4 minute read

Opinion: Early data points to Christmas cheer

oOh!media's Chief believes Christmas 2020 is going to be good for retailers – at least a lot better than previously expected. The data he’s collected backs up the theory (and his name lends credibility to his opinion!) Early data points to Christmas cheer

What could well be one of the most unusual Christmases in living memory is approaching, and many in the retail industry will be eagerly looking forward to the holiday season and the advent of a more prosperous 2021.

Advertisement

But after a strange and challenging year, what will Christmas look like? Will we see cautious consumers feeling the effects of 2020 stubbornly refusing to open their wallets? Or will it be a much happier occasion, with people realising the state of our nation managing COVID is improving and therefore spending with renewed optimism?

There are arguments on both sides at a time of many challenges and unpredictable events both here and overseas, but there are signs, backed by data, that the shopping season could be better than expected.

What the numbers say

As a leading Out of Home media owner, we have a deep and abiding interest in what people are doing and where they are spending their time. To that end, we frequently collect and analyse numerous data streams, keeping a close eye on audience movements across retail centres and offices, roads and transport hubs, cafés and universities, among many other public spaces. At the time of writing this article, markets across Australia are in a positive position. From a retail perspective, our latest findings have given us a look into how Australians are feeling and behaving. National audiences at local and medium shopping centres have been recovering consistently, and are now over 90% of where they were pre-COVID.1

Home-maker centres are also doing well, at almost 90% of 2019 levels, while in regional areas, audiences have actually surpassed last year by almost 10% – a promising sign of normality returning and a look into just what the summer holidays might look like for Australian travel.1

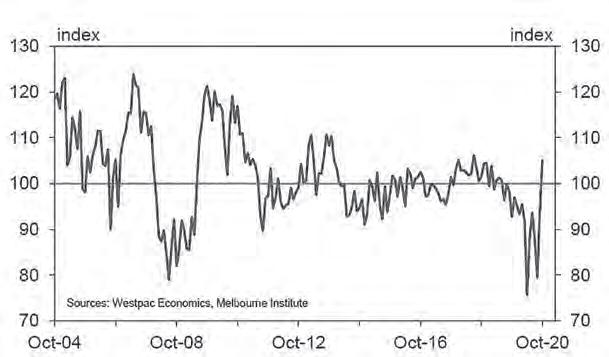

Consumer confidence also increased across the country, presumably driven by successful COVID containment strategies in most areas, plus tax cuts and a mooted interest rate cut on the near horizon, courtesy of the RBA.

Despite the conditions in Victoria, and many people still working from home, we can confidently say that shoppers across the nation are out NOEL COOK Chief Commercial and Operations Officer oOh!media

and about again. This is confirmed by recent research released by Vamp Australia in October showing that 84% of respondents expect they’ll spend the same or more on Christmas this year, compared to last year.2

Along with the extensive government support packages, one additional and intriguing factor helping drive this may be the current absence of international travel. Australians who usually spend thousands of dollars holidaying overseas will be staying in country, presumably with money available that they would have previously spent in far-flung locations.

Christmas shopping starting early

With the data pointing to a better than expected end to the year, it’s an

opportune time to take a closer look at some of the themes around Christmas this year. In many ways, the pandemic has encouraged people to reflect more than usual on their own lives and the world around them.

That is not a great surprise at such a trying time, but what is interesting is how many Australians have seen the economic damage wreaked by COVID and decided to help in whatever way they can.

Tellingly, our ongoing consumer survey series shows that 90% of

Australians say they will be making an effort to support local in the build up to Christmas, which clearly has implications for centre owners and retailers looking to tailor their product mix to prevailing attitudes.3

When it comes to what Australians expect from brands this Christmas, 80% said they would be looking for different brand offerings compared to what they would typically go for, highlighting products within budget that are a quality brand, from small/local businesses and are Australian made.3

When it comes to shopping strategies, consumers are planning ahead. Two in five are thinking about Christmas earlier than usual, while a third will be purchasing products and services earlier.3

Demonstrating awareness of lingering health concerns, half of respondents intend to visit shopping centres earlier in the morning or later in the afternoon to avoid crowds, while 45% intend to wear a face mask or covering so they can shop at their own pace and with peace of mind. Somewhat surprisingly, just over half expect the same level of service in centres as previous years, for example, help with gift ideas.3 This could well be acknowledgement of the damage done by COVID during the past few months. insight, Christmas this year looks set to be one characterised by shoppers exercising caution in their shopping habits, while preparing to spend early and positively. This suggests retailers and centre owners should be making moves earlier than usual to pull people in as they consider their purchasing options.

Team Australia will be the order of the day, with consumers feeling patriotic and supportive of businesses doing it tough. Local centres highlighting local products and services should do well, and while anything can happen in these volatile times, there seems to be a real opportunity for centre owners and their retailers to make up some lost revenues over the previous months – a good way to set the stage for a better year ahead. SCN

Sources: 1. Dspark data, 500+ Retail locations nationally, week ending Oct 12th 2020 vs same week 2019. 2. Adnews, Five reasons COVID Christmas marketing needs influencers, 9th October 2020 3. oOh!media Pulse Report | Timing 1st – 4th & 18th – 19th May, 1st – 3rd June, 24th – 28th July, 2nd – 9th October 2020 | Research Panel: Dynata | Australians aged 6+, n=4,479. Wave 5 results displayed above n=753.