Your brand can reach up to 250,000+ trade customers across 6 national publications. Download the 2025 group drinks deck.

Your brand can reach up to 250,000+ trade customers across 6 national publications. Download the 2025 group drinks deck.

Welcome to the December-January issue of National Liquor News – our final edition for 2025 and the one that leads us into another busy summer of trading. It’s been an exceptionally energetic year for Australia’s liquor retail industry, and this issue brings together the talent, innovation and momentum that continue to shape the sector.

We bring you full coverage of the 30th annual Australian Liquor Industry Awards (ALIA) – a milestone year that transformed Sydney’s Fullerton Hotel into a celebration of 90s pop culture and recognised the outstanding people, brands and businesses that define our industry. From rising retail talent like Georgia Monaghan, to Best Retail Group winners Camperdown Cellars, Best Retail Store winners Oldfield Cellars, category standouts across beer, wine and spirits, and the many suppliers and distributors honoured on the night, the ALIAs once again showcased the strength, diversity and resilience of the trade.

We also recap the Retail Drinks Industry Summit & Awards, where more than 350 members of the trade came together to share key insights, explore the regulatory landscape, and celebrate the retailers and suppliers whose year-round

contribution strengthens the entire sector.

This issue also features our annual Prosecco Buyer’s Guide – an in-depth look at one of the strongest growth engines in sparkling wine. With Australian Prosecco continuing to lead the category and shopper demand evolving across styles, formats and price tiers, our panel’s insights offer valuable guidance heading into peak summer trading.

And on the cover, we explore how Gage Roads is setting up for its biggest summer yet, powered by a national ‘Made for Yewww!’ ATL campaign, new partnerships and a major consumer promotion.

As we wrap up 2025, I want to extend a heartfelt thank you to all of our contributors, and to every retailer whose stories, insights and generosity have helped shape the pages of National Liquor News this year.

Wishing you all a successful Christmas and New Year – and a well-earned break when it arrives.

Cheers, Deb

Deb Jackson, Managing Editor 02 8586 6156 djackson@intermedia.com.au

Tel: 02 9660 2113 Fax: 02 9660 4419

Publisher: Paul Wootton pwootton@intermedia.com.au

Managing Editor: Deb Jackson djackson@intermedia.com.au

Senior Journalist: Molly Nicholas mnicholas@intermedia.com.au

Journalist: Sienna Martyn smartyn@intermedia.com.au

General Manager Sales –Liquor & Hospitality Group: Shane T. Williams stwilliams@intermedia.com.au

Group Art Director –Liquor and Hospitality: Kea Webb-Smith kea@intermedia.com.au

Prepress: Tony Willson tony@intermedia.com.au

Production Manager: Jacqui Cooper jacqui@intermedia.com.au

Subscription Rates

1yr (11 issues) for $70.00 (inc GST) 2yrs (22 issues)for

(33

– Saving 30% To subscribe and to view other overseas rates visit www.intermedia.com.au or Call: 1800 651 422 (Mon – Fri 8:30-5pm AEST) Email: subscriptions@intermedia.com.au FOOD & BEVERAGE

for $147.00 (inc

Gage Roads ramps up summer with major ATL investment, new partnerships and a huge Bali getaway promotion.

On the back of 11 per cent growth* across Australia, Gage Roads is set to go large this summer with its ‘Made for Yewww’ campaign and all new partnership with The Mad Hueys, plus this summer three lucky consumers and their mates will win their way to the Gage Roads Bali Beach House.

Gage Roads is increasing its investment in above-the-line (ATL), rolling out its biggest media spend nationally, running from September through March. The ‘Made for Yewww!’ campaign celebrates the energy and excitement of Australia’s coastal lifestyle, capturing the spirit of adventure that defines the brand.

“We’re going bigger this year to drive awareness and excitement for Gage Roads across the country, focusing on getting our products to more Aussies with high cut-through placements over longer duration,” says Mick McKeown, GM of Sales and Marketing at Good Drinks Australia.

The ATL campaign focuses on an unmissable out-of-home buy, ensuring high visibility in key markets of Western Australia and Queensland, plus a comprehensive digital campaign driving awareness nationally across WA, QLD, NSW and VIC. Retailers can expect more foot traffic as the campaign builds excitement and drives sales during the summer months.

Gage Roads beers are brewed to suit different tastes, and they continue to grow well (+11.3 per cent) ahead of the declining beer category with their approachable profile and positioning representing a solid trade up opportunity for retailers to get behind with confidence this summer.

Single Fin Summer Ale is the number one independent craft beer in Australia, outperforming category growth (+13 per cent) as the number three contributor to national total craft beer growth.

“The Gage Roads range is versatile, offering something for

everyone, and we’re excited to have our newest brew Huey Coastal Lager in the mix for summer to bring more people into the brand with an easy-drinking premium mid,” McKeown adds.

The recent release of Huey Coastal Lager, in partnership with Gold Coast-based lifestyle brand The Mad Hueys, is designed to appeal to new drinkers and support value growth through trade-up in the contemporary beer segment.

This summer, Gage Roads is running a major on-pack promotion with more chances to win, including one of three trips to the Gage Roads Bali Beach House for a winning consumer and three mates. and three mates. Plus, with every purchase, the chance to win a share of over $320,000 worth of $20, $50 and $100 Dometic vouchers, perfect for all your summer camping needs.

Retailers will benefit from a full marketing push, including POS kits, social media amplification, ATL comms and event support.

“This promotion rewards loyal customers but also attracts new drinkers,” says McKeown. “Who wouldn’t want to escape Aussie winter and continue the fun in Bali next year. Last year’s highly successful on-pack promotion delivered an uplift of 15 per cent sales growth, we anticipate retailers will see the same again this year.”

With significant investment in both ATL and below-the-line (BTL) activities, now is the time for retailers to stock up on Gage Roads products. The combination of strong consumer demand, compelling promotions and a broad range of beers makes Gage Roads a muststock brand this summer.

To learn more or stock the Gage Roads portfolio in-store, visit www.gageroads.com.au or follow the brand on Instagram @gageroadsbrewco to stay up-to-date. ■

*Source: Circana MarketEdge Australia Liquor Weighted, MAT To 05/10/25

https://theshout.com.au/national-liquor-news/subscribe

With nearly 30 years in liquor retail, meet the man behind two award-winning stores, devoted to championing community and industry-shaping advocacy.

Retail unfiltered dives behind the counter to uncover the real people of Australia’s liquor retail industry. This issue we get to know John Wilson, the owner of two Liquor Legends stores in Canberra (Hawker and Charnwood).

His career began at 18 with Liquorland where he worked for nine years, progressing through a variety of management roles, in Canberra and Sydney stores.

“I had no intention of making this my career. I was going to be a carpenter and at the time I was working under cars. There was a sign at the local Liquorland saying ‘casuals needed’. I quickly went up and got the job. Now here we are,” he told National Liquor News

In the early 2000s Wilson moved to Brisbane where he began working with

Liquor Legends Founder John Carmody, before eventually moving home to Canberra to open his own store with wife, Shannon.

Creating a store that stands out

Wilson explained that what has given his stores longevity has been a combination of his legendary banner group and its ability to stand out from the crowd in more ways than one.

“In the beginning it was Liquor Legends that set us apart. When I moved back to Canberra, the banner was largely unheard of outside of Queensland and northern New South Wales. I had been given free reign, so we strived to create something different to the other bottle shops around. But now, I think it all comes down to the incredible staff, competitive pricing and our range.”

He emphasised that the team and their commitment to upholding values around quality, service and community have been instrumental in the stores’ ongoing success.

“They’re the face of it. In the early days I was there every single day so I could build those relationships. But when you’re not there the staff are everything. Customers want to know the people behind the business, so the staff need to be able to pass that on, and they are.”

He added: “I get more good customer comments about my staff than I do complaints. I think that’s pretty rare because generally, people don’t make the effort to say positive things.”

Motivated by innovation, Wilson recently invested in an immersive premium spirit space in his Hawker store, which he said

elevates the customer experience with more people now reaching for high-quality spirits.

“We’ve got seating for 14 people and a collection on display, some of which I have been collecting for the past 20 years that can now be sold. We do masterclasses and tastings too. Our customers are starting to get to know the range more and it’s great to see things like Tequila, Mezcal, smallbatch whisky and Bourbon going home with them.”

Beyond his work behind the counter, Wilson once served as a board member for the former Liquor Stores Association and was one of the founding members for Retail Drinks Australia in 2018, where he remains a board member.

Wilson’s passion for community engagement, policy and advocacy echoed through his words as he explained what motivates him is a genuine love for the industry and collaboration.

“I love it. I do this to give back to the industry that’s helped me a hell of a lot. It’s also about having representation in Canberra. We are our own little jurisdiction with a lot of liquor licenses. It’s important to know what’s coming up and what other jurisdictions are doing.

“Collaboration has been so important to seeing change. Retail Drinks has kept us going, and their advocacy is phenomenal. A lot goes under the radar. Most people have no idea that it even happens, they just show up and go to work. But what is being done is incredible. They’re collaborating with every state’s government, so it’s a big job they’ve got.”

His advocacy also goes beyond the liquor retail landscape. Since 2020, Wilson has participated in the annual Bravehearts 777 Marathon challenge. Each year he has run a marathon a day over seven days and states (a total of 295km) and so far, raised close to $150,000.

The event raises money for work in the prevention and treatment of child sexual abuse – a cause close to Wilson’s heart and family.

“It’s what got me into it and kept me going. There’s a need to have these conversations. I’d love to say that money was going to make it go away but we’ve got a long way to go.

“Me getting up and running every day when I don’t want to is a lot easier than what some people go through, to get up every day when they don’t want to because of what they’ve experienced.”

He added: “It’s amazing to see people continue to show up. The Liquor Legends, John Carmody, the industry, my customers; they have all been the most amazing supports.”

Wilson will run for the seventh year in 2026 and hopes to have raised a total close to $180,000. ■

“Customers want to know the people behind the business, so the staff need to be able to pass that on.”

John Wilson

In under a year, the independently owned store has created a liquor retail experience that larger chains simply cannot replicate.

Bunnerong Wine Shop & Deli only opened its doors a year ago, but already it’s making waves in Sydney’s liquor retail landscape. The independent bottle shop and deli champions small producers, with a selection of craft beers rotating monthly, and carefully selected wines and spirits.

The mission behind the store is simple – to bring a new and unique liquor retail experience to Matraville, a suburb that Bunnerong Wine Shop & Deli Owner Jeff Beresford describes as “crying out for more nice things to open”. But it’s more than just a place to shop – it’s a space for discovery, where every bottle has a story and every visit promises something new.

“The concept focuses around the independent wine scene, with the majority of our wines not in the major retailers,” Beresford tells National Liquor News

“Our spirit and beer selection is centred around the smaller indie brands and craft producers too, with our deli section offering what we feel is the best of the best that Australia and beyond can produce, that still fits in with the ‘good value’ vibe of the shop.”

Beresford brings years of experience to the store from wineries, vineyards, hospitality and wine retail, which is reflected in the way he curates the store’s shelves. Each product reflects a commitment to supporting small and lesser-known producers, inviting customers to explore beyond the familiar.

Beresford takes a no-frills approach to deciding which products earn a place on the shelves, and there’s no doubt that he has successfully filled a gap in the local drinks scene by doing so.

“We try everything before we get it in. If we don’t like it or we don’t think it provides

good value, it doesn’t earn a place on the shelf,” he explains.

As a store with a preference for smaller producers, an important consideration for Beresford is how he helps his customers navigate the shelves and discover something new or unexpected.

“We do tastings most weekends and we train our staff in WSET as soon as they start,” says Beresford, who is a certified WSET educator himself. “This allows them to be way more comfortable in recommending wines if a customer is struggling at all or wants a recommendation.”

Free in-store tastings play an important role in education, but within this space, the store also hosts ticketed events, such as the recent masterclass in Australian, New

Zealand and Scottish whisky, hosted by The Whisky List brand rep Jimmy Shore. Earlier this year the store also welcomed ex-Mendoza winemaker Tom Egan to the table for a rare masterclass on all things Argentinian wine – taking customers on a curated journey through the country’s top red wines and iconic regions like Salta, Patagonia and Mendoza.

Just as his customers are eager to learn, Beresford himself has also learned some lessons of his own in his first year of trading. One of those, despite being a craft-focused store, is to not overlook the growth potential of RTDs.

“This is a huge category worldwide and something we have focused on in the last six months,” he stated.

It’s a reminder that even niche retailers need to stay attuned to broader market trends, but at the same time, Beresford still focuses most of his efforts on working with smaller, craft producers, and carving out a space that larger chains can’t replicate.

“The biggest opportunity in the indie retail scene is the rise of the producers that do not want to be in the major retailers. They outnumber the big mainstream producers massively and they allow you to charge accordingly for their wares as opposed to trying to compete on price.

“New South Wales wines are a huge part of our sales too, as well as organics. Indie retailers should definitely give a solid focus on these categories,” Beresford added. ■

“We try everything before we get it in. If we don’t like it or we don’t think it provides good value, it doesn’t earn a place on the shelf.”

Jeff Beresford

In less than a year, Bunnerong Wine Shop & Deli has already built a loyal following, proving that thoughtful curation and community-focused retail can make an independent store stand out in a crowded market.

“Matraville has an awesome community spirit, and the locals have been amazing since we opened,” Beresford stated. “Our proudest moment [in our first year] has just been the response to us being here from the local community. The amount of ‘thank you for opening’ comments we have received has been overwhelming.”

As a way of giving back, the store offers a free membership to customers – a points-based system that offers money off purchases and exclusive offers on new or rare products. Members also receive free farm eggs or sourdough bread when spending $70 or more, case price on three bottles of wine or more, and exclusive invites to premium wine and spirits tastings.

“We offer the best free membership in the industry, and the locals love it. We truly believe you have to give back and provide value to all demographics in this age, so our local customers have been very happy indeed,” Beresford added.

Australia’s leading liquor retailers, suppliers and distributors were recognised at The Fullerton Hotel as the ALIAs celebrated 30 years of excellence.

The Australian Liquor Industry Awards (ALIA) have once again showcased the very best in Australia’s retail liquor industry at an event held at The Fullerton Hotel in Sydney.

Now in its 30th year, ALIA brings together the who’s who of Australia’s on- and off-premise liquor trade, celebrating the people, brands and venues that continue to shape and elevate the industry.

The milestone event saw the ballroom transformed into a celebration of 90s pop culture, with Spice Girls, the Backstreet Boys, and a whole lot of double denim setting the stage for an unforgettable night of dancing, laughter and industry celebration.

Hosted by National Liquor News, The Shout, Australian Hotelier, Beer & Brewer and Bars and Cocktails, the ALIAs remain the most anticipated celebration on the industry calendar.

Among the many highlights, Georgia Monaghan from Wilberforce Cellars was named Best Liquor Retail Manager, taking out the title for her energy and modern approach to leadership.

“It’s insane to win, I didn’t even expect to be nominated,” she told National Liquor News on the night. “I think it comes down to having a new look on the industry, from a younger perspective.”

Camperdown Cellars took home the Best Retail Group award, recognised for its consistency, independence, and commitment to customer relationships.

Accepting the award on the evening was Jesse Ball, Operations Assistant at Camperdown Cellars, who said: “This is overwhelming. It means a lot –we’re independent and with that there are a lot of challenges, but we just do the best that we can always. We have a really good team, and we all work on building good relationships and maintaining them with our customers.”

In the Best Retail Store category, the trophy went to Oldfield Cellars, applauded for its innovative approach and community connection.

“It’s very exciting,” said Garth Oldfield. “Our team works so hard and our key to success has really been difference. As a small country bottle shop, we’re competing with the big players, but if you think outside the box, you get there.”

The trade’s best suppliers and distributors were also honoured, with Australian Liquor Marketers (ALM) awarded Best Off-Premise Distributor or Wholesaler.

Georgia Monaghan says winning Best Liquor Retail Manager at just 23 feels “surreal,” describing the recognition as a powerful reminder that “dedication, long hours, and a genuine passion for what I do truly pay off”.

Among the night’s youngest award recipients, Monaghan says her approach to retailing centres on genuine connection.

“I focus on understanding what customers enjoy, providing thoughtful recommendations, and creating a welcoming, enjoyable store environment,” she told National Liquor News

She believes celebrating the next generation of retailers is vital, noting they bring “new energy, new ideas, and a fresh understanding of how people shop today”.

Family support has been central to her journey, acknowledging the role her aunt and father have played in her career.

“The person who has inspired me the most in my career is my Auntie Belinda,” she said, praising the role her aunt played in shaping her confidence and leadership. She also credits her father, who taught her “the importance of customer connection, and always leading by example”.

Looking ahead, Monaghan said Wilberforce Cellars will continue elevating its customer experience through merchandising improvements, staff development and a focus on innovation.

She closed with gratitude to the ALIAs , saying: “It’s an honour to be acknowledged… and I’m truly grateful for the support.”

Lion’s eight wins at the 2025 Australian Liquor Industry Awards (ALIA) have reaffirmed the supplier’s strong connection with both retailers and consumers, says Executive General Manager – Sales, Kerry Appathurai.

Among the honours were two of the night’s most significant titles – Best Off-Premise Supplier and Best Liquor Brand for Guinness.

“We’re so proud to have taken home such a wide range of awards for our business, recognising Lion as a supplier, as well as our own and partner brands,” she said.

Appathurai credits the success to long-term consistency, saying: “Everyone at Lion has been putting in an incredible amount of effort… and we all share a commitment to keep raising the bar.”

She said the ALIAs remain a vital occasion for the industry to come together and celebrate excellence.

“It’s an opportunity for us to recognise our peers and challenge each other to keep going the extra mile.

“Our ambition is to be world class… to be more than a trusted supplier, but a true strategic partner.”

She closed with a message to the trade: “A big cheers to all our industry partners for their trust, support and partnership.”

“There are a lot of people in this business, so we are very proud to have achieved this,” said ALM’s Travis Hall on the night. “We set ourselves apart by trying to connect with our customers, trying to understand what’s important to them, and we’ve strived to deliver on that promise.”

Lion was named Best Off-Premise Supplier, with Rosie Fay, Brand Manager for Hahn, accepting on behalf of the team.

She said: “This is incredible. Lion has put in a lot of hard work this year. To be recognised in the industry is a massive deal and we are so grateful for the support from all our venues and all our reps – we do this for you.”

Meanwhile, Hard Rated Lemon Lime, from Asahi, took out Best New Product, capping off what has been an exceptional few years for the brand.

“Winning this award is an absolute honour,” said Nick Sargeant, On-Premise Sales Manager. “Hard Rated has been on a bit of a rocket ship over the last couple of years, and it wouldn’t be there without the support of our customers, partners and consumers. Its success has been driven by flavour – citrus is in big time and people are loving it.”

Oldfield Cellars was crowned Best Retail Store at the Australian Liquor Industry Awards, a win that Owner Garth Oldfield says still doesn’t feel quite real.

“One minute you’re sitting at ALIAs thinking, ‘This is a pretty big night,’ and the next they’re calling out Oldfield Cellars as Best Retail Store in Australia. Not bad for a small independent shop in Gosford,” he says.

Oldfield says the win comes down to a clear philosophy and a fiercely independent approach.

“Every bottle earns its spot, and the team brings a great level of service… For a small store, we punch well above our weight… We’ve always thought outside the square. Inside has never been our thing.”

That mindset flows into how he runs the shop day-to-day.

“I run the shop the same way I’d want to shop. Real conversations, honest advice, and no pushing whatever’s on promo… We treat the store like a place to explore, not a warehouse with bright lights and pallets.”

Looking ahead, he’s focused on more tastings, more unique bottles, and developing what he hopes will become “maybe the best in the country” for online retail.

Above all, Oldfield is grateful, saying: “This award belongs to everyone… We appreciate it more than we can say, and we’re excited for what comes next.”

Although unable to attend on the night, Nicks Wine Merchants was named Best Online Liquor Retailer, recognised for its pioneering role in the e-commerce liquor space.

Managing Director Alex Chlebnikowski told National Liquor News the win was a proud moment for the longrunning family business.

“Receiving this award is a fantastic result for the four generations of our family and all of the staff that have worked at Nicks Wine Merchants over the last 50 years, including over 30 years online,” he said.

He credited Nicks’ success to its global product sourcing and dedication to quality.

A huge congratulations to all of the nominees and winners of the 2025 ALIAs. And thank you to all of our sponsors and all those who attended and helped us celebrate ALIAs 30th anniversary in style. ■

Camperdown Cellars has been named Best Retail Group at this year’s Australian Liquor Industry Awards, a recognition Managing Director Rip Viropoulos describes as a powerful endorsement of the group’s philosophy and point of difference.

“Winning the award is a significant affirmation of our commitment to independence and our unique market position,” he says. “It demonstrates that by offering a distinctive point of difference and curating a diverse range of products that are often unavailable elsewhere, we can be leaders in our industry.”

He adds that the win is also “a testament to our teamwork and our daily dedication to what we refer to as doing things the ‘Camperdown Way’”.

Viropoulos puts the achievement down to a clear and consistent focus on the customer.

“In today’s competitive retail landscape, we have always remained truly customer driven,” he says. “This customer-centric philosophy is not just a tagline; it is the foundation of our operational strategy.”

Each of Camperdown Cellars’ eight locations, he notes, has a range curated by the store team to meet the unique tastes and needs of its community.

“No two stores in our group are identical; each one carries a selection of products tailored to the specific demographics and desires of its clientele,” he says.

Even through economic challenges, Camperdown Cellars continued investing in stores with compelling offers and engaging, colourful and textured displays.

“The more clutter, the better we say,” says Viropoulos.

Thank you to all of the sponsors that made the 2025 Australian Liquor Industry Award a night to remember.

HOSTED BY

NETWORKING BARS BY

AFTER PARTY SPONSOR OFFICIAL MIXER OFFICIAL AUDITOR

AWARD & DRINK SPONSORS

More than 350 members and industry colleagues came together to share the latest trends, information and ideas, and celebrate the yearround efforts of the industry.

Retail Drinks Australia held its annual Industry Summit and Awards on 11 November, which saw more than 350 liquor retailers, banner groups, wholesalers and suppliers meet at Sydney’s Doltone House Hyde Park to share an overview of the market and celebrate outstanding achievements across Australia’s retail liquor sector.

Retail Drinks Australia CEO Michael Waters opened the Summit providing an overview of the federal, state and territory regulatory landscape currently impacting liquor retail, emphasising the importance of a united and informed industry response.

“There’s a clear government agenda that is to some extent allowing emotion to cloud rational, collaborative decision making, and our efforts are being hindered by a broader industry that’s not completely aligned on this issue. Nevertheless, we will keep fighting to enhance your freedom to retail responsibly for your social license to operate, and the overwhelming majority of Australians that are increasingly making more informed and sensible choices about their drinking behaviour,” he said.

Waters also outlined Retail Drinks’ recent and planned policy and advocacy activities in each state, and achievements from the past year that have helped to nurture a stable political, social and commercial environment in which liquor retail can continue to grow.

The achievements included abolishing minimum unit pricing in the Northern Territory, recognition of interstate digital driver licences as valid ID in New South Wales, Queensland and Western Australia, stronger laws for criminals and protections for retail workers across the country, and the ongoing success of the Safe to Serve toolkit.

A key Summit session featured Rob Sherwin, Director of Policy for International Alliance for Responsible Drinking (IARD), who provided an in-depth analysis of the United Nations’ global alcohol monitoring and harm-reduction targets. He also explored the IARD Roadmap to 2030 – a strategic plan to combat harmful drinking through research, policy and collaboration.

Building on Sherwin’s insights, a panel discussion explored how global policy is shaping Australia’s retail landscape. Facilitated by Retail Drinks Australia’s Head of Policy & Advocacy, Kary Petersen, panellists – including Gavin Saunders (Liquor Marketing Group), Dan Hamilton (Diageo), Jodi Dixon (Coles) and Sherwin – discussed global consumption trends, new regulations, rising taxes, compliance challenges and the need for evidence-based approaches.

Circana’s Director of Health & Lifestyle Jarna McLean and MST Marquee’s Senior Consumer Analyst Craig Woolford each delivered a keynote address at the Summit, providing an overview of market momentum, industry headwinds, and the outlook for liquor retail channels.

McLean highlighted a rebound in consumer confidence, and a rebound in willingness to spend on premium products, indicating positive momentum for Christmas trading.

While some consumers choose to cut back their alcohol intake, Circana’s data demonstrates that through a category lens more segments are recording annual growth than are in decline. In particular, glass spirits are showing sustained growth, and wine is accelerating, recording positive dollar and volume sales growth. As we move into summer, McLean anticipates that demand for “light, fresh and fun” beverages will present opportunities across all categories.

Building on McLean’s presentation, Woolford offered a top-level look into the Australian consumer and the prospects for a continued recovery in retail spending into 2026.

As post-pandemic behaviour continues to play out, despite converging retailer growth rates over the last quarter, Woolford explained that independent liquor retailers have won, and held, market share over the last five years, thanks to their agility and category mix.

“The independents won during Covid and have retained those customers. The differential in growth between independents and majors has narrowed, but there’s been no swing back to the majors at this stage,” Woolford concluded.

That evening, the full-day conference wrapped up with the 2025 Retail Drinks Industry Awards, where national awards winners were crowned across both retailer and supplier categories.

Waters told National Liquor News that the awards highlight the strength and integrity of the sector.

“The Retail Drinks Industry Awards are run with the utmost of integrity and professionalism as a service for members and the broader industry. These awards celebrate exceptional businesses and individuals, showcase talent from all parts of the country, and importantly, promote liquor retailing as a career,” he stated. ■

Liquor Store of the Year: Red Bottle Pitt Street, NSW

Large Format Liquor Store of the Year: Liquorland Warehouse Hindmarsh, SA

Online Liquor Retailer of the Year: Tipple

Young Liquor Retailer of the Year: Caitlain Siega, Bottlemart

Lower Plenty, VIC

Liquor Store Manager of the Year: Steve Connors, Liquorland Warehouse Balwyn, VIC

Liquor Store Owner of the Year: Murray Croft, Murray’s Porters Liquor Group, NSW

Sales Representative of the Year: Belinda Gallagher, Taylors Wines

Beer Supplier of the Year: Lion

Wine Supplier of the Year: Treasury Wine Estates

Spirits Supplier of the Year: Diageo

Services Partner of the Year: Uber Eats

National Supplier of the Year: Lion

Murray Croft and his wife Charlotte run three local stores with one mission –to champion independent retail in Sydney’s west.

At the 2025 Retail Drinks Industry Awards, Murray Croft of Murray’s Porters Liquor Group, part of the Independent Brands Australia (IBA) banner group, was named Liquor Store Owner of the Year – recognised for his year-round efforts to deliver exceptional customer service and professional standards across his network of stores.

Croft didn’t expect to take out the award on the evening, but he describes the win as vindication of the hard work that he and his wife Charlotte put in.

“You think you’re doing a good job, but it’s nice when other people, particularly as esteemed as Retail Drinks Australia, say you’re doing a great job. We said from the outset that we never wanted to work 80-hour weeks, so we had to make sure to get good people in that would enable us to balance the business with raising our family, and this is an indication that we’ve got that right and employed a great team, which we’ve very proud of,” he told National Liquor News

Murray’s Porters Liquor Group operates three stores in lower Blue Mountains, all within a 10-kilometre radius, with a strong community focus. With a local team and active community support through sponsorships and fundraising, Croft fosters loyalty and lasting shopper relationships.

“If we perform really well, it encourages people to not just go to the chains, and know that there is quality, independent retail out there – it doesn’t have to be the big guys.

“Not only has our success led to dollars in our till, but hopefully while customers are shopping with us, they also duck next door to the butcher or the shop for milk – it helps out other local businesses too,” he stated.

Murray’s Porters has long partnered with IBA, supporting key programs and becoming a platinum retailer. Croft values the network, finding IBA’s initiatives highly impactful for his stores.

“The Porters program has been really good for us in taking care of a lot of the marketing and price promotion responsibilities, which then frees us up to take care of things in-store and focus on the other aspects of running a business.

“The level of category and data insights that IBA has been able to provide us has been really helpful in terms of staying ahead of the curve as paces change and trends move on. I couldn’t imagine our business without IBA,” he explained. ■

Croft will add a fourth store to the Murray’s Porters network in 2026, and with three stores already in the fold, he is well versed in scaling a business while keeping customer experience consistent and at the heart of what he does.

“My wife Charlotte is a graphic designer, so she’s got a great eye for detail – she does all our store layouts and design to keep it consistent. Whether it’s Glenbrook, Blaxland East or Warrimoo, getting the look right was really important for us.

“It also comes down to the culture of the team – our staff are the ones that make or break it for the customer. We’ve worked hard to ensure that we recruit well, train well, and retain staff – our turnover is so small.

“I’m also really appreciative of Giuseppe Minissale, who’s a bit of an industry legend and has really helped me out. I’ve known him for the better part of 16 years, and he’s been wonderful at giving advice, opening doors for things, and really looking after me and my family,” Croft concluded.

Metcash has delivered its financial results for the half-year ended 31 October 2025, with Group CEO Doug Jones saying: “In Liquor, the benefits of our diversified channel strategy led to sales growth in a more difficult market.”

Total liquor sales increased by 1.4 per cent to $2.6bn, reflecting Metcash’s market share gains in Australian packaged liquor and an acceleration in wholesale sales to on-premise customers.

Liquor EBITDA was 4.8 per cent lower at $55m and EBIT declined 11.4 per cent to $43.5m reflecting the contribution from the business’ positive trading performance being more than offset by the impact of one-off strategy costs of $1.5m, lower wholesale price inflation on strategic buying, and higher labour costs.

Metcash’s digital B2B marketplace, Sorted, saw rapid expansion in the half, and now accounts for around $4bn of annualised sales. Sorted was extended into liquor at the end of the half and is now available in Western Australia, South Australia, Victoria, Tasmania and the Northern Territory, and will be in Queensland and New South Wales from January 2026.

The first half also included renewal of the Liquor Stax contract for a further 10 years (~$350m sales p.a.) and the Redcape Group (54 stores) became a member of the IBA retail banner group. The business also completed the acquisition of Steve’s Liquor Warehouse group in mid-October.

Endeavour announces new MD for Dan Murphy’s

Endeavour Group has announced Benjamin Ward as the new Managing Director of Dan Murphy’s after the group made changes to its leadership team to support the next phase of growth and refreshed business strategy.

Ward brings more than 25 years of retail experience to Endeavour with leadership roles at Super Retail Group and Aldi, and will commence in his new role on 27 January 2026.

His appointment follows Agi Pfeiffer-Smith stepping down from Dan Murphy’s after five years with Endeavour Group. Pfeiffer-Smith will remain in the role until the end of March, ensuring a focus on trading for the important Christmas period and enabling a smooth leadership transition.

Further changes to the leadership team see Catriona Larritt join Endeavour from Qantas in the newly created role of Chief Customer Officer. This position will integrate Marketing, Customer Insights, Digital, e-commerce, Data & AI and Loyalty to strengthen the group’s refreshed customer strategy and focus.

Brendan Sweeney will join Larritt’s team as Chief Digital and Data Officer following Claire Smith’s decision to leave Endeavour Group. Sweeney joins Endeavour Group from Catch, where he has been the Managing Director for the past two years.

Finally, Jill Henderson has been appointed Chief Legal Officer following Peter Atkin’s decision to leave Endeavour Group. Henderson joins Endeavour Group from BHP Limited, where she was consulting on various legal and people matters, including leading the development of an overarching global Pay Compliance & Governance Framework.

Michael Waters, CEO of Retail Drinks Australia, writes about protecting public health without punishing responsible businesses or consumers.

A federal parliamentary inquiry commenced in August 2024 to examine the health impacts of alcohol and other drugs (AOD). This was a health-focused review of policies, treatment services, and community programs to inform future government action.

Retail Drinks lodged a submission to the Inquiry and was then invited to appear and give evidence at a public hearing in February. However, the Federal Election was called, and the Committee charged with the Inquiry didn’t have time to hear from industry or complete it.

In late August the Federal Minister for Health & Ageing re-established the Committee and the Inquiry was re-opened, with public hearings expected to start again in early 2026.

Separate to the AOD Inquiry, there’s the current National Plan to End Violence against Women & Children 2022–2032 and in May last year the Prime Minister announced a rapid review to accelerate action against the plan.

Just three months later a report titled Unlocking the Prevention Potential was published (without industry consultation) providing recommendations, including for governments to adopt clear primary objectives in liquor regulatory regimes to prevent gender-based violence, alongside existing objectives around alcohol harm reduction. This included for governments to place further restrictions on alcohol sales, delivery timeframes and advertising.

A month later discussion on the report and matters concerning gender-based

violence ensued in National Cabinet, with the report’s findings endorsed and the call made for the states and territories to action the recommendations.

Since then, most jurisdictions have commenced, recommenced, or are about to commence reforms of their legislation, with same day alcohol sale and delivery the focus.

Proposed measures include a mandatory two-hour delay between sale and delivery of alcohol, a restricted sale and delivery window of 10am – 10pm, onerous data reporting and retention requirements, and bespoke training for delivery drivers. Some are going further, proposing daily purchase quantity limits.

There’s a clear government agenda that is to some extent allowing emotion to cloud rational decision making, and our efforts are being hindered by a broader industry that’s unfortunately not completely aligned on this issue.

Measures like a two-hour delay, restricted delivery hours, quantity limits, and excessive reporting are disproportionate, unnecessary, lack evidence, and risk creating unintended consequences for consumers, industry, and public safety without solving the issues in question.

What we do support and have consistently recommended are the measures that exist in our industry-first and globally recognised Online Alcohol Sale & Delivery Code of Conduct, which was developed and launched in 2019, before the existence of any legislation or regulation in this space.

Code Signatories today cover over 85 per cent of the entire online alcohol sale

and delivery market and are enhanced by a robust compliance program that has undertaken over 40,000 independent mystery shop audits, achieving a 94 per cent compliance rate in 2024.

We’ve also got strong data and evidence to support our case for commonsense. The inaugural Online Alcohol Sale & Delivery in Australia report by Frontier Economics published in mid-2023 assessed over 10 million transactions in 2022. It’s still the most comprehensive body of work ever undertaken in this space, dispelling common misconceptions surrounding consumer behaviour in relation to online alcohol sale and delivery.

In complementing Frontier Economics’ groundbreaking quantitative report, earlier this year we commissioned Circana to undertake a consumer survey of over 1,600 Australian households on their online alcohol purchase and consumption habits.

With our Online Code, not to mention the significant body of research, data and insights we have at our disposal, Retail Drinks is an authority in this respect and is engaging constructively with State and Territory governments to deliver solutionsfocused reforms that protect public health without punishing responsible businesses and consumers.

Retail Drinks continues to advocate to enhance the freedom to retail responsibly, for our members’ social licence to operate, and the overwhelming majority of Australians that are increasingly making informed and sensible choices about their drinking behaviour. ■

DrinkWise partners with government to help school-leavers make safer choices and understand key alcohol-related risks.

As 2025 draws to a close, DrinkWise has continued its focus on helping Australians make safer, healthier choices around alcohol by supporting people at key life moments. One of the most significant of these is Schoolies and this year DrinkWise partnered with the Australian Government and Smartraveller to launch an important national campaign aimed at keeping Australian school-leavers safe as they celebrate the end of their school journey.

The Schoolies and Drinking? Drink Mindfully campaigns were officially launched at Melbourne Airport by Minister for Foreign Affairs Penny Wong and Minister for Education Jason Clare. The campaign messaging focuses on moderation if drinking, looking after mates and making smart decisions to avoid risks. A key focus of the campaign is also to raise awareness of the dangers of methanol poisoning, following the tragic deaths of Bianca Jones and Holly Bowles overseas last year after being served alcohol containing methanol. Having the families and friends of Bianca and Holly involved in the launch and campaign provides a powerful reminder of the real risks that can arise when travelling abroad.

The practical guidance ahead of Schoolies celebrations is centred around two short educational videos – one designed for schoolleavers and one for parents – offering clear, evidence-based advice and information. While many school-leavers are already making safer choices, DrinkWise research shows that some risks remain poorly understood, with only 18 per cent of overseas Schoolies reporting concern about methanol, despite its potentially fatal consequences.

Encouraging parents to speak with their teens before they go on their Schoolies adventures has been a central theme. DrinkWise research highlights that 94 per cent of parents want their teens to understand alcohol-related risks, yet fewer than 70 per cent have discussed these issues as part of their Schoolies planning and only half have talked about how they will stay in touch during the trip. To make these conversations easier and more accessible for families, the video resources and tip sheets have been made available to schools through SchoolTV and state education departments and can be found online for parents and school-leavers on the DrinkWise and Smartraveller websites.

To ensure messages reach schoolleavers at the right moments, DrinkWise and Smartraveller are also delivering targeted communication around international airports, through social and digital channels and even via activation teams at airports to remind school-leavers to make smart choices and prioritise

their safety so they can return home with positive memories.

Additional Drinking? Drink Mindfully messaging will also reach school-leavers in Australia via social media and music streaming services, as well as through messaging in almost 800 retail stores in popular Schoolies locations around Australia. These placements, supported by Endeavour Group, Coles Liquor, Retail Drinks Australia and MGA Independent Businesses Australia liquor retailers, ensure young people receive timely prompts at the very moments they are making purchasing decisions.

These Schoolies and Drinking? Drink Mindfully campaigns reinforce DrinkWise’s commitment to consistent, evidencebased messaging that supports Australians at every life stage. As we look ahead to 2026, we encourage industry partners to join us as we continue to collaborate with government, industry partners and community organisations to embed a safer and healthier culture around alcohol and help Australians make informed choices. ■

The report highlights the many opportunities and challenges facing New Zealand’s wine industry, and growth coming from emerging export destinations.

Across three decades of consumer-driven international growth and success, the New Zealand wine industry has built a strong reputation for highly distinctive, premium, sustainable wines.

This year marks the 30th anniversary of Sustainable Winegrowing New Zealand, an industry-led, independently audited, sustainability certification programme. Sustainability is a key differentiator for New Zealand wine’s reputation.

That reputation has lifted exports to over $2.1 billion per annum. Success has fuelled investment in 42,000 hectares of vineyards across regional New Zealand, state-of-the-art processing facilities, and strong brands that proudly bear New Zealand on the label. Wine from New Zealand is exported to over 100 countries, with 90 per cent of wine produced here heading to global markets.

While the industry has many positives, Fabian Yukich, Chair of New Zealand Winegrowers, outlines challenges in the report.

“A strong reputation and in-market performance ahead of competitors are real positives on which to build for the future. However, producers are currently navigating their way through a complex and uncertain business environment.

“Much of the current focus of industry activity is on the immediate challenges confronting growers and wineries. Market and economic developments are compounding industry-specific issues to create a highly uncertain environment,” he said.

Despite imposition of the higher tariffs late in the year, the major market for New Zealand wine remains the USA with exports valued at $762 million, down three per cent in the past year. While the increased tariffs have been in place since April with a further increase in August, it is not yet possible to discern the effect of these in the export data.

The strongest growth in the past year has been from emerging export destinations. Shipments to China grew 47 per cent to $56 million, while exports to South Korea lifted 92 per cent to $44 million. Overall exports to second-tier markets (all those except the UK, USA and Australia, which take over 70 per cent of our exports) grew 17 per cent in the past 12 months to just under $600 million. This reflects strong trade and consumer interest as well as the ability of wineries to develop new markets with improved supply. According to market researcher IWSR, lighter refreshing styles are outpacing overall wine category performance. This shift is driven by varietals with more refreshing palate profiles, which New Zealand excels in delivering.

Favourable weather conditions in the run-up to vintage 2025 delivered a crop that would have significantly exceeded any previous vintage in New Zealand’s history. Throughout the country, vintage weather was marked by warm, dry days and cool nights – positive conditions for a high-quality harvest. Against the backdrop of an uncertain demand outlook, it was unsurprising that wineries limited their grape intake.

Concluding the Annual Report, Yukich has this to say of the outlook for the industry: “While much has changed since 2020, the fundamentals that have made New Zealand wine successful over the past three decades have not. Success in the future will reflect this: we must continue to produce highly distinctive, premium and sustainable wines that are an enduring reflection of New Zealand and its people.” ■

Angelica Crabb, Senior Analyst for Wine Australia, highlights the growing opportunity for rosé in Australia, where consumption is growing faster than all other major markets.

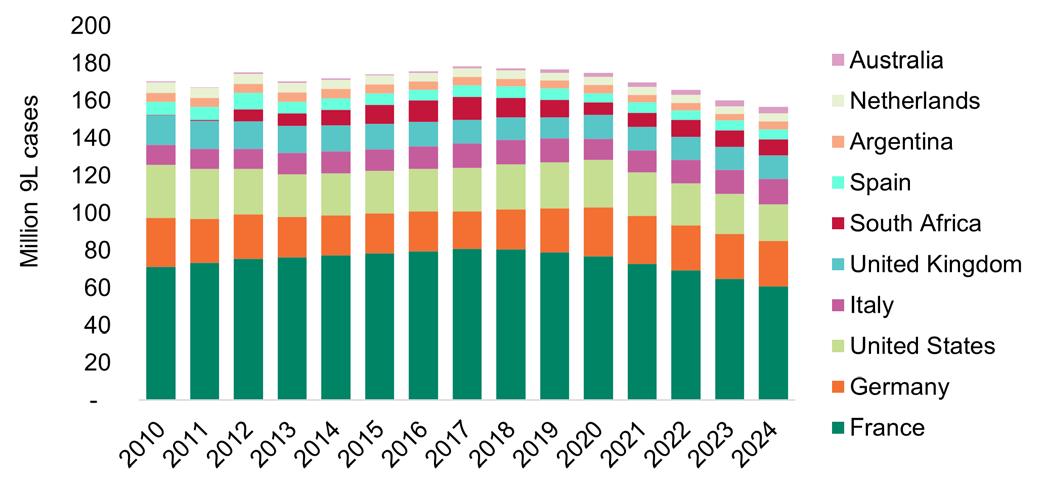

According to Rosé Wines World Tracking, 2.3 billion litres of rosé were produced globally in 2022, up 17 per cent in 10 years. The largest producers are France, Spain, the United States, and Italy.

The centre of both rosé production and consumption globally is France, where one in three bottles of wine consumed are pink and the style is more popular than white wine. Provence is the powerhouse of rosé production, with 91 per cent of vines in the region used to produce the rosé1

However, rosé is not immune to the global decline in wine consumption. Over the past five years, consumption of still rosé has decreased in volume by 1.9 per cent per year, according to IWSR. However, this is a slower decline than still red (4.9 per cent decline per year) and still white (2.4 per cent), but its performance is not as good as sparkling, which recorded 2.1 per cent growth per year.

The main driver of the decline in rosé consumption is France, where consumption peaked in 2017. Rosé is also under threat in the United States, where consumption peaked later – in 2020. These two markets now represent a shrinking share of rosé consumption as other markets grow – including Germany, Italy, the United Kingdom, Brazil, and Sweden.

Source: IWSR

However, the real star performer when it comes to rosé consumption is Australia. Over the past five years, rosé consumption in Australia has grown by an average of 13 per cent per year, outperforming all other major markets.

Australians are drinking rosé at a faster rate than even sparkling wine (which has grown by two per cent per year). This brings Australia to having a two per cent share of worldwide rosé consumption, up from just over zero a decade ago. It has climbed from the 27th largest rosé market in 2014 to 10th largest in 2024 and is expected to grow at a rate of one per cent per year in the next five years.

Driving this trend in Australia are younger drinkers – Gen Z and Millennials; more regular wine drinkers from these generations are reporting drinking rosé than sparkling wine2. Endeavour’s State of the Grapes report also supports this view; indicating rosé is one of the top wine styles preferred among Gen Z and Millennials (see Figure Two). There is also evidence in the report that more affluent consumers are preferring rosé over Sauvignon Blanc – indicating it is seen as a more premium and aspirational product. ■

Figure Two: Wine sub-category preferences by generation

Sources: 1Vins de Provence 2IWSR

In this article, I want to look at some simple ‘points to ponder’ that sometimes sit in your brain and jump out at you at various times to remind you of an important business aspect. In this edition, I’ll look at four ‘tag lines’ that I find resonate with liquor managers.

Create ‘order-makers’ not just ‘order-takers’

When we start work, we’re told about systems and service but not often enough about selling. Yet, profit margins (and dollars) rely largely on that ‘extra’ sale. Remember, in food retail up to 45 per cent of the basket or trolley is an impulse buy, yet in liquor retail it’s only 10 per cent (only five per cent in a drive-through where customers don’t get out of the car).

An ‘order-taker’ simply serves when a customer has decided what they will buy, but does little to further the sale.

An ‘order-maker’ does more; he or she might think of a trade-up (most customers are happy to go up by 15 per cent without thinking they’re being ripped off), an additional sale, or sell an upcoming new stock line.

Peter Hall shares four practical prompts to stay sharp on the business fundamentals that drive profitable liquor retailing.

Train your staff to become ‘bottom line’ thinkers

We tend not to share sales information with staff for the simple reason that staff confuse sales dollars with profit. And, as they don’t really see invoice detail and have limited information on store costs, it’s no wonder that staff, when asked how much of a $100 note entering the till is cost and how much is profit, will answer about 50/50.

Given that they believe in the 50 cost/50 profit split, what is a typical staff member’s approach to pilferage, wastage, breakages, missed sales, customer service etc. The answer: they say, “Don’t worry, the store’s doing just fine!”

Now, we will never share full financials with staff, but we do have to get them thinking bottom line. I put 100 dollar coins on a table and show staff a rough split. After all costs, there aren’t that many coins left on the table.

Give away as much as you like, as long as you get it back

Sell an item on special and you probably haven’t generated enough GP dollars to cover the cost of the sale. So, if you’re

going to give something away (reduced GP, bonus, giveaway), you’ve got to work out how to get it back. The ‘loss leader’ is a valid promotional tool to generate traffic but it’s the in-store strategies to get it back that are missing.

What about bundle buys, association selling, his and hers, “what are you doing this weekend?”, the new stock item etc. It won’t work if you only have ‘order-takers’.

Everyone is interesting, but at work, it’s best to be interested

I don’t bother with ‘customer service’ training. It doesn’t work, as it tends to train staff on treating everyone the same. We understand that customers are different and have different needs and wants, so I focus on ‘customer satisfaction’. Carrying product to a car for a customer is great customer service but not always great customer satisfaction.

Try this tag line then. Everyone is interesting, but interesting people tend to talk about themselves. Being interested means you concentrate on the other person leading to improved customer satisfaction. Food for thought. ■

BrightSide Executive Search is the only dedicated drinks recruitment specialist nationally and has been a trusted advisor to the industry for well over a decade. Through accessing its wide-reaching network of potential candidates, BrightSide takes the hassle out of recruitment for drinks businesses, advising how they can stay nimble and competitive in a tight market to attract the absolute right person for each role. The latest BrightSide success stories below show the strong abilities of the recruitment agency in partnership with drinks businesses of all sizes, country-wide.

Prue Andrews joins Divas Beverages as Head of National Accounts bringing exceptional account management expertise.

Paul Weaving has joined Divas Beverages as its new Head of Retail and Export, bringing excellent sales leadership experience.

Check

David Pike is loving his onpremise sales role at Young & Rashleigh, bringing a wealth of wine experience and industry contacts.

Francisco Benvenuto has hit the ground running with his extensive drinks experience as BDM NSW for We Are Tailored.

Florcita is thrilled to have the energy and vast experience that Wylie Beck is bringing to the Queensland team as Brand Ambassador.

Brendan Da Costa is bringing his global networks and a strong track record to Meditrina Wines as its new Export Director.

Proximo welcomes Bailey Wall-Bardelmeyer to the team, utilising his strong drinks and hospitality background as ASM VIC. Leon Thomas brings leadership and account management expertise to his new role as National Sales Manager at Burch Family Wines. Visit us

Four Pillars has released its 10th annual Australian Christmas Gin. This unique release smells like gin and tastes like Christmas with lush pudding botanicals and Muscat barrel finish creating aromatics of classic juniper and a hint of cinnamon, backed up with a rich palate and a hint of sweetness.

The Australian Christmas Gin was originally inspired by a family tradition of Four Pillars Co-Founder, Cam Mackenzie, in tribute to his late mum Wilma who made her famous Christmas puddings on Derby Day each year. Fast forward a decade and over a quarter of a million bottles later, Cam’s family tradition has become an iconic annual ritual of drinking, gifting, and celebrating the festive season.

Each year, the delicious gin is wrapped in an artists’ impression of what an Australian Christmas means to them. Over its 10 years of label designs, the bottle has featured an array of quintessential Aussie Christmas motifs, from pavlovas and prawns, to Christmas beetles and bells, to Illawarra flame trees and backyard pools. For this year’s label, Four Pillars returned to one of their favourites, 2021 label artist, Andrea Huelin. Her work this year is an ode to Christmas table staples, featuring nods to the nine previous labels.

A delightful companion to any occasion (not just Christmas lunch), Four Pillars Australian Christmas Gin is an annual tradition not to be missed.

Distributor: Vanguard Luxury Brands

Willie Smith’s launches summer’s sessionable cider – introducing Willie’s Gold

Award winning Tasmanian cider maker Willie Smith’s has launched Willie’s Gold, a 3.5 per cent cider crafted for summer occasions and the growing demand for sessionable drinks.

Delivering a crisp, refreshing apple profile, Willie’s Gold reflects the brand’s signature ‘farmto-can’ philosophy – the orchard sits just 27 steps from the cidery.

The launch follows a standout year for Willie Smith’s, which was named Most Successful Larger Producer at the 2025 Australian Cider Awards, taking home two trophies, eight medals, and two Best in Class awards.

Leading the shift toward lighter ABV options, Willie’s Gold, alongside the popular Willie Smith’s Non Alc cider, exemplifies the brand’s ongoing commitment to quality, innovation and approachability.

Distributor: ALM and Paramount Liquor

ZZVINO – or ZERO.ZERO VINO – is a new no-low wine alternative made for people who enjoy the taste and feel of wine, without the alcohol. Created by winemakers who wanted to keep the essence of wine intact, the result is a wine alternative focused on flavour, texture and the integrity of the grape.

For this new release, Doom Juice Wine has partnered with one of Australia’s early leaders in organic viticulture, Windowrie, to source Shiraz and Chardonnay grapes for the base.

ZZVINO blends the organically grown grapes with cherries, blueberries and blackberries to create a layered and approachable profile. It’s built from grape pomace – the skins and pulp which are left behind after pressing and usually discarded – giving the product a sustainable edge and reducing waste.

Unlike many no- and low-alcohol wine alternatives, ZZVINO uses a ‘low touch’ production process, meaning it has not been dealcoholised. Nothing has been removed or altered, meaning the wine’s natural flavours remain intact.

The team behind ZZVINO say: “ZZVINO is a project by winemakers, for wine drinkers - born from a desire to make a <0.5 per cent alc alternative that still feels like wine, tastes like wine, and celebrates the grape.

“Together, we’re creating something that bridges the gap between tradition and innovation – real grapes, grown with care, crafted with intent.”

ZZVINO is now available to the trade, and already ranged across 200 retailers nationally.

Distributor: Doom Juice

Absolut Vodka has released its new Absolut Haring Artist Edition in Australia, almost 40 years since Keith Haring first painted the famous Absolut bottle.

The limited release revisits Haring’s 1986 partnership with Absolut, when he became the second artist to reimagine the Absolut bottle, aiming to introduce his renowned style to a new generation of consumers and collectors.

Though Haring originally created four artworks, each featuring an iconic silhouette, the chosen artwork depicted a crowd of dancing figures against a bold yellow canvas and became an iconic Absolut campaign.

The new bottle draws on Haring’s goal of taking art beyond gallery walls and into everyday life, translating one of his 2D paintings into a 3D collectible piece. Reflecting the brand’s ongoing mission to celebrate creativity as a unifying force, the new bottle features Haring’s signature red linework, embossed dancing figures and a hand-drawn interpretation of the Absolut medallion.

Kristy Rutherford, Marketing Director ANZ, stated: “Following a hugely successful Absolut Warhol release in 2024, we’re keeping the creative energy flowing with the launch of Absolut Haring. Haring’s work captured everything Absolut stands for – art that’s open, joyful, and for everyone. This new release invites a new generation to celebrate that spirit and reminds us that creativity has the power to inspire and unite us.”

Distributor: Pernod Ricard

Hawkesbury Brewing Co is looking to tap into summer drinking trends with the launch of three new flavours for its Little Fat Lamb brand.

Inspired by sparkling cocktails and soju, the new flavours are: Peach Bellini (eight per cent ABV), Zesty Orange Mimosa (eight per cent ABV) and Fortified Peach (18 per cent ABV).

Joanna Lynsky-Smith, Marketing Director at Hawkesbury Brewing Co, says these flavours land precisely where the market is headed.

“Fruity refreshment, sparkling cocktails and soju-inspired drinks are the flavours of the moment. Little Fat Lamb has always been about meeting drinkers where they are –social, spontaneous and ready for something new. This summer’s line-up does exactly that,” she said.

Mitchell Elmes, HBC Sales Director, added: “Our customers have been asking for more flavour variety and more convenience.

“These formats – including the 375ml x10 packs – give retailers extra flexibility and give consumers more ways to enjoy Little Fat Lamb. We’re expecting strong pickup across independent channels.”

The new Little Fat Lamb summer flavours are currently available nationally through independent retailers.

Distributor: Hawkesbury Brewing Co

Lark Distillery has unveiled its limited-release Christmas Cask 2025, bringing together Christmas tradition, the best of Tasmanian artisanry and local culinary creativity, and marking the seventh year of the annual release.

Crafted to celebrate bold flavours and festive indulgence, the special release is matured in port and sherry casks, before finishing in Frogmore Creek’s red wine barrels infused with Jean Pascal Bakery’s Fruit Mince Pie jus.

Tasting notes describe a layered and inviting whisky with aromas of freshly baked rhubarb pie, Christmas pudding and subtle mulled wine spice. On the palate, the whisky offers hints of caramel, creamy coconut, gingerbread and marzipan, finishing long with fruit mince pie, cinnamon buns and frosted orange cupcakes.

Each bottle of Lark Christmas Cask 2025 is packaged in a bespoke gift box featuring an illustration of the Pontville distillery. Lark’s founders Bill and Lyn Lark are depicted on the label alongside distillers and the baker, raising a toast beneath the starry sky. Presenting a quintessential Tasmanian Christmas, the design also features native botanicals, Christmas bells, curling everlasting flowers and forest flax lily.

Distributor: Lark Distillery

Skrewball Whiskey is expanding its footprint in Australia and New Zealand with the launch of a global first 200ml PET hipflask format for its peanut butter whiskeyflavoured liqueur.

The new size, available exclusively in both markets, marks the brand’s first foray into smaller, portable packaging.

Positioned as a convenient, shareable and giftingfriendly option, the 200ml hipflask delivers Skrewball’s signature sweet, smooth and nutty profile in a lightweight, pocket-ready format. The launch aligns with strong regional demand for smaller whiskey pack formats, with 200ml hipflasks in the American whiskey category recording high single-digit dollar growth year-on-year – significantly outperforming 700ml bottles.

Skrewball is currently the number two growth-driving brand in flavoured whiskey in Australia and New Zealand, and in Australia it also ranks as the number two growth driver in the American whiskey segment, according to Circana data.

For retailers, the new hipflask offers an additional format to encourage trial, capture impulse purchases and complement existing 700ml SKUs. Its portability also positions it well for gifting occasions and on-the-go consumption moments, such as picnics, festivals or outdoor gatherings.

Distributor: Pernod Ricard

Prosecco has become Australia’s go-to sparkling, loved for versatility, value and ease. So where is the category heading next?

According to Circana data analysed by Wine Australia*, Prosecco has grown nine per cent in value and seven per cent in volume over the past year, outpacing both total sparkling and still wine.

“This has been driven by Australian Prosecco (up 14 per cent in value and 10 per cent in volume), whereas Italian Prosecco has declined by four per cent in value and three per cent in volume,” says Sandy Hathaway, Senior Analyst, Wine Australia.

Emma Brown, fourth-generation Brown Family and Head of Innovation at Brown Family Wine Group, says: “Prosecco continues to be one of the strongest growth drivers in Australia’s sparkling wine category.”

Retailers now face an increasingly complex category: Australian versus Italian, DOC versus regional heroes, under $20 staples, $20–30 ‘everyday premium’, rosé styles, zero-alc, spritz-ready options, and ongoing GI debate. Prosecco is no longer a simple ‘cheap bubbles’ play.

In a soft sparkling landscape outside Champagne, Prosecco remains one of the few genuine growth engines.

“Prosecco’s one of the few sparkling categories still growing in Australia. It’s outperforming Champagne and traditional sparkling because it fits how people drink today,” says Andrew Santarossa, Winemaker and CEO at Gapsted Estate Wines. “The big picture is simple. Prosecco has become the everyday sparkling Australians feel confident buying and pouring.”

Wine Australia shows Prosecco growing faster than sparkling overall, which increased six per cent in value and four per cent in volume. Australian Prosecco now accounts for 77 per cent of volume and 74 per cent of value, with an average bottle price of $14.60 versus $16.16 for Italian Prosecco.

At banner and wholesaler level, the trend is even stronger.

“At Independent Liquor Group (ILG), we are seeing great growth in Prosecco and currently growing at 23.3 per cent (MAT) in value and 23.7 per cent in volume,” says Jesper Kjaersgaard, Category Manager –Wine, ILG.

Major producer De Bortoli is also experiencing double-digit growth across both 750ml and 250ml formats. Dal Zotto Wines in the King Valley – long-time category champions – say: “We (the Dal Zotto family), are thrilled to see Prosecco thriving in Australia, a category we’ve championed since our father Otto planted the first vines in 1999.”

For many retailers, Prosecco is no longer a side category – it’s a structural driver of sparkling performance.

“Prosecco has become a social default,” says Santarossa. “People open it at brunch, take it to barbecues, mix it into spritzes, or keep it in the fridge for an easy mid-week glass.”

Younger drinkers, especially Millennials and Gen Z, are central to this shift – seeking lighter, approachable, relaxed styles suited to mindful drinking and multi-occasion use.

For Dal Zotto, Prosecco’s informal positioning is a major advantage. Their Pucino and Pucino Spritz ranges tap directly into aperitivo culture, offering ‘everyday luxury’ without Champagne pricing. Style-wise, rosé Prosecco continues to rise, combining visual appeal with approachable flavour. Zero- and low-alc Prosecco is also gaining traction among moderationminded shoppers.

Kjaersgaard highlights a key behavioural development.

“We see a stabilisation and maturity in the category and (it’s) no longer seen as just a driver of a spritz but also a wine in its own right,” he says.

Amanda Matral, Brand and Portfolio Manager, Independent Brand Partners (IBP), adds: “Prosecco’s crisp, refreshing, easy-drinking nature makes it perfectly suited to these changing preferences.”

Hathaway’s data reveals a clear trend: Australian Prosecco is rising; Italian Prosecco is gradually declining. Santarossa says local producers have earned consumer trust: “Around 80 per cent of sales are local, and people trust Australian regions to deliver consistent, fresh styles.”

The Dal Zottos emphasise respect for Italian heritage, saying: “As proud stewards of Australia’s Prosecco legacy… we have

always tried to pay respect to the variety as Otto, our father, had known it from when he was growing up in Valdobbiadene.”

Brown echoes this, saying: “Australian Prosecco is increasingly stealing the spotlight, celebrated for its fresh, fruit-forward style, vibrant character, and strong sustainability credentials.”

Déjà Vu Wines – importers of Ca’ di Rajo – report solid by-the-glass performance in Victoria and NSW, though sub-$20 retail dominates volume.

Kjaersgaard warns the market is becoming crowded, saying: “It’s become increasingly hard for consumers to recognise quality and see through the jungle of new wines that keep coming out.”

The EU continues to push for ‘Prosecco’ protection as a geographical indication. Australia has not agreed to restrict domestic use, but the issue persists in FTA negotiations. For now, the name remains fully usable in the Australian market.

Most industry feedback points to the $20–30 segment as the category’s core.

Dal Zotto recommends a simple range ladder: under $20 for trial, $20–30 for everyday drinking, and focused premium options above $30 for gifting.

Kjaersgaard is blunter, saying: “Prosecco in Australia lives in a space around and under $20. I don’t see any real growth in premium Prosecco at all.”

Multi-buys, seasonal offers and spritz bundles all perform strongly.

“Promotions that work are the ones that build value without cheapening the category,” Santarossa says.

Déjà Vu Wines highlights chilled front-of-store displays and multi-buy incentives as key drivers of impulse sales.

“At Dal Zotto Wines, we’ve honed strategies to grow Prosecco sales,” the family explains, recommending aperitivo-themed displays, Prosecco carts, and clear provenance cues.

Prosecco for every occasion

De Bortoli agrees, saying: “Eye-catching displays, dedicated sparkling wine spaces, and crossmerchandising with mixers or entertaining food items elevate Prosecco as a celebratory and versatile choice.”

Kjaersgaard sums it up: “Always understand and re-tell the story.”

Brown adds: “Educate staff on Prosecco’s versatility, food pairing opportunities, and new formats to drive confident recommendations and upsell.”

Future outlook: Prosecco’s next two to three years

Australian Prosecco, particularly from King Valley and Alpine Valleys, is poised for continued growth.

“The shift toward provenance is only getting stronger… consumers want a wine with a story,” says Santarossa.

Dal Zotto expects steady premiumisation within the $20–30 band as packaging, sustainability and storytelling improve. De Bortoli foresees further momentum behind smaller formats, lighter styles and spritz-driven occasions among Gen Z.

Déjà Vu anticipates increased demand for lighter, ultra-dry, lower-alcohol and provenance-driven styles.

And Kjaersgaard raises a challenge, saying: “When the traditional Australian Prosecco producers started making their wines, it meant something… Today, I feel that much of that has been lost.”

Matral captures the opportunity, saying: “Momentum is strongest where products deliver value, refreshment, convenience, and a sense of fun.”

The retailers and operators set to win will curate ranges that balance value with authenticity, invest in staff knowledge, and lean into Prosecco’s dual ability to serve as both everyday sparkling and the backbone of modern spritz culture.

*Data from Circana (off-trade retail sales data) for YE 28 September 2025 (and the previous 12-month period) analysed by Wine Australia ■

Amanda Matral, Brand & Portfolio Manager, Independent Beverage Partners

Amanda is a seasoned wine industry professional with over 20 years’ experience spanning sommelier work, fine wine sales, customer marketing and portfolio management. She began her career as a sommelier, and spent 18 years in fine wine sales representing iconic brands such as Petaluma, Henschke, and Bollinger. After four years leading APAC innovation at Campari, Amanda now serves as Brand and Portfolio Manager at ALM. WSET Level 4 and Court of Master Sommeliers certified, she brings a passion and expertise for the industry.

Anastasia Savkova, Educator (Wines & Spirits) and Owner, Wine Symfonia

Anastasia is WSET Diploma (Wines & Spirits) Alumna 2013 and WSET Certified Educator (Wines & Spirits – Level 1, 2, 3) teaching at Wine InTuition. Anastasia’s wine curiosity developed in Lithuania with consequent work experience in liquor wholesale and distribution, moving to Sydney in 2004. Anastasia is experienced in liquor wholesale, distribution, retail, administration, marketing and events, and has always loved sharing her passion for the fascinating world of wines and spirits.

Andrew Graham, Wine Buyer and Journalist

Andrew Graham is a renowned wine critic and wine expert, with over 25 years in the industry. He is the wine and drinks buyer for Good Pair Days and runs the Australian Wine and Drinks Review website. Andrew holds a Master of Wine Technology & Viticulture and a Bachelor of Environmental Management. He is a co-founder of The Tasting Glass and contributes to National Liquor News. Passionate about wine and climate change, Andrew also enjoys ultramarathons in his spare time.

Andy Milne, Marketing Specialist

Andy Milne is a drinks and marketing specialist with over 19 years’ experience in the global drinks industry. Originally from the UK, he spent five years at The Whisky Exchange, where he managed one of Europe’s largest whisky shows. Seven years ago, he made Sydney his home, stepping into a Brand Manager role that has seen him champion an impressive portfolio across bourbon, Scotch, tequila, mezcal, rum, and beyond.

Christina Butcher, Co-founder, Mr & Mrs Romance

Christina Butcher is a New York Times bestselling author, a professional photographer and the founder of Romance Media, which includes both MrAndMrsRomance.com, an award-winning lifestyle and travel site, and HairRomance.com, one of the world’s biggest hair sites. Christina is passionate about advocating for women in business and she has spoken at numerous conferences and summits, including Women of Australian Distilling and International Women’s Day events. Christina has worn many hats throughout her colourful career.

Daryl Fisher, General Manager, Fisher Fine Wines

With over 30 years’ experience in the liquor industry, Daryl Fisher has built a career across retail, distribution, marketing, and production. He has held key roles with leading companies including Chambers Cellars, Porters Liquor, Vintage Cellars, Mildara Blass, Tucker Seabrook, and Samuel Smith & Son. Beginning in retail, he became a buyer for a major retail chain, gaining valuable insight into consumer trends, product selection, and supplier relationships. His background also includes marketing and product development, catalogue design, and hands-on winemaking.

Emma Sefton, Trade Marketing Specialist, Independent Beverage Partners