Aus der Praxis für die Praxis.

Made by professionals, for professionals.

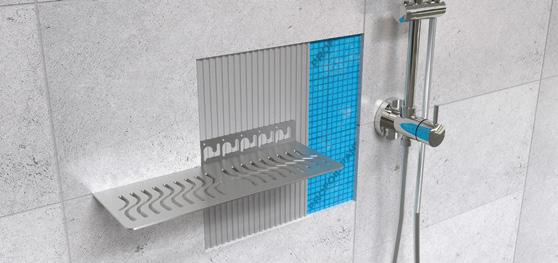

Bei Schlüter-Systems verstehen wir Innovation als Antwort auf die Anforderungen all jener, die täglich mit unseren Produkten arbeiten. Mit einem tiefen Verständnis für die Bedürfnisse unserer Kunden entwickeln wir Systemlösungen, die das Verlegen von Fliesen sowie Naturstein einfacher und das Ergebnis besser machen. Von cleveren Profilen über smarte Entwässerungssysteme bis hin zu effizienten Heizsystemen und praktischen Verarbeitungshilfen – Lösungen von Schlüter-Systems entstehen aus der Praxis und garantieren so die bestmögliche Mischung aus Funktion, Präzision, Design und Verarbeitungskomfort.

schluetersystems

At Schlüter-Systems, we define innovation as our response to the requirements of those who work with our products every day. Based on the in-depth understanding of our customers’ needs, we develop system solutions that not only facilitate the installation of tiles and natural stone, but also improve the results. From intelligently designed profiles to smart drainage systems, efficient heating systems and convenient installation aids – the solutions of Schlüter-Systems are made by professionals to guarantee the best possible combination of functionality, precision, design and handling ease.

PUBLISHER:

Kairos Media Group S.r.l.

Capitale Sociale: Euro 51.400,00

R.E.A. 329775

Periodico bimestrale registrato presso il Tribunale di Modena al n. 22/17 in data 10/08/2017 Iscrizione al ROC n. 9673

OFFICE:

Kairos Media Group S.r.l. Via Fossa Buracchione 84 41126 Baggiovara (Modena) - Italy

Tel. +39 059 512 103 - Fax +39 059 512 157 info@kairosmediagroup.it - www.surfacesinternational.com

EDITOR: DAVIDE MISERENDINO - d.miserendino@kairosmediagroup.it

© 1989 Tile Italia

CO-EDITOR:

Sabrina Tassini

CONTRIBUTING EDITORS:

Sara Falsetti

Paola Giacomini

Chiara Poggi

Sabrina Tassini

SECRETARIAT: info@kairosmediagroup.it

GRAPHIC LAYOUT:

Sara Falsetti

EACH COPY: Euro 4

SUBSCRIPTION: https://kairosmediagroup.it/en/shop/subscription-tile-international

• 1 year: Euro 20

• 2 years: Euro 35

L’abbonamento decorre dal mese di distribuzione. Tariffe speciali per gli abbonamenti collettivi sono disponibili su richiesta Conto Corrente Postale 20026415 intestato a Kairos Media Group srl. Spedizione in abbonamento

postale presso la Filiale di Modena. L’IVA sugli abbonamenti, nonché sulla vendita dei fascicoli separati, è assolta dall’Editore ai sensi dell’art 74 primo comma lettera C del DPR 26.10.72 N. 633 e successive modificazioni.

ADVERTISING:

Kairos Media Group

Tel. +39 059 512 103 Fax +39 059 512 157

• Paola Giacomini

p.giacomini@kairosmediagroup.it +39 335 186 4257

• Teresa Contissa t.contissa@kairosmediagroup.it · +39 342 092 8002

• Elisa Verzelloni e.verzelloni@kairosmediagroup.it · +39 338 536 1966

PRINT:

Faenza Printing Industries SpA Via Vittime Civili di Guerra, 35 48018 Faenza (RA) - Italy

Tutti i diritti di riproduzione e traduzione degli articoli pubblicati sono riservati. E’ vietata la riproduzione anche parziale senza l’autorizzazione dell’Editore. Manoscritti, disegni, fotografie e altro materiale inviato in redazione, anche se non pubblicato, non verrà restituito. L’Editore non accetta alcuna pubblicità in sede redazionale. I nomi, le aziende e i prezzi eventualmente pubblicati sono citati senza responsabilità a puro titolo informativo per rendere un servizio ai lettori. La Direzione non assume responsabilità per opinioni espresse dagli autori dei testi redazionali e pubblicitari.

Entire contents Copyright Kairos Media Group srl All right reserved. Opinions expressed by writers are not necessarily those held by the publisher who is not held responsible. http://www. .com INTERNATIONAL.COM

wedge & clip and screw-type levelling systems

complete program of tools for cleaning, grouting, handling and more

Since day one, back in 1974, our mission has been to fully satisfy the needs of the professional tiles installer by providing him with effective and reliable tools that increase productivity while reducing fatigue.

50 Years later our mission hasn’t changed.

Visit us at Coverings, Orlando 29 April - 2 May 2025.

machines for cutting, mixing, floor preparation and more

extensive range of tools for large format tiles

BOOTH #2640

From geopolitics to economic tensions, the opening months of 2025 have once again shown the United States to be a major protagonist on the world stage.

The new US President, Donald Trump, has brought the word “tariffs” into everyday parlance, forcing a long line-up of European business leaders to keep putting on their glasses and checking the latest economic news, in an often vain attempt to see what fate awaits their overseas exports. We believe this year’s Coverings will provide a golden opportunity for the ceramic industry to take stock of the situation.

And that is why, in the issue of Tile International you are reading, we have aimed to shine a spotlight on the key issues affecting the American mar-

Miserendino d.miserendino@kairosmediagroup.it

ket, by interviewing two experts, namely Eric Astrachan, Executive Director of TCNA and Joseph Lundgren, of JLC Consulting (see article on page 30). Forecasts for the US point to a 5% upturn in tile consumption in 2025, on the back of the hoped-for recovery in the residential sector that should go hand in hand with a cut in interest rates. It would be nice, on this front at least, if the clouds of uncertainty gave way to a patch of blue sky. ✕

LATICRETE Acquires Majority Stake in fuma-Bautec

LATICRETE, the manufacturer of globally proven construction solutions for the building industry, has acquired a majority stake in fuma-Bautec, one of the leading German profile manufacturers. Since April 2023, fuma-Bautec was the exclusive profile supplier of LATICRETE for the United States and Canada markets.

The acquisition takes the established relationship between the two companies to the next level, expanding capabilities in developing profiles and engineered systems worldwide.

The partnership with fuma-Bautec builds on the LATICRETE legacy of manufacturing products of the highest quality for tile and tone installation systems, with now the capability to deliver aluminum and stainless-steel profiles with industry-leading precision in every region.

Consistent color and finishing embolden the LATICRETE product roster while also dovetailing with the brand’s innovative color matching to grouts and sealants.

The acquisition further underscores the LATICRETE objective of delivering the most comprehensive installation systems with a leading warranty.

“We are excited to welcome fuma-Bautec to the LATICRETE family,” said Patrick Millot, CEO of LATICRETE. “Their exceptional brand reputation and product innovation align perfectly with our mission to deliver premium solutions globally. With this partnership, LATICRETE is now the only player that can offer a full portfolio of premium solutions worldwide for tile and stone installation systems. We are eager to partner with existing and new customers in every region to accelerate growth with them in every channel.”

With LATICRETE acquiring a majority stake in fuma-Bautec, the remaining shares will be retained by the fuma-Bautec CEO Michael Demeter.

As part of the LATICRETE Group, fuma-Bautec will continue to operate and expand under Demeter’s leadership while maintaining its strong brand identity and commitment to innovation. Globally, LATICRETE and fuma-Bautec will leverage their combined strengths to accelerate development and drive market leadership in every region.

Marazzi inaugurates new exhibition spaces in the heart of Rome

Marazzi has opened the doors of its new exhibition spaces on Via Vittorio Emanuele Orlando in the heart of Rome, just steps away from the Roman Baths of Diocletian and Palazzo Barberini, designed by ACPV ARCHITECTS. An exceptional location, with 400 square meters spread over two levels, welcomes visitors into a stunning space where the versatility of ceramic materials takes center stage, in a perfect balance between innovation and design. The large windows on Via Vittorio Emanuele Orlando offer a captivating preview of the space’s layout, where plays of perspectives and materials lead visitors through a continuous discovery experience within the showroom. Marazzi Privé, the heart of the project, evokes the exclusive atmosphere of a hotel lobby, combining elegance and functionality. Three autonomous yet connected settings explore the versatility of Marazzi products, reinterpreting rugs, furniture, and porcelain seating in a sequence of spaces characterized by privacy and comfort. The high backrests create intimacy, transforming every corner into a cozy retreat. Here, the use of ceramics demonstrates their ability to offer innovative solutions where advanced technology, adaptability, and timeless beauty take shape, alongside objects and sculptures that explore the nuances of new classics. A succession of themed rooms emphasizes the preciousness of Marazzi materials, which, displayed in dynamic and interconnected spaces, interact with the architecture to create a visual flow that invites visitors to explore every detail. Each themed room offers a unique experience that highlights the excellence of the materials. The large slabs, arranged like rich oriental rugs, are carefully illuminated to enhance their beauty, as are

the museum shelves that display an exclusive selection of finishes, surfaces, and colors. This transforms the exhibition space into a wunderkammer of colors and materials, evoking artisanal craftsmanship, precious marbles, elaborate inlays, and three-dimensional structures. The creation of the new Marazzi exhibition spaces in Rome is the result of valuable collaboration with leading design partners such as Flexform, Viabizzuno, Ideal Standard, Foster, and Riflessi.

Mohawk Industries sees a softer downturn

A slight uptick in the fourth quarter of 2024 enabled Mohawk Industries to reduce its decline in full-year revenue compared to the -3.8% reported in the first nine months.

For the global flooring giant, 2024 closed with net sales of $10.8 billion, a decrease of 2.7% compared to the $11.1 billion of 2023. Adjusted EBITDA and adjusted operating income both increased by 0.7% versus 2023, while adjusted net earnings grew by 5.1% to $617 million. The company generated $680 million of free cash flow, ending the year with approximately $1.6 billion in available liquidity.

Chairman and CEO Jeff Lorberbaum

noted that these results exceeded expectations, “thanks to our sales actions, marketing initiatives and new product introductions, as well as significant restructuring efforts and measures to lower costs and improve productivity. This was in spite of persistently unfavourable market conditions throughout the year. Consumers continued to limit large discretionary purchases, and consumer confidence remained constrained by cumulative inflation, economic uncertainty and geopolitical tensions. Residential demand remained soft in all our markets, both in new home construction – due to higher home costs and interest rates –and in remodelling.”

During 2024, existing US home sales fell to a 30-year low.

For the Calhoun, Georgia-based group, commercial sales also declined during 2024, though they remained higher than residential remodelling.

At the end of 2024, the Global Ceramic Segment recorded net sales of $4.2 billion (-1.7% versus 2023), maintaining a 39% share of total company revenues and confirming its status as the world’s largest ceramic tile producer, with plants in the USA, Mexico, Brazil, Italy, Spain, Bulgaria, Poland and Russia, and brands including American Olean, Daltile, Marazzi, Ragno, Emilgroup, Eliane, Elizabeth, Vitromex, Kai and Kerama Marazzi.

As Lorberbaum noted, the Segment’s operating margin (6.9% for the whole year) was reduced by unfavourable pricing, partially offset by productivity gains and cost containment initiatives, which included reengineering products, improving processes and rationalizing higher cost operations.

Key actions taken by Global Ceramic in its main markets include an increased focus in the US on growing contractor sales through its ceramic service centres and strengthening its position with kitchen and bath dealers. In Europe, high-end product offerings and dedi-

cated showrooms for the architecture and design community in major cities (the most recent Marazzi opening was in Rome in January) are driving commercial sales growth. Export sales outside the region are also on the rise.

In Mexico and Brazil, the integration of Vitromex and Elizabeth, acquired in 2023, has enhanced the product offering, sales structure and market strategies. With respect to Brazil, exports have improved following the weakening of the local currency, while a restructuring project is currently under way in Mexico that is expected to save approximately $20 million per year when completed.

“Our industry has been in a cyclical downturn for multiple years, and we are confident that our markets will return to historical levels, though the inflection point remains unpredictable,” said Lorberbaum. According to Mohawk Industries’ Chairman, the first quarter of 2025 will confirm ongoing softness in all markets, alongside heightened competition that will continue to place intense pressure on pricing.

A market recovery may be delayed further into the year, even though both the US and Europe continue to face a housing shortage as well as a pressing need to update ageing homes after several years of postponed remodelling projects.

In the meantime, the company is proceeding with the development of new products designed to meet consumer demand and continuing with a restructuring program launched in 2023 (including the Mexican ceramic business) which will generate annualized savings of approximately $285 million when completed in 2026.

“As the world’s largest flooring manufacturer, we are uniquely positioned to manage this market cycle, pursue opportunities for long-term profitable growth and emerge stronger when housing markets improve,” concluded Lorberbaum.

Paolo Mularoni, President of Ceramica Faetano and Del Conca USA, has died suddenly, at the age of 45. He belonged to the third generation of the family that has run the business since its foundation in San Marino in 1979. The Group currently has three production sites spanning Italy’s Romagna region and its ceramic cluster in Sassuolo, and opened a factory in Tennessee, USA, in 2014.

In that same year, Paolo played a key role in the transatlantic expansion of Del Conca Group and, following the death

of his father, Enzo Donald Mularoni, in 2016, became President of Ceramica Faetano, the San Marino-based parent company of the family multinational, which he headed, alongside his brothers Marco and Davide. In November last year, Mularoni signed an agreement for Ceramica Faetano to participate in Expo 2025 Osaka, thereby confirming its role as a strategic partner for the San Marino pavilion. Following his premature death, the Del Conca Group’s management has signalled its commitment to continuity by launching a process of corporate reorganisation and appointing Marco Mularoni as the new President of Ceramica Faetano SPA and Del Conca USA.

Laminam, world leader in the large ceramic slabs sector, makes a further step in its growth and internationalization path. In January 2025, the Italian group based in Fiorano Modenese has purchased from the Zapatero family the controlling stake in Iberstone, which is the main player in Spain for the distribution of large-format Laminam slabs and

natural stone for kitchens and interiors. In continuity with the previous management, Iberstone’s nine logistics centers, all its personnel, and all commercial assets have been transferred into the newly formed Iberstone Lam, of which Laminam is the main shareholder and the Zapatero family has a significant holding. The new company structure will therefore ensure continuity in the commercial dynamics, with José Luis Zapatero and his son Rubén Zapate-

ro continuing as company directors. The current nine logistics centers (Barcelona, Valencia, Madrid, Majorca, Zaragoza, Valladolid, Basque Country, Asturias, Gran Canaria), plus the distribution network, provide total coverage and guarantee fast, accurate and timely delivery of slabs to over 1000 fabricators. The recognizability of the Laminam brand has allowed the Italian company to win ever-greater market share in Spain over the years. Now, the consolidated experience of the Zapatero family and Laminam’s investment capacity will allow further development of the market potential and ambitious new goals to be set.

“Our acquisition of Iberstone is the natural evolution of a profitable and professional partnership and friendship, based on reciprocal trust and esteem, which has seen both companies grow and establish themselves,” said Alberto Selmi, CEO of Laminam. “This operation not only allows us to strengthen our presence in a strategically important market, but also to combine our expertise with a team which shares our values and our vision”.

The new agreement is testament to Laminam’s international growth path: the new company will, indeed, join the other foreign subsidiaries which cover the most important foreign markets: Australia, Japan, China, Canada, USA, Benelux, France, Germany, UK, Russia, Israel.

two

VitrA has increased its total haul of Good Design Awards to 55 this year, by winning two more of the prestigious prizes celebrating design excellence.

Founded in 1950 and held continuously ever since, the Good Design Awards are among the longest-running and most renowned design competitions in the world. This year VitrA has added two new Good Design Awards to its trophy cabinet, bringing the total number to 55. The 74th Good Design Awards, held by the Chicago Athenaeum: Museum of Architecture and Design assessed over 1,100 product designs and graphic designs from 55 countries.

VitrA won these latest awards for VitrA QuantumFlush, the company’s innovative flushing technology, which harnesses the power of water to assure the utmost hygiene, and VitrA Recycled Washbasin, the first and only 100%-recycled ceramic washbasin in its class.

Last year VitrA won Good Design Awards for its Origin Classic, Metropole and Suit collections, in the bathroom category, and for its Resincrete, CobbleMix and ModePaper series of tiles, designed by the VitrA design team.

Clerkenwell Design Week (CDW) returns to London’s EC1 from May 20-22, 2025, for its 14th edition, promising its largest event yet. This year, the festival introduces three new exhibition venues: The Charterhouse and Charterhouse Square, Studio Smithfield, and Church of Design (St Bartholomew the Great), adding a vibrant southern district to the event. The Charterhouse will showcase leading bathroom brands such as Geberit, Toto, and Victoria and Albert Baths, along with British fabric and wallpaper company Colefax and Fowler. It will also host Conversations at Clerkenwell, featuring talks in a specially designed theatre by London-based studio Kapitza. In Charterhouse Square, artist Alex Chinneck will unveil a new public artwork, returning to his signature sculptural style using brick and repurposed steel, sponsored by Cleveland Steel. Studio Smithfield, a 27,000-squarefoot Grade II* listed space above Smithfield Market, will house commercial and workplace interior brands. Meanwhile, Church of Design, inside the historic St Bartholomew the Great, will feature Roche Bobois and host Design Dialogue by Sandow, a new talk series in collaboration with US-based publisher Sandow. Ahead of the event, Sandow has also launched the CDW Product Awards, recognizing the most innovative design products. Beyond the new venues, CDW 2025 will feature 350+ design brands, 16+ exhibition venues, and 160+ local showrooms. Returning locations include Design Fields (contemporary furniture and lighting), Light (global lighting brands), Elements (architectural hardware and finishes), and Ceram-

ics of Italy, showcasing Italian ceramic and porcelain design. With an expanded footprint and an impressive lineup of brands and events, CDW 2025 is set to be a must-visit destination for design professionals and enthusiasts alike.

Roca Group wins EcoVadis Platinum Medal

Roca Group, which specialises in bathroom furnishings, has been awarded the highest possible endorsement by EcoVadis, the world’s most established standard for corporate sustainability ratings. EcoVadis assesses sustainability on the basis of 21 criteria in four key areas: environment, employment and human rights, ethics and sustainable procurement. Over the years, the organisation has assessed over 150,000 companies from 185 countries. The platinum medal is awarded only to the top 1% of companies assessed over the course of the previous year. This Platinum Medal bears witness to the Group’s firm commitment to integrating sustainability into every aspect of its business. “Being ranked in the top 1% worldwide is a major tribute to our team’s work and to the positive impact we are making globally. We see sustainability as an ongoing pathway, and this result boosts our determination to push boundaries, drive change in the business world and keep moving forward towards a more sustainable future,” explained Carlos Velázquez, Roca Group’s Sustainability Director.

“A space for architectural design”: the poster for Cersaie 2025

Cersaie is proud to present the poster for the 42nd edition of the International Exhibition of Ceramic Tile and Bathroom Furnishings, to be held in Bologna from 22-26 September. The image for 2025 reinforces the concept of architectural space that has been the hallmark of the Bologna-based exhibition, showcasing responsible, integrated interior and exterior design, for some years. This year’s visual, which is an evolution of the concept developed for the last edition of Cersaie, offers a broader, more three-dimensional vision: as a multi-polar view, featuring multiple levels and multiple perspectives, it captures present and future needs of everyday living and dwelling. Globalisation, high-speed travel and migration have created cities and places where different cultures, traditions and lifestyles coexist, giving rise to cross-pollinations that spawn new habits and redefine the priorities of the built environment. The visual that Interpromex has created for Cersaie 2025 symbolically depicts this evolution by means of a composition of volumes on multiple levels and a series of coloured planes that create dynamic, interconnected spaces. The poster is a graphic and conceptual narrative of what visitors find at Cersaie: a multi-faceted ecosystem of designer products, rang-

ing from ceramic coverings to bathroom furnishings, non-ceramic coverings, furnishing accessories and interior finishes that meet the needs of designers, contractors, interior designers and dealers from all over the world.

Despite a sharp decline in the building construction industry in Europe, the Geberit Group – one of the world’s largest producers of sanitaryware and bathroom solutions – reported a currency-adjusted increase in net sales of 2.5% in 2024. At CHF 3,085 million, net sales in Swiss francs remained practically constant compared to the previous year due to unfavourable currency developments. EBITDA margin is expected to be slightly below the 2023 level, mainly due to significant investments in marketing, digitalisation and IT projects.

Growth was driven entirely by higher volumes. In addition to a rebuilding of inventories by wholesalers in the first half of the year, Geberit further strengthened its market position, supported by the strong development of various new products.

Although European markets continued to suffer the most from the highly challenging conditions facing the sanitaryware industry, currency-adjusted net sales in Europe increased by +1.9% in 2024. Above-average increases were achieved in Eastern Europe (+7.1%), Italy (+6.2%), Benelux (+3.8%) and Germany (+3.2%). Austria (+0.3%) also made slight gains, while net sales in Switzerland were in line with the level seen in the previous year (-0.1%). In con-

trast, declines were recorded in Western Europe (-2.6%) and Northern Europe (-4.2%). Outside Europe, positive currency-adjusted increases were achieved in the Middle East/Africa (+17.1%), America (+3.0%) and the Far East/Pacific (+0.2%), where the decline in China was offset by strong growth in India.

Regarding the group’s three Business Units, currency-adjusted net sales increased by 4.8% in Installation and Flushing Systems, 1.3% in Piping Systems and 1.1% in Bathroom Systems. Following the strong declines in the building construction industry experienced since mid-2022, demand is expected to stabilise as a whole during the course of 2025. In Europe, the number of building permits in the first nine months of 2024 was only slightly lower than in 2023 (-1%). However, in Germany, the Nordic countries and Austria – traditionally key markets for Geberit – permits fell by a total of 12%, suggesting a continued slight decline in the new construction segment. In contrast, the renovation segment, which accounts for around 60% of Geberit’s business, is expected to see stable to slightly positive development. Outside Europe, a mixed market environment is expected in 2025. While demand in India and the Gulf region is expected to remain high, further declines are anticipated in China.

Raimondi S.p.A. acquires its US distributor and opens its own subsidiary in the USA

Raimondi S.p.A., the Italian based company that has been a leader in professional tools for ceramic tile installation since 1974, completed the acquisition of its US distributor, Donnelly Distribution Inc., at the end of 2024, acquiring 100% of its assets. On 1 January 2025, Raimondi USA Corp. was born to consolidate and further expand the brand’s presence in a strategic market such as the North American market, where Raimondi is relying on more than 20 years of trading development and service network in the territory. Raimondi USA, has acquired the entire structure of its distributor, maintaining the Staff unchanged: the management (including previous owners and President), all the sales, administrative and logistic personnel are now part of the Staff of Raimondi USA, to ensure maximum continuity of management and consequently the best service for customers. Raimondi USA is based in Sussex (WI), just outside of Milwaukee, where offices and warehouse are located, fully operational and independent in terms of logistics, order management, after-sales assistance, technical commercial training. In addition to its head office, Raimondi USA covers the US market with resident managers already operating in Southern regions, North-East and Mid-West States. Recognized leader in the installation tools industry and known for its innovative technical solutions dedicated to make the installers job easier, safer and more productive, Raimondi has identified in the North American market the basic characteristics necessary to establish its first foreign commercial subsidiary: long time presence, high brand recognition, well-established distribution network, a market with strong potential for further development.

“With the expansion in the United States

- Marco Raimondi, general manager of Raimondi S.p.A. and president of Raimondi USA, said - our company opens a new chapter of its history, selecting US market as the first chance to move from a distribution business model to a real direct presence on the spot, with all the benefits that this step entails, in terms of both competitiveness and understanding of the specific needs of the market. Today, new colleagues and employees are part of our company and -thanks to their added value- we aim to further devel-

op one of our main markets. We have been exporting to the States for more than 2 decades and we are constantly attending major trade shows. Through these years we built our brand image and communicated in the market our mission and the history of our company. We are very pleased to finally land firmly and directly on this high-potential market, where we believe that our quality and attention to customer’s needs can drive our success in largescale projects.”

Kaleseramik at Coverings 2025 with 2mm Ultra-Thin

Kaleseramik, Turkey’s leading ceramic tile manufacturer, ranked 4th in Europe and 21st globally, is set to make a strong impression at Coverings 2025 with its ultra-thin 2mm porcelain slabs. With a $25 million investment in its production lines, Kaleseramik has revolutionized the industry with large-format porcelain slabs that combine minimal thickness with exceptional durability, offering versatile applications for architectural projects. At the exhibition, in addition to the 100x300 cm slabs, Kaleseramik showcases an extensive range of large-format slabs in sizes 120x280 cm, 120x360 cm, 160x320 cm, and 162x323 cm, available in thicknesses of 3mm, 5mm, 6mm, 12mm, and 20mm. These innovative products aim to provide visitors with an inspiring and cutting-edge design experience. Moreover, embracing sustainability with the slogan “Take Care of Your World”, Kaleseramik focuses on continuously improving environmentally friendly production processes with its Kalesinterflex products. By utilizing innovative technologies, the company aims to reduce natural resource consumption and minimize environmental impact through lower energy and water

usage during production. Particularly, the 2 mm ultra-thin porcelain tiles maximize resource efficiency by using 33% less raw material, save energy in logistics processes due to their lightweight structure, and significantly reduce the carbon footprint. Kaleseramik’ s General Manager, Timur Karaoğlu, emphasizes that Kalesinterflex is not just a ceramic product, but also offers innovative and sustainable living solutions. Karaoğlu states that Coverings 2025 presents a strategic opportuni-

ty to introduce this groundbreaking product to the North American market. He further expresses that Kalesinterflex has become an indispensable choice for architects, designers, and industry professionals due to its flexibility, durability, and aesthetic qualities. Karaoğlu also highlights that Kalesinterflex is not merely a material but a transformation shaping the architecture of the future, emphasizing that Kaleseramik will continue to lead the industry globally.

Luca Baraldi - MECS / Centro Studi Acimac - l.baraldi@mecs.org

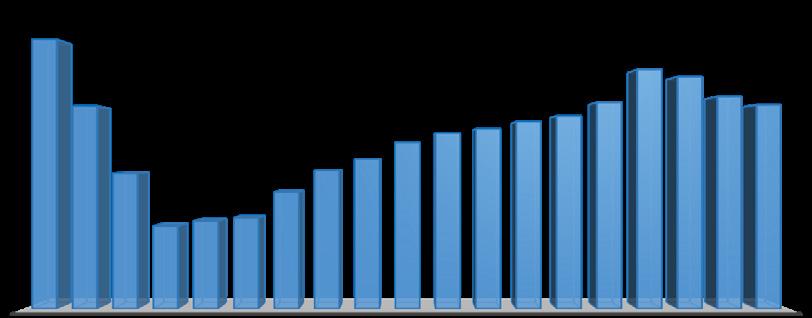

The fourth edition of the forecast report for the global ceramic tile market , published last November by the MECS-Acimac Research Centre , analyses production and consumption trends for the period

2024-2028, both by macro-areas and for 91 individual countries.

The 238-page report concludes with summary tables ranking 90 producer and 146 consumer countries based on projected volume changes over the five-year period. Unsurprisingly, India tops the list for both production and consumption growth , while China sits at the bottom of the ranking with a negative outlook.

As in previous editions, Ceramic Tile Market Forecast Analysis. TRENDS 2024-2028 is based on econometric models developed by MECS, integrating multiple quantitative indicators, including GDP trends, industrial and construction investments, demographic and urbanisation dynamics and household spending capacity. The analysis also factors in the impact of public policies, consumption patterns, sustainability trends and the state of logistics and infrastructure. This methodology allows a reliable projection to be made of the average annual growth rate for tile production and consumption over the period 2024-2028, even in the midst of significant structural shifts and global uncertainty. Ongoing geopolitical crises and the wars in Ukraine and the Middle East, coupled with potential policy shifts under a second Trump presiden-

TABLE 1: FORECASTS

cy, could reshape trade patterns and impact commercial relations with various countries and regions, including Europe.

After a decidedly negative 2023 for the global ceramic tile industry (marked by a 5% drop in consumption and a 5.5% decline in production, equating to a loss of 1 billion square metres compared to 2022 and nearly 3 billion sqm less than in 2021), MECS forecasts a gradual recovery over the five-year period from 2024 to 2028. However, this rebound will not be sufficient to return to the record levels seen in 2021. Global tile production is projected to grow at an average annual rate of +2.2%, increasing from 15.9 billion sqm in 2023 to over 17.8 billion sqm in 2028.The key regions driving this recovery will be Africa, the Middle East (despite ongoing

Source: Ceramic Tile Market Forecast Analysis TRENDS 2024 - 2028, MECS 2024

Ceramic Tile Market Forecast Analysis TREND 2024—2028

geopolitical uncertainty), non-EU European countries and the Americas, all of which are expected to grow at above-average rates. Africa, in particular, could see an annual increase of +5.6%, with production rising from 1.2 billion sqm in 2023 to 1.5 billion sqm in 2028. The European Union is expected to expand in line with the global average (+2.2% per year), while Asia is projected to see a more modest annual growth rate of +1.6%. Asia’s overall performance will be significantly impacted by China’s ongoing real estate crisis, which is expected to drive a continued contraction in demand (-1.6% per year) and consequently production (-0.9%). Conversely, India is poised to acquire a growing share of global ceramic tile production, with output forecast to rise by an average of 5.9% per year through 2028. This corresponds to more than 800 million sqm of additional output over five years, nearly matching the projected growth in domestic demand of 778 million sqm.

World consumption set to grow by 2 billion sqm in five years

Over the five-year period, the global ceramic tile market is projected to expand by just over 2 billion sqm, an encouraging rebound compared to the past three

years, though still below the rapid growth seen in previous periods. Global demand is expected to rise from 15.6 billion sqm in 2023 to 17.7 billion sqm in 2028, reflecting an average annual growth rate of +2.5%. Africa is forecast to experience the highest growth, with an annual increase of +6%, followed by South America at +4.8% and non-EU European countries at +3%. In contrast, demand in other regions is expected to grow at a slower pace. The European Union, Asia and the Middle East will see annual growth rates ranging between +1.6% and +1.8%, indicating less dynamic market conditions in these areas.

While Africa and South America will be the key regions to watch in terms of market growth, the leading players in the global ceramic industry are unlikely to change significantly. However, the MECS report highlights the emergence of new dynamic markets, particularly in Africa and Asia. Countries such as Bangladesh, Kenya and Kazakhstan are rapidly expanding their production, with annual double-digit growth projected until 2028. On the consumption side, these nations, along with Cameroon and Uganda, are also

Source: Ceramic Tile Market Forecast Analysis TRENDS 2024 - 2028, MECS 2024

expected to see much faster growth in demand than global averages.

The Far East is the geographical macro-area with the most positive economic growth prospects for the next few years. Between 2024 and 2028, the region’s overall GDP is projected to grow at an average annual rate of 4.3%, while investment in residential and non-residential construction is expected to rise by 3% annually. In 2028, the Far East will continue to account for 70% of global construction investment. However, the MECS forecast report predicts more moderate growth for the ceramic industry and market in this macro-area. Tile production is projected to increase from 10.8 billion sqm in 2023 to 11.6 billion sqm in 2028 (average annual growth rate of +1.6%), while tile consumption is set to rise at an average annual rate of 1.8%, from 9.9 billion sqm in 2023 to 10.8 billion sqm in 2028.

By 2028, China and India – the world’s top two tile producer and consumer countries – will account for 54.5% of global tile production, producing 9.7 billion sqm out of an estimated global total of 17.8 billion sqm. However, their growth patterns will follow opposite trajectories.

In China, the real estate crisis may lead to a further decline in domestic tile consumption (5,656 million sqm in 2028, an average annual contraction of 1.6%), with production volumes also expected to fall (6,441 million sqm, an annual decline of 0.9%). As a result, China’s share of global tile production will drop to 36%. In contrast, India will maintain its rapid and sustained growth trajectory and will be the country with the biggest increase in production volumes by 2028. Output is expected to grow by 813 million sqm compared to 2023, bringing total production to 3,263 million sqm, with an average annual growth rate of 5.9% and a global market share of 18%. Domestic tile consumption will rise even more rapidly (CAGR +7.8% from 2024 to 2028), reaching 2,478 million sqm in 2028 (an increase of 778 million sqm compared to 2023). The Indian ceramic market’s expansion will be driven by a robust national economic performance, with GDP projected to grow by 6.6% annually over the next five years, alongside steady investment in construction, expected to increase by 3.7% per year through 2028. However, the ceramic industry in the Far East is not

limited to these two giants. Vietnam and Indonesia, which will rank as the fourth- and seventh-largest ceramic tile producers worldwide by 2028, also merit attention.

Over the five-year period 2024 to 2028, the MECS forecast report points to a two-speed growth trend for the European ceramic industry, with the European Union experiencing lower annual growth rates than non-EU European countries. This disparity reflects the differing economic forecasts made by the International Monetary Fund (IMF), which projects average annual GDP growth rates of 1.5% for the EU and 2.3% for non-EU Europe over the period.

Ceramic tile consumption in the EU is expected to increase from 831 million sqm in 2023 to 907 million sqm in 2028 (average annual growth rate of 1.8%). After two consecutive years of decline, a slight recovery is anticipated in 2024-2025, driven more by renovations than by new construction. The strongest consumption growth is expected in Poland Spain, the Czech Republic and Bulgaria, while Italy, France and Germany are likely to experience more challenging market conditions.

Tile production in the EU is projected to grow from 1.04 billion sqm in 2023 to 1.16 billion sqm in 2028 (average annual increase of 2.2%) with a similar pattern to that of consumption, namely a modest rebound after the contraction in 2023 and a gradual recovery over the subsequent years.

In non-EU European countries, ceramic tile production is projected to increase from 615 million sqm in 2023 to 728 million sqm in 2028, with an average annual growth rate of 3.4%, a significant acceleration compared to the +0.8% per year recorded between 2014 and 2023. Tile consumption is also expected to rise at an average annual rate of 3.0%, from 636 million sqm in 2023 to 737 million sqm in 2028, again an improvement over the 1.7% average annual growth of the previous decade. However, it is important to note that this region has experienced two years of sharp contraction, largely due to the instability caused by the war in Ukraine. The recovery will be driven primarily by Turkey and Russia, the area’s two largest ceramic tile producers. According to MECS forecasts, Turkish production is expected to reach 433 million sqm in 2028 (average annual growth rate of +3.1%), while Rus-

sian production will grow to 208 million sqm (annual growth rate of +3.2%).

The MECS forecast for North America (NAFTA region consisting of the United States, Canada and Mexico) estimates an increase in tile production from 349 million sqm in 2023 to 403 million sqm in 2028 (CAGR +2.9%). Tile consumption is also expected to rise over the same period from 551 million sqm to 616 million sqm (CAGR +2.2%). For the five-year period 20242028, MECS forecasts higher average annual growth rates for both production and consumption compared to the decade 2014-2023.

Mexico will play a key role in driving both production and demand. The country’s tile production is expected to reach 305 million sqm by 2028 (CAGR +2.9%), accounting for three-quarters of North America’s total output, while domestic consumption will reach 302 million sqm (CAGR +3.5%).

The ceramic tile industry and market in the United States are likewise poised for growth. Production is projected to reach 97 million sqm by 2028 (CAGR +3.1%), while domestic consumption will grow from 264 million sqm in 2023 to 283 million sqm in 2028 (CAGR +1.4%). More than two-thirds of US tile consumption will continue to be met by imports.

According to the MECS Research Centre’s forecast for the main countries in Latin America from 2024 to 2028, the region’s ceramic industry will maintain a stable share of global tile production at 7.2%, while strengthening its position as a major consumer market.

Ceramic tile production is projected to grow from 1.12 billion sqm in 2023 to 1.28 billion sqm in 2028, with an average annual growth rate of 2.7%. This marks a sharp recovery from the negative trend of the decade 2014-2023 (CAGR -1.5%). This anticipated expansion will largely be driven by Brazil, the region’s biggest player and the world’s third-largest tile producer. Brazilian tile production is expected to increase by 2.6% annually from 793 million sqm in 2023 to 903 million sqm in 2028.

On the demand side, the South American market is poised for even stronger growth, with tile consumption projected to rise by 4.8% annually, from 1.22 billion

sqm in 2023 to 1.54 billion sqm in 2028, an increase of 321 million sqm over the five-year period. Once again, Brazil will play a pivotal role, with domestic demand expected to reach 896 million sqm (an average annual increase of +5.2%). This optimistic scenario marks a significant shift from the previous decade, when demand stagnated (CAGR of -1.7% from 2014 to 2023). The new growth cycle is driven by favourable macroeconomic conditions, with regional GDP projected to expand by 2.6% annually until 2028. Additionally, the construction sector is expected to benefit from public incentives and funding for infrastructure and innovation, factors that are likely to drive investment at an average annual rate of 2.3% over the five-year period.

Africa: sustained growth in production and consumption

Africa remains the fastest-growing macro-area within the global ceramic industry, driven by a rapidly evolving economy and a significant infrastructure gap compared to developed nations. Following a decade of extraordinary expansion with average annual growth rates of 11% in tile production and 6.3% in consumption, the latest MECS analysis confirms that the continent will continue its upward trajectory, albeit with slightly more moderate growth. For the period 20242028, MECS forecasts an average annual increase of 5.6% in tile production (from 1.18 billion sqm in 2024 to 1.55 billion sqm in 2028). Consumption is expected to grow at an annual rate of 6%, reaching 1.97 billion sqm by 2028, an increase of 500 million sqm compared to 2023, equivalent to 11.1% of global tile consumption. This expansion is being driven not only by general economic growth, with GDP expected to rise by 4.1% annually through 2028, but also by the booming tourism industry and the surge in investments in infrastructure and hospitality. These factors are fuelling a significant acceleration in construction activity (projected by MECS to grow at an average annual rate of 2.5%), in turn driving up demand for ceramic tiles.

As for production, a number of new players including Benin Cameroon Côte d’Ivoire and Mozambique are emerging alongside the existing major producer countries such as Egypt, Algeria, South Africa, Nigeria and Ghana. These will help to strengthen Africa’s ceramic tile manufacturing base, although part of the continent’s demand will continue to be met by imports..

The European construction market is going throug ng period, marked by the persistence of external factors (e.g., the war in Ukraine), the effect of new one (the possible changes in US policy), as well as

internal factors that continue to weigh on financial conditions (high interest rates and energy costs as well as increasing labour costs), that are hindering construction activity and investment plans.

According to the new estimates, the construction activity in the 19 Euroconstruct countries is projected to decline by 2.4% in 2024, while a slight recovery is expected in 2025 with growth of just 0.6%, due to gain

Source / Fonte: Euroconstruct December 2024

After a first decline in 2023, 2024 was the most difficult year for the industry since 2020. However, forecasts point to a positive turnaround from 2025 onwards. This is in brief the picture that

momentum in the following two years. This forecast represents a modest upward revision for 2024 by 0.3 percentage points compared to previous estimates, though the growth in 2025 is slightly weaker than initially anticipated, while the modest growth path for 2026 remains unchanged.

emerges from the survey presented during the 98 th Euroconstruct conference held in Milan in December 2024 and hosted by Cresme.

The primary challenge for the European construction market in 2024 is the significant decline in new residential construction, following the one recorded in 2023. High property prices, still elevat-

ed interest rates (albeit declining) and high construction costs are the main obstacles. However, the sector is anticipated to stabilize in 2025, with growth accelerating in the following years.

The residential renovation market is also in contraction, with a mod-

est decline in 2024 and a further decrease in 2025 year. An improvement in the housing sector is forecast from 2026 onwards, driven by demographic factors, economic conditions and more favourable subsidy schemes for housing renovation.

The non-residential construction sector has faced challenges, with a modest decline experienced in 2023. This downward trend is expected to be confirmed in 2024, due to new non-residential construction projects that are under pressure. Despite these challenges, growth is projected to resume starting from 2025, with both new construction and renovation activities contributing positively to the overall non-residential construction sector. New investments will be particularly bright for the mainly public funded market segments, while incentives and structural policies targeting “green goals” will create consistent push for renovation activities across the sector.

Civil engineering remains a bright spot, driven by the urgent need for upgrades in transport networks and energy infrastructure.

Investments in these areas are crucial to meet new demands and political goals. New civil engineering projects, after a weak 2024, are expected to grow significantly in the next two-year period, against a more stable and moderate development for renovation works, expected to be solid this year, with a gradual slowdown by the end of the forecast period.

2024 was another year of struggles for the U.S. ceramic tile market. Tile consumption decreased for the third straight year largely due to issues in the residential market,

with which the tile industry is closely connected. Feeling the pinch from high mortgage rates, inflation, rising material costs, labor shortages, increasing home prices, and nervous buyers, the housing market continued to decline . Total new home starts fell for the third consecutive year for the first time in fifteen years. The 1.36 million

The National Association of Home Builders (NAHB) projects 2025 total housing starts to fall 2.6% to 1.33 million units, with single-family starts rising 0.2% but multifamily starts declining 10.7% from 2024.

Existing single-family home sales last year were at 3.67 million units. Although this represented a marginal increase vs. 2023 (+0.3%), it was the third lowest annual total since the mid-90s. Additionally, the median sales price of existing single-family homes in 2024 was $412,400, a 4.6% increase from 2023 and a record high. This also was a 50.2% increase from just five years ago, when the median existing single-family sales price was $274,600.

New home sales rose for the second straight year (+2.5% vs. 2023) but have not come close to approaching their level prior to the Great Recession. In fact, new home sales in 2024 (683,000 units) were down 46.8% from the record high of 1.28 million units sold in 2005 (source: U.S. Census Bureau).

Mortgage rates were at an annual average of 6.72% (30-year fixed) in 2024. Other than the slightly higher 2023 rate (6.81%), this was the highest annual mortgage rate since 2001 (source: Freddie Mac).

In some positive news, U.S. foreclosure filings, a key inverse indicator of the housing market’s health, fell 9.8% vs. 2023. The 322,000 foreclosure filings last year represented the third lowest annual total on record (source: ATTOM Data Solutions).

Also on the positive side, overall total U S construction spending (includes private and public residential and non-residential construction) increased for the thirteenth year in a row, reaching an all-time high of $2.15 trillion in 2024, up 6.5% from the preceding year (source: U.S. Census Bureau).

units started in 2024 represented a 3.9% decrease from the previous year. According to U.S. Census Bureau, while the 1.01 million single-family new home starts in 2024 represented

a 6.5% increase vs. 2023, multi-family starts (354,800 units) were down 24.9% over the same timeframe. Single-family starts comprised 74.0% of all new home starts last year.

Source: U.S. Census Bureau

Council of North America, total U.S. ceramic tile consumption in 2024 was 250.9 million sq.m (2.70 billion sq. ft.), down 5.1% from the previous year.

The volume of domestically produced tile decreased by 9.8%, from 83.5 million sq.m in 2023 to 75.3 million sq.m last year. U.S. manufacturers shipped 71.5 million sq.m (769.9 million sq. ft.) of ceramic tile domestically, down 9.1% from the prior year and the lowest annual total since 2013.

By volume, U.S. shipments’ share of total U.S. consumption was 28.5% last year, down from 29.8% in 2023. Even so, domestically produced tiles’ share of total U.S. consumption far outpaced the shares of any individual country exporting to the U.S.

The next highest shares of total consumption by volume were held by India (14.6%), Spain (12.6%), and Italy (11.4%).

By value, U.S. FOB factory sales of domestic shipments in 2024 were $1.37 billion, an 8.4% decrease from the previous year. U.S. shipments comprised 36.2% of total U.S. tile consumption by value, down from 36.9% in 2023.

The per unit value of domestic shipments in 2024 was $19.22/sq.m ($1.79/sq. ft.), up from $19.06/sq.m ($1.77/sq. ft.) the preceding year.

U S ceramic tile exports in 2024 were 3.8 million sq.m (41.1 million sq. ft.), down 19.5% from the previous year. The lion’s share of U.S. exports by volume went to our North American neighbours, Canada (78.1%) and Mexico (9.9%). U.S. exports by value in 2024 were $46.4 million, down 13.0% from 2023.

According to figures by the U.S. Dept. of Commerce, in 2024 U.S. ceramic tile imports were at 179.4 million sq.m (1.93 billion sq. ft.), a 3.5% decline from the previous year.

Although imports from India declined 2.7% from 2023 to 36.6 million sq.m, India was the largest exporter to the U.S. by volume for the second straight year. Indian tile comprised 20.4% of total U.S. imports, up slightly from its 20.3% share the preceding year.

Values in million sq.m. Shipments include exports. Consumption = Shipments - Exports + Imports.

Source: U.S. Dept. of Commerce & Tile Council of North America (TCNA)

Spain remained the second largest exporter to the U.S. last year despite its volume falling 2.6% vs. 2023. Spanish imports held a 17.6% share of 2024 total U.S. imports by volume, up from 17.4% the previous year. Italy passed Mexico to become the third largest exporter to the U.S. by volume with a 16% share of total U.S. imports, up from 15% in 2023. Imports from Italy rose 2.9% by volume vs. the prior year.

Each of the next three largest exporters to the U.S. by volume in 2024 experienced double-digit declines compared to 2023: Mexico (-12.3%), Brazil (-17.7%), and Turkey (-16.9%).

It was a different story, however, for the two largest exporters from Southeast Asia. Vietnam and Malaysia each experienced robust growth in their shipments to the U.S. and reached record high volume totals. Vietnamese imports rose 36.7% vs 2023, and Malaysian imports soared 94.6% from the previous year.

In 2024, the total value of ceramic tile imports decreased by 5.6% to US$ 2.42 billion. On a dollar basis (CIF + duty), Italy remained the largest exporter to the U.S., comprising 29.2% of 2024 U.S. imports (US$ 707 million, -2.1%), followed by Spain with a 24.8% share

Source: U.S. Dept. of Commerce & Tile Council of North America (TCNA)

(US$ 600 million, -9%) and Mexico with an 11.2% share (US$ 271 million, -6.6%).

Table 4 shows the average values of tile (CIF + duty) from the ten largest exporting countries (based on volume) in 2024. These values are significantly affected by the mix of tiles imported, with different types of tiles impacting the average value, in addition to differences in pricing for the same types of tile. Once again in 2024, Italian tiles had the highest average price of $24.69/ sq.m, down 4.8% from $25.94/sq.m in 2023. Spanish average value also decreased from $20.35/ sq.m to $19.03/sq.m (-6.5%).

The average price of Indian tiles decreased for the second straight year, from $6.88/sq.m in 2023 to $6.64 in 2024 (-3.5%), the lowest price among the ten largest exporting countries.

According to figures from Statistics Canada, Canadian ceramic tile consumption last year was 31.8 million sq.m (342.7 million sq. ft.), up 1.8% from 2023.

As there is no significant ceramic tile production in Canada, imports approximately equal consumption.

The five countries from which the most tiles were imported into Canada in 2024 based on volume were: China (8.7 million sq.m, -1.8% in volume; and +1% in value FOB); Italy (7.6 million sq.m, +8%; and +1.6% in value FOB); Spain (4.1 million sq.m, +4.8%; and -2.2% in value FOB); Turkey (3.4 million sq.m, +1.3%; and -10.1% in value FOB); and India (3.1 million sq.m, +5.2%; -5.3% in value FOB).

On the sidelines of the presentation of the 2024 figures for the US ceramic tile industry and market by the Tile Council of

North America, we asked TCNA Executive Director Eric Astrachan and Joseph Lundgren (JLC Consulting), an expert consultant

TILE INTERNATIONAL: Following another decline in production and consumption of ceramic tiles in the United States in 2024, the US market is expected to see a 5% rebound in tile consumption in 2025 in both volume and value. What factors will drive this recovery?

Eric Astrachan: If there is a recovery in housing, the ceramic tile market will follow suit, as the two are closely interconnected. There is pent up demand for housing as many potential homeowners have been sidelined due to high interest rates and other issues making a home purchase unaffordable. While there are forecasts that new and existing home sales will improve, and remodelling is expected to experience modest growth throughout the year, NAHB expects to see another year of decline in new home starts as well as relatively high mortgage rates, which could hamper any potential market bounce back.

on the US ceramic market, for their insights on the outlook for the current year and the main industry trends.

Joe Lundgren: While I expect to see a 5% increase in 2025, I believe it will be concentrated in the second half of the year. The current market volume is the lowest we’ve seen in the United States since 2014, and while there is significant pent-up demand for projects, interest rates continue to be a key factor. We hope to see a gradual rise in new projects and remodelling activity, as a sudden spike could lead to labour shortages, which in turn would cause higher installation costs.

TILE INTERNATIONAL: What are the main strategies that US ceramic tile manufacturers are adopting to overcome challenges and be prepared for recovery?

Eric Astrachan: US manufacturers will continue to innovate and adapt to the needs of the market, providing high-quality, affordable and sustainable products while supporting domestic jobs and their local economies.

Joe Lundgren: As with any slowdown, US manufacturers are using this time to maintain their equipment and ensure it is ready to operate at full capacity once the market rebounds. Some are taking a conservative approach by keeping inventory levels low, while others are investing in quick-turning products to capitalize on market growth once interest rates start to decline. Additionally, manufacturers are reassessing their distribution and sales teams to ensure they are well-positioned for the ramp-up of business.

TILE INTERNATIONAL: In 2024, India remained the largest exporter of tiles to the US, despite the uncertainty surrounding the introduction of anti-dumping duties, while Mexico and Brazil recorded double-digit declines in sales to the US market. What are your expectations regarding the upcoming decision by the US Department of Commerce?

Eric Astrachan: The decision from the US Depart-

ment of Commerce is expected on 16 April. We are confident the US Government will recognize that exporters in India are benefiting from Indian government subsidies and dumping tile in the US market in their efforts to gain market share. This has a disastrous effect on US manufacturing jobs, and when there are product failures consumers often have little recourse against far-off foreign manufacturers. Regarding the decline in imports from Mexico and Brazil, their sales are also impacted by dumped and subsidized tiles from India.

Joe Lundgren: It’s impossible to predict what the Commerce Department’s final decision on anti-dumping and countervailing measures against Indian exporters will be. According to available data, a significant portion of anti-dumping and countervailing duties are increased when finalized, so in many cases the final duty rate is higher than the preliminary rate, though the exact percentage varies de-

pending on the specific case and jurisdiction. What is certain is that the exponential increase in sales in Indian tiles in recent years has impacted both Mexican and Brazilian exports.

TILE INTERNATIONAL: President Trump has announced his intention to impose import duties on a wide range of products from many countries, including the EU and BRICS. What should we expect?

Eric Astrachan: We don’t know yet [February, editor] whether these tariffs will materialize, but they are part of the Trump administration’s broader trade policy aimed at reducing trade deficits, protecting domestic industries and addressing concerns over unfair trade practices. Potential tariffs could of course greatly impact the US ceramic tile industry, of which roughly 70% is imported tile, and many of the largest exporters to the US are EU/BRICS members.

Joe Lundgren: It’s truly anyone’s guess at this point [February, editor]. However, if I were to speculate, I would suggest that the current administration is exploring all possible avenues, beginning with large requests that could result in tariffs or incentives to boost domestic production of specific materials such as aluminum and steel. While one might logically expect many importers to establish factories in the US, it’s worth noting that seven of the twelve existing US tile factories are already owned by foreign companies, primarily Italian. This trend would likely continue with more foreign investment in US manufacturing, but the high cost of building a plant in the United States makes the payback period significantly longer compared to other countries, potentially limiting new developments.

TILE INTERNATIONAL: Sustainability is a key focus for the global flooring industry, and the United States is no exception, as demonstrated by TCNA’s support for the Flooring Sustainability Summit. Do you fear that the new environmental approach may impact the growing sensitivity and efforts of both industry and consumers?

Eric Astrachan: TCNA continually monitors the sustainability landscape to ensure that our initiatives,

along with those of our members, align with evolving specification trends and the latest green building practices. Sustainability drivers are constantly changing due to factors such as policy shifts, standardization, current events, resource priorities and market demands. However, the core goal of supporting both people and the planet remains unchanged. With this in mind, we are confident that our efforts will continue as always to evolve in the right direction, adapting to shifting environmental priorities.

Joe Lundgren: Ceramic Tile is certainly one of the most sustainable products in the flooring industry and will only continue to improve as the industry sets and achieves new sustainability targets while carefully calculating their cost impacts and benefits.

Folding frame: compact size for easy movement

Bag/trolley for handling and

• Self-priming battery-powered electronic suction cups

Merola Tile has grown from a small local distributor into a national leader in tile distribution. With deep Italian-American roots

and a commitment to excellence in design, the company based in Manalapan, NJ, stands out for its ability to anticipate trends while

offering unique products that blend quality and timeless style. Merola Tile’s claim, “Improving Homes. Improving Lives.”, reflects

Tile International: Mr. Merola, your company has a rich history and a well-defined mission. Can you share with us its origins and how its mission has evolved over the years?

My brother Kevin started the company in 1988, and I joined him in 1989 in Brooklyn, NY. At the beginning, it was just the two of us. We were a small New York distributor, offering adhesives, tools, and ceramic tile. Over the next 12 years, we grew by focusing on quick delivery and excellent customer service. I fell in love with tile and the industry. In 1999, we won an opportunity to develop a special-order tile program with a major national big box retailer. I drew upon my personal tastes, creativity, and passions to create a unique mix of high-quality, emotionally inspiring products that would forge our reputation as one that challenges the trends of the day to build a truly one-of-a-kind program. We don’t follow trends, we set our own. It’s about what’s right for our customers, not what’s trendy.

Tile International: In which countries or regions do you primarily operate, and what about the products you offer?

Starting as a regional distributor in the Northeast, we’ve expanded over time to a national presence across the

its dedication to creating inspiring and welcoming spaces for its customers.

We talked with John Merola, co-owner and CEO of Merola Tile Distributors of

America, which shares the company’s journey, its distinctive approach to design, and the strategies that have shaped its success over the decades.

U.S. and Canada. It’s been an exciting journey. We recently acquired Pan American Ceramics in California, thus allowing us speedy delivery to the west coast of the USA.

We’ve always been strong advocates for Spanish-made tiles. We also have a full offering of products from Japan, Portugal, Thailand, Turkey, Peru and more. The last two years have seen us expanding our range of Made-in-Italy products. We’re now offering large-format tiles with mixed glazing effects and decorative designs, all while staying true to Merola’s unique style. Many of our Italian products are gaining traction, and we’re excited to expand these relationships and find even more Italian partners.

Tile International: Rather than following market trends, Merola Tile has been shaping its own distinct style for decades. How do you approach product development to ensure your collections remain both unique and relevant over time? And how do you balance timeless aesthetics with the evolving needs of your customers?

We create product lines and collections that inspire. Our largest clients are major importers and distributors. They already have access to a vast product se-

lection and have many items that satisfy 80% of their customers’ needs. It’s our job to help them capture the other 20%. Our product mix is truly unique, sometimes strange and some have even called our choices “Brave”. It’s that distinct Merola look. Interestingly, many of our products naturally gain popularity over time. In 1999, we were among the first to introduce wood-plank ceramic tiles. Even earlier, in 1995, we offered an extensive selection of patterned and encaustic-look tiles-long before the industry caught on nearly two decades later.

Chiara Bruzzichelli

c.bruzzichelli@tiledizioni.it

We’ve always carried todays popular styles like black tiles, bold colors, hexagons, terracotta’s, mosaics, and outdoor/pool tiles-these are not new for us but they are on trend. We’ve been offering these tiles for 25 years or more. When something becomes trendy, you’ll see others jump on the bandwagon. But when the trend fades, we’ll still be here, offering the timeless styles that matter. We prefer to attract customers who appreciate our distinct approach rather than chasing mass-market trends. We want to empower our customers to create spaces that they can live-in. We know there is an investment that goes along with this, and they should know that when they buy Merola Tile this look will last.

Tile International: Your customer-first approach seems a cornerstone of your business. How do you support your partners and customers?

My first job was working in my father’s butcher shop in Brooklyn, NY, back in the 1970s. At seven-year-old, I watched my Dad. He knew every customer by name, whether they were a client or supplier, and made sure everyone felt welcome. Whatever they needed, whether related to the shop or not, he was always there to help. We take that same approach at Merola Tile. We take pride in being approachable and accessible. Our door is always open to assist with challenges, answer questions, and support your projects-whether by providing solutions, connecting you with the right people, or simply offering the knowledge you need to make informed decisions. We’re not just here to sell tiles; we’re here to build lasting relationships and guide you toward success.

Tile International: Given the increasing popularity of DIY home improvement projects, how does Merola Tile hold up homeowners in selecting and installing the right tiles for their spaces?

A big part of our market is the residential remodel sector, which is where a lot of DIY enthusiasts turn to us. We’re also seeing growth in the commercial and A&D markets. Helping homeowners find the right tile is our top priority. We ask key questions like: Is it for a wall or floor? Does it need to be slip-resistant or outdoor-rated? Does it need to resist chemicals or have anti-microbial properties? And, of course, does it fit the look they’re going for? We help the consumer by giving them the answers to the questions they are asking. We offer one of the most comprehensive tile databases(selections) in the U.S. market, so we can provide an-

swers to almost any question about our products. We also offer fantastic visual content and room-visualizing tools to help customers create the spaces of their dreams. Educating is key for us.

Tile International: How do you see the American real estate and interior finishes market evolving in the near future? Are there any significant challenges or opportunities that you foresee?

Over the past decade, plastic flooring, particularly SPC (stone-plastic composite), has gained a lot of attention. But now those floors are a few years old and they didn’t age well. People are realizing SPC doesn’t have the staying power and durability that ceramic and porcelain tiles do. For longevity and quality, ceramic & porcelain tile is always the best choice.

We’re also in the midst of a technological revolution in tile production. The innovations happening in glazes, slip resistance, color depth, textures, and reactive effects are incredible. Ceramic tile technology is truly at a golden age right now. The biggest challenge in our industry, however, is finding qualified installers who know how to work with these advanced materials and installation techniques. That’s why we support organizations that are educating and training the next generation of installers.

Tile International: Moreover, what are the most significant challenges facing the ceramic and tile distribution industry in the coming years? How is Merola Tile preparing to address them?

The ceramic tile industry has experienced a substantial influx of private equity over the past decade, presenting unique challenges for family-owned businesses like ours. Unlike private equity firms, which of-

ten prioritize acquiring market share over earning it, we remain committed to organic growth. This shift in the market landscape exerts pressure on margins, compelling us to stay agile, innovative, and deeply connected to our core values.

Our trade and dealer partners are integral to our success, and our strategy is straightforward: maintain profitability, stay focused, and consistently operate with honesty and integrity. By adhering to these principles, we position ourselves not only to compete but to endure and thrive in an evolving marketplace. While we might lose a few battles in the short term, we’re committed to winning the long-term marathon. We have a

deep commitment to the ceramic tile industry, and to our customers, we’re in it for the long haul.

Tile International: Your products are available through various retailers, including Amazon. What is your experience regarding digital channels?

We live in an increasingly digital world, where more purchasing decisions are made online than ever before. While this shift offers convenience and speed, we believe that people still crave authentic, human connections-it’s part of who we are.

When it comes to something as personal and enduring as ceramic tile, customers seek more than a

transaction.

They want expert guidance, genuine interactions, and the confidence that comes from making informed decisions.

This is why our most significant investment in the coming years will be in our dealer partners-local tile, flooring, and home design stores across the continent. Digital platforms are invaluable for expanding our reach, but they can never replicate the trust, expertise, and personalized service that define a truly meaningful tile-buying experience. By collaborating closely with our dealers and master distributors, we ensure that customers receive not only high-quality products but also the support and insight that elevate their experience.

Our goal is to share the Merola Tile experience and welcome customers into our family-just like stepping into my father’s butcher shop back in 1975, where every interaction was built on trust, care, and a sense of belonging.

Tile International: Considering your extensive experience in the American market, what advice would you give to international ceramic producers looking to collaborate with U.S. distributors and adapt their offerings to local consumer and design trends?

At Merola Tile, we look for three key things when partnering with any factory:

1. The Right Product – It’s essential that the product fits the needs of our customers. We know what the Merola look is, and we want to see products that align with our style.

2. The Right Price – The right price means that everyone in the supply chain-Merola, our dealers, and the consumer-can make a fair profit while maintaining competitiveness.

3. Business with Honor – Transparency and honesty are critical to building trust. Without trust, there’s no real partnership. We expect clear, open communication with our factory partners and everyone in the supply chain. ✕

Product designed and manufactured in Spain with international recognition.

A fusion of time-honored craftsmanship and cutting-edge innovation, setting the stage for what’s next in ceramic tile and reaffirming its role at the forefront

of design and installation. This is the basis of the annual global tile trends report by Coverings, the North America’s largest global showcase of ceramic tile and natural stone.

The world is known for rich colors and calming hues of sand on and near beaches, dunes, deserts, ocean floors and other sites and places. With a warm and often calming palette, the colors of sand are earnest and neutral, portraying the essence of a natural, earthy and eco-friendly environment. So too does ceramic tile in the colors of sand give rise to peaceful, relaxing and eye-catching atmospheres. Sand-inspired tile colors stem from the color wheel’s warmer and lighter side of the brown spectrum, extending from off-white and cream to golden beige, tawny, fulvous and tan. The design and installation options with tile in a range of colors inspired by sand are limitless, as evidenced by nearly infinite product selections seen in widely popular indoor and outdoor applications around the globe.

The 2025 lineup of groundbreaking tile trends, chosen by Coverings’ three leading sponsors and international tile associations –Ceramics of Italy/Confindustria

Ceramica, Ceramic Tile Manufacturers Association of Spain (ASCER)/Tile of Spain and Tile Council of North America (TCNA) –showcases the most sought-after and

stylish designs from the worldwide tile industry.

Coverings spokesperson Alena Capra, owner of Alena Capra Designs and Certified Master Kitchen and

As AI and smart home technology advance, the domestic automation sector is also rapidly growing, with a focus on enhancing quality of life and energy efficiency. Ceramic tile is essential in this evolution, thanks to its non-conductive properties that protect electrical systems while maintaining connectivity. Modern tiles now incorporate features like pressure-sensitive LED lighting and induction cooking, making it easier to blend cutting-edge technology with elegant design.

Bath Designer, collaborated with the associations to forecast the trends which are expected to dominate tile design and installation decisions throughout the year and beyond.

As the integration of technology in residential settings continues to rise, there is a growing desire to incorporate natural elements into built environments. Reflecting on the urgent impacts of climate change on the environment, our connection to nature has become a central focus in architectural and interior design. Ceramics, with their inherent properties and moisture resistance, create an ideal environment for houseplants to thrive without the risk of deterioration. Additionally, advancements in digital technology enable the realistic recreation of organic details, ensuring that both the cladding and greenery in a space provide a rich biophilic experience.

Color drenching takes a bold turn with the use of gauged porcelain panels. Enveloping entire spaces in the rich tones and textures seen in marble, onyx or travertine creates a seamless and dramatic effect. From floors and walls to countertops and even furniture, the natural beauty and texture of marble-look tile – be it a bold black, grounding green or luminous white – become the dominant visual elements, transforming the space into an immersive work of art, as luxurious as it is grounding.

This season, it’s all about lines. Thanks to impressive innovations in 3D technologies, these decorative details – whether it be striped, ribbed or fluted looks – create dynamic volumes and plays of light and shadow with contrasting materials and colors, adding depth and character into a space, while geometric patterns and bold stripes bring moments of movement and intrigue.

From café entrances to cathedral ceilings, mosaic tiles have long combined beauty and functionality, allowing designers to create personalized patterns and artistic statements. Today, mosaics are having a big (or rather, large format) resurgence. Porcelain panels with stone looks artfully cut together, either in geometric layouts or flowing organic designs, merge traditional mosaic artistry with modern durability and low maintenance. Whether handcrafted or large format, mosaic styles continue to transform surfaces large and small into captivating focal points.

Interior designers are going beyond the visual spectrum to curate spaces that engage all five senses. Thanks to advancements in digital decorative technology, ceramic manufacturers are now able to perfectly replicate natural textures and patterns, creating tiles with enhanced tactile and visual experiences. Furthermore, many designers are paying closer attention to the sense of smell. As ceramic tiles are naturally free of VOCs, they do not retain odors; rather, they assist with establishing an aromatically pleasing and clean environment.

In an age dominated by AI and algorithms, there is a revived longing for the tactile, human experience. As such, tile surfaces are increasingly drawing inspiration from materials like corrugated paper, torn fabric, textile design and handcrafted wooden textures, while showcasing delicate floral engravings and three-dimensional extruded volumes, working to powerfully bridge the gap between hightech and hand-made artistry.