Hello readers and welcome to September’s issue of THE CRUST. This month, the Indonesian shrimp industry continues to grapple with the radioactive shrimp scare that first surfaced back in August. What began as a single import alert has now stretched into months of uncertainty, with the FDA advising against certain shipments and U.S. buyers growing increasingly cautious. This delay has been compounded by what many see as a slow response from the Indonesian government in providing the requested clarifications. The result has been sluggish offtake, dipping farmgate prices, and growing anxiety among producers. For farmers already battling disease pressures and rising costs, this is another heavy blow.

In recent weeks, the situation escalated when the FDA expanded its recall to more states and confirmed the presence of Cesium-137 in certain samples traced back to PT Bahari Makmur Sejati (BMS Foods). Interestingly, the reported levels, around 68 Bq/kg, are far below the FDA’s own intervention threshold of 1,200 Bq/kg. This has led some industry watchers to question whether the scale of the response is proportional or whether this issue is becoming heavily politicized. Some even speculate that this might be a form of retaliation against Indonesia for recently joining BRICS, a move that has already attracted strong rhetoric from the U.S. administration.

Beyond Indonesia, global shrimp trade is facing turbulence. Rabobank recently warned that seafood trade patterns may never return to “normal,” citing geopolitical tensions, tariff wars, and fragile supply chains. India, another major shrimp supplier, is also reeling from newly announced U.S. tariffs, which have forced exporters to slash farmgate prices by nearly 20%, putting even more pressure on producers. Indonesia, too, is now looking to diversify its markets, with plans to increase shipments to China and other Asian buyers to offset U.S. weakness, a move that could reshape trade flows over the coming years.

And as if the markets weren’t complicated enough, political instability continues to add uncertainty. Revolutions and widespread criticism of governments in Indonesia, Nepal, and several other countries have dominated headlines. Any prolonged unrest risks further disrupting supply chains, logistics, and consumer confidence.

The question now is whether this radioactive shrimp scare and the subsequent chain reaction of market disruptions will be short-lived or whether they will leave lasting scars on consumer behavior. A prolonged scare risks making consumers wary of shrimp entirely, regardless of its origin, which would be devastating for a sector already struggling to stay profitable.

As always, THE CRUST will keep following these developments closely and bring you updates as they unfold. In the meantime, let us stay focused on producing safe, high-quality shrimps.

Rizky Darmawan Chief Editor

Sustainability is now a shared concern, including within the global seafood industry. As one of the parameters of sustainability, certification in aquaculture is no longer simply a need but has become almost a requirement. The issue of sustainability is taken seriously by both consumers and retailers at the downstream side of the industry. Major retailers such as Walmart and Costco even accept only certified seafood.

“This is not about being able to command a premium price for your product because it’s certified because nobody’s paying for that. It’s about getting shelf space or the right to play. If you’re not certified, in many markets you don’t have a right to even sell your product,” said Stephen Gunther, Director of Consulting and Applied Sciences at Wittaya, at The USSEC Southeast Asia Aquaculture Certification Workshop 2025 in Ho Chi Minh, Vietnam.

Although Stephen raised this point in relation to salmon, the same trend applies to other globally traded commodities, such as shrimp. However, only 5–10 percent of global aquaculture is certified, as most production is still destined for local markets where certification is not required.

However, the adoption of certification schemes still faces major challenges. The pressure to meet sustainability standards comes hand in hand with administrative complexity and high costs. This has led some industry players to question whether certification is truly worth the investment.

“We need to certify our systems in order to be able to sell to the market. But it’s complex. So farmers that are pursuing certification under ASC, BAP, GlobalG.A.P, ESG, they’re facing so much pressure to manage the data. The main challenge lies in the complexity of the supply chain,” he said.

A feed formula alone can involve dozens of ingredients from various sources—marine, terrestrial, or animal— each of which must be ensured to come from sustainable origins. Under ASC standards, for example, every ingredient that makes up more than 1% of the formulation must be traceable. Stephen said that this requires a strong management system, continuous

monitoring of suppliers, regular audits, and public transparency on how sustainability is being implemented.

Furthermore, certification is not the endpoint but a process of ongoing transformation. Even after obtaining certification, companies must undergo regular audits and recertification. The complexity increases when a feedmill is producing not only aquafeed but also for poultry, swine, and pets.

In the aquafeed industry, one of the key challenges in certification lies in the reliance on manual systems. Every incoming raw material must be accompanied by complete documentation such as certificates, analysis reports, sustainability reports, and even life cycle assessment (LCA). According to Stephen, these documents are usually sent separately by suppliers, then compiled at the feed mill, and often have to be digitized manually.

This becomes critical be-

Stephen Gunther

cause when auditors arrive for a feed audit, the mill must be able to quickly demonstrate that the raw materials used meet the standards and come from approved suppliers.

Stephen stressed that this fragmentation is a serious problem because it slows down the verification process. In the context of an audit, auditors require fast, centralized information: where the raw materials came from, whether they comply with certification standards such as ASC or BAP, and how much volume was used. But when data is dispersed across multiple departments, the process becomes timeconsuming and risks inconsistencies.

One solution that is increasingly being discussed is digitalization. According to Stephen Gunther, the industry needs to start digitizing and centralizing data. Digitalization allows all information to be collected in

one place. With a centralized platform, certification and traceability processes can be faster, more transparent, and standardized.

The challenge, however, is determining the scale of digitalization. Should it be built only at the feed mill level? Or should there be a national, or even global, system that enables all stakeholders to access the same data? This question is crucial as it will shape the direction of industry collaboration. If every player builds their own system, the risk of fragmentation could resurface. On the other hand, a shared platform could bring benefits across the entire supply chain.

Stephen shared a concrete example from the salmon industry. The Global Salmon Initiative (GSI), together with the World Wildlife Fund (WWF), developed an ESG sustainability tool to address the challenges of feed ingredient complexity. In salmon farming, even though 50 percent of production is already certified, the process remains costly and complicated. Through collaboration with one of big salmon farming companies

out of Europe, they created a system that enables faster assessments of feed ingredient suppliers.

The tool works by compiling information on hundreds of feed ingredients and evaluating them across 13 risk categories, ranging from transparency, land use and biodiversity, carbon footprint, and water consumption to nutritional value. The results are presented in a simple table that shows the level of risk for each supplier. In this way, feed mill procurement teams can make better decisions—not only based on price, but also on sustainability and compliance with certification.

Another success story comes from Ecuador, where consulting firms have begun to play a key role in bridging the gap between feed mills and their many suppliers. Rather than forcing each feed company to chase certificates and reports from dozens of ingredient providers, these firms have built centralized platforms where suppliers upload all compliance data such as certificates, reports, and other documentation, into a single system.

Feed companies can then log in directly, instantly see which suppliers meet certification standards, and pull the necessary information without delay. What makes this model noteworthy is that it is being developed at the national level, with regional and government support pushing for centralized data management. In Ecuador, the system has already streamlined audits, reduced duplication of effort, and given feed manufacturers greater confidence in the integrity of their supply chains.

Stephen concluded that the solution no longer lies in individual efforts, but in more standardized collaboration and digitalization. The industry must move forward together—at the company, national, and even regional levels—so that aquacultureproducing countries like Indonesia, Vietnam, and Thailand can prove that their products deserve a place on global supermarket shelves. By simplifying processes and embracing cross-sector collaboration, the transition toward sustainable aquaculture is not only possible but also the only way for the industry to remain relevant and competitive in the future.

If we think of aquaculture certification as merely a way to differentiate products and secure premium prices, that perspective may already be outdated. As food safety and sustainability concerns grow into shared priorities, certification—once seen as optional—has become a basic requirement for entry into major retailers. Today, it functions less as a ticket to higher prices and more as a passport to the market: without it, selling your product is simply not an option.

Syamsul Arifin, Country Coordinator of the Global Seafood Alliance (GSA), highlighted this point at the Seafood Expo Asia in Singapore during a session titled Driving Market Access and Credibility: The Strategic Value of Certification in Sustainable Seafood. According to him, aquaculture certification is often seen as complicated, but at its core, it starts from something simple: ensuring that the seafood we consume comes from healthy sources, is responsibly managed, and is produced in ways that do not harm the environment.

“The fish is sourced from well-managed, healthy stock, and then caught or farmed using methods that have minimal impact on the environment. And who will recognize that your organization is making a true or valid claim about sustainable seafood? That’s why certification is one step toward being recognized globally, by choosing seafood sources that help en-

sure a healthy ecosystem and a productive fishing industry in the future,” Syamsul said.

In the seafood business, just like in any other market, prices are ultimately determined by supply and demand. But when it comes to certification, the driver is not the producer, it is the consumer, mediated by retailers. Syamsul said that certification exists because buyers want assurance: that the fish, shrimp, or other seafood they purchase comes from responsible sources, produced without harming the environment, and free from unethical practices such as child or illegal labor. As one he noted, “Certification is about recognition. Consumers expect a guarantee, and retailers must provide it. If they fail, they risk losing the consumer’s trust.”

The push for certification comes not only from export markets but also from within Indonesia. Major retailers such as Hero and SuperIndo now require seafood suppliers to hold at least one recognized certification. An eco-label logo on products has become an important signal for consumers.

“Because in my opinion, we also need to be champions in our own countries. Indonesian trade must be a champion in the Indonesian market, not only abroad. The same applies to Vietnam, Thailand, Malaysia, and the Philippines. If people are aware of the label and the recognition, it will accelerate progress. And then we won’t be dependent on other countries, especially the U.S. or Europe,” Syamsul said.

In practice, certification is far from simple. Producers often face a maze of standards such as ASC, BAP, GlobalG.A.P, and others, that demand both time and significant financial investment. “When I visit factories, I often see meeting rooms with walls covered in certificates, almost like wallpaper. They display them all just to stay competitive,” said Syamsul. Southeast Asia alone accounts for nearly 40 percent of all BAP certifications worldwide, with Vietnam holding around 600 and Indonesia about 100.

Even so, certification does not automatically shield pro-

Syamsul Arifin

ducers from market risks. Issues such as antibiotic use, or even concerns over radioactivity, can quickly spread through the media and erode consumer trust, even if the product is certified. This is where certification is seen not just as paperwork, but as a guarantee of quality and food safety that must be continually proven in the marketplace.

Another major driver is pressure from global retailers. Restaurants, hotels, and supermarket chains in Japan, Europe, and the United States are becoming increasingly strict in requiring products with sustainability certification labels. This pushes producing countries such as Indonesia, Vietnam, and India to move faster. “What really drives us to pursue certification is the retailers. They want logos, labels, recognition. And if we don’t comply, our products won’t reach the market,” said Syamsul.

Looking ahead, the challenge is to ensure that certification benefits not only export markets but also domestic consumption. If the local market begins to place greater value on certified products,

the added benefits will be enjoyed not only by global consumers but also by Indonesians themselves. In this way, certification becomes more than just a requirement, it becomes an opportunity to strengthen the position of the fisheries and aquaculture industry at home.

While certification opens significant opportunities, one of the main challenges lies in the cost of obtaining it. This is especially difficult for traditional and small-scale farmers in Indonesia, who often face financial constraints. Another challenge is the layout of existing ponds, particularly older ones that were not designed to meet certification criteria. Redesigning those ponds to comply with standards recommended by certification bodies inevitably adds more cost. At the same time, certification is now more of a requirement to access certain buyers and retailers, rather than a ticket to premium prices as it once was.

Rizky Darmawan, CEO of Delta Marine Group, who spoke on the same panel as

Syamsul, pointed out that certification can be viewed from two angles. On one hand, it may seem like a burden, an obligation that brings added costs and requires sacrifices from farmers. On the other, it represents an opportunity, particularly for those looking to expand. With certification, farmers can showcase their operations, strengthen their branding, and set themselves apart from other producers.

Moreover, for those seeking investors or external funding to grow their business, certification can be a strong advantage. It provides a standard that is easily understood by investors and helps convince them that their investment will be both reliable and sustainable.

Since certification is a complex system and process, making it relevant and practical for farmers is essential. One of the most pressing needs is technical support, as many farmers still struggle to fully understand the requirements for obtaining certification. A simplified checklist could make it easier for them to apply the standards in daily practice. Another major challenge is cost. Finding ways to streamline the process—for example, submitting applications collectively to share expenses—would greatly reduce the financial burden on small-scale farmers.

Insights from The Aquaculture Roundtable Series 2025, by

Robin McIntosh

When Robin McIntosh took the stage at The Aquaculture Roundtable Series (TARS) 2025, he posed a question that made the room pause: “Is the Asian Shrimp Model Broken?” It was a bold way to frame an issue that has long been debated among farmers, breeders, and investors. Shrimp farming in Asia has powered the global industry for decades, but today it stands at a crossroads.

McIntosh’s answer, however, was clear: the model is not broken. Instead, it is widely misunderstood. To understand why, we need to look at how technology, biology, and management have shaped Asian shrimp aquaculture, and where the pressure points now lie.

Technology and the Price Squeeze

Over the past decade, new technologies have transformed shrimp farming. From better aeration systems to improved formulated feeds, productivity has soared. But with this success has come a paradox: efficiency has driven down costs and, with it, international market prices. New York wholesale prices, often treated as an industry benchmark, continue to slide downward as supply rises faster than demand.

This “more shrimp for less money” dynamic poses a challenge. Farms that once thrived on volume now struggle to protect margins. McIntosh stressed that the purpose of technology should be to lower costs through smarter production, not simply to churn out more shrimp at any cost.

The so-called “Asian Shrimp Model” has often been reduced to a caricature of crowded ponds and relentless output. In reality, the model is defined by intensive or super-intensive farming systems built around a few key pillars: aeration, quality and balanced feed, domesticated shrimp stocks, and strict biosecurity.

Today, the majority of shrimp in Asia are produced using these intensive technologies. By any objective measure, the model has proven itself. It leads the world in production volume while delivering shrimp at competitive costs. Far from broken, it has shown remarkable adaptability.

A recurring theme in McIntosh’s talk was the uneasy tradeoff between growth and robustness. Evidence suggests that shrimp bred for fast growth often lack resilience under stress, leaving them vulnerable to disease or fluctuating pond condi-

tions.

This raises an uncomfortable question: must growth always come at the expense of robustness? Increasingly, breeders and farmers recognize that the answer should be no. The future lies in developing stocks that grow quickly while maintaining the durability needed for long-term success. This is not only a breeding challenge but also a management one, requiring balanced strategies that prioritize shrimp health alongside productivity.

Environmental pressures, from climate variability to shifting water quality parameters, are forcing the industry to rethink how success is defined. It is no longer just about maximizing kilograms per hectare. Animal health, hatchery sanitation, and biosecurity are becoming equally critical.

McIntosh emphasized that hatcheries, in particular, remain the foundation of the entire system. If sanitation and biosecurity break down at this early stage, the impacts ripple through grow-out farms and into markets. Strengthening these weak points will be essential to maintaining industry resilience.

One open question is whether Southeast Asia’s heavy investment in super-intensive farms has inadvertently reduced flexibility. Large capital commitments demand quick returns, which can pressure farmers to keep stocking rates high, even when conditions suggest that lowering densities would improve survival and yields.

This lack of management flexibility can amplify risks. Farmers may find themselves locked into practices that serve financial obligations more than biological realities. McIntosh urged the industry to ask whether the current path strikes the right balance between return on investment and long-term sustainability.

In short, the Asian shrimp model is not a system in decline but it is one that requires better understanding and discipline refinement. Its success has always come from adaptability, and its future will depend on balancing efficiency with resilience, profit with flexibility, and the growth with health that make farming sustainable in the long run. The idea is that mode’s strength is not lying on being perfect, but it is more on the capacity to evolve.

THE CRUST - MIDA

Shrimp farming is entering a phase where efficiency and sustainability can no longer be treated as separate goals.

Farmers today face a combination of fluctuating shrimp price, high feed costs, unpredictable weather patterns, and the ever-present risk of disease outbreaks that can wipe out an entire production cycle within weeks. In this landscape, feed additives have become more than just supplementary products, they are emerging as strategic tools to help farmers stabilize performance, safeguard animal health, and maintain the continuity of production.

At their core, feed additives are substances designed to complement the nutritional value of feed while delivering specific functional benefits. These range from improving digestion and organ health to enhancing the immune system and accelerating recovery after disease challenges. By bridging nutritional gaps and strengthening shrimp resilience, modern feed additives help farmers not only improve productivity but also reduce losses, creating a pathway toward more efficient and sustainable aquaculture systems.

Martha Aulia Mamora, Farm Application Manager Aquaculture APAC at Adisseo, tells The Crust that feed additives can be simply defined as substances or products added to feed, either to complement nutritional needs or to serve specific functions, such as improving organ health, strengthening the immune system, or enhancing nutrient absorption efficiency.

The most urgent challenge that feed additives are designed to address is disease outbreaks, which remain a serious threat to shrimp farmers, sometimes wiping out an entire production cycle in just weeks. To mitigate this risk, feed additives strengthen the shrimp’s immune system to improve resistance against pathogens, support vital organs such as the gut and hepatopancreas that are essential for growth and performance, and accelerate recovery after outbreaks to reduce the risk of losing the entire stock.

“By combining these functions, feed additives not only

boost productivity but also safeguard the continuity of production cycles, making shrimp farming more efficient and sustainable,” says Martha.

The development of shrimp feed additives today is increasingly focused on natural and environmentally friendly approaches.

According to Martha, one innovation being advanced is the use of Quorum Sensing Inhibition (QSI) Technology combined with herbal extracts, organic acids, and immunostimulants. This formulation is claimed to stop the germination of EHP spores, accelerate growth recovery, and work through a selective antimicrobial mechanism.

“In other words, this formulation can eliminate and suppress the growth of pathogenic bacteria without disrupting beneficial bacterial populations. This helps maintain gut microbiome diversity while supporting the health of the digestive tract and hepatopancreas,” Martha explains.

Another innovation involves blended organic acid formulations designed specifically to control Vibrio while simultaneously promoting the growth of beneficial bacteria in the shrimp’s digestive system.

“Other products, such as Lipogest, a bile salt (active

ingredient derived from bile acid), have also been developed and specially designed for aquaculture species by Adisseo. It acts as a fat emulsifier and a cholesterol substitute, both of which are essential for shrimp, while also supporting hepatopancreas health,” Martha adds.

The advantage of these modern feed additives lies in the technological touch behind their formulations. For example, QSI Technology is specifically designed to disrupt communication between pathogenic bacteria, thereby minimizing the production of harmful toxins. Other innovations focus on selecting safer and more efficient sources of bile acids. These advancements set modern additives apart from conventional ones, which typically focus only on boosting basic nutrition, without addressing the more complex biological challenges in shrimp farming

From a sustainability perspective, Martha shares that her feed additives are developed under strict standards, from the selection of raw materials to production and distribution. Every stage is closely monitored to ensure there is no use of antibiotics or harmful substances that could leave residues. Some products have even undergone Life Cycle Assessment (LCA) based on field perfor-

mance, demonstrating their contribution to more sustainable aquaculture systems.

“In this way, feed additives not only enhance shrimp health but also support the industry’s shift toward safer and more environmentally friendly practices, while improving farm efficiency,” she says.

She acknowledges that using feed additives adds to production costs. While the price of these products can vary, farmers can adjust their application based on specific needs, target purposes, critical production phases, and current shrimp market prices. She argues that feed additives should no longer be seen merely as an expense, but rather as an investment—one that must yield measurable improvements in farm productivity, with returns carefully evaluated through ROI at the farm level.

Feed additives are expected to continue evolving, moving toward functional feed additives that enable feed mills to develop diets with more specific purposes, whether for health, digestion, or growth promotion—while aligning with advances in genetic lines.

According to Martha, her company is consistently developing products based on natural ingredients, packaged with the latest biotechnolo-

Martha Aulia Mamora

gy, yet always tailored to the realities and developments in the farming sector. “Feed additives, by nature, are supportive and additional. Their role is to help the feed industry optimize feed quality in terms of FCR and growth, while also serving as one of the solutions that can work in synergy with farming activities to boost pond productivity and reduce the ever-present risk of disease,” she explains.

Beyond their functional role, feed additives are also increasingly viewed as alternatives to antibiotics, which are no longer permitted in aquaculture due to food safety concerns and the global issue of antimicrobial resistance (AMR). While antibiotics may appear to deliver quicker results than natural antimicrobials, the long-term consequences are far more damaging.

“By eliminating antibiotics, we are allowing shrimp to naturally build their own defense systems. The use of phytobiotics, as contained in feed additives, can stimulate the shrimp’s immune response, enhancing their resilience against pathogens and enabling them to react more quickly to infection threats. In addition, maintaining gut microbiome diversity improves intestinal health, which in turn optimizes digestion and nutrient absorption while minimizing organic waste,” Martha concludes.

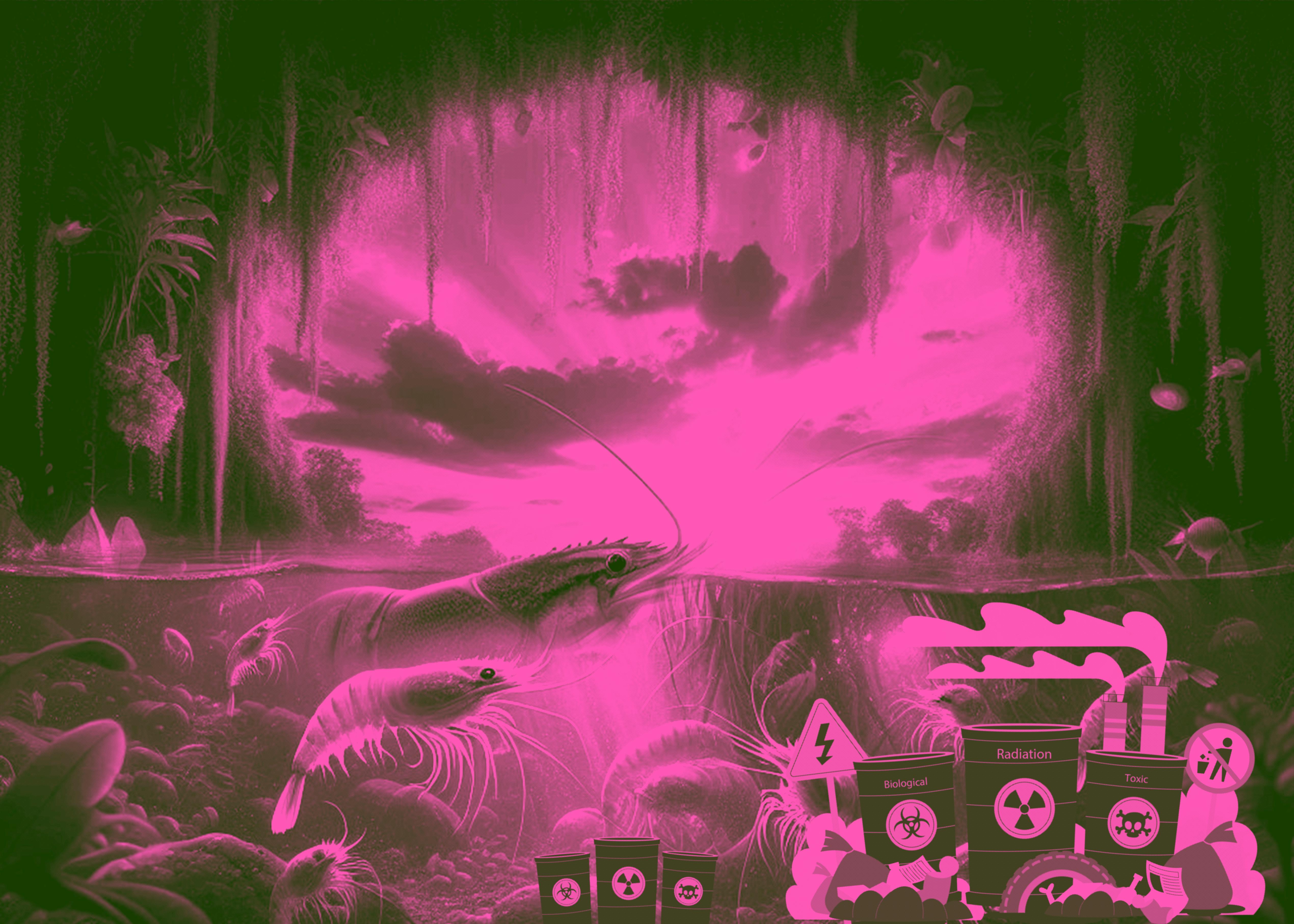

The recent radioactive shrimp scare has understandably worried consumers and farmers alike. With reports citing 68 Bq/ kg of detected activity, many are asking whether this is dangerous. The truth is, natural radioactivity is all around us — and even in the foods we eat every day.

Here are specific foods that naturally contain more radioactivity than the shrimp in question — mostly due to potassium-40 (40K) or other naturally occurring radionuclides:

1. Shrimp – 68 Bq/kg, isolated case and not a normal value for farmed shrimp.

2. Brazil Nuts – Among the highest, with up to 400 Bq/kg from radium isotopes absorbed from deep soil.

3. Bananas – About 80–120 Bq/kg from 40K — the source of the famous “banana equivalent dose.”

4. Potatoes – A major dietary contributor of 40K, often >100 Bq/kg

5. Kidney Beans – Reported at 250–350 Bq/kg from 40K

6. Lentils – Very potassium-rich, can reach 500–600 Bq/ kg.

7. Carrots – Often measure ~100–150 Bq/kg

8. Spinach – Dark leafy greens are high in minerals,

usually ~200 Bq/kg

9. Wild Mushrooms (e.g., Boletus, Chanterelles) –Typically 100–300 Bq/kg, sometimes higher if growing in cesium-rich soils.

10. Beef – Muscle tissue contains 40K, commonly 100 Bq/ kg

11. Pork – Similar to beef, typically 90–120 Bq/kg.

12. Chicken – Slightly lower than red meat, still ~70–90 Bq/ kg

13. Salmon – Fatty fish can measure 100 Bq/kg (40K and small 210Po contributions).

14. Milk – Naturally contains 40K, usually ~40–80 Bq/kg, with higher values in cheese.

This shrimp case is an isolated incident, and its level is still far below anything dangerous. Radioactivity is a natural part of many foods we eat every day — so enjoy your meals, eat a balanced diet, and stay healthy.

My secret to joy in life is in finding balance Balance in family, sweating, and making decisions