OPINION Dan Holdsworth discusses the rising tide risk to shopping centres from online sales and how the 'new normal' postpandemic is going to require a new flexibility in relation to their dealings and arrangements with retailers.

A new normal DAN HOLDSWORTH Director BlueRock Law

I

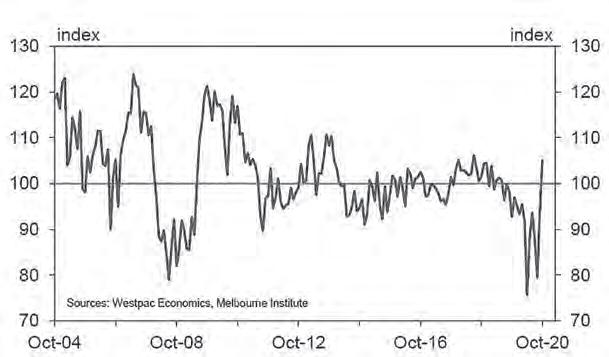

t's fair to say that the COVID-19 pandemic has led to the greatest challenge for both landlords and tenants across Australia in more than a generation. The reality is, though, that cracks had already begun to emerge in the context of the Australian retail scene. For as long as I can remember, the threat of online sales to bricks-andmortar locations has been raised as a potential risk for centre landlords. Each year, the risk would creep forward, but the continual growth of the Australian economy and rampant consumerism meant that there was a growing pie to spend and enough for all to share. Unlike what has been seen in the US, occupancy rates at centres continued to remain exceptionally strong and shopping centres remained highly attractive to both retail tenants and their customers. The high streets of Australia had a far more mixed performance but, by and large, that could be put down to their failure to invest in a cohesive way in capital improvements and the retail ‘experience’ – something that Australia’s shopping centre landlords have been incredibly good at. While the barriers to entry into shopping centres remained high for newcomers (predominantly because of local planning requirements), the existing key players have largely gone from strength to strength (ignoring of course the significant blip that was felt as a result of the GFC). This year, however, had already started as a difficult one. A number of high profile collapses had seen the closure of a significant number of premises. In an ordinary year, those would typically be able to be blown off largely as the failure of a retailer to understand their customer or poor 62 SCN

62_Opinion Holdsworth_FINAL.indd 62

taken into account. So too will centres that rely predominantly on convenience, at least for those retailers that operate in that space. I expect that the greatest concern will be around medium sized centres – the sub regionals, not a bright enough light to pull a crowd but too big to make any trip frictionless.

Northland shoppers financial management – or both. That is undoubtedly true in many cases, but the model that some of these retailers have pursued is one that is inextricably linked to the centres themselves, ie. put your shop into a place that is well maintained, well managed and one that attracts high traffic, and the punters will spend their money in-store. But what if the COVID-19 pandemic has fundamentally affected the equation or hastened a systemic change in the buying habits of Australian consumers? We will know the answer to that fairly shortly as the country attempts to get back to its new normal. If that includes a consumer trained to value instant purchase gratification online rather than the experience of a centre, the essential foot traffic numbers may permanently be affected. If that occurs, retailers are going to have to make difficult decisions regarding their mix of bricks-and-mortar and online presence. The costs of operating and staffing those sites will be considered more on an opportunity cost basis (where else could I place this money?) rather than whether or not the numbers simply stack for a particular site. Flagship sites are more likely to withstand the pressure as the intangible benefits of brand awareness will be

In an uncertain world, the key to the mutual success of landlords and tenants is going to be about flexibility. Tenants are often referred to as ‘partners’ of the landlord but the reality is that the nature of the relationship has remained pretty static, and so too have the contractual agreements between them. Given the vast sums expended by centre owners and the volume of tenants to deal with, consistency and certainty around the basics at least (rent, term, security) is (or has been) fundamental to success. But in a changing economy, any inflexibility is going to make it harder for retailers to commit to sites. The quandary for centre owners is whether the adoption of greater flexibility in the terms of their leases is going to significantly alter their own risk profiles and whether that risk is worth the potential reward. SCN

COPYRIGHT©

2020 SHOPPING CENTRE NEWS – ALL RIGHTS RESERVED

16/11/20 11:26 am