The Superyacht Report

OWNERS FOCUS

Editor-in-chief Martin H. Redmayne says that after an unprecedented year for incidents involving superyachts, owners might choose different times of the year to go cruising or explore remote locations.

Ihave labelled myself @superyachtobserver on Instagram – because I suppose it’s what I do. It’s like being a yacht spotter albeit with a bit more knowledge or understanding of what is really happening in the market. But as an observer of superyachts for the past 35-plus years, with some time on board prior to this, I’ve never witnessed such an eventful year when it comes to dramatic weather and superyacht incidents, especially in the Mediterranean.

Fires on board, in shipyards and in marinas, vessels hitting rocks, beachings and groundings, big yacht collisions, bumps in marinas and, of course, significant sinkings have all made the headlines, the social-media pages and been the subject of many expert debates and much amateur speculation.

Many of these incidents have been caused by significant weather systems, ranging from excessive heat in lazarettes that may have led to overheating poorly stored batteries all the way to significant storms that have blown up in Formentera, Ibiza and Greece – and obviously the most recent devastating one in Sicily.

BY MARTIN H. REDMAYNE

When we add into the mix the variety of groundings and navigational incidents that seem to have been relatively commonplace, and where weather wasn’t involved, we have to ask ourselves what’s happening out there because with all the mini disasters, major catastrophes and insurance nightmares, you can expect that owners, potential owners and charter clients will start to ask questions.

If we look at the variety of accidents and disasters, and perhaps focus on the most high-profile event in Sicily, we have to consider some facts and figures. Every year we build several hundred superyachts over 24 metres, many of which are destined for Mediterranean cruising, with safety and integrity at the

fundamental of design and engineering. We hire, train and employ tens of thousands of crewmembers who have been through a series of mandatory training programmes to ensure they should know what they are doing when things go wrong. We have insurance policies, surveyors, yacht managers and regulators who work together to ensure that yachts are operating safely and securely in open waters. We have navigational instruments, sonars, weather routing and reporting that are typically installed on the vast majority of superyachts in order to plan the best cruising pattern and conditions.

However, if there’s a submerged rock or shifting sand bar that hasn’t been correctly mapped or updated. and if a storm blows up within minutes due to moisture-filled skies, winds and warmer than typical water temperature – these are some of the unexpected factors that cause chaos for anyone at sea.

Nature is more powerful than anyone can design or build for, and climate change has without doubt impacted the shifting sands and weather systems that we’ve witnessed over the past few years in the Med and maybe, just maybe, seamanship and real ocean experience may not be what it used to be.

Based on the facts that will come out of the various incident investigations, there will be some major recommendations and updates to rules, regulations and training curriculum, this we can be sure of, but we may also see owners and their guests choose different times of the year to go cruising or explore unique locations, when the weather systems are less unpredictable or more stable. Greece in October is absolutely beautiful, and Formentera in May is stunning … and, just saying, without the crowds of tourists. MHR

What are the multi-million-dollar questions prospective owners should be asking?

Nic Arnold, UK head of JTC Private Office, lists the priorities that should be considered by anyone before they enter the realm of yacht ownership.

Why the yacht survey report is essential reading

Richard Franklin, managing partner of Yacht Survey Partners, explains the importance of engaging with your surveyor before purchase.

Creating the custom culture

Richard Orme, founder of The Superyacht Mentor, on why reputation matters … and that the responsibility for this starts at the very top.

Optimising yacht ownership through lending

Adina Bates, head of yacht finance, and Nicolas Feit, CEO of Société Générale Private Banking Monaco, on how well-structured lending can be part of a pragmatic ownership strategy.

A challenging future for the once discreet fleet

Christophe Bourillon, CEO of the Professional Yachting Association, explains how owners can adapt to recruit top crew … and meet sustainability demands.

Eco-friendly expenditure … It all figures out

Hanna Dąbrowska, technical director of Water Revolution Foundation, explores the intersection of environmental considerations and yacht ownership costs.

We dissect the American superyacht market, its current economic trends and the latest wealth data to determine the health of the market across the Atlantic.

A fraction of the problems

Tapping into the real potential of shared ownership models in order to draw more UHNWIs into yachting.

We explore whether an 80-metre superyacht, together with a support sister ship or shadow boat, delivers a better ownership experience than a 100-metre-plus project.

Is this new charter concept the future of yachting? 57

The new Pastrovich X-PAGODA taps into a potential market that our industry has often struggled to attract.

A new name to add to the spec list 74 F/Yachting has arrived to change the superyacht interiors landscape, with a clear objective as an innovator, game-changer and partner.

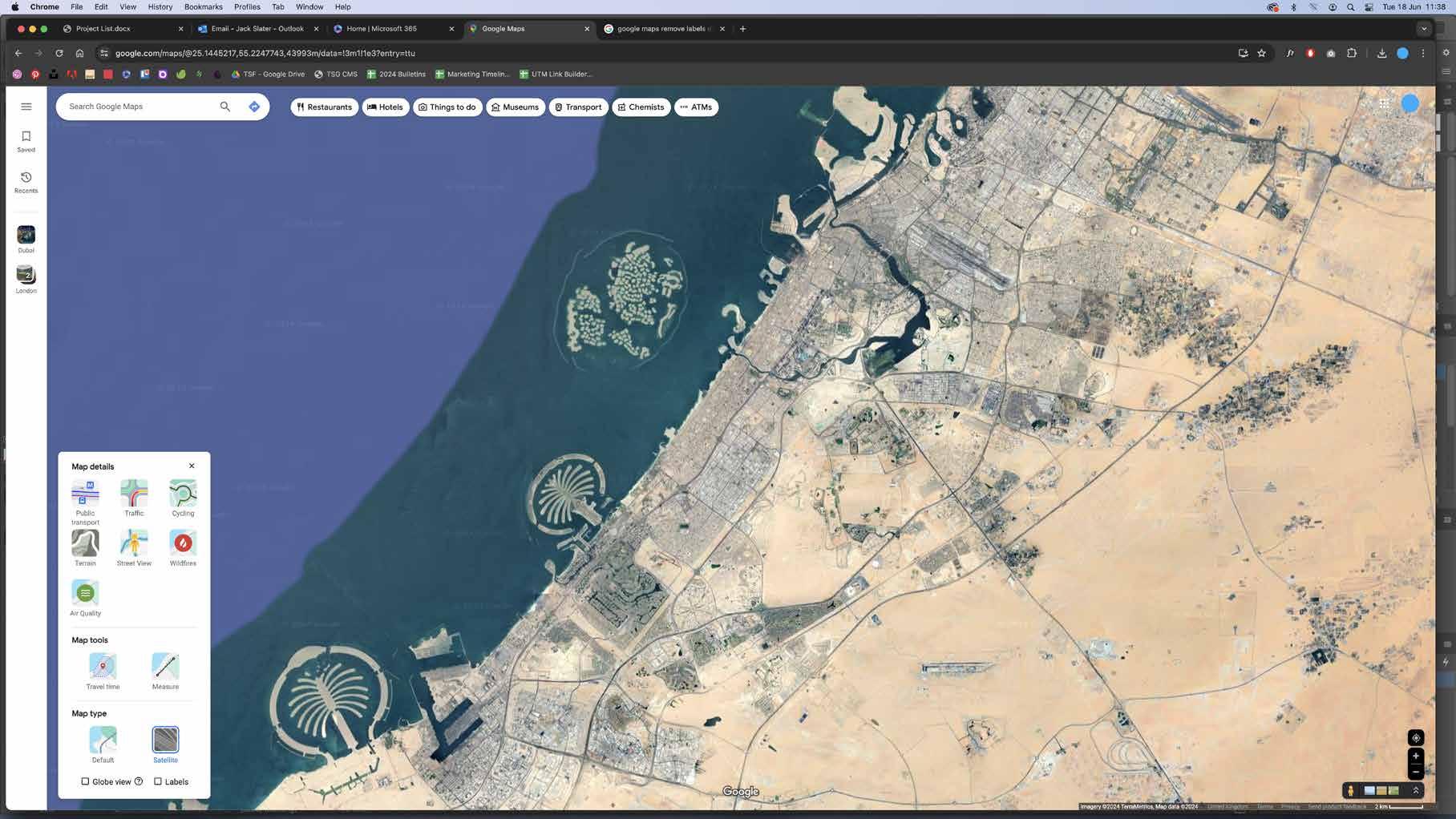

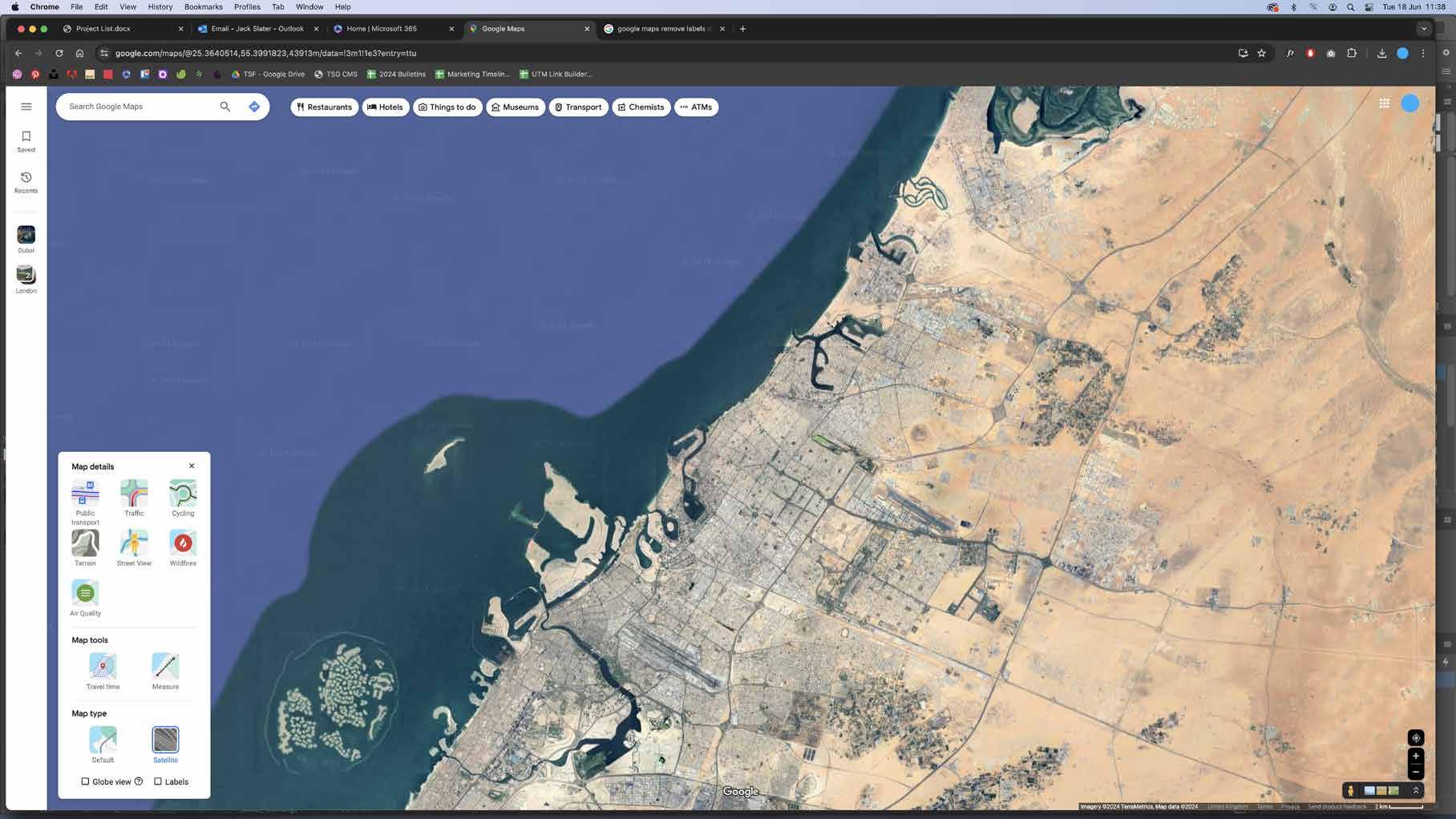

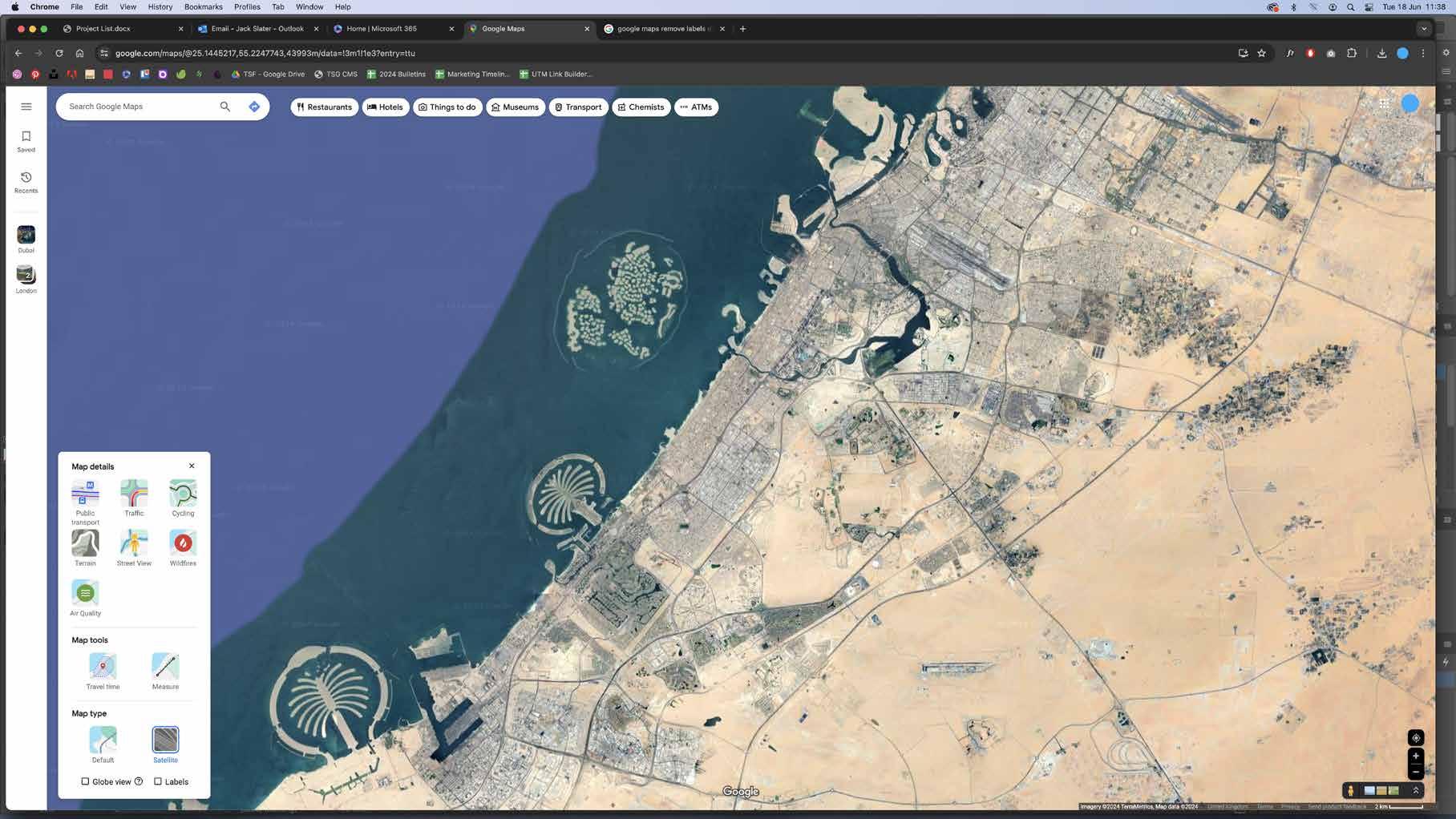

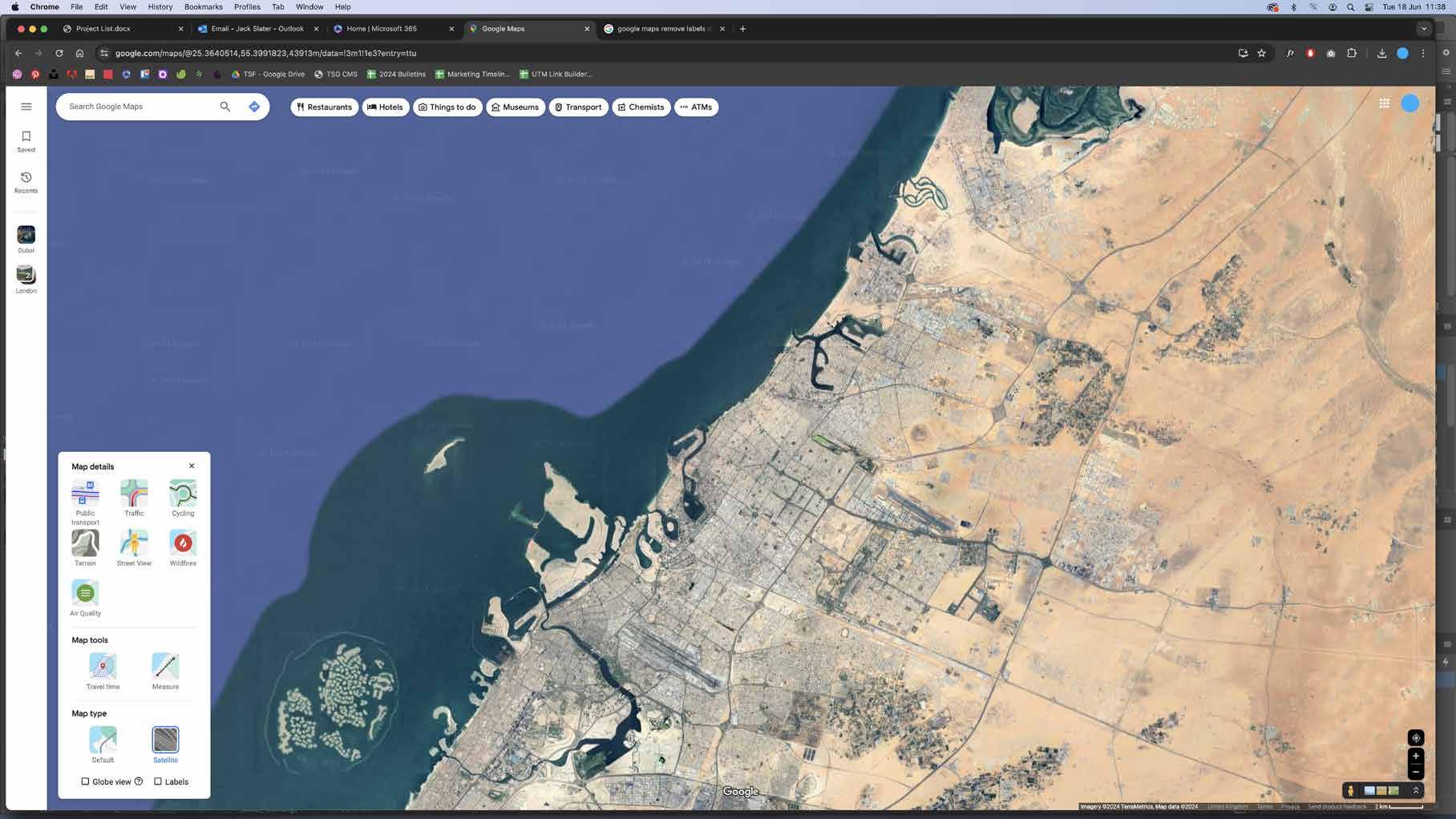

The development of major marina assets over the next 10 years in the Red Sea will extend the traditional cruising itinerary.

We didn’t start the fire … but are we fanning the flames?

CEO SURVEY

After a spate of highly publicised fires, both on board yachts and in shipyards, is the industry currently doing enough to take a more proactive stance and make the necessary improvements before the next disaster forces the issue?

Percentage increase of operating costs and raw material prices increased in the past two years

64

The big CEO survey 83 Market leaders in the superyacht industry reveal their current thinking as well as their ambitions for the next few years.

Sustainability: Why owners should choose, not snooze 99

How incorporating more eco-friendly practices can benefit owners and guests while not negatively affecting their on-board experience.

"Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum."

"Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum."

"Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in

QUARTER 3/2024

For more than 30 years The Superyacht Report has prided itself on being the superyacht market’s most reliable source of data, information, analysis and expert commentary. Our team of analysts, journalists and external contributors remains unrivalled and we firmly believe that we are the only legitimate source of objective and honest reportage. As the industry continues to grow and evolve, we are forthright in our determination to continue being the market’s most profound business-critical source of information.

Editor-In-Chief

Martin H. Redmayne martin@thesuperyachtgroup.com

News Editor

Conor Feasey conor@thesuperyachtgroup.com

Sustainability Editor

Megan Hickling megan@thesuperyachtgroup.com

Guest Authors

Nic Arnold

Adina Bates

Christophe Bourillon

Hanna Dąbrowska

Nicolas Feit

Richard Franklin

Richard Orme

Dan Robsham

Michelle van der Merwe

COMMERCIAL

Head of Commercial

Eliott Simcock eliott@thesuperyachtgroup.com

Group Account Director

Luciano Aglioni luciano@thesuperyachtgroup.com

Head of Intelligence

Charlotte Gipson charlotteg@thesuperyachtgroup.com

Research Analyst

Isla Painter isla@thesuperyachtgroup.com

Senior Research Analyst

Amanda Rogers amanda@thesuperyachtgroup.com

Data Analyst

Miles Warden

miles@thesuperyachtgroup.com

DESIGN & PRODUCTION

Content Manager & Production Editor

Felicity Salmon

felicity@thesuperyachtgroup.com

Front cover: The new Amels 80m in an advanced stage of construction at the Vlissingen facility, due for delivery in 2025.

Photo credit: Damen Yachting.

ISSN 2046-4983

The Superyacht Report is published by TRP Magazines Ltd (trading as The Superyacht Group) Copyright © TRP Magazines Ltd 2024 All Rights Reserved. The entire contents are protected by copyright Great Britain and by the Universal Copyright convention. Material may be reproduced with prior arrangement and with due acknowledgement to TRP Magazines Ltd. Great care has been taken throughout the magazine to be accurate, but the publisher cannot accept any responsibility for any errors or omissions which may occur.

The Superyacht Report is printed sustainably in the UK on a FSC® certified paper from responsible sources using vegetable-based inks. The printers of The Superyacht Report are a zero to landfill company with FSC® chain of custody and an ISO 14001 certified environmental management system.

SuperyachtNews

Spanning every sector of the superyacht sphere, our news portal is the industry’s only source of independent, thoroughly researched journalism. Our team of globally respected editors and analysts engage with key decision-makers in every sector to ensure our readers get the most reliable and accurate business-critical news and market analysis.

Superyachtnews.com

TheSuperyachtReport

The Superyacht Report is published four times a year, providing decision-makers and influencers with the most relevant, insightful and respected journalism and market analysis available in our industry today.

Superyachtnews.com/reports/thesuperyachtreport

TheSuperyachtAgency

Drawing on the unparalleled depth of knowledge and experience within The Superyacht Group, The Superyacht Agency’s team of brilliant creatives, analysts, event planners, digital experts and marketing consultants combine four cornerstones – Intelligence, Strategy, Creative and Events – to deliver the most effective insights, campaigns and strategies for our clients.

www.thesuperyachtagency.com

Follow The Superyacht Group channels on LinkedIn

@thesuperyachtgroup

@thesuperyachtgroup @superyachtobserver @superyachtagency

Join The Superyacht Group Community

By investing in and joining our inclusive community, we can work together to transform and improve our industry. Included in our Essential Membership is a subscription to The Superyacht Report, access to SuperyachtIntel and access to high-impact journalism on SuperyachtNews.

Explore our membership options here: www.superyachtnews.com/shop/p/MH

With over 25 years of experience, we have overseen more than 150 successful new-build and refit projects in all major international yacht locations. Trust us for state-of-theart materials, cutting-edge technology and unparalleled expertise. Guarantee a flawless finish with WREDE Consulting.

With a presidential election looming, we dissect the American superyacht market, its current economic trends and the latest wealth data to determine the health of the market across the Atlantic.

BY CONOR FEASEY

As the old adage goes, ‘If you can’t beat them, join them’. In yachting, however, it might be more fitting to say, ‘If you can’t build one, buy one’. With US shipyards struggling to keep pace with their European counterparts, American ultra-high-net-worth individuals (UHNIs) have shifted their focus to Europe – not to compete but to invest in the best. And without their influence, the landscape of our industry would be unrecognisably different.

The United States has long been a cornerstone of the global superyacht market, a trend that has only intensified in recent years. North America continues to hold the title of the world’s largest wealth sector, with the UHNW population in the region expanding by 11.9 per cent in 2023 to 161,280, according to Wealth-X World Ultra Wealth Report 2024

This growth outpaced gains in Europe and Asia, increasing North America’s share of the global ultra-wealthy demographic to 38 per cent. Collective net worth in the region also surged by 11.7 per cent to $18.6 trillion, bolstered by a surprisingly resilient US economy and double-digit equity returns, particularly from the so-called ‘magnificent seven’ mega-cap technology stocks.

Simply put, the American superyacht market has always been the largest and remains a significant source of owners and guests, but the upcoming US election presents a new wave of uncertainty. Furthermore, shifts in global wealth, geopolitical tensions and other potential political changes may reshape the industry in the coming years. So what does the changing economic landscape and the prospect of revitalised leadership mean for the US sector?

Within this context, Miami has emerged as a prominent financial hub – it’s not all Hawaiian shirts and Tom

Selleck-esque moustaches, but a place where deals are done. The city now ranks 24th on the Global Financial Centres Index and seventh among North American cities, and its rise as a financial centre has been driven by an influx of hedge funds, private-equity firms and international banks, drawn by Florida’s favourable economic environment compared to traditional financial centres such as New York and California.

“During Covid, there was a noticeable migration of businesses from other states to Florida, driven by a combination of factors,” explains Erin Ackor, partner at Miami-based law firm Moore & Co and president of the International Superyacht Society. “One significant reason, in my view, is political. Florida is run by a Republican governor, which led to policies that were quite different from those in states governed by Democrats.

“For instance, New York took a very strict approach to lockdowns, which led many people to reach a point where they felt enough was enough. In contrast, Florida’s approach was much less restrictive. Businesses and individuals were attracted to Florida because children were back in school within six months, and people were allowed to be outside, unlike in some states where even outdoor activities were heavily restricted.”

There’s also a sizeable tax difference between states. Some have a state income tax, while Florida does not. This creates a very favourable business environment because not having to pay state income tax can save businesses a substantial amount of money. In New York, for example, businesses face not just state income tax, but also local and county taxes.

“People realised they could save eight to 10 per cent by moving to states like Florida,” adds Ackor. “It wasn’t just

Following the Russian invasion of Ukraine, the resulting sanctions have effectively removed Russian UHNWIs from the majority of the industry – leaving a significant gap that North American buyers have been quick to fill.

Florida, though. A lot of companies also moved to Texas, Tennessee and other Republican-run states with zero state income tax. Miami, in particular, is very vibrant with a diverse mix of people, includingmanywealthyindividualswith the resources to buy yachts. The favourable tax environment combined with the beautiful surroundings makes it not just a place to do business, but also a desirable lifestyle.”

In light of this burgeoning financial prominence of Florida, our industry is poised to benefit, particularly as the beating heart of the superyacht industry lies but a train ride away from Miami. Often hailed as the ‘Yachting Capital of the World’, Fort Lauderdale’s renowned yachting infrastructure, combined with the wealth influx into Miami, presents sizable prospects for the industry.

“The US is an incredibly important market. It’s a crazy market, particularly at the moment,” says Jonathan Beckett, CEO at Burgess Yachts. The brokerage recently opened a new office in Miami’s Brickell area, also known as Wall Street South, in a bid to seize opportunities for new and existing owners in the region. The firm’s move to the city’s financial district to set up shop in a building that also houses tenants such as JPMorganChase and Boston Consulting Group follows the relocation of several hedge funds and tech companies.

“Ofcourse,thereisabitoftrepidation in the US at the moment regarding the election, which happens every time,” adds Beckett. “But that will be relatively short-lived and once the election is over, themarketwillmoveagain.Whenyou’ve been in the business for a long time, you simply factor [in] instances like this.”

Robb Maass, attorney at Alley, Maass, Rogers & Lindsay, adds, “Jonathan sees strengthintheUSmarketfromapersonal perspective. I think he’s refocused Burgess, not by moving away from Europe but by putting more resources and attention on the US market, which is just logical. We are an extremely wealthy country, not just in terms of average wealth, but also in terms of the individuals who have the resources to buylargeyachtsandareinclinedtodoso. There’s a lot of wealth in other countries

Data gathered from Wealth X, an Altrata company.

Note: Planes/jets and yachts worth a minimum of US$5M. Ownershop of jets can be either full or fractional. The data represents the whole UHNW population, taking into account luxury asset ownership and the size of each cohort.

Source: Wealth-X, an Altrata company, 2023.

but people aren’t necessarily as prone to buying large yachts as we are, and that’s something more and more businesses are starting to recognise.”

Miami not only holds significant concentrations of wealth, but also serves as a cultural luxury epicentre, where it’s more a way of life than a commodity. For brokers, this concentration of affluence presents a golden opportunity, and in a market where relationships are paramount, understanding the geographic and cultural nuances of wealthy enclaves is vital.

Over the years, the distribution of UHNWIs has shifted significantly across the globe. In 2005, Europe was the dominant region, housing the largest proportion of the world’s wealthiest people. However, by 2023, North America had gradually overtaken Europe and is expected to solidify its position as the primary hub for UHNWIs by 2028. The region is currently maintaining its lead, with the number nearly doubling from 81,700 in 2017 to a projected 161,280 this year. This substantial increase points to a favourable economic environment, particularly during the Trump administration, where economic policies significantly benefited the ultrawealthy, leading to accelerated wealth accumulation.

Asia has also been on a rapid upward trajectory. Although Asia’s share of the global UHNW population was relatively modest in 2005, it grew significantly by 2023. Projections for 2028 suggest that Asia will see wealth concentration levels similar to North America’s. Asia’s UHNW population is also expected to climb from 59,900 in 2017 to 110,600 this year.

On the other hand, Europe is experiencing a relative decline. Although it remains an important market, the region’s share of the world’s ultrawealthy is shrinking by comparison. Europe is expected to grow from 64,400 UHNWIs in 2017 to 111,500 this year, reflecting a stable, albeit slower, economic expansion compared to North America and Asia.

The broader geopolitical landscape has further tilted in favour of the American market following the Russian invasion of Ukraine. The resulting sanc-

tions have effectively removed Russian UHNWIs from the majority of the industry – leaving a significant gap that North American buyers have been quick to fill. The exodus of Russian superyacht owners has also led to their share taking up 8.1 per cent, down from 9.1 per cent last year. As a result, Russian ownership has not only decreased but the nation’s influence in the global superyacht market has also waned, further enhancing the US’s dominant position.

Wealth-X data confirms that this shift has bolstered the US market. This reallocation of wealth presents both opportunities and challenges for the industry. On the one hand, American buyers are stepping up to fill the void left by Russian clients, continuing to drive demand. On the other, brokers must grow and understand a slightly new landscape, where both traditional market dynamics have shifted and expectations of buyers have evolved. Understanding these nuances will be key to capturing the emerging opportunities in an already competitive market.

“The market has changed dramatically, and global wealth has increased significantly, says Maass. “This trend is expected to continue, with wealth continuing to rise worldwide. However, it doesn’t follow a straightforward upward trajectory, it’s more like a roller coaster, with peaks and valleys. But overall, the trend remains upward, and that translates to more people being in a position to purchase large yachts.”

Some in the industry have been more affected than others. Beckett explains that the loss of that demographic landed a weighty blow to Burgess, with the company losing 20 to 25 per cent of its clients seemingly overnight. “It’s about working harder in those markets,” says Beckett. “But this is one of the reasons I’ve gone to America: to rally the troops and perhaps recruit more people committed to making a real impact over here. The harder you work in the marketplace, the more success you have.

“As a broker, understanding the nuances of different cultures and people is key. For instance, Americans tend to

YOUR YACHT DESIGNED, ENGINEERED, CRAFTED. YOUR WORLD

A unique shipyard is defined as a shipyard to make at least one delivery in that calendar year.

Cumulative number of annual deliveries of the four most prominent US shipyards since 2000

In terms of the US fleet delivered since 2000, Palmer Johnson Yachts and Trinity Yachts have been dominant players. However, it should be noted that both builders ceased operation in 2016.

Westport continues to be the main contributor to the US fleet, delivering an average of five yachts a year since the turn of the century. Unique US shipyards

be more enthusiastic about doing deals. They typically have more of a hunger and an appetite for closing a deal, and like credit. Europeans, on the other hand, are more cautious when approaching a deal and also tend to shy away from financing a yacht.”

Therefore, in tandem with the highest number of UHNWIs, it will come as no surprise that the US leads in ownership too, with 23.6 per cent of the world’s superyacht owners residing in the US as of 2023, an increase of 0.6 per cent from the previous year. The country’s preference for larger vessels is also on show, with an average length of 54 metres.

However, the prominence of American owners hasn’t translated into a thriving domestic new-build industry. The 1990s and early 2000s were periods of growth for superyacht shipyards in the US, with builders such as Westport, Christensen, Palmer Johnson and Trinity Yachts at the forefront, delivering some of the world’s largest and most highly acclaimed boats. But by 2008, the industry had hit the peak of its golden age before experiencing a sharp decline, largely due to the global financial crisis.

There was also a significant shift in the euro-dollar exchange rate, which at one point was close to 1.6. It’s now around 1.12 but back then, European builds were much more expensive for Americans, giving US builders a price advantage that’s since disappeared. That shift completely changed the market. “The American market at the moment is the European market when it comes to new yacht construction. More and more Americans are entering contracts to build boats in Europe,” says Maass.

“It’s much less of an Americandominated world in this industry now. We have very few yards still building

large yachts, although we do have a lot of production builders. In terms of the number of boats built, if you include everything from bass boats to superyachts, we’re still number one in the world, but when it comes to large yachts, we’re just a fraction of what we used to be.”

Unlike other sectors that rebounded a few years after the financial downturn, the US new-build sector has struggled to return to its former production levels, with signs of recovery still elusive, according to Superyacht Intelligence data. By 2016, both Palmer Johnson and Trinity Yachts had ceased operations, and Christensen’s output had significantly diminished. The high costs of launching equipment and the geographic challenges of American shipbuilding further compounded the industry’s decline, leaving US shipyards struggling to compete with their European counterparts.

The decline of American shipbuilding aligns closely with broader deindustrialisation trends seen across the US. Since the mid-1990s, shipbuilding in the US has diminished exponentially, which has directly affected the superyacht industry and is vividly illustrated by the slump in deliveries and the number of active US shipyards. In 2008, at the peak of the market, US shipyards delivered 34 superyachts with a total length of more than 1,368 metres. However, by 2023, this number had plummeted to just two deliveries, with a combined length of only 76 metres.

The drop in the number of active shipyards from 16 in 2001 to just one as of 2021 poignantly hits home the dramatic contraction of the industry. While Delta Marine continued to make a small number of deliveries until 2020, it hasn’t built a boat since, although it

Robb Maass, attorney, Alley, Mass, Rogers & Lindsay.

“I think American manufacturers could easily bring in some European talent but it’s very difficult to establish a new yard capable of building boats to the same quality you see in Europe overnight.”

is predicted to deliver a 44-metre yacht in 2025. Westport continues to be the major US shipyard, although production has slowed, producing an average of five yachts a year since the turn of the century.

This trend is exacerbated by the lack of subsidies and supportive economic policies in the US, making it difficult for domestic shipbuilders to compete on a global scale. Some countries continue to invest in their emerging industries through targeted initiatives. For example, the UK government has launched a new financing plan to support domestic shipbuilding, including yacht and superyacht yards. The Shipbuilding Credit Guarantee Scheme (SCGS) is a key component of this effort, where the government acts as a guarantor for up to 80 per cent of a shipping loan.

The US government has failed to provide similar levels of support. The Jones Act further complicates matters by adding costs to US-built yachts, requiring goods transported between US ports to be carried on American-built, Americanowned and American-operated vessels. This legislation has increased the cost of transporting yachts within the US, making domestic shipbuilding less competitive.

“Now [that] European boats are less expensive relative to American-built ones, the decision of where you’re going to build your yacht tends to be an easy one,” says Maass. “If the euro rises, that could change, and we might see growth in the domestic market in America again. But it’s unclear if that will happen. Once these yards go under or are repurposed, it would take a lot to regenerate that manufacturing capacity.

“It also would take a prolonged period of higher euro rates to make a significant difference, but I don’t see that happening any time soon. In a world that’s increasingly volatile, the

dollar remains the refuge currency. In fact, there’s more US cash, particularly hundred-dollar bills, in circulation outside the US than within it. Under these conditions, it’s unlikely we’ll see a radical shift in exchange rates.”

There’s also a prevailing belief among some owners that European-built yachts are of superior quality, which has diverted attention away from USbuilt vessels. This perception is then reinforced by economic factors such as the exchange rate between the euro and the dollar, making European yachts more financially attractive to potential buyers. Changes in the tax code, particularly those affecting income and luxury taxes, can also deter potential superyacht owners. Moreover, tariffs on imports to the US increase the cost of materials, pushing up the final price of a vessel and making US-built yachts less competitive. Maass vividly recalls a conversation he had with Paolo Vitelli, founder of Azimut Yachts, more than 30 years ago, just after he acquired Benetti. “He said that his dream, when starting out, was to build more yachts than Broward.” A dream that he has no doubt since achieved.

Maass adds, “US builders have had to fight the perception that European yachts are of a higher quality. Once that perception exists, it takes a long time to dispel, and right now, it’s not particularly relevant because there aren’t many US manufacturers prepared to compete with European builders. I don’t want to say there aren’t any. For example, Delta is still building and they produce very high-quality boats.

“It will be difficult fort he US builders to come back. One of the problems is that when you have such a significant drop in capacity, your skilled labour goes off into other industries. The knowledge and experience gained from working in a shipyard for 30 years is something you can’t just replicate instantly.”

Leading provider of luxury outfitting for yachts, hotels, private aircrafts and homes.

We offer a complete customer experience with historical purchase information, billing and quotations. Enabling a simple reorder process and removing the need for multiple suppliers.

Reduce shipping costs by benefitting from our courier discounts. Pay lower prices utilising our bulk ordering buying power.

We can arrange storage and ship whenever it is convenient for you.

Our interior designers will help you with all aspects of a project. From reviewing the finer details to implementing a major refit. Our graphic designers will assist with branding, logos and supporting artwork.

Backed by 20 years of experience in the yachting industry, we have the best brands, equipment and expertise available to deliver results for our clients.

European builders have been doing well for decades, working with subcontractors and suppliers who have also been in the industry for a long time. You can’t just snap your fingers and recreate that. While importing talent from abroad could be a solution to boost the domestic market in the US, it’s not a straightforward option.

“For instance, I know that some Chinese builders have brought in nonChinese middle-management types to assist with production, which is crucial because they oversee the younger labour force, and their supervision is probably the most important factor,” says Maass. “I think American manufacturers could easily bring in some European talent but, again, it’s very difficult to establish a new yard capable of building boats to the same quality you see in Europe overnight.”

Although the current state of the American new-build sector remains bleak, there are ways for the industry to reverse the decline. The simplest step is to communicate and show the market the quality of vessels that American builders produce. But to truly revitalise the industry, stakeholders need to take collective action and advocate for legislative changes that will support the sector to make it happen – and with the US election looming, that opportunity could be on the horizon.

The upcoming election adds an extra layer of complexity to the fabric of the American market. Initially, many around the world anticipated a return of Donald Trump’s presidency because the polls seemed to favour the former businessman over current President Joe Biden. However, with Kamala Harris now the Democratic candidate following Biden’s decision to step down, the landscape has dramatically shifted.

“What I’m observing in my practice is a definite slowdown as we approach the election,” says Ackor. “Now there are likely several reasons for this. The wars in Europe, particularly the conflict between Ukraine and Russia, and the situation in the Middle East with Israel, are certainly not helping. These events are understandably unsettling. Then the uncertainty surrounding our political landscape and the upcoming elections is contributing to this slowdown.

“When Trump was leading by a significant margin, things seemed to stabilise somewhat. But now, with so much uncertainty, people are holding off. It’s very clear to me that transactions have slowed but I don’t think it’s because people lack the money. It’s more that they want to see what’s going to happen.”

The economic policies of Trump’s presidency had notable effects on the wealth of the industry’s primary clientele, which in turn influenced the superyacht market. Post-election, the US economy experienced a surge in business confidence due to expectations of favourable economic policies under the Trump administration, with the Dow Jones Industrial Average rising by 4.2 per cent in just two months after his inauguration.

A key piece of legislation from his tenure was the Tax Cuts and Jobs Act of 2017, which lowered the corporate tax rate from 35 per cent to 21 per cent. This was intended to stimulate economic growth by increasing corporate profits and encouraging investment. However, it’s important to note that while these tax cuts did benefit the wealthiest individuals, the broader impact on the economy was more modest.

In terms of what this meant for the superyacht industry, this policy not only boosted corporate profits, but also

“While I think Trump has been a disaster for America, damaging our international reputation and lowering our standing in the world, from a yachting perspective, he likely represents a better outcome in the election than Harris would.”

led to increased stock buybacks, further elevating share prices across the US. It meant that many potential buyers –who are, more often than not, business owners or major shareholders – saw a significant rise in their wealth, thereby enhancing their ability to invest in, and purchase, assets such as yachts.

There’s also a whole sector of young people involved in the cryptocurrency environment. Trump is, if not very procryptocurrency, at least supportive of it and is also pro-deregulation, which contrasts with the Biden-Harris administration which is much more focused on regulation. We could speculate that a Harris administration could still support a new era of superyacht buyers but marked by increased environmental consciousness. However, the potential for tax reforms and heightened economic uncertainties is more likely to lead initially to a more conservative approach to spending, affecting how and when UHNWIs decide to invest in the industry.

people are in a holding pattern. I have many clients with boats for sale and nobody is buying all of a sudden. This seems to have started in the last two or three months. There was also a bit of a blip when Trump’s poll numbers shot up and people thought he was going to win.

“Things seemed to normalise for a while and we started seeing more transactional deals come through. But now, everything has stopped again. When times are great, we have a busy transactional department, and similarly, when times are tough, we have a booming litigation practice.” And the latter seems to be the case at present, she says.

There are also fears of what it would mean for the supply chain and the wider industry in the US if Harris was to hike taxes. “I would be concerned that businesses that feed into the industry would be hit very hard by tax increases,” says Ackor. “With increased taxes and regulation, it becomes really difficult to sustain a small business. The superyacht industry feeds into so many livelihoods, and that’s one of our biggest strengths. The economic impact we have on communities, especially in South Florida, is massive, with so many people working in the industry. If these small businesses are taxed more heavily, it would be a real challenge.”

For Ackor, more regulation and higher taxes won’t help the situation. In terms of what she sees in her practice, from a purely economic standpoint, a Trump administration would likely lead to greater stability, a more vibrant economy and more opportunities for people, and with a booming industry there’s more opportunity to innovate and solve issues that the industry faces in other areas.

“We don't know what Harris is planning policy-wise,” says Ackor. “It’s interesting because, in my opinion,

“If Trump gets elected again, I think we’ll see a boom. When people see the economy stabilising, it gives confidence to the markets, and that’s where you see the superyacht industry flourishing.”

Ackor adds, “If Trump gets elected again, I think we’ll see more of an economic boom. When people see the economy stabilising, it gives confidence to the markets, and that’s where you see the superyacht industry flourishing. There’s more money being made. The superyacht industry as a whole provides significant economic support to so many, and it’s important that we take this into consideration.”

Maass reluctantly agrees, but only up to a point. “I have mixed feelings about this because while I think Trump has been a disaster for America, damaging our international reputation and lowering our standing in the world, from a yachting perspective, he likely represents a better outcome in the election than Harris would.

“However, even though this is my business and my industry, I believe there are other reasons why we should be considering someone other than Trump. It’s not all about the wallet. There are intrinsic values that are extremely important. I don’t believe in people voting solely based on their financial interests.”

Erin Ackor, partner, Moore & Co and president, International Superyacht Society.

Worldwide economic factors have a part to play too. Recent stock-market activity witnessed severe fluctuations, which could be a cause for concern. In early August this year, global markets experienced a sharp downturn, largely triggered by Japan’s decision to raise interest rates, which led to the unwinding of the yen carry trade – a strategy that investors had relied on for stability. This, combined with disappointing US

jobs market data, which showed much weaker growth in non-farm payrolls than anticipated, spurred fears of an impending recession.

For yachting, this market instability could have several implications. Historically, fluctuations in the stock market have directly impacted the purchasing power and investment behaviour of UHNWIs. Therefore, a prolonged period of market volatility, such as the one we’re currently seeing, could be another reason leading to more conservative spending patterns among these individuals, dampening demand for yachts. The full impact will depend on whether these recent market disturbances mark the beginning of a longer-term trend or if they are primarily driven by short-term factors.

“So far, however, at least for us, it really hasn’t had much of an effect. We’ve been involved in a number of very large new builds this year. But what I’ve always said is that buying a boat isn’t necessarily about money,” says Maass. “There’s always money out there. There’s a tremendous amount of wealth in the world, and a lot of it is still untapped when it comes to the yacht market. What causes a person to buy isn’t whether they’re able to, but whether they’re in the right frame of mind. It’s more about psychology than ability. In times of volatility or uncertainty, that mindset can change.”

Regardless of the election and economic volatility, Ackor maintains that collaborating across the industry is key, and tackling issues that face our industry directly head on should remain our focus. “Superyacht owners are key, and they’re generally very interested in finding ways to be more environmentally conscious,” she says.

“At the moment, we have a lot of resources and superyacht funding, but that will change over time. The US won’t

Regardless of the election and economic volatility, collaborating across the industry is key, and tackling issues that face our industry directly head on should remain our focus.

always be the leader in yacht ownership. Things shift globally, and there are many owners in places like England, which has a significant yacht ownership population. We’re also looking at emerging markets like China, the Middle East and others. But we need to figure out how to work productively with these markets and promote sustainability together. Yacht owners are leaders and innovators and have the wealth behind them to help us effect change, including developing more sustainable solutions for the future.”

Despite some trepidation, many remain cautiously optimistic. Wealth is expected to continue its upward trajectory and having navigated previous economic storms, the industry is likely to follow suit. As the brokerage sector expands across the US, increasing exposure to the benefits of yachting, the market stands to gain from this momentum. And although current economic and geopolitical factors will continue to contribute to volatility in the market, staying informed and

drawing lessons from past experiences will all but secure the industry’s future in the United States and beyond.

“This year is softer due to the American election, the election in France, the war in Russia and Ukraine, and the Israel-Gaza conflict. The economy in Europe is also a bit shaky. But the US and global brokerage sector is in a good place, though it may not reflect the same highs of the last two exceptional years,” explains Beckett.

Maas concludes, “As the saying goes, ‘It’s the economy, stupid’. If people are confident, they will buy. It’s a matter of psychology. If the world calms down a bit, people will buy more. But if we end up with more regional conflicts, especially in the Middle East, and if the situation in Ukraine continues, those are not good factors. So we have to watch that. However, if you look at things over a longer time horizon, I believe the yachting industry still has a bright future.” CF

All analysis was undertaken by our data and research consultants. We provide bespoke consultancy projects that help clients make informed, data-driven decisions. Scan the QR Code to see examples of our work.

by Nic Arnold

Nic Arnold, UK head of JTC Private Office, lists the priorities that should be considered by anyone before they enter the realm of yacht ownership.

Are there many other assets that have the emotional draw of a yacht? Whether it be a longstanding childhood dream, the prize of many years of hard work or the desire for an oasis away from the prying world, these motivations connect an owner to their yacht in a way that happens with few other assets – bar, perhaps, the business or ventures that have often generated the funds required to buy these expensive pinnacles of wealth.

And here lies the rub. What can be missed when bringing a superyacht into an owner’s life is that while their complexity, financial commitment and propensity for risk is akin to the operation of a business, the level of strategic governance usually applied to running a business is rarely applied to superyacht ownership.

I’m not referring solely to the day-today operation of the yacht which, with an experienced captain and reliable yacht manager, should be perfectly manageable. It’s the bigger picture that often needs factoring into the decisionmaking process before getting into this mad, mad world of yacht ownership. So what questions should a prospective owner be asking themselves?

The questions should not only be considered in terms of the operations of the yacht, but also the complexities of the world through which it will sail and the nuances of the family into which the yacht will arrive.

When it comes to the yacht’s operations and buying or building a yacht, the fundamental question is: ‘Am I asking the right question, of the right person, in the right place, at the right time?’

Prospective owners are busy people with a myriad of other things to focus on and sometimes do not equip themselves with enough initial knowledge to ask the right questions to challenge and hold the people they are dealing with to account in a way that will work for them personally.

Depending on the situation, an owner will be dealing with a wide range of advisers: a yacht broker, ownership structuring corporate service provider, specialist yacht lawyer, corporate lawyer, Flag state representative, specialist VAT and customs tax adviser, personal or family tax adviser, yacht charter broker, yacht manager, the captain, yacht crew employer and consultant, local tax agents and

reporting representatives and yacht insurance broker. If embarking on a yacht build, the owner can add in the shipyard, a yacht build consultant or project manager and naval architect, among others.

That’s quite a list! And I list it to make the point that there’s a lot of information from a lot of people who may cover multiple jurisdictions. Yachting is a bespoke business. Even with a production yacht, the way it’s going to be used and what the owner wants to get out of the experience will be unique to them. There really is no one size fits all and, therefore, owners need to ask themselves how they are going to get what they need out of these advisers and generate a feeling for whether they are being told what the adviser knows just because it’s what they know or that it’s actually the right answer for the owner.

Where to start? A prospective owner should ask themselves if they are buying a yacht capable of only being funded and used by them. Or is their dream to have something bigger that requires chartering to third parties to raise additional funds? Where do they want to enjoy their yacht and how

much of the globe do they expect to visit with it?

These fundamental questions will drive the conversation on the yachting experience the owner will have before even getting to the question of yacht design and functionality. If the owner doesn’t know the answers, they should keep talking and researching, and if they think it will be a combination, they need to understand up front what this looks like as it will materially impact the complexity of their arrangements. Another part of the complexity of owning a yacht is that it moves. This might seem obvious, but it means that an owner needs to look beyond the yacht as to how it will function in the various jurisdictions it will visit and consider the complexities of the world through which it will sail.

Whether choosing a home port, the location for maintenance and refits, cruising grounds or chartering locations, it’s important to ask the question: do I understand the status of my yacht and what this means in any given location? The additional challenge is that rules and attitudes change and so asking

these questions once doesn’t mean they don’t need to be asked again. Many of these questions will relate to taxation and the rules applied by the yacht’s Flag state. In particular with taxation, cross-referencing the answers received from multiple sources will help guard against working with outdated or incorrect information.

One might say that these considerations are relatively technical and manageable and can, to a certain extent, be delegated to trusted advisers within the family office or a family consultant with the right knowledge. However, questioning the impact of bringing a superyacht into family life speaks to the wider values and characteristics of the owner and their family, and one should consider the nuances of the family into which the yacht will arrive.

The ‘burden of wealth’ is a thing and is generating questions around how families interact with their wealth more than ever as the tide of newly generated capital starts to pass to the next generation.

The ‘burden of wealth’ is a thing and is generating questions around how families interact with their wealth more than ever as the tide of newly generated capital starts to pass to the next generation.

Thinking through how the yacht will be used – and who will enjoy it – will help to make it a more sustainable asset within the family. Is the new owner assuming that it will be a popular central meeting place for family holidays and celebrations, whereas the immediate impression of the next generation is that it’s an outdated expression of planet-busting excess? Would bringing the whole family into the upfront decision-making on choosing the yacht enable everyone to come together in a middle ground? Or does the owner have no expectation of anyone using the yacht other than themselves, counter to the assumptions of the rest of the family? Yachts really can bring a family together or create cracks between them.

As a possession of passion, a yacht can represent a heart-breaking asset on the death of a family principal. Does the next generation keep it, along with all the running costs, as a nod to their parent’s legacy? Or is the yacht sold immediately as they never connected to it in the way their parents did? Yachts are becoming assets considered up front in this way alongside the rest of the family’s succession and governance planning.

So, in summary, I haven’t thought to list the questions an owner should ask in order to challenge whether they should have a yacht or not. Deciding to buy a yacht isn’t a particularly logical decision in the first place. I merely seek to raise awareness of the questions that should be asked to ensure that bringing a yacht into an owner’s life is done with as much governance as possible and in a way that works for them personally as the owner. This way the old adage of the second-best day of an owner’s life being the one they got rid of their yacht can be a thing of the past. NA

With an expected dramatic shift in wealth and a generational shift in attitude towards superyachts, it makes sense to tap into the real potential of shared ownership models in order to draw more UHNWIs into yachting.

BY MARTIN H.

Globally, the wealth numbers are consistently increasing and for the past couple of decades we’ve analysed the number of buyers/owners in comparison with the number of potential clients. The conclusion is that we are still only scratching the surface. The usage data also makes interesting reading, where owners and their guests potentially spending only 10 to 20 per cent of the year afloat.

Looking at the evolution of our industry, there’s still a fixation on the billionaire category and the larger yachts in the fleet (above 50 metres), but there’s a very exciting and interesting market between 24 and 40 metres. These are, and always have been, the feeder sectors to the market. Yes, there have been some new UHNWIs jumping straight in at 60 metres-plus but it’s not a constant flow. The majority of buyers seem to move up the ranks from the entry-level superyachts and grow with their wealth and experience.

So the big question is: Where is the market heading when it comes to buying and owning yachts? Having discussed the topic with various owners over the years and met charter clients who have decided that owning is not for them, there’s a consensus among those with the potential to buy that the capital required versus the asset usage and the operating costs doesn’t always add up.

One very well-known and experienced owner explained that if you can’t use your yacht for more than 10 weeks a year, it’s wise to charter for those 10 weeks and remove any of the headaches or distractions, and use your capital for other things. Obviously, he’s right and this is definitely one of our barriers for the future. We’ve seen a variety of new buyers jump into to the market over the past few years during Covid, deciding

that owning a yacht was a great idea; safe, secure, private, a personal bubble were the common terms. However, it became apparent that some of those buyers realised they had underestimated the cost and the fact that it’s not always straightforward to get on board and enjoy their new toy often enough to justify the CAPEX/OPEX.

Over the past two decades, we’ve looked at the world of real estate and private aviation, even the luxury automotive sector, and the emerging trend is actually not to own but to have access with flexibility. There’s a new generation of UNWIs and HNWIs who may own their primary residence, or perhaps two, but have recognised that owning multiple properties around the world is expensive and demanding, even though their property may be a good investment.

In conversation with an owner who recently sold a dozen properties across the globe, he realised he was employing hundreds of staff and paying hundreds of thousands in maintenance and security per annum, but only staying in each property for a few days or weeks, leading to the decision to sell. The good news is that he bought a large yacht and is currently enjoying a round-the-world tour for a few years.

If we look at private aviation, there are about 300 smaller-body jets built each year plus 20 larger private jets entering the market from the handful of builders. The majority enter operator programmes such as VistaJet, Victor and NetJets, where the market has been driven by a demand for private air travel. Customers and operators recognise that the OPEX/CAPEX doesn’t make sense and we’ve therefore seen a boom in private travel because the model makes more sense to a bigger market potential.

Buying access or hours of use when you need to get from A to B has created very successful business models and a market dynamic where the assets are no longer sitting on the tarmac because there’s always customer who wants to buy time on board.

The evolution of asset use, where you no longer want to tie your capital up in a large asset, is starting to make sense and, by definition, offers more flexibility, more access to multiple opportunities and frees up cash to invest elsewhere. So perhaps the future of yacht ownership will start to evolve in the same way.

The numbers start to make sense when breaking down and analysing the yachting CAPEX/OPEX. A €20million investment in a smaller semi-custom superyacht with a €2million operating budget, for a programme that delivers 10 weeks per annum of private use and maybe six weeks of charter operation at €100,000 per week becomes an expensive operation. Those 10 weeks of private use end up costing €140,000 per week. Add in the capital cost and the depreciation, plus other distractions of management and crew, and this won’t make sense for some buyers.

With over 400,000 UHNWIs and many more HNWIs in the world today, all of whom are changing their buying habits and have a wide cross-section of passions and pastimes, it’s becoming harder to compete with an asset class that is never perceived as an investment and tends to just cost more money than you thought or were told.

Over the past few years we’ve done some strategic research for investors and owners on future models for ownership and asset use. We have seen more and more programmes emerge where builders and investors are developing shared-ownership programmes and

fractional offerings that deliver a smarter approach. Essentially, less capital and less cost for just enough use when you need it.

Yes, these programmes tend to be focused on the smaller end of the superyacht spectrum, where a millioneuro investment can deliver access to a 30-metre yacht for 25 per cent of the usable time per annum, with a fixed operating cost of only €240,000, but when you do the maths, for those who would typically spend €t10 million or more on a 30-metre yacht, this suddenly looks interesting.

If you look at yachts above 50 metres and apply similar numbers and economics, it starts to look as though a charter programme makes financial sense. If there are 24 weeks of cruising available and four owners with eight weeks each (perhaps the average amount of time some owners spend on board), dividing the CAPEX of, say, €60 million by four – it all starts to add up. €15 million per owner, eight weeks of use, 25 per

cent of all operating costs (assuming €3 million per annum) for, say, an average of five years, gives you €468,750 per week of ownership cost. If you’re the 100 per cent owner and invested €60 million in CAPEX and €15 million in OPEX, using the yacht for, say, 12 weeks a year, the cost per owner week jumps to €1.25 million.

Having watched the evolution of the private jet market and now the luxury villa and residence market, where wealthy clients are buying fractions of use or access to a global network of assets, it’s inevitable that superyachts will one day follow suit because the 400,000 wealthy individuals who have decided not to own a superyacht are more than likely to be in a jet-use programme or some form of

Having watched the evolution of the private jet market and now the luxury villa and residence market, where wealthy clients are buying fractions of use or access to a global network of assets, it’s inevitable that superyachts will one day follow suit.

vacation residence plan such as the Four Seasons Residences.

Another benefit to some of the ownership programmes, where you’re no longer the individual ultimate beneficial owner (UBO), is an increase in privacy, and perhaps anonymity, due to structures and asset use. Flying with Victor or Vista Jet is clearly an intelligent approach, saving time, money and being much more discreet than having your name splashed over X with your flight tracker data from your excessive private jet use there for all to see.

It’s highly likely that with the right investment plan and a well organised fleet that buying access to a yacht in all the right places without all of the risks and headaches will become a key driver of our future market. We will experience a dramatic shift in wealth and a generational shift in attitude towards superyachts, so it makes sense that investors, private equity and venture capitalists start to look more closely at the real potential of big yachts as a new fraction model.

Rather than hearing the old adage that ‘no one needs a yacht’ or the more recent ‘only buy a yacht if you can afford to give it away’, perhaps the time is right for the smart money to create a business model and ownership programme where every UHNWI can have access to a yacht. After all, using a yacht is the fun part, if everything is organised, well managed and taken care of. Owning a yacht is sometimes where the fun stops. MHR

by Richard Franklin

Should you read your survey report? Yes, of course, because one way or another it will cost you time and money if you don’t read it and understand the key conclusions.

For pre-sale, pre-delivery and insurance surveys, there’s generally more time for the client’s advisors to engage with the surveyor to ensure the client is fully aware of its conclusions, recommendations and cost estimates, and for them to filter the essentials back to the owner. Here, we are focusing on pre-purchase surveys because this is when the stakes are highest and where the buyer will need to make key decisions within tight deadlines.

Only the pre-purchase survey takes place within a legal context, this usually being the MYBA Memorandum of Agreement (MOA). The key areas of the MOA that are of interest to us are clause 17 (sea trial/condition survey), which sets out the buyer’s right to conduct a survey and sea trial; clause 26 (sea trial), which states that the buyer has the right to reject the yacht without reason within 24 hours of concluding the sea trial; and clause 27 (condition

survey), which sets out the options open to the buyer within seven days of completing the condition survey.

The technical sea trial allowed under clause 26 is the surveyor’s opportunity to ensure that everything that should function does indeed function as required and to record all key operating parameters. Our detailed sea-trial protocol usually requires at least four hours (or more if there are noise and vibration specialists on board), during which the surveyor will ensure that the yacht meets expected performance criteria.

While we don’t try to replicate original sea-trial tests, we do want to explore the yacht’s capabilities and limitations. In doing so, the engines will be kept running at full power for an extended period and turning manoeuvres will be undertaken that exceed anything that might be experienced during normal operations. Why? Because where problems are going to present themselves, this is when they will become apparent, nine times out of ten.

Our sea-trial report covering the performance of each system forms

part of the final survey report and is essential reading for the buyer. If there are concerns, it’s the buyer’s easiest opportunity to reject the yacht based on its findings. Once the process progresses beyond the sea trial, options become more limited as explained below.

The condition survey allowed under clause 27 is the surveyor’s opportunity to examine in detail every aspect of the yacht that couldn’t be covered during the sea trial. The 150-plus points we examine in detail build a clear picture for the buyer of the condition of each and every system and structure on board and, where there are nonconformities, to define the remedial work required and provide an estimate of the likely cost to rectify any such non-conformities.

In doing so, we pay particular attention to any items that are classed as ‘defects’ within the meaning of clause 27, which defines defects as ‘affect(s) the operational integrity of the vessel, or her machinery, or her systems, or renders the vessel unseaworthy’. Once we’ve defined a non-conformity as a

defect and certified it as such, clause 27 states that the buyer has three options: to require the seller to rectify the defects at their own expense, or agree a commensurate reduction in price or, if neither can be agreed, for the MOA to be terminated.

For this reason, if the buyer finds time to read nothing else within the survey report, it should be the list of certified defects, together with the estimated cost to rectify them. These should form the

basis of their post-survey negotiations and, ultimately, whether or not the transaction succeeds or fails.

All the above assumes that the buyer has little time or wish to engage in the detail of the survey, but sometimes the opposite is true. Certain clients want to understand as much as they can about their proposed purchase. Some have even been known to read a surveyor’s report in full! Admittedly this is unusual, and even I struggle with

As much as reading the report, it’s what can’t be read in the report that’s important, and the buyer should spend some of their time on their sea-trial meeting the crew and visiting the engine room because they’ll quickly get a sense of how the crew cares for the yacht.

reading the hundreds of pages as I edit each report prior to sending, so these are our recommendations for where to direct the buyer’s attention, given the opportunity.

The buyer should be digging into the service history for all the major machinery because regular care and maintenance is key to performance and reliability. As much as reading the report, it’s what can’t be read in the report that’s important, and the buyer should spend some of their time on their sea-trial meeting the crew and visiting the engine room because they’ll quickly get a sense of how the crew cares for the yacht. We also advise checking the spreadsheet and survey web portal carefully, working out how much it’s going to cost and what the priorities should be.

So, in summary, do read your survey report, get comfortable with the numbers and look at the yacht through your surveyor’s eyes, but while you’re on board, chat with the crew and ask them to take you into the areas where you wouldn’t usually be taken to. You’ll soon see what the surveyor picks up when they first step on board, which is whether or not a yacht has had an owner who cares, who has provided the budget requirement and who has employed a crew who have a passion for the yacht. These yachts stand out head and shoulders above the rest. RF

Editor-in-Chief Martin H. Redmayne explores whether an 80-metre superyacht, together with a support sister ship or shadow boat, delivers a better ownership experience than a 100-metre-plus project.

Introduction

Back in 2015, The Superyacht Agency, the consultancy division of The Superyacht Group, was tasked with a major research project on behalf of the then German shipbuilder Blohm+Voss. The brief was to investigate the perfect large superyacht that would reinvigorate this iconic shipyard and bring to the market a super platform that would meet all the ownership parameters and deliver a semicustom platform that would make money.

Unfortunately, the project was at the time when the shipyard was at a crisis point and perhaps it was already too late to save the yard from collapse. But all the work we delivered and the research and analysis were a fascinating insight into what is now becoming a new sweet-spot superyacht.

The question we now want to explore is ‘Does an 80-metre superyacht deliver a

better ownership experience, along with a support sister-ship or shadow boat, than a 100-metre-plus project?’. The following report will highlight the current market behaviour and performance and explore the key builders that are making their mark on the sector. We present a variety of concepts and opportunities that are likely to make more sense for the future when it comes to operational modes, cruising patterns, anchorages and guest service.

Following a secret tour of a recently delivered 150-metre-plus new build and various conversations with captains of 100-metre-plus superyachts, including the owner’s representative of one of the largest yachts in the fleet, I’ve often asked myself the question ‘Why build at this size?’.

These vast private palaces are meas-

ured in several thousands of GTs, with mazes of amazing interiors, exterior decks that look like running tracks at Olympic stadiums as well as garages, lazarettes and vast storage bays that house a multitude of toys, cars, bikes, dive gear, work boats, tenders and limousines – reaching more than double figures on some of these leviathans.

I remember sitting in a third-floor office in Venice at the time when another 160-metre-plus yacht was berthed alongside the commercial dock and the main deck was level with where I was seated. Two female guests were chatting, drinking tea on the exterior deck, looking miniscule and lonely on this 250-sqm-plus outdoor lounge area. Four decks below at the aft section, a group of ant-like crew were helping two tiny male guests boarding what looked like a toy Venetian tender.

So back to my question of ‘Why?’.

Only a handful of yards have been successful in the 100-metre category, with some of them experiencing financial pain and the huge risk of stepping into the sector for the first time … and as a result leaving the category to the experts.

It’s hard to ever apply logic or reason to building a yacht of this size and scale, not to mention value, but having witnessed the variety of 100-metre-plus yachts built in the past decade, perhaps the next generation may reconsider the opportunity of building such a highprofile statement asset and revert to a more intelligent size and scope of build.

Operationally, when you consider the requirements and planning for berthing, anchorages, crew numbers, refit facilities and operational costs, it’s hard to contemplate that the 0.1 per cent of the 0.1 per cent who can just about afford these gargantuan assets will, in the next few years, keep investing in such projects. This is why it’s easy to consider that a 6,000gt-plus platform of 100-metresplus could be replaced by a 2,500gt-plus 80-metre and a 700gt-plus 60-metre support yacht – with a significant amount of capital left in the private bank account.

With approximately 16 key builders and 25-plus facilities around the world that have the skills, capability, capacity and experience in the 80-metre market compared to the 100-metre sector, it makes sense for the industry to consider the optimum sizes and projects. Only a handful of yards have been successful in the 100-metre category, with some of them experiencing financial pain and the huge risk of stepping into the sector for the first time … and as a result leaving the category to the experts.

In no particular order, the shipyard brands of Benetti, Oceanco, Lürssen, Feadship, Abeking & Rasmussen, Turquoise, Heesen, The Italian Sea Group, CRN, Freire, Nobiskrug, Fincantieri, Silver Yachts, Bilgin Yachts, Palumbo and Amels/Damen Yachting make up the lion’s share of key builders who understand this category, with new projects likely to be announced during the Monaco Yacht Show 2024.

It’s becoming clear that they are all looking very seriously at this size range for a whole host of reasons. An attractive sweet spot in the upper tier gives plenty of GT between 2,000 and 3,500, but not dominating the facility or exhausting the supply chains.

Having witnessed the success of the Amels 242 (74 metres) and the new Amels 80, with eight and four units sold respectively, and the recent Oceanco 80-metre Simply Custom concept project with an array of designers working with a proven technical and engineered platform, it’s possible the market is trying to encourage owners and their project teams to be slightly more controlled and conservative with their specifications, customisation and investment.

If you consider the origins of Oceanco and its hugely successful 80-metre Alfa Nero era, it’s possible that owners may need some further education on the value proposition of this size category and the additional value a support vessel brings; the more you look at it, the more the numbers make sense.

COMPACT AND POWERFUL THE BEST SIZE RATIO ON THE MARKET

SUPER FAST SPOOL UP READY TO USE

ABSOLUTELY SILENT ENJOY THE SEA

LOW MAINTENANCE REDUCED COST OF OWNERSHIP

MC 2 Quick Gyro X75 is super compact and the most powerful stabilizer of the range. It is 30% smaller than market standards, power being equal. It takes just 30 minutes to stabilize 90’ boats. Multiple installations ensure the stabilization of boats up to 400 tons. Exceptionally water-cooled to enjoy every positive result achieved.

Research and analysis

The accompanying data is a snapshot of how the market has evolved (excluding support vessels) and evidence of who the key players are and their delivery performance.

Figures 1 and 2 break down which shipyards have recently built yachts in the LOA categories of 75 to 90 metres and 90 metres-plus. The charts display the total number of yachts each shipyard has built during this period, as well as their output in three-year increments, providing insight into which shipyards have been more active in recent years.

Figures 3 and 4 analyse the current fleet of 75 metres-plus yachts by country

of build and shipyard, highlighting the top five shipyards and countries in terms of fleet share.

The data shows that more than 60 per cent of yachts in this size range are built in Germany or the Netherlands, and more than 80 per cent are built in the top five countries. Lürssen holds the largest share among shipyards. However, just over 46 per cent of the fleet of this size is constructed by shipyards outside the top five, reflecting a more diverse distribution, with around 60 different shipyards having built yachts of this size historically.

It is also worth noting that for yachts over 80 metres, the same five shipyards

and countries lead in both categories.

Figure 5 (overleaf) presents the annual construction of yachts of more than 75 metres and 80 metres in length, highlighting the clear upward trend in this size category since 2000. A simple linear trend line has also been added, indicating that if this trend continues, by 2030 the industry could consistently see the construction of more than 13 yachts over 75 metres and over 10 yachts over 80 metres each year.

Following this, Figure 6 illustrates the percentage of the fleet comprising yachts 80 metres or larger, showing how this proportion has grown significantly, especially since 2010.

Figure 2: Number of 90-metre-plus builds, 2015-2023

*Other: 1 each – Abu Dhabi MAR (ADM), Elefsis Shipyard, Freire Shipyard, Golden Yachts, Kusch Yachts, Lloyd Werft Bremerhaven, Nobiskrug and PT Bahtera Bahari Shipyard.

Figure 3: 75-metre-plus

Figure 4: 75-metre-plus fleet by shipbuilder

Figure 5: Yearly 75- and 80-metre-plus builds, with linear forecast

Figure 6: Percentage of the fleet that is 80 metres-plus vs 75 metres-plus

The current concepts and projects

The following pages are designed to provide a shop window of the myriad of projects built, in build or in concept stage, in a form of compare and contrast spectrum for the 75 to 85-metre category.

Editor's Note

The various Oceanco Concepts are part of a dynamic ‘Simply Custom’ campaign, where the yard invited a wide cross-section of the yacht designer network to create a variety of exterior and interior styles based on an optimised hull and engineering package in partnership with Lateral Naval Architects. The idea demonstrates very clearly that simplifying and managing the technical elements of the platform creates a more logical approach, with all of the exterior and interior guest elements being fully personalised to the client’s style and taste.

Your mission is unique... Your support vessel should be.

Complete your fleet with the industry’s most stable and efficient shadow series

Obviously, this is not a marketing phrase that is used very often in the market, but having discussed the current new-build pricing with a cross-section of brokers and owners’ reps, there are some incredible prices today for large tonnage new builds. Driven by energy costs, raw materials, labour costs and other factors, owners and their advisers are starting to ask more and more questions about the price and value of very large yachts. We’ve seen owners get diverted to commercial yards, large conversion projects and buying second hand because the build slots are not always available or the delivery time is beyond their expectations.

When you look closely at the 80-metre market and the number of options available, there are approximately 24 shipyards capable of building an 80-metre superyacht, with a reasonable spectrum of prices. Also, when considering the support/shadow vessel options from the current market, conversion sector and commercial yards, you can simply build

a small fleet that will deliver incredible value and also perhaps a more enjoyable operational profile.

Consider the vast amount of on-board real estate that is often taken up by all the tenders and toys on the owner’s and captain’s wishlist, and then all the operational requirements to manage and deploy this small support fleet. The vast garages and tender bays, the lifting mechanisms, large hatches and watertight compartments, the fueling stations and washdown areas all take up valuable and expensive space and are a distraction for the team on board. Add into the mix a helicopter or two and things get really interesting, from both a regulatory standpoint and a manning and fueling perspective, so perhaps the time has come to show owners the real benefits of two or more yachts.

Perhaps the added value and increased cost of the larger fleet is driven by the percentages that all the intermediaries

chase: the bigger the build costs, the bigger the percentage. Maybe we have to ask the client what they really want to do with the yacht and create a better explanation of the operations and logistics to make sure they get what they expect without having on-board restrictions due to half the crew getting involved in mini-fleet logistics.

Following on from tenders, toys and helicopter operations, there’s another major consideration that is often overlooked and needs careful consideration at the upper scale of these projects. A large yacht is supposed to deliver a level of service excellence that is beyond anything a customer can expect, but often, due to a lack of experience on board from designers or project teams who are just trying to maximise the guest real estate, crew service and operations play second fiddle. How many times does a captain and his senior crew join a large – or in fact any – new build and ask where the service pantry is, or the bonded wine cellar, or crew uniform and laundry store?

We often hear that space is at a premium and guest accommodation takes priority, but perhaps guest service and operations needs to be given more attention these days to ensure the yacht works well and the crew have access and capacity to do their jobs properly. Having spoken to a captain recently involved in building an 80-metre, his situation was equally frustrating, where so much space was wasted or boxed away because the designer, builder and subcontractors just wanted nice simple installations, ignoring the couple of metres of space behind the structure.