IMPROVING MEMBERS’ LIVES...

COMMUNITY -MINDED...

SUSTAINABLE GROWTH...

EMPLOYEE EMPOWERMENT...

IMPROVING MEMBERS’ LIVES...

COMMUNITY -MINDED...

SUSTAINABLE GROWTH...

EMPLOYEE EMPOWERMENT...

After an incredible tenure with Suncoast Credit Union, Mr. Anthony D. Satchel will be retiring from his position in March of 2024. Mr. Satchel served the School District of Hillsborough County for an impressive 41 years, retiring in 2013.

Mr. Satchel has been a credit union member since 1973 and has actively participated in various committees and roles. Beginning with the Fair Housing Committee, he later shifted to the Supervisory Committee in 1995. By 2003, he was elected to the Board of Directors, where his influential role was solidified. Throughout his tenure, he displayed remarkable leadership skills, serving as Committee Chairperson, Secretary, and a remarkable three years as Chairman of the Board. His guidance and expertise have been instrumental in shaping the organization’s growth and success.

As Mr. Satchel enters a well-earned retirement, we extend our heartfelt appreciation for his steadfast commitment. He consistently upheld our mission and offered invaluable insights to help us improve the financial well-being of our members. The profound impact he has had on Suncoast and the lives he has touched will be remembered and celebrated for years to come.

Suncoast’s flourishing culture is rooted in connection, financial wellness, and service to our communities. As we work to change members’ lives for the better, we continue to create a culture of ownership, empowerment, and advocacy.

“Got it” represents one of our cultural beliefs: to own every experience and find solutions. In other words, when it comes to our members, our employees, and our communities, we’ve got it!

Dear Suncoast Credit Union Members,

We started and ended 2023 with immense gratitude for the members we serve and the team who bring their very best to work each day. Our commitment to helping our members improve their financial lives and supporting our local communities shined through all of our accomplishments last year.

No matter what opportunities and challenges are set before our team, we’re always ready to meet them with an enthusiastic “Got it!” We own every member and employee experience and confidently find solutions. This annual report shows how “Got it” has become a cultural belief our team demonstrated consistently in 2023 with their dedication and superior service.

Suncoast continued to maintain financial strength in 2023, ending the year with $17.5 billion in assets. Our board of directors upholds an enduring financial structure that lets us provide life-changing savings to our members. This allowed us to continue offering low-rate loans, leading to $6.4 billion in loan origination. Suncoast members saved $330 per household last year compared to the Florida average, according to research from the Credit Union National Association. All of these savings allow our members to live their best lives and save for their bright financial futures.

Providing the best possible service to our members is a top priority at Suncoast. Every interaction is met with the utmost care and personalized attention.

Gary C. Gresham Chairman, Board of Directors

Gary C. Gresham Chairman, Board of Directors

Kevin Johnson President and CEO

Kevin Johnson President and CEO

Making a positive impact on others’ lives enhances job satisfaction, leading to our recognition once more as one of the Best Places to Work by the Tampa Bay Times.

Another reason our team is so proud to work at Suncoast is the opportunity to give back to the local community through volunteer efforts. It was a record-shattering year for volunteering at Suncoast, with team members volunteering for an extraordinary 41,217 hours.

“

“ We own every member and employee experience and confidently find solutions.

Thanks to our strong financial position, we also had the opportunity to support local communities through the Suncoast Credit Union Foundation. Since two cents are donated to our foundation every time a member uses their debit or credit card, we donated $4.4 million to children in our local communities, and a collective $44 million since the foundation’s inception in 1990.

On behalf of our board of directors, leadership team, and all of our employees, we’re proud to share our 2023 annual report so you can see our accomplishments and philanthropy. We truly got it and it’s all for you, our members.

Gary C. Gresham Kevin Johnson Chairman, Board of Directors President and CEO

The credit union operates under the laws of the United States of America and is a state chartered financial institution, which is regulated by the Office of Financial Regulation (OFR) for the State of Florida. Deposits are insured by the National Credit Union Administration (NCUA), an agency of the federal government. Examiners of both the OFR and NCUA make periodic examinations to ensure proper operation of the credit union.

The credit union’s Board of Directors appoints a Supervisory Committee responsible for safeguarding the credit union’s assets and protecting the interests of the members. In this capacity, we are pleased to present the 2023 report.

The committee engaged the certified public accounting firm of Moss Adams LLP to perform an independent audit. In the opinion of the auditors, the credit union’s complete set of financial statements, which are not included in the report, present fairly, in all material respects, the financial position of the credit union as of December 31, 2023. They also reflect the outcomes of its operations and cash flows for the year ending. Furthermore, the committee meets monthly and reviews the work performed by the Internal Audit Department in financial and operational areas of the credit union.

Based on the above activities, it is the unanimous opinion of the Supervisory Committee that Suncoast Credit Union is financially solid and is being operated safely and soundly.

– Brando Fetzek, Chairman Gary C. Gresham Chairman, Board of Directors Jounice L. Nealy-Brown Vice Chairman Andrea L. Falvey Treasurer Victor M. Arias Director Lorraine Fernandez Director Stephanie Mathews Director Anthony D. Satchel Director Dr. Robert Jones Secretary Zamir Ode Immediate Past Chairman Dr. Marc R. Johnson Director Manuel G. Lopez DirectorOur future has never been brighter at Suncoast Credit Union. As we prepare for continued growth opportunities, we’ve harnessed and nurtured the strengths of our greatest asset – the people of Suncoast.

Julie Renderos Executive Vice President Chief Financial Officer

Darlene Johnson Executive Vice President Chief Growth Officer

Kevin Johnson President and Chief Executive Officer

Melva McKay-Bass Senior Vice President Chief Business Development Officer

Jackie Gilbert Senior Vice President Chief Risk Officer

Michael Parks Senior Vice President Chief Information Officer

Sheila Cline Senior Vice President Finance and Accounting

Jennifer Bolivar Senior Vice President Business Transformation and Retail Branching

Jana Manley Senior Vice President Marketing and Digital Strategy

Terry Wood Senior Vice President Human Resources

Julie Renderos Executive Vice President Chief Financial Officer

Darlene Johnson Executive Vice President Chief Growth Officer

Kevin Johnson President and Chief Executive Officer

Melva McKay-Bass Senior Vice President Chief Business Development Officer

Jackie Gilbert Senior Vice President Chief Risk Officer

Michael Parks Senior Vice President Chief Information Officer

Sheila Cline Senior Vice President Finance and Accounting

Jennifer Bolivar Senior Vice President Business Transformation and Retail Branching

Jana Manley Senior Vice President Marketing and Digital Strategy

Terry Wood Senior Vice President Human Resources

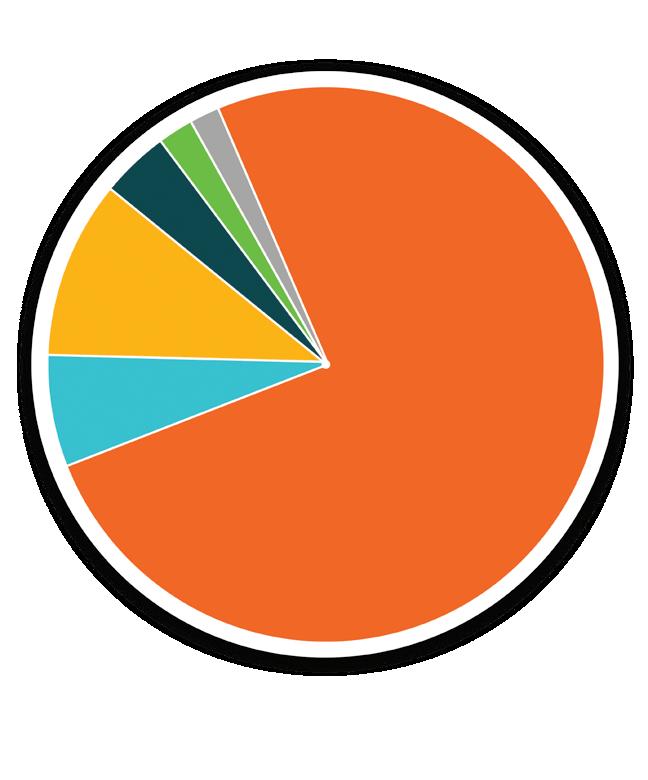

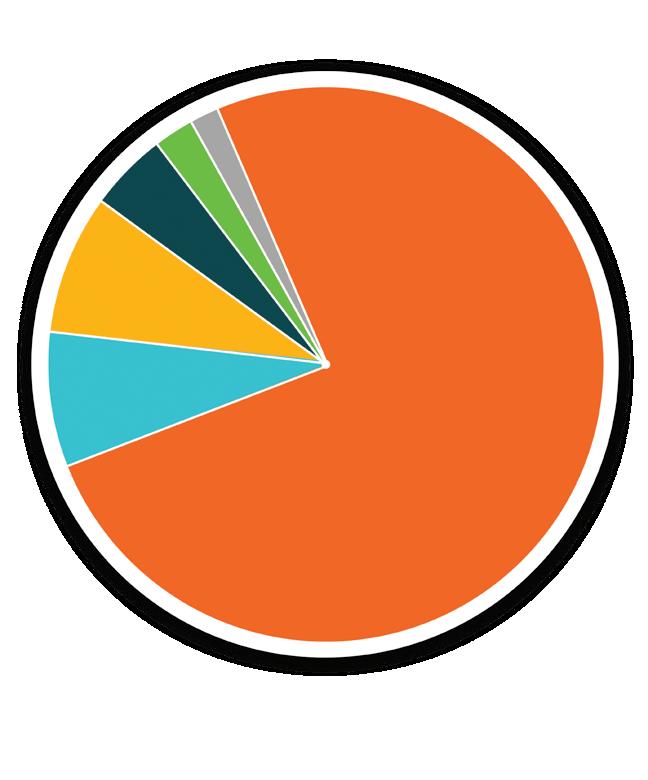

In 2023, Suncoast faced both successes and challenges. Despite a slow-down in loan growth to 7.25%, we proudly assisted over 200,000 members, reaffirming our commitment to people helping people. Despite headwinds from inflation and rising interest rates, Suncoast demonstrated resilience and achieved notable growth in surpassing $17.5 billion in assets, a 7.4% increase from 2022. We continued to see growth in membership of 7.8% or 87,000 and we bolstered reserves by a substantial $84 million.

Driving our loan growth were auto loans, line of credit loans, and credit card loans, contributing to a total of $6.4 billion in new loans for our members. Despite the Federal Reserve’s rate hikes, we maintained a competitive edge, offering rates that supported member loyalty. Our savers capitalized on our attractive deposit rates, with certificates of deposit growing by over $1.3 billion. While core deposits experienced a temporary 13% decline due to inflationary pressures, our overall deposit balance only saw a modest 1% decrease.

Throughout 2023, increased Federal Reserve rates, rising from 0.25% in March 2022 to 5.50% in July 2023, influenced both loan and share rate increases. While some members capitalized on our certificate of deposit promotions, the overall effect was a slowdown in membership and lending growth.

Acknowledging the impact of inflation on our members, we remain steadfast in finding practical solutions for their financial needs. As we approach the uncertainties of the coming year, Suncoast stands prepared and ready to meet our members’ financial needs. Our commitment to supporting local communities and enhancing our members’ financial well-being remains constant. The Suncoast Board of Directors, management, and staff are dedicated to serving our members and safeguarding their financial health.

LOANS TO MEMBERS, NET

CASH & CASH EQUIVALENTS

OTHER ASSETS

NCUA SHARE INSURANCE FRAUD PROPERTY & EQUIPMENT, NET

TOTAL INTEREST INCOME

INTEREST EXPENSE

Dividends to Members

Cost of Borrowed Funds

TOTAL INTEREST EXPENSE

NET INTEREST INCOME

Net Interest Income

Provision for Loan Losses

Net Interest Income after

TOTAL SERVICE INCOME Provision for Loan Losses

NET NON-INTEREST EXPENSE

TOTAL OPERATING EXPENSE INCOME FROM OPERATIONS

NON-OPERATING

Non-Operating Gains (Losses)

NET INCOME

$504,861,976 $(81,607,311) (718,631) $(82,325,942)

$619,688,953 93,011,742 $712,700,696 $(188,216,245) (29,168,152) $(217,384,397)

$422,536,034 (50,000,000)

$372,536,034

$495,316,299 (145,000,000)

$350,316,299

$136,397,389 $150,206,617

$(325,433,232)

$183,500,191

$(375,416,730) $125,106,186

$(33,383,526) 150,116,665

$9,481,631 $134,587,818

ASSETS

Cash & Cash Equivalents

Investments

Loans to Members

Allowance for Loan Losses

Loans to Members, Net

Property & Equipment, Net

Accrued Income

NCUA Share Insurance Fund

Other Assets

TOTAL ASSETS

LIABILITIES

Total Deposits

Borrowed Funds

Accounts Payable & Other Liabilities

TOTAL LIABILITIES

MEMBERS’ EQUITY

12/31/22

$883,227,053

2,654,793,486

12,137,392,046 (129,878,623)

12,007,513,423

172,337,071 36,247,862

136,089,075 424,024,422

$16,314,232,392

12/31/23

$1,795,264,258

2,096,796,544

13,017,885,862 (205,595,146) 12,812,290,716

178,331,916

47,189,111

139,243,719

445,345,637

$17,514,461,902

$14,795,201,328 175,000,000 199,914,958

$15,170,116,286

$14,675,110,494

1,337,979,502 235,863,142

$16,230,953,138

Accumulated Other Comprehensive Income

Regular Reserve & Undivided Earnings

TOTAL MEMBERS’ EQUITY

MEMBERS’ EQUITY

1,402,750,246

$1,144,116,106

TOTAL LIABILITIES & $(258,634,140)

$16,314,232,392

$(202,829,300)

1,486,338,064

$1,283,508,764

$17,514,461,902

We’re able to provide the best service because we have the very best team! Suncoast hires talented and caring people and gives them the opportunity to grow with us.

Suncoast had a record number of applicants in 2023, with almost 80,000 people applying for jobs with us. We hired 549 new team members and by the end of the year, we had a total of 2,505 employees working together to help our members live their best financial lives.

Successful careers start at Suncoast! Our ongoing professional development opportunities let our team build their skill sets and grow their abilities. Professional development courses are always available for our team to learn about topics that can enrich their careers, like public speaking and critical thinking.

Employees also have the chance to shadow and learn from another department in the credit union in our CU360 program. Our management team gets the chance to continually develop their leadership skills in a series of workshops called the Manager Development Journey.

Plus, current and future leaders have the opportunity to cultivate their leadership abilities in the coveted, year-long Leadership Excellence Achievement Program (LEAP).

As our members’ lives change, we adapt to ensure we’re always here to support their needs. That’s why 30 years ago, we opened our Member Care Center (MCC) to help support our members over the phone.

MCC has evolved over the years to include a call center and an online support team to help with member inquiries. One thing that hasn’t changed is how incredible our team is and always has been!

In 2023, MCC team members from the past and present came together to celebrate 30 years of making a difference in the lives of our members.

It’s an honor to be named a Top Place to Work in Tampa for the 8th consecutive year. We strive to make work fulfilling and support our employees in every way we can, so it’s rewarding to see our team thriving in their careers!

Our services are designed to cover all of the financial needs of our members in a way that fits into any lifestyle.

When members want to improve their financial lives, we’ve got it!

Suncoast’s expansion to Orlando and Kissimmee is part of our goal to provide financial wellness to the greater Central Florida community. Since the Orlando market is the fastest growing population in Florida, we have the opportunity to impact so many lives!

All three of our new Central Florida locations have English and Spanish speaking employees, allowing members to speak in the language they are most comfortable with and receive the service they deserve.

We’ve already had so many new members join us in Orlando and Kissimmee, and we can’t wait to continue to support this incredible community!

As our members dream of buying a car, owning a home, or starting a business, our lending options help make these dreams come true.

$4,370,465,000

MORTGAGE LOANS

32,416 FAMILIES IMPACTED

$6,574,894,000

INSTALLMENT LOANS

367,329 MEMBERS IMPACTED

$322,115,000

BUSINESS LOANS

1,114 BUSINESSES IMPACTED

Suncoast continues to help employers and their employees grow opportunities. Our Workplace Banking program exists to help employers and employees achieve a bright financial future.

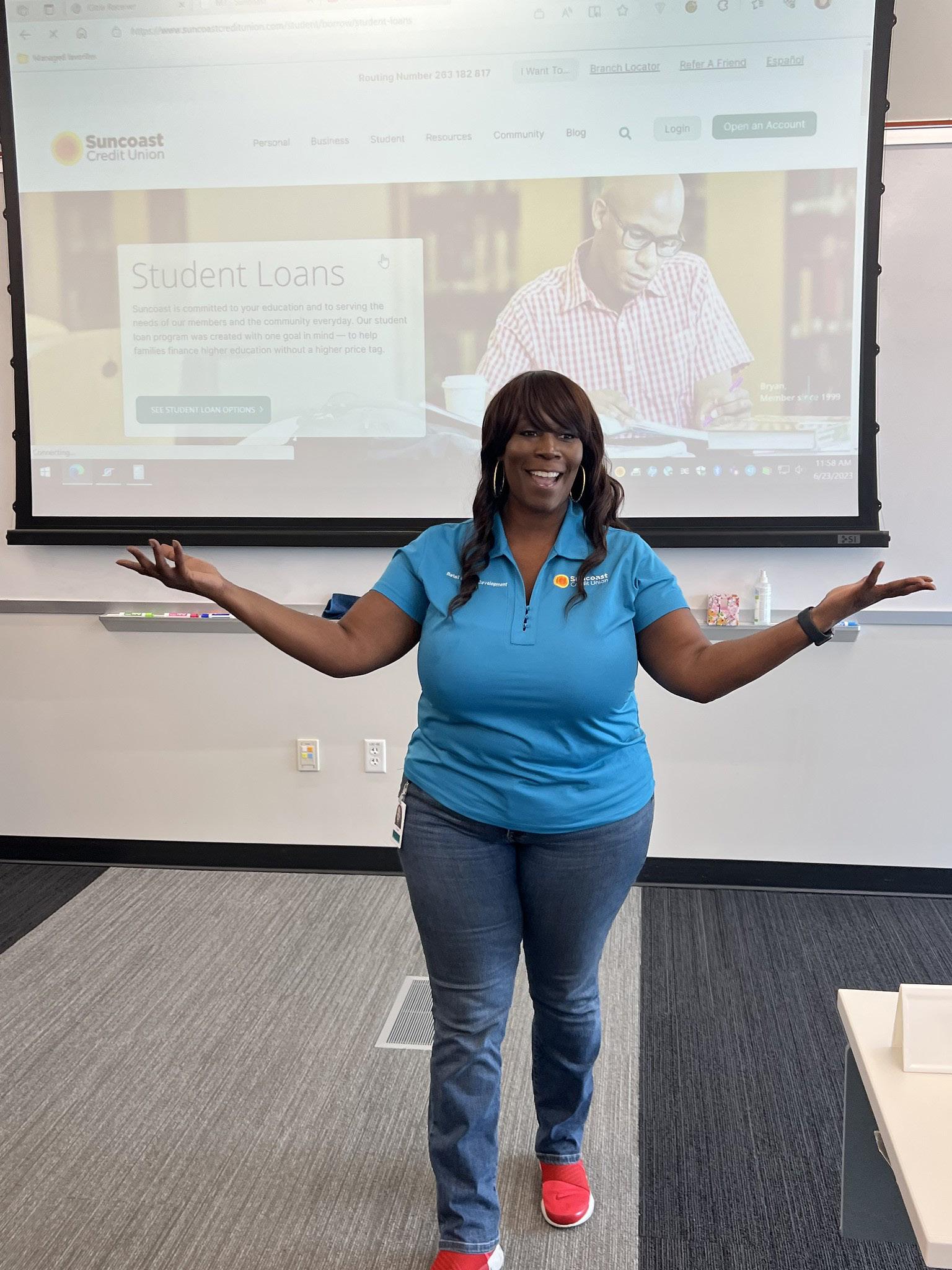

This program offers dedicated relationship coordinators to guide businesses and their employees utilizing both onsite and virtual meetings and consultations. We provide these personal services to meet the needs in our communities in ways that work for their lives.

OVER 70 BUSINESSES/ORGANIZATIONS ACTIVELY PARTICIPATING IN OUR WORKPLACE PROGRAM

OVER 700 NEW MEMBERS ENROLLED

$6 MILLION IN LOANS BOOKED AND $3 MILLION IN TOTAL NEW DEPOSITS

2,000 MEMBERS ASSISTED SINCE INCEPTION - 2,300 IN TOTAL PRODUCTS SINCE INCEPTION

287 TOTAL EVENTS SINCE INCEPTION (206 IN 2023)

BUSINESS/COMMERCIAL HIGHLIGHTS

56,075 $142 MILLION $692,107,511 $260,425,618

TOTAL BUSINESS MEMBERS

YEAR-OVER-YEAR GROWTH OF COMMERCIAL SERVICES

TOTAL AMOUNT BUSINESS LOANS

TOTAL AMOUNT BUSINESS DEPOSITS

MICROENTERPRISE 70+

MICRO ENTERPRISE DEVELOPMENT PROGRAM EVENTS

OVER $8.1 MILLION MICROLOANS $30,000 AVERAGE LOAN AMOUNT

“Because of the efficiency, knowledge, and creativity of Alain Fernandez (Business Relationship Manager) from Suncoast Credit Union, we were able to update and remodel our entire school. Since our personal and business accounts were already with Suncoast, our trust and satisfaction with them was already established. Suncoast is always our first choice in banking.”

- Katy Wilbekin | Owner, Little Pioneers Preschool

“Thanks to the loan, we were able to purchase equipment for our med spa. This equipment benefits our clinic in gaining new clients looking for the new services we have started to provide. I do recommend Suncoast to any business because the low rates, customer service, and satisfaction are unbeatable!”

- Karla Daniel | Owner, Din Style Naples Aesthetics

Our commitment to providing our members with the very best is reflected in every accolade we receive. We’re so grateful for every vote and acknowledgement, because it shows how hard our team works to make a difference each day.

OUR COMMUNITY IS THE THE CENTER OF EVERYTHING WE DO AT SUNCOAST

From Big Bend to Fort Myers to Orlando and beyond, we know that the communities we serve are each special in their own way. We couldn’t do it without you. That’s why, when it comes to supporting our community, we’ve got it!

SUNCOAST CREDIT UNION FOUNDATION BY THE NUMBERS

$4,494,447

TOTAL DONATIONS

413,476

TOTAL NUMBER OF CHILDREN AND STUDENTS IMPACTED

$211,500

TOTAL IN COLLEGE SCHOLARSHIPS

This year, Suncoast expanded our partnership with the Tampa Bay Rays to help donate to local nonprofit organizations. Our initiative, “Every Hit is a Win,” has exceeded our expectations, truly living up to its name.

Each month during baseball season, we hand-picked 3 local nonprofit organizations with missions aligned with our core values to participate. Each time the Rays made a hit, Suncoast added $78 to a donation pot ($1 for each of our branches across Florida).

The nonprofits each had one month to rack up votes on Suncoast’s Facebook poll. At the end of the month, the funds were divided between the three organizations based on the percentage of votes they received, so no organization walked away empty-handed. That’s what we call a win!

MAY

Boys & Girls Clubs of Central Florida Children’s Dream Fund HEAVENDROPt

JUNE

Habitat for Humanity Greater Orlando & Osceola County St. Matthew’s House

Tampa Metropolitan Area YMCA

JULY

Big Brothers Big Sisters of Tampa Bay Harbor House of Central Florida

Valerie’s House

AUGUST

Early Learning Coalition of Pasco & Hernando Counties

Heart of Florida United Way

Meals on Wheels of Tampa

SEPTEMBER

HOPE Partnership

NAMI Pasco

PACE Center for Girls of Lee County

TOTAL FUNDS DONATED:

$73,182

education of children in the communities we serve with grants and scholarships.

Grants for Great Ideas was created to help schools fund larger projects without the usual financial constraints. Five grants were funded, ranging from $2,200 to $8,000, to meet the school’s needs and encourage engagement and achievement among students. This program put supplies in the hands of over 54,000 students!

AmeriCorps Polk Reading Tutors provided students with 28,000 hours of one-on-one tutoring. 75% of students met their reading goals!

COMMUNITY MINDED

At Suncoast, we are dedicated to creating lasting, positive change in the communities we serve. Each year, we collaborate with one another to make this possible. Through our charitable donations and emotional connections, we strive to make a positive impact and pave the way for a brighter future.

COMMUNITY IMPACT BY THE NUMBERS

41,217

TOTAL VOLUNTEER HOURS

1,700 $1.32M

TOTAL NUMBER OF EMPLOYEE VOLUNTEERS

AWARENESS & OUTREACH

937

TOTAL NUMBER OF INITIATIVES SPONSORED

VALUE OF VOLUNTEER TIME

FINANCIAL EDUCATION

371 $1.84M

PROVIDED TO SUPPORT COMMUNITY PROGRAMS, SERVICES, & FUNDRAISING EFFORTS

18,078+

FINANCIAL EDUCATION PRESENTATIONS

LEARNERS/PARTICIPANTS

that backpack is their major source of nutrition for the weekend.

Over the years, Thomas Promise has had a significant impact on the lives of students and their families. Not only does providing food to students help with their academics and behavior, it also takes some burden off the shoulders of the parents/guardians enduring financial hardships.

Suncoast is proud to support the Thomas Promise Foundation and contribute to the positive ripple effect it’s already creating in Tampa Bay.

Suncoast has been a proud partner of the Florida Future Farmers Association Foundation for upwards of 3 years. This past summer, we had the privilege of being a title sponsor of the 95th Florida FFA State Convention & Expo, where we received recognition for our contributions and support over the years. This annual event attracts nearly 6,000 attendees from every county in Florida each year to celebrate the achievements and bright futures of past and present generations of agriculturalists. We know that our agriculturalists are an integral part of our communities, and we’re overjoyed to be able to support them.

Suncoast employees have a long history of volunteering and making a positive difference. In 2023, we celebrated the winners of our inaugural Community Impact Awards for their work the previous year.

Named after a former Suncoast employee who brought her heart to work every day during her almost 50 years at Suncoast, this award is our greatest honor.

Winner: Sandra Wright, Hillsborough Avenue Assistant Service Center Manager

This award went to two employees who used their time and talent to empower and encourage audiences to improve their financial habits.

Winners: (from left to right) Gissell Herrera, Member Care Center Development Facilitator, and Ashley Espinal, Senior Facilitator - Retail Branch Support

Four winners were chosen by their peers at Suncoast, each from a different area of Suncoast’s footprint. These Peer Choice Award winners showcased exemplary acts of service, meaningful impact in the community, and a remarkable level of commitment.

Winners: (clockwise starting upper left) Courtney Kelley, Senior Direct Loan Processor; Tonya Kalosis, Charlotte Harbor Service Center Manager; Caitlin Morejon, Member Care Center Development Facilitator; Sandra Wright, Hillsborough Avenue Assistant Service Center Manager

more than a quarter of a million children, families and seniors each month. Suncoast has also agreed to serve as a sponsor of the Care and Share Senior Feeding program. The program supplements the diets of more than 2,200 low-income seniors in Charlotte, Collier, and Lee counties with nutritious easy-to-prepare food.

We believe that all seniors and caregivers deserve access to the resources they need, and this donation to Harry Chapin Food Bank’s Care and Share Senior Feeding Program will help make that goal a reality!

“We are thrilled to partner with Suncoast Credit Union to support our Care and Share Senior Feeding Program. Their generous support will allow us to provide more seniors in our communities with access to healthy and nutritious food.

- Stuart Haniff, Chief Development Officer at Harry Chapin Food BankOver 120 employees were in attendance as we sponsored the St. Jude walk for the first time! They walked, ran, and volunteered in the Community Connection area giving out “hero” capes to the children who participated in the “St. Jude Fun Run” for kids. Suncoast received recognition for having both the largest Corporate and Individual Teams. “Avery’s Army” consisted of over 70 family and friends participating in honoring the granddaughter of our longest tenured employee!

St. Jude is ranked as one of the top children’s cancer hospitals in the United States. Although located in Memphis, St. Jude is every community’s hospital and has treated children from every state in the nation and around the world. St. Jude doctors freely share their research, protocol, and treatment plans with physicians and scientists around the world. Treatments developed at St. Jude have helped push the over childhood cancer survival rate from 20% to more than 80% since it opened its doors 60 years ago.

YOUTH OUTREACH BY THE NUMBERS

FINANCIAL EDUCATION AWARENESS & OUTREACH

13,619 LEARNERS IMPACTED

223 FINANCIAL LITERACY PRESENTATIONS

22,276 INDIVIDUALS REACHED

85 YOUTH OUTREACH EVENTS

asked to answer financial questions – for each correct answer, teams earn points and a chance to have their school’s name on the coveted Financial Football trophy. Plus, students also get the chance to win money for their schools!

This year, we impacted 60 schools and 6,640 students through the 2023 in-person Great American Teach-In opportunity. We are also proud to announce that 2023 marked our record number of schools and students impacted by our Suncoast Credit

Suncoast Credit Union partners with Hillsborough County School District, specifically with their Academy of Finance high schools: Armwood, Brandon, Jefferson, King, and Spoto. Our Academy of Finance Internship Program provides juniors from the participating high schools with the opportunity to work full time at the Suncoast headquarters for six weeks during the summer. They worked in Accounting, Consumer Loan Fulfillment, Member Solutions, Records & Research, and Special Accounts. Along the course of the internship, they were also immersed into professional development sessions presented by Suncoast staff on goal setting, public speaking, branding, and leadership. Participation in this program is key for Academy of Finance students to meet requirements for graduation and program completion.

When developing any new skill, there’s no better teacher than immersive experience. In our scaled down credit union branches, known as Student Run Branches (SRBs), students take on roles like Branch Manager, Marketing Manager and Teller, accepting applications and deposits from students and staff members.

Suncoast employees and the student branch staff work together to spread credit union awareness to other students through various campaigns and seminars - all led by the students! Aside from providing financial education, SRBs give students a sense of responsibility and valuable experiences and lets them hone skills they can carry with them into adulthood. Not only does this enhance their resume, it gives them a competitive edge when applying for jobs and college.

The 2023-2024 school year marks our first year back in our local schools post-COVID. This year, the program has 18 active SRBs operating in 10 counties within our footprint, with 6 additional schools participating in the BETA SRB program to become fully functional SRBs.

Charlotte

Port

Punta

West Hernando

2140 Commercial Way (U.S. 19) | Spring Hill, FL 34606

Sebring

6505 U.S. Highway 27 North | Sebring, FL 33870

Belmont

14391 South U.S. Highway 301 | Wimauma, FL 33598

Brandon

1370 Oakfield Drive | Brandon, FL 33511

Citrus Park

8017 Citrus Park Drive | Tampa, FL 33625

East Tampa Community

1920 East Hillsborough Avenue | Tampa, FL 33610

Fletcher

950 West Fletcher Avenue | Tampa, FL 33612

Galleria

4340 West Hillsborough Avenue Suite 704 | Tampa, FL 33614

Hillsborough Avenue

6804 East Hillsborough Avenue | Tampa, FL 33610

New Tampa

17505 North Palms Village | Tampa, FL 33647

Plant City

1905 South Alexander Street | Plant City, FL 33566

Riverview

10405 Gibsonton Drive | Riverview, FL 33578

Ruskin

150 Teco Road | Ruskin, FL 33570

Seffner

901 West Dr. Martin Luther King Jr. Boulevard | Seffner, FL 33584

South Tampa

2502 South Manhattan Avenue | Tampa, FL 33629

Town ‘n’ Country

8201 West Waters Avenue | Tampa, FL 33615

Valrico

3234 South Miller Road | Valrico, FL 33596

West Tampa

3300 North Armenia Avenue | Tampa, FL 33607

Bonita Springs

25183 Chamber of Commerce Drive | Bonita Springs, FL 34135

Cape Coral Del Prado

5 Del Prado Boulevard South | Cape Coral, FL 33990

Cape Coral Southwest

1730 Cape Coral Parkway West | Cape Coral, 33914

Cape Coral Santa Barbara

2325 Santa Barbara Boulevard | Cape Coral, FL 33991

College Parkway

9131 College Parkway Suite #135 | Fort Myers, FL 33919

Daniels Parkway

13465 Daniels Commerce Boulevard | Fort Myers, FL 33966

East Fort Myers

4491 Underwood Drive | Fort Myers, FL 33905

Estero

19750 South Tamiami Trail | Fort Myers, FL 33908

Fort Myers - Matthew Drive

1533 Matthew Drive | Fort Myers, FL 33907

Lee Boulevard

5705 Lee Boulevard Suite #7 | Lehigh Acres, FL 33971

Lehigh Acres

226 Beth Stacey Boulevard | Lehigh Acres, FL 33936

North Fort Myers

565 Pine Island Road | North Fort Myers, FL 33903

Chiefland

2153 Northwest 11th Drive | Chiefland, FL 32626

MANATEE COUNTY

Bradenton

6001 26th Street West | Bradenton, FL 34207

East Bradenton

8700 East State Road 70 | Bradenton, FL 34202

Lakewood Ranch

11021 State Road 64 East | Bradenton, FL 34212

West Bradenton

6367 Manatee Avenue West | Bradenton, FL 34209

ORANGE COUNTY

South

South Semoran

OSCEOLA COUNTY

West Osceola

1221 West Osceola Parkway | Kissimmee, FL 34741

PASCO COUNTY

Dade City

12510 U.S. Highway 301 | Dade City, FL 33525

Holiday

3422 U.S. Highway 19 | Holiday, FL 34691

Land O’ Lakes

1837 Collier Parkway | Lutz, FL 33549

Port Richey

7225 Ridge Road | Port Richey, FL 34668

11370 State Road 54 | New Port Richey, FL 34655

Wiregrass

27213 State Road 56 | Wesley Chapel, FL 33544

Zephyrhills

32745 Eiland Boulevard | Zephyrhills, FL 33545

PINELLAS COUNTY

Countryside

26232 U.S. Highway 19 North | Clearwater, FL 33761

Downtown St. Petersburg

1022 Central Avenue | St. Petersburg, FL 33705

South St. Petersburg

2120 34th Street South | St. Petersburg, FL 33711

St. Petersburg Roosevelt

12450 Roosevelt Blvd North Street | St. Petersburg, FL 33716

POLK COUNTY

Lakeland

919 Lakeland Park Center Drive | Lakeland, FL 33809

South Lakeland

6405 South Florida Avenue | Lakeland, FL 33813

SARASOTA COUNTY

Bee Ridge

4402 Bee Ridge Road | Sarasota, FL 34233

Fruitville 5851 Fruitville Road | Sarasota, FL 34232

North Port

4451 Aidan Lane Suite #100 | North Port, FL 34287

Venice Walmart (inside Walmart)

4150 Tamiami Trail | Venice, FL 34293

SUMTER COUNTY

Bushnell 217 West Belt Avenue | Bushnell, FL 33513

The Villages at Walmart (inside Walmart)

4085 Wedgewood Lane | The Villages, FL 32162

Wildwood

5625 Seven Mile Drive Suite #102 | Wildwood, FL 34785

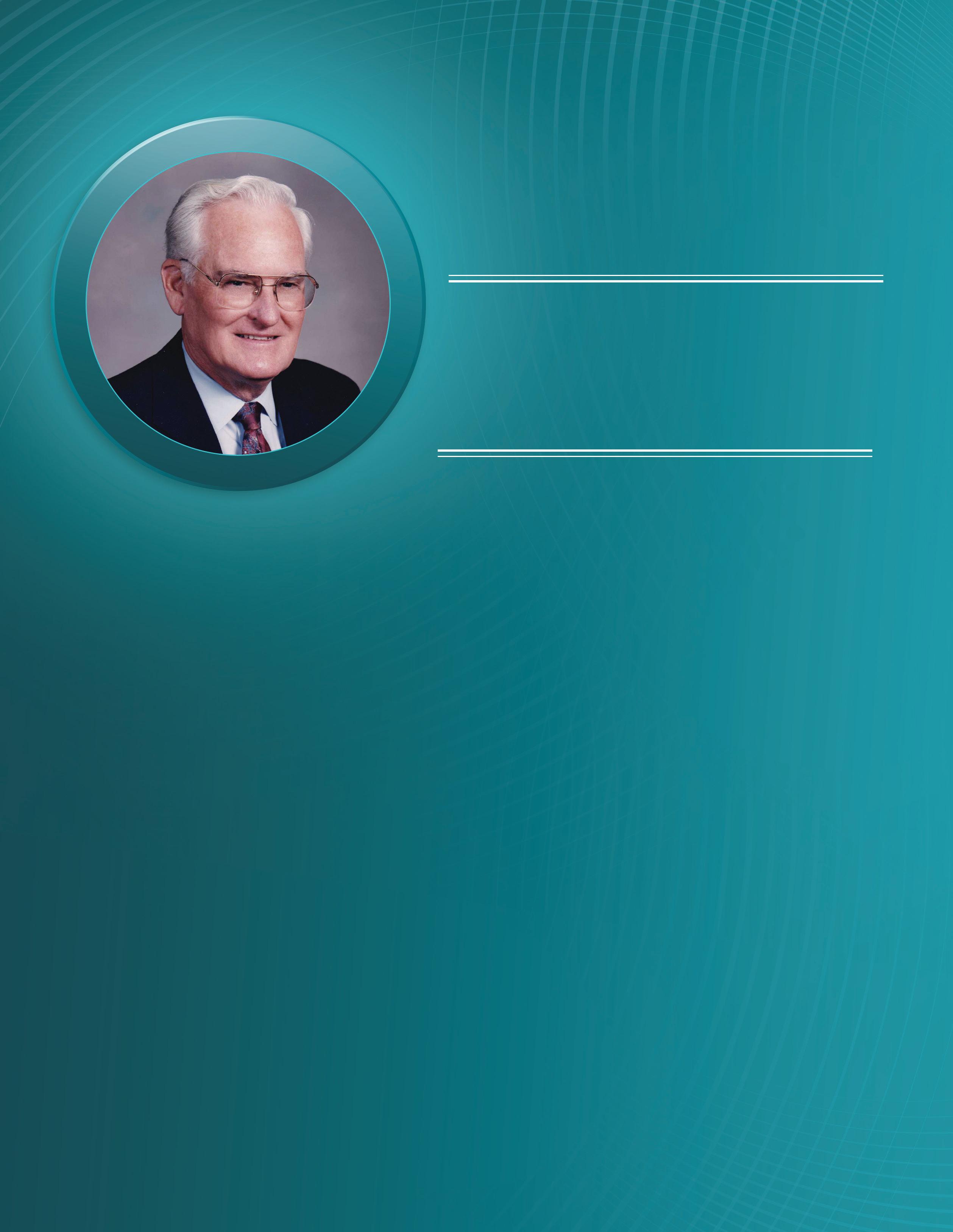

Dawson, beloved former President and CEO of Suncoast Credit Union, who passed away in 2023.

During his distinguished career spanning over four decades, Mr. Dawson dedicated 29 years of his life to Suncoast. Under his guidance, Suncoast flourished from its humble beginnings of 4,500 members and 18 employees to becoming the 12th largest credit union in the country when he retired.

One of Mr. Dawson’s defining qualities was his open-door policy. He was a leader who believed in sharing knowledge and empowering others to achieve financial well-being. To employees, he was known as a caring leader who valued listening, took a personal interest in individuals, and loved the credit union and staff wholeheartedly.

At the forefront of the credit union movement, Mr. Dawson embodied the philosophy of people helping people. He devoted himself to prioritizing member returns and advocating for the underserved. His commitment to ethical practices and financial democracy has profoundly impacted the industry. Mr. Dawson played a pivotal role in the initial expansion of credit unions across the country, utilizing his exceptional ability to engage at both state and federal levels.

Beyond his professional achievements, Mr. Dawson was devoted to his family. He leaves behind his wife Ruth, four daughters, and nine grandchildren.

Mr. Dawson will be remembered fondly, and his enduring legacy will continue to inspire and guide us as we strive to carry forward his vision of a better future for all.