Volume: 114. Issue.05. May 2025

Volume: 114. Issue.05. May 2025

Gold Vs Bitcoin Who Wins In 2025?

Next Consolidation The Future Beneath Our Feet

How 2025’s Iron Ore M&A Boom Is Redrawing the World’s Resource Map

05 Black Cat Begins Gold Production at Lakewood Facility

08 Metro Mining’s Record Q1: Bauxite Shipments Put It on Track for 2025 Export Target

12 Fury Gold Mines Acquisition Puts Sakami Gold Project in the Spotlight

23 Petra Diamonds Pauses Cullinan Sales Amid U.S. Policy Uncertainty

31 Vedanta IPO Plans Signal New Chapter for Konkola Mines

31 Macro Metals Secures Key Role in New Iron Ore Project in WA

32 New Cobalt Alternative Alloy Developed by U.S. Lab to Curb Reliance on China

33 Environmental Impact of DSM: Critical Study Warns of Deep Sea Mining Risks

Equipment Design: How Virtual Prototypes Are Transforming Mining Industry US FOREIGN POLICY IN AFRICA Congo Mineral Deal Sparks Sovereignty Fears

How Explosives Engineers Are Redefining Mining in 2025

From Blasting to AI, from Deep Earth to Deep Space—Inside the Evolution, Contrasts, and Coming Revolution of Mining’s Most Explosive Profession.

The Great Store of ValueShowdown in 2025 & Beyond: Expanded Analysis and Strategic Contrast By Skillings Mining Review 06 Adapt or Decline: The Future of Mining Organizations Is Being Forged Now 20 Beyond 2025: The Next Era of Iron Ore M&A 10

34 How Trump’s Tariffs Are Fueling the Rise of a ‘Beijing Global Economic Zone’

36 Europe: Rare Earth Production Falls Short

37 BHP Repurposes Mt Arthur Mine with Pumped Hydro Plan

42 THE CONTRASTED FUTURE: Will Engineers Be Obsolete?

46 Statistics

Skillings Mining Review of CFX Network LLC, publishes comprehensive information on global mining, iron ore markets and critical industry issues via Skillings Mining Review Monthly Magazine and weekly. SMR Americas, Global Skillings and Skilling Equipment Gear newsletters.

Skillings Mining Review (ISSN 0037-6329) is published monthly, 12 issues per year by CFX Network, 350 W. Venice Ave. #1184 Venice, Florida 34284. Phone: (888) 444 7854 x 4. Printed in the USA.

Payments & Billing: 350 W. Venice Ave. #1184, Venice, FL 34284. Periodicals Postage Paid at: Venice, Florida and additional mail offices.

Postmaster: Send address changes to:

SKILLINGS MINING

Digital Monthly Magazine 12 issues

Paywall-free website experience

Digital archive back to 1912

Skillings video stories and podcasts

Subscriber-only newsletter

Rich multimedia contentData, Photographs and Visuals

Access paperless reading across multiple platforms. Portable, carry with you, anytime, anywhere

UNITED STATES

$72 Monthly in US Funds

$109 Monthly in US (Funds 1st Class Mail)

OUTSIDE OF THE U.S.A.

$250 US Monthly for 7-21 day delivery

$335 US Monthly for Air Mail Service All funds are monthly

Skillings mining review, 350 W. Venice Ave. #1184, Venice, Florida 34284.

Phone: (888) 444 7854 x 4.

Fax: (888) 261-6014.

Email: Advertising@skillings.net.

PUBLISHER CHARLES PITTS chas.pitts@skillings.net

EDITOR-IN-CHIEF JOHN EDWARD john.edward@skillings.net

CONTRIBUTING EDITORS ROB RAMOS AALIYAH ZOLETA MARIE GABRIELLE

MEDIA PRODUCTION STANISLAV PAVLISHIN media.team@ cfxnetwork.com

MANAGING EDITOR SAKSHI SINGLA sakshi.singla@skillings.net

CREATIVE DIRECTOR MO SHINE mo.shine@skillings.net

DIRECTOR OF SALES & MARKETING CHRISTINE MARIE advertising@skillings.net

MEDIA ADMINISTRATOR SALINI KRISHNAN salini.krishnan@ cfxnetwork.com

PROFILES IN MINING mining.profiles@skillings.net

GENERAL CONTACT INFORMATION info@cfxnetwork.com

CUSTOMER SERVICE/ SUBSCRIPTION QUESTIONS: For renewals, address changes, e-mail preferences and subscription account status contact Circulation and Subscriptions: subscriptions@Skillings.net. Editorial matter may be reproduced only by stating the name of this publication, date of the issue in which material appears, and the byline, if the article carries one.

Black Cat Syndicate has achieved a critical production milestone with the first gold pour at its Lakewood processing facility, signaling the company’s transformation from developer to active producer in Western Australia’s fiercely competitive gold sector.

The Lakewood plant, located just 6 kilometers from Kalgoorlie, processed its first gold on April 16, yielding 757 ounces.

The commissioning follows Black Cat’s A$85 million acquisition of the site from Westgold Resources, completed in early April.

Operations at Lakewood began swiftly after acquisition, with ore haulage starting immediately and the plant operating “safely and smoothly,” the company said.

Since April 1, Black Cat has hauled approximately 60,000 tonnes of ore from its Myhree deposit, with processing throughput ramping up to an annualized rate of 1.2 million tonnes per annum (mtpa). Unreconciled gold production so far totals 2,740 ounces, recovered from 42,000 tonnes at 2.10g/t, with recovery

rates exceeding 95%. The company also confirmed that crushed ore stockpiles have surpassed 10,000 tonnes, a key indicator of operational momentum.

“The commencement of processing through Lakewood has started well with throughputs, grade and recoveries all above expectation,” said Managing Director Gareth Solly.

“First gold at Lakewood is yet another successful milestone in the accelerated Kal East plan.”

Rajani Modiyani, one of Chevron’s leading experts in the mining sector, answered eight pressing questions from owners and managers in the industry. Scan the QR code for the full Q&A.

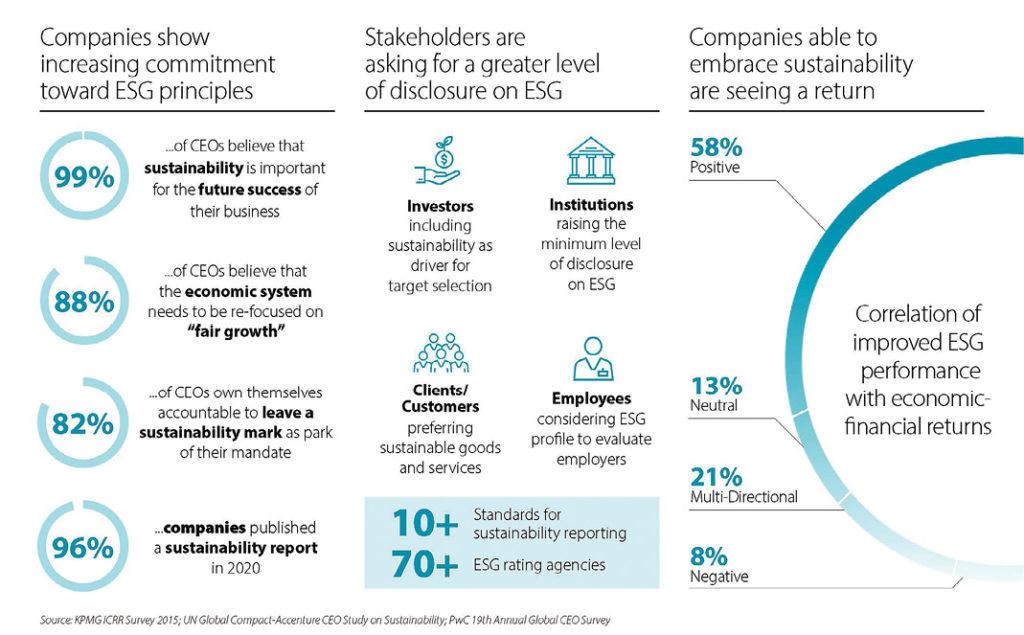

As ESG reshapes the mining industry, organizations that combine technical strength with adaptability and social intelligence are leading the future of mining.

The global mining industry is in the throes of transformation, now defined more by how companies operate than what they extract. In a world of rising geopolitical tension, investor scrutiny, and social demands, ESG and adaptability are no longer optional.

Tomorrow’s leading miners will not be the biggest or richest, but those with technical excellence, social intelligence, and agility.

Environmental, Social, and Governance (ESG) factors have become essential to operations. Companies like Rio Tinto and Anglo American have integrated ESG into strategy. Mid-tier and junior miners must now follow suit or risk losing capital and trust.

“ESG is now an operational lens,” said a sustainability officer at a Canadian firm. “It shapes permits and retention.” Emissions, water use, and Indigenous rights are under intense scrutiny. Investor coalitions like Climate Action 100+ demand progress in transition-critical metals.

Recent disruptions—from pandemics to inflation—have forced companies to become more responsive. Traditional mining lifecycles are giving way to adaptive operations.

“Success is now about responsiveness and credibility,” said an executive at a lithium firm. Companies like B2Gold and Ivanhoe Mines pivot quickly, localizing supply chains and digitizing remote operations.

The mining sector increasingly values trust-building and cultural fluency alongside technical skills. Roles in Indigenous relations, ESG auditing, and climate modeling are growing fast. DEI initiatives are also expanding amid regional resistance.

“We hire for values,” said a recruiter in West Africa. “Empathy now matters as much as engineering.”

Mining tech must now support ESG goals. AI, drones, and automation are measured by their ability to reduce environmental impact and support transparency—not just productivity.

The new mining model is not just extraction—it’s ecosystem management. “Credibility is at stake,” said a London analyst. “Those who evolve will lead.”

Mining is being redefined in real time, and companies that fail to adapt quickly risk being left behind.

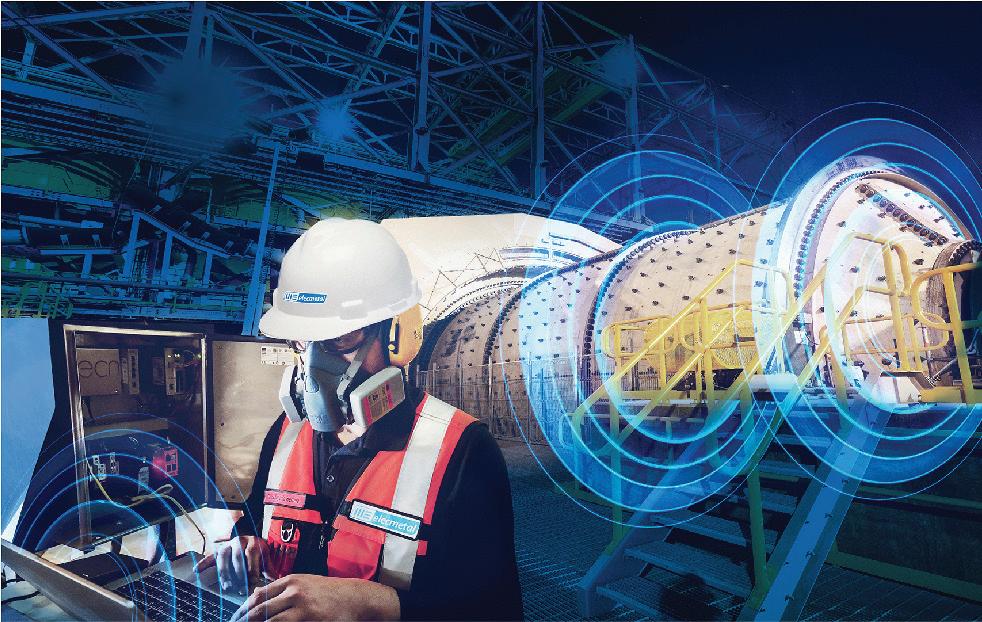

ME Elecmetal delivers more than just mill liners — we provide innovation, tailored support, custom designs, and essential tools to create a complete comminution solution tailored to your needs. By partnering closely with our customers, we establish shared objectives and deliver timely, effective responses through seamless collaboration. Leveraging decades of expertise and cutting-edge technology, we help optimize processes, extend wear part longevity, minimize operational risks, and enhance profitability.

Rubber

Stand #2222

Steel

Crusher Wear Parts • Iron

Composite

• SAG Mills: 4.0” to 6.5”

• Ball Mills and Regrind Mills: 7/8” to 4.0”

• Rod Mills: 3.0” to 4.0” Diameter • Gyratory Crushers

Jaw Crushers

Cone Crushers

Australia’s Metro Mining sets new benchmark with 184,000 WMT shipped in Q1, banking $9 million in revenue as global bauxite demand tightens.

Metro Mining Ltd. kicked off 2025 with a record-breaking first quarter, shipping 184,000 wet metric tonnes (WMT) of bauxite and generating $9 million in FOB revenue—an early signal that the Queensland-based company is on track to meet its ambitious annual target of 6.5 to 7 million WMT.

The strong performance comes amid heightened global demand for bauxite, a key input in aluminum production, and positions Metro as a leading lowcost exporter in a volatile commodity environment.

The company’s strategic offtake agreements and operational upgrades have placed it at the front of the line for supplying bauxite to markets increasingly squeezed by supply constraints—most notably China.

“This quarter’s numbers show that Metro is not just keeping pace with demand, it’s out in front,” said Hugh Callaghan, a Brisbane-based mining analyst. “They’ve executed well on capital projects that improve throughput while locking in buyers for the long term.

Metro’s performance in 2024 laid the groundwork for this year’s targets. The company shipped a total of 58.7 million WMT last year, up 24% from 2023. In January, it set a full-year 2025 shipping

capacity goal of 7 million WMT—an aspirational target that now looks well within reach.

Supporting that confidence is the timely deployment of infrastructure improvements. The addition of a new wobble circuit has enhanced ore processing reliability, especially under wet conditions, while the implementation of Ikamba systems has improved environmental risk management—key in securing export credibility with ESG-sensitive buyers.

On March 17, 2025, Metro loaded its first vessel of the year, following the traditional cyclone-season hiatus. With that, it not only hit a production milestone but

also reaffirmed its shipping timeline—a crucial detail for offtake partners operating on tight inventory cycles.

Metro’s forward momentum is underpinned by a pipeline of multi-cargo agreements with major global aluminium producers. In Q1, the company advanced negotiations with Emirates Global Aluminium and extended offtake agreements with China’s Xinfa Aluminium Group, Shandong Lubei, and Chalco.

“Securing multi-year offtakes with industrial powerhouses like EGA and Chalco provides Metro with revenue certainty

and bargaining leverage,” said Melanie Xu, a Hong Kong-based commodities trader. That timing couldn’t be better. Bauxite contract prices have edged higher in 2025 and are expected to climb further, offering favorable margins for well-positioned exporters. Metro’s low-cost base—bolstered by automation and port logistics advantages—allows it to compete on price while preserving profit in a tightening supply environment.

China’s domestic bauxite production remains insufficient to meet its surging aluminum demand, opening a structural import gap that exporters like Metro are rushing to fill. Although Beijing continues to explore new domestic and Southeast Asian sources, reliability and quality issues persist.

“The Chinese market remains hungry for high-quality, consistent bauxite supply,” said Xu. “That gives Australian producers like Metro a strategic advantage, especially with ports and political risk factored in.”

Beyond China, Metro is also eyeing supply deals with buyers in Malaysia, Indonesia, India, and the Middle East—regions where infrastructure growth and aluminum smelting capacity are accelerating.

Metro’s market capitalization stands at USD 328.9 million as of April 2025, reflecting investor confidence in the company’s production pipeline and long-term offtake strategy. While rising costs and currency fluctuations present potential headwinds, the firm’s cost discipline and customer diversification offer a buffer against downside risk.

With Q1 in the books and output trending upward, Metro appears increasingly likely to not only hit its 2025 targets but exceed them—cementing its position as a key supplier in the global bauxite ecosystem.

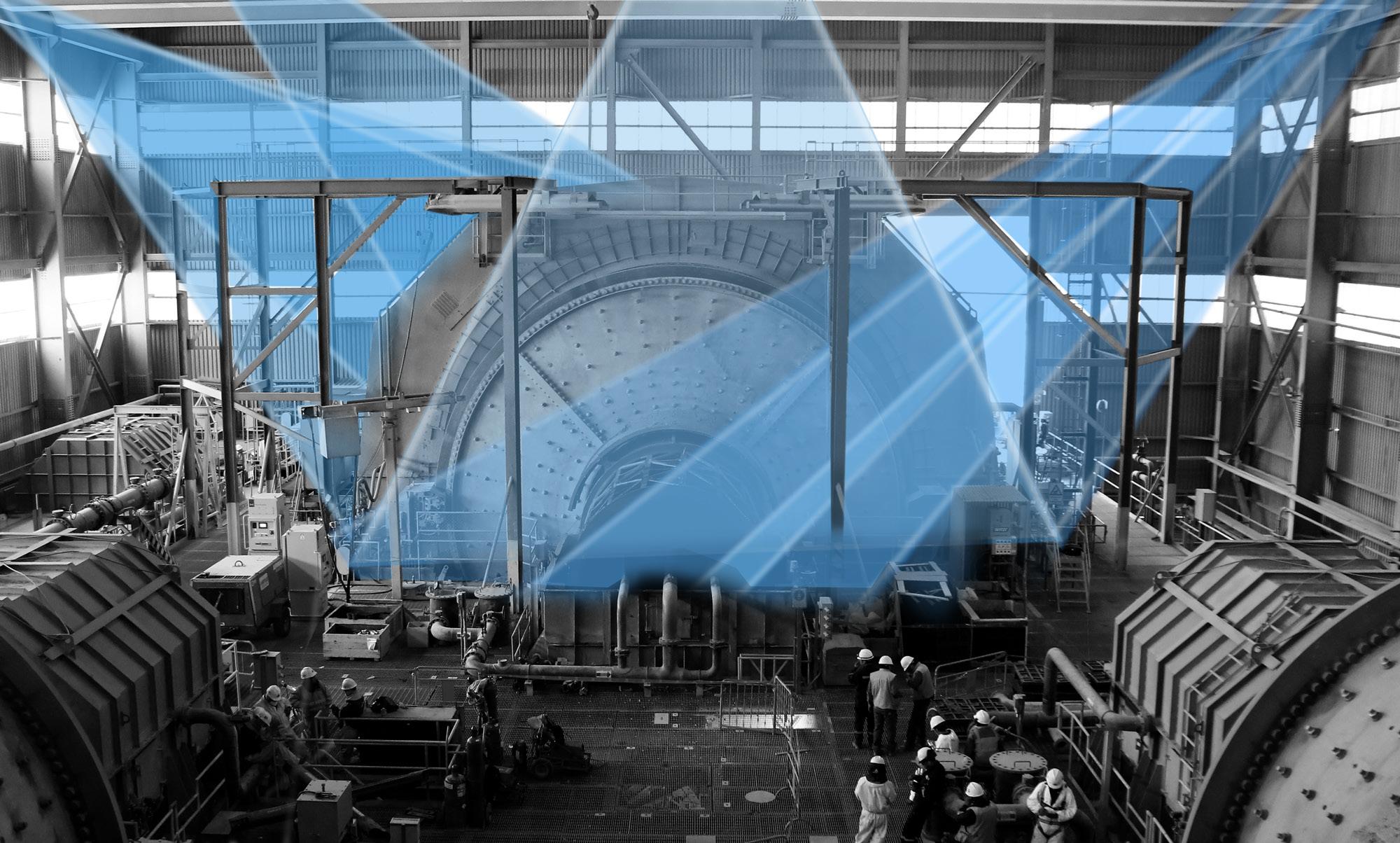

For more than a century, mining equipment design depended on physical prototypes—costly, laborintensive models that left little room for failure. Now, a digital revolution is reshaping how mining machinery is developed, with virtual prototypes at the center of the transformation.

Thanks to the convergence of simulation technologies, data analytics, and artificial intelligence, mining companies are driving innovation, cutting costs, and accelerating equipment development at an unprecedented pace.

Virtual prototypes have moved beyond theory to become essential tools in modern mining equipment design. Technologies such as finite element analysis (FEA),

discrete element method (DEM) simulations, and AI-driven digital twins allow engineers to simulate the real-world behavior of crushers, feeders, and blast furnaces—without a single weld or cut.

“Virtual prototyping gives us the power to experiment more and fail less,” said Pär-Ola Jansell, Vice President and Global Technical Lead for Heavy Equipment, Trucks, and Rail at Altair. “You can push boundaries that would be cost-prohibitive with physical models.” By replacing traditional trial-and-error with predictive modeling, companies are gaining speed, precision, and a decisive competitive advantage.

The traditional method of developing heavy machinery required multiple physical builds and destructive testing—processes that often spanned years. Today, virtual prototypes slash development timelines and lower costs dramatically.

Once trained, AI-powered deep learning models can simulate material flows through mining systems 1,000 times faster than traditional methods.

This acceleration is changing how companies approach mining equipment design, allowing them to run complex “what-if” scenarios on components like jaw crushers and vibrating screens in mere days.

The impact of virtual prototypes is already evident across mining operations. Engineers now use DEM simulations to predict how ores and coal behave across different equipment configurations, identifying potential failure points before they cause costly downtime.

In one case, virtual simulations allowed a mining operator to optimize material discharge from a belt feeder, extending equipment lifespan and reducing maintenance costs.

Similarly, modeling the breakage of materials in cone crushers has led to improved designs that better withstand the harsh realities of mining environments.

Looking ahead, the combination of AI, digital twins, and virtual prototypes is set to redefine mining equipment design once again. AI agents, leveraging knowledge graphs, are already enhancing productivity by optimizing workflows and predicting maintenance needs. Digital twins allow engineers to simulate not just individual components but entire mining ecosystems—integrating electronic, mechanical, and thermal performance into a single virtual environment.

“By moving away from silos and embracing integrated simulations, mining companies can innovate faster and deliver more sustainable solutions,” Jansell said.

Adopting virtual prototypes presents challenges, including high initial investment and the need for specialized expertise. Integrating new platforms with legacy systems can also be a hurdle.

Nevertheless, companies that embrace virtual prototyping early will gain significant commercial advantages, building equipment that is stronger, lighter, more sustainable, and faster to market.

In a high-risk, high-reward industry, virtual prototypes are no longer optional— they are fast becoming the foundation of next-generation mining equipment design.

Fury Gold Mines completes its acquisition of Québec Precious Metals, securing full control of the Sakami gold project and doubling its exploration footprint in Quebec’s James Bay region.

Fury Gold Mines Ltd. has finalized its acquisition of Québec Precious Metals Corp. (QPM), securing control over the Sakami gold project and expanding its strategic footprint in northern Quebec. The deal, structured as a court-approved share exchange under the Canada Business Corporations Act, increases Fury’s land position in the province to more than 157,000 hectares.

Under the terms of the transaction, former QPM shareholders received 0.0741 of a Fury common share for each QPM share held. Fury issued 8,394,137 common shares in total, and assumed QPM’s outstanding options and warrants, adjusted according to the agreed exchange ratio.

Fury now holds 100% interest in a portfolio that includes three exploration-stage properties: the Sakami gold project, the Elmer East property, and the Kipawa rare earth project.

The Sakami project—located in the Eeyou Istchee James Bay region—was the primary driver of the acquisition. The 140-kilometer mineralized corridor has shown strong early results and lies within a geological structure historically linked to major gold deposits. With QPM

“This acquisition doubles our footprint in Quebec and adds one of the most prospective assets in the region,” — Tim Clark, CEO, Fury Gold Mines

“Sakami is quietly one of the best undrilled gold targets in Canada. This deal gives Fury scale and optionality—two things institutional investors want,” — Laurent Picard, Mining Analyst, BMO Capital Markets

“Combining our financial and technical strengths with QPM’s assets positions us for operational efficiency and accelerated progress,” — Tim Clark, CEO, Fury Gold Mines

“This validates the years of groundwork we’ve put into Sakami. Under Fury, the project now has the resources and leadership to move forward,” — Normand Champigny, CEO, Québec Precious Metals

previously limited by capital constraints, Fury’s stronger balance sheet is expected to accelerate exploration.

The expanded land position overlaps with traditional Eeyou Istchee territory, making community engagement and environmental stewardship key components of the integration strategy.

Both Fury and QPM have existing relationships with local Cree communities, and management emphasized continuity.

Fury’s recent ESG disclosures suggest that community consultation and responsible exploration will remain cornerstones of its Quebec strategy.

With gold trading near $2,300 per ounce, Fury’s timing appears fortuitous. Investor appetite for early-stage projects in stable jurisdictions is climbing, particularly for assets like Sakami that offer near-term drill targets and district-scale potential.

While the company’s broader portfolio includes critical mineral projects like Kipawa, the Sakami gold project is likely to remain the centerpiece of Fury’s exploration strategy going into 2026.

From Pilbara to Carajás, Labrador to Simandou—inside the geopolitical power plays, green steel revolutions, and strategic realignments defining the future of iron mining.

The iron ore mining sector, traditionally characterized by stability, has experienced a notable surge in mergers and acquisitions (M&A) activity in 2025. This shift is driven by a confluence of factors, including evolving global demand, strategic realignments by major players, and geopolitical influences.

Major Transactions Reshaping the Industry

One of the most significant deals this year is Japan's Mitsui & Co.'s agreement to acquire a 40% stake in the Rhodes Ridge iron ore project in Western Australia for $5.34 billion. This project, operated by Rio Tinto, is among the world's largest undeveloped iron ore deposits, with production expected to commence by 2030.

In Brazil, Vale has taken full control of the Baovale iron ore project by acquiring the remain ing 50% stake from its Chinese partner Baosteel. This move consolidates Vale's position in the region and reflects a broader trend of companies seeking greater control over their assets.

In Norway, Grangex completed the acqui-

sition of Sydvaranger Mining AS, signaling a potential revival of the historic iron ore operations in the region.

The increased M&A activity is partly attributed to major mining companies reevaluating their portfolios. BHP, after its unsuccessful $49 billion bid for Anglo American in 2024, has indicated a focus on organic growth while remaining open to strategic acquisitions citeturn0news23. Similarly, Rio Tinto and Glencore engaged in merger discussions that, if realized, would have created a mining entity valued at approximately $158 billion. Although talks ceased, the potential for future consolidation remains.

Geopolitical factors are also influencing M&A decisions. The Biden administration's blockage of Nippon Steel's proposed $14.9 billion acquisition of U.S. Steel underscores the growing scrutiny of foreign investments in critical industries.

Looking ahead, the iron ore market is projected to grow by $60.9 billion from 2025 to 2029, driven by rising demand for high-strength iron ore and steel. This anticipated growth, coupled with the ongoing energy transition and infrastructure developments, suggests that M&A activity in the sector will remain robust.

Companies are expected to continue pursuing strategic acquisitions to secure resource supply chains, enhance operational efficiencies, and adapt to the evolving global landscape. As the industry navigates these changes, stakeholders must remain vigilant and responsive to emerging opportunities and challenges.

As M&A heats up in iron ore mining, 2025 is also witnessing the emergence of a new wave of consolidation—not just among the majors like BHP, Rio Tinto, and Vale, but increasingly among mid-tier and regionally focused players seeking to bulk up or streamline operations in response to ESG (Environmental, Social, Governance) pressures, carbon mandates, and tightening capital markets.

A significant factor driving deal-making is the pressure to decarbonize. Iron ore, a critical raw material in steelmaking, is central to the green energy transition— but it also faces scrutiny over emissions and water use.

As investors and regulators demand cleaner operations, companies are shedding high-emission assets and consolidating around direct shipping ore (DSO) and magnetite operations with lower environmental footprints.

One notable example is Fortescue’s rumored divestiture of some of its older, less efficient Pilbara tenements, while doubling down on its Iron Bridge magnetite project and green hydrogen efforts under its Fortescue Future Industries (FFI) subsidiary. Industry observers expect Fortescue to consider strategic asset swaps with Chinese partners to access decarbonization technologies and long-term off-take agreements.

At the same time, mines with strong ESG credentials, such as low strip ratios, renewable energy integration, and Indigenous partnership frameworks, are commanding premium valuations in M&A markets.

While Chinese investment once dominated iron ore joint ventures across Africa and Latin America, 2025 marks a subtle but marked retreat of Chinese statebacked miners from frontier markets. With Simandou in Guinea still facing infrastructure delays and nationalization talks, China’s appetite for high-risk international exposure is softening.

Instead, Chinese mills and trading houses are shifting focus to long-term supply security through offtake-linked acquisitions, rather than outright ownership. A case in point: Baowu Steel’s minority investment into Brazil’s Centaurus Metals’ Jambreiro project, which secures premium grade supply without overextending its capital footprint in politically volatile jurisdictions.

Africa, despite hosting some of the largest untapped iron ore deposits, remains a high-stakes chessboard in the M&A landscape. In March 2025, Zanaga Iron Ore Company renewed its search for

development partners for its Republic of Congo project after Glencore exited the JV in late 2024. Multiple private equity funds and sovereign-backed firms are reportedly circling—but infrastructure financing and political risk remain major stumbling blocks.

Simultaneously, in Mauritania, SNIM (Société Nationale Industrielle et Minière) has invited bids from Western partners to co-develop the Guelb II expansion, aiming to modernize and double national output capacity by 2030. However, as of April, no deal has been finalized, signaling how difficult African iron ore M&A remains despite the geology.

2025 has also spotlighted India as a rapidly consolidating iron ore jurisdiction. The country’s National Mineral Development Corporation (NMDC) has initiated a buyout of its own JV partner in the Donimalai mine, with a view to scaling up export capacity as domestic infrastructure booms.

Meanwhile, Vietnam and Laos have quietly attracted interest from regional midtier firms such as Malaysia’s Southern Alliance Mining and Singapore’s OM Holdings, both seeking to tap small-scale, high-grade iron ore plays for Southeast Asian steel markets increasingly divorced from Chinese control.

As interest rates remain elevated and risk appetite subdued, most 2025 M&A deals in iron ore are being structured without heavy leverage. Debt-funded mega-deals like those of the 2000s are gone; instead, cash-rich balance sheets, disciplined capital allocation, and lowrisk optionality are the rule.

Private equity, once absent in mining, is returning—but cautiously. Notably, Resource Capital Funds and Appian Capital have both increased exposure to magnetite and pellet feed producers with ESG-linked performance triggers.

Looking ahead to Q3 and Q4 2025, the iron ore M&A cycle shows no signs of slowing. Analysts expect: BHP and Fortescue to explore selective bolt-on acquisitions in magnetite or “green steel” upstream ventures; Renewed JV activity between Western miners and Gulf sovereign wealth funds seeking to hedge energy transition volatility; Increased interest in North American iron ore assets, such as those in Labrador Trough, as U.S. protectionism and IRA-linked steel incentives grow.

Iron ore may be a century-old industry, but its M&A playbook in 2025 is being rewritten by climate goals, resource nationalism, and market realignment. In this environment, only those with strategic foresight, operational discipline, and capital efficiency will rise above the rubble.

By extrapolating current M&A trends, we can paint three divergent futures: Scenario Description Winners

Green Supermajors

Bifurcated Markets

Fragmented Retreat

ESG-compliant magnetite mines consolidate; green hydrogen-ready steel mills dominate.

West vs. China split supply chains and pricing mechanisms; CBAM creates two-tier iron market.

Nationalism chokes cross-border M&A, infrastructure gaps worsen; only low-cost incumbents survive.

Brazil, Canada, mid-tier tech-savvy miners

Rio Tinto, Chinese SOEs, Gulf States

Vale, Fortescue, Indian state miners

In 2025, iron ore M&A is no longer a numbers game about reserves and strip ratios. It’s a geopolitical chessboard, a carbon scoreboard, and a supply chain insurance policy. As ESG mandates tighten, nations isolate, and steel decarbonizes, the miners that will thrive aren’t just digging deeper—they’re thinking farther.

Australia: Scaling to Dominate vs. ESG Scrutiny

Contrast: The Pilbara remains the iron ore heartland of global production. But Australia’s M&A strategy—led by giants like Rio Tinto, BHP, and Fortescue—is all about scale, automation, and ESG redemption. Rio Tinto's push into Rhodes Ridge, with Mitsui’s $5.3 billion invest-

ment, is emblematic: expand capacity while emphasizing automation, heritage consultation with Indigenous groups, and renewable-powered haulage. BHP, still licking wounds from its failed Anglo American bid, has shifted to smaller, surgical acquisitions and portfolio shuffles. It sold legacy assets in the Yandi region to concentrate on long-life mines like South Flank.

But cracks are forming. Australia’s mining carbon footprint is under international pressure, especially as steel buyers— especially in Europe and Japan—demand “green ore” with a traceable carbon trail. Contrast: While Pilbara’s ore is abundant and low-cost, it’s mostly hematite with limited flexibility for decarbonized steelmaking without beneficiation—unlike magnetite-rich competitors.

Contrast: Brazil has seen consolidation inward—a reversal from its earlier globalization push. Vale’s buyout of Baovale (exiting Chinese partner Baosteel) signals growing preference for national control of premium resources in Carajás and Itabira. Meanwhile, Chinese firms—once eager investors—have scaled back exposure in light of rising Brazilian environmental lawsuits, political volatility, and the Mariana dam legacy haunting international partners.

Vale’s moves also reflect Brazil’s positioning as a magnetite-rich “green iron” exporter. The high-grade ore from northern Brazil fetches premiums in markets transitioning to direct-reduced iron (DRI) and electric arc furnace (EAF) steel.

Contrast: Unlike Australia, Brazil has abundant hydropower and access to higher-grade iron ore, making it more suitable for low-carbon steel—aligning with EU Carbon Border Adjustment Mechanism (CBAM) standards.

Contrast: Africa boasts the world’s richest undeveloped iron ore belts, but M&A optimism is frequently outpaced by logistical inertia and geopolitical hurdles.

The Simandou saga in Guinea drags on with intermittent Chinese, Emirati, and Rio Tinto involvement, but road and rail challenges persist. Zanaga (Congo), despite being listed on the AIM exchange, still lacks a credible development partner, though rumors of interest from Korean and Indian firms persist.

Mauritania’s SNIM, one of Africa’s few operational iron ore exporters, has been fielding JV interest for Guelb II—but high capex costs (~$1.2 billion) remain a barrier. Contrast: While Africa’s ore grades often rival Brazil’s, access to ports, power, and peace remain elusive. The M&A environment is speculative, with equity buyers scarce and sovereign deals preferred.

Contrast: Chinese firms have pivoted away from ownership toward supply security. After setbacks in Guinea, Cameroon, and Brazil, state-run enterprises now focus on offtake agreements, minority equity, and investment in logistics chains.

Sinosteel and Baowu have initiated offtake-linked investments in Canada, Brazil, and even India, hedging against geopolitical shocks. Domestically, China is investing heavily in recycling and steel scrap, aiming to reduce dependency on imported ore altogether by 2030.

Contrast: China's M&A strategy has matured. From chasing headline-grabbing acquisitions in the 2010s, the focus in 2025 is on invisible control—long-term contracts, shipping logistics, and leverage over third-party processing.

Contrast: The U.S. is reasserting control over domestic iron supply as resource nationalism collides with the defense-industrial complex.

The blocking of Nippon Steel’s $14.9B U.S. Steel bid by the Biden administration signals a hard pivot to “Buy American” in critical minerals—including iron ore. Cleveland-Cliffs, Tacora Resources, and Champion Iron are potential M&A targets or consolidators as North America gears up for IRA-incentivized green steel infrastructure.

Contrast: While North America’s iron ore output is modest compared to global giants, political dynamics make these assets strategically priceless—not commercially dominant. M&A will be policy-driven, not just market-driven.

The Next Moves for Miners

Player Strategic Play Future M&A Role

Rio Tinto ESG-first, automation, green hydrogen Anchor buyer in Australia & Canada

Vale Magnetite expansion, China hedging Consolidator in Brazil, hybrid partner in Asia

Fortescue Green diversification (FFI), asset swaps Seller of legacy assets, buyer of clean ore

Cliffs/Arcelor

India NMDC/ SAIL

Downstream expansion

Domestic consolidation

China Baowu/ Sinosteel Indirect control via offtake

Saudi Arabia/ UAE Sovereign-backed consolidation

Likely buyers of upstream DR-grade feed

Strategic acquirers in Africa and Southeast Asia

Less visible, more strategic partnerships

Emerging force in magnetite, infrastructure M&A

1. The Rise of Iron as a "Critical" Mineral

Iron ore has traditionally been excluded from “critical mineral” lists—those typically dominated by lithium, cobalt, and rare earths. That’s changing. In the wake of geopolitical fragmentation, iron ore is being reevaluated not just as a bulk commodity—but as a strategic enabler of national industrial policy, especially for:

• Domestic green steel production;

• Defense procurement (e.g., armor-grade plate);

• Infrastructure tied to stimulus programs.

Prediction: By 2027, the U.S., EU, and India will designate high-grade iron ore (particularly magnetite and DR-grade ores) as strategic or semi-critical, triggering new investment incentives and tightening FDI scrutiny.

2. Magnetite and DR-Grade Ore Will Be the New M&A Goldmine

As global steel pivots toward hydrogen-based Direct Reduced Iron (DRI), only certain iron ore grades will qualify as feedstock. High-grade magnetite, with >67% Fe content and fewer impurities, will command premiums and become a bullseye for M&A.

Australia’s Iron Bridge, Brazil’s Carajás, and Canada’s Labrador Trough will become consolidation hotspots.

New mid-tier entrants will appear—specializing in “green feedstock mining.”

Prediction: By 2030, at least 40% of iron ore M&A will target magnetite or pellet-feed quality assets, up from <10% in 2020.

Decades of divestment and specialization led to miners selling off steelmaking arms. That model is now under question. Steelmakers—particularly in the EU, Japan, and the U.S.—will pursue backward integration to secure low-carbon ore inputs.

Expect ArcelorMittal, POSCO, and Cleveland-Cliffs to pursue asset buyouts or long-term partnerships in magnetite

mining regions. Gulf states like Saudi Arabia and the UAE—flush with capital—are already making sovereign-aligned acquisitions (e.g., Manara Minerals’ rumored interest in magnetite assets).

Prediction: Expect a resurgence of mineto-steel verticals, blending low-carbon ore with regional EAF capacity to meet CBAM and domestic resilience goals.

M&A will increasingly follow geopolitical lines. The world is heading toward a “dual iron ore market”:

Western Alliance: Australia, Brazil (Vale), Canada, India, U.S., EU—linked by CBAM and ESG-aligned trade standards.

China-Centric Axis: Guinea (Simandou), Indonesia, parts of Africa—feeding China’s state-controlled, lower-regulation demand.

This will reshape M&A behavior: Western deals will be governed by transparency, ESG compliance, and democratic accountability.

Eastern deals will emphasize speed, ownership control, and off-balance-sheet infrastructure swaps.

Prediction: By 2028, iron ore pricing mechanisms could diverge—ESG-compliant “green ore” commanding a premium over standard 62% Fe grades on the spot market.

Technological advancement in geospatial analytics, AI-driven exploration, and blockchain traceability will radically streamline M&A:

AI-based resource modeling will allow investors to price deposits faster and more accurately, even in remote jurisdictions. Tokenized royalty streams (already piloted in gold and lithium) could allow retail investment into iron ore production.

Prediction: By 2030, digital due diligence platforms will be industry standard for mining M&A, reducing timelines by up to 40%.

By the 2030s, a growing portion of global steel will come from recycled scrap and urban mining, potentially flattening iron ore demand.

But not everywhere: Developing nations (India, Africa, Southeast Asia) will still require raw ore, making their deposits M&A targets. Advanced economies will shift from quantity to quality—demanding only green, traceable ore for premium applications.

Prediction: The global iron ore market will bifurcate not just by region, but by purpose—scrap vs. ore, basic steel vs. green steel, domestic use vs. export.

Investor pressure on mining companies is intensifying: Funds like BlackRock, Norges Bank, and IFM Investors are embedding ESG, carbon risk, and Indigenous rights into M&A approval criteria.

Companies failing to meet these expectations will see capital cost premiums and rising insurance costs.

Prediction: By 2026, most major min-

ers will create M&A ESG task forces to assess not just geological and financial fit—but reputational, regulatory, and social license risks of every deal.

• 2025–2027: Fragmentation. More mid-tier deals, rising nationalism, green premiums begin.

• 2028–2030: Consolidation around DR-grade. Diverging markets. ESG-led capital reshapes strategy.

• 2030+: Decoupling. Iron ore becomes a critical security asset for some, and a surplus liability for others.

Just as energy M&A in the 1970s redefined oil supermajors, the iron ore deals made this decade will determine who dominates the green steel era—and who fades with the blast furnace.

As geopolitical headwinds sweep through the global diamond industry, Petra Diamonds has taken a strategic pause. The company has postponed a major sale of rough diamonds from its Cullinan mine in South Africa, citing rising U.S. tariff uncertainty. This move reflects a broader unease gripping mineral exporters as protectionist policies ripple through fragile commodity markets.

The delayed sale of 200,000 carats of rough diamonds from Petra Diamonds’ Cullinan mine has sent ripples through the global gemstone market. Originally scheduled as part of Tender 5, the sale was postponed in response to rising U.S. tariff uncertainty, a consequence of the Trump administration’s recently announced import duties on both rough and polished diamonds. Petra says it hopes to achieve more favorable prices once the implications of the new trade policy become clearer.

South Africa, home to Cullinan and a major supplier of rough stones to the U.S., is among the hardest hit. The Cullinan mine, best known for producing the 3,106-carat diamond that now adorns the British Crown Jewels, is a cornerstone of Petra’s portfolio. However, in recent months, the mine has struggled to deliver larger, high-value stones—leading to a decline in average realized prices and growing pressure on company revenues.

Excluding the postponed sale, Petra has generated $103 million in rough diamond revenue for fiscal 2025 to date— down 25% from $138 million in the same period last year. Operationally, the company has been forced into a comprehensive restructuring effort, including layoffs under South Africa’s section 189 retrenchment law and asset divestitures, such as the recent $16 million sale of its stake in Williamson Diamonds in Tanzania.

Petra has also launched a full life-of-mine review to align future investment with expected cash flow. While a recent 81-carat gem-quality recovery at Cullinan offers a positive signal, the company has warned that consistent free cash flow generation remains unlikely without a significant improvement in product mix and market pricing. With tariff risks and oversupply weighing on the global diamond sector, Petra’s decision to pause the Cullinan sale

underscores how geopolitical developments far from mine sites can destabilize even the most iconic assets.

Petra’s pause at Cullinan reflects more than a pricing strategy—it signals the fragility of global resource markets in an era where trade policy can shift overnight, and where even century-old mines must adapt or risk obsolescence.

In 2025, the age-old debate between gold and Bitcoin as stores of value has taken on renewed urgency. With global markets swaying under the weight of geopolitical uncertainty, central bank policy shifts, and technological upheaval, investors are split between the allure of a 5,000-year-old metal and the promise of digital scarcity.

Both assets have had strong starts this year—but their trajectories reflect radically different narratives. Gold, the stalwart of conservative capital, surged past $2,300 per ounce in April 2025, hitting fresh all-time highs on the back of central bank buying and global unrest.

Bitcoin, on the other hand, soared past $73,000 in March, buoyed by growing institutional adoption and the long-awaited launch of several U.S. Bitcoin spot ETFs in late 2024. As investors recalibrate in a post-COVID, high-inflation, AI-dominated world, the question looms larger than ever: which asset truly wins the safe-haven crown in 2025?

Gold’s latest rally isn't driven solely by speculative retail interest. According to

the World Gold Council, central banks added a record 1,136 tonnes of gold in 2023, with early 2025 data indicating that pace has not slowed. Notably, China, Turkey, and India have continued to diversify away from the U.S. dollar, increasing their gold reserves to shield against currency volatility and geopolitical risk.

Joseph Cavatoni, market strategist at the World Gold Council. “...investors who buy shares in gold ETFs do not have to deal with the management or safekeeping of their holdings, and it’s as easy as investing in the stock market. ”

In the private sector, escalating tensions in the Middle East, sluggish Chinese real estate recovery, and mounting U.S. debt have pushed high-net-worth individuals and institutions to increase allocations

to bullion. Meanwhile, ETFs like GLD and IAU have reported renewed inflows after two years of stagnation.

Mining executives, too, are bullish. Newmont and Barrick have both increased exploration budgets in 2025, while junior miners are reporting improved financing conditions. But the real shift is the rise of sovereign-backed gold mining initiatives. Russia’s state-owned Polyus has doubled down on Siberian expansion, and Zimbabwe recently fast-tracked foreign investment licenses for gold projects as part of its "Vision 2030" economic plan.

Bitcoin: Wall Street’s New Darling – or Dangerous Disruptor?

Bitcoin's run above $70,000 in 2025 comes on the heels of the SEC’s historic approval of several spot Bitcoin ETFs in

January 2024. BlackRock, Fidelity, and Franklin Templeton all now manage Bitcoin funds, pulling in over $50 billion in combined inflows in the last 14 months, according to CoinShares.

Moreover, the Bitcoin halving in April 2024 slashed miner rewards to 3.125 BTC per block, reducing new supply and reinforcing the asset’s deflationary nature. This has made Bitcoin even more attractive amid fiat currency dilution concerns.

Institutions are no longer on the sidelines. Goldman Sachs now offers crypto trading to select clients, and JP Morgan’s Onyx blockchain division is facilitating tokenized asset transfers for sovereign clients. The asset has gone mainstream.

Critics warn of the volatility

Bitcoin plunged by nearly 20% in two weeks during January 2025 after speculation around new taxation measures in the EU. And environmental scrutiny hasn’t gone away—even as miners like Riot Platforms and Marathon Digital continue to adopt cleaner energy strategies.

In mining terms, Bitcoin's "digital extraction" increasingly mirrors the capital-intensive nature of traditional mining.

Electricity is the new dynamite, and ASIC rigs the new rock crushers. Yet, unlike gold, Bitcoin production isn't bound by geography—it’s dictated by hash rate, regulation, and energy costs.

Gold appeals to physicality, longevity, and political neutrality. It thrives in a world of war, inflation, and broken trust in fiat systems. Bitcoin, by contrast, offers sovereignty without borders—resistant to seizure, portable across oceans, and immune to manipulation by central banks.

"Gold is the past and present of wealth preservation. Bitcoin is the future," argues Michael Saylor of MicroStrategy, whose firm now holds over 190,000 BTC as of Q1 2025. Yet many wealth managers advise a blended approach, noting that Bitcoin’s digital nature does not offer the same protection during grid failures, government bans, or systemic hacks.

Gold vs. Bitcoin, April 2025

Feature Gold Bitcoin

Current Price ~$2,325/oz (April 2025) ~$71,400/BTC (April 2025)

YTD Performance +11% +38%

Volatility Low (historically ~15%) High (historically ~60–80%)

Central Bank Demand Record High None

Institutional Adoption Steady

ESG Concerns

Regulation Risk

Scarcity Mechanics

Medium (cyanide use, tailings)

Low (entrenched commodity)

Physical Limit (mine depletion)

The real winner in 2025 may not be one over the other—but the portfolio that smartly balances both.

According to a 2025 report by Fidelity Digital Assets, a 60/40 portfolio that included 5% gold and 3% Bitcoin outperformed traditional asset mixes by over 12% during the first quarter of the year, with reduced drawdowns.

More notably, new hybrid products are emerging. Swiss-based startup Kinesis has launched a gold-backed digital token tied to physical reserves but transferable like crypto.

Meanwhile, tokenized gold mining shares, which merge real-world output with blockchain traceability, are attracting venture capital attention in Canada and Singapore.

Though they exist in different realms— one under the Earth’s crust, the other in cyberspace—the mining metaphor still

Accelerating via ETFs

High (energy use, emissions)

High (IRS, EU, SEC scrutiny)

Algorithmic Limit (21M coins)

unites gold and Bitcoin. Gold miners, such as Newmont, Barrick, and Agnico Eagle, remain some of the largest players in the resource sector. In Q1 2025, Barrick reported a 7% production increase year-over-year, aided by expanding operations in Mali and the DRC. ESG (Environmental, Social, and Governance) requirements are now more central than ever—driven not just by investor pressure but evolving global regulation.

Canada’s 2024 Critical Minerals Strategy, though mostly focused on lithium and nickel, has also fueled investment in gold as a co-product in key deposits.

Bitcoin mining, on the other hand, is experiencing a fundamental shift in location and energy sourcing. After China's mining ban and the 2021 exodus, 2025 has seen a new wave of movement toward Latin America, where Bitcoin mining firms are partnering with geothermal plants in El Salvador and hydroelectric grids in Paraguay.

In the U.S., Texas remains a hotspot— but miners are under scrutiny for grid stress, especially after February’s winter storm blackouts.

The post-halving environment has compressed margins. Only miners with access to ultra-cheap energy—below 3¢ per kWh—remain competitive.

This has triggered consolidation in the sector: Riot Platforms recently announced a proposed $700 million merger with Bitdeer to achieve economies of scale.

Gold’s regulation remains largely unchanged. It is universally accepted, taxed predictably, and deeply integrated into the global banking system. Gold ownership carries few surprises; even taxation on capital gains is well understood.

Bitcoin, however, is in the crosshairs. In March 2025, the European Union enacted the Markets in Crypto-Assets (MiCA) framework, mandating comprehensive KYC/AML compliance and reserving powers to restrict high-energy mining. In the U.S., the IRS proposed new tax reporting rules for crypto wallets, brokers, and decentralized exchanges—sparking backlash from the industry.

“There’s still no regulatory consensus globally,” said Sheila Warren, CEO of the Crypto Council for Innovation. “This patchwork creates volatility—not in price alone, but in trust.”

In contrast, Russia, Venezuela, and some Gulf states are embracing Bitcoin as a tool for sanctions circumvention, drawing scrutiny from the IMF and U.S. Treasury. This dual identity—freedom tool vs. financial threat—complicates Bitcoin’s mainstream path.

Inflation, De-dollarization, and Deglobalization

In 2025, global inflation remains stubborn. Although headline rates in the U.S. have receded to 3.4%, core inflation in Europe and emerging markets has proven sticky. Commodities, especially oil and food, continue to show volatility amid supply chain fragmentation and conflict in the Red Sea and Taiwan Strait.

This environment plays to gold’s strengths. When trust in fiat wavers,

MAY NOT be one over the other—but the portfolio that smartly balances both.

gold shines. And with talk of BRICS+ developing a new gold-linked trade settlement system, gold’s strategic relevance is surging—especially in countries seeking to bypass the U.S. dollar.

Bitcoin, meanwhile, is increasingly used in peer-to-peer remittances and offshore savings in nations facing capital controls (e.g., Argentina, Lebanon, Nigeria). Its volatility remains a barrier to use as a daily medium of exchange—but as a censorship-resistant reserve, it’s gaining ground.

As the gold vs Bitcoin narrative plays out, new hybrid assets are emerging. Consider:

Tokenized gold (e.g., PAXG, Tether Gold): Backed by real gold but transferable via blockchain. These tokens offer the best of both worlds—physical security and digital utility.

Central Bank Digital Currencies (CBDCs): Over 130 countries are piloting or developing digital versions of their currencies, according to the Atlantic Council. While CBDCs won’t replace Bitcoin or gold, they introduce state competition in the digital money race.

Green Bitcoin? Projects like Crusoe Energy are converting flared gas into power for Bitcoin mining, reducing net emissions and making BTC more ESG-friendly. Investors are watching closely.

A Fidelity Institutional survey in Q1 2025 showed a stark generational split:

• Boomers and Gen X preferred gold (56%) over Bitcoin (12%) as a store of value.

• Millennials and Gen Z, however, favored Bitcoin (48%) over gold (22%).

This isn’t just preference—it’s trajectory. As trillions in generational wealth transfer in the next decade, the tilt toward digital assets may accelerate.

However, older investors still control institutional portfolios, where compliance rules and fiduciary duty keep gold firmly entrenched. For many pension and endowment funds, Bitcoin remains an “alternative” allocation, not a core one.

Gold is rooted, real, and recognized. Bitcoin is new, nimble, and increasingly normalized. In 2025, both have proven their worth—but in different ways.

If you fear war, currency collapse, or political instability, gold is your fortress. If you bet on technology, freedom from centralized control, and exponential adoption, Bitcoin is your bet.

Most importantly, the smartest investors in 2025 aren’t choosing sides—they’re allocating wisely, hedging across assets that speak to different threats and opportunities.

Despite high prices, mine output is declining. The average grade of gold mined globally has fallen from 1.3 g/t in 2012 to under 1.0 g/t in 2024, increasing cost and environmental tolls. Projects are becoming riskier and more capital-intensive, especially in politically unstable regions like West Africa or South America.

Modern gold operations are under intense pressure to align with ESG mandates. Cyanide use, water scarcity, and indigenous rights issues continue to challenge the social license to operate.

This has created a two-tiered market: premium pricing for gold sourced from certified ethical supply chains, and discounted pricing for high-risk jurisdictions.

Bitcoin is no longer speculative fringe. With U.S. spot ETFs holding nearly 5% of all mined Bitcoin by April 2025, mainstream investors are in.

Even traditional stalwarts like BlackRock and State Street are integrating BTC into 401(k) products and target-date funds.

Gold continues to be the go-to reserve asset for emerging market central banks looking to hedge against Western sanctions, currency volatility, and geopolitical fragmentation. In fact, as of April 2025, central banks have purchased over 400 metric tonnes of gold in Q1 alone—on pace to exceed last year’s record. Yet, challenges persist.

On April 5, 2025, Bitcoin plummeted 11% in a single day after the Bank of Japan unexpectedly raised rates and U.S. lawmakers hinted at a capital gains reclassification on crypto assets.

This reminds markets that Bitcoin’s price is still highly sensitive to both macroeconomic policy and regulatory noise.

Post-halving, break-even costs for many miners are now above $42,000 per BTC. Only the most efficient, vertically integrated players—like CleanSpark or Hut 8—can maintain profitability.

Meanwhile, Kazakhstan, Texas, and even Kenya have emerged as low-cost mining hubs, using stranded renewable power.

Head-to-Head Battle Across Key Dimensions

History

Tangibility

Regulatory Landscape

Supply Limit

Energy Use

Price Stability

Use in Finance

5,000 years of monetary use; universally recognized

Physical, needs secure storage and transport

Stable, globally harmonized

Finite but expandable with tech and exploration

Mining impact concentrated in environmental degradation (land/ water use)

Relatively low volatility; moves in response to inflation/geopolitical fears

Held by central banks and sovereign wealth funds

Demographics Favored by older investors and institutions

Role in De-dollarization

Strategic reserve asset for multipolar currency systems

15 years old; recognized in some legal systems, banned in others

Digital, borderless, vulnerable to cyber risks

Fragmented, rapidly evolving, politically charged

Algorithmically fixed at 21 million

High energy demand, but shift toward renewables underway

Highly volatile; reacts to macro, tech, and media events

Now accepted in ETFs, financial products, and as collateral in DeFi

Heavily adopted by Millennials, Gen Z, tech-forward funds

Tactical escape route in countries facing monetary instability

Gold's Path Forward: The Silent Strategist

Gold is likely to remain the cornerstone of wealth preservation. But its role may quietly evolve from speculative asset to financial infrastructure—especially in non-Western systems.

BRICS+ and Gold-Backed Settlement:

Talks in early 2025 suggest a possible trade settlement system backed by gold, aimed at reducing dependence on USD trade.

Tokenized Gold Surge: The $20B+ tokenized asset market is booming, with projects like Kinesis and Paxos offering digital gold linked to vaults in Zurich and London.

Mining Investment Renaissance: Higher gold prices and geopolitical hedging could spark a new wave of mergers and expansions in secure jurisdictions like Canada and Australia.

Risks Ahead: Industrial substitution is low for gold, and there is little threat of technological disruption. However, peakgrade issues and ESG compliance costs will squeeze margins unless mining practices innovate rapidly.

Bitcoin's Path Forward: The Radical Transformer

Bitcoin’s appeal is amplified in a world of:

• Currency debasement

• Digital mobility

• Technocratic control

And it is adapting quickly:

Layer 2 Solutions (e.g., Lightning Network) are scaling payment use cases.

Institutional Infrastructure is maturing, with custodians like Coinbase Prime and Bakkt now securing sovereign and corporate holdings.

Rather than converging into a winner-take-all outcome, gold and Bitcoin are charting parallel paths toward financial relevance across radically different use cases.

Gold will anchor states, systems, and legacies. Bitcoin will empower individuals, platforms, and movements. The most resilient investors, nations, and institutions will leverage both—as a bifurcated defense against a bifurcating world.

Final Word from Skillings: 2025 is not the climax. It's the threshold.

The real battle for value—between code and metal, mobility and mass, decentralization and tradition—is just beginning.

For the miners, the investors, and the policymakers who understand both gold and Bitcoin, the future isn't uncertain—it's dual-powered.

Bitcoin ETFs are reducing barriers for pension fund inclusion, pushing prices toward $100,000 by some forecasts.

Risks Ahead: The path is volatile. Environmental scrutiny, centralized mining pools, and global regulatory crackdowns could erode trust. Bitcoin also lacks a “floor” in crises where liquidity vanishes.

Convergence

Ironically, the future of gold and Bitcoin may not be a zero-sum game—but an integration of both into a multi-asset hedging strategy:

Multi-Asset Inflation Hedges: BlackRock and Bridgewater have begun blending allocations into “digital gold” and “physical gold” across inflation-targeted portfolios.

Synthetic Reserve Assets: Countries like Singapore and Switzerland are exploring

the use of gold-backed stablecoins and crypto baskets in sovereign fund diversification.

Institutional Adoption Packages: Hedge funds like Pantera Capital and SkyBridge now offer “digital commodity” funds, bundling BTC, gold, and tokenized metals. In a multipolar, de-globalizing world, diversification is defense—and both assets are likely to be essential components of financial resilience.

Conclusion: 2025 Has No Clear Winner

In truth, Bitcoin is not replacing gold— yet. It is augmenting the idea of wealth preservation with programmability, decentralization, and immutability. Gold, meanwhile, remains the bedrock for sovereigns, institutions, and cautious capital in an age of monetary confusion. For 2025, the best portfolio is not gold or Bitcoin—it’s gold and Bitcoin, in a careful ratio, regularly adjusted to the changing winds of policy, population, and planet.

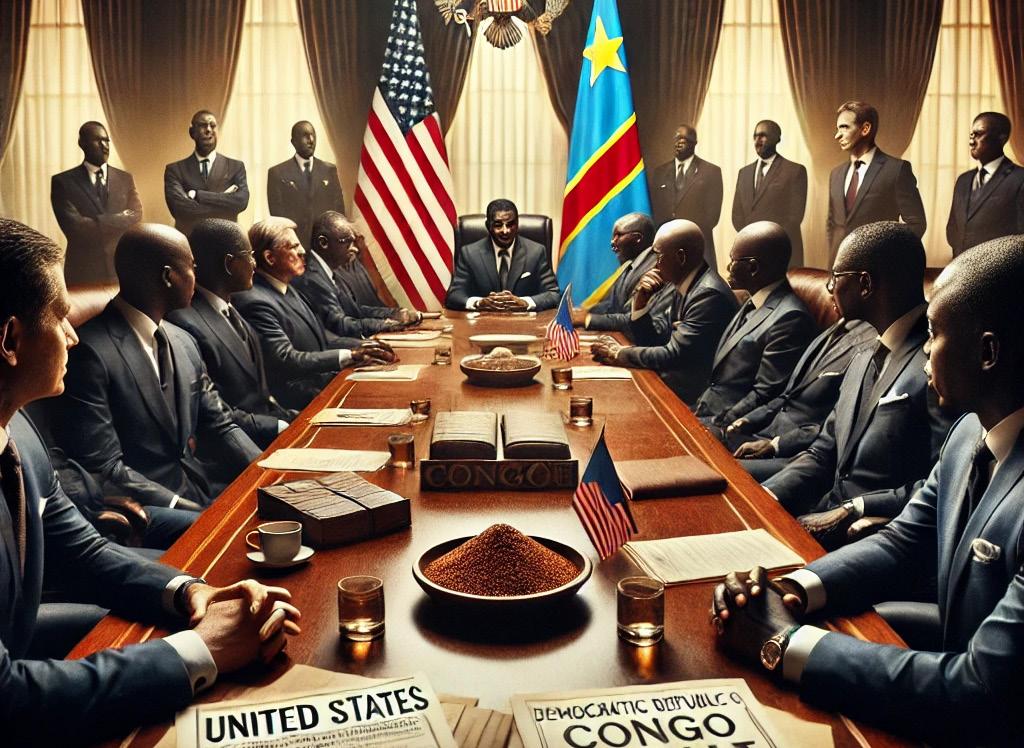

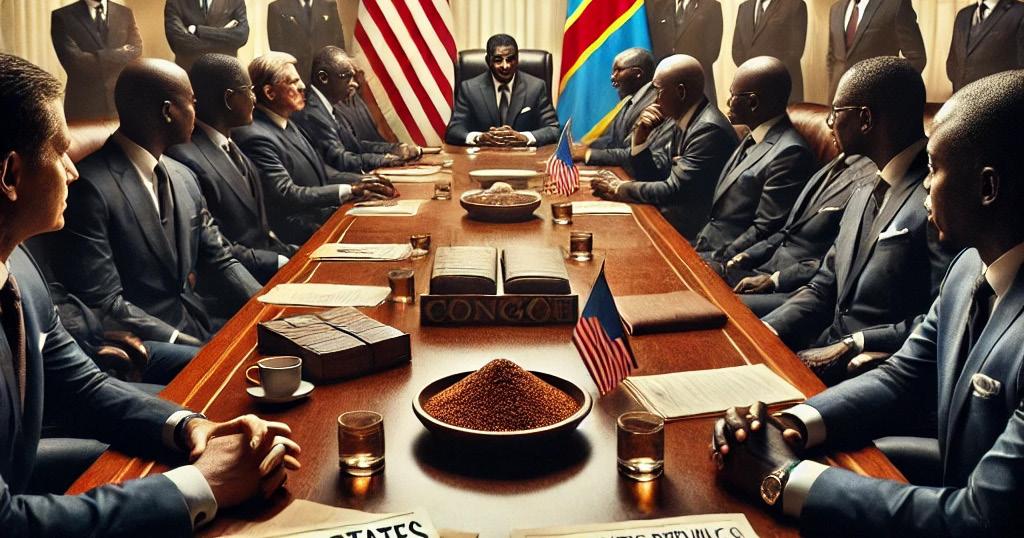

Congo’s mineral deal with the U.S. triggers activist backlash amid concerns over sovereignty and shifting U.S. foreign policy in Africa. A secretive mineral-for-security agreement reportedly under negotiation between the Democratic Republic of Congo (DRC) and the United States is sparking outrage among Congolese activists, who warn it risks entrenching foreign control at a critical moment for the country’s sovereignty.

Aproposed mineral agreement between the United States and the Democratic Republic of Congo (DRC) is drawing global scrutiny. First revealed by Reuters on April 17, the deal would grant U.S. firms priority access to Congo’s cobalt and copper reserves in exchange for military support.

Behind the scenes: Erik Prince—founder of Blackwater and a name synonymous with controversial military ventures.

This initiative signals a shift in U.S. foreign policy, aimed at securing essential minerals for electric vehicles and clean energy tech.

Yet many in Kinshasa warn this reflects the past more than progress.

Home to over 60% of the world’s cobalt and vast lithium, copper, and gold reserves, the DRC is essential to the global energy transition. But in its eastern provinces, violent conflict persists, driven by armed groups like M23—allegedly supported by Rwanda and Uganda, both U.S. allies.

“This deal isn’t about development,” says activist Kambale Musavuli. “It’s about locking down American access to our resources.”

Over 6.9 million Congolese are displaced—a record underscoring the failures of current foreign-led security models.

The opaque negotiation process has outraged Congolese lawmakers and civil society groups. “Mineral rights belong to the people, not presidents,” says constitutional scholar Nelly Mbangu. “Parliament’s exclusion violates democratic oversight.”

The DRC Constitution requires public accountability for resource deals—absent here. Critics warn the agreement could face future legal and political challenges.

Erik Prince’s

Prince’s involvement raises red flags. Linked to war crimes in Iraq, he has long pushed for private security in conflict zones—from Afghanistan to Somalia.

“Letting Prince near our minerals is a betrayal,” says Stewart Muhindo of LUCHA.

While Washington aims to curb Chinese influence, experts like Dr. Amelia Morgan ask: “Is this about African sovereignty— or securing cobalt at any cost?” Mali, Niger, and Burkina Faso are reclaiming their resources. Musavuli is blunt:

“Congo must assert its sovereignty. Or risk losing it—again.”

Vedanta Resources is charting a new course to finance its African mining ambitions, exploring a Vedanta IPO that could raise up to $1 billion to develop Konkola Copper Mines (KCM).

Vedanta Resources is preparing to raise up to $1 billion through a U.S. IPO, aimed at scaling up its operations at Zambia’s Konkola Copper Mines (KCM). The UK-based company, led by Indian billionaire Anil Agarwal, has enlisted Barclays and Citigroup as advisors. The listing, still in early planning stages, marks a renewed push to capitalize on soaring demand for clean energy minerals.

KCM is central to Vedanta’s African strategy. With some of the world’s highest-grade copper reserves and 400,000 tonnes of cobalt, the mine is critical to meeting global needs for electric vehicles and renewable energy infrastructure.

VEDANTA Resources is preparing a $1 billion U.S. IPO to expand its copper and cobalt operations in Africa, centering on Zambia’s prized Konkola Copper Mines.

Following a years-long legal dispute with Zambia’s government, which placed KCM under provisional liquidation in 2019, Vedanta regained operational control in 2023. Since then, the company has cleared supplier debts, resumed community investments, and outlined plans to boost copper output to 300,000 tonnes annually within five years.

To strengthen its U.S. appeal, Vedanta has formed Global Transition Resources, a new American entity focused on African copper, cobalt, and gold. Whether KCM will be folded into this unit remains to be seen.

Although Vedanta previously pursued a private sale with UAE-based International Resources Holding, the talks collapsed. Now, a public offering appears to be its best path forward. If successful, the IPO could signal a turning point in African mining investment—anchored in critical minerals and the accelerating clean energy transition.

Macro Metals secures mining services contract for Extension Iron Ore Project in WA, expanding its Pilbara operations and integrating supply chain control.

Macro Metals has secured a life-of-mine contract to deliver services at a new iron ore project in WA, strengthening its position as a vertically integrated player in Western Australia’s mineral export market.

The deal—signed through its subsidiary, Macro Mining Services (MMS)—grants the company exclusive rights to carry out technical services, mining operations, and processing at the Extension Iron Ore Project, located near Port Hedland in the resource-rich Eastern Pilbara.

Project Rusty, a privately held firm, owns the tenement and has appointed RE:GROUP as the primary mining contractor. MMS will partner with RE:GROUP under a build-own-operate (BOO) model, positioning Macro to influence every phase of the mine’s supply chain.

“This life-of-mine mining services contract with RE:GROUP locks in revenue and margins for our business,” said Macro Director Simon Rushton. “It creates a very solid foundation for the contracting order book we are currently building.” The Extension project covers 27.6km² and holds an indicated mineral resource of 16.1 million tonnes at 54.2% iron.

PNNL unveils a cobalt alternative alloy using manganese, aiming to reduce U.S. reliance on Chinasourced cobalt for nuclear and aerospace tech.

Ateam at Pacific Northwest National Laboratory has developed a cobalt alternative alloy that could shift the balance in global energy and defense supply chains.

Designed to replace cobalt—a critical material largely sourced from China—the manganese-based alloy shows potential for use in nuclear reactors, turbines, and aerospace components. A government research team has developed a cobalt alternative alloy that may help the United States sidestep one of its most persistent supply chain vulnerabilities: dependence on China for cobalt, a metal essential to high-performance components in energy and aerospace applications.

Scientists at the Department of Energy’s Pacific Northwest National Laboratory (PNNL) engineered a new alloy that swaps out cobalt for manganese. The development could lessen U.S. exposure to volatile global cobalt markets and advance domestic clean energy efforts, particularly in the nuclear sector.

“More researchers must realize the opportunities to reduce or replace critical materials that are on the supply risk list,” said Isabella van Rooyen, senior technical advisor for advanced material systems at PNNL. “This allows us to move faster during manufacturing while maintaining performance requirements.”

Cobalt is a key ingredient in nickel-based superalloys, valued for its ability to withstand extreme heat and stress. These alloys are essential in nuclear reactors, jet turbines, and space vehicles—sectors where material failure is not an option.

More than 75% of the world’s refined cobalt is controlled by China, most of it mined in the Democratic Republic of Congo.

The cobalt alternative alloy developed at PNNL replaces cobalt with manganese, a more abundant and domestically available element. Manganese offers similar thermal stability and corrosion resistance, making it a promising substitute in environments like next-generation reactors and aerospace engines.

Rather than relying exclusively on lab experiments, the PNNL team used advanced computational modeling to simulate various alloy compositions. These simulations identified manganese as a prime candidate for replacing cobalt without sacrificing mechanical integrity. To fabricate the alloy, researchers employed two techniques: Conventional casting for baseline comparison and riction stir consolidation, a modern process that uses frictional heat and pressure to customize the alloy’s microstructure without melting it.

A new peer-reviewed study published in PLOS ONE warns that deep sea mining risks may significantly outweigh the economic rewards, highlighting the profound environmental impact of DSM on fragile marine ecosystems and coastal communities.

Anew peer-reviewed study published in PLOS ONE warns that deep sea mining risks may significantly outweigh the economic rewards, highlighting the profound environmental impact of DSM on fragile marine ecosystems and coastal communities.

As demand for critical minerals— such as cobalt, nickel, and rare earth elements—soars in the electronics and renewable energy sectors, this study urges a re-evaluation of mining the ocean floor.

The research centers on one critical question: Can the extraction of seabed minerals be justified when weighed against the ecological damage it causes?

Using a Fuzzy Cognitive Mapping (FCM) model, the study assessed how different risks—environmental, economic, and social—interact in deep sea mining (DSM) scenarios. The analysis revealed that environmental factors have the highest centrality in the risk network, demonstrating how pivotal they are to the entire DSM equation.

In scenarios involving DSM, environmental risks increased by 13% compared to land-based mining. The most pressing concerns include:

• Irreversible biodiversity loss

• Habitat destruction in underexplored deep-sea zones

• Long-term pollution from sediment plumes and mining discharge

“These ecosystems recover over centuries, not decades,” the study notes.

“Disruption from mining may result in damage that outlasts the technologies it seeks to enable.”

Beyond ecological concerns, the study underscores significant socio-economic risks—particularly for coastal nations and communities that depend on marine ecosystems for their livelihoods.

The study documents:

• An 8% to 11% increase in social risks, including reduced participatory rights and potential violations of national and international laws.

• An 11% uptick in economic risks, such as breaches in mining contracts and intergovernmental disputes.

“These communities may not benefit from the revenues generated but will certainly bear the brunt of the fallout,” said Dr. Lina Herrera, a marine policy analyst not involved in the study. In its final phase, the study shifts the spotlight to solutions—particularly those anchored in the circular economy. Instead of mining the ocean floor, the authors recommend:

• Urban mining (recovering materials from electronic waste)

• Enhanced recycling infrastructure

• Stronger regulations on e-waste exports

The Trump administration’s tariffs are accelerating China’s push for technological self-reliance and the creation of a Beijing global economic zone, reshaping the future of global trade and standards.

The re-election of Donald Trump has reignited an economic confrontation with China that’s triggering tectonic shifts in the global technological landscape. At the center of these changes is what analysts now call the Beijing global economic zone — a self-sustaining ecosystem of technology, supply chains, and standards, driven by China and untethered from U.S. dominance.

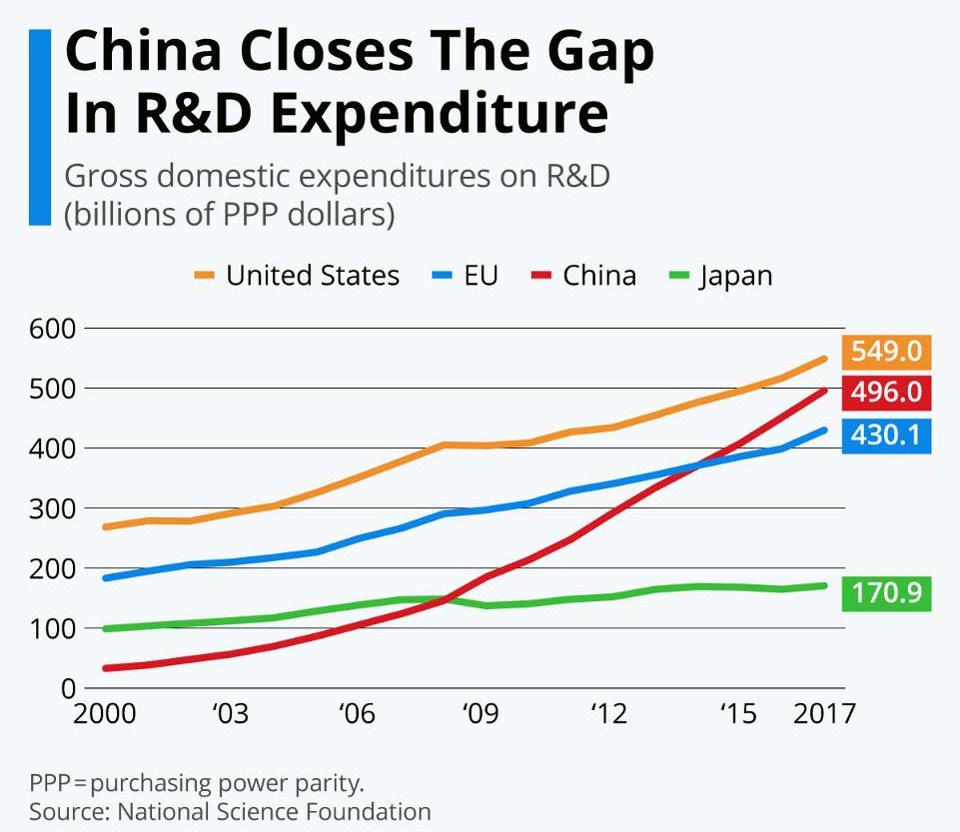

According to the China Tech 2025 report by GlobalData, Beijing is rapidly constructing an independent, innovation-led economic sphere as a direct response to Washington’s latest wave of tariffs.

“Oil was the control point of the last century, and data will replace it in the 21st,” the report notes. “China will have more of this fuel than any other country.”

The Beijing global economic zone refers to a new, China-led framework of global trade and technology standards. It is being engineered to insulate China from Western sanctions and enable its leadership in critical technologies including:

• Artificial Intelligence

• Robotics

• Internet of Things (IoT)

• Genomics and biotech

• Space-based networks

The initiative is underpinned by China Standards 2035, a 15-year blueprint to set international norms and technical protocols in emerging technologies. It is China’s bid not just to catch up, but to control how future innovations operate — and who profits from them.

Since taking office in January 2025, President Trump has doubled down on economic pressure, introducing a new suite of tariffs targeting key sectors of Chinese tech: semiconductors, EV batteries, and AI hardware. While these measures have created short-term disruptions for Chinese exporters, they’ve also accelerated Beijing’s drive toward full technological self-sufficiency.

China’s response? A blend of retaliatory tariffs, rare earth mineral export controls, and a five-fold increase in subsidies for domestic tech firms. “Trump’s tariffs have only hardened China’s resolve,” said Elsa Kania, a senior fellow at the Center for a New American Security. “They’ve fueled a shift from integration to insulation.”

As the U.S. and China race to dominate the Fourth Industrial Revolution, they

are also pulling the world into competing spheres of influence.

While Washington attempts to shore up supply chains with allies in Europe and the Indo-Pacific, China is deepening its ties across the Global South — especially in Africa, Latin America, and Southeast Asia.

For multinational firms, this bifurcation poses a serious challenge: How to navigate two different technology stacks, regulatory environments, and geopolitical allegiances?

“This isn’t Cold War 2.0 — it’s economic Darwinism,” said Susan Shirk, Chair of the 21st Century China Center at UC San Diego. “And the Beijing global economic zone is evolving faster than most expected.”

The GlobalData report flags several unintended consequences of this divide:

• Severed supply chains are raising costs for manufacturers across Asia and the U.S.

• Global skills shortages — particularly in AI, chip design, and advanced manufacturing — are reaching critical levels.

• Standard fragmentation may force smaller economies to pick sides, undermining global interoperability.

Despite the risks, Beijing is pressing forward. The Beijing global economic zone is not just reactive — it is strategic. It is reshaping the rules of engagement for trade, technology, and power.

The Trump administration may have hoped to hobble China’s tech ascent through tariffs. Instead, it has triggered a shift that could prove enduring. China’s Beijing global economic zone isn’t just a defensive response — it’s a blueprint for a new world order where Beijing writes the rules, controls the data, and exports the infrastructure.

“The Fourth Industrial Revolution won’t be borderless,” said Matthew Bey, senior global strategist at RANE. “It’ll be defined by who owns the platforms — and right now, China is building its own.”

One of the defining features of the Beijing global economic zone is China’s strategic investment in digital infrastructure abroad.

Through initiatives like the Digital Silk Road and state-backed firms such as Huawei and Hikvision, China is laying the groundwork for data ownership and influence in developing nations. These networks, spanning from smart cities in Africa to surveillance systems in Latin America, give Beijing unprecedented access to data flows outside its borders.

Moreover, China is rapidly forging tech alliances that bypass U.S.-dominated institutions. Regional pacts on digital currency interoperability, cross-border e-commerce, and joint semiconductor R&D are solidifying a parallel global system.

Analysts warn that if this trend continues, future innovation ecosystems could be split not only by ideology but by incompatible technical backbones — forcing global firms into a binary choice.

Europe’s efforts to reduce its reliance on China for critical minerals are being undercut by steep cost disadvantages, casting doubt over the continent’s ability to meet soaring rare earth demand by the end of the decade. At the center of the issue is the growing gap between Europe rare earth production capabilities and the projected rare earth elements demand by 2030, largely driven by the rapid scale-up of electric vehicles and wind energy.

Europe is expected to produce less than 5,000 metric tons of rare earth oxides annually by 2030, according to Bain & Company. That is a fraction of the 30,000 metric tons the continent is projected to require by that year—a 50% increase from current levels.

“Today there’s a cost gap of 20% to 40% between a value chain in China and a potential value chain in Europe,” said Laurent Migom, a partner at Bain. “And that is why we do not expect sufficient permanent magnet making in Europe in the current environment.”

This shortfall could jeopardize Europe’s clean energy goals, as permanent magnets made from rare earths like neodymium and praseodymium are vital to powering electric motors and turbine generators.

The economic challenge is stark. China accounts for 65% of global rare earth mining and nearly 90% of global processing. According to industry sources, Chinese

output, just 6,000 tons would be suitable for magnet manufacturing—further tightening supply.

The expected jump in rare earth elements demand by 2030 is being driven by the continent’s aggressive push toward decarbonization. The EU’s Green Deal and growing bans on internal combustion engine vehicles are set to accelerate EV adoption. Meanwhile, wind energy capacity is forecast to expand by 60% across the bloc by 2030. That creates a €1.5 billion annual market for rare earth oxides by the end of the decade,

rare earth products are not just cheaper—they’re sometimes 60% to 70% less expensive than those made in Europe.

This pricing pressure is making it nearly impossible for European projects to compete. Bain’s data shows that of the 50 mining initiatives outside China targeting production by 2030, only two to five are expected to be financially viable under current rare earth prices. Of the expected

one that Europe is ill-prepared to meet domestically.

Chemical giant Solvay is attempting to fill part of that gap. At a recent event in La Rochelle, France, the company launched an expansion of its rare earth processing facility. It hopes to supply 30% of Europe’s rare earth needs by 2030, but

acknowledges that support from both policymakers and downstream buyers—such as automakers and turbine manufacturers—will be critical.

Solvay’s effort reflects a broader push under the EU’s Critical Raw Materials Act, which sets a goal for Europe to mine 10%, process 40%, and recycle 25% of its own critical materials by 2030.

Still, industry experts remain skeptical that meaningful progress can be made without stronger price support or state incentives.

While recycling rare earths from endof-life magnets is a long-term solution, it won’t make a dent this decade. “We won’t see meaningful recycled volumes until after 2035,” Migom noted, adding that most EVs and wind turbines on the road today won’t reach end-of-life until then.

The widening gulf between Europe rare earth production and the continent’s rapidly increasing demand poses a risk to its clean energy transition. While investments like Solvay’s expansion are steps in the right direction, the dominance of Chinese suppliers continues to undercut the economic viability of new European projects.

Without aggressive intervention—from subsidies to tariffs to coordinated procurement—Europe is unlikely to close the gap in time to meet its 2030 targets.

Unless Europe takes bold, coordinated action—through subsidies, strategic procurement, and stronger industrial policy—it risks replacing its reliance on fossil fuels with a new dependency on China for the critical raw materials that underpin its clean energy future.