SMEs signal trouble ahead as automotive industry feels the pinch Tighter economic times are changing consumer behaviours

The crucial role of well-drafted terms of trade in business. John Caine explains how to avoid misunderstandings with customers

The automotive industry transitions, with substantial training and development occurring in EV safety

Automotive Industry Awards celebrate top businesses, rising stars, and VACC and TACC’s graduating apprentices

Geoff Gwilym and President Chris Hummer visit members Vin Rowe Farm Machinery and Olivier Panel Works in South East Victoria

Celebrating the legacy of GEL Motors. Geoff Gwilym talks EVs, skills shortages and apprentices with owner Adam Gocentas

Three generations of excellence: from post-WWII immigrant to thriving Tasmanian automotive business

Tasmanian Government ’s boost for automotive education through TACC grant and TasTAFE upgrades

David McLeod, Managing Director of Ozwide Tools & Mechanics Tool Hire is a leader in specialty automotive tooling

There’s increasing concern about the safety of Li-ion batteries used in EVs. Should you be concerned?

Getting Technical this issue addresses the Ford Everest SCR system and the common diagnostic trouble codes

Find everything from the latest products to the best business services you need all in one place

Take advantage of VACC and TACC corporate partnerships and services, and drive your business forward

From our archives, a page from The Australian Automobile Trade Journal published 100 years ago in August 1924

WHEN you’ve got your head under a bonnet, in a 2025-26 budget projection spreadsheet, or in yet another Zoom meeting, it’s hard to know what’s happening in your world, your industry, and your sector. That’s why it’s great to know you have a team of experts who are always in your corner.

A quick glance at the VACC website (vacc.com.au/About/Submissions) will show you some of what’s going on.

This year, the VACC Industry Policy team has compiled and published submissions to governments on:

Response to Automated Vehicle Safety Reforms Consultation

MTAA’s response to Jobs and Skills Australia’s Draft Core Skills Occupation List

Response to the strategic review of the Australian apprenticeship incentive system

Skills shortages in the Australian automotive industry

2024 EV transition submission

• 2024-2025 Tasmanian prebudget submission

A fair transition: Developing a pragmatic New Vehicle Efficiency Standard

2024-25 Victorian prebudget submission

MTAA 2024-25 pre-budget submission

You can read all these, and more, online. (We publish some of this material under the MTAA banner to improve the national industry, too.)

These submissions, though, are just the start.

VACC Industry Policy Advisors attend and contribute to other important things, such as meetings, advocacy roundtables, member visits and more. VACC makes submissions and representations on your behalf to the

Australasian 57, 672 READERSHIP

MANAGING

David Dowsey

03 9829 1247

editor@australasianautomotive.com

SUB-EDITOR

Andrew Molloy

DESIGNERS

Faith Perrett

Gavin van Langenberg 03 9829 1189 creative@australasianautomotive.com

CONTRIBUTORS

John Caine, Geoff Gwilym, Rod Lofts, Bruce McIntosh, Imogen Garcia Reid, Paul Tuzson

Annual Wage Review, the Productivity Commission, the Victorian Law Reform Commission, and the Australian Law Reform Commission. The policy team also publishes state and federal election manifestos, which are sent to all relevant politicians, regulators and media representatives, all with one aim: to improve the trading environment within the automotive industry so you can do what you do best: run a great business.

of trade practices or fair trading legislation, violation of rights of privacy or confidential information or licences or royalty rights or other intellectual property rights, and warrant that the material complies with all relevant laws and regulations. This publication is distributed with the understanding the authors, editors and publishers are not responsible for the results of any

whomsoever

a

of this

and

or not in respect of

to

and of the consequences of anything done or omitted to be done by any such person in reliance, whether whole or partial upon the whole or any part of the contents of this publication. Advertising accepted for publication is subject to the conditions set out in the Australasian Automotive rate card, available from editor@australasianautomotive.com

INDUSTRY sentiment generally isn’t based on the rigors of data analytics and is often drawn from feedback and observations made among a group of similar businesses.

In automotive, for instance, tighter economic times are often indicated through changing consumer behaviors, things like less vehicle servicing coming into workshops, an increase of bald tyres on cars and consumers asking for the ‘most unsafe’ parts of the car to be fixed first.

While we are not there yet, indications from a recent small-to-medium sized business sentiment survey, by independent market research company, Fifth Quadrant, suggests there is tightening occurring with potentially weaker business conditions looming.

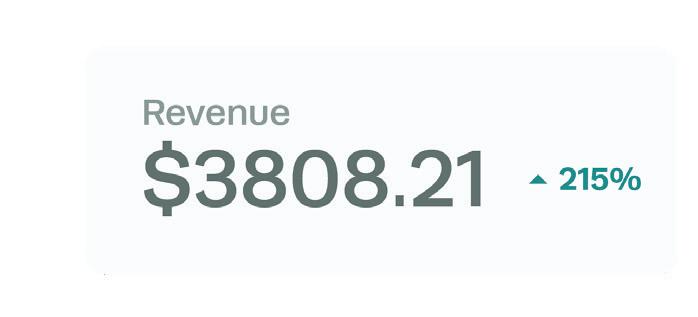

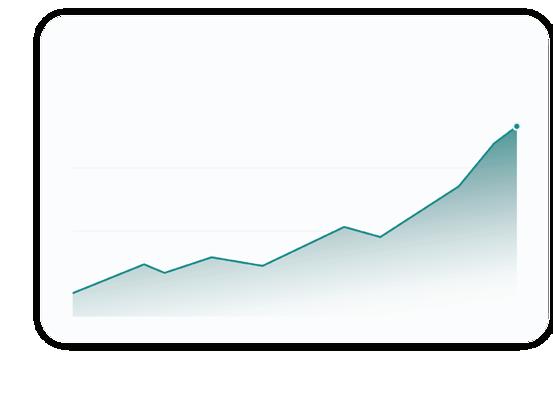

The latest report indicates a downward trend in revenue, profits, and employment figures, casting a subdued outlook on Australia’s economic prospects in the near future.

Profitability continues to be a major

concern, with only half of the small and medium enterprises (SMEs) reporting profits last month, a significant decline compared to the previous month’s figure of 59 per cent.

Furthermore, 19 per cent of SMEs also anticipate a decline in revenue for June 2024, the second highest figure since July 2023.

The data indicates unemployment will rise again next month and hence the ongoing commentary that interest rates will again point lower. Hopefully, this will stimulate greater consumer confidence and spending activity.

Either way, VACC urges motorists to not put the vehicle’s service and repair at the bottom of the to-do list.

These can be life changing oversights and ones that can have catastrophic consequences.

Want to hear more from VACC CEO Geoff Gwilym? Read his weekly column in The Herald Sun.

NOW more than ever, a properly drafted set of terms of trade is essential for your business. They avoid misunderstandings about goods and services you are selling and the terms on which you are selling them.

You cannot sell some goods and services without a signed contract in a specific format that contains certain prescribed terms and conditions such as a contract for the sale of a new or used motor vehicle.

Most automotive service and repair transactions don’t need that sort of detailed documentation to form a legally effective and binding contract. Where a dispute arises, the onus of proof will be on the business to show they had the necessary authorisation from the client to supply goods and or carry out services.

For terms of trade to be binding, all parties to the agreement must know them from the outset. Often,

the terms don’t form part of the deal at all as they are notified too late (eg where they are printed on the back of a receipt after the transaction is finalised). Terms need to be supplied and agreed upon before the deal is done. Properly drafted terms and conditions establish a legally binding contract between you and your clients.

The terms and conditions should cover commercial factors such as price, delivery and payment terms. In appropriate circumstances, they may seek to limit your liability, ie: disclaiming your liability for failure or delay caused by weather or power events, protecting your intellectual property rights and passing title and risk. If you have a clear set of terms and conditions, it is much easier to establish where there has been a breach of contract. Written contracts provide certainty and are much easier to enforce should you need to. If you have a robust set of terms

and conditions, the chance of a legal dispute is minimised. It is much wiser to have a set of terms and conditions prepared than to be involved in lengthy and costly litigation.

Terms and conditions help provide clarity about what should happen in a given situation. They should set out the key commercial terms you are offering to your customers and help the parties understand their duties, rights, roles and responsibilities.

Providing your clients with a clear set of terms and conditions from the outset helps you deliver a consistent level of service. There are no surprises, as the terms and conditions (payment on completion, for example) ensure there is no ambiguity. An agreed set of terms helps you manage your client’s expectations regarding delivery and payment, so you don’t end up in legal disputes where expectations haven’t been met.

THE Victorian State Revenue Office (SRO) announced in its Revenue Ruling DA.022 what elements impact the dutiable value of new motor vehicles for the purposes of the Duties Act 2000 (Vic).

Using the guidance of DA.022, providing accessories, options, protection products and vehicle additions by the dealer, prior to registration, or included in the transaction, are all costs that form part of the vehicle’s dutiable value and therefore increase the amount of motor vehicle duty paid by a consumer.

These aftermarket parts or accessories can include, for example, the fitment of sunroofs, bull bars and tinted windows. So, for instance, a consumer who purchases a new vehicle from a new car dealer and wants a tow bar fitted must pay motor vehicle duty on that tow bar. The conundrum sets in when the customer can decide to not have the dealer do the work, walk across the street to an aftermarket fitment provider, and pay no duty.

The question is how is the dealer able to compete fairly with aftermarket suppliers when the impost of motor vehicle duty is placed on the dealer-supplied accessory or part and not on the aftermarket supplier?

VACC has argued for some time that the discriminatory and enforced nature of applying duty on one party’s parts and service provision, over another, directly provides a disadvantage to the dealer and a market advantage to the independent aftermarket provider. It also limits the endto-end new motor vehicle delivery process

and experience for Victorian consumers. This situation is contrary to the principles of a fair taxation system. The discriminatory nature of DA.022 could also be viewed as being contrary to sections of the Competition and Consumer Act (2010) as it inadvertently enables anti-competitive behaviour, with aftermarket suppliers placed at a financial advantage over new vehicle franchise dealers in Victoria when delivering identical products.

VACC recommends sensible motor vehicle duty reform to remove this anomaly.

Much has changed since the original SD.004 (released in the 1980s) and revised DA.022 (which replaced SD.004 in 2000 and was re-released in 2002) were written. SD.004 and DA.022 were released at a time when aftermarket providers were few. However, since that time, the automotive aftermarket parts supply and fitment sector has grown so much that in Victoria it includes corporate monoliths such as GPC Corporation which, in 2022, recorded a turnover of more than USD$22 billion, and ARB Corporation, who recorded an Australian after-tax profit of $88 million in 2023. The most recent research conducted by IBIS World advises that in August 2023, the parts retailing market in Australia turned over $6.1 billion.

Compounding this situation, the aftermarket has now been supported by the Australian Federal Government’s introduction of the Motor Vehicle Information Scheme. Introducing the

scheme is a key policy reform that was achieved by VACC on behalf of the wider Australian automotive aftermarket vehicle service and repairer sector. The scheme has made it possible for independent retail motor service and repair providers to have access to the repair and diagnostic data of the vehicle manufacturers, once the domain of its dealer network.

This is supported by the Motor Vehicle Service and Repair Information Sharing Scheme Act 2021. Now, to ensure an even playing field, reform measures must be introduced to ensure new car dealers can compete in the open market without the burden of a tax that was introduced over 40 years ago when the market was immature.

VACC engaged with Treasurer Tim Pallas, the SRO and the Department of Treasury and Finance (DFT) in 2019 regarding this issue. At the time, DFT was concerned that vehicle dealers could take a windscreen out or remove other parts of a vehicle to lessen the vehicle’s dutiable value. VACC views DFT’s position on this issue as extreme. There are many mandated vehicle standards and state and federally-based consumer laws that would render such an action by a dealer as unlawful. VACC argues that reform of DA.022 is overdue, which includes an exemption allowing dealers to fit a threshold amount of up to $10,000 (retail) worth of accessories or aftermarket fitments to a new motor vehicle without increasing its dutiable value for motor vehicle duty.

THERE’S much discussion in the automotive industry regarding the safe handling of electric vehicles (EVs).

This includes the training technicians need to ensure the vehicles they work on are safe.

A study commissioned by the Insurance Council of Australia, ChargingAhead: Electric Vehicles and Insurance, explores key insurer issues regarding EVs, including potential fire risks.

The report noted EVs (not including electric bikes, scooters or light delivery vehicles) don’t present a higher fire risk than conventional internal combustion vehicles.

This should comfort buyers who see occasional EV meltdowns on the news.

The report highlights the challenges for emergency services once EV fires start.

They need a ton of water and time to burn out.

This is not a new or local phenomenon. Many countries learn from EV fires each year.

Australia can take much from their experiences.

As scientists develop new technology, batteries will also come with less risk and improved range.

It’s an exciting space.

But questions remain.

How do tow truck operators remove damaged EVs from the roadside?

How do repair shops safely store EVs with compromised batteries?

The industry is in transition with substantial training and development occurring.

It’s key you take your EV to a qualified technician.

This isn’t the time to penny pinch with back-yarders.

If they’re incompetent, it may be a real meltdown… literally.

And that could make for a very difficult conversation when you call your vehicle insurance company.

Want to hear more from Bruce? Read his weekly column in the Mercury.

Podium is powering the Australian automotive industry into the future. Australia’s leading text messaging platform is helping over 100,000 businesses communicate with customers, schedule services and collect payments – all through the power of two-way text.

"Podium is so good that we have cancelled our traditional eftpos machines. I’ve never been more impressed with a software provider, and can’t wait to see what features Podium releases next."

Justin

Walker, General Manager, Grant Walker Parts

TWENTY elite businesses, business people and apprentices have been announced as leaders in their field at the 2024 Automotive Industry Awards, the premier night dedicated to the Victorian and Tasmanian automotive industry.

Victorian Automotive Chamber of Commerce CEO Geoff Gwilym said that the awards demonstrate member and apprentice commitment to quality and customer service.

“It is a huge accolade to be named the best in Victoria and Tasmania. These winners go above and beyond, and have proved themselves more than worthy of these titles,” said Mr Gwilym.

Categories crowned at the 2024 Automotive Industry Awards include Best Small and Best Large Business, Employer of the Year, Employee of the Year and Apprentice of the Year.

The next generation, VACC and TACC Automotive Apprenticeships’ graduating apprentices, were also celebrated on the night.

“The Automotive Industry Awards have been very well supported this year, proving that they are valued by the industry and recognised by consumers,” said Mr Gwilym.

An independent judge evaluated entries based on business management, workplace practices, customer service and environmental impacts. To ensure only the finest of VACC and TACC’s 5,000 members would be crowned, finalists were randomly audited.

“Congratulations to all our 2024 winners and finalists. We recommend them to Victorian and Tasmanian motorists.

So remember to look for the famous orange sign: the mark of the industry professional,” said Mr Gwilym.

Winners were announced at the VACC President’s Gala Dinner, a formal evening that combined industry awards and apprentice graduation festivities. Attendees heard from master of ceremonies, VACC Ambassador Shane Jacobson, and a string of top-notch entertainers on Saturday 29 June at the Palladium at Crown, Melbourne.

Special thanks to major event partner and President’s Awards sponsor DENSO for its support, as well as AIA category sponsors Spirit Super, SP Tools, Podium, Sixfam, VicRoads, BASF, Haynes Pro – proud partner of VACC MotorTech, Exedy, Shell Card, Mas National, Commonwealth Bank, Apprenticeships Victoria and Tecalemit.

Employee of the Year

Sponsor DENSO

David Pyne

Original Engines Co

Employer of the Year

Sponsor DENSO

Best Small Business

Metropolitan

Bosch Car Service Ringwood

Best Large Business

Metropolitan Sponsor

President’s Award

Employer of the Year

Patterson Cheney

President’s Award

Employee of the Year

David Pyne

Original Engines Co

Best Large Automotive Business

Metropolitan Victoria

Original Engines Co

Best Small Automotive Business

Metropolitan Victoria

Bosch Car Service Ringwood

Best Large Automotive Business

Regional Victoria

Warragul Nissan & Mitsubishi

Best Small Automotive Business

Regional Victoria

AUTOMOTIVE APPRENTICESHIPS

Outstanding 1st Year Apprentices

Riley Balcombe

Original Engines Co

Best Small Business

Regional

President’s Award VACC Apprentice of the Year

Geelong Performance Centre

Best Large Business Regional

Outstanding 1st Year Apprentices

Warragul Nissan & Mitsubishi

Geelong Performance Centre

Outstanding 2nd Year Apprentices Tecalemit

Dylan Bunlay

Outstanding Trainees of the Year

Mitchell Cannon

Outstanding 3rd Year Apprentice Apprenticeships Victoria

Best Small Business Sponsor

Outstanding 2nd Year Apprentices

Outstanding Trainees SP Tools

Automotive Industry Awards recognise excellence in business and apprenticeships

VACC Progressive Excellence

Fatbuilds 4x4

Dylan

Best Large Business

South

Outstanding 3rd Year

JMC Automotive Group

TACC Progressive Excellence Award

Mas National

Creating positive change for your business and the environment.

Taking sustainable action can make a real difference to your bodyshop. In fact, those who’ve already chosen our sustainable products are now using less materials, conserving resources, saving money and more importantly, protecting the environment. Contact us and find out how you can switch your bodyshop to eco-friendly products today.

Graham Rowe - Vin Rowe Farm Machinery, Warragul

VACC President Chris Hummer, CEO Geoff Gwilym and Area Manager Matt Devenish grouped up to spend another day getting into member workshops to understand key issues affecting automotive and business owners. This time it was Warragul, Morwell and Traralgon, in Victoria’s southeast that was the focus of attention.

The day kicked off with Graham Rowe and Vin Rowe Farm machinery in Warragul. If you haven’t seen this longstanding Warragul business, it takes up a large chunk of the central business strip on Endeavor Street, just off the Princess Highway. Not only was visiting the site a great privilege, it was also a celebration of the Vin Rowe business being a 50-year VACC member, right at the beginning of COVID and now clocking up 52 years of membership.

VACC President Chris Hummer said at the meeting, "It is these long-term members that reflect the VACC and VACC member commitment to the automotive industry." Multigenerational family members maintaining their membership and contributing to the work of the Chamber; this is recognised and deeply appreciated.

Vin Rowe was established in the early 1960s when Warragul was the centre of the most intensive dairying area in Australia.

Vin Rowe, son of a Brisbane farmer and later a fitter and turner apprentice came south to work in a parts manufacturing enterprise, the Polsen Motor Company. In 1943, Vin was recruited by the Royal Australian Air Force as an engine fitter, assisting with the fitting of engines to planes. He was located in Sale.

build his local reputation as a farm machinery and equipment supplier.

The business grew to become one of the largest machinery dealerships in the country. In the mid 1970s, with the discontinuance of milk contracts, and a general downturn in dairy farming, the business diversified to provide equipment to farmers growing vegetables for a booming Melbourne population. This is also when Vin, and son Graham, added new car sales to their repertoire.

Graham said, "Dad asked me to come into the business to help sell some new vehicle models, like Datsun, alongside some true and tested products like Hilman and Leyland."

While the family business has been in and out of the car dealership world, it would always maintain its core business of providing farm machinery and agricultural equipment to farmers, both locally and across Australia.

Twenty years ago, Graham let go of the car sales side of the business to focus on what they are really known for, and that is farm machinery and equipment, sales and service.

Graham Rowe said, "You can still drive around Australia now and see Vin Rowe badging on farm machinery all over regional areas. We are immensely proud of the family brand and the support we have provided to farmers and their families over generations’.

Graham shared with the VACC team: "Machinery is only part of the solution. If you don’t have a good and reliable parts supply to support machinery sales you are just going to let people down. That’s why we still have lots of gear that others may have thrown out years ago. We know someone will want it one day."

And it's true, there are a lot of parts in there.

"Skills," said Graham, "are still the biggest challenge facing us in the industry today. We have been finding it harder and harder to get new skilled tradespeople into the industry. We have been lucky recently and we have picked up a bright young female apprentice, Emily, and we have high hopes for her."

Following his service in the Air Force, Vin started work with Laceys and later qualified as a fitter and turner. Vin later become an agricultural sales representative with Laceys and was ultimately offered a position managing a newly established branch in Warragul in 1962.

In the 1970s, Vin took over the Laceys Warragul business and started to

From a toddler, Emily grew up working on trucks in the family trucking business, as well as a range of machinery at home. Aged 16, Emily also started as a contractor, driving tractors on different jobs around the area. Emily always wanted to do mechanical work and started at Vin Rowe Farm Machinery in 2023, working one day every week in workplace placement through her school's VCAL program. Emily now works as an apprentice both in the workshop and onsite at regional locations, on heavy machinery, tractors and attachments.

Emily said she is looking forward to becoming fully qualified and spending her time repairing machinery.

Graham said, "We really need more work experience students coming through from secondary schools, if we can’t show them the opportunities in the industry we will just lose them to other occupations."

We ended this first visit of the morning with a great diet-busting biscuit lineup from Graham and a look around the workshops. Great facilities and with a big focus on retaining good staff. VACC thanks Graham and the Rowe family for supporting VACC for many years. It is recognised and appreciated.

Traralgon

The final stop for the day was a drop in on Elsie and son Chris Olivier of Olivier Panel Works in Traralgon. Elsie, who’s been a key part of the business first, with husband Ken and now with son Chris, just looks as though she started work yesterday. Chris Hummer, Geoff and Matt commented

that they had never seen someone with such vast time in the industry but still with a big smile on her face and ready to take on the next decade.

While building the business for decades until Ken’s untimely passing in 2006, Elsie and Chris have not dropped a beat. Insurer challenges from time to time, yes, and the constant challenges with finding the right skills for the workplace, yes, but how many panel shops can say they never advertise, don’t have a dedicated website and can still run a business and employ a team of local tradespeople? Well, Olivier panels can.

VACC asked Chris what his biggest challenges were for the future and what he would like VACC to say to governments on his behalf.

Chris said, "Even though there were many business challenges, it’s finding the right young people to come into the industry" was where they needed government to step in. Chris and Elsie agreed that they used to see more young people coming in for work experience from the local schools and that was a great way to try someone out.

Elsie added, "We have found really good apprentices through the work experience program in years past, but we haven’t had anybody come to our door over the past few years."

Geoff advised that getting hold of the VET coordinator at the local schools would be the key to getting this running again. Elsie raised the constant issues of insurance company compliance and administration work as a major barrier to actually getting cars fixed. Geoff informed Elsie and Chris that much was in play in the space at VACC and through the national body, the Motor

Trades Association of Australia. The Motor Vehicle Insurer Repair Industry Code of Conduct has been under review recently and its key recommendations were being taken up by the Code Administration Committee. It is anticipated the writing of a revised Code would be available for comment later in the months ahead and would welcome feedback from repairers; but more importantly, a revised Code would form the basis of a clearer and less combative environment for the industry, where it finds itself in disputes with insurance companies. Overall, Elsie and Chris said, "There are lots of people in the insurance industry who are just doing their job; they are not bad people. The issue comes when estimates are constantly questioned and where there is a constant requirement to provide more information in an estimate, even when the repair cost and repair methods are obvious. Elsie and Chris will keep doing what they've done for a long time yet, even though the margins are tighter. Chris Hummer commented on leaving the workshop: "There's a great feeling of a multi-generation business at Olivier’s and it doesn’t look as though they are going to give up doing a good job any time soon."

IT’S 50 years of VACC membership for GEL Motors North Geelong, and VACC CEO Geoff Gwilym and Area Manager Paul Georgievski caught up with owners, Adam and Sarah Gocentas to celebrate.

Adam talked about his journey from school to running a family business that fixes cars for the same local families his grandfather Joe and his father Jeff also served.

Like many automotive businesses, this family enterprise started with a migrant family arriving in Australia, this time just after WWII. Adam’s grandfather, Joe, came to Australia as his family moved out of Lithuania into Germany, where the family worked the land.

Like many technologists of the day, Joe spent his time learning how motor vehicles worked and started repairing them. Qualifications came later, as Joe established and then grew the business.

For Joe, however, much had to be done to support his newly arrived family in what was a foreign land. So, fix things Joe did and this included renovating houses up at night to put food on the table and help establish what would become a multi-generational business in Geelong. This expanded into selling renovated houses, which helped build the foundations of Joe’s automotive business. Starting off on Ballarat Road, the business moved in 1974 to its current location on Separation Street. Joe had the wisdom to purchase three blocks in a row in what

would have been paddocks destined for commercial use at that time. And what a wise decision that was, providing enough space for two huge workshops that today house vehicles for repair and the tray truck for commercial vehicle tows and transportation.

Adam said, “The location of the current workshop is great given the throughtraffic and the local businesses in the area. It worked out very well.”

Adam’s father worked in the business at 15 and later took over the reins from Joe and kept growing the business, expanding its customer base, mainly to the local community and local businesses.

When Adam completed school at 17, he also went into the business, as an apprentice, being originally exposed to the business world through Saturdays in the workshop, cleaning up and getting interested in the diagnostics and car repairs. During these early days, he learned through his father and grandfather that focusing on quality and technical expertise paid dividends. It's testament to GEL’s focus on customer service that they still today service vehicles for families that Joe brought to the business.

Geoff Gwilym asked Adam about the business’ future challenges and, like many VACC members, Adam cited skills shortages, changing technology and increasing red tape, as major hurdles.

Adam remains positive, though, and this was evident through a vibrant activity in the workshop and Adam’s continuing support for putting young and adult apprentices through the business.

Adam said, “I am really happy with adult apprentices. They seem to be far more settled than the younger apprentices we’ve had here and they pick up new skills much quicker than the younger apprentices.”

Adam was asked if he would consider taking on a female apprentice, and he said he was happy to pick up a male or female apprentice as long as they were able to train.

Dad still visits the workshop to carry out the VIV inspections and to ensure the family business values are actioned. Adam commented, “It’s great to see Dad around the place. Without him, there wouldn’t be a business.”

Adam added, “I see myself as someone who’s just carrying on the business in the way it was intended. In a way, I am the custodian of something that belongs to three generations of the family.”

On electric cars, Adam said he doesn’t see much of this today but plans to prepare the business and his team with the skills to work on EVs. Adam believes it’s inevitable more EVs will come into the car fleet and, by extension, into the GEL business.

And who knows, Adam has three teenage children, which means there could be a fourth-generation family member who leads the business into the future.

In closing, Geoff asked Adam about any intriguing stories that had surfaced in the business over the past 50 years.

Adam said, “Well, there was a customer who used to come into the business to have the ghosts cleaned out of her car.”

Convinced the car had a regular spirit on board, Adam’s father vacuumed the car of its unwanted passengers. The customer was happy, but we are still not sure who had the job of emptying the Hoover.

It was a great visit to a really top family business.

Well done Adam and team and thanks for the legacy Jeff and Joe have left the family. Thank you for your long-term support for VACC, too. It’s appreciated and valued.

FIFTY-YEAR TACC member, De Haan Bodyworks is a family affair. Dirk De Haan, started the business on 10 March 1958 in Devonport and he passed it on to his son, Dirk Junior, in 1981. Today, the founder’s grandchildren – the third generation –play an important role in the business.

Dirk De Haan Senior has an incredible story.

Jeremy De Haan: “My grandfather got taken away as a prisoner of war during WWII and he worked near Hitler’s house (in Berchtesgaden) taking care of a disabled elderly lady. He was a servant, I guess you could say.

“When the British bombed the area, my father knew the end was coming, so he hid in an underground cellar. The RAF (Royal Air Force) bombed the house where he worked and destroyed it.”

After the war, Dirk De Haan travelled to Australia with his wife, three children, and a suitcase.

“My grandfather had some experience with sheet metal repairs, which was about it, but this led to him fixing vehicle bodies. As time went by, he gained more capability,” Jeremy said.

This led Dirk to establish De Haan Bodyworks at 35 Formby Road, Devonport. Dirk moved the business to its current location, 39 Wenvoe Street, in 1960.

Today, Dirk Junior’s children, Simon and Jeremy own and run the business, along with their sister, Teresa in the office.

De Haan’s has 10 staff on the floor – five in the panel shop and five in the paint shop – with the three siblings taking care of business in the office. And the family connections keep growing.

“Three of the staff in the panel shop are family and one in the paint shop has married into the family,” Jeremy said.

De Haan’s specialise in passenger cars and 4WD smash repairs.

“Generally, we don’t work on trucks and buses. We’re trying to back away from too many restorations, too, because the smash work is so busy.”

Over the years, a few smaller trucks have passed through the doors and De Haan’s still do repair and paintwork for motorcycles, tractors, excavators and has even done kitchen cabinets in the past.

Jeremy is upbeat about business.

“Each year, things get better and better,” he said.

“We put through about 15 jobs a week, mostly insurance work.”

Jeremy says the company’s relationship with insurance companies is “pretty good” and that connecting with the assessor is paramount.

“Yes and no,” is Jeremy’s answer to whether the business experiences parts supply issues.

“We’re booked three-to-four months out, so when we do a quote, it allows us to order the parts and we know then whether there might be a delay and we can usually work around that.”

COVID had a huge impact on parts supply, with newer brands to the Australian market such as MG and LDV having the biggest supply issues recently. Many of the other brands have at times also had delays on parts availability. This is improving though all the time.

Sourcing parts through local dealerships is important. De Haan's also gets a bit of scratch and dent work through its relationships with local dealerships. The other big issue in automotive land – staff – so far has not been a big issue for the business.

and keeping staff. Employees come and go. They want a change of career or place of employment, but on the whole it’s been fairly stable.

There’s a theme here: better businesses who look after their people rarely have major staffing issues.

TACC State Manager Bruce McIntosh said De Haan’s 50-year membership has been a magnificent partnership.

“I like to think TACC has had a small hand in De Haan Bodyworks’ success but, of course, it is their dedication to quality work, and looking after their customers and staff that has created their second-tonone reputation in northern Tasmania.”

A half-century association, however, says much about how TACC looks after its members.

“We have everything an automotive business needs in terms of support: we have industrial relations, OHS and technical services and more that really eases the worry and pain business owners sometimes feel,” said Bruce.

“We’ll always be here for members like De Haan Bodyworks. If ever they need something, we’re only a phone call away.

TASMANIA’S automotive education sector is receiving a significant boost through two major initiatives aimed at enhancing training capabilities and addressing industry skills shortages.

TACC has secured substantial government funding to improve automotive apprenticeship programs, while TasTAFE is upgrading its facilities to provide state-of-the-art training environments. These developments represent a coordinated effort to strengthen the state’s automotive workforce and align educational offerings with industry needs.

TACC has received a grant through the Tasmanian Automotive Training Partnership which is supported by the Tasmanian Government through the Department of State Growth’s Industry Partnerships Program. The Chamber will utilise this funding to support TasTAFE’s initiative to implement a new delivery model for automotive apprentices. The primary focus is to upgrade learning management systems, providing ‘teacher and learner ready’ nationally recognised learning and assessment resources.

With over 900 automotive VET students and apprentices currently engaged at TasTAFE, this initiative will play a crucial role in addressing industry

skills shortages over the next twoto-three years. TACC will collaborate with the VACC Skills Development Centre and TasTAFE’s Automotive Education team on this project.

“We have a lot of work to do to improve future outcomes for these young people, and already TasTAFE is demonstrating that. Re-imagining TasTAFE is not just a catchphrase,” said TACC State Manager Bruce McIntosh.

In a related development, TasTAFE will unveil a new ‘industry current’ training facility at its Devonport Campus. This upgrade includes

improvements to the refinishing spray booth, refinishing area, and body repair area. The investment aims to provide enhanced support for industry autobody and refinishing apprentices. These initiatives represent a significant step forward in automotive education and training in Tasmania, aligning educational resources and facilities with current industry

Transform your automotive workshop with the unbeatable combination of Flexfuel HyCarbon I-Connect and Flexfuel Carbon X3. This dynamic duo o ers comprehensive engine cleaning solutions, covering all the essential maintenance your customers demand.

Flexfuel I-Connect excels in hydrogen cleaning, ensuring optimal performance by targeting and removing carbon build-up. This preventive maintenance solution keeps engines running smoothly, enhancing e ciency and prolonging the lifespan of critical components.

Complementing this, Flexfuel Carbon X3 provides state-of-the-art chemical cleaning technology. It targets the intake manifold, fuel injection system, and Diesel Particulate Filters (DPF), dissolving stubborn deposits and restoring optimal engine performance. Carbon X3 is also an easy-to-connect car cleaning solution, making it user-friendly and e cient. Regular chemical cleaning with Carbon X3 ensures thorough maintenance and peak performance for every vehicle. It's a better option to clean these components before considering replacement, saving time and costs for your customers.

By integrating both Flexfuel I-Connect and Carbon X3 into your services, you can address a wide range of engine cleaning needs, ensuring comprehensive maintenance and peak performance for every vehicle. This approach not only satis es customers but also sets your workshop apart as a leader in automotive care.

For more details, visit Carbon-tech.com.au, Call 1800 595 180 or scan the QR code. Finance option available

AS the Australian motor industry gears up for 2024 (after a record-breaking 2023), dealerships are facing an array of challenges that demand strategic foresight and adaptability. At Pitcher Partners, we have been delving into the top 10 challenges that are shaping the landscape and here we explore how industry players can navigate through these tumultuous times.

1. Margin compression has returned, and unprepared dealerships will experience significant financial strain

For many brands, the order books are lean, and dealers have already chewed through them in CY23, setting a record in sales volumes (read deliveries) of 1.2 million units. The concerning resurgence of margin compression is exacerbated by the increasing supply of cars from OEM brands and waning customer demand due to rising prices and finance rates.

2. Strategic stock management will be back ‘en-vogue’

We are already back to overstocking dilemmas in new cars for some brands in Australia.

The importance of managing stock levels is resurging in 2024. Dealerships will need to implement manual releases for floor planning of new vehicle stock (where they can) and regain control of ordering. This applies to new cars and the used car market. Dealers will need to buy and sell used cars in the same market by optimising stock turnover to 30 days’ supply maximum (12 stock turns per year). Buying right for used cars has always been the key to profit and emphasises the need for pricing and stock management tools like AutoGrab to make sure you get it right.

3. Used car valuations will decline further

We are in a falling used car market and dealers’ customers will be returning to the dealership with vehicles purchased during the COVID years at inflated values. The negative equity position of these customers will be significant and the temptation to over-trade to get the new car sale will be high. Dealers need to separate valuations from the new car department. The risk of leaving trade-in valuations with the new car department could be fatal by overloading the used car department with overvalued stock.

4. Cost structure re-evaluation

With some dealerships already facing monthly losses, a critical look at cost structures is imperative. We have noted that new car break-even points in recent years have moved to more than $3,000 per unit. Preparing for the possibility of normalised grosses in the realm of $2,000 per unit ($3k less than 2023 levels), means every car will be sold at a loss. Dealer groups must make tough decisions now to ensure resilience in the face of tougher economic headwinds ahead in 2024.

5. Building your own brand loyalty (retention)

Dealer groups should focus on building their own brand and cultivating customer loyalty. Owning the customer relationship becomes paramount for sustained success. Late cycle retail buyers will be hard to find, trade-in values will be high, family budgets are stretched and securing financing to purchase will be difficult. Dealers make purchasing easier, so customers will keep returning. Keep this as your principal focus, invest in your complete customer journey (online and physical) and learn to manage your customers individually through the life cycle.

6. Cybersecurity vulnerabilities: the importance of being prepared

Cyber-attacks are emerging as a major threat in 2024 and dealerships are at risk as high-value targets. Dealerships should prioritise cybersecurity measures to safeguard sensitive information and maintain operational continuity.

7. The rise and rise of Chinese-built vehicles

Chinese-built vehicles are poised to challenge their Japanese counterparts for market supremacy in volume (16.7 per cent) in 2024, marking a significant shift since they constituted only 3.3 per cent of the market in 2020. Chinesebuilt cars made up nearly one in six new vehicles sold in CY23, totalling 193,433 (VFACTS). This trend aligns with the growing popularity of electric vehicles (EVs), introducing a transformative dynamic to the industry. But slowing local demand in China and overcapacity at their OEMs after years of statedirected growth means the Chinese manufacturers are looking to overseas

markets for their products. Exports surged in 2023, as we have seen in Australia, and we expect this to continue

8. Electric vehicle revolution

Complementing the above, China’s cost advantage and proliferation of brands and products will only increase the affordability and variety of electric vehicles which will continue to drive their popularity.

While Australia should expect to face a similar EV adoption plateau as the USA, the fact is that EVs are undeniably the future

9. Fuel and emissions standards

The Australian Government’s commitment to announcing a fuel emissions target by the end of 2023 has come and gone without an announcement. However, they have announced they are adopting Euro 6d by 2025 and we expect some announcement of a fuel and emissions standard in 2024.

If they adopt anything near the UK, Europe or the now repealed NZ models, the importation and retail of many brands’ models to Australia could be uneconomical, requiring proactive adaptation and urgent industry attention.

10. Agency and direct to customer sales model adoption postponed further

Following the sharp declines in sales for Mercedes-Benz and Honda, the adoption of agency sales models is likely to slow down further.

Sales experiences and pricing challenges present significant hurdles, dissuading other brands and new entrants to Australia from considering a switch from their current franchise distribution model. Dealer groups that proactively navigate these challenges and invest in building their brand and resilience will reap the benefits once the market stabilises. Despite the current market turbulence and evolving drivetrain disruptions, the transition presents opportunities for those prepared to face the economic headwinds and emerge stronger in a steady-state market.

LEGENDARY automotive parts and accessories company Repco today revealed its new brand and marketing identity for Australia and New Zealand.

The 102-year-old automotive icon has revitalised its logo, tagline and marketing with a refreshed look and message.

The centre-point of Repco’s new identity is the phrase ‘Gets you goin’, which refers to the emotive drive of the company’s many passionate customers and the role Repco plays in invigorating their shared love for cars.

“Repco’s new brand line ‘Gets you goin’ has been inspired by our customers,” said Wayne Bryant, CEO of Repco. “Everything that our customers and Repco Crew do

with cars gets us goin’, and our customers want us to join them in showing our shared love for cars.

“Repco has long been the trusted automotive parts and accessories go-to for workshops and people who love cars, right across Australia and New Zealand.

“For more than a century we’ve been getting cars, people and automotive businesses goin’ and we’re celebrating this with our new voice.”

Repco’s credentials in retail and trade automotive markets run deep. The company supplied the engine parts for Australia’s first Holdens. It also built the engine that powered Sir Jack Brabham to the 1966 F1 World Championship, and Repco even created a one-of-

a-type Research Concept Car called the Repco Record in the late 1950s.

Repco also enjoys an extensive local motorsports history, which includes success in Formula 5000, Sportscars and Sport Sedan racing to now being the naming rights partner of both the Repco Bathurst 1000 and the Repco Supercars Championship.

Repco has brought to life its passion for all types of cars in its newest series of advertisements. Some of the project cars that appear in the new ads are owned by Repco team members.

Repco developed its allnew marketing program in conjunction with award-winning Melbourne-based marketing agency Thinkerbell.

David McLeod is the Managing Director of Ozwide Tools & Mechanics Tool

Hire, leaders in specialty automotive tooling. He has more than 25 years experience in the automotive industry, starting out as a VACC apprentice, then becoming a VW specialist before starting Ozwide Tools in 2009. David is also a VACC General Division committee member.

Ozwide Tools is an Australian company that you started. Tell us about its origins.

Prior to starting Ozwide Tools, I spent 10 years on the tools as a mechanic and part of those 10 years were spent as a VACC apprentice, under the VACC apprenticeship program. Back then, there were over 1,000 applicants that went for the 26 positions available. From there, I specialised in European vehicles as a technician for VW/ Audi, moving to several dealerships and then aftermarket Euro workshops. After 10 years on the tools, I wanted a change and in late 2009 I found myself starting Ozwide Tools. Back then, my office and showroom was an old 1989 model Toyota Hiace. I was selling more premium German and Japanese general hand tools in those early years.

I spent six years building the brand and my background as a mechanic helped me build a good reputation.Then one day I had an interesting enquiry from one of my customers. He had seen a specially designed tool to quickly remove and refit a part on a VW Transporter. The tool only fits that one model of vehicle. I found the tool overseas along with a lot of other specialist tooling. After surveying many of my customers, I decided to arrange a meeting with the manufacturing bosses overseas about importing their products. I needed a factory and fast, which luckily I found and then had one month to pack up my old house, move into a factory, learn how to import, work out how to price overseas products all while continuing to run the business. That was the start of Ozwide Tools. The company now employs

11 full-time and part-time staff and we stock over 4,000 SKUs of specialist tools. Our services are nationwide and we are very proud to have achieved our vision of being the industry leaders in our field.

Can you tell us about Ozwide Tools’ portfolio of offerings and how does Ozwide Tools help automotive professionals do their jobs?

Specialty automotive tooling is a real problem faced by all workshops today. No workshop can have every tool to repair every make and model of car today. Ozwide Tools helps automotive professionals by stocking, selling and hiring the largest range of hard-to-find automotive tooling in the country. You name it, we have it. If it’s not on our shelves, chances are no one in Australia has it.

How have your previous experiences informed what you do at Ozwide Tools?

It came down to good timing, being involved in Euro vehicles from the start, and some foresight into what was potentially coming down the automotive road. When I started the last year of my apprenticeship, I was with a VW dealership in Doncaster and Euro cars were certainly not as prevalent as they are today. When we were working on them there were some specialty tools that you needed, but not many. As the years went on, they were becoming more and more common. By the time I had started the tooling business, it was perfect timing as speciality tooling was really only just starting to raise its head. What awards and achievements has Ozwide Tools accomplished?

There have been so many ups and downs. Running a business is certainly like being on a roller coaster, but we have been very privileged over the years to achieve some great milestones. Being a finalists in the VACC best small business awards three times and winning the best booth award at the Capricorn Victorian trade show. Other achievements have included onboarding many large companies over the years as distributors. You can get so caught up with trying to push the business forward you sometimes forget where you started and considering I started this business from out the back of a van it’s been a great reflection to look back at the growth and stop and appreciate the journey.

Mechanics Tool Hire is part of the Ozwide Tools brand. How can automotive workshops benefit from them?

Almost every workshop can benefit from our hiring department. It’s a service that you may not need every week, but I guarantee

there will be times when you are really stuck and MTHire will be there to assist you. When I started the hire business, I was still on the road selling direct to workshops and I could see these poor mechanics spending quite a significant portion of the profit from the job they were carrying out which was going straight to purchasing the tooling. Most of those workshops would rarely use them again.

You started your career in the automotive industry as a VACC apprentice. Tell us about this. Yes, that’s correct. It was a great way to springboard my automotive career. When I was completing Year 12, I actually still had no idea what I wanted to do. I had been top of the class with my grades in automotive and my teacher wanted me to go for the VACC apprenticeship scheme. Those four years provided great insight into seeing how workshops ran, due to the structuring of the scheme where I was rotated around to different workshops throughout the four years of my apprenticeship. By the end of my apprenticeship, I was fully trained and confident in my abilities. I would like to

thank VACC for its continued support of the apprenticeship scheme. I imagine it’s a difficult area of their business to run, but with the skills shortages we are experiencing it certainly is an invaluable department in attracting and keeping apprentices in the trade.

What is the future for Ozwide Tools?

I am very excited about the future of the company. Business always keeps me on my toes. It’s constantly changing and moving, whether its software, products, business direction or the industry itself. Ozwide Tools/MTHire continues to be fluid in its approach to changing times and circumstances, not only for its customers, but also for its staff. We have many plans present and future that will further grow and propel the business forward, from software, continually new and improved products and other unique offerings. Our focus is and always will be the customer. What’s the best piece of advice you have received?

Listen to your gut instinct. No one knows your business like you do and you have 24 hours in a day. Use them wisely.

Lithium-ion

battery fires. How they occur. Should you be worried?

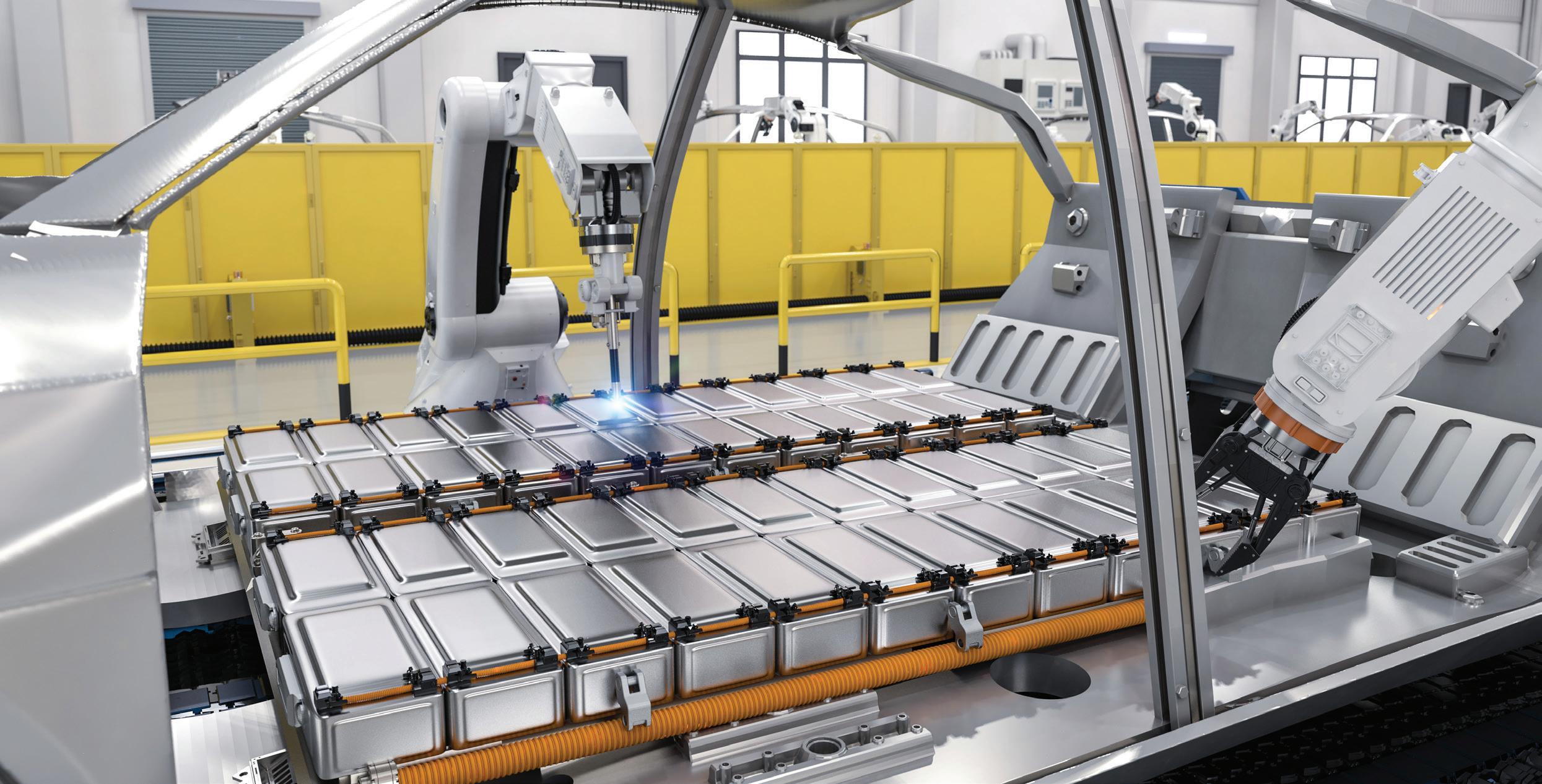

LITHIUM-ion (Li-ion) batteries are about the best thing since sliced bread. The only problem is that sometimes they turn everything into toast. They can store and then deliver large amounts of energy, but the elements that make this possible also make Li-ion batteries unstable. And this instability leads to catastrophic fires when things go wrong. There is increasing concern about the safety of Li-ion batteries used in EVs. However, as we pointed out in our article on Net Zero last edition, fires are less common in EVs powered by Li-ion batteries than liquid fuelled fires are in ICE powered cars. So nothing to worry about, right? Not so fast. The problem is, a burning Li-ion battery pack creates a deadly combination of rapidly ejected toxic gasses along with jets of extremely hot flame that will consume everything in proximity. This is a particular disaster in enclosed spaces like underground car parks but, by the same token, it’s not like liquid fuelled fires don’t spread. They do, however they’re much easier to extinguish than Li-ion fires. So, how many Li-ion fires are there?

According to information from NRMA, there have been only half a dozen battery fires in BEVs in Australia out of around 120,000 such vehicles on our roads. In the Swedish study we mentioned last issue relating to BEV battery fires in that country found ICE vehicles are about 20 times more likely to burn than EVs. The actual figures were one in 1,294 for non-battery vehicles and one in 26,565 for battery vehicles. Globally, there have been around 400 BEV Li-ion fires out of many millions of EVs on the world’s roads. These figures will change, but the point is there aren’t many Li-ion based fires in EVs. Well then, why all the fuss? Reportage of any Li-ion battery fire elevates overall awareness of the subject. However, many of the incidents mentioned occur in devices other than EVs. Most Li-ion fires occur in personal transportation appliances like electric scooters, bicycles, skateboards, and more. Cars figure more prominently in the minds of people, so any awareness if Li-ion fires is associated with BEVs. That’s our hypothesis, anyway. EV manufacturers are aware of Li-ion battery dangers. No car company likes a recall or, even worse, customer deaths. Consequently, car companies use their considerable resources to research the battery technologies they use. This results in a particular usage regimen that’s defined by system management sensors, protocols and controls that keep OE Li-ion EV battery systems as safe as they can be. Great.

It’s also important to note that research into Li-ion and other lithium based battery systems is ongoing. Unfortunately, many manufacturers of personal transportation devices, particularly novelty types, do not have the resources for this type of research.

Li-ion cells (a battery is an assembly of multiple cells) are available from a wide range of sources. A quick online search will reveal many. It’s possible such cells might be from reputable manufacturers and will perform well. It’s also possible that many aren’t and will catch fire or explode, or both.

There are also second-hand cells from EVs available and these can be a risk, because of the finely tuned management systems that should control them. If cells and battery modules do not have the carefully matched management systems engineered for them, they can be subject to increased risk of failure. Some people buy second-hand Li-ion cells and cobble together their own batteries with control modules sourced

from online suppliers or constructed according to plans and schematics sourced from the internet. This is unwise.

We’re not saying all second-hand Li-ion batteries are bad and there’s no safe way of using them. We’ve seen operations engineer installations that accommodate the limitations of second-hand batteries in niche applications, like electrifying classic vehicles. Possible safety strategies might include keeping temperatures low by slower charging. Indeed, during manufacturing, the first charge of a battery must be done with very low current over an extended time. Also, limiting total charge of a secondhand battery in service seems prudent because there is evidence that lower states of charge reduce (not eliminate) failure and mitigate it when it occurs.

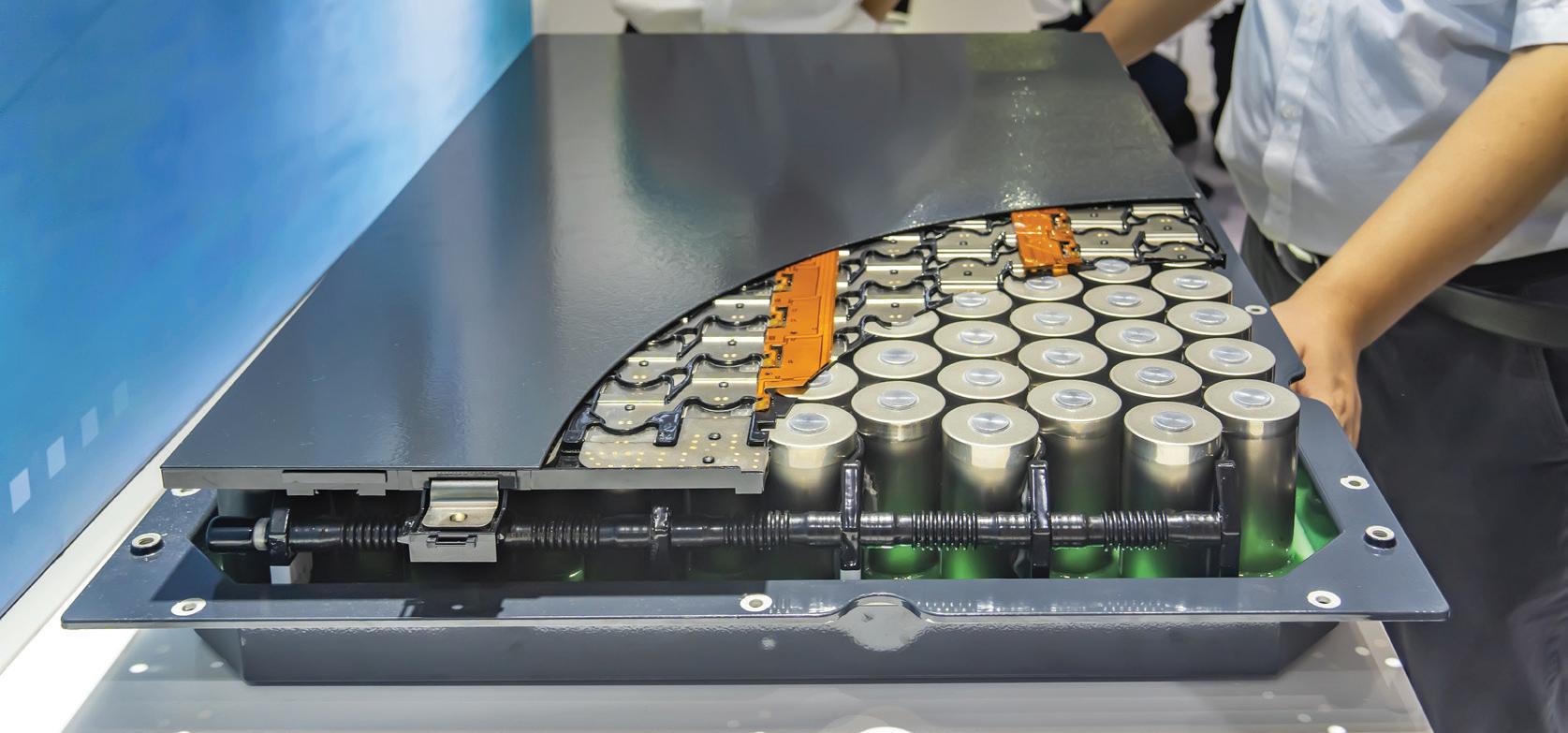

Lithium-ion battery module with 12 pouch cells

on the subject are essential viewing for anyone wanting to understand the subject in greater detail. We’ve provided QR code links to a couple of them at the end of the article in which he explains thermal runaway in great detail.

High temperature is the enemy of Li-ion batteries and can be a precursor to the oft-mentioned condition called ‘thermal runaway’. This is the state in which rising temperatures result in degraded materials within battery cells, which causes further heat, which causes further degradation, then further heat, and so on and so forth. When a battery starts so-called ‘smoking’, even just a little, it has entered the process of thermal runaway. At that point, it’s time to leave the scene as quickly as possible because there’s nothing else you can do. The gas ejected from a battery entering, or undergoing, thermal runaway is often mistaken for smoke or steam, but it’s neither. It may at first seem wispy but it’s a cloud of noxious, flammable gasses that are precursors to fire and explosion. Professor Paul Christensen of Newcastle University in the UK is a specialist in Li-ion battery fires. His lectures and interviews

Professor Christensen begins one of his presentations with the rhetorical question: “What’s the problem with lithium-ion batteries? Number one, they shouldn’t exist. They are thermodynamically unstable” is his answer. He continues by explaining that when a lithium-ion battery is first manufactured, the initial charge must be added slowly over a couple of weeks. This is because the lithium ions created in the process enter the graphite anode and form a highly concentrated store of energy. This reacts with the solvent in the electrolyte and generates gasses and heat. If this process continued, heat would build up and the cell would explode. Fortunately, transferring energy from the anode into the electrolyte is stopped by forming a protective layer known as the SEI (Solid/Electrolyte Interface). This forms on the graphite and prevents further interaction with the electrolyte, yet allows the passage of lithium ions. The thing is, formation of the SEI is not really a chemically engineered process; neither is it understood. However, that it happens naturally is fortuitous because without it there would be no lithium-ion batteries. If the SEI becomes damaged, graphite can once again come into contact with the electrolyte and the process of heat build-up resumes. As Professor Christensen points out, heat builds throughout the interior volume of the battery while it can only dissipate through the surface. Heat builds exponentially while it dissipates only linearly and the battery enters thermal runaway. Dissipation is further hindered by the external metal packaging of the battery pack and also the surrounding car body.

The fact battery cells are encased in metal containers also hampers attempts to get at them during fires (above left). EVs will rely on renewable energy sources and Li-ion batteries are employed here as well. There have already been fires in grid batteries (above centre). Lithium dendrites caused by incorrect charging can break through the SEI and short the anode and cathode resulting in heat and thermal runaway (above right)

Professor Christensen has performed many experiments on fires in Li-ion batteries and made considerable analysis of the vapour clouds emitted by burning battery packs. It turns out there are three distinct types of clouds, which are lighter than air, heavier than air, and emitted micro particles. Specifically, these clouds contain hydrogen, carbon monoxide, carbon dioxide, hydrogen fluoride, hydrogen chloride, hydrogen cyanide, small droplets of organic solvents from the electrolyte, ethane, methane, propane and sulphur and nitrogen oxides. There will also be a black cloud of heavy metal nanoparticles from the cathode. So, poisonous and flammable. What could go wrong?

If the vapour cloud ignites immediately, there will be a fire. As the gasses vent under pressure, the fire will be like a 1,000 to 2,000 degrees Celsius blow torch. If, however, ignition is delayed, gas will build up and eventually explode. Li-ion battery fires are difficult to extinguish. The main technique is to flood them with huge amounts of water and waiting for them to burn themselves out, but this only cools them as opposed to extinguishing them. Of course, it helps reduce flame propagation. It’s also difficult to get water directly onto the seat of the fire because of battery pack construction, high pressure gasses venting from it and the overarching structure of the car. If all that isn’t depressing enough, water poured onto a Li-ion fire can be electrolysed into oxygen and hydrogen by the electrical energy in cells that have not yet become involved in thermal runaway. Another reason Li-ion fires are difficult to put out is often said to be because they create their own oxygen.

But Li-ion fires rely on atmospheric oxygen as evidenced by videos showing the effectiveness of fire blankets (big ones for cars) in extinguishing the flames. But it doesn’t always work as well as it might and, even though the flames can be suppressed, thermal runaway continues. When the blanket is removed, the gasses are likely to reignite and the party continues. What’s more, reignition can occur hours, days or even weeks after the fire is seemingly finished. Additionally, even if the flames are extinguished, the vapour cloud can continue to build and explode. All these factors create challenges for EV recycling. Most Li-ion fires begin because of damage to the SEI. So the normal practice of crushing and stacking cars at EVL (End of Vehicle Life) is out for EVs. Battery packs must be removed as part of the stripping process before crushing. Using batteries from vehicles

Recycling Li-ion batteries is important and research into reuse is needed. The Future Battery Industries CRC, with CSIRO, has produced a report called Australian landscape for lithium-ion battery recycling and reuse in 2020 that covers these subjects (above left). The CSIRO has produced a report called Lithium-ion battery safety. Both the reports mentioned here are readily available on line (above right)

that have been involved in accidents should never occur because, even if a pack hasn’t entered thermal runaway, it’s impossible to tell if the SEI is damaged. Several Li-ion EV fires have made the news, but they’re rare. However, as we also pointed out, fires in personal mobility appliances are not. The ABC recently ran a story about the 1,000-plus (another story claimed 10,000) Li-ion fires each year from other devices as these batteries are discarded into waste disposal systems. Li-ion batteries should never be placed in household rubbish bins, including recycling bins. They should always be taken to battery recycling disposal points.

CSIRO works to address the Li-ion recycling issue and has published a paper called Australian landscape for lithiumion battery recycling and reuse in 2020, which suggests improvements to treat used Li-ion batteries. The organisation

also examines ways to determine the safety and suitability of reusing Li-ion batteries. Developing testing in this area is vital and if anyone can come up with a solution, it’s likely to be the CSIRO. The report says only around three per cent of lithium batteries are recycled with the other 97 per cent going into landfill. While Australia doesn’t mind digging up and exporting lithium, developing recycling techniques and building an industry around them is also vital. We’ve discussed Li-ion batteries because these are the most common type used in EVs, but there are other types in development. Sodiumion, lithium-sulphur, solid-state, aqueous magnesium, seawater based, magnesium, glass and flow batteries are all touted as viable alternatives. We’ll examine those technologies in another article.

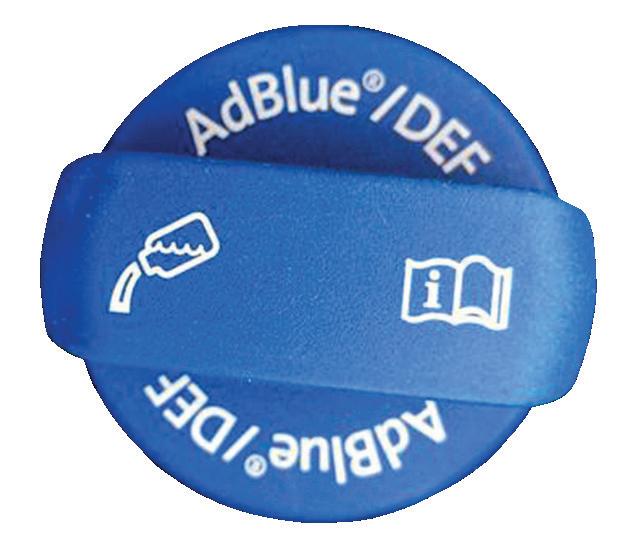

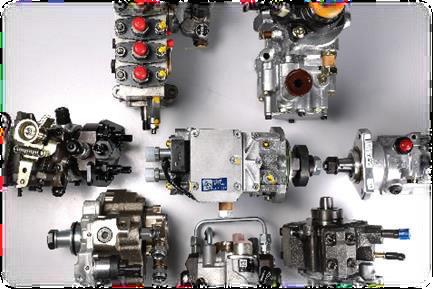

The Ford Everest is the five-door SUV variant of the Ford Ranger T6 platform, designed in Australia and built in Thailand from 2015 to current models. The Everest shares most of its powertrain with the Ranger with a few interesting additions, like coil spring rear suspension and a Selective Catalytic Reduction (SCR) system. This article provides an overview of the Everest SCR system and the common diagnostic trouble codes (DTCs) that members regularly request.

An SCR system is used to reduce the amount of oxidises of nitrogen (NOx) in the vehicle’s exhaust, which contributes to smog and irritates eyes and respiratory systems. It does this by injecting ammonia in the form of urea into the exhaust stream in front of a catalyst unit. A chemical reaction then takes place which breaks down the NOx. The ammonia is mixed into a liquid which is called a reductant – commonly called Diesel Exhaust Fluid (DEF) – which has the trademarked name of AdBlue.

Why does the Everest have SCR and the Ranger does not?

Vehicles in Australia are classified under different categories depending on their designed purpose or role. The ‘M’ classification is for passenger vehicles, which has sub-categories that include

‘MA’ for Non-Offroad Operation, and ‘MC’ for vehicles with special features for Off-Road Operation (there are other categories which are not relevant to this article). As the Everest and Ranger have two-wheel drive and four-wheel drive options and potentially different intended markets, Ford placed the Everest in the MA category and the Ranger in the MC category. However, the MA category has stricter emission requirements (Euro 5 and 6), which is why a SCR system was fitted to the Everest and not the Ranger. This SCR system is starting to cause some trouble as these vehicles are now getting out of their warranty period and turning up in members’ workshops.

SCR/Reductant System component

The Everest’s SCR system is laid out in a similar way to other vehicles with these systems. However, Ford likes to call it a Reductant System and labels the components as such. The reductant system is a stand-alone system which communicates with the rest of the vehicle systems via CAN Bus.

The control unit is called the Reductant Dosage Control Module (RDCM) and is mounted under the covers in the LH side of the rear luggage compartment.

The RDCM monitors the two NOx sensors in the exhaust so it can inject the correct amount of reductant (AdBlue) into the exhaust via an injector

upstream of the SCR Catalyst Unit in the exhaust (downstream from the DPF)

See Diagram 2. There is a reductant tank in the LH rear corner of the vehicle which has a pump to pressurise the AdBlue, heaters and level gauge senders mounted in a unit on top, and in the tank. See Diagram 5. This tank is refilled by the driver from a separate AdBlue filler, which is a smaller blue cap next to the diesel tank filler cap See Diagram 1. The driver will be prompted to refill the AdBlue tank via warnings on the dash and display screen. Like all other vehicles with SCR systems, it will reduce engine performance if the level gets too low and will not allow the car to restart if the system is below a minimum level.

If you have ‘AdBlue System Malfunction’ warnings on the display screen or dash after repairing DTCs, software updates or refilling the system, you may have to complete the following drive cycle to clear them. Ignition off, until the PCM and CAN Bus system shut down or goes to sleep. Start the engine and allow it to reach operating temperature and allow it to idle for five minutes.

For more information on SCR system operation and AdBlue see the following Tech Talk articles:

• What is Urea SCR: October 2005 p. 2309

• Diesel Emission Systems: April 2015 p. 3960

• Diesel Exhaust Fluids Q & A: April 2019 p. 4676

Diagram 2 – SCR system component locations

SCR injector

SCR catalyst unit

You might be able to access most connectors with the spare wheel removed. If not, remove the tank from below

Note: There are aftermarket bash plates for this tank

Diagram 3 – Wiring diagram

Y/GR G/V V/GR

Earths at the rear of the LH rear door opening under the trim.

Earths at the RH rear corner of the engine bay

Spliced into harness and earths on the transmission

The easy-to-use diagnostic tool comes softwareenabled, providing auto-detection, top-range health reports, monthly updates and more.

Seamlessly integrates with VACC MotorTech, saving time diagnosing many technical issues.

Flexible payment plans, available in-house with no interest or fees.

Connect a compatible scan tool and monitor the mode 1 exhaust temperatures via the powertrain OBD test modes. Allow the vehicle to idle until the exhaust temperature sensors are approximately 220-300 degrees Celsius. Ensure the exhaust temperatures remain in this range for the following steps. Drive the vehicle up to 80km/h and maintain this speed for at least 20 seconds.

Decelerate to a complete stop. Drive the vehicle gently on a level road at approximately 75 to 85km/h for four minutes.

Decelerate to a complete stop. Use heavy braking if safe to do so. Drive the vehicle up to 80km/h and maintain this speed for at least 20 seconds.

All AdBlue related warnings should now be clear. If not, there are other faults in the system.

Software update for RDCM

Back in 2016, Ford released a bulletin concerning early Everest models which were giving incorrect AdBlue level warnings to the driver, and caused DTCs to be stored. In some cases, the vehicle would not restart even after it had been refilled with AdBlue, as the system would not recognise the level signal. A software update for the RDCM was released and seems to have fixed this problem. However, if you come across a vehicle which presents with DTCs P218F, P02BB, P20BC or P20BF you might have found one that has missed this updated software. It is good practice to check for software updates before getting too deep into any diagnostic procedures or parts replacement. There are many possible fault codes for the SCR system, and the following DTCs are the ones that we have received the most calls on. Information in this article, and the following SCR related articles should assist you in repairing these codes.

Performance (Bank 1)

Description:

The PCM monitors the SCR system by monitoring the rate of reductant flow and feedback from the nitrogen oxides bank 1, sensor 2 (NOx12 Downstream) sensor. These values are compared to a calculated model. This DTC sets when the difference between the modelled and actual system

performance exceeds a threshold and a restriction in the SCR system is suspect. Possible causes:

Faulty/restricted SCR injector

Restricted reductant pressure line

Restricted reductant filter in tank

SCR injector testing

This is the quickest fault test. Remove the injector harness connector. Measure the resistance across the injector terminals. It should be 11-13Ω If it is not within the above specifications, replace the injector. Check the injector for shorts to ground. The resistance should be greater than 10kΩ. Check the wiring from the Reductant Dosage Control Module to the injector and repair any open or short circuits. The resistance in the wiring should be less than 5Ω. If the injector and its circuit are ok, you should perform a SCR Injector Dosing Measurement Test. See TechTalk April 2020, page 4846.

heater and sender assembly

A Control Performance

Description:

The RDCM monitors the conductance of each reductant heater during peak power and compares this conductance to an expected threshold. This DTC sets when the module detects that the reductant heater conductance is out of tolerance with this threshold.

Possible causes:

Faulty wiring or connectors. Faulty reductant tank heater.

Reductant heater testing

Turn ignition off.

Disconnect the harness from the Reductant Dosage Control Module. Connect a jumper wire with a fiveamp fuse in series between the module’s harness terminal 28 and ground. This will energise the SCR relay to give power to fuses F43, F55, F50 and F54. See Diagram 3

Turn the ignition on, engine off.

Measure the voltage between the modules harness terminal 1, 3, 5, 51 and 73 and ground. You should have battery voltage of at least more than 10.5 volts.

If not, check all fuses and wiring. If no power is passing through the relay, a new fuse box is required as this relay is not serviceable. If the voltage is correct.

Turn ignition off.

Disconnect the harness from the Reductant Heater and Sender Assembly on top of the AdBlue tank. See Diagram 5 Measure the resistance between terminal 1 and 2 of the Reductant Heater and Sender Assembly. The resistance should be between 1.0 - 2.5 Ω. See Diagram 3 & 4

If not, you will need to replace the Reductant Heater and Sender Assembly. If the resistance is correct, check the wiring and connectors from the Reductant Heater and Sender Assembly to the Reductant Dosage Control Module for open or short circuits and loose or corroded connectors. All continuity tests should be less than 5 Ω. If not repair any open circuits or high resistances. If OK: Clear all DTCs and repeat the self-test.

If not correct: Check the earth circuit from Reductant Heater and Sender Assembly terminal 1 to earth.

If OK: Clear all DTCs and repeat the self-test.

If not, measure the voltage at the Reductant Heater and Sender Assembly terminal 1 and ground. There should be voltage present. Note: There is no voltage specification given. However, it will probably be a PWM signal if you want to check it with an oscilloscope. If OK. Clear all DTCs and repeat the self-test.

If not, check the Reductant Dosage Control Module.

This article is only a brief overview of some of the common problems with is this system. Refer to TechTalk April 2020 which covers other components in more detail and other vehicles with SCR systems problems and diagnosis. Ford is using SCR systems on the 2.0-litre Transit and the new Endura SUV. However, they are using different component designs.

For more information on the Ford Everest, log on to VACC MotorTech or call the VACC Technical Advisory Service.

With Commonwealth Bank, VACC members can take advantage of preferential rates on credit and debit card merchant fees. Whether you’re a small or large business, the savings you could be making in merchant fees could be invested in other areas of your business, like purchasing equipment, employing staff or online marketing.

How much could you save?

When comparing credit and debit card merchant fee charges for VACC members versus non-members, the savings can be surprising. We have reviewed our merchant base^ for the industry and found that on average, members processing less than $500,000 could save up to 23%.^

We can easily create a customised comparison for your business, by simply providing us your Merchant statement for one whole month.

With Commonwealth Bank, VACC can also take advantage of our latest technology with either an Essential Lite or Essential Plus device, no contracts and 24/7 support.

Here for you, for however you do business.

To find out how much you could save with Commonwealth Bank, contact VACC on 1300 013 341 or email membership@vacc.com.au and they’ll put you in touch with a Commonwealth Bank Relationship Manager.