ENERGY FOCUS

ENERGY 2025 UNPACKED Policy, markets and the road ahead

DATA CENTRES Fuelling AI’s global energy revolution OIL AND GAS The backbone of energy security

HYDROGEN, CARBON CAPTURE, UPSTREAM & DOWNSTREAM

ENERGY 2025 UNPACKED Policy, markets and the road ahead

DATA CENTRES Fuelling AI’s global energy revolution OIL AND GAS The backbone of energy security

HYDROGEN, CARBON CAPTURE, UPSTREAM & DOWNSTREAM

• Local gasket manufa turing

• Sealing solutions

• Bolting technology

• Expansion joints

• On-site services

• Ultra-high pressure seals

• Bespoke engineered solutions

• Media validation and testing

• Low temperature sealing

6 View from the top Miranda Hochberg, VP, Transformation of Industry Communications, Siemens Energy 10 News and events Updates from the EIC

14 Hollowed out: The cost of policy drift on the UK’s supply chain

Rebecca Groundwater, Head of External Affairs, EIC UK

16 The big question Is LNG entering a new boom thanks to data centres?

18 Special feature: A bright future for all energy technologies

Tom Wadlow, Partner, WD Editorial

22 Energy 2025: Policy, markets, and the transition ahead

Jonathan Dyble, Partner, WD Editorial

26 The power behind AI: securing energy for the data-driven era

Neil Golding, Director of Market Intelligence, EIC UK

89 Albert Embankment, London SE1 7TP Tel +44 (0)20 7091 8600 Email info@the-eic.com Chief executive: Stuart Broadley

Should you wish to send your views, please email: info@redactive.co.uk

38 My business

Bradley Savoldelli, Global Sampling Engineering and Product Line Manager, Proserv

32 Project watch: Top 10 global developments

Nabil Ahmed, Energy Analyst, EIC UK

Project watch: Top 10 global developments Lucas Ramos, Lead Energy Analyst, EIC South America

Project watch: Top 10 global developments

Jack Boggis, Energy Analyst, EIC UK

STUART BROADLEY

One

of EIC’s five golden rules for

a healthy supply chain is ‘a role for all technologies’ – explored in this issue

I’m writing this foreword from Abu Dhabi at ADIPEC, the world’s largest and, to me, most exciting energy show –I like to call it “the Glastonbury of energy events”. EIC is proudly hosting its biggest-ever UK Pavilion here, with 127 British companies showcasing their innovations and global capabilities.

This edition of Energy Focus highlights one of EIC’s five golden rules for a healthy energy supply chain – “a role for all technologies”. The others are: consistent policy, a pipeline of profitable projects, funding and exports. These principles underpin energy success by enabling governments to turn energy policy into real-world outcomes that drive investment, skills, taxes, exports and progress towards energy security and net-zero.

Some countries embrace these principles and thrive. Others think their circumstances allow them to ignore one or more of the rules – but that fails every time. When policymakers neglect these fundamentals, they risk policy traps, underdelivering on energy security and decarbonisation, and driving innovative companies to relocate to nations that “get it”, such as the UAE.

Beyond advocacy, EIC is proud to run the world’s largest energy awards programme,

the World Energy Supply Chain Awards (WESCAs) – highly sought after in the global energy community. This year, 138 EIC member companies participated in our five ceremonies worldwide, and I was thrilled to announce Siemens Energy as the 2025 Company of the Year.

Our five golden rules enable governments to turn energy policy into real-world outcomes

EIC was founded in 1943 by 13 pioneering companies, including Ruston and Hornsby, a leader in gas turbine technology; its innovation helped power industrialisation and global growth. Today, that same company, albeit renamed, continues to thrive as part of Siemens Energy – a proud EIC member and an enduring example of technological excellence.

In this edition’s View From The Top feature, Miranda Hochberg, Vice President of Transformation of Industry Communications at Siemens Energy and a non-executive director of EIC, explores how industries can cut emissions without compromising reliability or competitiveness. She reminds us that

the energy transition is as much about partnership as it is about technology.

I feel optimistic about 2026. Market intelligence indicates that many regions and sectors are entering a growth phase, driven by surging power demand, population growth, AI expansion and investment in energy security and decarbonisation. However, challenges persist. AI may displace some jobs, but the sector faces skill shortages in areas such as electrical work, welding, technology and cybersecurity.

Next year is my tenth as CEO of the EIC, and I’m immensely proud of how far we’ve come. We’re launching several exciting innovations, including an AI search tool for EICDataStream, a new API to link members’ systems to our CAPEX projects database, and expanded tracking of data centre projects across our market intelligence platforms. Our podcast network is also growing rapidly, giving members new ways to share insight and thought leadership.

I hope you enjoy this edition of Energy Focus. Please feel free to contact me directly with feedback or to contribute to future issues at stuart.broadley@the-eic.com

STUART BROADLEY

Chief Executive Officer,

Energy Industries Council

stuart.broadley@the-eic.com

Miranda Hochberg is Vice President of Communications for the Transformation of Industry at Siemens Energy. She has extensive experience in international development, governmental relations, and communications in both public and private sectors. In her current role, she works closely with the Board and other senior executives to position Siemens Energy as a thought leader and partner for the energy transition. Previously, Miranda worked for non-governmental and government organisations in post-conflict countries, including the Balkan States and Sri Lanka. She holds a degree in international law.

Miranda Hochberg at Siemens Energy talks to Energy Focus about driving the transformation of industry, the role of technology and collaboration in decarbonisation, and how Siemens Energy is helping customers navigate a rapidly changing energy landscape

What does ‘transformation of industry’ mean to you personally, and how do you see Siemens Energy’s role in helping customers navigate the transition?

For me, transformation of industry means helping industries get ready for the energy transition – not just reacting to change, but shaping it. It’s something that affects all of us: how we power homes, how goods are made and how economies stay strong. Turning big ambitions into practical steps is what matters most.

At Siemens Energy, we work with customers to make that happen. That could mean helping a paper mill in Brazil eliminate fossil fuels, supporting data centres to run more efficiently, or scaling electrolyser production for green hydrogen. Our role is to help industries cut emissions without losing reliability or competitiveness. And that’s not just about technology –it’s about experience, insight and long-term partnership.

Siemens Energy works across oil and gas, nuclear, renewables and emerging technologies. In your role, how do you convey the importance of all these technologies working together to create a reliable, sustainable and low-carbon energy future?

The energy transition isn’t about picking winners – it’s about making different technologies work together.

In communications, we focus on showing how each piece fits into the bigger picture.

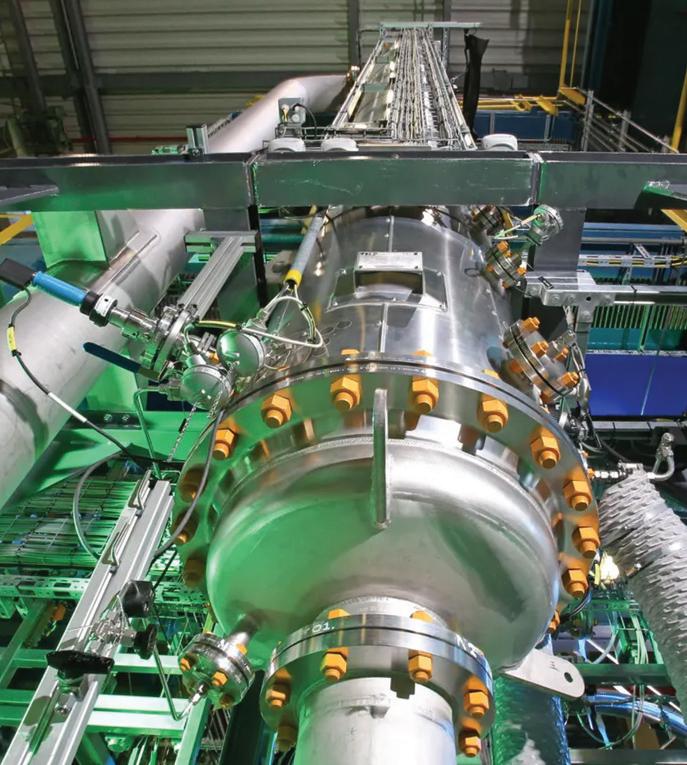

We start by acknowledging complexity. Different regions and industries face different challenges, and no single solution works everywhere. That’s why we talk about the value of a balanced mix. Combined heat and power systems can boost efficiency in industrial sites, while hydrogen production partnerships are beginning to scale up infrastructure. For example, together with Air Liquide we have launched an electrolyser factory in Berlin that is now producing at 1GW capacity. This facility will supply key projects such as the 200MW Normand’Hy electrolyser in France, which is expected to reduce CO₂ emissions by 250,000 tonnes annually.

Digitalisation and automation are part of the story, too. They make systems smarter, whether it’s modernising older infrastructure, integrating renewables into grids or using AI to optimise operations. Our job is to demonstrate how these technologies, working together, deliver real-world impact for our customers.

How quickly is automation becoming a major opportunity for your business, both within your operations and for developing and selling technology to your clients? Automation is becoming central to how we work and what we offer. Inside

The energy transition isn’t about picking winners – it’s about making different technologies work together

>€1.2 billion

INVESTED IN RESEARCH AND DEVELOPMENT (FY 2025)

103k

EMPLOYEES WORK AS A TEAM TO ENERGISE SOCIETY (AS OF 13 NOVEMBER 2025)

€58.9 billion

GLOBAL ORDER INTAKE

(ORDERS ROSE 19.4% YEAR ON YEAR – FY 2025) 1/6 OF GLOBAL ELECTRICITY GENERATION IS BASED ON SIEMENS ENERGY’S TECHNOLOGY

>90

SIEMENS ENERGY OPERATES IN MORE THAN 90 COUNTRIES

Siemens Energy, it helps us simplify processes, cut down on manual tasks and make better decisions. Predictive maintenance and automated data analysis are already improving speed and transparency.

A great example is our gigawatt electrolyser factory; automation is one of its key features. It allows us to produce electrolysers at gigawatt scale, making the plant one of the most advanced in the emerging hydrogen industry. That level of efficiency simply wouldn’t be possible without smart automation.

For customers, automation is a big part of the energy transition. It helps them to lower emissions and stay competitive. We see strong interest in solutions such as AI for grid management, digital twins for industrial assets, and systems that optimise energy use. Automation isn’t a trend on its own, but part of a bigger shift toward electrification and digitalisation.

Electrification is a hypertrend. Do you think this trend is under- or over-estimated, and how do you plan for this?

Electrification is essential and it’s always been part of the industrial story, but it’s not a quick fix. It’s one piece of a complex puzzle, and it only works if we think about the bigger system. For industries, electrification means rethinking processes that have relied on fossil fuels for decades, and that takes time.

We’re planning for it by focusing on practical steps: building high-voltage infrastructure, supporting electrified production lines and making sure automation and digital tools are in place so the shift is efficient and reliable. Honestly, there’s still a lot to figure out, and that’s what makes it exciting.

How are you embracing AI in your business? How do you manage the threat and maximise the opportunity?

We use AI to make operations smarter. Tools such as Microsoft’s Copilot help our teams collaborate, analyse and communicate more effectively. Beyond that, AI powers predictive maintenance, energy optimisation and better planning for complex projects. It helps us work

faster and anticipate issues before they become problems.

Of course, there are risks. We take data security and transparency seriously, and we make sure people stay in the loop. AI should support decisions, not replace judgment. The opportunity is huge, but it only pays off if we use it responsibly and keep the focus on real value.

We’ve only started to chip away at the top of the iceberg when it comes to AI. We know there’s so much more potential to release and our teams – regardless of their job or function – are determined to advance their knowhow.

Data centres are among the world’s fastest-growing energy consumers. How is Siemens Energy helping to make them more sustainable and resilient?

Data centres need enormous amounts of power, and demand is increasing. We help operators by focusing on efficiency and reliability. One approach is using systems that recover and reuse energy, such as combined heat and power solutions. We also integrate automation and digital tools so operators can predict demand and adjust in real time. As more renewables enter the grid, we support stability with flexible generation and storage options.

Our role is to help industries cut emissions without losing reliability or competitiveness

Hydrogen-ready turbines give operators a path to lower emissions over time because they can run on natural gas today and switch to hydrogen as it becomes available. Combined heat and power systems add another layer of efficiency by using waste heat for cooling or other processes, which is especially valuable in data centres. Together, these technologies provide reliable power for critical loads while creating a clear route toward decarbonisation.

ESG and net zero are arguably more embattled than embraced in 2025. How do you approach this?

It’s true that ESG and net zero have become more contested, politically, economically and socially, but that’s not a reason to step back. If anything, it’s a reason to lead.

Our approach is grounded in realism. Decarbonisation isn’t linear. It’s complex, regionally diverse and often constrained by legacy infrastructure and market volatility. That’s why our Transformation of Industry business exists to help industrial players navigate this complexity with solutions that are sustainable and economically viable.

Siemens Energy’s SGT5-9000HL gas turbine is hydrogenready, with plans for 100% hydrogen combustion by 2030 Siemens Energy wins Company of the Year at the 2025 EIC World Energy Supply Chain Awards

Combining Siemens Energy’s electrolysis and Evonik’s fermentation expertise, the Rheticus project links the energy and chemical sectors for a more climate-friendly chemical industry

Congratulations on winning the 2025 EIC Company of the Year award. What has been the key to the successful growth of Siemens Energy?

Winning is a huge credit to our teams and the trust that our customers place in us. Siemens Energy has grown into a global leader in energy technology, present in more than 90 countries and powering about one-sixth of global electricity generation. Recognition such as this matters because it reflects real work delivered with customers across service, new-build and digital.

When you look at other awards for which we were nominated, you see why we succeed. Our UK Subsea team was recognised for innovation and new market diversification. Colleagues in Sweden won a sustainability and social impact award. It’s about people driving change in their areas.

What message would you like to share with EIC members about collaboration opportunities and the path toward an integrated, decarbonised industrial future?

I’ve long respected EIC and the work it does to bring industry players together. Joining the Board last year was an honour. No company can do this alone. We continue to draw value from EIC’s global project data, events and insights, and I look forward to learning from peers and sharing our perspective. Collaboration is the strongest lever we have – whether through joint ventures, knowledgesharing or co-developing solutions tailored to sector needs.

If you look five to 10 years ahead, what do you think will define the ‘next frontier’ in industrial energy transformation?

The next frontier won’t be one big breakthrough – it will be about integration and scale. Electrification, automation and sustainable energy systems will need to work together. Hydrogen-ready infrastructure, AI-driven optimisation and realtime data intelligence will become standard. These technologies will not only cut emissions but also build resilience into industrial systems. Looking ahead, the real challenge –and opportunity – is how we make all this work across sectors. That’s what will define the next decade.

Take a closer look at EIC’s five biggest milestones of 2025 – new tools, new voices and new global reach – all designed to empower members and strengthen the energy supply chain worldwide

BY STUART BROADLEY, CEO, EIC

1.EICDataStream API and data centres

Launched in 2000, EICDataStream was EIC’s first digital market intelligence tool, designed to track capital expenditure (CAPEX) projects across energy industries worldwide. Today, EICDataStream monitors more than 17,000 projects valued at more than US$17tn across all energy sectors – oil and gas, power, renewables, nuclear, energy transition, and transmission and distribution.

EIC global members will now benefit from a new upgrade to EICDataStream – the launch of an application programming interface

(API). This innovation allows members to link EICDataStream data directly with their own project or customer relationship management systems and on analytical tools such as PowerBI. Following an extremely successful pilot scheme with three member companies, we have already received API enquiries from 90 EIC global members.

EIC global members will now benefit from a new upgrade to EICDataStream – the launch of an application programming interface

In response to member feedback and the growing opportunities within the large-scale digital infrastructure sector, EIC Market Intelligence platforms will also soon expand to include data centre project data. This addition marks another step forward in helping members to identify and capitalise on emerging trends across the global energy landscape.

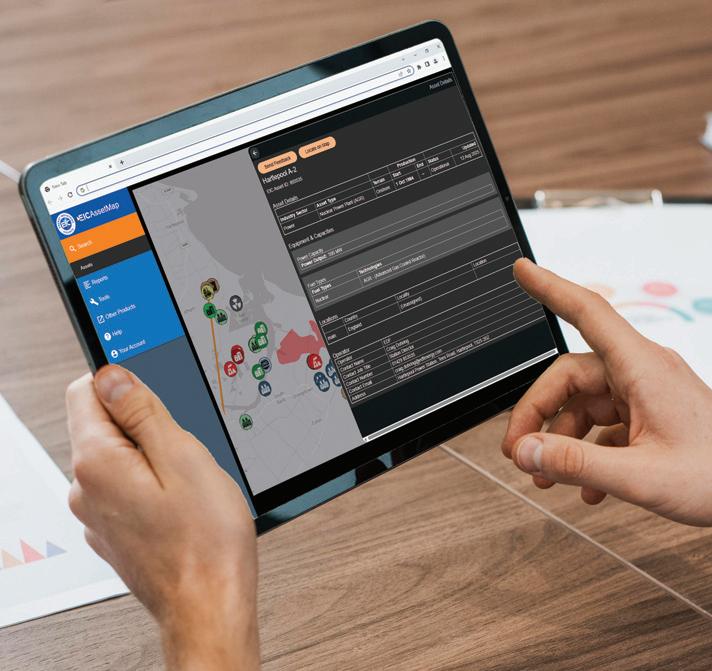

2.EICAssetMap 1.5

Launched in 2017, EICAssetMap is the world’s only OPEX and operations and maintenance database to detail and map close to 50,000 energy facilities worldwide (except those in China, North Korea and Russia) across all technologies. Image: iStock

4

The latest version, EICAssetMap 1.5, delivers a clearer and faster way to explore global energy assets. The upgrade introduces a results summary list, detailed asset pages, a locator tool, flexible pan-and-zoom mapping and a satellite view option. Users can also connect to related projects through EICDataStream, benefiting from a refreshed interface and a more integrated experience.

3.EICSupplyMap expansions

EICSupplyMap was launched in 2019, and focuses on identifying energy supply chain businesses (companies with revenues surpassing £1m) and their detailed capabilities – again,

across all energy sectors. Originally focused on the 3,700 UK energy supply chain businesses, EICSupplyMap is now growing quickly across the globe.

With more than 10,000 businesses and their detailed capabilities now analysed in Asia, Europe, the Middle East, the US and Brazil, the database continues to expand. In 2025, we added Indonesia, Italy, Oman, Spain and Louisiana, allowing users to map supply chains in these additional markets by location, explore proven and emerging capabilities across sectors, and identify new suppliers of equipment and services. More countries will be added every year until the global dataset is complete.

1

Trade delegation to Angola 23–27 February 2026 Luanda, Angola

For more information: internationaltrade@the-eic.com

Bankable Energies 17 March 2026

London, UK

For more information: global.events@the-eic.com

Wind Expo 17–19 March 2026 Tokyo, Japan

For more information: internationaltrade@the-eic.com

Offshore Technology Conference (OTC) 04–07 May 2026 Houston, US

For more information: internationaltrade@the-eic.com

Check out our full calendar with in-person events, webinars, trade delegations, pavilions and training sessions on the-eic. com/Events/Calendar

EIC Country Report: Oman

EIC Insight Report: USA Offshore Wind

Access to these reports and more is free to EIC members on EICDataStream. If you are not a member and want to know more, please visit the-eic.com/Membership

SERIES LAUNCHED IN NEW EIC PODCAST

In 2025, EIC made an exciting move into podcasting, launching a series of in-house productions hosted by CEO Stuart Broadley.

Each episode blends highquality production with insightful, conversational storytelling on the shifting global energy landscape – exploring new opportunities, celebrating the achievements of members and spotlighting the latest EIC insights, services and advocacy. Together, these podcasts offer a fresh platform for sharing knowledge, sparking ideas and inspiring innovation across the energy community.

EIC Clearly

Monthly in-depth discussions with C-level business, policy and thought leaders from the energy landscape, tackling the most critical issues, trends and innovations shaping the industry.

EIC Energy Insights

A closer look at lessons and perspectives drawn from EIC’s many platforms – from market intelligence and reports to events and members themselves.

Survive & Thrive

Building on the acclaimed Survive & Thrive Insight Report, this podcast explores the inspiring and innovative growth strategies that are driving success across the global energy supply chain.

Energy Focus

Extending the reach of EIC’s trusted quarterly magazine, Energy Focus brings a conversational twist to C-level insights, with key contributors and energy leaders sharing fresh perspectives on the issues that matter most.

EIC’s expanded presence in Europe will boost networks and market intelligence in this key energy region

From fostering dialogue and building powerful networks to delivering events, advocacy and enhanced market intelligence, the new European team is focused on connecting and empowering members.

Sara Castiglioni, Business Development Manager for Southern Europe, operates from Milan, extending EIC’s reach across key markets.

European events

In September this year, EIC was pleased to welcome Events and Office Coordinator Tunde Sebok to the EIC Continental Europe team, bringing further expertise as the team launches

a new series of local events. With this growing presence, 2026 promises to be an exciting year for EIC and its European members.

GET INVOLVED AND FIND OUT MORE

Contact membership@ the-eic.com to learn more about these new developments and how to join the EIC.

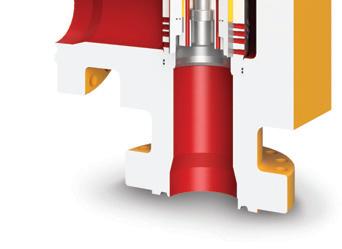

As a UK based manufacturer with over 50 years of experience in supplying Control and Choke valve products to the world’s energy markets, KOSO Kent Introl is ideally positioned to support the energy sectors on their journey into cleaner energy be it land, sea or below.

We engineer and supply high-quality valves to perform in some of the most severe service conditions throughout the world.

Supporting your investment over its life cycle with OEM spares, ensuring your valves continue to perform to their optimum.

With our comprehensive records of every valve and component we have ever supplied, we can help you devise and implement a strategic plan for the asset management of your valves.

We have the facilities, expertise and flexibility to ensure that your valves are maintained safely, effectively and promptly.

As the assets life progresses, we can review and engineer a suitable upgrade or replacement internals to ensure your process is running at its optimal level.

With our in-house Laser Powder Bed fusion technology and a team of expert additive engineers, we can specify, design and produce components quickly in-house.

Constant policy change and lack of delivery are leaving the UK supply chain struggling to compete. Without stability, then people, investment and innovation will move overseas – taking vital capability with them

BY REBECCA GROUNDWATER, HEAD OF EXTERNAL AFFAIRS, EIC

Our members help shape the policy positions and work that we do. They are fundamental in driving our advocacy efforts, and we call on all sectors, sizes of business and positions in the value chain to help them grow and diversify.

Our Regional Committees in the UK and our Shadow Board in the US consistently relay members’ insights on the real-world impacts of high-level policy decisions. Too often, these policies aspire to net zero by 2050, and prioritise operators and developers. None consider the realities of those further down the energy system – the thousands of SMEs across the entire energy supply chain, which are advocating and delivering technology at pace to drive decarbonisation and net zero, while being hampered by these very policies at the same time.

In the UK, we have spoken at length at our Regional Committees about the impact of high energy prices on manufacturers and factory companies. We have discussed the increase in the minimum wage, which adds further costs –particularly for those that encourage and promote apprenticeships. While these employers are willing to absorb the additional expense, there must be some balance or support to offset the burden.

A refusal to act meaningfully on local content – combined with non-binding targets and weak enforcement – has left the UK supply chain unable to compete on cost, despite stronger expertise and sustainability policies. The shift from the Conservative Party’s anti-fossil fuel stance to a ban on new licences and exploration has effectively frozen investment, meaning no new work for the domestic supply chain. Meanwhile, continual changes in government focus – from carbon capture, utilisation and storage, to hydrogen, to data centres, to solar –have created instability and uncertainty, preventing long-term investment and undermining our ability to build a viable business case.

As a result, supply chain businesses are turning to markets such as the Middle East, North Africa and India, where significant work and investment are underway. They are also focusing on sectors that offer greater security in payments and project delivery, such as defence. These markets are pulling on the UK supply chain at pace. We see our members relocating talented staff into these regions, not only to deploy their expertise, but also to retain their talent. For many, the only way to keep their workforce is to provide international opportunities.

What we could be left with in the UK is a hollowed-out supply chain – one that wants to be here but is not being given the opportunity to develop and grow

policy environments are also allowing these companies to grow. For the past 18 months, we have emphasised that this is a single, interconnected supply chain, with companies using their profits from the oil and gas sector to drive their move into renewables and newer technologies. With the lack of projects in these technologies, and the oil and gas slowdown resulting in reduced work and fewer profits to transition, technology adaptation is stagnating in the UK. By bidding for and winning work internationally, these companies are regaining momentum. They are beginning to reinvest –on a smaller scale at first – in transition projects, often located in the same regions as their oil and gas operations. In doing so, they are achieving abroad what they had aimed to do at home: establish a sustainable business model, plough profits into new technologies, expand capacity, and ultimately bid for larger projects, creating a renewed cycle of growth.

What we could be left with in the UK is a hollowedout supply chain – one that wants to be here but is not being given the opportunity to develop and grow. This is undermining our capability to deliver our own net-zero targets. A reduced workforce, shrinking margins and a lack of work stability are leaving businesses present on paper, but without the capability to deliver in practice. It is not difficult. It is made difficult by a cluttered energy system, short-term political cycles, a stream of headlines, and a failure to deliver on the substance. GB Energy, the National Energy System Operator, Sovereign Wealth Fund, Hydrogen Allocation Rounds 1 and 2, Allocation Round 7, Net Zero Teesside, The Acorn Project – all have been flagged as priorities, yet none have delivered tangible results on which the supply chain can act.

A call for meaningful policy Policy must be stable, actionable and meaningful. The Middle East is proving it can be done — why is the UK not doing the same?

EIC members explore liquefied natural gas’s (LNG) expanding role in global trade and the rising energy demands of data centres. With growth in supply, infrastructure and innovation, is the gas sector entering a new era of expansion?

Nils Hansen Head of Business Development at Bertling

The war between Russia and Ukraine has accelerated the role of LNG in Europe

LNG is seen as the key transition fuel. It is a slightly cleaner, hydrocarbonbased fuel with a predictable and reliable range of supply sources. The war between Russia and Ukraine has accelerated the role of LNG in Europe, with countries in the region seeking more stable, long-term supplies from sources such as Australia, Qatar and the US.

The energy demand from data centres is placing a new, high-level and long-term pressure on energy supply and infrastructure. It’s not just LNG that is powering this sector, as we have seen in the US, but also renewable power and, to some extent, revitalised technologies such as nuclear energy. Hydrogenbased fuel cells are also beginning to attract attention as an alternative for sustainable backup power. The data centre demand is certainly adding a lot of supply requirement, and is powering development across many supply sources.

The LNG boom is here. Data centres, with their AI and cloud expansion plans, are multiplying, with new long-term investments announced in many countries. For these projects, energy supply and security will be paramount. Downtime isn’t an option – and logistics plays an important role in ensuring this.

Off shore Director

at Cargostore Worldwide

We’re certainly seeing strong growth. The LNG market has been transformed, particularly amid the diversification of supply sources in Europe and the growth in demand in Asia. Major capacity additions from Qatar, the US and Africa are reshaping global energy trade patterns.

The AI and data centre demand has emerged rapidly. These facilities need reliable, continuous power, and gasfired generation is playing a crucial role in meeting those needs. Many tech companies see gas as a practical solution to ensure grid stability as they scale operations.

The flexibility and reliability of gas complement the broader energy transition

What makes this period unique is how gas is positioning itself. LNG infrastructure investments are accelerating because the flexibility and reliability of gas complement the broader energy transition. It’s providing energy security while other technologies mature.

I think ‘growth phase’ is more accurate than ‘boom’ – it’s substantial, but also strategic. Different regions are experiencing this in different ways; some are seeing rapid expansion while others are more measured. The fundamentals are strong: rising global energy demand, the need for reliable baseload power, and LNG’s role in energy security all point to continued growth for the foreseeable future.

About Cargostore Worldwide Cargostore Worldwide is a global leader in the supply of DNV 2.7-1 and Zone 2-certifi ed off shore containers and ISO shipping containers, making container leasing and purchasing easy, effi cient and reliable.

Gregory Gedney

Business Development Manager of Industrial Operations at Greene Tweed

The gas sector is entering a new phase of growth, fuelled by LNG’s expanding role in global trade and increasing energy demands for data centres. As a lower-carbon alternative to coal and oil, LNG is uniquely positioned to serve as a bridge technology in the energy transition, balancing sustainability with reliability.

This growth brings technical challenges that need to be addressed to ensure continued success. Cryogenic temperatures for liquefaction, highpressure environments and LNG’s low lubricity as a fluid all demand advanced engineering solutions. Innovations in materials and sealing technologies are helping overcome these hurdles to ensure safe and efficient operations. For example, cryogenic seals and materials that resist rapid gas decompression for high-pressure compressors in the liquefaction process are critical for safe and efficient operation, while products designed for the poor lubrication properties of lowspecific-gravity fluids enable greater reliability in LNG applications.

Growth brings technical challenges that need to be addressed to ensure continued success

As LNG’s role in the global energy mix expands, collaboration and innovation will be important in navigating future challenges. By addressing these technical demands, the gas sector can secure its position as a cornerstone of the energy transition.

About Greene Tweed Greene Tweed is a leading global manufacturer of high-performance thermoplastics, composites, seals, and engineered components. For 160 years, it has served clients in semiconductor, oil and gas, aerospace, defence, pharmaceutical and chemical processing, and other critical industries.

Net zero may dominate the energy debate, but it is not the only priority. Governments, policymakers and industry players are grappling with how to balance energy access, demand, affordability and reliability. The real test for a good transition is finding a pragmatic, inclusive path forward – not simply racing to abandon traditional energy sources

BY TOM WADLOW, PARTNER, WD EDITORIAL

The energy sector’s direction of travel is clear: to reach net zero by 2050, there must be a shift away from fossil fuels and towards renewable energy sources.

According to the International Energy Agency, energy accounts for more than three-quarters of total global greenhouse gas emissions. Progress in this industry is imperative to meet climate goals – and steps are being taken in the right direction.

In the first half of 2025, renewable energy overtook coal as the world’s leading electricity source. This came after renewables and nuclear provided more than 40% of the world’s electricity generation in 2024. However, while such statistics are promising in the net zero context, it is crucial that the shift from fossil fuels to renewables is balanced with competing priorities.

“Population growth, increasing energy access, technology adoption and data centre requirements are all continually driving up the demand for power,” explains Stuart Broadley, CEO of EIC. “In a perfect world, decarbonisation would be the main priority for all governments. But the reality is that they also need to consider power demands, energy affordability and energy security. Right now, much of the focus is about which fuels and power sources are available fast enough – in the right place and in a nonintermittent and consistent way – to meet demand.”

Broadley makes the point that we cannot blindly try to shoehorn renewable energy into every location, every industry and every power source. Indeed, in many cases, the difficulties of leveraging renewables are prohibitive and it does not make sense to do so.

Transmission costs are a case in point. “You have to get that power from where it’s generated to where it’s needed,

into population centres – and those infrastructural requirements can come at a significant cost,” Broadley adds.

“All of these are the reasons why oil and gas still firmly has a place at the table, and why there’s a simple need to respect, nurture and invest in all energy sources and technologies.”

A reliable energy future depends on balanced priorities Clearly, there is a need to balance power demand and energy affordability, access and availability with net zero. For that reason, oil and gas will remain essential for the foreseeable future, alongside renewables and emerging innovations.

There’s a simple need to respect, nurture and invest in all energy sources and technologies

Stuart Broadley, EIC

“Fossil fuels represent a reliable technological certainty,” says Massimiliano Tacconelli, VP Nuclear & Big Science Director at Walter Tosto SpA. “They are able to guarantee continuous and flexible service, independent of environmental factors, and they are still the only deployable technology capable of matching demand growth at the same pace – as seen, for instance, with the rapid rise of data centres.”

Geopolitical tensions are further ingraining the need for a reliable, balanced energy mix, with many governments focusing on both protecting existing energy and bolstering domestic supplies to ensure energy security. Today, it is estimated that around 80% of the global population lives in a country

that is a net fossil fuel importer. In other words, around six billion people depend on other countries for their energy, making them susceptible to geopolitical shocks and crises.

“A balanced energy mix, tailored to the specific conditions of each country, is essential to ensure energy security and stable costs over time,” Tacconelli says. “In recent years, we have learned how risky and costly it is to depend too heavily on a single source of energy – particularly when that source lies outside the sovereignty and control of the state.”

Broadley agrees, stating that overreliance on others for energy “makes for a very vulnerable situation”. He explains: “While there’s an argument to say that interconnectors are great because they provide you with an easy means of balancing, they are also easy to disconnect in a time of war. In the current climate, that is a concern for many countries.”

In this context, clean energy becomes appealing. Renewables are available to many countries in one form or another – whether that’s wind, solar or hydropower. The International Renewable Energy Agency believes that 90% of the world’s electricity can and should come from renewable energy by 2050. However, a lot needs to happen before this target becomes viable.

“The greatest challenge lies in the evident mismatch between the speed of demand growth and our ability to build new low-carbon generation facilities,” says Tacconelli. “On top of this, the entire supply chain capable of delivering such plants is far narrower than it was between the 1970s and 1990s, when many of the strategic assets we still benefit from today were built.

“Bridging this gap will require joint programmes in training and recruitment, substantial investment, and new platforms for collaboration.”

Syed Muzakir Aljoofre, Managing Director of RelyOn Asia, agrees,

A balanced energy mix, tailored to the specific conditions of each country, is essential to ensure energy security and stable costs over time

Massimiliano Tacconelli, Walter Tosto SpA

adding that sequencing is the main challenge in meeting growing global energy demand while driving towards a lower carbon future.

Syed Muzakir Aljoofre, RelyOn Asia

“We must meet rising consumption without destabilising economies or underinvesting in proven sources,” he says. “Premature divestment from oil and gas creates supply shocks, which ultimately hurts consumers and slows the transition. The solution is dual investment – maintaining reliable hydrocarbon output while funding renewables, efficiency improvements, and carbon-management technologies.”

Policymakers and industry players must collaborate and align In recent times, national oil companies (NOCs) in the Middle East have been setting the dual-

investment standard, advancing their research in and development of renewables while sustaining traditional operations.

Oman’s NOC, for example, has created separate entities to manage its energy transition while maintaining oil and gas development. Similarly, Saudi Aramco is actively investing in advanced technologies such as direct air capture and taking innovations from pilot to commercial scale, despite widespread criticism over its cost and perceived effectiveness. By backing these innovations and supporting their development, NOCs are demonstrating their commitment to creating a viable and diversified energy future.

That said, the responsibility should not lie solely on industry players’ shoulders. In all regions, the path forward demands collaboration, a clear direction and policy frameworks that reflect complex global energy needs, with scope for investment across oil, gas and renewables.

“Industry cannot transition in isolation,” says Aljoofre. “Regulators and policymakers must provide predictable frameworks that reward both emission reduction and energy security.

“Collaboration works best where governments and private

firms align. We’ve seen this with Malaysia’s progress on carbon capture, utilisation and storage cluster development, and the Middle East NOCs investing simultaneously in solar, wind and advanced oil recovery. These are models that show how diversification can be accelerated without destabilising supply.”

Broadley highlights examples of effective policy in action, pointing to marine, aerospace and electric vehicles as industries that have clear timelines and targets. “Regulators have set clear expectations, and while some deadlines may be shifting because consumers aren’t yet ready to move at the same pace, the presence of those targets is driving progress,” he notes. “In contrast, industries like carbon capture, hydrogen and nuclear lack that same urgency. There are no penalties for falling short, and without consequences, there’s little incentive to act.”

To build towards net zero while sustaining an energy future that is resilient, diversified and inclusive, policymakers must work with industry to define expectations and set the pace of change while protecting critical capabilities and essential resources.

For Tacconelli, the most significant contribution to a resilient and inclusive

Refinery operations continue to underpin global energy security

Premature divestment from oil and gas creates supply shocks, which ultimately hurts consumers and slows the transition. The solution is dual investment

Syed Muzakir Aljoofre, RelyOn Asia

energy future will come not from a single breakthrough in technology, but from intelligent management of the overall energy mix.

Aljoofre has a similar outlook: “The future of energy is not either/ or. It is both/and. We must invest in hydrocarbons responsibly while scaling renewables and lowcarbon innovation.”

This is the blueprint for a balanced energy future. A good transition requires a pragmatic, inclusive approach rather than an accelerated exit from traditional energy sources – one that works for all regions, all sectors and all people.

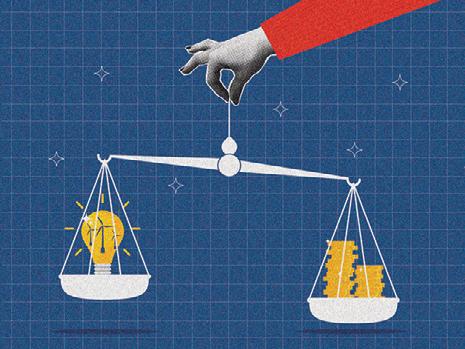

Energy in 2025 was defined by shifting priorities – governments recalibrating policy, investors chasing stability and markets reacting to global tensions and rising demand. Amid disruption and reinvention, what do these forces reveal about the transition ahead as innovation, investment and resilience drive future growth?

JONATHAN DYBLE, PARTNER, WD EDITORIAL

The outlook for the energy sector was promising ahead of 2025. According to EIC’s 2025 Survive & Thrive Report, 78% of companies reported record revenue growth in 2024, with an average increase of 24%. This momentum was expected to continue, with 86% of firms forecasting similar growth this year. Such optimism was not misplaced. Milestones have been met, with global renewable electricity generation having surpassed coal for the first time in the first half of 2025. Likewise, in June, the

International Energy Agency reported that global energy investment for the year would likely hit a record US$3.3tn, with US$2.2tn of this flowing into clean energy. Behind these headlines, however, challenges have remained. Policy fragmentation, infrastructure bottlenecks and disparities in regional performance have all remained prevalent, and much like any other year, there have been winners and losers. As 2025 draws to a close, we review some of the sector’s defining developments, while offering informed perspectives on the opportunities and risks shaping up in 2026.

Global policy and geopolitical shifts As expected, Donald Trump’s return to the US presidency had a major impact on energy policy and intent.

Rebecca Groundwater, Head of External Affairs at the EIC, says that while the shift in US policy was stark, not all technologies suffered equally. “Obviously in the US we had the significant move away from wind, and a refocus on oil and gas and liquefied natural gas (LNG),” she explains. “But we haven’t seen the drop-off in carbon capture, utilisation and storage (CCUS) that was expected.”

Data centres alone could face a renewable shortfall of up to 500TWh by 2030

to progress. “Stronger coordination and support from European technical organisations will be essential to reduce complexity, accelerate delivery, and attract investment,” he says, specifically highlighting nuclear energy as an area that could benefit from such coordination.

Looking at the UK, she also flags that earlier pivots away from oil and gas are now exposing cracks in the supply chain, highlighting that investment has stalled and that technologies such as hydrogen are still too limited in their development to offset any major decline in traditional energy.

“They are too far away, and at too small a scale, to make a difference and deliver a ‘transition’ in jobs and growth,” she says, pointing out that, as a consequence, some UK companies are looking abroad, with rising interest for UK supply chain expertise in Spain, Malaysia, the Middle East and Australia.

Developing export and international trade strategies in new regions continues to be seen by business leaders as the hardest growth strategy, as outlined in EIC’s Survive & Thrive research, with just 7% of EIC member companies pursuing it as a growth strategy in 2024. It has long been viewed as a difficult route to growth due to the complexity of international compliance and logistics. However, Groundwater believes that a corner may have been turned in some regions in 2025.

“We see UK companies beginning to shift personnel out to the Middle East specifically to work on projects,” she says. “With that said, moving people within Europe is trickier due to the issues with movement of people, work visas and the points systems.”

In Europe, Hans-Michael Kursawe, Principal Adviser at TÜV SÜD Energietechnik GmbH, also believes regulatory fragmentation remains one of the biggest barriers

Asia-Pacific’s (APAC) policy landscape, meanwhile, has also seen significant changes. Teo Han Yong, Head, Renewable Energy Solutions at GoNetZero, states that carbon management has shifted from being compliance-driven to strategy-driven in 2025. “Disclosure standards and supply chain pressures have been the biggest catalysts, driving rapid adoption in Singapore and Australia, while markets like Vietnam and Indonesia have moved more cautiously amid regulatory uncertainty,” he says.

Can other regions learn from the Middle East model?

Clearly, policy has moved in different directions in different geographies, with a mixed impact on financing. “The geopolitical narrative has reduced investment in some areas, increased it in others, but every country is different and many will be getting on with the projects which were underway before announcements,” Groundwater says.

One region that has continued to gather momentum is the Middle East. Indeed, it was a standout performer

In the US, we had the significant move away from wind, and a refocus on oil and gas and LNG. But we haven’t seen the drop-off in CCUS that was expected

Rebecca Groundwater, EIC

78%

OF COMPANIES REPORTED RECORD REVENUE GROWTH IN 2024, WITH AN AVERAGE REVENUE INCREASE OF +24% (EIC SURVIVE & THRIVE IX INSIGHT REPORT, JULY 2025)

86%

OF COMPANIES FORECAST SIMILAR GROWTH IN 2025 (EIC SURVIVE & THRIVE IX INSIGHT REPORT, JULY 2025) US $3.3tn

GLOBAL ENERGY INVESTMENT IN 2025 PROJECTED AT US$3.3TN WITH US$2.2TN IN CLEAN ENERGY (IEA, 2025)

Policy shift under Trump administration: refocus on oil, gas and LNG

CCUS investment remained stronger than expected

Rising carbon footprint reduction pressures amid Russia–Ukraine conflict

Middle East 90% of companies reported growth in 2024

Average revenue increase: +68%

Hydrogen and new technologies are still too limited to offset a decline in oil and gas

Investment in domestic energy has stalled

Growing exports of UK energy expertise – especially to Spain, Malaysia, the Middle East and Australia

Only 7% of UK companies pursued exporting as a growth strategy in 2024, but the trend is rising in 2025

Regulatory fragmentation and grid bottlenecks remain key barriers

65% of executives cite poor policy/governance as a threat to competitiveness

Success driven by balanced investment across: oil, gas, renewables, hydrogen and digital infrastructure

APAC

Added 400GW of renewables in 2024

Investment topped US$0.5tn

Renewable shortfall risk: up to 500TWh by 2030 for data centres

Carbon management became strategy-driven in 2025

Europe has been tackling mounting infrastructure and grid challenges

before 2025. EIC statistics show that 90% of companies in the region reported growth in 2024, with average revenues jumping a whopping 68%.

A balanced approach to energy transition has been key to this success. Rather than picking winners, regional companies are investing across the board. More than 90% of EIC member companies in the region are still focused on oil and gas, yet renewables, hydrogen and digital infrastructure are also gaining ground.

Europe, by contrast, has been tackling issues such as mounting infrastructure and grid challenges. Despite strong net-zero commitments, 65% of European executives previously cited poor policy and governance as a threat to competitiveness.

Enter Björn Fagerström, Director of Innovation HUB Sweden for HARTING Technology Group. He explains that the cost of operating and migrating energy technologies in Europe has increased notably, in part due to the limited number of suitable suppliers.

Digitalisation has played a crucial role in 2025, enabling better utilisation of the grid

Björn Fagerström, HARTING Technology Group

“The market has remained concentrated around major players such as ENEL, E.ON, and EDF,” Fagerström adds. “There’s also mounting pressure to reduce carbon footprints and decreased dependency on gas, especially in light of the RussiaUkraine situation.” It is a similar story in APAC. According to Yong, the region added more than 400GW of renewables last year, with investment topping half a trillion

US dollars. However, despite the positives, faster progress is needed.

“Data centres alone could face a renewable shortfall of up to 500TWh by 2030,” Yong warns. “This is why companies are increasingly pairing renewables procurement with complementary solutions like carbon credits and digital traceability to manage their full emissions footprint.”

Energy transition, technology and supply chain trends

Before the turn of the year, the biggest growth strategy among energy supply chain firms was innovation (including AI and technology), cited by 38% of EIC member companies. For Fagerström, those ambitions have largely materialised and will continue to do so.

“Digitalisation has played a crucial role in 2025, enabling better utilisation of the grid,” he says. “The surge in electricity demand from data centres and e-mobility led to power constraints. However, smart use of data and AI-driven solutions will increase grid utilisation rates to increase from 20/30% to 40/50% in the future. These advances have made grid management more efficient and flexible, supporting the growing needs of modern energy infrastructure.”

Other innovations have taken off this year. For example, the UK conducted

Stronger coordination and support from European technical organisations will be essential to reduce complexity, accelerate delivery and attract investment

Hans-Michael Kursawe, TÜV

SÜD

Energietechnik

its first real-world trial of hydrogen blending, with 2% green hydrogen injected into the national gas grid to power a Midlands plant. Yet for Fagerström, renewables growth has been tempered by “technological limitations, the scale of required investments, and regulatory challenges” in 2025.

With renewables arguably stuttering, there have been growing calls to use the Middle Eastern model of balancing investments in clean and traditional fuels. Indeed, the OPEC general secretary warned that oil and gas will still contribute approximately 30% of the global energy mix through 2050, calling for more investment.

In this sense, while we are set to see record investment in energy and clean energy, the dial may well shift again this year.

From grid bottlenecks and regulatory fragmentation to geopolitical curveballs, many hurdles still need to be overcome while balancing competing industry objectives. Energy transition remains a long-term aim. Yet power demands, energy affordability and energy security cannot be ignored at the expense of net zero.

Indeed, perhaps the leading challenge in 2026 will be finding the right balance between these varied priorities.

Innovation and technology = top growth strategy for 38% ` of firms

Digitalisation improving grid efficiency — utilisation rates rising from 20–30% 40–50%

UK’s first hydrogen blending trial: 2% green hydrogen injected into gas grid

Challenges: high investment costs, regulatory hurdles and technology limits

Oil and gas projected to still make up about 30% of global energy mix by 2050 (OPEC, October 2025)

Balancing net zero, energy security and affordability will be the top challenge

Key obstacles: grid constraints, policy fragmentation and geopolitical shifts

As AI and data centre growth accelerate, the race is on to secure reliable and sustainable power while balancing cost, environmental impact and technological innovation. From natural gas expansions and massive solar projects to nuclear small modular reactors, the global energy sector is adapting to fuel the data-driven age

BY NEIL GOLDING, DIRECTOR OF MARKET INTELLIGENCE, EIC UK

Soaring global demand for data generation is driving unprecedented growth in electricity consumption. Data centres, the backbone of the digital world, are consuming more power than ever before, with AI at the core of the surge. The International Energy Agency projects that data centres will account for approximately 10% of global electricity demand growth by 2030.

Growth is global, but the pace will vary by country and region. The US, Western Europe and ASEAN countries are expected to see the sharpest increases in data centrerelated electricity consumption as digital services expand rapidly.

Data centres run continuously – 24 hours a day, seven days a week – so they require reliable baseload power, supported by robust infrastructure. While current grids have generally managed to support expansion, the next wave of data demand will require targeted upgrades to ensure resilience and reliability. Energy planners are increasingly recognising the need to future-proof infrastructure to accommodate AI-driven workloads and the ongoing digital transformation.

In the US, rising demand for natural gas-fired power generation is prompting renewed investment in natural gas infrastructure, aiming to boost supply and support emerging power generation facilities. Instead of constructing entirely new pipelines to boost capacity, operators are focusing on expanding existing systems. One notable example is TC Energy’s ANR Northwoods Pipeline Expansion, a US$900m development that will increase capacity by 400m cubic feet of gas per day. The project aims to serve natural gas-fired power plants and data centres across the Midwest.

Offtake agreements give developers the financial certainty needed to invest in large-scale energy projects – and data centres are increasingly becoming the most reliable offtakers. Their consistent, long-

term electricity demand gives developers confidence that their power will find a steady buyer.

Competition for clean power is intensifying across several industries, but the certainty of demand from data centres is causing renewable project developers to change offtaker channels. A prime example of this can be seen in the UAE. In January 2025, Masdar announced plans for a 5.2GW Solar PV project in Al Azeezah, Abu Dhabi, combined with a 19GWh battery energy storage system to support green ammonia production. However, in August 2025, Masdar revealed that the project’s output would instead power data centres, given the current lack of demand for green hydrogen.

Many data centre developers are turning to renewable energy to power their facilities and meet their sustainability commitments. Meta stands out as a leader, signing long-term power purchase agreements with clean energy power producers. Most of these projects are solar PV developments in the US, but Meta is expanding its renewable footprint in other global markets that are experiencing data centre growth. In Singapore, Sembcorp Solar Singapore Pte Ltd, entered into a 25year agreement with Malkoha Pte Ltd, a subsidiary of Meta Platforms Inc., to develop a 150MWp floating solar project on Kranji Reservoir. Under the deal, Sembcorp will build, own and operate

By Jason Martin, Global Managing Director, Clean Energy and Transmission, Turner & Townsend

AI is transforming the data centre landscape, driving demand for high-density, liquid-cooled, powerintensive facilities. These centres require delivery models that balance speed, cost and resilience. To meet this demand, our global experts are enabling faster deployment through modular construction and phased execution. However, infrastructure and supply chain readiness remain critical challenges.

Energy access is a major constraint. We are working with transmission system operators to reform connection processes and advance work programmes to increase system capacity. Similarly, we are working with utilities and developers to procure and deliver new sources of electricity generation that can support the grid or provide direct power to major customers. Material shortages, labour constraints and evolving sustainability requirements also add complexity. Our embedded procurement strategies and market intelligence are securing value-driven supply chains.

The International Energy Agency projects that data centres will account for approximately 10% of global electricity demand growth by 2030

We’re working with clients to anticipate regulatory bottlenecks and build agility into delivery models.

Powering AI infrastructure is not just technical – it’s strategic. Success depends on adapting to shifting constraints and opportunities. We’re proud to help our clients achieve predictable outcomes that deliver sustainable, secure and affordable energy solutions.

s on to nts and proud ts achieve comes ainable, dable s.

By Tom Pashley, Chief Commercial Officer, Unger Steel Fabrication FZE

Unger Steel is responding to global data centre demand with a strategy that combines proactive planning, intelligent design and effective local compliance management.

As many data centres share standardised structural designs, we pre-purchase raw materials in bulk, reducing exposure to steel price volatility and supply chain disruptions. Through value engineering, we develop modular, pre-assembled structural assemblies that enable faster, safer installation and lower on-site labour costs. Third parties can often pre-install equipment to the modules before installation to further reduce time spent on-site.

Painting and fireproofing are completed in-house before shipment, minimising environmental exposure and reducing time and cost at the job site. Most data centre projects have limited laydown areas, so Unger Steel ensures each delivery is sequenced precisely to match site activities, streamlining logistics and eliminating unnecessary material handling.

In a sector governed by stringent environmental, safety and permitting regulations, our experts engage early in the pre-qualification process to ensure full compliance. By partnering with domestic firms in the country of construction, we effectively manage regulatory and fi including potential import tariff

the project, supplying renewable energy to support Meta’s regional operations, including its Singapore data centre.

As data centres’ power requirements rise, new technologies are gaining momentum – and small modular nuclear reactors (SMRs) are among the most promising. SMRs offer reliable, lowcarbon, consistent baseload power and are scalable enough to match large data facilities’ needs. As such, various deals and partnerships have been made to use SMRs to power data centres.

In September 2025, under the Atlantic Partnership for Advanced Nuclear Energy, Holtec, EDF and Tritax announced their intent to work together to develop two of Holtec’s SMR-300 reactors at the former Cottam coal-fired power station in Nottinghamshire. The reactors will provide 650MW of baseload

capacity to power a 1GW data centre that is expected to come online by 2030.

Many data centre developments will rely on a mix of grid connections and one or two complementary energy sources to power the facilities. However, the scale of some project proposals is prompting developers to use a fully integrated approach that combines multiple generation technologies.

In June 2025, Texas Tech University System announced a collaboration with Fermi America to develop a landmark 11GW data centre campus near Amarillo. The facility, requiring tens of billions of dollars of investment, will use combined cycle gas power generation, utility grid power, solar, onshore wind, battery energy storage systems and a new 4GW nuclear power plant. This ambitious project has already seen agreements signed with Siemens Energy, which will provide up to 1.1GW of gas turbines, and with Westinghouse, which will contribute AP1000 reactors. Fermi has also signed agreements with Energy Transfer to connect its pipeline infrastructure, located to the south of the planned campus.

This integrated approach allows us to deliver data centre projects faster, more safely and more economically, supporting global expansion of AI infrastructure with reliability and innovation.

and financial risks, tariffs. pproach entre and more orting astructure nnovation.

The future of data infrastructure will be built on diversified, resilient and forward-thinking energy solutions

After all the above talk of data centres, it would be remiss of me not to use AI to help with my closing remarks. As the digital age accelerates, the demand for reliable and sustainable energy to power data centres will continue to reshape global energy strategies. From natural gas expansion and long-term renewable agreements to the emergence of nuclear SMRs, the energy mix is evolving to meet the sector’s unique needs. With largescale projects such as those in Texas and Nottinghamshire leading the way, it is clear that the future of data infrastructure will be built on diversified, resilient and forward-thinking energy solutions. The challenge now lies in scaling these efforts to keep pace with demand – sustainably, securely, and globally.

ARE YOU READY TO EXPLORE DATA CENTRE OPPORTUNITIES?

Email: neil.golding@the-eic.com

At Penta Global we deliver innovative, sustainable EPC solutions to the ever-evolving energy sector across the Middle East, Southeast Asia and beyond.

Founded in the UK and headquartered in the UAE, Penta Global has two decades of rich experience in construction and fabrication, catering to the rising demand for global energy conversions. Our diverse and highly skilled workforce delivers Engineering, Procurement, Construction, Mechanical, Civil and E&I capabilities across field-based contracts with safety, quality and sustainability at the core.

Headquartered in the UAE with a global reach

4,500+ Global Workforce

Recognised by leading international organisations for our commitment to Safety including RoSPA Silver Award for Health and Safety Performance 2025 and British Safety Council International Safety Award 2025

For more information visit: www.penta-global.com or contact: Enquiries: sales@penta-global.com Supply Chain: procurement@penta-global.com

Saudi Arabia

Yanbu Green

Hydrogen Hub Phase 1

US$5BN

ACWA Power

Development of a green hydrogen hub in Yanbu, Medina Province, Saudi Arabia. The hub is fully integrated with renewable energy for power source, desalination plants to supply water for its electrolysers and ammonia conversion facilities, and a dedicated export terminal.

Oman HYPORT Duqm Green

Hydrogen Project – Phase 1

US$500M

BP

Australia

Broken Hill Compressed Air Energy Storage

US$434M

Hydrostor

Australia

North Queensland

Alcohol-To-Jet SAF Plant

US$600M

Jet Zero Australia

South Africa

Eastern Cape Green

Ammonia Plant

US$5.8BN

Hive Hydrogen South Africa

The project will deploy an electrolyser with an initial capacity of 250–500MW in Phase 1, with scope for future expansion. This phase will produce about 330,000 tonnes per year of green ammonia, increasing to up to 650,000 tonnes annually in Phase 2.

3

A 200 MW compressed-air energy storage facility with 1,600MWh capacity will be built adjacent to the Perilya Potosi Mine in Broken Hill, far west New South Wales. The developer has secured US$55m in funding from Export Development Canada to advance the project’s development and construction.

2 1 4

This will produce up to 113m litres of sustainable aviation fuel a year using Technip Energies’ Hummingbird® and LanzaJet’s alcoholto-jet technologies. The Australian government has invested US$730m in the Cleaner Fuels Programme to support the development of the domestic low-carbon liquid fuels sector.

5

A green ammonia export plant is planned for Nelson Mandela Bay, Eastern Cape, South Africa. Powered by 3.7GW of combined solar and wind energy, the 1.2GW electrolyser will produce 1m tonnes of green ammonia annually. A final investment decision is anticipated in 2026.

MAPPING ENERGY TRANSITION

Green hydrogen and green ammonia, compressed-air energy storage and sustainable aviation fuel... across the globe, a whole variety of pioneering energy transition projects are starting to take shape, ready to help shift the planet to a greener future

BY JACK BOGGIS, ENERGY ANALYST, EIC UK

UK Altalto SAF (Zero Carbon Humber-East Coast Cluster)

US$500M

Velocys Inc

Construction of a commercial-scale waste-to-renewablejet fuel plant on 32ha of land in Immingham, Lincolnshire. The facility will process 600,000 tonnes of post-recycled waste, converting it into clean-burning sustainable aviation fuel. It is expected to produce 60,000 tonnes of jet fuel annually.

Denmark HØST PtX Esbjerg - Green Ammonia Production Plant

US$2BN

Copenhagen Infrastructure Partners

Deployment of a Power-to-X green hydrogen and ammonia production plant in Esbjerg, Denmark. Powered by offshore wind, a 1GW electrolyser will produce 100,000 tonnes of hydrogen annually, convertible to 600,000 tonnes of green ammonia. Excess heat will heat about one-third of Esbjerg’s households.

Brazil Pecém Port Green Hydrogen Plant

US$3.58BN

Fortescue Future Industries

The project includes a 1.2GW alkaline electrolyser capable of producing about 170,000 metric tonnes of low-carbon hydrogen per year. It also involves the construction of a green ammonia facility with a supply capacity of 250,000 tonnes annually. A final investment decision is expected in 2026.

Malaysia H2biscus Green Hydrogen and Ammonia Project

US$2BN Sarawak Economic Development Corp. Development of a green hydrogen and ammonia project in Bintulu, Sarawak. The facility will produce 120,000 tonnes of green hydrogen and 800,000 tonnes of green ammonia per year for shipment to Korea and Sarawak. A final investment decision is targeted for 2026.

South Korea Donghae 1 Green Hydrogen Project

US$200M

Hyundai Heavy Industries

The project will develop a 100MW demonstration electrolyser plant in Donghae, using power from the Donghae 1 floating offshore wind farm. The facility will produce hydrogen from seawater, with construction expected to be completed by March 2026.

3 ARE YOU READY TO EXPORT? Email: jack.boggis@the-eic.com

UK Floating Offshore Wind Farm

Aspen

US$4.6BN

Cerulean Winds

This 1,008MW floating offshore wind farm will sit 100km off the coast of Aberdeen. Offshore consent applications, including the environmental impact assessment, have been submitted. Approval expected in 2026, followed by a Contract for Difference Auction Round 8 application and final investment decision.

Kazakhstan Onshore Wind Farm Mirny

US$1.9BN

Total Eren

Qatar Dukhan Solar Power Plant

US$1.2BN

QatarEnergy

Saudi Arabia Bilghah Onshore Wind Farm – NREP 7

US$1BN

Saudi Power Procurement Company

South Korea Floating Offshore Wind Farm Munmubaram 1

US$2.25BN

Hexicon

A 1GW onshore wind farm with 200 turbines is set for development in Moyinkum, Kazakhstan, paired with a 300MW/600MWh energy storage facility. Construction will begin in Q1 2026, supporting large-scale renewable energy generation and strengthening regional grid stability.

Samsung C&T Corporation has won a US$1.2bn engineering, procurement and construction contract to develop a 2GW solar project for completion in 2030. With solar tracking and advanced inverters for desert resilience, it will supply clean energy to 750,000 households. Samsung will oversee design to construction.

The development of a 1.3GW onshore wind farm. Saudi Power Procurement Company issued a request for qualification for Round 7 of Saudi Arabia’s National Renewable Energy Program, totalling 5.3GW. The round includes four solar PV projects (3.1GW) and two wind projects (2.2GW).

3 2 1 4 5

Hexicon has signed a Letter of Intent with Ulsan Metropolitan City to advance the floating offshore wind industry and promote regional economic development. Ulsan will create a supportive environment for investment and project implementation, while MunmuBaram will invest in the 750MW project under development.

MAPPING RENEWABLES

From the North Sea to the most southerly reaches of South America, agreements and decisions are starting to come through for a whole new wave of renewable projects, mostly encompassing solar and offshore and onshore wind

BY NABIL AHMED, ENERGY ANALYST, EIC UK

UAE Al Azeezah Solar PV Plant

US$4BN

Masdar

Masdar’s 5.2GW Solar PV project, combined with 19GWh battery energy storage, will deliver up to 1GW of continuous baseload power. Also known as the Round The Clock project, Masdar has shifted from its original plan of producing 350,000 tonnes of green ammonia annually to supplying power to data centres instead.

Chile

HNH Wind Farm Phase 1

US$2BN

HNH Energy

The 1.4GW wind farm under development in Chile’s southerly Magallanes region will feature 194 turbines, each with 7.2MW capacity. On completion, it will be used to power a 1GW electrolyser, which will enable the production of approximately 800,000 tonnes of green ammonia per year.

Libya Eastern Libya Solar Project

US$2BN

General Electric Company of Libya

A 1.5 GW solar power plant is set for development in eastern Libya. The project is part of the country’s US$10bn solar energy programme, which targets 4GW solar power capacity by 2035. EDF and PowerChina will collaborate to deliver the project, boosting Libya’s renewable energy expansion.

Australia Upper Calliope Solar Farm

US$1.3BN

European Energy A/S

Under development, the 1.3GW solar photovoltaic power project near Gladstone will supply renewable energy to three production facilities: Boyne aluminium smelter, Yarwun alumina refinery and Queensland alumina refinery, supporting decarbonisation and sustainable energy use in Queensland’s heavy industry sector.

Morocco NOOR Midelt 2 – Hybrid PV and CSP Solar Power Plants

US$800M

ACWA Power

With a capacity of 400MW, the project will include concentrated solar power, photovoltaic technology and energy storage. ACWA Power will be developing the Noor Midelt II and III hybrid projects under a buildown-operate model, with a 30-year power purchase agreement signed with the Moroccan Agency for Sustainable Energy.

ARE YOU READY TO EXPORT? Email: nabil.ahmed@the-eic.com

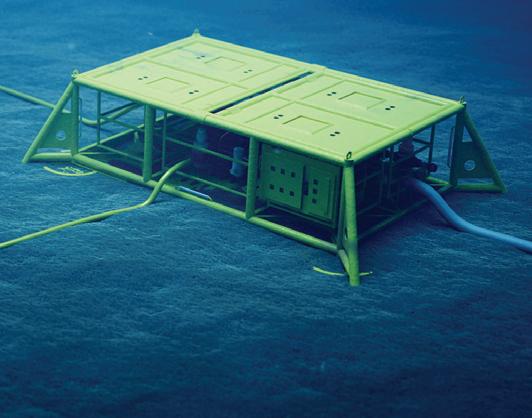

Indonesia

Abadi Gas Field

US$21BN

Inpex

Located in water depths of 400–800 metres, the field holds 18.5Tcf of gas. The development will use a floating production, storage and offloading unit with a processing capacity of 1.8Bcf of gas and 35,000 barrels of condensate per day. Gas produced will support the Abadi liquefied natural gas plant.

Argentina Sierra Grande FLNG Export Terminal Phase 1

US$7BN

YPF

The development will see the installation of one floating liquefaction structure with a capacity of up to 6m tonnes of liquefied natural gas per year. Partners Shell and YPF plan to begin front-end engineering design in December 2025, targeting a final investment decision in 2026.

Namibia Venus Oil Field

US$5BN

TotalEnergies

Located in water depths of up to 3,000 metres, the field holds around 2bn barrels of oil and substantial gas reserves. The development will use a floating production, storage and offloading unit, handling 160,000 barrels of oil and 500Mcf of gas per day, supported by about 40 subsea wells tied back to the vessel.

Belgium Antwerp Polyolefins Complex

US$1.7BN

Vioneo

The plant will produce 300,000 tonnes of polyethylene and polypropylene annually, using green methanol as a feedstock. Contracts have been awarded to a number of players, including Wood, Honeywell and Lummus Technology. A final investment decision is anticipated by the end of 2025.

Mozambique Rovuma LNG Liquefaction Plant

US$30BN Mozambique Rovuma Venture

3 2 2 1 4 5 7

This liquefied natural gas liquefaction plant, fed by Mozambique’s offshore Mamba fields, will comprise 12 modular units with a total liquefaction capacity of 18Mtpa. With electricdriven gas trains instead of turbines, the project is expected to a reach final investment decision in 2026.

MAPPING OIL AND GAS

Stalwarts of the global energy industry, oil and gas are not going anywhere, securing energy supplies during uncertain times. New discoveries are waiting to be explored, while an array of infrastructure is needed to make the most of reserves

BY LUCAS RAMOS, LEAD ENERGY ANALYST, EIC SOUTH AMERICA

Qatar

Bul Hanine Oil Field –Redevelopment Phase 2

US$6BN

Qatar Energy

Phase 2 involves building a central super complex that will include production, compressing, utility and living quarter platforms, with topside weights of up to 14,000 tonnes. The scope of work includes new processing and riser platforms, subsea pipelines, platform modifications and decommissioning works.

Mexico Polok and Chinwol Oil Fields

US$600M

Repsol

Repsol plans to fast-track development of the two discoveries using the existing OSX-1 floating production, storage and offloading unit, which has a production capacity of 60,000 barrels per day and storage for more than 900,000 barrels of oil.

BW Offshore completed front-end engineering work for the unit.

Papua New Guinea Elk-Antelope LNG Liquefaction Project (Papua)

US$9BN

TotalEnergies

The project will include four electric liquefied natural gas trains with a combined capacity of 6Mtpa. The project has faced difficult regulatory requirements, but the operating company continues to advance critical scopes of work, and a final investment decision is targeted for 2026.

Cyprus Cronos Gas Field

US$1.5BN

Eni

The Cronos gas discovery, made by the Cronos-1 well in Block 6, 160km offshore Cyprus at 2,287m depth, holds an estimated 3Tcf of gas. The development will use facilities at Egypt’s Zohr field for transport and processing, and export via the Damietta liquefied natural gas plant, with a final investment decision targeted in 2026.

Iraq Basra Fertiliser Plant

US$1BN

KAR Electrical Power Production Trading FZE A fertiliser plant is set for construction in Basra, Iraq. It will have a daily production capacity of 2,300 tonnes of ammonia and 3,850 tonnes of urea, and the finished facility will employ KAR’s advanced ammonia technology solutions.

ARE

US Palisades SMR Nuclear Power Plant

US$2.6BN

Holtec International

Two SMR-300 units are planned to begin operations in mid2030s. One is expected to produce around 300MW of electrical power or 1050MWt of thermal power. Work so far includes site preparation and geotechnical studies, with progress expected to accelerate following the restart of the Palisades Nuclear Power Plant.

Slovakia

Slovakia SMR Project

US$1BN

Slovenské Elektrárne

Slovakia plans to build small modular reactors, supported by US-led coal-tonuclear initiative Project Phoenix. Synthos Green Energy and Slovenské Elektrárne have signed a memorandum of understanding to deploy GE Vernova Hitachi’s BWRX-300, outlining cooperation across Central and Eastern Europe.

Kuwait

Al Khairan IWPP Phase I

US$5.8BN

Kuwait Authority for Partnership Projects

The facility will generate 1,800MW of power and produce 125m imperial gallons (568,000m³) of desalinated water daily. Originally designed to use low-sulphur fuel oil with crude, gas oil and natural gas backups, the project will now operate primarily on natural gas.

US ARC Fusion Power Plant

US$1BN

Commonwealth Fusion Systems

A commercial ARC fusion power plant is planned at Dominion Energy Virginia’s James River Industrial Park in Chesterfield County, with a capacity of 400MWe. The preceding SPARC fusion demonstration project at Commonwealth Fusion Systems’ site in Massachusetts aims to achieve first plasma in 2026.

Malaysia Kapar Gas Fired Power Plant

US$2.1BN