for the four decades we worked together, so I strongly trusted his judgement. They met up and Andrew gave the thumbsup to Darryl and his plans for the company, endorsing the belief I also had. So, I pressed the Darryl button to move forward with his proposal and it has resulted in a fantastic journey for Burson Auto Parts with him and his talented management team at the helm over the past decade. I would never have thought they would have achieved the growth that has been made and reach a market capitalisation of just under three billion dollars within 10 years. It has been truly extraordinary and Darryl is the rock star of it all.

DA: It was an interesting process. I remember speaking with Garry and asking him what he wanted to see happen with the business and his clear mantra all the way through it was to ensure he was doing the right thing by his people. I could see the challenges with selling to private equity or competitors, or to companies that bid at one price, then tried to lower it again and again. It was clear there were people involved in the game you would not trust to do the right thing by the company. So, I approached some private equity contacts I personally knew from prior business dealings and Quadrant stood out because they weren’t interested in buying and gutting businesses, they were all about growing their business investments. So, I put an agreement in place with them that stated all the things we had to achieve with this acquisition, so they couldn’t destroy the fabric of the company and its significant growth potential.

GJ: That was always my fear in selling to private equity, this was my greatest concern.

DA: Once we made the acquisition my management team and I spent six months understanding the business, its people and

its processes. It was very profitable and was operating well and we didn’t change anything during that time. We then assembled all the store managers at a Melbourne hotel and outlined our growth plans and sales targets for the next 12 months. It was a positive and productive session and my famous last words to them were that if we achieved these targets, the next store manager’s meeting will be held at a far more exotic location. Over the next 12 months, our team just blew the lights out, far exceeding our targets, paving the way for us to accelerate our expansion plans. We started with 92 stores and wanted to become national quickly, as we could see the opportunity to really knock our major competitor off their perch. At this stage we were approached by the then owners of Automotive Brands who wanted to sell their retail businesses to us, but we were extremely focused on our trade business and let that opportunity go. We were really gaining strong momentum with store roll-outs, having bought up most of the multi-store independent parts groups and having established excellent new greenfield sites across the country. In line with keeping our people happy, one year after setting our targets, we kept our promise and took all our store managers to Thailand and that was really important in showing how much we valued their extraordinary efforts. Half of them didn’t even have passports! We had an absolute ball over there and it really strengthened our team bonding. We turned the process of establishing new stores into a fine art and they were immediately performing strongly. It was during our second year of owning the company that we realised there was potential for further growth when Metcash approached us seeking to sell their automotive businesses. Part of our rationale behind acquiring these businesses was to stop them becoming competitors and to provide us with both wholesale and retail channels to market. This was the first big step we took and it was the right step to take, bringing in wholesale businesses enabling us to establish more quality private label products along with direct retail access. We wanted to introduce these factors gradually, as taking care of our people was always of the utmost importance.

GJ: I used to also take my people away to reward them – some of them had never been on an aeroplane! We took them to Sydney, Queensland, Uluru and other great places and shared some fantastic experiences. This was all about building up the Burson culture. Does that same Burson culture exist today?

GJ: I speak to some people who are still with the company and most of them really love it, which gives me great pleasure. Even though the company is now much bigger, the feedback I receive is it is still a great company to work for. There are so many promotional opportunities for

IT, store, and product management that have come with the company’s growth. I couldn’t be happier with how the journey has progressed with little to no impact on the company’s pre-existing culture. Did you ever think the company you cofounded would become this big?

GJ: No, I didn’t and I am sure Darryl didn’t either! Not within 10 years, for sure. Darryl grasped the opportunity to consolidate a major automotive aftermarket company with the Metcash acquisition, to become the biggest in the country and this was an excellent strategic move, the opportunity presented itself at the right time.

DA: In the early days, we set a target of having 175 Burson Auto Parts stores, it was never anything beyond that. Then as things transpired it changed our thinking somewhat, but the one thing we have and will never lose sight of is that Burson Auto Parts is a trade business and won’t ever become anything but that. We have expanded our product ranges and so forth, but there will always be a definite delineation between the retail businesses we acquired and Burson Auto Parts. This works well because our businesses are not competing with each other and they are not trying to be dual retail and trade businesses. We also know what each business is all about and we respect there are distinct differences between retail customers and trade customers. Trade is all about service and working closely with mechanics. It requires a far more intrinsic knowledge set to best service our customers. The other important change was our move into Specialist Wholesale businesses. We bought into the bearings and auto electrical sides of the business and in 2017 acquired Hellaby’s auto parts businesses in New Zealand. We also had the ability to get involved in the truck and heavy duty side of the business because no one was doing it the Burson way, using the synergies of the entire group. We have now become the only group in Australia that supplies parts for all types of vehicles – cars, light and heavy commercial,

deal with each vehicle sector separately, linked to our sourcing businesses which allows them to access quality products directly. We are adding about 60 new locations each year across all our Australian automotive aftermarket businesses, when we already have the largest footprint of any automotive aftermarket business not only in Australia, but across the entire Asia Pacific region. Each business sector has five-year targets and they are already exceeding our expectations. We have specific growth plans for every business in the group and each is progressing perfectly. We have approached these growth plans in steps and have not tried to do everything at once, which has worked extremely well for us. Did you ever think there would be a Burson Auto Parts store overseas?

GJ: No, I never did. It was exciting enough opening 92 stores across Australia, let alone now having reached 200 stores and to be still growing today. I’m very proud Burson Auto Parts has become the first Australian auto parts company to successfully expand into Asia. Others have talked about it, Burson Auto Parts was the company that actually did it.

What makes the Burson Auto Parts style of doing business so special?

DA: There are three core things Burson Auto Parts has done extremely well. We have ensured all the people in our stores, including those who deliver the parts, are Burson team members and not contractors. Our people build strong relationships with customers and are the face of our business. They make our customers feel important and valued. Secondly, we have set a target of each store making deliveries to its workshop customer base within 30 minutes or at the most within the hour. This customer service focus is imperative to our continued success. The third and biggest Burson difference is our team members will do whatever they need to do to get the part to the customer, even if they have to buy it from a competitor. While we carry the broadest range of

parts in store compared to any competitor, our team members are authorised to do whatever is necessary to ensure the customer always gets what they need promptly. All our staff are rewarded based on their store performance and all Burson Auto Parts store managers earn a percentage of the profits their store has generated. This has really made our managers and staff more committed to the business, treating it as if it was their own.

GJ: We started paying bonuses when KPIs were reached in the early years as well and our staff retention was incredible. Our staff always worked so hard, they would even drop off parts on their way home or before work in the mornings, doing all they could to provide the best possible service to their customers.

DA: Garry used to ring everyone in the company on their birthday and I kept doing that for the first 18 months, but then we became too big and I now send cards these days instead. So, I now spend most of my Sunday nights writing birthday cards! Garry also presented service awards for longterm staff and we have continued this tradition with gift cards, ensuring the long standing Burson culture of taking care of the company’s people remains strong. How do you best summarise what has taken place since you stepped away from running the business you created?