A 2023-I 221 SPEPERMIANBASINSECTION

SPE Permian Basin Calendar of Events…………………………..……………………………………………………………………………….3

Chairman’s Corner……..…………………………………….…………………………………………………………………………………………….4

Member of the Month………………………….……………………………..……………..........…..……..………………………………………6

Texas Tech SPE Golf Tournament…...………………..…….……………….…….....…………………..………………………………………7

2023 SPE PB Scholarship Recipients………………......….……………………………………………………………...………………………8

SPE PB Welcome Happy Hour Social Event………………..……………..…………………..………………….….………………………10

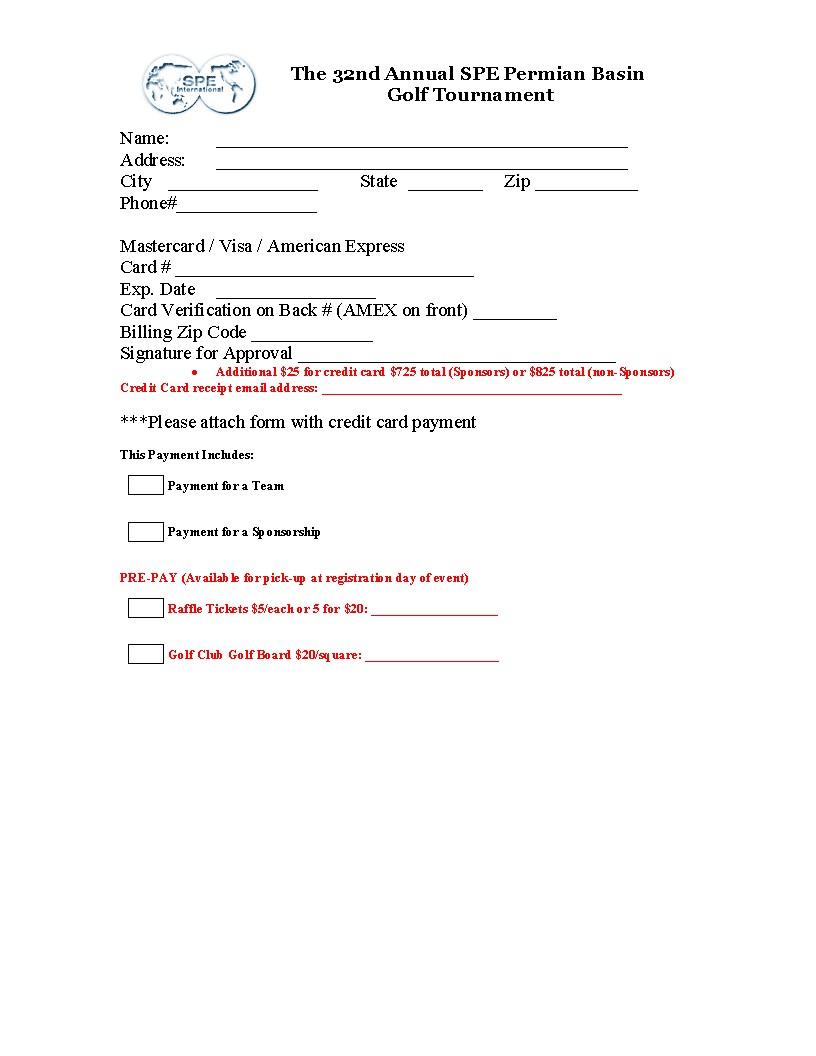

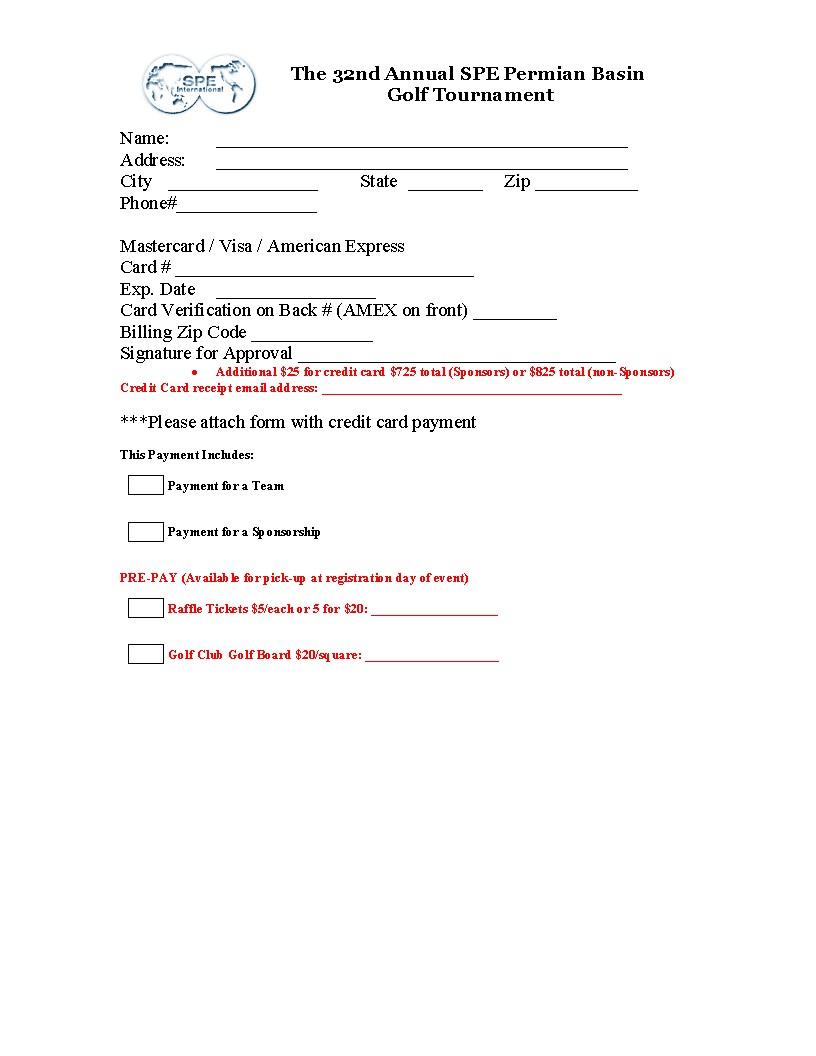

SPE PB Golf Tournament Informa on..............….……..….………….…….....…………………………………………………………11 Technical Tour...…………….…………………………..…………....……………..…………………..………………….….………………………20

SPE Young Professionals Resume Workshop….....……………….…..……………………………………...……………………………22

UTPB Engineering Internship Fair…...………………..…….……………….…….....…………………………………………………………24

UTPB SPE Golf Tournament……………..………..……..…….……………….…….....…………………………………………………………25

SPE Southwest Regional Awards Banquet...……..…….……….……….…….....…………………………………………………………28

Midland PPDC 2023 Course Schedule………………..…….……………….…….....…………………………………………………………32

SPE Permian Basin Board………………………..…….………………………………………………………………………………………………35

2 A 2023-I 221

ADVERTISE IN THE PIPELINE Contact Miles Landry for affordable pricing! Miles.Landry@permianres.com

T C

SPE P B C E

Save The Date!

Produc on & Facili es Study Group Luncheon: Aug 8, 2023

SPE PB Welcome Happy Hour: Aug 16, 2023

Texas Tech SPE Golf Tournament: Aug 18, 2023

YP Resume Workshop at UTPB: Sep 6, 2023

SPE PB 32nd Annual Golf Tournament: Sep 8, 2023

UTBP Engineering Internship Fair: Sep 13, 2023

UTBP SPE Golf Tournament: Sep 25, 2023

A 2023-I 221 3

Publica on of the SPE-PB Sec on www.spepb.org

S M T W T F S 1 2 3 4 5 6 7 8 Prod & Facil SG Luncheon 9 10 11 12 13 14 15 16 Happy Hour 17 18 TTU Golf Tournament 19 20 21 22 23 24 25 26 27 28 29 30 31

A 2023

Taylor Montoya

SPE-PB Chairman 2023-2024 Senior Reservoir Engineer ConocoPhillips

Welcome Back!

To my fellow Permian Basin SPE members,

I hope everyone has been enjoying summer so far and taken some much deserved vaca on to enjoy quality me with family and friends. It is easy to get caught up in the whirlwind of ac vity in West Texas, making it even more impera ve to take me off to refuel and reset. My husband and I recently took our first vaca on of the year and spent a week cycling along Norway’s Lofoten Islands. A er 4 flights, a 4-hour ferry ride, and a 6-mile bike ride, we finally arrived in Reine, a small fishing village within the Arc c circle. The lengthy trek was worthwhile, and the trip was incredible as evident in the photos on the next page.

We arrived back in Midland to a sweltering heat wave, recording the most consecu ve days over 100°F in Midland/Odessa since 1930 according to the Na onal Weather Service. These are the days I wish I didn't listen to my Dad back in 2016 and bought the house with the pool. These are also the days I’m humbly reminded of my expecta on for reliable and affordable energy. Leave it to a West Texas summer to drive home why we do what we do and the impact we have on society’s standard of living.

Throughout the summer, your SPE Permian Basin Board of Directors has been working diligently to prepare for the upcoming 2023-2024 term. My name is Taylor Montoya and I am proud to serve you as Chairman alongside a strong team of 19 Board members.

Our sec on goals are simple: create engaging and educa onal opportuni es for our members to learn, network, and give back to the community. If I’ve learned anything in my 7 years in Midland, it has been the importance of leaning in and ge ng involved in your community to make a place feel like home.

West Texas is full of bright, bold, and innova ve individuals. Our goal is to (Con nued on Next Page)

4 A 2023-I 221

CHAIRMAN’S CORNER

A 2023-I 221

CHAIRMAN’S CORNER

bring all of you together. Whether it’s expanding your knowledge base at one of the monthly technical luncheons, demonstra ng a science experiment to an eager elementary student, or mentoring a college student on their resume, we have plenty of opportuni es to get involved.

I know it can be difficult to make me for extracurriculars, but I can assure you SPE events will be worth your me. Like everything in life, you get out what you put in, so lean in to SPE Permian Basin and you will not be disappointed.

Now that you are convinced, mark your calendar for our kick-off social on Wednesday, August 16th from 5-8pm at The Waystone. Bring a friend, play a board game, and enjoy free food and drinks. I look forward to mee ng you there!

If you want to volunteer, sponsor, collaborate or provide feedback, please do not hesitate to reach out to us at spepb@outlook.com.

Cheers,

5

6 A 2023-I 221

SPE PB Members

A 2023-I 221 7 TTU SPE

8 A 2023-I 221 SPE PB Scholarship

A 2023-I 221 9

10 A 2023-I 221 SPE PB Social

A 2023-I 221 11 SPE PB Scholarship

Only PM Tee Times Remain!!

12 A 2023-I 221

SPE PB Scholarship

A 2023-I 221 13 SPE PB Scholarship

14 A 2023-I 221

A 2023-I 221 15

16 A 2023-I 221

TECHNICAL TOUR

Permian supply risk: consolida on creates new ac vity signals—condensed

By: Nathan Nemeth & Ryan Duman (Wood Mackenzie)

Introduction

Permian portfolios are churning. As we move into H2 2023, the US$22 billion of Permian deal spend in H1 eclipsed last year’s entire figure. The majority of transaction value this year has been in the form of public E&Ps consolidating ten high-growth private companies.

But something stands out in this chapter of Wolfcamp A&D. Buyer plans to slow growth and cut rigs on their acquired assets have intensified. Where 2021 deals saw buyers cut one or two rigs, some deals this year involve all rigs on acquired assets being released.

In aggregate, at least 11 rigs will be available because of consolidation alone. This is atop the already established trend of Permian rig count sliding since late April. It’s a bold call, but consolidation is now the supply watchword, more than softening oil prices or well performance.

Scoopinguphigh-growthprivatecompanies

It’s been well documented that private operators have been responsible for the bulk of Permian production growth over the past few years. While some private operators like Mewbourne leaned into counter-cyclical OFS contracting and low costs, others like Tap Rock built production and cash flow to become more attractive acquisition targets.

Over the past two years, we’ve seen a flurry of deals that have featured an increasing number of public companies acquiring highgrowth private operators like Tap Rock and Hibernia. The ten private sellers in 2022 increased production by about 80,000 b/d or roughly 14% of all Permian growth. However, the six buyers (e.g.Vital, Callon, Matador, Ovintiv, etc.) only grew Permian oil production by just 50,000 b/d over that same period.

Permian private sellers oil production growth (gross operated volumes)

20 A 2023-I 221

Source: Wood Mackenzie

A 2023-I 221

Buyermindset

It’s often said that companies are bought for what they can be, not what they are. And that’s exactly the mentality of H1 buyers. However, the future is about drilling less, not more.

Thanks to generous deal transparency, buyer announcements have included rig plans for H2. Project areas included in the ten transactions above will see over 10 rigs retired by Q4 2023.

Ovintiv plans to drop five rigs. Civitas plans to cut three. And one rig will be dropped by Vital, Callon and Earthstone each. Matador plans to keep the one Advance rig active. Overall, the split is seven fewer rigs in the Midland Basin and four less in the Delaware Basin.

Permian 2023 rig count changes: acquisition and post-closing plans

Source: Wood Mackenzie

Nextyear’sgrowthfeelstheimpact

Planned rig drops will occur through Q3 and Q4 of 2023, meaning the bulk of the production impact from announced cuts will start to be realized in 2024. In a scenario where the idled Permian rigs don’t quickly return to work or move to other basins our models suggest 80,000 b/d less oil production in Q4 2024 than what would have likely been produced if the ten Privates had maintained their activity and growth trend.

Our oil price forecast calls for slightly higher prices later this year and the allure of drilling into a stronger NYMEX strip while there’s newfound rig capacity will no doubt incentivize some. But pinpointing who exactly might re-contract the rigs in the Permian is tricky.

Operatoraction

Most public E&Ps have messaged ‘stability’ in their planning, so it’s not a given independents will immediately jump at the opportunity to pick up additional rigs. That said, this could be a test for their resolve. The additional high-spec rig capacity could put moderate

21

Technical Tour

Technical Tour / YP

downward pressure on day rates, making picking up a rig more attractive than last year. Remember, following some cost savings, SM Energy announced it will add a rig in Q4 2023.

Beyond the large independents, Majors could be interested in adding rigs to meet their outlined production targets. It would be opportunistic and driven by margins. Chevron already outlined earlier this year that it’ll increase Permian activity in H2. Recall the Majors’ Permian targets are the longest dated in the basin.

And it could flip back to private E&Ps again too, albeit a different grouping. Endeavor is flush with cash and there remains a group of 10,000 b/d to 30,000 b/d privates in the wings. If those management teams like the outcome of H1 consolidation for their competitors, they might also scale up production to meet materiality thresholds as well.

For more information or questions, please contact Nathan Nemeth (Nathan.nemeth@woodmac.com) and Ryan Duman (ryan.duman@woodmac.com)

22 A 2023-I 221

A 2023-I 221 23

24 A 2023-I 221 UTPB

A 2023-I 221 25 UTPB SPE

26 A 2023-I 221

A 2023-I 221 27

28 A 2023-I 221 SPE Awards

A 2023-I 221 29 SPE Awards

SPE Awards

Recipient

Mr. Wesley Ingram

Mr. Danny Lewis

Name of Recipient Award Company

Paul Brown Regional Service Award

John Foster

Mohamed Mehana

Data Science and Engineering Analy cs Award

Reservoir Descrip on and Dynamics Award

Young Professional Member

Taylor Montoya

Arvind Ravikumar

Shivani Vyas

Outstanding Service Award

Chevron

Assistant Professor Aus n TX

Los Alamos Na onal Laboratory Research Scien st Albuquerque

ConocoPhillips

Sustainability and Stewardship in the Oil and Gas Industry Co-Director of the Energy Emissions Lab at UT Aus n

Young Professional Member

Outstanding Service Award

Mark Watson Comple ons Op miza on and Technology Award

Odessa Separator Inc

ConocoPhillips

30 A 2023-I 221

A 2023-I 221 31

Midland College PPDC

PPDC Courses

Midland College PPDC

221 N. Main Street Midland, TX 79701 (432) 683-2832

h ps://mcce.midland.edu > Oil & Gas Training

Petroleum Land Basics: Becoming LandWise

Instructor: Ralph Lea

August 1-3, 2023, 8:00 a.m. to 5:00 p.m.

Cost: $895, Out of State: $920

SafeLand USA (Veriforce/PEC)

Instructor: R. Glen Gann

August 3, 2023, Thursday, 8:00 a.m. – 5:00 p.m.

Cost: $200; Out of State $225

Adult & Pediatric CPR, AED, and First Aid

Instructor: Glen Gann

August 7, Monday

8:00 a.m. - 12:00 p.m.

Cost: $50, Out of State $75

Permian Basin STEPS Mee ng (Safety) – Open to the public

Sponsored by Precision NDT, LLC and Founda on Energy Services.

August 8, 2023, Tuesday, 8:30 a.m. to 11:30 a.m.

Midland College, 3600 N Garfield St, Midland, TX 79705

Scharbauer Student Center – Carrasco Room

2nd Annual - Monahans Excava on Safety Day – Free Admission

Damage Preven on Council of Texas

August 10, 2023, Thursday, 7:30 a.m. – 2:30 p.m.

Ward County Event Center

1525 E Monahans Pkwy, Monahans, TX 79756

OSHA 30-Hour General Industry Training

Instructor: R. Glen Gann

August 14-17, 2023 Monday -Thursday, 8:00 a.m. – 5:00 p.m.

Cost: $200; Out of State $225

Introduc on to SQL

Instructor: Mark Edgar

August 21, 2023 Monday, 8:00 a.m. – 5:00 p.m.

Cost: $475; Out of State $500

Remedia on and Restora on of Hydrocarbon and Brine Contaminated Soils - Self-paced and Online

Instructor: Dr. Kerry Suble e

August 21 – September 29, 2023

Cost: $750, Out of State: $775

Introduc on to Oilfield Opera ons

Instructor: Albert S. Garza

August 22-23, 2023, Tuesday – Wednesday, 8:00 a.m. to 5:00 p.m.

Cost: $625, Out of State: $650

32 A 2023-I 221

A 2023-I 221

IADC Basin United Building the Basin: Fundamentals

Instructor: Glen Gann

August 23, 2023, Wednesday

8:00 a.m. - 5:00 p.m.

Cost: $200, Out of State $225

Midland College PPDC

Show us verifica on of your company’s Texas Mutual Insurance to get a discount and pay only $50. For Basin United classes only

Basic Pipeline (Veriforce) – New class

Instructor: R. Glen Gann

August 30, 2023, Wednesday, 8:00 a.m. – 5:00 p.m.

Cost: $200; Out of State $225

Managing Sucker Rod Li Well Failures

Instructor: Albert Garza

August 24, 2023, Thursday, 8:30 a.m. – 4:30 p.m.

Cost: $475; Out of State $500

Introduc on to Geology for Non-Geologists

Instructor: Paul Pausé

September 13-14, 2023, 8:00 a.m. to 4:30 p.m.

Cost: $1,000, Out of State: $1,025

H₂S Clear Training

Instructor: R. Glen Gann

September 14, 2023, Thursday, 8:00 a.m. – 12:00 p.m.

Cost: $50; Out of State $75

Oilfield Terminology

Instructor: Jack T. (Tommy) Lent

September 25-26, 2023, 8:30 a.m. to 4:30 p.m.

Cost: $625, Out of State: $650

Basic Drilling for Non-Drilling Engineers

Instructor: Jack T. (Tommy) Lent

September 27-28, 2023, 8:30 a.m. to 4:30 p.m.

Cost: $625, Out of State: $650

Petroleum Geology for Non-Geologists

Instructor: Paul Pausé

October 9-12, 2023, 8:00 am to 4:30 pm

Cost: $1835, Out of State $1860

Incident/Accident Inves ga on

Instructor: R. Glen Gann

October 11, 2023, Wednesday, 8:00 a.m. – 5:00 p.m.

Cost: $200; Out of State $225

Economic Evalua on & Investment Decision Methods (2.5 or 3.5 days)

Instructor: John M. Stermole

Before-Tax (2.5 Days) October 16-18, 2023, Mon & Tues, 8:00 am to 5:00 pm, Wed 8:00 am – Noon

Cost: $2,250, Out of State $2,275

A er-Tax (3.5 Days, Builds on Before-Tax Program) October 16-19, 2023, Mon-Wed, 8:00 am to 5:00 pm, Thur 8:00 am – Noon

Cost: $3,100, Out of State $3,125

33

34 A 2023 I 221

SPE PB Board

2023-2024 SPE Permian Basin Board Members

Posi on Board Member Name Employer Email - Primary

Chairman Taylor Montoya ConocoPhillips Taylor.Montoya@conocophillips.com

Vice-Chairman Tyler Yancey Chevron Yanceyty@chevron.com

Treasurer Paul Brown Chevron Paulbrown@chevron.com

Secretary Ma hew Farris Core Lab Ma hew.Farris@corelab.com

Past Chair Shivani Vyas Odessa Separator Inc Shivanivy928@gmail.com

Awards Banquet Chair Aylin Ordonez TenEx Technologies aordonez@tenextechnologies.com

Clay Shoot Chair Dalton Kille Extract Companies Dkille@extractproduc on.com

CO2 Conference Chair Pamela Boring Baker Hughes Pamela.Boring@bakerhughes.com

Community Rela ons

Chair Heidi Higginson Endeavor Energy Resources Heidih@eeronline.com

Golf Tournament Chair Jeane e Reyes Endeavor Energy Resources Jreyes@eeronline.com

Marke ng Chair Sara Booth SCI Sara.f.foster@gmail.com

Member at Large Libby Einhorn Angelo State Libbyeinhorn@aol.com

Newsle er Chair Ryan Smith Chevron Ryan.a.smith@chevron.com

Programs Chair Andrea Switzer Velocity Insight Andrea.e.switzer@gmail.com

Public Rela ons Chair Miles Landry Permian Resources Miles.Landry@permianres.com

Scholarship Chair Ma hew Watson ConocoPhillips Ma hew.a.watson@conocophillips.com

Student Chapter Chair (UTPB & TTU)

Victoria Kuzmich Community Na onal Bank Vkuzmich@cnbtx.com

Study Group Chair Gustavo Gonzalez Odessa Separator Inc Ggonzalez@odsep.com

Vice-Treasurer Raul Paz ConocoPhillips Raul.Paz@conocophillips.com

Young Professionals Chair

Andrew Carpenter Diamondback Energy ACarpenter@diamondbackenergy.com

Study Group Chairs Chair Person Name Employer Email Data Analy cs Study Group

Comple ons & Operaons Study Group

Comple ons & Operaons Study Group

Reservoir Study Group

Vincent Doczy vmdoczy@gmail.com

Erica Sledge Erica.sledge411@gmail.com

Jesse Street Universal Pressure Pumping Jesse.Street@patenergy.com

Open Posi on – contact spepb@outlook.com if interested

Produc on & Facili es Study Group Mar n Lozano Diamondback

mlozano@diamondbackenergy.com

A 2023-I 221 35

Midland, TX 79702

36 A 2023-I 221

P.O. BOX 3366