energy focus

FROM THE ENERGY INDUSTRIES COUNCIL

VIEW FROM THE TOP

RENEWABLES

It is time to take geothermal energy seriously

OIL AND GAS

Petrobras’ big spending presents lucrative supply chain prospects in Brazil

POWER

Navigating coal’s complexities for a sustainable energy future

Stranger times

The energy industry is thriving, but 2024 could also bring new challenges to overcome. Should we be worried?

ISSUE 54 SPRING 2024

Abel Martins-Alexandre, MD and Head of Infrastructure, Energy and Industrials, Lloyds

Bertling – where excellent operational performance speaks for itself. Stay informed about your carbon footprint and take proactive measures to reduce and offset emissions with our comprehensive transport tracking solution. Join us today on our Road to Zero!

Visit www.bertling.com/sustainability to find out more.

OIL AND GAS 26 Petrobras’ vision for growth and opportunities in Brazil Lucas Ramos, Energy Analyst (Oil and Gas), EIC South America POWER 30 The resurgence of the coal reality Michelle Manook, CEO, FutureCoal NUCLEAR 32 UK invests in high-tech nuclear fuel Tim Yeo, Chairman, New Nuclear Watch Institute Contents ISSUE 54 SPRING 2024 The heat beneath our feet 24 30 Coal reality –the way forward The Energy Industries Council 89 Albert Embankment, London SE1 7TP Tel +44 (0)20 7091 8600 Email info@the-eic.com Chief executive: Stuart Broadley Should you wish to send your views, please email: info@redactive.co.uk Editors Sairah Fawcitt +44(0)20 7880 6200 sairah.fawcitt@redactive.co.uk Lucas Machado +55 21 3265 7402 lucas.machado@the-eic.com Account director Deniz Arslan Production director Jane Easterman Senior designer Gene Cornelius Picture editor Akin Falope Content sub-editor Kate Bennett Sales and advertising Richard Hanney +44(0)20 7324 2763 richard.hanney@redactive.co.uk Energy Focus is online at energyfocus.the-eic.com ISSN 0957 4883 © 2024 The Energy Industries Council Energy Focus is the official magazine of the Energy Industries Council (EIC). Views expressed by contributors or advertisers are not necessarily those of the EIC or the editorial team. The EIC will accept no responsibility for any loss occasioned to any person acting or refraining from action as a result of the material included in this publication. ENERGY TRANSITION 22 Africa’s clean energy revolution Idoko Isaac, Head of Technical Sales and Hope George, Commercial Manager, LES Energy FROM THE EIC 5 Foreword From the Chief Executive 6 View from the top Abel Martins-Alexandre, Managing Director and Head of Infrastructure, Energy and Industrials, Lloyds Banking Group 10 News and events Updates from EIC 12 The big question How are members driving sustainability? 14 Special report Sara Verbruggen delves into the forces at play in 2024, making for strange times in the energy landscape Publisher Redactive Media Group, Fora, 9 Dallington Street, London EC1V 0LN www.redactive.co.uk 06

18 Navigating the biodiversity crisis: A call to action for businesses John Miller on how businesses can pave the way for protecting nature 34 My business Alex Greenwood, Carbon Management Team Lead for Energy, Mott MacDonald RENEWABLES

Geothermal energy: A serious contender for sustainable heat and power

Ryan Law, Founder & CEO, Geothermal Engineering Ltd www.the-eic.com | energy focus 3 18 Boosting biodiversity 14 What’s in store for 2024?

View from the top: Abel MartinsAlexandre

24

Dr

Enhancing our clients’ confidence in their energy transition and renewable projects

Hydrogen Nuclear Wind Solar Energy from waste

ukinspection@lrqa.com | lrqa.com/uk | 0800 014 9152

Foreword

Stuart Broadley CEO

From the Chief Executive: In this edition, we confront the euphoria surrounding the energy market with sobering reflections on the challenges ahead as we navigate an unpredictable world

This should be the best of energy markets for the world’s energy supply chain to play in. Oil and gas is booming after 10 years of underinvestment and is now going through a supply-side correction, with no short-term signs of falling demand. Concurrently, interest in nuclear energy is resurging after decades of lethargy. In many countries nuclear power is now hailed as clean technology, with traditional new-build projects, small modular reactors and advanced modular reactors attracting high funding rates. The anticipation of fusion technology also looms on the horizon, adding to the excitement.

Renewable energy, particularly wind and solar, continues to astound with year-on-year growth in project announcements and gigawatt installations. Moreover, the decarbonisation of existing energy assets is marching forward, driven by owner-operator sustainability goals rather than a government carrot-and-stick approach. This is what we’ve all been waiting for – consumer belief in fixing our problems now, not kicking the can down the road. There are also plenty of new energy transition technologies that address harder-to-abate emissions, including hydrogen, carbon capture and energy storage. These are poised to become the primary drivers of future wealth creation within the industry, albeit at a considerable cost – but what a future in which to invest!

Many EIC members talk about 2023 being a record year and predict that 2024 will be better still, while the net-zero rhetoric is going nowhere and getting louder. So, with all this positivity and evidence that investment and careers for life in the energy system should be a ‘shoo-in’, why does it feel like something ominous is waiting just around the corner, and we should all be quaking in our boots?

This edition of Energy Focus tackles this conundrum head-on. We’re delighted to

feature Abel Martins Alexandre, Managing Director and Head of Infrastructure, Energy & Industrials at Lloyds Banking Group, who sheds some light on how this major player in the world investment community sees its role in the future energy market.

An obvious reason for the feeling of unease is the apparent and worsening lack of consistency and stability in the world. This is compounded by the escalating threats to peace, the fact that nearly 50% of the world’s population are going to the polls this year, the realisation that we can’t just ‘pay later’ for the high costs of net zero, and policymakers grappling to garner widespread support to stimulate demand for harder-to-abate markets, having ticked off the easy wins in the previous decade.

Forecasters draw the emission reduction charts projecting out to 2050 as smooth, almost effortless downward trajectories. A chart is easy to draw; the reality is starkly different. It will involve high costs, head-spinning technical and global regulatory challenges and levels of collaboration, a huge amount of investment, running at trillions of dollars per year, and perhaps most importantly, growing societal doubts about affordability and fairness as we approach 2050.

If this is truly reflective of the change needed, none of this may be smooth sailing. Instead, it may be increasingly uncomfortable, stormy and even scary – a real test of how committed we really are to net zero. Will we look back on ourselves in 26 years and say we passed the test?

Stuart Broadley Chief Executive Officer, Energy Industries Council stuart.broadley @the-eic.com

www.the-eic.com | energy focus 5

View from the top

Our external sector statements are clear: we don’t finance new greenfield oil and gas projects

6 energy focus | www.the-eic.com

Abel MartinsAlexandre, Managing Director and Head of Infrastructure, Energy and Industrials, Lloyds Banking Group

From the EIC Abel Martins-

Alexandre

Energy Focus talks with Abel Martins-Alexandre about the Group’s commitment to combating climate change, supporting the transition to cleaner energy, and fostering global collaboration for a net-zero future

Please explain Lloyds’ strategy to support and invest in the world’s energy industry. Climate change is one of the biggest challenges of our times, and it requires us all to rethink our energy sources, the conversion and generation of energy and electricity, its transmission and distribution, and our consumption.

This requires moving away from fossil fuels and, more fundamentally, a retrofit of the entire energy system. We are very focused on playing our part and our strategy is clear and consistent:

No financing of thermal coal

No direct financing of new greenfield gas and oil projects

Support our clients with decarbonisation activities

Actively support renewable energy and transition technologies.

This is underpinned by our active engagement with clients regarding their credible transition plans and by our Net Zero Banking Alliance (NZBA) commitments, which are all science-based.

Do you regard specific energy sectors as providing higher returns and lower risks than others? For instance, how do you rate oil and gas projects versus offshore wind projects? Our external sector statements are clear: we don’t finance new greenfield oil and gas projects.

We set clear expectations for clients to establish credible transition plans, which include reviewing the capital expenditure allocated to decarbonisation activities, renewables and transition technologies.

For any financing and investing activity, we consider returns and risks, as well as environmental, social and governance and sustainability factors, including compliance with our NZBA commitments. We are not interested in returns that are not sustainable and do not have a real economic and environmental impact.

We believe short-term returns should not be generated to the detriment of medium and long-term sustainability and value creation. The business risk of not transitioning to renewable energy sources is high

and may not necessarily be fully recognised. We are working hard to embed tools that provide us with the right credit and pricing decisions that include sustainability factors.

Policy mechanisms are often essential to support renewable and transition technologies. They provide the proper risk allocation, certainty of minimum returns, and de-bottleneck planning or supply chain issues that may hinder returns.

How is Lloyds Banking Group ensuring that energy financing is inclusive, reaching a diverse range of projects and stakeholders, including those in emerging markets?

Our purpose – Helping Britain Prosper – is key to everything we do. We help Britain prosper by creating a more sustainable and inclusive future for people and businesses, shaping finance as a force for good. This is embedded in our values, processes and decisionmaking across our entire business.

Supporting the transition to a low-carbon economy and contributing to a just transition is an essential part of our business:

Reduce carbon emissions we finance by more than 50% by 2030, on the path to net zero by 2050 or sooner Net-zero own operations by 2030

Sustainability outcomes embedded across business priorities.

How is Lloyds Banking Group measuring the impact of its global energy financing initiatives in terms of environmental and social outcomes, and are any specific metrics or benchmarks being used?

We measure our financed emissions against our board-approved targets, and our key performance indicators are aligned with these and other sustainability measures to assess the performance and remuneration of group executive committee members.

Our comprehensive sustainability reports outline the specific measures regarding our financing activities across businesses and how we strive to do them sustainably and inclusively.

About Abel MartinsAlexandre

Abel MartinsAlexandre is Managing Director and Head of Infrastructure, Energy and Industrials in Corporate & Institutional Banking, Lloyds Banking Group, which he joined in October 2021.

Mr Martins-Alexandre leads a team of experienced coverage bankers across three main industry pillars: Infrastructure & Transport, Manufacturing & Industrials, and Energy, Commodities & Utilities. Prior to Lloyds, he spent 15 years in the diversified metals and mining group Rio Tinto, where he held a range of strategy, business development, restructuring and finance roles, including Group Treasurer.

www.the-eic.com | energy focus 7 Q&A Abel

: From the EIC

Martins-Alexandre

Our purpose – Helping Britain Prosper – is key to everything we do. We help Britain prosper by creating a more sustainable and inclusive future for people and businesses, shaping finance as a force for good

Does Lloyds collaborate with other financial institutions, industry players, or international organisations to address challenges and drive positive changes in the global energy sector?

We are members of strategic working groups for the Transition Plan Taskforce, and we are exploring and contributing to the future of transition plan disclosure in the UK.

We also recently partnered with the University of Edinburgh to deliver a bespoke training programme for 173 commercial banking colleagues on low-carbon transition technologies, including carbon capture, utilisation and storage, and hydrogen.

We are working group members of the World Economic Forum’s Financing the Transition to a Net-Zero Future initiative. This global initiative focuses on low-carbon technologies and the risks and opportunities they present. Members include US and UK government departments, as well as many different technology producers, banks, and supply chain stakeholders.

Finally, we are an NZBA Founding Member.

Lloyds Banking Group net-zero ambitions

50%

Work with customers, government and the market to help reduce the carbon emissions financed by more than 50% by 2030 on the path to net zero by 2050 or sooner

Halve

Halve the carbon footprint of investments by 2030

Reduce supply chain emissions by 50% by 2030 on the path to net zero by 2050 or sooner

90%

Achieve net-zero operations by 2030 and reduce direct carbon emissions by at least 90%

IMAGE: ALAMY

From the EIC: Q&A Abel Martins-Alexandre 8 energy focus | www.the-eic.com

2030

Hughes Safety Showers is a premier manufacturer of emergency safety showers and eye/face wash equipment.

Whether you require a simple drench shower or a fully customized solution, our equipment will provide you with a safer working environment, greater protection against serious injury and peace of mind that you’re compliant with crucial safety standards.

Delivering safety, from the essential to the exceptional.

Emergency safety showers designed to operate in all environments and climates.

Stay safe. Stay compliant.

L-R: 1500L jacketed emergency tank shower

eye wash; Self-contained 114L mobile safety shower with eye wash; Self-draining safety shower with eye wash.

Models pictured

with

Get in touch. US & Canada T: 1 866 312 1652 E: customer.service@hughes-safety.com Rest of World T: +44 (0)161 430 6618 E: sales@hughes-safety.com

news&events

Upcoming events in 2024

Offshore ConferenceTechnology (OTC) 2024

Date: 6–9 May 2024

Location: Houston, US

About the EIC

Established in 1943, the EIC is the leading trade association for companies working in the global energy industries.

Our member companies, who supply goods and services across the oil and gas, power, nuclear and renewables sectors, have the experience and expertise that operators and contractors require.

As a not-for-profit organisation with offices in key international locations, the EIC’s role is to help members maximise commercial opportunities worldwide.

Events

EIC LIVE events

EIC has an exciting and diverse agenda lined up for the coming months. Members and industry professionals from all corners of the energy sector will have the opportunity to engage with us globally. Whether it is at Offshore Technology Conference in the US, joining a trade delegation in Rio de Janeiro or attending our renowned Energy Exports Conference in Aberdeen, there are ample opportunities to connect. We look forward to welcoming you to one of our events!

Remember, this is just a glimpse into everything that we have in store. To discover other events, including webinars, check out our calendar at: www.the-eic.com/events/calendar

Why attend? The Offshore Technology Conference (OTC) serves as the premier global gathering for energy professionals to exchange ideas and insights, driving the advance of scientific and technical knowledge in offshore resource exploration. With 300 presentations, at least 1,000 exhibitors and more than 24,000 energy professionals, OTC provides attendees with access to cutting-edge technical information, the industry’s largest equipment exhibition, and valuable networking opportunities with professionals from around the world.

As the world’s largest oil and gas producer, the US remains a hub of project activity in this sector, offering significant business prospects for the supply chain. EIC is proud to be organising and managing the UK and EIC Pavilions at OTC.

If you are attending OTC this year, seize the opportunity to visit us! Get in touch at internationaltrade@ the-eic.com to find out more about our schedule during the event, or visit www.the-eic.com/Events/Exhibitions/ OffshoreTechnologyConference2024

Trade delegation to Rio de Janeiro

Date: 3–6 June 2024

Location: Rio de Janeiro, Brazil

Why attend? The EIC is currently organising another trade delegation; this time we are heading to Rio de

10 energy focus | www.the-eic.com

THE ENERGY

COUNCIL

UPDATES FROM

INDUSTRIES

Janeiro. Delegates will have the chance to participate in organised group meetings with prominent local stakeholders, attend briefing sessions led by qualified speakers with in-market expertise, join a networking reception, and potentially visit the Hydrogen Expo South America.

These group meetings will be coordinated by the EIC’s Rio de Janeiro office and will feature key industry players, including representatives from national and international operations, as well as international EPC contractors operating in Brazil. The final programme will be customised to align closely with the needs and preferences of delegates.

event of the year and the ultimate platform for discovering global energy prospects and engaging with key decision-makers.

Reports

EIC Country Report: US

Amid political tensions, soaring inflation and ageing infrastructure, the EIC Country Report: US navigates readers through the country’s expansive and diverse energy market, shedding light on aspects to consider when establishing a business there. Starting with a comprehensive examination of the oil and gas sector’s upstream, midstream and downstream segments, the report also delves into the US renewables market and energy transition developments.

If you want to find out more, please visit www.the-eic.com/MediaCentre/ Publications

EIC Insight Report: Net Zero Jeopardy

If you would like to book your place or learn more, please contact the team at internationaltrade@ the-eic.com or visit www.the-eic. com/Events/OverseasDelegations/ TradeDelegationtoRiodeJaneiro2024

Energy ConferenceExports2024

Date: 11–12 June 2024

Location: Aberdeen, UK

Why attend? Registration is already open for Energy Exports Conference

In today’s challenging market conditions, finding new avenues for growth and resilience is crucial for business owners. With numerous exciting energy project opportunities currently emerging worldwide, the EEC offers companies unparalleled access to hundreds of contacts and valuable insights into multiple export opportunities.

Join us to listen, engage, and connect with international operators, developers, contractors, government officials, export advisers, ambassadors, and trade experts from all around the world!

For more information on our exhibition and sponsorship packages, or if you have any questions, contact the team at eec@the-eic.com or visit www.the-eic.com/EEC

We are delighted to launch our latest Insight Report: Net Zero Jeopardy.

Following the model of our Survive & Thrive Report, we interviewed EIC members around the globe to uncover perspectives on the disparity between policy aspirations and industrial reality in the energy transition. Recognising the precarity of net-zero 2050 commitments, and as the energy supply chain’s global voice, EIC is committed to addressing this issue. We have gathered evidence from members, delving into their experiences, challenges and successes in the green energy space.

If you want to find our more and access a comprehensive exploration of the net-zero state of play, please visit: www.the-eic.com/MediaCentre/ Publications/EICNetZeroReport

From the EIC News and events www.the-eic.com | energy focus 11 NEW REPORT OUT NOW NEW REPORT OUT NOW

The BIG question

Driving sustainability: what is your primary focus in 2024?

Businesses increasingly recognise the urgent need to minimise their environmental footprint and proactively adapt to mitigate the effects of climate change and biodiversity loss on their operations. While the challenges ahead are significant, there is mounting momentum for transformative change among companies. So, how are businesses driving this necessary shift towards sustainability and resilience in 2024?

Energy Focus puts the big question to three members

Adam Kramer

Vice President Corporate Sustainability Officer at KBR

KBR’s journey in sustainability during 2023 was remarkable. We were honoured by USA Today as one of America’s Climate Leaders for that year, achieved a Gold Rating from EcoVadis for our exceptional dedication to sustainability, and saw a significant improvement in our MSCI ranking, soaring from BB to AAA.

Looking ahead to 2024, KBR’s Corporate Sustainability Office is concentrating our efforts on several key initiatives. These include the roll-out of a new carbon reporting system that is designed to enhance data collection capabilities, collaborating across the company to

We will deploy carbon reduction strategies aimed at achieving operational net-zero emissions by 2030

deploy carbon reduction strategies aimed at achieving operational net-zero emissions by 2030, and leveraging this knowledge to assist clients in reaching their own net-zero targets.

Although KBR is not a major carbon emitter, the global urgency is clear, with the daily addition of 227,000 people and the loss of 42 million trees emphasising the imperative for all to contribute to

carbon reduction. KBR is actively engaged in not only reducing its own carbon footprint but also in providing sustainable technology solutions that align with the needs of its customers, including advancements in blue and green ammonia, plastics recycling technologies, and sustainable aviation fuel.

KBR delivers science, technology and engineering solutions to governments and companies around the world. The company employs approximately 34,000 people performing diverse, complex and mission-critical roles in 33 countries. KBR is proud to work with its customers across the globe to provide technology, value-added services and long-term operations and maintenance services to ensure consistent delivery with predictable results.

12 energy focus | www.the-eic.com From the EIC Members’ comment

Emma Scott

Vice President of Sustainability at Kent

Our primary focus is to ensure we are doing everything we can to strengthen and improve our efforts across the sustainability spectrum. This entails a steadfast commitment to advancing in our nine focus areas, organised under three core pillars: empowering people to prosper; supporting a thriving planet; and living with purpose and principles.

Last year, we launched our first sustainability report; our focus now is to build on our foundation, which was established in 2022, a year after Kent was launched. During this short time, we have reached sustainability milestones, such as measuring and reporting on our scope 1 and 2 carbon emissions, with scope 3 to follow soon. We will also focus on enhancing our approach to community engagement, developing tools and systems to measure the carbon handprint of our projects and designs, and working with each region to develop their inclusion improvement plans.

We are looking at biodiversity, beginning with internal biodiversity awareness training, which is a key sustainability success metric for 2024.

Our plan is to ensure that biodiversity is prioritised at people and business level first, to ensure success when engaging with third-party partners down the line.

We’re also looking at adaptation, which involves using greener travel methods through employee incentive schemes for commuting, minimising the use of harmful materials in our offices, and adopting smart technology practices. Furthermore, we are running pilot projects to leverage renewable energy to power our projects.

Kent designs, builds and maintains the assets that power the world today and make it future-ready for tomorrow. From consulting to design, build, commissioning and start-up to maintenance and decommissioning, the company is committed to becoming the global leader in integrated energy services. Kent is well-equipped to address current industry challenges and is future-ready for the emergence of new and innovative energy solutions in diverse locations and disciplines.

Christina Horspool

Vice President Sustainability & Climate Action at X-Academy

We are looking at biodiversity, beginning with internal biodiversity awareness training, which is a key sustainability success metric for 2024

The path to net zero presents a unique opportunity to cultivate a thriving energy workforce. Recognising the importance of securing sustainable energy roles, X-Academy was founded in 2021 to accelerate job opportunities for the energy transition while emphasising the value of prioritising people and planet.

Our focus in 2024 is on creating additional energy jobs in a responsible and sustainable way. By leveraging X-Academy’s expertise across the energy transition, including social impact, project origination and industry enablement, we are actively involved in the key areas shaping the future of energy. When bringing the necessary expertise to achieve net-zero targets across the entire energy

Our focus in 2024 is on creating additional energy jobs in a responsible and sustainable way

mix, it is crucial to consider biodiversity and adaptation.

We believe delivering meaningful climate action will require considering biodiversity enhancement and the need for adaptation across every project. At X-Academy, we provide the budding energy workforce with real-world project experience focused on delivering tangible impacts for communities, fostering a holistic understanding of challenges and opportunities.

Creating social value within the framework of climate action is integral to X-Academy’s strategy. We achieve this through both our in-house projects and collaborative efforts with partners, including developers, local authorities and third-sector charities. We actively look to bring initiatives and organisations together to maximise impact.

Through working on projects that focus on biodiversity net gain and adaptation risks, we are creating a workforce that has the skillset necessary to implement these projects in years to come. By establishing these roles now, we can cultivate essential experience, giving the energy professionals of tomorrow the toolkit needed to establish a net-zero economy.

X-Academy is a not-for-profit, world-first energy jobs accelerator empowering people and enabling the energy transition. X-Academy is committed to making the industry accessible to all, where anyone and everyone can develop relevant experience and thrive. A 100% subsidiary of Xodus Group, X-Academy works with governments, the private and public sectors, rethinking how things are done to take on challenges, break down barriers, enable progress and deliver the energy transition.

www.the-eic.com | energy focus 13 Members’ comment: From the EIC

As the energy sector braces for the challenges and opportunities of 2024, caution and uncertainty pervade the outlook. From impending elections shaping policy shifts to COP momentum and supply chain tensions, the landscape remains unpredictable, Sara Verbruggen finds out

Stranger times

14 energy focus | www.the-eic.com Special report Outlook 2024

While 2023 was a positive year for many in the energy supply chain, global events and sector challenges – from labour shortages to demand uncertainty – mean 2024 will be daunting, but by no means dull.

Election outcomes

With many countries going to the polls this year, changes to energy policies could impact certain sectors. It is not hard to imagine what Donald Trump could do to America’s Inflation Reduction Act (IRA) should he take power in November.

The Federal licensing administrator Bureau of Ocean Energy Management (BOEM) has efficiently processed several offshore wind projects during Joe Biden’s tenure. Whether the pace will continue under a Republican government remains to be seen. Compared with four years ago, several US states – blue and red – have introduced policies to support offshore wind, with some projects now constructionready, helping to offset any grinding of the Bureau’s gears in relation to renewables.

In countries with pending elections, it may be prudent to wait. “As an owner, you may decide to put on hold a major investment in a new vessel or port upgrade until you fully understand the policies of the new government,” says International Marine Contractors Association (IMCA) Chief Executive Iain Grainger.

COP momentum

With the UAE – a leading oil exporter –hosting last year, COP28 was in danger of looking like a cop-out on keeping emissions on the 1.5°C path. Yet it is the only platform capable of bringing together governments and energy industries (many state-owned) from across the world. “But unless there is political will to maintain those discussions and targets going forward, they will lapse,” says EIC Head of External Affairs Rebecca Groundwater. “The energy sector is global, the supply chain moves, and we can all help deliver for each other – but only if we can have a joined-up conversation.”

In February, during an event organised by the International Energy Agency at its Paris headquarters, COP28

President Sultan Al Jaber urged all parties that signed the UAE Consensus to enhance their Nationally Determined Contributions ahead of the next cycle in 2025, and said he would “continue to push for more” from the oil and gas industry to expand on the goal of 40% of global oil production committing to zero-methane emissions by 2030.

Supply chain tensions

The energy sector is global, the supply chain moves, and we can all help deliver for each other – but only if we can have a joined-up conversation

Rebecca Groundwater, Head of External Affairs, EIC

The wider supply chain’s cross-sector ability is “made more challenging to fully leverage” due to lack of a pipeline of projects and visibility of projects on a sector-by-sector basis in the near-term, says Neil Golding, EIC’s Director of Market Intelligence.

This is particularly acute in offshore wind. After stability and growth, the sector seems markedly capricious. With leading developer Ørsted rolling back on its 2030 target of 50GW, companies that might have otherwise diversified into the sector will be putting investment decisions on hold. “All of this will-they-won’t-they, in terms of projects proceeding, is very unhelpful for the supply chain,” says Golding.

Smulders, a steel construction firm that diversified into offshore wind a few years ago, is on a good footing. “We secured our supply chain and have capacity for 4.5GW annually but actually hope to secure 6GW during 2024, which will see us through 2025,” says Eric Finé, Business Development Manager. “Then orderbooks are already starting to fill from 2026 onwards.”

In offshore energy, the volume of work is out there and the supply chain is better equipped to choose projects, where and whom to work for, according to Grainger. To assist contractors, IMCA published a set of contracting principles and a standard contract, free to use, as a starting point to share risk and reward more fairly between developers and contractors. IMCA is

focused on avoiding mistakes of the past when offshore oil and gas companies moved into offshore wind.

“The offshore wind supply chain has reduced in the past two to three years,” says Grainger. “The growth in oil and gas, due to a heathy oil price, has seen some contractors return there, where clients tend to work more collaboratively and fairly with their supply chain.”

Workforce issues

Labour shortages are also compounding some of offshore wind’s woes, notably in the UK where anti-immigration policy is delaying construction.

Grainger says: “The UK offshore oil, gas and wind industries rely on big international vessels for construction and then they leave to go to another project, making it neither safe nor economic to change the crew out for what amounts to a few months. IMCA, along with Renewable UK, Scottish Renewables, OEUK, NOF, Global Underwater Hub, and the UK Chamber of Shipping have informed the UK government of the impact that the UK Offshore Wind Workers Visa issue is having in terms of realising the UK’s net-zero ambitions and on the onshore UK jobs that supports these international vessels.”

Grainger says IMCA has had success in educating US lawmakers on the American Offshore Worker Fairness Act’s shortcomings. “There aren’t sufficient numbers of US mariners and trained personnel to man the construction vessels required for offshore wind farms, so we, along with US trade associations, have been informing US lawmakers about how any new Act would delay or impede these projects.”

Energy transition needs targets and more

With countries including India and Indonesia announcing targets for hydrogen and carbon, capture and storage, respectively, momentum is building – but

www.the-eic.com | energy focus 15 Outlook 2024: Special report

SHUTTERSTOCK / ISTOCK / DESIGN

Energy supply chain outlook 2024: Navigating transformative shifts and challenges

Election implications

Potential shifts in energy policies due to election outcomes worldwide, particularly in the US

COP continuity

Importance of continued global cooperation in tackling emissions despite challenges

the real action is happening in markets incentivising investments. US projects in hydrogen, biofuels and sustainable aviation fuels will reach a final investment decision (FID) in the next year or two. The IRA has been a “game changer” across cleantech, though its trajectory post-election remains uncertain, cautions Golding.

In the UK, carbon, capture and storage agreements will be reached at end of 2024. “But the UK needs to move faster with green hydrogen and the second allocation round,” says Golding. “We’ve seen the target of 1GW in production by 2025 turn into in production or construction by then.”

Energy transition requires clear objectives

Momentum building for renewable energy projects, but challenges remain in financing and policy uncertainty

Workforce struggles

Labour shortages affecting offshore wind construction, highlighting visa issues

Inflation affects FID

Inflation affecting project viability across energy sectors, including oil and gas

Supply chain strain challenge

Challenges in the offshore wind sector, including project uncertainties and workforce shortages

Collaboration for solutions

Importance of collaboration and analysis in navigating energy challenges

Innovative energy sector

Despite challenges, the energy sector has the potential to overcome obstacles through collaboration and innovation

Policy uncertainty and lack of financing can delay projects. “Even markets that were anticipated to quickly establish, such as green hydrogen in Australia, have question marks over commercial viability,” says Golding. “First mover projects need to show the demand and prove the business case.” While there have been several mega-project announcements, such as the Western Green Energy Hub, FID is still some years away. That project has an Memorandum of Understanding with South Korean utility KEPCO, which paves the way for it to meet both domestic demand as well as demand for export to South Korea.

Inflation impact

The value of projects reaching FID in upstream oil and gas was up in 2023, according to EIC data – but the volume has reduced, a sign that price inflation is not only impacting sectors such as offshore wind. “There are large projects in the Middle East that have gone back out to retender,” says Golding. “Projects are struggling to reach FID even with a relatively stable oil price.” Meanwhile, with the Hinkley Point C nuclear project seeing another increase in prices, there are questions about affordability along with energy security. “Politicians are concerned about what’s going to give the taxpayer the best value for money,” Golding adds.

Joining up the dots

The energy industry supply chain has the collective will, experience and ingenuity to deliver but can often be hindered by the silos around different sectors, sometimes unintentionally exacerbated by policy. Groundwater reports members struggling to access finance where lenders and governments are reluctant to provide funding to low and zero-carbon projects when companies involved also operate in oil and gas.

“You cannot shut down one energy sector and hope another picks up the pace when we have a lack of capacity or a shortage of skills,” she says. The industry could be better served with analysis of market data to indicate where the work is, analysis of policy and geopolitics to help global members navigate risk, and insight into where markets are heading for the bigger picture, she adds.

Special report: Outlook 2024

16 energy focus | www.the-eic.com

Attend Energy Exports Conference 2024, the #1 event to identify global energy opportunities and meet key decision makers

2024 Confirmed Exhibitors, Partners & Speakers

energy project opportunities around the world, EEC provides companies access to hundreds of contacts and to learn about multiple new export opportunities. Listen, engage and connect with international operators, developers, contractors, government and export advisors, ambassadors and trade experts from across the globe. www.the-eic.com/EEC

FREEREGISTERFORYOUR PLACETODAY

Energy Exports Conference 2024 P&J Live, Aberdeen, Scotland | 11th - 12th June 2024 Contact us – for more information or if you are interested in one of our exhibition or sponsorship packages, get in touch with a member of the team… email EEC@the-eic.com

to attend

day

to

Show Highlights Organising Partners Travel Partner Principal Media Partner Strategic Partner Sponsors Free

2

exhibition & conference Access

all conference sessions Access to the networking reception Unlimited networking opportunities

Navigating the biodiversity crisis: A call to action for businesses

In an era marked by alarming statistics of biodiversity loss and the urgent need for environmental stewardship, businesses stand at the forefront of driving transformative change towards sustainability. From embracing reporting frameworks to fostering nature literacy within organisations, businesses can pave the way for protecting nature while ensuring long-term resilience and success, says

John Miller at Curlew Action

18 energy focus | www.the-eic.com Feature Biodiversity and business

Since 1970, the World Wide Fund for Nature has reported a staggering loss of 68% of our vertebrate wildlife, while the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services suggests that approximately one million species may have been lost during this period. While humanity has prospered immensely in recent decades, the ways in which we have achieved such prosperity have come at a devastating cost to nature. Estimates of our total impact on nature suggest that we would require 1.6 Earths to maintain the world’s current consumption levels.

The urgency of protecting biodiversity

Human activities such as agriculture, urban development and infrastructure expansion have led to widespread habitat loss and fragmentation, driving many species towards extinction. This loss of habitat not only directly affects the species living within those ecosystems but also disrupts entire food webs and ecosystem functions, leading to cascading impacts on biodiversity and human wellbeing.

While climate change often dominates discussions around environmental issues, it is crucial to recognise that habitat destruction and degradation are equally pressing concerns in terms of their impacts on maintaining a healthy thriving planet – if not even more immediate.

Integrated strategies: biodiversity and climate change

Efforts to address biodiversity loss must go hand in hand with climate change mitigation and adaptation strategies. Protecting and restoring natural habitats, such as meadows, wetlands and forests, provides essential refuge for threatened species and contributes to carbon sequestration, water purification and flood mitigation.

How to be a nature-positive business: 10 steps to boost biodiversity

To tackle the biodiversity and business-related challenges and opportunities outlined in this article, businesses should consider the following actions:

1

R ecognise the importance of biodiversity:

Understand that biodiversity is crucial for the functioning of ecosystems, human wellbeing and economic activities, including those of your business.

2

Assess your impact on nature:

Evaluate how your company’s operations and supply chains may contribute to biodiversity loss or conservation. Identify specific areas where your activities may have the most impact.

3 Take proactive measures to improve your company’s environmental performance and reduce biodiversityrelated risks.

Efforts to address biodiversity loss must go hand in hand with climate change mitigation and adaptation strategies

Even conserving specific individual endangered species can have broader benefits for entire ecosystems, as many species play key roles in maintaining ecological balance and resilience.

Recognising this urgency of protecting biodiversity alongside addressing climate change is crucial for achieving sustainable development and ensuring our planet’s

4 Adopt reporting frameworks:

Consider adopting reporting frameworks such as the TCFD and TNFD. These enhance transparency and provide information on the financial implications of naturerelated risks and opportunities.

5 Establish a team: Create a multidisciplinary team, including people from finance, data management and other relevant departments. This can assess your impact and develop strategies to mitigate risks and enhance outcomes.

www.the-eic.com | energy focus 19 Biodiversity and business: Feature

ISTOCK SHUTTERSTOCK

How to be a nature positive business:

10 steps to boost biodiversity

Continued...

6 Seek sponsorship and empowerment: Secure board-level sponsorship and empower an individual or team to lead integration of biodiversity considerations, ensuring issues are addressed effectively and efficiently.

8 Monitor and measure progress:

Establish metrics and targets to track progress in mitigating biodiversity risks and contributing to positive outcomes. Monitor and report on performance for transparency and accountability.

10 Build nature literacy: Invest in training and awareness programmes to enhance employees’ understanding of biodiversity and its relevance to your business. Foster a culture of environmental stewardship.

7

Engage stakeholders: Collaborate with stakeholders such as investors, lenders, employees and regulators to understand their expectations, concerns and preferences. Involve them in decision-making and seek their input on nature-related actions.

long-term health and resilience. It requires a holistic approach that considers the complex interactions between ecosystems, biodiversity, climate and human wellbeing.

Business imperative: recognising nature as an asset

According to a report by PwC, 55% of global GDP relies to some extent on nature, with the energy industry having a 35% dependency. Addressing biodiversity loss and promoting sustainable practices mitigates business risks and presents opportunities for innovation and long-term resilience.

We are part of nature, not separate from it; as the 2021 Dasgupta Review says, we need to think of nature as an asset and treat it accordingly.

9 Support and engage with upcoming legislation, such as Biodiversity Net Gain, to ensure the incorporation of naturepositive practices.

The emergence of new nature markets, similar to carbon credits, aims to address some of these issues. The Environment Bank is one such provider, sharing its expertise on nature solutions with companies.

Technological advancements in biodiversity monitoring

When looking at the risks and opportunities for business, it is essential to remember that this is a journey. Only recently, an active investor criticised bp for moving away from fossil fuels and towards green energy too quickly. This road will be bumpy. The clarity of your message and the integrity of your nature data are key – and this is where new technology can help.

Let us consider the recent classification of Atlantic salmon in the UK as a newly endangered species. Technological advances are providing new evidence –for example in the use of tiny transmitters, the size of a grain of rice, to monitor salmon smolt migration patterns. For a long time, we thought salmon’s decline was mainly due to factors at sea. Thanks to this new technology, we know that there are challenges we can mitigate within the rivers themselves. By helping to solve the river issues, we are creating healthier waterways for all kinds of other fish and plants, too. Healthy rivers mean healthy wetlands and carbon capture. Dead or depleted rivers cannot play their part in thriving ecosystems.

Ultimately, we need fat, fit smolts to increase their survival rates at sea. This new data enables stakeholders to implement more precise and targeted actions, river by river. Businesses need similar targeted actions to avoid accusations of greenwashing.

Shifting perspectives: connecting people to local environments

Transitions need to take people with them, but I would speculate that people can relate better to nature’s positive messages than to longer-term climate goals. The two are interconnected, but sometimes the

Feature: Biodiversity and business

20 energy focus | www.the-eic.com

argument is back to front. Protect nature and, by default, its habitat, and you can often reduce or at least mitigate carbon emissions.

The key here is connecting people to their local environment rather than incessantly focusing on polar bears. Yes, polar bears are awesome, and yes, they are a key indicator species, but they do not necessarily connect with a postal worker in Basingstoke. Bring the problem closer to home –when did you last hear a sparrow chirp in the UK?

If all this seems daunting, consider it part of a continuous movement to improve corporate responsibility and reduce risk after the financial crash of 2008.

Policy initiatives and corporate responsibility

The term ESG was first used at COP21 in 2015 to focus on environmental, social and governance issues in business decisions. I remember this being a footnote in a company report and a quick decision on where we pumped in some donations. It became mainstream once investors began asking for more detail and prospective employees started questioning HR.

The Task Force on Climate-related Financial Disclosures (TCFD) subsequently established guidelines to improve transparency on the financial impacts of climate-related risks and opportunities. By adopting TCFD guidelines into their annual reports, organisations provide investors, lenders and insurers with clear, comprehensive and high-quality information to facilitate long-term financial decisions. The 11 disclosure recommendations are structured around four core elements: Governance, Strategy, Risk Management, and Metrics and Targets.

Acting in line with sustainable practices and integrating biodiversity considerations into your operations not only protects nature but also contributes to your resilience and business success

Similarly, the Taskforce on Nature-related Financial Disclosures (TNFD) aims to position nature risk alongside other financial and operational risks. Although not yet law, TNFD is considered a key milestone in the relationship between nature, business and financial capital. The good news is that this can build on existing TCFD processes and incorporate them into annual accounts.

The Biodiversity Net Gain legislation, which became mandatory for major developments on 12 February 2024, aims to mitigate environmental damage and mandates developers to achieve a minimum of 10% Biodiversity Net Gain on new developments in England. This legislation, which will be applied to small sites starting 2 April 2024, aligns with the government’s objective of safeguarding 30% of land and sea by 2030.

The strength of this law lies in the mandate to maintain the habitat for 30 years. It is not simply about setting aside an area; instead, it entails proactive management for the benefit of nature. Having governments establish a framework makes it easier for businesses to operate on an equal footing.

Businesses have a crucial role

The focus on climate change can mask the immediate challenges we face, which may not be climate related. Global campaign ‘It’s Now for Nature’ makes this point, calling for businesses to act together to build a more nature-positive world by 2030. It talks about a net zero and a nature-positive equitable future, with businesses contributing by setting credible nature strategies. And remember, acting in line with sustainable practices and integrating biodiversity considerations into your operations not only protects nature but also contributes to your resilience and business success.

Biodiversity and business: Feature

GETTY / ISTOCK / SHUTTERSTOCK

Africa is accelerating its energy transition with investments in green hydrogen, carbon capture and energy storage, fostering sustainable development and collaboration, say Idoko Isaac and Hope

George at LES Energy Services Ltd, Nigeria

Solar and wind in Africa

239 CAPEX projects worth US$133bn

Countries to watch Egypt, Morocco, South Africa, Tunisia, Nigeria

Africa’s clean revolutionenergy

Africa is at a pivotal moment in its energy transition journey. With a rapidly growing population and increasing energy demand, the continent faces challenges and opportunities in its quest for sustainable development. In recent years, there has been a surge of interest and investment in green hydrogen, carbon capture, energy storage and renewable resources across Africa, promising to revolutionise the energy landscape while tackling energy poverty. According to the International Energy Agency, 600 million people in

Africa lack access to electricity, primarily in rural areas.

Demographic trends and energy demand

Africa’s population is on a trajectory of exponential growth, with the UN projecting that it will double by 2050 to reach 2.5 billion people. This substantial increase in population will naturally lead to higher energy demand to power homes, businesses, transportation and industries. Meeting this demand in a sustainable way will be crucial for the continent’s socioeconomic development.

International investments and collaborative efforts

Africa’s energy transition is being bolstered by strategic partnerships and investments from international stakeholders. Countries and organisations from around the world are collaborating with African governments and businesses to drive forward clean energy projects and initiatives. These partnerships bring not only financial resources but also technological expertise, knowledge transfer and opportunities to build capacity.

22 energy focus | www.the-eic.com Energy Transition Africa

(Above) view of windmills at the onshore Zaafarana windfarm (producing a total capacity of 544.82 megawatts) along the Gulf of Suez on Egypt’s Red Sea coast

The UAE has emerged as one of the top investors in Africa, ranking fourth globally behind China, the EU and the US. Having invested more than US$12bn to help unlock Africa’s clean energy potential, the UAE pledged a further US$4.5bn last year to help speed up the development of clean energy projects.

Building on the UAE’s Etihad 7 initiative to supply clean energy to 100 million Africans by 2035, UAE-based Masdar is advancing its US$10bn 10GW by 2030 growth plan across Angola, Uganda, the Republic of Congo, Kenya, Mozambique and Zambia.

According to Masdar, Africa possesses a theoretical clean energy capacity of 850TW from solar and wind sources and could secure up to 10% of the global green hydrogen market.

Africa’s green hydrogen ambitions

Green hydrogen in Africa

43 CAPEX projects worth US$153bn

Countries to watch

Egypt, Morocco, Mauritania, Algeria, South Africa, Namibia

energy transition strategy. Carbon capture and storage (CCS) technologies offer a promising solution to mitigate emissions from power generation and manufacturing. In South Africa, the Leandra Carbon Capture and Storage Pilot Project stands out as one of the world’s largest CCS initiatives, aiming to capture millions of tonnes of CO2 annually from Sasol’s coal-toliquids facility.

Storage Project and Xlinks Morocco–UK Power Project showcase Africa’s potential for grid-scale energy storage, crucial for integrating intermittent renewable sources, expanding energy access in remote areas and exporting electricity abroad.

Pumped hydro storage is another promising option. It leverages Africa’s abundant water resources to store excess energy during periods of low demand and release it when needed. Once completed, the Grand Inga Dam project in the Democratic Republic of Congo could become the world’s largest hydroelectric facility, providing clean energy and supporting regional energy integration.

Green hydrogen, produced through water electrolysis using renewable energy, has emerged as a game-changer in Africa’s quest for clean energy. EICDataStream lists 43 major CAPEX projects worth US$153bn across Africa. Initiatives such as South Africa’s SA-H2 initiative, Namibia’s US$3bn Tsau Khaeb project with plans for 3GW of clean hydrogen and 7GW of solar and wind energy, and Egypt’s US$13bn Acme green hydrogen plant, which will produce 2 2m tonnes of hydrogen per year, highlight the continent’s ambition in this sector. Siemens Energy, Enel Green Power and TotalEnergies have all announced investment in green hydrogen projects. Additionally, partnerships with international organisations such as the Green Climate Fund and the World Bank are providing crucial financial support for green hydrogen infrastructure development in Africa.

CCS in Africa

Addressing carbon emissions is a critical aspect of Africa’s

Furthermore, African countries are exploring opportunities for natural carbon capture through reforestation and sustainable land management practices. Projects such as the Great Green Wall initiative, spanning multiple countries in the Sahel–Sahara region, aim to restore degraded land and sequester carbon while promoting biodiversity and combating desertification.

The Global CCS Institute, backed by major energy companies and governments, is providing technical expertise and funding for CCS research and deployment in the region. Moreover, initiatives such as the African Development Bank’s Climate Investment Funds are catalysing private sector investment in CCS infrastructure across Africa.

Harnessing resources for energy storage

CSS in Africa

4 CAPEX projects worth US$0.4bn

Countries to watch

Egypt, Angola, South Africa

Africa’s abundant mineral reserves, including cobalt, manganese, platinum, lithium and copper, play a crucial role in manufacturing the batteries and other green technologies needed for reliable energy storage.

Projects such as Mozambique’s US$150m 50MW Nacala Energy

Engie, GE Renewable Energy and Fluence are actively involved in developing energy storage projects across Africa. Additionally, multilateral institutions such as the African Development Bank and the International Finance Corporation are providing financial support and advisory services for energy storage initiatives in the continent.

Africa’s role in a clean energy future

Africa’s energy transition journey is marked by a commitment to sustainability, innovation and collaboration. Initiatives focused on green hydrogen, carbon capture and energy storage are at the forefront of this transition, offering solutions to address climate change, expand energy access and enhance energy security for its population, as well as drive economic development. With the support of international investors and strategic partnerships, Africa is poised to emerge as a leader in the global transition to a clean energy future.

By Idoko Isaac, Head of Technical Sales and Hope George, Commercial Manager, LES Energy Services Ltd, Lagos, Nigeria

FOR PROJECT

IMAGES: GETTY

SOURCE

DATA: EICDATASTREAM

Africa: Energy transition

www.the-eic.com | energy focus 23

(Right) A Kustec hydrogen cooling system at a compressor plant creating green hydrogen in Mogalakwena, South Africa

Geothermal energy:

A

serious contender

for sustainable heat and power

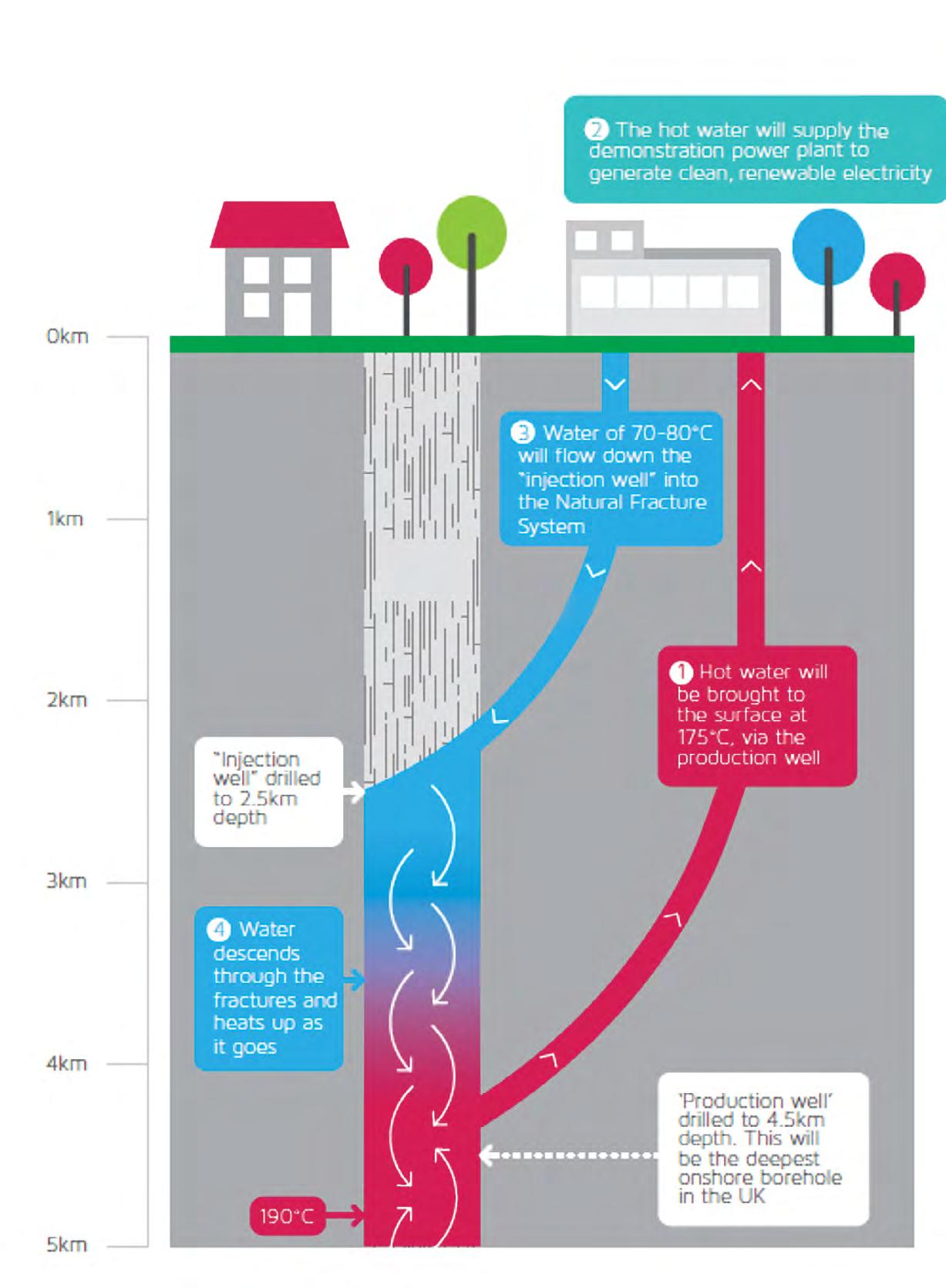

This year the UK will generate its first power from the heat beneath our feet. It is time to take geothermal seriously, says Dr Ryan Law at Geothermal Engineering Ltd

As countries and companies continue their push to reach net-zero targets, new and technologically innovative strategies in the energy sector will be more crucial than ever.

Despite strides in solar and wind power, their intermittent nature means we still need 24/7 baseload power generation, which is often reliant on carbon-intensive methods. Overcoming this is imperative if renewable sources are to supplant fossil fuels.

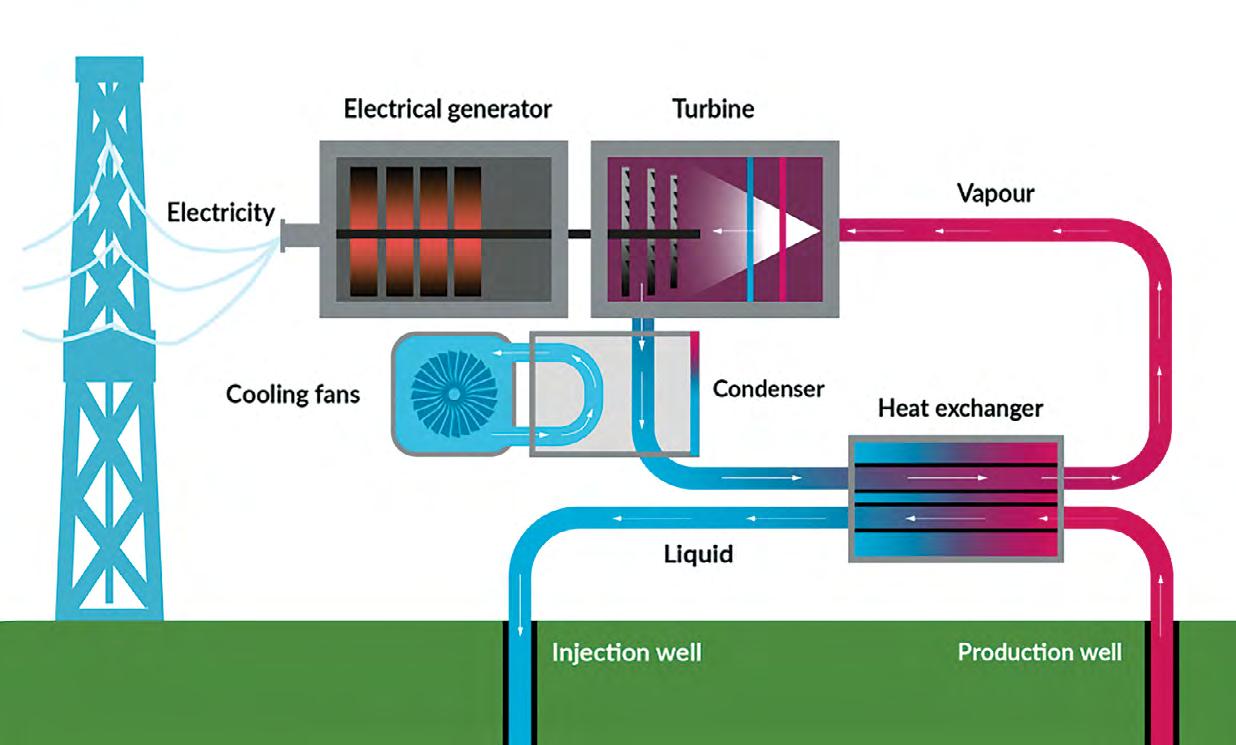

Geothermal: a clean baseload solution

The geothermal resource (heat and power) offers a consistent, zero-carbon renewable energy source. Harnessing the heat from deep beneath the Earth’s surface, geothermal power plants can generate electricity continuously, whatever the weather. This guarantees a constant supply of electricity to the grid –essential for balancing our power networks as we integrate increasing amounts of intermittent energy from wind and solar.

From ancient roots to modern innovation

Geothermal resource is nothing new: geothermal heat has been used since

pre-Roman times, primarily for hot water supply. Electricity plants have been in operation for more than 100 years. Historically, major geothermal power producers include Italy, Iceland, the US and Indonesia. These nations predominantly developed power plants in areas of high heat flow, often where steam was readily available at the surface.

More recently, Africa (notably Kenya) and Turkey have begun tapping into their geothermal resources, resulting in rapid growth in these regions. In other parts of the world where geothermal resources are deeper, projects are now proliferating, with Germany notably increasing its investment in this sector.

The UK’s geothermal revolution

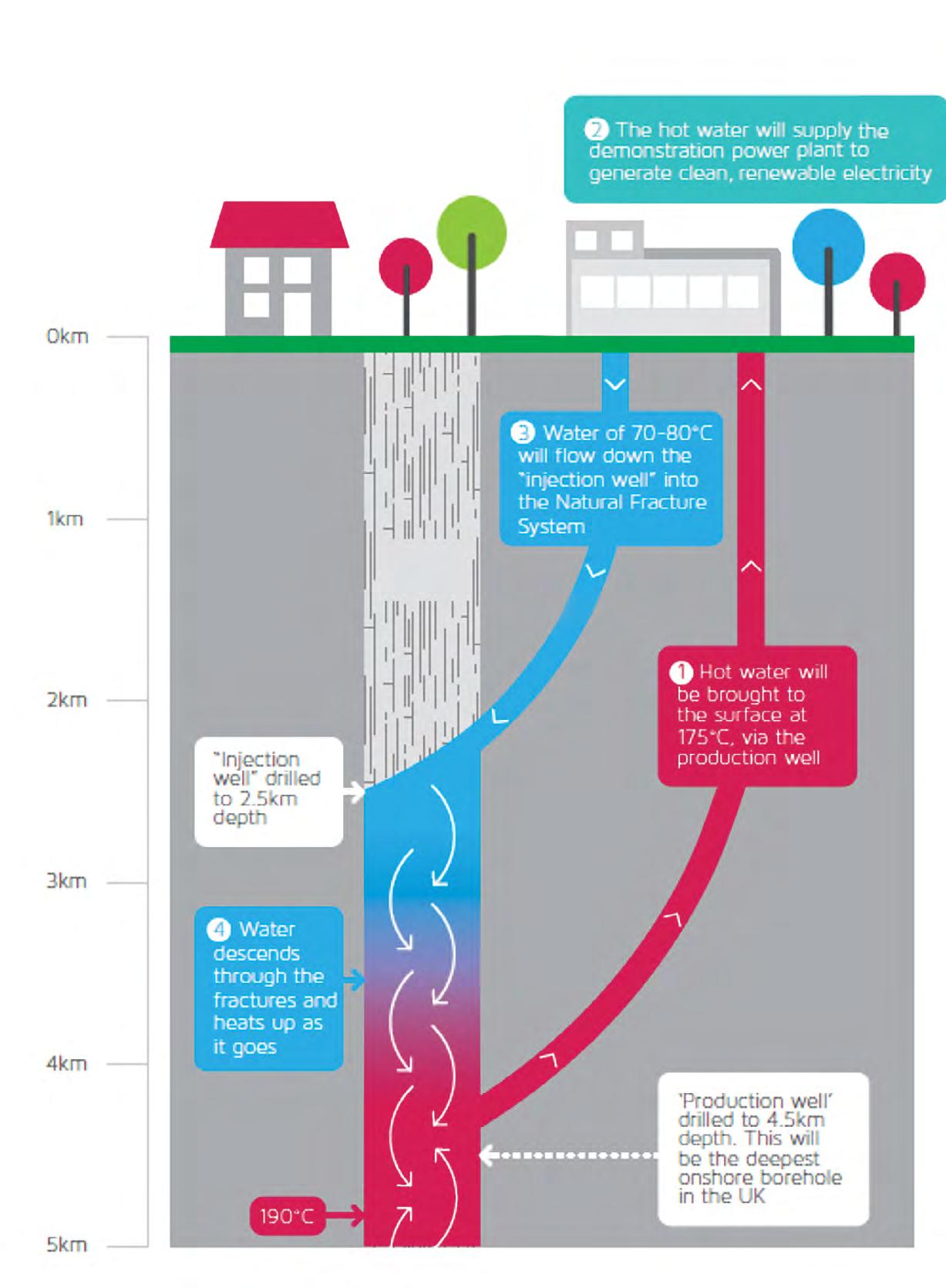

In the UK, Geothermal Engineering Ltd (GEL) has been targeting deeper resources.

The United Downs Geothermal Power project began in 2009, with site acquisition and planning commencing the following year. Initial funding agreements were secured in 2017, and by 2019, the drilling of two wells, 5,275m and 2,393m deep respectively, was successfully completed. Final production testing concluded in 2021, marking a significant milestone as the site

produced geothermal steam in July – a first for the UK.

Construction of the plant started on the site at the start of 2024, and electricity generation is scheduled to commence in Q4 of this year, with the actual construction work set to finish in the summer.

The United Downs site is a ‘proof of concept’ and, in combination with the rest of the GEL portfolio, the company is targeting 5MWe of baseload electricity and 100MWh of heat energy by 2028. This will be enough to power and heat as many as 70,000 homes – an exciting reminder of just how important geothermal energy will be for the UK and the wider world as we strive to deliver on our commitments to reach key environmental goals.

Last year, the company was awarded three Contracts for Difference (CfDs) in the UK Allocation Round 5 process, a historic first for geothermal projects. These 15-year agreements, supported by the government, provide revenue stabilisation to protect renewable power generators and electricity buyers from market price fluctuations. The initial CfDs were awarded to the United Downs, Manhay and Penhallow projects – another exciting opportunity for the UK’s broader renewable energy landscape.

24 energy focus | www.the-eic.com Renewables Geothermal

Geothermal lithium: powering clean transportation and sustainable industry

Geothermal power and heat are not the only benefits of all the hard work that has gone into developing these geothermal sites in Cornwall. During the well testing at United Downs, fluid samples were collected from around 5km underground. The company made an incredible discovery: a lithium concentration of approximately 340 parts per million, one of the highest recorded at any European commercial geothermal lithium project. With demand for electric vehicle (EV) batteries rising amid as cleaner transport options become more necessary, lithium is experiencing heightened demand.

Direct lithium extraction techniques are also more prevalent around the world due to it being a carbon-friendly process, which presents a huge advantage for the operation already in place at United Downs, as well as other sites under development in Cornwall. Lithium can be extracted from the hot geothermal brine produced as a natural by-product of the main baseload geothermal power and heat operation. GEL aims to produce as much as 12,000 tonnes of lithium carbonate equivalent per year by 2030, enough for 250,000 EV batteries for average-sized cars.

The biggest bonus is that the whole process is fuelled by zero-carbon geothermal power, as opposed to the environmentally damaging quarrying at many mines today.

Additionally, as lithium extraction is set to take place within UK borders, the country is poised to emerge as a dominant force in European and potentially global lithium production. This, combined with advances in geothermal energy generation, the creation of job opportunities, and the driving of business towards the south-west of England, makes us proud of our achievements –both in plotting a course towards a cleaner planet and reviving Cornwall’s ancient mining industry in a modern, safe and sustainable way.

Geothermal’s role in a green future

Geothermal mining opportunities are substantial, driven by the demand for baseload power, renewable heat and zero-carbon lithium. The skillset and supply chain required for deep drilling and project development are already strong in the UK due to the oil and gas industry. We expect to see an increasing number of projects developed over the next decade.

By Dr Ryan Law, Founder & CEO, Geothermal Engineering Ltd

The United Downs project

This project near Redruth accesses Cornwall’s naturally heat-producing granite with two deep, directional wells: a 5,275m production well (the UK’s deepest onshore) and a 2,393m injection well. Geothermal fluid is extracted, and the heat is used to generate electricity in a power plant. It is then re-injected underground via the injection well to reheat

GEOTHERMAL ENGINEERING LTD

Geothermal: Renewables

www.the-eic.com | energy focus 25 1 Hot water will be brought to the surface at 175˚C, via the production well

Water of 70-80˚C will flow down the ‘injection well’ into the Natural Fracture System

The hot

supply

demonstration power plant to generate clean, renewable electricitity 4 Water descends through the fractures and heats up as it goes ‘Injection well’ drilled to 2.5km depth ‘Production well’ drilled to 4.5km depth. This will be the deepest onshore borehole in the UK Granite UD1 UD2 Production well Injection well Natural Fracture System 190˚C

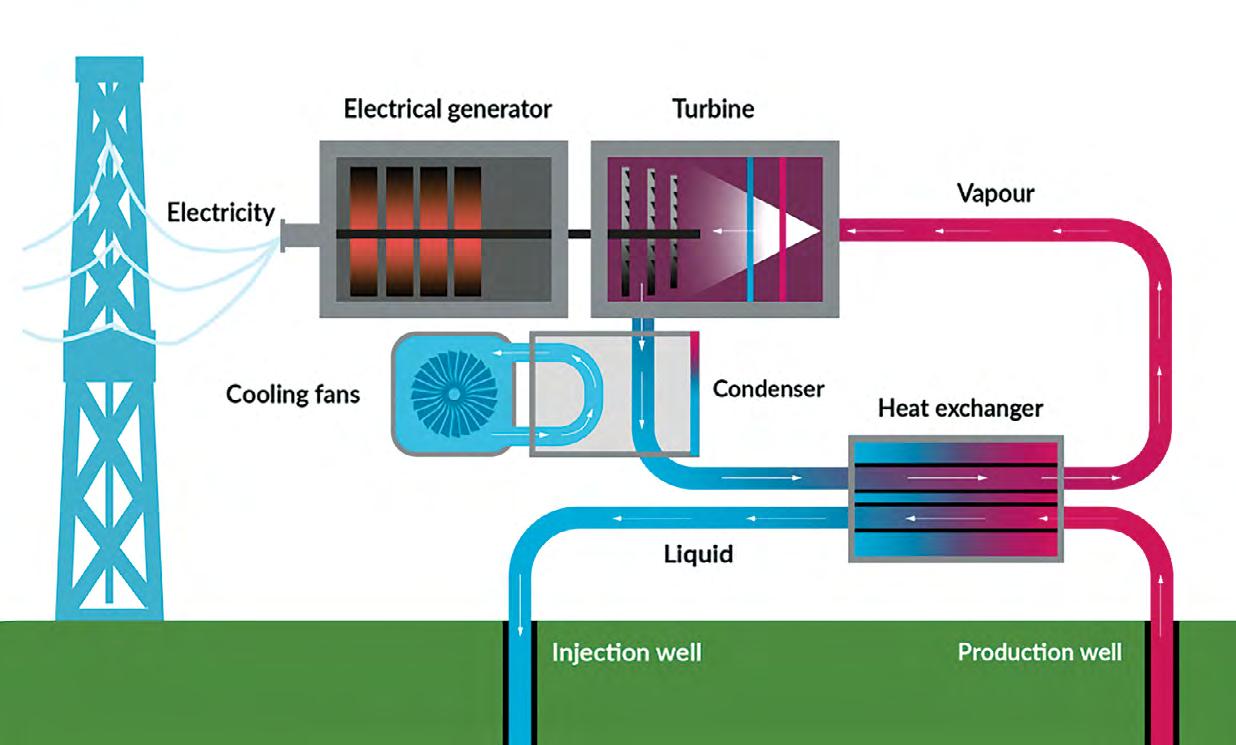

Left: An artist’s impression of a geothermal power plant

3

2

water will

the

vision for growth and opportunities in Brazil Petrobras’

Petrobras’ bold vision for 2024–2028 prioritises sustainability and innovation in oil and gas exploration while offering lucrative opportunities for global supply chain collaboration, says EIC Energy Analyst Lucas Ramos

Petrobras, Brazil’s state-owned energy giant, has laid out an ambitious strategic vision for 2024–2028. This forward-looking plan includes a substantial investment of US$102bn, representing a significant 31% increase on the firm’s 2023–2027 plan.

Focus on exploration and production

With a keen focus on oil and gas exploration and production (E&P), Petrobras aims to expand its operations while prioritising sustainability and technological innovation.

More than 70% of the allocated capital will be directed towards E&P.

Key objectives include the further development of presalt reserves in the Santos Basin (US$41bn), revitalising infrastructure in the Campos Basin (US$22bn), and conducting exploration activities in Brazil’s Southeastern Basins, the Equatorial Margin, and offshore Colombia (US$7.5bn). Petrobras views the Equatorial Margin as a promising frontier, with potential exploration successes similar to those seen in the GuyanaSuriname basin.

ALAMY

26 energy focus | www.the-eic.com Oil and gas Global projects

Prioritising decommissioning activities

In tandem with its expansion plans, Petrobras is prioritising decommissioning activities, earmarking almost US$8bn for green decommissioning in the Campos Basin, involving local shipyards. By 2028, the company aims to decommission 15 out of 23 platforms in this basin alone, with plans to target an additional 40 platforms across the country beyond 2028.

More than 70% of Petrobras’ US$102bn investment will be directed towards oil and gas exploration and production

Expansion through FPSO deployments

Petrobras is set to bolster production capacity by deploying floating production, storage and offloading

vessels (FPSOs). With 13 FPSOs scheduled to commence oil production by the end of 2028, the company anticipates exceeding 2bn barrels of oil per day in incremental capacity. These FPSOs will exploit reserves in fields within the Santos, Campos and Sergipe-Alagoas Basins. At the time of writing, tenders to charter three FPSOs – SEAP I, SEAP II (deadline 14 June 2024) and Barracuda-Caratinga (deadline 1 July 2024) – are open. In early 2024, Petrobras initiated direct negotiations with two companies –Ocyan for the Albacora FPSO and Seatrium for the P-84 and P-85 FPSOs.

Technological advancements for emissions reduction

T he Albacora FPSO will feature emission reduction technologies including a closed flare system, while the P-84 (Atapu) and P-85 (Sépia) platforms, targeting first oil after 2028, are being engineered for full electrification, potentially slashing greenhouse gas emissions by up to 30%. However, Brazil’s inaugural FPSO with an

ISTOCK Global projects: Oil and gas

www.the-eic.com | energy focus 27

Below: Oil rig of the Brazilian oil company Petrobras passing Sugarloaf Mountain, Guanabara Bay, Rio de Janeiro, Brazil

MAJOR PROJECTS TO WATCH

Búzios Oil Field (Phase 11 – P-83 FPSO)

Value: US$5.4bn

Start: 2027

Stage: EPC

Status: Contract awarded

Operator: Petrobras

Barracuda-Caratinga Oil Field Redevelopment

Value: US$8bn

Start: 2028

Stage: EPC

Status: Tendering and bidding

Operator: Petrobras

Agulhinha-Cavala Oil Fields (SEAP I)

Value: US$3.5bn

Start: 2028

Stage: EPC

Status: Tendering and bidding

Operator: Petrobras

Sépia Oil Field (Phase 2 – P-85 FPSO)

Value: US$6bn

Start: 2029

Stage: EPC

Status: Preferred bidder

Operator: Petrobras

Raia Manta/Raia Pintada Gas Fields (Raia FPSO) (Equinor)

Value: US$9bn

Start: 2028

Stage: EPC

Status: Contract awarded

Operator: Equinor

D e carbonisation partnerships signed with Petrobras beyond E&P

Company Partnership agreement content Date

China Energy Intl Memorandum of Understanding (MoU) with purpose of identifying potential business opportunities in Brazil related to renewable energy generation and sustainable hydrogen and green ammonia production.

Vale Two-year partnership to assess joint decarbonisation opportunities by accelerating the development of low-carbon solutions (hydrogen, green methanol, green bunker, green ammonia, renewable diesel and CCS technologies).

European Energy MoU to investigate e-methanol opportunities in Brazil.

ArcelorMittal MoU to study potential business models for lowcarbon fuels, hydrogen and its products, renewable energy, and a CCS hub in Espírito Santo.

Yara Two-year partnership to study potential business partnerships in fertiliser segment and decarbonisation of production.

all-electric setup will be the Maria Quitéria FPSO, expected to commence production in the Jubarte pre-salt field (Campos Basin) by 2025.

In January 2024, Petrobras awarded TechnipFMC the contract to supply its High-Pressure Separation technology for CO2 separation and reinjection on the seabed, shifting the process away from the topside platform. Apart from emissions reduction, this innovation could enhance production capacity by alleviating bottlenecks in the topside gas processing plant. Petrobras’ proprietary technology is presently undergoing testing at the Duque de Caxias FPSO, part of the third development phase of the Mero pre-salt field, slated to commence oil production in the second half of 2024.

13 FPSOs are scheduled to commence oil production by the end of 2028

Further innovations, spanning topside and subsea systems, are slated to drive decarbonisation in the forthcoming years. These include flexible pipelines that can withstand increased depths and pressures, subsea electrification, all-electric well completion, rig automation, and pioneering solutions for well abandonment. Digitalisation initiatives such as digital twins will also be integral to this transformation. Petrobras aims to achieve zero routine flaring by 2030 and to

August 2023

September 2023

November 2023

February 2024

February 2024

have reinjected a cumulative 80m tonnes of CO2 by the end of 2025.

Embracing renewable energy and sustainability

With a commitment to achieving net-zero emissions by 2050, Petrobras is actively participating in energy transition initiatives alongside other major players. Its strategic plan allocates substantial funds (US$11.5bn) towards decarbonisation efforts, including ventures in renewable energy, carbon capture and storage (CCS), blue and green hydrogen production and biorefining. Specifically, it aims to acquire 5GW of operational/under development renewable assets by 2028 and has initiated partnerships for wind turbine development, CCS hubs and green hydrogen projects.

In 2023, Petrobras signed a US$26m partnership with national manufacturer WEG for the development of 7MW onshore wind turbines. It has also disclosed plans for a CCS hub in Macaé, Rio de Janeiro, and is investing US$18m in a green hydrogen pilot project in Rio Grande do Norte. Additionally, there are plans to produce renewable diesel (hydrotreated vegetable oil) and BioQAV (sustainable aviation fuel) through dedicated units at the Presidente

28 energy focus | www.the-eic.com

Bernardes refinery and at the GasLub Cluster. It also has agreements in place with several companies to explore the potential of lowcarbon technologies (see table on facing page).

Strengthening local industry

Local enterprises have consistently shown their ability to provide logistics and maintenance services, a trend that looks set to continue into the future. Additionally, local manufacturers play a crucial role in supplying components, fabricated structures and machinery for various projects. The Lula administration’s recent initiatives aim to further enhance the development of local industry, fostering growth and sustainability.

In 2023, Petrobras subsidiary Transpetro unveiled a fleet expansion project involving the construction of 25 transport vessels, including gas carriers, Aframax and Panamax product tankers. These vessels will be constructed in Brazilian shipyards through to 2032, underscoring Petrobras’ pivotal role in bolstering the local naval industry. This project is poised to drive positive economic outcomes, foster technological advancements and enhance infrastructure development.

Recent regulatory changes mandated by the National Energy Policy Council dictate that

future auctions organised by the National Petroleum Agency under Concession or Production Sharing regimes must have a local content of 30%, up from 25% – emphasising the focus on domestic industry growth.

Opportunities for global supply chain collaboration

Brazil offers ample business prospects in the oil and gas sector, with opportunities for international businesses specialising in offshore drilling, seismic imaging and reservoir characterisation to collaborate with Petrobras and other industry stakeholders in developing additional reserves. Key EPC contractors through to 2028 include MISC Berhad, SBM Offshore, Yinson, Hyundai Heavy Industries, Seatrium and DSME/Saipem, while main subsea contractors include TechnipFMC, OneSubsea and Subsea7.

As Petrobras continues to navigate the evolving energy landscape, collaboration with global companies renowned for innovation and efficiency will be crucial for the company to realise its strategic goals while promoting worldwide growth and sustainability.

By Lucas Ramos, Energy Analyst (Oil and Gas), EIC South America

Petrobras is prioritising decommissioning activities, earmarking almost US$8bn for green decommissioning in the Campos Basin

GETTY

Global projects: Oil and gas

www.the-eic.com | energy focus 29

Above: View of Petrobras’ Presidente Bernardes refinery in Cubatão, São Paulo state, Brazil

The drumbeat of peak coal may have echoed through boardrooms and media headlines in recent years, but a different story is unfolding on the ground. As concern over energy security surges and geopolitical realities bite, the global energy narrative is shifting. This is not simply a resurgence, but a continuation of a complex reality that is often ignored by those wielding simplistic narratives.

The shift comes as traditional funders remain chained to virtue signalling and one-size-fits-all solutions dictated by trends emanating from the Global North.

As energy security concerns pose an immediate threat, this approach seems increasingly detached from the realities of many nations that are now turning back to fossil fuels out of economic and social necessity.

Policy shifts and energy dilemmas

The UK, a staunch advocate of ending coal, has backtracked by reactivating coal plants. Prime Minister Rishi Sunak abandoned the net-zero commitment to ban coal from October 2024, giving the government the flexibility to reactivate coal plants if necessary to prevent blackouts. Reports suggest that Britons

pay 75% more for electricity than Americans due to carbon costs on fossil fuels, a surge in the price of gas-fired power, and renewable energy subsidies.

In 2023, Sweden’s authorities ratified an amendment to its energy targets, shifting from a 100% renewable target to a 100% fossil-free target, with nuclear being the new priority.

In Canada, as temperatures plunged to -40°C, the state of Alberta relied on coal power after renewables proved insufficient to meet demand. The country’s plan to phase out unabated coal by 2030 jeopardises Alberta’s ability to meet demand in future winters.

The resurgence of coal reality

As global energy dynamics evolve, the debate over coal’s role continues to intensify. Nuanced strategies such as sustainable coal stewardship, collaboration and innovation are key for a sustainable future, says

Michelle Manook at FutureCoal

30 energy focus | www.the-eic.com Power Coal

Below: Canada’s Boundary Dam carbon capture and storage (CCS) facility is the world’s first fully integrated full-chain CCS facility on a coal-fired power station

The case for sustainable coal stewardship

The solution that traditional funders are searching for is not the abandoning of coal assets, but the adoption of more nuanced and responsible strategies. FutureCoal’s Sustainable Coal Stewardship (SCS) blueprint offers a roadmap that transcends the outdated binary of ‘good’ and ‘bad’ energy sources. Instead, it showcases the vast commercial opportunities throughout the entire coal value chain.

The SCS model maps out a pathway for optimising efficiency across the global coal value chain. The pathway’s three phases are: Pre-combustion, Combustion and Beyond Combustion. Every step contributes to energy security and the minimisation of environmental impacts. Through innovation and responsible production, we aim to extract maximum value from each tonne of coal and all by-products from its waste.

Shifts in investor sentiment