Bailout Talks

Unfold: Rio Tinto’s Tomago Plant in Limbo

Fed Rate Cuts

Could Anchor Gold in Second Half of 2025

Bailout Talks

Unfold: Rio Tinto’s Tomago Plant in Limbo

Fed Rate Cuts

Could Anchor Gold in Second Half of 2025

Canada Rises, the U.S. Stalls, and Mexico Waits: In 2025, Canada, the United States, and Mexico stand at a crossroads.

Will Gold Rebound as Israel-Iran Tensions Ease? MINERAL BREAKTHROUGH China’s Rubidium Breakthrough Redefines Global Supply Chains

Geochemical Scanning Challenges Decades of Kimberlite Theory

Continuous geochemical scanning is forcing geologists to revisit long-held assumptions about kimberlite formation. At a De Beers site, petrologist Alexandrina Fulop watched her magmatic pulse hypothesis collapse.

Skillings Mining Review of CFX Network LLC, publishes comprehensive information on global mining, iron ore markets and critical industry issues via Skillings Mining Review Monthly Magazine and weekly. SMR Americas, Global Skillings and Skilling Equipment Gear newsletters.

Skillings Mining Review (ISSN 0037-6329) is published monthly, 12 issues per year by CFX Network, 350 W. Venice Ave. #1184 Venice, Florida 34284. Phone: (888) 444 7854 x 4. Printed in the USA.

Payments & Billing: 350 W. Venice Ave. #1184, Venice, FL 34284. Periodicals Postage Paid at: Venice, Florida and additional mail offices.

Postmaster: Send address changes to:

SKILLINGS MINING

Digital Monthly Magazine 12 issues

Paywall-free website experience

Digital archive back to 1912

Skillings video stories and podcasts

Subscriber-only newsletter

Rich multimedia contentData, Photographs and Visuals

Access paperless reading across multiple platforms. Portable, carry with you, anytime, anywhere

UNITED STATES

$72 Monthly in US Funds

$109 Monthly in US (Funds 1st Class Mail)

OUTSIDE OF THE U.S.A.

$250 US Monthly for 7-21 day delivery

$335 US Monthly for Air Mail Service All funds are monthly

Skillings mining review, 350 W. Venice Ave. #1184, Venice, Florida 34284.

Phone: (888) 444 7854 x 4.

Fax: (888) 261-6014.

Email: Advertising@skillings.net.

PUBLISHER CHARLES PITTS chas.pitts@skillings.net

EDITOR-IN-CHIEF JOHN EDWARD john.edward@skillings.net

CONTRIBUTING EDITORS ROB RAMOS AALIYAH ZOLETA MARIE GABRIELLE

MEDIA PRODUCTION STANISLAV PAVLISHIN media.team@ cfxnetwork.com

MANAGING EDITOR SAKSHI SINGLA sakshi.singla@skillings.net

CREATIVE DIRECTOR MO SHINE mo.shine@skillings.net

DIRECTOR OF SALES & MARKETING CHRISTINE MARIE advertising@skillings.net

MEDIA ADMINISTRATOR SALINI KRISHNAN salini.krishnan@ cfxnetwork.com

PROFILES IN MINING mining.profiles@skillings.net

GENERAL CONTACT INFORMATION info@cfxnetwork.com

CUSTOMER SERVICE/ SUBSCRIPTION QUESTIONS: For renewals, address changes, e-mail preferences and subscription account status contact Circulation and Subscriptions: subscriptions@Skillings.net. Editorial matter may be reproduced only by stating the name of this publication, date of the issue in which material appears, and the byline, if the article carries one.

In the Nevada desert near Tonopah, American Battery Technology Company has secured a $900 million Letter of Interest from the U.S. ExportImport Bank to develop a largescale lithium project.

The initiative aims to produce 33,000 tons of battery-grade lithium hydroxide annually—enough for 500,000 electric vehicles—and reduce America’s dependence on Chinese refining. “This proposed financial support can greatly accelerate commercialization,” said ABTC CEO Ryan

Melsert. The project reflects federal policy shifts, including a recent executive order prioritizing domestic lithium as a strategic asset.

While the economic promise is significant—over 300 permanent jobs and new investment—uncertainty remains. Claystone lithium extraction has never been proven at commercial scale, raising questions about technical execution and permitting.

“This is promising but must deliver consistent volumes,” said Simon Moores of

Benchmark Mineral Intelligence. For automakers, localized supply could lower costs and carbon emissions, shielding the industry from geopolitical risks.

ABTC plans to break ground in 2026, though full production could take years. Success would establish Nevada as a key hub in the battery supply chain.

“This is about more than one company,” said Emily Hersh of Luna Lithium. “It’s about whether the U.S. will invest in raw materials to power electrification.”

Rajani Modiyani, one of Chevron’s leading experts in the mining sector, answered eight pressing questions from owners and managers in the industry. Scan the QR code for the full Q&A.

President Yoweri Museveni of Uganda has officially inaugurated the Uganda National Mining Company (UNMC), a state-owned enterprise designed to take a significant stake—up to 15%—in all medium and large-scale mining projects nationwide. This initiative was announced during the recent State of the Nation Address in Kampala.

The primary aim of UNMC is to ensure Ugandans benefit directly from the country’s mineral wealth while still attracting foreign investment.

The Ugandan government plans to invest UGX 500 billion (approximately $130 million) into the company over the next five years, to improve oversight, enhance revenue generation, and promote technology transfer.

Uganda is rich in valuable minerals, including gold, iron ore, lithium, graphite, rare earth elements, and limestone. De-

spite this abundance, most minerals have traditionally been exported in raw form, which has limited the country’s ability to benefit from value addition, job creation, and industrial growth.

President Museveni highlighted recent progress in gold refining and steel production, signaling a shift towards more processing domestically.

Currently, Uganda has ten operational gold refineries producing high-purity gold (up to 99.9%), with Chinese company Wagagai Gold playing a major role in Busia. The government is also working to formalize artisanal mining communities.

To improve sector governance, Uganda is completing a modern mineral testing laboratory in Entebbe, which will ensure exports meet international quality standards.

Downstream developments include the operation of three cement factories (in Tororo, Hima, and Simba), the construction of a new tin smelter in Mbarara, and plans for additional cement plants in Karamoja, home to large limestone deposits.

highlighted recent progress in gold refining and steel production, signaling a shift towards more processing domestically.

The creation of UNMC mirrors the model of the Uganda National Oil Company (UNOC), reflecting a strategic move by the government to retain a significant stake in resource exploitation.

As global demand for critical minerals like lithium and rare earths grows—driven by the shift toward clean energy— Uganda’s efforts position the country to participate more actively in international supply chains and foster sustainable economic development.

At ME Elecmetal, we understand that success requires a balance of high quality products and services, advanced technologies, and dedicated client support. By combining wear parts with advanced digital tools, expert guidance, comprehensive training, and ongoing monitoring, we deliver substantial value to our customers.

Discover the possibilities with ME Elecmetal and unlock the full potential of your mining operations. Together, we’ll ensure optimal performance, efficiency, and success in every aspect of your processes.

Grinding Mill Liners

• Iron • Steel

Rubber

Composite

Grinding Media

• SAG Mills: 4.0” to 6.5”

• Ball Mills and Regrind Mills: 7/8” to 4.0”

Crusher Wear Parts

• Rod Mills: 3.0” to 4.0” Diameter • Gyratory Crushers

Cone Crushers

Jaw Crushers

Rio Tinto in bailout talks with Australian government over its Tomago aluminium smelter. Power costs, tax credits key to survival. Read the full story.

The fate of Rio Tinto’s Tomago aluminium smelter in New South Wales is hanging in the balance as the mining giant holds advanced bailout talks with both federal and state governments, according to people familiar with the matter.

The discussions centre on a potential multibillion-dollar package of energy price relief and federal production tax credits aimed at keeping Australia’s largest aluminium plant operational amid surging power costs.

“This is a strategically important asset, but one that is no longer competitive under current electricity market conditions,” said a senior Australian government official involved in the talks.

Rio Tinto declined to comment on the specifics of the negotiations but confirmed it is “working collaboratively with all levels of government to ensure a sustainable path forward for Tomago.”

Tomago, majority-owned by Rio Tinto alongside joint venture partners, produces about 25% of Australia’s primary aluminium.

But the plant, like other aluminium smelters globally, is highly exposed to

electricity prices—energy accounts for roughly 40% of its production costs. With Australian wholesale power prices soaring to record levels—averaging A$213 per MWh last quarter, according to the

Federal officials are exploring options including tax credits modelled after the U.S. Inflation Reduction Act, which in-

Australian Energy Regulator—Tomago has struggled to maintain profitability.

“The economics simply don’t stack up without intervention,” said David Leitch, principal at energy consultancy ITK Services.

“Without long-term affordable power contracts, closure is a real risk.”

centivises domestic metal production for critical supply chains.

“This isn’t about corporate welfare,” said Senator Tim Ayres, Assistant Minister for Manufacturing. “It’s about preserving Australian industrial capability at a time of global supply chain volatility.”

However, critics argue public subsidies for a carbon-intensive industry run counter to Australia’s climate goals. “Aluminium smelters are among the largest single consumers of coal-fired power,” said Suzanne Harter of the Australian Conservation Foundation. “Public funds should be directed toward clean energy, not propping up legacy polluters.”

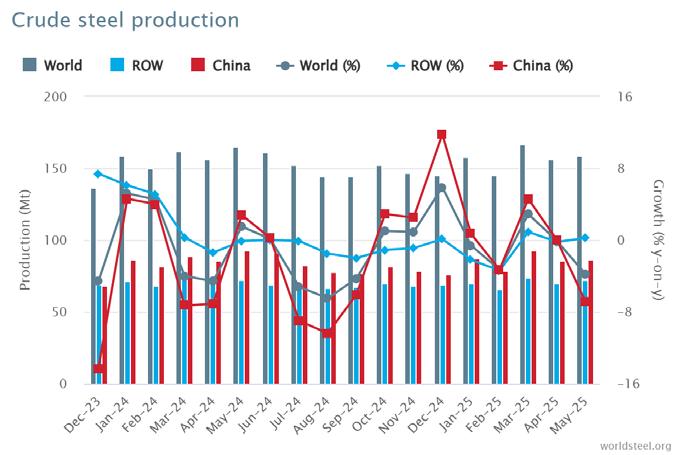

The bailout talks come as global aluminium markets remain in flux. China has expanded low-cost production, while European smelters have shuttered capacity amid the continent’s energy crisis.

“Tomago’s competitiveness must be viewed in a global context,” said Laura Brooks, metals analyst at CRU Group. “Without intervention, Australia risks losing its foothold in an increasingly consolidated aluminium market.” Benchmark aluminium prices on the London Metal Exchange recently rose to $2,490 per metric ton, driven partly by supply disruptions in Europe.

A decision on the Tomago package is expected before the end of Q3, according to people familiar with the talks. Industry players warn delays could accelerate workforce attrition and supply chain impacts.

The World Bank, in a recent metals outlook, cautioned that government interventions must balance industrial resilience with climate commitments: “Decarbonisation pathways must be considered alongside competitiveness concerns.”

For Rio Tinto, the outcome could shape its broader Australian strategy. The company has already shuttered its Gove alumina refinery in the Northern Territory and faces growing ESG scrutiny from investors.

“This is a test case for the future of heavy industry in a decarbonising Australia,” said Professor Samantha Hepburn, energy law expert at Deakin University. “The decisions made here will echo across the economy.”

President Donald Trump is invoking the Defense Production Act to accelerate U.S. production of critical minerals, a strategic move aimed at enhancing national security and securing leadership in the global green energy race.

The action, part of the emerging Trump critical minerals policy, comes amid rising concerns about U.S. dependence on foreign sources—particularly China—for minerals such as lithium, cobalt, nickel, and rare earth elements. These materials are essential for both military applications and advanced clean energy technologies.

“The United States must end its dangerous reliance on foreign adversaries for these vital materials,” Trump stated

this week, outlining a policy designed to reshape U.S. industrial capacity through targeted federal action under the Defense Production Act.

Under the Defense Production Act, which empowers the president to prioritize industrial production for national defense, the federal government will now support domestic mining and processing of critical minerals through funding,

fast-track permitting, and public-private partnerships.

The U.S. Geological Survey reports that more than 80% of U.S. rare earth imports currently originate from China, which dominates the global market. National security experts have repeatedly warned that this leaves U.S. defense systems exposed to potential supply disruptions.

“Critical minerals are foundational to everything from precision-guided munitions to electric vehicle batteries,” said a senior Department of Defense official. “This initiative under the Defense Production Act is essential to safeguarding our national security.”

Beyond defense, the Trump critical minerals policy is intended to future-proof America’s clean energy ambitions. Demand for minerals like lithium and cobalt is surging due to their role in electric vehicle batteries, wind turbines, and solar panels.

According to the International Energy Agency, demand for these critical miner-

als could quadruple by 2040 as countries worldwide push for decarbonization. The U.S. risks losing its competitive edge without a secure domestic supply chain.

“This is about American leadership in the industries of the future,” said an official with the Department of Energy’s Critical Materials Institute.

“The Defense Production Act provides a powerful tool to scale up domestic capacity and reduce dependence on geopolitically unstable sources.”

U.S. mining firms welcomed the announcement as a long-awaited catalyst for new investment. “Invoking the De-

fense Production Act is a game-changer,” said the CEO of a major American mining company. “It signals that the federal government is serious about building a robust domestic critical minerals sector.”

However, environmental groups urged caution. “We must ensure that expanded mining under the Trump critical minerals policy does not undermine environmental protections,” said a representative from the Natural Resources Defense Council. “There is a way to balance security needs with sustainable practices.”

Trump’s use of the Defense Production Act marks a pivotal escalation in U.S.

efforts to secure supply chains for critical minerals. Key next steps include identifying priority projects, streamlining regulatory approvals, and expanding public-private partnerships across the mining, processing, and manufacturing sectors.

As the global race for critical minerals intensifies, this bold application of the Defense Production Act could position the U.S. to reduce strategic vulnerabilities while accelerating the transition to a clean energy future.

The unfolding Trump critical minerals policy is set to have lasting implications for both U.S. security and economic competitiveness in the years ahead.

Early monsoon rains across India have offered a reprieve from the summer’s searing heat but have simultaneously upended state-owned mining behemoth Coal India’s strategy to reduce its substantial coal inventories. The unexpected damp weather has curbed electricity demand, leaving the company with record-high stockpiles and diminishing its ability to command premium prices.

The confluence of sustained high coal inventories, increasing competition from renewable energy sources, and growing output from other miners is challenging Coal India’s dominance and eroding the massive profit margins it enjoyed just a few years ago.

“Coal India’s growth window is narrowing,” said Rupesh Sankhe, senior vice president for research at Elara Capital India. He pointed to the accelerating adoption of renewable energy, emerging energy storage projects, and a renewed governmental push for nuclear power as factors that will increasingly pressure demand for coal.

The Kolkata-based miner has been grappling with an unsold inventory exceeding 100 million tons since the fiscal year began in April. Meanwhile, coal stockpiles at power stations - Coal India’s primary customers—have swelled by nearly a third from a year earlier, reaching over 58 million tons, the highest level in 17 years of record-keeping.

This supply glut is directly impacting the premiums Coal India can fetch in auctions, a critical component of its earnings. In 2022, when a post-pandemic economic rebound fueled coal shortages, customers were willing to pay premiums of more than 300% above baseline prices.

That margin has since plummeted to 43% and could potentially slide further to 30%, according to marketing director Mukesh Choudhary, who shared the outlook on a recent investor call.

THIS SUPPLY GLUT IS directly impacting the premiums Coal India can fetch in auctions, a critical component of its earnings.

The softened demand and abundant supply are casting a shadow over the company’s prospects. India’s coal-fired electricity generation saw a 6% decline year-on-year during the first two months of the current fiscal year.

Peak electricity consumption for the year remains more than 10% below February projections and over 5% short of last year’s maximum. Unless heat waves this

month trigger a drastic surge in power usage, this fiscal year could mark the first annual decline in coal demand in at least two decades.

Further complicating matters for Coal India is the rise of other domestic players. A growing number of companies are not only mining coal for their own plants but also increasingly pushing surplus production into the open market. NTPC, India’s largest power producer and a significant coal consumer, aims to nearly double its own coal production to 50 million tons this fiscal year and is actively seeking to source more fuel from non-state entities.

These independent producers are capturing a larger share of India’s coal output, having mined 198 million tons in the year through March, roughly a fifth of the nation’s total.

This trend is expected to weigh on Coal India’s sales. While Mr. Sankhe anticipates the miner’s volumes could grow by as much as 5% annually for the next three to four years, he projects a decline thereafter.

He contends that the increased competition will offset any gains from higher volumes, signaling that Coal India’s profit has likely peaked.

GLOBAL IRON ORE PRODUCTION REPORT

Iron ore is no longer just a commodity—it’s becoming a strategic pillar of decarbonization and supply chain realignment. From Guinea’s Simandou breakthrough to Australia’s green iron pivots, the industry is redefining value through technology, provenance, and emissions performance. While prices soften, premiums for high-grade, low-carbon ore are reshaping trade flows and investment priorities. Our 2025 report examines the new dynamics transforming iron ore into the backbone of green steel and industrial sovereignty.

AUSTRALIA AND BRAZII TOGETHER DOMINATE WORD'S IRON ORE EXPORTS, EACH HAVING ABOUT ONE-THIRD OF TOTAL EXPORTS

(Data Source: Usgs)

2025 is proving to be a turning point in global iron ore. While prices soften, power dynamics harden - from Guinea’s long-awaited Simandou breakthrough to Western Australia’s green-tech pilot lines. The industry is redefining itself not just by tonnes, but by technology, traceability, and trade tensions.

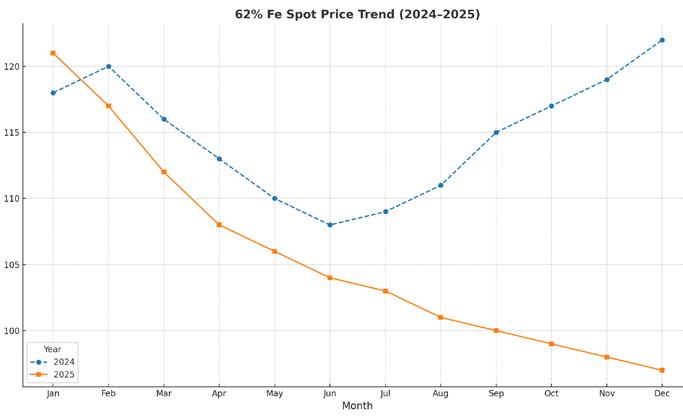

Iron ore production worldwide is poised to exceed 2.65 billion tonnes by year’s end—up 1.2% YoY—despite a cooling of spot prices, which fell to $104/tonne for 62% Fe in June, an 18% decline yearover-year. But volume alone no longer defines market success. Today, purity, provenance, and process emissions are just as critical.

Guinea’s Simandou finally nears export readiness with 100 Mt/year capacity, as Chinese-backed infrastructure nears completion. Yet, local instability threatens consistent delivery.

Simandou (Guinea): A geopolitical keystone for China, the $15B+ investment highlights Beijing’s plan to outflank Australian-Brazilian dominance. Cameroon’s Grand Zambi project began exports in June 2025, aiming at Indian and European buyers.

Fortescue’s shift to low-carbon iron marks a historic evolution for the Pilbara. Fenix Resources commenced Beebyn-W11 mining with strict cost controls and logistics efficiency.

Champion Iron’s Bloom Lake Phase II runs at 95% capacity, producing ultra-high-grade 66.2% Fe concentrate powered by Québec hydro. Nippon Steel’s Canadian JV, now in prefeasibility, could herald Japan’s industrial hedging away from Chinese-Australian sources.

Cleveland-Cliffs dominates domestic taconite but faces zero expansion; aging assets and policy inertia are choking growth. Mesabi Metallics is stalled amid lease disputes in Minnesota—despite a proposed 7 MTPA pellet plant.

AHMSA, in restructuring, is eyed by U.S. steelmakers to build a tariff-free North American steel corridor under USMCA, pending acquisition clarity.

Australia, led by Fortescue’s green iron pilot at Christmas Creek, is pivoting from raw exports toward ESG-aligned midstream processing. India’s Lloyds Metals prepares a leap to 25 Mtpa at Surjagarh, aligning with Prime Minister Modi’s “Iron for Infrastructure” campaign, though security concerns linger.

Buyers, especially in the EU, now demand green steel feedstocks—low in impurities and produced with mini-

mal emissions. Canada and Australia lead; Brazil and India face scrutiny over tailings.

Direct Reduced Iron (DRI) and Hot Briquetted Iron (HBI) are reshaping how iron reaches steelmakers. Fortescue and Champion are early movers; ArcelorMittal is expanding vertically.

Red Sea disruptions and infrastructure gaps in West Africa pushed shipping costs up 11% YoY. Guinea’s proximity to political unrest and China’s dominant stake in rail pose mid-term supply threats.

Simandou and Cameroon exports will ease supply pressure, keeping 62% Fe between $90–$105/tonne through late 2025. ESG-compliant ore is already fetching a premium, with EU buyers offering up to 15% more for low-carbon concentrates.

Watch Fortescue, Champion, and Simandou. They define the axes of power in green steel inputs. Follow Nippon Steel’s Canadian investment - a potential template for East Asian decoupling. Monitor U.S. permitting reform. Without it, the nation’s strategic autonomy in steel is fiction.

Iron ore has always been essential to industrial economies—but in 2025, it has become a strategic enabler for low-carbon steel, supply chain sovereignty, and industrial decoupling.

This shift isn’t theoretical. It’s visible in:

• Japan’s strategic joint ventures in Canada.

• India’s central government directives prioritizing domestic ore for infrastructure.

• U.S. legislative focus on electric arc furnaces (EAF) over blast furnaces— de-emphasizing iron ore altogether unless it’s tied to low-emission value chains.

Champion Iron (Canada) has the ESG edge: 66% Fe, low impurities, and hydro-powered operations. Fortescue (Australia) leads in R&D, pioneering green iron but still heavily reliant on hematite exports and fossil-intensive rail.

Advantage: Canada in ESG metrics and EU market access; Australia in scale and capital deployment.

The U.S. is sitting on vast reserves but paralyzed by permitting and litigation. Mexico could become the steel arc’s logistical linchpin if AHMSA restructures and aligns with USMCA rules. Advantage: Mexico in agility and proximity to U.S. steelmakers; U.S. in raw asset base—if reforms occur.

2025 marks the beginning of a multi-tiered pricing regime: High-grade, low-carbon ore fetches up to $15/tonne more than conventional ore.

Projects linked to renewable power grids (e.g., Québec, Scandinavia) enjoy access to green premiums, tax incentives, and long-term contracts.

Brazilian and Indian producers are under pressure due to tailings concerns and environmental governance failures.

U.S.

China is diversifying imports, not out of preference but out of necessity—its decarbonization drive is clashing with historical sourcing channels.

For Investors:

Shift exposure from raw iron miners to integrated green iron players. Watch for M&A activity around Canadian and Scandinavian midstream processors.

Avoid jurisdictions with legacy infrastructure, permitting delays, or unclear ESG frameworks.

For Governments:

Streamline permitting—especially in the U.S.—or risk becoming irrelevant in future supply chains. Subsidize midstream processing to retain value domestically. Foster binational partnerships that anchor ESG-friendly sourcing under

trade frameworks like USMCA and EU Green Deal.

RISKS ON THE HORIZON

Risk Area Impact

ESG Non-Compliance High

Geopolitical Volatility Moderate

China Overreach Low–Mod

Invest in beneficiation and decarbonized transport. Bundle ESG metrics with pricing, making green premiums transparent and auditable. Engage early with regulators on circular economy incentives—especially tailings reprocessing and carbon sequestration via mineralization.

Impact of Israel Iran Ceasefire on Gold Market: Prices Slide Amid Risk-On Shift. Gold dropped sharply after U.S. President Donald Trump announced a ceasefire between Israel and Iran, triggering a sudden shift in investor sentiment and weakening the safe-haven appeal that had fueled bullion’s rally in recent months.

The impact of the Israel-Iran ceasefire on the gold market was immediate. Prices fell as much as 1.6% to $3,316 an ounce in early trading before recovering to $3,322. The drop marked gold’s lowest level in two weeks, as markets recalibrated following weeks of geopolitical escalation.

The ceasefire, first disclosed on Trump’s Truth Social platform and later confirmed by Israeli Prime Minister Benjamin Netanyahu, was intended as a “lasting end to the fighting.” That narrative

was enough to trigger a sharp reversal in safe-haven flows.

Safe-Haven Gold Appeal Fades on Geopolitical Optimism

“Gold prices are trending lower today, driven by a shift towards greater risk appetite,” said Ricardo Evangelista, senior analyst at ActivTrades.

“I don’t believe that gold will fall below $3,000 in the short term, but $3,300 looks like a solid floor.

”Global equity markets rallied on the ceasefire news. Oil tumbled. The U.S. dollar weakened. And non-yielding bullion - historically a port in stormy markets - lost its immediate appeal.

Though the ceasefire’s credibility remains in question - Israel resumed air strikes later Tuesday citing violationsthe mere prospect of a pause in conflict was enough to diminish the safe haven gold appeal.

Date Gold Price (USD/oz) Key Event

June 10, 2025

June 24, 2025

$3,482

$3,316

July 2025* TBD

Gold peaks amid Middle East crisis

Israel-Iran ceasefire announced

Fed July meeting anticipated

Fed Rate Cuts Could Anchor Gold in Second Half of 2025

Yet markets barely had time to recalibrate. By midday Tuesday, Israel’s defense minister ordered retaliatory strikes on Tehran, alleging a breach of the ceasefire terms. That duality—hope of de-escalation undermined by fresh violence—underscored gold’s precarious position as a geopolitical hedge.

THE technical outlook for gold remains broadly constructive. ANZ sees a bullish bias anchored above $3,300, with resistance at $3,500 and a breakout target of $3,600 before year-end.

“The pullback may be temporary,” said ANZ analysts in a note. “We expect gold to reach $3,600 by year-end and peak in 2025 before softening in 2026.”

What happens to gold when risk appetite returns?

The market’s attention is also fixed on the Federal Reserve.

Chair Jerome Powell is set to testify before the House Financial Services Committee this week. His tone could set the trajectory for bullion prices in the second half of 2025.

Fed Vice Chair Michelle Bowman said Monday that labor market risks justify a rate cut as early as July. “Should inflation pressures remain contained, I would support lowering the policy rate,” she said at an event in Prague.

Lower interest rates generally benefit gold, which yields nothing but holds value during periods of monetary easing. As of Tuesday, investors were pricing in 57 basis points of Fed rate cuts by year-end.

Despite the volatility, the technical outlook for gold remains broadly constructive. ANZ sees a bullish bias anchored above $3,300, with resistance at $3,500 and a breakout target of $3,600 before year-end.

Compared globally, bullion remains one of the best-performing major assets of 2025. Central bank demand- particularly from emerging economies diversifying away from the U.S. dollar- continues to support prices. The current pullback is seen by many as a reset. With technical support intact and fundamentals aligned, strategists argue the impact of Israel Iran ceasefire on gold market may be temporary- particularly if the Fed loosens policy or conflict resumes.

But for now, gold’s geopolitical narrative has lost its anchor. Markets are watching Jerusalem and Tehran. And all eyes are on Powell.

In a packed convention hall buzzing with dealmakers and geologists, Iran’s mining authorities launched 30 private-sector investment packages on Sunday, opening the door to an estimated $2 billion in new capital inflows, according to industry analysts. The move, unveiled at the Iranian Mining Investment Forum in Tehran, signals an ambitious pivot toward technology-led partnerships, at a time when global mining giants are racing to modernize operations amid rising demand for critical minerals.

Global investment models have evolved — from resource-driven to capital-based, and now to technology-led,” said Touraj Zare’, head of the Iranian Mines and Mining Industries Development and Renovation Organization (IMIDRO)’s subsidiary IMPASCO.

“Our goal is to empower the private sector at every step, forging strategic alliances that drive a smarter, more sustainable mining future.”

Zare’ outlined a new model that positions private firms not merely as financiers but as full-spectrum development partners - spanning data collection, analysis, exploration and operations.

The forum showcased tangible progress: in the past five years, IMPASCO has spearheaded more than 70 joint exploration projects with domestic companies, covering 500,000 square kilometers via aerial geophysics and geochemical surveys.

Over 60 local firms have participated under various joint venture models.

Deputy Minister of Mining and Mineral Industries Vajiollah Jafari told attendees that Iran’s known mineral wealth remains underutilized. Of 80 identified mineral types in the country, only 40 have been properly surveyed and documented.

“Asset identification is our critical weakness,” Jafari said bluntly. “We must clearly know what resources we have - and address this challenge head-on if we are to achieve the 13% annual growth target.”

To that end, the Seventh National Development Plan now mandates greater private-sector involvement across both exploration and operational phases. The government has released new data packages, operational licenses and detailed 1:50,000-scale geological maps to incentivize investment.

Among the offerings: 270 exploration licenses bundled into 30 investment packages - designed to streamline entry for private firms.

“This is about activating dormant assets,” one government advisor said on condition of anonymity. “Private capital and modern technologies are essential to making these mines commercially viable.”

Analysts welcomed the initiative but cautioned that structural hurdles remain.

“There’s clear potential here, particularly in copper, iron ore and rare earths,” said Dr. Sara Jalali, mining economist at the University of Tehran. “But international sanctions, financing constraints and outdated infrastructure could temper investor enthusiasm.”

In a global context, Iran’s drive echoes trends seen in other mineral-rich nations like Kazakhstan, which recently fast-tracked foreign partnerships in its mining sector to align with green transition demand.

“Global players are hungry for new supply chains outside China, but political risk remains a concern in Iran,” noted a recent International Council on Mining & Metals (ICMM) briefing.

The forum’s timing is strategic. Global mining investment rose 8% year-on-year in 2024, according to World Bank data, driven by a surge in demand for lithium, copper and rare earths tied to the energy transition.

Iran’s mineral exports, however, lag regional peers — constrained by sanctions and logistical bottlenecks. In comparison, Turkey’s mining exports hit a record $6.5 billion in 2024, driven by aggressive private-sector integration.

IMPASCO has spearheaded more than 70 joint exploration projects with domestic companies, covering 500,000 square kilometers via aerial geophysics and geochemical surveys.

Industry participants said unlocking Iran’s mineral potential hinges on fostering trust between state bodies and private actors - and navigating geopolitical complexities. “Success in today’s market requires organizational agility, strategic collaboration and mutual trust,” Zare’ emphasized.

NGO voices urged transparency and environmental safeguards.“We welcome private investment, but it must be paired with rigorous environmental standards and community engagement,” said a spokesperson for Iran’s Environmental Policy Think Tank (EPTT).

Looking ahead, officials pledged to revise regulatory frameworks and facilitate export pathways.

“If implemented effectively, these reforms could position Iran as a competitive regional player in mining,” said ICMM’s regional analyst in a forward-looking note. “But the window of opportunity is narrowing as global players race to secure critical mineral sources.”

The Trump administration’s EPA is moving to repeal federal emissions rules for power plants, a decision that could revive Wyoming coal but spark legal and environmental backlash. Critics warn the rollback dismantles decades of climate protections and threatens public health.

Ipolicy, the Trump administration’s Environmental Protection Agency announced Wednesday its intention to repeal greenhouse gas emissions standards for fossil fuel-fired power plants — a decision cheered by Wyoming coal interests and denounced by environmental watchdogs as regulatory sabotage.

The move would roll back Obama- and Biden-era mandates designed to curb air pollution and phase out aging coal plants, with the agency now declaring such emissions “do not contribute significantly to dangerous air pollution.” Critics argue the decision guts federal oversight just as global pressure to reduce carbon intensifies.

According to the EPA’s proposal, greenhouse gases no longer meet the threshold for regulation under the Clean Air Act — a reinterpretation that could upend years of precedent.

The agency’s new rationale would remove requirements for power plants to adopt carbon capture technology or shut down.

In a statement, EPA Region 8 Administrator Cyrus Western said the change would relieve utilities of “mandates forcing up utility bills by 20% or more,” a claim energy economists contest.

“This is about regulatory freedom,” Western said. “The EPA should not be in the business of picking energy winners and losers.”

Wyoming, which produces over 40% of the nation’s coal, has long lobbied for relief from federal emissions rules. With more than 90% of its coal exported to aging power plants across the U.S., the state’s economic model has struggled under the weight of collapsing demand and competition from cheaper, cleaner alternatives.

“This rollback is a political victory, not an economic strategy,” said a regional energy analyst. “It won’t reverse the structural decline of coal, but it may slow the retirements.”

Advocates say the repeal will undercut public health and legal accountability.

“This is regulatory capture in its purest form,” said a senior attorney at Earthjustice.“Communities downwind of these plants will bear the costs — not the utilities, not the policymakers.”

The Center for Biological Diversity’s Climate Law Institute warned that stripping

EPA authority from power sector emissions could have ripple effects across clean air and climate litigation for years.

While the EU, China, and major trading partners advance decarbonization targets, the U.S. rollback signals a retreat

from international commitments. “This casts doubt on the U.S.’s credibility at the climate table,” said a foreign policy expert. “Other countries are investing in the future.

We’re reverting to the past.” The rule enters public comment this month. Lawsuits are all but certain.

In 2025, Canada, the United States, and Mexico stand at a crossroads. As global steelmakers demand cleaner, high-grade iron ore, Canada surges ahead with ESG-certified supply, the U.S. stalls under bureaucratic gridlock, and Mexico eyes a strategic comeback. This report explores how policy choices, infrastructure investments, and green premiums are reshaping the continent’s iron ore destiny.

In 2025, the North American iron ore sector finds itself at a pivotal juncture - marked by Canadian innovation, American stagnation, and Mexican ambiguity. With global steelmakers demanding cleaner, high-grade feedstock, Canada is seizing the green steel opportunity while the U.S. is gridlocked by permitting constraints and legacy infrastructure.

Mexico, meanwhile, could rise as a pivotal supply-chain node - if industrial restructuring succeeds. Certainly.

Here's the continuation and conclusion of the article - deepening the analysis, adding contrasts, offering future outlooks, and suggesting next steps for industry players:

North American Iron Ore 2025:

In 2025, North America’s iron ore market has bifurcated along policy, investment, and infrastructure lines:

Canada is expanding with government-backed green initiatives, ESGaligned exports, and integrated logistics—driven by political stability and

Canada has emerged as North America’s most forward-leaning iron ore supplier, led by:

Champion Iron's Bloom Lake Phase II Expansion (Québec): Now running at 95% capacity, it produces 15 million tonnes per annum (Mtpa) of 66.2% Fe concentrate. Its proximity to hydroelectric power makes it carbon-free and attractive for green steel buyers in Europe and the U.S. Northeast.

Strategic Value: Eligible for U.S. Inflation Reduction Act incentives, and with rail access to the Port of Sept-Îles, it's poised to become the region’s flagship low-carbon exporter.

Nippon Steel’s JV Project (Labrador Trough or Central Québec): Currently in the pre-feasibility phase with ¥4.5 billion (~CAD$41M) committed, this project seeks to diversify Japanese sourcing away from Australia and China.

Implication: Canada is being seen as a politically stable, ESG-compliant upstream partner.

AHMSA (Altos Hornos de México): Currently undergoing bankruptcy restructuring, its integrated steel and iron ore assets in Monclova are attractive to U.S. buyers seeking rail-connected supply close to Texas and Arizona.

Future Outlook: If acquired and modernized, AHMSA could serve as a tariff-free supplier under the USMCA framework, closing a major gap in North America’s vertically integrated steel corridor.

Despite vast reserves, the U.S. is hamstrung by:

Cleveland-Cliffs (Minnesota & Michigan): Continues to dominate domestic blast furnace supply but faces headwinds from stagnant flat steel demand and limited EAF alignment.

Mesabi Metallics (Nashwauk, MN): With a proposed capacity of 7 MTPA, it's America’s largest unrealized iron ore investment. However, litigation over mineral leases and political gridlock continue to stall progress.

Tacora Resources (Scully Mine, Newfoundland & Labrador): Though Canadian, it is U.S.-owned and now tied via a 10-year offtake deal with Big River Steel (Arkansas). It feeds EAF steelmakers, indicating a strategic pivot toward low-emission steel.

MARKET INDICATORS – MID-2025 SNAPSHOT

Spot Price (62% Fe) $104/tonne -18% YoY

Canadian Iron Ore Output ↑ 22% Driven by Champion Iron U.S. Pellet Output ↔ Stable No new expansion

Exports to EU ↑ Moderate Canada gains market share due to green premiums

proximity to EU and U.S. green steel buyers. Champion Iron’s rise is no accident; it’s a product of coordination between private capital and federal-industrial strategy.

The United States is stagnating despite holding vast reserves. The problem is not the rock - it’s the red tape.

The Mesabi Metallics impasse is a microcosm of national dysfunction: overlapping permits, legal gridlock, and legacy infrastructure. Cleveland-Cliffs remains dominant, but inward-focused and vulnerable to shifts toward Electric Arc Furnace (EAF) production and Hot Briquetted Iron (HBI) feedstock.

Mexico stands in limbo, holding undervalued strategic assets like AHMSA that could revitalize regional steel supply chains if restructured. Its fate hinges on capital flow, legal reforms, and U.S. industrial policy integration.

This contrast has left Canada emerging as the hemisphere’s green ore supplier of record, while the U.S. risks ceding long-term competitiveness unless it unlocks permitting and infrastructure investment.

Green Premiums Are Real: Buyers in Europe and parts of Asia are already pay-

ing 10–20% premiums for ESG-compliant iron ore. Canada is capturing that margin; the U.S. is not.

The Future Is DRI & EAF: As traditional blast furnace economics falter under carbon constraints, the growth lies in HBI-compatible feedstock. The U.S. must pivot toward midstream processing- fast.

Permitting Is National Security: Iron ore isn’t just a commodity—it’s a pillar of industrial sovereignty. The failure to modernize permitting processes is becoming an economic liability.

Short-Term (2025–2026)

Champion Iron expands role as ESG-aligned exporter.

Nippon Steel may greenlight a Canadian mega-project.

Cleveland-Cliffs faces rising pressure from EAF competitiveness.

Mid-Term (2027+)

Mesabi Metallics revival hinges on political resolution.

Mexican assets could enter U.S. supply chains under new ownership.

Growth of DRI feedstock and HBI (hot briquetted iron) may refocus investment toward midstream processing.

Global data has revealed that over 922 iron ore mines are operational worldwide. Iron is indispensable in manufacturing and construction because it is the primary component of steel production. Iron ore is a mineral that significantly contributes to enhancing infrastructure and economic growth on a global scale.

Without large supplies of iron ore, industrial growth and development would stagnate, affecting several key industries and economies worldwide. Fortunately, the future outlook for iron ore mining looks promising, with most mines on this list showing growth and increased year-on-year yields.

For the U.S.:

• Launch a Federal Permitting Accelerator for strategic minerals.

• Integrate iron ore into the Defense Production Act and Inflation Reduction Act amendments.

• Invest in rail, port, and pellet plant retrofits in Minnesota and Michigan.

For Canada:

• Double down on green steel partnerships with the EU and U.S.

• Incentivize further Japanese and Korean upstream investments.

For Mexico:

• Resolve AHMSA’s bankruptcy swiftly and transparently.

• Position Mexican iron within the USMCA low-carbon steel corridor.

Green Steel: Steel produced using low-emission technologies such as Electric Arc Furnaces (EAF) powered by renewable electricity and Direct Reduced Iron (DRI) from low-carbon sources.

HBI (Hot Briquetted Iron): A compacted form of DRI used in EAFs, crucial for green steel production.

USMCA Steel Corridor: A potential integrated North American supply chain for ESG-compliant iron and steel, leveraging tariff-free trade under the U.S.–Mexico–Canada Agreement.

Permitting Gridlock: A bureaucratic backlog of environmental and development reviews, often at state and federal levels, delaying mining and processing projects.

Looking ahead to 2030, North America will either be a leader in green steel supply or a laggard in global industrial

Category Challenge Impact Level

Permitting

Infrastructure

EPA and state reviews stall new projects in MN, MI High

U.S. rail and processing plants need major upgrades Moderate

Market Consolidation Limited independent developers left in U.S. High

Policy Incentives

U.S. IRA favors low-carbon steel, not raw ore Low to Moderate

"GREEN PREMIUMS AREN’T THEORETICAL - BUYERS are already paying 10–20% more for clean, traceable ore. Canada is capturing that margin. The U.S. is not."

realignment. The decisions made in 2025–2026 will set that path.

If Canada maintains momentum, it may outpace Brazil and Australia in supplying ESG-compliant ore to Europe and northeastern U.S. steelmakers.

If the U.S. fails to adapt, it could see its domestic steel industry weakened by import dependency and disinvestment.

If Mexico seizes reform opportunities, it could emerge as the missing middle in an integrated continental steel ecosystem - bridging Canadian feedstock and U.S. downstream demand.

Global buyers - particularly from Japan, Korea, and Germany—are watching closely. Those who secure early contracts with North American suppliers will lock in geopolitical and carbon security for the next industrial decade.

As demand for battery metals accelerates, France is moving to cement its position in the global race for Argentina lithium mining. At the French Embassy in Buenos Aires, officials signed an agreement to deepen cooperation on critical minerals, underscoring Europe’s urgency to secure supplies essential for electric vehicles and renewable energy storage.

Argentina sits at the heart of this competition. Alongside Chile and Bolivia, it forms the so-called “lithium triangle,” a region believed to hold over half of the planet’s known reserves. According to the U.S. Geological Survey, Argentina ranked as the fourth-largest producer in 2023, trailing only Australia, Chile and China. This surge in Argentina lithium mining has made the country a top destination for new investments.

“We see this as a roadmap to anchor mining as a strategic priority in Franco-Argentine relations,” said Laurent Saint-Martin, France’s Minister Delegate for Foreign Trade. “It is also a way to accelerate the rollout of French investments in Argentina.”

French Investments in Argentina Fuel Mining Expansion

For Europe, the stakes are rising. The European Union adopted the Critical Raw Materials Act to cut dependence on Chinese processing and incentivize domestic refining capacity.

The act includes incentives for European companies to expand French investments in Argentina and secure long-term access to lithium supplies.

“Countries don’t want to be caught unprepared when supply chains are tested,” said Eduardo López, an energy transition researcher at the Inter-American Development Bank. “The lithium triangle is rapidly becoming the focus of strategic competition.”

French investments in Argentina surged 43% in 2024, reaching $7.6 billion. Mining has driven much of that growth, notably Eramet’s $850 million launch of Argentina’s first direct lithium extraction plant in Salta Province.

The project marked a milestone in Argentina lithium mining, using innovative technology to improve output while reducing environmental impact.

For Buenos Aires, the agreement is an opportunity to attract more capital and technology. Luis Lucero, Argentina’s mining secretary, called the memorandum “a tool that opens a field of cooperation” that will soon evolve into concrete measures supporting Argentina lithium mining.

“Argentina has world-class mineral resources,” Lucero said. “Our role in the energy transition is undeniable.”

Yet rapid expansion of Argentina lithium mining has sparked concerns. “It is essential that any new projects uphold strict safeguards,” said María Eugenia Di Paola, an environmental law scholar at the University of Buenos Aires. “Otherwise, this will replicate the same extractive model that communities have opposed for decades.”

Analysts expect the France-Argentina accord could become a model for other European deals as global competition intensifies.

The International Energy Agency projects lithium demand will quadruple by 2030. For France, the memorandum is part of a strategy to secure critical supplies and expand French investments in Argentina before shortages threaten Europe’s energy ambitions. “These minerals are not just commodities,” Saint-Martin said. “They are the foundation of our future industrial sovereignty.”

China has achieved a global first by extracting ultra-pure rubidium chloride from salt lake brine, slashing its import dependence and signaling a new era in strategic mineral autonomy.

The metal has extensive military, technological and civilian applications. For example, rubidium ions can help improve the performance of perovskite solar cells, while ultra-precise rubidium atomic clocks lose less than one second every 3.7 million years. The breakthrough could reshape global supply chains tied to quantum tech, defense systems, and renewable energy.

China has achieved the world’s first commercial extraction of rubidium chloride at high purity levels from ultra-dilute salt lake brine, marking a critical leap in mineral self-sufficiency.

The development was announced by the Qinghai Institute of Salt Lakes under the Chinese Academy of Sciences. Researchers produced 99.9% pure rubidium chloride using potassium chloride material containing just 0.001% rubidium.

The pilot operation was conducted at Qinghai’s Qarhan Salt Lake, where do-

mestic reserves are technically accessible but historically underutilized.

Though often overlooked in commodity markets, rubidium underpins critical functions in high-precision and defense technologies.

The metal enhances the stability of perovskite solar cells, is integral to GPS and encrypted communications, and enables rubidium atomic clocks—vital for space navigation and secure networks. These clocks deviate by less than one second

over millions of years. In recognition of its strategic relevance, the U.S. designated rubidium as a critical mineral in 2022, joining a growing list of rare materials seen as vulnerable to geopolitical disruption.

China’s Rubidium Paradox: Reserves

Despite having sizable reserves, China remains structurally dependent on rubidium imports. The underlying reason is geological.

“Although China is a major global rubidium producer, its industry relies heavily on imported ores,”said He Xinyu, a senior geologist at the China Non-Ferrous Metals Resource Geological Survey.

“In 2021, China imported 19,500 tonnes of rubidium concentrate with a 66.3% external procurement rate—primarily from Canada and Zimbabwe.”

Roughly 97% of China’s known rubidium is embedded in hard rock deposits— high-cost, low-yield formations that are difficult to exploit. Only a narrow 3% margin is found in salt lakes and geothermal waters, notably across Qinghai and the Tibet Autonomous Region.

The breakthrough stems from years of parallel research—both theoretical and engineering. Scientists first developed a predictive model to trace how rubidium distributes during potassium salt production. This allowed them to identify stages where rubidium resists enrichment and locate windows for capture.

They then engineered a complete process chain: ore washing, rubidium leaching, trace enrichment, solvent extraction, and purification. The resulting product is industrial-grade rubidium chloride— technically competitive, and critically, domestic.

The innovation is not just scientific but commercial. A 2022 cost analysis led by ISL researcher Gao Dandan estimated the production cost of rubidium chlo ride via this method to be one-third the prevailing market price - a rare convergence of technological feasibility and economic incentive.

overlooked, but China’s breakthrough is a loud signal: the race for critical minerals now extends beyond rare earths into every corner of strategic technology.

The project was jointly backed by the National Natural Science Foundation of China and Qinghai provincial authorities, a model increasingly used to reduce mineral import dependence via state-supported R&D.

The timing is notable. Amid intensified mineral nationalism and supply chain realignment, China is moving to harden control over critical inputs to aerospace, energy, and AI infrastructure.

Its dominance in rare earths markets during the 2010s provides precedent. Rubidium, while still a niche commodity, is poised to gain prominence as next-generation technologies mature.

Control over its supply—and the process to extract it economically—could become a lever in broader tech sovereignty strategy.

For countries reliant on secure, non-Chinese sources of critical minerals, the rubidium breakthrough adds a new pressure point. The West’s attempts to build diversified supply chains may now face a tighter window.

If scaled, China’s process could flood the global rubidium market with lowcost, high-purity material - undercutting competitors and shifting price discovery to domestic platforms.It would also give Beijing added leverage in defense-linked supply chains where rubidium is non-substitutable.

The success at Qarhan Salt Lake reframes rubidium as more than a specialty metal. It is now a bellwether for how nations intend to compete in materials science, strategic autonomy, and technological resilience.

As rubidium exits obscurity, China’s chemical engineering edge could shift more than just the market—it may alter the rules of industrial power.

A loophole in the U.S. aluminum tariff policy is redrawing global scrap trade. By exempting aluminum scrap from steep import duties, Washington has triggered a rush in cross-border shipments, fueling record premiums in the U.S. and draining European recycling streams. Now, Brussels is preparing countermeasures, and China is bracing for tighter feedstock supply. What began as a domestic protectionist measure may be reshaping the global aluminum economy.

Aregulatory gap in the Biden administration’s aluminum tariff policy has unleashed a global scramble for aluminium scrap, transforming a niche commodity into a flashpoint of international trade friction.

While tariffs on finished and semi-finished aluminum now stand at 50%, scrap imports remain untouched—prompting a surge in U.S. demand and triggering economic countermeasures from Europe and Asia.

U.S. imports of aluminum scrap spiked to over 80,000 metric tons in March, the highest in two years, driven by buyers taking advantage of the tariff exemption. The carveout was designed to support domestic mid-stream processors, but the unintended effect has been a dislocation in global supply chains.

Across the Atlantic, the European Aluminium association is sounding the alarm over what it calls a “full-blown scrap crisis.” Exports to the U.S. surged in Q1 2025, as American buyers offered premiums beyond what European recyclers and manufacturers could match.

“The economics are broken,” said Paul Voss, Director General of the association. “Critical raw material is bleeding out of Europe.”

The European Commission, citing its Circular Economy Action Plan, is now weighing retaliatory duties to restrict the outflow of aluminum scrap. A final decision is expected by Q3, but political pressure is mounting for earlier intervention.

the premium spike to structural changes: scrap substitution, tariff arbitrage, and limited inflows of ingot from traditional suppliers.

The Midwest aluminum premium—a key benchmark tracked by the London Metal Exchange—has reached a record $1,325 per metric ton. That’s well above the global spot price of roughly $2,430.

Analysts attribute the premium spike to structural changes: scrap substitution, tariff arbitrage, and limited inflows of ingot from traditional suppliers.

The result is a two-speed market: scraprich U.S. processors enjoy a margin advantage, while manufacturers and consumers face rising input costs. A Harbor Aluminum report previously showed that processors typically pass along tariff

costs, even when sourcing domestically. That practice is now entrenched, further widening margins for mid-stream firms.

China, the world’s top aluminum scrap importer, is feeling the squeeze. With annual intake averaging 1.8 million tons, Beijing had eased import standards to promote green manufacturing. But now, with the U.S. absorbing larger volumes and the EU contemplating restrictions, Chinese buyers face limited access and inflated prices.

“The market is bifurcating,” said a Hong Kong metals trader. “What used to be regional arbitrage is now a global realignment.”

This is more than a protectionist episode. The aluminum tariff policy—by exempting scrap—has reordered global trade patterns. Markets have responded swiftly. So have policymakers.

If Europe introduces duties, and China escalates sourcing efforts, the global aluminium scrap market could fracture into closed loops. The U.S. may benefit in the short term, but retaliation and volatility loom.

sweeping mining law overhaul, marking its most significant economic pivot in decades. A new law passed by the lower house of parliament on Monday permits foreign entities to own as much as 80% of mining projects, while also introducing streamlined permitting designed to attract investment.

The legislation, which now proceeds to the largely compliant upper house, is expected to clear without resistance.

For decades, Algeria enforced a restrictive 51/49 ownership rule, deterring multinationals wary of minority stakes and bureaucratic friction.

The new legislation offers a single mining license valid up to 30 years, covering both exploration and extraction—an administrative overhaul aimed at reducing delays and boosting project continuity.

Officials say the law will revitalize dormant mineral reserves, trim the import bill, and reduce economic vulnerability to energy price shocks. “This is a structural shift, not a one-off,” said Omar Belkheir, an independent analyst in Algiers. “The state finally admits that it cannot go it alone.”

Despite sharing borders with phosphate-rich Morocco and gold-producing Mali, Algeria has remained a peripheral

player in global mining. Its own reserves - phosphate, iron ore, lead, zinc - remain largely undeveloped, hamstrung by policy inertia and infrastructure deficits. The reform aligns with broader regional trends.

Egypt, Nigeria, and Angola have all revised extractive sector laws to court foreign investors and tap new revenue streams amid waning hydrocarbon margins. But Algeria’s move is unusually sweeping in scope, effectively reversing decades of post-colonial economic nationalism.

The International Monetary Fund, which projects 3.5% GDP growth for Algeria this

year, has repeatedly called for economic diversification and improved capital flows. The mining law represents a response - if not yet a resolution.

“There’s potential here, but real challenges too,” said Nadia Ghoulam of the London-based Energy & Resources Forum. “Transparency, infrastructure, and credible local partnerships will determine whether this is transformative or merely cosmetic.”

Skeptics warn that Algeria’s state-heavy model and currency controls remain major drags on private investment. Others point to governance risks, from tendering opacity to shifting regulatory interpretations.

Still, the new framework gives foreign firms clearer exit options and control thresholds, increasing the odds of longterm commitments. Chinese, Canadian, and European mining companies are seen as early contenders for new concessions, particularly in phosphate and iron.

The upper house is widely expected to approve the bill. From there, attention will turn to implementation—regulatory clarity, local workforce development, and infrastructure coordination.

“This is not about liberalization for its own sake,” said Belkheir. “It’s about survival. Algeria knows it cannot fund its future on gas alone.”

Continuous geochemical scanning is forcing geologists to revisit long-held assumptions about kimberlite formation. At a De Beers site, petrologist Alexandrina Fulop watched her magmatic pulse hypothesis collapse. The chemical transitions she thought were from different eruptions? Host rock contamination, revealed only through a full-core scan.

It shifted everything,” petrologist Alexandrina Fulop said. “You think you’re reading the earth’s history, then realize the text was smudged.” Her discovery highlights a broader disruption occurring quietly within the mineral exploration sector. For decades, interpretations of drill core chemistry relied heavily on sparse, manually captured data points. But new technology is pushing geoscientists toward high-resolution, visual-first interpretations.

The turning point came with Scan by Veracio, a continuous geochemical scanning tool that captures centimeter-scale data across entire drill cores. Compared to traditional XRF spot checks, the system offers dense, visual, and comparable geochemical data. “You don’t just get numbers,” Fulop said. “You get patterns, continuity, and insights you never saw coming.”

This change matters most in geologically complex zones like kimberlites, where contamination and fragmentation complicate analysis. With continuous data, trends and correlations emerge across holes and over hundreds of meters.

Geologists using the Scan by Veracio system are able to map subtle shifts in mineralogy, identify alteration halos, and distinguish lithological boundaries with greater certainty. This empowers teams to ask better questions of their cores — and to do so earlier in the exploration process.

The tool isn’t trying to replace lab precision. Instead, it provides context. And context, Fulop argues, is what changes decisions. “You don’t need 100% accuracy on every point,”

Feature

Handheld XRF Scan by Veracio

Data Density Sparse Continuous

Resolution Spot-based Centimeter scale

Core Coverage Selective 100% length

Interpretation Time Days to Weeks Near Real-Time

Use in Complex Geology

Limited High

she said. “If your baseline is strong and consistent, you can interpret meaningfully and act faster.”

Exploration teams now use the data to correlate lithologies, test hypotheses, and adjust drilling strategies in near real time. With continuous scanning, what used to take weeks can happen in days.

That shift is not just a technical leap; it’s an operational one. In high-cost environments like diamond exploration, faster turnaround and better targeting mean significant capital savings.

Rather than displacing geologists, continuous scanning expands their toolkit. Fulop describes the transition as moving from a notepad to a dashboard.

“You’re still interpreting,” she said. “But now it’s with full visibility.”

That shift is altering field protocols and modeling workflows. Data scientists collaborate with geologists to extract meaning from the high-density geochemical scans. The result: more confident decisions and fewer missed signals.

Scan by Veracio, which stems from technology originally commercialized by Minalyze, has already seen deployment beyond De Beers. Other major miners are piloting the tool across copper, gold, and critical mineral projects.

And as younger geologists enter the field with backgrounds in data science and digital tools, adoption is accelerating.

The real power of continuous scanning lies in hypothesis testing. In Fulop’s case, it disproved an entrenched theory about

magmatic pulses in kimberlite pipes. But the implications go further. With continuous data, researchers can isolate single-element anomalies and correlate them with structural breaks or alteration zones.

This supports 3D modeling and even machine learning applications that can prioritize drill targets. Exploration teams increasingly expect software integration, remote collaboration, and rapid hypothesis iteration. Continuous geochemical scanning sits at the center of that evolution.

“It’s not about replacing the geologist with AI,” Fulop said. “It’s about equipping them with data so rich they can actually think bigger, faster.”

While the breakthrough occurred in a diamond context, its reach extends across commodities.

Base metals, rare earths, and nickel projects are integrating continuous scanning to better understand alteration halos, structural overprints, and mineralization controls.

Academic institutions are beginning to train geology students in scanning interpretation and data integration. Even junior miners are exploring cost-effective partnerships to gain access to the technology.

According to Fulop, the shift will create a new standard in exploration geochemistry: one where dense, visual data is no longer the exception but the expectation.

“This isn’t a novelty,” she said. “This is how we should have been doing it all along.”

Australia’s resource wealth has long powered its economy, but the real story behind AU$415 billion in mineral exports last year is diversification. From the Pilbara to offshore LNG terminals, the mineral portfolio is evolving fast.

According to the Department of Industry, mineral resources accounted for 59% of all exports in 2023/24. The top five—iron ore, LNG, coal, gold, and copper—formed most of that figure. Yet forecasts show a shifting hierarchy.

“It’s the range of commodities that gives Australia stability,” said a Canberra policy advisor. Four states ranked among the world’s top 20 for mining investment attractiveness in the 2023 Fraser Institute survey.

Iron ore earned AU$141 billion but is forecast to decline to AU$81 billion by 2029/30 as Chinese demand slows. LNG brought in AU$70 billion, projected to rise slightly before falling to AU$45 billion due to U.S. competition and the renewables transition. Coal, earning AU$94 billion combined, is forecast to fall to AU$55 billion.

Gold earned AU$34 billion with modest growth. Copper is set to expand from AU$12 billion to AU$18 billion as electrification accelerates. Lithium production led globally, with exports forecast to reach AU$9.2 billion. Rare earths could climb to AU$3.7 billion as new processing plants open.

Diversification, rather than reliance on any single resource, will shape Australia’s future resilience.

Australia’s top miners are demanding Australia energy subsidies to prevent smelter shutdowns amid soaring power costs, warning of major job losses and supply chain disruptions.

Australia’s mining heavyweights are urgently calling for Australia energy subsidies, warning that without government relief, domestic smelters could close within months.

Rio Tinto, Alcoa, BHP, Glencore, and MMG say energy prices have spiraled beyond operational viability. Gas and electricity bills have more than doubled for key facilities, straining high-energy sites such as aluminum and zinc smelters. “This isn’t a long-term concern. It’s happening now,” said a senior executive involved in consultations with the federal government.

Executives argue that without targeted Australia energy subsidies, smelters face imminent closure or relocation offshore.

Alcoa’s Portland facility and Rio Tinto’s Gladstone operations are considered especially vulnerable, according to internal forecasts reviewed by the Financial Times.

Electricity pricing in Australia remains among the most volatile in the OECD. While the country has abundant renewable potential, its grid transition is incomplete, leaving major industrial users exposed to fossil-fuel market swings.

“We’re not asking for permanent protection,” one senior industry official noted. “We’re asking for bridge support during an unstable transition.”

The Albanese government has pledged deep decarbonization by 2030, but miners warn that losing smelters to energy shocks could undermine national goals. Critics argue that handing out Australia energy subsidies to legacy industries contradicts climate policy.

Still, mining leaders counter that domestic smelting is key to clean-tech supply chains. Shuttering these operations would mean importing higher-emission metals and exporting skilled jobs.

Richie Merzian of the Australia Institute offered a counterpoint: “Taxpayer-funded bailouts for high-pollution infrastructure won’t solve the long-term energy problem. The transition needs to prioritize sustainability.”

Europe and North America have seen similar shutdowns as energy volatility reshapes industrial strategy. Australia - without a national manufacturing framework or industrial energy corridors - is particularly exposed.

A recent draft from the Productivity Commission recommends industrial energy zones tied to renewables, but industry insiders warn such plans are years away from execution. “We can’t wait five years,” said a mining executive. “Without Australia energy subsidies, many of these operations won’t last five quarters.”

Australia stands at a crossroads. Its ambition to become a clean-energy superpower depends on domestic refining, yet energy insecurity threatens that foundation.

The call for Australia energy subsidies is not just a plea for financial aid - it’s a test of whether the country can maintain its industrial base while transitioning to net-zero. Industry leaders say the time for debate has passed.“We need clarity, not ideology,” said one executive. “The transition must be just - not just for the climate, but for the workers, the supply chains, and the nation’s economic backbone.”

THE U.S. ACCELERATES SEABED MINING approvals under Trump’s directive, pushing TMC’s bid ahead of global rules.

President Donald Trump’s April executive order has triggered the most aggressive U.S. push into deepsea mining in over four decades. The order directs the National Oceanic and Atmospheric Administration (NOAA) to expedite licenses and permits for companies targeting critical minerals on the ocean floor - setting a 60-day window for approvals under the Deep Seabed Hard Mineral Resources Act (DSHMRA).

The administration positions the directive as a response to U.S. supply chain vulnerabilities and China’s dominance in rare minerals. But critics say it marks a unilateral challenge to multilateral seabed governance.

Within days, TMC USA - a U.S. unit of The Metals Company - filed for two exploration licenses and one commercial recovery permit.

The permit targets a 25,160-square-kilometer section of the Clarion-Clipperton Zone (CCZ), estimated to contain millions of tonnes of battery-grade metals.

“With these applications, we offer a shovel-ready path to critical minerals,” said Gerard Barron, CEO of TMC. He claimed the resource could support U.S.

infrastructure and clean energy expansion. TMC is the first company to test the U.S. mining code beyond exploration, an unprecedented step in the modern era.

The NOAA proposal under White House review revises parts 970 and 971 of its mining regulations to enable streamlined commercial permit processing.

Officials say all statutory requirements will be met. Yet NOAA’s refusal to disclose details, combined with its short review timeline, has drawn fire.

“You can’t responsibly evaluate a mining proposal of this scale in that timeframe,” said Matthew Gianni of the Deep Sea Conservation Coalition.Historically, NOAA has only issued exploratory licenses, both granted in the 1980s to Lockheed Martin.

The U.S. is not a party to the United Nations Convention on the Law of the Sea and has never recognized the International Seabed Authority’s jurisdiction over its nationals.

Most coastal states operate under ISA frameworks, which have yet to approve any commercial permits.

“This could set a precedent for mining without international oversight,” said Kristina Gjerde of the IUCN. “It risks a regulatory vacuum.”

China, meanwhile, holds more ISA exploration contracts than any other country. Experts fear that U.S. unilateralism may accelerate competitive mining with reduced environmental controls.

Gamble?

The executive order also calls for the Departments of Defense and Energy to explore offtake agreements and mineral stockpiling. Environmental advocates warn that no amount of domestic regulation can replicate the environmental safeguards built into multilateral governance.

Whether NOAA’s decision becomes a model for responsible resource recovery or a precedent for chaotic ocean exploitation may depend on how it handles TMC’s application—expected to be ruled on by July.

Sweden lifts uranium ban after four decades, aiming to secure nuclear energy future and cut reliance on Russian fuel — locals push back.

setting off a chain of consequences for nuclear policy, mining investment, and EU energy independence. The Sweden uranium ban, initially enacted over environmental fears, is being reversed as Stockholm pursues nuclear expansion and strategic independence from Russian energy.

The Swedish government is preparing legislation that would reclassify uranium as a standard concession mineral under the Swedish Minerals Act. The law, currently under parliamentary review, is expected to take effect on January 1, 2026.

The reversal follows a December 2024 inquiry recommending the repeal of restrictions dating back to the Cold War. Uranium, once stigmatized as a toxic liability, is now being reframed as a strategic asset.

“Domestic uranium supply is foundational to our long-term energy resilience,”

said Romina Pourmokhtari, Sweden’s climate and energy minister. “We must build a self-sufficient, secure energy future.”

Sweden hosts two of the continent’s largest undeveloped uranium deposits: the Viken deposit in Jämtland and the Häggån site in Bergslagen.

Viken, operated by Canadian-listed District Metals, holds an estimated 3.2 billion pounds of uranium oxide (U₃O₈) along with significant co-deposits of vanadium, rare earths, and zinc. Aura

Energy’s Häggån deposit, meanwhile, contains 800 million pounds of U₃O₈ and is under renewed development talks with Neu Horizon Uranium.

“This isn’t marginal material,” said Aura CEO David Woodall. “It’s energy-grade uranium with the capacity to anchor Sweden’s nuclear base load for decades.”

Anticipating legislative approval, mining companies have begun mobilizing. District Metals secured C$2 million this quarter to fund permitting and exploration.

Aura Energy has restarted local consultations and intends to submit an environmental impact report by mid-2026.

“If this legislation passes, Sweden becomes one of the world’s most strategic uranium plays,” said Garrett Ainsworth, CEO of District Metals. “We’re not just talking extraction - there’s potential for a fully integrated nuclear fuel chain.”

In Jämtland, opposition is already mounting. A grassroots movement, “Stop Uranium Jämtland,” has gathered over 18,000 signatures against the Viken project.

“They want to dig up our land for a radioactive future,” said Eva Nordström, a local farmer and campaign organizer. “We’re not expendable.”

National environmental groups share the concern.

“There is no green uranium,” said Johanna Sandahl, president of the Swedish Society for Nature Conservation. “No method of mining it can guarantee the protection of ecosystems and water sources.”

Even former regulators caution against fast-tracking. “Uranium does aid decarbonization,” said Åke Dahlberg, ex-inspector at the Swedish Radiation Safety Authority. “But Sweden must prove it can mine responsibly — without bypassing its own standards.”

The bill is supported by Sweden’s center-right coalition and the Sweden Democrats, who hold a working majority. Yet opposition from the Greens and Left Party — amplified by rural protests — could narrow that margin ahead of a Q4 2025 vote.

“We back nuclear,” said Kristina Winberg, an independent MP. “But our constituents have real concerns. If they say no, we must listen.”

Brussels is watching closely. The European Union, which added nuclear to its green finance taxonomy last year, views Sweden’s uranium reserves as vital to reducing dependency on Russian, Kazakhstani, and Nigerien imports. Today, over 95% of the EU’s uranium is imported.

“Sweden could become a nuclear materials hub,” said Klaus-Dieter Borchardt, former deputy director-general at the European Commission. “It’s a geopolitical advantage, not just a national asset.”

Should the bill pass, uranium developers will enter a multiyear permitting process — Sweden’s mining approvals are among the strictest in Europe. First production from Viken or Häggån could arrive by 2028, assuming sustained political and market momentum.But the broader arc is unmistakable: Sweden is betting big on uranium. And in doing so, it’s igniting a contest over land, legacy, and the true cost of nuclear independence.

“The ban may be over,” said Johan Bergström, a nuclear policy scholar at Uppsala University. “But the real fight is only beginning.”

Power Metals Corp has confirmed that its Case Lake project in Ontario contains the world’s fourth-largest hard-rock cesium resource, positioning Canada to challenge China’s dominance in the critical mineral supply chain.

“With an estimated 13,000 tonnes at 2.40% Cs₂O, based on just 7,264 meters of drilling, Case Lake represents an extraordinary opportunity,” said Haydn Daxter, Power Metals CEO. “And the majority of the pollucite-bearing pegmatites remain unconstrained—the growth potential is enormous.”