VALUES

Serving Others

Caring for and serving our members is at the core of everything we do at Suncoast. Our 2022 annual report is centered around our core values, the fundamental beliefs that drive us forward, allow our team to provide the best possible service to our members, and help us make a meaningful difference in the communities we serve.

Our compassionate team brings kindness and empathy to more than a million members, helping them live their best financial lives.

Thank you for another year of meaningful moments. In 2022, we experienced the true depth of our mission to help members live their best financial lives. There were moments of growth and celebration. There were also moments that challenged us, and moments of thoughtful reflection. But through it all, we remained committed to serving our members and our communities.

Our motivation comes from a deep-seated commitment to stay true to who we are as an organization. The founding principles at our core are what guide us, shape our every move, and keep us grounded in our beliefs. This year’s annual report shares those core values through the real-life stories of members and team members who live them every day.

From a financial perspective, Suncoast remains in a very strong position, ending the year with over $16 billion dollars in assets. Our board of directors continue to maintain a resilient financial structure that allows us to pass remarkable savings and extraordinary value on to our members.

With inflation impacting so many, our low-rate loans and higher yield deposits were more important than ever to help members save money. An incredible $7 billion in loans were funded in 2022 which translated to helping over 260,000 members gain access to money they need to help improve their daily lives. In fact, last year we were able to save members an average of $172 per household compared to the Florida average, according to research from the Credit Union National Association.

Our financial impact extends to every area of our members’ lives, from managing their

daily finances, to securing their financial futures and even building wealth. In 2022 a new alliance relationship was established with LPL Financial, an industry leader in technology and support for financial advisors. This relationship provides our members broader advisory capabilities, enhanced digital tools, and robust mobile access to their investment accounts - anytime, anywhere.

We continued the commitment to helping members get the most from our products and services in many ways. We updated our digital services by providing a streamlined Open & Apply function that made it easier for members to open deposit accounts and apply for loans online or through our mobile app. We added personalized financial insights to help members save time and make informed decisions about their spending habits. We also incorporated automation across many areas of the credit union, using artificial intelligence and robotics to help improve organizational efficiency and member convenience, providing more value to our members.

Our financial achievements also help strengthen our ability to assist local communities through outreach, education, and support from the Suncoast Credit Union Foundation. The Pennies Add Up program donates two cents every time a member uses their debit or credit card. In 2022, a total of $4.4 million was given to help children in our local communities and a collective $40 million since the inception in 1990. We also provided a $500,000 grant to the Skills Center Collaborative in East Tampa, a multi-use facility that will provide education, health, and workforce readiness for local youth.

A memorable moment of note in 2022 was when Hurricane Ian barreled through the state in late September. Our team rallied in support of each other, our members, and the communities we serve. We donated $500,000 to Volunteer Florida in support of recovery efforts for Hurricane Ian.

even expanded our day of giving through the end of the year to make the biggest impact for the communities that were in need. We prioritized making a positive difference, volunteering a total of 18,246 hours in 2022.

Founded in the philosophy of people helping people, and as many people as possible, Suncoast was honored to earn the Juntos Avanzamos designation to help communities achieve financial independence. We also received $175,000,000 from the U.S Treasury’s Emergency Capital Investment Program which provides additional capital to help small and minorityowned businesses and low to moderate income consumers.

Living by our core values also provides us with a greater capacity to help members with their specific needs. The dedication our team puts into every interaction was reflected in a 98.41% member feedback score. It shows that our team members bring their heart and mind to work each day to ensure that our members feel cared for and supported throughout every step of their financial lives. Creating a positive difference also provides greater job satisfaction which is why Suncoast was selected as one of the Tampa Bay Times Best Places to Work.

On behalf of our board of directors, leadership team and entire staff, we’re proud to present our 2022 annual report where you will see our core values come to life and lead to countless accomplishments.

These pages are dedicated to you, in gratitude for being our members.

Zamir Ode Chairman, Board of Directors

Zamir Ode Chairman, Board of Directors

We were more motivated than ever to give back for our annual Pay it Forward Day in October. We

Kevin D. Johnson President and CEO

The credit union operates under the laws of the United States of America and is a state chartered financial institution, which is regulated by the Office of Financial Regulation (OFR) for the State of Florida. Deposits are insured by the National Credit Union Administration (NCUA), an agency of the federal government. Examiners of both the OFR and NCUA make periodic examinations to ensure proper operation of the credit union.

The credit union’s Board of Directors appoints a Supervisory Committee responsible for safeguarding the credit union’s assets and protecting the interests of the members. In this capacity, we are pleased to present the 2022 report.

The committee engaged the certified public accounting firm of Moss Adams LLP to perform an independent audit. In the opinion of the auditors, the credit union’s complete set of

financial statements, which are not presented in the report, present fairly, in all material respects, the financial position of the credit union as of December 31, 2022 inclusive of the results of its operations and its cash flows. Furthermore, the committee meets monthly and reviews the work performed by the Internal Audit Department in financial and operational areas of the credit union.

Based on the above activities, it is the unanimous opinion of the Supervisory Committee that Suncoast Credit Union is financially solid and is being operated safely and soundly.

Our future has never been brighter at Suncoast Credit Union. As we prepare for continued growth opportunities, we’ve harnessed and nurtured the strengths of our greatest asset – the people of Suncoast.

We experienced phenomenal growth during 2022, even with the challenges of a rapidly rising interest rate environment, persistently high inflation, and the impact of a major hurricane. In the midst of these economic and environmental challenges, we were able to expand our mission by growing membership at more than 10% during the year, bringing the total to over 1.1 million members. Our total assets exceeded $16 billion, an incremental increase of over $1 billion from the prior year, which equates to an overall 9% annual growth rate for the organization. We transferred $150 million to reserves, and significantly strengthened our capital position with $175 million in secondary capital awarded to us by the US Treasury.

It was a momentous year for lending. Outstanding loan balances surpassed $12 billion by year end, fueled by the record high annual loan growth rate of 20%. As the Federal Reserve aggressively raised rates throughout the year, members locked in our competitive rates. We funded over $7 billion in new loans to more than 260,000 members! Loan growth did slow toward the end of the year. However, the quality of the loan portfolio remains extremely healthy with under 1% of the portfolio currently delinquent or charged off.

Increasing our staffing levels was a high priority for the organization in 2022. Our growth rate over the last several years has outpaced our hiring rate and staffing levels needed to be increased to meet the needs of our members. Inflation and the tight job market drove up salaries and the continued low unemployment rate limited the number of candidates applying for positions. Ultimately, we were able to bring staffing levels up to meet our needs and we are well positioned for the coming year’s growth goals.

As we prepare for the potential economic uncertainty of the coming year, we are well positioned and ready to meet our members’ financial needs. The Suncoast Board of Directors, management, and staff all remain firmly committed to serving our members, improving their financial health and wellbeing, and supporting our local communities.

SHARES & DEPOSITS LOANS RESERVES ASSETS MEMBERS

$14,795,201,328 $13,333,960,493 $12,137,392,046 $10,092,525,508 $1,273,994,729 $1,365,359,488 $16,314,232,392 $14,957,762,346 1,105,101 1,003,373

* Unaudited and unconsolidated

Interest on Loans

Interest on Investments

TOTAL INTEREST INCOME

INTEREST EXPENSE

Dividends to Members Cost of Borrowed Funds

TOTAL INTEREST EXPENSE

NET INTEREST INCOME

Net Interest Income

Provision for Loan Losses

Net Interest Income after Provision for Loan Losses

TOTAL SERVICE INCOME

TOTAL OPERATING EXPENSE

INCOME FROM OPERATIONS

Non-Operating Gains (Losses)

TRANSFER TO RESERVES

Cash and Cash Equivalents

Investments

Loans to Members

Allowance for Loan Losses

Loans to Members, Net

Property and Equipment, Net Accrued Income

NCUA Share Insurance Fund

Other Assets

TOTAL ASSETS

Total Deposits Borrowed Funds

Accounts Payable & Other Liabilities

TOTAL LIABILITIES

EQUITY

Accumulated Other

Comprehensive Gain (Loss)

Regular Reserve & Undivided Earnings

TOTAL MEMBERS’ EQUITY

TOTAL LIABILITIES & MEMBERS’ EQUITY

Simplicity is the key to make banking work seamlessly into our members’ lives. One of our major digital banking enhancements of 2022 was streamlining our digital account opening and loan application processes to make it even easier for members to get what they need from anywhere, any time.

The Open & Apply feature delivers a quick, userfriendly experience for opening and applying for new deposit or loan products through our digital channels. Suncoast members are always in the driver’s seat of their financial futures.

At Suncoast, we treat people as people, not transactions, vendors or numbers. We always do what’s necessary to get things done because we know it’s not about us, it’s about others.

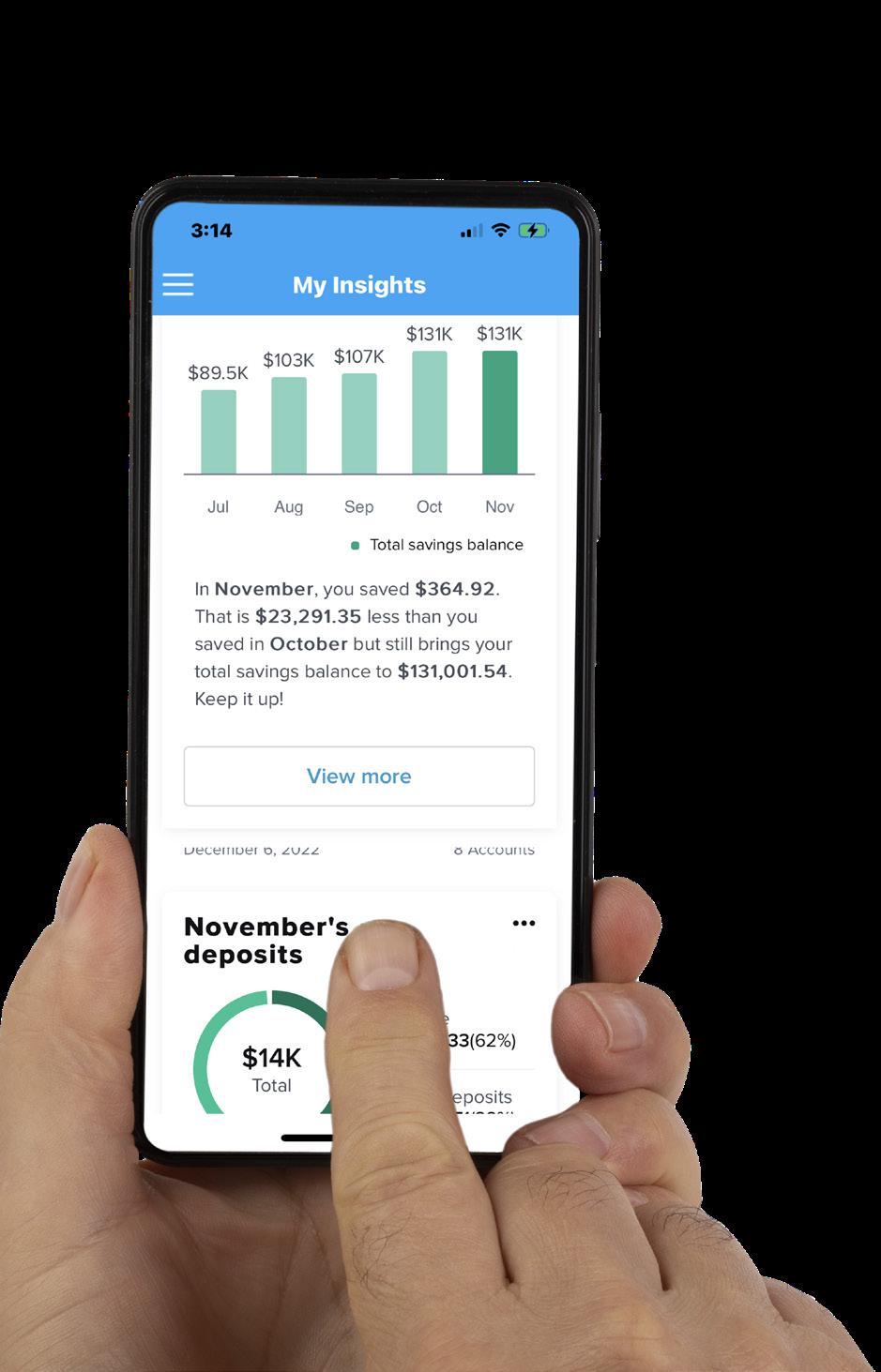

In 2022, we launched a digital banking feature that offers our members personalized insights into their spending patterns. This financial feed is tailored to each member and offers predictive insights and recommendations.

Insights give our members spend comparisons and savings opportunities to protect, guide, and inform them. We’re so excited to offer this new way to empower members to make decisions that positively impact their financial goals.

One of the most rewarding parts of working at Suncoast is helping people achieve their dreams of buying a home, owning a car, starting or growing a business. It’s an honor to support our members during the most pivotal moments in their lives.

$1,182,494,063

$3,390,076,671 $130,862,140

HOME LOANS FUNDED IN 2022

AUTO LOANS FUNDED IN 2022

BUSINESS LOANS FUNDED IN 2022

“The team at Suncoast has become integral to our company’s growth and success over the last several years. They are focused on exceeding expectations on the large deals the same as the day-to-day account items. The Suncoast team’s level of attention to our relationship and needs is exceptional.”

-Brandon T. Clark President, The Ruthvens

“Suncoast Credit Union was the best when it came to credit. It was kind of a no-brainer when it came to what they can offer us and how they can take us to the next level of building this place out. Suncoast Credit Union was the best, it was the only place to go with.”

Meet Tre and learn more about D1 by watching this “Suncoast Success” video.

“Partner with Suncoast and they help you go through the process of getting funding to expand or start your business. In my case, they helped me expand my business and I’m very grateful for the opportunity. A lot of this is about relationships and how you can help the community. They saw what we were doing, and they supported us.”

-Tiffany Autumn Bell Co-founder, Street GamezWatch this “Suncoast Success” video to learn about our Micro Enterprise Development program and how it helped Street Gamez expand their business!

Personal and professional growth at Suncoast is an ongoing process of understanding and developing oneself in order to achieve one’s fullest potential. We rise to the call of bettering ourselves for the benefit of the whole.

Our ability to provide our members with the very best starts with hiring the very best employees and giving them what they need to develop a flourishing career.

By the end of the year, we had a total of 2,355 incredible employees working together to serve our members.

In order to attract and retain top talent, we launched a new career website in 2022. Prospective employees can now browse jobs, discover potential career paths, and learn about how special the workplace culture is at Suncoast.

Another exciting feature of the new website is the opportunity to join our Talent Network. Prospective employees can create a profile and upload their resumes so that we can reach out if an open role becomes available to match their skill set.

Visit careers.suncoastcreditunion.com

to see our new career website!

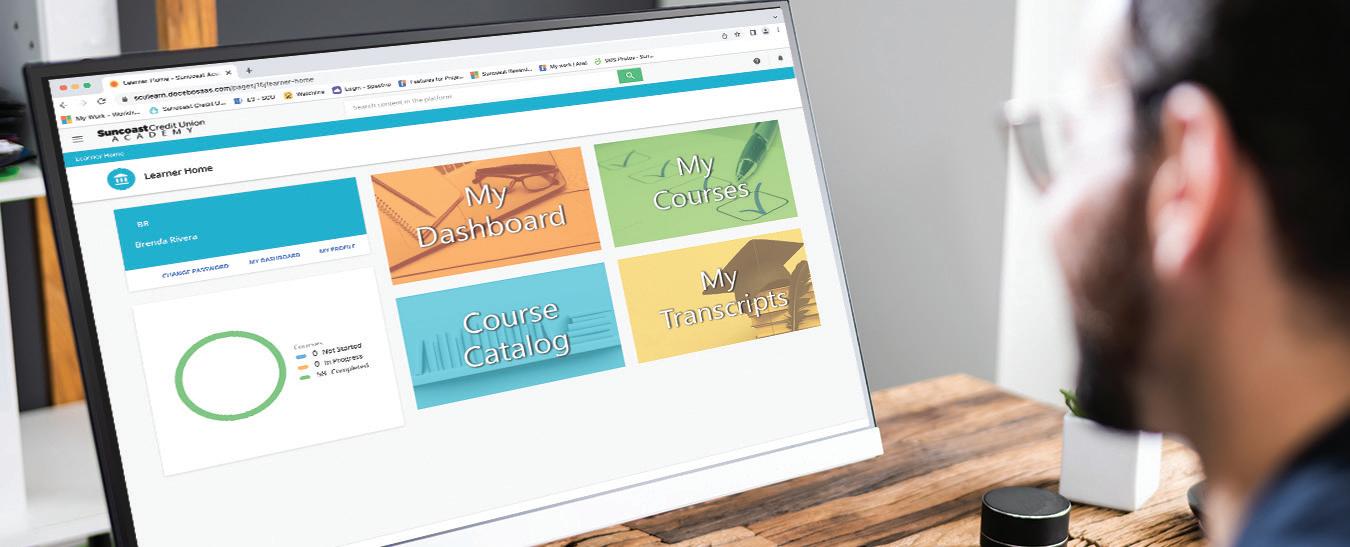

PROFESSIONAL DEVELOPMENT COURSESall Suncoast employees can sign up for these courses to learn about a range of topics, like communication and critical thinking

CU360 PROGRAM - this program lets employees shadow another department in the credit union to develop new skills and better their understanding of how other areas operate

MANAGER DEVELOPMENT JOURNEY- this series of workshops helps our management team continue to grow the competencies needed to be effective leaders

LEADERSHIP EXCELLENCE ACHIEVEMENT PROGRAM (LEAP)- employees can apply for this year-long program that cultivates management and leadership talent

Suncoast provides employees with everything they need to have successful careers. Our robust professional development offerings provide the opportunity to build skills and learn new things.

Creating a happy and fulfilling work environment for our team is always a priority, which is why we’re honored to be named a Top Place to Work in Tampa for the 4th consecutive year!

Suncoast fosters a workplace culture that values diverse backgrounds, experiences, and perspectives. We show respect and appreciation towards our members and our teammates, accepting everyone for who they are.

Within the credit union philosophy, diversity, equity, and inclusion are some of the cooperative principles we live by. Suncoast believes that we are stronger and better when we weave the spectrum of our differences together.

People helping people means providing equitable support and opportunities to all of our members and employees.

Suncoast remains dedicated to:

we consistently seek and recruit the most talented people from a wide range of diverse candidate pools. We actively encourage and nurture our minoritymajority workforce and provide equitable learning and leadership development opportunities for all.

OUR

we reach out and provide access to affordable financial services for all demographics, equipping our members with the tools they need to have financial control and freedom in their lives. This outreach to all includes not only valuable low-cost products, but financial education and opportunities to build wealth and achieve their financial goals.

our strategic investments to support education, local needs, and important causes continues to impact our communities through positive change. This trickledown of positivity sets the stage for breaking negative stereotyping and cultivating acceptance of one another. These types of investments yield exponential return for all people.

Suncoast’s Employee Resource Group (ERG) initiative brings team members together to connect, learn, and effect change. An ERG is a workplace group founded and led by volunteer team members.

Our ERGs meet, support each other, and share their unique experiences to enhance the work environment and our communities.

LGBTQ+ & Allies exists to ensure equality and equity while promoting inclusion and increasing awareness of LGBTQ+ issues in the workplace and our local communities.

LGBTQ+ and Allies participated in St. Pete Pride and partnered with B.L.A.C.C. for the Juneteenth Shades of Pride event

CHANGE (B.L.A.C.C.)

The Black Leaders and Allies Cultivating Change (B.L.A.C.C.) ERG exists to unite Black employees (of all backgrounds) and allies in the intentional work of strengthening the Black community both internally and externally.

B.L.A.C.C. visited historical landmarks to make an educational video about Juneteenth with Senior staff.

SUNCOAST’S ALLIANCE FOR LEADERSHIP AND UNIFICATION OF TROOPS AND EMPLOYEES (S.A.L.U.T.E.)

S.A.L.U.T.E. improves the quality of life for our military, civilian and veteran members, their families, and our employees by working as a team to build relationships through assistance, resource awareness, and by providing outstanding support in our local communities.

SALUTE funded, organized, and packed over 2,000 hygiene kits for four chapters of United Way, who will distribute the kits to Veterans, family members, and areas impacted by Hurricane Ian.

Our connections with one another are a thread that weaves through everything we do at Suncoast. As individuals, we work together towards common goals and as trusted partners, we always communicate with one another to overcome obstacles.

$4.4 million

TOTAL DONATIONS

253,809 $214,700

TOTAL NUMBER OF CHILDREN AND STUDENTS IMPACTED

TOTAL IN COLLEGE SCHOLARSHIPS

Walking into a chemotherapy room can be a harrowing experience, especially for children. So instead of making a standard clinical room at the Golisano’s Children’s Health Center of Naples, they created a one-of-a kind space that lets pediatric cancer patients visit outer space, the beach, under the sea, and so much more.

The Suncoast Credit Union Foundation was honored to help fund the total immersion virtual reality chemotherapy room, helping young patients reduce stress and escape reality for a little, while going through chemo.

Aside from exploring the galaxy or an underwater sunken shipwreck, this space also allows patients to play games or watch movies. The room debuted in April 2022 and patients already love it!

Changing a scary experience into something positive for these children is a real gift. We’re so proud to have contributed to this project!

Watch our video to learn more about our partnership with Lee Health and check out the total immersion virtual reality chemotherapy room.

The Suncoast Credit Union Foundation granted $500,000 to kickstart the Skills Center Collaborative, a multi-use facility in East Tampa that will level the playing field in education, health, and workforce readiness for young people in our community.

The funds will help with renovating and expanding a state-of the-art facility that will offer a unique service model, housing 5 experienced youth-serving organizations in a coordinated approach to leverage resources, programming, and funding. Plus, it is expected to create 180 jobs, serve 3,500 youth and make a $23 million economic impact on the East Tampa community.

We can’t wait to see this phenomenal program continue to develop and support Tampa youth!

7,749 learners impacted in 2022

EverFi K-12 Program

53 schools visited 5,237 students reached 34,598 Modules completed and 16,949 hours of education completed

33 outreach events with 12,482 people reached

198 Financial Literacy presentations given

• 3 campuses visited (St. Petersburg College Clearwater Campus, Hillsborough Community College Brandon, Pasco Hernando State College New Port Richey)

• 500 students impacted

• 2 free financial webinars

• Almost 50 new accounts opened

Great American Teach In 37 schools visited

4,500 students impacted

• 1,600 new youth accounts opened

• 1,900 deposits made into youth accounts

Check out this fun video playlist to see what some of our young members were saving for in 2022.

One of our annual events to help teach high school students about money is our Financial Football tournament. In 2022, this was a virtual event with individual competitors answering financial questions. James from Largo High School was the winner, earning a $250 Visa gift card and a $250 donation to the charity of his choice, the Ryan Nece Foundation.

After almost two years of being closed due to the COVID pandemic, we were so excited to reopen our student run branches (SRBs) in 2022! Our Youth Outreach team helped all 16 schools have grand reopening festivities for their SRBs.

Educators Choice is a financial guidance and planning program exclusively for Florida Education Association (FEA) and local affiliate union members.

Through Educators Choice, local union members gain access to complimentary webinars, seminars, and face-to-face financial education. They also receive exclusive benefits and no-cost one-on-one counseling to create an individual, unique, and customized financial plan. The value and opportunities the program provides continues to receive appreciation from those in the education community as they work towards their financial goals.

“I’m one of those ones that 10 years ago started putting money in and didn’t know anything about what’s going on, this has revived me. Now when I have my appointment set up with the advisor I know the language to use and questions to ask.

“I’ve been extremely impressed with the financial and educational opportunities Educators Choice, powered by Suncoast Credit Union, provides. They take a very individualized, easy-to-understand approach to financial planning, a topic that honestly intimidates many people. Educators Choice has a very professional and responsive staff. The feedback I’ve received from everyone who has worked with them has been stellar. I’m very grateful we can offer their very necessary and comprehensive financial planning services to our members and staff.”

- Anna Fusco, President, Broward Teachers Union Natasha, UTD attendeeJuntos Avanzamos means “Together We Advance.” Suncoast was proud to earn this credit union designation from Inclusiv, a not-for-profit advocacy group with the mission to help low- and moderateincome people and communities achieve financial independence.

As a Juntos Avanzamos-designated credit union, Suncoast employs a large number of bilingual staff and leadership, accepts alternative forms of ID, and treats all of our members with the same respect, regardless of their immigration status.

Our Workplace Banking program helps businesses in our communities expand the benefits they offer their employees. This complimentary program, provides employees easy access to financial services, free financial support and education, plus opportunities to save with comprehensive services - all from the convenience of their workplace.

33 ORGANIZATIONS

Building strong relationships within our team, with our members, and in our communities is always rewarding. The accolades we receive are so meaningful to us, as they reflect our team’s dedication to bringing their hearts to work each day.

GOLD WINNER FOR BEST CREDIT UNION- TAMPA BAY TIMES BEST OF THE BEST

#5 CREDIT UNION IN FLORIDA- FORBES BEST-IN-STATE CREDIT UNIONS

GOLD WINNER FOR BEST CREDIT UNION- BRADENTON’S BEST, BRADENTON HERALD

FINALIST BEST BANK- THE HOTTEST 2022, HARBOR STYLE/VENICE STYLE

WINNER BANKING CATEGORY- 2022 BEST OF THE GULFSHORE, GULFSHORE LIFE

TOP 20 BEST CREDIT UNION- BEST BANKS AND CREDIT UNIONS, GO BANKINGRATES

TOP 100 BEST BANK- BEST BANKS AND CREDIT UNIONS, GO BANKINGRATES

#3 IN THE NATION FOR TOP CUSTOMER EXPERIENCE- AMERICAN BANKER

AARP BANKSAFE CERTIFIED- AARP

#6 TOP 100 CREDIT UNIONS- CREDITUNIONSONLINE.COM

#8 TOP WORKPLACES IN TAMPA- TAMPA BAY TIMES

During difficult times, members and employees can count on Suncoast. When Hurricane Ian was approaching Florida at the end of September, our team immediately sprung into action.

Before the hurricane made landfall, we waived nonSuncoast ATM fees and overdraft fees, plus increased ATM and credit card limits to make sure that members were able to have easy access to funds as they made their hurricane plans.

Then, to ensure that our employees were able to get to safety before the storm, we closed operations early for anyone in an evacuation zone on September 27th and closed operations for all employees on September 28th.

Our team came together after the hurricane passed to make sure our staff was safe and to get our branches back up and running so we could help our members get through Ian’s aftermath.

All of our staff were accounted for and safe within two days of the hurricane. Suncoast resumed operations the day after the storm for everyone who was safely able to do so. Within one week after the storm, we were able to reopen 72 of our 75 branches and all 75 locations were open within two weeks. (cont’d)

Giving our members the best of us requires uncompromising adherence to strong moral and ethical principles. At Suncoast, we’re trustworthy, dependable and can also be counted on to behave in an honorable manner.

Many of our members were impacted by Hurricane Ian, so we made sure to offer assistance once the storm was over. We provided loan extensions, offered mortgage payment assistance, and provided lifeline loans. Our mobile units visited areas without power to help members easily access cash and receive the services they needed.

Some of our Suncoast team members were also impacted by Hurricane Ian. Suncoast offered an employee disaster assistance program, offered generators to staff who needed them, and brought in crisis management and trauma specialists to support our team’s mental health.

Our entire organization came together to gather food and supplies for our team members who needed it. We even created childcare and family care spaces in our corporate offices so our team could get back to work knowing that their families would be taken care of.

Hurricane Ian was a challenge to our community and our team, but we came together to support each other and show how we are Suncoast strong!

In 2022, the U.S. Treasury awarded Suncoast Credit Union $175,000,000 under the Emergency Capital Investment Program (ECIP). These funds help us better serve the members who need it most.

As a certified Community Development Financial Institution, and the largest CDFI in the nation, Suncoast is dedicated to supporting those in need. The additional capital from the ECIP allows Suncoast to provide loans and grants to small businesses, minority-owned businesses, and low to moderate income consumers.

Low-income and underserved areas have been disproportionately impacted by the economic effects of the COVID-19 pandemic, so these funds are an incredible tool to help bolster communities in need.

In recent years, scammers continue to come up with new ways to try to trick people into losing their hard-earned money. Suncoast provides a safe banking experience, while also educating our members on how to protect themselves from fraud.

Through consistent touch points such as, email, social media, and blog posts our goal was to make sure members stayed informed, while providing proactive steps to help them safeguard their funds and personal information.

Collectively, our Suncoast team are active members of our communities. We positively impact the lives of others through our generous contributions and actions.

18,246 OF VOLUNTEER HOURS

1,017 EMPLOYEES VOLUNTEERED IN 2022

6,485 HOURS VOLUNTEERED FOR PAY IT FORWARD DAY (PIFD) 784 EMPLOYEES VOLUNTEERED FOR PAY IT FORWARD DAY

MORE THAN 180 COMMUNITY INITIATIVES SPONSORED

Suncoast employees have a long history of volunteering in the community and making a positive difference. In 2022, we celebrated the winners of our inaugural Community Impact Awards for their work the previous year.

Six incredible Suncoast employees were recognized for the positive impact they’ve made in the community. Here are the phenomenal award winners:

CAROLYN PARSLOW LEGACY AWARDnamed after a former Suncoast employee who brought her heart to work every day during her almost 50 years at Suncoast, this award is our greatest honor.

EXCELLENCE

AWARD - this award went to two employees who used their time and talent to empower and encourage audiences to improve their financial habits.

PEER CHOICE AWARD - four winners were chosen by their peers at Suncoast, each from a different area of Suncoast’s footprint. These Peer Choice award winners showcased exemplary acts of service, meaningful impact in the community, and a remarkable level of commitment.

A special highlight in 2022 was a beautiful reminder of how we’re all connected in our support for our local communities. It started when Suncoast sponsored the 25th Anniversary of the Homes for the Holidays Celebration to support Warrick Dunn Charities, Inc (WDC).

This event was right up our alley, as this program empowers families to break the cycle of generational poverty and achieve a better quality of life through home ownership.

Sponsor donations help WDC to turn houses into homes for single parent families. The program surprises single parent families who are actively working to support themselves with home furnishings and down payment assistance.

As our community team sponsored the Homes for the Holidays Celebration, two new single mothers were presented with their new homes. As it turns out, the homes were built by a local minorityowned business contractor who won a bid in 2022 to build affordable homes in East Tampa.

In a beautiful turn of events, that builder’s financing for that same project also came from Suncoast! He worked with our business development and lending departments to get the funding for his affordable homes project.

To see two different departments, support different sides of the same initiative and help support affordable housing efforts was a gift we won’t soon forget!

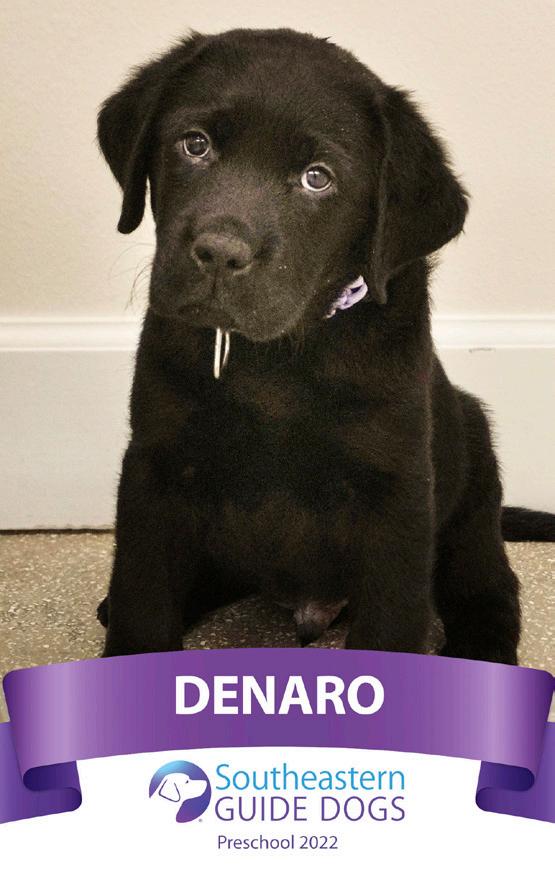

The extraordinary dogs from Southeastern Guide Dogs (SEGD) provide freedom and hope to people with vision loss, veterans with disabilities, and children with significant challenges. This organization provides life-changing services at no cost to the recipients, which is why we’ve been a proud partner for years.

In 2022, we once again had the honor of naming a new guide or service dog and we decided to let our members choose through a social media contest! The winning name was Denaro, which is Italian for “money.”

Our Community Impact team also took advantage of a special invitation from SEGD to bring members of our S.A.L.U.T.E. employee resource group to tour the campus to see where puppies are born and how they are trained. Our team also had a chance to step into the shoes of someone living in the shadows of blindness through a multisensory experience called Beyond the Dark.

The experience was life-changing for our team and proves the immense value that nonprofits like SEGD provide our communities.

“This was an amazing experience. As a veteran it was nice to see how much individual attention is provided to form the strong bond needed for trust. The commitment level shown not just for the wellbeing of the recipient but also the dog was exceptional.”

-Debra Steele“SEGD’s Beyond the Dark presentation opened my eyes to the challenges of the visually impaired that I take for granted daily.”

-Matthew Kimball“The pride, passion and care of the SEGD staff and volunteers definitely shows in every aspect of what they do on a daily basis. If you have not visited their facility or signed up for a presentation/tour, I highly recommend doing so to truly know what they do and how they help so many people.”

-Donna MosesSuncoast Credit Union operates 75 full-service branches and serves more than one million members in 40 counties across Florida. As a community credit union, anyone who lives, works, attends school, or worships in Suncoast Credit Union’s service area is eligible for membership. In 2021, Suncoast Credit Union’s field of membership was expanded to include public K-12 teachers, college educators, and educational support staff from all of Florida’s 67 counties, as well as all members of the American Consumer Council.

CORPORATE

MAIN OFFICES

6801 East Hillsborough Avenue, Tampa, FL 33610

6536 E. Hillsborough Avenue, Tampa, FL 33610

BUSINESS SERVICES

950 West Fletcher Avenue, Tampa, FL 33612

CHARLOTTE COUNTY

Charlotte Harbor 23141 Harborview Road, Port Charlotte, FL 33980

Port Charlotte 19501 Cochran Boulevard, Port Charlotte, FL 33948

Punta Gorda 2310 Tamiami Trail, Punta Gorda, FL 33950

Walmart Port Charlotte 375 Kings Hwy Port Charlotte, FL 33983

CITRUS COUNTY

Crystal River 1101 Northeast Street, Crystal River, FL 34429

Inverness 2367 East Gulf to Lake Highway, Inverness, FL 34453

COLLIER COUNTY

Berkshire Commons 7211 Radio Road, Naples, FL 34104

Golden Gate 7465 Vanderbilt Beach Road, Naples, FL 34119

Immokalee

1243 North 15th Street, Immokalee, FL 34142

Naples Horseshoe

2728 Horseshoe Drive North, Naples, FL 34104

North Naples 1035 Crosspointe Drive, Naples, FL 34110

Pine Ridge 3655 Pine Ridge Road, Naples, FL 34109

South Naples 8797 Tamiami Trail East, Naples, FL 34113

DESOTO COUNTY

Arcadia 1711 East Oak Street, Arcadia, FL 34266

LaBelle

231 East Hickpochee Avenue , LaBelle, FL 33935

HERNANDO COUNTY

Brooksville

18915 Cortez Boulevard, Brooksville, FL 34601

Spring Hill 4176 Mariner Boulevard, Spring Hill, FL 34609

West Hernando

2140 Commercial Way (U.S.19), Spring Hill, FL 34606

Sebring

6505 U.S. Highway 27, Sebring, FL 38870

HILLSBOROUGH COUNTY

Big Bend 13141 U.S. Highway 301 South, Riverview, FL 33578

Brandon 1370 Oakfield Drive, Brandon, FL 33511

Citrus Park

8017 Citrus Park Drive, Tampa FL 33625

East Tampa Community

1920 East Hillsborough Avenue, Tampa, FL 33610

Fletcher 950 West Fletcher Avenue, Tampa, FL 33612

Galleria

4340 W. Hillsborough Avenue, Tampa, FL 33614

Hillsborough Avenue

6804 East Hillsborough Avenue, Tampa, FL 33610

New Tampa 17505 North Palms Village, Tampa, FL 33647

Plant City 1905 South Alexander Street, Plant City, FL 33566

Riverview

10405 Gibsonton Drive, Riverview, FL 33578

Ruskin 150 Teco Road, Ruskin, FL 33570

Seffner 901 West Dr. Martin Luther King Jr. Boulevard Seffner, FL 33584

South Tampa

2502 South Manhattan Avenue, Tampa, FL 33629

Town ‘n’ Country

8201 West Waters Avenue, Tampa, FL 33615

Valrico 3234 South Miller Road, Valrico, FL 33596

West Tampa 3300 North Armenia Avenue, Tampa, FL 33607

LEE COUNTY

Bonita Springs

25183 Chamber of Comme -rce Drive, Bonita Springs, FL 34135

Cape Coral Del Prado

5 Del Prado Boulevard South, Cape Coral, FL 33990

Cape Coral Southwest

1730 Cape Coral Parkway West, Cape Coral, FL 33914

Cape Coral Santa Barbara 2325 Santa Barbara Boulevard, Cape Coral, FL 33991

College Parkway

9131 College Parkway, Fort Myers, FL 33919

Daniels Parkway 13465 Daniels Commerce Boulevard, Fort Myers, FL 33966

East Fort Myers 4491 Underwood Drive, Fort Myers, FL 33905

Estero 19750 South Tamiami Trail Fort Myers, FL 33908

Fort Myers - Matthew Drive 1533 Matthew Drive, Fort Myers, FL 33907

Lee Boulevard 5705 Lee Boulevard, Lehigh Acres, FL 33971

Lehigh Acres

226 Beth Stacey Boulevard, Lehigh, FL 33936

Metro Administrative Building 4315 Metro Parkway Ft. Myers, FL 33919

North Fort Myers 565 Pine Island Road, Fort Myers, FL 33903

Riverdale 14201 Palm Beach Boulevard, Fort Myers, FL 33905

San Carlos 18011 South Tamiami Trail, Fort Myers, FL 33908

Treeline 10580 Colonial Boulevard, Fort Myers, FL 33913

LEVY COUNTY

Chiefland

2153 Northwest 11th Drive, Chiefland, FL 32626

MANATEE COUNTY

Bradenton 2615 57th Avenue West, Bradenton, FL 34207

East Bradenton

8700 East State Road 70, Bradenton, FL 34202

Lakewood Ranch 11021 SR 64 East, Bradenton FL, 34212

West Bradenton

6367 Manatee Avenue West, Bradenton, FL 34209

PASCO COUNTY

Dade City 12510 South Highway 301, Dade City, FL 33525

Holiday 3422 U.S. Highway 19, Holiday, FL 34691

Land O’ Lakes 1837 Collier Parkway, Lutz, FL 33549

Port Richey 7225 Ridge Road, Port Richey, FL 34668

Trinity 11370 State Road 54, New Port Richey, FL 34655

Wiregrass

27213 State Road 56, Wesley Chapel, FL 33544

Zephyrhills

32745 Eiland Boulevard, Zephyrhills, FL 33545

PINELLAS COUNTY

Countryside 26232 U.S. Highway 19 North, Clearwater, FL 33761

Downtown St. Petersburg 1022 Central Avenue, St. Petersburg, FL 33705

South St. Petersburg 2120 - 34th Street South, St. Petersburg, FL 33711

St. Petersburg Satellite 12003 - 28th Street North, St. Petersburg, FL 33716

POLK COUNTY

Lakeland

919 Lakeland Park Center Drive, Lakeland, FL 33809

South Lakeland 6405 South Florida Avenue, Lakeland, FL 33813

SARASOTA COUNTY

Bee Ridge 4402 Bee Ridge Road, Sarasota, FL 34233

North Port 4451 Aidan Lane, North Port, FL 34287

Venice Walmart (inside Walmart) 4150 Tamiami Trail, Venice, FL 34293

Fruitville 5851 Fruitville Road, Sarasota FL 34232

SUMTER COUNTY

Bushnell

217 West Belt Avenue, Bushnell, FL 33513

The Villages at Walmart (inside Walmart) 4085 Wedgewood Lane, The Villages, FL 32162

Wildwood 5625 Seven Mile Drive, Wildwood FL 34785

At Suncoast, we love to share the stories of our employees and members.

And there’s no better way to stay connected than following Suncoast on all of our social media channels: